1. Introduction

With the rising demand for resources, the sharing economy has gained more and more attention among the public. The sharing economy is to provide idle resources for others’ short-term usage, thereby maximizing the use of resources and improving economic benefits [

1,

2]. In recent years, the sharing economy has developed rapidly and many digital platforms can provide various types of sharing services, such as housing (Airbnb), working (Impact Hub), and transportation (Uber, Car2GO). As a form of the sharing economy, shared mobility emerges as the advancement of urbanization. Shared mobility is defined as the travel option of separating vehicle ownership and usage to maximize the utilization of social mobility resources [

2]. Urbanization leads to an increasing number of vehicles and complex urban planning. However, the current urban transportation systems are often associated with insufficient public transport access and high motorization as well as high environmental pollution, bringing huge financial and environmental burdens [

3]. This boosts the demand for shared mobility. Shared mobility allows consumers to access various transportation modes on demand, including car-sharing, ride-hailing, car-pooling, etc.[

4]. Digital platforms such as Uber provide shared mobility services, allowing people to access temporary resources to fulfil travel demands with high flexibility and convenience. As part of sustainable urban development, shared mobility improves the efficiency of urban space utilization, and reduces the number of vehicles and parking needs in cities, thereby reducing traffic congestion and environmental pollution [

2].

As shared mobility has played an important role, new autonomous driving technology enables the application of shared autonomous vehicles (SAVs), which stimulates high market potential. Autonomous driving technology is to use computer-controlled systems in road vehicles to replace humans in driving. The ultimate goal is that vehicles can automatically drive to the required destinations without human interaction [

5]. Autonomous vehicles (AVs) are believed to create promising innovative visions for urban transportation systems since they can reduce human errors that cause traffic problems, increase road safety, enhance traffic efficiency, and improve sustainability in various aspects [

5]. Thus, it is worth exploring the market potential of AVs that provide shared mobility services.

Concerning applying AVs in the shared mobility market, previous studies adopted data-driven modelling approaches based on limited vehicle travel information [

6,

7], surveys targeting potential users in the shared mobility market [

8,

9] and literature review [

10] to analyze the feasibility of SAVs. However, few studies apply the combined analysis methods in the shared mobility market. Adopting market analysis tools can provide a comprehensive view of the business environment and organization’s competitiveness, especially for analyzing the market potential of innovative technologies and products [

11]. SWOT analysis, PESTLE analysis and Porter’s Five Forces are important strategic analysis tools that have been adopted for decades. The combination of three analysis models of PESTLE, Porter’s Five Forces and SWOT analysis are also widely used to analyze the market situation and future development in various industrial sectors. For instance, PESTLE analysis, Porter’s Five Forces, and SWOT analysis were adopted to thoroughly analyze the current internal and external conditions of the company Indah Kiat Pulp and Paper to develop subsequent strategic plans [

12]. These three analysis tools were also used to analyze the company Sido Muncul’s situation, concerning its internal company situation and changes, as well as the external environment [

13]. A research gap exists for using the three methods to strategically analyze the market potential of applying AVs in the shared mobility market from a comprehensive perspective. Therefore, this study adopts the combination of these three analysis tools to provide an in-depth and comprehensive understanding of the market potential of AVs in the shared mobility market. This study also contributes to proposing strategic implications for promoting SAVs.

This study is organized as follows. SWOT analysis is conducted in

Section 2. A detailed PESTLE analysis is developed in

Section 3. Porter’s Five Forces presented in

Section 4 is used to critically analyze the market potential of introducing AVs to the shared mobility market.

Section 5 provides implications based on findings.

Section 6 gives a summary of the study.

2. SWOT Analysis

SWOT analysis is a fundamental tool to analyze the organization’s internal environment, external environment and market position, focusing on four aspects: strengths, weaknesses, opportunities and threats [

11]. It is regarded as a simple and concise method that can provide a reliable analysis towards the organization [

14].

2.1. Strengths

AVs can increase transportation safety by reducing human errors and car accidents [

15]. Specifically, over 40% of fatal car accidents are related to the combined human errors of alcohol, fatigue, drug involvement and distraction [

16]. More than 30 thousand people die from vehicle accidents in the U.S. per year, and about 2.2 million accidents lead to human injuries [

17]. The application of AVs can significantly increase road safety. It is estimated that when the market penetration rate of AVs is 10%, AVs can reduce the risks of vehicle crashes and injuries by 50%; when the penetration rate is improved to 50%, the risks can be reduced by 90% [

16].

Apart from enhancing transport safety, AVs can also optimize traffic by increasing transport efficiency and reducing congestion. Autonomous driving technology features technological innovation in transportation, requiring artificial intelligence, smart sensors, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technology, etc., which can bring high efficiency, convenience and better passenger experience [

18]. Specifically, AVs can exchange information with other AVs on the road and predict the driving trajectories of surrounding vehicles, such as whether they will brake or accelerate in the following time [

16]. Based on this information, AVs can adjust driving speed and stability by changing speed, lane, etc. in advance. With a traffic monitoring system, AVs can improve the efficiency of driving on roads and across intersections by maintaining shorter but safe and reasonable distances between vehicles, selecting more efficient routes, and achieving more coordinated fleets [

19]. In this way, SAVs can significantly alleviate traffic congestion, improve traffic efficiency and save vehicle fuel consumption. Hence, the application of AVs in the shared mobility market can bring massive benefits by enhancing road safety and improving traffic efficiency.

2.2. Weaknesses

There are high initial investment costs for developing, testing and purchasing AVs, leading to increasing financial burden and decreasing early-stage profitability for automobile manufacturers and shared mobility service providers [

6]. AVs are equipped with sensors, communication technology, GPS technology, digital platforms, etc. For instance, the light detection and ranging system equipped by many AVS costs

$30,000 to

$85,000 each [

20]. The high costs also impede the wide application of AVs by influencing large-scale production and public accessibility. However, the initial purchasing costs of AVs may be influenced by the market penetration rate and mass production. It is predicted that if the market penetration rate of AVs is around 10%, there can be an additional

$10,000 of the purchase price of a new AV in the first seven years after the initial launch. If the market penetration rate is around 90% rate, this will drop to

$3,000 [

16]. It is also estimated that after mass production, the added costs per AV can be around

$1,000 to

$1,500 eventually [

21]. However, it may remain expensive for some price-sensitive stakeholders.

2.3. Opportunities

AVs have competitive advantages in the market, which gain large opportunities. As also discussed in sub

Section 2.1, AVs can improve user experience by providing a safer and more efficient ride experience than conventional vehicles [

6,

22]. This can attract more users and increase user satisfaction. In addition, SAVs can connect the first-mile and last-mile travel in areas with low public transport density, by cooperating with public transport. It can enhance synergies between vehicles and transit [

22]. In this way, these areas can maintain accessibility even during hard times of poor climate or energy disruption, increasing traffic resilience. Hence, SAVs provide opportunities for attracting consumers and developing closer relationships with public transport.

