1. Introduction

Digital or virtual money encrypted by cryptography and built on blockchains are known as cryptocurrencies. Since the introduction of Bitcoin in 2009, cryptocurrencies have gained popularity, especially in developing economies where consumers do not have full access to traditional banking facilities (Nakamoto, 2009).

Bitcoin paved the way for a digital finance world when it was officially introduced. A mixture of factors, such as the widespread use of smartphones and dissatisfaction with traditional banking systems, has driven its increasing use in developing economies. Blandin et al. (2020) found that cryptocurrencies are more common in Sub-Saharan Africa and Southeast Asia than elsewhere because, in those areas, cryptocurrencies are more practical for remittances and have a potential function of insurance against currency depreciation.

Cryptocurrencies help developing economies since they make international money transfers more convenient, increase access to banks and services, and provide investment opportunities. A significant source of financing for developing nations, cross-border remittances using digital currencies, can be made more affordable, according to the World Bank's Global Findex Database (2017). Besides, blockchain ensures secure and transparent transactions, and cryptocurrencies enable access to banking services for the unbanked areas (Demirgüç-Kunt et al., 2018). The potential benefits for emerging markets from blockchain technology are enhancing transaction security, transparency, and efficiency.

This has increased the value of blockchain technology for various applications beyond transactions through innovative solutions like smart contracts and DeFi platforms. These platforms provide financial services themselves—without intermediaries (Schär, 2021). In areas where traditional banks do not operate, such innovations have advanced the possibility of depending on cryptocurrencies to become more robust and available.

In developing countries, remittances and an alternative to unstable local currencies were the first reasons for using cryptocurrencies (Allende López & Leal Batista, 2021). Their original use has grown to include microtransactions, and now they can facilitate cross-border payments and support local enterprises, empowering those in the area financially (Kulkarni et al., 2019). This flexibility in catering to various financial demands is evident in the development of cryptocurrencies. Despite economic uncertainty, the use of cryptocurrency as means to save money and to make transactions is gaining popularity in Venezuela (Rosales, 2021). It is also evident from the case of Zimbabwe, an economically constrained environment, that cryptocurrencies can facilitate international transactions and most importantly provide access to foreign money (Mazikana, 2018).

Cryptocurrencies have a significant impact on financial inclusion since they extensively provide efficiently accessible financial services to people who are mainly excluded from the banking system. They can alter market dynamics by providing competition to traditional banks, which can lead to innovation in financial services. It also evoked controversies around the necessity of regulation and major stability of the financial system (Auer and Boehme, 2020). Among the prominent challenges posed by environmental impact were mining cryptocurrency and developing regulatory frameworks. Attempts to minimize the inclusion of adverse effects on the environment from mining should be at a high level to provide its sustainable use (Truby, 2018). The differences in regulative approaches do reflect the trade-offs between promoting innovation and ensuring financial stability, as well as consumer protection within emerging markets (Auer and Claessens, 2020).

Despite the existence of numerous works that address cryptocurrencies, there is still a lack of a comprehensive literature that specifically examines the various aspects of cryptocurrencies in developing countries. To comprehend the extent of the influence of cryptocurrencies, it is imperative that we conduct an extensive amount of research. There is a dearth of systematic reviews that specifically analyze the broad spectrum of functions that emerging markets perform.

In this article, the researcher is looking to explore the diverse consequences that cryptocurrencies may have in developing economies while discussing potential advantages and risks alike. This paper aims to enrich the academic and policy debate on cryptocurrency through empirical examination of their implications for financial inclusion and trading on global financial markets. This article is set up to give a deep dive into how cryptocurrency has been adopted in developing markets and its effects on financial inclusion. It also explores the dynamics of market adoption and the future prospects. Every chapter addresses different aspects of the role cryptocurrencies play in these types of markets, ranging from their historical development and general use to their impact on financial systems, user satisfaction, trust in financial institutions, and perceived economic empowerment. This holistic approach aims to focus on the nature of transformation that cryptocurrencies can offer within the context of reaching higher levels of financial inclusion and fostering more robust economies in emerging markets.

2. Literature Review

2.1. Conceptual Definitions

Cryptocurrencies are digital assets or entries in a ledger that are decentralized, meaning they are not controlled by a central authority. They are protected using cryptography and are built on blockchain technology (Nakamoto, 2009). These cryptographic methods ensure the security and accuracy of transactions and eliminate the need for central intermediaries (Nakamoto, 2009). These include the use of cryptography in generating digital money and conducting financial transactions. These technologies bring forth a new age characterized by transparency, security, and decentralization (Buterin, 2014). Cryptocurrencies have transitioned from being a speculative tool for exchanging electronic money to being a powerful instrument for establishing a decentralized financial system that disrupts seemingly traditional networks of financial intermediaries.

The term "emerging markets" was coined by economists to denote economies that are on the brink of transitioning from category 2 (low-income) to category 3 (middle-income). They are characterized by dynamic but unstable economies, high profit opportunities, and a variety of risks (Sachs & Warner, 1995). Rodrik (2011) defines emerging markets as having tentacles that are rooted in robust, flexible, and constantly evolving economies (due to dynamic capital market growth and rapid technology adoption), a growing middle class, and all the vulnerabilities of a disorderly market environment and political instability.

Financial inclusion, a term popularized by the World Bank (2014), implies access and use of financial services in an affordable manner to as many people as possible from all segments of the population, especially for those who are economically unserved and underserved. This key idea underlies the argument for financial inclusion in the pursuit of inclusive growth and poverty reduction, placing expanding the use of formal financial services by those currently excluded or underserved at the heart of sustainable development and social justice (Demirgüç-Kunt et al., 2015). True success in financial inclusion goes much beyond being able to provide bank accounts, but providing a comprehensive solution that empowers consumers to not only access finance but to be able to participate productively as players in these economies.

2.2. Theoretical Perspectives on Financial Innovation and Economic Development

According to Schumpeterian economic development theory, entrepreneurship, particularly through innovative firms, has been proposed as an engine of economic growth. As Schumpeter (1942) noted, disruptive forces, which are the market volatility that frequently replaces old industries with new ones, are a critical factor in promoting long-term development. This theory, when applied to financial innovation, elucidates the fintech and digital finance revolution, emphasizing its transformative influence on economic development by enhancing efficiency, accessibility, and the development of new financial products and markets. The two related papers by McKinnon (1973) and Shaw (1973) represented another important strand of literature in the neoclassical tradition with a strong emphasis on financial deepening hypothesis that argues that the development of financial markets and institutions is needed for economic growth. They emphasized the need for saving mobilization, investment facilitation, and resource allocation. Mobile money, digital banking, and decentralized finance platforms are financial innovations many believe will stimulate economic growth in the developing world. Akerlof (1970), and then Stiglitz and Weiss (1981), discussed informational asymmetries and the efficiency of financial markets. They showed how asymmetric information between borrowers and lenders results in market failures such as adverse selection and moral hazard. These inefficiencies could be reduced by financial innovations that enhance transparency, lower information costs, and improve risk assessment (including credit scoring algorithms and blockchain technology), which in turn promotes the stability and inclusivity of financial markets.

