1. Introduction

Biodiversity loss and the destruction of natural ecosystems are critical global challenges, due to significant consequences for both society and the economy (UNEP, 2020). The emergence of the concept of corporate biodiversity and nature-positive outcomes is a result of the urgent need to protect and enhance biodiversity. These terms describe the actions and initiatives followed by businesses to mitigate their impact on the environment and promote sustainability. Biodiversity can be defined as the variety of living organisms in each area, including the differences among individual species as well as the interactions and relationships between these species. It includes taxonomic, phylogenetic, and functional aspects, showing the richness of life on Earth (Stork, 2009).

Factors like climate change, environmental pollution, changes in land use, excessive exploitation of resources, and the spread of invasive species are the main causes for biodiversity decline. These issues are usually linked to broader problems like unsustainable production and consumption (Damiani et al., 2023). According to the facts disclosed by UNEP, (2023), approximately one million out of the estimated eight million plant and animal species on earth face the risk of extinction. Human activities, such as fishing and pollution, have impacted around 66% of the world’s ocean area. Also, nearly 90% of global marine fish stocks are either fully exploited, overexploited, or depleted, demonstrating the urgent need for conservation measures to address the threats faced by biodiversity and marine ecosystems. Nearly 40% of the world’s insect pollinators are at risk of extinction due to factors such as pollution, habitat destruction, and climate change.

The World Economic Forum’s Global Risks Report for 2024 has identified pollution as one of the key challenges among the top 10 risks threatening the planet (World Economic Forum, 2024). Current worldwide assessments highlight that the deterioration of the natural world poses a substantial threat to the effective operation of our communities and economies too. These assessments show the importance of key changes to tackle the loss of biodiversity systematically (Dasgupta, 2021). The recognition of the importance of addressing environmental impact has persuaded an increasing number of businesses to incorporate biodiversity and ecosystem-related information in their sustainability reports. Sustainability reporting standards like the Global Reporting Initiative (GRI) emphasize the importance of including biodiversity in reporting obligations, encompassing the count of protected species and the extent of land managed for conservation purposes (GRI, 2020). This growing trend highlights the significant role that businesses play in safeguarding the natural environment while simultaneously ensuring their long-term sustainability and profitability.

Businesses are increasingly urged to prioritize biodiversity awareness due to their significant impact on the global biodiversity crisis. Following biodiversity initiatives not only addresses environmental concerns but also unlocks opportunities for innovation, enhances product appeal, and reduces operational expenses. Certain companies, leveraging their strategic positions, can enact changes using widespread effects (Kurth et al., 2021). Investors are evaluating ways to include biodiversity considerations in their evaluations, directing funds towards nature-friendly approaches (Gazzo & Bell, 2022). This shift is evident as some business leaders acknowledge their role and seek to rectify it, since Scandinavian companies are particularly inclined to alter their business models. Overall, there’s a positive trend towards biodiversity conservation in the business world (Zollo, 2023).

The International Union for Conservation of Nature (IUCN) defines nature positive as halting and reversing the nature loss from the present status. The aim is to avoid future negative impacts while recovering nature from the current losses (IUCN, 2022). Corporate biodiversity and nature-positive outcomes offer numerous benefits to businesses. First and foremost, they enable companies to effectively manage risks caused due to natural resource scarcity, climate change, and regulatory compliance (Eccles and Serafeim, 2013). By proactively engaging in biodiversity conservation and ecosystem restoration, businesses can enhance their resilience to environmental shocks and uncertainties. It is vital to strengthen the accountability of organizations regarding biodiversity to ascertain whether businesses are fulfilling their role as caretakers of the Earth’s biological diversity. This entails evaluating how they handle their influence on ecosystems and species and proactively addressing the threat of life extinction on our planet (Ermgassen et al., 2022). Incorporating strategies that prioritize biodiversity and positive interactions with nature into business activities can motivate innovation and encourage the creation of value. Companies can devise fresh products, services, and business models that suit sustainability objectives by considering environmental and social aspects, (Eccles and Serafeim, 2013; Abson et al., 2017). This approach paves the way for creativity, promotes resource efficiency, and opens new market opportunities. Incorporating corporate practices that support biodiversity and have positive impacts on nature can help to achieve global sustainability milestones, including the Sustainable Development Goals (SDGs). This is particularly relevant to goals such as goal 6, addressing clean water and sanitation; goal 13, focusing on climate action; goal 14, concerning life below water; and goal 15, relating to life on land, supporting the targets mentioned in the Paris Agreement (UN, 2015). Businesses play a critical role in supporting these goals by actively participating in the conservation and restoration of ecosystems and biodiversity conservation (TNFD, 2021). Focusing on the importance of corporate commitments to biodiversity and nature-positive results, global entities like the Convention on Biological Diversity (CBD) and the United Nations Framework Convention on Climate Change (UNFCCC) have emphasized their relevance. Businesses can contribute to global efforts to conserve and restore nature, mitigate climate change, and ensure a sustainable future by promoting corporate biodiversity concepts. Task Force on Nature-related Financial Disclosures (TNFD) was founded to support the shift to a sustainable and more nature positive economy. TNFD mainly aims to provide businesses with a framework to disclose their impacts and dependencies on nature and to integrate this information into financial decision-making processes (TNFD, 2021).

This initiative recognizes the critical link between a company’s financial activities and their implications for nature and biodiversity. This review paper comprehensively analyzes the current status related to the knowledge of corporate biodiversity and nature-positive outcomes. It aims to identify the drivers and barriers to the adoption of nature-positive strategies by businesses, explore key sustainable frameworks, and assess the recommendations on biodiversity and ecosystem protection. The paper will also focus on the challenges and opportunities of integrating nature-related disclosures into financial reporting and decision-making, offering insights into how businesses can align their strategies toward nature conservation and restoration goals. This paper aims to contribute to the understanding and advancement of corporate practices that prioritize biodiversity and nature-positive outcomes by examining the existing literature and research.

2. Biodiversity and Nature-Related Issues

2.1. Importance of Biodiversity in the Corporate Environment

Human activities over the past 50 years have resulted in a considerable loss of biodiversity when compared to history, driven by the necessity to support a growing population’s demands, such as fresh water, food, timber, and fuel (Churchill, 2005). The depletion of resources and pollution has had far-reaching consequences, forcing businesses to reassess their operations which can have direct or indirect reliance on biodiversity and natural resources (Katic et al., 2023). The risks a company faces due to the loss of nature can be straightforward, like agricultural firms experiencing reduced crop yields from a decline in pollination or soil health. There are also more long-term threats, such as the potential danger to any organization arising from the emergence of zoonotic diseases caused by changes in land use or wildlife trade (NEE., 2023).

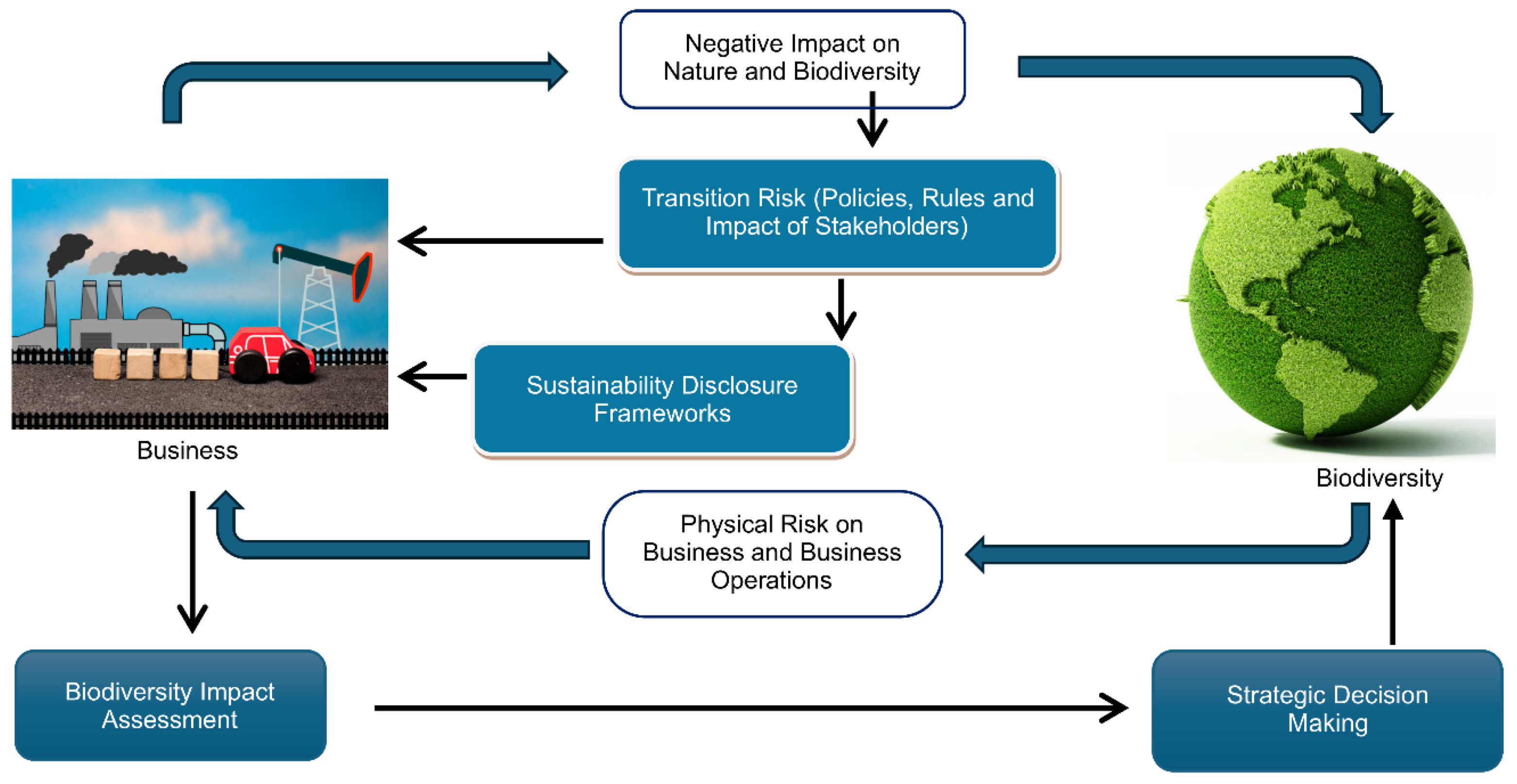

Business operations can exert negative impacts on nature and biodiversity, presenting biodiversity-related transition risks for organizations (

