1. Introduction: Is the new central bank’s goal for financial stability a solution for a stable economy?

We live in exciting times. The financial and the pandemic crisis are shaking up economic development. Further upheavals are on the horizon. The climate crisis requires a change in the existing economic process. The global economy is in danger. Political and military concerns are increasingly coming to the fore. A new era is emerging. New ideas and concepts are needed, which should be based on a clear review of the current economic and social situation.

The financial crisis in 2008 has marked a turning point in central bank policy. Let’s regard two central banks and their traditional objectives. The European Central Bank, the ECB, has stable prizes as the main goal. The American Central Bank, the Fed, also has as the objective to keep the prices. Furthermore, it considers itself in charge for economic growth, high employment and for the stability of the American financial system.

The financial crisis that occurred in connection with the bankruptcy of the Lehman Brothers Bank has shaken the global financial system and brought the international economic system to the edge of collapse. This danger should be avoided in the future and should not burden future generations.

As a consequence, central banks (CB) intervene massively in the financial market. They are buying up unprecedented amounts of bad securities and thereby taking considerable risks off the market and lowering interest rates to stimulate high profits and investments. They are creating outside money and facilitating debt financing to secure their new target: financial stability. Much outside money and cheap bank credits, creating inside money, should provide sufficient liquidity at low cost and low risk in the economy and prevent insolvencies and unemployment.

Prasad has succinctly expressed the new situation in which central banks now operate as follows: “In the aftermath of the global financial crisis, it became untenable for central banks to subordinate financial stability to other objectives”, Prasad (2021, p.317). We take this statement as our first point: The new core objective of CB policy is financial stability, while the original main objective of price stability takes a back seat.

With the high level of debt financing having increased since the financial crisis at that time, a new financial crisis would now be far more difficult to master than in 2008. In the face of increased instability, it is therefore difficult to imagine that central banks will be able to return to their traditional policies in the foreseeable future.

In view of the uncertain future, the question arises as to whether the new financial stability objective can provide a sound basis for long-term economic development. Doubts arise because it does not promote confidence in the economy, the social basis of economic activity. Financial stability has considerable follow-up costs for the economy and society. By backing the financial system unilaterally, it creates a long-term imbalance between credit expansion and economic growth.

Basically, the question is whether financial stability puts economic and social stability at risk.

2. Credit in modern capitalist economy: Its mechanism and its consequences

2.1. Banks promote profits by credit financing and central banks keep credit costs low to ensure financial stability

At the beginning of capitalism, companies increasingly used machines to produce goods. Their use generates enormous growth in the economy and leads to considerable prosperity in Western industrialized nations. With increasing credit financing of the capital used, banks and central banks now become the main players in economic development.

The modern capitalist credit economy is characterized by close cooperation between companies and banks. Credit financing is its link. It allows entrepreneurs to significantly increase their return in capital through debt financing. Increasing debt financing raises business risks and makes the economy unstable. The instability has come to light with the financial crisis. With this crisis, central banks now feel obliged to use all their means to ensure the stability of the financial system

As we face a new era, it is imperative to understand how the new central bank policy works for credit in the capitalist economy. In this regard, we are interested in the impact of its expansionary liquidity at reduced cost and risk. To do this, let’s first look at the situation faced by an entrepreneur who wants to secure its future earnings and profits through today’s investments.

Investment decisions are based on important research and development work. At that level different specialists such as biologists, chemists, physicists, engineers, IT specialists and designers drive technical progress. It manifests itself in innovation, such as new products, novel services and concepts, and new production processes. This level creates the basis for lucrative sales opportunities and worthwhile project returns rp.

The entrepreneur will decide to invest if his project return r

p is greater than the market interest rate i. If r

p > i, then his investment project looks profitable in the future. Otherwise, it would be better if he gives his money to a bank earning interest. If the investment project is expected to generate profits, then it is also of interest to the bank.

It can participate in the promising project by supporting it with credit. On the one hand, credit financing is associated with additional costs, but on the other hand, it can significantly increase profitability. The bank charges the market interest rate i plus a risk premium p

r for the loan. The loan reinforces the profitability r

e of the entrepreneur’s invested money via a

leverage v according to the formula

as long as the project return r

p is greater than the finance cost i + p

r. Otherwise in bad times with increasing financial costs, the

return on equity r

e will be reduced and can even be negative. Then the firm may lack the necessary liquidity and it must use part of its equity to pay its finance cost and runs the risk of insolvency. The leverage v is the ratio of debt capital to equity.

The new central bank policy with financial stability aims to lower the market interest rate i and the risk premium pr.