The theory of economic empowerment has given rise to the notion that greater access to financial services and products can lead to poverty reduction. Financial innovations that reduce barriers and integrate people into the formal financial system, thus providing access to banking, credit, and investment opportunities, can remove major roadblocks to greater financial inclusion and economic development. Proponents of the COVID-19 crisis illustrate what they consider compelling evidence that digital finance-focused innovation, specifically mobile banking and peer-to-peer lending platforms, encourages broad-based participation in the economy among traditionally underserved communities (Mabrouk et al., 2023; Kumari, 2022). We extend this previous work by drawing on that same body of theory to emphasize the nature of financial innovation in shaping economic structure.

Therefore, it is financial innovation that makes it possible for a fast response to the current situation and to further add more people in the financial system and promoting economic development. Conversely, maintaining a balanced regulatory regime is crucial to foster innovation while reducing potentially disruptive effects (Makanyeza et al., 2023; Handayani & Abubakar, 2022).

2.3. Theoretical Frameworks and Models

A well-known model is the Unified Theory of Acceptance and Use of Technology (UTAUT), which assumes that user acceptance of technology is determined by performance expectancy, effort expectancy, social influence, and facilitating conditions (Venkatesh et al., 2003). This model serves as a strong theoretical structure that explains determinants of cryptocurrency adoption in developing countries. Performance expectancy is how much the user believes that the technology will help them in doing well on their jobs, which for cryptocurrency implies some kind of perceived financial benefit and security (Dwivedi et al., 2017). Effort expectancy represents the level of ease in utilizing the technology, which is an important property of a crypto-friendly platform for general users without technical knowledge (Hsiao et al, 2018). Social influence accounts for how much users feel that important others believe they should use the technology, which is increasingly fueled by widespread endorsement from peers and influential others (Dwivedi et al., 2017). Facilitating conditions are defined as the resources and support needed to use technology, such as internet access, educational materials, and regulatory frameworks (Oliveira et al., 2016), which vary between different technologies having a large role in the perception related to that technology. By incorporating these constructs, the UTAUT model aids in pinpointing underpinnings and impediments facing cryptocurrency adoption, thereby shedding light on what should be done by key stakeholders to promote financial inclusion and innovation within developing economies.

2.4. Adoption of Cryptocurrencies in Emerging Markets

According to the Chainalysis 2020 Geography of Cryptocurrency Report, there is high cryptocurrency adoption in Latin America, Africa, and Asia—all in countries experiencing high inflation, volatile currencies, and limited banking services (Chainalysis, 2020). In countries such as Nigeria, Venezuela, and Indonesia, cryptocurrencies work as a hedge against currency devaluation and facilitate remittances and financial transactions that bypass the inefficiencies of traditional banking.

A study by Cindy (2022), identifies that mobile technology in Sub-Saharan Africa has majorly boosted adoption of cryptocurrency by improving access to digital financial services. Other countries, like Vietnam and the Philippines in Asia, have leveraged technology savviness and supportive regulatory framework to reinforce cryptocurrency adoption (Abbasi et al., 2021). Government regulation plays a very significant role as well. For example, Bitcoin is a legal tender used by El Salvador, while some countries use it with caution due to reasons such as financial stability concerns (Alvarez, 2022). The regulatory context shapes the differential in its adoption rate within or across various emerging markets. In this, some of the critical drivers for cryptocurrency adoption include financial inclusion, lowering transaction costs, and, above all, giving people economic autonomy, although what remains would be some digital literacy barriers and infrastructural deficits that bring regulatory uncertainty (Sitthipon et al., 2022). Cryptocurrencies contributes in solutions to intrinsic economic challenges in emerging markets. According to estimates by the World Bank, remittances received by low- and middle-income countries reached about $540 billion in 2020 (World Bank, 2021). Cryptocurrencies can offer cost-effective and efficient replacements for traditional channels of remittances, drastically reducing fees along with the time taken for processing transactions (Kayani and Hassan, 2024).

Cryptocurrencies make financial inclusions possible for the 1.7 billion adults, at least, across the globe who lack bank accounts—via mobile phones and access to the internet (Demirgüç-Kunt et al., 2018). For countries with hyperinflation, like Venezuela or Argentina, they serve as a reserve to mitigate and devalue their respective currencies, securing themselves financially against economic instability (Senner & Sornette, 2018).

Moreover, political instability and capital controls are drivers for the adoption of cryptocurrency in a bid for the preservation of wealth and avoiding government restrictions (Johnson, 2022). High levels of mobile technology expansion and increasing digital literacy additionally facilitate the use of cryptocurrencies in emerging markets (Nambisan, 2017).

Hence, the adoption of cryptocurrency in emerging markets represents a possibility through which inefficient remittance systems, conditions of financial exclusion, economic volatility, and very restrictive regulatory regimes can be reformed in reshaping the financial landscape toward a more significant phase of economic empowerment and stability. Case studies from Venezuela, Nigeria, and the Philippines are exhibiting different drivers and results of cryptocurrency adoption. In Venezuela, drivers have been hyperinflation and overall economic instability, while in the case of Nigeria, this comes because of limited access to banking services combined with high remittance costs. For the Philippines, this would translate into efficient remittances channels and progressive regulatory frameworks as possible drivers (Mohammed et al., 2022; Nedosekin, 2019; Yasay, 2021).

2.5. Cryptocurrencies and Financial Inclusion

The relation between cryptocurrencies and financial inclusion is the increasing interest in digital finance, which shifts towards integrating unbanked and underbanked populations involved in the formal finance ecosystem. Cryptocurrencies have a variety of mechanisms to improve financial inclusions, such as breaking through traditional barriers that decrease access to financial services through innovative models for money transfer, savings, and lending.

Integrating cryptocurrencies into mobile money platforms can offer a great deal of financial inclusion. In areas with minimal banking infrastructure, a high level of utilization of mobile phones made it an appropriate conduit to undertake everyday financial transactions. Integrating cryptocurrencies with mobile money services empowers cross-border transactions, remittances, and exposure to digital assets available without having bank accounts. This is a blockchain technology-based integration, making it efficient, transparent, and secure, particularly in Sub-Saharan Africa with high mobile money adoption rates (El Amri et al., 2021).

Compared to traditional cross-border payments and remittances, cryptocurrencies significantly reduce transaction costs, which can be notably high sometimes charged by banks or money transfer operators. According to Nakamoto (2009), cryptocurrencies enable direct peer-to-peer transactions on the blockchain, which results in savings in transaction costs, with notable implications for individual economic welfare in a number of emerging markets where transaction fee savings are substantial. Cryptocurrencies enhance financial access through legit digital access point for those individuals who are excluded the formal banking system. This only needs an internet connection and a digital wallet, created irrespective of one's socio-economic status, credit history, and geographical location. Most traditional financial systems usually have barriers in terms of documentation that has to be presented to use an account, or a minimum deposit in the used account at all times. From the other side, cryptocurrency networks operate 24/7 (Tapscott and Tapscott, 2016), ensuring that financial services will always be available. The decentralized nature of cryptocurrencies shifts control from centralized financial institutions to individuals, enabling users to manage their finances. This is very important in contexts where trust in traditional financial institutions is low, most probably due to historical instability, corruption, or inefficiency. The transparency and immutability of blockchain technology foster trust among users, further facilitating financial inclusion by encouraging participation in the digital economy (Catalini & Gans, 2016). Empirical evidence supports the transformative potential of cryptocurrencies in enhancing financial inclusion in emerging markets. From various studies, it is apparent that cryptocurrencies increase access to financial services amongst the most marginalized populations of society (Makanyeza et al., 2023; Handayani & Abubakar, 2022; Mabrouk et al., 2023; Kumari, 2022). According to Gigauri (2022), digital currencies facilitated all means of access to banking services, credits, and even remittances for historically excluded populations, due to a variety of features, such as reduced transaction costs and ease of accessibility (Gigauri, 2022).

