1. Introduction

The risk management system is a broad and complex topic involving a body of knowledge covering many aspects. Its construction process is not uniform but according to different business structures for “targeted” shape from the perspective of industry division, standard credit card industry, cash loan industry, third-party payment/transaction industry, auto finance industry, and financial leasing industry. From the perspective of the division of the end audience, it can be divided into B end (to B) and C end (to C). With the continuous improvement of national policy supervision, especially in the financial industry, the importance of risk compliance has increased sharply.[

1]Therefore, the construction of the risk management sub-system can be divided into risk prevention and control and risk compliance.

The division from different angles is to focus better, but it does not mean that these are independent, divided states. On the contrary, it can achieve better integration, make full use of limited risk control resources, and put forward higher requirements for the compatibility of the entire risk system. The risk management system of online credit products includes modules such as anti-fraud, credit approval, in-loan management, and post-loan management. [

2]In the process of carrying out business, banks and other financial institutions focus on the structure and constantly improve the strategies and models of each link so that the product business can better meet the needs of the Internet credit scene, solve the pain points, and difficulties of risk control of banks and other financial institutions, and constantly improve the asset quality on the premise of balancing the asset scale.

Anti-fraud risk management covers customer credit and money applications for Internet revolving credit products. Among them, the leading fraud prevention in the credit application process includes non-personal applications, false information, gang fraud, etc. The prominent fraud cases to be prevented in the application of funds include account theft, account cracking, and dragging the library into the library. In this complex risk management environment, machine learning-driven fraud detection systems have become a powerful tool that can provide effective fraud prevention and control at all process stages and improve financial institutions’ overall risk management capabilities.

2. Related Work

2.1. Review of Relevant Research

Ahmed et al. (2007) conducted a comprehensive review focusing on techniques for risk management in project environments. They explore various methodologies and strategies to identify, assess, and mitigate risks within project contexts. The study evaluates the effectiveness of these techniques in enhancing project success rates by minimizing potential disruptions and optimizing resource allocation. By synthesizing existing literature, the authors provide insights into best practices for integrating risk management into project management frameworks, thereby contributing valuable guidelines for practitioners seeking to improve project outcomes [

3]; Hopkin (2018) presents a foundational text on risk management, emphasizing a comprehensive approach to understanding, evaluating, and implementing effective risk management practices across diverse organizational settings. The book covers fundamental principles such as risk identification, assessment, treatment, and monitoring, highlighting their critical roles in mitigating threats and seizing opportunities. By integrating theoretical insights with practical examples, Hopkin provides a structured framework for developing robust risk management strategies that align with organizational objectives. This contribution serves as a vital resource for professionals and academics seeking to navigate the complexities of contemporary risk landscapes; Rasmussen (1997) addresses risk management within the context of dynamic and complex societal systems, viewing it as a modeling challenge. [

4]The study explores how risk emerges from interactions between technological, organizational, and human factors, proposing models that account for these interdependencies. By examining case studies across various domains, Rasmussen underscores the importance of adaptive risk management strategies capable of responding to evolving environments. The research contributes theoretical frameworks that enhance our understanding of risk dynamics in modern societies, advocating for integrated approaches that promote resilience and sustainability.

Ogwueleka (2011) investigates the application of data mining techniques in credit card fraud detection systems. The study explores how data mining algorithms, such as neural networks and decision trees, analyze transactional data to identify patterns indicative of fraudulent activities. By evaluating case studies and experimental results, Ogwueleka demonstrates the efficacy of these techniques in enhancing fraud detection accuracy while minimizing false positives. The research contributes to advancing methodologies for real-time monitoring and prevention of credit card fraud, offering practical insights for financial institutions and regulatory bodies striving to secure electronic payment systems; Ong et al. (2024) propose an LSTM-based deep learning model tailored for predicting stock prices in financial markets. The study leverages long short-term memory (LSTM) networks to capture temporal dependencies in historical stock data, aiming to forecast future price movements with improved accuracy. By evaluating the model’s performance against traditional forecasting methods, the authors highlight its potential to enhance decision-making processes for investors and financial analysts. This research contributes to the evolving field of financial market prediction by integrating advanced machine learning techniques, paving the way for more reliable investment strategies and risk management practices.