2.4. Threats

Users tend to worry about the safety performance of AVs in the shared mobility market [

15]. When AVs are applied on public roads, it is challenging for autonomous driving systems to operate well under all circumstances due to technological limitations, which is explained in detail in sub

Section 3.4. Although AVs can significantly reduce human errors that cause car crashes, machine errors still exist [

23]. The autonomous driving system should identify objects on the path, their materials, possible next paths, etc., to make judgments and actions. However, identifying people, objects and obstacles on the road is much more difficult for self-driving systems [

24]. Objects on the road may have various positions, movement trajectories, line of sight occlusion, etc., which affects the judgment of the autonomous driving system. Different materials of objects also influence recognition capabilities because computer vision is much more difficult than humans in identifying material components [

24]. Bad weather may also affect sensor recognition. For example, road reflections on rainy days may have a greater impact on the camera than the naked eye, further affecting autonomous driving operations. In March 2018, a self-driving Uber SUV had a fatal car crash and killed a pedestrian in Tempe, Arizona. Although Uber adopted quick actions to respond to the tragedy, including withdrawing its AVs from public roads, firing test drivers, and closing the autonomous driving testing hub in Arizona, the sad news still triggered people’s safety concerns over SAVs [

25].

In addition, there are cyber security concerns over the autonomous driving system. The public is worried about whether the driving system may be attacked by hackers to influence normal driving behaviors and bring safety problems. If the technological system is malfunctioned or attacked, it will pose threats to the reliability and security of the service. The most severe and possible attacks happening to AVs are expected to be intervening vehicles’ Global Navigation Satellite Systems and confusing vehicles’ operating systems with fake information [

26]. They can lead to incorrect driving destinations and unstable driving paths. However, the majority of cyber-attacks are considered to obtain unauthorized access to a system to get information, rather than disrupting the normal operations of the system [

27]. Although the possibility of disruptive cyber-attacks is relatively low, potential data leakage can also influence the reputation and sustainability of SAVs. Because AVs are highly dependent on autonomous driving systems and are largely influenced by the normal operation of systems. Therefore, it is important to ensure the stability and security of large-scale autonomous driving systems through strong defence measures. The National Institute of Standards and Technology in the U.S. has developed a cyber security system to protect critical network infrastructure which will be used in autonomous driving technology [

28]. The security architecture can be installed at the early stage of setting up V2V and V2I technology and relevant communication infrastructure, thereby limiting cyber-attack occurrence and reducing potential damages.

There are also concerns about determining the liability of possible AV accidents. When AVs are widely applied, accidents are inevitable. Different from human drivers, AVs have smart sensors and computer vision software that enable them to make wiser decisions. However, their decisions can still be challenged when injuries and property losses occur. For instance, if pedestrians and passengers may be harmed at the same time, whose safety should AVs prioritize? How should liability be determined for an accident caused by veering into another lane to avoid a collision with an obstacle ahead? How should liability be determined for accidents caused by vehicle loss of control due to road reasons such as slippery roads, damaged road surfaces, etc.? Compared with property losses, is it more important to discuss how self-driving cars should prioritize minimizing injuries to passengers or pedestrians? These questions have raised concerns about the liability of AVs in accidents. In practice, methods are adopted to help determine liability. For example, the California Department of Motor Vehicles requires crash and disengagement reports to evaluate faults. In addition, datasets obtained by sensors are also useful for determining liability [

29]. However, these practices are far from enough to establish a standard and systematic system for identifying liability. Therefore, unclear accident liabilities of AVs remain threats before regulated determinations of liabilities are proposed in consensus.

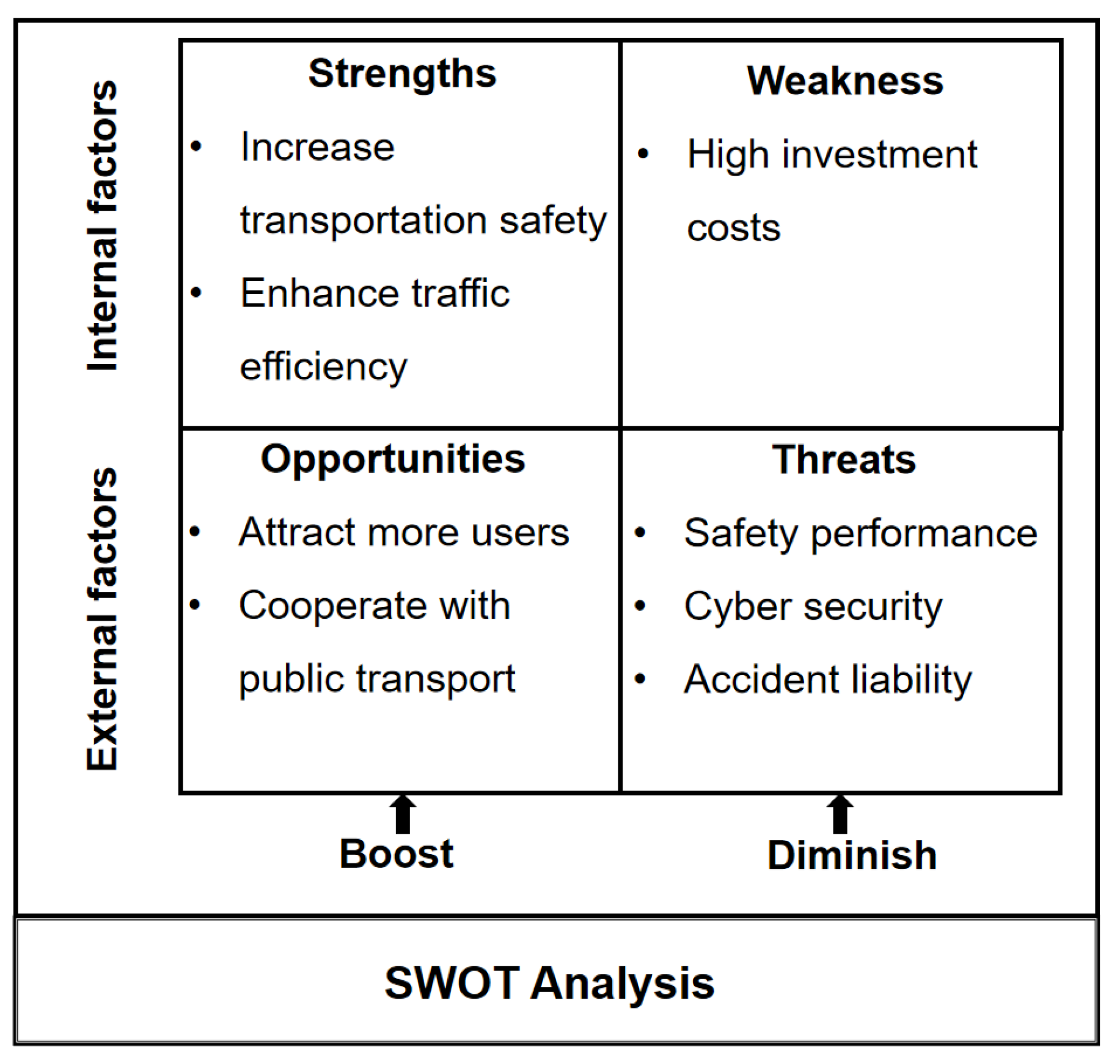

The main findings based on the SWOT analysis are summarized in

Figure 2.1:

Figure 2.1.

Summary of main findings of SWOT analysis

Figure 2.1.

