1. Introduction

The debate within the scientific community regarding power-law behavior in social and physical systems has been long-standing [

1,

2]. Typically, power-law behavior is observed at the macro level of a system, prompting researchers to seek microscopic interpretations of these phenomena. Mathematically, the power-law is unique in its satisfaction of the scale-free property

[

1], establishing a close relationship between the self-similarity of stochastic processes and power-law behavior [

3]. This statistical property is a characteristic feature of both social and financial systems. Measures of long-range memory based on self-similarity are often ambiguous, as Markov processes with power-law statistical properties can exhibit long-range memory, including slowly decaying auto-correlation [

4,

5,

6,

7,

8,

9,

10,

11,

12]. Financial markets, in particular, provide empirical limit order book (LOB) data that exhibit these power-law statistical properties [

13].

From the perspective of econophysics, it is essential to provide microscopic interpretations of econometric models that typically serve as macroscopic descriptions of complex social systems. These models frequently rely on assumptions of self-similarity and long-range dependence. To deepen our understanding of long-range memory in social systems, it is crucial to integrate macroscopic modeling with empirical analyses. In our prior review [

14], we questioned whether the observed long-range memory in social systems arises from true long-range memory processes or merely from the non-linearity inherent in Markov processes.

In this contribution, we demonstrate the critical role of assumptions regarding fractional Lévy stable motion (FLSM) and illustrate how a straightforward model of opinion dynamics can challenge these assumptions. Our proposed model is empirically grounded on the order imbalance time series from financial markets [

15,

16]. Empirical data from order books reveal that market order flows exhibit long-range persistence, a behavior attributed to the order-splitting actions of individual traders [

17]. This finding supports the existence of genuine long-range memory in financial systems, recently confirmed by a comprehensive investigation [

18]. The order-splitting behavior of traders should be evident in the sequence of submitted limit orders.

Section 2 provides a brief overview of the limit order time series, serving as the foundation for a broader interpretation of opinion dynamics. In

Section 3, we present a model of power-law waiting times arising from a system of heterogeneous agents.

Section 4 offers evidence of the broken self-similarity assumption when opinion cancellation is included in the model. Finally, we discuss our results and offer conclusions in

Section 5.

2. Modeling Limit Order Flow and/or Opinion Dynamics

In our recent work [

15], we analyzed the sequence of limit order submissions to the market, denoted as

:

where

represents the volume of the submitted limit order. We examined

through the lens of fractional Lévy stable motion (FLSM), as the probability density functions (PDFs) of order volumes

exhibit power-law tails. We documented fluctuations in the memory parameter for various stocks, finding values in the range

. Despite the rough approximation of the PDF of volumes

by the Lévy stable distribution, the time series

can be considered FLSM-like.

The series

serves as a macroscopic measure of opinion in the order flow, exhibiting long-range dependence due to the heterogeneity of agents. However, a more comprehensive measure of traders’ macro opinion should incorporate events of order cancellation and execution. Therefore, we explore an alternative sequence of order flow:

where the first sum includes all live limit orders, encompassing all limit order volumes

submitted before event

j and awaiting cancellation or execution. A sequence of limit order submissions of length

N generates a series of order imbalance

of length

, as each submission pairs with a cancellation or execution event. Notably,

differs significantly from

:

is bounded while

is unbounded. Additionally, our evaluation of the memory parameter

d for

using FLSM assumptions yielded contradictory results. Our previous work [

15] concluded that the time series defined in (

2) does not exhibit FLSM-like properties. Consequently, persistent limit order submission flow or long-range dependence is concealed from econometric methods when analyzing the time series of order imbalance

.

To reinterpret the order imbalance series

, we introduce a discrete

q-exponential probability mass function:

as a

q-extension of the geometric distribution, based on the generalized Tsallis statistics [

19]. This distribution fits empirical limit order cancellation times more accurately, revealing their weak sensitivity to order sizes and price levels. The fitted parameters,

, and

, remain consistent across the ten stocks and trading days analyzed. The power-law distribution of cancellation (waiting) times may stem from a stochastic queuing model where tasks are executed based on a continuous-valued priority [

20,

21]. In

Section 3, we derive the power-law of waiting time originating from an alternative agent heterogeneity approach.

We propose a relatively simple model of limit order flow imbalance by combining fractional Lévy stable limit order inflow with the

q-exponential lifetime distribution. This model, derived from empirical analysis [

15], serves as an illustrative example of broader social system modeling.

