2.1. The Game Theoretical Model

Since the focus of this article is to apply game theory to the financial markets, we will start by presenting the game proposed in [

50] and the subsequent decision model that we developed from it. But, before constructing a game model for the market, we need to understand how the market works, how can we model it and what our goals are. Thus, we will start by identifying what kind of player in the market we will be, because there are two kinds of participants in the financial markets:

Investors: these participants are interested in making a predictable rate of return from their investments, through interest payments dividends and so on.

Speculators: these are interested in trying to profit from changes in the price of an asset.

Thus, since our goal is to predict prices and then act according to our predictions, henceforth we will take the part of a speculator. Also, to be a participant in the market, we must accept some level of risk (high or low risk acceptance level) and we also must have a clear profit objective in mind. Formally, the speculator needs to set a quantity for "Less Risk", "high risk" and "profit objective", always assuming that the asset will be held until the price reaches one of these targets. So, these targets must represent an individual’s actual risk and reward appetites, because if they are set randomly, then it is possible that neither are reached or that they are reached sooner than expected. Thus, these must have some basis on reality and the asset should stand a chance of hitting one of them.

Once the decision has been made to take a position in the market (by buying or selling a particular asset), the interaction between the asset’s price fluctuation and the speculator’s risk acceptance level and profit objective will determine whether or not a profit will be made.

Remark 1. Note that, this is consistent with game theory, where the outcome is determined by the choices made by both players, not just one.

Thus, speculators take positions in markets and market prices fluctuate. As such, the speculators’ strategies involve determining how much risk to accept, then the market will fluctuate the prices. It is the interaction between the speculator’s and the market’s actions that determine if a trade is profitable or not. Hence, after setting the profit objective and risk acceptance levels, we have the following scenarios:

Zero Adversity: when there is no price fluctuation against the speculator’s position severe enough to cause the trade to hit either risk acceptance levels. In this case, it doesn’t matter how much risk is accepted, because the market movement is completely favorable. We will term this pattern of price movement as Zero Adversity.

Minor (or Moderate) Adversity: when the market moves somewhat against the speculator’s position, which will cause the speculator to lose money if Less Risk were accepted but would have resulted in a profit if More Risk were accepted. So, any pattern of price movement that will cause a loss if Less Risk is accepted, yet still yield a profit if More Risk is accepted falls into this category, which we will term as Minor Adversity.

Major Adversity: when the market moves completely against both risk acceptance positions, so the Less Risk acceptance position results in a small loss, and the large risk acceptance position results in a large loss. Also, the profit objective was never reached. We will term this pattern of price movement as Major Adversity.

Note that, many different price movement patterns yield the same result and that it is possible to classify all market price movements into these three categories. These classifications are:

the speculator accepts Less Risk and then the prices move favorably, resulting in a profit to the speculator;

the speculator accepts More Risk and then the prices move favorably, resulting in a profit to the speculator;

the speculator accepts Less Risk and the prices move moderately against the position, resulting in a small loss to the speculator;

the speculator accepts More Risk and the prices move moderately against the position, resulting in a profit to the speculator;

the speculator accepts Less Risk and the prices move severely against the position, resulting in a small loss to the speculator;

the speculator accepts More Risk and the prices move severely against the position, resulting in a large loss to the speculator.

Thus, if we quantify our risk acceptance levels and profit objective, the pattern of price fluctuation that subsequently occurs will result in one of the six outcomes previously described. Also, there is no price line that can be drawn that will not yield one of the above six results.

However, even though there are six categories, there are only three possible outcomes that can result from any trade, because the speculator must decide between accepting More Risk or Less Risk on any particular trade, and there are three outcomes associated with either of these actions. In other words, the speculator must decide on how much risk to take, either take More Risk or take Less Risk, then the market decides on how to fluctuate the prices, either fluctuate them so as to cause the speculator zero adversity, minor adversity or major adversity. So, after the speculator’s decision, one of three possible states of nature will prevail.

The previous discussion also holds true for short sales. A short sale is where the individual sells a particular asset first, then buys it back at a later date. Typically, the shorted asset is "borrowed" from the brokerage firm, and the broker will require a high margin against the short. Intuitively, a short sale is the inverse of a long position (i.e., a buy-sell position that we have been discussing so far), so short sellers make a profit when the value of an asset declines and loses money when the prices rise. Thus, the risk acceptance levels are set at prices higher than the price that initiated the trade. However, there is no significant difference in the concepts of risk acceptance levels and profit objectives between being either long or short in the market. But, because of the added costs of being a short seller, profit objectives generally have to be higher in order to recoup margin costs. Thus, henceforth, we will only concentrate on long positions, and its risk acceptance levels and profit objectives.

2.1.1. The Financial Game

To create the game that mimics the financial markets, we need to meet game theory’s requirement to have at least two players and that their identities are known, in our case the players are the speculator and the market. However, the market is an abstract entity, thus we enter the subclass of games (developed in [

16,

17,

26,

29]), called games against nature, where one of the players is an abstract entity.

In spite of this being a standard game against nature, we must make some important observations and assumptions:

The market does not come up with prices in a vacuum, rather the prices are the net result of the buying and selling decisions of all the individual participants in the market.

Generally, an individual has no influence on nature, yet in the financial markets a participant may have an effect on the price movements due to his/hers own actions. Of course that this depends on the individual and on the market. For instance, if the market is small and thinly traded, a large order will tend to move the prices either up or down, or if a person making the order is known (to other participants) to be astute, then his/hers actions may also influence the prices. However, since the majority of the individuals cannot affect "large" markets (such as in the USA, EU, UK markets), we will assume that we are working on a large market and that the effect of any individual is negligible.

Since the payoffs of each individual are unrelated, then we will assume that the market plays the same game against all participants. This also guarantees that all the individuals are playing against the market separately.

We will also assume that the goal of the speculator is to make a profit and that the goal of the market is to try and make the speculator lose money.

Remark 2. Note that with the previous assumptions, we have a game against nature where we assume the Wald’s (max-min) Criterion (for more details check [16,17,26] and/or [29]).

Here the market "tries" to make the speculator lose money by attempting to fluctuate the prices in such a manner so as to make it impossible to find a good combination of risk acceptance levels and profit objectives. Also, because we are using a theory that will enable an individual to find a way to beat the market, assuming that the market is also trying to beat the individual is the most conservative approach. So, ascribing a motive to the market allows us to analyze the market’s strategies as if it is a rational player in the game.

In order to have a game theoretic construction, we need to be able to draw a game matrix outlining the strategies of each player as well as the payoffs. Also, this should be done from the perspective of the individual speculator, because the point of this analysis is to find a set of strategies that will enable an individual to beat the market. Thus, the possible strategies for the speculator are accepting More Risk or relatively Less Risk. And the market’s strategies are price movements relative to the speculator’s position, i.e., the market can "choose" between three price movements: Zero Adversity, Minor Adversity or Major Adversity.

With this, we have that there are two possible strategies that the speculator can play and three possible strategies the market can play, resulting in six possible outcomes from the interaction between price movements and risk acceptance levels, all of which results in the following game table:

Table 1.

The game table for the financial market game.

Table 1.

The game table for the financial market game.

| |

Speculator |

| Market |

\ |

More Risk () |

Less Risk () |

| |

Zero Adversity () |

Profit |

Profit |

| |

Minor Adversity () |

Profit |

Small Loss |

| |

Major Adversity () |

Large Loss |

Small Loss |

Remark 3. Note that, in the game table, we added between parenarticle some notation so that we can refer to those strategies in a simpler manner.

Looking at the game table suggests that we should play the strategy of Less Risk, because this column has a minimum of a small loss, which is larger than the minimum in the More Risk column, which is a large loss. Similarly the market will "look" at the payoff table and "decide" to play a strategy that leaves us with the smallest minimum, i.e., the market will choose to play the Major Adversity strategy, because this row’s maximum is a small loss, which is the smallest maximum available. Hence the most likely outcome is that the speculator will lose money, which makes this game rather unattractive. However, in the real world a lot of people play the markets and some of them make money (at least some of the time).

Note that the solution Major Adversity, Less Risk is based on the concept of pure strategies. So this solution requires that the speculator always plays the strategy of Less Risk, and the market always plays the strategy of Major Adversity. Thus, this renders the game entirely pointless from the speculator’s point of view. But there are some caveats, the market is simultaneously playing against a myriad of players and, as such, it does not know all of the risk acceptance levels, the profit objectives and how many are short sellers or long traders. So, the market has to make its decision on which strategy to play under conditions of both risk and uncertainty.

Given the multitude of players and their strategies, the market will try to fluctuate prices in such a manner so that as many people as possible lose money. Also, from the point of view of any individual speculator, these fluctuations will make it look as if the market is varying its strategy each different time the game is played. All of this (and considering the theory so far) implies that playing each different strategy with some probability is called playing mixed strategies (for further details see [

19,

20,

21,

25,

28] and/or [

27]).

The speculator may also play mixed strategies, if they vary their risk and reward amounts each time they play the game. Also, they do not know how advantageous it is to play either strategy with any regularity, due to the market’s continually changing mixed strategies. But, in the financial markets, the players do not usually change their strategies, i.e., they pick the risk acceptance levels and then wait the assets’ prices to hit the corresponding thresholds. So, with this in mind, we will only consider pure strategies for the speculator to play in the financial game.

Now we need to be able to calculate the payoffs to the speculator for any set of strategies he/she plays against any set of mixed strategies that the market may play, in order to determine the merits of playing any one strategy at any particular point in time. Furthermore, this has to be done in the general case, because to have a coherent theory, the solutions must hold true for each and every individual speculator, no matter what strategy they play.

The market will play one of three strategies: fluctuate the prices in a way that causes major adversity to the speculator, fluctuate the prices in a manner that causes minor adversity to the speculator, or fluctuate the prices in a manner favorable to the speculator. Also, the market will choose one of the strategies in an unknown manner to the speculator, so each strategy will have a certain probability of being played. Thus we will use the following notation:

:= the probability the market plays Minor Adversity;

:= the probability the market plays Major Adversity;

:= the probability the market plays Zero Adversity.

This notation is in terms of the probability that either event will occur and, because the market is playing mixed strategies, the sum of the probabilities of playing all of the strategies must equal 1. Therefore, if the market plays Minor Adversity with a probability of and Major Adversity with probability , then it follows that Zero Adversity occurs with a probability of .

Regarding the speculator, theoretically, he/she may play two different strategies: More Risk or Less Risk. Analogously to the market, the speculator may play the More Risk strategy with some probability and the Less Risk strategy with some probability. Thus, the speculator is playing mixed strategies, just as the market is. With this, we can define the probabilities of playing the two strategies as follows:

Once again, the sum of the probabilities of playing both strategies must equal one.

Next we need to make a representation of the payoffs. Recall that there are three different results for this game, a speculator may: make a profit, lose money equal to the Less Risk amount, or lose money equal to the More Risk amount. We will denote this as follows:

w := profit to the speculator (this corresponds to a "win" to the speculator);

:= loss equal to the "Less Risk" amount (this corresponds to a "small loss" to the speculator);

:= loss equal to the "More Risk" amount (this corresponds to a "large loss" to the speculator).

Here, and . So, with this notation we do not need to specify monetary amounts associated with a profit, a small loss, or a large loss, because we have the relative magnitude of these variables. Thus, putting together the above ideas into a game table, we obtain the following:

Table 2.

The "updated" game table for the financial market game.

Table 2.

The "updated" game table for the financial market game.

| |

|

Speculator |

| |

|

|

q |

|

| |

|

|

|

|

| Market |

|

|

w |

w |

| |

|

|

w |

|

| |

|

|

|

|

Now, to determine when it is advantageous to play one strategy or the other, we need to start by isolating the pure strategies in terms of their expected profitability, and each of the speculator’s strategies must be compared with each of the market’s strategies, also all the results must be quantified.

Remark 4. Even though we presented the probabilities associated with the speculator’s strategies, we will not consider them for our model.

We know that there are three outcomes that can happen after the speculator takes a position in the market: a profit (equal to the profit objective), a small loss (equal to the Less Risk amount) or a large loss (equal to the More Risk amount). And, each of these three outcomes happens with some unknown probability. Also, these events are mutually exclusive, i.e., only one of them can happen at any one point in time (or trade). This is because, if the speculator gets stopped out of the market, he/she made a profit or suffered a loss (large or relatively small), and the highest probability that any event can occur is . Given this, it is possible (although unlikely) that one of the three outcomes happens with probability, but since we want to develop our model in terms of the speculator getting stopped out for either a large loss or a small loss, we will construct a diagram (specifically, a probability triangle) which will reflect these two possibilities.

Remark 5. The diagram that we will be constructing goes along with the algebraic exposition, in order to make the model much easier to interpret.

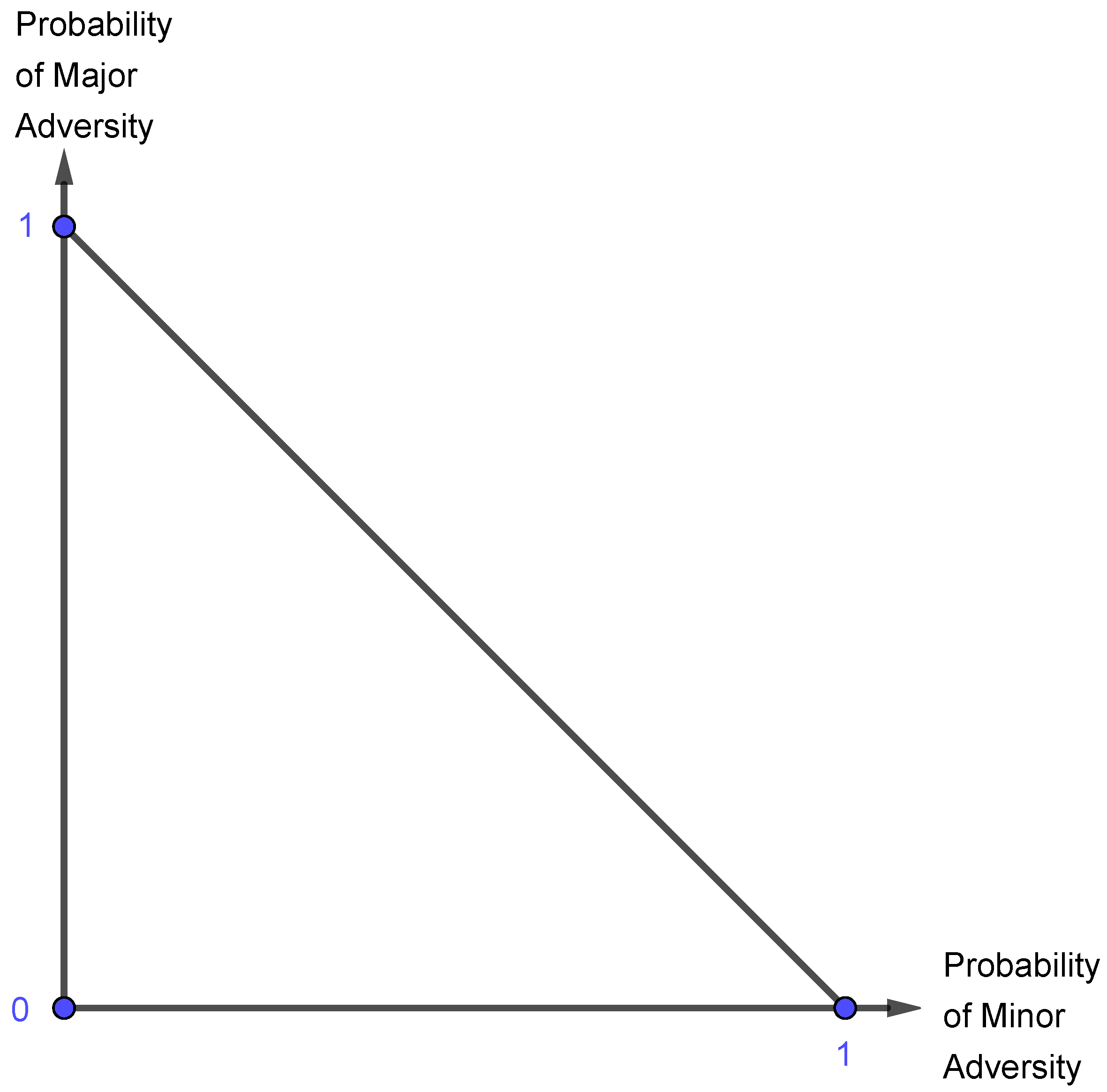

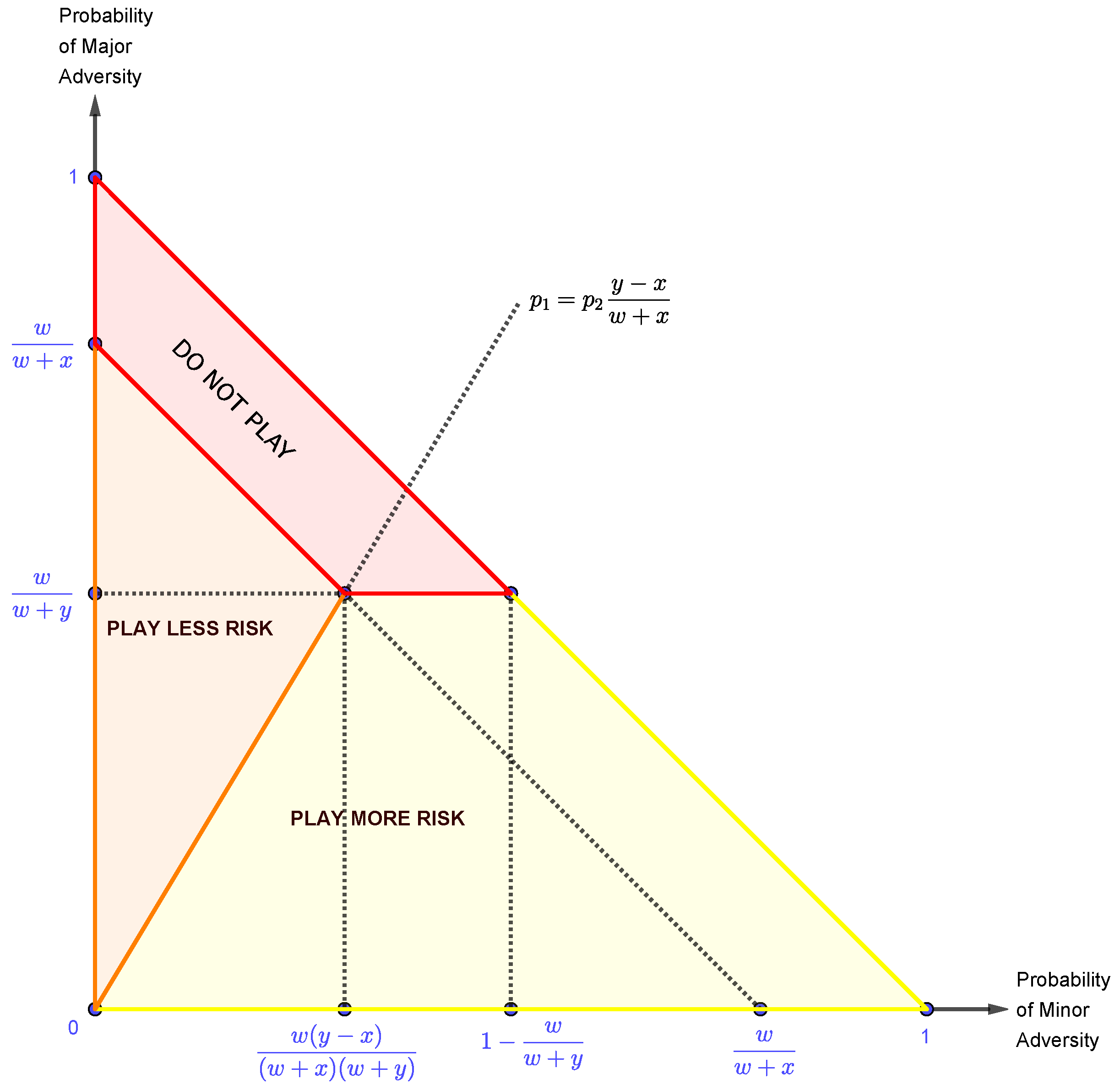

2.1.2. The Probability Triangle

For the diagram, consider the market’s probability of playing Major Adversity on the vertical axis, and the market’s probability of playing Minor Adversity on the horizontal axis. Also, since the highest value either axis can have is (because neither condition can prevail more than of the time), this implies that all combinations of Major Adversity and Minor Adversity can never sum to more than . This being the case, a diagonal line must be drawn between the mark on both axis, which will contain all possible combinations of the market’s strategies of Major Adversity and Minor Adversity. Thus, with all of this, we obtain the following probability triangle:

Figure 9.

