Submitted:

29 June 2024

Posted:

01 July 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Related Work

2.1. Financial Market Data Management

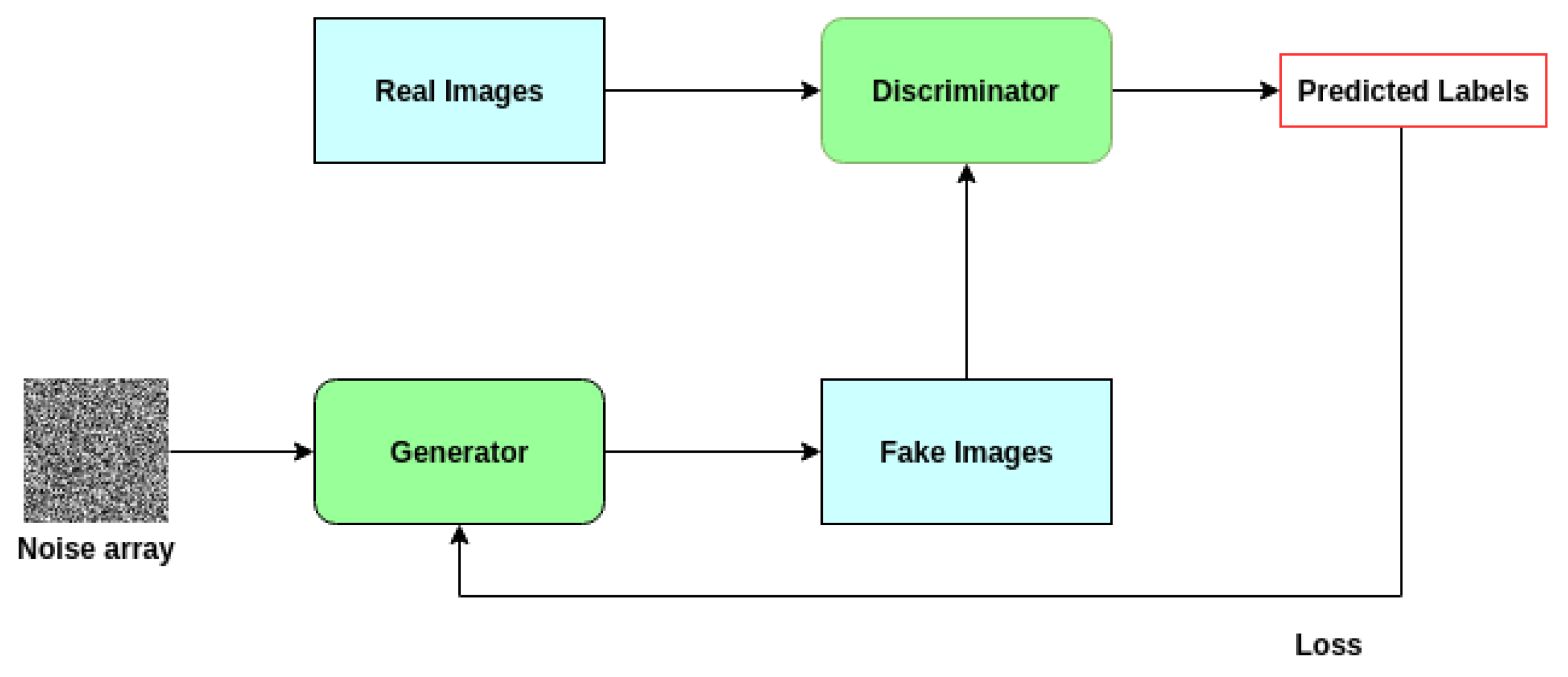

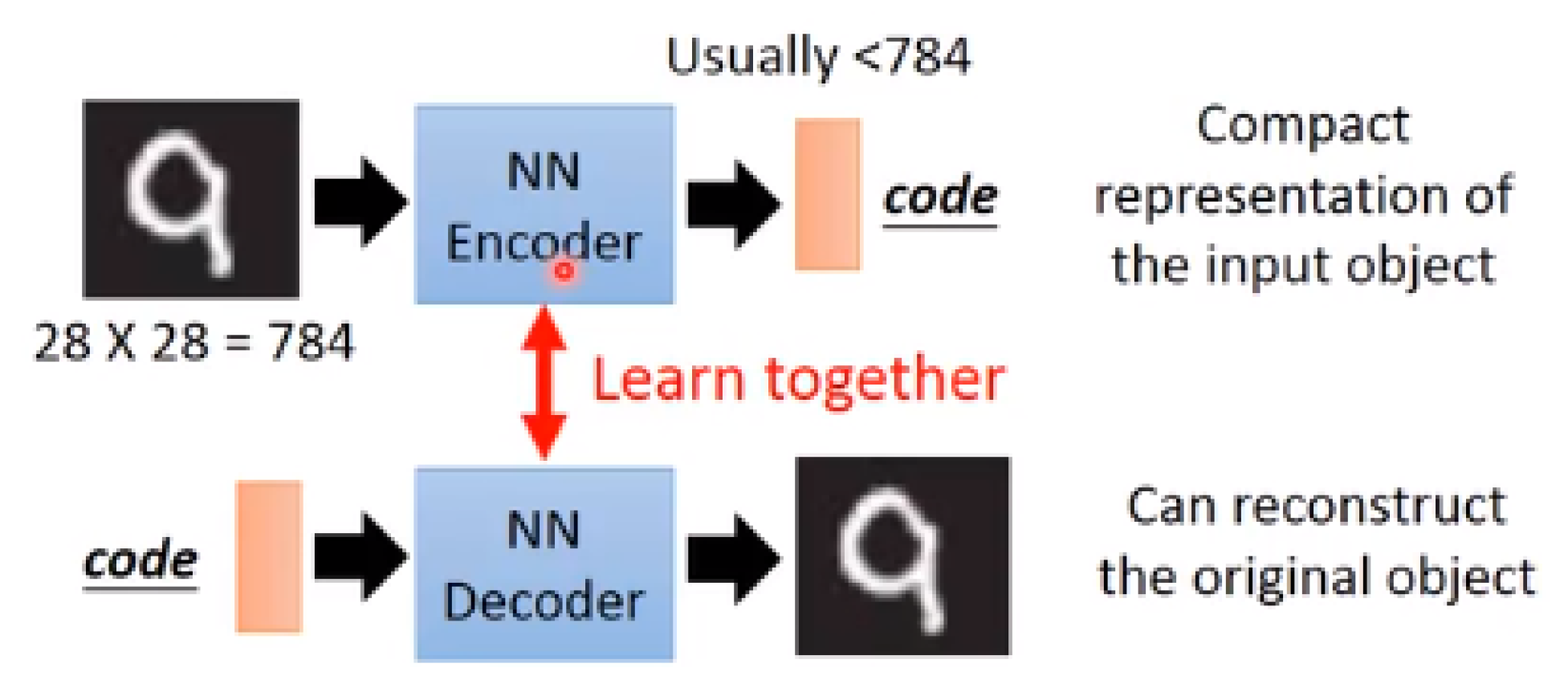

