1. Introduction

The banking sector is a predominant source of funding that significantly underpins the growth of the business sector. In Indonesia, lending activities represent the majority (64%) of bank assets and are the principal contributors to bank revenue. (Financial Services Authority of the Republic of Indonesia (OJK) 2022). Recently, there has been a growing global dynamic in the banking industry, namely increasing public awareness of environmental and social issues, the issuance of regulations regarding sustainable taxonomies for various business sectors and the potential for greenwashing. These conditions are challenges because stakeholders also expect banks to overcome them. To satisfy stakeholder expectations and adapt to the dynamics of the external environment, state-owned conventional banks, which possess 44.6% of Indonesia's national loan portfolio, need specific business models and strategies to promote sustainable lending growth.

The value chain concept, as proposed by Strakova et al. (2021), serves as a foundation for developing business models and is also essential for strategic planning (Hergert and Morris 1989). This approach is particularly pertinent to lending activities, which involve primary and support activities that interact to create margins (financial performance) and encompass various internal resources of the bank. Performance measures are developing not only economic performance but also non-financial performance consisting of environmental and social aspects which include governance principles in an effort to achieve sustainable lending growth goals.

The creation of sustainable business models is increasingly vital for aligning internal operations and resources with sustainable principles. Various approaches to sustainable business models have emerged, including the eight sustainable business model archetypes formulated by Bocken et al. (2014), a taxonomy of eleven pattern groups of sustainable business models developed by Lüdeke-Freund et al. (2018) and six business drivers differentiating sustainable business models developed by Schaltegger et al. (2016). However, banks need the right business model to run their business activities including sustainable lending. This is a challenge for banks because they must identify internal conditions in implementing sustainability values in their business model.

One of the business models that applies the concept of sustainability is the triple layer business model canvas (TLBMC) framework, which has been relatively new and was popularized by Joyce and Paquin (2016). The TLBMC has advantages including providing a global overview of a business model in a relatively simple visual. In addition, TLBMC can be used to support sustainability-oriented business model innovation including economic, environmental and social aspects where there are governance elements (Joyce and Paquin 2016). TLBMC emphasizes the sustainability approach, especially the social and ecological aspects (Stubbs and Cocklin 2008) as a development of the business model canvas by Osterwalder and Pigneur (2010).

Dynamics at the macro level, industry and companies that change business models with sustainable concepts will influence bank business strategies. This is because strategy is an approach to external competition using capabilities developed in the business model (Newth 2012). This opinion is confirmed by Slavik and Zagorsek (2016) that there was a relationship between business models and strategy, where the strategy determined has relevance to the business model. Banks can use a sustainable business model approach, as a basis for formulating business strategies. The bank's internal activities and resources that have potential sustainability values in the business model elements can be used as key drivers of competitive advantage strategy (Bocken et al. 2014).

Currently there is very limited research that combines the canvas business model with a sustainable concept in the context of sustainable lending. Győri et al. (2021) conducted research on sustainable banking by combining the canvas business model with the sustainable principles of the global alliance for banking on values (Global Alliance for Banking on Values 2012). The research results showed that the MagNet bank's way of doing business sustainably can be part of the transition towards inclusive, fair and carbon-free.

Determining the selected business strategy alternative generally does not only take into account internal resource factors contained in the business model, but also needs to pay attention to aspects of stakeholders and relevant external factors. However, research in the selection of structured strategic alternatives for sustaineable lending by considering the role of stakeholders and relevant external factors is still in the early stages. Sum (2015) research on risk management decision making uses hierarchical elements of decision makers and external factors (economic scenarios) in choosing alternative strategies.

Based on the background and problems stated previously, the following research questions arise:

What is a sustainable lending business model that is suitable for state-owned banks in Indonesia?

What is the formulation of a structured sustainable lending strategy for state-owned banks in Indonesia?

Therefore, this research aims to build a business model for sustainable lending and formulate a structured strategy for sustainable lending in state-owned conventional banks in Indonesia.

2. Literature Review

2.1. Sustainability

2.1.1. Sustainable Development Goals (SDGs)

SDGs is an agenda to achieve global sustainable development in three dimensions, namely economic, social, and environmental, which is realized in the form of an action plan for people, earth, prosperity, and world peace. The Sustainable Development Goals (SDGs) are integrated and encompassing, with a global scope that allows for universal application. They consider the varying capacities and developmental stages of nations, respecting each country's policies and priorities. Generally, the SDGs are driven by global climate change and the ongoing presence of poverty affecting individuals worldwide (Panuluh and Fitri 2016).

Climate change is characterized as an intense response to weather events that negatively affect agricultural and water resources, human health, and the ozone layer, as well as vegetation and soil, leading to a doubling of carbon dioxide levels in ecosystems (Okoli and Ifeakor 2014). Some researchers (Butt et al. 2005; Mertz et al. 2009) are of the view that global temperature will rise further if the factors involved in climate change are not urgently addressed. Poverty is characterized as a state in which an individual cannot sustain themselves according to the standard of living of their community and is also unable to employ their mental or physical capabilities within that group (Soekanto 1982). According to Kuncoro (2018), at a macro level, poverty arises because of unequal patterns of resource ownership which gives rise to unequal income distribution, poor people only have resources in limited quantities and of low quality. From this description, there are two important aspects that need to be considered besides the economic aspect, which are the environmental aspect related to climate change and the social aspect related to poverty.

2.1.2. Triple Bottom Line and Sustainable Value Chain

Elkington (1994) introduced the concept of business sustainability, which encompasses three dimensions: economic, social, and environmental, collectively known as the triple bottom line (TBL). The economic dimension pertains to the company's ability to generate profit, the social dimension considers the company's contributions to the welfare of the community, and the environmental dimension focuses on the company's efforts to conserve the environment through the use of new, eco-friendly resources. Stauropoulou and Sardianou (2019) measured sustainable performance in the banking sector with a sustainable index structure following the TBL approach. In this concept, in addition to social and environmental aspects as in the TBL concept, there are aspects of governance which are a series. Meanwhile, according to Joyce and Paquin (2016), governance aspects are included in the social aspects.

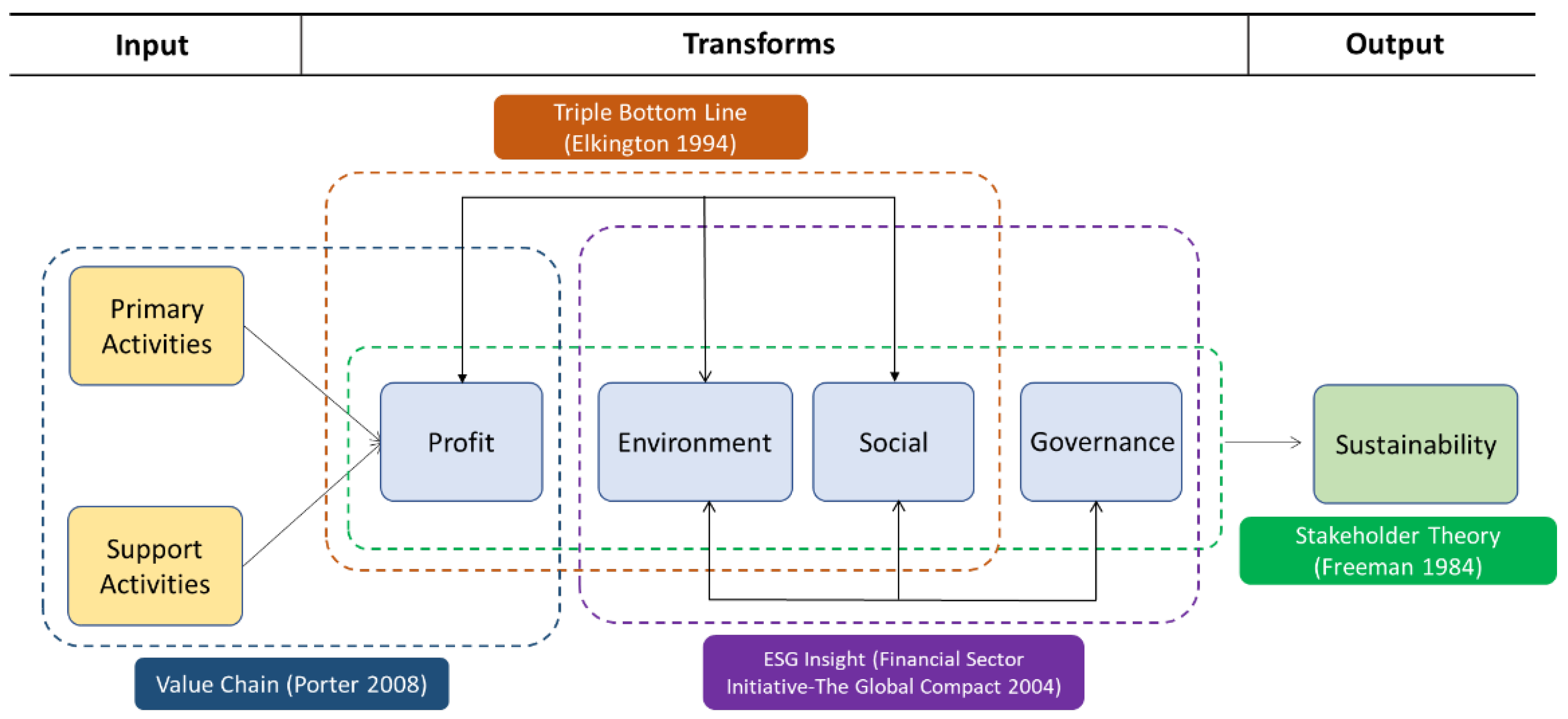

The TBL concept can be used to support the value chain concept in order to implement sustainability concerns. The generic value chain developed by Porter (Porter 2008) consists of primary activities and support activities that synergize to produce financial performance in the form of margins. The generic value chain output which is limited to financial performance still needs to be strengthened with non-financial performance to build a sustainable value chain. The value chain variant needs to be expanded by combining the three pillars of sustainability consisting of economic, environmental and social pillars (Fearne et al. 2012). The theory of sustainable value chains (SVC) is an extension of the initial value chain concept developed by Porter. The research results of Wu et al. (2023) explain that the SVC model can improve company capabilities that cannot be handled optimally by the traditional value chain. Sustainable value chains link the resources of environmental management, social responsibility, and economic well-being through the selection of strategies to ensure sustainable development (Sultan and Saurabh 2013). The conceptual framework of a sustainable value chain for lending had been developed by Manurung et al. (2024b), based on a value chain approach combined with the application of the triple bottom line concept and ESG insights to meet the interests of stakeholders is presented in

Figure 1.

2.2. Business Model

Business model is necessary in business activities and refer to Strakova et al. (2021) concluded through their research that the value chain can be used as the basis for a business model. Business model describes a system with elements that are compatible with each other (Magretta 2002).

2.2.1. Generic Business Model

Lending as a business activity requires a specific model approach tailored to the primary activities and support activities with their various elements. According to Magretta (2002) a business model is basically what explains how a company works. The business model describes how an organization creates, delivers and captures value (Osterwalder and Pigneur 2010) and describes the relationship between the resources owned by the company and the activities carried out to create value that makes the company profitable (PPM 2012). There are two groups of views regarding the orientation of the business model, namely as an economic concept and a combination of economics and value (Slavik and Richard 2014). The group of views of business models oriented to the combination of economics and value includes the canvas business model developed by Osterwalder and Pigneur (2010). This business models see the concept of economy for the benefit of shareholders and value for the benefit of customers.

