1. Introduction

On July 30, 2020, Chinese government proposed that China should accelerate the formation of a new development pattern, which would consider domestic macro-circulationas the primary focus, with the domestic and international cycles mutually reinforcing each other. This new strategy emphasized deepening supply-side reform, expanding domestic demand, and leveraging China's vast market advantage and innovative capability. At present, China's NVC construction has blockages and pain points in many links, and faces the threat of insufficient security, stability and competitiveness, which hinders the long-term development of the economy.

Firstly, China's high value-added products heavily rely on foreign countries. The independent R&D capabilities for key basic and advanced applicable technologies are insufficient. Many industries are embedded in the Global Value Chain(GVC) system dominated by developed countries, lacking real control and dominance over value chain [

1]. Secondly, industry monopolies and regional protectionism inhibit market vitality and the optimal allocation of production factors to a certain extent, hindering the division of labor and extension of the National Value Chain (NVC). This is not conducive to forming a dominant position in the NVC[

2]. To strengthen the NVC division and push smooth development of domestic macro-circulation, it is urgent to find new channels to overcome these bottlenecks.

Simultaneously, with the rapid development of big data, cloud computing, artificial intelligence, and other digital technologies, digital methods have gradually permeated all aspects of China's economic life[

3,

4]. These technologies have become a driving force for national economic development and have profoundly influenced the innovation in China's science and technology as well as the adjustment of its economic structure. According to the statistics of China Academy of Information and Communication Research, the scale of China's digital economy will reach 50.2 trillion yuan in 2022, accounting for 41.5% of GDP. The Chinese government's 14th Five-Year Plan emphasizes that accelerating the development of the digital economy is anticipated to be a new engine for high-quality growth, thereby affirming its robust potential as a key growth driver. Over the years, China has continuously strengthened the construction of information and communication technologies, data centers, the internet, and other digital infrastructure. This ongoing enhancement of the digital architecture has not only elevated the digital level but also created favorable conditions for enterprises to participate in the value chain and adjust their production layouts. With the help of digital technology, domestic enterprises continue to extend to the upstream and downstream segments of the value chain, and then participate in more productive links in the NVC division of labor. This provides new solutions for unimpeded domestic and international double-cycling and a construction of a more secure and reliable value chain system in digital era[

5,

6].

Accelerating the deepening of National Value Chain (NVC) is not only a breakthrough approach to adapt to changes in external trade environment but also a fundamental strategy to promote regional synergistic development and industrial upgrading. It is crucial for Chinese academic to examine whether the level of digitization can foster the development of NVC and through which channels it exerts its influence. This understanding is essential for China to overcome the predicament of "low-end lock-in" in GVCs and to achieve integration of NVC and GVC[

7].

The measurement of NVC follows the framework of GVC measurement. Trade statistics that use value-added as the accounting standard can more accurately reflect the specific conditions of countries' participation in the value chain. This approach scientifically and precisely depicts the size and direction of value-added flows in the international division of labor network[

8], and eliminates "statistical illusion" caused by traditional trade statistics, which focus solely on total amount of trade.

Hummels et al. (2001)[

9]pioneered the vertical specialization index(hereinafter referred to as HIY), which decomposes a country's exports into domestic value added and foreign value added. Scholars have continued to relax the strict assumptions of HIY along the logic of vertical specialization, and gradually tended to generalize and universalize value-added trade accounting[

10,

11,

12]. In order to study the intrinsic connection with decomposed components, Koopman et al.(2014)[

13] further subdivided total exports into nine components based on forward linkages (referred to as the KWW method) . On this basis, Wang Z. et al. (2015) extended the national level measurement to bilateral country and sector level (referred to as WWZ method), and the value added of exports is decomposed into sixteen items based on different sources of trade value added, final consumption destination and absorption path. Along with the maturity of the decomposition of export value sources, some studies have begun to try to measure the level of the NVC division of labor within a country. Li(2016)[

14] improved the Input-Output model and analyzed NVC characteristics at the sectoral as well as regional levels. Based on China's inter-regional input-output table, Li & Pan(2016)[

15] divided the "domestic value-added" in KWW into "domestic value-added in the region" and "value-added in other regions of the country" in a more refined way". Su(2016)[

16] developed a framework for tracing the sources of regional export value within a country using the KWW methodology. By integrating China's inter-regional Input-Output table with the World Input-Output table, the study decomposed the value-added sources of China's provincial-level exports. Li et al.(2018)[

17] differentiated between trade objects and third-party involvement in the WWZ method, categorizing third parties as either domestic or foreign. Building on this distinction, he expanded the original 16 items decomposed by the WWZ method into 20 items, thereby constructing an index that reflects the degree of participation of domestic regions in both GVC and NVC.

Current research on the impact of digitization on the division of labor in various regions of China is mostly qualitative. The level of digitization empowers China's "double-cycle" strategy through the simultaneous upgrading of both demand and supply systems[

18]. On the supply side, digitalization would provide robust support for the interconnection of all industrial factors by offering computational power, algorithms, and data for the economy and society. This can help eliminate mismatches between supply and demand in the economic cycle, reduce transaction costs, and promote the optimal allocation of data factor markets. Technological innovation is the main driving force of economic growth in the new development stage. With independent innovation as the core, digital economy as a new opportunity can better build the industrial support role of the Double-Cycle[

19].

On the demand side, digital economy has innovated a new mode of business, which can satisfy the diversification of domestic and overseas consumption, promote the quantity and quality of the internal and external demand market, and speed up the economic internal cycle[

20]. Additionally, some scholars have quantitatively examined the impact of digitalization levels on regional labor division within China, focusing on how digitalization influences consumption upgrading, technological advancement, and value chain synergy. Bogers et al.(2023)[

21] utilized provincial-level data in their study and found that digitization level significantly positively affects the division of labor in NVC through technology promotion, economies of scale, and consumption upgrading effects. Based on provincial level data, Sun&Guo (2023)[

22] pointed out that digital technology can increase the share of inter-provincial trade value added through consumption upgrading and cost reduction, and smooth the domestic general circulation. Wang et al. (2023)[

23] used provincial industry-level data and found that the digitization level can promote the integration of NVC and GVC by increasing linkage of value chains and upgrading production technology level. Tan (2022)[

24] utilized cities data to argue that the digitalization level can enhance domestic macro-circulation by expanding consumption demand and improving economic efficiency from the perspectives of consumption growth and efficiency enhancement. In general, the existing literature lacks studies exploring the impact of digitization level on the division of labor in NVC from the city level, as well as relatively few studies on the spatial heterogeneity and spatial spillover effects of digitization level. Meanwhile, it is still worthwhile to study whether the development of different regions and types of cities will all benefit from the level of digitization.

