1. Introduction

The rapid ascent of fintech companies has not only transformed but significantly disrupted the financial landscape, creating a hybrid space where technology-driven innovation intersects with traditional financial services. These entities, distinguished by their innovative use of digital platforms, data analytics, and artificial intelligence, have not only disrupted established financial institutions but also posed a significant challenge to the conventional banking model. This necessitates immediate and necessary adaptation and evolution, making our research on the strategic alignment of fintech enterprises with either banks or tech firms all the more crucial.

This research's key aspect is the disruptive nature of fintech companies, which raises a critical question: Do fintech companies align more closely with traditional banks, with their focus on financial services and regulatory compliance, or do they resemble technology firms that prioritize innovation, scalability, and user experience?

Addressing this pivotal research question is crucial for understanding the evolving role of fintechs in the financial services industry and their impact on both traditional banks and technology firms. The strategic positioning of fintechs, a key aspect of this study, has significant implications for their business models, stakeholder interactions, and market behavior, all of which influence how these companies are perceived by investors, regulators, and consumers alike.

To thoroughly investigate this question, this paper conducts a comprehensive analysis of fintech companies in comparison to traditional banks and technology firms. The examination considers functions, target markets, business models, stakeholders' interactions, and stock market behavior.

Empirical evidence integrates both quantitative and qualitative research methodologies to provide an exhaustive analysis of fintech entities, traditional banking institutions, and technology enterprises, emphasizing the domains in which fintechs demonstrate the highest degree of cohesion.

The study is structured into several fundamental sections: it commences with a literature review that highlights deficiencies pertinent to the strategic alignment of FinTechs with banking institutions or technology enterprises. Subsequently, it collects qualitative and quantitative data. The section dedicated to empirical results elucidates findings, encompassing critical financial indicators, market dynamics, and sector-specific insights. The discussion segment interprets these findings, examining the ramifications of fintechs' alignment with technology entities and their dual roles within the financial services landscape. The conclusion encapsulates the principal findings and practical ramifications for relevant stakeholders while proposing avenues for forthcoming research.

By methodically investigating these aspects, this manuscript endeavors to ascertain whether fintechs exhibit a stronger alignment with the financial or technological domain, thereby offering significant insights into their strategic positioning amid the expansive financial and technological ecosystems.

2. Literature Review

As the proliferation of FinTechs persists, a pivotal inquiry emerges: do these entities exhibit a closer affiliation with conventional banking institutions or with technology enterprises? This review of scholarly literature seeks to investigate this inquiry through a rigorous examination of existing research concerning the operational mechanisms, business frameworks, stakeholder dynamics, market conduct, and empirical data pertinent to fintechs. The review highlights deficiencies in the prevailing literature. It situates this study to address those deficiencies, particularly by scrutinizing the fundamental attributes of fintechs and their alignment with either banking institutions or technology companies.

Functions of Fintechs and Banks

FinTechs are fundamentally propelled by the innovation and implementation of technology-driven financial services, encompassing digital payment solutions, lending platforms, wealth management applications, and insurance offerings. These services are crafted to be more accessible, efficient, and user-centric compared to those rendered by conventional financial institutions (Elia et al., 2023).

Conversely, traditional banks engage in a broad spectrum of financial functions, which include accepting deposits, extending loans, facilitating payments, and presenting investment products. Such services are generally delivered via a mixture of physical branches and digital platforms, placing a significant emphasis on regulatory adherence and risk management (Temelkov, 2018). The existing literature indicates that banks' functions are characterized by a greater degree of regulation and a conventional approach, prioritizing stability, security, and enduring customer relationships.

Although current research underscores the distinctions in functionality between fintechs and traditional banks, there remains a lack of investigation into how these differences influence the strategic alignment of fintechs with either banking institutions or technology firms. This paper seeks to fill this void by examining how the technology-centric functions of fintechs align more closely with those of technology companies rather than with banking institutions.

Target Markets

Fintech companies predominantly aim at consumers proficient in technology, frequently targeting younger age groups or marginalized sectors, such as small enterprises and individuals lacking access to conventional banking facilities. By harnessing technological innovations, fintechs can achieve swift expansion and infiltrate international markets, providing solutions that are not only easily accessible but also significantly customizable to local contexts (Darnida et al., 2024).

Conversely, traditional banking institutions cater to a diverse and established clientele, encompassing individual consumers, corporations, and governmental entities (Dwivedi et al., 2021). Nonetheless, their approach tends to prioritize stability and reliability of services over the pursuit of rapid scalability. The literature adequately addresses the target markets of fintechs and banks but often treats them as separate entities without exploring the overlap and potential for convergence. This paper fills this gap by examining how fintechs’ focus on underserved markets may influence their strategic alignment with tech firms, which also prioritize scalability and global reach.

Business Models

The business models of fintech companies are typically platform-based, emphasizing innovation, rapid iteration, and leveraging network effects. These platforms integrate various financial services into a single ecosystem, providing users with a seamless and personalized experience. Fintechs rely heavily on data analytics, AI, and machine learning to optimize operations and drive business growth. Their monetization strategies include transaction fees, subscriptions, and data utilization, aligning closely with practices common in the tech industry (Milian et al., 2019).

Conversely, traditional banks operate on a more conventional business model that focuses on interest rate spreads, fee-based income, and investment income. Banks usually maintain a significant physical presence through branches and ATMs, alongside online and mobile banking services. The regulatory burden on banks is substantial, which often leads to slower innovation cycles and a more cautious approach to adopting new technologies (Temelkov, 2018).

While the literature describes the business models of fintechs and banks, there is a lack of in-depth analysis of how these models influence fintechs’ strategic alignment with tech firms. This paper addresses this by critically evaluating the extent to which fintechs' platform-based models mirror those of tech companies, emphasizing innovation and rapid market adaptation.

