1. Introduction

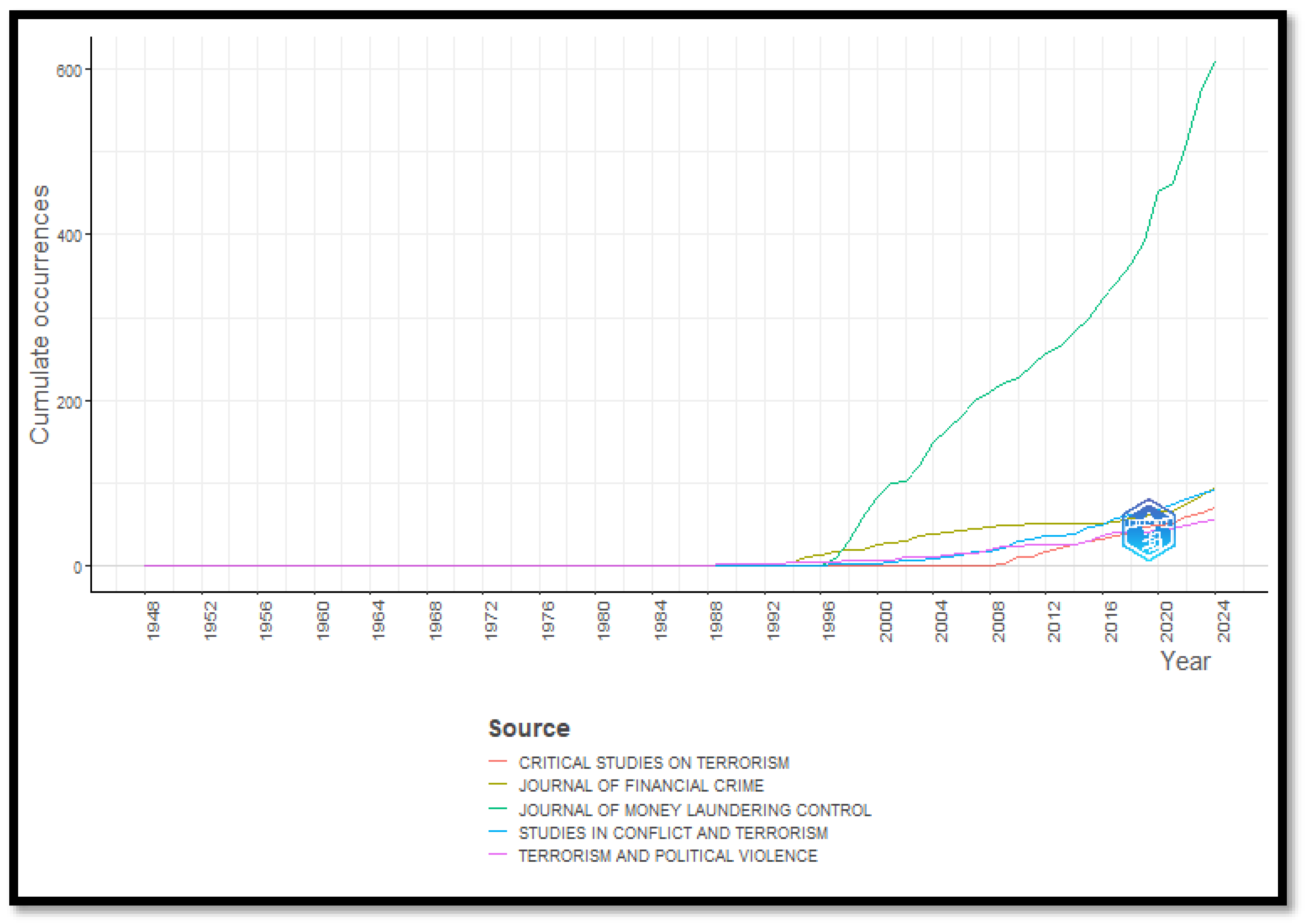

A robust and transparent financial system contributes significantly to the global fight against money laundering for terrorist financing. Consequently, research into the vulnerabilities and countermeasures within the banking sector has been gaining the interest of researchers across the globe. This is evident in the growing body of literature dedicated to understanding the intricacies of financial crime within the banking system, as illustrated by the increasing number of publications over the years –

Figure 1.

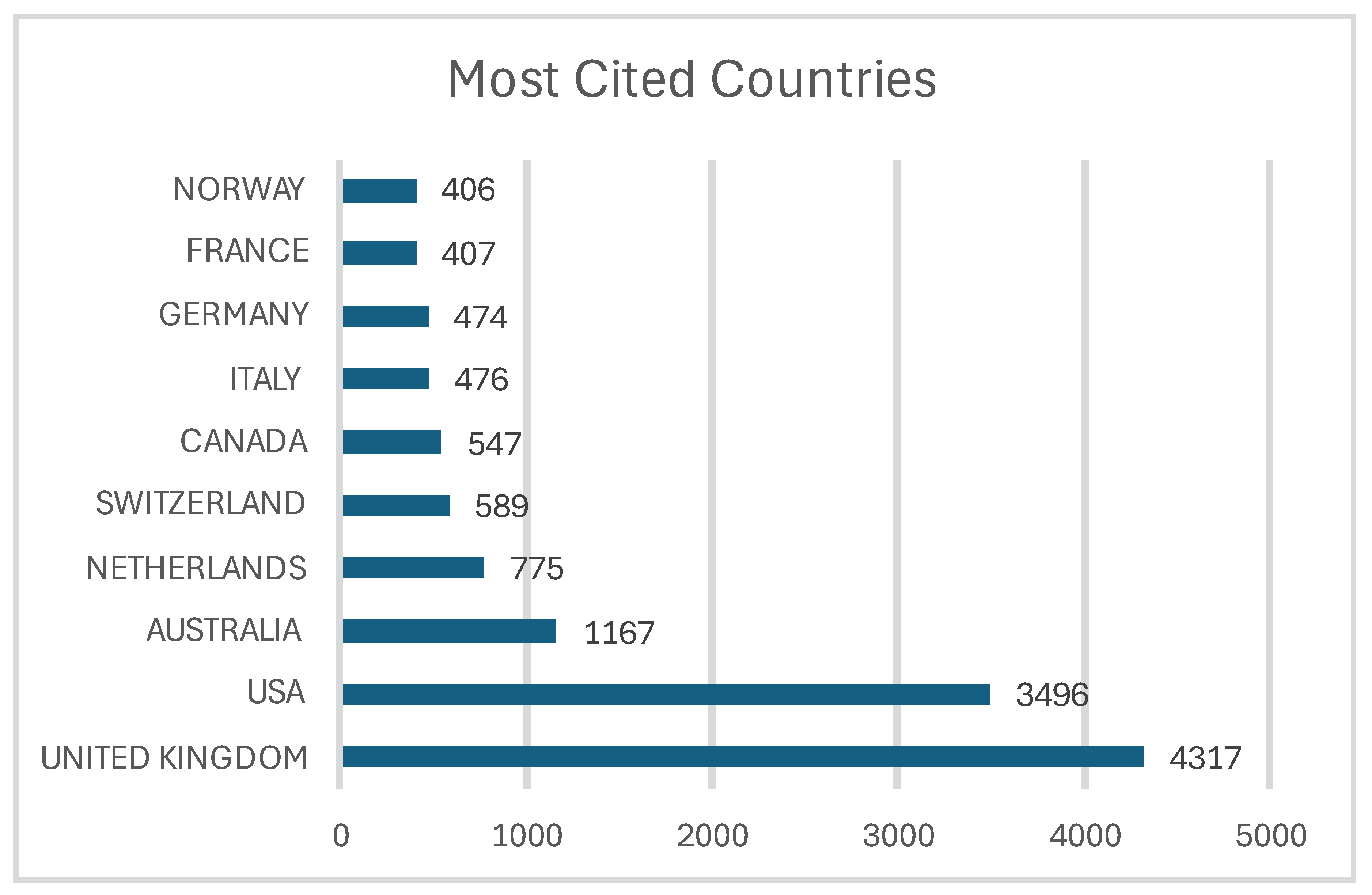

The Bibliometric analysis shows that the United Kingdom with a substantial total of 4,317 citations, as illustrated in

Figure 2, was the most cited country. This indicates that the UK holds a significant position in the realm of research. Together, the United States and Australia accounted for more than 4,663 citations, with Australia showcasing notable productivity in Asia and highlighting its considerable research contributions in that area. Furthermore, the Netherlands and Switzerland are noted with 775 and 589 citations, respectively. This provides a thorough summary of the five most cited countries.

Money laundering for the purpose of financing terrorism (ML/TF) poses a significant threat to global security and financial stability. Criminal enterprises and terrorist organizations take advantage of financial systems to obscure the origins of their money and fund their operations. Addressing ML/TF requires a comprehensive strategy that incorporates robust legislative measures, efficient Financial Intelligence Units (FIUs), and collaborative efforts on an international level.