The research on risk management in artificial intelligence shows a trend of diversification and deepening. Researchers have extensively explored how machine learning, deep learning, and data mining can enhance risk identification, assessment, and response. For example, risk prediction models based on big data analytics are being developed to identify potential financial and business risks. At the same time, natural language processing techniques are being applied to understand and analyze risk management documents and data. In addition, reinforcement learning shows potential for optimizing risk decisions by simulating and learning from experience to enhance the effectiveness of decisions. These studies drive innovation in risk management techniques and provide businesses and organizations with more reliable tools and methods to deal with complex risk environments.

2.2. Traditional Fraud Detection Methods

Many foreign scholars studied fraud detection relatively early, starting in the late 1980s, and gradually developed various fraud detection methods. [

5,

6]In the late 1980s, researchers presented a fraud detection case study using simple statistical techniques, one of the first attempts. This was followed by another study for fraud detection using regression analysis methods, further advancing the field. For credit card fraud detection in the late 1990s, a study applied distributed data mining technology to credit card fraud detection, significantly improving detection efficiency. This method marks an essential advancement in credit card fraud detection.

In the 21st century, credit card fraud detection methods based on cost-sensitive learning have been proposed.[

7]This method defines a performance measure that reflects the cost of a classifier within a specific operating range and directly optimizes this performance measure through evolutionary programming to train a classifier suitable for real-world credit card fraud detection. This innovation has achieved remarkable results in improving the practical application effect of the classifier. In addition, a credit card fraud detection method based on the Hidden Markov model (HMM) is also proposed. In this approach, the researchers simulated the sequence of operations that process credit card transactions using HMM. HMM is trained on the expected behavior of the cardholder. If HMM does not accept a credit card transaction received with a high enough probability, it is considered fraud. This method uses serial pattern recognition technology to provide a new perspective and method for credit card fraud detection.

In recent years, more studies have compared various data mining techniques to credit card fraud detection. One study used three models: random forest, support vector machine, and logistic regression, and the results showed that random forest performed best in this process. [

8]In addition, the new method based on a cost-sensitive decision tree has better performance indicators such as accuracy and actual positive rate on a given set of problems than the existing known methods. The method also defines a cost-sensitive measure for credit card fraud detection. New approaches are also emerging. For example, a new model that uses an artificial immune system to detect credit card fraud improved accuracy by 25 percent, cost by 85 percent, and system response time by 40 percent by improving the Immune System Heuristic algorithm (AIRS). In addition, a feature engineering strategy for credit card fraud detection was studied, and a new feature collection based on von Mises distribution was proposed to analyze the periodic behavior of transaction time, which saved 13% on average.

These traditional and emerging methods have laid a solid foundation for fraud detection research and driven the continuous evolution and application of the technology.

2.3. Application of Machine Learning in Fraud Detection

Because ML algorithms can learn from historical fraud patterns and identify them in future transactions, fraud detection using machine learning becomes possible. Machine learning algorithms are more efficient than humans regarding information processing speed. In addition, machine learning algorithms can detect complex fraud features that humans cannot.

1. You work faster. [

9]A rules-based fraud prevention system means creating precise written rules that “tell” the algorithm which types of operations look normal and should be allowed and which shouldn’t because they look suspicious. However, writing rules takes a lot of time. Moreover, manual interactions in e-commerce are so dynamic that things can change significantly in days. Here, machine learning fraud detection methods will come in handy to learn new patterns.

2. Scale. ML methods show better performance as the data sets, they fit grow - meaning that the more samples of fraudulent operations they accept, the better their ability to identify fraud. The principle only applies to rules-based systems if they never evolve independently. In addition, data science teams should be aware of the risks of rapid model scaling. If the model does not detect fraud and incorrectly flags it, this will lead to underreporting in the future.

3. Efficiency. Machines can take over the repetitive work of routine tasks and human fraud analysis, and experts will be able to spend their time making more advanced decisions.