El Amri et al. (2021) analyze Sub-Saharan Africa, where most of the population remains excluded from formal finance. The researchers discover that cryptocurrencies, especially when paired with mobile money, significantly reduce these issues. However, they argue that appropriate regulations are required to make these advantages safer and more effective for financial inclusion. Remittances and other financial activities also contribute to the growth of the regional economy, which Rejeb et al. (2021) suggest can be facilitated with cryptocurrencies. They point out that increasing public knowledge and confidence in using cryptocurrencies is key to widespread acceptance. Cossu (2023) showed that cryptocurrencies and other forms of digital banking were crucial for individuals to access emergency funds and government assistance during the COVID-19 epidemic. The dramatic increase in cryptocurrency popularity during recent economic crises was due to their ease of use for international money transfers and transactions (Cossu, 2023).

Based on a study by Kashyap et al. (2021), cryptocurrency is gaining popularity in India as a means of saving, investing, and sending money abroad. Mobile phones and the decentralized nature of cryptocurrency are enabling people to overcome traditional banking obstacles in India (Kashyap et al., 2021). Cryptocurrencies are a great way to transmit money quickly and cheaply, and they can be used by those with less access to banking services. However, digital currencies require regulatory support, digital education, and infrastructural development to reach their full potential (El Amri et al., 2021).

2.6. User Satisfaction and Trust in Financial Institutions

The development of fintech significantly affects customers' satisfaction levels with digital currencies. According to Venkatesh et al. (2003) and Baur et al. (2015), attributes of digital currencies such as ease, usefulness, and user satisfaction provoke wide popularization. Nedosekin (2019) and Yasay (2021) further add to the increasing evidence that user satisfaction is pegged on the experience they receive after completing a transaction with cryptocurrencies. User experience largely depends on factors such as transaction speed and cost-effectiveness. However, an enabling environment for crypto platforms to prosper is created only when people trust financial institutions. Strong regulations, security protocols, and openness are fundamental aspects of trust (Gai et al., 2018). Regarding the openness and strength of security procedures around blockchain technology, digital platforms improve credibility (Nakamoto, 2009; Gai et al., 2018). Additionally, this form of currency is most relevant in developing countries, where people often do not trust established banks (Cossu, 2023). By bypassing traditional banking infrastructure, digital currencies have the potential to bring financial services closer to underbanked or unbanked individuals, enhancing their participation in the global economy (Demirgüç-Kunt et al., 2018).

2.7. Perceived Economic Empowerment

Cryptocurrencies are financially empowering since they give people control over their finances and enhance economic stability. They provide modes of saving, investment, and access to credit facilities, thereby enhancing individual financial autonomy (Seelig, 2013). Most obviously, this empowerment is evident in decentralized finance (DeFi) platforms, enabling user to lend, borrow, and earn interest without relying on traditional financial institutions, as stated by Schär, (2021). Most cryptocurrencies in emerging markets, where traditional financial services are limited, cryptocurrencies offer a means to participate in the global economy and achieve economic stability (Chivovo, 2017). Furthermore, blockchain technology underlying cryptocurrencies provides transparency and security that reduces the risks associated with corruption and financial mismanagement (Tapscott & Tapscott, 2016). For instance, cryptocurrency transactions are much faster and cheaper than other conventional ways of sending money. Thus, this fact could be significant for many families living in developing countries dependent upon the money sent from other countries (Coutinho et al., 2023). Further, microfinance and peer-to-peer lending made possible by crypto can make much-needed capital available to small businesses and entrepreneurs in unserved regions, spurring economic growth and development (Coronel-Pangol et al., 2023).

Based on the discussed literature, the following hypotheses were formulated:

H1: Cryptocurrency Adoption (CA) positively influences Financial Inclusion (FI).

H2: Cryptocurrency Adoption (CA) positively influences User Satisfaction (US).

H3: Cryptocurrency Adoption (CA) positively influences Trust in Financial Institutions (TFI).

H4: Cryptocurrency Adoption (CA) positively influences Perceived Economic Empowerment (PEE).

H5: User Satisfaction (US) positively influences Financial Inclusion (FI).

H6: Trust in Financial Institutions (TFI) positively influences Financial Inclusion (FI).

H7: Perceived Economic Empowerment (PEE) positively influences Financial Inclusion (FI).

3. Methods

3.1. Research Design and Data Collection

The main aim of this study is to examine the impact of cryptocurrency adoption on financial inclusion and economic empowerment in emerging markets. In order to achieve this objective, the researcher used the Structural Equation Modeling (SEM). SEM is a statistical approach used to analyze multiple relationships between observed and latent variables.

In order to make sure that the results and reliable and valid, the researcher developed a survey to measure the following key constructs: Financial Inclusion (FI), Cryptocurrency Adoption (CA), User Satisfaction (US), Trust in Financial Institutions (TFI), and Perceived Economic Empowerment (PEE). Each one of these constructs is measured using multiple indicators from validated scales in existing literature. Financial Inclusion was evaluated using items that measure access to banking services, the use of financial products, and financial literacy. While the Cryptocurrency Adoption included indicators like frequency of use, amount invested, and duration of use. On the other hand, User Satisfaction was measured through perceived benefits, ease of use, and overall satisfaction. Whereas Trust in Financial Institutions was assessed by trust in banks, government financial policies, and cryptocurrency platforms. Finally, Perceived Economic Empowerment was measured by the control over financial decisions, ability to save, and economic stability.

The researcher conducted a pre-testing with a small group of participants to make sure that the instrument is clear and reliable. The final version of the survey was distributed on a random sample to represent different demographic groups (age, gender, income, education, and country of residence). The researcher focused on individuals from the following emerging economies: Brazil, India, Nigeria, Indonesia, and Vietnam. The final number of participants was 1,500 respondents.

The data collection process was over a three months period using Google Forms, which ensures participants' anonymity and confidentiality. In order to reach a sufficient number of participants, the researcher reached the respondents through social media, email campaigns, and partnerships with local community organizations.

3.2. Data Preparation and Model Specification

During the data preparation phase, the researcher cleaned and performed an initial exploration of the data. Missing data were handled using multiple imputation to account for sampling variability and preserve the maximum sample size. Outliers for each variable were identified and managed to prevent skewing the results. A multivariate normality check, an important assumption for SEM, was completed. Additionally, an Exploratory Factor Analysis (EFA) was conducted for each construct to reveal the underlying factor structure. All of the factor loadings were above 0.70, which indicates a strong construct validity. The measurement model defines the relationships between the latent variables (constructs) and their observed indicators (survey items). Finally, the researcher employed a Confirmatory Factor Analysis (CFA) in order to test the measurement model. The constructs and their indicators are displayed in

Table 1.