In summary, this paper intends to expand from the following aspects. First, from the data measurement, this paper uses match Eora National Input-Output Table with China Customs Database to get the index of the NVC at city level and can categorize the NVC and the GVC into one system for research. Second, this paper examines the influence mechanism of digitalization to promote the expansion of NVC labor division under the existing theoretical framework, and verifies that digitalization can affect urban NVC through cost reduction, consumption upgrading and market integration effects. Third, the spatial effect of the digitalization level on the division of labor of NVC is verified through the spatial econometric panel model. Meanwhile, the sample is divided into different regions and different types of cities for further empirical tests.

2. Theoretical Framework

Based on existing related studies, this paper proposes that the digitization level can deepen the division of labor in the cities through three paths: cost reduction effect, consumption upgrading effect and market integration effect.

Firstly, digitization level can deepen the division of labor in the urban NVC through cost reduction effect. First, the level of digitization can promote the deepening of the division of labor in the NVC by reducing the information cost of enterprises. Through the sharing of digitized information, enterprises can reduce the information asymmetry between upstream and downstream, reinforce the matching products quality between upstream and downstream, and diversify intermediate products input [

25]. The enterprises can leverage informational and cost advantages to consolidate the production of homogeneous products, thereby achieving economies of scale and enhancing product competitiveness through network externalities [

26,

27]. In addition, under digital economy, the credit status, performance records, market evaluation and other information of enterprises are recorded, stored and widely disseminated for a long period of time. This significantly enhances the transparency of enterprise information and increases the cost of default, creating favorable conditions for domestic and international enterprises to engage in division of labor and cooperation. Furthermore, the digitization level can reduce the production cost of enterprises, and then accelerate the deepening of the division of labor in the NVC [

28]. The penetration and integration of digital technology and production and operation processes directly improve production efficiency and management efficiency of enterprises, making the production process more intelligent, automated and flexible. Enterprises can use big data analysis to optimize production planning and resource allocation, use internet technology to achieve remote monitoring and management of equipment, and use artificial intelligence technology to replace some of the human work [

29,

30,

31]. This reduces the production cost of enterprises and further promotes the division of labor and specialization of the NVC.

As can be seen, the level of digitization could push the deepening of division of labor in the NVC by reducing innovation costs [

32]. The construction of digital networks and digital platforms provides an opportunity for enterprises to access heterogeneous innovation elements and knowledge linkages [

33,

34].The integration and expansion of knowledge across enterprise boundaries and technological fields foster collaborative innovation, addressing insufficient knowledge reserves and high risks faced by individual enterprises in technological innovation. This process enhances the R&D capabilities and innovation inclination of enterprises, and provides increased opportunities and support for their innovative activities. It not only reduces the innovation costs of enterprises, but also improves their innovation capacity and competitiveness, further promoting the division of labor and upgrading of the NVC [

35].

Secondly, digitization level can deepen the division of labor in the urban NVC through consumption upgrading effect. The level of digitization enables enterprises to analyze consumer behavior, identify consumption trends and product preferences, and maximize the potential consumption power of the market [

36]. So, the enterprises could improve product mix differentiation in order to precisely match supply with demand, and enhanced responsiveness to market changes, thus boosting the efficiency of production, logistics, and delivery to deepen the cooperation in the NVC. In addition, enterprises can take advantage of network externalities to achieve economies of scale and economies of scope, meet more tail and marginalized consumer demand at low cost through customized flexible production [

37,

38], expanding market capacity and domestic industrial division of labor. The optimizing the consumption structure brought by digitization, in turn promotes the deepening of the division of labor in the NVC.

The "Internet+" empowers traditional industries with technology and knowledge, increasing the proportion of domestic service consumption. This not only brings significant benefits to traditional industries but also creates a wide array of new consumption options [

39,

40].It offers consumers more diversified products, enables industries to engage in higher specialized divisions of labor in developing countries. Furthermore, the digitization level is conductive to raising resident income and promoting consumption upgrading, with the view of accelerating the division of labor in NVC [

41]. With the advancement of technology and innovation, the integration of digital technology with real economy has given rise to many emerging industries and new business forms, which is conducive to employment expansion [

42]. The digital employment service platform, combined with robust resource integration and digital technologies such as algorithms, can significantly enhance matching efficiency of labor market. This effectively reduces transaction costs for both supply and demand, contributes to the income growth of urban and rural residents, fundamentally stimulates consumption growth, boosts consumer demand, and promotes the division of labor in National Value Chain [

43].

Thirdly, the digitization level can deepen the labor division in urban NVC through market integration effect. The geographic and spatial constraints, along with local protectionism resulting from inter-provincial administrative decentralization, have led to market segmentation. The developing of regional economy relies more on local factors, and interregional high-quality factor cannot fully flow and share resulting in long-term impediment to improving of regional synergistic linkage mechanism [

44,

45]. All of these are not conducive to the full development of inter-regional division of labor. As a strong adhesive force, digital technology and information from network platforms is able to break down trade barriers between regions, reduce logistics and other transaction costs, and facilitate the flow of commodities and factors. So, the enterprises can timely collect, process, and analyze information so as to enhance inter-regional economic links and promote market integration.

In turn, the enhanced market integration helps to increase the degree of industrial association and broaden the structure of enterprise cooperation network [

46,

47]. The digital platform generated by the level of digitization can connect the production resources to the virtual network, and rematch and reallocate resources on a national scale. Strengthening network cooperation will drive producers, service providers, financing institutions in NVC system to gather together to form low-cost, high-efficiency ecosystem, through which enterprises can achieve the fully collaboration with enterprises in other regions [

48]. The abovementioned points promote the circular development of domestic economy and increases the dependence degree between domestic industries, thus contributing to the deepening of the division of labor in NVC.

It is well known that there is a certain degree of correlation between any two things, saying that correlation will gradually increase as distance decreases, so does economic activities. It means that the varieties of economic activities in a region will often have a significant impact on neighboring regions. Under the role of market factors, there are often close economic linkages between neighboring regions, including cross-regional flows of production factors and commodities, industrial transfer, knowledge and technology spillovers. Digital information technology can spread across time and space, as well as break through geographical constraints, so that the economic linkage between regions become more frequent and extensive [

49].

Cities with advanced digital elements will attract more digital talents, speed up the building of digital infrastructure, accelerate the development of digital industrialization and industrial digitization. All of these will promote the growth of industries in surrounding areas and further deepen the construction of the NVC. Therefore, the digitization level of a region not only promotes the deepening of local NVC, but also promotes the deepening of the NVC in neighboring regions.

