1. Introduction

The intraday electricity market (IM) has an increasingly important role within the electricity market. For market participants, the intraday electricity market is the last option where they can, even shortly before the delivery date, respond to the current situation in the electricity grid or in their production, i.e., to buy or sell the respective amount of electricity. This article introduces real-life examples of the contribution of the intraday market to prevent and/or solve prevention and resolution of Sthe emergencies in the electricity system [

1,

2]. This article shows the positive contribution of the integration of the intraday electricity market into the Single Intraday Electricity Market in Europe (SIDC).

The liberalized market has not only brought new opportunities to involve individual market participants in electricity trading, but also brings greater complexity in the management of the electricity system. The ever-increasing share of decentralized generation with a high proportion of intermittent energy sources (mainly renewable) – such as wind and solar power plants, causes another demand on the Transmission System Operator´s (TSO) to ensure a balanced power system and to maintain nominal frequency in the electricity system. For transmission system operators, this means careful planning of a sufficient volume of Ancillary services (AnS) and subsequently activating these back-up sources or otherwise obtaining regulating energy. The price of regulating energy is one of the most important aspects in determining the price of the imbalance [

3,

4]. If the price of regulating energy at a given hour is high, the corresponding imbalance price is at least at the same level. Financial losses on the part of market participants, who have an imbalance at a given time, are noticeably increasing. The aim of this article is not to analyze processes on the part of the TSO, but to point out the existence of other opportunities that will help to solve exceptional situations in the transmission system.

One of the most important opportunities for market participants is their involvement in

the short-term electricity markets [

5]. On the Czech market, these short-term electricity markets are organized by OTE (the market operator) [

6]. In the Czech Republic, these short-term electricity markets currently consist of day-ahead

ahead before (spot) market that allow trading on days before

the delivery date and also an intraday marketplace (IM)

allowing trading which permits trade up to 5 minutes before the delivery hour starts [

7,

8].

These markets allow market participants to trade at a time close to the day or hour of delivery. Long-term trading primarily serves to ensure long-term price and expected load/generation, while short-term markets allow market participants to respond effectively to exceptional operational or trading situations. The aim and purpose of the short-term markets is not only to reduce the risk of imbalance, but also to increase security and reliability of supply and to offer the last opportunity for market participants to buy or sell electricity [

9].

Additionally, liquid short-term markets are important regarding their pricing influence, the final prices of trades on these markets are used as a basis for the settlement of financial instruments traded on commodity exchanges or serve as a guide for prices of other contracts between the market participants [

10].

Since the number of studies on the Czech intraday market is limited and there are

no actual studies concerning the impact of the intraday electricity trading on the Czech transmission system operation, the aim of this paper is to examine this matter and fill the gap.

2. Materials and Methods

2.1. Intraday Electricity Market

The intraday electricity market plays the most important role in the prevention and resolution of emergency situations in the electricity grid from the above-mentioned short-term markets. A well-functioning intraday market significantly helps to lower costs for the market participant with an imbalance and subsequently for the whole system [

11,

12].

Since 2004, this market has allowed market participants in the Czech Republic to continuously trade anonymous bids up

to until 60 minutes before

the start of the a delivery hour, Since 2021, however is this time being reduced by 5 minute prior start of the delivery hour. This type of trading gives market participants opportunities to react to in many different situations

on the market a marketplace,

e.g for example. the development of their consumption estimations or changes in the production of intermittent sources. Although it is an anonymous market,

it the site provides comprehensive market information. The submitted bids reflect actual market prices, market liquidity, and real-time changes in prices and volumes. This summary information changes during the time, the difference between the price of the offer for sale and the purchase determines the spread. Thus, market participants are at any time able to assess their potential in the electricity markets. This includes assessing the actual prices and the offered volumes of electricity, whether it is possible to generate additional trading profits or to sell or buy the necessary electricity to avoid imbalance and consequently the financial damage resulting therefrom. The development of traded quantities and prices on the intraday electricity market can also act as an indicator of the situation in the power system in cooperation with, for example, the system imbalance published on the TSO’s website. Examples of such conditions may be inaccurate predictions of solar power generation, when the production surplus could lead to significant price drops, and vice versa. Mainly at due to lower-than-expected production, there could be a significant increase in prices and

quantities volumes, as the market is reacting on to the market participants that are trying to fulfill the planned production by purchasing on the intraday market. Other examples might be public holiday or weather developments that could significantly affect electricity consumption, and last but not least, an unexpected system power outage may occur [

13,

14,

15].

The importance of the intraday market in the Czech Republic has further increased in connection with its integration with other European intraday electricity markets on 19 November 2019. The integration of the OTE intraday market took place on 3 out of 4 cross-border profiles - with Germany, Austria, and Poland. Nowadays all borders are incorporated, and 25 EU countries is involved in SIDC. A major change was the shift from explicit trading of cross-border capacities to the implicit trading. Explicit trading means that cross-border capacity and electricity are traded separately, while within the implicit cross-border capacity trading is cross-border capacity acquired together with electricity if the cross-border bids are matched. Another difference between explicit and implicit trading is that explicit trading works on the principle of bilateral electricity contracts. Within the implicit continuous trading, traders can anonymously trade electricity from all countries where the transmission capacity is available from/to the Czech Republic [

16,

17].

A positive sign of the integration of the intraday electricity market is the impact on the volatility of electricity prices. When comparing intraday electricity market operation before and after the connection to SIDC, price volatility is significantly lower and the intraday market prices achieved are more correlated with prices of the day-ahead electricity market. However, sufficient cross-border transmission capacities play an important factor, especially towards the German market. There is a plan to extend the possibilities to trade within the day by introduction of so-called Intraday Auctions which is planned in June 2024. These Intraday auctions will be implemented together with other European short-terms markets within SIDC cooperation [

18,

19].