The expected rate of return r

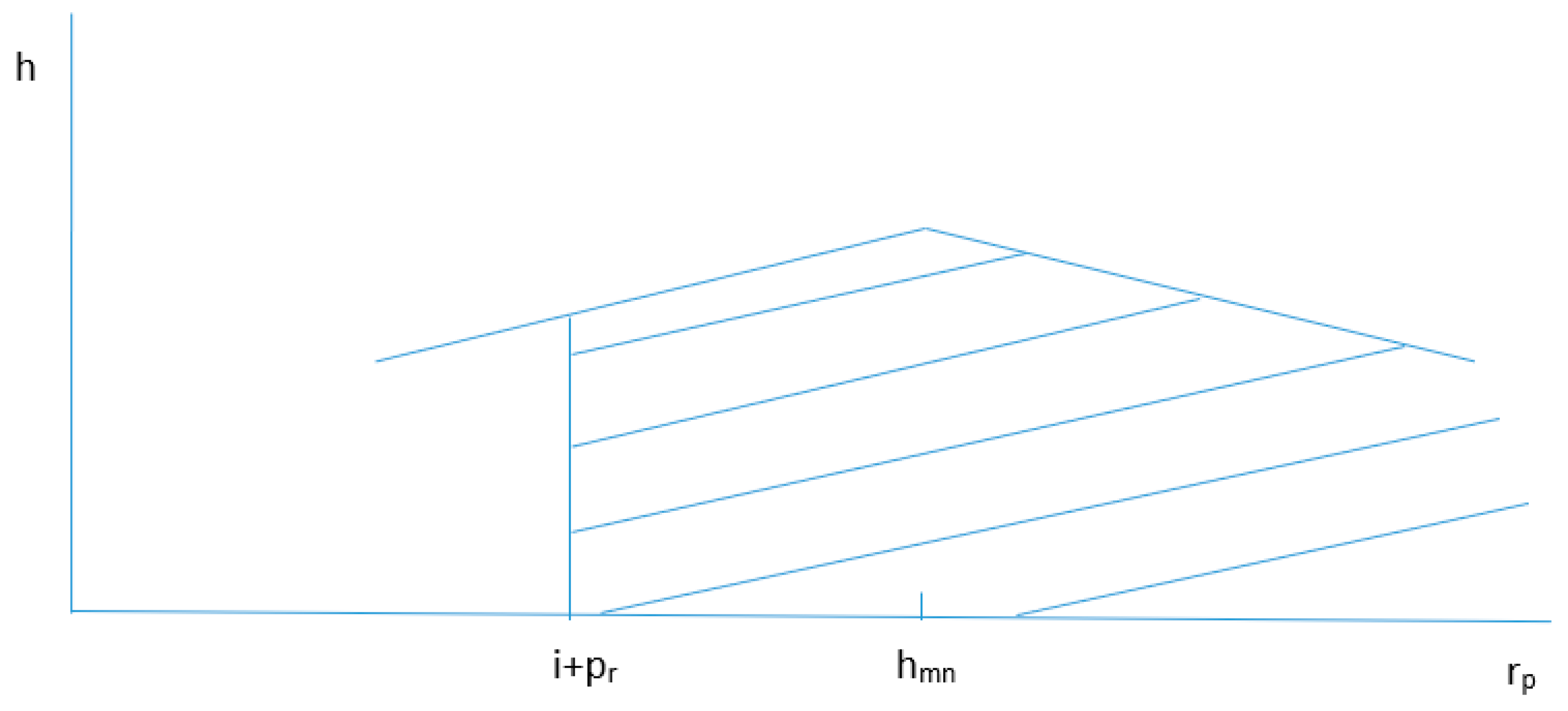

p varies from project to project. Statistically, we have a distribution of returns as schematically illustrated in

Figure 1 “Distribution of project returns in normal times”.

We start the schematic representation of the distribution of project returns h(r

p) with a symmetric diagram for normal economic times. The symmetry places the maximum h

mn of the distribution h(r

p) in its center. The financial costs i + p

r represent a lower limit, a break-even point. All projects with a return r

p greater than the threshold i + p

r should be considered worthwhile to receive recognition and for banks to support them through loan financing. The scope of worthwhile projects is shown shaded in

Figure 1 “Distribution of project returns in normal times”. As the break-even point i + p

r is approached, the risk of insolvency increases.