Payment fraud detection is the most common type of fraud solved by artificial intelligence (AI). It is as varied as the fraudsters can imagine. [

10]However, here are some of the most common types of payment fraud: lost card, stolen card, fake card, stolen card ID, and card not received. The recent emergence of cards with chips (EMV cards) has helped reduce card fraud in Europe but not in the United States, where the elimination process for magnetic stripe cards has been prolonged.

Cardless transactions come in many forms. After attacking the user by phishing, contacting their mobile provider, and breaking into the account online in a way that allows the criminals to gather enough card details, the fraudster orders goods or loans. [

11]A loan scam may occur if someone contacts you to offer a loan on unrealistically good terms, the lender does not provide a check confirming the loan, the lender asks for bank details or an advance payment, or the company pretends to be from a particular country, but the number is international.

Furthermore, fraud models can be solved by supervised and unsupervised machine learning algorithms. A traditional classification algorithm is used. In the second case, we can use anomaly detection techniques. The use of neural networks is also effective, but it requires a lot of training data, with two types of data points in equal numbers: abnormal and normal. However, in the case of fraud detection, there is always a lack of balanced data sets.

2.4. Risk Management Framework

Under the influence of big data, the financial risk may become the ignition point of the financial crisis at any time, and the impact and consequences of the financial crisis are tremendous, far from the specific measures that financial institutions can solve alone. [

12]Therefore, the financial industry must implement measures at the early stage of financial risks to avoid financial crises. In their work, those working in the financial industry must ensure the security of funds in each transaction and consider its potential to create financial risks. The relevant personnel of financial enterprises need to keenly perceive financial risks, control the overall development situation when dealing with financial business, and effectively avoid financial risks.

Risk management measures mainly include four aspects. First of all, enterprise risk analysis is conducted, transaction data in financial business is analyzed, data security is ensured, and an in-depth analysis of ACH transaction data is conducted. Second, the staff needs to analyze business contacts and fraud by identifying credit card holder information and verifying portrait, fingerprint, or personal information to ensure that there is no fraud. Third, cross-account reference analysis should be carried out, the scope of financial business expanded, and comprehensive analysis should be conducted through ACH transaction data. Finally, statistics and analysis of network risks are carried out so counterparties can fully grasp the potential risks. The comprehensive application of these measures can effectively improve the risk management capabilities of financial institutions and prevent financial risks from evolving into financial crises.

2.5. Conclusion and Transition to Methodology

Traditional fraud detection methods have laid the groundwork for current practices by employing statistical techniques, regression analysis, and data mining methods, achieving significant advancements in fraud detection efficiency. The development of cost-sensitive learning and the application of Hidden Markov Models (HMM) have further enhanced the detection of fraudulent activities. These methods, along with new approaches like the artificial immune system and feature engineering, have progressively improved fraud detection systems.

Machine learning (ML) has revolutionized fraud detection by offering rapid, scalable, and efficient solutions unlike rules-based systems, which require manual updates, ML algorithms can learn and adapt from historical data, identifying complex fraud patterns that are challenging for humans to detect. The application of ML in fraud detection ranges from supervised and unsupervised learning algorithms to neural networks, although challenges such as imbalanced datasets remain.

A robust risk management framework is crucial for the financial industry to prevent crises by identifying and mitigating risks early. [

13]Effective risk management involves analyzing transaction data, verifying customer information, conducting cross-account analyses, and monitoring network risks to ensure the security of financial operations.

Given the continuous evolution of fraud detection methods and the critical role of risk management, the next section will explore the methodology for developing a machine learning-driven fraud detection model. This model aims to address the complexities and dynamic nature of fraudulent activities, leveraging advanced ML techniques to enhance the accuracy and efficiency of fraud prevention in financial institutions.

3. Methodology

In digital financial payments, accurately predicting user payment behavior is crucial to help financial institutions better understand user needs, manage risks, and optimize services. Ensemble learning is not a single machine learning algorithm; it integrates multiple base learners (i.e., weak learners), eventually forming a strong learner. These base learners should have a degree of predictive accuracy and diversity; that is, they differ in the learning process. Decision trees and neural networks are commonly used as base learners.