2.2. The Intraday Electricity Market and the Loss of a Significant Production Volume in the Power System

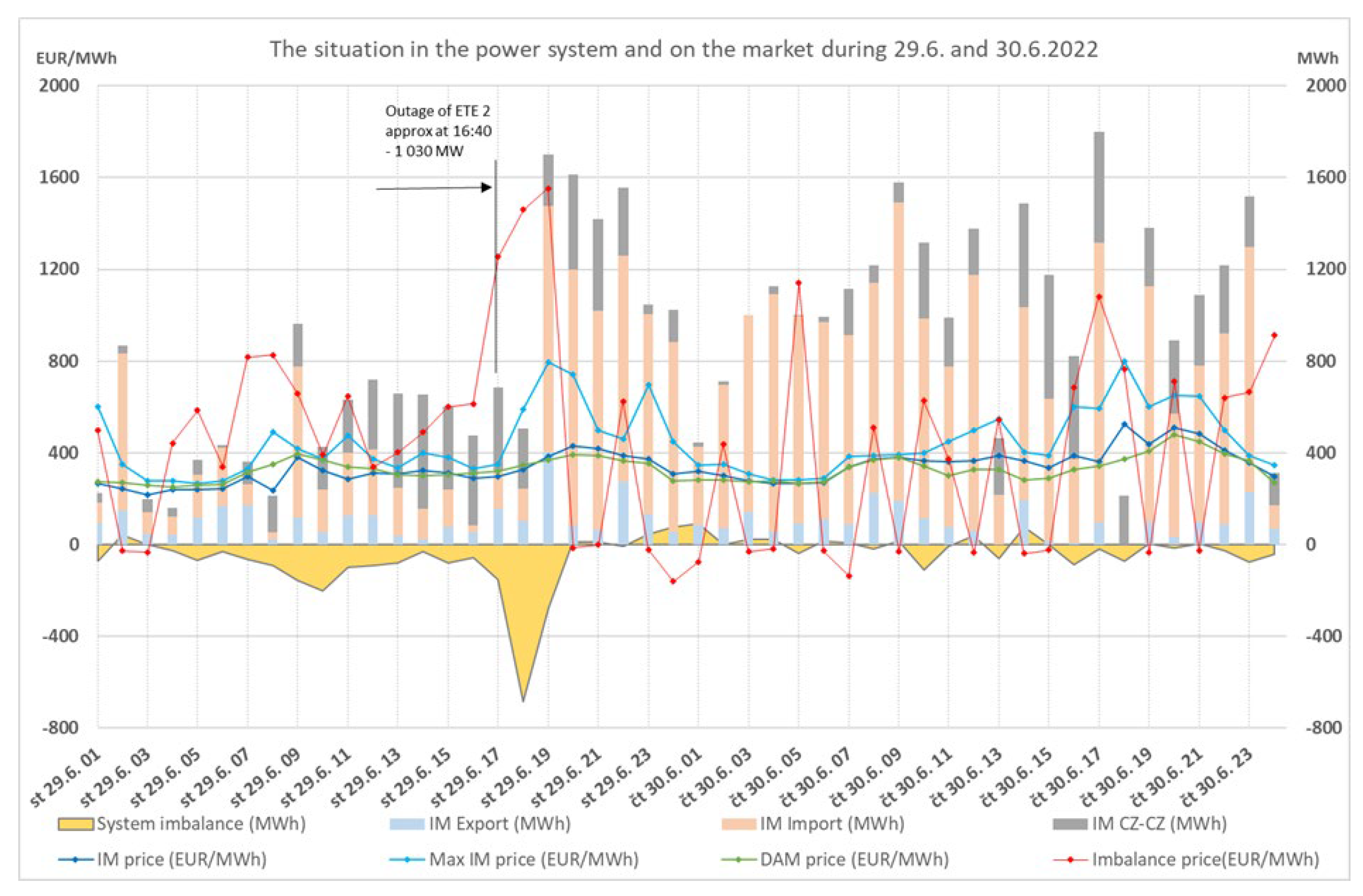

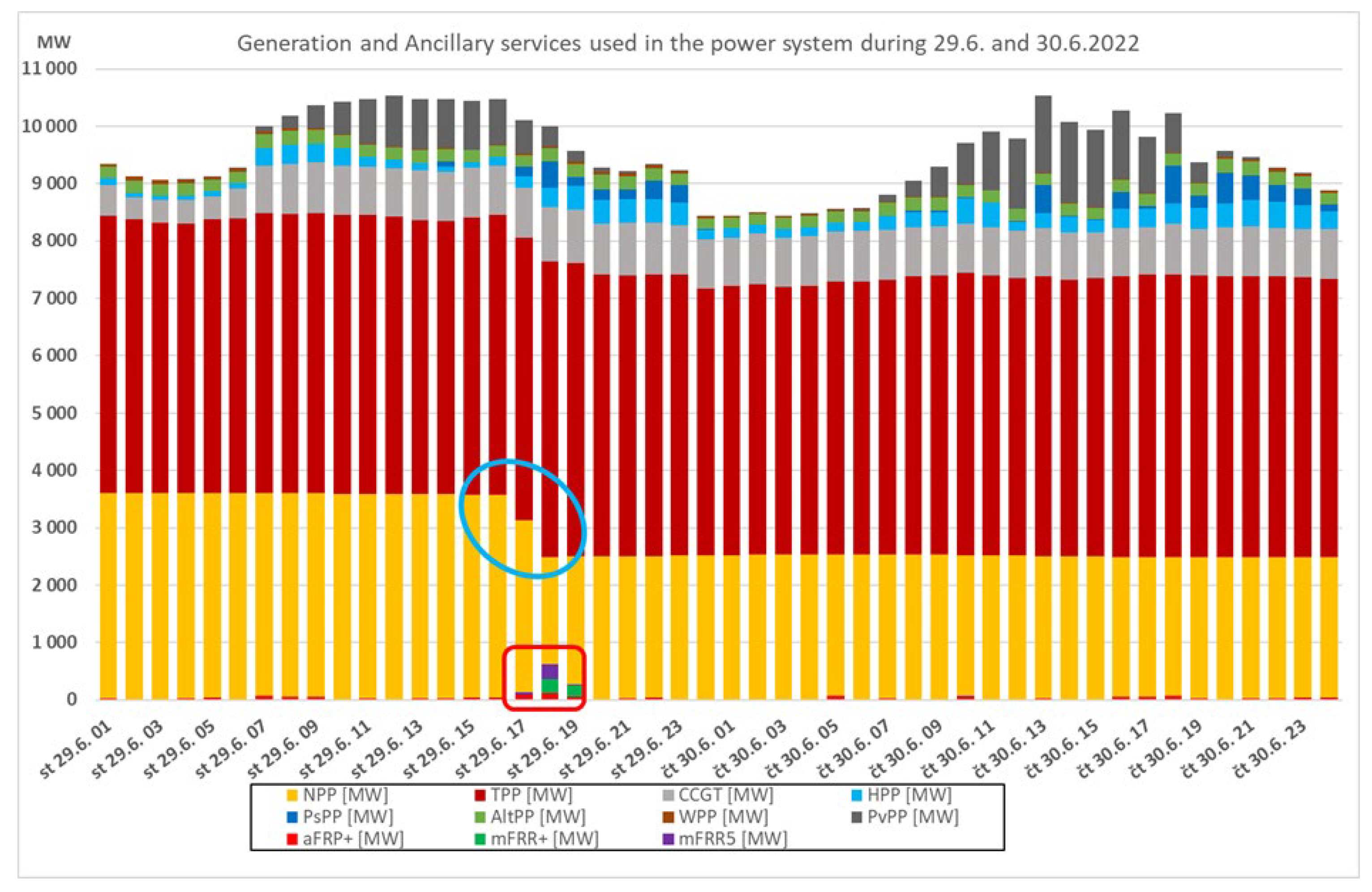

There is a rising the influence of IM in case of solving exceptional situations in the transmission system. The IM is creating price signals that results in “price spreads” between demand and supply. Typical example of a major operational event is the outage of the biggest power plants in the electricity grid on 29 June 2022.

