Introduction

A tax is a mandatory financial obligation or form of payment imposed by a government entity on individuals or entities to cover various public expenses (Khorasani, 2019). Taxes are fees paid by members of society to their government for the utilization of services, resources, public necessities, security guarantees, and national development (Dallari, et al., 2020). They serve as crucial components of government revenue and play a significant role in a country's economy (Fu et al., 2019). Taxes are essential for the implementation of the government's financial policies, which are aimed at achieving objectives such as social equity, economic stability, improved income distribution, and efficient resource allocation. Governments typically collect taxes with the goals of funding their expenses, addressing social inequalities, promoting equitable income distribution, and achieving economic objectives (Sikvland et al., 2022). Taxes are also utilized to counteract inflation, safeguarding individuals' purchasing power by regulating the amount of circulating money. Furthermore, tax collection aims to control unnecessary expenditures, preventing losses stemming from unnecessary luxury goods (Kluzek et al., 2022).

Taxation serves as a potent tool for executing economic policies, including distributional and financial strategies, and guiding economies towards macroeconomic goals such as economic stabilization, job creation, growth, and enhanced social welfare. Tax revenues are viewed as the most stable form of income for governments (Soleimani, 2021) and are a primary income source for many developed nations, significantly influencing social and economic development (Azizi & Jabbari, 2024). Governments seek to boost tax revenue to provide essential social services and bolster social and economic progress (Al-Rahmane and Bidin, 2022). Taxes are categorized into direct and indirect taxes, with income tax being a key component of direct taxes that garners attention from policymakers and economists. Modigliani and Miller (1958, 1963) underscored the insignificance of taxes in determining firms' values within financial markets, presenting an alternate theory grounded in financial market assumptions. They advocate for optimal structures emphasizing maximal costs, high debt returns, and tax hindrances to high-quality responses (Armestrong et al, 2012).

The discourse surrounding corporate capital structure has been sparked by Modigliani and Miller's controversial models (1958, 1963), initiating continued debates in economics and finance. As economists explored additional factors influencing capital structure decisions, the trade-off theory emerged (Azizi, 2024). This research delves into identifying the factors that shape Iran Khodro Company's capital structure, specifically examining the impact of the effective tax rate, company size, tangible assets, risk, profitability, non-debt tax shields, and liquidity as independent variables; and short-term debt, long-term debt, total debt, and net equity as dependent variables.

Problem Statement

One of the significant financial and accounting issues, as well as a complex management decision, is the capital structure, comprising of debt and equity. A well-structured capital can enhance market share price and company value (Abdullah and Torsavi, 2023). Recent studies by Heidrand Ljungqvist (2015) and Azizi. (2010) have highlighted the substantial influence of corporate taxation on capital structure, as per the trade-off theory which views this relationship as a cost-benefit analysis of borrowing. According to Myers (2001), capital structure theories entail certain conditions, propositions, and assumptions, offering an incomplete narrative when analyzing determinants of capital structure. In contrast to the trade-off theory which emphasizes the importance of the target capital structure level, hierarchal theory fails to acknowledge this by starting with internal financing sources like retained earnings, moving on to borrowing, and finally external equity (Khorasani, 2019). Azizi & Yazdani (2007) suggests that hierarchal theory is more suited to short-term strategies while trade-off theory supports long-term financial strategies. Institutional variances among countries serve as critical determinants leading to substantial changes in capital structure preferences. Institutional differences have been attributed to varying results in past studies, with variables like taxation, stock market development, creditor protection, and legal systems influencing the costs and benefits of debt financing based on the institutional context (La Porta et al., 1997).