3.1. Model Discussion

Decision trees are a standard machine learning method that can generate 3-5 layers of decision trees based on selected specific variables to generate anti-fraud rules. A decision tree can decompose the complex decision process into a series of simple steps, making the decision process more intuitive and easier to understand. In the anti-fraud field, decision trees can be used to identify fraud, for example, to determine whether a transaction is authentic based on the user’s behavior, transaction history, and other characteristics.

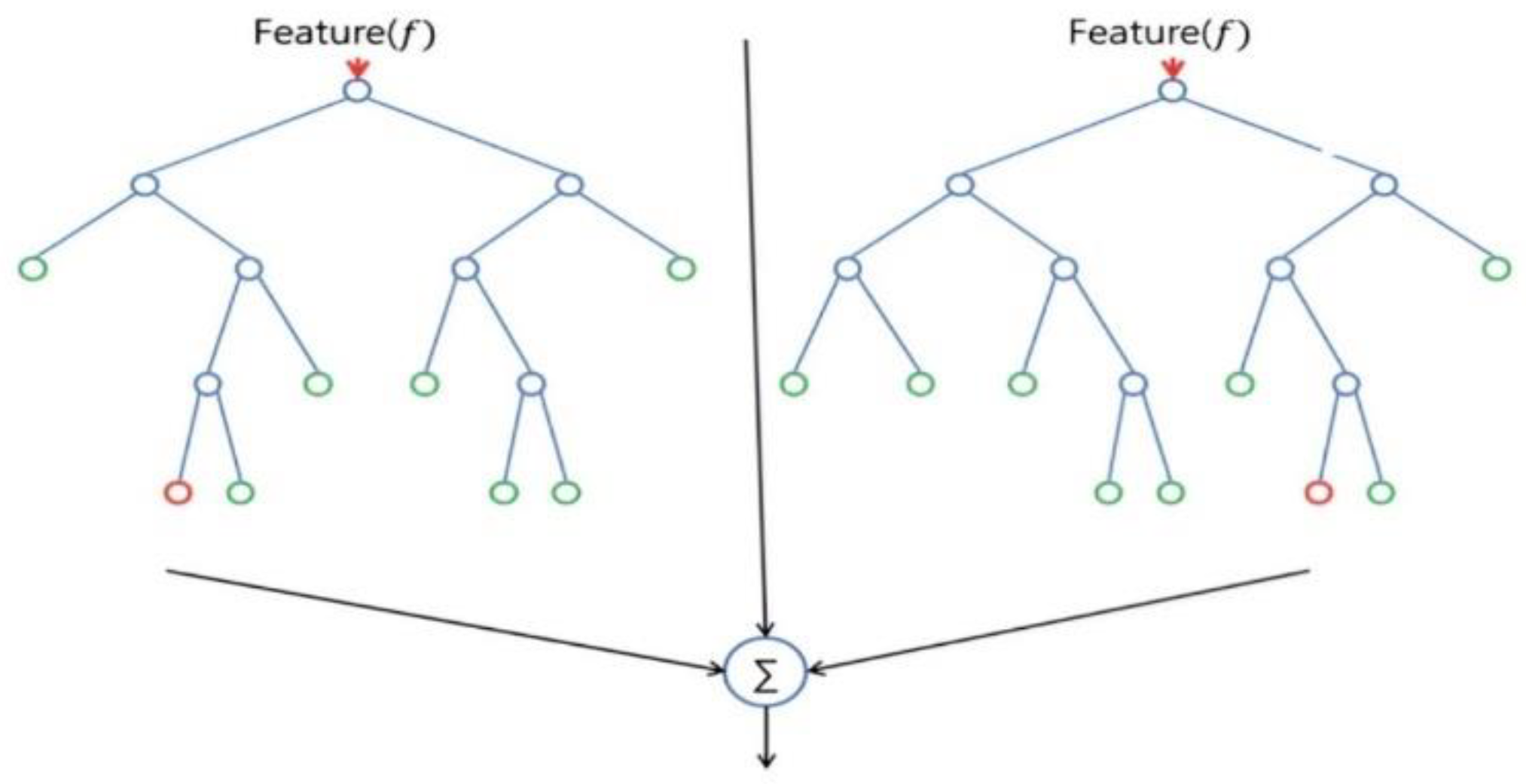

1. Random forest is an ensemble learning method that makes predictions by generating many decision trees and taking the average of their outputs. [

14,

15,

16]This approach can generate hundreds or thousands of trees, allowing for more non-human-controlled combinations of variables and entry threshold possibilities. This means that random forests can deal with complex fraud more flexibly and with higher recognition accuracy.

