Submitted:

11 August 2024

Posted:

13 August 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Overview of Jordan’s Energy Landscape

2.1. Jordanian Energy Sector in Number

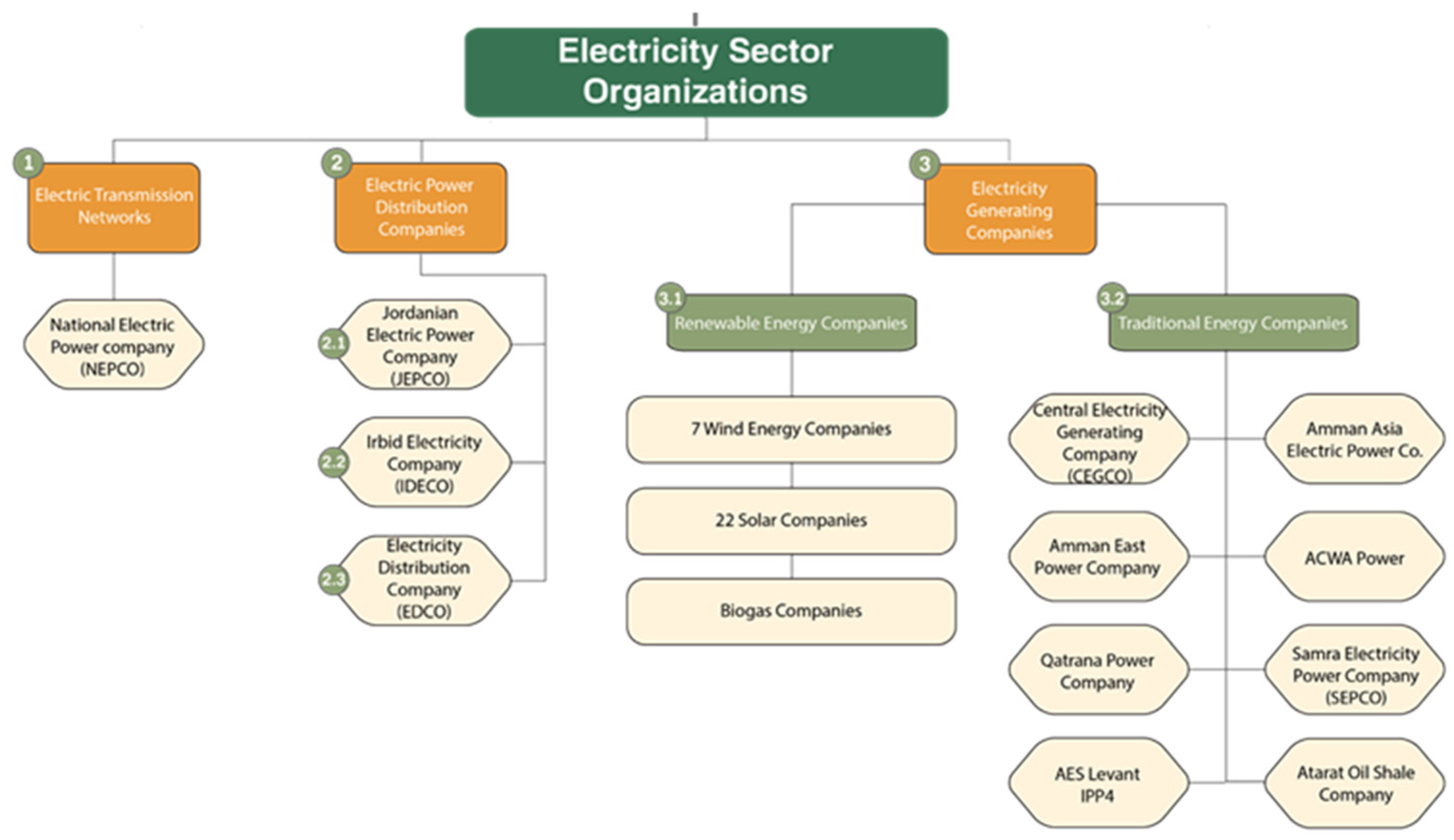

2.2. Electricity Sector Organization

- National Electric Power company (NEPCO)

- 2.

- Electric Power Distribution Companies that include:

- 3.

- Electricity Generation Companies:

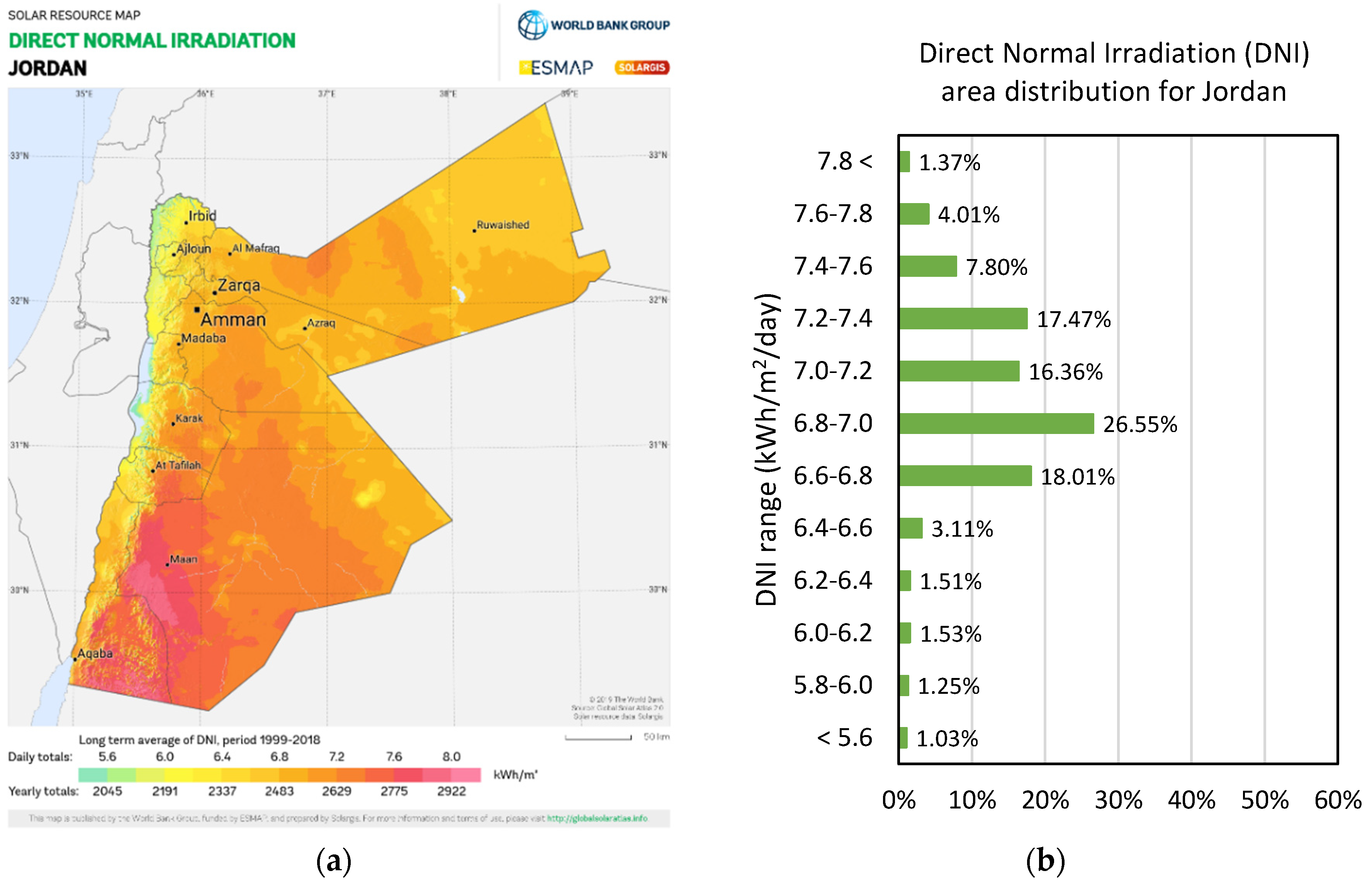

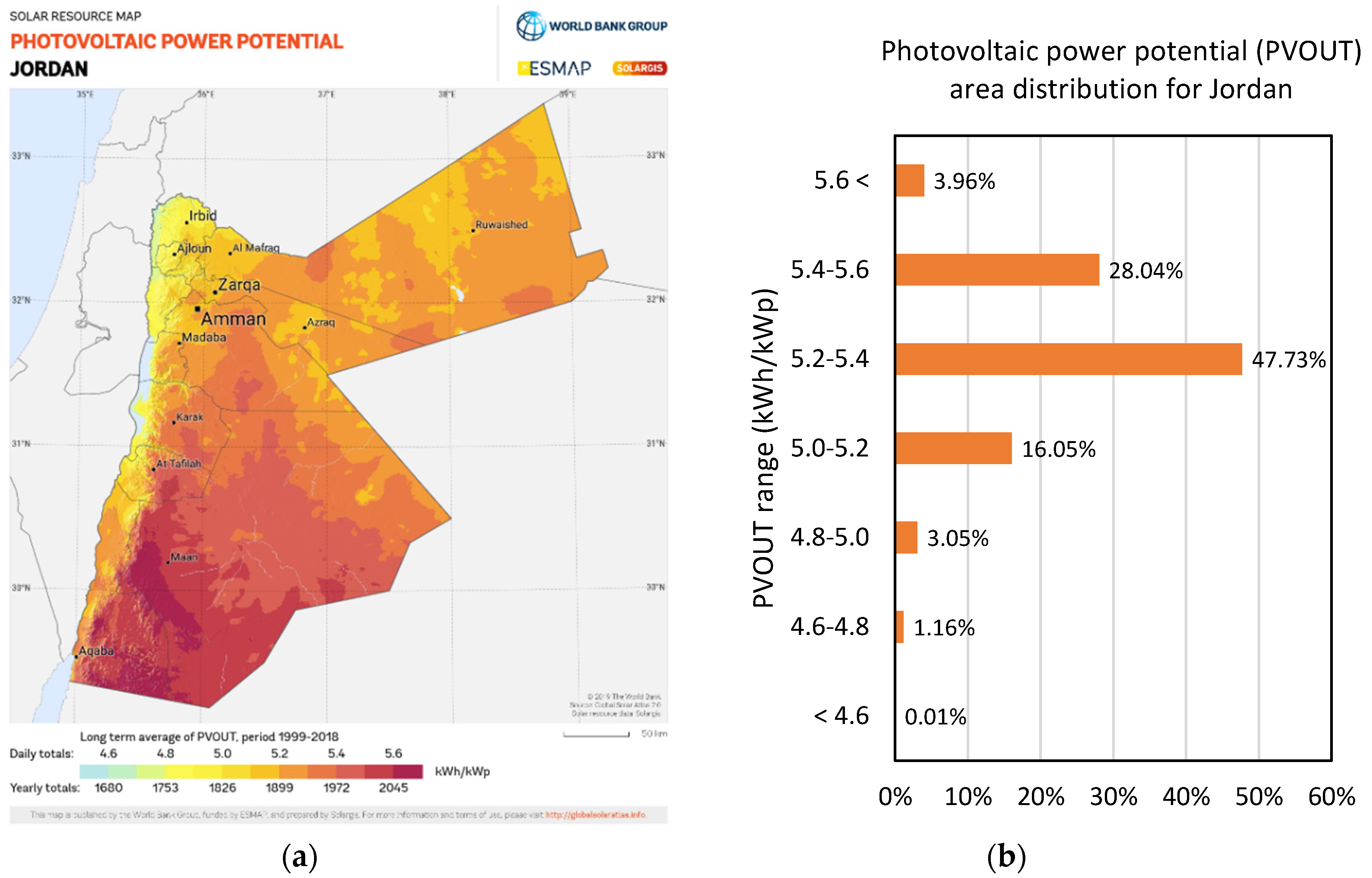

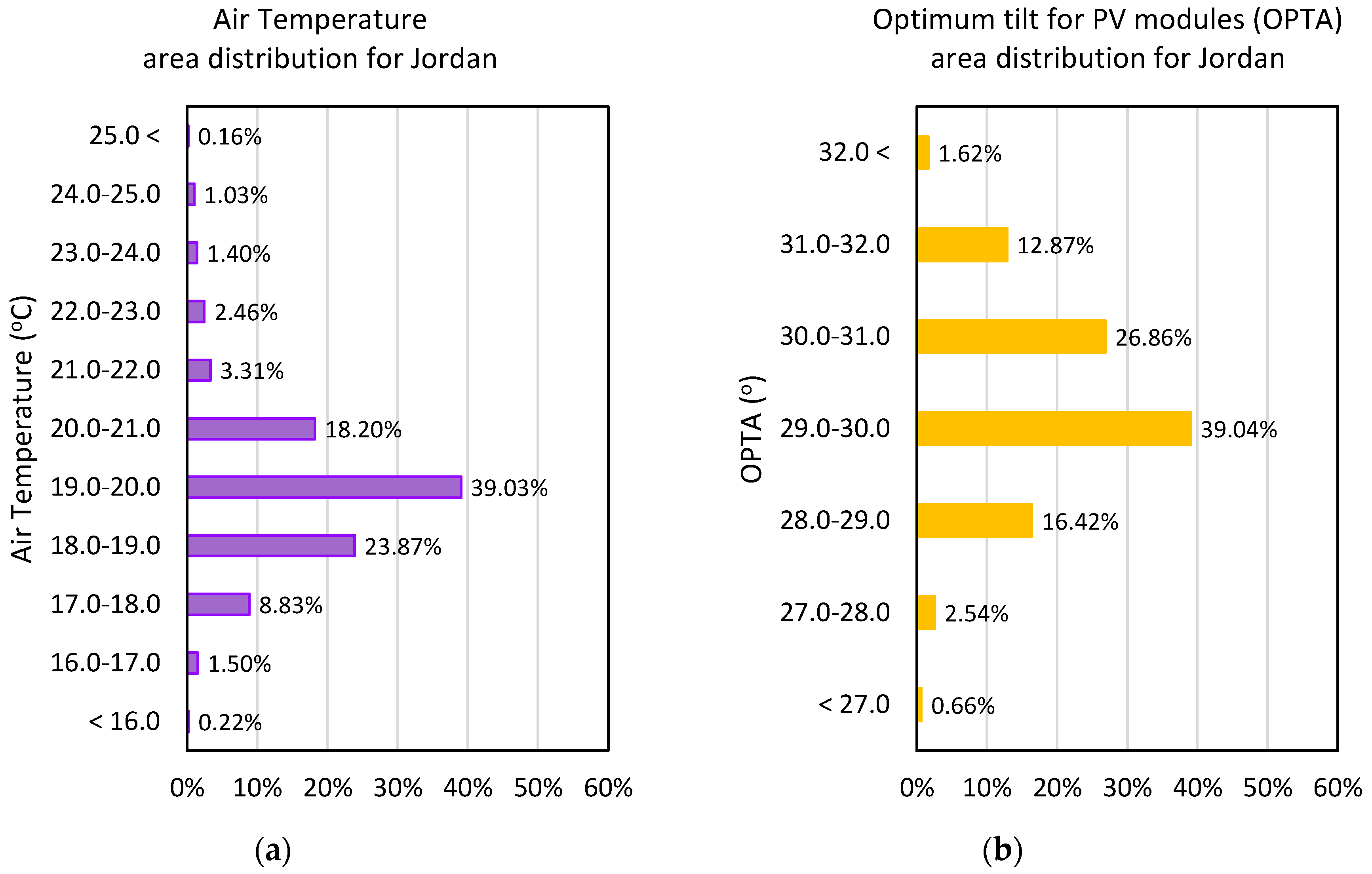

3. Solar Resources Potential in Jordan

4. Current State of Solar Energy in Jordan

4.1. Policies and Regulations

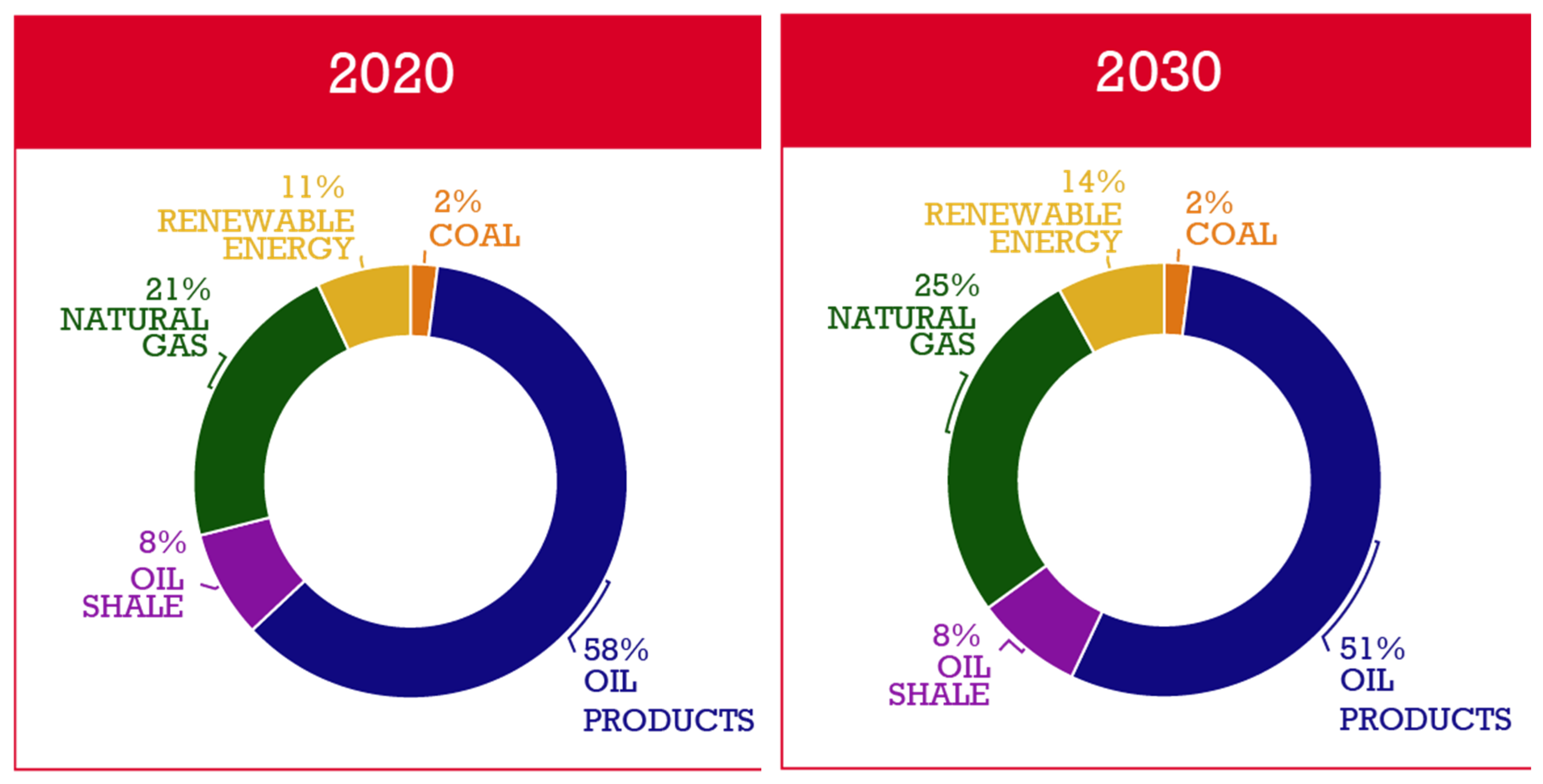