Based on this, this paper proposes the following hypothesis:

Hypothesis 1: The digitization level can deepen the division of labor of NVC in neighboring regions through spatial spillovers. An increase in digitization level not only positively deepens the construction of local NVC, but also deepens the construction of NVC in neighboring regions.

Hypothesis 2: The urban digitization level will influence division of labor in the NVC through the following mechanisms such as cost reduction, consumption upgrade and market integration effect.

3. Data Sources and Research Methods

3.1. Indexes Measurement

3.1.1. Explained Variable: NVC (National Value Chain, NP)

At present, the index of NVC is mainly measured by using the Domestic Inter-Regional Input-Output Table to reflect the inflows and outflows of various industries in different regions, accurately reflecting the input-output situation of various industries in different provinces at a certain point in time. However, this Inter-Regional Input-Output Table can only obtain the data for three to four years, resulting in certain inaccuracy for panels with a longer research period. Eora National Input-Output Table reflects the inflow and outflow of different industries in different countries, as well as the inflow and outflow of different industries between domestic regions. Firstly, we use Eora National IO Table to firstly measure the full coefficient of domestic input-output of 8-bit coding sectors in China from 2000-2016. Further, after matching the industry classification of Eora National IO Table with China Customs Database, this paper next uses the share of each sector export to total enterprise exports to be weighted average with the full coefficients of domestic input-output of sectors to achieve the NVC index for enterprises. It next achieve the NVC of cites after enterprise exports as a share of city exports, weighted average of enterprise’s NVC to obtain the NVC for each city. The division of labor at city level is formed. The theoretical derivation is as follows.

Assuming that there are

countries (industries), the

Eora National Input-Output Table can be visualized in

Table 1 as follow, based on global production of value added generation.

The output of each country (industry) can be used either as an intermediate product in the production process of any kind of industry or as a final product. In contrast, under the Global Value Chain model, a country's output of product

can be used either as intermediate goods or as final goods, either domestically or exported for use in other countries. The "rows" in

Table 1 show the total output according to its use, while the "columns" indicate the specific inputs used in the production process. Among them, the

indicates the product

used in the production of product

. The vector

is the importing need of country

to the final product

. In terms of the value creation process, since total inputs equal total outputs, for any country

, there is clearly the following equation:

If we define

, i.e.

denotes the proportion of product

as an intermediate input in the total output of product

(i.e. the direct consumption coefficient). As a result, the input-output relationship between countries in

Table 1 can be expressed as a matrix:

Where

is expressed in terms of vectors as

,

is the total output of industry of country

. The

is represented as:

, where

denotes the sum of final demand from all other countries to the industries of country

.

From the formula(3), the

is the direct consumption matrix, and

denotes the intermediate products of country

used by industries from country

. Further collation of formula (2) yields:

When we look at all other nations as a whole, the world consists of the domestic country

and other countries

, then the matrix is simplified to formular(5):

Here, the is the direct coefficient of input-output between industries in domestic country and the is its inverse matrix. The represents the complete coefficients of input-output in domestic country . Furthermore, means the direct coefficient of input-output across industries between domestic country and the other country which denotes coefficients of Global Value Chain. As a result, National Value Chain and Global Value Chain are able to be unified into one system.

The domestic input-output coefficients measured by

Eora National I-O Table do not reflect the inflows and outflows between provinces, regions and cities. So, after matching

Eora National I-O Table with the 8-dit code of China's Customs Database, we obtain the input-output coefficient at enterprise level, and next define the degree of depth of the NVC at city level through formula(6):

Then, the index of NVC at city level named NP is thus obtained. Where, the represents the NVC of city in year , and theis the complete coefficients of input-output of enterprise in year determined by . And the representsthe share of export of enterprise of city in total exports of city .

3.1.2. Core Explanatory Variable: the Digitization Level (DEI)

Following Yang et al.(2022)[

50], , this paper measures the index of the digitization level from the following four dimension, i.e., digitalization base level, equipment level, application level, and effectiveness level (see

Table 2). Next, the paper uses the number of employees to describe digitization basic level, the cell phone penetration to indicate digitization equipment level, the internet penetration rate to signify digitization application level, and the scale of internet-related output and tertiary industry to denote digitization effectiveness level.

Lastly, the Entropy Value Method is used to measure the digitalization level called DEI, and the specific measurement index system is shown in

Table 2.

3.1.3. Relevant Control Variables

Drawing on the research of Wang et al.(2023)[

51], this paper chooses the control variables as follows. The index of Foreign direct investment after taking logarithms (FDI), is used to indicate the contribution of foreign-funded enterprises to the local economy . The level of human capital (HUM), is calculated as the formula: the urban human capital= elementary school enrolment × 5 + secondary school enrolment× 12 + university school enrolment × 15. Then, we next choose the ratio of non-agricultural population to total population at the end of year to represent the level of urbanization (URB).The index of government market participation (GOV), measured by the logarithm of local government expenditure, represents the government's ability to intervene in the market. At last, the index of level of science and technology inputs (TECH), is measured by logarithm of the expenditures of science and technology expenditures of cities.

3.2. Data Description

The data sample of this paper covers the period 2001-2016, and mainly involves the following three sets of data: The first dataset, the Eora National IO Table, is used to measure the input and output coefficient of each sector. The second dataset, China's Customs Database, is able to measure the enterprise’s export share, and then weights average with input-output coefficient to achieve NVC at enterprise level and urban level. The third dataset, we use the China Urban Statistical Yearbook to calculate digitizationlevel, the control variables, the consumption upgrading effect, market integration, number of urban population, and number of students enrolled in high education institutions. The missing values are processed using the linear difference method. Next, the paper shows the specific statistical indicators are shown in

Table 3.

3.3. Model Building

Research manuscripts reporting large datasets that are deposited in a publicly available database should specify where the data have been deposited and provide the relevant accession numbers. If the accession numbers have not yet been obtained at the time of submission, please state that they will be provided during review. They must be provided prior to publication.

This paper firstly constructs the following benchmark regression model as follows:

This paper firstly constructs the following benchmark regression model as follows:

In formula (7), themeans the embedding degree of NVC of city in year . is the digitization level, andrepresentsall the control variables. Here, is city fixed effects, is year fixed effect, is randomized disturbance term, and , as well as are the parameters to be estimated.