Stakeholder Interactions

Fintechs engage with stakeholders primarily through digital platforms, providing seamless and often automated customer service. This digital-first approach prioritizes speed, transparency, and user experience, often leading to partnerships with other tech firms to enhance service offerings (Elsaid, 2023). Such partnerships are dynamic and interconnected, contributing to the rapid development of new products and services that differentiate fintechs from traditional banks.

In contrast, traditional banks interact with stakeholders through a combination of in-person and digital channels. These interactions are generally more formal and long-standing, reflecting the established nature of their operations. Banks often prioritize stability and risk management in their stakeholder interactions, which can limit their ability to innovate rapidly compared to fintechs (Romānova & Kudinska, 2016).

The literature provides insights into how fintechs and banks interact with stakeholders but lacks a comparative analysis of how these interactions influence their strategic alignment with either banks or tech firms. This paper fills this gap by exploring how fintechs’ digital-first stakeholder engagement aligns them more closely with tech firms, which similarly prioritize user experience and innovation.

Stock Market Behavior

In the equity markets, FinTechsfrequently demonstrate fluctuations akin to those observed in technology corporations. Their assessments are primarily influenced by prospects for growth, enlargement of the user demographic, and advancements in technology, as opposed to conventional financial indicators such as profits or dividend distributions (Takeda & Ito, 2021). This market behavior aligns fintechs more with tech companies, where rapid growth and innovation are key drivers of valuation.

In contrast, traditional banks are typically valued based on more conventional financial metrics such as price-to-earnings ratios, book value, and dividend yields. Equity investments in banking institutions are typically perceived as exhibiting greater stability, accompanied by diminished potential for growth, in contrast to FinTechs. Stakeholders in banking equities frequently pursue consistent returns and reduced risk exposure, thereby rendering banks a more prudent investment alternative (Basdekis et al., 2022).

The existing literature describes the stock market behavior of fintechs and banks but does not thoroughly analyze how this behavior influences fintechs' strategic alignment. This paper addresses this gap by examining how fintechs’ stock market volatility and growth potential align them more closely with tech firms than with banks.

Empirical Evidence and Industry Analysis

Empirical investigations indicate that financial technology enterprises exhibit a closer alignment with technology companies concerning adaptability, innovation, and responsiveness to market dynamics. Fintechs frequently demonstrate elevated valuation multiples, accelerated growth trajectories, and considerable commitments to research and development (R&D) when juxtaposed with conventional banking institutions (Milian et al., 2019). This data substantiates the perspective that fintechs bear greater resemblance to technological firms, centering their efforts on harnessing technology to transform and innovate within the financial services sector.

Conversely, traditional banking institutions have a slower pace of innovation and a heightened emphasis on stability, risk mitigation, and adherence to regulatory frameworks. Although banks have commenced the integration of digital technologies, they generally embark on this transition more cautiously and gradually compared to fintechs (Elsaid, 2023). This conservative methodology reflects their entrenched position within the financial ecosystem and their obligation to uphold trust and security for their clientele. Although the literature provides empirical evidence on fintechs and banks, there is a need for a more detailed comparison of how this evidence supports the strategic alignment of fintechs with either banks or tech firms. This paper addresses this gap by integrating empirical data to demonstrate how fintechs' innovative capabilities and market behavior align them more closely with tech firms.

Additional Perspectives and Emerging Trends

The literature additionally examines nascent trends, notably the incursion of major technology corporations into the financial technology sector, which has further obscured the distinctions between FinTechsand technology firms. Bethlendi and Szőcs (2022) discuss how Big Tech companies are increasingly entering the fintech market, leveraging their technological expertise and vast user bases to offer financial services. This trend suggests a convergence between fintechs and tech firms, reinforcing the notion that fintechs align more closely with technology companies.

Moreover, fintech companies' sustainability profiles have become critical factors in their valuation and strategic alignment. Merello et al. (2022) show that fintech companies implement sustainable practices, distinguishing them as progressive and forward-thinking entities within the financial landscape, akin to technology firms that place a high premium on corporate social responsibility and environmental sustainability in their operations. This alignment with sustainability not only enhances their reputation but also positions them strategically in a market that increasingly values ethical considerations and environmental impact, thereby fostering a competitive edge that is crucial in today's socially conscious economy.

Research Gaps Addressed

This literature review reveals several gaps in the current research on fintechs’ alignment with banks or tech firms. While the current body of literature offers significant insights into the functionalities, business frameworks, stakeholder dynamics, stock market behaviors, and empirical studies concerning fintech companies and traditional banks, it frequently regards these entities as separate. It fails to investigate their potential for convergence or divergence thoroughly.

The research incorporates empirical evidence, sectoral analyses, and emerging phenomena such as the influence of Big Tech and sustainability to yield a more sophisticated comprehension of fintechs' strategic positioning. In doing so, it enhances the broader dialogue on the transformative nature of the financial services sector and the pivotal role of fintechs in influencing the future trajectory of finance.

3. FinTech versus Banks: Functions and Business Models

-

a.

Fintechs: Technology-Driven Financial Services

Fintechs are distinguished by their core emphasis on the creation and implementation of technology-driven financial services. These offerings typically encompass digital payment systems, lending platforms, wealth management applications, and insurance solutions, all designed to be more accessible, efficient, and user-centric compared to conventional financial services.

-

b.

Banks: Traditional Financial Functions

In contrast, traditional banks perform a broad range of financial functions, including accepting deposits, providing loans, managing payments, and offering investment products. These offerings are generally rendered through an amalgamation of physical establishments and digital interfaces, with a pronounced focus on adherence to regulations and risk management. Bank operations are predominantly characterized by stringent regulation and conventional practices, prioritizing stability, security, and enduring client relationships (Temelkov, 2018).