Summary of main findings of SWOT analysis

3. PESTLE Analysis

PESTLE analysis is adopted to evaluate the political, economic, social, technological, legal and environmental aspects from a macro-level. PESTLE analysis can capture many external risks and issues by evaluating the environment before starting a project [

30].

3.1. Political factors

Political factors are the influencing policies and regulations for SAVs. Policy support, government regulations, and a stable political environment are necessary during the shift from conventional vehicles to AVs in the shared mobility market.

For policy support and regulations, the development and application of AVs have aroused political interest. Strong support from governments enables individuals to adopt innovative technologies [

31]. Policies issued by governments in Europe and the U.S. have played important roles in supporting the development of autonomous driving technology [

32]. For instance, the National Highway and Traffic Safety Administration has already encouraged states in the U.S. to start allowing AV testing on public roads with standard procedures. However, directly licensing AVs to the public is still not allowed [

33]. Governments are suggested to provide more support through transportation policies and regulations to stimulate more sustainable mobility, such as establishing standard and official guidelines for certifying AVs [

34].

The stability of the political environment and long-term government commitment are also critical to the sustainable development of AVs in the shared mobility market. In the U.K., the government established the Centre for Connected and Autonomous Vehicles in 2015, aiming to implement legislative frameworks for the commercial application of AVs [

35]. Its parliament also started legislation for identifying liability problems when AVs are involved in car crashes. The goal is to ensure that the U.K. can lead the world in testing, developing and applying AVs [

32]. The London government also aimed to reduce the travel trips provided by taxis and private-owned cars to 20% by 2041 [

36]. It shows the intention to enable Mobility-as-a-Service and encourage shared mobility services, which provide long-term political support and development opportunities for AVs. For governments all over the world, guidelines should be developed based on practical situations to fulfil national or even worldwide requirements. They can provide a supporting political environment for encouraging the application of SAVs. In addition, political support for the unprecedented issues that AVs may face is still lacking. For instance, the wide application of SAVs requires the government to invest in public infrastructure including V2V and V2I communication systems with traffic signals. However, few relevant communication systems for AVs have been established [

21]. Therefore, as solutions to future smart mobility for urban transportation, AVs should gain high and stable political commitment from local and national authorities.

3.2. Economic Factors

Economic factors refer to economic conditions that can influence SAVs. The development levels of the local economy and the industrial structure can affect the application of AVs in the shared mobility market.

When the local economic level is weak, consumers tend to choose shared mobility services instead of purchasing and maintaining private cars. When maintaining the same travel intensity as private cars, SAVs can replace a significant number of private or family-owned cars to reduce individual financial burdens. For instance, a study found that each SAV could replace approximately 10 private or family-owned vehicles in a high-intensity mobility area [

37]. Thus, consumers will tend to choose SAVs to obtain more economical transportation solutions in areas with weak economies. In addition, attracted by the economic benefits discussed in sub

Section 2.1, areas with weak economies can further promote SAVs. The strengths of safe driving and high traffic efficiency of SAVs can reduce travel costs and bring economic benefits [

19]. For instance, it is estimated that in the U.S., travellers experience delays of up to 8.4 billion hours. Traffic congestion can waste 4.5 billion gallons of fuel, causing huge financial losses [

38]. In addition, smart parking made by SAVs can save fuel by reducing the amount of fuel wasted searching for parking spaces, and can also save costs through remote parking [

39]. Moving a parking space outside CBD is estimated to save

$2,000 per year, and moving it to suburban areas can save an additional

$1,000 per year [

40]. Overall, the economic impacts brought by AVs are expected to range between

$200 billion to

$1.9 trillion worldwide by 2025 [

41]. Hence, applying SAVs is financially attractive for areas with low economic levels.

Considering areas with specific industrial structures, the application of SAVs can also be boosted due to added values. During autonomous driving, drivers and passengers can enjoy safer and more comfortable rides, enabling them to carry out a range of non-driving related activities [

34]. For instance, they can watch movies, drink, use laptops, and entertain themselves. Relevant companies such as the IT industry, entertainment industry and beverage industry can benefit a lot from SAVs by providing on-board entertainment and office services [

42]. For example, applying SAVs is expected to bring an extra

$100 billion to the relevant industries for entertainment and advertising and

$28 billion to the beverage industry worldwide [

43]. Hence, when the relevant industries are important components of local economies, applying SAVs will be promoted.

3.3. Social Factors

Social factors refer to the social, cultural and demographic situations that influence the application of SAVs. Specifically, changes in demographic structure affect the demand for shared mobility. SAVs can provide more equitable travel options by providing mobility for the elderly, disabled, low-income, and non-drivers [

22]. For instance, within the aging society, an increasing number of non-drivers face travel inconvenience and declining travel demands. Because they have physical limitations in transport, they may choose to reduce trouble by avoiding driving under poor climate conditions, unfamiliar roads, heavy traffic, at night, etc. Similarly, for vulnerable groups such as children and people with mobility impairments, it is also difficult to travel with conventional vehicles. However, SAVs enhance their mobility independence as stated in sub

Section 2.1 and

Section 2.3. From a social perspective, SAVs increase mobility equality and transport demand for the overall population [

2], contributing to positive social atmospheres.

However, within a social environment that promotes healthy work and lifestyle, promoting AVs can be discouraged due to potential negative impacts. The application of AVs may lead to a rising unemployment rate because many taxi drivers can be replaced by AVs, which may lead to opposition against AV among the public. In addition, a larger market penetration of AVs can decrease the walk distance of users, which may influence health and social welfare [

16].

3.4. Technological Factors

Technological factors refer to technological development and innovation that influence SAVs. Due to technological limitations in autonomous driving technology and inadequate communication infrastructure, practical services provided by SAVs are restricted.

Limited development of autonomous driving technology increases the difficulty of applying AVs. Shared mobility has been accepted widely with the emergence of mobile internet technology in the past decade [

2]. Similarly, the application and user acceptance of AVs are also significantly influenced by the development of autonomous driving technology. The Society of Automotive Engineers defines 6 automation levels but only vehicles at level 5 can be considered completely AVs [

44]. However, existing AVs still need human control when necessary and it is estimated that completely autonomous driving vehicles which do not need human intervention and control can only be available from 2030 onwards [

34]. In other words, the current autonomous driving technology is still developing and has technical limitations. When facing complex environments such as poor weather and imperfect road conditions, the limited autonomous driving technology may affect the performance and reliability of autonomous vehicles, leading to safety concerns [

45]. Waymo provided autonomous ride-hailing services to a limited number of cities, namely Phoenix, San Francisco, Los Angeles and Austin [

46]. Therefore, the trials of SAVs have still been limited, which shows a distance from the wide application of SAVs. However, with the rapid development of autonomous driving technology, the limited application of AVs can be improved. It is expected that in 2035, the market share of highly and fully AVs can optimistically achieve 11 to 42 % [

34].

In addition, to fully utilize the benefits of AVs, the problem of inadequate communication infrastructure needs to be solved. Stable and high-speed communication and Internet infrastructure are critical to support real-time communication, navigation and data transmission for SAVs. For instance, when Avs need to exchange driving information with other vehicles on the road, they need the technological support of V2V and V2I communication infrastructure. The National Highway and Traffic Safety Administration required that V2V and V2I communication capabilities should be equipped forcibly for AVs [

47]. Therefore, communication infrastructure need to be widely constructed and applied before applying AVs in the shared mobility market.