Shafer et al. (2005) define business models in four main categories: strategic choices, value creation, value capture, and value networks. A business model is defined as a description of the core logic underlying a company and the strategic choices to create and capture value in a value network. The business model canvas is a logical description of how an organization creates, delivers and captures value (Osterwalder and Pigneur 2010). The business model canvas categorizes the business model into nine primary components, which are further distinguished into the right side (creative aspects) and the left side (logical aspects). These components include customer segments, customer relationships, channels, revenue streams, value propositions, key activities, key resources, cost structure, and key partnerships. These elements are organized into four main areas: management infrastructure, value propositions, customer relationships, and economic viability.

2.2.2. Sustainable Business Model

The development of the industry and regulations towards a sustainable system brings changes in the concept of traditional banking. Banks that are still adopting generic business models need to make adjustments to these developments.. The sustainable business model presents an ideal condition, namely a business model that focuses on providing positive environmental and social impacts through business activities using the triple bottom line concept (Bocken 2021). The transformation of this business model into a sustainable business model in driving growth and profitability and reducing company costs can even become a competitive advantage and key to the success of a business (Ziolo et al. 2020). Weber (2005), developed several models to integrate the concept of sustainability with the business strategies of banks and financial institutions, based on their respective business motivations. The motivation underlying these models is not only financial but also other aspects, namely sustainability as a value driver and sustainability as a new bank strategy. Research by Yip and Bocken (2018) related to sustainable business models in the banking industry shows that technological through digitalization and social factors actively safeguard the interests of stakeholders and reduce the misselling of banking products.

Business organizations take different approaches in implementing the concept of sustainable development of business models. This is related to the level of understanding and prioritization of sustainability issues in business operations (Rudnicka 2016). Sustainable business models in commercial banks can be a key driver in dealing with economic conditions affected by climate change (Grijalvo and García-Wang 2023). This is done through a re-evaluation of the general business model which includes three keys: targets, sustainable value proposition, and sustainable value creation.

In determining the type of sustainable business model, one basis is the adoption of sustainable values that include a comprehensive and systemic triple bottom line (people, planet and profit), in addition to criteria for sources of competitive advantage (Grijalvo and García-Wang 2023). The value of sustainability in business models was also put forward by Bocken (2023) with a depiction of a sustainable business model canvas consisting of four clusters, namely value creation, value proposition, value delivery and value capture.

In order to evaluate sustainability performance, Rebai et al. (2012) developed a model through a stakeholder approach, which consists of customers, regulators, shareholders, communities, managers, and employees. The determination of criteria for each stakeholder uses the respective viewpoints that are commonly used, namely risk attributes related to credit and liquidity risk management, service quality attributes related to credit facilities (credit portfolio), accessibility attributes related to information technology, attributes of benefits and incentives related to training and employee salaries (human resources).

Other research on models for sustainable performance evaluation in the banking sector was developed by Raut et al. (2017) by looking at four perspectives, namely the dimensions of financial stability, customer relationship management, internal business processes, and environmentally friendly management systems. These dimensions have criteria according to the characteristics of the dimensions, with the results showing that the green management system is the lowest compared to other dimensions. As a strategic planning framework, the value chain can help companies to identify and build competitive advantage through analysis of the various primary and support activities in the value chain. Hergert and Morris (1989) stipulate three things that need to be considered in effective strategic planning, namely the identification of activities that are sources of sustainable competitive advantage, the strength of the linkages between activities, and the identification of strategies to be followed in different value creation activities.

García-Muiña et al. (2020) explained that a sustainable business model is the introduction of several sustainable practices in the production process. In parallel, each sustainability practice should be evaluated with environmental, economic, and social assessment tools to assess its feasibility. In order to optimize company value, it is important for companies to understand and integrate the concept of sustainability into their management strategy and company value chain. In this way, companies can achieve long-term success that is balanced between economic profits, social welfare, and environmental conservation. One popular approach used to build a sustainable business model is the triple-layer business model canvas (TLBMC) framework. The TLBMC is a relatively simple business model, supports sustainable business innovation, and is considered appropriate to the current situation which focuses on environmental preservation activities and the social impact of a business (Susanto et al. 2021). TLBMC itself is the result of development from a generic business model canvas resulting from developments carried out by Joyce and Paquin (2016).

2.3. Business Strategy

Business model and business strategy are two things that are necessary in business activities. Magretta (2002) explains that business models and business strategies both have enormous practical value. However, they differ in their application where the business model describes a system with elements that are compatible with each other, while the strategy deals with the reality of facing competition. Sequentially, the business model comes first, followed by the business strategy (Seddon and Lewis 2003).

Strategy is the creation of a distinctive and valuable company position by involving a series of different activities (Porter 1996). The strategy aims to achieve superior long-term investment returns, which are achieved from various elements of the company that are compatible with each other. Do and Nguyen (2020) revealed that implementing proactive strategies produces competitive advantages in the form of differentiation and cost leadership. The strategy must be able to help develop the current condition of the company (short term) and build it into a foundation for future interests (long term) through policies and programs. The selection of policies and programs is adjusted by taking into account several internal factors (company resources) and external factors (environmental) which are adapted to the business field (Wheelen and Hunger 1998). According to Ansoff (2007), environmental turbulence is a variable that determines types of strategic behavior, where different levels of environmental turbulence require different responses from the organization.

The flurry of sustainability concerns in recent decades has transformed business models into sustainable business models that must be responded in business strategy formulation. This is because strategy is an approach to external competition using the capabilities developed in the business model (Newth 2012). Currently, financial performance is no longer sufficient as a means of creating sustainable value (Fearne et al. 2012). The existence of awareness of stakeholder interests and encouragement of industrial developments and regulations for business continuity encourages companies to adjust their business strategies to become sustainable. This is in line with the concept of sustainability development, which is development that meets the needs of the present without compromising the ability of future generations to meet their own needs at the global level (United Nations 1987). However, this concept can be applied at the company level by adjusting its objectives to meet the needs of stakeholders (Dyllick and Hockerts 2002). This sustainable business strategy is the integration of economic, environmental and social concepts into the company's goals, activities and planning to create long-term value, which not only takes into account shareholders but also stakeholders (Long 2019). Therefore, companies need to formulate new strategies that are capable of mapping sustainability issues by relying on internal resources identified in the sustainable business model.

In determining strategies using existing resources to face competition, companies identify different value-creation activities. Resources in credit distribution activities include the quality of the credit portfolio (Dura and Drigă 2015; Bhat et al. 2020; Wang et al. 2020; Muriithi et al. 2016), risk management through credit policies (Alalade et al. 2014; Nawaz et al. 2012; Abdou and Pointon 2011; Weissova et al. 2015), human resource capabilities (Alalade et al. 2014; Rahman and Taniya 2017), the role of banking technology (Hac 2021; Appiahene et al. 2019; Romdhane 2013; Dangolani 2011). In order to implement the concept of sustainability, it is necessary to adjust the management of existing resources. This adjustment is done by linking resources or activities with aspects of the three pillars of sustainability with various alternatives, such as developing a TBL or ESG-oriented credit portfolio (He et al. 2019; Khatun et al. 2021), adjusting risk appetite policies for green banking financing products (Cui et al. 2018; Al-Qudah et al. 2023), building a credit culture (Chimuka 2019), caring for the environment and social or digitizing for data accuracy (Jonsdottir et al. 2022; Roshan and Abdi 2022), environmental and social care or digitization in the context of data accuracy (Jonsdottir et al. 2022; Roshan and Abdi 2022).

Existing resources need to be chosen as a priority that will be used as a key driver to encourage sustainable lending significantly. Banks don’t have unlimited budgets, so the selection of priority resources to be developed into key drivers is part of the bank's strategy to be able to lend sustainably. Some approaches in making the choice of sustainable activities, among others, were carried out by Rebai et al. (2012) using a multi-stakeholder bank sustainability evaluation hierarchy framework. The hierarchy consists of four levels: overall performance score, stakeholders, attributes and sub-attributes. Another approach was conducted by Raut et al. (2017) using a hierarchical framework of balance score card performance evaluation criteria with AHP and TOPSIS analysis tools. Meanwhile, Sum (2015) chose alternatives to achieve goals, through risk management decision-making using analytical hierarchy processes.

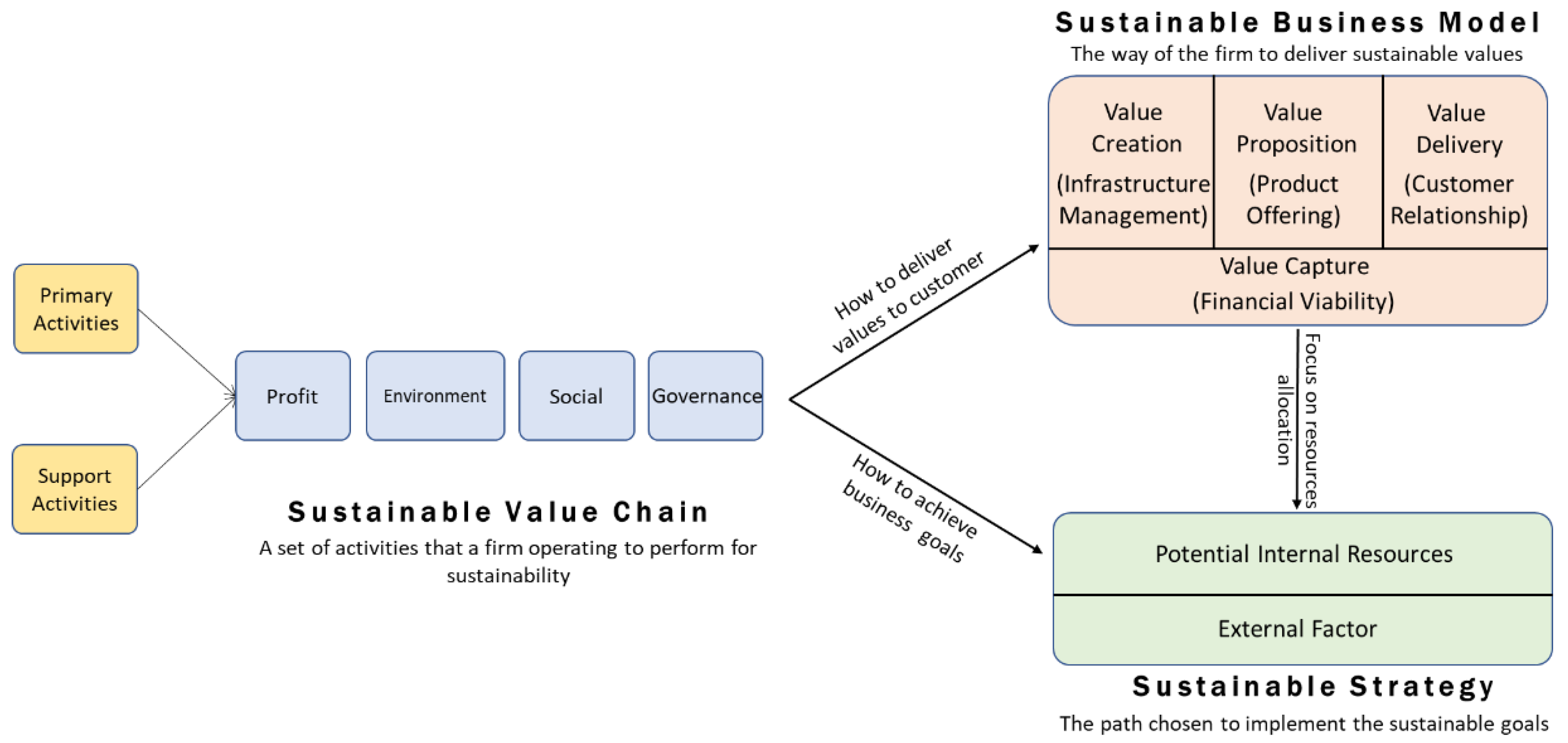

Coccia (2020) stated that decisions on complex problems involving organizational leadership include a process of thinking, consultation, action, and agreement in obtaining an optimal solution. Situations that may occur include limited resources, uncertainty factors, and confusing circumstances. Therefore, an efficient method is needed to recognize and act in order to assist decision-making in dealing with certain situations. The strategy selection activity which is the key driver or competitive advantage in sustainable lending, is generally carried out by multiple factors consisting of several relevant aspects. Apart from that, long-term strategic plans for banks also require approval from the bank owner. Research on structured decision-making by considering the role of stakeholders and relevant external factors is still limited. Based on the description of the value chain, business model and business strategy in sustainable lending activities, there was a relationship framework as presented in

Figure 2.