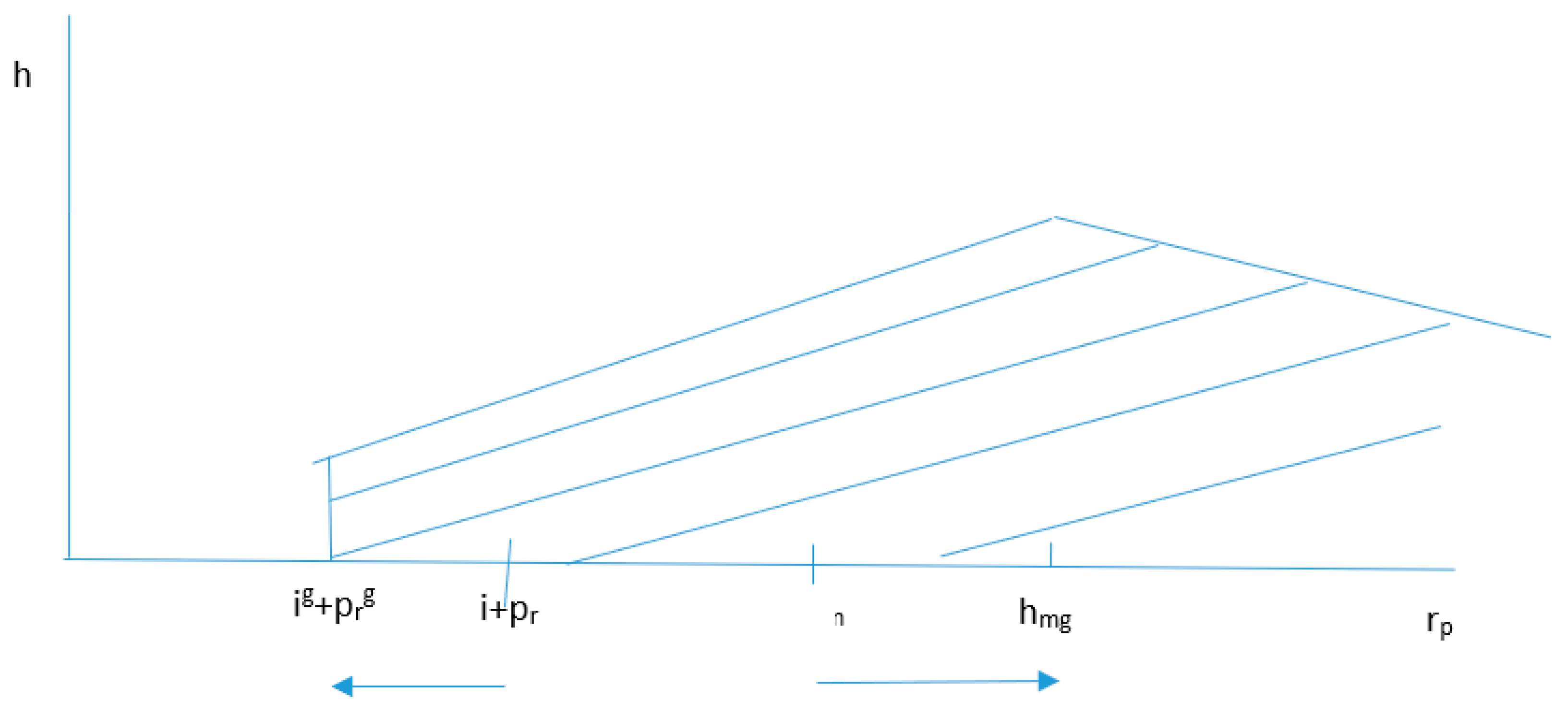

In the transition from normal to good times, sales opportunities and financial conditions improve for entrepreneurs. Increased demand leads to higher project returns r

p for many more companies. The result in

Figure 2 “Distribution of project returns in good times” is that the maximum h

mg of the distribution h(r

p) slides further to the right into the area of higher returns r

p. Lower financing costs make projects of additional firms with low returns profitable, the threshold i + p

r is moving to i

g + p

rg in the left of the area of low returns r

p. As in

Figure 1,

Figure 2 shows the amount of profitable projects shaded. Due to better economic conditions it has increased significantly compared to

Figure 1. Moreover, as banks lend now more easily, the leverage v rises and so does the return on equity r

e and, finally, the company’s profits П.

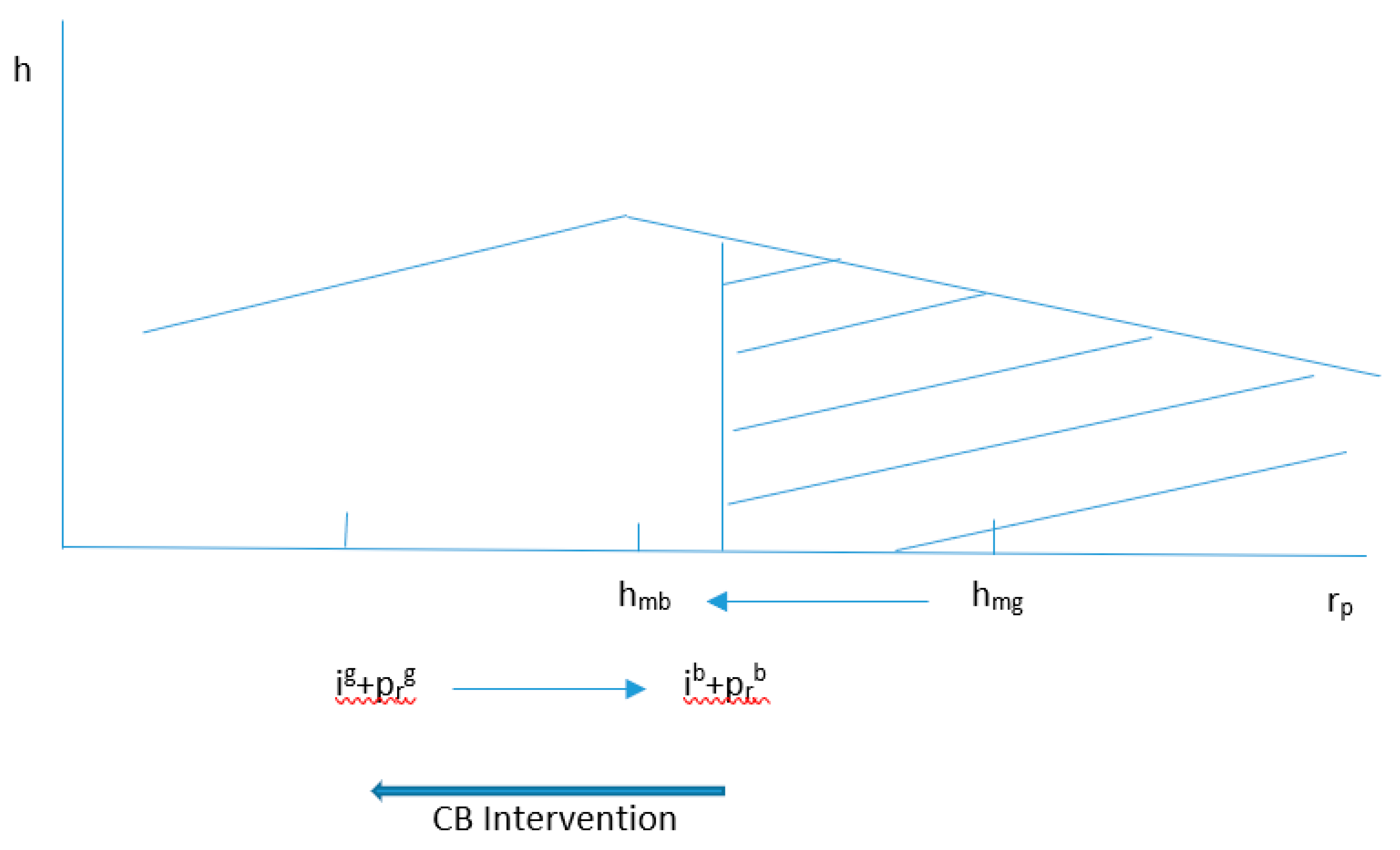

In bad times, the economic situation reverses. Sales opportunities shrink and financing costs rise. Under these conditions banks are more cautious in granting loans, the leverage v decreases.