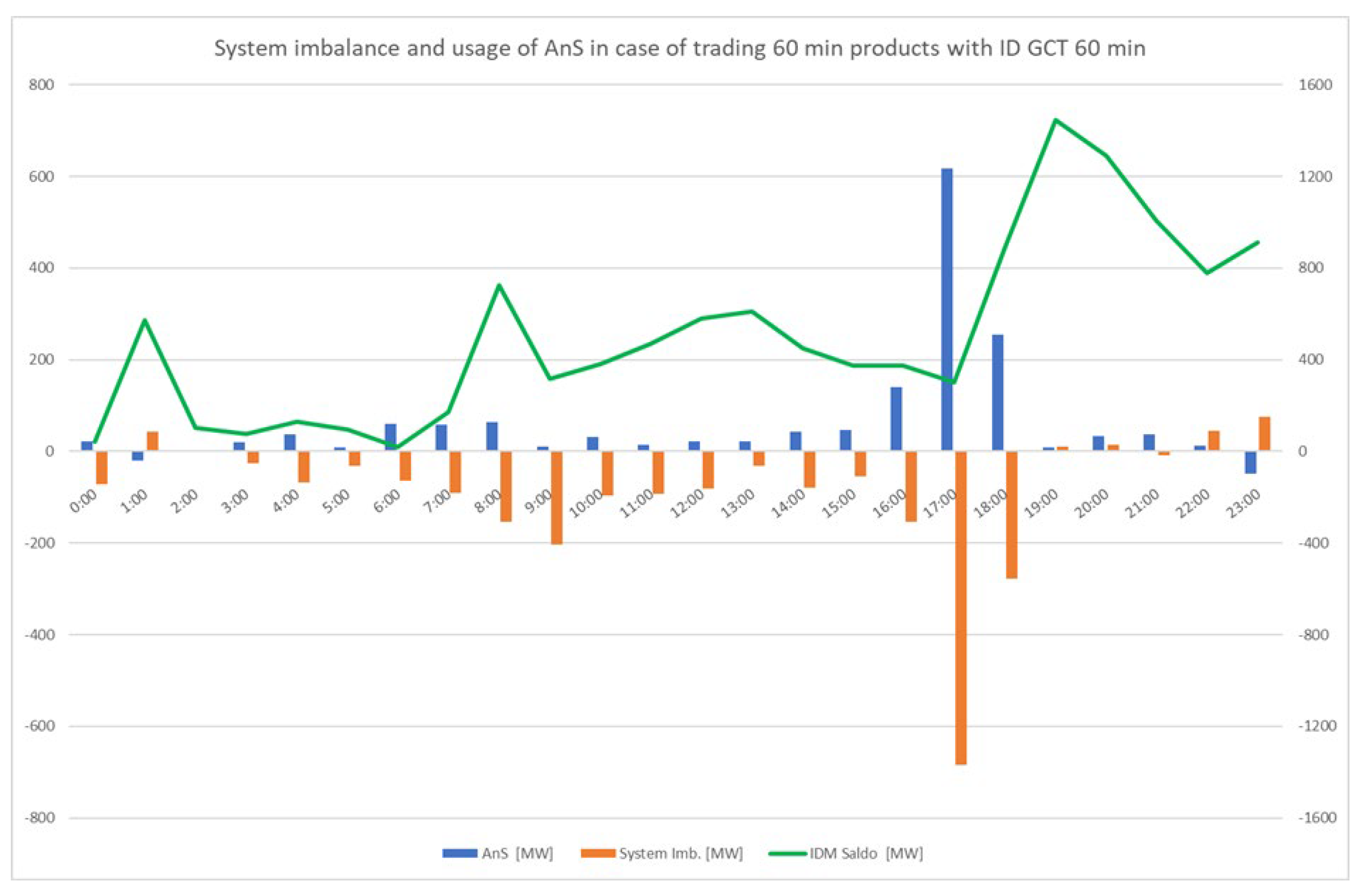

Figure 1 shows the situation in the power system around the outage of 1,030 MW units at around 16:40 on Wednesday 29.6.2022.

So, there was three impacted delivery hours where the activation of AnS was necessary. There was activation of 140 MWh of Ancillary Services by TSO and with combination of the activation of other units (mainly Hydro Power Plants and Pumped-Storage Power Plant), it results in the System Imbalance -153 MWh (see also

Figure 2) in 17th delivery hour. During the 18th delivery hour was activated 618 MWh of AnS and System Imbalance was -685 MWh and in 19th delivery hour, there was activated 255 MWh of Ancillary Services and total System Imbalance in this hour was -278 MWh. Next delivery hours were not directly impacted by this outage in the sense of activation of Ancillary Services by TSO.

The imbalance price rise in these hours between 1.200 and 1.600 EUR/MWh (red line).

The first tradable hour on the market was 19th delivery hour of June 29 where was bought 1.070 MWh of imported power (pink column), 226 MWh was traded locally (grey column) and 405 MWh was exported (blue column), so the saldo of IM was 890 MWh that helps limited the system imbalance during this delivery hour.

For the 20th delivery hour, there was bought 1.116 MWh of imported power, and the exported power was only 84 MWh, so the System Imbalance was +10 MWh with price 14 EUR/MWh, compared with price of previous delivery hour that was 1.554 EUR/MWh, the positive impact of intraday trading is clear.

As there were enough cross-border capacities also during following delivery hours, there was traded more than 800 MWh of imported power in 12 out of 14 delivery hours. Sufficient liquidity of the market based on the availability of the cross-border capacities also enable to maintain the average weighted price on IM market (dark blue line) very close to day-head price (green line), even the maximum price of individual trades raised up to double during the first hours after the outage (light blue line).

3. Results

Case study

The basis for this case study was the data from the outage on 29/06/2022, which is described above, and when the following state within the system was as follows:

Calculation of the system imbalance and activation of Ancillary services took place in 60-minute granularity.

Trading on the intraday electricity market (IDM) took place with 60-minute products, with the deadline for cross-border trading (ID GCT) being 60 minutes before the start of the delivery hour.

As described in previous chapter, the outage of 1.030 MW unit happened at 16:40, so as it is shown on the

Figure 3, there are impacted 3 (three) delivery hours/imbalance intervals (16-17, 17-18 and 18-19).

The difference between the size of the unit (1.030 MW) that was in fault and the size of the activated AnS (618 MW) during delivery hour 17-18 is given by the fact that the operator of this unit has at its disposal, among other, a fast-starting pumped-storage power plant with an installed capacity of 320 MW that was activated shortly after the outage.