Figure 1). These risks stem from a disconnect between economic activities and efforts to safeguard nature, encompassing regulatory changes, legal precedents, technological advancements, and shifts in investor and consumer preferences (TNFD Recommendations, 2023). Similar to climate change, biodiversity-related transition risks can disrupt production, global value chains, and productivity, leading to diminished corporate profitability. Consequently, these effects can propagate through the financial system, affecting asset valuations and impacting macroeconomic variables such as exchange rates and commodity prices (Rudgley & Seega, 2021). To address these challenges, sustainability frameworks and standards have emerged, mandating the disclosure of biodiversity-related impacts by business sectors (Finance for Biodiversity, 2021). Such disclosures are instrumental in informing strategic decision-making that positively influences nature. Moreover, there are physical risks posed by nature and biodiversity to businesses (

Figure 1), arising from the degradation of natural ecosystems and the subsequent loss of ecosystem services. These risks can manifest as acute or chronic events, contingent upon changes in both biotic and abiotic conditions necessary for supporting healthy ecosystems. Some biodiversity-related physical risks may materialize financially within a shorter timeframe compared to the anticipated impacts of climate change, urging businesses to assess and mitigate their biodiversity footprint (TNFD Recommendations, 2023; Kedward et al., 2022). Hence, it is vital for businesses to carefully evaluate their impact on biodiversity and make informed strategic choices to minimize these effects, ultimately playing a pivotal role in promoting biodiversity conservation efforts (

Figure 1).

Traditionally, environmental impact assessments (EIAs) focused solely on pollution, but modern approaches integrate biodiversity together with health, social, and environmental factors. Biodiversity is now a key consideration on corporate agendas, seen as both a risk and an opportunity. This emphasizes the need for comprehensive assessments and robust environmental management. Effective biodiversity management reduces risks and promotes opportunities, enhancing stakeholder relations and operational stability Athanas, (2005). International initiatives, such as the UN SDGs UN, (2015) and Planetary Boundaries Steffen et al., (2015), along with the Dasgupta Review Dasgupta, (2021), emphasize the vital role of biodiversity in maintaining the sustainability of both natural and socioeconomic systems. Virtually every nation worldwide agreed to back the CBD and its Global Strategic Plan for Biodiversity 2011–2020, which included the twenty Aichi Biodiversity Targets. The assistance provided has extended to the forthcoming global biodiversity framework post-2020. Nevertheless, there has been an incomplete achievement of any of the Aichi Biodiversity targets, with approximately one-third of them either experiencing stagnation or exhibiting indications of negative shift, as documented by Beck-O’Brien and Bringezu (2021) and Kopnina et al. (2024).

As of the analysis conducted in 2020 on the progress of the Aichi Biodiversity Targets set in the 2010 summit, out of the 20 listed targets, 15 have been partially met. Unfortunately, one target indicates no progress at all, and the remaining five show negative progress, suggesting a concerning trend towards adverse impacts (Kopnina et al., 2024). Acknowledging the urgency of the situation, there has been a significant increase in research and practical efforts to understand and measure the impact of business operations on biodiversity. Collaborative initiatives involving various groups, platforms, and partnerships are actively working to assist businesses and financial institutions in comprehending and mitigating their biodiversity impact (Beck-O’Brien and Bringezu, 2021). The goal of these collective actions is to equip businesses with the necessary tools and standards to consider biodiversity effects and benefits in their decision-making processes (Katic et al., 2023). Due to the unsuccess of Aichi Biodiversity targets, COP 15 introduced the Kunming-Montreal Global Biodiversity Framework, in December 2022, aiming to halt and reverse biodiversity loss by 2030, building upon the Strategic Plan for Biodiversity 2011–2020 (Kunming-Montreal Global Biodiversity Framework, 2023). It seeks to reshape humanity’s relationship with biodiversity, aligned with the 2030 Agenda for Sustainable Development, with the ultimate goal of achieving harmonious coexistence with nature by 2050 (Lehmann, 2023). Despite the introduction of the 2010 Biodiversity Strategy by the EU, companies listed in the EU exhibit limited commitment to biodiversity protection (Scarpellini & Álvarez-Etxberría, 2023b). This emphasizes the importance of aligning policy initiatives with corporate actions to bridge the gap and ensure effective commitment to disclose the impact on biodiversity and nature by corporate sector.

Biodiversity mainstreaming, as defined by the Convention on Biological Diversity and UNEP, emphasizes the integration of biodiversity considerations into decision-making across various sectors. However, despite substantial investments and efforts to enhance tools, persistent gaps remain in existing criteria for biodiversity in certification, standards, business accounting, and scientific modeling (Beck-O’Brien & Bringezu, 2021b). In addressing these challenges, Smith et al. (2020) propose a pragmatic strategy known as “embedded mainstreaming”. This approach suggests bundling biodiversity considerations within broader frameworks, such as environmental, natural capital, or climate change mainstreaming. The aim is to ensure the effective integration of biodiversity concerns amidst competing priorities, particularly in a world with scarce resources.

2.2. Role of Mandatory and Non-Mandatory Regulations on Corporate Environmental Reporting

Economic evidence suggests that damage to nature caused by businesses can finally affect the financial health of the company (Bubna-Litic, 2004). Failure to meet biodiversity standards can bring about fines, license revocations, customer dissatisfaction, employee disengagement, and increased capital costs. Conversely, achieving strong biodiversity performance can facilitate easier capital access, maintain operational permissions, and cultivate loyalty from both customers and staff (Vorhies, 2002). According to the findings by Huang et al. (2023), the introduction of the Greenhouse Gas Reporting Program (GHGRP) in the United States resulted in a reduction in environmental litigation risks for corporations. The same study reveals the importance of mandatory reporting of greenhouse gas (GHG) emissions in shaping the environmental conduct of companies. It emphasizes the interconnectedness among regulatory actions, corporate responsibility, and financial results.

Charitou (2022) analyzed the impact of European Union (EU) legislation on corporate environmental disclosures in Europe and that analysis revealed that regulations have led to an increase in the extent of environmental disclosure. Tang & Demeritt (2017) conducted an analysis to compare GHG emission reporting before and after Mandatory Carbon Reporting (MCR). The findings reveal that post-MCR implementation, every sector experienced an increased percentage of sustainability reporting. However, imposition of mandatory reporting requirements may not uniformly raise the standard of non-financial disclosures, particularly for companies already engaged in voluntary sustainability reporting Carungu et al., (2020) study suggests that mandating companies to disclose non-financial reports (NFR) does not consistently lead to improved overall quality of the reports. Approximately 25% of companies who voluntarily shared extra sustainability reports did not show enhanced quality in their disclosures even when NFR reporting was made mandatory (Tang & Demeritt, 2017). Similar consequences can be anticipated when it comes to reporting on nature positivity.

3. Corporate Sustainability Disclosure Frameworks

3.1. Corporate Sustainability Disclosures – Evolution throughout the History

Transitioning to the aspect of corporate sustainability, the evolution of sustainability reporting frameworks has been marked by significant milestones. As investors showed a growing interest in non-financial information, various sustainability accounting frameworks have been introduced to standardize the reporting of environmental, social, and governance (ESG) data, as mentioned by Bose in 2020. Developing sustainability frameworks involves considering two key perspectives: the sustainability paradigm (environmental, social, economic) and the decisional paradigm (strategic, tactical, operational). Integrating both is important for effective implementation, yet studies note limited integration in decision-making facets (Chofreh & Goni, 2017).

In et al. (2023) have examined the evolution of sustainability reporting guided by Kuhn’s scientific revolution theory, revealing four key periods in sustainability reporting. The initial phase (1973–2005) lacks a consensus on theories. The subsequent period (2006–2011) witnesses a rise in conceptual frameworks, dominating the landscape. The following years (2012–2015) show a crisis phase with increased empirical analysis, and attention shifts to integrated reporting and sustainability transition. The latest period (2016–2019) suggests a potential paradigm shift with sustained interest in sustainability reporting. This period is designated as the age of stakeholder engagement, there is a considerable shift in focus towards recognizing the significance of materiality in sustainability considerations (In et al., 2023). Sustainability reporting has a growing trend, and while the initial emphasis was on reporting climate-related issues, currently a shift in the trend towards addressing broader nature-related issues has been noticed (Ögren, 2023). The primary contemporary sustainability reporting frameworks and standards have been established by influential entities such as the GRI, the Sustainability Accounting Standards Board, the Climate Disclosure Project (CDP), and the Climate Disclosure Standards Board (CDSB). These frameworks are pivotal in providing guidance to organizations in the disclosure of their environ-mental, social, and governance (ESG) performance (Bose, 2020).