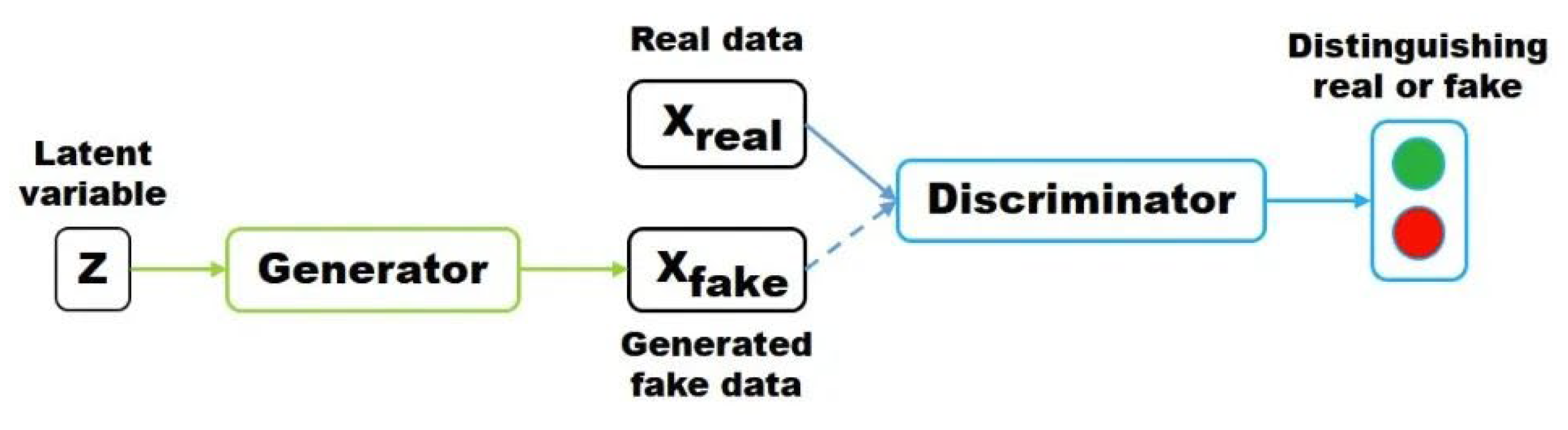

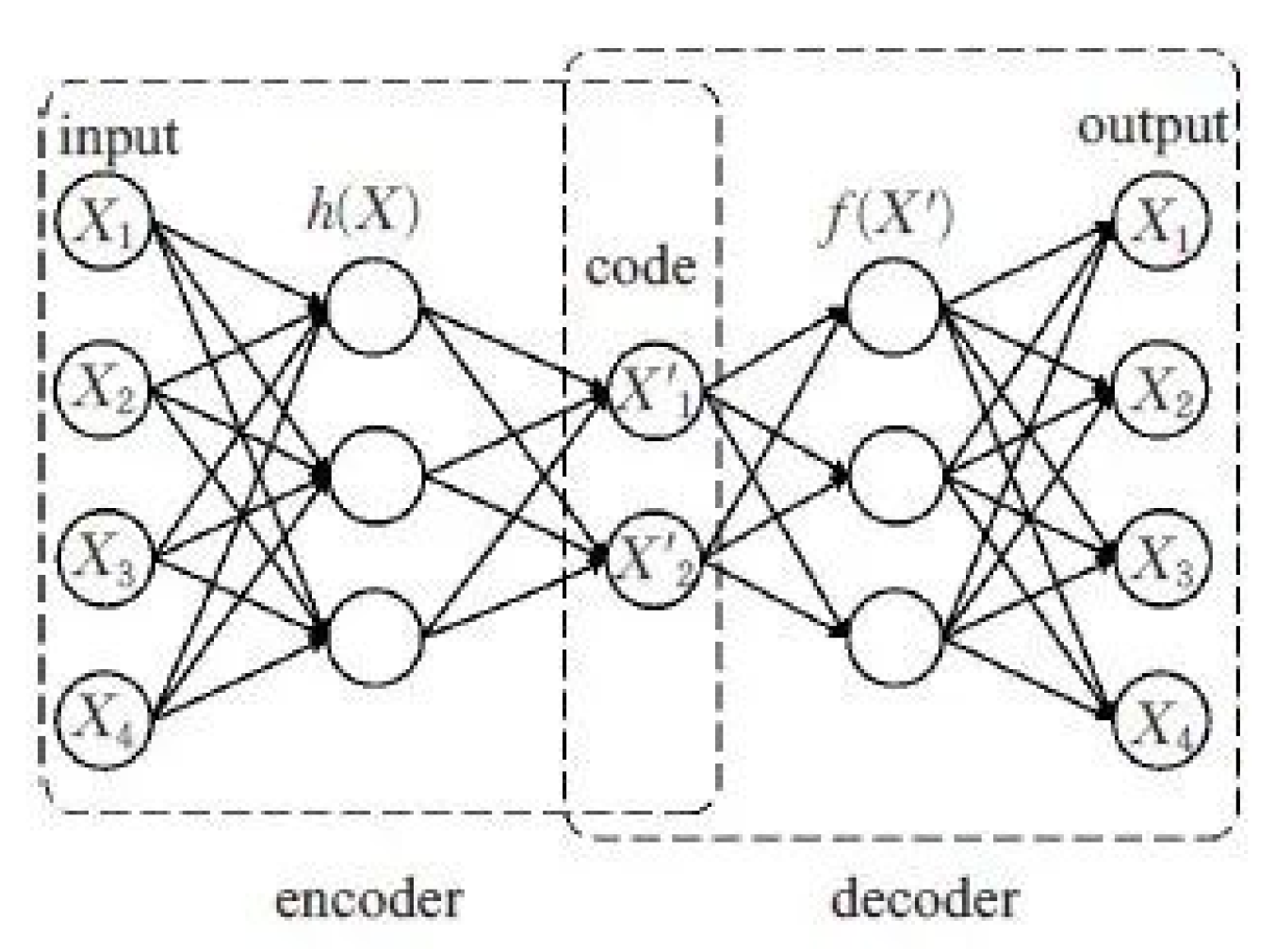

2.2. Generative Artificial Intelligence (GAN) Technology

3. The Application of Generative Artificial Intelligence in Financial Market Data Management

3.1. Data Collection and Preprocessing

3.2. Data Enhancement and Synthesis

| Dataset | Sample Size | Sample Diversity | Data Quality | Model Performance |

|---|---|---|---|---|

| Before | 1000 | Low | Medium | Average |

| After | 3000 | High | High | Excellent |

4. Predictive Models of Financial Markets by Generative Artificial Intelligence

4.1. Construction of Prediction Model

(1)

(1)