The new situation is shown in

Figure 3 “Distribution of project returns in bad times”. The drop in demand shifts the maximum h

mb of the returns distribution h(r

p) to the left. Fewer projects are now profitable. The increased financing costs make the critical financial threshold shift to the right, from i

g + p

rg good times to i

b + p

rb bad times. They further reduce the number of profitable projects. Many companies now run into difficulties. Graphically, this becomes clear in

Figure 3 by the fact that the shaded area, showing the profitable companies, decreases significantly.

Now central banks have to step in and ensure stability. To do this, they have to intervene heavily in the financial market to restore conditions as in normal or good times. Central banks measures have

a less significant impact on sales than on financing costs. They could move the threshold i

b + p

rb toward i

g + p

rg as indicated by the bold arrow in

Figure 3, but not noticeably change the distribution of returns h(r

p). With the impact of financial costs a lot of firms with low returns can stay in the market that would otherwise go bankrupt. Under the bad market conditions, central banks keep many companies with low returns from insolvency and thus they favor evergreening. These firms can continue to borrow and increase their profits through the leverage v. But it is not only firms with low profitability that benefit. The new central bank policy provides additional profits П to all firms with profitability above the critical threshold.

2.2. Long-term instability on the rise

Two effects of central bank’s policy are apparent. Overall, profits П increase and firms with low profitability can remain in the market or join it. The second effect favors evergreening and weakens the market forces in economic development as described by Schumpeter (1883 -1950). On top of this, banks are likely to be more willing to lend because of the central bank’s takeover of risk, thus expanding debt financing. This puts the balance between credit and growth in jeopardy, as growth falls behind.

In debt financing, Minsky (1919 – 1996) has seen the cause of economic instability. He distinguishes three types of finance:

Hedge finance

Speculative finance

Ponzi finance

With hedge finance, current revenues are sufficient to meet all payment obligations of the considered firm over a longer period of time. Current interest is paid including risk premium, and outstanding debts are repaid. In the case of speculative and Ponzi finance, current earnings are not sufficient to meet all financial payment obligations. In the case of speculative finance, the interest and the risk premium are repaid and the old debts that are repaid are replaced by taking on new debts, without increasing the indebtedness. In the case of Ponzi finance, the current finance costs are settled and the debt level is increasing. With the rise of debt the follow-up costs of credit financing increase and financial costs and risk are postponed into the future. Both debtors and creditors are now highly dependent on the development of the financial market.

One can argue that debt expansion à la Ponzi is economically viable as long as profitability is greater than financial costs, as long as rp is greater than i + pr. However, the volatility shows that this situation is highly risky and can easily lead to an economic crisis. In the long term, therefore, the CB new policy based on increasing credits cannot form a stable foundation for economic development as long as sales opportunities lag behind.

The new central bank policy is aimed at increasing companies’ profits П and reducing their market and financial risks. This policy also favors government spending. By buying up bad government loans, the central bank frees the state from old burdens, and the low interest rates allow the state to borrow cheaply to finance its current expenditures. Thus, the central bank supports the monetary financing of government activity and the expansion of government debt. Fiscal policy thus becomes dependent on central bank policy.

2.3. Inequality on the rise

Companies and governments benefit from high liquidity at low cost. This statement does not apply to all private households. The low interest rates are hardly an incentive to save money for the poor. They are increasingly dependent on help. Their dependence on it is increasing. The situation is quite different for richer people with income from profits. The result is a divided society with increased inequality.

As explained, the new central bank policy focuses on increasing the return on equity re and thus profits П. This is how it intends to stabilize the economy. By far the largest share of profits goes to the richer households. They consume much less of it than poorer households do from their income. The savings rate sП of the richer households is close to one, whereas the consumption rate cw of the poorer households is close to one, see Pauly, (2021, 4.2 Inequality of income and wealth, p. 144-149).

With the policy of low interest rates, the central bank reduces the incentive among the poorer to save and provide for their future. Their propensity sw to save is falling. As the propensity to save falls among the poorer and the profits of the richer rise, inequality in society grows. In addition, the richer can venture more. Much risk in investment decisions has been taken away by the central bank.

In Keynes’ day money, especially from households, was still flowing into real investment projects, at that time the main function of the financial system was the transformation of household’s savings into productive investment. Today much of banks’ money, outside and inside money, is directed into profitable financial projects. If real investments are productive for economic growth, most financial investments are unproductive, for example, a lot of money that is going into the real estate market has no effect on growth. Real investments I increase the national capital stock K and thus the national growth rate g. Investments as a whole increase wealth Σ and will further increase inequality. This has been pointed out by Piketty (2013) in his well-known inequality r > g, the return of wealth r is greater than the growth rate g.

Let us reformulate Piketty’s inequality by distinguishing more clearly between productive capital K and wealth Σ. By including the price p

Σ of the stock of wealth Σ and noting that savings from profits П substantially determine the increase in wealth, the increase in wealth is

And after transforming this results in the growth rate g

∑ = ΔΣ/Σ

Central bank policy, with its cheap liquidity policy, pushes the rate of inflation of stocks in the economy, significantly increasing p∑, prices especially in the real estate and art markets, but also in the stock market. Central bank policy makes, as we know, profits П in (2) swell and thus the rate of return of wealth r in (3). As there is a tendency for the growth rate g to decrease via evergreening, g will clearly lag behind the growth rate of wealth gΣ, gΣ > g. Inequality continues to grow.

2.4. Loss of confidence: Credit expansion - the source of imbalance in the economic development

And now more about loans. Mankind for centuries has been amazed to find that with orientation of the future in their present life, it actually makes the future a better place to live. This forward orientation has been successful for centuries and the success is based on credit and exploitation of nature. The credit system finances a promising future with the obligation to pay the finance costs tomorrow, especially via the Ponzi finance system. The economy has a tendency to postpone the follow-up costs, such as financial costs and costs of environmental exploitation, into the future.