3.5. Legal Factors

Legal factors focus on the influence of legal regulations and frameworks on SAVs. The legal aspects of licence, security, liability and data privacy should be critically evaluated.

For licensing AVs, many U.S. states such as Washington, D.C., California, Michigan, Florida and Nevada have proceeded with AV-enabling legislation to regulate AV licensing and operation. In California, U.S., a law enabling AV license (SB 1298) was issued in 2012, stipulating specific requirements for AVs through more detailed legislation [

48]. China has issued the Draft Proposed Amendments of the Road Traffic Safety Law that regulates the requirements of testing and passing, as well as the liability allocation when traffic accidents or violations occur [

49]. Although individual U.S. states have adopted incremental methods to legislate AVs, no federal guidance for fully or partially AVs on public roads apart from testing has been issued [

16]. Hence, governments need to establish systematic regulatory frameworks to support the application of SAVs [

33].

In addition, user privacy is another concern [

50]. During the operation of SAVs, sensitive privacy information can be obtained. For instance, to provide personal shared mobility services, AVs need to record and evaluate user data, including the frequency of using the sharing mobility service, average trip time, frequently visited places, etc. SAVs can also identify users through mobile numbers, facial recognition and fingerprints. Although it seems normal for SAVs to improve service quality, the information obtained is highly sensitive and involves personal privacy. There are privacy concerns about AVs’ data process, storage and transmission abilities that may cause data leakage. In addition, since the shared mobility platforms possess SAVs and have access to collected data, these platforms face strict data protection requirements when collecting, analyzing and storing user data. Some governments may also require access to AV travel data, including trip destinations and driving routes, which is also controversial. The leakage and misuse of personal private data can cause serious legal violations [

50]. Ensuring the security of private user data is a critical issue during the application of SAVs.

3.6. Environmental Factors

Environmental factors are related to the influence of the natural environment and sustainable development on SAVs. Environmental problems faced by the transportation industry, such as road congestion, environmental pollution, noise, excessive carbon emission, etc., promote the application of AVs in the shared mobility market [

34]. Over the last decades, the transport industry has been mainly responsible for global warming and carbon emissions [

51]. 23% of carbon emissions generated in 27 EU member countries are from the transport sector [

52]. Facing these problems, global efforts have been made to reduce the negative impacts brought by transportation. The shift to AVs is a good way to bring positive impacts on the environment. As discussed before, the application of AVs can enhance traffic efficiency and reduce carbon emissions. It is estimated that AVs can help reduce carbon emissions up to 94% [

34]. If SAVs are driven by electricity, it may further reduce carbon emissions and benefit the environment.

However, there are also potential environmental negative impacts of SAVs. Since SAVs provide more travel mobility, there can be increasing travel demand and empty runs. An increase of 8% to 17% vehicle-miles travelled (VMT) is estimated since SAVs need to relocate, arrive or depart for empty runs [

53], leading to increasing carbon emissions and fuel consumption.

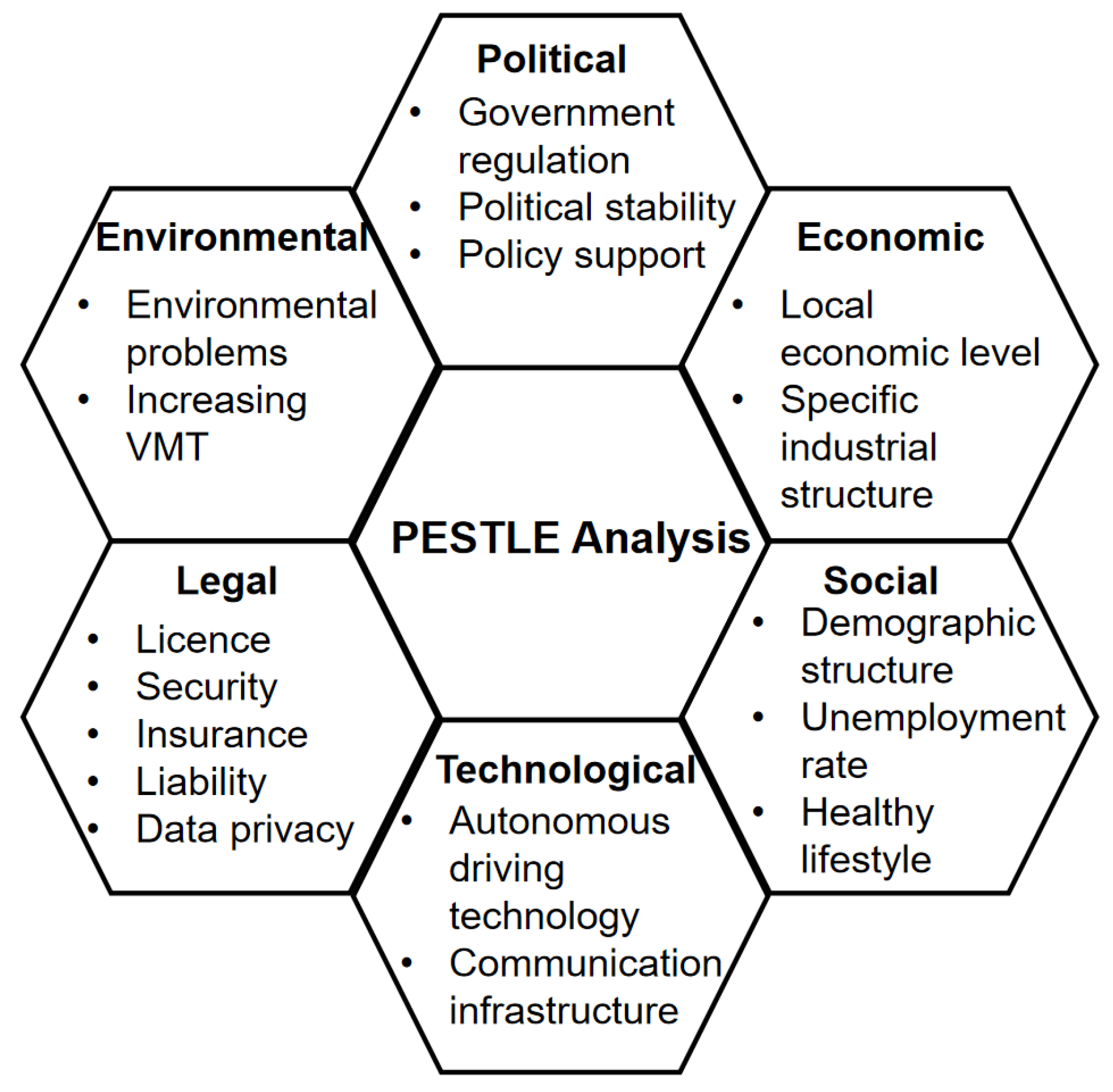

Thus,

Figure 3.1 summarizes the major findings of PESTLE analysis:

Figure 3.1.

Summary of main findings of PESTLE analysis

Figure 3.1.