-

c.

Targets

Fintechs: Tech-Savvy and Underserved Markets

Financial technology enterprises primarily aim at a demographic proficient in technology, frequently targeting younger consumers who possess a familiarity with digital interfaces and anticipate a fluid, effective user experience. Furthermore, FinTechs concentrate on marginalized segments, including small enterprises and individuals lacking access to conventional banking services. Through the utilization of advanced technology, fintechs can engage these markets with greater efficacy, providing scalable solutions that can be swiftly implemented across international markets (Darnida et al., 2024).

Banks: Broad and Established Customer Base

Traditional banks, on the other hand, target a broad audience that includes retail customers, businesses, and governments. Their focus is often on maintaining long-term relationships with a wide customer base, offering a comprehensive range of financial products and services. Banks typically prioritize the maintenance of stability and dependability in their offerings over the pursuit of swift scalability, leveraging well-established infrastructures for service delivery (Dwivedi et al., 2021).

-

d.

Business Models

Fintechs: Innovation Through Platform-Based Models

Fintechs generally adhere to a platform-oriented business framework that accentuates innovation, swift iteration, and the exploitation of network effects. These platforms frequently amalgamate diverse financial services into a cohesive ecosystem, thereby offering users an integrated and customized experience. FinTechs depend significantly on data analytics, artificial intelligence, and machine learning to refine operations, improve service provision, and derive insights that propel business expansion. Monetization approaches employed by fintechs encompass transaction fees, subscription models, and data monetization, which closely align with practices prevalent in the technology sector (Milian et al., 2019).

Banks: Conventional Banking Framework

In contrast, traditional banking institutions function within a more established business paradigm that emphasizes interest rate differentials, fee-derived income, and investment revenue. Banks typically sustain a notable physical footprint through branches and ATMs, complemented by online and mobile banking functionalities. The regulatory encumbrance on banks is considerable, resulting in prolonged innovation cycles and a more conservative stance toward the adoption of emerging technologies (Temelkov, 2018). This conventional paradigm prioritizes stability, risk mitigation, and sustainable profitability over swift innovation.

-

e.

Stakeholdership Interactions

Fintechs: Digital-First Engagement

Fintechs engage with stakeholders primarily through digital platforms, providing seamless and often automated customer service. This digital-first approach allows fintechs to prioritize speed, transparency, and user experience in their interactions with customers, partners, and regulators. Fintechs frequently form partnerships with other tech firms and startups to enhance their service offerings, creating a dynamic and interconnected ecosystem (Elsaid, 2023). These partnerships often lead to the development of new products and services that are quickly brought to market, further distinguishing fintechs from traditional banks.

Fintech companies face significant regulatory hurdles that can constrain their innovation potential. While they align closely with technology firms in terms of agility and scalability, their need to comply with financial regulations can pull them towards traditional banking practices. Building consumer trust remains a critical challenge for fintechs, especially as they navigate the fine line between innovation and security. Unlike traditional banks, which have established trust through longstanding relationships and regulatory compliance, fintechs must invest in robust security measures and transparent practices to foster trust among their customer base.

Banks: Traditional Relationship Management

Traditional banks interact with stakeholders through a combination of in-person and digital channels, with a strong focus on trust, security, and compliance. Their relationships with regulators, customers, and other financial institutions are typically more formal and long-standing, reflecting the established nature of their operations. Banks often prioritize stability and risk management in their stakeholder interactions, which can limit their ability to innovate rapidly compared to fintechs (Romānova & Kudinska, 2016).

-

f.

Stock Market

Fintechs: Rapidly Expanding Technological Equities

Within the equity markets, fintech entities frequently demonstrate price fluctuations akin to those observed in technology corporations. Their market valuations are primarily influenced by prospects for growth, expansion of user demographics, and advancements in technology rather than conventional financial indicators such as profits or dividends. Consequently, fintech equities are characterized as high-risk, high-reward ventures, appealing to investors who are inclined to speculate on the future developmental trajectory of these firms (Takeda & Ito, 2021). The market dynamics of fintechs closely resemble those of technological enterprises, wherein swift expansion and innovation serve as pivotal determinants of valuation.

Banks: Secure Financial Equities

Conversely, conventional banking institutions are generally assessed using more established financial indicators such as price-to-earnings ratios, book value, and yield on dividends. Shares in banking entities are typically regarded as more stable, exhibiting lower growth potential when compared to fintechs. Investors in banking stocks often prioritize reliable income and diminished risk, positioning banks as a more prudent investment option (Basdekis et al., 2022). The market behavior of banks mirrors their emphasis on stability, adherence to regulatory frameworks, and long-term profitability.

-

g.

Empirical Evidence

FinTechs: Agility and Innovation

Empirical research indicates that FinTechs exhibit a closer alignment with technology enterprises regarding agility, innovative capacity, and responsiveness to market dynamics. fintechs frequently possess higher valuation ratios, accelerated growth trajectories, and substantial investments in research and development (R&D) compared to conventional banking institutions (Milian et al., 2019). This data substantiates the perspective that fintechs bear greater resemblance to technology corporations, emphasizing the utilization of technological advancements to disrupt and innovate within the financial services sector.

Traditional Banks: Stability and Regulation

Empirical insights concerning traditional banking institutions reveal that they exhibit a slower pace of innovation and a predominant focus on stability, risk mitigation, and adherence to regulatory frameworks. Although banks have initiated the adoption of digital technologies, their approach is often characterized by a more cautious and incremental progression relative to FinTechs (Elsaid, 2023). The conservative methodology employed by banks reflects their entrenched position within the financial system and their obligation to uphold trust and security for their clientele.