Figure 1.

Decision tree random forest model.

Figure 1.

Decision tree random forest model.

2. In the anti-fraud field, the number of samples is usually tiny, and the fraud risk of each sample is different. In this case, traditional machine learning methods may not accurately identify fraud due to insufficient data volume. Therefore, it is recommended that ensemble learning methods such as random forest be used to improve the accuracy of recognition.

3.2. Data Set

The dataset used in this study is from a Kaggle challenge focused on predicting fraudulent activities in credit card transactions. The [

17]”Credit Card Fraud Detection” dataset records transactions made by European credit cardholders in September 2013. It contains a total of 284,807 transactions, of which 492 are fraudulent.

This study aims to explore and compare the performance of three commonly used machine learning models: XGBoost, decision tree, and random forest on financial digital payment datasets. Therefore, by comparing the classification prediction performance of these three models on financial digital payment datasets, we aim to determine which model is most suitable for digital payment behavior prediction.

This dataset is commonly used in machine learning research for fraud detection due to its imbalance between every day and fraudulent transactions, making it challenging yet representative of real-world scenarios.

Table 1.

Dataset Description.

Table 1.

Dataset Description.

| Feature Column |

Description |

| PCA Component 1 |

Description of PCA component 1 |

| PCA Component 2 |

Description of PCA component 2 |

| ... |

... |

| PCA Component 29 |

Description of PCA component 29 |

| Class |

Target variable indicating fraudulent (1) or normal (0) transaction |

3.2.1.1. Notes:

Purpose: The dataset aims to study and predict fraudulent credit card transactions to enhance the security of payment systems and user trust.

Features: The transformed dataset contains 29 principal component columns derived from PCA, representing linearly independent components of the original data.

Feature Examples: These components may encapsulate various transaction-related factors such as transaction amount, time, location, and other transaction details.

By presenting the dataset characteristics in this tabular format, readers can easily grasp the structure and purpose of the data used in your study. This approach clarifies the use of PCA for dimensionality reduction and emphasizes the focus on predicting fraudulent transactions to improve financial system security and user confidence.

3.2.1.2. Prediction Model

Random forest is a very representative Bagging integration algorithm, which is strengthened based on Bagging. All its base learners are CART decision trees [

18]. The traditional decision tree selects the optimal attribute in the attribute set of the current node (assuming d attributes) when selecting partition attributes. However, in the decision tree of random forest, now the attribute set of each node randomly selects a subset of some k attributes, and then selects an optimal feature in the subset to make the left and right subtree division of the decision tree:

In sci-kit-learn, the classification class of Random Forest is Random Forest Classifier and the regression class is RandomForestRegressor. Parameters for parameter adaptation include two parts. The first part is the parameters of the Bagging framework [

19]. The second part is the parameters of the CART decision tree.

This study focuses on optimizing the Random Forest (RF) model parameters for predicting fraudulent credit card transactions using the Kaggle dataset. The dataset comprises 284,807 transactions from September 2013, with a significant class imbalance—492 fraudulent cases and the remaining normal transactions. To address this imbalance, an under-sampling strategy was employed to balance the dataset for training. The primary objective was to enhance model performance by tuning key parameters such as estimators, adept, and min_samples_split.

3.3. Experimental Design

Initially, the RF model was trained using default parameters, achieving an initial out-of-bag (OOB) score and test AUC of 0.924 and 0.967, respectively. Subsequently, parameter optimization began with a grid search approach. First, estimators were optimized, resulting in the selection of 50 trees for improved performance. Next, adept was tuned to 6, followed by min_samples_split set to 5, yielding further improvements in AUC to 0.978 and 0.982, respectively. Integrating these optimized parameters into the final RF model significantly enhanced its predictive capabilities. The refined RF model with estimators=50, adept=6, and min_samples_split=5 achieved an OOB score of 0.933 and a test AUC of 0.978, demonstrating notable improvements over the default settings.