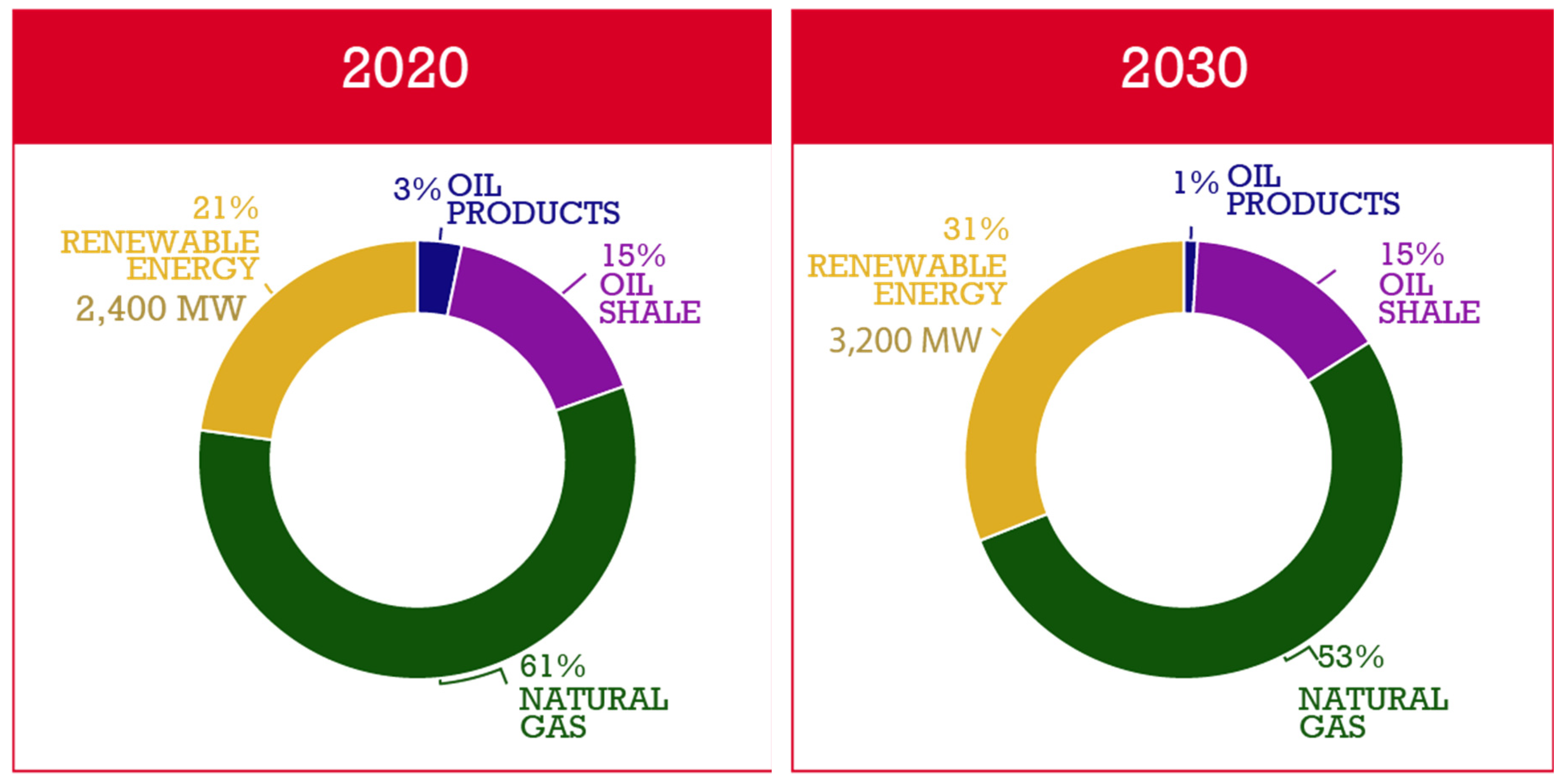

- Increasing Renewable Energy: Jordan has an ambitious goal to increase the share of renewable energy in its overall generation. This includes the implementation of large-scale solar and wind power projects.

- Reducing Dependence on Fossil Fuels: The country aims to reduce its dependence on fossil fuels through the diversification of energy sources.

- Energy Efficiency: Promoting energy efficiency in various sectors, such as industrial, residential and commercial, is a priority to reduce overall energy consumption.

- Bylaw No. 50 of 2015 and its amendment in 2016 (conditions and procedures of the renewable energy direct proposal submission and connection to the grid).

- Instructions for costs of connecting renewable energy sources to the distribution system in the cases of competitive bidding and direct proposals related to Article 9/B of the REEEL.

