Submitted:

09 July 2024

Posted:

11 July 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review and Hypotheses Development

2.1. Literature Review

2.2. Hypotheses Development

3. Methodology

| Hypothesis | Variables | Formulas | Units |

|---|---|---|---|

| Return on Equity | ROE | (Net Income/Net Worth) *100 | Percentage |

| VAICTM | Value Added Intellectual Coefficient | ICE + CEE | Percentage |

| ICE | Intellectual Capital Efficiency Coefficient | SCE + HCE | Percentage |

| SCE | Structural Capital Efficiency Coefficient | SC/VA | Percentage |

| CEE | Capital Employed Efficiency Coefficient | VA/EC | Percentage |

| SIZE | Total assets of the company | Logarithm of total assets | Logarithm of total assets |

| INDEBTEDNESS | END | (Total assets/Total liabilities) *100 | Percentage |

4. Results

4.1. Linearity

4.2. Independence from Errors

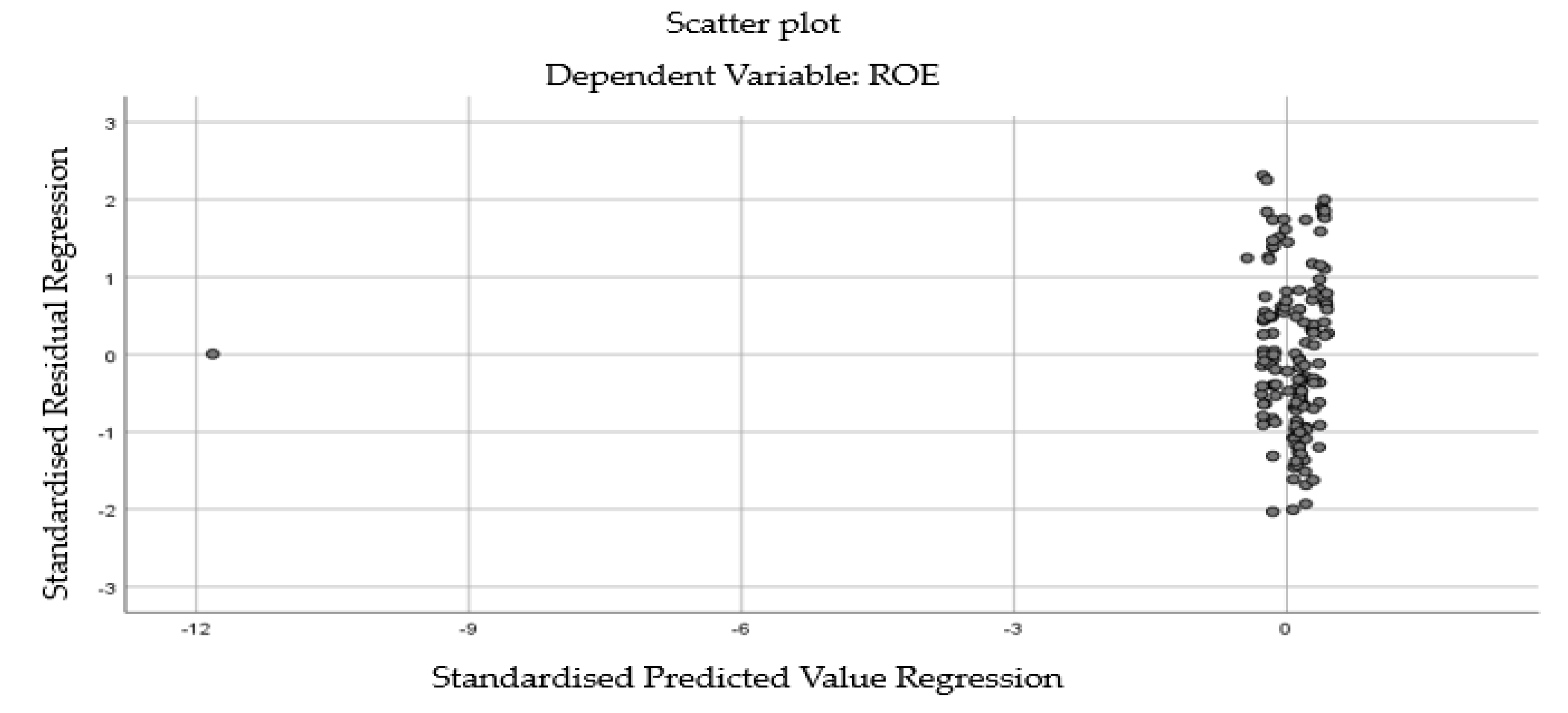

4.3. Homoscedasticity

4.4. Normality

4.5. Non-Collinearity

4.6. Model Goodness of Fit

4.7. Multiple Linear Regression Model

4.8. Goodness of Prediction

5. Discussion

6. Conclusions, Limitations, and Future Perspectives

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abdulsalam, F., Al-Qaheri, H., & Al-Khayyat, R. (2011). The Intellectual Capital Performance of KuwaitiBanks: An Application of vaicTM1 Model. IBusiness, 03(01), 88–96. [CrossRef]

- Alipour, M. (2012). The effect of intellectual capital on firm performance: An investigation of Iran insurance companies. Measuring Business Excellence, 16(1), 53–66. [CrossRef]

- Al-Musali, M. A. K., & Ismail, K. N. I. K. (2014). Intellectual Capital and its Effect on Financial Performance of Banks: Evidence from Saudi Arabia. Procedia - Social and Behavioral Sciences, 164, 201–207. [CrossRef]

- Arslan, M. L., & Kızıl, C. (2019). Measuring Intellectual Capital of Turkish Banks Listed on Borsa Istanbul Banking Index (BIST XBANK) with the Market Value / Book Value Method and Value Added Intellectual Coefficient (VAIC) Model. EMAJ: Emerging Markets Journal, 9(1), 101–116. [CrossRef]

- Awwad, M. S., & Qtaishat, A. M. (2023). The impact of intellectual capital on financial performance of commercial banks: the mediating role of competitive advantage. International Journal of Learning and Intellectual Capital, 20(1), 47–69. [CrossRef]

- Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99–120. [CrossRef]

- Bombiak, E. (2023). Effect of Green Intellectual Capital Practices on the Competitive Advantage of Companies: Evidence from Polish Companies. Sustainability (Switzerland), 15(5). [CrossRef]

- Bontis, N. (1998). Intellectual capital: an exploratory study that develops measures and models. Management Decision, 36(2), 63–76. [CrossRef]

- Bontis, N. (1999). Managing organisational knowledge by diagnosing intellectual capital: framing and advancing the state of the field. International Journal of Technology Management, 18(5/6/7/8), 433. [CrossRef]

- Bueno, E., Murcia Rivera, C., Longo, M., & Merino, C. (2011). Modelo Intellectus: Medición y Gestión del Capital Intelectual. Madrid, España: CIC, Universidad Autónoma de Madrid.

- Bykova, A., & Molodchik, M. (2012). Applying the VAIC Model to Russian Industrial Enterprises.

- Chen Goh, P. (2005). Intellectual capital performance of commercial banks in Malaysia. Journal of Intellectual Capital, 6(3), 385–396. [CrossRef]

- Chen, J., Zhu, Z., & Yuan Xie, H. (2004). Measuring intellectual capital: a new model and empirical study. Journal of Intellectual Capital, 5(1), 195–212. [CrossRef]

- Chen, M., Cheng, S., & Hwang, Y. (2005). An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. Journal of Intellectual Capital, 6(2), 159–176. [CrossRef]

- Demuner Flores, M. del R., Saavedra García, M. L., & Camarena Adame, M. E. (2017). Medición del capital intelectual en el sector bancario: Aplicación de los modelos Skandia y VAIC. Innovar, 27(66), 75–89. [CrossRef]

- Post-Capitalist Society; Butterworth-Heinemann: Oxford.

- Duho, K. C. T. (2020). Intellectual capital and technical efficiency of banks in an emerging market: a slack-based measure. Journal of Economic Studies, 47(7), 1711–1732. [CrossRef]

- Duho, K. C. T., & Onumah, J. M. (2019). Bank diversification strategy and intellectual capital in Ghana: an empirical analysis. Asian Journal of Accounting Research, 4(2), 246–259. [CrossRef]

- Edvinsson, L. (1997). Developing intellectual capital at Skandia. Long Range Planning, 30(3), 320–373. [CrossRef]

- Edvinsson, L; Cómo Identificar y Calcular el Valor de Los Recursos Intangibles de su Empresa: , & Malone, M. S. (1997). El Capital Intelectual.