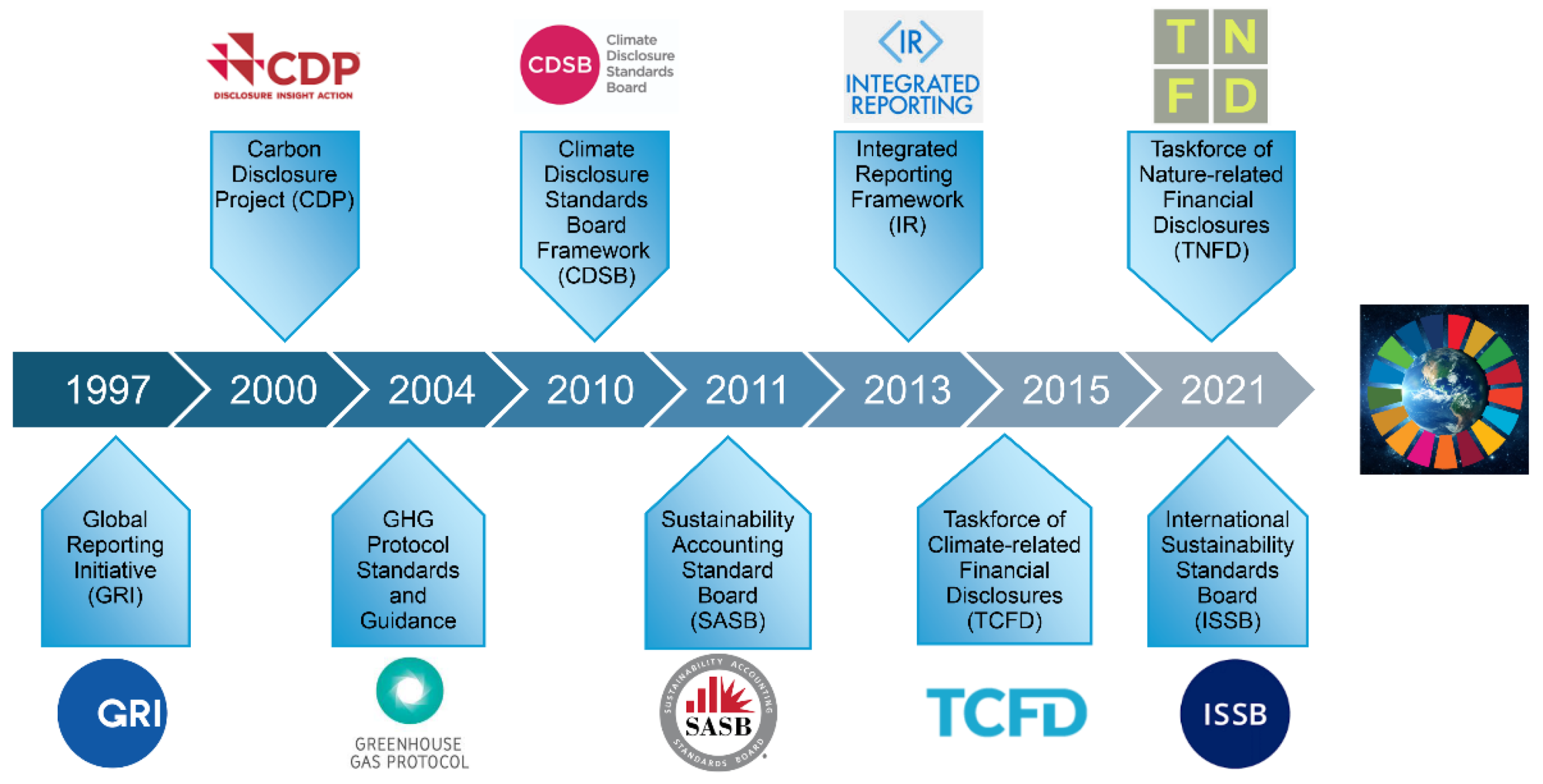

GRI stands as a leading framework for sustainability reporting since its establishment in 1997 (

Figure 2). The GRI, which was founded in partnership with organizations like the Coalition for Environmentally Responsible Economies (CERES) and the UN Environment Program (UNEP), introduced the G4 guidelines in 2013, reinforcing its commitment to providing comprehensive standards for organizations engaged in sustainability reporting (GRI, 2024.). GRI addresses the information needs and expectations of various stakeholders across different sectors (Goswami et al., 2023). CDP which was established in year 2000 (

Figure 2) stands as an online reporting infrastructure. Its main purpose is to furnish stakeholders with the autonomy to disseminate information unilaterally (Goswami et al., 2022). The GHG protocol, initiated in 2004, (

Figure 2) is a universal, standardized framework on a global scale. These frameworks facilitate the quantification and regulation of GHG emissions across both private and public sector activities, supply chains, and efforts to reduce emissions (GHG Protocol, 2024). The Climate Disclosure Standards Board (CDSB) provides companies with a structured approach to reporting environmental data. The framework was introduced initially in 2010 (

Figure 2). This enables companies to furnish investors with pertinent environmental insights within their regular corporate reports (CDSB, 2022). Sustainability Accounting Standard Board (SASB) framework was introduced in 2011 (

Figure 2) with the objective of creating and promoting standards for sustainability accounting that enable publicly traded companies to communicate relevant and valuable information to investors (SASB, 2019).

Since its inception in 2013 (

Figure 2), the International Integrated Reporting Framework has aimed to expedite the global uptake of integrated reporting. By improving the quality of information available to financial stakeholders, it facilitates a more efficient allocation of capital. Moreover, it supports a unified and thorough approach to corporate reporting, integrating various reporting aspects to convey the full spectrum of factors influencing an organization’s long-term value creation (Integrated Reporting Framework, 2022).

TCFD (The Taskforce of Climate-related Disclosures) initiative introduced in 2021 (

Figure 2) is actively crafting guidelines for disclosing climate change-related risks (O’Dwyer & Unerman 2020). TCFD has given a broad definition of climate risk. This definition focuses on two main categories of risks: the challenges associated with transitioning to a lower carbon economy and the potential impacts of climate change on the physical environment (Jona & Soderstrom, 2022). However, both the G20 and G7, which bring together the heads of state and governments of leading industrial nations, have identified a gap in best practices specifically addressing the management of natural risks (Carney, 2019). The TCFD and CDP play significant roles in overseeing environmental risks and demonstrating leadership in this domain (Andrew & Cortese, 2011). The TNFD has similar goals and might become a leading authority in disclosing risks related to nature (Deweerdt et al., 2022). As concerns about the perceived risks associated with climate change grow, companies in various industries are adjusting their corporate risk management approaches to align with the recommendations of the TCFD. Notably, the automotive, oil and gas, mining, and financial services sectors are leading the way in incorporating these recommendations into their risk management strategies, outpacing other industries in this regard (Goswami et al., 2022).

TNFD has a goal to set up a unified system for financial institutions to report on Biodiversity-related Financial Risks (BRFR) starting from 2023. This approach follows a similar structure to what the TCFD has already established (TNFD, 2021). The TNFD significantly influences corporate and financial practices by emphasizing the integration of sustainable approaches and robust risk management (TNFD, 2023); (Deweerdt et al., 2022). Its comprehensive recommendations show a versatile framework appropriate to entities of all sizes, with a focus on identifying and disclosing nature-related issues. TNFD provides strategic disclosures for the Kunming-Montreal Global Biodiversity Framework. This collaboration is a significant step toward achieving global biodiversity goals and can influence sustainability and environmental resilience positively (TNFD, 2023).

It is important to understand the main sustainability frameworks like GRI, SASB, CDP, TCFD, and TNFD for companies engaging in sustainability reporting. This comparison table shows their purpose, stakeholder focus, materiality approach, disclosure structure, and biodiversity approach. It shows a clear and concise overview of each framework’s features and their applicability, supporting the companies to choose compatible frameworks for their reporting needs. Further, it shows the contribution of selected frameworks for biodiversity disclosures highlighting the improvements that need to be made in order to have robust frameworks for biodiversity disclosures.

3.2. Comparison of Sustainability Frameworks

When comparing the main sustainability reporting frameworks, it is noticed that there are differences in what they prioritize such as scope, stakeholder focus and materiality (Guthrie, 2006). Although sustainability reporting frameworks may seem confusing, they have common elements and agreements. Even though they look different at first glance, experts agree that we need to make more efforts to align and organize them better.

The GRI standards offer flexibility for thorough reporting, SASB specializes in industry-specific metrics, CDP facilitates an online platform for companies to disclose their readiness regarding climate change risks and opportunities, and TCFD provides guidance on disclosing financial risks related to climate change and supports adherence to reporting standards covering environmental dependencies and impacts (Goswami et al., 2022). TNFD focuses mainly on biodiversity, aiming to create a standardized framework for financial institutions to disclose biodiversity-related financial risks. This approach highlights the TNFD’s dedication to addressing the critical issue of biodiversity conservation and integrating it into financial considerations for a more holistic approach to sustainability reporting (TNFD, 2023). Robert Eccles, a prominent figure in the ESG field, has expressed concerns about the complex landscape created by distinct reporting standards from entities like SASB, GRI and TCFD. This has led to what he refers to as the “alphabet soup”, causing confusion among companies and investors (West, 2019). According to Bendell (2022), a forthcoming framework should be connected to a fresh eco-social agreement between citizens and the state, tapping into existing capabilities relevant to a world facing escalating disruptions.

Analyzing how sustainability standards define materiality is necessary because it directly impacts what issues companies choose to report. GRI serves as a comprehensive reporting standard that emphasizes impact and involves input from multiple stakeholders. GRI’s attention is directed towards an organization’s current economic, environmental, and social performance, and its materiality considerations extend beyond solely financial matters to include broader significance (Goswami et al., 2022). GRI employs a double materiality approach (

Table 1), comprising both financial materiality and societal materiality. This framework revolves around two key dimensions. Firstly, it evaluates the significance of an organization’s economic, environmental, and social impacts. Secondly, it gauges the substantial influence these impacts have on the assessments and decisions of stakeholders (Cooper & Michelon, 2022). GRI’s material approach discusses that material topics should not be deprioritized merely because the organization does not recognize them as financially significant (Goswami et al., 2022).