3. Methodology

3.1. Data Collection

This research was conducted on conventional state-owned banks in Indonesia, a group of banks with core capital greater than IDR 70 trillion and are state-owned companies, from November 2023-April 2024, consisting of three banks headquartered in Jakarta. The three banks have similar processes and credit products and are the first movers of sustainable banking in Indonesia.

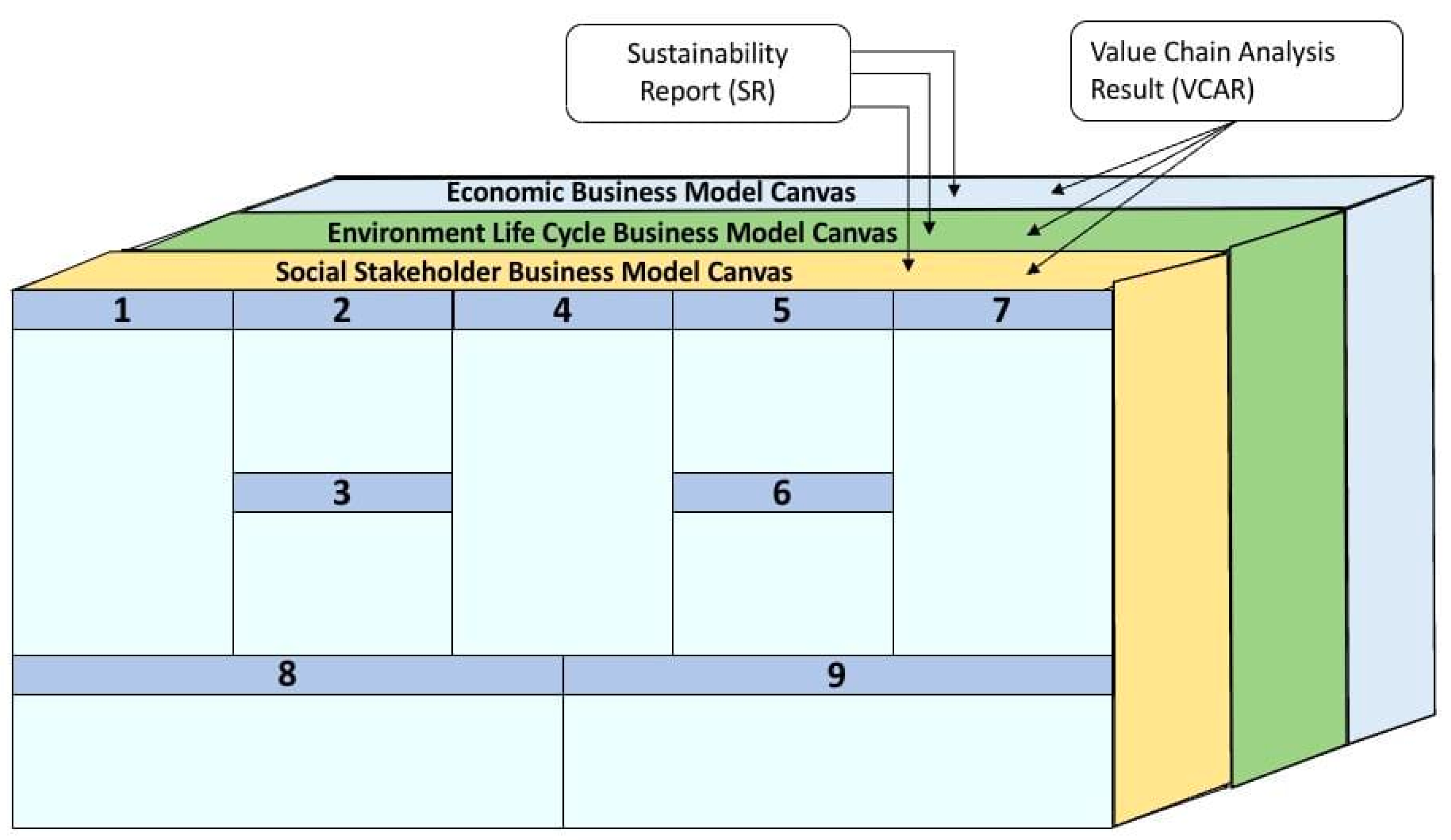

In this study, business model development and strategy formulation were conducted through a value chain approach. The results of previous research on sustainable value chain for sustainable lending of state-owned banks in Indonesia by authors (Manurung et al. 2024a) were used as input in analyzing the business model and strategy formulation, namely value chain analysis result (VCAR). The VCAR included primary and support activities (bank specific determinants) on sustainable lending through economic performance and ESG-oriented performance. Activities or resources in previous research analyzed using structural equation modeling (SEM). Both are the main elements in credit distribution, so they are very relevant to be used as input to complete elements in preparing a sustainable lending business model. Apart from that, it is supported by data from the sustainability report (SR) of the three banks was last published in 2022.

To formulate a strategy for selecting key drivers for sustainable lending growth using primary data. The primary data was obtained through a survey conducted with a questionnaire instruments to six experts consisting of experts in their respective fields relevant to the research topic. The questionnaire was distributed to respondents from banking practitioners, regulator, academic and banking association to obtain their opinions on the hierarchy leveling and hierarchy elements to be used in the analysis of hierarchy process (AHP) to select sustainable lending strategies.

3.2. Data Analysis Method

3.2.1. Triple Layer Business Model Canvas

In this research, the approach to the credit distribution business model in state-owned conventional banks in Indonesia used the business model canvas (BMC) introduced by Osterwalder and Pigneur (2010). In relation to implementing the sustainable concept, utilised the triple layer business model canvas (TLBMC) developed by Joyce and Paquin (2016). The consideration for using TLBMC was that this business model is quite popular and can be widely adopted as a tool to develop a business model that integrates social aspects, governance and the environment by adding layers of business model that is in line with economic aspects which was the initial orientation (Joyce and Paquin 2016)

TLBMC mapping includes three layers of aspects (Joyce and Paquin 2016), as follows: 1) Economic layer, namely analysis carried out on nine blocks of business model elements consisting of key partners, key activities, key resources, value proposition, customer relationship, channel, customer segment, cost structure and revenue stream; 2) Social stakeholder layer, namely an analysis carried out on nine blocks of business model elements consisting of social value, employees, governance, communities, societal culture, the scale of outreach, end users, social impacts and social benefits; 3) Environmental life cycle layer, namely an analysis carried out on nine business model element blocks consisting of functional value, materials, production, supplies and outsourcing, distribution, use phase, end of life, environmental impacts and environmental benefits.

The preparation of the business model with TLBMC was carried out by following the three-stage approach (Devlin 2020) which consists of planning, conducting and reporting. This approach was implemented as a mechanism in preparing business models with adjustments to objectives. Planning, namely identifying needs by presenting the condition of the bank's internal resource capabilities, determining the object of the research, namely the distribution of credit facilities by the bank, determining objectives that can make it easier for the bank to understand, consider and decide on resources that have the potential to be developed into key drivers for sustainable lending. The conducting stage refers to the implementation guidelines of the Indonesia Financial Services Authority, namely technical guidelines for banks related to the implementation of POJK No.51/POJK/03/2017 (Financial Services Authority of the Republic of Indonesia (OJK) 2017). Especially related to the process of preparing sustainable financial action plans, the determining factors for the plans which support the setting of goals and priorities sustainable finance can be in the form of organizational capacity. The reference to the conducting stage is previous research regarding, the sustainable value chain analysis result (VCAR) in the form of valid and reliable indicators. Another reference is sourced from sustainability report (SR). The reporting stage is pouring the analysis results into a canvas and building a canvas sustainable business model. The framework for the relationship between the sustainable value chain analysis result (VCAR) and sustainability report (SR) data in preparing the TLBMC analysis is presented in

Figure 3.