There was no possibility to trade for the first two impacted delivery hours, but for the third one (18-19) such volume of electricity was traded that the need for activated AnS was reduced to half the value of the previous hour.

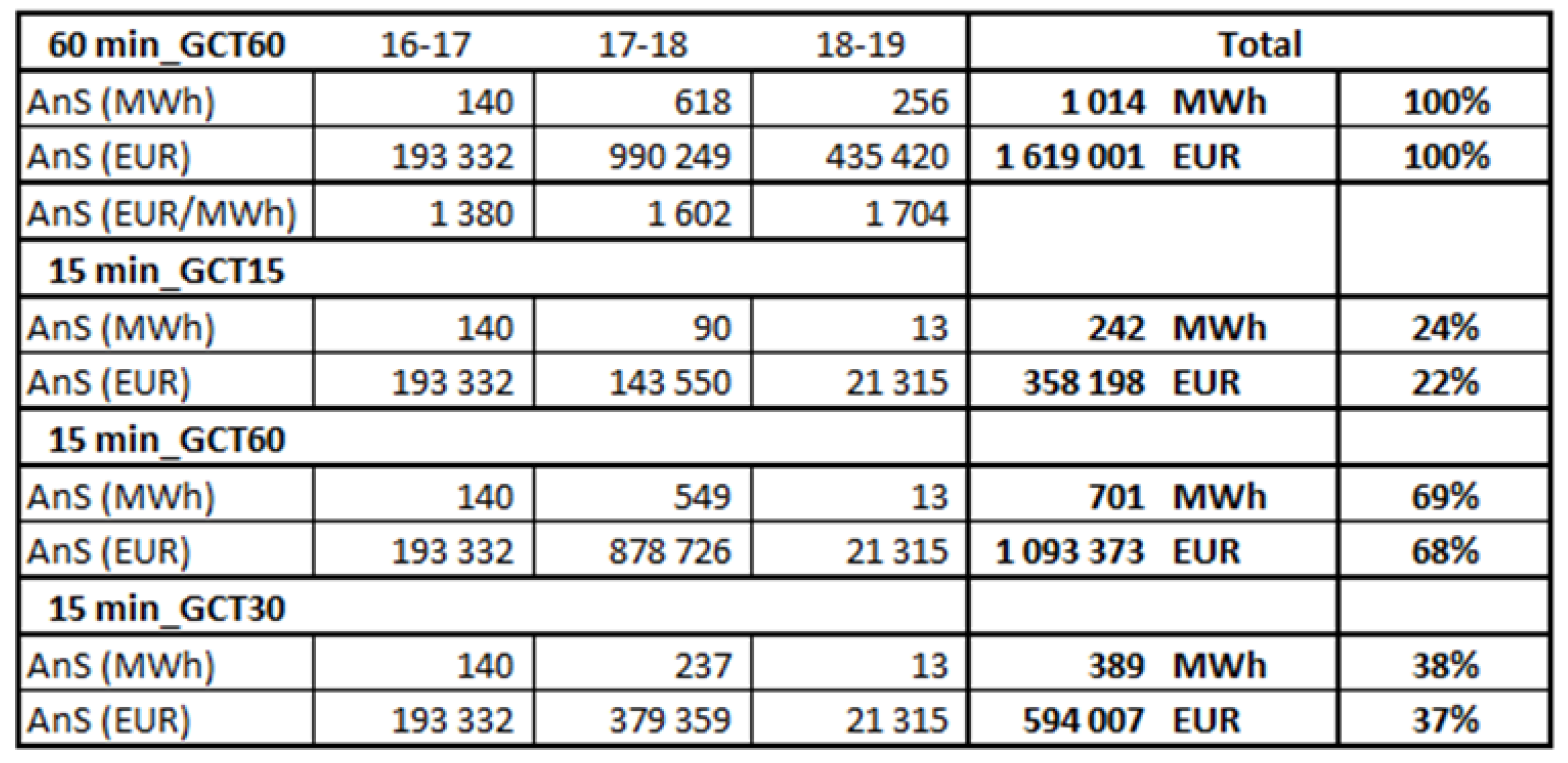

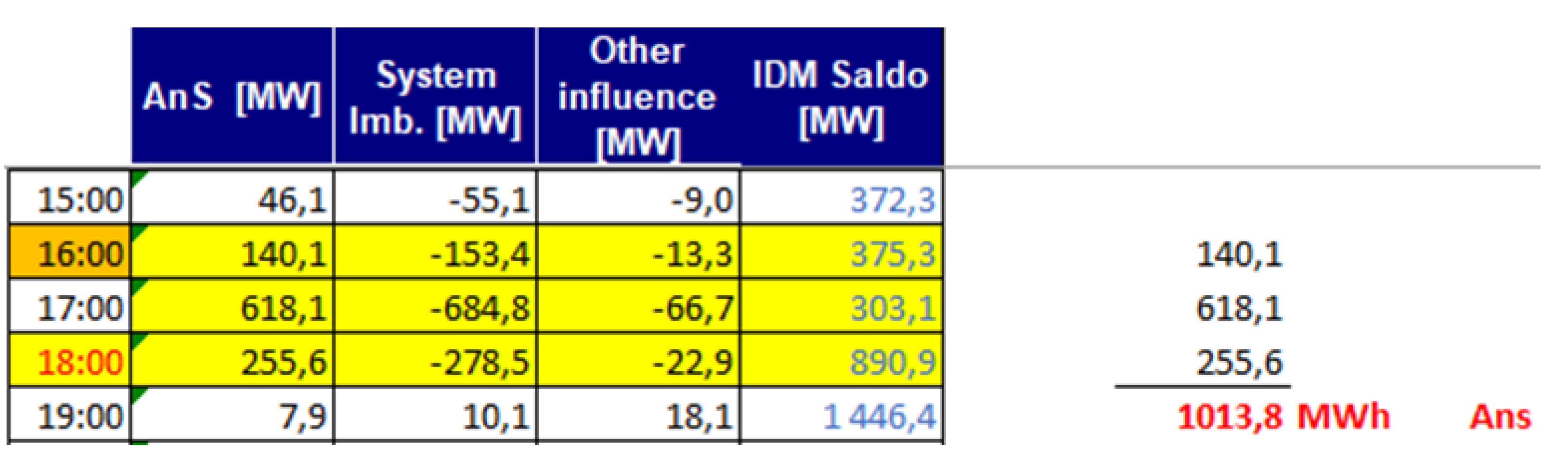

Figure 4 shows in yellow cells volume of activated AnS, total System Imbalance, other influence to SI a Local trades) related to mentioned outage. Total volume of activated AnS was 1.014 MWh with overall price 1.619.001 EUR.