We can look back on a long glorious history of credits. In former times, farmers could observe that working the soil today with better tools produces additional yield in the next period. An increased use of technical products that farmers bought from craftsmen made it necessary for them to finance their purchases with external funds. They are taking on debt today. And it pays off for them, as long as their tomorrow’s return will exceed the financial costs they incurred yesterday. Later in the industrial revolution, entrepreneurs have taken advantage of credit financing and bought machinery and factories financed with credit.

With our orientation towards the future, we become slaves to our expectations that we will be better off tomorrow than we are today. In order for these expectations to be realized, we need growth tomorrow with which we can pay our credit obligations that we have made today. Banks together with central banks and political actors are expanding the volume of credit in the economy, which requires further growth. However, when the growth will not be high enough to finance the credit costs, the equilibrium of the evolutionary economy based on high credit and high growth would be endangered.

We can now state the proposition that people become slaves to their expected growth increasingly based on credits. This attitude is typical in the modern capitalist credit economy. More pointedly we can say that the overstretched credit-financed capitalist economy makes the state and society slaves to growth. This is how the state-supported capitalist credit economy comes into being.

Innovative entrepreneurs are the main actors in the modern process of credit based economic evolution. They are supported by commercial banks. They provide the loans that entrepreneurs need to finance and market the production of their new goods. Following Schumpeter one can say that credit creation is the complement of innovation.

More generally, today entrepreneurs finance their production with loans and tomorrow they sell their produced goods at a profit after paying their financial costs. This is the economically fruitful intertemporal exchange that has sustained economic development for centuries and in which economic agents have confidence. This trust is based on a lot of credit and a lot of growth. According to Harari (2011), trust, credit and growth are the pillars of the modern economy. This long-lasting stable balance between much credit and high growth is becoming unstable and trust is dwindling.

We can regard growth g as beneficial to investment on projects as it increases sales opportunities, in

Figure 1-3 the sales opportunities are reflected in the distributions of project returns r

p and have a great impact on the economic development. Thus, growth g can be seen as closely linked to project returns on r

p. Some economists view future growth opportunities as low, for example R. J. Gordon (2016). Others consider the future full of opportunities, for example J. Mokyr. According to Gordon, the era of high growth is over. J. Mokyr sees it differently: “Mokyr, on the other hand, sees a bright future for economic growth, spurred by nations competing to be the leader in science and technology, and the resulting rapid spread of innovation worldwide. He sees the potential for progress in laser technology, medical science, genetic engineering and 3D printing”, here quoted from Banerjee and Duflo (2019), p. 151.

The future is open and also the answer to the growth question. What can be said, however, is that central banks favor evergreening and thus impede economic growth as Schumpeter saw it with innovative companies.

Furthermore, the transformation of production, as required by the climate crisis, will first make it more difficult for an economy to grow as it will increase the costs and will further stimulate credit expansion. The splitting of the global economy into a few large economic areas of strategic partnerships is also to lead to higher costs.

Credit can be a blessing for mankind, but it can also be a danger. As Minsky argues, debt financing is a source of economic instability. In crises, sales threaten to collapse, growth g is slowing down, and thus the project profitability p

r can fall below the financial costs i + p

r , companies have to fall back on their equity capital and the insolvency spiral can begin, as we know from formula (1) and

Figure 1-3.

3. Imbalance between credit and growth endangers the economic and social stability

3.1. The great challenge: Green production transformation

Now we can come to our second point. When it comes to the change in economic production caused by the climate crisis, the important factor is that: To maintain trust and stability the modern capitalist credit economy is obliged to grow. Central banks can make financing more favorable. But that may not be enough to secure sufficient growth in the long term. This is all the more true as the climate crisis requires a drastic change in production with additional costs and further credit requirements. This brings us to the third point: The climate crisis calls for a substantial change in production with additional costs and credits.

The clean-energy transformation in the production process has features of innovative developments, as described by Schumpeter in his economic evolution. And yet many things are totally different. What is essential in Schumpeterian development is that the old is replaced by the new, for example in production. And, a new economic prosperity emerges, because the new is more productive and opens up new opportunities in the future with greater growth. High profits bear the financial costs, so the external financing can be settled.

Since the industrial revolution, coal, oil and natural gas have been the energy base in production. Their intensive use has played a decisive role in economic growth over long decades. Without them, machines would not have been able to develop their productivity. But their use has had long-term harmful effects on the environment and climate. It has taken a long time for this long-lasting mode of production to be considered responsible for the adverse effect, especially for global warming.

Nowadays, the evidence is clearer, and the change in the mode of production is being insistently demanded more and more in society: away from the dirty fossil raw materials to the CO2 free green energy. The old is to be replaced by the new. As in Schumpeter’s approach to economic development, the production process should change, and change fundamentally.

It is not the entrepreneurs who are behind the transformation process. It is not profitable innovations that are reshaping the previous economic process. Now it is the state and society. The old mode of production has led to damage. It must be replaced by a new one to prevent further damage. The state intervention in the economy is enormous, the costs are high and so are the necessary credits. Even if the effort is great, it does not necessarily lead to more growth. High costs and more money in circulation are pointing in the direction of stagflation for the future.

The climate crisis is an unprecedented, enormous economic challenge. Two options are sometimes discussed. The first envisages green growth. The aim is to try to achieve the green transformation with growth. The second puts the transformation in the foreground and makes growth subordinate to it. According to our second point, the second option cannot be realized without endangering the modern credit economy. An increase in instability with stagflation would threaten the economy and society with disastrous consequences. So only the first path remains. And here extraordinary efforts are necessary with serious changes not only in production but also in consumption.