3.2.2. Analytical Hierarchy Process (AHP)

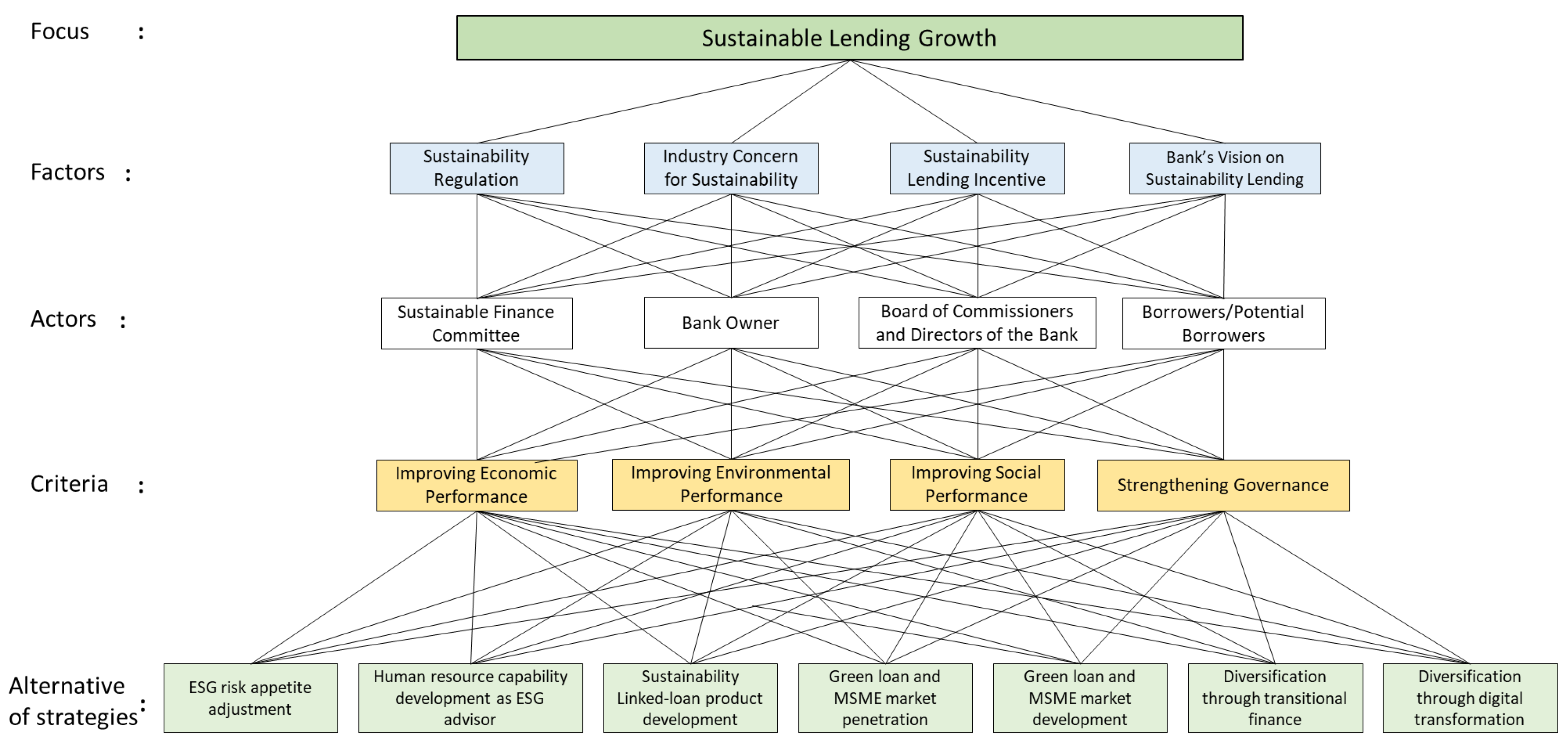

A business model canvas of sustainable lending was used to formulate the sustainable lending strategy as part of the AHP hierarchy. The bank's internal resources that have the potential to be used as key drivers to encourage sustainable loan growth are alternative strategies. These elements of internal resources group in four clusters, including management infrastructure, value proposition, customer relationship and financial viability (Osterwalder and Pigneur 2010). To achieve the ultimate goal of the strategy to encourage sustainable growth in credit distribution, is done by paying attention not only to internal capability contained in the business model elements but also to external factors.

External factors that support sustainable credit growth include regulations as a compelling element, industrial society's concern for sustainability as an encouraging element and incentives as a stimulating element. Apart from that, stakeholder factors also play a role in sustainability (Freeman 1984) which include committees or policy makers who issue sustainability provisions, bank owners, board of commissioners and directors, and borrowers. Meanwhile, internal capabilities use the results of SEM analysis on the influence of the value chain on sustainable lending through economic performance and ESG performance (environmental, social and governance), as an input. The results of the SEM analysis show that the dimensions that make the biggest contribution to each variable are support activities, social oriented aspects, green credit financing and principle of responsible investment (Manurung et al. 2024a). By referring to the results of the research, and the Ansoff matrix approach, several alternative strategies were developed that came from the bank's internal resources. The alternatives are ESG risk apptetite adjustment, human resource capability development as an ESG advisor, sustainability linked-loan product development, green loan and MSME market penetration, green loan and MSME market development, diversification through transition financing and diversification through digital transformation.

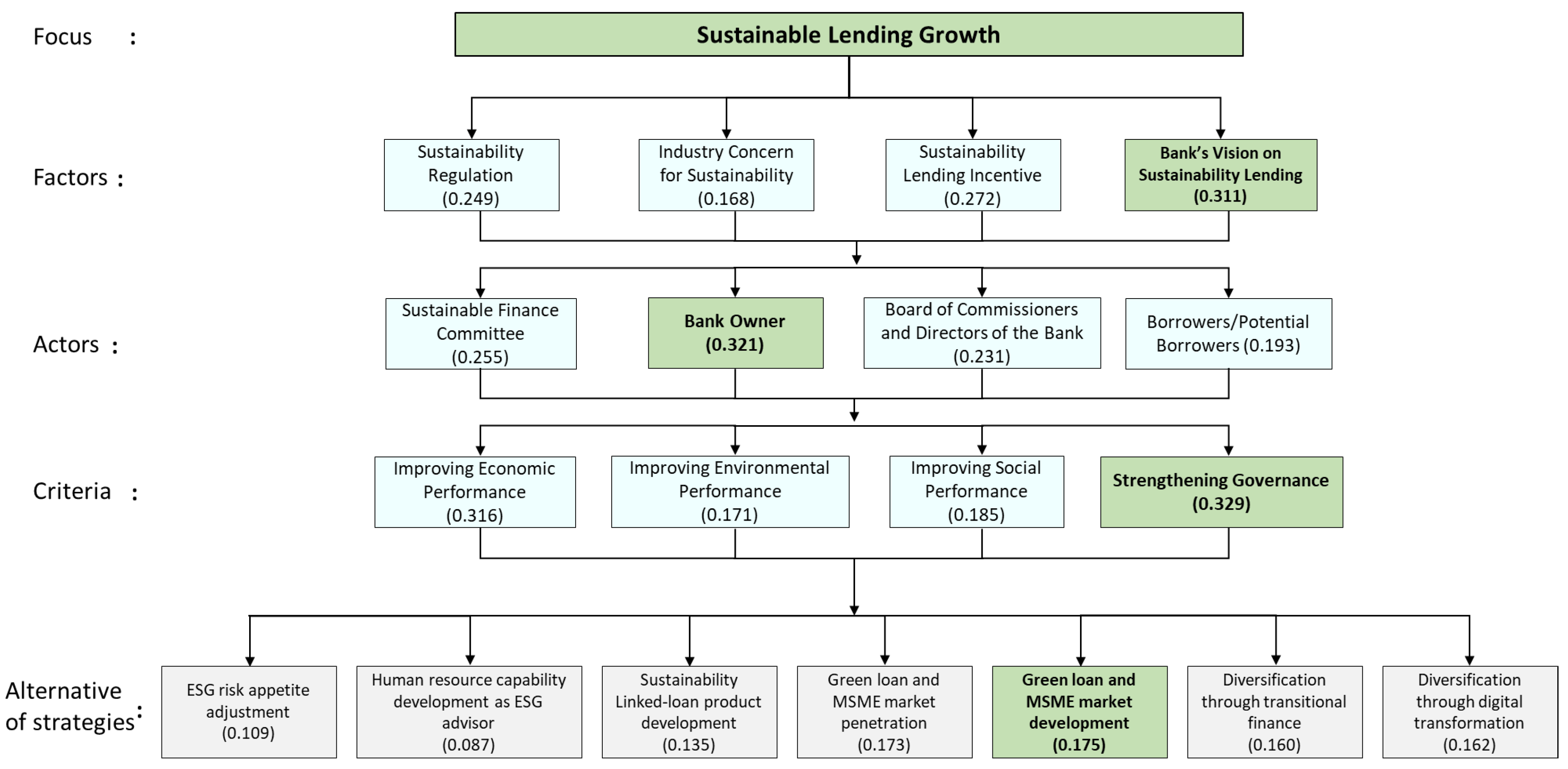

Determining choices of priority activities or resources to encourage sustainable lending growth using the analytical hierarchy process (AHP). Hierarchy is defined as a representation of a complex problem in a multilevel structure, where the first level is the goal, followed by the levels of factors, criteria, sub-criteria until the last level is an alternative (Saaty and Vargas 2012). The AHP hierarchy chart and its elements in this research showed in

Figure 4.

Decision making in AHP is carried out using a multi-criteria approach through pairwise comparison which comes from a preference scale between a group of alternatives (Saaty and Vargas 2012). The pairwise comparison process starts from the highest level of the hierarchy which is aimed at selecting criteria. The relative comparison values are then processed to determine the relative rating of all alternatives and perform consistency testing. The results of filling in the matrix by experts are declared consistent if the consistency ratio calculation is less than or equal to 10%. The final result is the weight of each level/component of the hierarchy was obtained and the component with the highest weight is the priority component of each level of the hierarchy.

4. Results and Discussion

4.1. Development of a Sustainable Lending Business Model

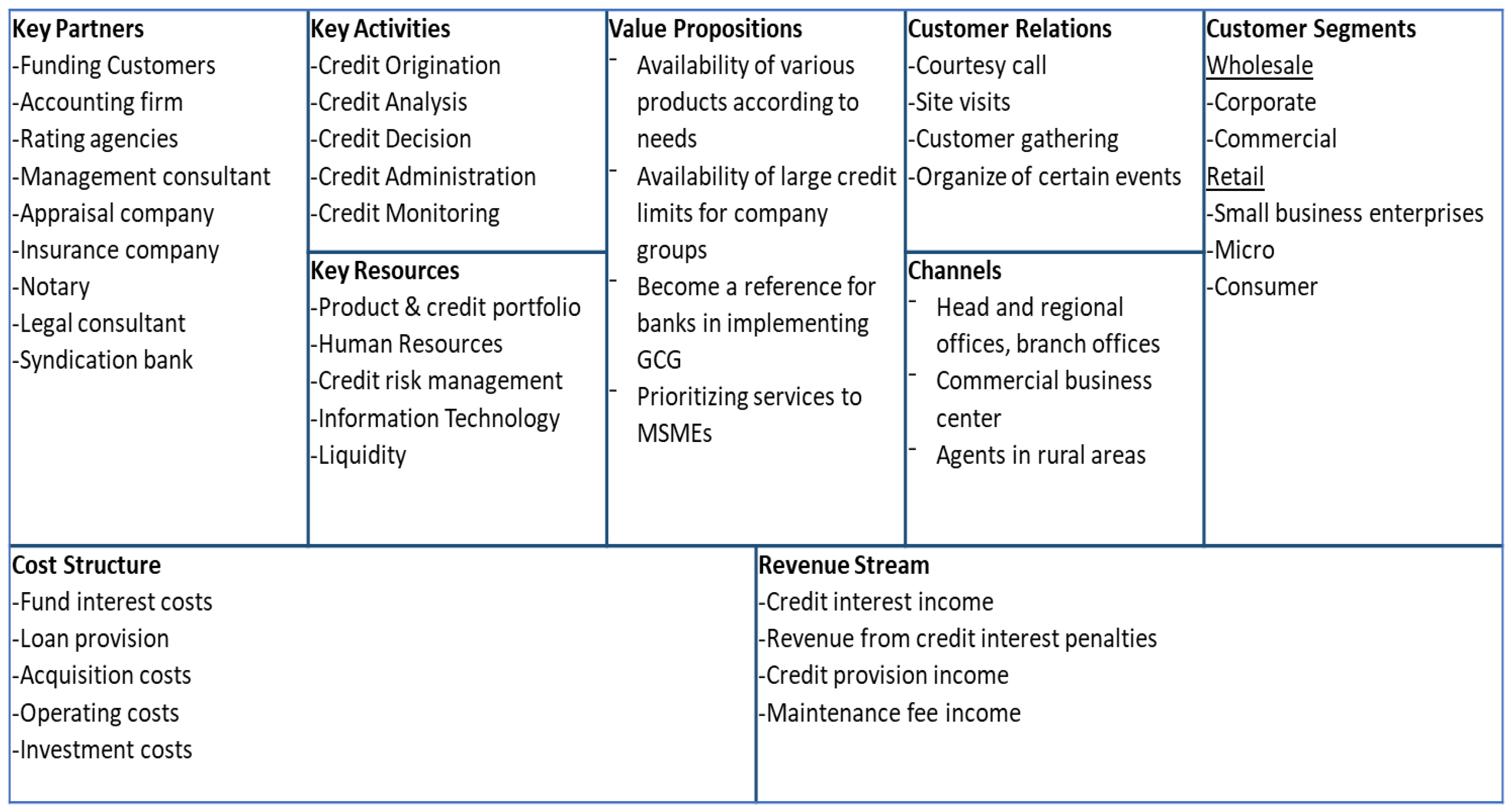

Development of a sustainable lending business model in conventional state-owned banks utilized the triple layered business model canvas (TLBMC) framework. The preparation of nine blocks of business model canvas elements in each layer consists of economic layer, environmental life cycle layer and social stakeholder layer. The application of TLBMC to the lending business model is focused on the practice of sustainability values, both for activities and internal resources contained in each block element. In addition, it is also to determined the objective achievement of sustainability through the benefits obtained and the impacts that need to be anticipated The results of applying the TLBMC framework to the sustainable lending business model was presented in

Figure 5 (Economic Layer),

Figure 6 (Social Layer), and

Figure 7 (Environmental Layer).