There are prices of the activated AnS are accessible on the OTE website [

20], so the activation of AnS in the delivery hour 16-17 cost a total of 193.332 EUR, which is converted to a unit price 1.380 EUR/MWh, in the hour 17-18 it was a totally 990.249 EUR, i.e., with 618 MWh of activated AnS it comes to 1.602 EUR/MWh. In the delivery hour 18-19, the activation of 256 MWh of AnS cost 435.420 EUR, so it is 1.704 EUR/MWh.

These unit prices will be used for following cases for valuation of activated AnS. This approach is not fully correct because the AnS are activated from the cheapest price to more expensive ones. So, in real state the price for activated AnS shall be lower, but as the prices are not public, but since the prices are not public, the average price approach used is sufficient for cost comparison.

The following 3 states are considered in this case study:

-

15 min_ID GCT 15 min

Calculation of the system imbalance and activation of AnS would take place in 15-minute granularity,

Trading on the intraday electricity market took place with 15-minute products, with the deadline for cross-border trading (ID GCT) being 15 minutes before the start of the delivery hour.

-

15 min_ID GCT 60 min

Calculation of the system imbalance and activation of AnS would take place in 15-minute granularity,

Trading on the intraday electricity market took place with 15-minute products, with the deadline for cross-border trading (ID GCT) being 60 minutes before the start of the delivery hour.

This status is assumed to be active within the transmission system from 1 July 2024 [

21].

-

15 min_ID GCT 30 min

Calculation of the system imbalance and activation of AnS would take place in 15-minute granularity,

Trading on the intraday electricity market took place with 15-minute products, with the deadline for cross-border trading (ID GCT) being 30 minutes before the start of the delivery hour.

This status is expected to be active within the transmission system from 1.1.2026 at the latest [

22].

For the purposes of this case study, the AnS activation data on June 29, 2022, in 15-minute and 30-minute resolution will be used [

23].

The traded quantity on IDM will be considered with the same dynamics with which it was traded within the 60-minute products. The specified GCT ID influences which trading period can already be traded in response to an outage.

The interval from 16:00 to 19:00, when the imbalance in the system was caused by this outage, will be essential for assessing the effect of the length of the system imbalance calculation period, IDM products and activation of support services.

15 min_ID GCT 15 min

The following state within the system is considered as follows:

Calculation of system imbalance and activation of AnS would take place in 15-minute granularity,

Trading on the intraday electricity market took place with 15-minute products, with the deadline for cross-border trading (ID GCT) being 15 minutes before the start of the delivery hour.

The trading deadline for all contracts on IDM is 5 minutes before the delivery interval, however, the local market is not as liquid as the connected European market, moreover, if an outage occurs on the side of a major producer in the BZ, the liquidity will decrease even more.

Figure 5 shows similarly as previous ones, that there are impacted 3 (three) delivery/imbalance intervals (16:30-16:45, 16:45-17:00 and 17:00-17:15).

Now we can also use unit prices calculated from hourly products for price of activation AnS in case of 15 minutes imbalance period. So, the activation of AnS in the imbalance periods between 16-17 costs also 193.332 EUR (13,4 MW*0,25 h + 17,9 MW*0,25 h + 115,8 MW*0,25 h + 413,2 MW*0,25 h = 140 MWh * 1.380 EUR/MWh), because no difference could happen also in 15 minutes interval.

Activation of the lower amount of AnS is expected in the first 15 minutes interval of the time interval 17-18 because of intraday trading and following 3 ones are expected to be balanced by trading on IDM, so the total volume of activated AnS is 90 MWh (320,9 MW*0,25 h + 12,5 MW*0,25 + 12,5 MW*0,25 + 12,5 MW*0,25). So, we can use for the whole interval 17-18 calculated unit price 1.602 EUR/MWh, and it gives us total activation price 143.550 EUR.

In the delivery hour 18-19, the activation of only 13 MWh of AnS at price 1.704 EUR/MWh costs 21.315 EUR.

In case of 15-minutes System Imbalance interval with 15-minutes IDM products with 15 minutes GCT, total volume of activated AnS would be 242 MWh with overall price 358.198 EUR.