Summary of main findings of PESTLE analysis

4. Porter’s Five Forces

Porter’s Five Forces is a comprehensive analysis method to assess industry competitiveness by considering five key elements, namely bargaining power of suppliers, bargaining power of buyers, threat of new entrants, substitutes and rivalry. This method can help understand the intensity of competition and profitability potential within an industry [

54]. As a commonly used market analysis tool, Porter’s Five Forces is widely used to analyze competition situations in various industries. For instance, it was used to evaluate the competition level of the Turkish apparel industry [

55], and to analyze the Shale gas industry in China [

54].

4.1. Bargaining Power of Suppliers

The bargaining power of suppliers depends on their controlling ability over key resources, technologies and services. For SAVs, suppliers may include autonomous driving technology providers, parts suppliers, IT companies, etc. Automobile manufacturers in the shared mobility market mainly act as new entrants which are further discussed in sub

Section 4.3. The rapid development of digital information technology has promoted the penetration of IT companies into various industries, including the shared mobility market [

56]. Although the IT industry has long been part of producing AVs, they are often classified as parts suppliers because automobile manufacturers have mainly controlled the industry from product design to distribution. Different from conventional vehicles, AVs are not only manufactured by the current automotive industry but also by non-automotive sectors. Because AVs incorporate multiple technologies such as sensing, artificial intelligence, navigation, and high-definition geospatial data, which enabled the IT industry to exert its competitiveness and enter the AV market [

56]. IT companies provide vehicle software systems such as entertainment and artificial intelligence applications. As ’gatekeepers’, they have direct access to users, which promotes their participation in SAVs. IT companies can also capture the opportunities provided by AVs through online access, connectivity and data-driven mobility [

57]. Therefore, the current market status held by conventional automobile manufacturers and parts suppliers such as Bosch, Denso and Continental is challenged by the penetration of IT companies including car-sharing platform companies, technology companies developing AI, sensing and navigation, such as IBM, NVIDIA and Intel, and technology investors, such as Apple, Baidu and Softbank [

56].

4.2. Bargaining Power of Buyers

Buyers in the shared mobility market are mainly consumers who have travel needs. Buyers’ bargaining power is mainly reflected in consumers’ travel needs towards SAVs. If consumers have high bargaining power, they can choose other shared mobility services or require cheaper service prices with high quality. As discussed in sub

Section 2.1 and

Section 3.2, SAVs can increase road safety, improve traffic efficiency, and provide services with added values [

22]. The benefits of SAVs reduce consumers’ bargaining power. On the other hand, the privacy and safety concerns over SAVs as discussed in sub

Section 2.4 increase buyers’ concerns and bargaining power.

4.3. Threats of New Entrants

The threat of new entrants measures the difficulty for new companies or innovative technologies to enter the market [

54]. For SAVs, the market barriers are mainly reflected in the investment costs and the development of autonomous driving technology. New entrants include automobile manufacturers, IT companies and transport network companies. For instance, automobile manufacturers of conventional vehicles have continued to develop autonomous driving technology. They aim to innovate driving technology so that computer-based systems can take over control of vehicles from human drivers. Automobile manufacturers have already participated in developing commercial AVs. Mercedes-Benz, Audi, BMW, Volvo, Toyota, Volkswagen, Cadillac, Ford, GM, and Nissan, have already tested autonomous driving systems [

16]. Nissan announced that it aimed to propose revolutionary commercially viable AVs to enter the mass market by 2025 [

58]. IT companies and transport network companies such as Apple, Waymo, Baidu, Tencent, Uber, Didi and SoftBank have also cooperated with automakers such as Ford and General Motors to develop a ’technology mix’ to meet the requirements of developing SAVs [

56]. With relatively low market entry barriers, the threats of new entrants increase, leading to fierce market competition.

4.4. Substitutes

Substitutes refer to alternatives to other products or services that meet similar needs. If alternatives are more competitive, consumers may tend to choose alternatives. The existence of substitutes reduces the attractiveness and profitability of SAVs. Conventional vehicles and public transport can be considered substitutes for SAVs.

Conventional vehicles obtain subjective advantages over AVs among some drivers [

34]. They refuse AVs and tend to maintain their control over vehicles. A study indicated that 60% of respondents prefer to drive by themselves and refuse AVs [

59]. Another survey with 1,214 respondents showed that 54.2% of them were not likely to give up their private vehicles [

60]. Conventional vehicles are considered to still maintain the dominant role in the market for the next 30 years [

61], indicating that the substitutes of AVs still play important roles in the shared mobility market. However, AVs are expected to shift user demand from private vehicles to on-demand mobility. The market share of AVs is expected to increase significantly due to strengths discussed in sub

Section 2.1. SAVs are estimated to reduce the total vehicle number by 31% to 95 % [

34]. One SAV is also expected to replace about 1.17 to 11 conventional vehicles, considering that the SAV’s trip length is longer [

62]. Thus, these findings indicate that SAVs can significantly reduce the competitiveness of many substitutes and replace the majority of them while achieving the same mobility level.

Another substitute for SAVs is public transport. On the one hand, public transport can replace SAVs in areas with well-developed public transportation, such as Hong Kong, where public transportation is highly available and can provide convenient travel. On the other hand, in areas with poor public transport availability, public transport and SAVs can complement each other. SAVs can be regarded as an extension of public transport because SAVs can provide services 24/7 and complete the first-mile and last-mile transport. In terms of space coverage, SAVs can provide better mobility service quality in urban areas than in rural areas [

63]. In Switzerland, AVs can improve accessibility in 85% of cities [

64]. Hence, SAVs can also supplement public transport in terms of location and time.

4.5. Rivalry

Rivalry refers to the competitive relationships between existing competitors in applying AVs in the shared mobility market. The intensity of competition mainly depends on the market share, number of competitors and service differentiation. For the market share, in New York, shared mobility has accounted for 26.11% of the total taxi travel [

6]. The market share of AVs in the shared mobility market is estimated to be less than 50% in the next 10–15 years [

65]. Hence, competitors need to compete fiercely for limited market share. For the number of competitors, as discussed in sub

Section 4.3, automobile manufacturers, IT companies and transport network companies are major competitors, showing intensified competition. Service differentiation is mainly reflected in developing autonomous driving technology. There has been a technology race involving major technology companies and automobile manufacturers to develop commercial AVs for decades, resulting in billions of dollars of investments every year. For instance, Ford has invested in four technological companies to strengthen the development of AVs. In 2016, Ford doubled its Palo Alto campus and tripled its AV testing fleets, showing strong ambition in implementing AVs [

66]. Hence, the competition in developing autonomous driving technology also reflects to the fierce rivalry of SAVs.