4.1.1. Economic Layer

The economic layer is generic of TLBMC, which focus on financial perspective which was explained through the nine blocks presented in

Figure 5 as follows.

Key Resources, Key Activities, and Key Partners

The key activities in credit distribution are end to end operational activities carried out by credit managers in order to distribute credit facilities so they can grow, be healthy and sustainable. These key activities were reflected in the bank credit process, which includes the front-end, mid-end and back-end areas consisting of credit origination, credit analysis, credit decision making, credit administration and credit monitoring. These activities were the primary activities dimension of the value chain variables in VCAR, which have a significant contribution.

In order to support key activities in achieving sustainable lending goals, key resources are needed in the form of internal bank capabilities. These key resources come from production factors which are used as support in each stage of the credit distribution process. These capabilities consist of credit products and portfolios, human resources, credit risk management, information technology and liquidity. To support credit analysis and decision-making in order to maintain a good quality credit portfolio, credit risk management methods and tools (portfolio guidelines, industry acceptance criteria, industry limits, credit rating/scoring, credit policies, and product manuals). To support the fluent credit process, it is necessary to have information technology systems (integrated end-to-end loan processing system) and liquidity for transactions. Research by Guerola-Navarro et al. (2022) has proven that the application of technological solutions is the fastest-growing thing because of the impact of its application on return on investment. In carrying out each stage of the credit process and developing internal bank resources that support sustainable lending, there were human resources involved. These key resources were support activities dimension of the value chain variables in VCAR that have a significant contribution.

As mentioned in key resources, one of the things that is really needed in credit distribution is funds or liquidity. Therefore, fund customers who are a source of public funds are the key partners in sustainable lending distribution, which can be seen in SR. Key partners are also needed to support key activities in evaluating credit proposals, including project feasibility, ESG rating, financial performance audit, mitigating business and legal risks, valuation of collateral, and risk sharing.

Value Proposition, Customer Relationship, Customer Segment and Channels

Infrastructure management of the three block elements (key activities, key resources and key partners) was expected to realise a sustainable value proposition, it is the value offered by the bank to borrowers for the costs they incur to obtain credit facilities according to their needs. This value was related to the availability of credit products according to needs, the availability of credit limits that are in accordance with the needs and priority services to MSME. This value proposition differentiates the bank from other banks in offering products and services in order to compete (Barney 1991; Teece 2018).

Apart from the value proposition, customer relationships were also needed, which is a form of relationship with borrowers in order to maintain the continuity of credit distribution, both quantity and quality. This was done through regular visits to the borrower's office or business location or by telephone to determine the extent to which the borrower's needs are met. This activity also monitors the development of the borrower's business to find out if there are any problems encountered and also to found out whether the borrowers were implemented sustainable practices. Apart from that, relationship development is also carried out through customer gatherings and holding certain other events that raise the theme of sustainability. Customer relationship needed to increase customer value was also revealed in research by Zhang et al. (2017), where customer relationship as a valuable asset was therefore chosen as a source of competitive strategy.

Borrowers served consist of various segments based on the size of the credit volume provided and in terms of sustainability lending, wholesale and retail segments. The wholesale segment consists of corporate and commercial sub-segments, both domestic and overseas. Meanwhile, the retail segment consists of domestic small and medium enterprises (SME) and micro and consumer loan sub-segments. In terms of sustainability, lending consists of green loans and MSMEs. This categorisation of borrowers per segment makes it easier for banks to manage similar borrowers who have their own characteristics that are different from other segments. This is in line with some research results on commercial banks that showed proper classification of borrowers was necessary for successful business development (Mihova and Pavlov 2018). It was explained that in the face of increasing competition, a market strategy is needed, one of which is through developing customer segmentation by offering products and services from various target customers.

In order to convey messages and services on credit facilities to borrowers and potential borrowers using channel infrastructure such as commercial business centres, business centres or branches that are strategically located in certain cities. Especially for the retail segment, banks, apart from physical infrastructure, also use website media, call centres and cooperative institutions that also act as channelling agents. The use of online and mobile banking channels is increasingly widespread and plays a role in increasing bank interactions with borrowers and supporting credit expansion. Research results of Mohammad and Bello (2022) also showed that channel distribution such as internet banking directly increased customer satisfaction, while mobile banking was mediated by the element of trust. This was related to the increasing development of innovation in information and communication technology which creates opportunities for additional service distribution channels to customers.

Cost Structure and Revenue Stream

Key resources for credit distribution in the form of liquidity require very large costs to obtain. Apart from interest costs, there were also costs for reserves for impairment losses, acquisition costs, operational costs and other costs related to lending. Apart from that, there were investment costs related to building credit information systems, credit tools, training and the like. These costs were expenses that must be met so that credit distribution operational activities run smoothly and the bank's ability to distribute credit and maintain credit quality.

From credit distribution activities, banks obtained their main income in the form of credit interest, as can be seen from the SR. Other income in line with providing credit were credit provisions, credit administration, and maintenance fees. This income is expected to cover all credit costs and generate profits that will encourage further development of credit distribution. The costs and the income were measured of financial performance, which is part of the economic performance variables in sustainable value chain analysis in VCAR, which showed a positive and significant influence on sustainable lending. This was in line with the results of research by Gonçalves et al. (2023), which showed that changing the conventional business model through its combination with the core sustainability proposition brings benefits that drive economic performance.

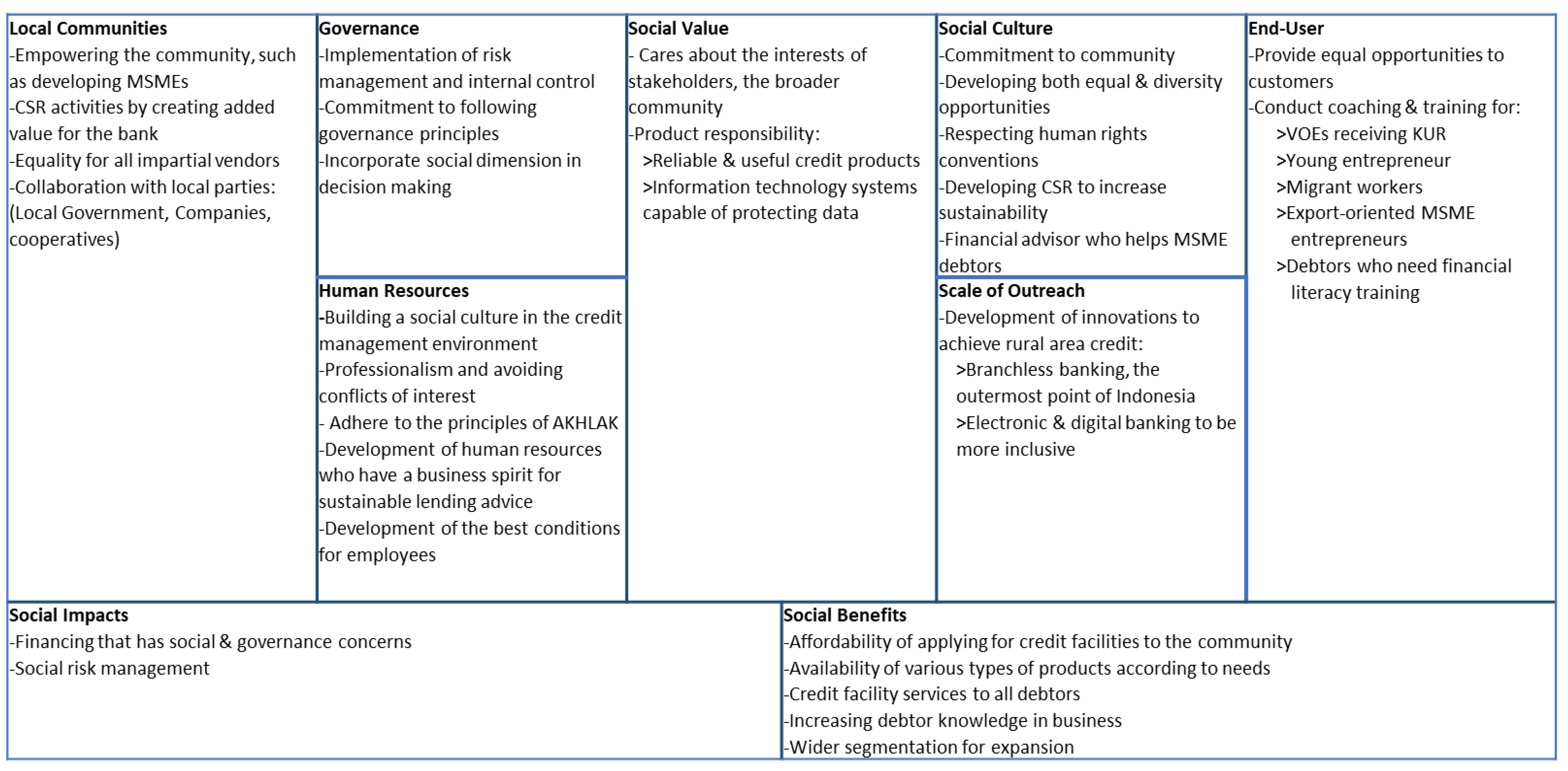

4.1.2. Social Stakeholders’ Layer

The Social Layer will discuss the nine blocks presented in

Figure 6, which are linked to the social dimension and describe the company's role in terms of social aspects related to the welfare of the surrounding community (Joyce and Paquin 2016).

Social Value, Human Resources and Governance

Social value is related to the organisation's mission to meet the interests of stakeholders and the wider community. According to the mission of each bank listed in the SR, it can be summarised as caring for the interests of stakeholders, the wider community and the implementation of governance, including in the bank's key activity of lending. This social value can be more clearly translated in the form of reliable and useful credit products according to the needs of borrowers and a credit information system that was able to stored and protected borrower’s data and information. Social value was the realization of the social-oriented dimension of the ESG performance variable in VCAR, where the social-oriented dimension of the ESG performance variable had a significant contribution. Research of Kocornik-Mina et al. (2021) showed the urgency for the banking industry to consider social aspects through a circular model that clearly showed how value-based financial institutions aim to fulfill social aspects.