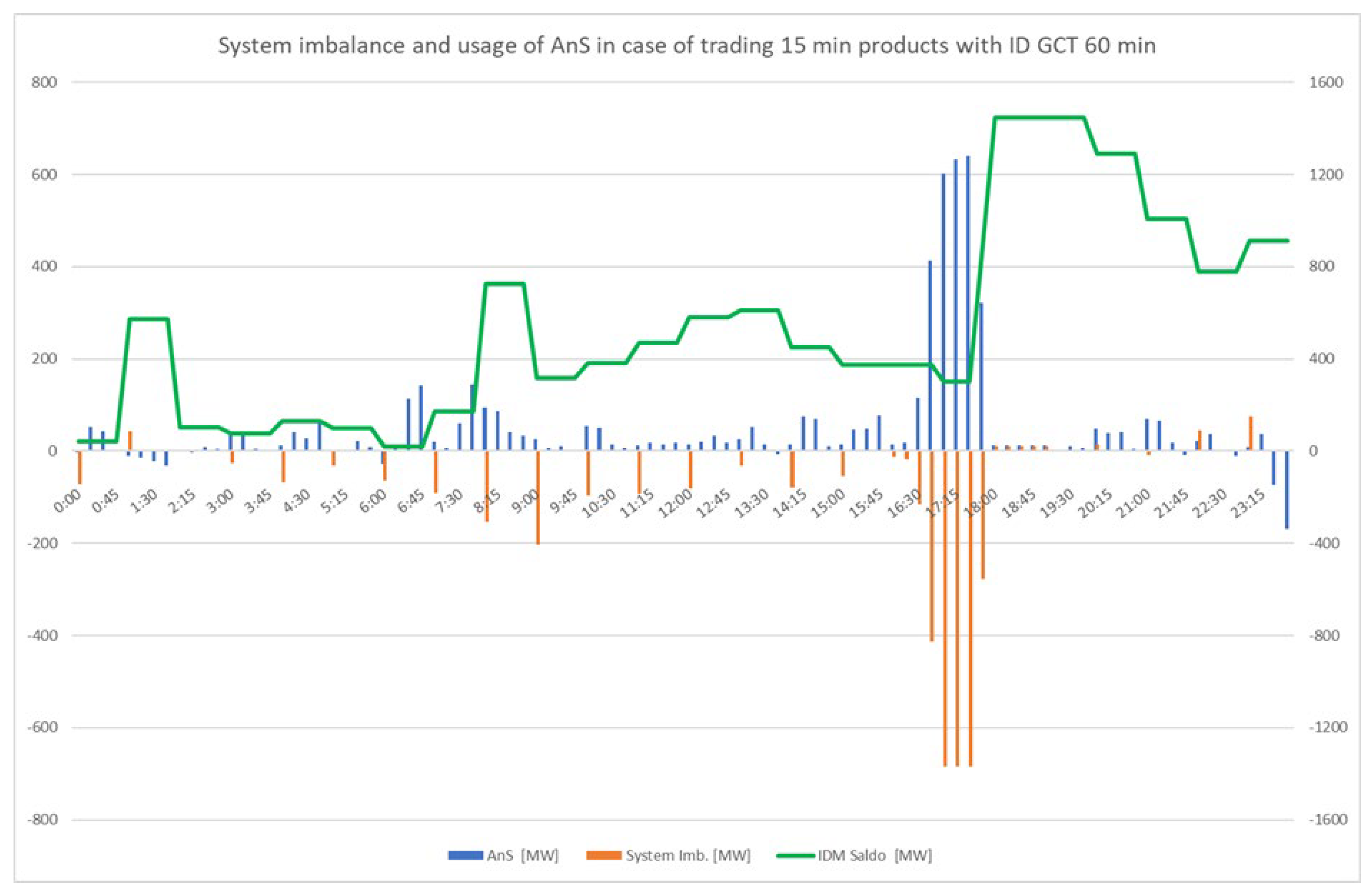

15 min_ID GCT 60 min

The following state within the system is considered as follows:

Calculation of system imbalance and activation of AnS would take place in 15-minute granularity,

Trading on the intraday electricity market took place with 15-minute products, with the deadline for cross-border trading (ID GCT) being 60 minutes before the start of the delivery hour.

Figure 6 shows that because of GCT 60 minutes that allows to trade as first delivery interval 17:45 – 18:00, so there are impacted 6 (six) delivery/imbalance intervals (16:30-16:45, 16:45-17:00, 17:00-17:15, 17:15-17:30, 17:30-17:45 and 17:45-18:00).

Now we use unit prices calculated from hourly products for price of activation AnS in case of 15 minutes imbalance period.

So, costs of the activation of AnS in the imbalance periods between 16-17 are still 193.332 EUR (13,4 MW*0,25 h + 17,9 MW*0,25 h + 115,8 MW*0,25 h + 413,2 MW*0,25 h = 140 MWh * 1.380 EUR/MWh), because no difference could happen also in 15 minutes interval.

Activation of the lower amount of AnS is expected in the last 15 minutes interval of the time interval 17-18 because of intraday trading, so the total volume of activated AnS is 549 MWh (601,3 MW*0,25 h + 632,0 MW*0,25 + 639,8 MW*0,25 + 320,9 MW*0,25). So, we use for the whole interval 17-18 calculated unit price 1.602 EUR/MWh, and it gives us total activation price 878.726 EUR.

In the delivery hour 18-19, all intervals are expected to be balanced by trading on IDM, so the activation of only 13 MWh of AnS at price 1.704 EUR/MWh cost 21.315 EUR.

In case of 15-minutes System Imbalance interval with 15-minutes IDM products with 60 minutes GCT, total volume of activated AnS would be 701 MWh with overall price 1.093.373 EUR.

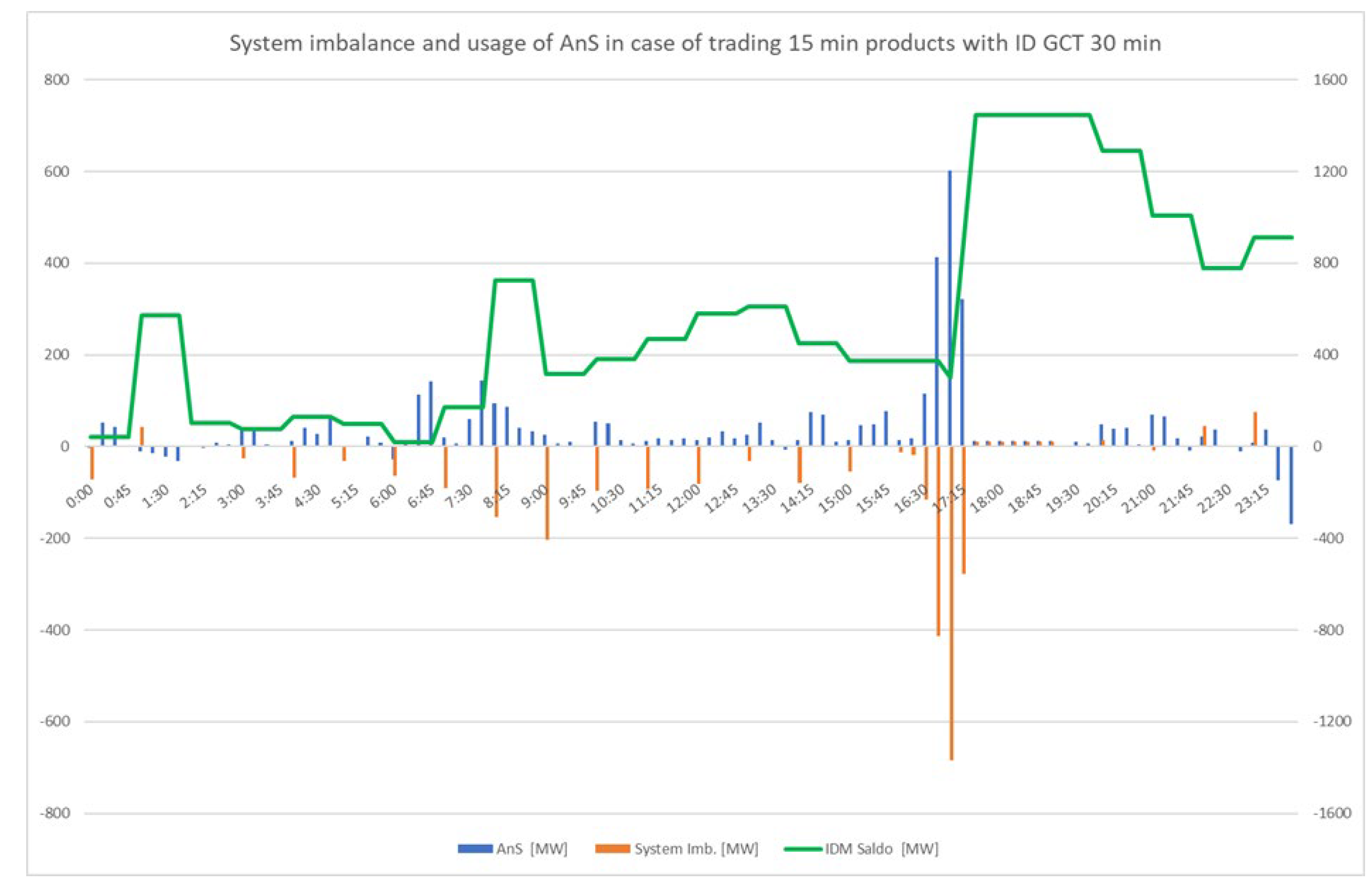

15 min_ID GCT 30 min

The following state within the system is considered as follows:

Calculation of system imbalance and activation of AnS would take place in 15-minute granularity,

Trading on the intraday electricity market took place with 15-minute products, with the deadline for cross-border trading (ID GCT) being 30 minutes before the start of the delivery hour.