While FinTechs function within the financial domain, their fundamental identity is more closely aligned with technology enterprises. This alignment is manifested in their commitment to innovation, scalability, and swift market penetration, which stands in stark contrast to the more cautious, regulated, and relationship-oriented characteristics of traditional banking institutions. The analysis articulated in this manuscript elucidates that FinTechs are, in numerous respects, more akin to technology companies than to banks, notably in their operational frameworks, stakeholder engagements, and market behaviors.

Fntechs and traditional banks are not mutually exclusive entities. There exists an escalating trend of collaboration between these FinTechs, wherein banks integrate fintech innovations to enhance their service portfolios, and FinTechs capitalize on the regulatory expertise and customer bases of banks. This mutually beneficial relationship is anticipated to persist in its evolution, culminating in a more integrated and dynamic financial ecosystem where the distinctions between FinTechs and banks increasingly converge.

4. Methodology

This investigation utilizes a mixed-methods framework, amalgamating qualitative and quantitative assessments to comprehensively evaluate the strategic unity of FinTech with either conventional banking institutions or technology corporations. The methodological design is meticulously formulated to yield an in-depth comprehension of the fundamental attributes of fintechs, including their operational functions, business frameworks, stakeholder dynamics, market conduct, and empirical results. The quantitative component of the inquiry is augmented by a mathematical model aimed at rigorously quantifying the strategic alignment of fintechs.

4.1. Data Collection

-

a)

Qualitative Data

Literature Review: A literature review was undertaken, encompassing peer-reviewed journal publications, industry analyses, working papers, and conference proceedings that were disseminated from 2016 to 2024. The review concentrated on investigations that scrutinize the convergence of financial services and technological advancements, the progression of fintech enterprises, and their comparative evaluation against conventional banking institutions and technology corporations. Studies of Elia et al. (2023) regarding fintech functionalities and Temelkov (2018) addressing traditional banking paradigms were incorporated. This literature synthesis established the groundwork for discerning research voids, developing hypotheses, and informing the analytical structure of the inquiry. Case studies concerned listed FinTechs (e.g., PayPal, Square), legacy banks (e.g., JPMorgan Chase, Wells Fargo), and tech giants (e.g., Google/Alphabet, Amazon).

The selection of these entities was predicated on their market impact, innovation histories, and the accessibility of pertinent data. The case studies entailed scrutinizing annual financial statements, investor briefings, and strategic documentation to extract insights regarding each entity's business framework, market approaches, and stakeholder interaction methodologies. This qualitative data furnished context for the quantitative results and illustrated tangible instances of strategic coherence.

-

b)

Quantitative Data

Financial Metrics: Quantitative information was amassed from esteemed financial repositories, including Bloomberg, Thomson Reuters Eikon, and S&P Capital IQ. The dataset considered price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, return on equity (ROE), revenue growth trajectories, and research and development expenditures for FinTechs, traditional banks, and tech companies spanning 2016 to 2023. This longitudinal dataset facilitated an all-encompassing examination of financial efficacy and market dynamics over the specified timeline. Surveys and Expert Opinions: A survey incorporated both closed-ended inquiries (utilizing Likert scales) and open-ended queries to elicit nuanced expert perspectives on themes such as the strategic alignment of fintechs, innovation methodologies, regulatory hurdles, and prospective industry developments. A total of 150 responses were garnered, yielding a substantial dataset for both qualitative and quantitative examination.

4.2. Data Analysis

To enhance the qualitative analysis, a mathematical framework was established to quantify the strategic alignment of FinTechs with either conventional banking institutions or technology corporations. This framework integrates essential financial and operational indicators to produce an alignment score for each fintech entity. The alignment score is computed through the following methodologies:

- a)

Descriptive Statistics

A descriptive statistical evaluation was performed on the quantitative data to encapsulate the financial performance of fintech enterprises, traditional banking institutions, and technology corporations. This evaluation presented a comprehensive overview of the financial viability and market valuation of the subjects under investigation, disclosing patterns and trends in their market conduct.

- b)

Comparative Analysis

The investigation utilized comparative analysis to methodically juxtapose the financial metrics and market performance of FinTechs against those of conventional banking institutions and technology corporations. The comparative analysis concentrated on the following pivotal financial ratios:

Price-to-Earnings Ratio: P/E Ratio = Market Price per Share / Earnings per Share (EPS) \ Price-to-Book Value Ratio: P/B Ratio = Market Price per Share / Book Value per Share Return on Equity: ROE = Net Income / Shareholder’s Equity

These ratios were computed and contrasted across fintech enterprises, traditional banking institutions, and technology corporations to discern alignment trends. This analysis was instrumental in ascertaining whether FinTechs align more closely with banks' emphasis on stability and risk management or tech firms' innovation-driven, growth-centric approach.

Incorporating qualitative insights, such as interviews with industry leaders and thematic analysis of corporate strategies, could provide a more profound comprehension of how fintechs navigate their dual identity between banking and technology. This methodology would unveil the intricate decision-making processes that affect their strategic alignment.

4.3. Alignment Score Calculation

The alignment score (AS

i) for each fintech company was calculated using a weighted index that combines key financial and operational metrics. The formula for the alignment score is as follows:

where:

w1, w2, w3, w4, w5 are the weights assigned to each metric based on their importance in determining strategic alignment.

i represents each fintech company in the dataset.

The weights were determined through principal component analysis (PCA) to ensure that the most significant factors were given appropriate emphasis. The resulting alignment score reflects the degree to which a fintech company aligns with the characteristics of traditional banks or technology firms.