To explore the current research environment surrounding ML/TF, this study employs quantitative methods via bibliometric analysis of scholarly publications. The focus of this research is the intersection where money laundering and terrorist financing converge. While both topics have been thoroughly examined in isolation, understanding their interconnectedness is crucial for creating effective prevention strategies. This study aims to deepen the understanding of the intricate relationship between money laundering and terrorist financing. It is anticipated that this knowledge will be significant to policy makers, law enforcement agencies as well as researchers who wish to disrupt criminal and terrorism related financial networks.The research depended on thorough search of Scopus database by using a specific search string consisting of principal words like money laundering, terrorist financing and related players such as FIUs and FATF. The data retrieved was thereafter examined through the use of bibliometric software such as VOSviewer in order to discern patterns of co-occurrence among keywords, authorship networks and citation patterns. The outcomes were presented in visualizations, tables and with a detailed conversation concerning their worth.

Table 1.

Earlier Bibliometric Studies on Money Laundering and Terrorism Financing.

Table 1.

Earlier Bibliometric Studies on Money Laundering and Terrorism Financing.

| Sr. No. |

Authors |

Title |

Year |

| 1 |

Tiwari M., Ferrill J., Allan D. M.C |

Trade-based money laundering: a systematic literature review |

2024 |

| 2 |

Khelil I., Khlif H., Achek I. |

The economic consequences of money laundering: a review of the empirical literature |

2023 |

| 3 |

Ahuja D., Bhardwaj P., Madan P. |

Money Laundering: A Bibliometric Review of Three Decades from 1990 to 2021 |

2023 |

| 4 |

Saxena C., Kumar P. |

Bibliometric analysis of Journal of Money Laundering Control: emerging trends and a way forward |

2023 |

| 5 |

Davidescu A.A.M., Lobont O.R., Manta E.M., Hapau R.G. |

Mapping the Field. A Text Analysis of Money Laundering Research Publications |

2023 |

| 6 |

Isolauri E.A., Ameer I. |

Money laundering as a transnational business phenomenon: a systematic review and future agenda |

2023 |

| 7 |

Tiwari M., Gepp A., Kumar K. |

A review of money laundering literature: the state of research in key areas |

2020 |

| 8 |

Al-Suwaidi N.A., Nobanee H. |

Anti-money laundering and anti-terrorism financing: a survey of the existing literature and a future research agenda |

2021 |

| 9 |

Alsuwailem A.A.S., Saudagar A.K.J. |

Anti-money laundering systems: a systematic literature review |

2020 |

With this background, the objective of this study is to provide the reader a brief outline of the literature on Money Laundering for Terrorism Financing. It focuses on emerging trends, the current status of the publication status and leading authors, organisations and countries who are contributing to the study.

2. Literature Review

The study used a cross-sectional design to investigate the link between money laundering risks and democratic governance in 117 countries. The analysis was quantitative, considering annual ratings for 2020 on money laundering/terrorism financing risks, democracy, criminality, and peace. Data were drawn from the Basel AML/CTF Risks Index, the Economic Intelligence Unit's Democracy Index, the Global Initiative's Criminality Index, and the Institute for Economics and Peace Index (Kalokoh, 2024). In Bosnia and Herzegovina, money laundering is defined under criminal laws at the state, entity, and Brčko District levels. The Law on the Prevention of Money Laundering and Financing of Terrorism outlines preventive measures, the duties of obligated entities, and the role of the Financial Intelligence Department. Despite existing regulations, expert assessments suggest that amendments are needed to improve effectiveness in addressing money laundering and terrorism financing, as risk assessments have identified practical deficiencies and laundering methods (Katica, 2024). This chapter reviews the perspectives of scholars in International Relations, Criminology, and Compliance on money laundering and terrorist financing. It aims to clarify existing discussions, highlighting the strengths and weaknesses of each field's arguments. By examining the theoretical approaches from these disciplines, the chapter identifies key gaps and promotes a more integrated, multidisciplinary approach to addressing the issue. It also relates to International Relations which focuses on the intricacies of global political interactions (Nizzero, 2023). The Financial Action Task Force (FATF) requires lawyers, notaries and other legal professionals to assess and mitigate the risks of money laundering and terrorist financing by providing relevant information to authorities. Nonetheless, these recommendations have been criticized for compromising client confidentiality between attorneys and their clients although many jurisdictions have enacted legislation that includes legal profession within its purview. This paper explores the discussions surrounding whether AML/CTF provisions should apply to lawyers (Goldbarsht & Benson, 2023). This paper focuses on how anti-money laundering/counter-terrorism financing measures can enable sustain financial system stability and fight hybrid threats. It also shows that as said in international AML/CTF practices, there is growing need for changing approaches to such threats and meet current requirements. In fact, there is a study that looks at how criminal proceeds and terrorism financing may be linked with hybrid threats that affect financial system stability (Korauš et al., 2024). Crowdfunding presents an excellent alternative for both commercial and non-commercial project funding. While it is a fast-growing digital financial tool, it has high associated risks too. Teichmann et al. (2022) suggest that it can serve as an avenue for money laundering and facilitate terrorism financing and fraud. This research aims at addressing the money laundering risks and terrorism financing issues in Indonesia and how its FATF membership has improved prevention and enforcement strategies. The study raises concerns on weak rules on cash declaration as well as limited supervisory capacity. As noted by Ginting et al. (2024), joining the FATF is expected to bolster Indonesia's economic reputation, thereby aiding its global policy goals. Consequently, we carried out a bibliometric analysis of these keywords; however, significant research in these areas appears to be lacking thus far

3. Materials and Methods

In the present study, the VOSviewer tool (van Eck & Waltman, 2017) was employed to investigate the emerging trends related to Money Laundering for Terrorist Financing. VOSviewer is a bibliometric software that utilizes a dataset composed of literature samples as input, constructs a knowledge map, and generates visualization maps (Huang et al., 2022). The visualization process, which is based on electronic bibliographic data, can be performed using various analytical options, including co-authorship, co-occurrence, citation analysis, bibliographic coupling, and co-citation (Deveci, 2023). Visualization methods serve as invaluable resources in research as they aid in comprehending intricate data and uncovering insights that may not be readily apparent through basic data analysis alone (Wagner Filho et al., 2018). Bibliometric methods, often referred to as bibliometric analysis, have become well-established scientific practices and are crucial for evaluating research, especially in scientific and applied disciplines. These methods are increasingly employed to examine different facets of science and play a significant role in ranking institutions and universities globally. With a substantial body of research now available, it is feasible to use bibliometric analysis to study the bibliometric methods themselves (Ellegaard & Wallin, 2015).

Research Questions

What is the current status of the publication in the Money Laundering and Terrorist Financing?

What are the emerging trends of Money Laundering for Terrorist Financing publishing citations?

What are the leading authors, contributing organisations and leading countries contributing to the Money Laundering for Terrorist Financing?

Searching & Retrieving Data

SCOPUS, Web of Science, Google Scholar, etc. are some of the databases that are available to search for the documents for the bibliometric analysis. The SCOPUS database provided us with more search results than the others (Moosa et al., 2021). The SCOPUS database has a large number and variety of publications. Further, in recent times, Scopus has earned its reputation as a comprehensive bibliographic data source, and it has proven to be reliable and, in some ways, even better than WoS (IFERP Blog, 2022). Due to this, the study used the SCOPUS database to search and retrieve the data for analysis.