The probability triangle showing the likelihood of loss.

Figure 9.

The probability triangle showing the likelihood of loss.

We will divide this probability triangle into several regions, which will reflect when it is more advantageous to accept More or Less Risk, or even when it is advantageous not to play the game at all. Furthermore, since game theory gives us methods to determine when a player is guaranteed a certain payoff, we can solve for when it is optimal to accept either More or Less Risk.

So far, we have concentrated on the speculator’s strategies which involve taking a position in the market. However, in reality, if we know when to take a position (i.e., when to play the game), we also know when not to take a position in the market (i.e., when not to play the game). So we will develop this model in order to determine when it is advantageous to take a position, along with when it is disadvantageous to do so. Thus, conditions where it is disadvantageous to take a position will correspond to the "Do Not Play" region of the probability triangle.

Now, we can determine, with the aid of the game

Table 2, the expected payoffs from playing each of the speculator’s strategies:

The Expected Payoff from playing Less Risk ():

The Expected Payoff from playing More Risk ():

Equation (

1) represents the expected payoff from playing the pure strategy Less Risk (

) and is written with several variables: the amount that can be won (

w), the amount that can be lost due to a small stop (

x), and the probability that the market will either give us minor adversity (

) or major adversity (

). Note that the speculator determines the values of

w and

x by his/hers risk-to-reward appetite, but the market determines the probabilities

and

.

If the equation

1 is greater than zero, the speculator expects a profit, but if it is less than zero, the speculator expects to lose money. Also, because the speculator is only in control of the variables

x and

w, we need to express the equation as strict inequality, and solve it in terms of

and

. In other words, we need to find out for which market conditions it is always advantageous to accept Less Risk by finding out when the expected payoff from playing Less Risk is greater than zero. Thus we obtain the following:

Note that we are considering a strict inequality because if it is not profitable to play the Less Risk strategy, because its expected payoff is zero.

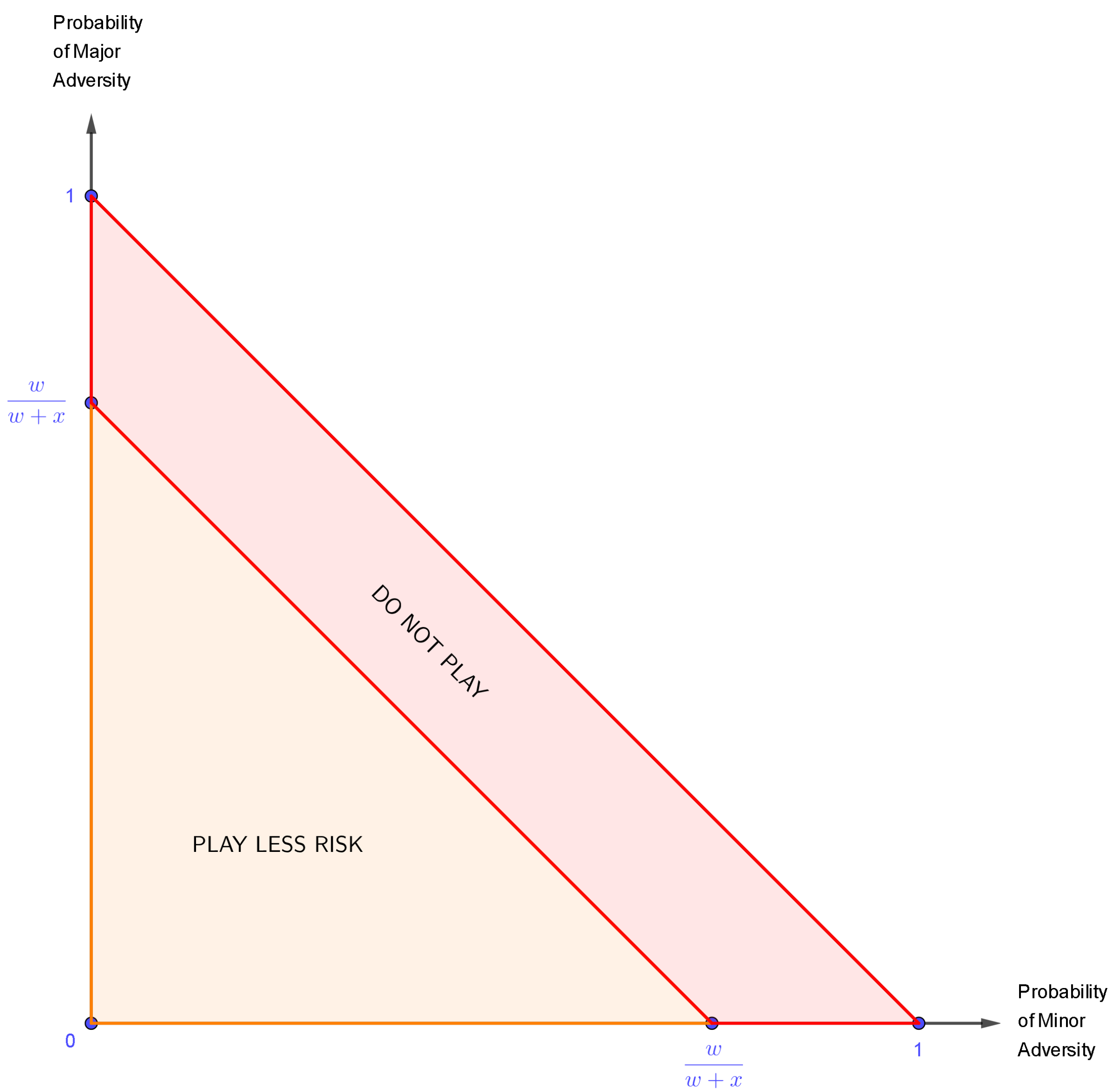

With all of this, we can incorporate equation

3 into the probability triangle yielding the following:

Figure 10.

The probability triangle divided into two regions: "Play Less Risk" and "Do not Play".

Figure 10.

The probability triangle divided into two regions: "Play Less Risk" and "Do not Play".

Remark 6.

Note that, by definition of w and x:

The "Play Less Risk" area contains the points where it is profitable to play the strategy of Less Risk, and the "Do Not Play" region contains money-losing strategies. Also, because equation

3 was developed as a strict inequality, the line diving the two regions is not included in the "Play Less Risk" area, so the points on the line (

) are included in the area of loss.

Again, the line dividing these areas is determined exclusively by the parameters set by the speculator, so this line will vary from individual to individual, always based on each individual’s risk-to-reward appetites, also the value yielded by is not a constant that holds true for all players in the market. But, since we are developing a model in the general case, it must hold true for each and every person, no matter what their individual circumstances are.

Moving forward, we can now focus on determining when it is advantageous to accept More Risk, however it is not as straightforward as it was for Less Risk, because it is only advantageous to accept More Risk when the market is playing Minor Adversity. And, under this condition, a strategy of Less Risk will cause a small loss, but a strategy of More Risk results in a profit.

under market conditions of Zero Adversity, both strategies yield a profit, so the speculator is indifferent between the strategies;

under market conditions of Minor Adversity, a strategy of More Risk generates a profit, and the strategy of Less Risk causes a loss, so it is advantageous to utilize the More Risk strategy;

if the market conditions correspond to Major Adversity, both the speculator’s strategies are unprofitable, but the Less Risk strategy causes a smaller loss than does the More Risk strategy, so it is less advantageous to play More Risk.

We know that, by equations

1 and

3, if the expected payoff from the Less Risk strategy is positive, then we are "guaranteed" a positive payoff when Less Risk is played. So, to find out when the strategy of More Risk yields a positive payoff when the strategy of Less Risk does not, we need to analyze equation

2 while

1 is negative.

So, we need to to find out for which market conditions it is always advantageous to accept More Risk by finding out when the Expected Payoff from playing More Risk (

) is greater than zero, assuming that

. Thus we obtain the following:

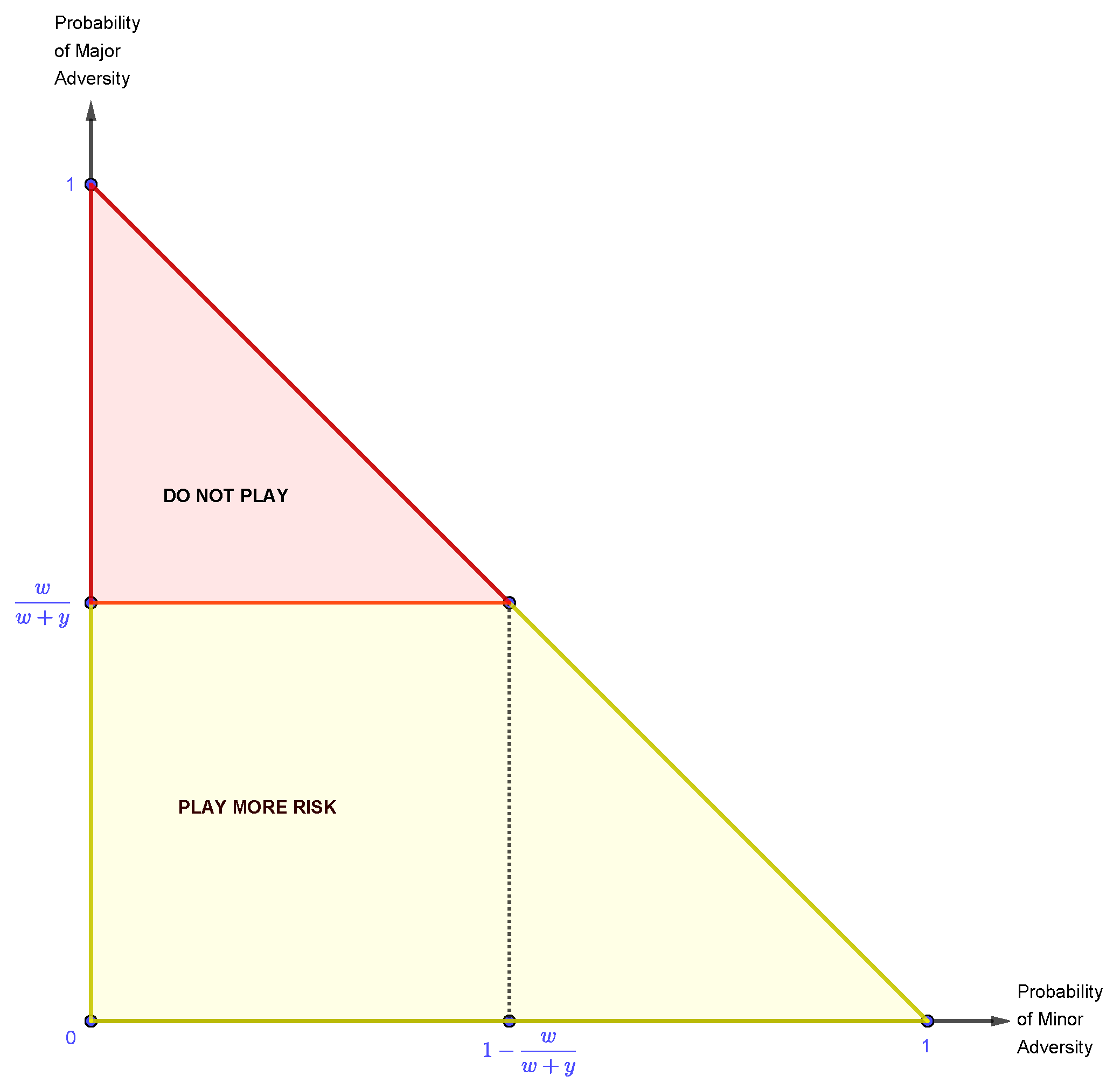

Note that we are considering a strict inequality because if it is not profitable to play the More Risk strategy, since its expected payoff is zero. Also, observe that equation 5 is only in terms of Major Adversity () and it implies that if the probability of Major is greater than then the trade will lose money, otherwise the trade will make money. In terms of game theory, if the probability of Major Adversity is greater than , then we will not play the game, and if the probability of Major Adversity is less than , then we play the pure strategy of More Risk. Additionally, if the probability of Major Adversity is equal to , then the trade will result in a profit of zero, thus we will also not play the game.

With all of this, we can incorporate equation 5 into the probability triangle yielding the following:

Figure 11.

The probability triangle divided into two regions: "Play More Risk" and "Do not Play".

Figure 11.

The probability triangle divided into two regions: "Play More Risk" and "Do not Play".

Remark 7. Regarding the previous probability triangle, note that:

Here, the lower region contains the conditions where it is advantageous to play the pure strategy of More Risk, and the upper region is where it is disadvantageous to play More Risk. Also, once again, the points in the separating line () are included in the Do Not Play area.

The same reasoning used to understand the implications of playing the pure strategy of Less Risk hold true for the strategy of More Risk, i.e., points within the "Play More Risk" area represent profitable trades and points within the "Do Not Play" area represent losses. Also, once again, the solutions must be interpreted in a probabilistic sense.

Now that we know when it is advantageous to play More Risk (assuming that the result of playing Less Risk is negative), we need determine when it is advantageous to play More Risk despite the result of playing Less Risk, because there is a region of the probability triangle where the two strategies overlap. So we still need to determine when it is advantageous to play More Risk, irrespective of the merit of playing Less Risk. Thus we need to solve the following equations:

Consider that equation 2 was developed as an equality, then if the probability of Minor Adversity is equal to zero (i.e., ), then the probability of Major Adversity has to equal to zero as well (i.e., ). However, in the inequality, if were zero, then would have to be less than zero, but this is in conflict with the variables’ definitions, because probabilities can only take values between zero and one, thus they cannot be negative. Also, the probability of Major Adversity occurring in the real world is not less than zero, because, if this were true, all the players in the market would always win. Moreover, since the formula that expresses the slope of the line () is always a positive number (as the variables x, y and w are all positive numbers), whenever is zero, then has to be zero, and vice versa. Also, the line itself represents the boundary where it is equally advantageous to play the pure risk strategies of either Less Risk or More Risk, and the area above the line defines where it is advantageous to play Less Risk.

All of these results are combined in the following probability triangle:

Remark 8. Regarding the previous probability triangle, note that:

, which is true because, by definition, ;

, which is true by definition of x;

;

;

.

In the previous probability triangle, there are three regions: the Do Not Play region, the Less Risk region, and the More Risk region. Also the dotted lines show the location of the original regions, as well some relevant intersection points. Note that all of the interior lines intersect at one point (), and that we included the separation line between the Less Risk and More Risk regions (i.e., ) in the Less Risk region, but the intersection point between all the interior lines is considered a part of the Do Not Play region.

Finally, observe that, in all of the obtained probability triangles, a "Do Not Play" region has appeared which is not related to any possible strategy (on the presented financial game) that the speculator can choose from. However, the "Do Not Play" strategy is implicit in the game

Table 1 and

Table 2. To see this consider the game

Table 2 and that the speculator has an additional "Do Not Play" strategy. So, if the speculator chooses this strategy, then he/she will not enter the trade, and thus will not lose or win with the trade. Hence, the payoffs from this strategy are always zero independently of the market’s strategy. So, the game

Table 2 becomes:

Table 3.

The game table for the financial market game including the "Do Not Play" (D) strategy.

Table 3.

The game table for the financial market game including the "Do Not Play" (D) strategy.

| |

|

|

Speculator |

| |

|

|

|

|

|

| |

|

|

|

|

D |

| Market |

|

|

w |

w |

0 |

| |

|

|

w |

|

0 |

| |

|

|

|

|

0 |

However, the payoffs from adding this strategy do not change any of the calculations that we made to determine the several probability triangles, also these would only be relevant if we wanted to determine the best mixed strategy for the speculator to play (specifically, the probabilities , and would be important). But, since we only want to determine the best pure strategy that the speculator should play (i.e., one of the speculator’s probabilities will be equal to one) by taking into account the market’s probabilities (, and ), the "Do Not Play" strategy being explicit or not in the game table is not relevant, but this strategy is still important to the overall, because it complements the speculator’s other two strategies (Play More Risk and Play Less Risk).

So, the complete model, which incorporates all of the previous calculations and graphic representations, has the general form shown by the probability triangle in

Figure 12. Also, this probability triangle represents the situation a speculator faces in a financial market, because it takes into account the speculator accepting either More Risk or Less Risk, and the market generating conditions of either Zero Adversity, Minor Adversity, or Major Adversity (always with respect to the speculator’s position). Additionally, the probability triangle has Minor Adversity and Major Adversity as its axes, yet it also shows the condition of Zero Adversity, which is the complete absence of both Major Adversity and Minor Adversity, which is represented by the origin point on the probability triangle.

Always have in mind that the model has to be interpreted in terms of "if these certain probabilities exist, then we should play a specific strategy". So the model cannot tell us what the probabilities are, it only tells us that if certain probabilities exist, then a particular strategy should be employed. Thus, if we play the financial game repeatedly, under some predetermined circumstances, the wins will outweigh the losses, and the net result of our successive plays will be profitable, this is because we need to interpret the model in the probabilistic sense rather than in an absolute sense. For instance, the model does not suggest that each and every trade that falls within the parameters of will necessarily be profitable, only that over time the amount won will be greater than the lost.

Now that we have the complete model, we need to estimate the probabilities of the market playing the strategies of Major Adversity and Minor Adversity. Furthermore, we need to make these estimates as accurate as possible, because if they are not, the model will lose its predictive value. And we will accomplish this in the next section, with the aid of Markov Chains.