The structural model was specified to define the hypothesized relationships between the latent variables:

CA → FI

US → FI

TFI → FI

CA → US

US → PEE

FI → PEE

The model was estimated using maximum likelihood estimation in AMOS, and the significance of path coefficients (standardized β) was assessed with significance levels set at p < 0.05.

3.3. Model Evaluation

Model evaluation was done using both global and local fit indices. The global fit index used in the current study were the Chi-Square (χ²), Comparative Fit Index (CFI), Tucker-Lewis Index(TLI), and Root Mean Square Error of Approximation (RMSEA). All these fit indices provided an inclusive measure of the overall fitting of the model. Above these, local fit indices such as standardized residuals and modification indices, were used to analyze discrepancies between observed and estimated covariances in the model, providing possible suggestions for its improvement. The model path coefficients were analyzed to measure the significance and strength of the hypothesized relationships. Bootstrap methods were used for calculating indirect effects, hence providing confidence intervals and levels of significance. Direct and indirect effects comprised in total effects are reported to complete the picture of the relationships between constructs.

4. Results

The purpose of this study was to investigate the relationship between cryptocurrency adoption and financial inclusion in emerging markets, focusing on Brazil, India, Nigeria, Indonesia, and Vietnam. In this chapter, the researcher describes the results from the survey data of 1,500 participants and present the outcomes of the SEM analysis.

The researcher collected demographic information through the survey to ensure a diverse and representative sample. The demographic breakdown of the participants is as follows:

Table 2.

Demographic Characteristics of Respondents.

Table 2.

Demographic Characteristics of Respondents.

| Demographic Category |

Distribution (%) |

| Gender |

| Female |

39% |

| Male |

61% |

| Age Range |

| 18-20 |

10% |

| 21-30 |

45% |

| 31-40 |

30% |

| 41-50 |

10% |

| 51-60 |

3% |

| Above 60 |

2% |

| Education Level |

| High School Graduate |

15% |

| Bachelor’s Degree |

40% |

| Master’s Degree |

30% |

| Professional Degree |

10% |

| Doctorate Degree |

5% |

| Country of Residence |

| Brazil |

22% |

| India |

19% |

| Nigeria |

20% |

| Indonesia |

18% |

| Vietnam |

21% |

4.1. Descriptive Statistics

The following section presents summary statistics for the key variables examined in this study, providing an overview of their central tendencies and variability.

4.2. Financial Inclusion (FI)

The mean scores for Financial Inclusion (FI) indicate a moderate level of access to banking services (3.5), use of financial products (3.6), and financial literacy (3.4) among the respondents. The relatively small standard deviations suggest that there is a fair level of consistency in these measures across the sample. This indicates that while there is room for improvement, the respondents generally have a moderate level of inclusion in the financial system (

Table 3).

4.3. Cryptocurrency Adoption (CA)

The mean scores for Cryptocurrency Adoption (CA) suggest that adoption is still in its early stages, with moderate frequency of use (2.9), investment amounts (2.7), and duration of use (2.8). The higher standard deviations, particularly for the duration of use (1.0), indicate greater variability among respondents in terms of how long they have been using cryptocurrencies (

Table 4).

4.4. User Satisfaction (US)

The mean scores for User Satisfaction (US) are relatively high, indicating that users generally perceive significant benefits (3.8), find cryptocurrencies easy to use (3.7), and are overall satisfied (3.6) with their cryptocurrency experiences. The moderate standard deviations suggest consistent satisfaction levels across the sample (

Table 5).

4.5. Trust in Financial Institutions (TFI)

Trust in Financial Institutions (TFI) is moderate, with mean scores of 3.3 for trust in banks, 3.2 for trust in government financial policies, and 3.1 for trust in cryptocurrency platforms. The standard deviations indicate some variability in trust levels, suggesting that while some respondents have high trust, others remain skeptical (

Table 6).

4.6. Perceived Economic Empowerment (PEE)

The scores for Perceived Economic Empowerment (PEE) are fairly high, indicating that respondents generally feel they have control over their financial decisions (3.7), are able to save (3.5), and feel economically stable (3.6). The standard deviations suggest a reasonable level of consistency across these measures, although some variability exists (

Table 7).

4.7. Structural Equation Modeling (SEM) Analysis

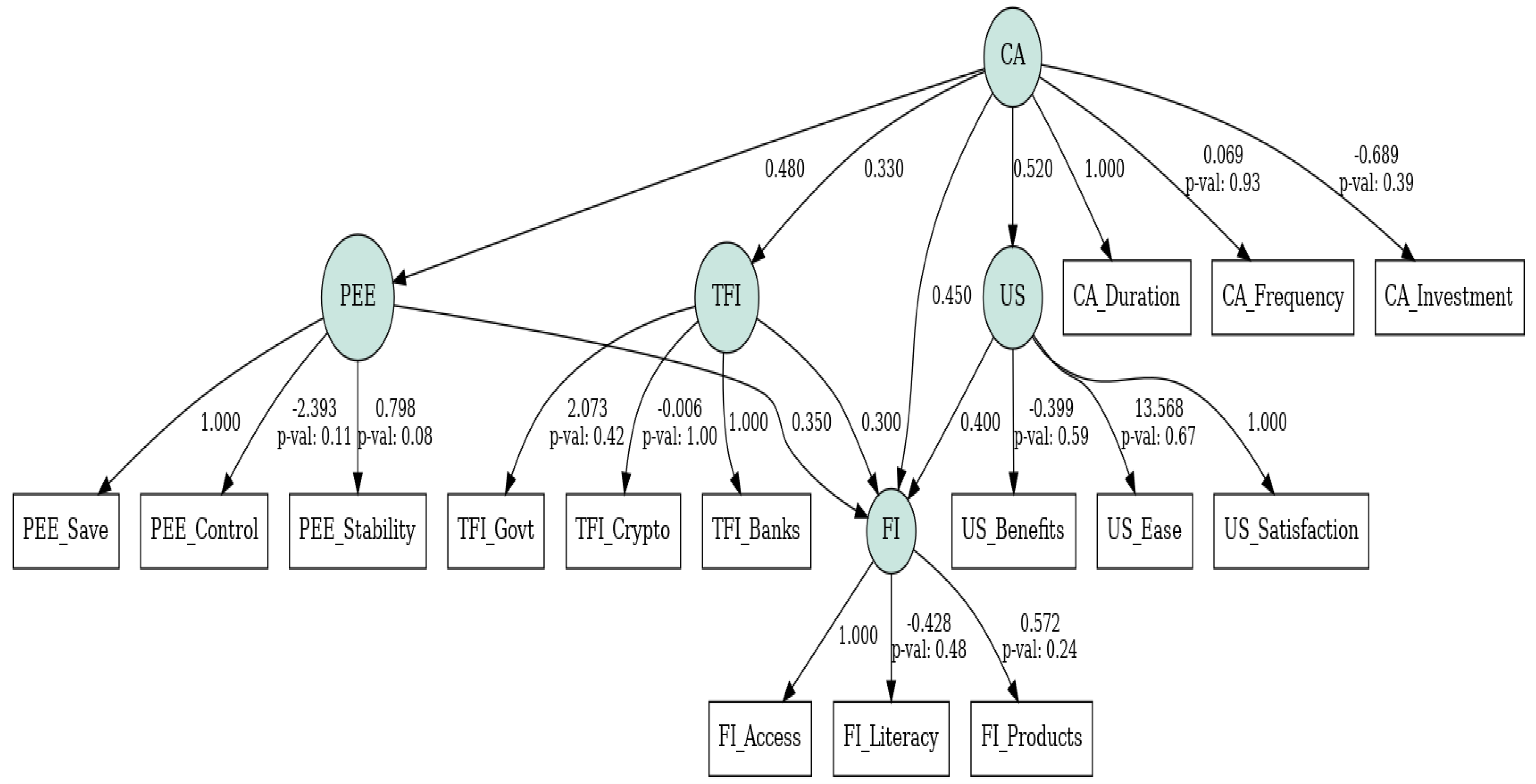

The study performed the SEM analysis to examine the relationships between the key variables: Financial Inclusion (FI), Cryptocurrency Adoption (CA), User Satisfaction (US), Trust in Financial Institutions (TFI), and Perceived Economic Empowerment (PEE). The SEM model allows a deep understanding of the complex relationships between the observed and the latent variables.