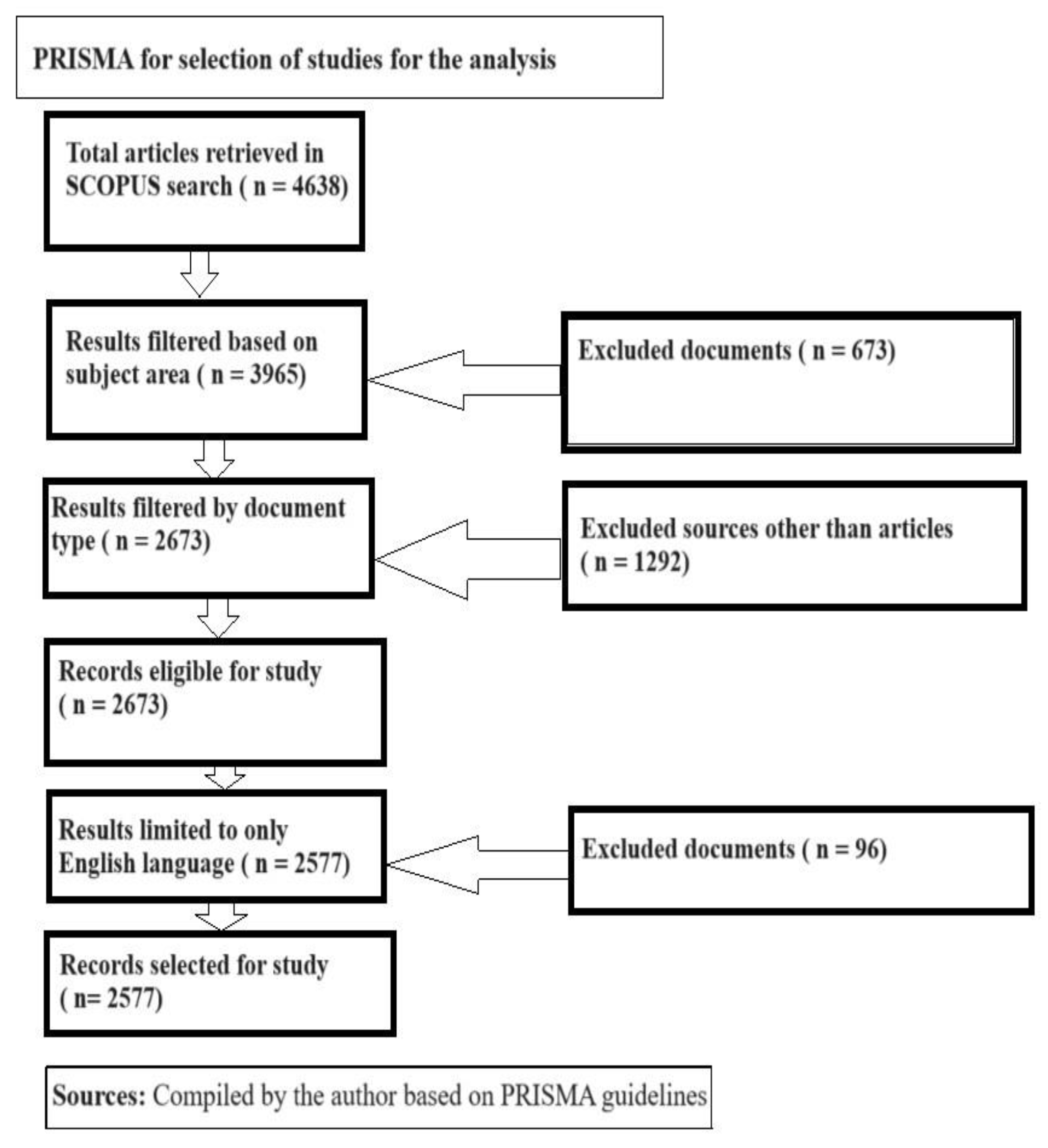

The search was done on 2 July 2024 using the keyword “Money Laundering”, “Terrorism Financing” and also adding the OR Boolean – “FATF”, “Anti-money Laundering” that resulted in a total of 4638 results. The preferred results were used for the systematic reviews (PRISMA) (Moosa et al., 2021) for identification, screening and selection of the final data for the analysis (

Figure 3).

The data file containing the 2577 documents was exported from the SCOPUS database as a .csv file and a BibTex file. The data could then be used for visualization purposes. In the study, we used the VOSviewer tool for the analysis (van Eck & Waltman, 2017). The Biblioshiny (An R tool for comprehensive Science Mapping Analysis) was utilized for the analysis (Aria & Cuccurullo, 2017). Biblioshiny contains the most extensive set of techniques and is suitable for practitioners through Bibliometrix, an R package (Moral-Muñoz et al., 2020).

TITLE ( "Money Laundering" OR "Terrorism Financing" OR "FATF" OR "Anti-money Laundering" OR "Terrorist Financing" OR "Financial Intelligence Units" OR "Financial Intelligence Unit" OR "Financial Action Task Force" OR "Financing of terrorism" OR "Financial Intelligence" OR "Counter-terrorism Financing" OR "Anti-money Laundering" OR "counter Terrorism Financing" OR "Counterterrorism" OR "Counter terrorism" ) AND ( LIMIT-TO ( SUBJAREA , "SOCI" ) OR LIMIT-TO ( SUBJAREA , "ECON" ) OR LIMIT-TO ( SUBJAREA , "BUSI" ) OR LIMIT-TO ( SUBJAREA , "MULT" ) ) AND ( LIMIT-TO ( DOCTYPE , "ar" ) OR LIMIT-TO ( DOCTYPE , "re" ) ) AND ( LIMIT-TO ( LANGUAGE , "English" ) )

4. Results

Analysis of Data

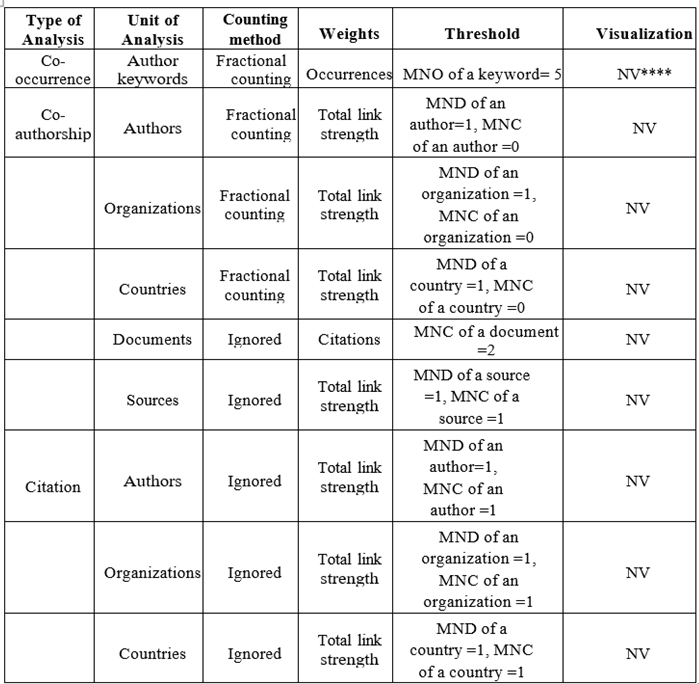

During the initial stage of the process, we obtained descriptive results. For this, electronic data files containing the descriptive values of 122 documents from the search results in the Scopus database were stored in the computer, the files were then arranged in the Excel electronic file and the descriptive results were obtained and in the next stage, visualization approaches were analyzed to reach the evaluative results (Deveci, 2023). Vosviewer which gives us the platform to use some of the methods and features for the analysis and the visualization process was used. VOSviewer is a software tool for the construction and visualization of bibliometric networks (Pires & Rafael) (van Eck & Waltman, 2017) and was used in this study to construct and view bibliometric maps. VOSviewer can display maps constructed using any suitable mapping technique and the program can be applied not only for displaying maps constructed using the VOS mapping technique but also for displaying maps constructed using techniques such as multidimensional scaling(van Eck & Waltman, 2009). VOSviewer runs on a large number of hardware and operating system platforms and can be started directly from the Internet (van Eck & Waltman, 2009). VOSviewer is a bibliometric software that has sample pieces of literature data as input, draws the knowledge map, and creates visualization maps (Huang et al., 2022). The visualization approaches based on the electronic bibliographic data can be carried out using the different analysis options available, such as co-authorship, co-occurrence, citation analysis, bibliographic coupling, and co-citation (Deveci, 2023). Further, there are different analysis options, such as author, organization, country, and source and then based on the analysis unit, the output is visualized using data mapping such as network visualization, overlay visualization, and density visualization (Deveci, 2023). The paper provides a comprehensive analysis of data utilizing co-occurrence, co-authorship, and citation mapping approaches derived from bibliographic data. The table below provides the comprehensive details of the mapping and visualization approaches based on the bibliographic data under consideration.

Table 2.

Types, Units, and Limitations of Analysis Considered in Evaluative Results.

Table 2.

Types, Units, and Limitations of Analysis Considered in Evaluative Results.

Evaluative Results

The evaluative results now include keyword co-occurrence, co-authorship, and citation analysis findings.

Co-Occurrence Keyword Analysis

The network visualization results of 219 keywords that meet the criteria out of 3788 keywords by choosing at least five occurrences of a keyword related to author keywords co-occurrence were given in the Figure below (Deveci, 2023).

The top 10 keywords with the highest co-occurrence of the top 219 keywords were money laundering (frequency of occurrence (FO)=663), terrorism (FO=273), counterterrorism (FO=234), anti-money laundering (FO=121), regulation (FO=70), corruption (FO=59), terrorist financing (FO=58), compliance (FO=48), security (FO=39). Among these keywords, the five keywords with the highest total link strength were money laundering [Total Link Strength (TLS)=541], terrorism (TLS=247), counterterrorism (TLS=198), anti-money laundering (TLS=98) and regulation (TLS=69) (Deveci, 2023).

Co-Authorship Analysis

The analysis of co-authorship among the authors yielded 1000 results and

Figure 4 displays the highest link strength for each of the 1000 authors' co-authorship connections (Deveci, 2023).

The top 10 authors with the highest total link strength of co-authorship were, respectively Mohamed norazida (TLS=11), falker marie-christen (TLS=11), omar normah (TLS=10), Unger Brigitte (TLS=8), salehi Mahdi (TLS=8), masciandaro Donato (TLS=8), kaunert christian (TLS=7), ofoeda isaac (TLS=5), kuzmenko olha (TLS=4), akartuna eray arda (TLS=4) and aish kinza (TLS=4).

The analysis of organizations' co-authorship produced 554 results.

Figure 5 displays the highest total link strength for each of the 554 organizations’ co-authorship links.

The top 10 organizations with the highest total link strength of co-authorship were respectively Teichmann International (Schweiz) AG (TLS=5), Accounting Research Institute, University Technology Mara, Shah Alam (TLS=5), School of Law, University Utara (TLS=3), Faculty of Law, University Kebangsaan (TLS=3), Association of German public sector bank (TLS=3), Bocconi University (TLS=3) , University of Gujarat (TLS=3), Prince Sultan University (TLS=2), Financial Intelligence Unit (TLS=2), University of Birmingham (TLS =2), European University Institute (TLS=2).