2.2. The Markov Chains Model

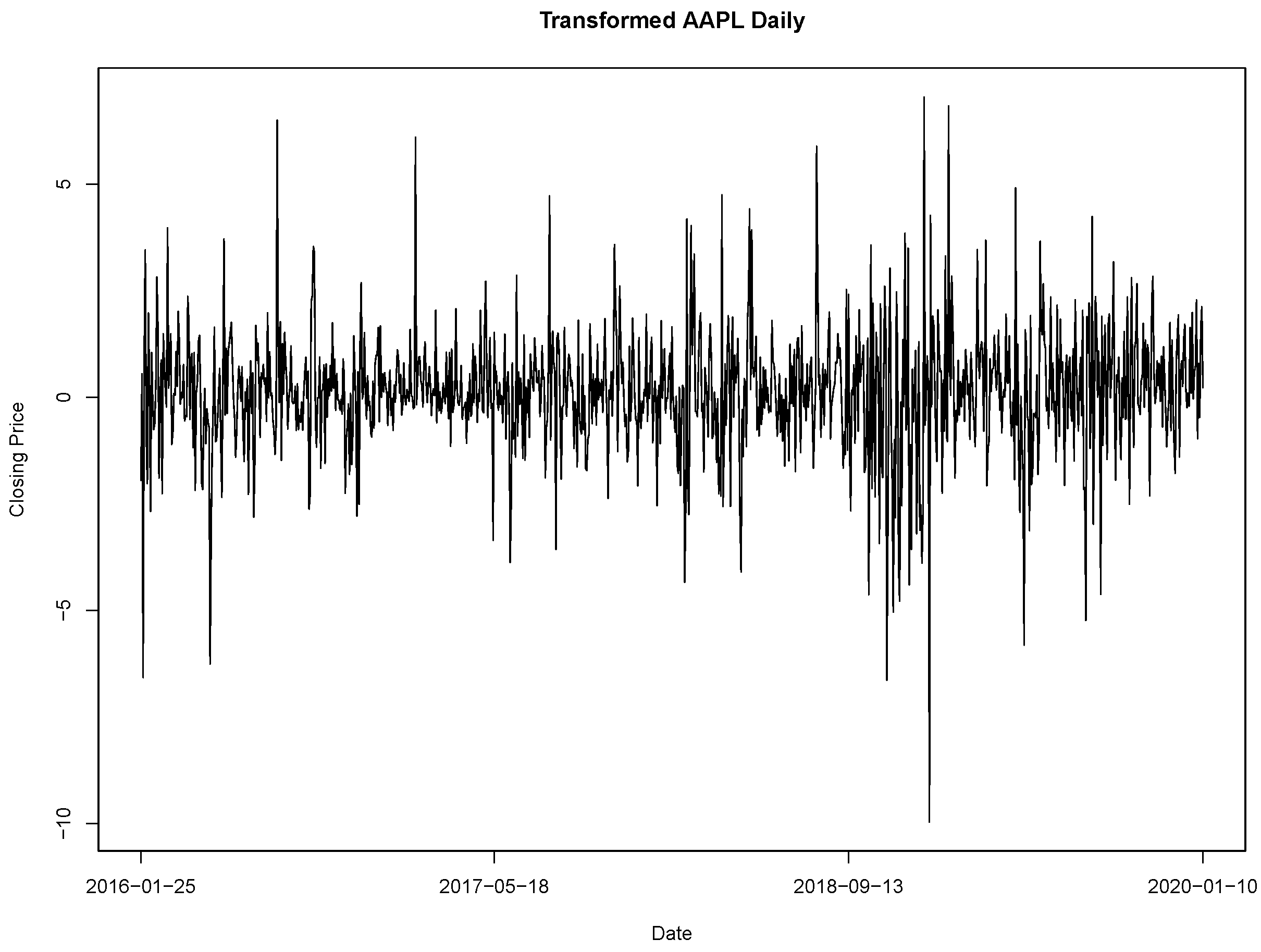

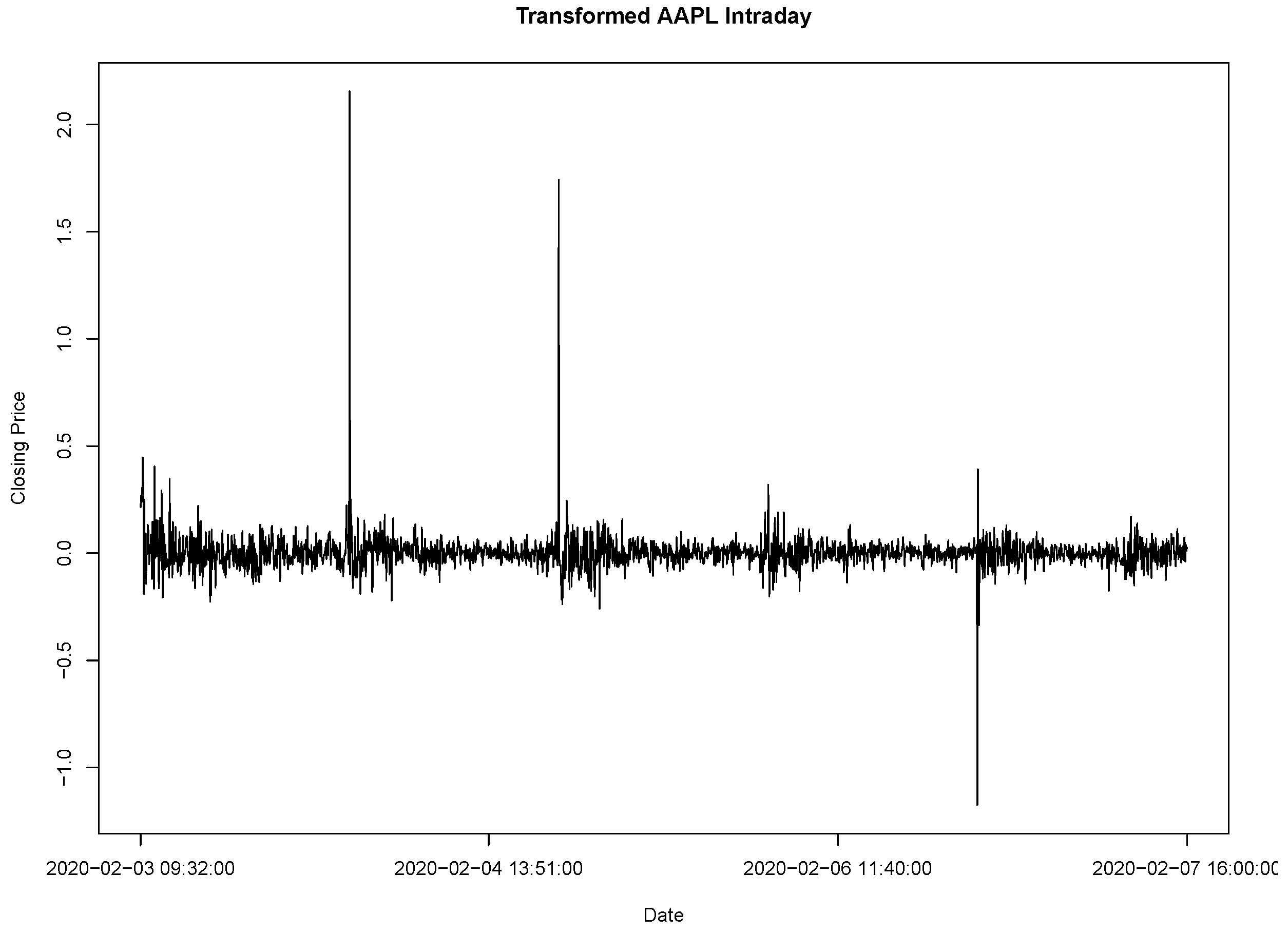

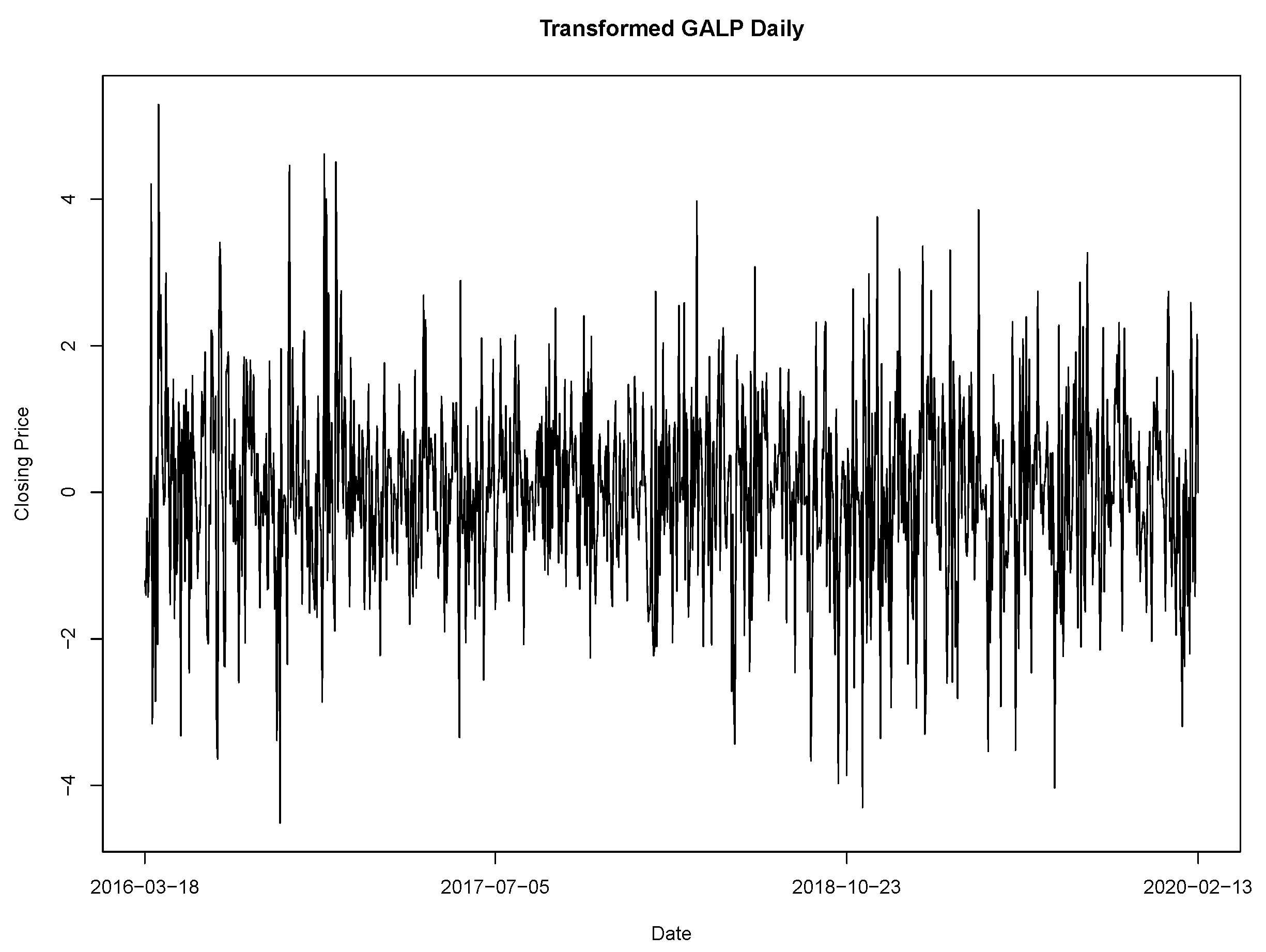

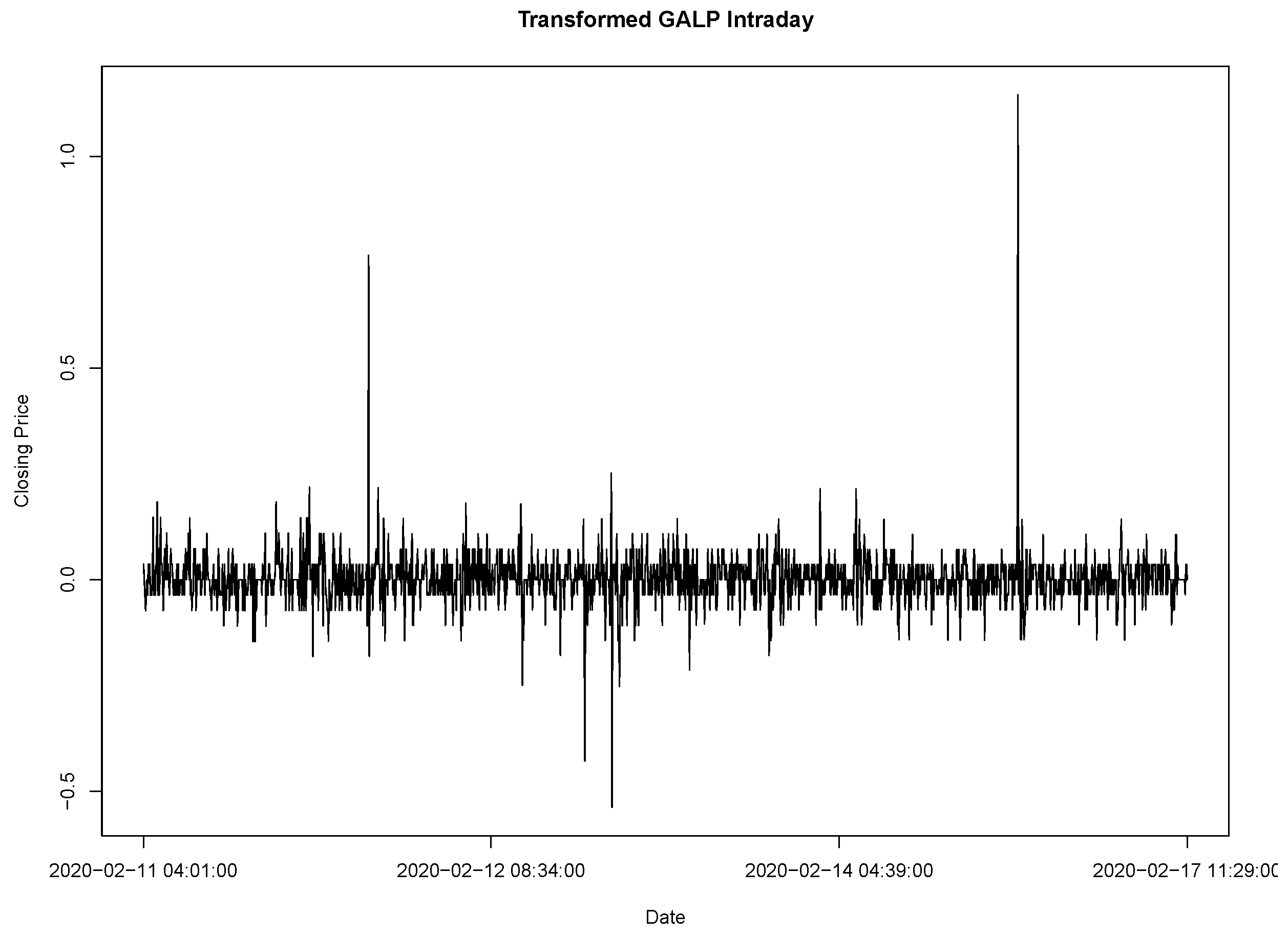

As we have seen in the previous section, playing the markets is an iterated game, so the next important task that we have to address is the (probabilistic) method that we will use to estimate the probabilities of the market playing Zero Adversity, Minor Adversity and Major Adversity (, and respectively). However, the financial assets’ prices fluctuate from a variety of ranges (but always strictly positive). Thus we need to split the data into classes in order for us to make some kind of probabilistic analysis. For this, consider the standard deviation () of a dataset transformed with the percentage change transformation, and define the strategies’ thresholds as:

the Less Risk threshold corresponds to minus two times the standard deviation of the data ();

the More Risk threshold corresponds to minus three times the standard deviation of the data ();

the profit threshold corresponds to three times the standard deviation of the data ().

Since different assets from the stock market have different price ranges and levels of volatility, then by defining the thresholds in this manner, we will maintain a certain coherence across all the datasets. Also, note that the less and More Risk thresholds have to be negative, because they correspond to possible losses. Additionally, since the datasets’ unit of measure is the percentage change, the standard deviation’s unit of measure is also the percentage change.

After defining the thresholds, we can formally say what is the relationship between the market’s chosen strategies with an asset’s price. Thus, to accomplish this, we will assume that:

the asset’s price drops further than the Less Risk threshold if and only if the market chooses to play the Minor Adversity strategy;

the asset’s price drops further than the More Risk threshold if and only if the market chooses to play the Major Adversity strategy;

the asset’s price increases further than the profit threshold if and only if the market chooses to play the Zero Adversity strategy.

Now, consider that we observed the asset’s percentage price change for N successive and mutually independent financial market games, and that we want to determine the mentioned probabilities for the next () game. Also, the percentage price change of game i is denoted by , . Additionally, assume that if the thresholds of Major Adversity or Zero Adversity are reached in a game, suppose that it was on game , then the speculator will not play on the following games, , otherwise the speculator will continue to play. We need to assume this because, if the speculator loses or wins on a game, then we will not continue playing, due to the trade being closed, and if the price does not reach one of the thresholds, the speculator will not win nor lose the game, so he/she needs to keep playing, because the trade is still open.

Remark 9. Note that if the market chooses to play Minor Adversity, the speculator only has to stop playing if he/she played the Less Risk strategy.

With all of this, we can start estimating the desired probabilities for the

game, knowing that the probability of the market playing a certain strategy at game

is related to the probabilities of the market’s choices on the

N previous games, i.e., we want to determine

Remark 10. Note that we will not directly estimate , because it is simpler to estimate and , due to the way we defined these probabilities. Also, we can do this because . So, moving forward, we will not reference the estimator of unless we see fit to do so.

Firstly, suppose that we only consider one game to determine our probabilities, i.e., we will start by considering , so we have the following:

We can interpret equation 10 for the probability of the market playing Major Adversity as follows: if the percentage price change reaches the More Risk threshold in game 1, then the speculator stops playing. So, the probability of the price change reaching the More Risk threshold is obtained by simply calculating the probability of the percentage change reaching the More Risk threshold in the previous game, i.e., .

Similarly, the probability of the market playing the Zero Adversity strategy is obtained by calculating the probability of the percentage change reaching the profit objective threshold in the previous game, i.e., .

However, since we have access to more historical data of the asset’s price, we can determine these probabilities more accurately by taking into account more games. Now, consider that we will use the results of two past games to determine our probabilities, i.e., we will consider

, thus we obtain:

Thus we can can interpret the new equation 10 for the probability of the market playing Major Adversity as follows: the speculator stops playing, if the percentage price change reaches the More Risk threshold in game 1 or if the threshold is only reached in game 2 (implying that, in game 1, no threshold was reached). So, the probability of the price change reaching the More Risk threshold is obtained by adding the probability of the percentage change reaching the More Risk threshold in game 1 to the probability of the percentage change reaching the More Risk threshold in game 2 without reaching it in game 1. And, a similar interpretation can be given to equation 11.

Finally, we can obtain even more accurate probabilities if we consider the results of all the played games (i.e., by considering all the historical price data). Thus, considering the results of

N games, the equations for the desired probabilities are:

The intuition behind the obtained equations 14 and 13 is similar to the one that we used to obtain the equations 8 and 9. Also, because the

N games are mutually independent, from basic probability theory we have that the equations 14 and 13 are equivalent to:

From these equations we can see that, for example, to estimate (and ), we would have to estimate probabilities, which would be computationally inefficient and the error from the final estimate would increase due to the large number of individual estimates. So, to overcome these problems we will use Markov chains to estimate the probabilities , and .

Thus, using the same assumptions and notations as before:

the asset’s percentage price change for N successive financial market games is known;

the percentage price change of game i is denoted by , ;

we want to determine the mentioned probabilities the game;

if any of thresholds is reached in a game, suppose that it was on game , then the speculator will not play on the following games, , otherwise the speculator will continue to play.

Now, because we will use Markov Chains, we need to assume that the probabilities associated with each game are related through the Markov property (for further details see [

31]):

Definition 1 (Markov Property).

A stochastic process with a discrete and finite (or countable) state space S is said to be a Markov chain if for all states and (steps) :

So, we obtain the following estimators for and :

In order for us to be able to use the percentage price change (of a given asset) at game i (i.e., to use ) as the underlying stochastic process of the Markov chain, we need to split the data into classes (or states). Also, by defining the Markov chain we will obtain its probability matrix, which will allow us to estimate and .

Before moving further, we need to note that, for instance, if the price is (at a certain time) on a lower price class (relative to the initial price), then it will have a higher probability of transitioning to a higher price class, due to the nature of the data that we are utilizing, and a similar argument can be made if the price is on a higher class (as we have seen in Chapter 1). However, this is represented by the Markov property, because the probability of the Markov chain being in a certain state at time t only depends on which state the chain was at time , so this probability may change according to which states the chain encounters itself in time . And this fact will also affect on how we will define the chain’s classes.

To define the classes we can utilize the standard deviation (which we previously denoted by ) of the dataset, and since we defined (and used) the strategies’ thresholds, we will split the data "around" these thresholds values, also the classes’ ranges and distance between them will be .

Additionally, due to the mentioned volatility and wide range of the assets’ prices, they may reach one of the thresholds in the first game (or iteration), or they may not reach them at all. So, for these reasons we will define some intermediate classes between the the classes associated with the thresholds (or market strategies). Thus, with all of this, we obtain that the classes (or states) are:

Remark 11. Note that, instead of using the previously defined threshold to limit the classes, we chose to define the classes around these thresholds, in order to include them. However, if all the classes maintain a certain coherence according to the thresholds and have the same range (excluding the and classes), then we will obtain similar results after applying our models.