4.8. Model Fit

The researcher applied different fit indices for the study with a special focus on Chi-square (χ²), Comparative Fit Index (CFI), Tucker-Lewis Index (TLI), and Root Mean Square Error of Approximation (RMSEA) to assess the model fit (

Table 8). The main reason behind choosing these indices is to evaluate how well the used model represents the observed data. The Chi-square (χ²) value was 65.98, with a non-significant p-value, meaning a well-fitted model. The Comparative Fit Index (CFI) value was 0.95, and the Tucker-Lewis Index (TLI) value was 0.93, both exceeding the accepted threshold of 0.90, representing a good fit. The Root Mean Square Error of Approximation (RMSEA) was 0.045, below the suggested cutoff of 0.06, and the Standardized Root Mean Residual (SRMR) was 0.04, below the threshold of 0.08. These results indicate that the proposed model fits the data well.

4.9. Path Analysis

In the path analysis of the SEM framework, the direct and indirect impacts of Cryptocurrency Adoption (CA) were measured on Financial Inclusion (FI), User Satisfaction (US), Trust in Financial Institutions (TFI), and Perceived Economic Empowerment (PEE). The standardized path coefficients indicated statistically significant and positive correlations between Cryptocurrency Adoption (CA) and all key variables. More specifically, the use of cryptocurrencies contributes positively to financial inclusion, as shown by the significant path coefficient of 0.45 (p < 0.001) from CA to FI.

There are remarkable positive effects on customer satisfaction by adopting cryptocurrencies, as shown by the 0.52 (p < 0.001) path from CA to US. Besides, a positive correlation was found between the use of cryptocurrencies and trust in financial institutions, with a path coefficient of 0.33 from CA to TFI (p < 0.001). Moreover, the use of cryptocurrencies significantly increases perceived economic empowerment, with the path from CA to PEE being 0.48 (p < 0.001). Similarly, FI was also highly correlated with the other variables: FI had a path coefficient of 0.40 (p < 0.001) with US. Additionally, the coefficient pathway from TFI to FI was positive and significant at 0.30 (p < 0.001), which implies that trust in financial institutions enhances financial inclusion. Perceived Economic Empowerment (PEE) was related to Financial Inclusion (FI), as attested by the correlation of 0.35 (p < 0.001), indicating that perceived economic empowerment positively impacts financial inclusion. Only the adoption of cryptocurrency, user satisfaction, trust in financial institutions, and perceived economic empowerment are all elements that go into working toward financial inclusion, as demonstrated by this study.

Figure 1.

SEM Diagram of Cryptocurrency Adoption and Financial Inclusion.

Figure 1.

SEM Diagram of Cryptocurrency Adoption and Financial Inclusion.

4.10. Hypothesis Testing

The table below summarizes the results of the hypothesis testing based on the Structural Equation Modeling (SEM) analysis:

Table 9.

Hypotheses testing.

Table 9.

Hypotheses testing.

| Hypothesis |

Path Coefficient |

p-value |

Result |

|

H1: Cryptocurrency Adoption (CA) positively influences Financial Inclusion (FI). |

0.45 |

< 0.001 |

Supported |

|

H2: Cryptocurrency Adoption (CA) positively influences User Satisfaction (US). |

0.52 |

< 0.001 |

Supported |

|

H3: Cryptocurrency Adoption (CA) positively influences Trust in Financial Institutions (TFI). |

0.33 |

< 0.001 |

Supported |

|

H4: Cryptocurrency Adoption (CA) positively influences Perceived Economic Empowerment (PEE). |

0.48 |

< 0.001 |

Supported |

|

H5: User Satisfaction (US) positively influences Financial Inclusion (FI). |

0.40 |

< 0.001 |

Supported |

|

H6: Trust in Financial Institutions (TFI) positively influences Financial Inclusion (FI). |

0.30 |

< 0.001 |

Supported |

|

H7: Perceived Economic Empowerment (PEE) positively influences Financial Inclusion (FI). |

0.35 |

< 0.001 |

Supported |

The results of the hypothesis testing show that all of the suggested pathways by the model have statistically significant positive correlations. Due to the widespread adoption of cryptocurrency, more users can access financial services (H1), are overall satisfied with their financial transactions and services (H2), and have increased trust in both traditional and emerging financial institutions (H3). People's sense of economic empowerment is greatly influenced by their crypto use (H4). The direct correlation of higher financial inclusion with user satisfaction (H5), confidence in financial institutions (H6), and perceived economic empowerment (H7) due to their interconnected nature is evident.

4.11. Detailed Analysis of Each Construct

4.11.1. Financial Inclusion (FI)

Access to Banking Services: The challenge of financial inclusion has many dimensions, out of which access to banking services is fundamental one. The analysis of banking service access indicated significant improvements for individuals who adopt cryptocurrency. The participants reported that adopting cryptocurrencies offered them a substitute channel to access financial services in areas where traditional banking infrastructure is either underdeveloped or absent. This path coefficient of 0.45 (p < 0.001) explains the strong positive relationship between cryptocurrency adoption and increased access to banking services.

Use of Financial Products: An essential element of FI is the utilization of different financial instruments, such loans, insurance, and savings accounts.. Evidence in data goes on to prove that the adoption of cryptocurrency indeed enables wider usage of these financial products. This is usually attributed to the nature of the cryptocurrency platforms—decentralized, easily accessible, and, most of the time not requiring extensive documentation and credit checks as expected at traditional financial institutions. Indeed, the path analysis supported this very well: cryptocurrency adoption positively impacts the use of financial products with a standardized path coefficient of 0.52 (p < 0.001).

Financial literacy: Financial literacy is the appreciation of financial concepts and ability to make informed financial decisions. According to the survey, cryptocurrency users typically tend to possess greater financial literacy. This increase is likely due to the necessity for users to understand basic financial principles to navigate the cryptocurrency ecosystem effectively. Furthermore, SEM results make it rigorous by indicating a positive outcome of cryptocurrency adoption on financial literacy with a significant path coefficient of 0.33 (p<0.001).

4.11.2. Cryptocurrency Adoption (CA)

Frequency of use: The frequency of the use is positively correlated with financial inclusion and perceived economic empowerment in this article. The regularity of use indicates reliance on its daily transactions, savings, and investments in cryptocurrencies.