4.2. Model Building

| Parameter | Description |

| batch_size | The batch size of the LSTM and CNN |

| cnn_lr | The learning rate of the CNN |

| strides | The number of strides in the CNN |

| lrelu_alpha | The alpha for the LeakyReLU in the GAN |

| batchnorm_momentum | Momentum for the batch normalization in the CNN |

| padding | The padding in the CNN |

| kernel_size | The kernel size in the CNN |

| dropout | Dropout in the LSTM |

| filters | The initial number of filters |

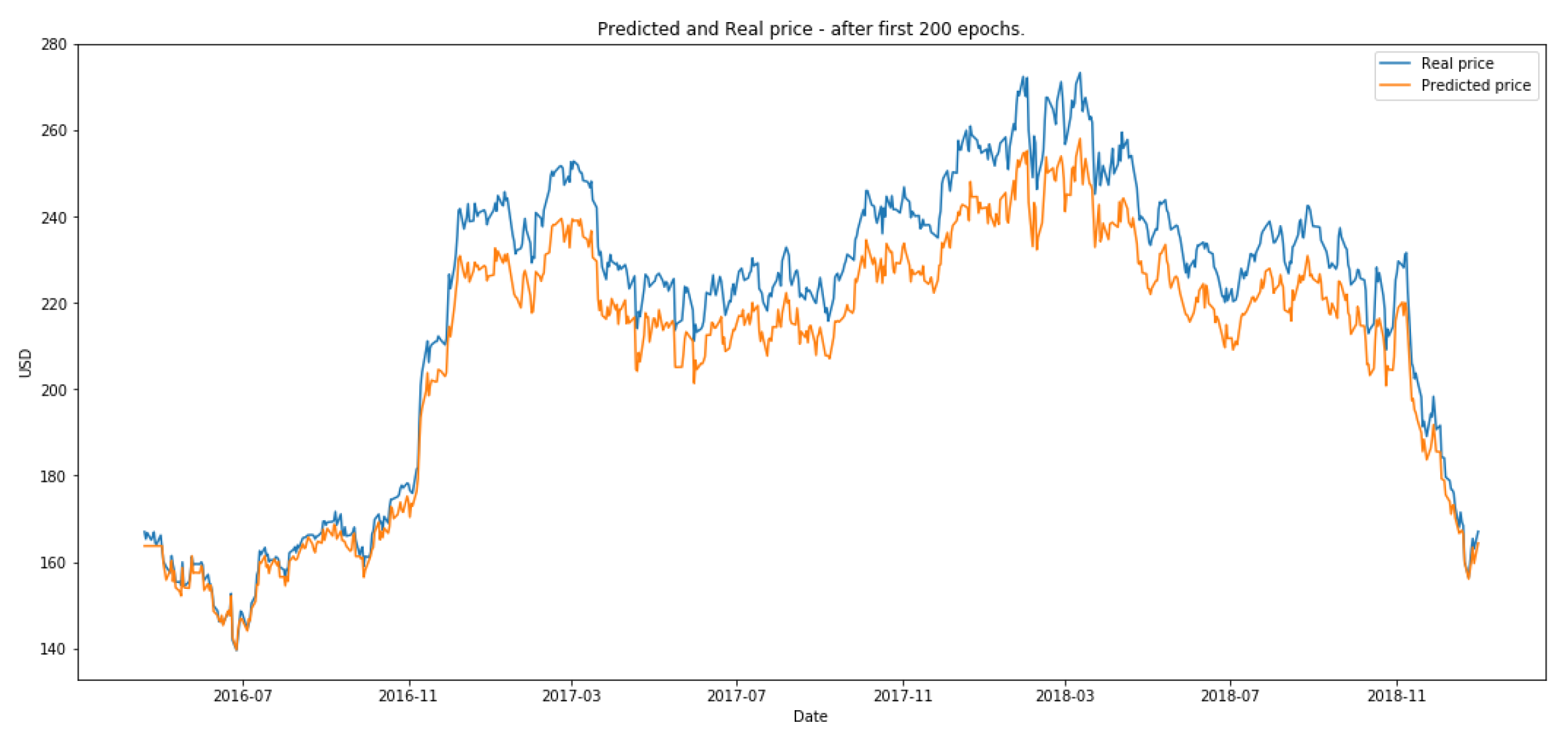

4.3. Model Results

5. Conclusion

Acknowledgment

References

- Ding, W.; Tan, H.; Zhou, H.; Li, Z.; Fan, C. Immediate traffic flow monitoring and management based on multimodal data in cloud computing. Appl. Comput. Eng. 2024, 71, 1–6. [Google Scholar] [CrossRef]

- Bai, Xinzhu, Wei Jiang, and Jiahao Xu. “Development Trends in AI-Based Financial Risk Monitoring Technologies.” Journal of Economic Theory and Business Management 1.2 (2024): 58-63.

- Ding, W., Zhou, H., Tan, H., Li, Z., & Fan, C. (2024). Automated Compatibility Testing Method for Distributed Software Systems in Cloud Computing.

- Qian, K., Fan, C., Li, Z., Zhou, H., & Ding, W. (2024). Implementation of Artificial Intelligence in Investment Decision-making in the Chinese A-share Market. Journal of Economic Theory and Business Management, 1(2), 36-42.