Extending the model’s interpretation, we consider it a version of opinion dynamics applicable to other social systems. Originally, the model involves two random sequences: (a) A sequence of limit order volumes

generated as ARFIMA{0,d,0}{

}, where

d is the memory parameter,

is the stability index, and

N is the sequence length. (b) A corresponding independent sequence of limit order cancellation times with the same length

N generated using the PMF

defined in Equation (

3).

For the extended model interpretation, represents the opinion weight, positive for a buy (first one) and negative for a sell (second one). The limit order cancellation time, measured in event space , represents the opinion lifetime. While initially designed for analyzing financial market order flow, this extended interpretation can investigate other instances of weighted opinions in social systems. This model exemplifies a simple time series constructed using an ARFIMA sequence, yet exhibiting properties beyond the assumption of self-similarity.

With these independent sequences, we calculate the model time series

defined by sequence

(see Equation (

2)). Here, the opinion submission event number

and its cancellation event number

are determined for each

of sequence (a) and the corresponding

k of sequence (b). The generated random sequence represents an artificial analog of the order imbalance time series, comparable with empirical order flow data in financial markets [

15]. We achieved good correspondence with empirical data by choosing the artificial model parameters:

;

;

[

15]. For other applications, the model can be simplified by replacing the sequence

with unit weights:

We denote these series with an additional index

S, for example,

. Another simplification involves choosing

in Equation (

3), yielding a geometric distribution:

where

. The geometric distribution, as a discrete version of the exponential distribution, is a common choice for waiting times in many physical and social systems.

3. Heterogeneity of Agents and Power-Law of Waiting Time

While power-law waiting times are observed in stochastic queueing models with continuous-valued priorities [

20,

21], another plausible explanation for this phenomenon could be the heterogeneity of trading agents. In financial markets, agents manage a diverse range of assets, leading to substantial variability in their trading activities and the lifetimes of their orders. To address this, we propose a model that combines agent heterogeneity to derive a power-law distribution for limit order cancellation times.

Consider n categories of agents, each with different rates for limit order submission and cancellation. The lowest rate is one limit order per trading day (the duration of the time series under investigation). Let denote this probability as . Agents who submit two orders per day have a probability , and agents submitting i limit orders have a probability . The most active traders, who submit n limit orders, have a probability .

Under this framework, the waiting (cancellation) time for agents in the

i-th category follows a geometric distribution with the probability mass function (PMF) given by

. To obtain the overall PMF for the ensemble of agents, we average this distribution over all categories. According to our assumptions, the arrival probability of orders from different agent categories is proportional to the index

i, and the number of agents in each category is inversely proportional, Zipf’s law. Thus, the PMF for the entire ensemble of agents can be expressed as:

To understand the result given by Eq. (

7), consider the limit as

:

which reveals a power-law with an exponent

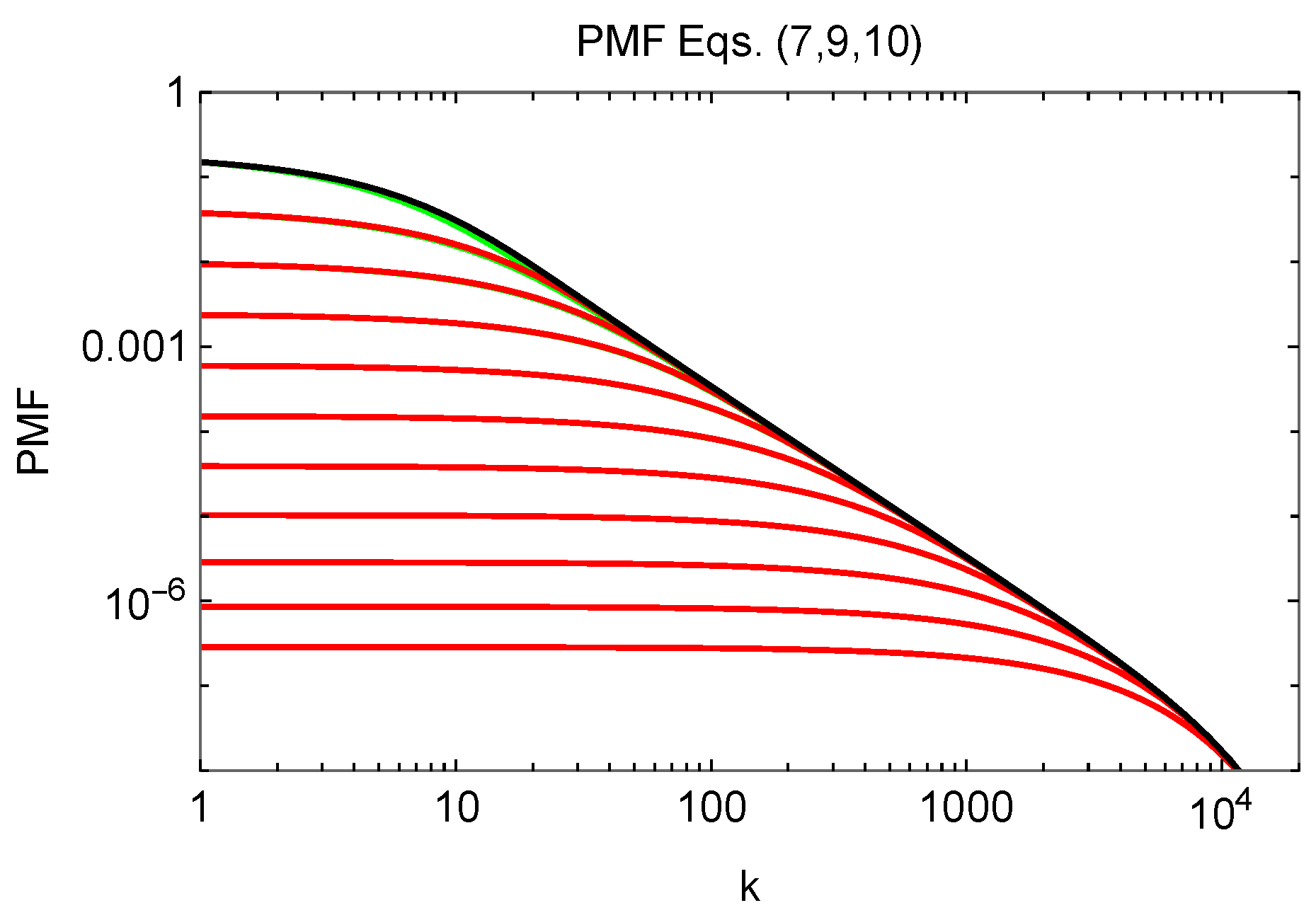

. This power-law nature is illustrated in

Figure 1, alongside partial sums defined by:

where

and

.

Our assumptions, incorporating Zipf’s law, lead to a power-law of cancellation (waiting) time that is exponentially stretched on both sides. This restriction arises from the fixed number of agent categories

n or the related number of opinions (orders) submitted,

. Crucially, the power-law exponent in Eq. (

7) is

. Given the relationship between the

q-exponential distribution and the Pareto distribution, this implies an exponent

, as empirically defined in [

15]. Therefore, the presented description of the PMF for waiting times in a heterogeneous agent ensemble supports the conclusion that a power-law exponent

is a stylized fact in financial markets. Further empirical studies of cancellation times using the proposed PMF in Eq. (

7) would be valuable.

4. Self-Similarity Analysis of Proposed Model

Building on previous efforts to unravel long-range memory in social systems [

14], it is crucial to juxtapose macroscopic descriptions with empirical analyses and agent-based modeling. Extensive empirical studies of volatility, trading activity, and order flow in financial markets have solidified the foundation for examining long-range memory properties [

17,

18,

22,

23,

24,

25,

26]. Various econometric models incorporating fractional noise have been developed to represent volatility time series [

22,

27,

28,

29,

30,

31,

32]. Yet, from an econophysics perspective, these models often serve merely as macroscopic interpretations of complex social phenomena, frequently relying on ad hoc assumptions of long-range memory. Despite advancements in trading algorithms and machine learning, predicting stock price movements remains a formidable challenge for researchers [

33,

34,

35].

In this section, we address the requirement of self-similarity, a cornerstone in modeling long-range dependence, within our proposed opinion dynamics model. Econometric methods commonly accept the assumption of self-similarity without scrutiny; however, a deeper examination is crucial [

36].

Stochastic time series are often assumed to be self-similar if they satisfy certain scaling relations. For instance, a series

is self-similar if it holds that

, where ∼ indicates identical distributions for any

and

. Moreover, these series should exhibit stationary increments:

for any

and

. These processes, characterized by self-affine increments, follow the rule:

for any

, [

37]. All these properties are defined through equality in distributions, thus the simplest estimation of

H should also be based on distributional equality. By analyzing these distributions, we can identify deviations from the self-similarity requirement.