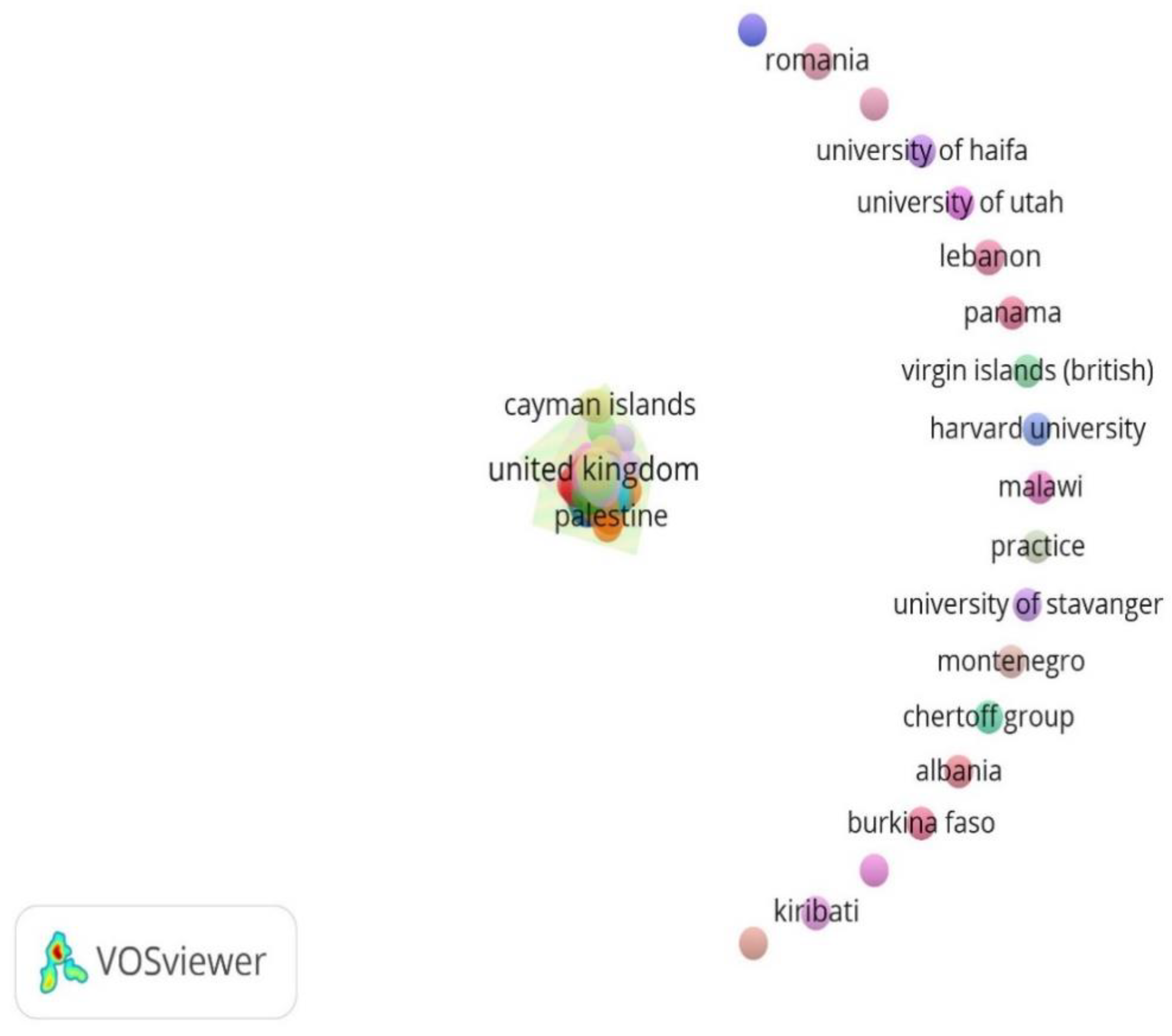

Countries were analyzed for co-authorship, yielding 140 results.

Figure 6 displays the highest total link strength for each country's co-authorship connections.

The top 10 countries with the highest total link strength of co-authorship were respectively United Kingdom (TLS=104), United States (TLS=77), Australia (TLS=50), Netherlands (TLS=28), Malaysia (TLS=23), China (TLS=16), Canada (TLS=15), Indonesia (TLS=14), Switzerland (TLS=9), India (TLS=8). The United Kingdom, with the highest total link strength, has the strongest connection with the United States and Australia.

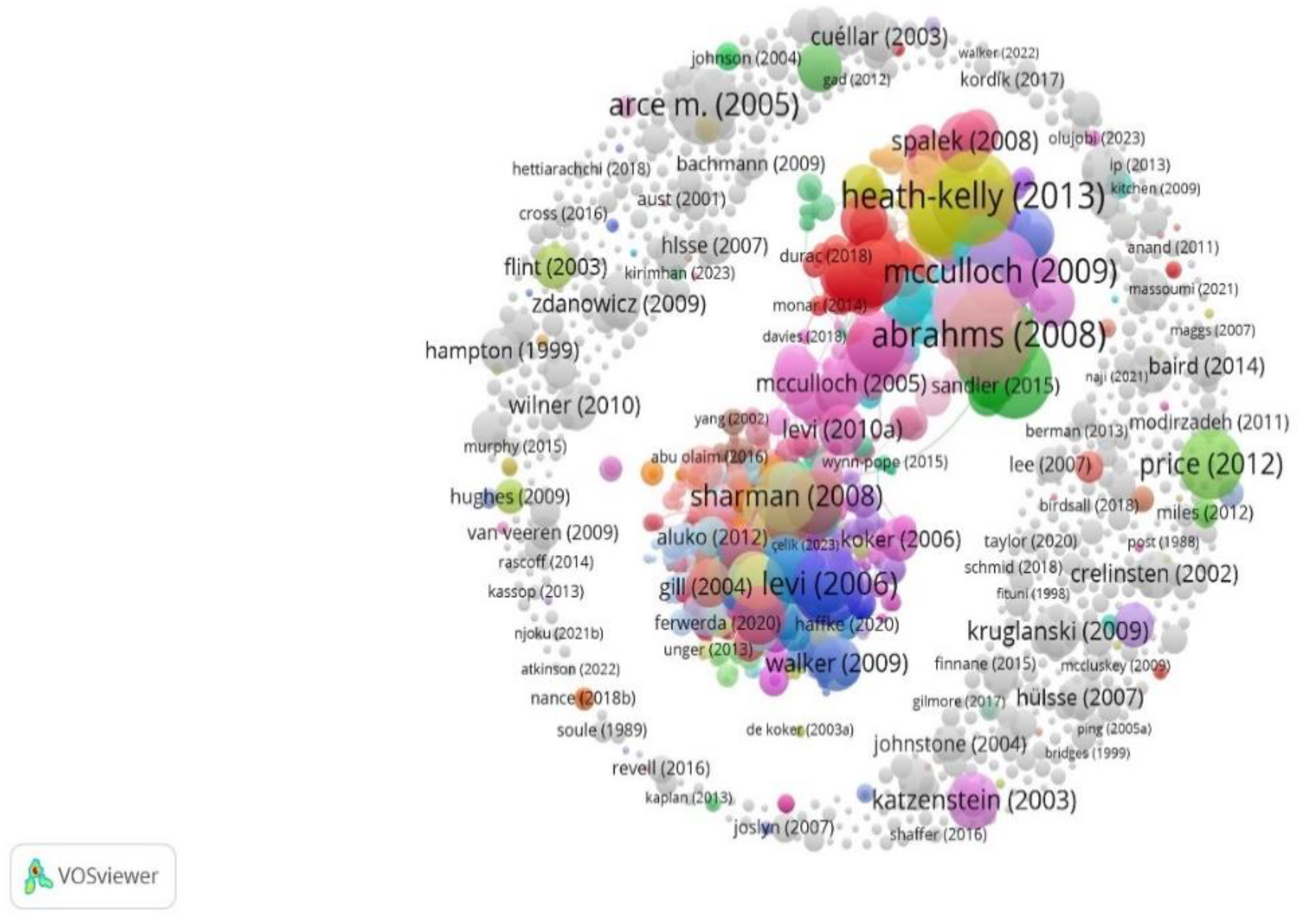

Citation Analysis

The network visualization of the citation links calculated for each of the 940 documents that meet the threshold value out of 1000 documents in the citation analysis results in terms of documents was given (Deveci, 2023) in

Figure 7.

The top 10 highly cited documents are as follows, with Abrahms (2008) leading the list with an impressive number of citations (NC)=293], Heath-kelly (2013; NC=281), Tyler (2010; NC=251), Mcculloch (2009; NC=226), Bueno de Mesquita (2007; NC=219), Lum (2006; NC=201), Levi (2006; NC=201), Koschade (2006; NC=144), Hoffman (2005; NC=135) and Den Boer (2008; NC=133). In addition, the top 10 documents with the highest citation link were respectively Abrahms (2008), Heath-kelly (2013), Tyler (2010), Mcculloch (2009), Bueno de Mesquita (2007), Lum (2006), Levi (2006), Koschade (2006), Hoffman (2005), Den Boer (2008). Moreover, the documents with the most citations were given in the reference list (Deveci, 2023).