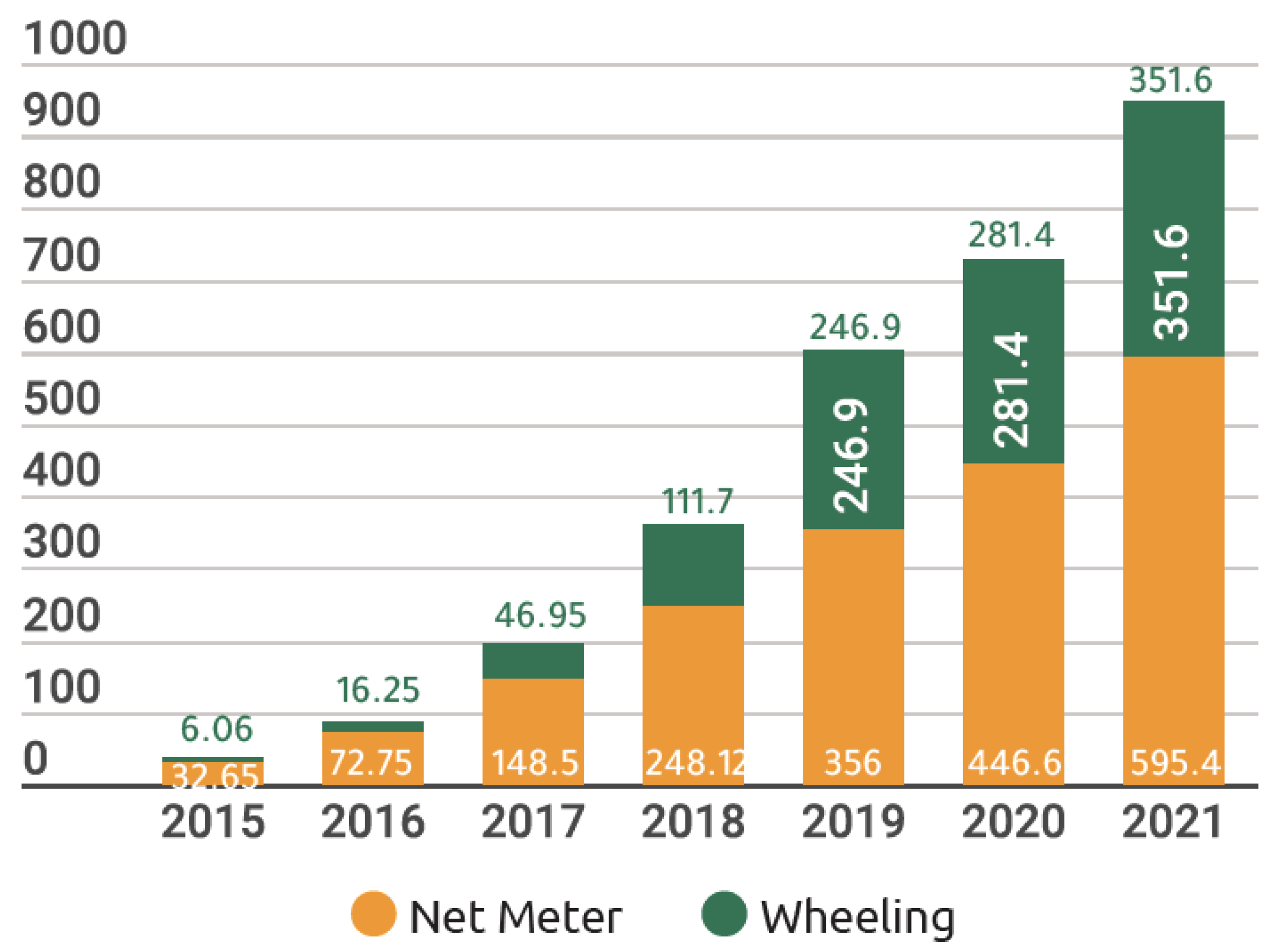

- Instructions for the sale of electrical energy generated from renewable energy systems related to Article 10/B of the REEEL (net metering system).

- Instructions governing electricity wheeling for energy generated from renewable energy sources, for consumption purposes and not for sale to others (electricity wheeling) and for wheeling charges (costs of the electricity wheeling).

- Bylaw No. 49/2015 (JREEEF).

- Bylaw No. 10 of 2013, amended in 2015, 2017 and 2018 (tax exemptions for renewable energy and energy efficiency systems and equipment).

- Intermittent Renewable Resources Distribution Connection Code at Medium Voltage.

- Guidelines for interconnection of renewable energy sources on distribution and transmission grids as well as on electric meters for net metering apply to both distribution and transmission grids.

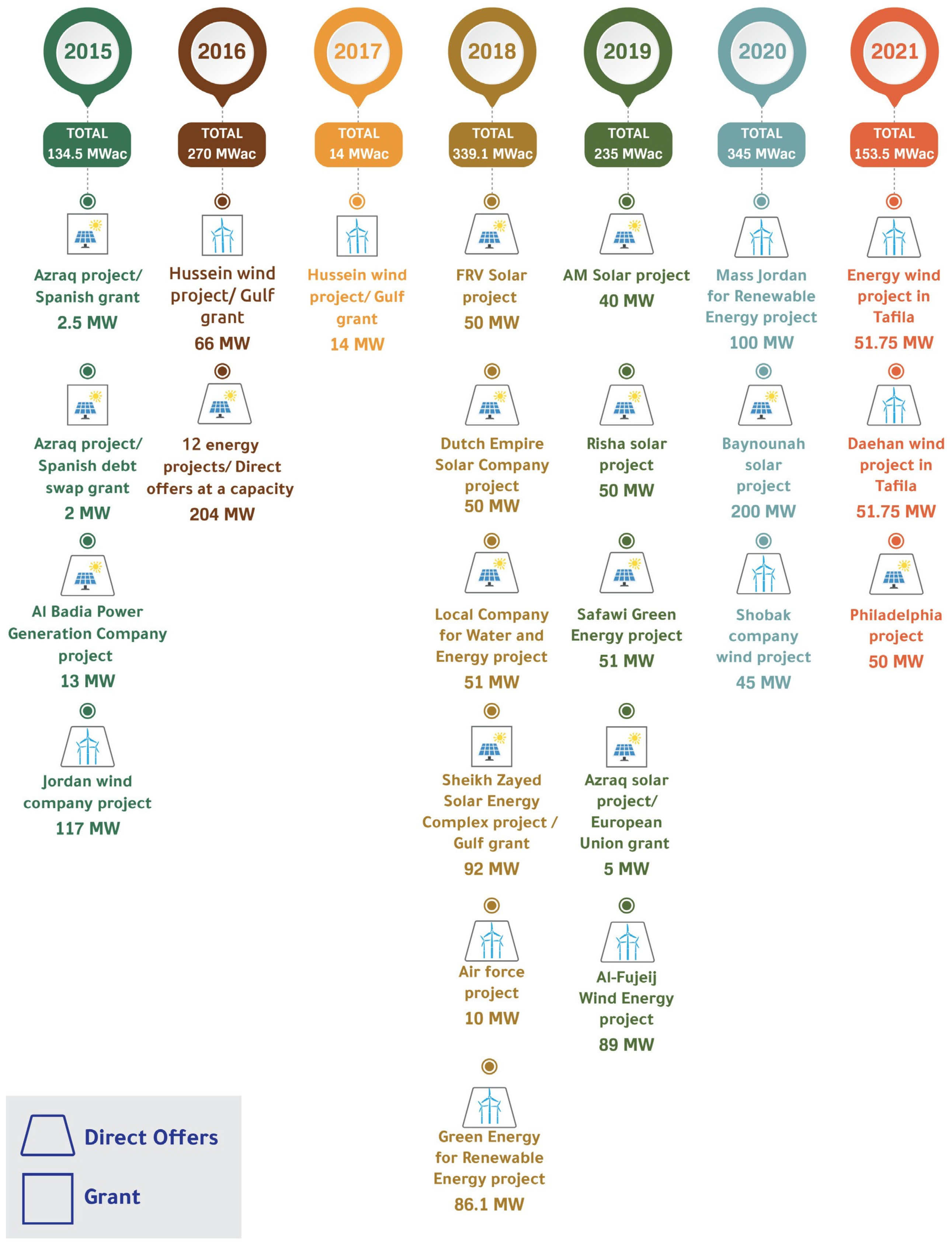

4.2. Installed Capacity

4.3. Investment and Funding

- Baynouna Solar Energy Project: The Baynouna Solar Energy Company, a joint venture between Abu Dhabi’s clean energy company Masdar and Finnish investment and asset management group Taaleri, operates Jordan’s largest clean energy project with a 200 megawatt (MW) capacity. The Baynouna Solar Park, developed through a power purchase agreement between Masdar and National Electric Power Company (NEPCO), Jordan’s state electricity provider, produces over 560 gigawatt-hours (GWh) of power annually. This project plays a crucial role in contributing to Jordan’s climate targets, providing clean energy access, creating jobs, and promoting economic growth [33].