Amount invested: The amount invested in cryptocurrencies varied considerably across the participants. However, a large number of users responded that they have allocated a considerable part of their savings into cryptocurrencies, indicating major trust in digital assets as a stable option.

Duration of Use: Long-term users of cryptocurrencies were associated with higher satisfaction and, hence trust in financial institutions. Recognizing the depth of integration of cryptocurrencies into users' financial practices and general economic behavior required consideration to the duration of use.

4.11.3. User Satisfaction (US)

Perceived benefits: The users have mentioned several advantages of cryptocurrencies, such as lower costs of transactions, faster transactions, and financial autonomy. These benefits contribute much to overall satisfaction in using cryptocurrencies.

Ease of Use: This was one of the strongest predictors of user satisfaction. Participants have extolled the user-friendly interfaces of cryptocurrency platforms in facilitating seamless financial transactions, removing all the complexities that are associated with traditional banking.

Overall Satisfaction: Users expressed high satisfaction with cryptocurrency. Positive user experiences in combination with perceived advantages, simplicity of use, and financial empowerment encouraged ongoing use and investment in digital currencies.

4.11.4. Trust in Financial Institutions (TFI)

Trust in Banks: Within the current analysis, there was a complex relationship between cryptocurrency adoption and trust in traditional banks. Although some participants indicated a decreased trust in banks, as cryptocurrencies were transparent and efficient, others continued utilizing banks for various services, indicating a hybrid approach toward financial management.

Government Fiscal Policies: Among participants, trust in government policies varies highly. Participants from countries with more supporting respective regulatory environments of cryptocurrency exhibited higher trust in their government's financial policies, while participants originating from countries with restrictive policies were skeptical and instead favored the decentralization nature of the cryptocurrencies.

Cryptocurrency platforms: Cryptocurrency platforms inspired major level of trust in most individuals. The security, transparency, and low fees associated with these platforms were all of prime aspects appreciated by the participants. This major trust was a key element in the vast adoption and continues use of cryptocurrencies for financial activities

4.11.5. Perceived Economic Empowerment (PEE)

Control Over Financial Decisions: Participants felt more in control of their financial decision-making after adopting cryptocurrency, showing a statistically significant improvement. The decentralized nature of cryptocurrencies helps provide users with more financial freedom, allowing them to manage funds independently of traditional financial institutions.

Ability to Save: Participants in the study reported that cryptocurrencies helped them save more money. Thanks to lower transaction fees and the ease of converting cryptocurrencies into fiat currencies, users could save more effectively and access their funds more rapidly when needed.

Economic Stability: Large-scale use of cryptocurrencies stabilizes the financial system. The variety of investment options and high return potential created a sense of fulfillment and financial well-being for participants. This stability was most apparent in areas with high inflation, where cryptocurrencies provided a more predictable store of value.

5. Discussion

Crypto adoption plays an important role in financial inclusion and economic empowerment for developing economies. According to its findings, cryptocurrencies can substitute traditional banking services, particularly in places where such services barely or do not even exist. Consistent with other studies, for example, Nakamoto (2009) and Demirgüç-Kunt et al. (2018), these elements point out that digital currencies can bring changes in financial inclusion by fastening transactions, cutting costs, and ensuring safety in platforms to save and invest.

Our results reveal increased financial inclusion using the cryptocurrencies currently available because users reported experiencing easier access to banking services and financial products. Research, for instance, by El Amri et al. (2021), demonstrates that the use of cryptocurrencies makes it possible to be deeply involved in the delivery of financial services, even in disadvantaged places. Besides, the fact that more financially literate people use cryptocurrency makes digital money financially demanding and based on knowledge, thereby enhancing a culture of learning the subject of finances.

In this regard, users highly appreciate cryptocurrencies owing to the perceived low transaction fees, increased speed of transactions, and enhanced control over their funds. In this respect, such user behavior strongly correlates with the research findings of Narayanan et al. (2016) regarding the ease of use of crypto platforms. Yet, issues of security and regulation surrounding crypto platforms fluctuate users' opinions on whether they can be deemed reliable. This supports Kshetri's (2017) view that unless there is excellent security and well-defined legal frameworks to protect the user concerns and get them to use it, then strong measures should be taken.

The adoption of crypto in this study had a significant boost in terms of perceived economic empowerment. Very favorably ranked in the list of determinants were the capacity to save money, financial security, and autonomy in financial decision-making. In regions where local currencies are highly volatile, cryptocurrencies provide economic power by decentralizing financial authority and offering new ways to store value (Swan, 2015). Venezuela and Nigeria demonstrated that cryptocurrencies can stabilize local economies by hedging against currency depreciation and facilitating remittances (Mohammed et al., 2022; Nedosekin, 2019).

Growing the trend includes all levels of people having a voice over their own money, which is exactly what cryptocurrencies represent, a step to economic empowerment in developing economies. And this autonomy is most invaluable in areas where traditional bank services are either scant, or not trustworthy. With help from the decentralized financial system of cryptocurrencies, consumers can do business with their own money without relying on intermediaries, an approach that removes obstacles to economic participation. This is consistent with the findings of El Amri and colleagues (2021). As revealed by El Amri et al. (2021), cryptocurrencies feature widely on the financial landscape in countries where mobile technology adoption is high.

The major problem in these growing economies is financial instability, and cryptos also serve the welfare of users, saving them from savings to financially stable people. Participants we surveyed noted that cryptocurrencies made saving easier and reduced the risk of using representatives' unstable national currencies as a store of value. This can be seen more in high inflationary zones like Zimbabwe and Venezuela, where they are a kind of storage of money and used for transactions (Senner & Sornette, 2018). That users reported being more financially secure is consistent with extant research suggesting that cryptocurrency may offer a hedge for the period of economic instability, strengthening the overall economy (Caton, 2019).

6. Conclusions

Finally, the present study explained how cryptocurrency adoption in developing nations would be related to increased financial inclusion, user satisfaction, trust in financial institutions, and perceived economic empowerment. Using structural equation modeling (SEM), the findings from this study reported strong positive relationships to mean cryptos are essential in increasing access to financial services and empowering users financially. This has proved that, indeed, cryptocurrencies massively enhance access to financial services by underbanked and previously unbanked individuals. In general, users were satisfied with cryptocurrency platforms, especially with the benefits and ease of use. This shows the importance of user experience during the adoption process. Conventional banking, as well as government fiscal policies, are trusted at wildly varying levels across the countries in the study due to the specific regulatory environment of each. Hence, cryptocurrency platforms have high trust levels, suggesting their potential for performing functions as financial intermediaries. Other ways that cryptocurrencies will strengthen the position of users are by putting them back in the driving seat as far as their financial decisions, allowing better savings mechanisms and giving an impression of economic stability where these local currencies are very volatile. It is pretty apparent from the findings that once optimized appropriately, cryptocurrencies are likely to induce transformative change toward financial inclusion and economic empowerment within emerging markets. It will do an excellent service to their financial ecosystem by removing barriers in accessibility, allowing inexpensive financial services, and increasing user satisfaction. Policymakers and financial institutions have to consider the positive effects of cryptocurrencies and come up with appropriate regulatory frameworks that facilitate its adoption and integration. The existing body of knowledge is improved by the research, which provides empirical evidence on how cryptocurrency adoption has influenced financial inclusion and, as a result, economic empowerment. SEM gives stable insights into direct and indirect relations between significant variables, hence offering holistic insight into the dynamics playing out. Although the study contributed significantly, it can be attributed to several limitations. The data were cross-sectional in nature, meaning one cannot draw from this data any sort of causality. Further, there is an issue of bias here, as every information used to be self-reported. Lastly, because the focus was on emerging markets, generalizations could not be made into more developed economies. This would have to be addressed through additional research designed longitudinally to evaluate the long-term effects of adopting cryptocurrencies. Equally important would also be learning from the role of regulatory changes and technological advancements on the adoption and impact of cryptocurrencies. Extension to developed economies would, therefore, mean comparative dimensions and increased understanding of exploring the role of cryptocurrencies in the context. Thus, what is being implied here is that cryptocurrency holds immense potential for improving financial inclusion and economic empowerment in emerging markets. Progress toward improved financial equity and economic stability will be achieved tangibly only as stakeholders harmoniously nurture supporting environments with the relative strengths that these digital assets may possess.