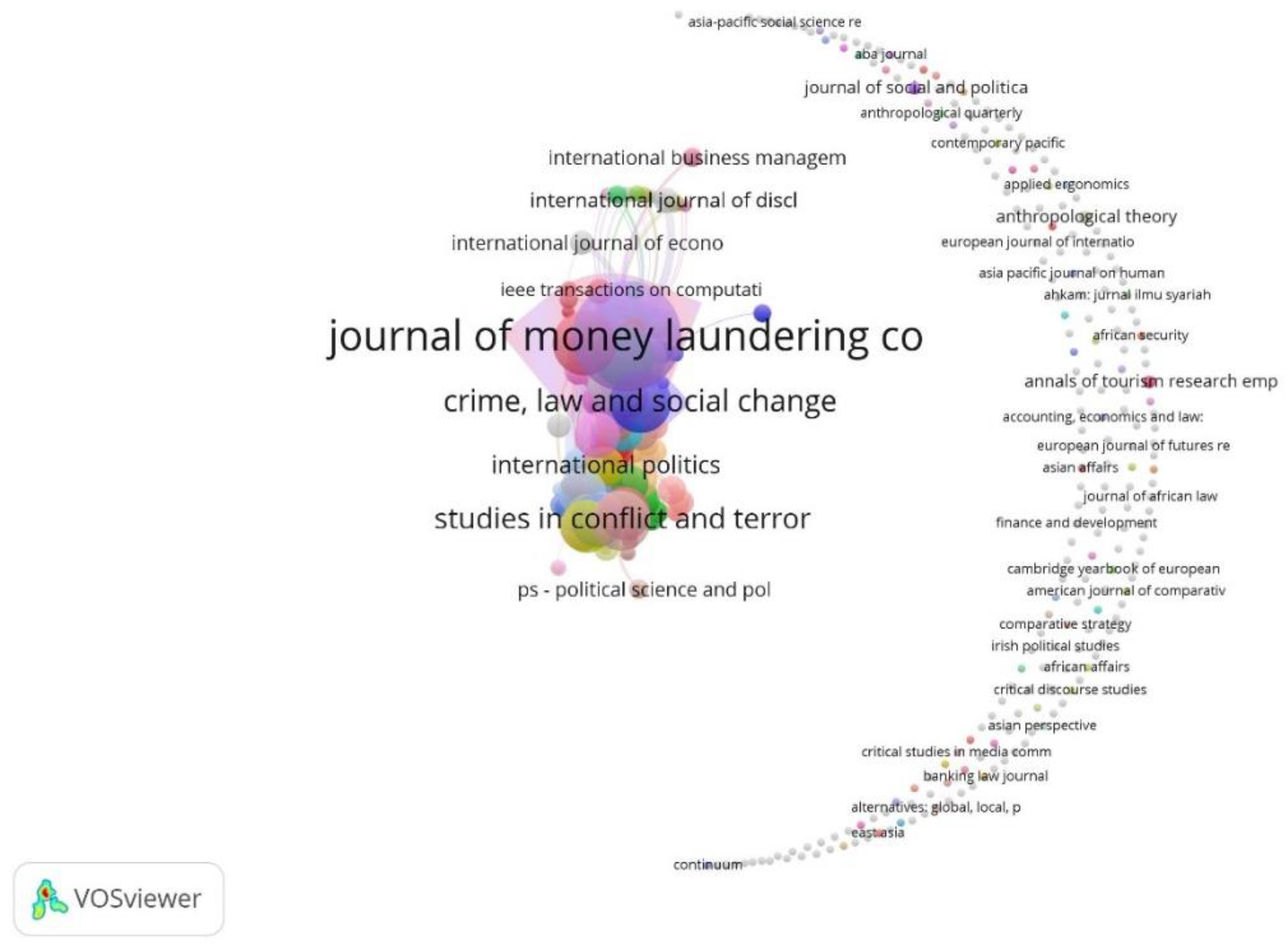

Total Link Strength According to Sources

A total of 760 sources (journal, congress, etc.) were reached according to the sources and the total link strength of citation links of 430 sources meeting the criteria from 760 sources was given (Deveci, 2023) in

Figure 8.

The top five sources with the highest number of citations were, respectively, the Journal of Money Laundering (NC=1169), Crime, law and Social Change (NC=170), Journal of Financial Regulation and Compliance (NC=153), Studies in Conflict and Terrorism (NC=148), and Terrorism and political violence (NC=100). Additionally, the top five sources with the highest total link strength of citation links were, respectively, the Journal of Money Laundering, Crime, law and Social Change, the Journal of Financial Regulation and Compliance, and Studies in Conflict and Terrorism and Terrorism and Political Violence.

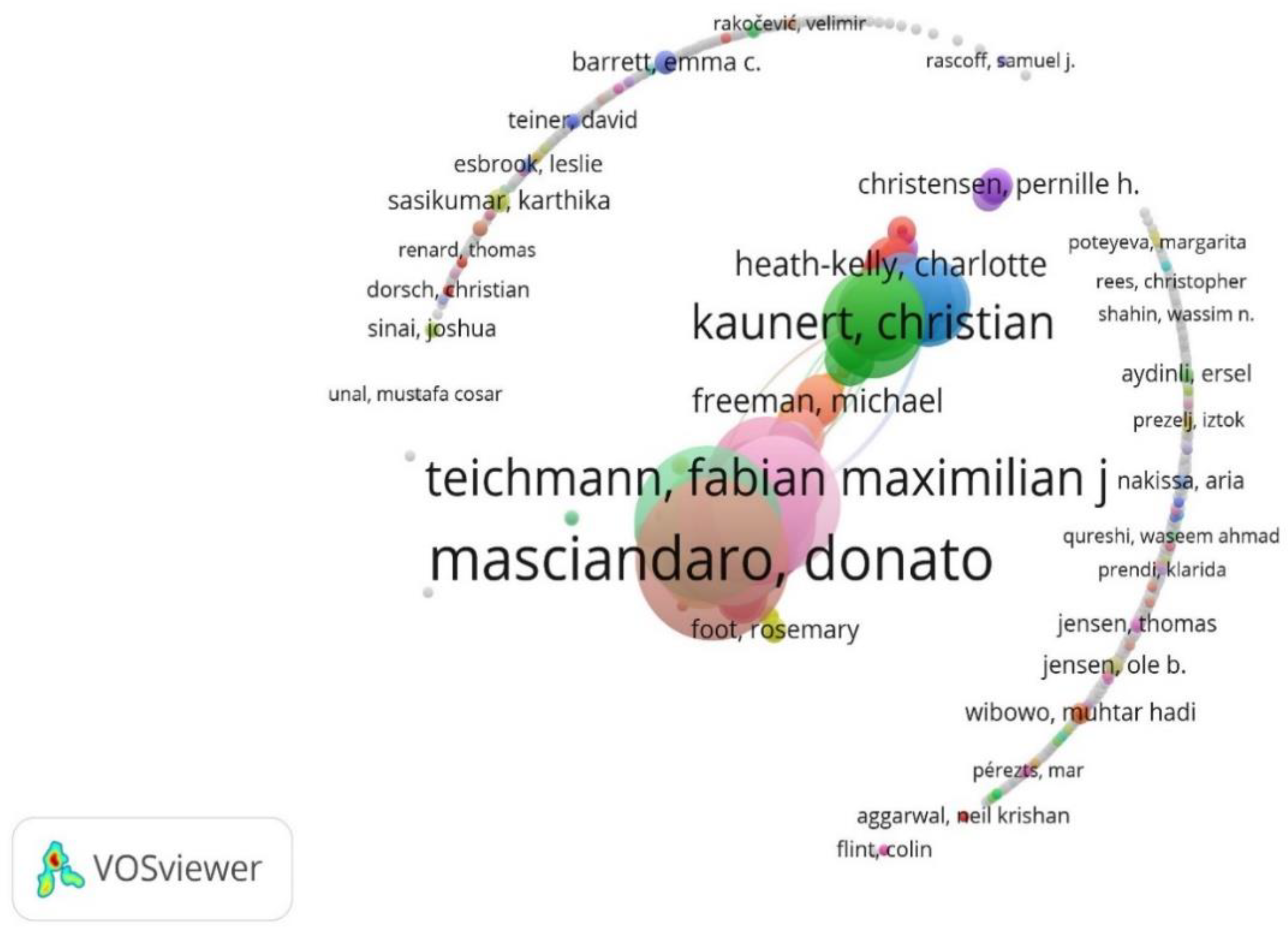

Total Link Strength to Authors

As a result of the citation analysis, a total of 2000 authors were reached and The total link strength of citation links of 1692 authors out of 2000 who met the criteria was given (Deveci, 2023) in

Figure 9.

The top 10 authors who have received the highest number of citations are as follows, respectively Masciandaro Donato (NC=349), Levi Michael (NC=229), Teichmann Fabian Maximilian johannes (NC=196), Mohammed Norazida (NC=180), Unger brigitte (NC=180), Salehi Mahdi (NC= 164), Ofoeda Isaac (NC=144), Ferwerda jonas (NC=143), Kaunert Christian (NC=139) and Naheem mohammed ahmad (NC=129). Furthermore, the following is a list of the top 10 authors with the highest total link strength of citation links, respectively, Masciandaro Donato, Levi Michael, Teichmann Fabian Maximilian Johannes, Mohammed Norazida, Unger Brigitte, Salehi Mahdi, Ofoeda Isaac, Ferwerda Jonas, Kaunert Christian, Naheem mohammed ahmad.