According to SASB, a material topic is considered one that is reasonably likely to impact the financial condition or operating performance of an organization (

Table 1). However, SASB’s conceptualization of materiality may not necessarily show critical sustainability issues, and thus, its framework may not be able to claim alignment with sustainable development as more broadly understood (Cooper & Michelon, 2022). The TCFD’s final report and recommendations are clear in their objective: to establish voluntary and consistent climate-related financial disclosures designed to assist investors, lenders, and insurance underwriters in evaluating material risks (

Table 1). This unique focus on climate-related financial disclosures distinguishes the TCFD recommendations from other frameworks, as they are tailored specifically to address climate-related aspects rather than offering a more comprehensive approach to sustainability reporting (Cooper & Michelon, 2022). The TCFD acknowledges that the disclosure of financially significant information is already a legal requirement in numerous jurisdictions. Therefore, if climate-related information holds financial materiality, it should already be part of mandatory disclosures. In this context, the TCFD emphasizes that its recommendations are intended to assist organizations in fulfilling their current disclosure obligations more efficiently (Jona & Soderstrom, 2022).

According to the comparison of materiality approaches of sustainability frameworks GRI, CDP, SASB, TCFD, and TNFD, they vary in their emphasis on different aspects. GRI Standards uniquely focus on an organization’s impact on sustainable development rather than solely on its sustainability. SASB focuses more on financial materiality which can have a significant impact on the performance of an organization. CDP aligns with the Climate Disclosure Standard Board’s materiality approach, emphasizing the significance of cli-mate-related information (

Table 1). TCFD recommends evaluating the materiality of climate-related information similar to other financial details. TNFD stands out by addressing the informational requirements of capital providers in alignment with International Sustainability Standards Board’s (ISSB) standards and TCFD recommendations, concurrently meeting stakeholders’ needs with a comprehensive materiality approach following GRI Standards.

Further, ISSB issued their sustainability reporting standards as International Financial Reporting Standards (IFRS) in June 2023. The IFRS Sustainability Disclosure Standards derive from the four foundational elements of the TCFD framework, governance, strategy, risk management, and metrics with associated targets. These standards mainly focus on financial materiality (IFRS, 2023).

The IFRS framework incorporates several standards directly and indirectly addressing environmental concerns. IFRS 6 focuses on extractive industries, IFRIC 5 guides decommissioning and restoration expenses, and ongoing discussions on IFRIC 3 and IAS 38 deal with government allocated emission rights. Indirectly, IAS 37 covers accounting for environmental liabilities, while standards like IFRS 3, IAS 27, IAS 28, IAS 31, IAS 24, and IFRS 8 touch on business combinations, joint ventures, associates, related parties, and reportable segments for geographically dispersed companies (Negash, 2012). While the IFRS comprehensively addresses various environmental aspects, it’s important to note that the current recommendations do not explicitly provide detailed guidance on disclosures related to biodiversity.

The examined sustainability frameworks, including GRI, SASB, CDP, TCFD, and TNFD, present diverse approaches to environmental and biodiversity-related disclosures. GRI emphasizes both management and topic-specific disclosures with a focus on biodiversity protection and habitat restoration. GRI 304: Biodiversity standards comprise two main aspects Management Approach and Topic-Specific Disclosures (

Table 1). The four key disclosures include details on operational sites in or near protected areas (304-1), significant impacts on biodiversity (304-2), efforts in habitat protection or restoration (304-3), and identification of species in affected areas (304-4). These disclosures aim to enhance transparency about an organization’s biodiversity management.

SASB covers a broad spectrum, addressing issues related to environment protection including GHG emissions, air quality, energy management, waste and wastewater management, hazardous waste management and ecological impact (

Table 1). These standards address biodiversity loss, habitat destruction, and deforestation at all stages but do not include the broader impacts of climate change on ecosystems and biodiversity. CDP’s questionnaires align with TCFD and established frameworks, anticipating future mandatory reporting standards (

Table 1). CDP currently utilizes four main questionnaires for environmental disclosures: Climate Change, Forest Stewardship, Water Security, and Plastic Pollution. Aligned with TCFD recommendations, the Climate Change questionnaire integrates ISSB’s climate disclosure standard, placing disclosing companies ahead in anticipating future mandatory reporting aligned with TCFD standards. The Forests questionnaire aligns with the Accountability Framework, enabling companies to meet expectations from buyers, investors, and stakeholders. CDP’s questions on plastics are based on established frameworks like The Ellen MacArthur Foundation and UNEP’s Global Commitment, transforming complex guidelines into a standardized annual format by incorporating best practices (CDP, 2023). Nevertheless, it appears that these questionnaires do not directly address disclosures related to the impact on biodiversity. The primary focus of TCFD lies in climate-related disclosures, encompassing GHG emissions (Absolute Scope 1, Scope 2, and Scope 3) and emissions intensity. Additionally, it describes the assessment of assets or business activities vulnerable to transition risks, as well as quantifies capital expenditure, financing, or investment dedicated to climate-related risks and opportunities.

TNFD pays close attention to biodiversity disclosures, exploring different aspects to understand how organizations affect ecosystems. The disclosures recommended by the TNFD Framework cover many aspects such as the total area an organization manages and any areas that have been disturbed or restored. Further changes in land, freshwater, and ocean use are considered, considering the type of ecosystem and business activity involved. TNFD also focuses on the average abundance of species, the potential loss of species due to human activities, and the extent of land degradation. They assess changes in populations of important species, the condition of forests, and metrics like the Species Threat and Restoration Metric (STAR), Global Extinction Probability (GEP), Persistence Score (PS), and Occurrences (

Table 1). This comprehensive approach helps evaluate an organization’s impact on biodiversity according to TNFD guidelines in 2023. Further TNFD has provided additional sector guidelines for specific sectors which shows further disclosures related to nature-related issues due to their significant influence on nature (TNFD, 2023). These sector guidelines mainly focus on key industrial sectors like oil and gas, metal and mining, forestry and paper, food and agriculture, electric utilities and power generations, chemicals, biotechnology and pharmaceuticals, aquaculture, and financial institutions. There is significant potential for the development of sector-specific guidance in industries such as automobiles, consumer durables, apparel, and retail construction to mitigate their considerable impact on the environment. Further Deweerdt et al. (2022) de-scribes that the TNFD’s targets and metrics exhibit six key features: clear differentiation between preparation and disclosure metrics, consistency with TCFD standards, applicability throughout the value chain, universality across sectors, periodic evaluations for ongoing relevance, and alignment with anticipated international frameworks like the Convention on Biological Diversity and the Science Based Targets Network. This design ensures robust and adaptable metrics for effectively addressing nature-related risks, especially considering negotiations at the COP-15. Further, TNFD and ISSB have decided to work together for nature-related issues, which will significantly accelerate business-driven biodiversity conservation efforts (TNFD, 2023).

The overall comparison of selected sustainability frameworks highlights TNFD’s greater focus on biodiversity-related corporate disclosures, distinguishing it from TCFD, which primarily concentrates on climate change (

Table 1). Although GRI, SASB, and CDP address environmental and biodiversity protection in their disclosure recommendations and standards, they do not prioritize in-depth disclosures related to biodiversity impacts when compared to TNFD. The TNFD recognizes the absence of standardized metrics for communicating nature-related risks to both investors and the public. The current information available is challenging to interpret and compare across industries. To address this gap, the TNFD has developed consistent standard metrics. These metrics align with existing and upcoming initiatives, including those by SASB and the ISSB (Deweerdt et al., 2022).

4. Discussion

We concentrate on the critical role of biodiversity within corporate environments, particularly by examining and contrasting existing sustainability reporting frameworks. With a specific emphasis on biodiversity aspects, we have compared these frameworks to gain insights into their approaches for disclosing biodiversity impact. Subsequently, we would like to provide further suggestions that can be used to improve the measuring of the biodiversity impact in corporate sustainability reporting.

Biodiversity, inherently complex and multidimensional, presents a significant challenge for businesses aiming to design successful conservation models (Purvis & Héctor, 2000; Bishop et al., 2009). The heightened public awareness of climate change and biodiversity loss has placed companies under increased scrutiny, necessitating the measurement and disclosure of their biodiversity relationships to maintain social approval (Boiral et al., 2017). However, existing frameworks lack comprehensive methods to quantify the environmental impact of industry on ecosystems, which are dynamic and subject to natural disturbances (Marshall & Toffel, 2004). Organizations often face limitations in reporting on biodiversity due to inadequate knowledge and disclosure (Roberts et al., 2021). Despite efforts to integrate sustainability into decision-making through evaluation frameworks, practical applications encounter drawbacks and limitations (Hurley et al., 2008). Critics argue that current reporting standards fail to address the decline in nature, highlighting a significant gap in accounting for biodiversity loss (Addison et al., 2018). In response, Layman et al. (2023) suggest innovative strategies for assessing a company’s biodiversity relationship, including evaluating risks from nature-related factors and minimizing contributions to species extinction threats using datasets. However, the practical application and real world impact of these strategies remain unclear, prompting a critical examination of their feasibility. This apparent gap in addressing the environmental impact highlights the critical need for a more holistic approach to sustainability frameworks. A comprehensive disclosure mechanism should be established to effectively account for the broader spectrum of biodiversity impacts.

When environmental performance indicators do not effectively evaluate the positive and negative impacts of all supply chain activities on biodiversity and ecosystem services, companies face challenges in providing holistic and standardized corporate responsibility reports (Lähtinen et al., 2016). Therefore, there is an urgent need for a comprehensive and standardized set of indicators to evaluate biodiversity and ecosystem services across the entire supply chains of a focal organization (Houdet et al., 2012). In addition to these existing suggestions, we would like to add the following specific suggestions for improving sustainability disclosure frameworks and corporate decision-making for biodiversity impacts to the general discussion.