Next ,we use spatial econometric model to test spatial spillover effect of the digitization level on the NVC at cities level. The model is set according to formula(8):

Where,is the spatial autoregressive coefficient of the explained variable, and are the spatial interaction coefficients of the explanatory variable and control variables . The is the spatial weight matrix, i.e. the geographic distance matrix. To improve robustness of model, this paper uses the Spatial Durbin Model under double fixed effects of city and year. In addition to exploring the direct effect of the digitization level on the NVC, we continue to test whether the digitization level would influence urban NVC through the mediating mechanisms such as cost reduction effect, consumption upgrading effect, and market integration effect.

Formula(9)-(10),formula(11)-(12) and formula(13)-(14)respectively test whether the digitization level would indirectly influence the labor division of NVC through the intermediary mechanisms including cost reduction effect, consumption upgrading effect. The regression model sare set as follows:

Whereandare the intercept terms,andare the regression coefficients for digitization level. Thatandare the regression coefficient of the control variables. That, and are the regression coefficients of cost reduction effect, consumption upgrade effectand market integration effect, respectively.

3. The Spatial Effects of the Digitalization Level on National Value Chain

In order to test the impact of digitization level on the labor division in the NVC, regression analysis was conducted on the full sample using OLS method without considering the spatial factor in the first place. Each control variable was added to the baseline regression one by one for observation. The regression results are shown in

Table 4.

From the baseline regression results in Column 6, for every 1% increase in the digitization level, the city's NVC will increase by 0.2805%. This result is still robust after controlling for other variables in economy, suggesting that the digitization level of China's cities will rise when the city's NVC shows an upward rising trend.

Then, this paper calculates the Global Moran's I index of NVC and digitization level for 263 cities in China, respectively. According to the results, both Global Moran's I indexes of NVC and digitization level are greater than 0 and significant at 1% level during the research period. This indicates that there is a significant positive spatial correlation between both the level of NVC and the level of digitization in China's cities. That’s to say, cities with higher levels are clustered together (HH clustering) and cities with lower levels are clustered together (LL clustering).

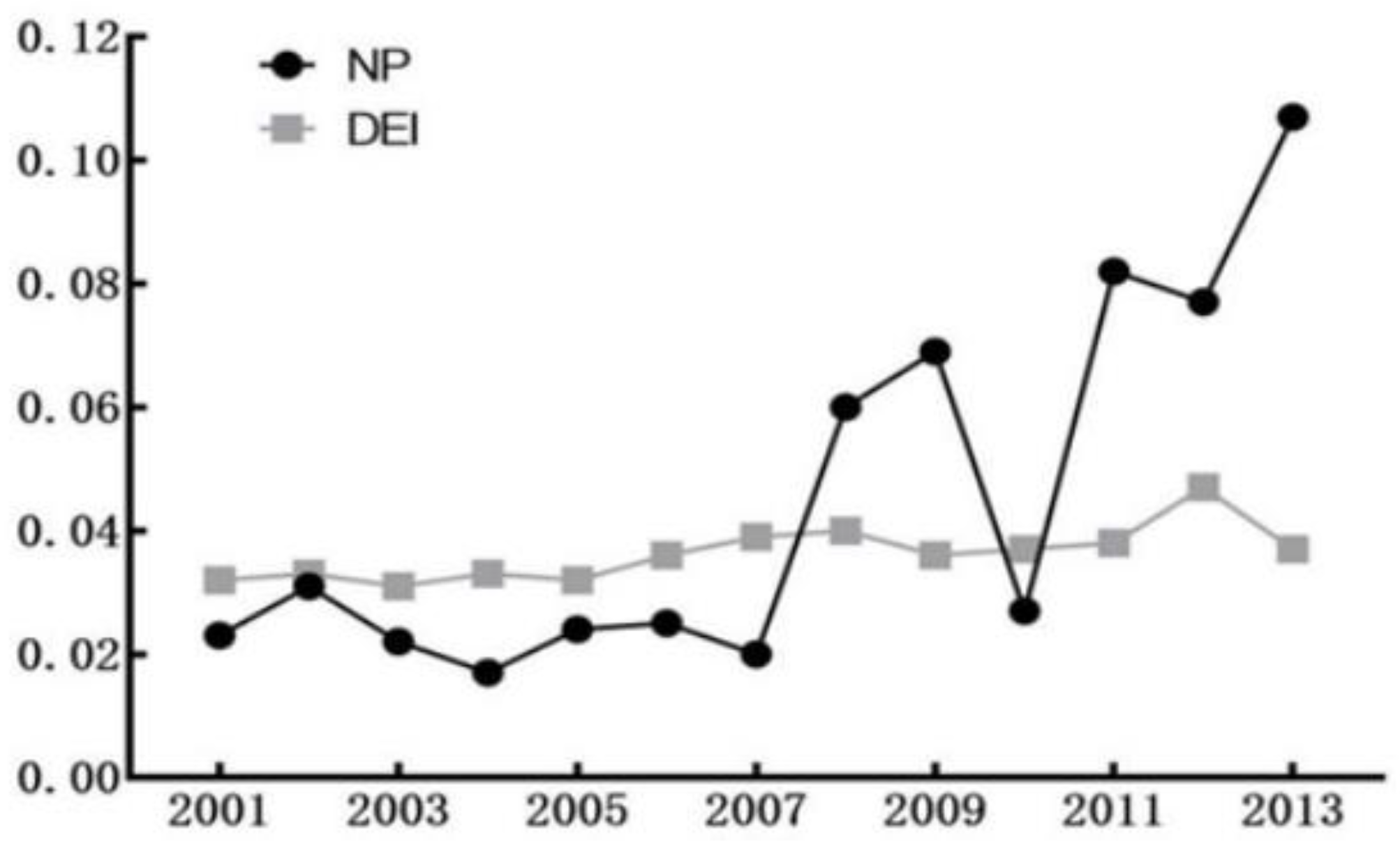

Figure 1 shows more visually in a line graph the Global Moran's I index change pattern of the NVC and digitization level in China during 2001year to 2013year. The Global Moran's I index for NVC has shown a consistent upward trend, indicating an increasing spatial concentration of NVC in Chinese cities. This suggests a pronounced economic agglomeration effect. Conversely, the Global Moran's I index for digitization levels shows an overall decreasing trend, indicating a strong radiation effect and a spatially dispersed development pattern. Through the test of Global Moran's I index, the explained variables and the core explanatory variables in this paper have significant spatial autocorrelation. Consequently, the paper chooses the spatial econometric model to test the effect of the digitization level on development of the NVC.

Figure 1.

Trend chart of global Mora’s I index.

Figure 1.

Trend chart of global Mora’s I index.