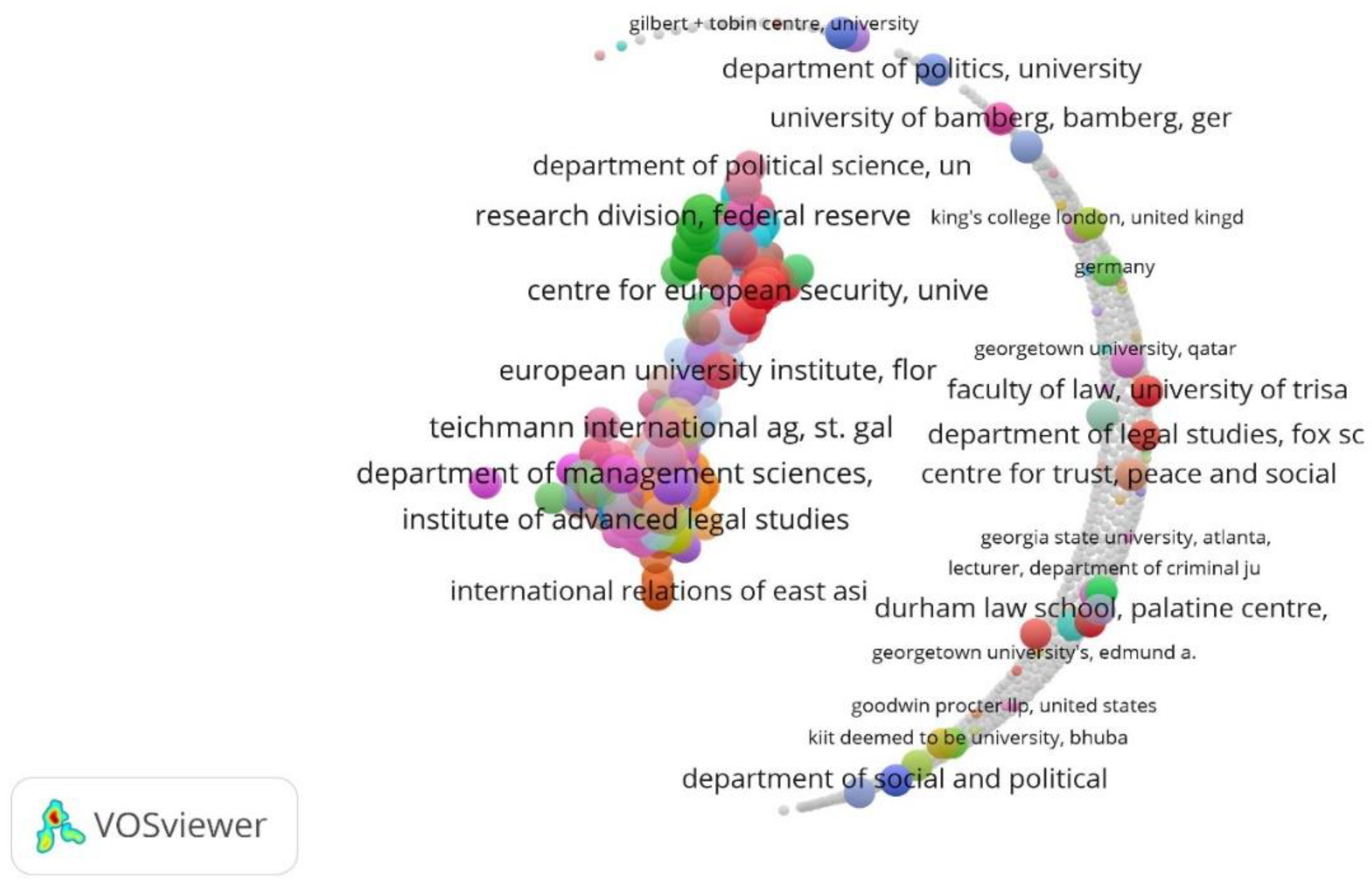

A total of 1500 organizations were identified through the organization's citation analysis.

Figure 10 presents the total link strength of citation links for 1477 organizations that met the specified criteria out of the total 1500 identified organizations.

Total Link Strength to Organizations

The top 10 organizations with the highest number of citations were, respectively Institute of Finance Management, Tanzania (NC=222); Teichmann International Ag, St. Gallen, Switzerland (NC=210), Teichmann International Schweiz, Switzerland (NC=129), Department of Economics and Administrative Sciences, Iran (NC=122), Department of Management and Administrative Sciences, Gujarat (NC=84), Department of Finance, Ghana (NC=85), Department of Accounting, Ghana (NC=70), Accounting Research Institute, Malaysia (NC=58), Bocconi University, Italy (NC=51), Southwest Jiaotong University, China (NC=48). In addition, the top ten organizations with the highest total link strength of citation links were identified as the Institute of Finance Management, Tanzania; Teichmann International Ag, St. Gallen, Switzerland; Teichmann International Schweiz, Switzerland; Department of Economics and Administrative Sciences, Iran, Department of Management and Administrative Sciences, Gujarat, Department of Management and Administrative Sciences, Gujarat, Department of Finance, Ghana, Department of Accounting, Ghana, Accounting Research Institute, Malaysia and Bocconi University, Italy and Southwest Jiaotong University, China.

The following list comprises the top 10 countries with the highest citation counts were, respectively United Kingdom (NC=1242), United States (NC=731), Australia (NC=670), Italy (NC=412), Malaysia (NC=364), Pakistan (NC=225), Canada (NC=262), China (NC=187), Iran (NC=182), New Zealand (NC=120). Furthermore, the top 10 countries with the highest total link strength of citation links were the United Kingdom, United States, Australia, Italy, Malaysia, Pakistan, Canada, China, Iran and New Zealand.

Total Link Strength to Countries

A total of 140 countries were identified in the citation analysis by country and the total link strength of citation links of 108 countries meeting the criteria from 140 countries was given in

Figure 12 (Deveci, 2023).

5. Emerging Trends in Money Laundering for Terror Financing

1. Increased Focus on Network Analysis:

The use of co-occurrence analysis of keywords suggests a shift towards studying money laundering and terror financing as interconnected networks. This emphasizes the significance of comprehending the connections between actors, methods, and vulnerabilities within the larger financial system.

2. Evolving Techniques and Actors:

The analysis suggests that there is an increasing amount of research focused on specific techniques, such as trade-based money laundering. Furthermore, delving into the co-authorship analysis could potentially uncover valuable information about the participation of non-state actors or individuals in terror financing endeavors.

3. Regulatory and Compliance Landscape:

The increasing usage of keywords such as "regulation" and "compliance" indicates a rising curiosity among researchers regarding the effectiveness of current anti-money laundering/counter-terrorist financing (AML/CTF) regulations. This corresponds to the necessity of modifying regulatory frameworks to tackle new and evolving risks.

4. Technological Advancements and Vulnerabilities:

The analysis does not directly address keywords associated with new technologies; however, it could be beneficial to investigate how the emergence of cryptocurrencies, virtual assets, and online platforms are being misused for money laundering and terrorism financing.

5.Geographic Trends:

Citation analysis shows a concentration of research in developed nations such as the UK and the US. Additional studies could examine money laundering and terrorism financing patterns in developing countries, where vulnerabilities may be more pronounced.

6.Heightened Focus on Specific Areas:

Although money laundering and terrorism financing continue to be central topics, the analysis reveals a growing focus on particular aspects within these issues. Terms such as "counterterrorism," "regulation," and "compliance" indicate a trend towards stronger measures to combat these activities.

7.Collaboration and Knowledge Exchange:

The co-authorship analysis indicates active cooperation among researchers from various countries and institutions (e.g., universities, Financial Intelligence Units). This reflects a global initiative to comprehend and combat money laundering and terrorism financing. The involvement of leading countries such as the UK, the US, and Australia further underscores this international collaboration.

8.Key Sources and Researchers:

The citation analysis identifies significant sources and researchers who are influential in this field. Journals like "The Journal of Money Laundering" and "Studies in Conflict and Terrorism" appear to be crucial platforms for research on this subject (Weinberg & Eubank) . Additionally, prominent researchers such as Masciandaro Donato, Levi Michael, and Teichmann Fabian are emerging as thought leaders in this area.

9Emphasis on Effectiveness:

The examination of highly cited documents indicates a growing interest in assessing the effectiveness of existing anti-money laundering and counter-terrorism financing (AML/CTF) measures. This is reflected in the high citation counts for works like "Abrahms (2008)" and "Heath-Kelly (2013)."

10.Technological Developments:

Cryptocurrencies and Virtual Assets: The rising use of cryptocurrencies and other digital assets in illicit financial activities represents a considerable challenge. Their anonymous nature complicates the tracing and monitoring of transactions, thus facilitating money laundering and terrorist financing.

E-commerce and Online Platforms: The expansion of e-commerce and online marketplaces has opened new avenues for money laundering, as criminals take advantage of these platforms to conceal illegal proceeds.