- Fan, C.; Li, Z.; Ding, W.; Zhou, H.; Qian, K. Integrating artificial intelligence with SLAM technology for robotic navigation and localization in unknown environments. Appl. Comput. Eng. 2024, 67, 22–27. [Google Scholar] [CrossRef]

- Lei, H.; Wang, B.; Shui, Z.; Yang, P.; Liang, P. Automated lane change behavior prediction and environmental perception based on SLAM technology. Appl. Comput. Eng. 2024, 67, 48–54. [Google Scholar] [CrossRef]

- Huang, J.; Zhang, Y.; Xu, J.; Wu, B.; Liu, B.; Gong, Y. Implementation of seamless assistance with Google Assistant leveraging cloud computing. Appl. Comput. Eng. 2024, 64, 170–176. [Google Scholar] [CrossRef]

- Wu, B.; Xu, J.; Zhang, Y.; Liu, B.; Gong, Y.; Huang, J. Integration of computer networks and artificial neural networks for an AI-based network operator. Appl. Comput. Eng. 2024, 64, 122–127. [Google Scholar] [CrossRef]

- Jiang, W.; Qian, K.; Fan, C.; Ding, W.; Li, Z. Applications of generative AI-based financial robot advisors as investment consultants. Appl. Comput. Eng. 2024, 67, 28–33. [Google Scholar] [CrossRef]

- Zhan, X.; Shi, C.; Li, L.; Xu, K.; Zheng, H. Aspect category sentiment analysis based on multiple attention mechanisms and pre-trained models. Appl. Comput. Eng. 2024, 71, 21–26. [Google Scholar] [CrossRef]

- Yang, P.; Chen, Z.; Su, G.; Lei, H.; Wang, B. Enhancing traffic flow monitoring with machine learning integration on cloud data warehousing. Appl. Comput. Eng. 2024, 67, 15–21. [Google Scholar] [CrossRef]

- Shi, Y.; Yuan, J.; Yang, P.; Wang, Y.; Chen, Z. Implementing intelligent predictive models for patient disease risk in cloud data warehousing. Appl. Comput. Eng. 2024, 67, 34–40. [Google Scholar] [CrossRef]

- Yu, D., Xie, Y., An, W., Li, Z., & Yao, Y. (2023, December). Joint Coordinate Regression and Association For Multi-Person Pose Estimation, A Pure Neural Network Approach. In Proceedings of the 5th ACM International Conference on Multimedia in Asia (pp. 1-8).

- Huang, C., Bandyopadhyay, A., Fan, W., Miller, A., & Gilbertson-White, S. (2023). Mental toll on working women during the COVID-19 pandemic: An exploratory study using Reddit data. PloS one, 18(1), e0280049.

- Fan, C., Ding, W., Qian, K., Tan, H., & Li, Z. (2024). Cueing Flight Object Trajectory and Safety Prediction Based on SLAM Technology. Journal of Theory and Practice of Engineering Science, 4(05), 1-8.

- Zhan, T.; Shi, C.; Shi, Y.; Li, H.; Lin, Y. Optimization techniques for sentiment analysis based on LLM (GPT-3). Appl. Comput. Eng. 2024, 67, 41–47. [Google Scholar] [CrossRef]

- Liang, P.; Song, B.; Zhan, X.; Chen, Z.; Yuan, J. Automating the training and deployment of models in MLOps by integrating systems with machine learning. Appl. Comput. Eng. 2024, 67, 1–7. [Google Scholar] [CrossRef]

- Li, H., Wang, X., Feng, Y., Qi, Y., & Tian, J. (2024). Driving Intelligent IoT Monitoring and Control through Cloud Computing and Machine Learning.arXiv preprint. arXiv:2403.18100.

- Qi, Y., Wang, X., Li, H., & Tian, J. (2024). Leveraging Federated Learning and Edge Computing for Recommendation Systems within Cloud Computing Networks. arXiv preprint. arXiv:2403.03165.

- Qi, Y., Feng, Y., Tian, J., Wang, X., & Li, H. (2024). Application of AI-based Data Analysis and Processing Technology in Process Industry.Journal of Computer Technology and Applied Mathematics,1(1), 54-62.

- Tian, J., Qi, Y., Li, H., Feng, Y., & Wang, X. (2024). Deep Learning Algorithms Based on Computer Vision Technology and Large-Scale Image Data.Journal of Computer Technology and Applied Mathematics,1(1), 109-115.