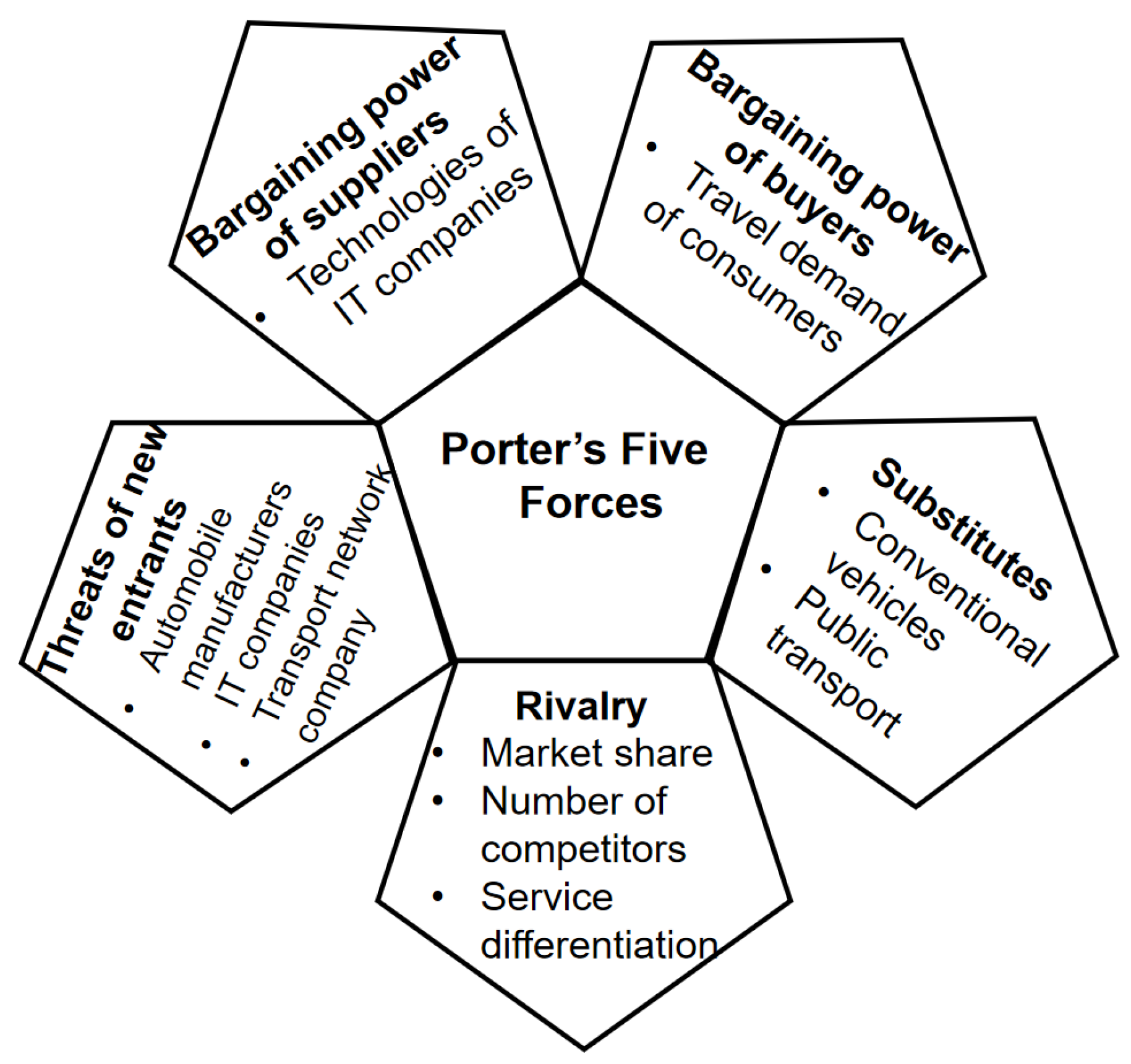

Based on the above discussion,

Figure 4.1 presents the main findings obtained from the analysis using Porter’s Five Forces:

Figure 4.1.

Summary of main findings of Porter’s Five Forces

Figure 4.1.

Summary of main findings of Porter’s Five Forces

5. Managerial Implications

Based on the above critical evaluation of applying AVs in the shared mobility market through SWOT analysis, PESTLE analysis and Porter’s Five Forces, we can develop comprehensive market insights and understand the market potentials of SAVs. Hence, managerial implications are proposed for relevant stakeholders of SAVs, including automobile manufacturers, third-party shared mobility service providers and governments.

For automobile manufacturers, the following suggestions are proposed to improve competitiveness and compensate for weakness. First, it is important to keep developing autonomous driving technology. In this way, SAVs can provide improved shared mobility services that reduce accident risks, alleviate traffic congestion and enhance passenger experience. In addition, technological advancements can make it difficult for new entrants to copy or catch up, contributing to higher competitiveness among competitors. Second, automobile manufacturers should pay high attention to addressing regulatory and compliance challenges based on policies at local and national levels. It is important to ensure that the operations of SAVs can comply with relevant regulations and policies. Third, automobile manufacturers are suggested to establish close partnerships with relevant stakeholders such as key suppliers. Instead of merely relying on a single supplier, automobile manufacturers can reduce the bargaining power of suppliers by cooperating with multiple suppliers. In this way, it helps ensure the stability and reliability of supply chains. Fourth, automobile manufacturers should cooperate with governments and other companies to construct more communication infrastructure to better apply AVs.

For third-party shared mobility service providers, the following recommendations are given. First, it is important to conduct market research to understand the competition intensity in the existing shared mobility market. For instance, evaluating the new entrants’ competitiveness such as service characteristics and pricing strategies is important. Second, third-party shared mobility service providers need to continuously improve passenger experience by providing high-quality user services to enhance customer loyalty and satisfaction to reduce customers’ bargaining power. Third, considering the impacts of the economic and social environment on the shared mobility market, service providers should provide positioned pricing services by analyzing the financial situation to determine appropriate pricing strategies. Considering economic factors such as the general income levels and unemployment rate, service providers can also offer flexible pricing strategies, such as discounts, subscriptions and on-demand pricing. They should also promote SAVs, especially in areas with low economic levels and specific industrial structures of IT, entertainment and beverage industries. Following the existing social environment, SAVs’ promoting travel equality can be emphasized. Fourth, service providers should cooperate with public transport. SAVs are suggested to integrate with public transport to reduce emissions, increase accessibility, and reduce transportation costs [

67]. AVs in the shared mobility market can be integrated with public transport systems, rather than as an alternative, which forms a more sustainable paradigm.

For governments, the following suggestions are provided. First, governments should propose standard regulations, establish a stable political environment and provide strong policy support for promoting AVs in the shared mobility market. Guidelines should be developed based on practical situations to fulfil national or even worldwide requirements. The application of SAVs should gain high and stable political commitment from local and national authorities. Second, governments should pay attention to developing legal regulations in aspects of licence, security, liability and data privacy. Because they affect the operations and compliance of SAVs in practice.

6. Conclusions

In conclusion, this study adopts the combination of SWOT analysis, PESTLE analysis and Porter’s Five Forces to investigate the market potential of applying AVs in the shared mobility market. SAVs can provide improved shared mobility services by increasing transportation safety, enhancing traffic efficiency, reducing emissions, reducing travel costs, promoting travel equality and bringing economic benefits. However, the current application of AVs is still restricted. There are still many limitations that impede the wide application of AVs, including technological limitations, high initial investment costs, lacking unified policies and regulations, lacking public communication infrastructure construction, and public concerns about SAVs’ transport safety, data privacy and cyber security.