Figure 7 shows that because of GCT 30 minutes that allows to trade as first delivery interval 17:15-17:30, so there are impacted 4 (four) delivery/imbalance intervals (16:30-16:45, 16:45-17:00, 17:00-17:15 and 17:15-17:30).

We use unit prices calculated from hourly products for price of activation AnS in case of 15 minutes imbalance period. So, the costs of the activation of AnS in the imbalance periods between 16-17 are still 193.332 EUR (13,4 MW*0,25 h + 17,9 MW*0,25 h + 115,8 MW*0,25 h + 413,2 MW*0,25 h = 140 MWh * 1.380 EUR/MWh), because no difference could happen also in 15 minutes interval.

Activation of the lower amount of AnS is expected in the second 15 minutes interval of the time interval 17-18 because of intraday trading and following 2 ones are expected to be balanced by trading on IDM, so the total volume of activated AnS is 237 MWh (601,3 MW*0,25 h + 320,9 MW*0,25 + 12,5 MW*0,25 + 12,5 MW*0,25). So, we use for the whole interval 17-18 calculated unit price 1.602 EUR/MWh, and it gives us total activation price 379.359 EUR.

In the delivery hour 18-19, all intervals are expected to be balanced by trading on IDM, so the activation of only 13 MWh of AnS at price 1.704 EUR/MWh cost 21.315 EUR.

In case of 15-minutes System Imbalance interval with 15-minutes IDM products with 30 minutes GCT, total volume of activated AnS would be 389 MWh with overall price 594.007 EUR.

4. Conclusions

. If we compare the results of individual cases, from the a point-of view of to minimized, the number of affected intervals – namely and 3, when, in the an ideal case, there is a possibility when that the 3rd interval increment could already be balanced on the IDM. So it would be ideal if the have been perfectif length of the was same for imbalance interval, trading interval, and GCT was the same.

As the value of GCT increases, the so does a number of intervals during which it is not possible to trade increases. This limits the of MP’s possibility to settle for setting its position as soon as possible and increasing the necessity of in activating AnS.

The volume of activated AnS and its price in individual trading periods has main impact to the imbalance price of impacted period, because the highest price of activated AnS is creating the price of system imbalance in CZ.

As the interval shortens, the a need for activated energy decreaseetho. Although however in terms of power it is necessary to cover the an outage as in the same way as with longer intervals times. This can have a negative impact on the use of units with lower dynamics. Ideal from this point of view would be hydroelectric plants and gas or PPC units.

Figure 8.

Usage and total price of AnS in individual cases.

Figure 8.

Usage and total price of AnS in individual cases.

Shortening all 3 parameters from 60 minutes to 15 minutes would reduce the activated energy from AnS by 76% and the price by at least 78%. This turned out to be an ideal solution, however, such a setting is unattainable under the current situation on the TSO side within the SIDC.

For the situation that should occur within the transmission system from 1.7.2024, which is a shortening of the imbalance and trading interval to 15 minutes while keeping the GCT at 60 minutes, there would be a reduction of the activated energy from AnS by 31% and the price by at least 32%.

From 1.1.2026, when the GCT will be shortened to 30 minutes, the activated energy from AnS could be reduced by 62% and the price by at least 63%.

Although not the best result, it is still the second best and the result shows a significant decrease in the required energy from AnS, which does not need to be activated. At the same time, a decrease in the total price of activated AnS, even if there could be a high unit price for activation, will be a motivation for MPs to balance their imbalances within the IDM.

The optimal solution from the Case study is not reachable in the close future but the European legislation that regulates energy sector is directing energy markets to be able to handle with the second-best case. The first important step was harmonization of the imbalance settlement period to 15 minutes, and another is shortening of the deadline for cross-border trading (ID GCT) to 30 minutes.