Our model of limit order flow

and opinion imbalance

assume stationary increments as they stem from a Lévy stable distribution. We express the self-similarity condition as:

To compare distributions, we employ the Kolmogorov-Smirnov (KS) two-sample test [

38] and compute the KS distance

D:

where

represents the cumulative empirical distribution functions for an integer sequence

and a corresponding sequence of

:

From the definition of self-similarity (

11), we expect consistent values of

H that minimize

D for any

. Divers values of

H across different

suggest a failure to meet the self-similarity criterion.

The proposed model of opinion dynamics is a good example of a time series to demonstrate how self-similarity is broken when opinion cancellation is introduced into a self-similar series, FLSM, of opinion inflow

. We generate FLSM series

with parameters:

,

,

and corresponding series of opinion duration (waiting time)

using (

3) with parameters

and

. Then we calculate series

of length

of opinion disbalance (

2).

Our opinion dynamics model provides a useful case study to illustrate how introducing opinion cancellation disrupts a self-similar series of opinion inflow

. We simulate the FLSM series

with parameters:

,

,

, alongside a series of opinion durations (waiting times)

using parameters

and

. We then generate the series

of opinion imbalance (

2) with a length of

.

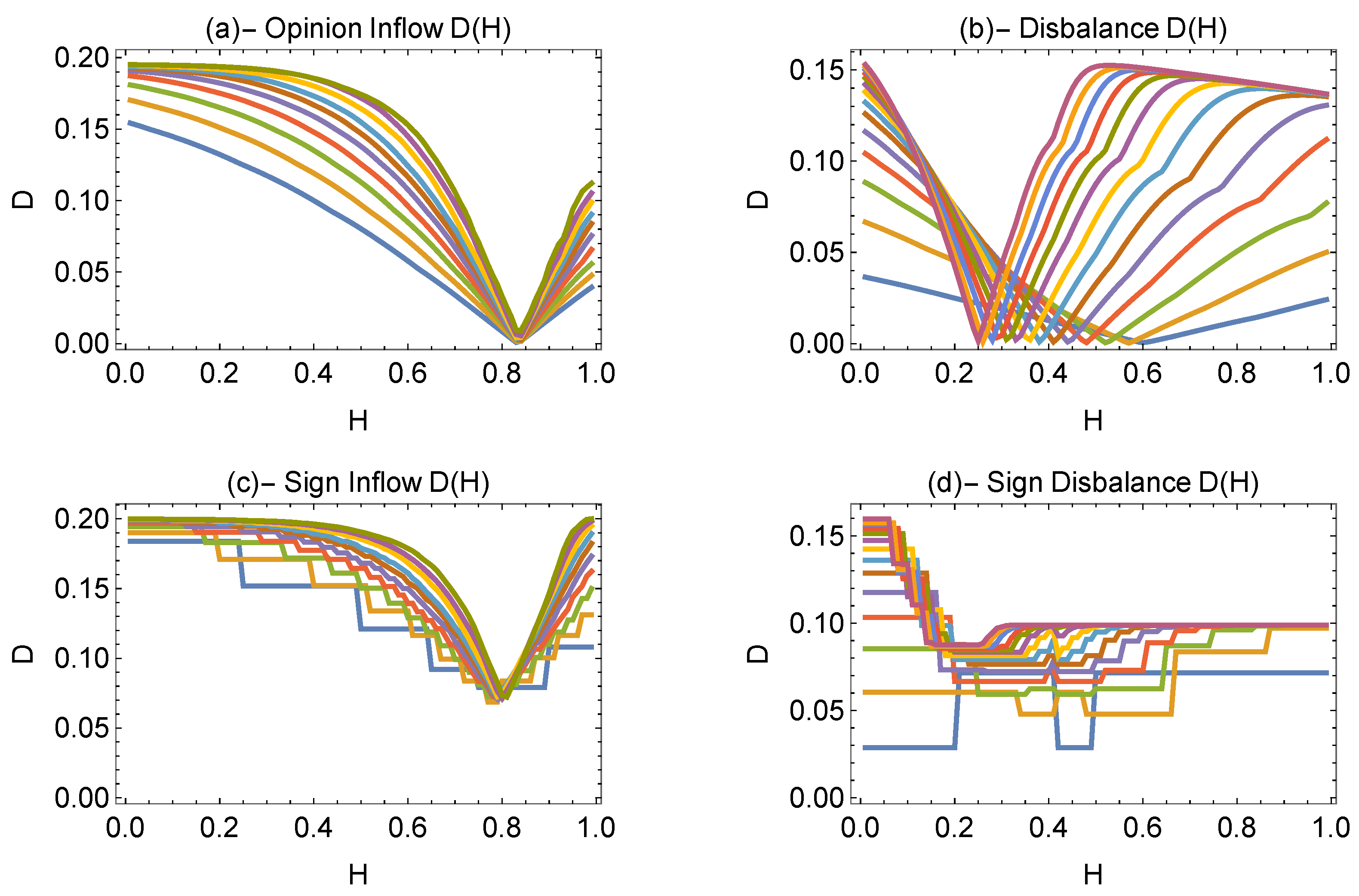

In

Figure 2, we compare numerically calculated KS distances

, Eq. (

12), as functions of

H for various series, demonstrating that while the series

maintains self-similarity, the series

does not, as evidenced by the range of

H values obtained for different

. Even when simplifying the model to only consider signs of volumes, the KS distance

is less sensitive to

H, supporting the conclusion that while

can be considered self-similar,

is not. From our point of view, this procedure to control self-similarity should apply to any observed time series.

While researchers employ various methodologies to estimate the self-similarity parameter

H of observed time series, there often lies a gap in validating the self-similarity assumption itself [

36]. It is imperative that we devote greater attention to developing and refining methods that rigorously test these self-similarity assumptions. Particularly, the method we propose here, while robust for complex models, shows limitations in accuracy when applied to simplified series such as

and

, where the numerically calculated functions

display a fractured structure indicative of potential method inadequacies.

In

Table 1, we list the Hurst parameter evaluation results using diverse methodologies for the model series

,

,

, and

. Further details on the estimation of mean square displacement (MSD) and

H using different methods, such as the Absolute Value Estimator (AVE) or Higuchi’s method, are elaborated in [

15,

16]. These results underscore that formally evaluated Hurst parameters can sometimes yield misleading conclusions regarding persistence and long-range dependence. Although all series were generated with the same memory parameter

d, a correct interpretation of self-similarity is essential for accurately understanding memory effects in these time series.