3.2. Follow-up costs in production and in finance

Externalities, caused yesterday, are increasingly emerging as costs in today’s economic calculus. External effects are subsequent costs that are not included in the current market prices and are borne by society with a delay, so we can speak of follow-up costs. Cost-minimizing production with fossil raw materials tends to pollute and even destroy the environment. The resulting damage is borne neither by producers nor consumers, but by the general public, usually with a greater or lesser time lag, often by people who had no benefit at all from the production yesterday. The term “external costs” is associated with A. C. Pigou (1877 -1959).

The expanding credit economy in the past is another burden for society now and in the future. Here the burden is debt with its financing costs. With the rise of debt, Ponzi financing increases the follow-up costs of credit financing and postpones financial costs further into the future.

Royal houses in early human history already knew about this burden of debt and its follow-up costs and also about the liberating effect of debt relief for their countries. They invented debt cancellation. It was supposed to enable a powerful new beginning. Now debt relief is more complicated. Credit is a mainstay of the modern economy, and it is internationally intertwined. Today, for the international financial community, debt relief may signal low financial reliability and increase the risk premium for the countries in question and may endanger their financial stability.

What was debt relief in the past could be anyone’s inheritance tomorrow. Donations can come alongside loans. A new central bank policy could develop in this direction. You will be able to inherit when you are young and when you are old. And the central bank can turn out to be the new “testator”, the new donator, for the whole society and for society in need. Here, it can establish direct relations with the individual economic agents and make a new contribution to the future development of civil society.

3.3. The changing relationship between growth and credit

According to Schumpeter, entrepreneurs drive economic development, and thus growth. They are the innovators and create new goods. They market the new. The new doesn’t just want to be developed and marketed. Development and marketing also need to be financed. Banks provide the financing, mainly in the form of loans.

Credit expansion requires growth, which - as discussed in

Figure 3 - cannot result from favorable financing conditions alone. If it does not occur with growth, it serves primarily to secure employment with evergreening. The evolutionary equilibrium between credit and growth thus becomes unbalanced.

Compared with earlier economic developments, the direction of the relationship between credit and growth is changing fundamentally. Whereas in the past growth required credit to unfold, today credit requires growth to pay for it. The credit expansion that follows from stabilization policy in crises will itself lead to further crises if growth is insufficient. It will also make the industrial transformation toward green technology much more difficult. This is because the transformation requires money on a large scale.

The fight against the climate crisis is costly. It costs a lot of money. Loan financing would further increase the follow-up costs in finance. The increased debt will then place a heavy burden on future generations. What is serious is that they will have less growth to pay off the loans and that inflation will tend to remain high, since in environmentally friendly production prices will capture all costs, part of which used to be left out as external costs in the past. The new climate policy in an unchanged capitalist credit economy will put confidence in the development equilibrium between credit and growth in serious jeopardy. A successful fight against the climate crisis can thus only take place in a reorientation of the modern capitalist credit economy, otherwise the new climate policy will be off target.

The question arises: How can traditional economic policy break out of the impasse? How can the follow-up costs, environmental damage, evergreening and the credit burden, be reduced? The state would have to move away from the policy of cheap money, low interest rates i and the taking on of business risks pr, toward strengthening project profitability rp and taking on civic risks.

A company’s profitability rp can be promoted through education, professional training, research and development. This promotion will benefit future growth and the development of a knowledge-based society.

4. Changing economic policy

4.1. A turnaround through reorientation of the state towards civil society

To better understand the scope of the change, let us briefly describe the existing economic system. The main actors in a closed economy without foreign trade are: the state sector, the business and the private household sector. The state with numerous greater municipalities and smaller communities at the local level and with the central bank. The business sector with more or less profitable companies and more or less large banks, with retail, commercial and investment banks. We expand the private household sector to civil society with children, students, consumers, employed and unemployed persons, as well as ill and retired people.

In the course of the recent crises, the dominance of the state in the economy has grown. In the process, central banks are becoming the central player in the state-dominated economy. Their new focus on financial stability favors the role of the state by providing the utmost support to companies and their pursuit of profit and henceforth strengthening the inequality in the society. In the long run, it will increase instability with further credit expansion in the capitalist economy. Thus, the focus on financial stability cannot contribute to a sustainable economic and social system.

The role of society in social and economic life has been weakened by the increasingly powerful state and its focus on economy, especially on the financial sector. But society should play a more prominent role as economic growth can benefit from a knowledge-based civil society.

Central banks can play a crucial role in strengthening civil society. They can use modern IT technology to do so. They can set up an account for every citizen, for children, students, consumers, employed and unemployed persons as well as ill and retired people. That could turn out to be revolutionary. Central banks can use the latest techniques and put themselves in the service of society.

If the focus of central banks with financial stability is clearly on private banks to promote profit by favoring the credit economy, the focus on civil society adds other objectives to the central bank policy: equal opportunities from an early age and protection of people in precarious situations. Improving equality of opportunity benefits education and thus the knowledge-based progress that sustains future growth. In the new path, central banks act as banks of social affairs with clearly defined tasks for supporting the civic society, an additional task to their traditional one in finance.

4.2. An additional task for central bank: Supporting the strength of the social and economic base without increasing the credit burden

New IT techniques allow central banks to break new ground by creating e-money. They can open accounts for citizens without recourse to private banks and enable them to make direct payments with their central bank digital currencies accounts, CBDC accounts. Prasad refers to this as account-based CBDC, Prasad (2021, 193 -238).