This experimental approach underscores the effectiveness of parameter tuning in enhancing RF model performance for fraud detection in credit card transactions, despite the dataset’s inherent imbalance. Future sections will explore additional aspects such as data preprocessing, feature engineering, and model assembling to further refine the predictive accuracy and robustness of the model.

3.4. Experimental Result

Figure 2.

Fraud detection training results of three models.

Figure 2.

Fraud detection training results of three models.

Discussion: Take the confusion matrix of the XGBoost model as an example.

The first line is the transaction with an actual fraud value of 0 in the test set. It can be calculated that 56,861 of the fraud values are 0. Of the 56,861 non-fraudulent transactions, the classifier correctly predicted 56,854 of them to be 0 and predicted 7 of them to be 1. This means that for 56,854 non-fraudulent transactions, the actual churn value in the test set was 0, which the classifier also correctly predicted. We can say that our model has classified non-fraudulent transactions and that the transactions are good.

The second line. There were 101 transactions with a fraud value of 1. The classifier correctly predicted 79 of them as one and incorrectly predicted 22 of them as 0. The wrong predicted value can be considered an error in the model.

Therefore, when comparing the confusion matrix of all models, the K-Nearest Neighbors model does an excellent job of classifying fraudulent transactions from non-fraudulent transactions, followed by the XGBoost [

20,

21] model.

This study optimized the Random Forest (RF) model parameters for predicting fraudulent credit card transactions using a Kaggle dataset from September 2013. Despite the dataset’s imbalance, with only 492 fraudulent cases out of 284,807 transactions, parameter tuning significantly improved the RF model’s performance. By adjusting estimators, adept, and min_samples_split through grid search, the model achieved an enhanced out-of-bag (OOB) score of 0.933 and a test Area Under the Curve (AUC) of 0.978. These results underscore the effectiveness of parameter optimization in strengthening the RF model’s predictive accuracy for fraud detection in digital financial payments. Future research will explore additional methodologies to refine model performance and robustness further.

This summary encapsulates the study’s key outcomes, emphasizing the impact of parameter tuning on improving the RF model’s ability to detect fraudulent transactions in financial digital payment systems.

4. Conclusion

With the rapid development of financial technology and the digital transformation of financial services, applying machine learning in financial risk management is particularly important and necessary. Especially in identifying and preventing fraudulent activities, traditional statistical methods have been unable to meet the increasingly complex fraud detection needs. Machine learning models, especially integrated learning methods like Random Forest, can reduce the risk of fraud faced by financial institutions by learning patterns and trends in historical data to identify and respond to ever-changing fraud automatically.

However, the current application of machine learning in finance still needs some challenges and limitations. For example, the data imbalance problem leads to skew in the model training process, limiting the identification accuracy of a few categories (fraudulent transactions). Future research can focus on solving these problems, exploring more complex and efficient machine learning models, and combining techniques such as deep learning and natural language processing further to improve the performance of financial fraud detection systems.

In addition, as regulatory requirements and consumer expectations rise, financial institutions are increasingly focused on risk management and security. Machine learning can help institutions respond quickly to potential fraud in real-time transactions and optimize overall risk management strategies through a data-driven approach. As a result, foreseeable future developments in the financial sector include more efficient risk prediction and management through enhanced learning and real-time data processing technologies, as well as the use of emerging technologies such as blockchain and secure computing to ensure the security and trust of financial information.

In summary, the application of machine learning in financial risk management is promising, but continuous innovation and progress are needed to meet the changing financial environment and technological challenges. Through interdisciplinary collaboration and technological innovation, we can expect more significant progress and achievements in fraud detection and risk management in the future.

References

- Power, Michael. “The risk management of everything.” The Journal of Risk Finance 5.3 (2004): 58-65. [CrossRef]

- Ahmed, Ammar, Berman Kayis, and Sataporn Amornsawadwatana. “A review of techniques for risk management in projects.” Benchmarking: an international journal 14.1 (2007): 22-36. [CrossRef]

- Hopkin, P. (2018). Fundamentals of risk management: understanding, evaluating and implementing effective risk management. Kogan Page Publishers.