Based on the statistical judgment of LM, Wald, and Hausman (see

Table 5,

Table 6 and

Table 7), the spatio-temporal double fixed spatial panel Durbin model is the optimal one. The spatial autocorrelation coefficient is significantly positive at the 1% level, indicating a notable spatial effect of digitization level on the division of labor in NVC. We find that not only spatial autocorrelation coefficients are significantly positive, but also interaction term of spatial matrix and digitization level, i.e. W×DEI are significantly positive at the 1% level. The result suggests both exogenous interaction effect of digitization level among regions and endogenous interaction effect of NVC. Further, it considers that there is a significant spatial spillover of digitization level, which can drive the development of NVC in neighboring regions.

As demonstrated in

Table 8, the coefficients for the direct and indirect effects are 0.1376 and 6.2265, respectively, and are statistically significant at the 1% and 5% levels. This shows that the increase in digitization level not only positively improves local NVC, but also improves NVC in neighboring regions, and indirect effect is even greater than direct effect. The integration of digitization and real economy has become an irresistible trend in the future economic development.

The level of digitalization will positively impact local economic development through different paths and dimensions. It will not only drive the transformation of new and old energies but also lead to disruptive changes in the region and rapid growth of platform economy, thereby promoting the division of labor in the regional NVC. Additionally, foreign investment, urbanization level, and technological input level also have a certain spatial correlation and can have a certain spatial spillover effect on regional development, which is reflected in this study. The direct coefficients of urbanization leve(URB)l and technological input level(TECH) are significantly positive, indicating that these variables are beneficial not only to the development of local NVC but also to the development of the NVC in surrounding areas. It is worth noting that the coefficient of foreign investment(FDI) is negative. One is possibly because local industries are likely to lose their market dominance under the competitive pressure from foreign investors, two is that a large amount of resources is used for labor-intensive industries under the influence of foreign investors, which is not conducive to the deepening of NVC. The coefficient of government intervention(GOV) is negative, which is possibly because the increase in government expenditure leads to a rise in interest rates and crowd out private investment. This means that the government should shift create a favorable economic institutional environment for enterprises under digital economy era.

First, the paper reconstructs the spatial economic matrix to replace the geographic distance matrix and regress the model again. The result is showing that the model of this paper is keeping robust(see Column1 of

Table 9). Then, because large different situation of economic development as well as digitization level exist in China's different regions, this paper excludes four municipalities from the sample including Beijing, Shanghai, Tianjin and Chongqin and regress the model again. As we can see, the empirical result keeps robust which is shown in Column 2 of

Table 9.

Next, two-stage least squares (IV-2SLS) is used for endogeneity test. We use postal data of each city in 1984 as the instrumental variable for digitization level. Since the postal data does not change over time, this paper uses the interaction term of this instrumental variable and the year dummy variable to carry out two-stage least squares analysis (see

Table 10). It can be seen that the coefficients are significantly positive in both stages of instrumental variables regression, which is consistent with the previous results of the fixed effects model. In addition, the K-P rk LM statistic is significant at the 1% level, rejecting the hypothesis that the instrumental variable is under-identified. The F statistic of K-P Wald rk is 42.54, which is greater than the 10% significance level with critical value 16.38, rejecting the hypothesis of weak instrumental variables. According to the abovementioned, the instrumental variable is set reasonably and the regression result is reliable.

6. Conclusions

6.1. Main Conclusions

This paper explores how the level of digitization plays a role in the division of labor in urban NVC by examining panel data for 263l cities from 2001 to 2016, using spatial autocorrelation and spatial Durbin models. The findings are as follows: first of all, there is a significant global spatial autocorrelation between the digitization level and labor division in NVC. The increasing of the digitization level not only positively affects the deepening of local NVC, but also contributes to the deepening of NVC in neighboring regions. Next, the digitalization level has a better effect on labor division in NVC in eastern region than in central and western regions. It finds that there is a more significant effect on the NVC in knowledge-driven sample than labor-driven sample, meanwhile a higher positive effect on the NVC in internationalized business-dominated sample than in domestic business-dominated sample. Finally, the cost reduction, consumption upgrading and market integration effect can be the important mechanisms through which digitization level affects labor division in NVC. Among these ones, consumption upgrading, cost reduction and market integration effects are the vital path to improve labor division of urban NVC brought by the digitalization level in eastern, central as well as western cities, respectively.

6.2. Policy Implications

Based on the above analysis, we have derived the following policies and insights. First, the authorities and industrial association should encourage enterprises to speed up the process of digital transformation. Favorable policies and measures should be enacted to reduce the threshold of enterprise digital transformation, for example, building perfect public service system and sound financial institutions to small and medium-sized enterprises. And large enterprises should take the lead in digital transformation process, deepen the collaboration of enterprises upstream and downstream of the industrial chain supply chain, and help small and medium-sized enterprises realize the "chain" transformation.

Second, enterprises should focus on how to promote cost reduction. As for frontier enterprises, they should pay close attention to artificial intelligence and advanced computing to acquire the key core technologies and obtain greater international competitiveness. The industry guild should promote the construction of digital cooperation, online promotion meetings, and cross-industry as well as cross-regional logistics information service platforms. Further, it should drive the aggregation of digital industries and enterprises, accelerate the supply of digital talents and provide a safeguard mechanism for high-level digital economy development. Speed up the construction of innovative policy and mechanisms, and form an innovative policy support system for digital talents.

Third, the government should intensify the consumer-driven function. It is vital to reinforce the building of information infrastructure, establish sound and reasonable system of digital commodity circulation. Accelerate the construction of scenarios of digital consumption, and empower the industrial production chain with digital technology to better meet the diversified, personalized and customized consumption needs of consumers. China should ensure that the effects of consumption policies will continue to be felt, and that the consumption-driven role will be brought into play to promote industrial quality and efficiency, and to stimulate economic growth.

Table 1.

Eora National Input-Output table.

Table 1.

Eora National Input-Output table.

| input |

intermediate input |

final need |

total outputs |

| country1 |

country2 |

... |

country |

country 1 |

country2 |

... |

country |

| intermediate input |

country 1 |

|

|

... |

|

|

|

... |

|

|

| country 2 |

|

|

... |

|

|

|

... |

|

|

| ... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

| country |

|

|

... |

|

|

|

... |

|

|

| value added |

|

|

|

... |

|

|

|

|

|

|

| total input |

|

|

|

... |

|

|

|

|

|

|

Table 2.

The index construction of the digitization level at city level.

Table 2.