- EUROFORUM. (1998). <i>Modelo de medición del Capital Intelectual</i> (I.U. Euroforum Escorial (Ed.) EUROFORUM. (1998). Modelo de medición del Capital Intelectual.

- Faruq, M. O., Akter, T., & Mizanur Rahman, M. (2023). Does intellectual capital drive bank’s performance in Bangladesh? Evidence from static and dynamic approach. Heliyon, 9(7), e17656. doi:. [CrossRef]

- García Castro, J. P., Duque Ramírez, D. F., & Moscoso Escobar, J. (2021). The relationship between intellectual capital and financial performance in Colombian listed banking entities. Asia Pacific Management Review, 26(4), 237–247. [CrossRef]

- Grant, R. M. (1991). The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation. California Management Review, 33(3), 114–135. [CrossRef]

- Jardon, C. M. (2015). The use of intellectual capital to obtain competitive advantages in regional small and medium enterprises. Knowledge Management Research & Practice, 13(4), 486–496. [CrossRef]

- Larios Prado, J. M. (2009). Capital Intelectual: un modelo de medición en las empresas del nuevo milenio. Criterio Libre, 7(11), 101–121.

- Mavridis, D. G. (2004). The intellectual capital performance of the Japanese banking sector. Journal of Intellectual Capital, 5(1), 92–115. [CrossRef]

- Meles, A., Porzio, C., Sampagnaro, G., & Verdoliva, V. (2016). The impact of the intellectual capital efficiency on commercial banks performance: Evidence from the US. Journal of Multinational Financial Management, 36, 64–74. [CrossRef]

- Mollah, Md. A. S., & Rouf, Md. A. (2022). The impact of intellectual capital on commercial banks’ performance: evidence from Bangladesh. Journal of Money and Business, 2(1), 82–93. [CrossRef]

- Oppong, G. K., & Pattanayak, J. K. (2019). Does investing in intellectual capital improve productivity? Panel evidence from commercial banks in India. Borsa Istanbul Review, 19(3), 219–227. [CrossRef]

- Özer, G., & Çam, İ. (2016). The Role of Human Capital in Firm Valuation: An Application on BIST. Procedia - Social and Behavioral Sciences, 235, 168–177. [CrossRef]

- Ozkan, N., Cakan, S., & Kayacan, M. (2017). Intellectual capital and financial performance: A study of the Turkish Banking Sector. Borsa Istanbul Review, 17(3), 190–198. [CrossRef]

- Pardo-Cueva, M., Armas Herrera, R., & Higuerey, A. (2018). La influencia del capital intelectual sobre la rentabilidad de las empresas manufactureras ecuatorianas. Espacios, 39, 14.

- Pulic, A. Pulic, A. (1998). Measuring the performance of intellectual potential in the knowledge economy.

- Pulic, A. (2000). VAICTM an accounting tool for IC management. International Journal of Technology Management, 20(5/6/7/8), 702. [CrossRef]

- Pulic, A. (2004). Intellectual capital – does it create or destroy value? Measuring Business Excellence, 8(1), 62–68. [CrossRef]

- Pulic, A. (2008). The Principles of Intellectual Capital Efficiency -A Brief Description.

- Shaban, M., & Vijayasundaram, K. (2019). ASSESSING THE RELATION BETWEEN INTELLECTUAL CAPITAL AND EXPORT PERFORMANCE AN EMPIRICAL EXPLORATION OF BSE 500 COMPANIES IN INDIA. 13, 38–49.