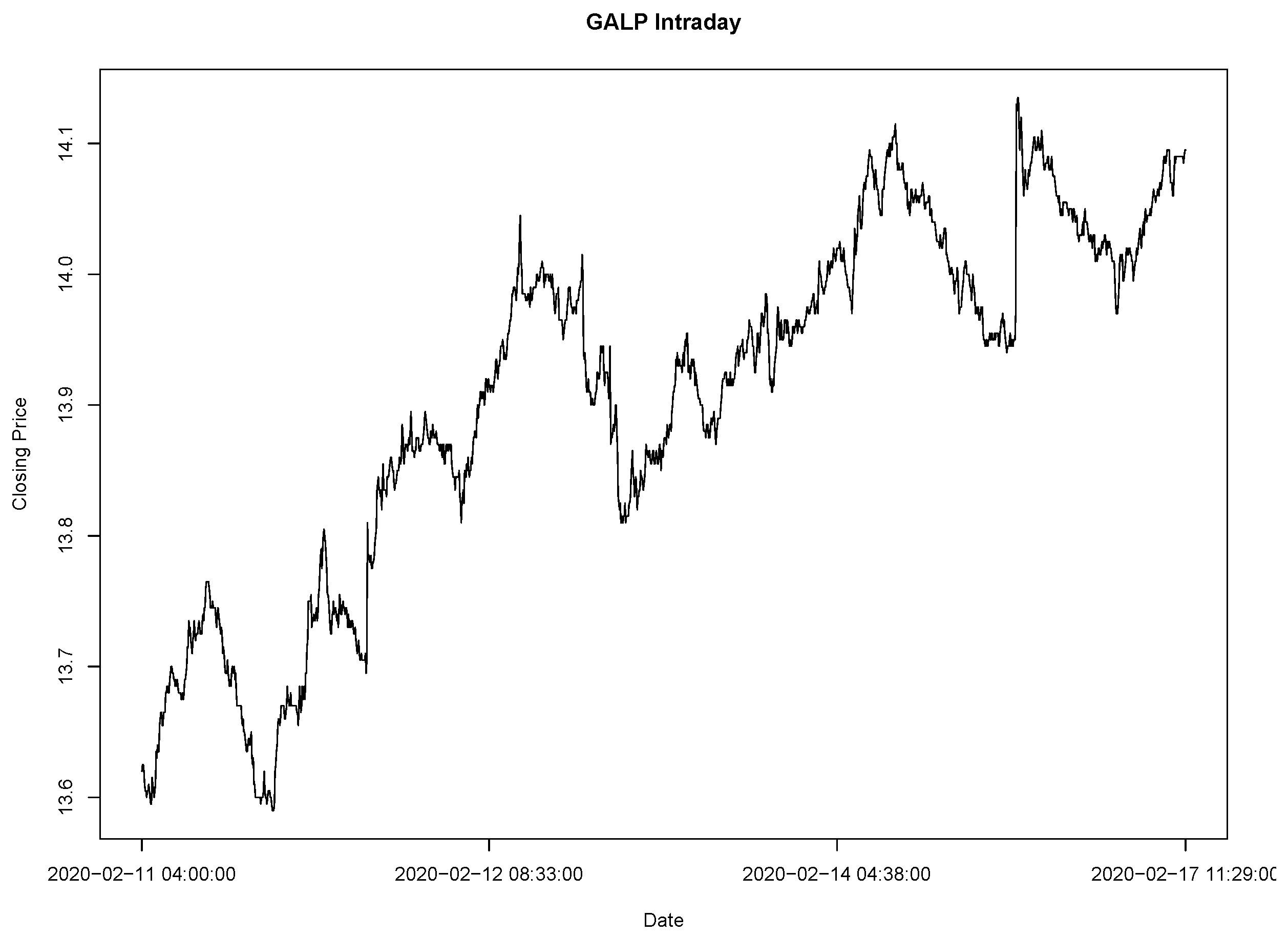

As an example, consider the dataset

to be the prices of some financial asset for ten consecutive days, then its percentage change transformed dataset (rounded to two decimal cases) is:

which was obtained by applying the percentage changes transformation. So, the standard deviation of this transformed dataset is

(which also is a percentage), i.e.,

. Hence the classes, for this example, are:

;

;

;

;

;

;

.

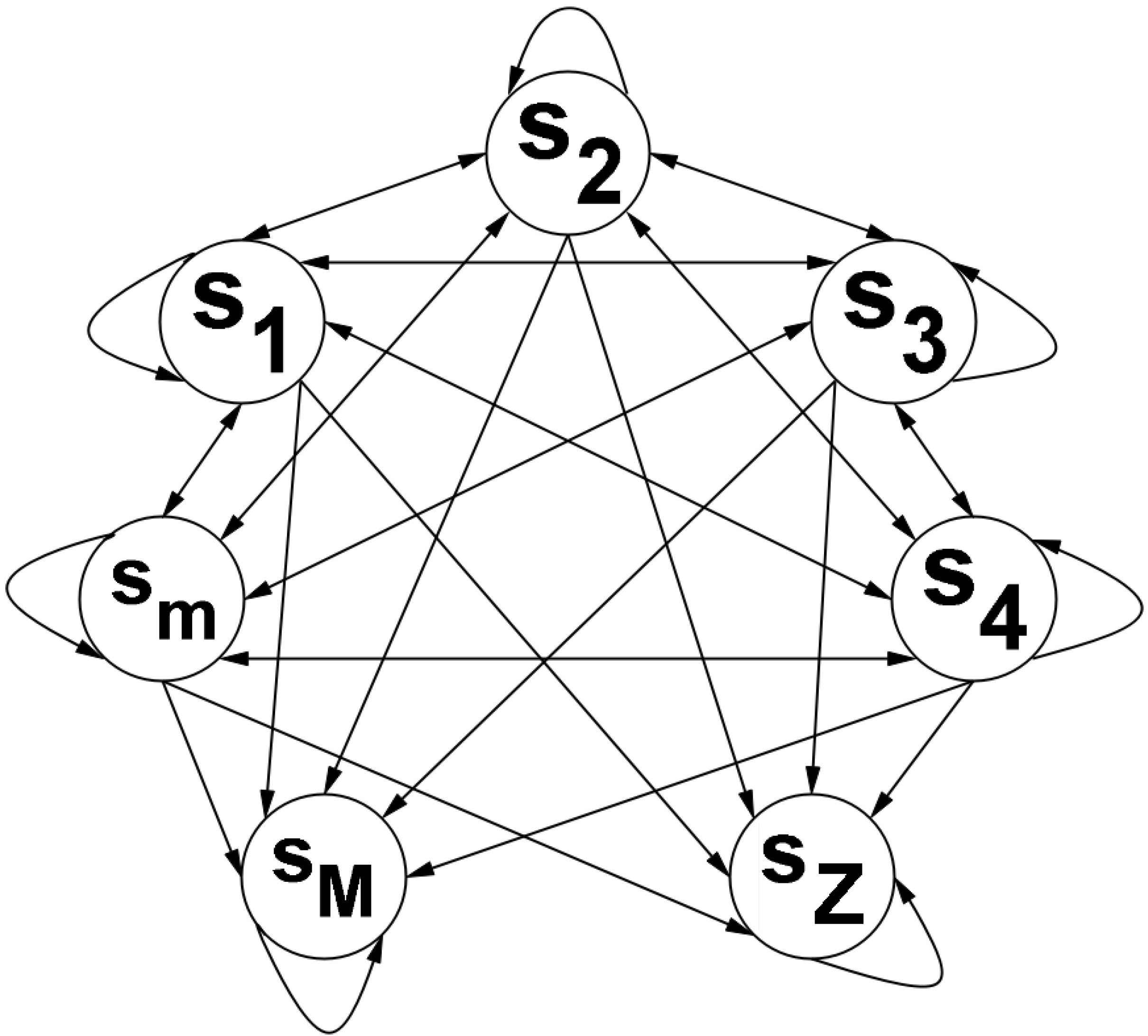

2.2.1. Defining the Markov Chains

Before formally defining the necessary Markov Chains, we need to make some observations about the described classes. According to our assumptions, if the market chooses to play Major Adversity or Zero Adversity, the speculator will have to stop playing (which will result in a major a loss or in a profit, respectively) independently of the speculator’s chosen strategy, but if the market chooses to play Minor Adversity, the speculator only has to stop playing if he/she chose the Less Risk strategy.

Also, with the aid of game table 2 (from the previous section (2.1)), we can see that the results of the market playing the Major Adversity strategy are only noticeable if the speculator chooses to play the More Risk strategy, because if the speculator chooses the Less Risk strategy he/she will stop playing the game immediately after the Less Risk threshold is reached, thus he/she will not know if the price further increased or decreased.

Thus, assuming that the speculator chose the More Risk strategy, we can determine the probability of the market playing the Major Adversity strategy. Also, if we assume that the speculator chose to play the Less Risk strategy, then we can determine the probability of the market playing the Zero Adversity strategy, this is because, in this case, the speculator only has a profit if the market chooses this strategy.

So, for these reasons we will define two Markov Chains, one where we consider that the speculator chose the Less Risk strategy and another where he/she chose to play the More Risk strategy. However, we will always use the same assumptions, strategies’ thresholds and data for both the Markov Chains, so that we can utilize the probability matrices from each to estimate the probabilities , and . Also, we will assume that is the initial state for both the Markov chains, because when the speculator enters for trade of a certain asset, then the asset’s initial percentage price change will be which is an element of the class.

Regarding the Markov Chain where we assume that the speculator chose to play the More Risk strategy, we have the following observations about its states (or classes):

The classes will retain the same definitions as before

To represent the fact that the speculator only stops playing if the price enters the Major Adversity class (

) or the Zero Adversity class (

) in the Markov Chain, we simply must define these classes as absorbing states, i.e., if the price enters one of these classes, then it will never exit them (for more details see [

30,

31] and/or [

34]).

Since the speculator does not stop playing if the price is in one of the remaining classes, the price may go to any class (including staying in the same class). And, to represent this in terms of Markov Chains, we simply define these classes as transient (for more details see [

30,

31,

34] and/or[

35]). Also, these states (

) communicate between themselves, thus they form a communicating class in the Markov Chain.

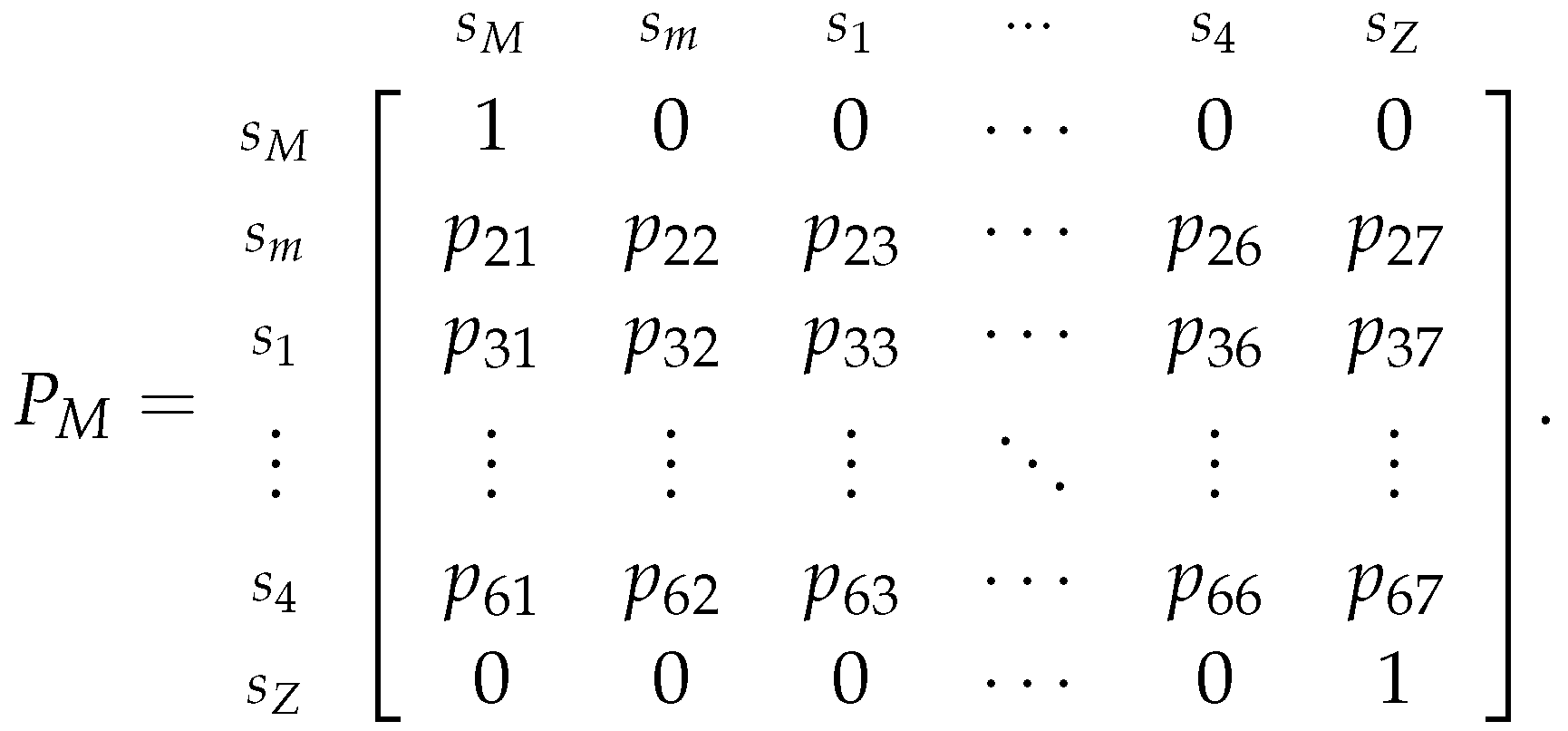

In the terms of Markov Chains, for this Markov Chain, we are considering the stochastic process

, where

is the percentage price change at game

t, with a discrete and finite state space

, where for all states

and steps (or games)

:

Here, the steps of the Markov Chain represent each successive game from 1 up until

N, and

represents a state from the state space

, which is composed by the classes that we previously defined, thus they have the mentioned properties. Also, the