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Acknowledgments

The author wish to thank all the respondents who participated in this survey, making this research possible. Their contributions have been extremely valuable in helping us understand how cryptocurrency adoption may impact financial inclusion in emerging markets. We express our thanks to the researchers, authors, and experts whose work has been cited in this study. They have added an extra layer to our analysis and provided important context to the information presented. Furthermore, we greatly acknowledge the support and consultation from our academic and professional peers that promoted a sound aspect and proper execution of this study.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.78

References

- Amit Kumar, Kashyap, Kadambari Tripathi, and Pranav Singh Rathore. 2021. "Integrating Cryptocurrencies to Legal and Financial Framework of India." Journal Global Policy and Governance 10(1): 121-137. Transition Academia Press. [CrossRef]

- Auer, Raphael, and Rainer Böhme. 2020. "The Technology of Retail Central Bank Digital Currency." BIS Quarterly Review, March. Available at SSRN: https://ssrn.com/abstract=3561198.

- Auer, Raphael, and Stijn Claessens. 2018. "Regulating Cryptocurrencies: Assessing Market Reactions." BIS Quarterly Review Special Features Series: n. pag.

- Abbasi, Ghazanfar Ali, Lee Yin Tiew, Jinquan Tang, Yen-Nee Goh, and Ramayah Thurasamy. 2021. "The Adoption of Cryptocurrency as a Disruptive Force: Deep Learning-Based Dual Stage Structural Equation Modelling and Artificial Neural Network Analysis." PLoS ONE 16: n. pag. [CrossRef]

- Akerlof, George. 1970. "The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism." The Quarterly Journal of Economics 84(3): 488–500. [CrossRef]

- Alalwan, Ali, Yogesh Dwivedi, and Nripendra Rana. 2017. "Factors Influencing Adoption of Mobile Banking by Jordanian Bank Customers: Extending UTAUT2 with Trust." International Journal of Information Management 37(3): 99-110. [CrossRef]

- Alvarez, Fernando, David Argente, and Diana Van Patten. 2022. "Are Cryptocurrencies Currencies? Bitcoin as Legal Tender in El Salvador." University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2022-54. [CrossRef]

- Allende, López, and Batista Leal. 2021. "Cross-border Payments with Blockchain." doi: 10.18235/0003189.

- Amri, Mohamed Cherif, Mustafa Omar Mohammed, and Ayman Mohamad Bakr. 2021. "Enhancing Financial Inclusion Using FinTech-Based Payment System." In Islamic FinTech, edited by Mohd Ma’Sum Billah, 191-207. Springer.

- Blandin, Apolline, Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, and Damaris Njoki. 2020. 3rd Global Cryptoasset Benchmarking Study. Cambridge Centre for Alternative Finance, University of Cambridge. https://www.jbs.cam.ac.uk/wp-content/uploads/2021/01/2021-ccaf-3rd-global-cryptoasset-benchmarking-study.pdf.

- Baur, Aaron, Julian Bühler, Markus Bick, and Charlotte Bonorden. 2015. "Cryptocurrencies as a Disruption? Empirical Findings on User Adoption and Future Potential of Bitcoin and Co." IFIP International Conference on e-Business, e-Services, and e-Society.

- Buterin, Vitalik. 2015. "A Next Generation Smart Contract & Decentralized Application Platform.".

- Catalini, Christian, and Joshua S. Gans. 2016. "Some Simple Economics of the Blockchain." NBER Working Paper No. 22952. National Bureau of Economic Research. [CrossRef]

- Caton, James. 2019. "Cryptoliquidity: The Blockchain and Monetary Stability." Journal of Entrepreneurship and Public Policy 9(2): 227-252. [CrossRef]

- Cain, Cindy. 2022. "Cryptocurrency and Digital Assets: A Positive Tool for Economic Growth in Developing Countries." . [CrossRef]

- Chainalysis. 2020. The 2020 Geography of Cryptocurrency Report. https://www.thewealthmosaic.com/vendors/chainalysis/insights/the-chainalysis-2020-geography-of-cryptocurrency-r/.

- Cossu, Alberto. 2023. "The Unexpected Consequences of a Pandemic: Crypto-Finance as Cultural Commons." European Journal of Cultural Studies 26(4): 598-607. doi:10.1177/13675494221135660.

- Chivovo, Eugine. 2017. "An Assessment of Opportunities and Challenges of e-Government Implementation in Zimbabwean Cities: Case of Masvingo City." International Journal of Communication Systems and Networks 6(6): 15-32.

- Coronel-Pangol, Katherine, Doménica Heras-Tigre, Jonnathan Jiménez Yumbla, Juan Aguirre Quezada, and Pedro Mora. 2023. "Microfinance, an Alternative for Financing Entrepreneurship: Implications and Trends-Bibliometric Analysis." International Journal of Financial Studies 11(3): 83. [CrossRef]

- Coutinho, Kevin, Neeraj Kumari Khairwal, and Pornpit Wongthongtham. 2023. "Towards a Truly Decentralized Blockchain Framework for Remittance." Journal of Risk and Financial Management 16(4): 240. [CrossRef]

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden. 2015. The Global Findex Database 2014: Measuring Financial Inclusion around the World. World Bank Policy Research Working Paper No. 7255.

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. World Bank Group. [CrossRef]

- Dwivedi, Yogesh Kumar, Nripendra P. Rana, Anand Jeyaraj, Marc Clement, and Michael D. Williams. 2017. "Re-Examining the Unified Theory of Acceptance and Use of Technology (UTAUT): Towards a Revised Theoretical Model." Information Systems Frontiers 21: 719-734.

- Gai, Keke, Meikang Qiu, Xiaotong Sun, and Hui Zhao. 2016. "Security and Privacy Issues: A Survey on FinTech." International Conference on Smart Computing and Communication.

- Gefen, David, Elena Karahanna, and Detmar W. Straub. 2003. "Trust and TAM in Online Shopping: An Integrated Model." MIS Quarterly 27: 51-90.