Artificial Intelligence and Machine Learning: While these technologies offer potential solutions for fraud detection, they can also be exploited by criminals to devise more sophisticated evasion tactics.

11.Changing Typologies:

Trade-Based Money Laundering: This method continues to be a common practice, with criminals using trade transactions to obscure the illegal origins of funds.

Non-Profit Organizations: Terrorist groups frequently utilize non-profit organizations as a façade for fundraising and money laundering operations.

Human Trafficking: The funds generated from human trafficking are increasingly laundered through intricate financial networks, highlighting the intersection between organized crime and terrorism.

12.Geographic Shifts:

Emerging Economies: The rise of emerging markets makes them appealing targets for money laundering and terrorism financing due to their weaker regulatory frameworks and financial systems.

Cross-Border Crime: The globalization of financial systems enables cross-border money laundering and terrorism financing, complicating efforts by law enforcement agencies to track illicit funds.

13.Regulatory Changes:

Enhanced Due Diligence: Financial institutions are adopting stricter customer due diligence protocols to detect and report suspicious activities.

International Cooperation: Increased cooperation among countries is vital for the fight against transactional financial crimes.

Public-Private Partnerships: Collaboration between government agencies and the private sector is essential for developing effective anti-money laundering and counter-terrorism financing strategies.

14.Additional Considerations:

While the analysis provides a starting point, considerations can be made to incorporate recent research on emerging trends like the exploitation of virtual assets, crowdfunding platforms, and even environmental crimes as potential sources of terror financing.

6. Findings

This bibliometric analysis of 122 research articles retrieved from the Scopus database revealed several key findings regarding the research landscape on money laundering (ML) and terrorist financing (TF).

- a)

Focus Areas:

Thematic analysis using co-occurrence keywords identified "money laundering" as the most frequent term, followed by "terrorism," "counterterrorism," "anti-money laundering," and "regulation." This highlights the primary focus on understanding the nature of ML and the strategies to combat it.

Citation analysis revealed the most cited documents dealt with broader themes of terrorism and counterterrorism, suggesting a potential gap in research specifically focused on the intersection of ML and TF.

- b)

Authorship and Collaboration:

The analysis of co-authorship revealed the top 10 authors and institutions that possess the highest total link strength (Deveci, 2023). This data is valuable for identifying leading researchers and potential collaborators within the domain.

The nations with the highest total link strength among the top 10 include the United Kingdom, the United States, and Australia, reflecting a strong research emphasis in developed countries.

- c)

Sources and Citations:

The "Journal of Money Laundering" emerged as the publication with the most citations, followed by "Crime, Law and Social Change" and "Journal of Financial Regulation and Compliance." These findings suggest that these journals serve as important venues for sharing research on money laundering (ML) and terrorist financing (TF).

Among the top 10 most cited authors were Masciandaro Donato, Levi Michael, and Teichmann Fabian Maximilian Johannes. These scholars have notably advanced the field.

The results indicate that research on ML and TF is becoming more interdisciplinary, establishing links between financial crimes, terrorism studies, and regulatory frameworks. While prominent researchers and institutions have been identified, there remains a need for further investigation into the effectiveness of prevailing strategies aimed at combating ML and TF activities.

7. Conclusions

This bibliometric analysis offers an extensive summary of the research landscape surrounding money laundering and terrorist financing. The study has explored co-occurrence patterns, authorship dynamics, and citation networks, highlighting significant research themes, prominent scholars, and essential publications within the discipline.

The prominence of "money laundering" as a central keyword brings to light its continued significance as a research focus. However, the relatively lower frequency of terms directly linked to terrorist financing suggests a potential gap in research dedicated to this specific intersection. This shows the need for further exploration of the evolving relationship between these two criminal activities.

The analysis reveals a concentration of research in developed countries, particularly the United Kingdom, the United States, and Australia. To enhance the global perspective on ML and TF, future research should prioritize collaborations with scholars from diverse geographical contexts, especially regions known for financial crime hotspots.

Furthermore, the study identifies a need for deeper investigation into the effectiveness of existing anti-money laundering and counter-terrorism financing measures. The practical implications of research findings can be examined by policymakers and practitioners so that they can develop more robust strategies to combat these transnational crimes.

8. Future Scope of Research

Further research is needed on the use of cryptocurrencies in money laundering and terrorist financing. Additionally, more research is required on how machine learning can aid in identifying money laundering and terrorist financing. Future research should also explore the gaps in anti-money laundering and counter-terrorism financing, as well as how these policies can be implemented in vulnerable countries.

Author Contributions

The five authors, H.T., S.D., P.B., S.B.D., H.B and S.O.J contributed equally to all aspects of this article. Conceptualization, H.T., S.D., P.B., S.B.D., H.B and S.O.J; methodology, H.T.; software, S.D.; validation, H.T., S.D. and P.B.; formal analysis, S.D.; investigation, S.D.; resources, H.T., S.D., P.B., S.B.D., H.B and S.O.J.; data curation, S.D.; writing—original draft preparation, S.D.; writing—review and editing, S.D., H.T. and P.B..; visualization, S.D. and H.T.; supervision, H.T., H.B and S.O.J.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abrahms, M. (2008). What terrorists really want: Terrorist motives and counterterrorism strategy. International Security, 32(4), 78–105. https://doi.org/10.1162/isec.2008.32.4.78. [CrossRef]

- Ahuja, D., Bhardwaj, P., & Madan, P. (2023). Money laundering: A bibliometric review of three decades from 1990 to 2021. Smart Analytics, Artificial Intelligence and Sustainable Performance Management in a Global Digitalised Economy, 55–72. https://doi.org/10.1108/s1569-37592023000110b003. [CrossRef]

- Al-Suwaidi, N. A., & Nobanee, H. (2020). Anti-money laundering and anti-terrorism financing: A survey of the existing literature and a future research agenda. Journal of Money Laundering Control, 24(2), 396–426. https://doi.org/10.1108/jmlc-03-2020-0029. [CrossRef]

- Alsuwailem, A. A., & Saudagar, A. K. (2020). Anti-money laundering systems: A systematic literature review. Journal of Money Laundering Control, 23(4), 833–848. https://doi.org/10.1108/jmlc-02-2020-0018. [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959-975. [CrossRef]

- Boer, m. D., hillebrand, c., & nölke, a. (2007). Legitimacy under pressure: the european web of counter-terrorism networks*. Jcms: journal of common market studies, 46(1), 101–124. Https://doi.org/10.1111/j.1468-5965.2007.00769.x. [CrossRef]

- Bueno de Mesquita, E., & Dickson, E. S. (2007). The propaganda of the deed: Terrorism, counterterrorism, and mobilization. American Journal of Political Science, 51(2), 364–381. https://doi.org/10.1111/j.1540-5907.2007.00256.x. [CrossRef]

- Davidescu, A. A., Lobont, O. R., Manta, E. M., & Hapau, R. G. (2023). Mapping the field. A text analysis of Money Laundering Research Publications. Smart Analytics, Artificial Intelligence and Sustainable Performance Management in a Global Digitalised Economy, 171–187. https://doi.org/10.1108/s1569-37592023000110b011. [CrossRef]

- Deveci, İ. (2023). Bibliometric analysis of published documents on entrepreneurship in basic sciences (physics, chemistry, biology). Journal of Turkish Science Education. https://doi.org/10.36681/tused.2023.012. [CrossRef]

- Ellegaard, O., & Wallin, J. A. (2015). The bibliometric analysis of scholarly production: How great is the impact? Scientometrics, 105(3), 1809–1831. https://doi.org/10.1007/s11192-015-1645-z. [CrossRef]

- Fractal tools in terrorist and financial crime prevention. https://dais.sanu.ac.rs/handle/123456789/866.

- Ginting, W., Hanita, M., & Riyanta, S. (2024). Analysis of the impact of financial action task force on money laundering and terrorism financing?(FATF) on the supervision of money laundering and terrorism financing crimes in Indonesia. Asian Journal of Social and Humanities, 2(8), 1832–1843. https://doi.org/10.59888/ajosh.v2i8.319. [CrossRef]

- Goldbarsht, D., & Benson, K. (2023). From later to sooner: Exploring compliance with the Global Regime of anti-money laundering and counter-terrorist financing in the legal profession. Journal of Financial Crime, 31(4), 795–809. https://doi.org/10.1108/jfc-08-2023-0201. [CrossRef]

- Heath-Kelly, C. (2012). Counter-terrorism and the counterfactual: Producing the ‘radicalisation’ discourse and the UK prevent strategy. The British Journal of Politics and International Relations, 15(3), 394–415. https://doi.org/10.1111/j.1467-856x.2011.00489.x. [CrossRef]

- Hoffman, A. M., & Shelby, W. (2017). When the “Laws of Fear” do not apply: Effective counterterrorism and the sense of security from terrorism. Political Research Quarterly, 70(3), 618–631. https://doi.org/10.1177/1065912917709354. [CrossRef]

- Huang, Y.-J., Cheng, S., Yang, F.-Q., & Chen, C. (2022). Analysis and visualization of research on resilient cities and communities based on Vosviewer. International Journal of Environmental Research and Public Health, 19(12), 7068. https://doi.org/10.3390/ijerph19127068. [CrossRef]