The index construction of the digitization level at city level.

| |

grade I indexes |

grade II indexes |

calculation method |

indexes

properties |

| the digitization level(DEI) |

digitalization base level |

number of internet workers |

informationtransmission, computer services and software/employees in urban units |

+ |

| digital equipment level |

cell phone penetration rate |

number of cell phone users per 100 population |

+ |

| digital application level |

internet penetration |

internet broadband usage per 100 population |

+ |

| digital effectiveness level |

internet-related outputs |

total telecommunication services/total population |

+ |

| scale of the tertiary sector |

scale of the tertiary sector |

+ |

Table 3.

Data descriptive statistics.

Table 3.

Data descriptive statistics.

| variable type |

variable name |

symbol |

observ |

average |

standard |

min |

median |

max |

| explained variable |

NVC |

NP |

3419 |

1.737 |

0.171 |

1.362 |

1.744 |

2.220 |

| core explanatory variable |

digitalization level |

DEI |

3419 |

0.034 |

0.046 |

0.001 |

0.022 |

0.552 |

| control variables |

foreign direct investment |

FDI |

3419 |

9.001 |

2.257 |

1.386 |

9.218 |

14.340 |

| human capital |

HUM |

3419 |

1.686 |

1.687 |

0.000 |

1.164 |

12.810 |

| urbanization level |

URB |

3419 |

0.345 |

0.195 |

0.074 |

0.290 |

2.774 |

| government market participation |

GOV |

3419 |

13.50 |

1.097 |

10.110 |

13.500 |

17.630 |

| input of scientific and technological |

TECH |

3419 |

8.273 |

1.925 |

1.386 |

8.326 |

14.760 |

| intermediary variables |

cost reduction effect |

CR |

3419 |

0.009 |

0.033 |

0.000 |

0.002 |

0.993 |

| consumption upgrade effect |

CI |

3419 |

0.392 |

0.896 |

0.002 |

0.148 |

16.200 |

| market integration effect |

INTE |

3419 |

1.426 |

0.293 |

1.169 |

1.340 |

5.160 |

Table 4.

Benchmark regression.

Table 4.

Benchmark regression.

| |

NP |

NP |

NP |

NP |

NP |

NP |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| DEI |

0.4180***

|

0.3781***

|

0.3793***

|

0.3625***

|

0.3267***

|

0.2805***

|

| (4.3822) |

(4.0991) |

(4.1507) |

(3.8784) |

(6.6173) |

(3.1223) |

| FDI |

|

-0.0094***

|

-0.0094***

|

-0.0092***

|

-0.0087***

|

-0.0085***

|

| |

(-5.3961) |

(-5.4119) |

(-5.4005) |

(-7.3549) |

(-4.9448) |

| HUM |

|

|

0.0033 |

0.0033 |

0.0035**

|

0.0027 |

| |

|

(1.5575) |

(1.5772) |

(2.5162) |

(1.3016) |

| URB |

|

|

|

0.0388 |

0.0369**

|

0.0356 |

| |

|

|

(1.3914) |

(2.5129) |

(1.3550) |

| GOV |

|

|

|

|

-0.0195***

|

-0.0268**

|

| |

|

|

|

(-3.1343) |

(-2.4077) |

| TECH |

|

|

|

|

|

0.0091**

|

| |

|

|

|

|

(2.5788) |

| constant |

1.5849***

|

1.6588***

|

1.6565***

|

1.6442***

|

1.8801***

|

1.9136***

|

| (462.6156) |

(115.9159) |

(115.3698) |

(105.2572) |

(24.7327) |

(14.4780) |

| control year |

be |

be |

be |

be |

be |

be |

| control city |

be |

be |

be |

be |

be |

be |

| adj. R2

|

0.9112 |

0.9129 |

0.9130 |

0.9132 |

0.9062 |

0.9139 |

| observation |

3419 |

3419 |

3419 |

3419 |

3419 |

3419 |

Table 5.

Spatial econometric model LM test.

Table 5.

Spatial econometric model LM test.

| LM test |

observation |

P-value |

conclusions |

| no error |

3649.955 |

0.000 |

SEM model can be used |

| no error (robust) |

3490.546 |

0.000 |

| no lag |

380.156 |

0.000 |

SAR model can be used |

| no lag (robust) |

173.478 |

0.000 |

Table 6.

Wald test for spatial measurement models.

Table 6.

Wald test for spatial measurement models.

| Wald test |

test statistic |

P-value |

conclusions |

| SEM model |

37.48 |

0.000 |

rejection of degradation from SDM to SEM models |

| SAR model |

66.24 |

0.000 |

rejection of degradation from SDM to SAR models |

Table 7.

Spatial panel Durbin model estimation results and model identification tests.

Table 7.

Spatial panel Durbin model estimation results and model identification tests.

| |

spatial-fixed

effect model |

time-fixed

effect model |

space and time double

fixed effects model |

| (1) |

(2) |

(3) |

| DEI |

0.1269***

|

-0.1663***

|

0.1135**

|

| (2.5932) |

(-3.4760) |

(2.2993) |

| FDI |

-0.0047***

|

0.0025**

|

-0.0048***

|

| (-4.1569) |

(2.4625) |

(-4.1716) |

| HUM |

0.0038***

|

0.0080***

|

0.0040***

|

| (2.8913) |

(8.7363) |

(3.0173) |

| URB |

0.0163 |

0.0230**

|

0.0158 |

| (1.2001) |

(2.5042) |

(1.1618) |

| GOV |

-0.0106*

|

-0.0125***

|

-0.0106 |

| (-1.6844) |

(-3.4918) |

(-1.6342) |

| TECH |

0.0038*

|

0.0070***

|

0.0017 |

| (1.8978) |

(3.5208) |

(0.8235) |

| W x DEI |

2.0562***

|

1.3777***

|

1.9385***

|

| (5.1707) |

(3.7039) |

(3.2640) |

| W x FDI |

-0.0330***

|

-0.0255***

|

-0.0386***

|

| (-4.3321) |

(-3.5371) |

(-4.0406) |

| W x HUM |

0.0080 |

0.0928***

|

-0.0034 |

| (1.6378) |

(6.3634) |

(-0.1894) |

| W x URB |

0.2679**

|

-0.2220***

|

0.2509*

|

| (2.3916) |

(-3.6410) |

(1.8418) |

| W×GOV |

-0.0218 |

-0.1214***

|

-0.0847 |

| (-1.5220) |

(-3.0930) |

(-1.4540) |

| W×TECH |

0.0074**

|

0.1756***

|

0.1146***

|

| (2.2427) |

(7.6086) |

(6.3556) |

|

0.9296***

|

0.5774***

|

0.6673***

|

| (72.3146) |

(6.1770) |

(8.6068) |

| Hausman |

|

|

20.85***

|

| adj. R2

|

0.6354 |

0.6426 |

0.6288 |

| Log L |

5770.4626 |

4011.0960 |

5807.0766 |

| observation |

3419 |

3419 |

3419 |

Table 8.