An account-based CBDC could promote reorientation to social issues in a variety of ways without increasing the credit burden. It could serve to improve equal opportunities. Each child could receive a starting capital, a donation, a kind of state inheritance, as many children have received this from their wealthy parents since forever. The central bank could support the propensity of citizens to make provisions by supporting savings through interest rates payments that are independent of the business cycle. In this way, the account-based CBDC becomes a savings account. The account can also serve to protect citizens against inflation and economic recessions, as well as against the needs of those who are elderly or have an illness.

With the new orientation, the state can tailor its policy more clearly to the companies and its traditional economic policy, and just as equally, to the society with its new social policy. In its new orientation toward society, the state frees itself from the burden of credit and interest payments that traditional policy entails. CB can inject new money into the economic cycle without increasing the credit burden and the imbalance between credit and growth.

Two examples may illustrate the new orientation of central banks to social issues and social investments.

4.3. Targeted measures to strengthen the social and economic base: Cash gifts for expectant and young mothers

Malnutrition in infancy hinders the physical and mental development of children and generates disabled people. Such people in poor economic conditions can only insufficiently act on their own obligations and assume their social responsibility, especially to give their children a healthy nutrition, a confidence in their own future and a good education with a perspective in social life.

Two studies shed light on the situation of young women in low-income positions. A study by Donohue and Levitt (2001) indicates that young and economically disadvantaged women are at high risk of giving birth to children who may later become criminals. In their analysis, they provide evidence that legalized abortion can significantly reduce the rate of criminalization. In their conclusion, they note at the end of their article that improving the living conditions of expectant mothers in bad economic environments and thus “providing better environments for those children at greatest risk for future crime” may be an alternative to abortion. In a following analysis Donohue and Levitt (2020) find strong support for their hypothesis that legalized abortion will account for a persistent decline in crime rates.

The second study investigates how better economic conditions can improve children’s development outcomes. Several studies are published under “Baby’s First Years”. According to Noble K. G., Magnuson K., Gennetian L. A. et al. (2021): “Childhood economic disadvantage is associated with lower cognitive and social-emotional skills, reduced education attainment, and lower earnings in adulthood”. The analysis of Troller-Renfree S.V. et al. (2022) is based on a randomized controlled trial. A total of 1000 low-income mothers of newborns were enrolled in the study. The study randomly assigned $333 or $20 monthly cash gifts. In summary, they provide evidence “that giving monthly unconditional cash (333) transfers to mothers experiencing poverty in the first year of their children’s lives may change infant brain activity”. This change allows for hope of better development of cognitive skills, of higher language performances and social-emotional qualities

4.4. Targeted measures to strengthen the social and economic base: Major infrastructure project managed by mediation

Long-term measures are not in the interest of politicians, who in democracies are interested in short-term results. It is for this reason necessary to be creative in times of change and to create institutions that can provide guidelines for long-term orientation. These new institutions should focus not only on the economy but also on society.

The productive forces of the citizens in the knowledge-based society must be made to unfold and thus be harnessed for the general interest, for the common good. As we know from Adam Smith, in a market economy the pursuit of individual interests often leads to social prosperity. But this is not always the case. Tensions often arise between citizens, the economy and the state. This is when mediation can help.

We are talking here about major projects in the field of important economic infrastructure: large new bridge constructions such as the new bridge in northern Italy near Genoa that has to replace the old collapsed bridge, tunnel constructions such as the Fehmarn Belt crossing between Denmark and Germany, as well as large communication networks in the sea, on land and in space and power lines for better energy supply in Europe and in many parts in the world.

And we are also talking about great projects of energy transition where global cooperation becomes necessary. Energy transition may be the greatest challenge in the future: the production shift from fossil to renewable energy, the green economic transformation. It needs to be mastered nationally, Europe-wide, for example in the North Sea, and globally. It can become a project that challenges humanity as a whole. As such, this challenge will require global cooperation.

Major projects affect the interests of citizens, the economy and the state. In order to speed up planning approval procedures and quickly move on to a permit process, the consent of the three main stakeholders must be secured. Essential to this is transparency. For comprehensive solutions, all available data must be used at the outset. Comprehensive data collection allows all parties to work out realistic scenarios, to expose conflict situations, but also to identify win-win situations. Bornschen and Weber are convinced that better use of data in modern, technologized, knowledge-based societies can ensure more efficient processes, for example in transportation planning or more generally in infrastructure projects. They therefore propose “the model of a public trustee for data management”. They see public data trusteeship as an important tool to ensure future prosperity. They hope that a convincing progress narrative can be developed from this approach, see Ch. Bornschein and E. Weber, Treuhänder für Daten. Lasst die Daten endlich arbeiten!

www.gaz.net/aktuell/wirtschaft/digitec/ein-neues-modell-fuer-die-datennutzung-in-europa, 25.08.2021, 1-4.

The process of public data trusteeship will come down to civic mediation, nowadays frequently used to regulate conflicts of interest in legal matters. The process can produce new institutions that can comprehensively strengthen society. With comprehensive access to data, mediators can help disclose decision-making situations and align the interests of citizens, business and government. The digital minister of Taiwan, A. Tang points in a similar direction with her model of collaboration between people, government and the private sector, what she called “people-public-private” partnership, The Economist, How technology can strengthen democracy. The world ahead 2022, November 8th 2021,p.91.

Targeted measures that strengthen the social and economic base give rise to expectations of growth in the long run.

5. Conclusion: Unstable modern capitalist credit economy with a state facing great challenges with new opportunities

The modern credit economy needs growth, otherwise it cannot exist. Political actors ensure credit expansion with words and actions, but their short-term policies bring about little growth. The conversion of polluting old production to green technology has a similar effect. It causes the credit to primarily grow, but less production. High loans demand high growth, which is difficult to meet with transition to green technology and with risky times, where the global economy is in the process of developing into a few larger areas with different political values. The imbalance between credit and growth weakens the trust of economic agents in the future and is becoming a serious economic problem.