- Wang, X., Tian, J., Qi, Y., Li, H., & Feng, Y. (2024). Short-Term Passenger Flow Prediction for Urban Rail Transit Based on Machine Learning.Journal of Computer Technology and Applied Mathematics,1(1), 63-69.

- Feng, Y., Li, H., Wang, X., Tian, J., & Qi, Y. (2024). Application of Machine Learning Decision Tree Algorithm Based on Big Data in Intelligent Procurement.

- Tian, J., Li, H., Qi, Y., Wang, X., & Feng, Y. Intelligent Medical Detection and Diagnosis Assisted by Deep Learning.

- Sha, X. (2024). Time Series Stock Price Forecasting Based on Genetic Algorithm (GA)-Long Short-Term Memory Network (LSTM) Optimization. arXiv preprint. arXiv:2405.03151.

- Zhou, Y.; Zhan, T.; Wu, Y.; Song, B.; Shi, C. RNA secondary structure prediction using transformer-based deep learning models. Appl. Comput. Eng. 2024, 64, 95–101. [Google Scholar] [CrossRef]

- Liu, B.; Cai, G.; Ling, Z.; Qian, J.; Zhang, Q. Precise positioning and prediction system for autonomous driving based on generative artificial intelligence. Appl. Comput. Eng. 2024, 64, 36–43. [Google Scholar] [CrossRef]

- Wang, B.; He, Y.; Shui, Z.; Xin, Q.; Lei, H. Predictive optimization of DDoS attack mitigation in distributed systems using machine learning. Appl. Comput. Eng. 2024, 64, 89–94. [Google Scholar] [CrossRef]

- Cui, Z.; Lin, L.; Zong, Y.; Chen, Y.; Wang, S. Precision gene editing using deep learning: A case study of the CRISPR-Cas9 editor. Appl. Comput. Eng. 2024, 64, 128–135. [Google Scholar] [CrossRef]

- Wu, B.; Gong, Y.; Zheng, H.; Zhang, Y.; Huang, J.; Xu, J. Enterprise cloud resource optimization and management based on cloud operations. Appl. Comput. Eng. 2024, 67, 8–14. [Google Scholar] [CrossRef]

- Wang, Y.; Zhu, M.; Yuan, J.; Wang, G.; Zhou, H. The intelligent prediction and assessment of financial information risk in the cloud computing model. Appl. Comput. Eng. 2024, 64, 136–142. [Google Scholar] [CrossRef]

- Xu, Jiahao, et al. “AI-BASED RISK PREDICTION AND MONITORING IN FINANCIAL FUTURES AND SECURITIES MARKETS.” The 13th International scientific and practical conference “Information and innovative technologies in the development of society”(April 02–05, 2024) Athens, Greece. International Science Group. 2024. 321 p.. 2024.

- Wang, Yong, et al. “Machine Learning-Based Facial Recognition for Financial Fraud Prevention.” Journal of Computer Technology and Applied Mathematics 1.1 (2024): 77-84.

- Song, Jintong, et al. “LSTM-Based Deep Learning Model for Financial Market Stock Price Prediction.” Journal of Economic Theory and Business Management 1.2 (2024): 43-50.

- Jiang, W., Yang, T., Li, A., Lin, Y., & Bai, X. (2024). The Application of Generative Artificial Intelligence in Virtual Financial Advisor and Capital Market Analysis. Academic Journal of Sociology and Management, 2(3), 40-46.

- Xu, J., Zhu, B., Jiang, W., Cheng, Q., & Zheng, H. (2024, April). AI-BASED RISK PREDICTION AND MONITORING IN FINANCIAL FUTURES AND SECURITIES MARKETS. In The 13th International scientific and practical conference “Information and innovative technologies in the development of society”(April 02–05, 2024) Athens, Greece. International Science Group. 2024. 321 p. (p. 222). (10个).

- Song, J., Cheng, Q., Bai, X., Jiang, W., & Su, G. (2024). LSTM-Based Deep Learning Model for Financial Market Stock Price Prediction. Journal of Economic Theory and Business Management, 1(2), 43-50.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).