- Shah, S. Q. A., Lai, F.-W., & Shad, M. K. (2023). Moderating Effect of Managerial Ownership on the Association Between Intellectual Capital and Firm Performance: A Conceptual Framework. In M. Al-Emran, K. Shaalan, & M. A. Al-Sharafi (Eds.), Lecture Notes in Networks and Systems: Vol. 550 LNNS (pp. 477–489). Springer Science and Business Media Deutschland GmbH. [CrossRef]

- Singh, S., Sidhu, J., Joshi, M., & Kansal, M. (2016). Measuring intellectual capital Performance of Indian banks: A public and private sector comparison. Managerial Finance, 42(7), 635–655. [CrossRef]

- Śledzik, K. (2012). The Intellectual Capital Performance of Polish Banks: An Application of VAICTM Model. SSRN Electronic Journal. [CrossRef]

- Soewarno, N., & Tjahjadi, B. (2020). Measures that matter: an empirical investigation of intellectual capital and financial performance of banking firms in Indonesia. Journal of Intellectual Capital, 21(6), 1085–1106. [CrossRef]

- Stewart, T. (1997). Intellectual Capital: The New Wealth of Organizations. In Doubleday / Currency.

- Sveiby, K. E. (1997). The New Organizational Wealth: Managing & Measuring Knowledge-based Assets (Berrett-Koehler Publishers, Ed.).

- Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic Capabilities and Strategic Management. Strategic Management Journal, 18(7), 509–533. http://www.jstor.org/stable/3088148.

- Tiwari, R. (2022). Nexus between intellectual capital and profitability with interaction effects: panel data evidence from the Indian healthcare industry. Journal of Intellectual Capital, 23(3), 588–616. [CrossRef]

- Tran, D. B., & Vo, D. H. (2018). Should bankers be concerned with Intellectual capital? A study of the Thai banking sector. Journal of Intellectual Capital, 19(5), 897–914. [CrossRef]

- Van Nguyen, T., & Lu, C. H. (2023). Financial intermediation in banks and the key role of intellectual capital: new analysis from an emerging market. Journal of Financial Services Marketing. [CrossRef]

- Villegas González, E., Hernández Calzada, M. A., & Salazar Hernández, B. C. (2017). La medición del capital intelectual y su impacto en el rendimiento financiero en empresas del sector industrial en México. Contaduría y Administración, 62(1), 184–206. [CrossRef]

- William, F., Gaetano, M., & Giuseppe, N. (2019). The impact of intellectual capital on firms financial performance and market value: Empirical evidence from Italian listed firms. African Journal of Business Management, 13(5), 147–159. [CrossRef]

- Xu, Haris, & Yao. (2019). Should Listed Banks Be Concerned with Intellectual Capital in Emerging Asian Markets? A Comparison between China and Pakistan. Sustainability, 11(23), 6582. [CrossRef]

| Hypothesis | Relationship Found | ||

|---|---|---|---|

| Positive | Negative | No relationship | |

| Relationship between ROE and CEE | Al-Musali and Ismail (2014) Arslan and Kızıl (2019) Mollah and Rouf (2022) Soewarno and Tjahjadi 2020) |

||

| Relationship between ROE and HCE | Al-Musali and Ismail (2014) Arslan and Kızıl (2019) Meles et al. (2016) Mollah and Rouf (2022) |

Soewarno and Tjahjadi (2020) | |

| Relationship between ROE and SCE | Arslan and Kızıl (2019) Soewarno and Tjahjadi (2020) |

Al-Musali and Ismail (2014) | |

| Relationship between ROE and VAIC | Al-Musali and Ismail (2014) Arslan and Kızıl (2019) Meles et al. (2016) |

||

| Relationship between ROE and SIZE | Meles et al. (2016) | Soewarno and Tjahjadi (2020) | |

| Relationship between ROE and INDEBTEDNESS | Arslan and Kızıl (2019) Soewarno and Tjahjadi (2020) |

||

| Steps to calculate VAIC | Purpose of the calculation | Formula | Formula Components |

|---|---|---|---|

| Step 1 | To determine the extent to which a company creates Value Added (VA). VA is calculated based on the difference between income and expenses | VA = OUT–IN | VA = Added value OUT = Total Revenue IN = Expenses, excluding personnel costs |

| Step 2 | Calculate the Human Capital Efficiency Coefficient (HCE) | HCE = VA/HC | HCE = Human Capital efficiency coefficient VA = Added value HC = Total wages and salary commitments of the company |

| Step 3 | Calculate Structural Capital (SC), the second component of the IC | SC = VA–HC | SC = Structural Capital VA = Value added HC = Total wages and salary commitments of the company |

| Step 4 | Calculate the Structural Capital Efficiency Coefficient (SCE) | SCE = SC/VA | SCE = Structural Capital Efficiency Coefficient SC = Structural Capital VA = Added value |