Long-term liabilities are closely associated with a structured bankruptcy environment, while short-term liabilities rely on efficient information and legal settings. The regulatory framework significantly impacts decisions regarding obtaining long or short-term debt (Azizi & Rahmani, 2024). Company characteristics play a crucial role in the sensitivity of financial leverage to the effective tax rate (Azizi, 2015). The tax implications of debt and equity financing are determined by the combined tax systems of both the company's subsidiaries and parent entities. Greater debt incentives within a company lead to a shift towards debt in that entity. The optimal corporate debt-to-asset ratio is positively impacted by the national tax rate and the variance between the national and corporate tax rates. Effective tax rates are crucial as they consider duplex tax rates and potential tax reliefs. This study investigates the impact of taxes and company attributes on the capital structure of Iran Khodro Company. Securing financing in the automotive sector necessitates substantial initial capital and significant long-term debt. Projects in the automotive industry face higher risks, influencing their financing significantly. Due to the sector's heavy manufacturing involvement, there is a higher demand for leverage to fund significant capital expenditures than in the service sector with reduced fixed asset utilization. Insufficient funding, excessive operational costs, and debt can impede the growth of the automotive industry. Companies in this sector are subject to corporate income tax payments and other obligations, with profits being taxed and potentially eligible for tax exemptions that can vary annually.

The primary aim of this research is to explore the determinants of Iran Khodro Company's capital structure. Examining the influence of the effective tax rate, company size, tangible assets, risk, profitability, debt-related tax shields, and liquidity on financial leverage are among the research's secondary objectives. The key hypothesis to demonstrate is that the factors determining the capital structure significantly affect the taxes of Iran Khodro Company. The sub-hypotheses focus on the effective tax rate, company size, tangible assets, risk, profitability, tax shields without debt, and liquidity significantly impacting financial leverage. Prior research predominantly demonstrates a strong association between corporate tax and capital structure (Liao, et al. 2014). Empirical studies indicate that factors like company size, growth opportunities, risk, and profitability play a crucial role in determining capital structure (Azizi, et al. 2024). Prior research also underscores the importance of industry-specific characteristics in shaping a company's capital structure. Considering company attributes is vital in financial decision-making, hence studying the impact of taxation and firm characteristics within a specific industry is valuable (Mayers, 2001).

Managers in organizations face the primary responsibility of making sound decisions, particularly when it comes to financial matters and capital structuring. Analyzing the impact of effective tax rates on financial decisions within Iran Khodro Company is essential to equip managers with the necessary information for prudent decision-making, thereby enhancing shareholder wealth and ensuring the company's sustainability. Financial decision-making is a critical aspect for companies and their long-term survival. Research and academic literature outline the primary reasons for company failure, often stemming from inadequate investments and inappropriate financial decisions. Therefore, according to the mentioned cases, the present research aims to answer the question whether changes in effective tax rates and special characteristics of Iran Khodro affect the capital structure or not?

Badri (2022) conducted a study on tax avoidance in relation to the amount of debt utilized by companies in their capital structure, considering the profitability and state ownership of companies. He found a significant negative relationship between tax avoidance and the amount of debt used. Furthermore, the impact of tax avoidance on debt utilization varied between profitable and loss-making companies, with a stronger negative relationship observed in state-owned enterprises.

Hamidian Khanqah (2022) analyzed the influence of value-added tax and various factors impacting the capital structure of companies listed on the Tehran Stock Exchange. His study revealed that company size, asset tangibility, risk, profitability, and liquidity are critical determinants of the capital structure. Most of these variables, except for risk, were found to have a positive and significant effect on the capital structure, while the risk variable adversely affected the capital structure.

Qaidi (2021) explored the effect of export tax discounts on the capital structure of companies listed on the Tehran Stock Exchange, with a focus on the moderating roles of company performance and investment. He concluded that export tax discounts significantly influence the capital structure, and both investment in fixed assets and company performance act as moderators in this relationship.

Majzoubi (2021) investigated the impact of export tax discounts on the qualitative signal affecting companies' capital structure decisions. He found that export tax discounts contribute to determining capital structure by stimulating investments in fixed assets, reducing financial costs, and enhancing domestic financing. The effect of financial leverage was primarily through improving productivity and profitability, with a lesser impact on private and foreign finance compared to state-owned enterprises.