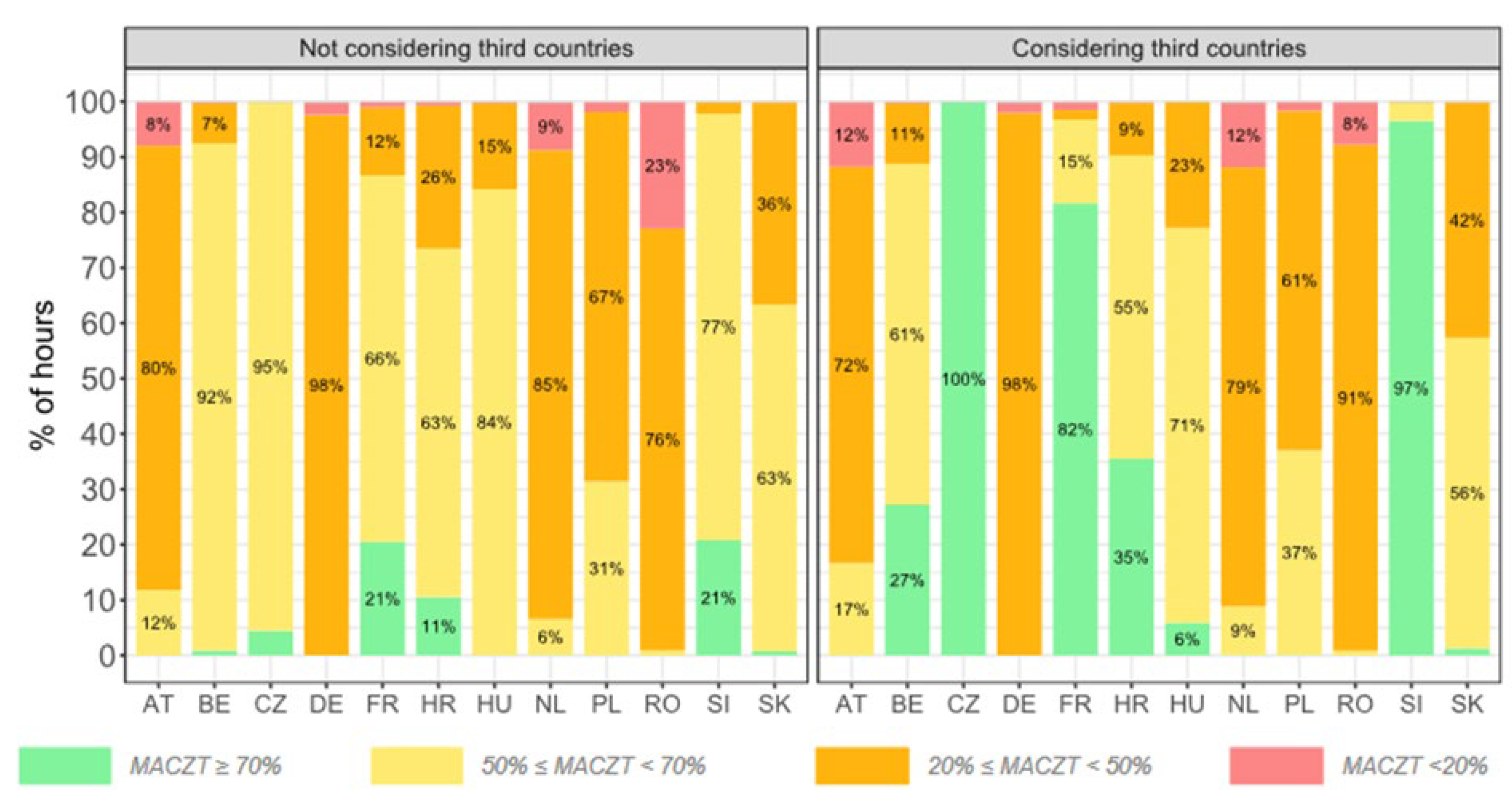

This is ideal state that could be limited in case that there are not sufficient cross border capacities, mainly with Germany.

Figure 9.

Percentage of hours when the minimum 70% target was reached in the CORE region (between 9. 6. 2022 and 31. 12. 2022 [

24].

Figure 9.

Percentage of hours when the minimum 70% target was reached in the CORE region (between 9. 6. 2022 and 31. 12. 2022 [

24].

But Clean Energy for All Europeans Package sets a minimum level of cross-zonal capacity - also called Margin Available for Cross-Zonal Trade (MACZT) – to be offered to the market by Transmission System Operators (TSOs), respecting operational security limits. This minimum 70% target took effect in 2020. The Electricity Regulation allows Member States to adopt transitional measures to gradually reach the minimum 70% target, by the end of 2025 at the latest.

Acknowledgments

The authors would like to acknowledge the Department of Electrical Power Engineering, Czech Technical University in Prague for providing the facilities for research development

NATIONAL CENTER FOR ENERGY / Project number: TN02000025, The project is co-financed by the Technology Agency of the Czech Republic

Conflict of Interest

The authors declare no conflict of interest

Use of AI tools declaration

The authors declare they have not used Artificial Intelligence (AI) tools in the creation of this article.

References

- Scharff, R., & Amelin, M. (2016). Trading behaviour on the continuous intraday market Elbas. Energy Policy, 88, 544–557. [CrossRef]

- Zalzar, S., Bompard, E., Purvins, A., & Masera, M. (2020). The impacts of an integrated European adjustment market for electricity under high share of renewables. Energy Policy, 136, 111055. [CrossRef]

- Chemišinec I. et al.: Obchod s elektřinou, Conte, 2010 .

- Clò, S., & Fumagalli, E. (2019). The effect of price regulation on energy imbalances: A Difference in Differences design. Energy Economics, 81, 754–764. [CrossRef]

- Jackson. R, Onar. O, Kirkham. H, Fisher. E, Burkes. K, Starke. M, Mohammed. O, Weeks. G; Opportunities for Energy Efficiency Improvements in the U.S. Electricity Transmission and Distribution System , ORNL/TM-2015/5.

- https://www.ote-cr.cz/en/short-term-markets/electricity/day-ahead-market. (Accessed on 25 April 2024).

- Naval, N., & Yusta, J. M. (2021). Virtual power plant models and electricity markets - A review. Renewable and Sustainable Energy Reviews, 149, 111393. [CrossRef]

- T: autorů, 2016; 8. Kolektiv autorů: Trh s elektřinou, Asociace energetických manažerů, 2016.

- https://www.europex.org/press-releases/cep-eu-electricity-market-design-press-release.( Accessed on 2 May 2024).

- Glantz, M., & Kissell, R. (2014). Equity Derivatives. Multi-Asset Risk Modeling, 189–215. [CrossRef]

- Gasparella, A., Koolen, D. and Zucker, A., The Merit Order and Price-Setting Dynamics in European Electricity Markets, European Commission, Petten, 2023, JRC134300 .

- International Bank for Reconstruction and Development / The World Bank, Wholesale Electricity Market Design, Washington, DC., 2022.

- Balardy, C. Auction and Continuous Market for Power: Organization and Microstructure. Ph.D. Thesis, Université Paris-Dauphine, Paris, France, 2021.

- MCSC. MESC—Market Europe Stakeholder Committee. 2022. Available online: https://eepublicdownloads.azureedge.net/clean-documents/Network%20codes%20documents/MESC/2022%20MESC%20documents/220914_MESC_3.4_Update%20on%20MCSC.pdf (Accessed on 3 June 2024).

- CNMC; ERSE. Request for Amendments of the Spanish and Portuguese Regulatory Authorities on Common Spanish and Portuguese TSOs and NEMO Proposal for Complementary Intraday Regional Auctions in Accordance with Article 63 of Commission Regulation (EU) 2015/1222 of 24 July 2015 Establishing a Guideline on Capacity Allocation and Congestion Management. 2017. Available online: https://www.cnmc.es/sites/default/files/Request%20For%20Amendments.pdf (Accessed on 17 June 2024).

- https://www.epexspot.com/en/marketcoupling. (Accessed on 9 June 2024).

- https://www.iea.org/articles/czech-republic-electricity-security-policy. (Accessed on 18 June 2024).

- Stojanović, B.; Kostić, Z. Convergence of Economic Performance in the European Union. In Researching Economic Development and Entrepreneurship in Transitional Economies; Ateljević, J., Trivić, J., Eds.; KarlFranzens-Universität Graz: Graz, Austria, 2015; pp. 55–66.

- Alberizzi, Andrea & Grisi, Paolo & Zani, Alessandro. (2021). Analysis of the SIDC market on relationship between auctions and continuous trading. 1-5. [CrossRef]

- https://www.ote-cr.cz/cs/statistika/odchylky-elektrina?version=2&date=2024-04-29. (Accessed on 29 April 2024).

- relevant legislative requirements (Regulation of the European Parliament and of the Council (EU) 2019/943 and Decree No. 408/2015 Coll. on Electricity Market Rules).

- REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL amending Regulations (EU) 2019/943 and (EU) 2019/942 as well as Directives (EU) 2018/2001 and (EU) 2019/944 to improve the Union’s electricity market design(= ‘‘EMDR‘‘), 19 December 2023 .

- https://www.ceps.cz/cs/data#AktivaceSVRvCR (Accessed on 12 May 2024).

- Cross-zonal capacities and the 70% margin available for cross-zonal electricity trade (MACZT) 2023 Market Monitoring Report, ACER.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).