4.1. Suggestion 1: Applying GHG Emission Methodology to Assess Biodiversity Impact on Business Operations

Inadequate communication of the adverse effects on biodiversity and ecosystem services, coupled with a gap between formal reporting practices and practical supply chain management requirements, can lead to a lack of transparency in corporate responsibility reporting (Boiral, 2013). The TNFD framework places significant emphasis on addressing biodiversity issues stemming from both upstream and downstream activities within business sectors (TNFD Recommendations, 2023). While these aspects are critical components of biodiversity impact within the supply chain, it’s important to recognize that they do not include the entirety of biodiversity impact. Winter et al. (2017) stresses the use of Life Cycle Assessment (LCA) in understanding the impact of products on biodiversity. They note gaps, like neglecting genetic diversity and incomplete consideration of biodiversity pressures and call for more innovative methods to enhance LCA’s ability to assess biodiversity impacts accurately.

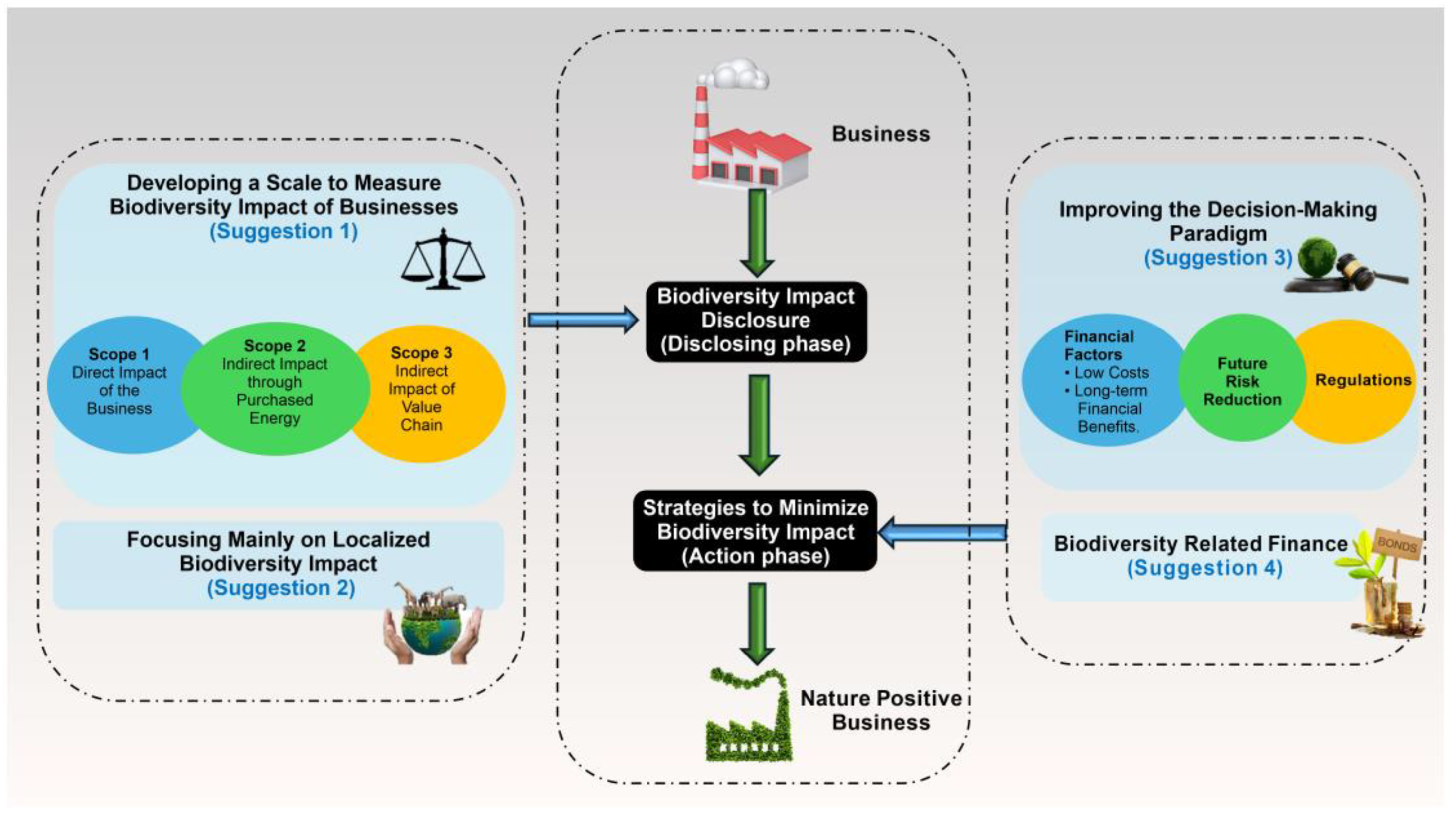

Therefore, we propose adopting a procedure similar to that used for GHG emissions to highlight the biodiversity impact across all aspects of the business procedure (

Figure 3). This holistic approach should involve developing a disclosure framework that can effectively assess the biodiversity impact stemming not only from the supply chain but also from all other direct and indirect facets of the business operations.

Scope 1 Biodiversity Impact: Quantifying the direct impact on biodiversity caused by the business entity itself. Similar to the Scope 1 GHG emissions, this can include activities like land use changes, habitat destruction, or species endangerment directly attributable to the company’s operations.

Scope 2 Biodiversity Impact: Quantifying indirect impact similar to the Scope 2 GHG emissions, this involve assessing biodiversity consequences of energy and resource procurement, transportation, and other outsourced activities associated with the business.

Scope 3 Biodiversity Impact: Quantifying the indirect effects attributable to the products or services offered by the company over their lifecycle. This includes assessing the biodiversity footprint associated with raw material extraction, manufacturing, distribution, product use, and disposal similar to the Scope 3 GHG emissions (

Figure 3).

Implementing such a structured disclosure framework enables businesses to systematically assess and disclose their biodiversity impact across different scopes, facilitating a comprehensive understanding of their ecological footprint. This approach supports targeted interventions to mitigate adverse effects and promote conservation efforts, aligning with broader sustainability goals and encouraging harmonious coexistence with the natural environment. Typically, biodiversity impact tends to be negative, with positive impact often seen in the reduction of these negative effects. However, in rare instances, there may be direct positive impacts, such as a product or production process that actively contributes to the enhancement of biodiversity.

4.2. Suggestion 2: Focusing on the Localized Biodiversity Impact to Improve Local Biodiversity Preservation

Garrett Hardin’s concept of the tragedy of the commons (1968) illustrates how individual self interest can lead to the depletion of shared resources. In recent times, evolutionary biologists have utilized this method to analyze various biological systems, highlighting how similar issues of resource exploitation and depletion can manifest in natural environments (Rankin et al., 2007). Biodiversity impacts may have both global and local dimensions, allowing companies to observe and respond to their effects on a regional scale such as land degradation in one place would directly affect the fauna and flora in that specific area more readily. While GHG emissions were once viewed as primarily local but are now understood to have significant global consequences (Ramanathan & Feng, 2009), the impact on biodiversity typically occurs more prominently at the local level (Newbold et al., 2015). This localized nature of biodiversity impacts makes it easier for companies to reap the benefits of investing in sustainability measures, as the positive impacts on their operations and reputation can more directly be recognized.

There are companies who assess localized biodiversity impact in their ESG reports. One such example is Samsung heavy industries. In their 2023 ESG report, they mention how they have regularly monitored and identify the impact on nearby freshwater ecosystems, terrestrial ecosystems, ecotoxicity, and domestic wildlife habitats (Samsung Electronics, 2023). Understanding and quantifying the risks and dependencies that extend beyond national boundaries is a complex task, which can pose significant challenges, even within the fields of natural sciences (Thomsen et al., 2017). Therefore, the localized nature of biodiversity impacts offers companies a clearer pathway to integrating environmental considerations into their business strategies (

Figure 3). A concrete approach to preserve local biodiversity needs to be introduced to drive businesses towards nature positivity.

4.3. Suggestion 3: Key Focus on the Decision-Making Aspect of Biodiversity Disclosures

Existing sustainability frameworks primarily concentrate on revealing the biodiversity impacts caused by various industries. However, the essential step of actively mitigating these impacts through strategic decision-making is still in its early stages. This proactive approach is key to effectively reducing biodiversity loss. Therefore, future sustainability frameworks should prioritize encouraging industries to focus on decision-making processes aimed at minimizing their impact on biodiversity, thus promoting a more sustainable relationship between industry and the environment (

Figure 3).

Chofreh & Goni’s (2017) also explains the integration of sustainability and decision-making paradigms within sustainability frameworks is essential for successful project execution. This comprehensive perspective aims to blend sustainability and decision-making paradigms, steering efforts effectively toward sustainable outcomes. However, the practical implementation and the level of commitment from decision-makers are areas that need to focus on to ensure the effectiveness of such integration. According to an analysis done by Al-Waeli et al. (2021), the connection between financial performance and environmental disclosure leans more towards a positive relationship rather than a negative one. Businesses are motivated to incorporate biodiversity into their financial decision-making for several reasons. Firstly, when legal obligations mandate compliance, it becomes a priority (

Figure 3). Additionally, if actions can be executed at minimal or no cost, businesses are more likely to follow biodiversity initiatives. Moreover, when such efforts yield tangible benefits, whether financial or non-financial, such as mitigating future risks, reducing capital costs, generating long-term financial gains, enhancing the organization’s reputation, and encouraging a long-term value creation, it strengthens the case for integration into financial strategies. Hence regulatory bodies and related stakeholders should focus more on motivating businesses to adopt nature-positive practices based on their above-mentioned characteristics.

4.4. Suggestion 4: Linking Business Profitability with Biodiversity Conservation

Addressing the challenges associated with biodiversity reporting requires adopting integrated reporting practices and utilizing external channels to ensure accountability (Venturelli et al., 2023). Investors often opt to allocate their funds toward assets that ensure a guaranteed profit (Nedopil, 2022), while disregarding environmental information (Choi et al., 2020). As per the research conducted by Hertati et al. (2022), stakeholders such as investors, management, and creditors can make informed decisions regarding policies when companies actively participate in environmental initiatives and transparently disclose these efforts in their annual reports. This proactive engagement demonstrates a firm’s commitment to long-term environmental preservation.