Moradzadeh et al. (2019) studied the impact of corporate income tax and financial expenses on the leverage ratio of companies listed on the Tehran Stock Exchange over a ten-year period. His findings indicated that an increase in the effective tax rate paid by the company, coupled with a reduction in interest expenses, could lead to a higher leverage ratio.

Banshi (2021) explored the relationship between export tax exemption and the capital structure of export-oriented companies listed on the Tehran Stock Exchange. They reported a significant association between export tax exemption and the capital structure of such companies.

Abdullah, et al. (2023) investigated the substitution effect between financial leverage in the capital structure and tax avoidance. They highlighted the significant moderating role of financial leverage costs in the relationship between financial leverage and tax avoidance. Furthermore, their study revealed that company size and growth opportunities positively impacted the use of financial leverage, while profitability, dividends, and collateral capacity had a negative effect.

Mahla and Badavar Nahandi (2018) examined the effect of the effective tax rate on investment decisions and stock dividends in influencing the capital structure of companies. They found that the effective tax rate negatively affected the debt ratio in the capital structure. Moreover, the effective tax rate did not influence the debt maturity structure, investment decisions, or stock dividends.

Doro et al. (2018) investigated the impact of taxes on the dynamic capital structure and leverage of domestic and multinational companies. Their study utilizing a dynamic capital structure model revealed a positive tax effect on the leverage of both domestic and multinational companies in the UK.

Al-Bakbashi and Al-Jaziri (2018) explored the relationship between company characteristics and capital structure, specifically looking at managerial and major ownership. They observed a negative correlation between managerial ownership and short-term financial leverage, whereas major ownership showed positive associations with total and short-term leverage. Their study emphasized the significant influence of ownership structures on a company's capital structure, supporting the hierarchical theory in explaining the behavior of Egyptian small and medium enterprises.

Sun et al. (2015) investigated the impact of ownership structure on capital structure and financial decision-making, specifically focusing on English firms. They found a non-uniform relationship between ownership structure and debt ratio, reflecting conflicting theories of balanced interests and managerial assumptions. Institutional ownership was positively associated with corporate leverage levels, and firms with concentrated ownership structures tended to reduce leverage by issuing more equity during hot market periods.

Oyar and Gazlit (2015) examined the effect of company characteristics on the capital structure of Turkish stock exchange-listed companies. Their findings indicated that company size and asset structure positively influenced the capital structure, while factors like liquidity, profitability, and interest expense coverage ratio had a negative and significant impact on companies' capital structures.

Hyder and Liangqvist (2015) studied the impact of taxes on the financial structure of companies, highlighting the preferences of American companies for equity over debt as tax rates increase. They found that with rising tax rates, companies showed a propensity to opt for equity financing over debt.

Methodology

The current study falls under the category of correlational research in terms of practicality, post-event nature, and method of execution. The data collection method utilized was the library method, involving references to archives, audited financial statements of sample companies, explanatory notes, board of directors' reports to the assembly, Tehran Stock Exchange Organization website, Kodal website, and Iran Financial Information Processing Center website. The research population focused on the automotive industry and parts manufacturing (Iran Khodro) from 2016 to 2022, meeting certain criteria such as being listed on the stock market by March 2015, maintaining a consistent financial year ending in March, continuous activity, and availability of financial information from 1396 to 1401. The systematic elimination sampling method was employed to select a sample of 36 automobile manufacturing companies and parts production companies for the study. Descriptive statistical methods like frequency distribution table, mean, and standard deviation were used for data analysis, along with inferential statistical methods to explore the relationship between factors and Kolmogorov Smirnov test for data normality. Furthermore, unit root test determined a stationary or divergent process for the time series, while Limer's and Hausman's F tests were conducted to choose between fixed or random effect models. Limer's F test determined the use of pooled or panel method in model estimation. Regression analysis was employed to test research hypotheses using EViews and Excel software for data analysis. The study used panel data comprising cross-sectional and time series analysis with ordinary least square, fixed effect, and random effect models to investigate the impact of effective tax rate changes and company characteristics on capital structure, focusing on Iran Khodro Company. The Hausman test was conducted to determine the most appropriate model for fixed or random effect estimation. The research introduced three estimates to assess the influence of effective tax rates and firm-specific characteristics on capital structure, where the regression equation was presented as:

A regression analysis, denoted in below, was developed:

followed by model validation and application of classical regression assumption tests. Lastly, the software-assisted regression employed abbreviations for variables, where A represented financial leverage, B denoted price-to-earnings ratio, S indicated market-to-book value ratio, E stood for company size, F represented beta coefficient, and Y reflected company debt.

Results

The results are meticulously outlined based on the gathered statistics, information, and methodology. Initially, it is necessary to evaluate the stability and instability of the data. Following this, attention must be given to assessing the normality of the data and controlling for heterogeneity in variance. Lastly, the estimate of the final model will be presented at a later stage.

The results of

Table 1 show that, in general, this regression is presented with a coefficient of determination of 0.98. As a result, the regression is very strong. Significance also shows a number less than 0.05, which expresses the significance of this regression. In the following, two F-limer and Hansman tests are applied to the regression relationship of the research given in the relationship, in order to determine the cross-sectional and panel nature and the effects of the data, either random or fixed.

According to Flimer's test, the null hypothesis of cross-sectionality is not rejected in

Table 2 and the data of the model are cross-sectional. Because the probability of significance in 2 tests are 0.59 and 0.6 and are more than 0.05.

According to

Table 3 and the result of the Hausman test, the randomness of the model data has a significance of 0.75 and is more than 0.05, and therefore the assumption of the randomness of the data is not rejected and the data have random effects.

Table 4 shows that the significance of the test is zero because it is less than 0.05, the heterogeneity of the variance of the error sentences can be seen in the regression. By using White's correction method, the heterogeneity should be fixed. White's correction standardizes the standard deviation and creates a new significance level for the coefficients in the model.

Above table shows that the significance of the test after White's correction is zero, so because it is less than 0.05, the heterogeneity of the variance of the error sentences is still seen in the regression and in fact, it has not been fixed. So this regression condition has not been fulfilled.