| Step 5 | Intellectual Capital Efficiency (ICE) is determined by combining the Human Capital Efficiency (HCE) and the Structural Capital Efficiency (SCE) | ICE = HCE + SCE | ICE = Intellectual Capital Efficiency Coefficient HCE = Human Capital Efficiency Coefficient SCE = Structural Capital Efficiency Coefficient |

| Step 6 | Since IC alone cannot create value (Pulic 2004), it is essential to also consider financial and physical capital. This involves calculating the Capital Employed Efficiency (CEE) | CEE = VA/CE | CEE = Capital Employed Efficiency Coefficient VA = Added value CE = Book value of the company's net assets |

| Step 7 | To compare the overall efficiency of value creation, the three efficiency indicators are added together | VAIC™ = ICE + CEE | VAIC™ = Value Added Intellectual Coefficient ICE = Intellectual Capital Efficiency Coefficient CEE = Capital Employed Efficiency Coefficient |

| Identification | Description | Source of the data |

|---|---|---|

| OUT | Total Revenue | Income Statement |

| IN | Expenses | Income Statement |

| OP | Operational Costs | Income Statement |

| EC | Employee Costs | Income Statement |

| D | Depreciation | Income Statement |

| A | Amortisations | Income Statement |

| HC | Total Wages and Salary Commitments of the Company | Balance Sheet, Income Statement, Notes to Financial Statements |

| CE | Book value of the company's net assets | Balance Sheet, Notes to Financial Statements |

| Banking Sector | Financial Sector |

|---|---|

| Bac International Bank Inc. | Colfinanza, S.A. |

| Banco Centro Americano de Integración | Corporación Bellavista de Finanzas, S.A. |

| Banco General S.A. | Corporación Finanzas del País, S.A. (Panacredit) |

| Banco Internacional de Costa Rica | Financia Credit S.A. |

| Banco La Hipotecaria S.A. | Financiera Pacífico Internacional, S.A. |

| Banco Nacional de Panamá | Hipotecaria Metrocredit S.A. |

| Banistmo S.A. | Mi Financiera S.A. |

| BCT Bank International S.A. | Multi Financiamientos S.A. |

| Canal Bank | |

| Capital Bank Inc. | |

| MultiBank Inc. | |

| Tower Bank International Inc. | |

| Unibank S.A. | |

| Banesco S.A. |

| Mean | Standard Deviation | N | |

|---|---|---|---|

| ROE | 8.54 | 7.71 | 148 |

| HCE | 5.14 | 2.72 | 148 |

| SCE | 3.78 | 36.49 | 148 |

| CEE | 0.08 | 0.07 | 148 |

| VAIC | 9.00 | 36.16 | 148 |

| INDEBTEDNESS | 0.91 | 0.69 | 148 |

| SIZE Ln_Assets | 19.82 | 2.51 | 148 |

| ROE | HCE | SCE | CEE | VAIC | INDEBTEDNESS | SIZE Ln_Assets | ||

|---|---|---|---|---|---|---|---|---|

| ROE | Pearson correlation | 1 | 0.102 | -.740** | 0.144 | -.739** | 0.003 | .270** |

| Sig. (bilateral) | 0.215 | 0.000 | 0.080 | 0.000 | 0.966 | 0.001 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 | |

| HCE | Pearson correlation | 0.102 | 1 | -0.155 | -0.160 | -0.081 | -0.003 | -0.054 |

| Sig. (bilateral) | 0.215 | 0.060 | 0.052 | 0.327 | 0.967 | 0.514 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 | |

| SCE | Pearson correlation | -.740** | -0.155 | 1 | -0.091 | .997** | -0.006 | -0.133 |

| Sig. (bilateral) | 0.000 | 0.060 | 0.271 | 0.000 | 0.939 | 0.107 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 | |

| CEE | Pearson correlation | 0.144 | -0.160 | -0.091 | 1 | -0.102 | .558** | -.404** |

| Sig. (bilateral) | 0.080 | 0.052 | 0.271 | 0.218 | 0.000 | 0.000 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 | |

| VAIC | Pearson correlation | -.739** | -0.081 | .997** | -0.102 | 1 | -0.006 | -0.139 |