- Isolauri, E. A., & Ameer, I. (2022). Money laundering as a transnational business phenomenon: A systematic review and future agenda. Critical Perspectives on International Business, 19(3), 426–468. https://doi.org/10.1108/cpoib-10-2021-0088. [CrossRef]

- Jensen, R. I., Ferwerda, J., Jørgensen, K. S., Jensen, E. R., Borg, M., Krogh, M. P., Jensen, J. B., & Iosifidis, A. (2023). A synthetic data set to benchmark anti-money laundering methods. Scientific Data, 10(1). https://doi.org/10.1038/s41597-023-02569-2. [CrossRef]

- Kalokoh, A. (2024). Money laundering and terrorist financing risks and Democratic governance: A global correlational analysis. Journal of Money Laundering Control. https://doi.org/10.1108/jmlc-09-2023-0151. [CrossRef]

- Katica, A. (2024). Money laundering and terrorism financing in Bosnia and Herzegovina: A review of the legislative framework and current situation. Kriminalističke Teme, 24(1–2), 63–78. https://doi.org/10.51235/kt.2024.24.1-2.63. [CrossRef]

- Khelil, I., Khlif, H., & Achek, I. (2023). The economic consequences of money laundering: A review of empirical literature. Journal of Money Laundering Control. https://doi.org/10.1108/jmlc-09-2023-0143. [CrossRef]

- Korauš, A., Jančíková, E., Gombár, M., Kurilovská, L., & Černák, F. (2024). Ensuring Financial System Sustainability: Combating hybrid threats through anti-money laundering and counter-terrorist financing measures. Journal of Risk and Financial Management, 17(2), 55. https://doi.org/10.3390/jrfm17020055. [CrossRef]

- Koschade, S. (2007). A social network analysis of Jemaah Islamiyah: The applications to counterterrorism and Intelligence. Studies in Conflict & Terrorism, 29(6), 559–575. https://doi.org/10.1080/10576100600798418. [CrossRef]

- Léonard, S., & Kaunert, C. (2012). Combating the financing of terrorism together? The influence of the United Nations on the European Union’s Financial Sanctions Regime. The Influence of International Institutions on the EU, 111–134. https://doi.org/10.1057/9780230369894_7. [CrossRef]

- Levi, M., & Reuter, P. (2006). Money laundering. Crime and Justice, 34(1), 289–375. https://doi.org/10.1086/501508. [CrossRef]

- Levi, M., & Reuter, P. (2006a). Money laundering. Crime and Justice, 34(1), 289–375. https://doi.org/10.1086/501508. [CrossRef]

- Lum, C., Kennedy, L. W., & Sherley, A. (2006). Are counter-terrorism strategies effective? the results of the Campbell systematic review on counter-terrorism evaluation research. Journal of Experimental Criminology, 2(4), 489–516. https://doi.org/10.1007/s11292-006-9020-y. [CrossRef]

- Maier, D., Maier, A., Așchilean, I., Anastasiu, L., & Gavriș, O. (2020). The Relationship between Innovation and Sustainability: A Bibliometric Review of the Literature. Sustainability, 12(10), 4083. [CrossRef]

- Masciandaro, d. (2013). Money laundering and its effects on crime: A macroeconomic approach. Edward Elgar. [CrossRef]

- McCulloch, J., & Pickering, S. (2009). Pre-crime and counter-terrorism: Imagining future crime in the “war on terror.” British Journal of Criminology, 49(5), 628–645. https://doi.org/10.1093/bjc/azp023. [CrossRef]

- Molla Imeny, V., Norton, S. D., Salehi, M., & Moradi, M. (2020). Taxonomies of money laundering: An Iranian perspective. Journal of Money Laundering Control, 24(2), 348–360. https://doi.org/10.1108/jmlc-07-2020-0074. [CrossRef]

- Moosa, V., Khalid, A. H., & Mohamed, A. (2021). The intellectual landscape of research on Change Management: A Bibliometric analysis. Management Research Review, 45(8), 1044–1059. https://doi.org/10.1108/mrr-04-2021-0256. [CrossRef]

- Moral-Muñoz, J. A., Herrera-Viedma, E., Santisteban-Espejo, A., & Cobo, M. J. (2020). Software tools for conducting bibliometric analysis in science: An up-to-date review. Profesional de la Información, 29(1). [CrossRef]

- Naheem, M. A. (2018). Is tackling trade-based money laundering (TBML) through stricter reporting regulations the most effective response? Journal of Money Laundering Control, 21(3), 345–357. https://doi.org/10.1108/jmlc-08-2015-0034. [CrossRef]

- Nizzero, M. (2023). Anti-money laundering and countering terrorist financing from an IR, criminology, and compliance perspective. Countering Terrorist and Criminal Financing, 19–30. https://doi.org/10.4324/9781003092216-3. [CrossRef]

- Ofoeda, I., Agbloyor, E. K., Abor, J. Y., & Osei, K. A. (2020). Anti-money laundering regulations and financial sector development. International Journal of Finance & Economics, 27(4), 4085–4104. https://doi.org/10.1002/ijfe.2360. [CrossRef]

- Pires, A. L., & Rafael, C. (2022). Analysis of scientific production on Technological Innovation in Tourism. European Journal of Tourism Hospitality and Recreation. https://doi.org/10.2478/ejthr-2021-0003. [CrossRef]

- Practice, A.-M. L., Muller, W. H., Kälin, C. H., & Goldsworth, J. G. (2012). Anti-Money Laundering: International Law and Practice. John Wiley & Sons Ltd.

- Saxena, C., & Kumar, P. (2023). Bibliometric analysis of the journal of money laundering control: Emerging trends and a way forward. Journal of Money Laundering Control, 26(5), 947–969. https://doi.org/10.1108/jmlc-06-2022-0075. [CrossRef]

- Software survey: VOSviewer, a computer program for bibliometric mapping | Scientometrics. https://link.springer.com/article/10.1007/s11192-009-0146-3.

- Teichmann, F. M., & Falker, M.-C. (2020). Money laundering through deposit boxes. Journal of Money Laundering Control, 23(4), 805–818. https://doi.org/10.1108/jmlc-07-2019-0058. [CrossRef]

- Teichmann, F., Boticiu, S. R., & Sergi, B. S. (2022). Compliance risks for crowdfunding. A neglected aspect of money laundering, terrorist financing and fraud. Journal of Financial Crime, 31(3), 575–582. https://doi.org/10.1108/jfc-05-2022-0116. [CrossRef]

- Tiwari, M., Ferrill, J., & Allan, D. M. C. (2024). Trade-based money laundering: A systematic literature review. Journal of Accounting Literature. https://doi.org/10.1108/jal-11-2022-0111. [CrossRef]

- Tiwari, M., Gepp, A., & Kumar, K. (2020). A review of Money Laundering Literature: The State of research in Key Areas. Pacific Accounting Review, 32(2), 271–303. https://doi.org/10.1108/par-06-2019-0065. [CrossRef]

- Tyler, T. R., Schulhofer, S., & Huq, A. Z. (2010). Legitimacy and deterrence effects in Counterterrorism Policing: A Study of Muslim Americans. Law & Society Review, 44(2), 365–402. https://doi.org/10.1111/j.1540-5893.2010.00405.x. [CrossRef]

- Unger, B. (2013). Money laundering regulation: From Al Capone to Al Qaeda. Edward Elgar.

- van Eck, N. J., & Waltman, L. (2009). Software survey: VOSviewer, a computer program for Bibliometric mapping. Scientometrics, 84(2), 523–538. https://doi.org/10.1007/s11192-009-0146-3. [CrossRef]

- van Eck, N. J., & Waltman, L. (2017). Citation-based clustering of publications using CitNetExplorer and Vosviewer. Scientometrics, 111(2), 1053–1070. https://doi.org/10.1007/s11192-017-2300-7. [CrossRef]

- van Eck, N. J., & Waltman, L. (2017a). Citation-based clustering of publications using CitNetExplorer and Vosviewer. Scientometrics, 111(2), 1053–1070. https://doi.org/10.1007/s11192-017-2300-7. [CrossRef]

- Wagner Filho, J. A., Freitas, C. M. D. S., & Nedel, L. (2018). VirtualDesk: A comfortable and efficient immersive information visualization approach. Computer Graphics Forum, 37(3), 415–426. https://doi.org/10.1111/cgf.13430. [CrossRef]

- Weinberg, L., & Eubank, W. L. (2008). Problems with the critical studies approach to the study of terrorism. Critical Studies on Terrorism. https://doi.org/10.1080/17539150802184595. [CrossRef]

- Zakaria, N. B., Mohamed, N., & Marzukai, N. (2022). Determinant of compliance perceptions among bank officers towards Anti-Money laundering. Universal Journal of Accounting and Finance, 10(2), 457–464. https://doi.org/10.13189/ujaf.2022.100210. [CrossRef]

- Zema, T., Zema, T., Sulich, A., & Sulich, A. (2022). Models of Electricity Price Forecasting: Bibliometric Research. Energies, 15(15), 5642. [CrossRef]

- (2023). Risk Assessment Partner For National And Sectoral Risk Assessments In Relation To Anti-money Laundering And Counter Terrorist Financing [Tender documents : T495219883]. MENA Report.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).