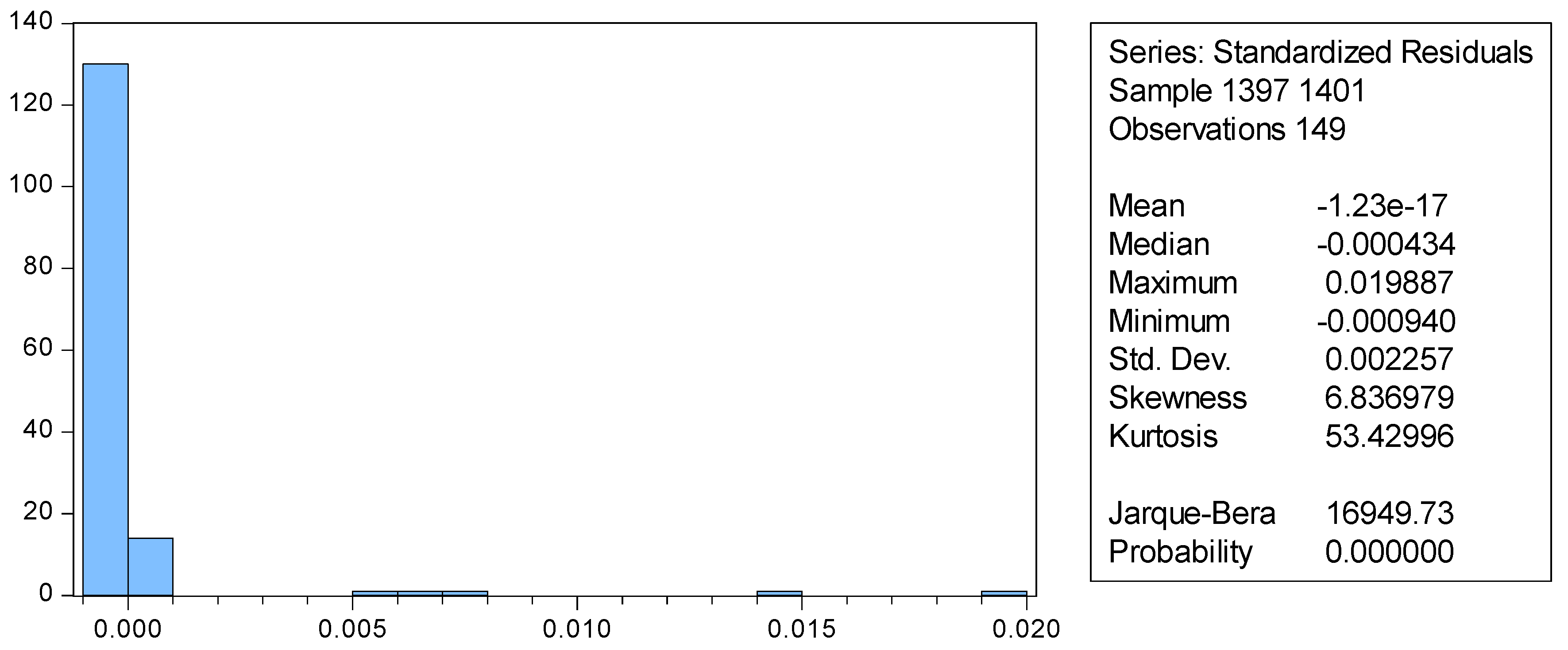

Figure 1 shows that there is no normality between the residual data in the regression. The data are not normal and the significance probability of the test is zero and less than 0.05. The test score is also high and far from normal conditions. Because the average of the error sentences is close to zero, the significance of the regression test is lost and the regression conditions are established.

In relation to the test of non-autocorrelation between error sentences, one of the appropriate methods is to use the Durbin-Watson statistic, which is also 2.53 according to the regression table 1 in this article. Therefore, it is in the range of 1.5 to 2.5 and has a small distance from this range. . So this condition is satisfied and there is no autocorrelation between error sentences. Finally, 4 main regression conditions out of 5 cases were seen. Only in the case of variance heterogeneity, variance heterogeneity was seen in the regression.