One of the elements that encourage social value is the role of human resources involved in credit management through their behaviour related to social aspects as stated in SR: (1) adhering to the principles of accountability, competence, harmony, loyalty, adaptive and collaborative; and (2) developing behaviour that has a spirit of growth and a business spirit. This behaviour was a form of governance enforcement of ESG performance variables in sustainable credit distribution in VCAR. The VCAR revealed that the governace-oriented dimension of the ESG performance variable has a significant contribution. From the results of this VCAR, independence indicators can be seen, namely fostering a professional attitude, free from conflicts of interest and free from influence or pressure from any party in the credit granting process. For the effectiveness and soundness of the banking sector, it was necessary to apply cultural standards that have become a general consensus held by the banking community (Morrison and Shapiro 2016).

Enforcement of governance is needed according to prudential banking principles so that lending is given properly and in accordance with applicable rules and regulations, not only for the benefit of banks in producing quality loans but also for the benefit of stakeholders. Implementation in lending was carried out through the principles of good corporate governance which includes transparency, accountability, responsibility, independency, and fairness, as stated in the SR. In addition to the commitment to meet the five principles of governance above, the results of VCAR showed that the dimensions of governance-oriented from ESG performance variables included implementation of risk management and internal control and considering social and environmental aspects in decision-making. In line with the additional governance indicators, social trust was needed in its implementation to overcome social pressure on the implementation of ESG activities (Miranda et al. 2023).

Local Communities, Societal Culture, Scale of Outreach and End-Users

Social relationships need to be built with different communities of fund customers and local vendors in various regions through maintaining and developing mutualistic relationships. Based on the SR, these social relations were applied to: (1) the community through developing micro and small businesses and empowering financial inclusion; (2) vendors of goods/services apply the principle of equality in the selection process. Apart from the community and vendors, there were local parties who played a significant role in credit distribution as the result of VCAR. This VCAR revealed that economic performance variables have a positive and significant effect on sustainable lending through local communities. The results of this analysis can complement the block elements in the following ways: (1) cooperation with local government, (2) collaboration with large local companies, and (3) collaboration with cooperatives.

In addition to building social relationships with local communities, it is necessary to recognise the organisation's behaviour towards societal culture. The SR indicated the following activities related to societal culture: (1) developing CSR programs to increase value for stakeholders; (2) placing branchless banking agents serving customers in remote areas; and (3) providing financial advisors to help MSME borrowers evaluate financial conditions. The above activities are confirmed by VCAR which showed social-oriented dimension of the ESG performance variable has a significant contribution. In the VCAR there were some indicators, including: (1) commitment for community, encouraging small business development to underserved communities and organizing business training to small entrepreneurs; and (2) respecting human rights conventions, applying equality to borrowers in terms of gender, social status, segment or location of the place of business.

More specific relationships in the application of social aspects are reflected in the scale of outreach, which explains the depth and breadth of bank relationships with customers through various ongoing activities (Joyce and Paquin 2016). The SR showed several activities, as follows: (1) developing branchless banking to reach customers located in remote areas; and (2) developing electronic and digital banking, to support financial inclusion. The results of VCAR regarding sustainable value chains for sustainable lending strengthen the role of those two activities. Referred to the VCAR, there was an inclusive principle dimension of the sustainable lending variable, with the following indicators: (1) affordability of credit applications by all levels of society; (2) credit facility services to all borrowers as needed. End-users, as parties who utilize the value proposition, strive to have their needs met in order to improve the quality of business activities. End-users or borrowers are supported not only by credit facilities but also by (1) credit products of various types that can be accounted for; and (2) a reliable credit distribution system, and comfortable and safe transactions.

Social Benefits, Social Impacts

As a measure of performance on the social layer, there are two things, including social benefit and social impact. Social benefits are positive social values generated in connection with credit distribution activities. The SR showed several expected benefits as follows: 1) development of knowledge and business capabilities of small entrepreneurs; 2) increasing access for small entrepreneurs to the banking industry. The positive social values above do not include the value expected from the application of inclusive principles of sustainable lending. This lack of the expected value was complemented by the value of VCAR results, namely the availability of various types of credit products according to community needs and government policies. Apart from that, there is open cooperation with third parties in distribution credit. This is slightly different from the research of Yang et al. (2021) which explained that the distribution of bank credit does not encourage companies to generate more economic and social benefits. However, government-backed credit guarantee funds may generate more economic benefits, although the impact on corporate social benefits remains unclear.

Social impact is a bank's social costs that arise from a socially caring attitude in lending. One of the implications of the research results of Kocornik-Mina et al. (2021) was to understand how finance can generate social impact. The SR showed several impacts as follows: (1) preparation and implementation of business training for small entrepreneurs; and (2) branchless banking development planning. The activities above do not include impacts that are restrictive in nature, such as the attachment to new provisions regarding the implementation of social awareness and governance enforcement. There was also an impact on social risk management by carrying out social risk identification, analysis, mitigation and monitoring activities in order to fulfill social aspects and also anticipate potential social-washing that were seen in the VCAR.

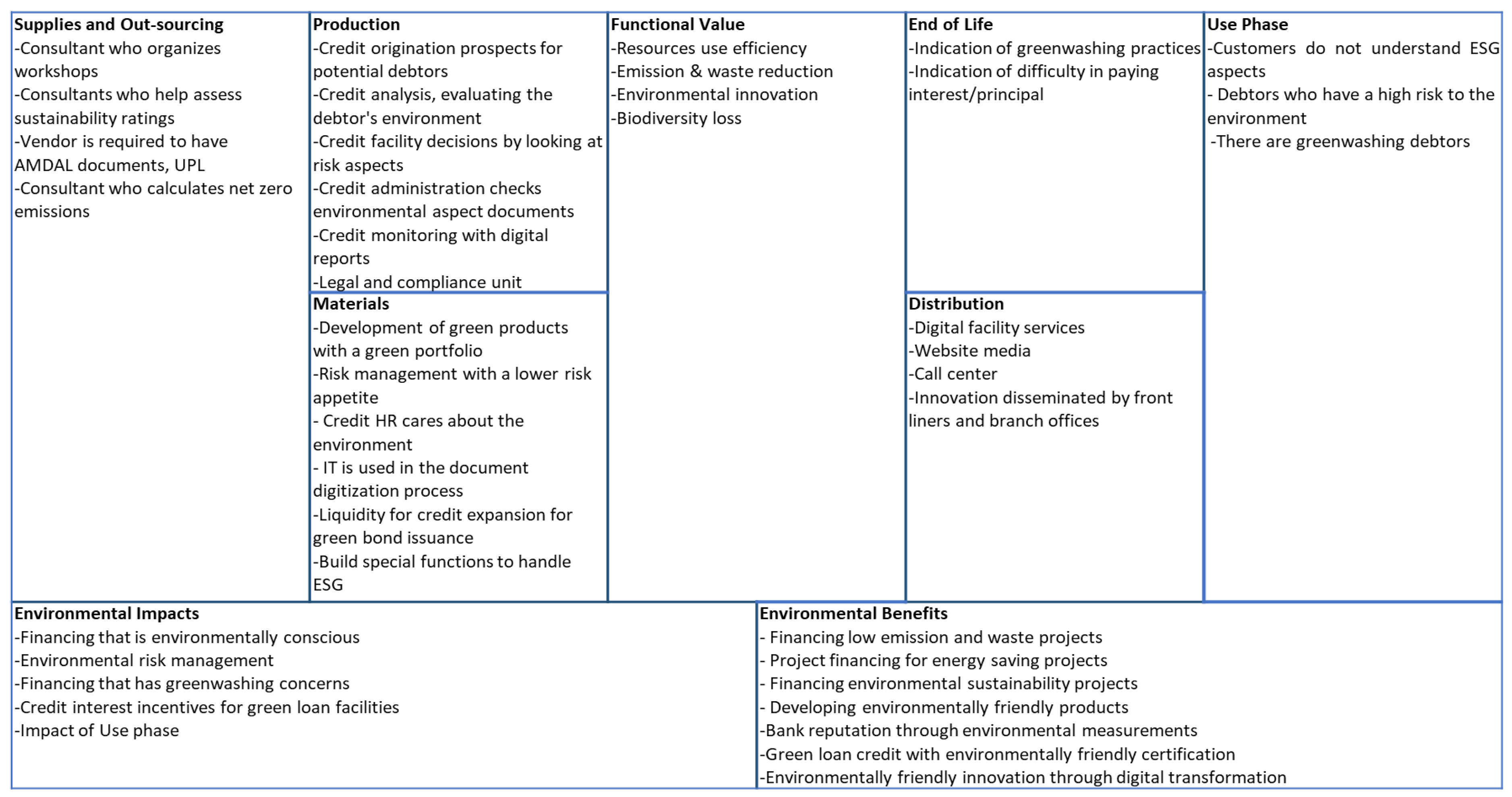

4.1.3. Environmental Life Cycle Layer

The environmental layer of the TLBMC aimed to assess the extent to which an organization can produce environmental benefits that are greater than environmental impacts (Joyce and Paquin 2016). Nine elements of the environmental life cycle business canvas model in sustainable lending related to green loan facilities are presented in

Figure 7.

Functional Value

Joyce and Paquin (2016) explained functional values, namely what is researched at the environmental layer and these values serve as a basis for exploring the potential impact of alternative business models. Banks, as financial intermediation institutions that are aware of the environment, play a role in financing distribution activities in the green loan (environmentally friendly) sector. In the SR, the bank has distributed credit facilities such as renewable energy, sustainable plantations, green property, and other green projects. This was due to increased awareness and responsibility for the environment, which is in the interests of stakeholders. Research by Jillani et al. (2024) explained that the role and needs of stakeholders have a positive relationship in taking part efficiently in the implementation of green banking throughout the country. The type of green loan provided is in line with the environmental-oriented dimension of ESG performance variables in VCAR, which have a significant contribution. There were some indicators, namely: (1) resource use efficiency, (2) emission and waste reduction, and (3) biodiversity loss prevention. This is supported by the research of Li et al. (2018) who explained that the company choose energy emission as one of the technical innovations to promote cleaner products.

Production, Materials, Distribution, Supplies and Out-Sourcing

The functional value is a reference in production activities, which is a series of end-to-end credit distribution processes in financing green loans (green projects). In the SR, there were environmental awareness activities which can be seen from: 1) credit origination by prospecting potential borrowers with business activities that are classified as environmentally friendly; 2) credit analysis, evaluating in more depth the borrower’s environmental factors; 3) credit facility decisions making, looking at risk aspects and environmental risk mitigation; 4) credit administration, monitoring ESG aspects including environmental requirements documents. These activities in the environmental credit process stated in the SR confirmed with primary activities dimension of the value chain variables in VCAR which have a significant contribution. The primary activities consisting of credit origination, credit analysis, credit decisions, credit administration to check compliance with environmental aspect documents, credit monitoring with digital reports (paperless). In essence, these activities were the same as the credit process stages used by Scannella (2015) and Hubbard et al. (2014).

Production activity need to be supported by various materials from internal resources that aware about the environment. In the SR, various materials were included: (1) development of green products with a green portfolio; (2) green loan credit risk management with a lower risk appetite; (3) human resources involved in credit have concern for green culture; (4) information technology is used in the process of digitizing credit documents (green technology); (5) liquidity for credit expansion comes from the issuance of green bonds; and (6) build a dedicated function to address ESG. These materials listed in the SR were support activities dimension of the value chain variables in VCAR which have a significant contribution. There were some indicators, namely credit portfolios and products, human resources, risk management, information technology and liquidity. These materials were relatively similar to the enabling factors required for commercial bank activities (Lamarque 2004; Lammers et al. 2004).