However, there are barriers to corporate environmental disclosure, as owners may prioritize preserving their share of profits over disclosing environmental information (Gerged, 2020). Nedopil, (2022) discusses that currently, biodiversity considerations are not adequately factored into financial decision-making processes. This is largely due to the absence of clear property rights for biodiversity and nature, leading to negative externalities being borne by society while positive externalities are difficult to quantify and often shared collectively. Therefore, he suggests four key principles, implementing regulations to curtail nature’s exploitation, prioritizing the assessment and mitigation of local biodiversity risks, leveraging secondary benefits of biodiversity finance alongside climate finance, and engaging financial decision-makers to lead and champion biodiversity finance initiatives to reduce the finance and biodiversity gap.

Kholmi & Nafiza (2022) explain introducing effective environmental accounting practices not only enhances a company’s long-term financial viability but also builds trust among investors and customers. Implementing strategies for environmental conservation not only contributes to financial success in the long run but also positively impacts the company’s reputation among key stakeholders, thereby enhancing its overall image and credibility (Susanti et al., 2023). According to Daugaard (2019), analysis of fund flows has revealed the strong commitment of ESG investors. The methodology devised by the Biodiversity Finance Initiative (BIOFIN) offers countries a systematic approach to track their spending on biodiversity (BIOFIN, 2021). Particularly, budget allocations that have an indirect impact on biodiversity are assigned a certain percentage that shows their contribution to biodiversity outcomes. The findings of a study conducted by Seidl et al. (2020) on 30 selected countries show a rising pattern in overall biodiversity spending, along with an uptick in the proportion of total public domestic investment allocated to biodiversity.

To expedite the advancement of biodiversity finance, it’s essential to adopt financial terminology that focuses on expenses (with transactional costs), income, and potential hazards when discussing biodiversity (Nedopil, 2022). Impact investments are directed towards projects that produce tangible environmental or social benefits, while also generating revenues that are returned to the investor as a financial gain. This return on investment could surpass, match, or fall below standard market rates (Trelstad, 2016). Advanced participants in impact investing span across various sectors and entities, including institutional investors such as banks, pension funds, and insurance companies, as well as foundations, family offices, high net worth individuals, and development finance institutions like the World Bank. Conventional bonds and impact bonds play a significant role because biodiversity conservation efforts, whether focused on safeguarding, restoring, or sustaina-bly managing ecosystems and species, often face a shortage of funding (Belt et al., 2017). In Peru, an impact bond was crafted to enhance the yield and sales of cocoa and coffee cultivated by an indigenous community. Although not all objectives were fully achieved, investors still received approximately 65% of their initial investment, showcasing a positive outcome amidst the challenges faced (Belt et al., 2017).

Green bonds operate similarly to conventional bonds, but with a distinctive feature: the funds raised from investors are dedicated solely to supporting initiatives that yield positive environmental outcomes, such as renewable energy projects and sustainable building developments (World Economic Forum, 2023). The green bond market has developed into a distinct infrastructure within capital markets. This infrastructure includes guidelines for green projects, commitments regarding the use of proceeds, external valida-tion of green initiatives, and reporting mechanisms to ensure transparency and accountability (Maltais & Nykvist, 2020). In 2017, the Federal National Mortgage Association in the US issued $24.9 billion worth of green bonds, representing 58% of the country’s total green bond issuance. These bonds were connected to Fannie Mae’s Multifamily Green Initiative, aimed at financing energy and water efficiency improvements in apartment buildings and cooperatives. This initiative serves as a notable example for EU authorities looking to attract private financing for similar projects, including installing solar systems and water saving irrigation systems in multifamily housing (Bhutta et al., 2022). According to the case study on Sweden by Maltais & Nykvist (2020), engagement with the green bond market is primarily driven by non-financial incentives, including attracting customers and staff, and signaling a commitment to sustainability goals. The financial sector’s sustainability norms reinforce this engagement, with investors accepting lower returns and issuers undertaking extra efforts for green bond issuance.

By utilizing green bonds, it’s possible to allocate the funds raised from this type of debt instrument directly to a biodiversity project. Simultaneously, this approach can lead to a reduction in the interest rate associated with the financing, providing a dual benefit of environmental impact and cost efficiency (

Figure 3). The existing literature shows the importance of a more robust and integrated approach to sustainability frameworks. The gaps identified in addressing environmental impacts, implementing biodiversity strategies, and leveraging standardized disclosures necessitate a critical reevaluation of the current paradigms. Practical applications, industry commitment, and the real impact on global sustainability goals require more in-depth studies and research to advance genuine progress in sustainable practices.

5. Conclusion

Studying sustainability reporting frameworks is important in finding the best approaches to address biodiversity-related issues. The existing sustainability frameworks such as GRI, SASB TCFD and TNFD have included disclosure standards for biodiversity impact in different ways and levels. But further modifications for the existing frameworks are needed to support businesses to disclose biodiversity impact. As an outlook, we refer to the new EU-related European Sustainability Reporting Standards (ESRS), which explicitly prescribe biodiversity and ecosystems accounting in detail in the E4 standard. This regulation can be seen as particularly progressive. However, it will be applied in the EU for the first time in 2024, so it is not yet possible to make a final assessment. Furthermore, it is unclear to what extent this regulation will then become a global role model (Jonkman, 2023b). However, to disclose biodiversity impact in a seamless way, development of a harmonized common ground framework is essential. To support the development of such a framework, the following summarized suggestions are provided.

The first suggestion is to develop a framework similar to that of disclosing carbon emissions, which includes Scope 1 (direct impact by the business entity), Scope 2 (indirect impact in the supply chain), and Scope 3 (indirect impact through products/services) which can provide a comprehensive impact assessment rather than assessing upstream and downstream impacts. The second suggestion is companies should consider both global and local impacts when evaluating the materiality of biodiversity investments and should focus more on local impacts which can be directly analyzed and controlled. The third suggestion is to improve sustainability recommendations and standards focusing on the decisional paradigm, to bring out the disclosures of the corporate sector into active decision-making step. Suggestion four shows the importance of aligning profitability with biodiversity conservation by integrating environmental initiatives into corporate reporting practices such as green bonds.

Author Contributions

Maheshika Senanayake: Writing - Original Draft, Writing – review & editing, Visualization. Iman Harymawan: Writing – review & editing, Conceptualization, Visualization. Gregor Dorfleitner: Writing –review & editing, Conceptualization, Visualization. Seungsoo Lee: Writing –review & editing, Conceptualization. Jay Hyuk Rhee: Writing – review & editing, Conceptualization, Visualization. Yong Sik Ok: Writing - Original Draft, Writing – review & editing, Visualization, Resources, Supervision, Project administration, Funding acquisition, Conceptualization.

Funding

This work was supported by the National Research Foundation of Korea (NRF) grant funded by the Korean government (MSIT) (No. 2021R1A2C2011734). This research was also supported by the Basic Science Research Program through the National Research Foundation of Korea (NRF) funded by the Ministry of Education (NRF-2021R1A6A1A10045235). This work was also supported by the National Research Foundation of Korea (NRF) grant funded by the Korean government (MSIT) (NRF-2021M3H4A3A02102349) and the OJEong Resilience Institute, Korea University.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

References

- Abson, D. J., Dougill, A. J., Stringer, L. C., Williams, P., & Adams, W. M. (2017). Socio-cultural values and ecosystem services: Insights from two communities in Panama. Ecosystem Services, 25, 51-63.

- Addison, P., Bull, J. W., & Milner-Gulland, E. J. (2018). Using conservation science to advance corporate biodiversity accountability. Conservation Biology, 33(2), 307–318. [CrossRef]

- Al-Waeli, A. J., Khalid, A. A., Ismail, Z., & Idand, H. Z. (2021). The Relationship between Environmental Disclosure and Financial Performance of Industrial companies with Using a New Theory: Literature Review. The Journal of Contemporary Issues in Business and Government, 27(2), 3846–3868.

- Andrew, J., & Cortese, C. (2011). Accounting for climate change and the self-regulation of carbon disclosures. Accounting Forum, 35, 130–138. [CrossRef]

- Athanas, A. (2005). The role of business in biodiversity and impact assessment. Impact Assessment and Project Appraisal, 23(1), 29–35. [CrossRef]

- Beck-O’Brien, M., & Bringezu, S. (2021). Biodiversity Monitoring in Long-Distance Food Supply Chains: tools, gaps and needs to meet business requirements and sustainability goals. Sustainability, 13(15), 8536. [CrossRef]

- Belt, J., Kuleshov, A., & Minneboo, E. (2017). Development impact bonds: learning from the Asháninka cocoa and coffee case in Peru. Enterprise Development and Microfinance, 28(1–2), 130–144. [CrossRef]

- Bendell, J. (2022). Replacing Sustainable Development: Potential frameworks for international cooperation in an era of increasing crises and disasters. Sustainability, 14(13), 8185. [CrossRef]

- Bhutta, U. S., Tariq, A., Farrukh, M., Raza, A., & Iqbal, M. K. (2022). Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technological Forecasting and Social Change, 175, 121378. [CrossRef]

- BIOFIN. (2021). Retrieved March 2, 2024, from https://www.biofin.org/.

- Bishop, J., Kapila, S., Hicks, F., Mitchell, P., & Vorhies, F. (2009). New business models for biodiversity conservation. Journal of Sustainable Forestry, 28(3–5), 285–303. [CrossRef]

- Boiral, O., Saizarbitoria, I. H., & Brotherton, M. (2017). Assessing and improving the quality of sustainability Reports: The Auditors’ perspective. Journal of Business Ethics, 155(3), 703–721. [CrossRef]

- Boiral, O. (2013). Sustainability reports as simulacra? A counter-account of A and A+ GRI reports. Accounting, Auditing & Accountability, 26(7), 1036–1071. [CrossRef]

- Bose, S. (2020). Evolution of ESG reporting frameworks. In Springer eBooks (pp. 13–33). [CrossRef]

- Bubna-Litic, K. (2004). Mandatory Corporate Environmental Reporting: Does It Really Work ? Chartered Secrataries Australia. https://opus.lib.uts.edu.au/bitstream/10453/1474/1/2004000319.pdf.