In

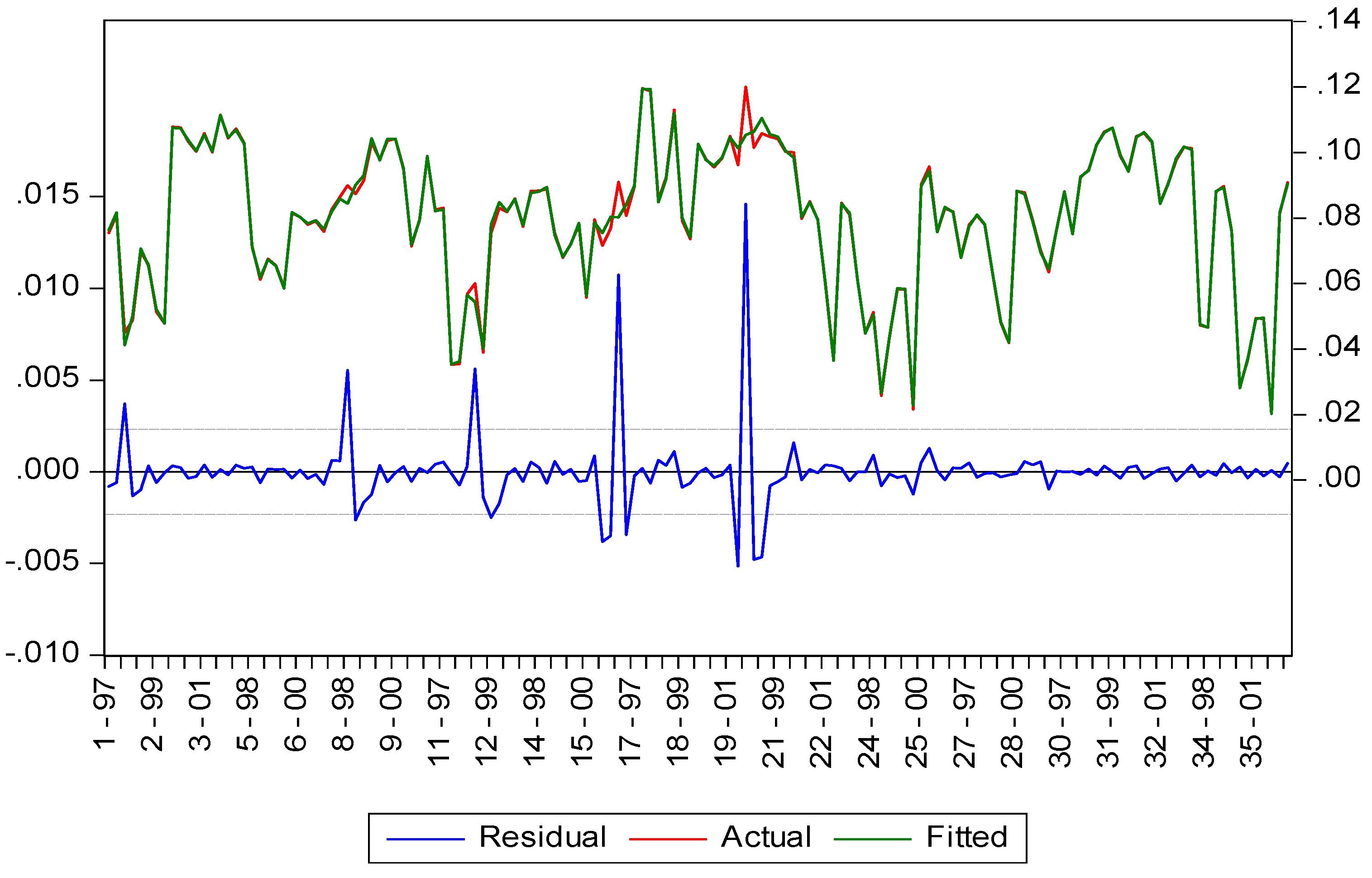

Figure 2, the curve of real data and predicted data and regression error are drawn in relation to the dependent variable of the company's debt.

The identification of determinants of capital structure has been a topic of discussion for many years. Changes in the macroeconomic environment and company-specific factors play a significant role in shaping a company's capital structure. Numerous studies have analyzed various theories of capital structure and their implications at a macroeconomic level. The primary objective of this study was to examine the determinants of capital structure and the influence of taxes specifically within Iran Khodro Company. The research is structured as correlational, serving practical, causal, and methodological purposes. Data collection involved referencing archives, studying audited financial statements, explanatory notes, reports from the board of directors, as well as utilizing resources such as the Stock Exchange Organization's website, Kodal's website, and the Iranian Financial Information Processing Center's website. The research population included companies in the automobile industry and parts manufacturing sector (Iran Khodro) from 2016 to 2023. The research sample was selected using a systematic elimination sampling method, resulting in information from 36 automobile companies, parts producers, and related industries, with 180 data points for each variable. Descriptive statistical methods including frequency distribution tables, means, and standard deviations were used for data analysis, while inferential statistical methods were applied to investigate the relationship between influential factors. The Kolmogorov-Smirnov test was employed to assess the normality of the data. Findings indicate a direct relationship between taxes and debt. Regression analyses revealed a positive relationship between debt and financial leverage, a negative relationship between debt and company size, and an inverse relationship between debt and price-to-earnings ratio and book value ratio. The study also found a positive relationship between debt and the beta coefficient, with financial leverage identified as the most significant element related to taxes.