| Sig. (bilateral) | 0.000 | 0.327 | 0.000 | 0.218 | 0.947 | 0.091 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 | |

| INDEBTEDNESS | Pearson correlation | 0.003 | -0.003 | -0.006 | .558** | -0.006 | 1 | -0.014 |

| Sig. (bilateral) | 0.966 | 0.967 | 0.939 | 0.000 | 0.947 | 0.863 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 | |

| SIZE Ln_Activos | Pearson correlation | .270** | -0.054 | -0.133 | -.404** | -0.139 | -0.014 | 1 |

| Sig. (bilateral) | 0.001 | 0.514 | 0.107 | 0.000 | 0.091 | 0.863 | ||

| N | 148 | 148 | 148 | 148 | 148 | 148 | 148 |

| Model |

R | R² | Adjusted R² | Standard Estimate Error | Change statistics | Durbin-Watson |

|---|---|---|---|---|---|---|

| Change in R² | ||||||

| 1 | .740a | 0.547 | 0.544 | 5.19296 | 0.547 | |

| 2 | .759b | 0.576 | 0.570 | 5.04183 | 0.029 | 2.065 |

| Absresid | Unstandardised Predicted Value | ||

|---|---|---|---|

| Absresid | Pearson correlation | 1 | 0.156 |

| Sig. (bilateral) | 0.059 | ||

| N | 148 | 148 |

| Kolmogorov-Smirnov | Shapiro-Wilk | |||||

|---|---|---|---|---|---|---|

| Test | Statistic | df | Sig. | Statistic | df | Sig. |

| Unstandardised Residual | 0.059 | 149 | .200* | 0.981 | 149 | 0.042 |

| Model | Collinearity Statistics | ||

|---|---|---|---|

| Tolerance | VIF | ||

| 1 | (Constant) | ||

| SCE | 1.000 | 1.000 | |

| 2 | (Constant) | ||

| SCE | 0.982 | 1.018 | |

| SIZE Ln_Assets | 0.982 | 1.018 | |

| Model | R | R² | Adjusted R² | Standard Error of Estimate | Change statistics |

|---|---|---|---|---|---|

| Change in R² | |||||

| 1 | .740a | 0.547 | 0.544 | 5.19296 | 0.547 |

| 2 | .759b | 0.576 | 0.570 | 5.04183 | 0.029 |

| ANOVA | ||||||

|---|---|---|---|---|---|---|

| Model | Sum of squares | df | Mean square | F statistic | Sig. | |

| 1 | Regression | 4788.318 | 1 | 4788.318 | 177.563 | .000b |

| Residual | 3964.119 | 147 | 26.967 | |||

| Total | 8752.437 | 148 | ||||

| 2 | Regression | 5041.113 | 2 | 2520.556 | 99.156 | .000c |

| Residual | 3711.324 | 146 | 25.42 | |||

| Total | 8752.437 | 148 | ||||

| Coefficientsa | ||||||

|---|---|---|---|---|---|---|

| Model | Non-standardised coefficients | Standardised coefficients | T | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | 9.11 | 0.43 | 21.29 | 0.00 | |

| SCE | -0.16 | 0.01 | -0.74 | -13.33 | 0.00 | |

| 2 | (Constant) | -1.34 | 3.34 | -0.40 | 0.69 | |

| SCE | -0.15 | 0.01 | -0.72 | -13.18 | 0.00 | |

| SIZE Ln_Assets | 0.53 | 0.17 | 0.17 | 3.15 | 0.00 | |

| N | Minimal | Maximum | Media | Standard deviation | |

|---|---|---|---|---|---|

| ROE | 148 | -60.43 | 21.01 | 8.54 | 7.71 |

| ESTROE* | 148 | -59.69 | 11.27 | 8.60 | 5.80 |

| N | Correlation | Sig. | |

|---|---|---|---|

| ROE & ESTROE* | 148 | 0.760 | 0.000 |

| ROE | TROE | |

|---|---|---|

| Mean | 8.54 | 8.60 |

| Variance (known) | 59.45 | 33.68 |

| Observation | 148 | 148 |

| Hypothetical difference of the means | 0 | |

| Z value | -0.07 | |

| p-value (two-tailed) | 0.94 | |

| Critical Z value (two-tailed) | 1.96 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).