- Busco, C., Consolandi, C., Eccles, R. G., & Sofra, E. (2020). A preliminary analysis of SASB reporting: disclosure topics, financial relevance, and the financial intensity of ESG materiality. Journal of Applied Corporate Finance, 32(2), 117–125. [CrossRef]

- Carney, M. (2019). TCFD: Strengthening the foundations of sustainable finance. In Proceedings of the TCFD Summit; SUERF (The European Money and Finance Forum): Vienna, Austria.

- Carungu, J., Di Pietra, R., & Molinari, M. (2020). Mandatory vs voluntary exercise on non-financial reporting: does a normative/coercive isomorphism facilitate an increase in quality? Meditari Accountancy Research, 29(3), 449–476. [CrossRef]

- CBD (Convention on Biological Diversity). (2010). Global biodiversity outlook 3. Retrieved from CBD website: https://www.cbd.int/gbo3/.

- CBD S.o.t.C.o.BD. 2005 Handbook of the convention on biological diversity including its cartegana protocol on biosafety, 3rd edn, p. 1493. Montreal, Canada: Secretariat of the Convention on Biological Diversity.

- CDP and environmental disclosure standards and frameworks - CDP. (n.d.). https://www.cdp.net/en/guidance/environmental-disclosure-standards-and-frameworks.

- CDSB Framework | Climate Disclosure Standards Board. (2022, January 19). https://www.cdsb.net/cdsb-framework/.

- Charitou, A. (2022). Discussion of “The Evolution of Environmental Reporting in Europe: The Role of Financial and Non-Financial Regulation.” The International Journal of Accounting, 57(02). [CrossRef]

- Chofreh, A. G., & Goni, F. A. (2017). Review of Frameworks for Sustainability Implementation. Sustainable Development, 25(3), 180–188. [CrossRef]

- Choi, D., Gao, Z., & Jiang, W. (2020). Attention to global warming. https://econpapers.repec.org/article/ouprfinst/v_3a33_3ay_3a2020_3ai_3a3_3ap_3a1112-1145.html.

- Churchill, E. (2005). Environmental degradation and human well-being: Report of the millennium ecosystem assessment. Popul. Dev. Rev, 31, 389-398. [CrossRef]

- Cooper, S., & Michelon, G. (2022). Conceptions of materiality in sustainability reporting frameworks: commonalities, differences and possibilities. In Edward Elgar Publishing eBooks (pp. 44–66). [CrossRef]

- Damiani, M., Sinkko, T., Caldeira, C., Tosches, D., Robuchon, M., & Sala, S. (2023). Critical review of methods and models for biodiversity impact assessment and their applicability in the LCA context. Environmental Impact Assessment Review, 101, 107134. [CrossRef]

- Dasgupta, P., 2021. Economics of Biodiversity: the Dasgupta Review. https://assets.publ ishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file /962785/The_Economics_of_Biodiversity_The_Dasgupta_Review_Full_Report.pdf.

- Daugaard, D. (2019). Emerging new themes in environmental, social and governance investing: a systematic literature review. Accounting & Finance, 60(2), 1501–1530. [CrossRef]

- Deweerdt, T., Caltabiano, K., & Dargusch, P. (2022). Original research: How will the TNFD impact the health sector’s Nature-Risks management? International Journal of Environmental Research and Public Health, 19(20), 13345. [CrossRef]

- Disclosing through CDP: The business benefits. (2023). CDP. Retrieved January 16, 2024, from https://cdn.cdp.net/cdp-production/comfy/cms/files/files/000/007/896/original/Benefits_of_Disclosure_brochure_2023.pdf.

- Eccles, R. G., & Serafeim, G. (2013). The performance frontier: Innovating for a sustainable strategy. Harvard Business Review, 91(5), 50-60.

- Ermgassen, S. Z., Howard, M. W., Bennun, L., Addison, P., Bull, J. W., Loveridge, R., Pollard, E., & Starkey, M. (2022). Are corporate biodiversity commitments consistent with delivering ‘nature-positive’ outcomes? A review of ‘nature-positive’ definitions, company progress and challenges. Journal of Cleaner Production, 379, 134798. [CrossRef]

- Finance for Biodiversity. (2021). Finance and biodiversity: Overview of initiatives for financial institutions [online]. Retrieved from https://www.financeforbiodiversity.org/wp-content/uploads/Finance_and_Biodiversity_Overview_of_Initiatives_April2021.pdf’.

- Gazzo, A., & Bell, M. (2022). Why biodiversity may be more important to your business than you realize. EY. https://www.ey.com/en_gl/insights/assurance/why-biodiversity-may-be-more-important-to-your-business-than-you-realize.

- Gerged, A. M. (2020). Factors affecting corporate environmental disclosure in emerging markets: The role of corporate governance structures. Business Strategy and the Environment, 30(1), 609–629. [CrossRef]

- About us | GHG Protocol. (2024, February 9). https://ghgprotocol.org/about-us.

- Global Risks Report 2024 | World Economic Forum. (2024, January 12). World Economic Forum. https://www.weforum.org/publications/global-risks-report-2024/.

- Goswami, K., Islam, M. K., & Evers, W. (2022). Aspire to attaining sustainability? let’s understand contemporary sustainability or esg frameworks (Vol. 4). The Blue Planet-A Magazine on Sustainability.

- Goswami, K., Islam, M., & Evers, W. (2023). A case study on the blended reporting phenomenon: A Comparative analysis of Voluntary Reporting Frameworks and Standards—GRI, IR, SASB, and CDP. The International Journal of Sustainability Policy and Practice, 19(2), 35–64. [CrossRef]

- GRI - Mission & history. (n.d.). globalreporting.org. Retrieved January 7, 2024, from https://www.globalreporting.org/about-gri/mission-history/#:~:text=GRI%20was%20founded%20in%20Boston,of%20the%20UN%20Environment%20Programme.

- GRI (Global Reporting Initiative). (2020). Sustainability reporting standards: GRI 300: Disclosure on biodiversity impacts. Retrieved from GRI website: https://www.globalreporting.org/standards/gri-standards-download-center/.

- GRI 304: BIODIVERSITY 2016. (2018). Global Reporting. Retrieved January 16, 2024, from https://www.globalreporting.org/standards/media/1011/gri-304-biodiversity-2016.pdf.

- Guthrie, J., & Abeysekera, I. (2006). Content analysis of social, environmental reporting: what is new? Journal of Human Resource Costing & Accounting, 10(2), 114–126. [CrossRef]

- Hertati, L., Puspitawati, L., Gantino, R., & Ilyas, M. (2022). The Sales Volume and Operating Costs as Key Influencing Factors in Covid-19 Pandemic Era. Global Journal of Accounting and Economy Research, 3(1), 83–105.

- Houdet, J., Trommetter, M., & Wéber, J. (2012). Understanding changes in business strategies regarding biodiversity and ecosystem services. Ecological Economics, 73, 37–46. [CrossRef]

- Huang, C., Patsika, V., Triantafylli, A., & Zhang, Y. (2023). Mandatory greenhouse gas emissions reporting and firm environmental litigation risk. Accounting Forum, 47(2), 249–277. [CrossRef]

- Hurley, L., Ashley, R., & Mounce, S. R. (2008). Addressing practical problems in sustainability assessment frameworks. Proceedings of the Institution of Civil Engineers, 161(1), 23–30. [CrossRef]

- NEE (2023) Biodiversity on the balance sheet. Nat Ecol Evol 7:1333. [CrossRef]

- IFC. (2023). Understanding the Global Reporting Frameworks | Beyond the Balance Sheet. https://www.ifcbeyondthebalancesheet.org/understanding-global-reporting-frameworks.

- IFRS - General Sustainability-related Disclosures. (2023). Retrieved February 5, 2024, from https://www.ifrs.org/projects/completed-projects/2023/general-sustainability-related-disclosures/.

- In, S. Y., Lee, Y. J., & Eccles, R. G. (2023). Looking back and looking forward: A scientometric analysis of the evolution of corporate sustainability research over 47 years. Corporate Social Responsibility and Environmental Management. [CrossRef]

- Integrated Reporting Framework | Integrated Reporting. (2022). https://integratedreporting.ifrs.org/resource/international-ir-framework/.

- IPBES (Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services). (2019). Summary for policymakers of the global assessment report on biodiversity and ecosystem services. IPBES secretariat.

- IUCN Leaders Forum. (2022). IUCN. https://www.iucn.org/our-work/iucn-convening/iucn-leaders-forum.

- Jona, J., & Soderstrom, N. S. (2022). Evolution of climate-related disclosure guidance and application of climate risk measurement in research. In Edward Elgar Publishing eBooks (pp. 397–420). [CrossRef]

- Jonkman, M. (2023b, November 30). ESRS E4: Biodiversity and ecosystems. https://www.linkedin.com/pulse/esrs-e4-biodiversity-ecosystems-maya-jonkman-kulyabina--oda5f/.