Decomposition of spatial effects of SDM model.

Table 8.

Decomposition of spatial effects of SDM model.

| |

direct effect |

indirect effect |

aggregate effect |

| (1) |

(2) |

(3) |

| DEI |

0.1376***

|

6.2265**

|

6.3640**

|

| (2.7121) |

(2.5149) |

(2.5655) |

| FDI |

-0.0053***

|

-0.1292***

|

-0.1344***

|

| (-4.8588) |

(-3.1683) |

(-3.3009) |

| HUM |

0.0041***

|

0.0014 |

0.0055 |

| (3.2557) |

(0.0251) |

(0.0977) |

| URB |

0.0185 |

0.8168*

|

0.8353*

|

| (1.3928) |

(1.7274) |

(1.7615) |

| GOV |

-0.0115*

|

-0.2843 |

-0.2958 |

| (-1.8444) |

(-1.5688) |

(-1.6385) |

| TECH |

0.0030 |

0.3584***

|

0.3614***

|

| (1.4690) |

(3.6275) |

(3.6410) |

Table 9.

Robustness test results.

Table 9.

Robustness test results.

| |

Replace the space weight matrix |

Delete municipalities |

| (1) |

(2) |

| DEI |

0.2186***

|

0.0943 |

| (4.1010) |

(1.4672) |

| FDI |

-0.0085***

|

-0.0048***

|

| (-7.5062) |

(-4.2582) |

| HUM |

0.0031**

|

0.0043***

|

| (2.2458) |

(3.3020) |

| URB |

0.0331**

|

0.0177 |

| (2.3528) |

(1.3269) |

| GOV |

-0.0252***

|

-0.0132**

|

| (-4.0697) |

(-2.0584) |

| TECH |

0.0090***

|

0.0011 |

| (4.3490) |

(0.5507) |

| W x DEI |

0.2946**

|

2.5933***

|

| (2.0693) |

(3.8750) |

| W x FDI |

-0.0017 |

-0.0302***

|

| (-0.5675) |

(-3.1307) |

| W x HUM |

-0.0063*

|

-0.0095 |

| (-1.7701) |

(-0.5432) |

| W x URB |

-0.0175 |

0.2467*

|

| (-0.2948) |

(1.8756) |

| W×GOV |

-0.0198 |

-0.0668 |

| (-1.1373) |

(-1.1813) |

| W×TECH |

-0.0044 |

0.1242***

|

| (-0.8634) |

(7.0714) |

|

-0.0344 |

0.6691***

|

| (-1.0934) |

(8.7105) |

| control year |

be |

be |

| control city |

be |

be |

| adj. R2

|

0.4514 |

0.6571 |

| observation |

3419 |

3367 |

Table 10.

Instrumental variable regression results.

Table 10.

Instrumental variable regression results.

| variant |

2SLS regression |

| First-stage regression |

Second-stage regression |

| (1) |

(2) |

| IV |

0.0015***

|

|

| (0.000) |

|

| DEI |

|

2.8805***

|

| |

(0.392) |

| FDI |

-0.0007*

|

-0.0054***

|

| (0.000) |

(0.002) |

| HUM |

-0.0002 |

0.0045**

|

| (0.000) |

(0.002) |

| URB |

0.0255***

|

-0.0491**

|

| (0.005) |

(0.023) |

| GOV |

-0.0282***

|

0.0641***

|

| (0.002) |

(0.016) |

| TECH |

0.0080***

|

-0.0142***

|

| (0.001) |

(0.004) |

| constant |

-5.1330***

|

0.1481 |

| (0.610) |

(0.289) |

| control year |

be |

be |

| control city |

be |

be |

| observation |

3419 |

3419 |

| adj. R2

|

0.879 |

0.866 |

| K-P rk LM Statistic |

41.756***

|

| K-P Wald rk F Statistic |

42.54***

|

Table 11.

Results of geographic location heterogeneity test.

Table 11.

Results of geographic location heterogeneity test.

| |

eastern |

middle |

western |

Yangtze River Delta

(eastern) |

Pearl River Delta

(eastern) |

Jing-Jin-Ji Delta (eastern) |

Sichuan and Chongqing

(western) |

middle reaches of the Yangtze River

(middle) |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

| DEI |

0.2155***

|

-0.2788 |

-0.0164 |

-0.1197 |

-0.3344**

|

0.5343***

|

0.1386 |

0.3290 |

| (3.8741) |

(-1.4626) |

(-0.0902) |

(-1.4455) |

(-2.3490) |

(4.2732) |

(0.4082) |

(1.3549) |

| FDI |

-0.0076***

|

-0.0118***

|

-0.0036*

|

-0.0106***

|

0.0787***

|

0.0041 |

-0.0097**

|

0.0074 |

| (-2.9258) |

(-6.0636) |

(-1.7343) |

(-2.7967) |

(2.7206) |

(0.5681) |

(-2.0994) |

(1.3529) |

| HUM |

-0.0020 |

0.0060***

|

0.0066**

|

-0.0058**

|

-0.0128 |

0.0163**

|

0.0019 |

0.0008 |

| (-0.9127) |

(2.9647) |

(2.0680) |

(-2.3810) |

(-1.2122) |

(2.4071) |

(0.3154) |

(0.2772) |

| URB |

0.0113 |

0.0002 |

0.0731 |

0.0681 |

0.0241 |

-0.0834 |

0.5084**

|

-0.1035*

|

| (0.7618) |

(0.0052) |

(1.0039) |

(1.5780) |

(1.1800) |

(-0.6350) |

(2.4964) |

(-1.6749) |

| GOV |

-0.0115 |

0.0136 |

-0.0117 |

-0.0090 |

-0.0657 |

-0.0387 |

-0.0075 |

-0.1218***

|

| (-0.8488) |

(1.1439) |

(-1.0334) |

(-0.6165) |

(-1.2700) |

(-0.6390) |

(-0.3330) |

(-4.7076) |

| TECH |

0.0121***

|

0.0067**

|

0.0023 |

-0.0070*

|

0.0315**

|

-0.0297**

|

0.0286**

|

0.0058 |

| (3.7283) |

(2.1992) |

(0.4441) |

(-1.9453) |

(2.3987) |

(-2.2300) |

(2.2945) |

(0.9845) |

| constant |

1.7176***

|

1.4828***

|

1.7009***

|

1.8344***

|

1.2765*

|

2.3002***

|

1.4698***

|

3.0188***

|

| (10.6483) |

(10.3286) |

(12.9471) |

(10.7043) |

(1.7960) |

(2.9344) |

(5.2795) |

(9.7806) |

| control year |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

| control city |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

yes |

| observation |

1196 |

1209 |

1014 |

481 |

104 |

169 |

234 |

351 |

| adj. R2

|

0.9363 |

0.9232 |

0.8544 |

0.9621 |

0.9524 |

0.9253 |

0.8823 |

0.9417 |

Table 13.