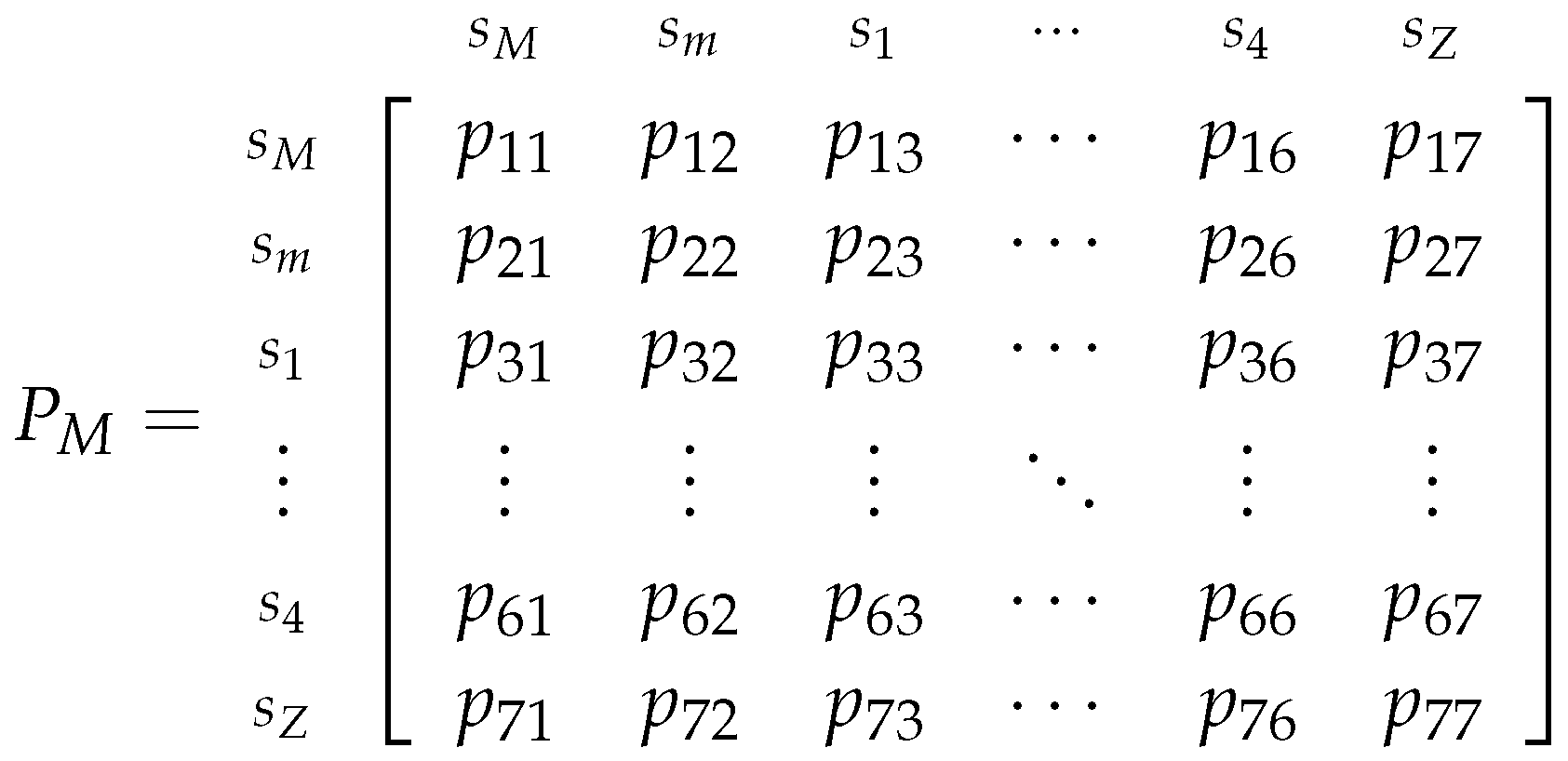

transition matrix

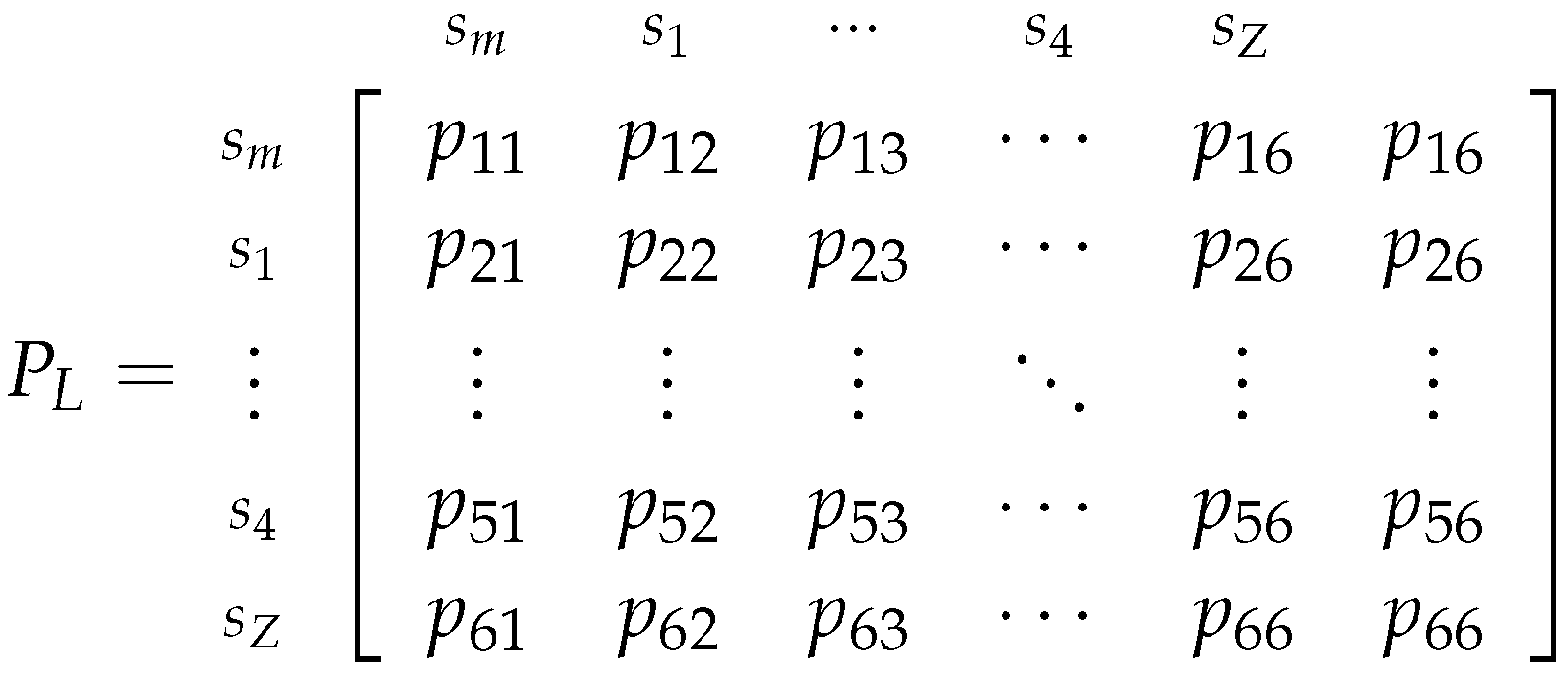

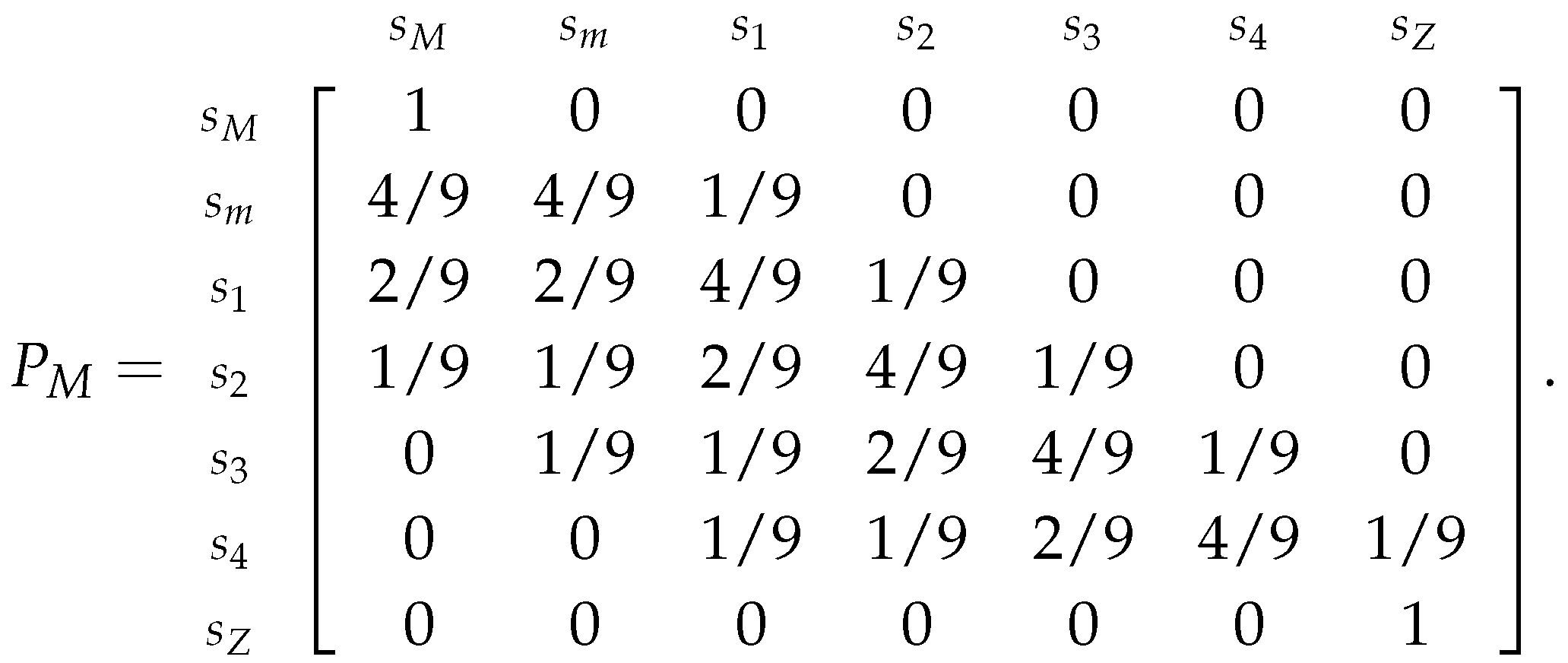

associated with this chain will be defined as:

To visualize this Markov Chain we can use the following diagram:

Note that we could have simplified the previous diagram by joining the states in the same communicating class. However, it is useful for us to present the Markov chain in this manner, because it allow us to take more conclusions on how the chain develops as we move forward in time.

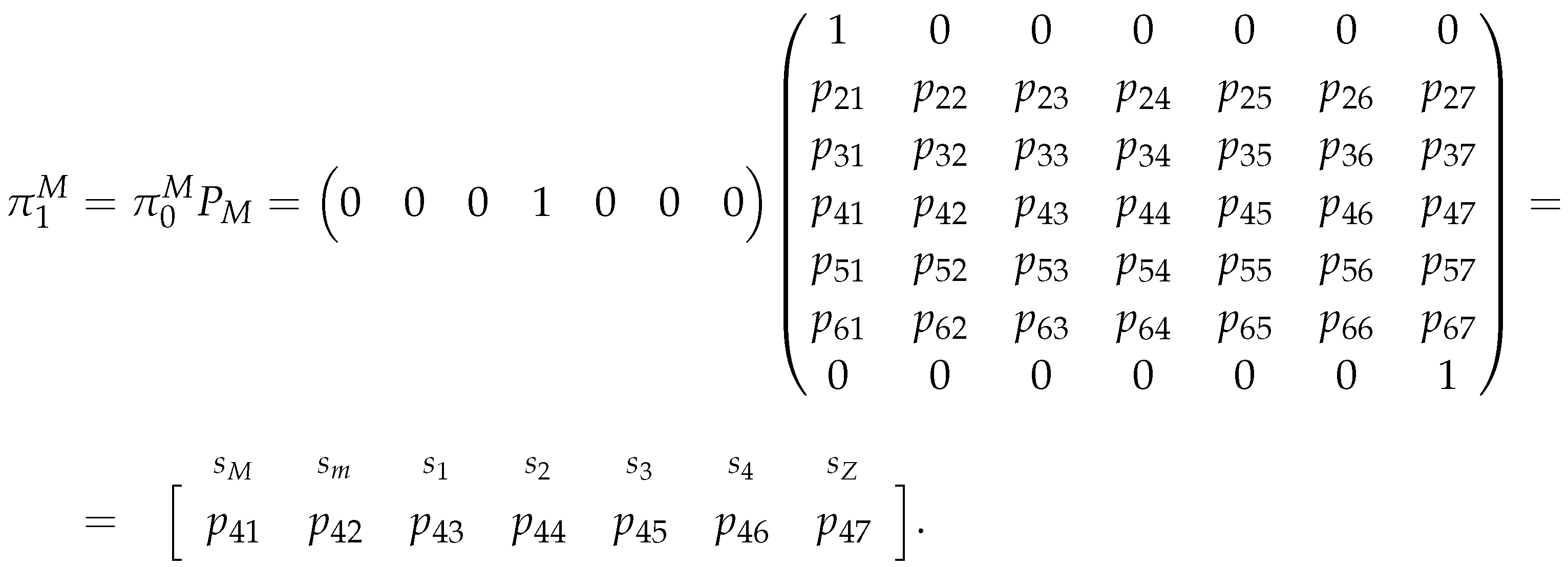

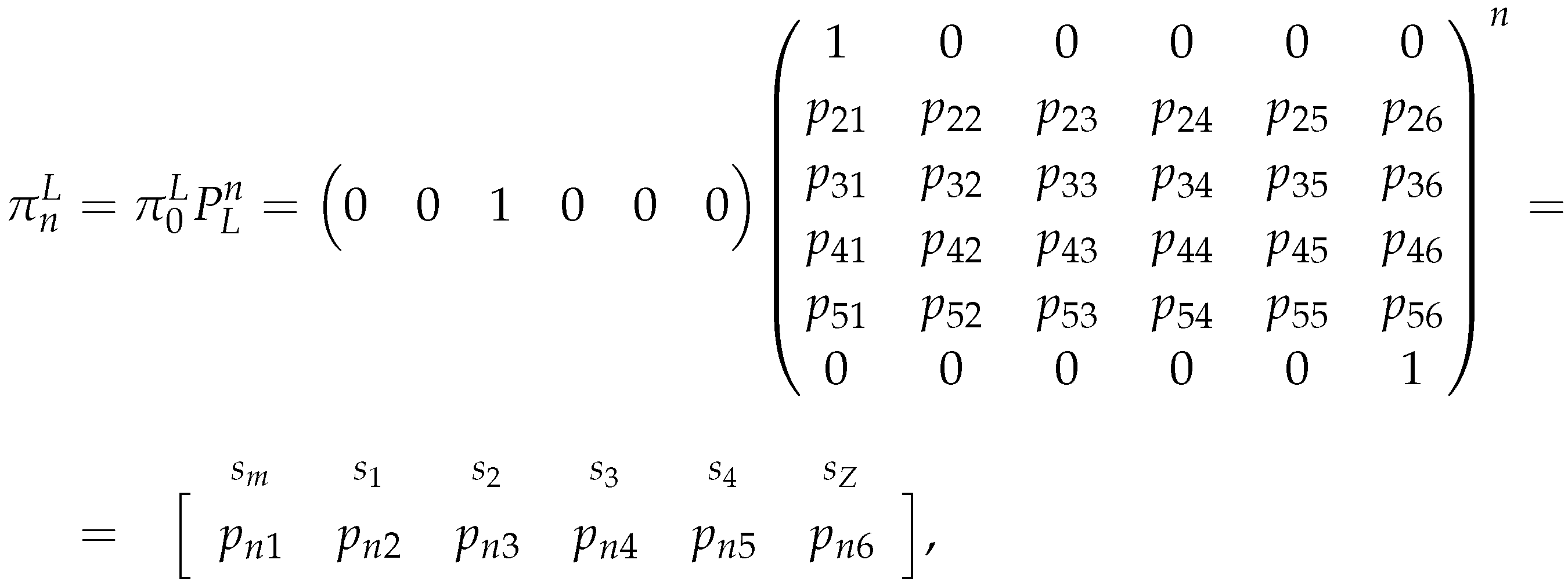

So, assuming that the initial state is (i.e., assuming that ) and that the transition matrix related to the Markov chain is well defined, the probability of the market playing the Major Adversity strategy () at time (or game) t is given by the first element of .

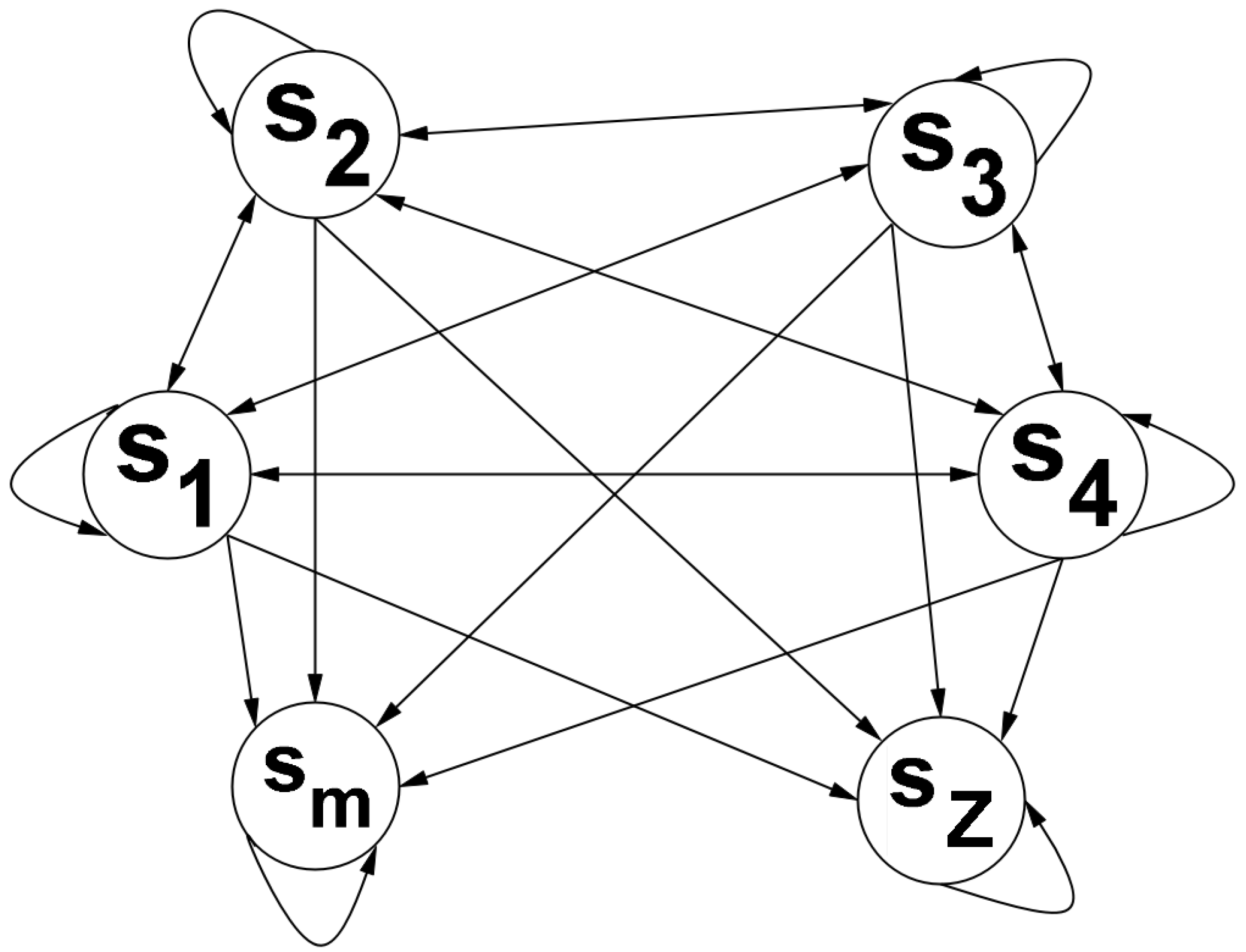

Now, regarding the Markov Chain where we assume that the speculator chose to play the Less Risk strategy, we can make similar observations as before, but with some modifications:

The Major Adversity class is not necessary for this Markov chain, because the speculator will stop playing if the price reaches the Minor Adversity class. So the class will be "included" in the class, thus is altered to (considering Example 26, this class becomes ).

The classes are defined as before.

To represent the fact that the speculator stops playing if the price enters the Minor Adversity class (

) or the Zero Adversity class (

) in the Markov Chain, we simply must define these classes as absorbing states, i.e., if the price enters one of these classes, then it will never exit them (for more details see [

30,

31] and/or [

34]).

Since the speculator does not stop playing if the price is in one of the remaining classes, the price may go to any class (including staying in the same class). And, to represent this in terms of Markov Chains, we simply define these classes as transient (for more details see [

30,

31,

34] and/or[

35]).

As before, in the terms of Markov Chains, we are considering the same stochastic process

, where

is the percentage price change at game

t, with a discrete and finite state space

, where for all states

and steps (or games)

:

Here, the steps of the Markov Chain represent each successive game from 1 up until

N, and

represents a state from the state space

, which is composed by the classes that we previously defined, thus they have the mentioned properties. Also, the

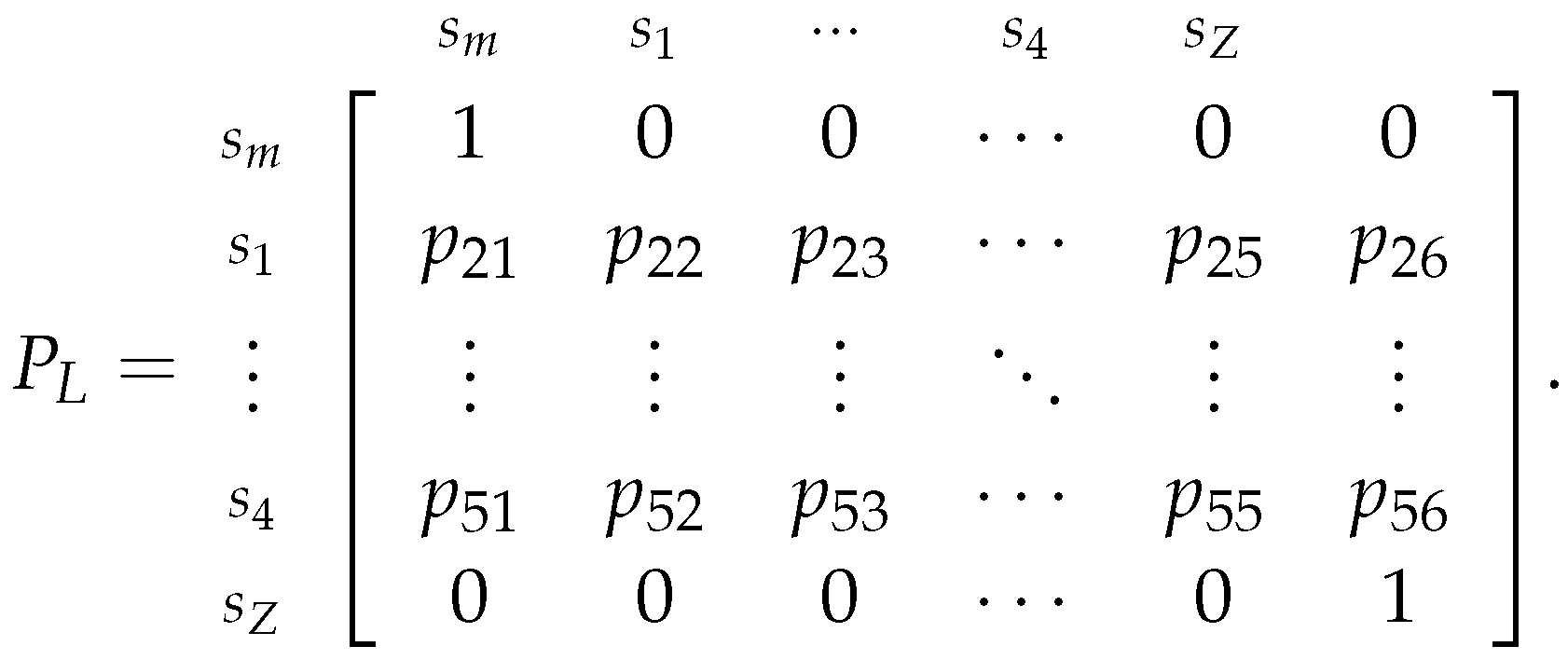

transition matrix

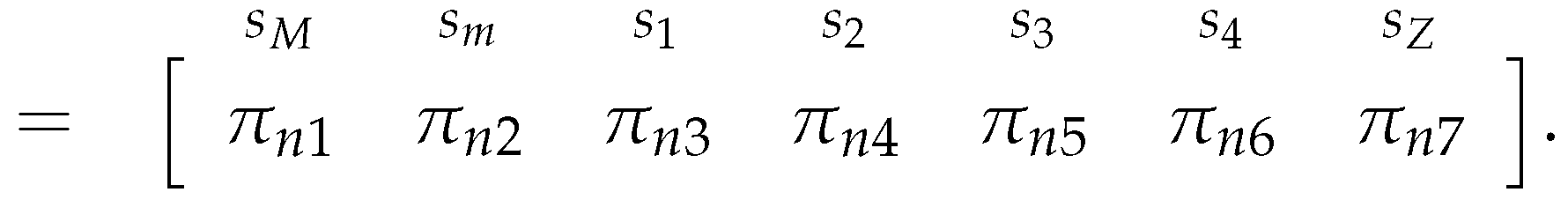

associated with this chain will be defined as:

To visualize this Markov Chain we can use the following diagram:

Regarding this diagram, note that is its similar to the previous one (

13), however, in this one, the state

is included in the state

. Additionally, we could have simplified the diagram by joining the states

in the same communicating class. But again, it is useful for us to present the Markov chain in this manner, for the same reasons as before.