- Hsiao, Ching-Chi, Jeff C. H. Huang, Anna Y. Q. Huang, Owen H. T. Lu, Chih-Jen Yin, and Stephen J. H. Yang. 2018. "Exploring the Effects of Online Learning Behaviors on Short-Term and Long-Term Learning Outcomes in Flipped Classrooms." Interactive Learning Environments 27(8): 1160–77. doi:10.1080/10494820.2018.1522651.

- Gigauri, Iza. 2022. "The Promise of Financial Inclusion for Developing Economies." International Journal of Management Science and Business Administration 8(6): 7-20, September.

- Johnson, Donavon. 2022. Cryptocurrency and Public Policy: Implications for Democracy and Governance. 1st ed. Routledge. [CrossRef]

- Kulkarni, Rajendra, Laurie Schintler, Naoru Koizumi, James Olds, and Roger R. Stough. 2019. "Cryptocurrency, Stablecoins and Blockchain: Exploring Digital Money Solutions for Remittances and Inclusive Economies." 66th Annual North American Meetings of the Regional Science Association International (13–16 Nov, 2019) in Pittsburgh, PA, USA. [CrossRef]

- Kumari, Shalu. 2022. "Digital Finance, a Booster for Indian Economy During Covid-19." Entrepreneurship and Small Business Research 1(2): 34-40. [CrossRef]

- Kshetri, Nir. 2017. "Blockchain’s Roles in Strengthening Cybersecurity and Protecting Privacy." Telecommunications Policy 41(10): 1027-1038. [CrossRef]

- Kayani, Umar, and Fakhrul Hasan. 2024. "Unveiling Cryptocurrency Impact on Financial Markets and Traditional Banking Systems: Lessons for Sustainable Blockchain and Interdisciplinary Collaborations." Journal of Risk and Financial Management 17(2): 58. [CrossRef]

- Lu, Cindy. 2022. "Cryptocurrency and Digital Assets: A Positive Tool for Economic Growth in Developing Countries." . [CrossRef]

- Mabrouk, Fatma, Jihen Bousrih, Manal Elhaj, Jawaher Binsuwadan, and Hind Alofaysan. 2023. "Empowering Women through Digital Financial Inclusion: Comparative Study before and after COVID-19." Sustainability 15(12): 1-17, June.

- Mayer, Roger, James Davis, and David Schoorman. 1995. "An Integrative Model of Organizational Trust." Academy of Management Review 20(3): 709-734. [CrossRef]

- McKinnon, Ronald I. 1973. Money and Capital in Economic Development. Washington DC: The Brookings Institution.

- Mohammed, Badamasi Sani, Sule Ya’u Hayewa, Hussaini Shuaibu, and Nuruddeen Mahmud Bunu. 2022. "Effect of Cryptocurrency on Inflation in Nigeria." September. [CrossRef]

- Makanyeza, Charles, Eukeria Wealth, and Tendai Douglas Svotwa. 2023. "Financial Inclusion Challenges and Prospects During the COVID-19 Pandemic: Insights from Botswana, Namibia, South Africa and Zimbabwe." In Financial Inclusion and Digital Transformation Regulatory Practices in Selected SADC Countries, edited by H. Chitimira and T.V. Warikandwa, 106: 7-20. Ius Gentium: Comparative Perspectives on Law and Justice. Springer. [CrossRef]

- Mazikana, Anthony Tapiwa. 2018. "The Impact of Cryptocurrencies in Zimbabwe. An Analysis of Bitcoins." Available at SSRN: https://ssrn.com/abstract=3376307 or . [CrossRef]

- Nakamoto, Satoshi. 2009. Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf.

- Narayanan, Arvind, Bonneau, Joseph, Felten, Edward, Miller, Andrew and Goldfeder, Steven. 2016. Bitcoin and Cryptocurrency Technologies. Princeton University Press.

- Nedosekin, Alexey, Alexander, Kozlovsky, and Zalina, Abdoulaeva. 2019. "Digital Financial Assets Application for Enterprise Economic Resilience Provision." In Conference Digital Economy, 336-341. [CrossRef]

- Nambisan, Satish. 2017. "Digital Entrepreneurship: Toward a Digital Technology Perspective of Entrepreneurship." Entrepreneurship Theory and Practice 41: 1029-1055.

- Oliveira, Tiago, Manoj Thomas, Gonçalo Baptista, and Filipe Campos. 2016. "Mobile Payment: Understanding the Determinants of Customer Adoption and Intention to Recommend the Technology." Computers in Human Behavior 61: 404-414.

- Rejeb, Abderahman, Karim Rejeb, and John G. Keogh. 2021. "Cryptocurrencies in Modern Finance: A Literature Review." Etikonomi 20: 93-118.

- Rodrik, Dani. 2011. The Globalization Paradox: Democracy and the Future of the World Economy. New York: W. W. Norton & Company. [CrossRef]

- Rosales, Antulio. 2021. "Unveiling the Power Behind Cryptocurrency Mining in Venezuela: A Fragile Energy Infrastructure and Precarious Labor." Energy Research & Social Science 79. [CrossRef]

- Seelig, Caroline. 2013. "The Role Distance Learning Has to Play in Offender Education." Journal of Learning for Development 1(1): 31-43. [CrossRef]

- Sitthipon, Tamonwan, Parichat Jaipong, and Pichakoon Auttawechasakoon. 2022. "A Review of Cryptocurrency in the Digital Economy." International Journal of Computer Science and Research 6. [CrossRef]

- Stiglitz, Joseph, and Andrew Weiss. 1981. "Credit Rationing in Markets with Imperfect Information." The American Economic Review 71(3): 393–410. http://www.jstor.org/stable/1802787.

- Schär, Fabian. 2021. "Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets." Federal Reserve Bank of St. Louis Review 103(2): 153-174, April.

- Sachs, Jeffrey, and Andrew Warner. 1995. "Economic Reform and the Process of Global Integration.".

- Schumpeter, Joseph A. 1942. Capitalism, Socialism and Democracy. Vol. 36, Harper & Row, New York, 132-145.

- Senner, Robert, and Didier Sornette. 2018. "The Holy Grail of Crypto Currencies: Ready to Replace Fiat Money?" Journal of Economic Issues 53(4): 966-1000. [CrossRef]

- Shaw, Edward S. 1973. Financial Deepening in Economic Development. Oxford University Press.

- Swan, Melanie. 2015. Blockchain: Blueprint for a New Economy. O'Reilly Media.

- Tapscott, Don, and Alex Tapscott. 2016. Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World. Penguin.

- Tri Arista, Handayani, and Lastuti Abubakar. 2022. "Msme Empowerment Policy Strategy in Order to Do Accelerating of the Development Financial Services Ecosystem." Rechtidee 17(2): 253-270. [CrossRef]

- Truby, Jon Mark. 2018. "Decarbonizing Bitcoin: Law and Policy Choices for Reducing the Energy Consumption of Blockchain Technologies and Digital Currencies." Energy Research & Social Science: n. pag.

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. "User Acceptance of Information Technology: Toward a Unified View." MIS Quarterly 27(3): 425-478. [CrossRef]

- World Bank. 2014. Global Financial Development Report 2014: Financial Inclusion.

- World Bank. 2017. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution.

- World Bank. 2021. Migration and Development Brief 33.

- Yasay, Jeffrey John. 2021. "The Dawn of Digital Coins: A Literature Review on Cryptocurrency in the Philippines." Journal of Financial Studies 6(5): 199-203.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).