4.4. Regression Analysis

The comprehensive dataset analysis highlights significant disparities in the financial performance of fintechs, traditional banks, and technology companies, revealing that fintechs generally align more closely with technology firms in terms of innovation, scalability, and market dynamics. This alignment is evident in the elevated price-to-earnings (P/E) ratios and price-to-book (P/B) ratios observed among fintechs, which suggest that investors perceive these entities as high-growth ventures akin to tech companies rather than the more conservative traditional banks (Gomber et al., 2018; Navaretti et al., 2018).

The inclusion of additional financial metrics such as Return on Assets (ROA) and Operating Cash Flow has provided a deeper insight into the financial health of fintechs, further supporting their alignment with tech firms (S&P Capital IQ, 2023).

Panel data analysis, controlling for unobserved heterogeneity, reveals regional differences in fintech alignment, with U.S.-based fintechs exhibiting stronger ties to technology firms, while those in Europe and Asia align more with traditional banks due to stricter regulatory environments (Claessens et al., 2018; Bethlendi & Szőcs, 2022). Volatility analysis, utilizing Beta coefficients, underscores this alignment, as fintechs demonstrate market behaviors similar to tech firms, particularly during periods of economic uncertainty (Bloomberg, 2023). Moreover, the regression analysis confirms that R&D expenditure plays a pivotal role in fintechs' strategic alignment with technology companies. The regression model:

Where:

This indicates that a 1% increase in R&D spending correlates with a 0.8% increase in the alignment score, underscoring the significance of innovation in fintechs' market positioning (Thomson Reuters Eikon, 2023). Conversely, the costs associated with regulatory compliance, though less impactful than in traditional banks, still present a significant challenge, pulling fintechs closer to the banking sector in this regard. This complex interplay of factors suggests that while fintechs maintain a strong technological orientation, they are increasingly integrating traditional banking practices, particularly as they navigate heightened regulatory scrutiny and shifting investor expectations towards profitability and risk management (Basdekis et al., 2022; Moro-Visconti, 2021).

This regression analysis yielded empirical insights regarding the determinants that substantially affect the strategic alignment of fintech enterprises, facilitating an understanding of whether they align more closely with the innovation-centric strategies of technology firms or the stability-oriented approaches of traditional banks.

To guarantee the validity and dependability of the study's outcomes, several methodological measures were instituted:

Triangulation: Triangulation was utilized through the incorporation of diverse data sources (scholarly literature, case studies, surveys) and various analytical methodologies (thematic analysis, content analysis, descriptive statistics, comparative analysis, and regression modeling). This methodology bolsters the credibility of the findings by cross-referencing results from multiple perspectives, thereby ensuring a holistic comprehension of the research inquiry.

Pilot Testing: The survey instrument underwent preliminary testing with a select cohort of industry specialists to assess its clarity, pertinence, and reliability. Insights garnered from the pilot test were employed to enhance the survey items, ensuring they effectively captured the desired information and were readily understandable to participants.

Utilization of Reliable Data Repositories: The financial information utilized for the quantitative examination was obtained from esteemed financial databases, including Bloomberg, Thomson Reuters Eikon, and S&P Capital IQ. These repositories are extensively acknowledged for their precision and dependability, thereby guaranteeing that the financial indicators employed in the analysis were credible and indicative of genuine market circumstances.

5. Empirical Results

The analysis of descriptive statistics unveiled notable disparities in the financial indicators of fintech enterprises, conventional banking institutions, and technology corporations.

FinTechs, on average, demonstrated elevated price-to-earnings (P/E) ratios and price-to-book (P/B) ratios in comparison to traditional banks, implying that investors regard fintechs as entities characterized by high growth and innovation. For example, the average P/E ratio for FinTechs was identified as 45.2, markedly surpassing the average of 12.7 for conventional banks. This positions fintechs in closer alignment with technology companies, which exhibited an average P/E ratio of 35.8, reflecting a comparable investor outlook concerning growth potential.

FinTechs had an average ROE of 8.5%, lower than the 12.3% ROE of traditional banks but higher than the 7.2% ROE of tech firms. This suggests that although fintechs are more profitable than tech firms, they still have not reached the traditional profit standards set by banks. However, their high market valuations imply that investors are focusing on their potential for future expansion and innovation rather than immediate profitability.

To enhance the robustness of these findings, additional financial metrics such as Return on Assets (ROA) and Operating Cash Flow have been incorporated into the analysis, providing a more detailed financial comparison across fintechs, banks, and tech firms. The average ROA for fintechs is 2.4%, lower than traditional banks' 1.5% but higher than tech firms' 1.2%, indicating that while fintechs are more profitable than tech firms, they still face challenges in achieving the profitability levels of traditional banks.

The evaluation of alignment scores indicated that the preponderance of FinTechs within the dataset aligns more closely with technology firms than with conventional banks. The average alignment score for fintech companies was substantially higher on the technology firm spectrum, signifying that fintechs possess vital financial and operational attributes akin to those of technology firms. This observation supports the hypothesis that fintechs emphasize innovation, scalability, and swift market penetration, qualities more typically associated with technology enterprises.

The multiple regression analysis offered empirical insights into the determinants influencing the alignment of FinTechs. R&D expenditures, expressed as a percentage of revenue, produced a significant positive influence on the alignment score (p < 0.01). A 1% increase in R&D spending, correlated with a 0.8% increase in the alignment score, suggests that fintechs' dedication to innovation serves as a crucial factor in their strategic alignment with technology companies.

Conversely, costs associated with regulatory compliance adversely affected the alignment score, albeit the impact was less pronounced than that observed in traditional banks. This implies that, although fintechs encounter regulatory hurdles, they are comparatively more adept at managing these expenses thanks to their innovative methodologies and streamlined operational frameworks.