So, assuming that the initial state is (i.e., assuming that ) and that the transition matrix related to the Markov chain is well defined, the probability of the market playing the Zero Adversity strategy () at time/game t is given by the last element of .

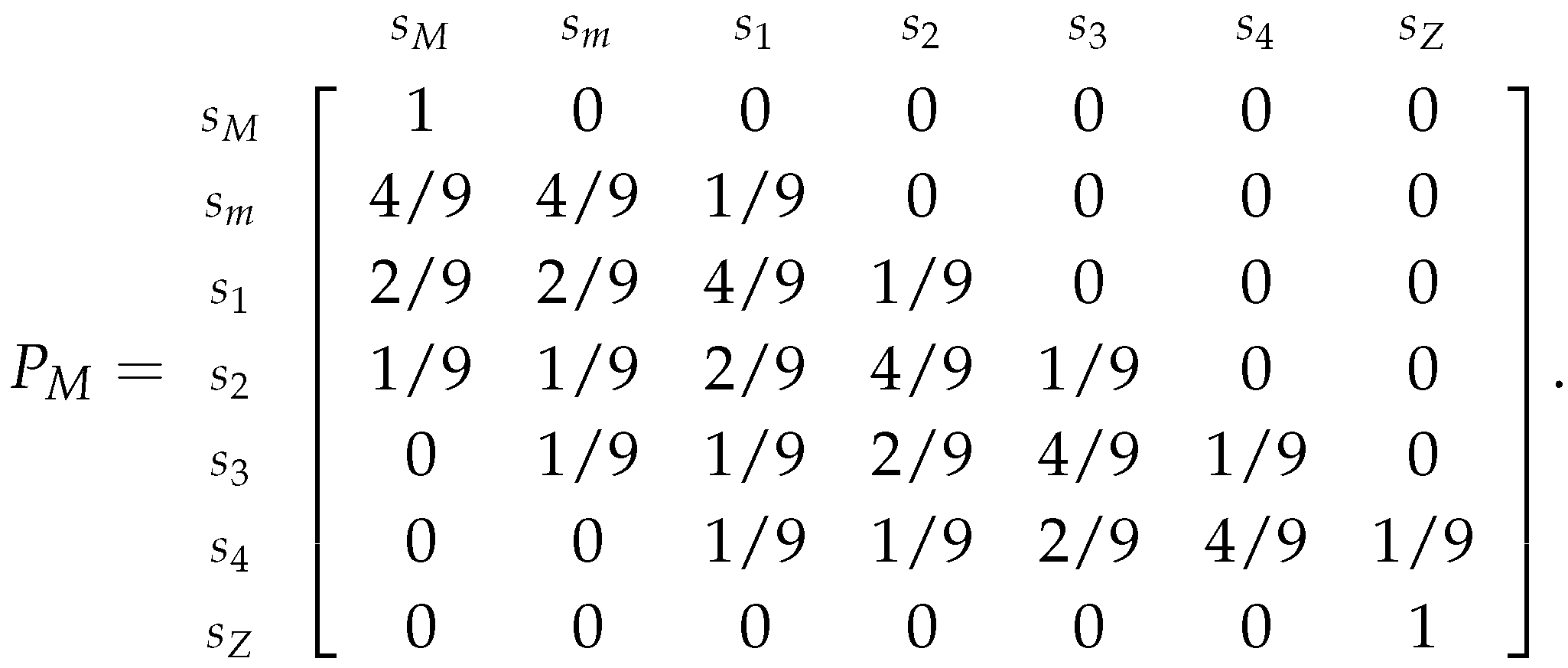

With all of this, we have the necessary methods to estimate the probabilities of the market playing Zero Adversity, Minor Adversity and Major Adversity, thus we also have a method on how to choose the best strategy for a certain dataset. However, the estimation method for the market’s probabilities is not complete, because we still have to estimate the transition probability matrix for each of the defined Markov chains. So, this is what we will focus on until the end of this section. But, before moving further, note that:

we will always use the same (percentage change transformed) dataset for all of the estimations;

since the state is absorbing in both of the chains, then we do not need to estimate its transition probabilities, i.e., the last row of both the transition matrices (28 and 29) is of the form ;

the state in the Markov chain related to the More Risk strategy, like the state, is absorbing, thus the first row of the transition matrix 28 is of the form ;

the state in the Markov chain related to the Less Risk strategy, like the state, is absorbing, thus the first row of the transition matrix 29 is of the form .

2.2.2. Estimation of the Transition Probabilities

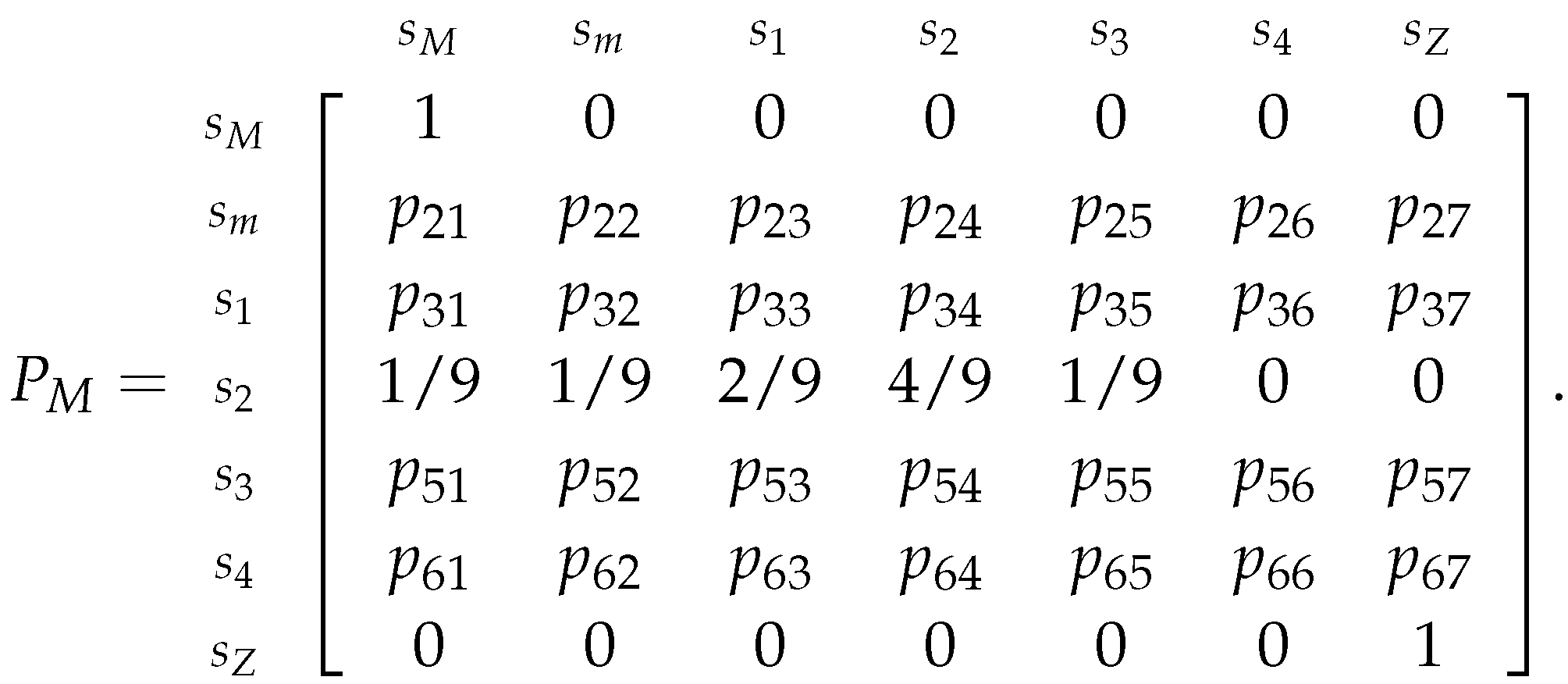

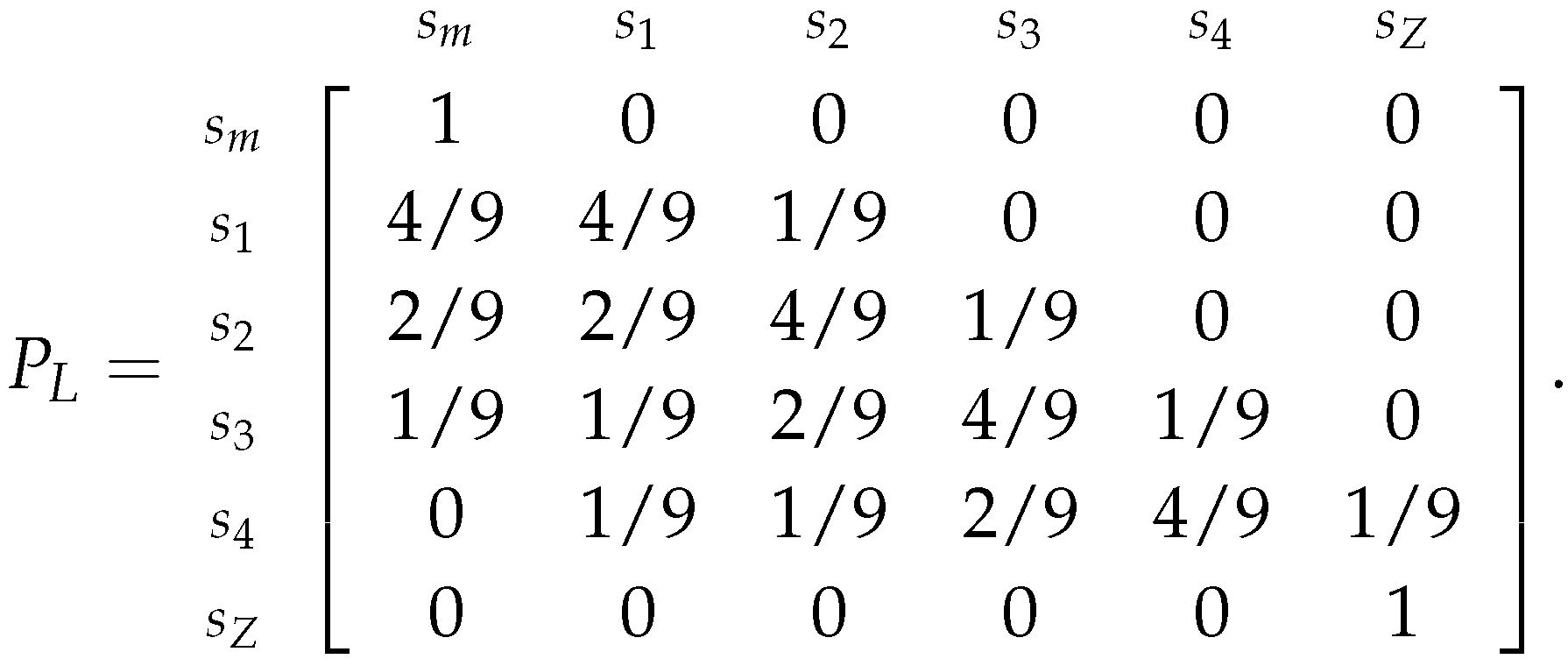

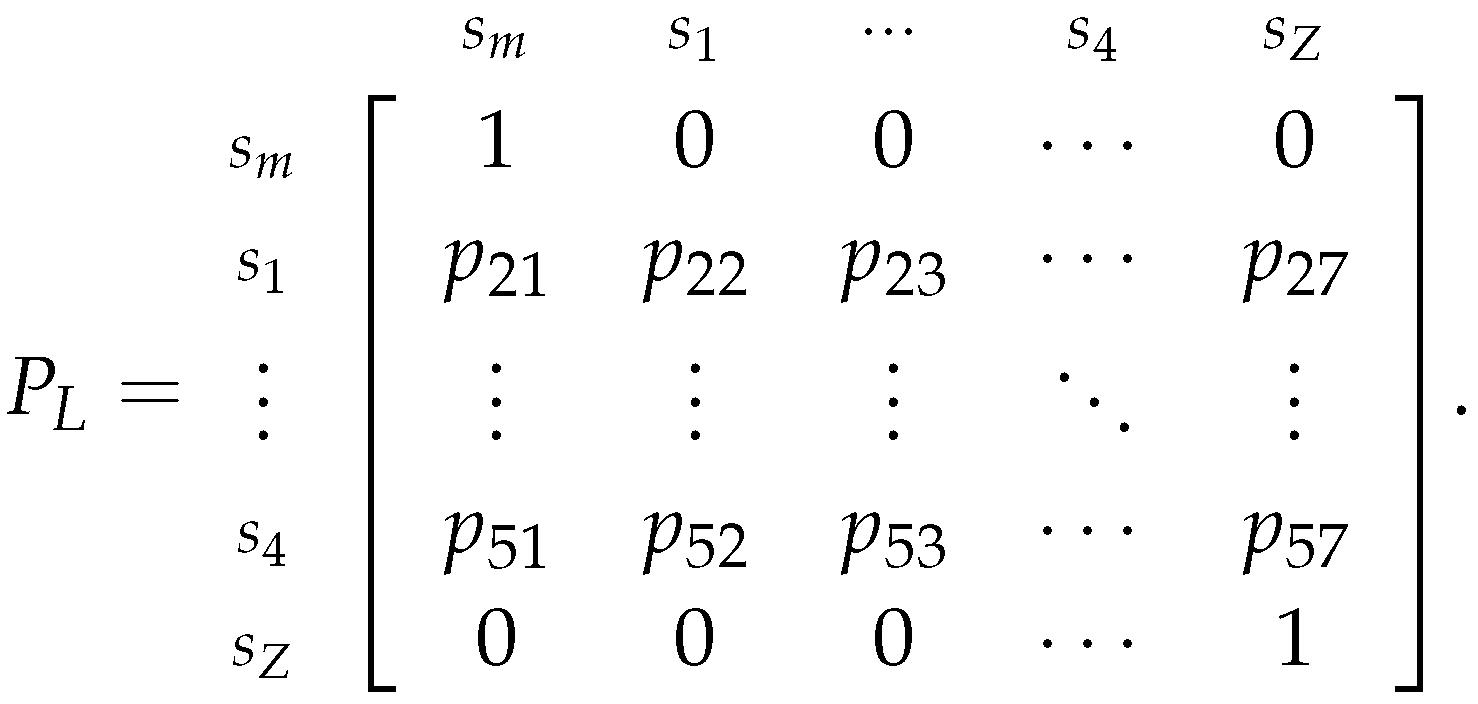

To estimate the transition probabilities for each of the Markov chains, lets start by considering the one where we assume that the speculator chose to play the More Risk strategy, represented by the following transition matrix (similar to the previously presented matrix 28):

Now, lets consider that we are departing from state (the assumed initial state of the chain), so to estimate the transition probabilities , we will just determine the relative frequency of each of the sates using the dataset, and we will use these frequencies on the corresponding row of the transition matrix.

Utilizing the Example 26, the relative frequencies for the transformed dataset for these classes are:

Table 4.

Relative frequencies table considering that the starting state is .

Table 4.

Relative frequencies table considering that the starting state is .

|

|

|

|

|

|

|

|

|

|

|

|

|

|

And, replacing in the transition matrix (related to Example 26’s Markov chain), we obtain:

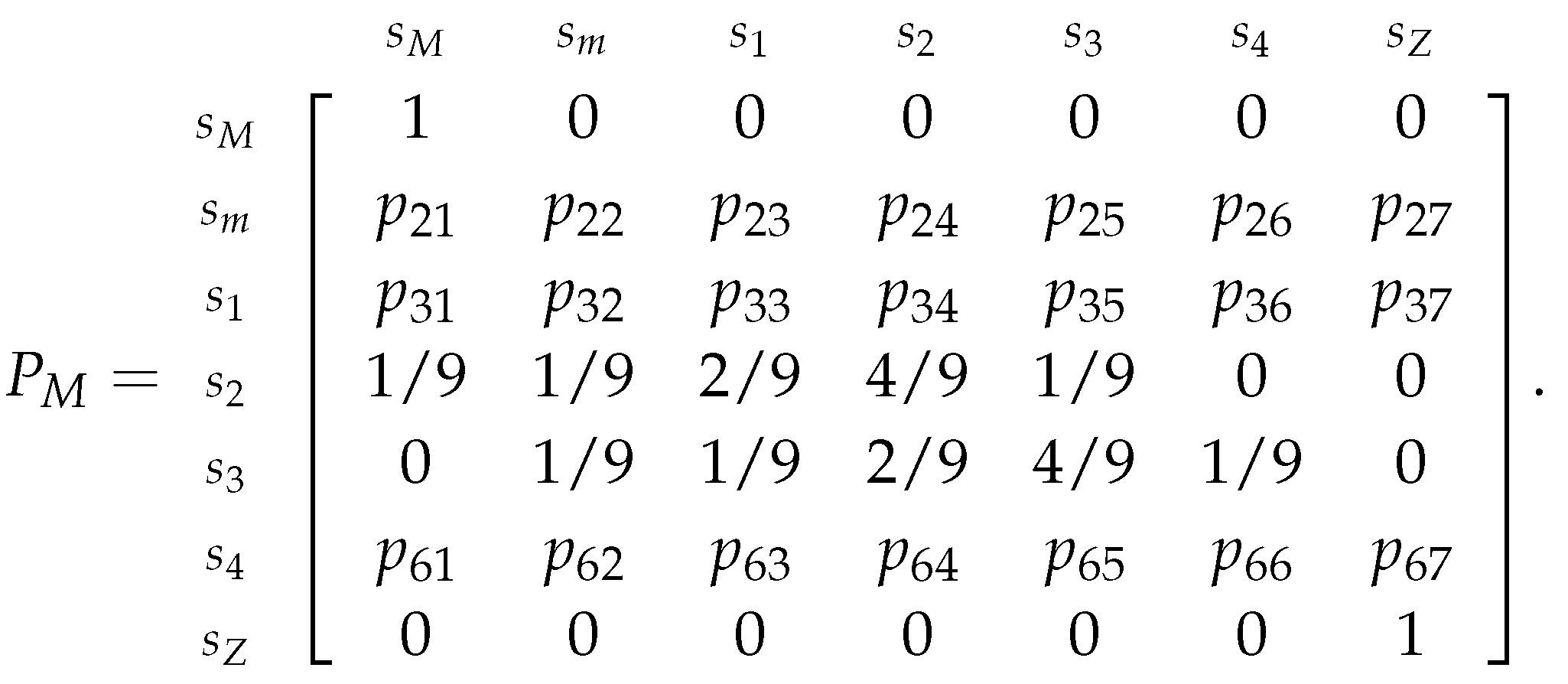

As it was previously observed, the probabilities of transitioning from state (to any other state) are not the same as if we considered that we started from a different state. Thus, in order to take this into account and to still use the relative frequency "method" to estimate the transition probabilities, we need to slightly alter the classes on which we will determine the relative frequencies.

For example, consider the classes obtained from Example 26, if the price increased (of its initial price) at the first iteration of the chain, i.e., the price went from to of its (initial) value (which translates in a percentage change in price), then the chain moved from state to the state . However, if the price is now at the state and it further increased (comparing to the initial price), the chain will not move from the state to the state, because , in this case, the price went from to of its (initial) value, so the percentage change in price is , which is not a member of the state, thus the chain will remain in the state. So, the transition from the state to all of the other states is not the same (in terms of percentage change) as the transition from to all of the other states. And, a similar argument can be made if we considered that we started from any state different from .