Hence, implications are provided for stakeholders of SAVs, including automobile manufacturers, third-party shared mobility service providers and governments. To maintain competitive advantages, automobile manufacturers should keep developing autonomous driving technology, follow political regulations, cooperate with key suppliers and promoting the construction of communication infrastructure. Third-party service providers are suggested to conduct market research, improve the quality of shared mobility services, develop proper pricing strategies, promote SAVs through social trends and cooperate with public transport. Governments need to propose standard and unified regulations, develop a stable political environment and provide strong policy support for AVs in the shared mobility market. Governments should also develop legal regulations in terms of licence, security, liability and data privacy.

For future research, it is suggested to better predict the market penetration rate of AVs. Because different levels of market penetration will greatly affect the performance of AVs in the shared mobility market. In addition, predicting the size and growth of the future shared mobility market can also help evaluate the potential opportunities and competitiveness for SAVs. Developing pricing strategies and profit models is also important to guide the future development of SAVs.

Author Contributions

Conceptualization, L.T.; methodology, L.T.; writing—original draft preparation, L.T.; writing—review and editing, M.X.; supervision, M.X.; project administration, M.X.; funding acquisition, M.X. All authors have read and agreed to the published version of the manuscript.

Funding

This work is supported by the Research Grants Council of the Hong Kong Special Administrative Region, China (Project No. PolyU 15222822).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Ranjbari, M.; Morales-Alonso, G.; Carrasco-Gallego, R. Conceptualizing the sharing economy through presenting a comprehensive framework. Sustainability 2018, 10, 2336. [CrossRef]

- Machado, C.A.S.; de Salles Hue, N.P.M.; Berssaneti, F.T.; Quintanilha, J.A. An overview of shared mobility. Sustainability 2018, 10, 4342. [CrossRef]

- Pojani, D.; Stead, D. The urban transport crisis in emerging economies: An introduction; Springer, 2017.

- Stocker, A.; Shaheen, S. Shared automated vehicles: Review of business models. International Transport Forum Discussion Paper, 2017.

- Beiker, S.A. Evolution–revolution–transformation: a business strategy analysis of the automated driving industry. Road Vehicle Automation 2. Springer, 2015, pp. 139–151.

- Liu, Z.; Li, R.; Dai, J. Effects and feasibility of shared mobility with shared autonomous vehicles: An investigation based on data-driven modeling approach. Transportation Research Part A: Policy and Practice 2022, 156, 206–226. [CrossRef]

- Dia, H.; Javanshour, F. Autonomous shared mobility-on-demand: Melbourne pilot simulation study. Transportation Research Procedia 2017, 22, 285–296. [CrossRef]

- Asgari, H.; Jin, X.; Corkery, T. A stated preference survey approach to understanding mobility choices in light of shared mobility services and automated vehicle technologies in the US. Transportation Research Record 2018, 2672, 12–22. [CrossRef]

- Fu, X.; Nie, Q.; Liu, J.; Zhang, Z.; Jones, S. How do college students perceive future shared mobility with autonomous Vehicles? A survey of the University of Alabama students. International Journal of Transportation Science and Technology 2022, 11, 189–204. [CrossRef]

- Golbabaei, F.; Yigitcanlar, T.; Bunker, J. The role of shared autonomous vehicle systems in delivering smart urban mobility: A systematic review of the literature. International Journal of Sustainable Transportation 2021, 15, 731–748. [CrossRef]

- Benzaghta, M.A.; Elwalda, A.; Mousa, M.M.; Erkan, I.; Rahman, M. SWOT analysis applications: An integrative literature review. Journal of Global Business Insights 2021, 6, 54–72. https://www.doi.org/10.5038/2640-6489.6.1.1148 .

- Putera, G.A.; Heikal, J. Business strategy of indah kiat pulp and paper Perawang Mill, Riau, Indonesia using PESTLE, Porter’s five forces, and SWOT Analysis under SOSTAC Framework. International Journal of Scientific Research in Science and Technology 2021, 8, 252–270.

- Kho, A.; Tan, J.D.; Nugroho, M.P.; Kornelius, S.M.; Prayoga, S.; Adi, S. THE competitive advantage of Sido Muncul: using PESTLE, Porter’s Five Forces, and SWOT Matrix Analysis. Milestone: Journal of Strategic Management 2023, 3, 41–50. https://www.doi.org/10.19166/ms.v3i1.6919.

- Thamrin, H.; Pamungkas, E.W. A rule based SWOT analysis application: A case study for Indonesian higher education institution. Procedia Computer Science 2017, 116, 144–150. https://www.doi.org/10.1016/j.procs.2017.10.056.

- Nazari, F.; Noruzoliaee, M.; Mohammadian, A.K. Shared versus private mobility: Modeling public interest in autonomous vehicles accounting for latent attitudes. Transportation Research Part C: Emerging Technologies 2018, 97, 456–477. [CrossRef]

- Fagnant, D.J.; Kockelman, K. Preparing a nation for autonomous vehicles: opportunities, barriers and policy recommendations. Transportation Research Part A: Policy and Practice 2015, 77, 167–181. [CrossRef]

- Protection, O.; Drivers, Y. Traffic Safety Facts 2012.

- Rahimi, A.; Azimi, G.; Jin, X. Examining human attitudes toward shared mobility options and autonomous vehicles. Transportation research part F: traffic psychology and behaviour 2020, 72, 133–154. [CrossRef]

- Atiyeh, C. Predicting traffic patterns, one Honda at a time. MSN Auto 2012, 25, 106–136.

- Shchetko, N. Laser eyes pose price hurdle for driverless cars. The wall street journal 2014, 21.

- Kpmg, C.; Silberg, G.; Wallace, R.; Matuszak, G.; Plessers, J.; Brower, C.; Subramanian, D. Self-driving cars: The next revolution. Kpmg: Seattle, WA, USA 2012.

- Ohnemus, M.; Perl, A. Shared autonomous vehicles: Catalyst of new mobility for the last mile? Built Environment 2016, 42, 589–602. [CrossRef]

- Taeihagh, A.; Lim, H.S.M. Governing autonomous vehicles: emerging responses for safety, liability, privacy, cybersecurity, and industry risks. Transport reviews 2019, 39, 103–128. [CrossRef]

- Milford, M.; Anthony, S.; Scheirer, W. Self-driving vehicles: Key technical challenges and progress off the road. IEEE Potentials 2019, 39, 37–45. [CrossRef]

- Troy Griggs, D.W. How a Self-Driving Uber Killed a Pedestrian in Arizona. https://www.nytimes.com/interactive/2018/03/20/us/self-driving-uber-pedestrian-killed.html, 2018.

- Petit, J.; Shladover, S.E. Potential cyberattacks on automated vehicles. IEEE Transactions on Intelligent transportation systems 2014, 16, 546–556. [CrossRef]

- Administration, N.H.T.S.; others. USDOT connected vehicle research program: vehicle-to-vehicle safety application research plan. Dot Hs 2011, 811, 373.

- Cybersecurity, C.I. Framework for improving critical infrastructure cybersecurity. Framework 2014, 1.