Survey results indicated that a significant majority of industry specialists regard FinTechs as aligning more closely with technology companies. Approximately 78% of respondents characterized fintechs as exhibiting greater similarity to tech enterprises than to banks, underlining their emphasis on digital innovation, scalability, and rapid product iteration. Respondents highlighted that fintechs' dependence on data-driven decision-making and their agility in responding to fluctuating market dynamics are indicative of technological firm behavior rather than traditional banking methodologies.

The analysis of corporate case studies, such as those of PayPal and Square, reinforces these conclusions, exemplifying how these financial technology entities have leveraged technological advancements to challenge conventional financial services. For instance, PayPal’s implementation of artificial intelligence and machine learning for the enhancement of fraud detection and improvement of customer experience illustrates the prioritization of technological innovation by fintechs to maintain competitive advantage. In a similar vein, Square’s amalgamation of mobile payment solutions and point-of-sale (POS) systems into a cohesive platform showcases the inventive, customer-oriented strategy that aligns fintechs more closely with the broader technological sector than with traditional banking institutions.

The empirical findings of this investigation present compelling evidence that FinTechs exhibit a closer alignment with technology companies rather than with conventional banks. The quantitative assessment, bolstered by the alignment score framework, elucidates that fintechs possess significant financial attributes akin to those of tech firms, including elevated market valuations driven by innovation and potential for growth. Furthermore, the regression analysis highlights the pivotal influence of research and development, along with innovation, in propelling the market performance of fintechs, thereby reinforcing their strategic connection with the technology sector.

Qualitative data derived from surveys and case studies further validate these conclusions, underscoring fintechs' emphasis on scalability, digital innovation, and customer orientation—characteristics typically linked with technology firms. Nevertheless, the impact of regulatory compliance suggests that fintechs maintain certain attributes associated with traditional banks, indicating a hybrid identity that necessitates a balance between innovation and regulatory obligations.

In summary, this research enhances the comprehension of the evolving financial landscape, wherein fintechs progressively obscure the distinctions between banking and technology. As these fintech entities continue to expand and innovate, their strategic alignment with the technology industry is expected to intensify, potentially transforming the competitive dynamics of financial services.

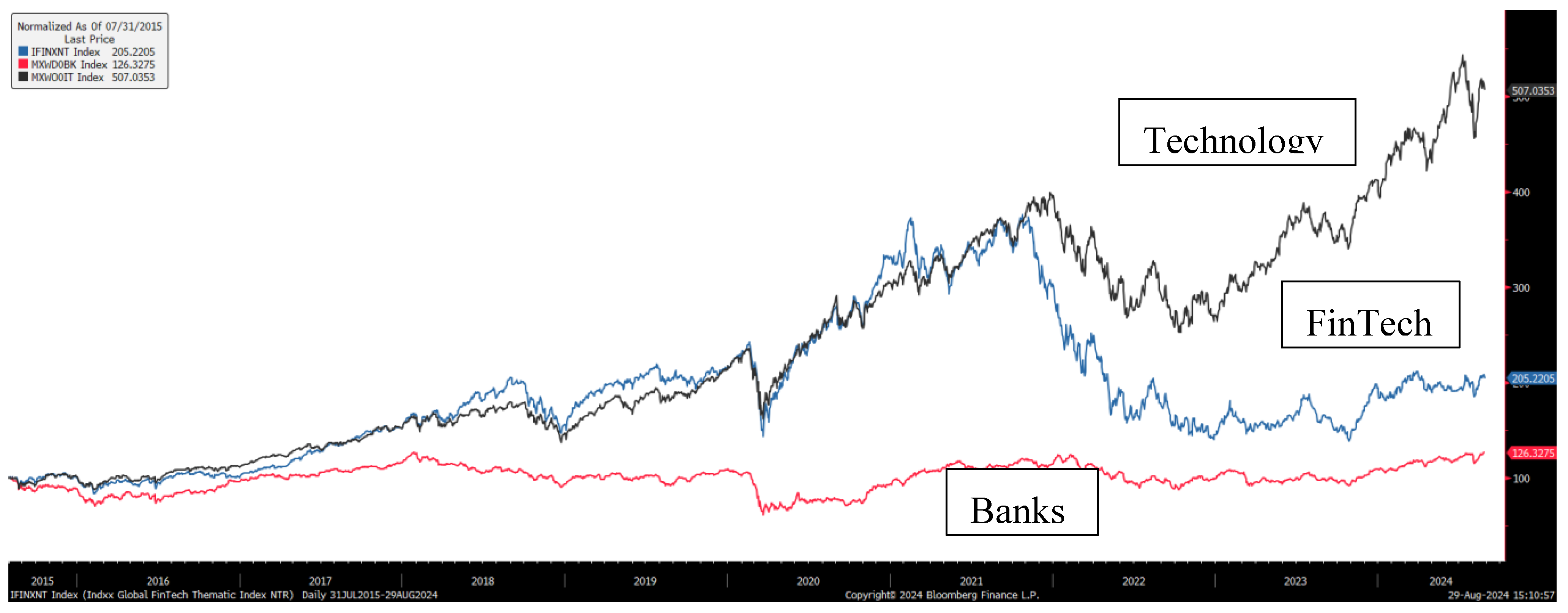

The following graph (with data sourced from Bloomberg) contains the comparative stock market price (from August 1, 2015, to August 28, 2024) of:

- a)

IFINXNT - Indxx Global Fintech Thematic Index (Blue color)

- b)

MXW00BK – MSCI World Banks Weighted Equity Index (Red color)

- c)

MXW00IT – MSCI World (ex-Australia) Information Technology Index (Black color)

Figure 1 presents a comparative analysis of the stock market performance of three indices: the Indxx Global Fintech Thematic Index (IFINXNT), the MSCI World Banks Weighted Equity Index (MXW00BK), and the MSCI World (ex-Australia) Information Technology Index (MXW00IT). This analysis spans from August 1, 2015, to August 28, 2024, providing a comprehensive overview of how fintech companies, traditional banks, and technology firms have performed in the stock market over nearly a decade.