With this in mind, if we want to use the relative frequencies of the dataset to estimate the transitions from any state to any other, then we need to "re-calculate" the classes in order for the estimation to be coherent with what we assumed and defined. So, to accomplish this, we need to consider the percentage change of price regarding the previous iteration of the chain, and not the percentage change regarding the initial price.

Again, for example, to estimate the transition from the state to the state, we need to assume that the initial state is the state and that we want to transition to the state, i.e., we need to assume the percentage price change (relative to the ) is at and that we want to know what is the percentage price change if the percentage price change transitioned to (relative to the ), which would be . Also, because we are dealing with classes, this obtained percentage change between classes will be used as the "new" to determine the limits (and ranges) of the classes, this is because and are consecutive classes in terms of their range of values (as and were in the base classes). Thus, in this case, the state (or class) becomes . So, we need to use these "re-calculated" classes to obtain the relative frequencies table, which will be the estimation for the transition probabilities if we consider that we started from state .

To generally define the classes which we will use in the relative frequencies table, we need to consider the direct correspondence

defined as:

So, the "altered" classes (or states) obtained considering that we started from state are:

Note that, the value of used in the equations of the new classes, also needs to be re-calculated, which we will see how to do so after determining the "re-calculated" classes for the Example 26 considering that we started from the state and with , which are:

;

;

;

;

;

;

.

Utilizing the dataset from Example 26, we have the following relative frequencies table for these classes:

Table 5.

Relative frequencies table considering that the starting state is .

Table 5.

Relative frequencies table considering that the starting state is .

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Replacing in the transition matrix 31 (related to Example 26’s Markov chain), we obtain:

Now, for the general case, consider that we want to determine the relative frequencies assuming that we are departing from the state, then we need to determine the range of each class, i.e., we need to determine the that we will use in the previously presented formulas 32-38. For this, we need to consider ’s consecutive class, which is the class that contains the values immediately before the lower limit of or after the upper limit of , and we will denote it as . Also, it is not relevant which of the two that we choose. For instance, if , then its consecutive classes are and , so can be either or ; likewise, the (only) consecutive class of is . Thus, after obtaining the consecutive class, consider and to be the midpoints of and , respectively. But, if is or , will be the or , respectively.

So, the

value is obtained by:

Remark 12. Note that we did not include and into the set of possible states that can be, this is because the probabilities of departing from these states are fixed, as we saw when we built the transition matrix 30. Also, in the calculation of the α, we need to consider the absolute value, in case is related to lower limit of .

Afterwards, we simply have to determine the classes by replacing the obtained in all of the equations 32-38, which we will use to calculate the relative frequencies table of the (same transformed) dataset. Finally, we just replace the obtained relative frequencies in the row of the transition matrix related to the state (or class).

Applying all of this to example 26, we obtain the following transition matrix:

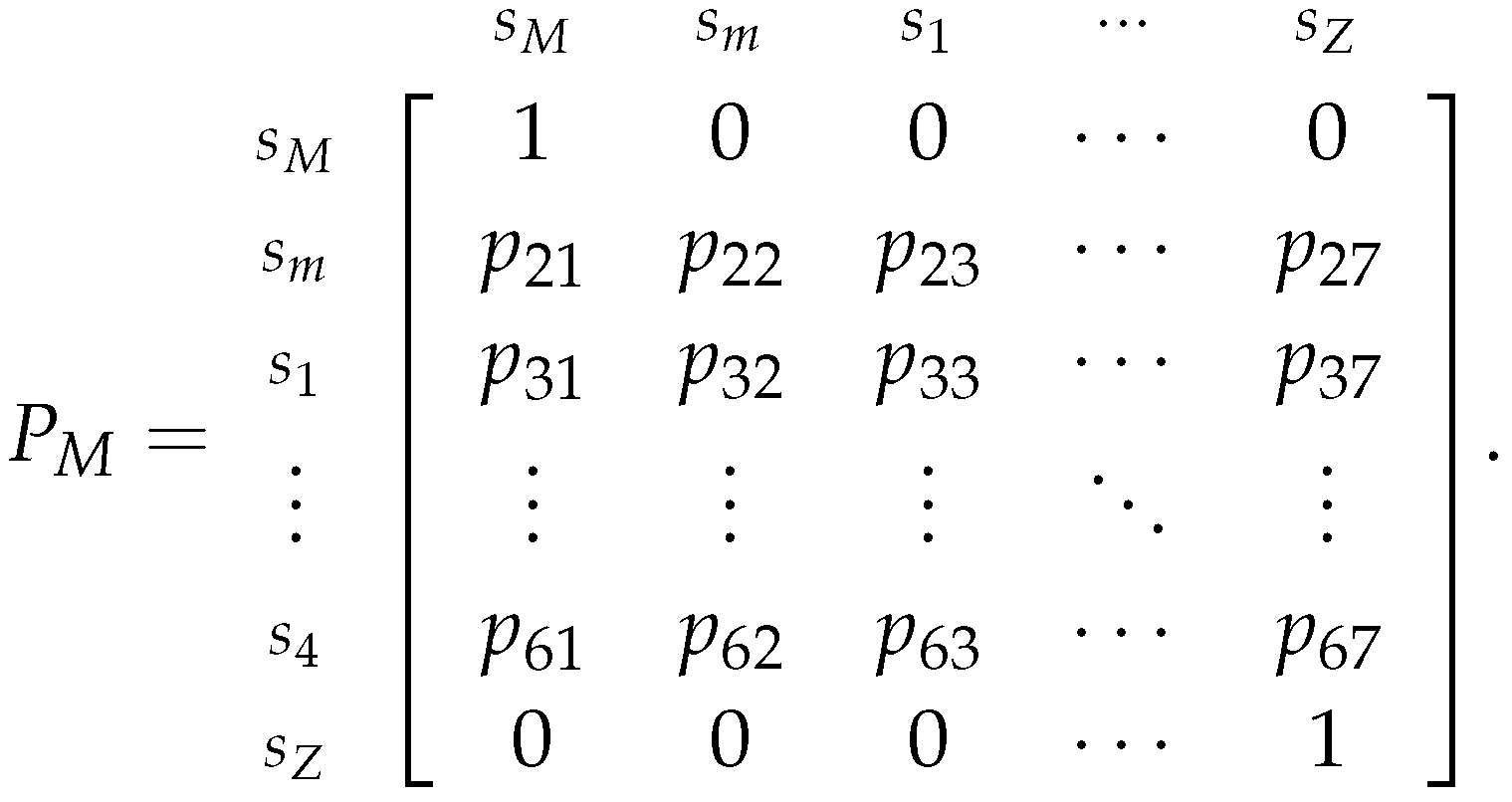

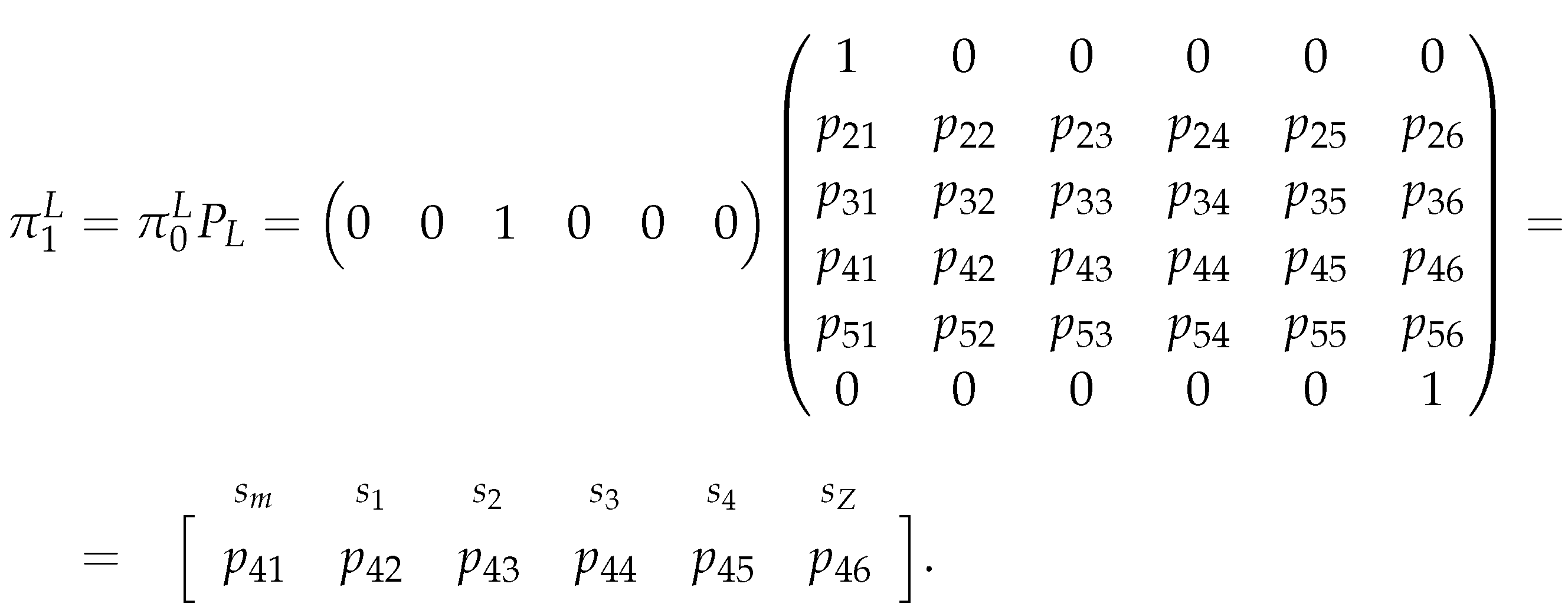

All the presented estimators and examples are related to the Markov Chain where we assume that the speculator chose to play the More Risk strategy. So, to estimate the transition probabilities for the Markov Chain where we assume that the speculator chose to play the Less Risk strategy, which is represented by the following transition matrix (similar to the previously presented matrix 29):

And, like in the case, we will determine the relative frequency tables considering that the chain started from each of the sates . So, again assume that we are departing from the state, then we need to determine the range of each class, i.e., we need to determine the that we will use in formulas similar to the previously presented ones (32-38). So, as before, consider a consecutive class to , denoted as . For instance, if , then its consecutive classes are and , so can be either or ; likewise, the (only) consecutive class of is . After obtaining the consecutive class, consider and to be the midpoints of and , respectively. But, if is or , will be the or , respectively.

So, the

value is obtained by:

Remark 13. Note that the equation to obtain α in the case is the same as the previous equation 40. Also, we did not include and into the set of possible states that can be, this is because the probabilities of departing from these states are fixed, as we observed when we built the transition matrix 29.

As in the

case, the transition probabilities are not the same as if we considered that the chain started from different states. Thus, in order to take this into account and to still use the relative frequency "method" to estimate the transition probabilities we need to slightly alter the classes on which we will determine the relative frequencies. So, again consider the direct correspondence

defined as:

So, the "altered" classes (or states) for the matrix considering that we started from a state are:

Now, we will estimate the

matrix for the same dataset

from Example 26, which resulted into the transformed dataset

Considering that we started from the

state (with the consecutive state

), i.e., considering that:

We obtain the classes

;

;

;

;

;

.

And, by replacing the relative frequencies,

is:

2.2.3. Estimating the Market’s Probabilities

Now, we have everything that we need to estimate the probabilities of the market playing Zero Adversity (), Minor Adversity () and Major Adversity (). And, to accomplish this, we will use two Markov chains to estimate and , as it was previously explained.

To estimate

we will make the use of the Markov Chain where we assumed that the speculator chose to play the More Risk strategy, which is represented by the transition matrix 30:

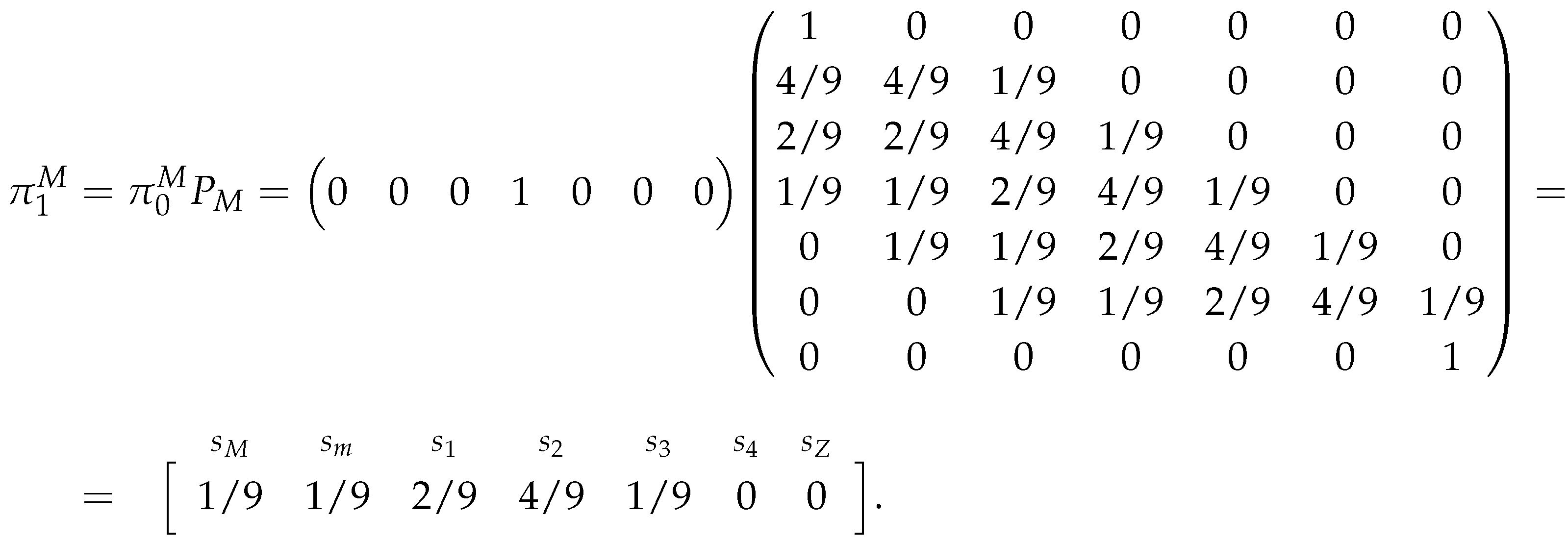

Also, as before, we will assume that the initial state of the chain is , i.e., the probability distribution of (the first percentage price change of the chain) is given by the .

Since we want to predict what will happen to an asset’s price after we buy it, that is, we want to know if we will have a profit or a loss (according to the financial game that we established) after we enter a trade, then it is sensible to consider what will happen immediately after we buy the asset and/or what is the asset’s price tending to. So, to this end, we will consider two separate estimators and analyze the obtained results. Thus, will be estimated by:

Regarding the first estimator, we will just compute the probability of the chain being at state

after one iteration of the chain, so we will compute:

Where, after the matrix multiplication, we obtained a vector , which is the probability distribution of the chain after one iteration. Here, note that is simply the transition probabilities starting from the state, which makes sense considering that the initial state is and we only want to know the probability distribution after one iteration of the chain. Thus, the first entry of is the probability of the chain being in state after one iteration and our estimator for is:

As we can see, this estimator is fairly simple, both in theoretical and in practical terms. So, to try to understand how the percentage price will evolve, we will also consider a estimator related to the long term distribution of the chain. However, we need to note that this probability distribution may not exist, because our chain is not irreducible. So, we cannot use Theorem II.C.3 from [

31] to guarantee that such distribution exists. Also, if such distribution is to exist, we know (from [

30,

34]) that the chain will tend to its absorbing states, thus, in our case, the long run probability distribution would be a

vector

where one of the absorbing states (

or

) has a probability of one. But, we do not know when this will happen or which state will have probability one. Hence, to overcome these issues, we will compute the probability distribution of the chain after

iterations:

Thus, after the matrix multiplication, we obtain a vector , and its first entry is the probability of the chain being in state after n iterations, so our estimator for is:

Observe that we cannot apply the Theorem II.C.3 from [

31] to determine the long-run probability distribution

of the chain, because it is not irreducible. So, we do need to compute the

n matrix multiplications.

Now, similarly to the estimator of

, we will estimate

using the Markov Chain where we assumed that the speculator chose to play the Less Risk strategy, which is represented by the transition matrix 42:

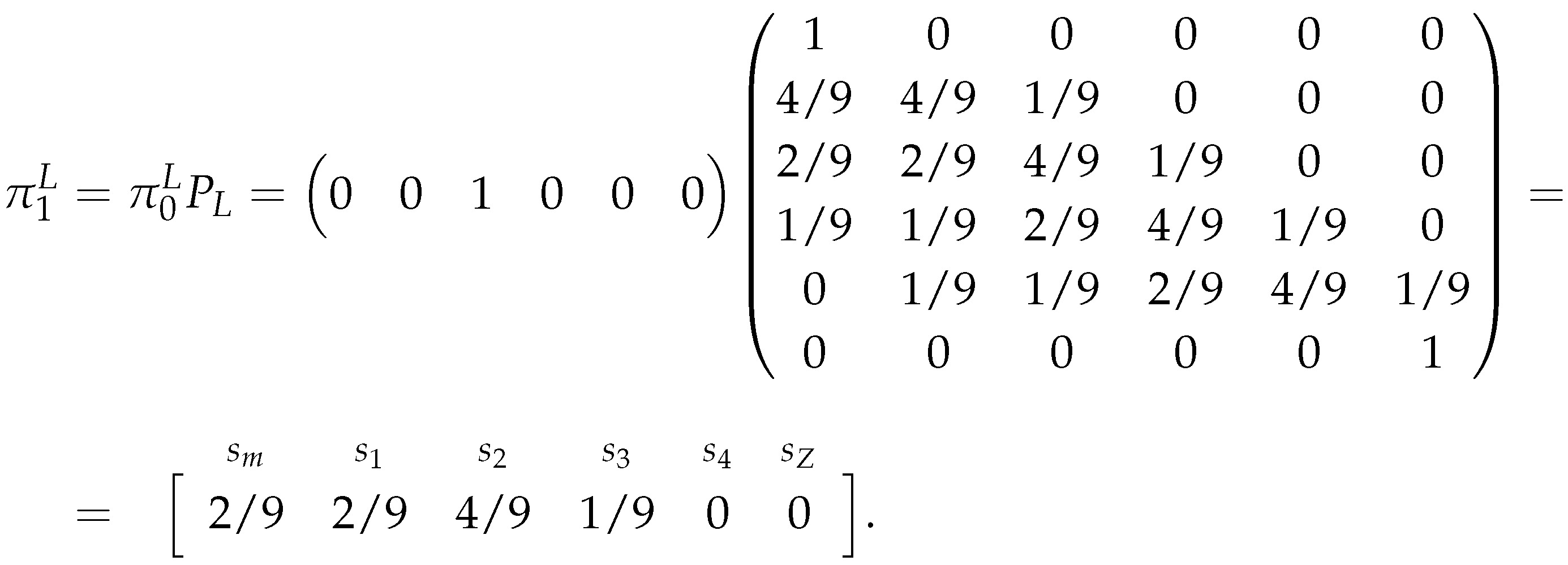

As before, we will assume that the initial state of the chain is , i.e., we will assume that . So, for the same reasons as before, will be estimated by:

Regarding the first estimator, we will just compute the probability of the chain being at state

after one iteration of the chain, i.e. we will compute:

Where, after the matrix multiplication, we obtain a vector . And, again, note that is simply the transition probabilities starting from the state. Also, the last entry of is the probability of the chain being in state after one iteration, so our estimator for is:

As before, this estimator is fairly simple, and because this chain is also not irreducible, we will compute the probability distribution (

) of the chain again after

iterations:

which, after the matrix multiplication, yields a

vector

. And, its last entry is the probability of the chain being in state

after

n iterations, so our estimator for

is:

Observe that we had the same issues in both estimators, because the chains were not irreducible, also we used the same number of iterations

n (to determine the long-run estimator) in both chains, so that we can compare the obtained results from the different chains. Finally, we need to note that these estimators (for

and

) sum up to a value

, because, by

Section 2.2, the theoretical probabilities that we are estimating have this property, and by the fact that we are under-estimating the market’s probabilities, since theoretically we should determine the long-run estimator by using infinite iterations (and not only

n).