- Katic, P., Cerretelli, S., Haggar, J., Santika, T., & Walsh, C. (2023). Mainstreaming biodiversity in business decisions: Taking stock of tools and gaps. Biological Conservation, 277, 109831. [CrossRef]

- Kedward, K., Ryan-Collins, J., & Chenet, H. (2022). Biodiversity loss and climate change interactions: financial stability implications for central banks and financial supervisors. Climate Policy, 23(6), 763–781. [CrossRef]

- Kholmi, M., & Nafiza, S. A. (2022). Pengaruh Penerapan Green Accounting dan Corporate Social Responsibility Terhadap Profitabilitas (Studi Pada Perusahaan Manufaktur Yang Terdaftar di BEI Tahun 2018-2019 ). Reviu Akuntansi Dan Bisnis Indonesia, 6(1), 143–155. [CrossRef]

- Kopnina, H., Zhang, S., Anthony, S. J., Hassan, A., & Maroun, W. (2024). The inclusion of biodiversity into Environmental, Social, and Governance (ESG) framework: A strategic integration of ecocentric extinction accounting. Journal of Environmental Management, 351, 119808. [CrossRef]

- Kotsantonis, S., & Serafeim, G. (2019). Four things no one will tell you about ESG data. Journal of Applied Corporate Finance, 31(2), 50–58. [CrossRef]

- Kunming-Montreal Global Biodiversity Framework And its monitoring framework. (2023, February 28). United Nations. Retrieved January 10, 2024, from https://seea.un.org/sites/seea.un.org/files/unsc_presentation_jillian_campbell_0.pdf.

- Kuprionis, Denise, and Pamela Styles. (2017). Translating Sustainability into a Language Your Board Understands. Corporate Governance Advisor 25 (5): 13–17. https://www.gsgboards.com/wp-content/uploads/2017/08/Corp-Gov-Advisor-Sept-Oct-2017-Translating-Sustainability-Into-A-Language-Your-Board-Understands-1.pdf.

- Kurth, T., Wübbels, G., Portafaix, A., Felde, A. M. Z., & Zielcke, S. (2021). The Biodiversity Crisis Is a Business Crisis. Boston Consulting Group. https://web-assets.bcg.com/fb/5e/74af5531468e9c1d4dd5c9fc0bd7/bcg-the-biodiversity-crisis-is-a-business-crisis-mar-2021-rr.pdf.

- Lähtinen, K., Guan, Y., Li, N., & Toppinen, A. (2016). Biodiversity and ecosystem services in supply chain management in the global forest industry. Ecosystem Services, 21, 130–140. [CrossRef]

- Layman, H., Akçakaya, H. R., Irwin, A., Ermgassen, S. Z., Addison, P., & Burgman, M. A. (2023). Short-term solutions to biodiversity conservation in portfolio construction: Forward-looking disclosure and classification-based metrics biodiversity conservation in portfolio construction. Business Strategy and the Environment. [CrossRef]

- Lehmann, I. (2023). Inspiration from the Kunming-Montreal Global Biodiversity Framework for SDG 15. International Environmental Agreements: Politics, Law and Economics, 23(2), 207–214. [CrossRef]

- Maltais, A., & Nykvist, B. (2020). Understanding the role of green bonds in advancing sustainability. Journal of Sustainable Finance & Investment, 1–20. [CrossRef]

- Marshall, J., & Toffel, M. W. (2004). Framing the Elusive Concept of Sustainability: A Sustainability Hierarchy. Environmental Science and Technology, 39(3), 673–682. [CrossRef]

- McElwee, P., Turnout, E., Chiroleu-Assouline, M., Clapp, J., Isenhour, C., Jackson, T., .. & Santos, R. (2020). Ensuring a post-COVID economic agenda tackles global biodiversity loss. One Earth, 3(4), 448-461.Sala, E., Mayorga, J., Bradley, D., Cabral, R., Atwood, T. B., Auber, A., .. & Lubchenco, J. (2021). Protecting the global ocean for biodiversity, food, and climate. Nature, 592(7856), 397-402. [CrossRef]

- McKean-Wood, N., Gaussem, J., & Hanks, J. (2016). Forging a Path to Integrated Reporting. Amsterdam, the Netherlands: GRI. Retrieved from https://integratedreportingsa.org/ircsa/wp-content/uploads/2017/05/GRI CLG_IntegratedReporting.pdf.

- Nedopil, C. (2022). Integrating biodiversity into financial decision-making: Challenges and four principles. Business Strategy and the Environment, 32(4), 1619–1633. [CrossRef]

- Negash, M. (2012). IFRS and environmental accounting. Management Research Review, 35(7), 577–601. [CrossRef]

- Newbold, T., Hudson, L. N., Hill, S. L. L., Contu, S., Lysenko, I., A, R., Senior, Börger, L., Bennett, D. J., Choimes, A., Collen, B., Day, J., De Palma, A., Dı́Az, S., Echeverría-Londoño, S., Edgar, M. J., Feldman, A., Garon, M., Harrison, M. L. K., Alhusseini, T. I., . . . Purvis, A. (2015). Global effects of land use on local terrestrial biodiversity. Nature, 520(7545), 45–50. [CrossRef]

- Nigel E. Stork, Chapter 21 - Biodiversity, Editor(s): Vincent H. Resh, Ring T. Cardé, Encyclopedia of Insects (Second Edition), Academic Press, 2009,Pages 75-80.

- O’Brien, K., Carmona, R., Gram-Hanssen, I., et al. (2023). Fractal approaches to scaling transformations to sustainability. Ambio. Advance online publication. [CrossRef]

- O’Dwyer, B., & Unerman, J. (2020). Shifting the focus of sustainability accounting from impacts to risks and dependencies: researching the transformative potential of TCFD reporting. Accounting, Auditing & Accountability, 33(5), 1113–1141. [CrossRef]

- Ögren, M. (2023, June 29). The journey of accounting for nature: A qualitative study of the strive to account for nature through translation of the TNFD framework from a Scandinavian Institutionalism perspective. https://hdl.handle.net/2077/77543.

- Purvis, A., & Héctor, A. (2000). Getting the measure of biodiversity. Nature, 405(6783), 212–219. [CrossRef]

- Ramanathan, V., & Feng, Y. (2009). Air pollution, greenhouse gases and climate change: Global and regional perspectives. Atmospheric Environment, 43(1), 37–50. [CrossRef]

- Rankin, D. J., Bargum, K., & Kokko, H. (2007). The tragedy of the commons in evolutionary biology. Trends in Ecology and Evolution, 22(12), 643–651. [CrossRef]

- Recommendations of the Task Force on Climate-related Financial Disclosures - Final Report. (2017, June). Bloomberg. Retrieved January 15, 2024, from https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf.

- Roberts, L., Hassan, A., Elamer, A. A., & Nandy, M. (2020). Biodiversity and extinction accounting for sustainable development: A systematic literature review and future research directions. Business Strategy and the Environment, 30(1), 705–720. [CrossRef]

- Rudgley, G., & Seega, N. (2021). Handbook for nature-related financial risks: Key concepts and a framework for identification [online]. Cambridge Institute for Sustainability Leadership and Banking Environment Initiative. https://www.cisl.cam.ac.uk/resources/ sustainable-finance-publications/handbook-nature-related-financial-risks.

- SASB Standards. (2023). Sustainability Accounting Standards Board. Retrieved January 16, 2024, from https://sasb.org/standards/materiality-finder/.

- Sustainability | Samsung Electronics. (2023). Sustainability | Samsung Electronics. Retrieved June 24, 2024, from https://www.samsung.com/global/sustainability/media/pdf/Samsung_Electronics_Sustainability_Report_2023_ENG.pdf.

- Scarpellini, S., & Álvarez-Etxeberría, I. (2023b). Trends in private sector engagement with biodiversity: EU listed companies’ disclosure and indicators. Ecological Economics, 210, 107864. [CrossRef]

- Secretariat of the Convention on Biological Diversity. (n.d.-b). Mainstreaming biodiversity in development cooperation. https://www.cbd.int/development/about/mainstreaming.shtml.

- Seidl, A., Mulungu, K., Arlaud, M., Van Den Heuvel, O., & Riva, M. (2020). Finance for nature: A global estimate of public biodiversity investments. Ecosystem Services, 46, 101216. [CrossRef]

- Smith, J., Bass, S., & Roe, D. (2020). Biodiversity mainstreaming: A review of current theory and practice. ResearchGate. https://www.researchgate.net/publication/347519511_Biodiversity_mainstreaming_A_review_of_current_theory_and_practice.

- Steffen, W., Richardson, K., Rockström, J., Cornell, S. E., Fetzer, I., Bennett, E. M., et al. (2015). Planetary boundaries: Guiding human development on a changing planet. Science, 347(6223). https://science.sciencemag.org/content/347/6223/1259855. [CrossRef]

- Stork, N. E. (2009). Re-assessing current extinction rates. Biodiversity and Conservation, 19(2), 357–371. [CrossRef]

- Susanti, I. D., Hertati, L., & Putri, A. U. (2023). THE EFFECT OF GREEN ACCOUNTING AND ENVIRONMENTAL PERFORMANCE ON COMPANY PROFITABILITY. CASHFLOW CURRENT ADVANCED RESEARCH ON SHARIA FINANCE AND ECONOMIC WORLDWIDE, 2(2), 320–331. [CrossRef]

- Sustainability Accounting Standards Board. (2020). Companies Reporting with SASB Standards. SASB. Retrieved from https://www.sasb.org/company-use/ sasb-reporters/.

- Tang, S., & Demeritt, D. (2017). Climate change and mandatory carbon reporting: Impacts on business process and performance. Business Strategy and the Environment, 27(4), 437–455. [CrossRef]

- Task Force on Climate-related Financial Disclosures: Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures. (2021, October). | TCFD). Retrieved January 16, 2024, from https://assets.bbhub.io/company/sites/60/2021/07/2021-TCFD-Implementing_Guidance.pdf.

- Taskforce on Nature-related Financial Disclosures. (2023). Additional Guidance by sector – TNFD. Retrieved January 29, 2024, from https://tnfd.global/tnfd-publications/?_sft_framework-categories=additional-guidance-by-sector#search-filter.

- Temple-West, P. (2019, October 6). Companies Struggle to Digest ‘Alphabet Soup’ of ESG Arbiters. Financial Times. Retrieved from https://www.ft.com/ content/b9bdd50c-f669-3f9c-a5f4-c2cf531a35b5.

- The Essential ESG Toolkit: Bloomberg Law: Comparison table: ESG frameworks. (2022). Bloomberg Law. Retrieved January 15, 2024, from https://pro.bloomberglaw.com.