Conclusion

The present study was carried out to examine the determinants of capital structure and taxes within Iran Khodro Company. The correlation between the components was analyzed using the multivariate regression method. The research established a debt-based tax for the automobile company, indicating a direct association between tax and debt. Consequently, the study investigated the dependency of the company's debt on various variables and modeled its regression relationship. Overall, the relationship between the financial debt of automobile companies and Iran Khodro was confirmed by the variables studied in this research. The relationship between the financial leverage component of Khodrosaz and Iran Khodro was observed to be linked to debt and tax factors, illustrating a direct relationship between these two variables. The significance of the research regression was validated with a zero probability of significance. The relationship between the main variable of debt and other independent economic variables was evident. The desired tax variable displayed a correlation coefficient of 0.98 with other variables. Ultimately, the data from the model constructed were deemed cross-sectional with random effects. The results of the regression analysis indicated a direct relationship between debt and financial leverage. Conversely, an inverse and negative relationship was found between debt and company size. The relationship between the debt factor and price-to-earnings ratio was reported to be in reverse regression. Similarly, the relationship between debt and book value ratio in the regression was noted to be inverse. In contrast, a direct and positive regression relationship was observed between the debt factor and beta coefficient. Notably, financial leverage emerged as the most important component of taxes. The significance of the financial leverage variable in the regression was zero and below 0.05. The width from the origin of the research regression equation was calculated using software to be 0.0006. The adjusted regression coefficient of the research was determined to be 98%. The financial leverage variable was identified as having the most substantial impact on determining the tax of Iran Khodro Company. The significant probability of the beta coefficient variable in the regression process was 0.29. The sum of squares of the regression error was computed to be 0.0007, indicating a minute value.

References

- Abdullah, H. , & Tursoy, T. (2023). The effect of corporate governance on financial performance: evidence from a shareholder-oriented system. Iranian Journal of Management Studies, 16(1), 79-95.

- Armstrong, S, C. Blouin, L,J. Larker, F.D. (2012). The Incentives for Tax Planing. Journal of Accounting and Economics. Vol. 53, pp:391-411.

- Azizi, J.; Jabbari, A. Estimating Monetary Demand Using a Flexible Model of Almost Ideal Demand System (AIDS). Preprints 2024, 2024061596. [Google Scholar] [CrossRef]

- Azizi, J. (2024). The Relationship between Exchange Rate, Interest Rate, and Tehran Stock Exchange Dividend and Price Index (TEDPIX). Preprints 2024, 2024051712. [CrossRef]

- Azizi, J.; Nikravesh, R.; Golshani, T. Investigating the Impact of an Integrated Project Management System on Financial Performance. Preprints 2024, 2024060124. [Google Scholar] [CrossRef]

- Azizi, J., & Rahmani, S. M. K. Analysis of the Data Flow Diagram in the Market of Agricultural Products (May 12, 2024). Available at SSRN 4825687.

- Azizi, J.; and et al. (2010). Effect of the Quality Costing System on Implementation and Execution of Optimum Total Quality Management. International Journal of Business and Management. Vol. 5, No. 8. P: 19-26.

- Azizi, J., & Yazdani, S. (2007). Investigation stability incom of export date of Iran. Journal of Agricultural Science, 13(1), 1-19. SID. https://sid.ir/paper/7704/en.

- Azizi, J. (2015). Evaluation of The Efficiency of The Agricultural Bank Branches by Using Data Envelopment Analysis and The Determination of a Consolidated Index: The Case Study in Mazandaran Province. Agricultural Economics, 9(1), 63-76. https://www.iranianjae.ir/article_12605_en.html.