Remark 14. Even though the used notations for both estimators are similar, the obtained estimated probabilities result from (n iterations of) different chains, so they represent different probabilities. Additionally, the estimator for is simply , for both cases.

So, with all of this, we can estimate the probabilities of the market playing a certain strategy and thus choose the speculator’s optimal strategy according to the previously presented financial game.

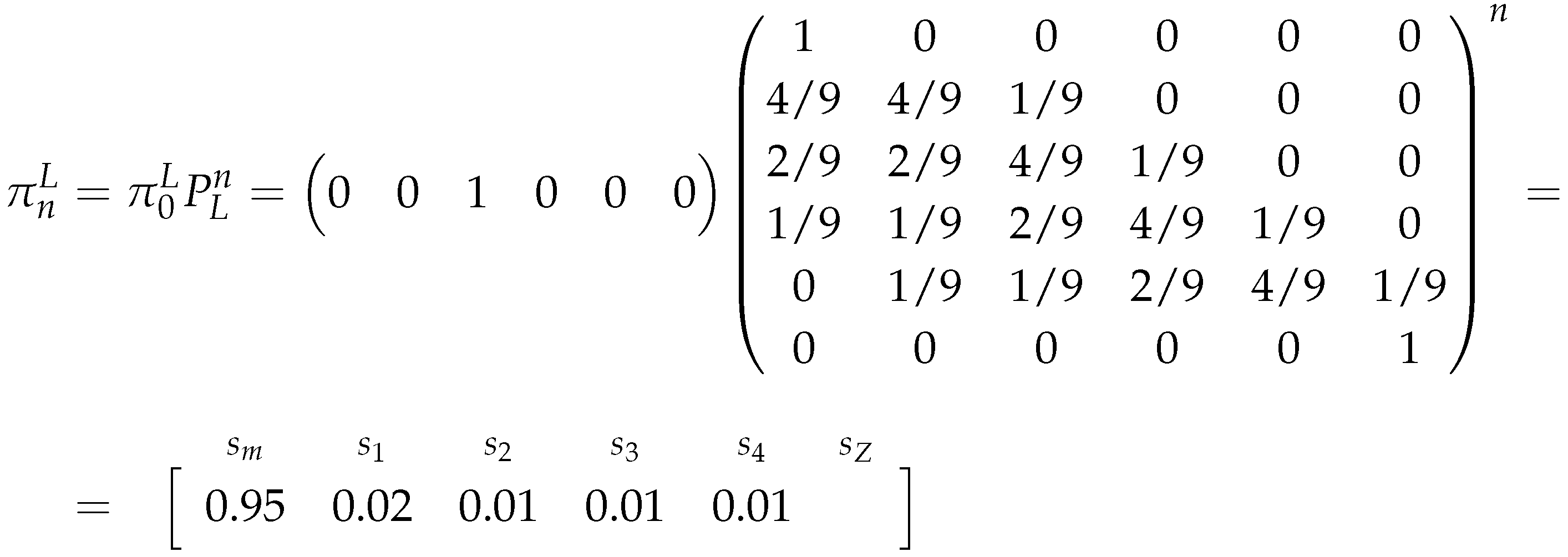

To finalize this section we will just pick up the dataset from the Example 26 (from the previous section) and compute the estimators for the market’s probabilities. For this, recall that the obtained transition matrix related to the chain where we assumed the More Risk strategy is:

The obtained transition matrix related to the chain where we assumed the Less Risk strategy is:

So, assuming

, we have that:

And with

we have:

So the one iteration estimators for the market’s probabilities, for this example, are:

Regarding the long run estimator with

iterations, we have that:

Remark 15. Note that the presented values are rounded with two decimal cases.

So the long-run estimators for the market’s probabilities, for this example, are:

Note that the estimated probabilities, in this example, change drastically from one estimator to the other, also they suggest that the market (as the iterations of the chain increase) is increasing its probability of choosing the Major Adversity strategy.

Table 6.

Example 26’s game table for the financial market game.

Table 6.

Example 26’s game table for the financial market game.

| |

|

Speculator |

| |

|

|

q |

|

| |

|

|

|

|

| Market |

|

|

9 |

9 |

| |

|

|

9 |

|

| |

|

|

|

|

To finalize, the previously presented game

Table 2 related to the financial game, for this example, becomes:

These payoffs (or strategy thresholds) were obtained by applying the theory on

Section 2.1 and considering the standard deviation of the transformed dataset (i.e., considering

), where we obtained

,

and

.

Now, with the one iteration estimators and considering the probability triangle (also presented in

Section 2.1, but considering these new values), for this case, the speculator should choose to play the More Risk strategy, because:

And, considering the long run estimator and the same probability triangle, the speculator should choose not to play, because:

Thus, as we can see the two estimators yield different strategies for the speculator to choose. All of this because the market "changes" its behavior as the iterations increase.

2.4. Procedures

Now that we have all the necessary models and estimators, it is time to describe how we will use each model to choose the optimal strategy for a certain dataset. Also, we need to explain how we will check if the predictions were accurate and how accurate.

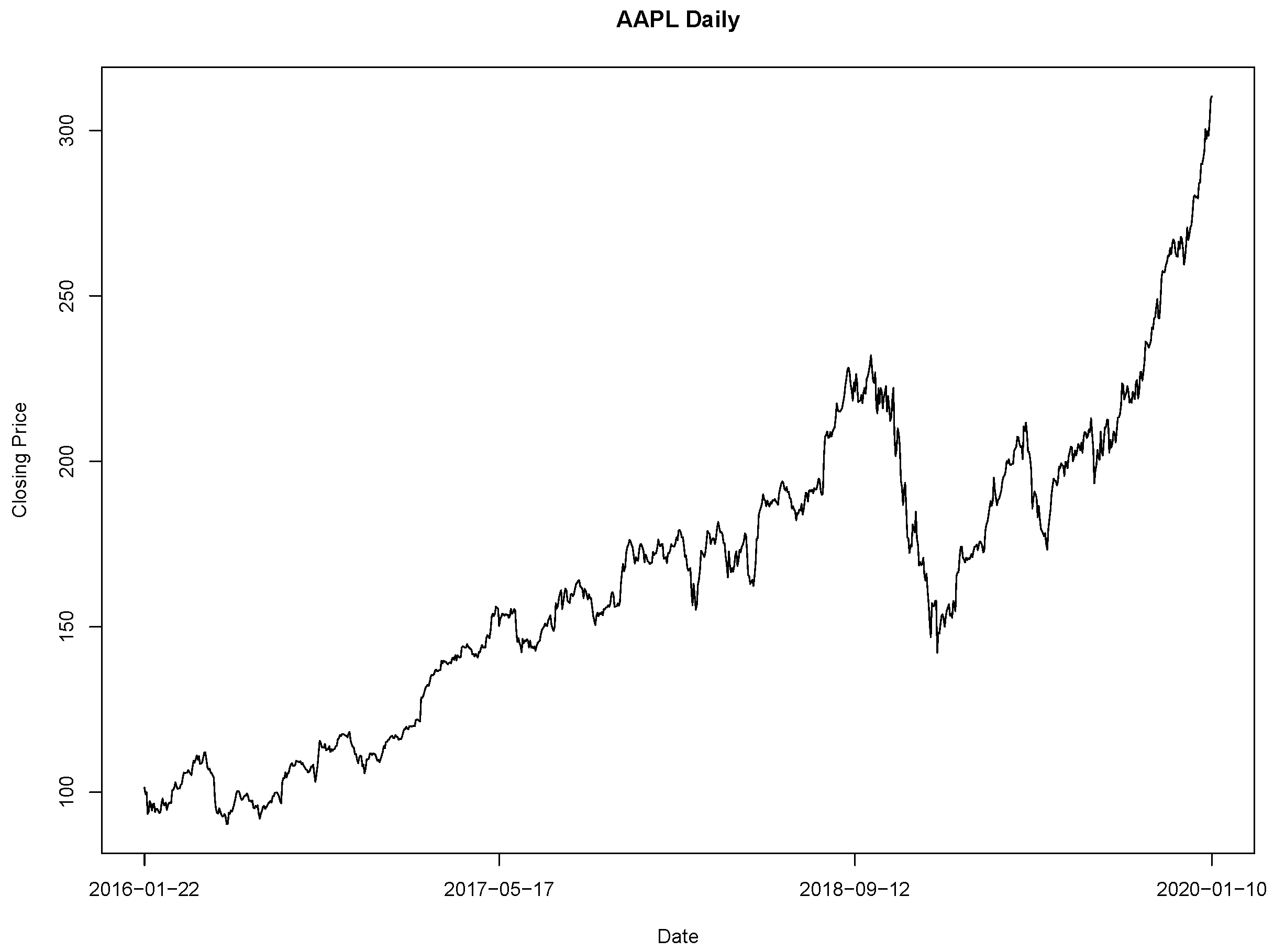

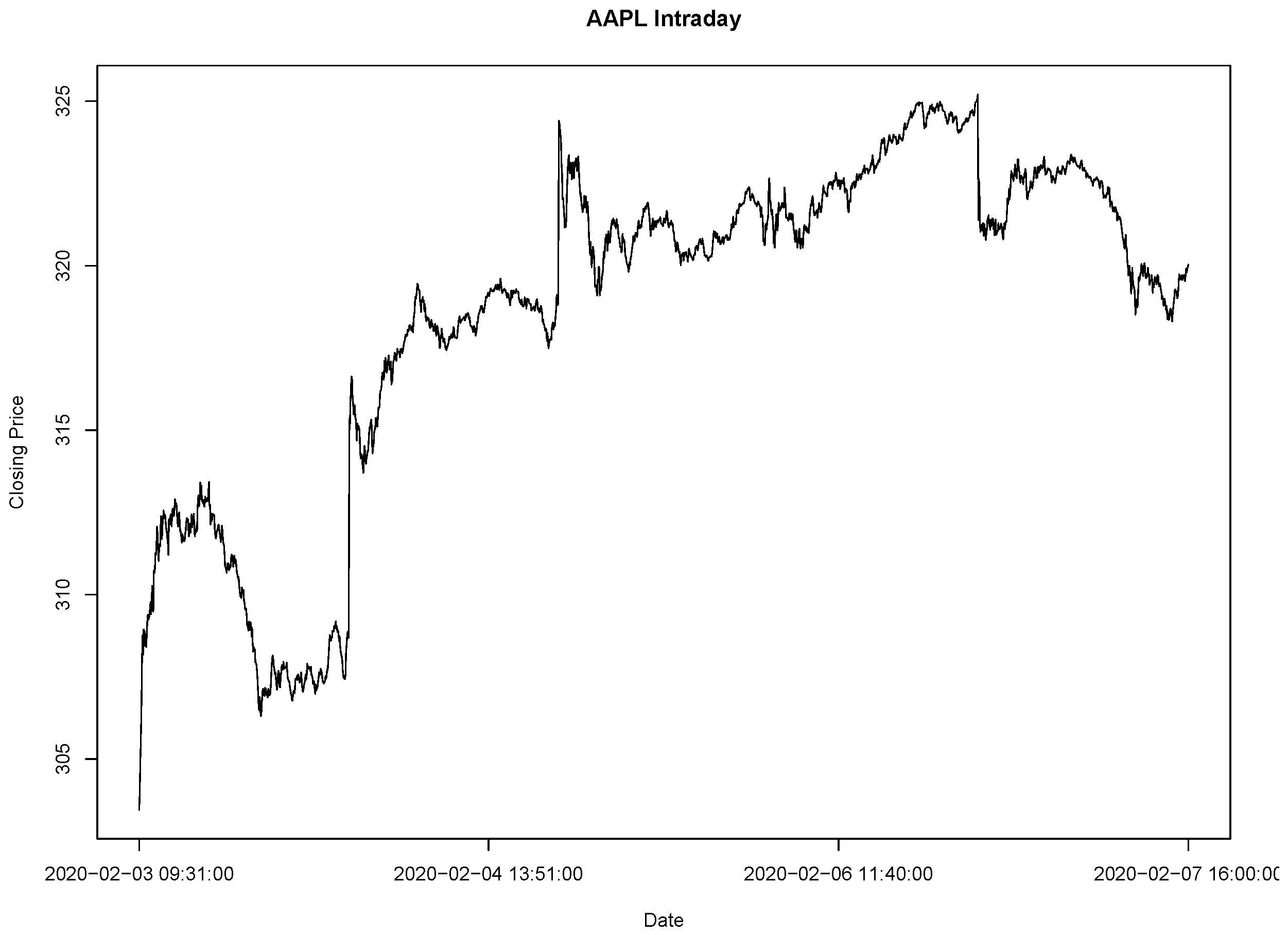

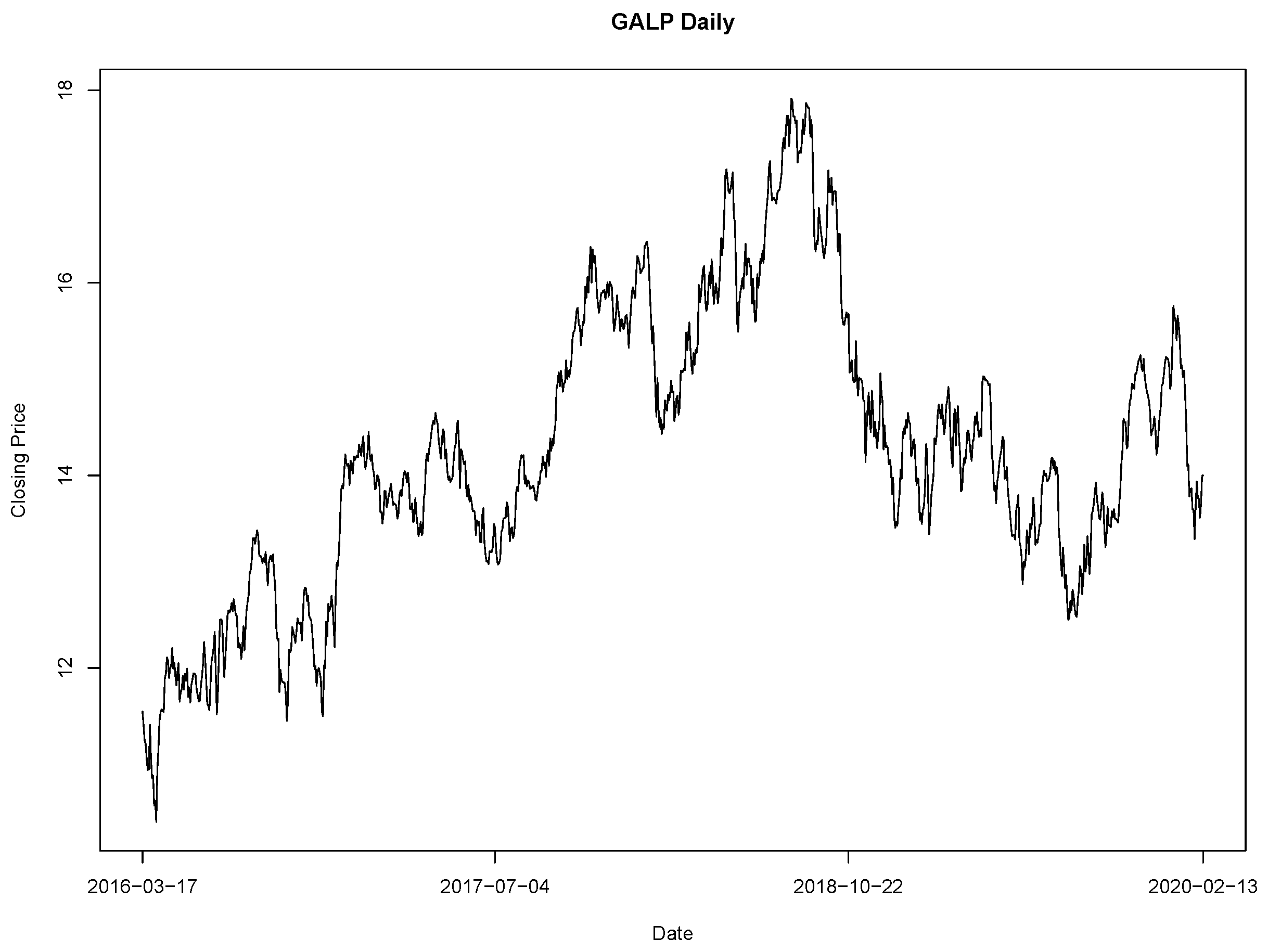

Consider an abstract dataset composed by strictly positive values, which will represent the price of a certain financial asset for consecutive iterations (it can be consecutive minutes, days,...). Since we worked with percentage change data in the game theoretical model, then we will apply the percentage change transformation to the dataset, obtaining a transformed dataset composed with percentage changes of consecutive iterations. So, we will apply all of our models to this dataset C. Also, in order to check the accuracy of our models, we will split the dataset into training () and test () sets, where the training set will be composed by the first of the observations and the remaining will belong to the test set. Thus, considering the set , the training set will be and the test set , for .

The general procedure applied to a (transformed and divided) dataset C, consists on estimating the market’s probabilities for each of the models (Markov chains, SARIMA and GARCH), thus obtaining three "pairs" of probabilities, then we will use them to determine the speculator’s optimal strategy, also obtaining three optimal strategies. Afterwards, we will use the test set to check if the obtained strategies were accurate predictions for the current training set.

To accomplish this, consider the speculator’s More Risk strategy thresholds (as we did in the previous section) in terms of the dataset’s standard deviation :

Then, using the test set, we will check which of the thresholds was reached first. So, this information together with the chosen optimal strategies, gives us the accuracy of the predictions, specifically:

considering that optimal chosen strategy was the More Risk strategy, then we will consider that strategy to be accurate if the first threshold to be reached in the test set was the Profit Objective threshold, otherwise the strategy will be considered to be not accurate;

considering that optimal chosen strategy was the Less Risk strategy, then we will consider that strategy to be accurate if the first threshold to be reached in the test set was the Profit Objective threshold, otherwise the strategy will be considered to be not accurate;

considering that optimal chosen strategy was the Do Not Play strategy, then we will consider that strategy to be accurate if the first threshold to be reached in the test set was the More Risk threshold, otherwise the strategy will be considered to be not accurate.

Note that the Less Risk threshold was not necessary to determine the accuracy of the strategies. Also, due the nature of the data, none of the thresholds may be reached, so, in this case, we will not consider the strategy to be accurate nor inaccurate. Hence, in this situation, we can decrease the thresholds and recalculate the optimal strategies, or we can just consider that the accuracy cannot be determined due to the nature of the data.

Finally, in order to have more samples to analyze, we will increase the training set by one observation and decrease the test set by one observation, thus obtaining the sets and . Then we will redo what we described before, but considering these new sets as training and test sets, respectively. Thus, we will obtain new accuracy data for the new optimal strategies.

To summarize, consider the transformed dataset split between a training set and a test set , then the procedure to be applied is:

-

Considering the training set :

estimate the market’s probabilities using the Markov chains model and determine the optimal strategy for speculator using the game theoretical model;

estimate the optimal SARIMA model, estimate the market’s probabilities using the model’s simulations and determine the optimal strategy for the speculator using the game theoretical model;

estimate the optimal GARCH model, estimate the market’s probabilities using the model’s simulations and determine the optimal strategy for the speculator using the game theoretical model.

-

Considering the test set :

check the accuracy of the three obtained optimal strategies, using the previously described method;

store the accuracy results for each of the models.

Increase the training set by one observation and shorten the test set also by one observation, thus we will now consider the training set to be and the test set to be .

Perform all of the previous steps considering the "new" training and test sets, but end the procedure when the test set only has one observation remaining.

After applying this procedure, we need to analyze the obtained results, which we will do next.