The output of materials and production of green loans, along with other relevant services and information, requires distribution facilities to speed up delivery to borrowers. Developing distribution facilities that are aware of the environment requires creativity. In SR there were facilities or media used, namely digital facility services, website media and call centers. The development of distribution facilities for environmentally conscious credit, as stated in the SR, is in line with the environmental-oriented dimension of ESG performance variables in VCAR. The VCAR found the dimension has a significant contribution to ESG performance through environmental innovation. One of the important distribution innovations was digital technology, which significantly supports the bank’s profitability in the long term (Shanti et al. 2023).

While input of materials and production process for providing green loan facilities supported by the supplies and outsourcing element. In the SR there were third parties who supported production activities and fulfil internal resource needs related to environmental aspects through collaboration with consultants to provide assistance, including 1) creating frameworks related to sustainability (ESG roadmap and policies); 2) assessing the bank's sustainability rating; 3) calculating baseline net zero emissions; and 4) holding ESG workshops.

End of Life and Use Phase

The quality of the bank's relationship with the borrower in providing green loan facilities does not always run normally, there are times when it decreases. End-of-life in credit distribution includes borrowers who are no longer actively transacting on green loan facilities or are experiencing problems with green loan facilities. In the SR, there were several borrowers' conditions that need attention, as follows: (1) the green loan facility cannot meet interest and/or principal obligations; (2) the ESG-linked loan experienced default; and (3) the green loans were indicated to be greenwashing.

Apart from the potential for bank and borrower relationships to decline, there are also conditions that cannot be anticipated during the credit period. The use phase describes customer involvement in using the bank's sustainability loan products. During the period of green loan facilities, borrowers also play a role in having a negative impact on green loan activities. In the SR, there were several borrower conditions that need to be categorised separately, as follows: 1) borrowers who use credit facilities for businesses that endanger the environment; 2) borrowers who have high risk indicators regarding environmental impacts; 3) borrowers who do not understand ESG aspects. This categorisation was to make it easier to recognise borrowers who need attention, such as those related to greenwashing potential. This was considered greenwashing's severe consequences on corporate reputation, financial performance, and stakeholder trust (Dempere et al. 2024).

Environmental Impacts and Environmental Benefits

Environmental impacts are a component of ecological costs for green loan distribution activities borne by banks. In the SR, there were several impacts as a result of the use phase above, as follows: (1) the need for coaching efforts for borrowers who do not understand ESG; (2) decreased bank reputation for green loan borrowers who actually use their credit facilities for businesses that endanger the environment or have high-risk indicators for environmental impacts. In addition, there is a credit interest incentive for providing green loan facilities. These ecological costs did not include limiting impacts as seen in the principles of environmental risk management and greenwashing awareness dimensions in the sustainable lending variable in VCAR, which have indicators as follows: (1) attachment to provisions regarding the application of environmental aspects by banks; (2) environmental risk management by carrying out environmental risk identification, analysis, mitigation and monitoring activities; (3) attachment to the provisions for submitting reports on environmental aspect measurement results; and (4) monitoring the performance of environmental aspect; 5) follow up on the decline in environmental aspect performance. These indicators contributed to complete the environmental impacts element. Alnassar (2022) has conducted research on the impact of green loans on environmental benefits. The results showed the role of green loans and environmental sustainability index policies in reducing emissions.

Environmental benefits are ecological values created by organizations through efforts to reduce negative environmental impacts. In SR there were several positive things, as follows: 1) Encouraging innovation to create new environmentally friendly banking products by reducing paper use and reducing carbon emissions through digital transformation; 2) Obtain a source of green funding through the issuance of green bonds. The ecological value above does not include aspects of reducing negative environmental impacts such as encouraging reductions in carbon emissions, saving energy and preserving nature. The results of VCAR showed a significant contribution of the green credit financing dimension that has some valid and reliable indicators, namely financing low-emission and waste projects, financing energy-saving projects, financing projects that preserve nature, developing environmentally sound products, improving bank reputation through the implementation of environmental measurement standards. These indicators contributed to completing the environmental benefits element. This is also supported by Fu et al. (Fu et al. 2023) which emphasises the important role of investment in environmental benefits and low-carbon initiatives to effectively address climate change and encourage sustainable economic growth.

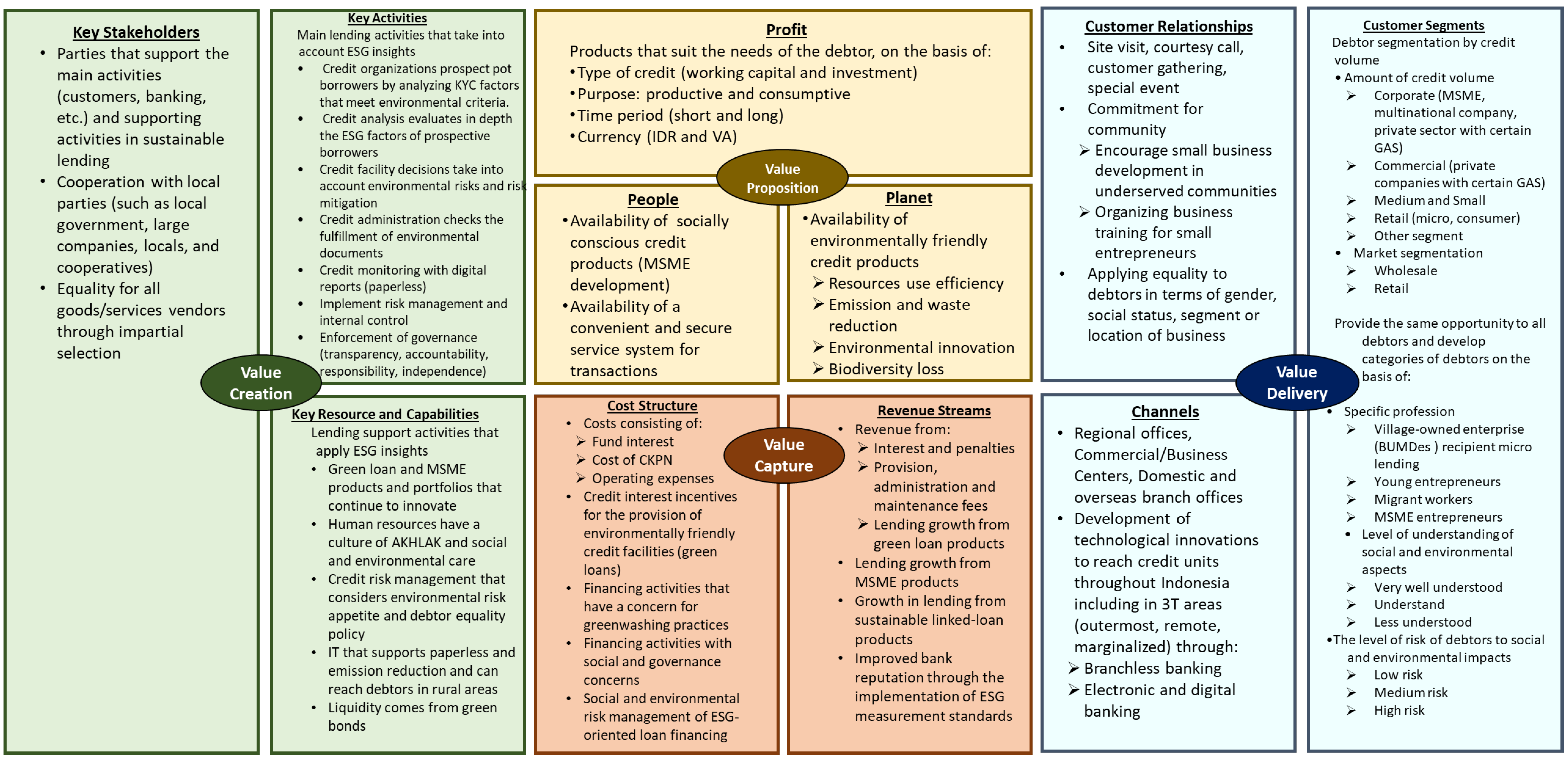

4.1.4. Triple Layered Business Model Canvas Integration

Based on the results of the analysis of each layer of the TLMBC framework, which consists of the economic, social stakeholder and environmental life cycle, it is then integrated into one layer. Picture of the sustainable lending canvas business model in

Figure 8. This integration aimed to simplify the appearance of the business model without reducing its essence by summarising the significant input in building each element. This makes it easier to group elements into infrastructure management, value proposition, customer relationships, and economic viability (Osterwalder and Pigneur 2010). This grouping was in line with the description of a sustainable business model canvas consisting of value creation, value proposition, value delivery and value capture (Bocken 2023). This grouping of business model elements provided a more explicit focus on areas requiring attention and was useful when used as a basis for formulating sustainable lending strategies.

Those results showed that the sustainable value chain approach in building a lending business model offers a major contribution. The lending business model built with the TLBMC framework can realize sustainability goals in the form of a sustainable lending business model. Therefore, the sustainable lending business model built by the TLBMC framework can be used as an input in the formulation of sustainable lending strategies, as confirmed by the opinion of Slavik and Zagorsek (2016). This was in line with the bank's obligation as stated in bank regulation (Financial Services Authority of the Republic of Indonesia (OJK) 2017) to prepare a sustainable financial action plan, where the bank needs to explain the factors that support the establishment of sustainable financial goals and priorities.

4.2. Selecting a Sustainable Lending Strategy

The analytical hierarchy process of sustainable lending consists of four levels: factors, actors, criteria, and strategies. At the factor, actor, and criteria levels, each consists of 4 selection criteria, while at the strategy level, there are 7 alternative strategies, as seen in

Figure 5. The results of the AHP analysis for sustainable lending based on expert assessments are presented in

Figure 9.

From

Figure 9, it can be seen that the factor that was the main priority to encourage sustainable loan growth according to the opinion of expert respondents is the bank's vision with a weight of 0.311, followed by incentive factors (weight of 0.272). The robustness of a corporate vision is crucial for companies to thrive and expand in a dynamic and complex business environment (Suranga 2014), as well as to enhance company performance (Su et al. 2023). The outcomes of the AHP analysis align with the findings of Y.-S. Chen et al. (2020), which verify that a green shared vision and an environmental organizational culture positively impact green absorptive capacity. This, in turn, favourably influences green product development performance. While incentives play a useful role in boosting green bond investment volumes (Baldacci and Possamaï 2022), it is crucial to remain vigilant against the potential for greenwashing practices. Both factors were related to the bank's internal factors, namely the ambition to fulfil the bank's dreams and stimulation to achieve sustainable loan growth. Another factor was sustainability regulations with a weight of 0.249. Nandiwardhana et al. (2022), in their research, explained that sustainability policies and regulations are not the only determining factor in implementing strategy initiatives to achieve sustainable lending growth. Industry concern for sustainability with a weight of 0.168 in the last priority order. The last two factors were external factors for banks, namely in the form of regulations that force and encourage banking industry players to have a positive attitude towards desired values. Based on these conditions, it showed that priority factors that originate from internal banks are given priority, considering that these factors are within the control of the bank.