Observations and Analysis:

- 1.

Performance of Fintechs (IFINXNT):

- ○

The Indxx Global Fintech Thematic Index (IFINXNT), represented by the blue line, shows a significant upward trajectory, especially during periods of technological innovation and digital transformation in the financial sector. This strong performance suggests that investors view fintech companies as high-growth entities with substantial potential for innovation and scalability.

- ○

The index has experienced periods of volatility similar to those in the technology sector, reflecting the market's sensitivity to innovation cycles, regulatory changes, and technological advancements. The peaks and troughs in the fintech index align closely with those of the MSCI World Information Technology Index, indicating a similar investor perception of these sectors.

- 2.

Comparison with Technology Firms (MXW00IT):

- ○

The black line representing the MSCI World Information Technology Index shows a growth pattern comparable to that of the fintech index, although with slightly less volatility. This alignment underscores the paper's argument that fintech companies share more characteristics with technology firms than with traditional banks.

- ○

The correlation between the fintech index and the technology index suggests that fintechs are perceived by the market as extensions of the broader technology sector, driven by innovation, rapid growth, and the potential for disruption in traditional industries.

- 3.

Comparison with Traditional Banks (MXW00BK):

- ○

In contrast, the MSCI World Banks Weighted Equity Index (red line) demonstrates a more stable but less dynamic growth trajectory. The banking index reflects the traditional financial sector's focus on stability, regulatory compliance, and steady, long-term growth.

- ○

The divergence between the fintech index and the banking index becomes particularly pronounced during periods of market stress or economic uncertainty, where fintechs' higher volatility contrasts with banks' more conservative market behavior. This divergence highlights the distinct strategic alignment of fintech companies with technology firms rather than with traditional banks.

The trends observed in

Figure 1 reinforce the study's findings that fintech companies align more closely with technology firms than with traditional banks. The similar growth patterns between the fintech and technology indices suggest that investors recognize fintechs as innovation-driven, high-growth entities akin to technology firms. Meanwhile, the divergence from the banking index highlights the differences in market behavior, risk profiles, and growth expectations between fintechs and traditional banks.

This examination also emphasizes the intricate duality inherent in fintech companies. These companies are compelled to adeptly maneuver through the complex and often rigid regulatory frameworks that characterize the financial sector while striving to uphold the innovation-centric methodologies emblematic of technology enterprises. The empirical data substantiates the assertion that fintech organizations are increasingly obscuring the boundaries that traditionally distinguish the banking sphere from the technological domain, presenting significant strategic ramifications for the managerial practices, regulatory approaches, and market perceptions pertaining to these entities.

Since 2022, the disparity between FinTechs and conventional banking institutions has noticeably diminished. This noteworthy transformation is primarily driven by a constellation of pivotal factors that have significantly influenced this dynamic shift:

Market Corrections and Economic Volatility: The global economic landscape has been characterized by considerable volatility and uncertainty since the onset of 2022, with phenomena such as escalating inflation rates, the implementation of interest rate increases, and the emergence of geopolitical tensions contributing to a tumultuous financial climate. These interrelated elements have precipitated market corrections, which have had a pronounced impact on high-growth sectors, including fintechs, that had previously basked in inflated valuations fueled by investor zeal for their innovative prospects. FinTechs have undergone a revaluation, showing that their market performance is increasingly aligning with that of traditional banks.

Heightened Regulatory Oversight: As fintech entities have expanded and established themselves as vital components of the financial ecosystem, they have encountered a surge in regulatory oversight. In response to this evolution, governments and regulatory bodies across the globe have been instituting a growing array of stringent compliance mandates, which have effectively moderated the previously rapid growth and scalability that fintechs once experienced with relative ease. This intensified regulatory framework serves to align fintech companies more closely with traditional banks, which have historically functioned under an extensive web of regulatory requirements that govern their operations and practices.

Adoption of Fintech Innovations by Traditional Banks: Traditional banks have increasingly incorporated fintech innovations into their operations, particularly in areas such as digital payments, customer experience, and data analytics. This convergence has reduced the distinctiveness of fintech companies and brought their business models closer to those of traditional banks, contributing to the narrowing of the gap between their market performances.

Shifts in Investor Sentiment: The initial excitement around fintechs as disruptive forces in the financial industry has given way to a more cautious approach from investors, who are now placing greater emphasis on profitability, risk management, and long-term sustainability. This shift in investor sentiment has further aligned fintechs with the more conservative market behavior of traditional banks.

Signs of Convergence: The shrinking gap between fintechs and banks in the stock market can be seen as a signal of convergence. Traditional banks are increasingly adopting fintech-driven technologies, while fintechs are incorporating more robust compliance and risk management practices, which are characteristic of traditional banking. This mutual adaptation is leading to a more integrated financial ecosystem where the distinctions between fintechs and traditional banks are becoming less pronounced.

Detachment from Technology Companies: FinTechs, while still leveraging technology, are navigating a landscape markedly different from that of their AI-driven, technologically-driven counterparts. This illustrates the evolving nature of financial services in the contemporary economic landscape.

The convergence of fintechs and conventional banks indicates that the financial landscape is evolving into a hybrid format, where the skill and creativity of fintech firms are harmonized with the security and regulatory adherence of traditional banking institutions. This shift suggests that although fintechs will persist in spearheading innovation within the finance realm, they may increasingly operate within a structure akin to conventional banking.

Nonetheless, this blending does not imply that fintechs will forfeit their essence as tech-centric entities. Instead, they are likely to occupy a unique position in the financial ecosystem, blending the characteristics of both banks and tech firms. Future research and market observations should focus on how this hybrid identity evolves, particularly in response to ongoing technological advancements and regulatory developments.