Results of heterogeneity test for internationalized business.

Table 13.

Results of heterogeneity test for internationalized business.

| variant |

International business-led |

Domestic operation-led |

| (Internationalization of business > 60% quartile of internationalization of business) |

(IB < IB 40% quartile) |

| (1) |

(2) |

| DEI |

0.1193**

|

-0.2398 |

| (2.3827) |

(-1.0806) |

| FDI |

0.0007 |

-0.0039**

|

| (0.3281) |

(-2.2629) |

| HUM |

-0.0054***

|

0.0077***

|

| (-2.7672) |

(2.7041) |

| URB |

0.0344**

|

-0.0584 |

| (2.3518) |

(-1.5281) |

| GOV |

-0.0167 |

-0.0198**

|

| (-1.5925) |

(-2.0455) |

| TECH |

0.0043 |

-0.0010 |

| (1.5649) |

(-0.2470) |

| constant |

1.7478***

|

1.8771***

|

| (14.0553) |

(16.5135) |

| control year |

yes |

yes |

| control city |

yes |

yes |

| observation |

0.9452 |

0.8805 |

| adj. R2

|

0.9354 |

0.8615 |

Table 14.

Mechanistic analysis test results.

Table 14.

Mechanistic analysis test results.

| |

cost reduction effect |

consumption upgrading effect |

market integration effect |

| CR |

NP |

CI |

NP |

INTE |

NP |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| DEI |

0.0551*

|

0.2766***

|

2.0166***

|

0.2519**

|

2.8612***

|

0.1812***

|

| (1.9408) |

(5.4885) |

(50.1849) |

(2.5480) |

(20.7967) |

(3.3858) |

| CR |

|

0.0702**

|

|

|

|

|

| |

(2.2172) |

|

|

|

|

| CI |

|

|

|

0.2404***

|

|

|

| |

|

|

(7.2396) |

|

|

| INTE |

|

|

|

|

|

0.0347***

|

| |

|

|

|

|

(5.3274) |

| FDI |

-0.0005 |

-0.0085***

|

-0.0035***

|

-0.0089***

|

0.0109***

|

-0.0089***

|

| (-0.7573) |

(-7.2456) |

(-3.7873) |

(-5.0731) |

(3.3855) |

(-7.6114) |

| HUM |

0.0002 |

0.0027*

|

-0.0030***

|

0.0017 |

-0.0053 |

0.0029**

|

| (0.2242) |

(1.9295) |

(-2.6703) |

(0.8554) |

(-1.3644) |

(2.0747) |

| URB |

-0.0014 |

0.0357**

|

0.1037***

|

0.0567***

|

-0.0173 |

0.0362**

|

| (-0.1680) |

(2.4366) |

(8.8843) |

(2.5890) |

(-0.4316) |

(2.4800) |

| GOV |

-0.0097***

|

-0.0262***

|

-0.0435***

|

0.1382***

|

0.0973***

|

-0.0302***

|

| (-2.6898) |

(-4.0661) |

(-8.4865) |

(29.6829) |

(5.5462) |

(-4.6973) |

| TECH |

0.0033***

|

0.0088***

|

0.0079***

|

0.0149***

|

0.0124**

|

0.0086***

|

| (2.7873) |

(4.1819) |

(4.6759) |

(6.2367) |

(2.1471) |

(4.1063) |

| constant |

0.1387***

|

1.9039***

|

0.4749***

|

-0.2150***

|

-0.0563 |

1.9155***

|

| (3.2302) |

(24.9572) |

(7.8166) |

(-5.1005) |

(-0.2707) |

(25.2456) |

| control year |

yes |

yes |

yes |

yes |

yes |

yes |

| control city |

yes |

yes |

yes |

yes |

yes |

yes |

| observation |

3419 |

3419 |

3419 |

3419 |

3419 |

3419 |

| adj. R2

|

0.1161 |

0.9145 |

0.6252 |

0.8084 |

0.3570 |

0.9152 |

Table 16.

Testing of subregional mechanisms.

Table 16.

Testing of subregional mechanisms.

| |

cost reduction effect |

consumption upgrading effect |

market integration effect |

| CR |

NP |

CI |

NP |

INTE |

NP |

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| eastern cities |

DEI |

-0.0097 |

0.1800***

|

2.0067***

|

0.2033*

|

2.4799***

|

-0.0295 |

| (-0.3484) |

(3.3175) |

(26.6992) |

(1.8301) |

(16.2699) |

(-0.5019) |

| CR |

|

-0.0207 |

|

|

|

|

| |

(-0.3495) |

|

|

|

|

| CI |

|

|

|

0.0235***

|

|

|

| |

|

|

(4.6027) |

|

|

| INTE |

|

|

|

|

|

0.0846***

|

| |

|

|

|

|

(8.0159) |

| central cities |

DEI |

0.1844***

|

0.6673**

|

2.2568***

|

0.6433 |

2.7881***

|

-0.0775 |

| (4.4452) |

(2.1836) |

(34.6097) |

(1.3324) |

(3.4366) |

(-0.3755) |

| CR |

|

0.8093***

|

|

|

|

|

| |

(3.3170) |

|

|

|

|

| CI |

|

|

|

0.0918 |

|

|

| |

|

|

(0.5547) |

|

|

| INTE |

|

|

|

|

|

-0.0050 |

| |

|

|

|

|

(-0.5894) |

| western cities |

DEI |

0.0799 |

0.0666 |

0.8182***

|

-0.2426 |

3.1447***

|

0.6473***

|

| (0.6994) |

(0.4068) |

(23.9874) |

(-0.8842) |

(9.7162) |

(2.8948) |

| CR |

|

0.0163 |

|

|

|

|

| |

(0.3819) |

|

|

|

|

| CI |

|

|

|

0.9312***

|

|

|

| |

|

|

(4.7148) |

|

|

| INTE |

|

|

|

|

|

-0.0276 |

| |

|

|

|

|

(-1.3639) |

| |

control year |

yes |

yes |

yes |

yes |

yes |

yes |

| control city |

yes |

yes |

yes |

yes |

yes |

yes |

| control variable |

yes |

yes |

yes |

yes |

yes |

yes |