- International Support: The project has garnered support from various international financial institutions, including the International Finance Corporation (IFC), the Opec Fund for International Development, the KfW Group’s DEG, and the Japan International Cooperation Agency. Masdar is active in more than 40 countries and has committed to investing in projects worth over $30 billion, to expand its renewable energy capacity to at least 100 GW by 2030. Additionally, Masdar signed a preliminary agreement with the Jordanian Ministry of Energy and Mineral Resources to explore the development of a further 2 GW of renewable energy projects in Jordan [33].

- Largest Private-to-Private Solar Project: The Climate Investment Funds (CIF), the European Bank for Reconstruction and Development (EBRD), and several multi-sector partners have financed Jordan’s largest private-to-private solar facility. This facility is expected to produce 70 GWh of energy annually and reduce carbon emissions by 41,500 tons every year. Jordan’s solar power capacity has seen a remarkable rise, jumping from around 20 MW in 2012 to over 1,000 MW, with an additional 1.2 GW under construction or development [34].

- Public-Private Partnerships (PPPs): Jordan has a history of using PPPs in the Mena region, financing key infrastructure, including renewable energy projects, through these partnerships. These PPPs are an essential part of Jordan’s Economic Modernization Vision 2023-33, which aims to attract a total capital investment of 41.4 billion JD (58.3 billion$) and achieve annual economic growth of 5.6 percent. The government is aiming to catalyze new PPPS worth 10 billion JD, with the private sector expected to contribute 73% of the funds.[35]

- Institutional Support and Investment Environment: To address challenges in PPPs, Jordan established the Project Preparation Development Facility with the help of the IFC. This facility aims to build government capacity for more informed decisions about PPPs and develop a pipeline of bankable projects. Additionally, in 2021, Jordan established a dedicated Ministry of Investment and introduced the Investment Environment Law.

4.4. Main Challenges and Barriers

4.5. Future Outlook of Solar Energy in Jordan

5. Conclusion

6. Acknowledgment

References

- Boutammachte, N., & Knorr, J. “Field-test of a solar low delta-T Stirling engine.” Solar energy 86, no. 6 (2012): 1849-1856. [CrossRef]

- Dascomb, J. “Low-cost concentrating solar collector for steam generation.” (2009).

- Al-Salaymeh, A. “Modelling of global daily solar radiation on horizontal surfaces for Amman city.” Emirates Journal for Engineering Research 11.1 (2006): 49-56.

- Summary of Jordan Energy Strategy 2020-2030 StrategyEN2020.pdf (memr.gov.jo).

- Department of Statistics- Jordan https://dosweb.dos.gov.jo/.

- Al-Salaymeh, A., Abu-Jeries, A., Spetan, K., Mahmoud, M. Elkhayat, M. “A Guide to Renewable Energy in Egypt and Jordan: Current Situation and Future Potentials”. Friedrich-Ebert-Stiftung Jordan & Iraq (2016).

- Jalilvand, D. R. “Renewable energy for the Middle East and North Africa. Policies for a successful transition.” (2012).

- Jordanian Ministry of Energy and Mineral Resources (MEMR) Annual Report 2021 https://www.memr.gov.jo/ebv4.0/root_storage/en/eb_list_page/annual_report_2021_en.pdf.

- World Bank Group. ESMAP (Energy Sector Management Assistance Program), “Power Sector Financial Vulnerability Assessment, Impact of the Credit Crisis on Investments in the Power Sector, Hashemite Kingdom of Jordan”. https://www.esmap.org/sites/esmap.org/files/P116206_Jordan_Power%20Sector%20Financial%20Vulnerability%20Assessment-Impact%20of%20the%20Credit%20Crisis%20on%20Investments%20in%20the%20Power%20Sector_Chavapricha.pdf.

- Central Electricity Generating Company (CEGCO) Annual Report 2021 https://www.cegco.com.jo/Admin_Site/Files/PDF/2a970f31-781f-4d70-93b7-ee0fd1edba34.pdf.

- Amman East Power Company website https://www.aesjordan.com.jo/about-us/ (accessed March 16, 2024).

- Power Technology, “Power plant profile: Al Qatrana IPP 2 Combined Cycle Power Project, Jordan”. https://www.power-technology.com/data-insights/power-plant-profile-al-qatrana-ipp-2-combined-cycle-power-project-jordan/ (accessed March 16, 2024).

- Samra Electric Power Company (SEPCO) website https://www.sepco.com.jo/en (accessed March 16, 2024).

- Solar Resource Glossary n.d. https://www.nrel.gov/grid/solar-resource/solar-glossary.html (accessed March 16, 2024).

- Suri M, Betak J, Rosina K, Chrkavy D, Suriova N, Cebecauer T, et al. Global Photovoltaic Power Potential by Country. World Bank 2020. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/466331592817725242/Global-Photovoltaic-Power-Potential-by-Country (accessed March 16, 2024).

- Solar radiation modeling n.d. https://solargis.com/docs/methodology/solar-radiation-modeling (accessed March 16, 2024).

- Tech Specs n.d. https://solargis.com/maps-and-gis-data/tech-specs (accessed March 16, 2024).