- Azizi, J. , Taleghani, M., Esmaeilpoor, F., and Gudarzvand, M., (2010). Effect of the Quality Costing System on Implementation and Execution of Optimum Total Quality Management. International Journal of Business and Management. 5(8), 19-26. [CrossRef]

- Badri, Mohammad (2022) The relationship between corporate aggressive taxation and capital structure decisions with an emphasis on profitability and ownership structure of companies. Master's thesis of Rajah Institute of Higher Education, Faculty of Humanities.

- Banshi A., Javar R. (2021). Investigating the relationship between export tax exemption and the capital structure of export-oriented companies admitted to the Tehran Stock Exchange. Scientific Journal of New Research Approaches in Management and Accounting, 5(19), 348-.

- Bhaduri, Saumitra N. 2002. Determinants of capital structure choice: A study of the Indian corporate sector. Applied Financial Economics 12: 655–65. [CrossRef].

- Dallari, Pietro, Mr Nicolas End, Fedor Miryugin, Alexander F. Tieman, and Mr Seyed Reza Yousefi. (2020). Pouring oil on fire: Interest deductibility and corporate debt. International Tax and Public Finance 27: 1520–56.

- Hamdian Khanqah, Gholamreza (2022) The effect of value added tax and factors affecting the capital structure of companies listed on the Tehran Stock Exchange. Master's thesis of Allameh Tabarsi Institute of Higher Education, Department of Accounting.

- Majzoubi, Majid (2021) Investigating the effect of export tax discount on the qualitative signal of determining the capital structure of companies. Master's thesis 1400 Ghiathuddin Jamshid Kashani University, Faculty of Industry and Management.

- Fu, J.R., Farn, ch.K., chao, W. P.,(2019) "Acceptanceof electronic tax filing: A study of tax payer intentions", Information and Management, 43, pages 109-126.

- Khorasani, Ibrahim. (2019). Advertising and Tax Avoidance: The Moderating Role of Institutional Investors. Master's thesis, Hakim Jurjani Institute of Higher Education, Department of Management.

- Kluzek, M. , & Schmidt-Jessa, K. (2022). Capital structure and taxation of companies operating within national and multinational corporate groups: evidence from the Visegrad Group of countries. Journal of Business Economics and Management, 23(2), 451-481.

- La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny. 1997. Legal determinants of external finance. The Journal of Finance 52: 1131–50.

- Liao Min-Yu (Stella) , Tamm Chris (2014), Capital Structure Changes around Cross-Listings, in Kose John , Anil K. Makhija , Stephen P. Ferris (ed.) Corporate Governance in the US and Global Settings (Advances in Financial Economics, Volume 17) Emerald Group Publishing Limited, pp.1 – 34.

- Modigliani, F. and Miller, M. H. (1958). The Cost of Capital, Corporate Finance and the Theory of Investment. American Economic Review, 48, 261-97.

- Modigliani, F. and Miller, M. H. (1963). Corporate Income Taxes and the Cost of Capital: A Correction. American Economic Review, 53, 433-43.

- Moradzadeh, Amir, and Elisabeth Paulet. (2019). The firm-specific determinants of capital structure–An empirical analysis of firms before and during the Euro Crisis. Research in International Business and Finance 47: 150–61.

- Myers, S.C. (2001). Capital Structure. The Journal of Economic Perspectives, 15(2), 81-102.

- Qaidi, Maryam (2022) The effect of export tax discount on the company's capital structure with the

moderating role of the company's performance and investment. Master's thesis of Shahid Ashrafi

University of Esfahani, Faculty of Administrative Sciences and Economics.

- Sikveland, M. , Xie, J., & Zhang, D. (2022). Determinants of capital structure in the hospitality industry: Impact of clustering and seasonality on debt and liquidity. International Journal of Hospitality Management, 102, 103172.

- Soleimani, Yasser. (2021). Substrates, incentives and fields of formation of tax evasion. Scientific Monthly "Economic Security", 9(1.2), 31-48.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).