- Sinha, A.; Chand, S.; Vu, V.; Chen, H.; Dixit, V. Crash and disengagement data of autonomous vehicles on public roads in California. Scientific data 2021, 8, 298. [CrossRef]

- Achinas, S.; Horjus, J.; Achinas, V.; Euverink, G.J.W. A PESTLE analysis of biofuels energy industry in Europe. Sustainability 2019, 11, 5981. [CrossRef]

- Yuen, K.F.; Huyen, D.T.K.; Wang, X.; Qi, G. Factors influencing the adoption of shared autonomous vehicles. International journal of environmental research and public health 2020, 17, 4868. [CrossRef]

- Metz, D. Developing policy for urban autonomous vehicles: Impact on congestion. Urban Science 2018, 2, 33. [CrossRef]

- Administration, N.H.T.S.; others. Preliminary statement of policy concerning automated vehicles. Washington, DC 2013, 1, 14.

- Pakusch, C.; Stevens, G.; Bossauer, P. Shared Autonomous Vehicles: Potentials for a Sustainable Mobility and Risks of Unintended Effects. ICT4S, 2018, pp. 258–269.

- GOV.UK. Centre for Connected and Autonomous Vehicles. https://www.gov.uk/government/organisations/centre-for-connected-and-autonomous-vehicles/about, 2024.

- for London, T. The Mayor’s Transport Strategy. https://tfl.gov.uk/corporate/about-tfl/the-mayors-transport-strategy, 2018.

- Fagnant, D.J.; Kockelman, K.M. Dynamic ride-sharing and optimal fleet sizing for a system of shared autonomous vehicles. Technical report, 2015.

- Schrank, D.; Eisele, B.; Lomas, T. urban mobility report. Texas A&M Transportation Institute, College Station, Texas, 2012.

- Bullis, K. How vehicle automation will cut fuel consumption. MIT’s Technology Review 2011, 24.

- Litman, T. Parking management: strategies, evaluation and planning; Victoria Transport Policy Institute Victoria, BC, Canada, 2016.

- Manyika, J.; Chui, M.; Bughin, J.; Dobbs, R.; Bisson, P.; Marrs, A. Disruptive technologies: Advances that will transform life, business, and the global economy; Vol. 180, McKinsey Global Institute San Francisco, CA, 2013.

- Clements, L.M.; Kockelman, K.M. Economic effects of automated vehicles. Transportation research record 2017, 2606, 106–114.

- Keeney, T. Mobility-as-a-service: Why self-driving cars could change everything. ARK Investment Management Research 2017.

- SAE. SAE and ISO refine the Levels of Driving Automation. https://www.sae.org/site/news/2021/06/sae-and-iso-refine-the-levels-of-driving-automation, 2023.

- Yap, M.D.; Correia, G.; Van Arem, B. Preferences of travellers for using automated vehicles as last mile public transport of multimodal train trips. Transportation research part a: policy and practice 2016, 94, 1–16. [CrossRef]

- Waymo. Ride-Hailing App - Make the Most of Your Drive. https://waymo.com/intl/zh-cn/waymo-one/, 2024.

- Harding, J.; Powell, G.; Yoon, R.; Fikentscher, J.; Doyle, C.; Sade, D.; Lukuc, M.; Simons, J.; Wang, J.; others. Vehicle-to-vehicle communications: readiness of V2V technology for application. Technical report, United States. National Highway Traffic Safety Administration, 2014.

- O’Brien, C. Sergey Brin Hopes People will be Driving Google Robot Cars in “Several Years”. Silicon Beat 2012.

- China.org.cn. China solicits public opinion on revised road-traffic safety law. http://www.china.org.cn/china/2021-04/04/content_77376009.htm, 2021.

- Brandon, J. Privacy concerns raised over California "robot car" legislation. https://www.foxnews.com/auto/privacy-concerns-raised-over-california-robot-car-legislation, 2012.

- Kopelias, P.; Demiridi, E.; Vogiatzis, K.; Skabardonis, A.; Zafiropoulou, V. Connected & autonomous vehicles–Environmental impacts–A review. Science of the total environment 2020, 712, 135237. [CrossRef]

- Givoni, M.; Banister, D. Mobility, transport and carbon. Moving towards low carbon mobility 2013, pp. 1–15. [CrossRef]

- Bischoff, J.; Maciejewski, M. Simulation of city-wide replacement of private cars with autonomous taxis in Berlin. Procedia computer science 2016, 83, 237–244. [CrossRef]

- Yunna, W.; Yisheng, Y. The competition situation analysis of shale gas industry in China: Applying Porter’s five forces and scenario model. Renewable and Sustainable Energy Reviews 2014, 40, 798–805. [CrossRef]

- Lee, H.; Kim, M.S.; Park, Y. An analytic network process approach to operationalization of five forces model. Applied Mathematical Modelling 2012, 36, 1783–1795. [CrossRef]

- León, L.F.A.; Aoyama, Y. Industry emergence and market capture: The rise of autonomous vehicles. Technological Forecasting and Social Change 2022, 180, 121661. [CrossRef]

- Grabher, G.; König, J. Disruption, embedded. A Polanyian framing of the platform economy. Sociologica 2020, 14, 95–118. [CrossRef]

- Newsroom, N.M.C.U. Nissan Announces Unprecedented Autonomous Drive Benchmarks. https://usa.nissannews.com/en-US/releases/nissan-announces-unprecedented-autonomous-drive-benchmarks, 2013.

- Asgari, H.; Jin, X. Incorporating attitudinal factors to examine adoption of and willingness to pay for autonomous vehicles. Transportation Research Record 2019, 2673, 418–429. [CrossRef]

- Menon, N.; Barbour, N.; Zhang, Y.; Pinjari, A.R.; Mannering, F. Shared autonomous vehicles and their potential impacts on household vehicle ownership: An exploratory empirical assessment. International Journal of Sustainable Transportation 2019, 13, 111–122. [CrossRef]

- Grush, B.; Niles, J. The end of driving: transportation systems and public policy planning for autonomous vehicles; Elsevier, 2018.

- Heilig, M.; Hilgert, T.; Mallig, N.; Kagerbauer, M.; Vortisch, P. Potentials of autonomous vehicles in a changing private transportation system–a case study in the Stuttgart region. Transportation research procedia 2017, 26, 13–21. [CrossRef]

- Zhang, W.; Guhathakurta, S. Residential location choice in the era of shared autonomous vehicles. Journal of Planning Education and Research 2021, 41, 135–148. [CrossRef]

- Meyer, J.; Becker, H.; Bösch, P.M.; Axhausen, K.W. Autonomous vehicles: The next jump in accessibilities? Research in transportation economics 2017, 62, 80–91. [CrossRef]

- Narayanan, S.; Chaniotakis, E.; Antoniou, C. Shared autonomous vehicle services: A comprehensive review. Transportation Research Part C: Emerging Technologies 2020, 111, 255–293. [CrossRef]

- Ford. Ford targets fully autonomous vehicle for ride sharing in 2021; invests in new tech companies, doubles Silicon Valley team. https://media.ford.com/content/fordmedia/fna/us/en/news/2016/08/16/ford-targets-fully-autonomous-vehicle-for-ride-sharing-in-2021.html, 2016.

- Salazar, M.; Rossi, F.; Schiffer, M.; Onder, C.H.; Pavone, M. On the interaction between autonomous mobility-on-demand and public transportation systems. 2018 21st international conference on intelligent transportation systems (ITSC). IEEE, 2018, pp. 2262–2269.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).