In conclusion, the model of artificial order imbalance and opinion dynamics time series provides valuable insights into the persistence and memory properties of financial market limit order flow. The comparison with empirical data underscores the utility of the model and supports the conclusion that the q-exponential nature of limit order cancellation times contributes significantly to the statistical properties of order imbalance time series.

5. Discussion and Conclusions

In our previous work [

15], we introduced the concept of a discrete

q-exponential distribution, as outlined in Equation (

3). This

q-extension of the geometric distribution is grounded in the theoretical foundations of generalized Tsallis statistics [

19]. Empirical validation of this model on limit order cancellation times across ten different stocks and trading days demonstrated its robustness, with the fitted

q-exponential PMF parameter

revealing weak sensitivity to order sizes and price levels. This model aligns with the second class Pareto distribution, which is known to exhibit a power-law tail with an exponent

[

39]. In this contribution, we utilize a heterogeneous agent model to elucidate this distinctive power-law characteristic.

Our approach categorizes trading agents based on their activity within selected intervals, such as one trading day, leading to

n categories where

represents the number of limit orders submitted per agent of category. Given that each order is canceled or executed, it is natural to model the lifetime

k of orders from each agent group

i with a Geometric PMF

. Assuming the number of agents in each group

i is inversely proportional to the group’s index, in consistence with Zipf’s law, the probabilities

contribute equally when averaging waiting times across all agent categories. This leads to the explicit form of the PMF of cancellation (waiting) times as defined in (

7), effectively capturing the empirically observed power-law behavior of limit order cancellation times [

15].

We further expand and generalize this model by integrating two independent random sequences, the ARFIMA{0,d,0}{a, N} and

from Eq. (

3), to form the imbalance series

, portraying opinion dynamics. This model not only elucidates the properties of limit order imbalance in financial markets but also offers insights into the complexity of long-range dependence observed in various social systems [

14,

16,

40].

The proposed model serves as an example of a time series with hidden long-range dependence. Thus, we propose the method of self-similarity tests and demonstrate that series and are not self-similar. Though the result is predictable, the proposed method might be useful in analyzing other empirical time series before using widely accepted methods of self-similar series analysis.

This study significantly advances our understanding of order imbalance and memory effects in financial markets. By integrating the FLSM with the q-exponential distribution, we provide a framework for modeling complex behaviors in social systems. Our findings not only bridge the gap between theoretical constructs and empirical observations but also pave the way for future research aimed at developing more precise models and gaining deeper insights into financial market dynamics and beyond.