At the actor level, some stakeholders played a role in the growth of sustainable lending. The top priority was the bank owner, with a weight of 0.321, and in second place was sustainable committee finance with a weight of 0.255. The owner of the bank is the entity that has the authority to manage the bank, in compliance with the relevant regulations and laws. The bank owner is the top priority was in line with the bank's vision as the top priority factor, where the bank owner's role was dominant in approving the bank's vision. While sustainable committee finance was related to the sustainability regulation factor. Other actors were board of commissioners and directors of the bank with a weight of 0.231 and borrowers/potential borrowers with a weight of 0.193. Borrowers or potential borrowers and board of commissioners and directors of the bank are not yet a priority in the overall choices of experts, because they tend to be influenced by incentive factors. This is because borrowers will benefit from incentives in the form of reduced loan interest rates or easy access to obtain sustainable credit from banks. On the other hand, board of commissioners and directors of the bank should also ideally be able to gain advantages in green project financing, for example in the form of adjusting risk-weighted assets (RWA) for green assets. However, until now there are no provisions governing this adjustment.

The top priority criteria for sustainable lending growth was strengthening governance with a weight of 0.329 followed by efforts to improve economic performance with a weight of 0.316. The difference in their weight values is very slight, indicating that both criteria were relatively equal for measuring sustainable lending performance. Banks are highly regulated financial institutions, so strengthening governance is the priority criterion for sustainable lending growth. Nevertheless, banks, as profit-centered institutions, are also integral to achieving economic performance. This perspective aligns with the views of Gleibner et al. (2022), who assert that economic sustainability encompasses all aspects concerning economic considerations across and within generations. The priority for bank owners to enhance economic outcomes through sustainable credit distribution continues to be a primary focus. The third criterion is improving social performance, with a weight of 0.185, and environmental performance, with a weight of 0.17. Based on expert opinion, the last two criteria were yet to be the top choice in driving sustainable lending growth. The divergent conclusions of various studies on the performance of these two elements for sustainability are intriguing. According to several studies (Cek and Eyupoglu 2020; Tarmuji and Maelah 2016; Velte 2017; Yilmaz 2021), the differing opinions are linked to the policies and awareness levels within the banking industry in each country. The results of the AHP analysis to select strategic priorities in order to encourage sustainable loan growth by considering various internal and external aspects of the bank are presented in

Table 1.

The results of the selection of seven alternative strategies as key drivers to encourage sustainable credit growth in state-owned banks in Indonesia showed that the strategy of developing and penetrating market of green loans and MSMEs is consecutively ranked first (weight 0.175) and second (weight 0.173). The difference in their weight values was very slight, indicating that both strategies are relatively equal choices in sustainable lending. Green loan and MSME market development strategy is an extensive growth strategy by entering new market segments where borrowers need funds to produce carbon credits or market segments that need funds but are constrained by banking access. The aims are using environmentally oriented financing or inclusive proceeds, such as financing forest conservation projects, improving the food security system. Green loan and MSME market development strategy rely on new market potential both for green loan and MSME products. Whereas green loan and MSME market penetration relies on existing borrowers who have the potential to increase their financing volume for both green loan and MSME products. It is a strategy to grow more intensively in the same market, namely borrowers who need funds to develop their business through increasing credit limits, with the aim of using environmentally oriented or inclusive proceeds. This is in accordance with the research results of Z. Chen et al. (2022) which explained the impact of green loan financing and responsible lending provides them with new income opportunities while mitigating risks.

In the third and fourth ranking were the diversification strategy through digital transformation (weight 0.162) and transitional financing (weight 0.160), with a very thin difference. Both strategies rely on issues that are being hot related to sustainability, namely the use of massive technology (Shanti et al. 2023) and the process of transitioning operations according to Indonesia's sustainable taxonomy (OJK 2024). Diversification strategy through digital transformation is a growth strategy through channel empowerment by carrying out digital transformation that reaches all levels of borrowers who need funds but are hampered by banking access. This result is in line with the role of social aspects in sustainable financing in financial decision making so that sustainable financing performance can be achieved optimally (Oktaviani et al. 2023). Diversification through transitional financing is a growth strategy through financing for borrowers who are committed to switching to more sustainable business practices, which require funds for the company's transition towards reducing environmental or social impacts, such as for adapting production technology, building infrastructure capable of dealing with climate change. These results are in line with the role of environmental aspects in sustainable financing that can help sustainably restore the economy and protect the environment (Barr-Pulliam et al. 2022).

When viewed from the two groups of strategy approaches above, it can be seen that the strategy of developing and penetrating market of green loans and MSME were conventional compared to diversification through digital transformation and transitional financing were more moderate. The research results showed that the conventional approach is preferred as an alternative compared to moderate strategies. This can be occured due to the different risk levels of the two strategic approaches, where the conventional strategy had a relatively lower risk level compared to the moderate strategy (Jiang et al. 2022), so that it was more comfortable to make decisions.

Next in the fifth place is the strategy through the development of sustainability linked-loan products (weight 0.135). Sustainability linked-loan product development is a new product development strategy without looking at the purpose of using the proceed (multi purpose) but in accordance with fulfilling the borrower's ESG rating and committing to maintaining it. This product is still relatively new in Indonesia, so it has not yet become the main choice in sustainable lending. In addition, the implementation still faces obstacles, namely the limited number of third parties that assess the quality of the borrower's ESG implementation or ESG rating. Research on sustainability-linked loans has been conducted by Auzepy et al. (2023), the results showed that sustainability-linked loan borrowers did not significantly improve their ESG performance.

The sixth strategy ranking was adjusting risk appetite to ESG (weight 0.109). ESG risk appetite adjustment was a consolidation strategy by reviewing the risk appetite for processes, credit decisions, credit products, pricing, risk acceptance criteria, and industry acceptance criteria in order to accelerate sustainable lending financing. The seventh last ranking is the development of human resources capabilities as ESG advisors (weight 0.087). Human resource capability development as an ESG advisor was a growth strategy through increasing the role of bank relationship managers to encourage and help borrowers/potential borrowers implement ESG in their business activities.

5. Managerial Implications

The results of developing a credit distribution business model using a triple-layer business model canvas with a value chain approach produced a sustainable lending business model, which has implications for banks is the need to transform the existing business model into a sustainable business model. This is implemented by making adjustments to the business model that adopts: a) economic layer: a series of credit processes for key activities element and internal resources for key resources element; b) social stakeholders layer: cooperation has social impacts for local communities element; governance principles for governance element; product responsibility for social value element; the principle of equality and underserved communities for societal culture element; equal opportunities for end-user element; c) environmental aspect: efficient use of resources, reduction of emissions and waste, and biodiversity loss prevention for functional value element.

Another managerial implication related to the results of the AHP analysis showed that there were relatively equal choices between development and market penetration strategies for green loans and MSME and that conventional strategic approaches were preferred compared to more moderate ones. These conditions provide an option for banks to implement one of them as a priority in encouraging sustainable credit growth with a lower level of risk. On the other hand, if one bank wants to apply a more moderate strategic approach, such as diversification through digital transformation and transitional financing, the bank needs more thorough preparation in managing potential risks.

6. Conclusions and Future Research

Developing a sustainable lending business model of state-owned banks in Indonesia using a sustainable value chain approach offered contributions for elements at each layer based on the results of the TLBMC analysis, as follows: a) economic through primary activities, support activities and financial performance dimensions which were reflected in key activities, key resources, cost structure and revenue stream elements; b) environmental life cycle through primary activities, support activities, environmental-oriented, environmental risk management and greenwashing awareness principle and green credit financing dimensions which were reflected in six elements, namely functional value, production, materials, distribution, environmental costs and environmental benefits; c) social stakeholders through social-oriented, governance-oriented, principle of governance, credit financing through cooperation, inclusive principle and credit financing based on ESG score dimensions which were reflected in eight elements, namely social value, human resources, governance, local communities, societal culture, scale of outreach, social impact and social benefits. This research showed that the lending distribution business model using a sustainable value chain approach can realize sustainability goals in the form of a sustainable lending business model. In addition, this sustainable lending business model can be used as a basis for selecting priority elements that will become key drivers for sustainable strategies.

The results of the selection of seven alternative strategies as key drivers to encourage sustainable lending growth in state-owned banks in Indonesia using AHP analysis showed that the strategy of developing and penetrating market of green loans and MSMEs were ranked first and second with a very slight difference. The third and fourth rankings were diversification strategies through digital transformation and through transitional financing with very slight differences. Furthermore, in the fifth rank was the strategy through the development of sustainability linked-loan products, followed by the sixth rank was the adjustment of risk appetite for ESG and ending in the seventh rank was the development of human resources capabilities as ESG advisors. The results of this AHP analysis also confirmed that for now the conventional strategy of developing and penetrating market of green loan and MSME are more encouraging for sustainable lending growth than the more moderate strategies of diversification through digital transformation and transitional financing.

For further research, the following things need to be considered and followed up: (1) Using quantitative data in implementing the TLMBC approach, especially to determine the impact and benefits of each layer; and (2) Expanding AHP research criteria, especially at the factor level, by including macroeconomic conditions.

Author Contributions

Conceptualization, K.A.A.M.; methodology, K.A.A.M.; software, K.A.A.M.; formal analysis, K.A.A.M.; resources, K.A.A.M. and H.S.; data curation, K.A.A.M.; writing—original draft preparation, K.A.A.M.; writing—review and editing, K.A.A.M., H.S., D.B.H., I.F. and T.N.; visualization, K.A.A.M.; supervision, K.A.A.M., H.S., D.B.H., I.F. and T.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are not publicly available, though the data may be made available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abdou, H.A.; Pointon, J. Credit scoring, statistical techniques and evaluation criteria: a review of the literature. Intell. Syst. Accounting, Finance Manag. 2011, 18, 59–88. [Google Scholar] [CrossRef]

- Alalade, Samson a, Babatunde O Binuyo, and James a Oguntodu. 2014. “Managing Credit Risk to Optimize Banks’ Profitability: A Survey of Selected Banks in Lagos State, Nigeria.” Research Journal of Finance and Accounting.

- Alnassar, Walaa. 2022. “The Effect of Green Loan and Ecological Sustainability on Pollution Depletion: Practical Evaluation in Developing and OECD Economies.” Academy of Strategic Management Journal 20 (January):2021.

- Al-Qudah, Anas Ali, Allam Hamdan, Manaf Al-Okaily, and Lara Alhaddad. 2023. “The Impact of Green Lending on Credit Risk: Evidence from UAE’s Banks.” Environmental Science and Pollution Research 30 (22). [CrossRef]

- Ansoff, H. 2007. Strategic Management. Palgrave Macmillan UK. https://books.google.co.id/books?id=bV9_Svdum70C.

- Appiahene, P.; Missah, Y.M.; Najim, U. Evaluation of information technology impact on bank’s performance: The Ghanaian experience. Int. J. Eng. Bus. Manag. 2019, 11. [Google Scholar] [CrossRef]

- Auzepy, A.; Bannier, C.E.; Martin, F. Are sustainability-linked loans designed to effectively incentivize corporate sustainability? A framework for review. Financial Manag. 2023, 52, 643–675. [Google Scholar] [CrossRef]

- Baldacci, B.; Possamaï, D. Governmental incentives for green bonds investment. Math. Financial Econ. 2022, 16, 539–585. [Google Scholar] [CrossRef]

- Barney, J.B. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]