- Duffie, J. A., Beckman, W. A., & Blair, N. Solar engineering of thermal processes. 2nd ed. New York: Wiley; 1991.

- Global Solar Atlas 2.0 : Technical Report. World Bank 2019. https://documents.worldbank.org/en/publication/documents-reports/documentdetail/529431592893043403/Global-Solar-Atlas-2-0-Technical-Report (accessed March 16, 2024).

- Global Solar Atlas n.d. https://globalsolaratlas.info/map?c=31.302022,37.144775,7&r=JOR (accessed March 16, 2024).

- Global Photovoltaic Power Potential by Country | Data Catalog n.d. https://datacatalog.worldbank.org/search/dataset/0038379 (accessed March 16, 2024).

- Global Solar Atlas n.d. https://globalsolaratlas.info/download/jordan (accessed March 16, 2024).

- [Data/information/map] obtained from the “Global Solar Atlas 2.0, a free, web-based application is developed and operated by the company Solargis s.r.o. on behalf of the World Bank Group, utilizing Solargis data, with funding provided by the Energy Sector Management Assistance Program (ESMAP). For additional information: n.d. https://globalsolaratlas.info (accessed March 16, 2024).

- Abu-Rumman, G., Khdair, A. I., & Khdair, S. I. “Current status and future investment potential in renewable energy in Jordan: An overview.” Heliyon 6, no. 2 (2020). [CrossRef]

- Sandri, S., Hussein, H., & Alshyab, N. (2020). Sustainability of the energy sector in Jordan: Challenges and opportunities. Sustainability, 12(24), 10465. [CrossRef]

- Alshwawra, A., & Almuhtady, A. (2020). Impact of regional conflicts on energy security in Jordan. International Journal of Energy Economics and Policy, 10(3), 45-50. [CrossRef]

- Alshwawra, A., Almuhtady, A., & Sakhrieh, A. (2023). Electricity system security in Jordan: A response for arab uprising. Heliyon, 9(5). [CrossRef]

- Fraihat, B. A. M., Ahmad, A. Y. B., Alaa, A. A., Alhawamdeh, A. M., Soumadi, M. M., Aln’emi, E. A. S., & Alkhawaldeh, B. Y. S. (2023). Evaluating Technology Improvement in Sustainable Development Goals by Analysing Financial Development and Energy Consumption in Jordan. International Journal of Energy Economics and Policy, 13(4), 348. [CrossRef]

- Danielson, M., Ekenberg, L., Komendantova, N., Al-Salaymeh, A., & Marashdeh, L. (2022). A participatory MCDA approach to energy transition policy formation. In Multicriteria and Optimization Models for Risk, Reliability, and Maintenance Decision Analysis: Recent Advances (pp. 79-110). Cham: Springer International Publishing.

- Ahmad A. Salah, Mohammad M. Shalby & Firas Basim Ismail (2023) The status and potential of renewable energy development in Jordan: exploring challenges and opportunities, Sustainability: Science, Practice and Policy, 19:1, 2212517.

- IRENA (2021), Renewable Readiness Assessment: The Hashemite Kingdom of Jordan, International Renewable Energy Agency, Abu Dhabi. ISBN: 978-92-9260-277-2.

- Solarquarter, “The Future Looks Bright for Solar Energy in Jordan: A 2023 Outlook”. https://solarquarter.com/2023/02/25/the-future-looks-bright-for-solar-energy-in-jordan-a-2023-outlook/ (accessed March 16, 2024).

- The national news, “Masdar opens Jordan’s largest solar project with 200MW capacity”. https://www.thenationalnews.com/business/energy/2023/02/25/masdar-opens-jordans-largest-solar-project-with-200mw-capacity/ (accessed March 16, 2024).

- Climate investment funds, “CIF, EBRD FINANCE LARGEST PRIVATE-TO-PRIVATE SOLAR PROJECT IN JORDAN”. https://cif.org/news/cif-ebrd-finance-largest-private-private-solar-project-jordan (accessed March 16, 2024).

- Arabian Gulf Business Insight, “PPP pioneer has all the right moves – now it needs new partners”. https://www.agbi.com/articles/jordan-special-report-public-private-partnerships/ (accessed March 16, 2024).

- Oxford business group, “Jordan’s energy sector turns focus to private development and renewable resources”. https://oxfordbusinessgroup.com/reports/jordan/2018-report/economy/energising-new-tactics-the-sector-is-increasingly-turning-to-private-development-and-renewable-sources-to-power-the-nation (accessed March 16, 2024).

| Indicator | World (209 countries) |

Jordan | Jordan world rank | |

|---|---|---|---|---|

| Highest | Lowest | |||

| GHI (kWh/m2/day) | 6.47 | 2.53 | 6.02 | 19 |

| PVOUT (kWh/kWp/day) | 5.38 | 2.51 | 5.32 | 3 |

| Seasonality Index (-) | 14.97 | 1.15 | 1.41 | 110 |

| Year | Primary Energy Demand (Overall domestic consumption) (toe) |

| 2020 | 10,039 |

| 2021 | 10,267 |

| 2022 | 10,420 |

| 2023 | 10,595 |

| 2024 | 10,668 |

| 2025 | 10,967 |

| 2030 | 11,760 |

| Year | Electricity Demand Gigawatt hour (GWh) |

| 2020 | 17,672 |

| 2021 | 17,831 |

| 2022 | 17,860 |

| 2023 | 17,950 |

| 2024 | 17,958 |

| 2025 | 18,686 |

| 2030 | 19,701 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).