- Rasmussen, J. (1997). Risk management in a dynamic society: a modeling problem. Safety Science, 27(2-3), 183-213. [CrossRef]

- Abdallah, Aisha, Mohd Aizaini Maarof, and Anazida Zainal. “Fraud detection system: A survey.” Journal of Network and Computer Applications 68 (2016): 90-113. [CrossRef]

- Ogwueleka, F. N. (2011). Data mining application in credit card fraud detection system. Journal of Engineering Science and Technology, 6(3), 311-322.

- Song, Jintong, et al. “LSTM-Based Deep Learning Model for Financial Market Stock Price Prediction.” Journal of Economic Theory and Business Management 1.2 (2024): 43-50. [CrossRef]

- Cheng, Qishuo, et al. “Monetary Policy and Wealth Growth: AI-Enhanced Analysis of Dual Equilibrium in Product and Money Markets within Central and Commercial Banking.” Journal of Computer Technology and Applied Mathematics 1.1 (2024): 85-92. [CrossRef]

- Li, Huixiang, et al. “AI Face Recognition and Processing Technology Based on GPU Computing.” Journal of Theory and Practice of Engineering Science 4.05 (2024): 9-16. [CrossRef]

- Qin, Lichen, et al. “Machine Learning-Driven Digital Identity Verification for Fraud Prevention in Digital Payment Technologies.” (2024). [CrossRef]

- Choudhury, M., Li, G., Li, J., Zhao, K., Dong, M., & Harfoush, K. (2021, September). Power Efficiency in Communication Networks with Power-Proportional Devices. In 2021 IEEE Symposium on Computers and Communications (ISCC) (pp. 1-6). IEEE. [CrossRef]

- Lakshmi, S. V. S. S., & Kavilla, S. D. (2018). Machine learning for credit card fraud detection system. International Journal of Applied Engineering Research, 13(24), 16819-16824.

- Qian, K., Fan, C., Li, Z., Zhou, H., & Ding, W. (2024). Implementation of Artificial Intelligence in Investment Decision-making in the Chinese A-share Market. Journal of Economic Theory and Business Management, 1(2), 36-42. [CrossRef]

- Qi, Y., Wang, X., Li, H., & Tian, J. (2024). Leveraging Federated Learning and Edge Computing for Recommendation Systems within Cloud Computing Networks. arXiv preprint arXiv:2403.03165. [CrossRef]

- Wang, Yong, et al. “Machine Learning-Based Facial Recognition for Financial Fraud Prevention.” Journal of Computer Technology and Applied Mathematics 1.1 (2024): 77-84. [CrossRef]

- Wang B, Lei H, Shui Z, et al. Current State of Autonomous Driving Applications Based on Distributed Perception and Decision-Making[J]. 2024. [CrossRef]

- Chen, Zhou, et al. “Application of Cloud-Driven Intelligent Medical Imaging Analysis in Disease Detection.” Journal of Theory and Practice of Engineering Science 4.05 (2024): 64-71. [CrossRef]

- Fawcett, T., & Provost, F. (1997). Adaptive fraud detection. Data mining and knowledge discovery, 1(3), 291-316. [CrossRef]

- Yu, D., Xie, Y., An, W., Li, Z., & Yao, Y. (2023, December). Joint Coordinate Regression and Association For Multi-Person Pose Estimation, A Pure Neural Network Approach. In Proceedings of the 5th ACM International Conference on Multimedia in Asia (pp. 1-8). [CrossRef]

- Bolton, R. J., & Hand, D. J. (2002). Statistical fraud detection: A review. Statistical science, 17(3), 235-255. [CrossRef]

- Xuan, S., Liu, G., Li, Z., Zheng, L., Wang, S., & Jiang, C. (2018, March). Random forest for credit card fraud detection. In 2018 IEEE 15th International Conference on networking, sensing, and Control (ICNSC) (pp. 1-6). IEEE. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).