A new start is needed and can only succeed if serious long-term ways out of the modern capitalist credit economy are pursued.

Under capitalism, entrepreneurs use machines together with people to produce goods. Both factors determine the production of goods in an economy and thus its prosperity. Machines, like people, are remunerated. With people the remuneration is referred to as wages and with machines as returns. For machines, one uses the more comprehensive term capital. The return on capital is increasingly determined by the financing of capital. Debt financing increasingly brings the financial system into play, which wants to share in the profits of economic development. Banks help companies to increase their return on equity through debt financing and thus participate in promising innovative projects of companies, as outlined in 2.1 Banks promote profits by credit financing and central banks keep credit costs low to ensure financial stability.

This cooperation between companies and banks is the basis of the credit economy in the modern capitalist economy, supported by central banks with their new financial stability objective. It is the engine for credit expansion or, in other words, for the increase in debt in capitalist economies and it endangers the economic and social stability with long lasting follow up costs in finance, the future costs of debts for upcoming generations.

Today’s credit enables enormous investments, which can increase production and in particular wealth in the future. But they also involve future payment obligations that must be met from future growth. This is where an intractable problem arises for the modern capitalist credit economy. In contrast to how it was for a long time, growth can no longer cover the cost of credit. The equilibrium of a lot of growth and a lot of credit is shaking.

There are some indications that the balance between “credit” and “growth” will become unbalanced in the future. The volume of credit is likely to continue to rise, and the increase in goods production will not be able to keep pace.

The previous method of production with coal, oil and gas has led to considerable follow-up costs, costs that were incurred during production yesterday, but which were not included in the pricing of the goods traded at that time. The costs are delayed until later in the form of environmental destruction and climate change.

At that time, goods offered too cheaply stimulated growth. Today, the inclusion of economic activity on the environment and climate burdens the economy in two ways. The damage caused yesterday wants to be repaired today and a new “clean” way of production wants to be introduced. The removal of the damage and the conversion of production are expensive and require enormous credit, but are likely to cause inflation and to trigger few growth impulses. The transformation in the economy will thus further widen the imbalance between “credit” and “growth”. The battle for the climate cannot be won without a transformation of the capitalist credit economy.

Going into debt for climate change would aggravate one of the follow-up costs for the other.

The long-term solution is for the state to loosen its one-sided ties to companies and financial systems and turn its attention more to citizens. This is less about social support for citizens who have drifted into precarious situations in the course of their lives and more about improving equal opportunities for all citizens in their economic lives from the very beginning. Here, central banks in particular have new tasks. They can use direct financial transactions to ensure greater equality of opportunity without expanding the volume of credit and can favor long-term growth by well targeted support. With better financial resources, citizens can dare to do more and can thus contribute to growth. In this way, a knowledge-based society can emerge. This modern civil society can be an important factor for competitiveness in the intensifying international competitive struggle and for a new national welfare.

In the face of these major challenges, the task now is to actively shape the future with a clear concept. The old “time will tell” leitmotif that has been valid for a long time will no longer be sustainable. Trusting that tomorrow will bring new opportunities for solutions may turn out to be an erroneous path and cost society dearly. We cannot continue to postpone our problems to future generations, they will already have enough to do with their own. Today we need to develop new sustainable concepts for a better future.

By using modern IT techniques in its reorientation, the state itself could transform itself into an efficient agent for economy and civil society. But without a substantial transformation of the capitalist credit economy, crises will constantly challenge society.

References

- Banerjee, A.V. and Duflo, E.: Good Economics for Hard Times, New York (2019).

- Bornschein, Ch. and Weber, E.: Treuhänder für Daten. Lasst die Daten endlich sprechen! www.gaz.net/aktuell/wirtschaft/digitec/ein-neues-modell-fuer-die-datennutzung-in-europa, 25.08.2021, 1-4.

- Donohue, J.J.; Levitt, S.D. The Impact of Legalized Abortion on Crime. Q. J. Econ. 2001, 116, 379–420. [Google Scholar] [CrossRef]

- Donohue, J.J. and Levitt, S.D.: The Impact of Legalized Abortion on Crime over the Last Two Decades, American Law and Economic Review V0, 2020, 1-62.

- Gordon, R. J. The Rise and Fall of American Growth, Princeton (2016).

- Harari, Y.N. Sapiens: A Brief History of Humankind; Signal McClelland & Stewart: Toronto, ON, Canada, 2016. [Google Scholar]

- Noble, K.G.; Magnuson, K.; Gennetian, L.A.; Duncan, G.J.; Yoshikawa, H.; Fox, N.A.; Halpern-Meekin, S. Baby’s First Years: Design of a Randomized Controlled Trial of Poverty Reduction in the United States. Pediatrics 2021, 148. [Google Scholar] [CrossRef] [PubMed]

- Pauly, R. : Economic Instability and Stabilization Policy. On the Path from Crises to State Directed Economies, Wiesbaden (2021).

- Piketty, T. Le capital au XXIe siècle, Paris (2013).

- Prasad, E.S. : The Future of Money. How the Digital Revolution is Transforming Currencies and Finance, Cambridge, Massachusetts, and London, England (2021).

- The Economist: How technology can strengthen democracy. The world ahead 2022, November 8th 2021, 91.

- Troller-Renfree, S.V.; Costanzo, M.A.; Duncan, G.J.; Magnuson, K.; Gennetian, L.A.; Yoshikawa, H.; Halpern-Meekin, S.; Fox, N.A.; Noble, K.G. The impact of a poverty reduction intervention on infant brain activity. Proc. Natl. Acad. Sci. 2022, 119. [Google Scholar] [CrossRef] [PubMed]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).