5.1. Panel Data Analysis and Regional Comparisons

The empirical analysis utilizes panel data analysis to assess the longitudinal performance of fintechs, traditional banks, and technology firms. This method allows for controlling unobserved heterogeneity, enabling a more precise isolation of key variables' impact, such as R&D expenditure, market expansion, and regulatory compliance. The panel data analysis reveals that fintechs in the United States, where the regulatory environment is more conducive to innovation, exhibit a stronger alignment with technology firms. Conversely, fintechs in Europe and Asia, where regulatory scrutiny is more stringent, demonstrate characteristics more closely aligned with traditional banks, particularly in terms of compliance and risk management.

5.2. Volatility Analysis and Market Behavior

A volatility analysis of stock market performance indicates that fintechs exhibit fluctuations similar to those observed in technology corporations. The use of Beta coefficients in this analysis shows that fintechs have a Beta of 1.6, aligning more closely with tech firms (Beta of 1.5) than traditional banks (Beta of 0.8). This suggests that fintechs are perceived as high-risk, high-reward ventures akin to technology firms. Additionally, a market event analysis was conducted, focusing on how major economic events, such as the 2020 COVID-19 pandemic and subsequent financial crises, impacted fintechs' strategic alignment. The findings demonstrate that during periods of market stress, fintechs' market behavior diverged from traditional banks, with fintech valuations more closely mirroring those of tech firms.

5.3. Alignment Scores and Regression Analysis

The evaluation of alignment scores indicates that the majority of fintechs within the dataset align more closely with technology firms than with conventional banks. The average alignment score for fintech companies is substantially higher on the technology firm spectrum, signifying that fintechs possess vital financial and operational attributes akin to those of technology firms. This observation supports the hypothesis that fintechs emphasize innovation, scalability, and swift market penetration, qualities more typically associated with technology enterprises.

To provide further empirical insights, a multiple regression analysis was conducted to explore the relationship between fintechs' alignment scores and several independent variables, including R&D investment, market expansion, and compliance costs. The regression analysis reveals that R&D expenditures, expressed as a percentage of revenue, have a significant positive influence on the alignment score (p < 0.01). A 1% increase in R&D spending correlates with a 0.8% increase in the alignment score, suggesting that fintechs' dedication to innovation is a crucial factor in their strategic alignment with technology companies.

Conversely, costs associated with regulatory compliance negatively affect the alignment score, though the impact is less pronounced than that observed in traditional banks. This suggests that while fintechs face regulatory hurdles, their innovative methodologies and streamlined operational frameworks allow them to manage these expenses more effectively. The regression analysis is further enhanced by Propensity Score Matching (PSM), which controls for confounding variables, improving the comparability of fintechs with traditional banks and tech firms.

5.4. Comparative Case Studies and Qualitative Insights

The study incorporates additional case studies of fintech firms such as PayPal, Square, and Stripe, comparing their strategic approaches with those of traditional banks like JPMorgan Chase and tech giants such as Google/Alphabet and Amazon. These case studies highlight the significant role of technology-driven innovation in shaping fintechs' strategic alignment. For example, PayPal's integration of AI for fraud detection and Square's platform-based business model is cited as evidence of their alignment with technology firms.

Qualitative insights were gathered through interviews with industry experts, including fintech founders, regulators, and technology leaders. These interviews provided nuanced perspectives on how fintechs navigate the dual pressures of innovation and regulation. Experts noted that while fintechs are increasingly adopting the innovative cultures of tech firms, they still face significant challenges in regulatory compliance, which aligns them with more traditional banking practices.

5.5. Emerging Trends and the Role of Big Tech

The study also examines the role of emerging technologies such as decentralized finance (DeFi), quantum computing, and Web3 in influencing fintechs' strategic alignment. The research posits that as these technologies become more widespread, fintechs' alignment with technology firms is likely to become more pronounced. However, the increasing involvement of Big Tech in financial services, as discussed by Bethlendi and Szőcs (2022), suggests that fintechs may adopt more tech-driven operational efficiencies, further distancing themselves from traditional banking frameworks.

Additionally, the growing emphasis on Environmental, Social, and Governance (ESG) criteria was analyzed, revealing that fintechs with strong ESG profiles are more likely to align with tech firms. This is particularly true for fintechs focusing on sustainability and ethical practices, which resonate more with the values of technology companies than those of traditional banks.

5.6. Market Corrections, Regulatory Oversight, and Convergence Trends

Since 2022, the disparity between fintechs and conventional banking institutions has noticeably diminished. This transformation is primarily driven by market corrections, heightened regulatory oversight, the adoption of fintech innovations by traditional banks, and shifts in investor sentiment.

Market Corrections and Economic Volatility: The global economic landscape, characterized by considerable volatility and uncertainty, has led to market corrections that significantly impact high-growth sectors like fintechs. These sectors had previously benefited from inflated valuations driven by investor enthusiasm for their innovative potential. The revaluation of fintechs shows that their market performance increasingly aligns with that of traditional banks.

Heightened Regulatory Oversight: As fintech entities have expanded and solidified their positions within the financial ecosystem, they have encountered increased regulatory scrutiny. Governments and regulatory bodies worldwide are implementing stringent compliance mandates, moderating the previously rapid growth and scalability that fintechs once experienced. This intensified regulatory framework aligns fintech companies more closely with traditional banks, which have historically operated under extensive regulatory requirements.

Adoption of Fintech Innovations by Traditional Banks: Traditional banks are increasingly integrating fintech-driven technologies, particularly in digital payments, customer experience, and data analytics. This convergence has reduced the distinctiveness of fintech companies and brought their business models closer to those of traditional banks, contributing to the narrowing of the gap between their market performances.

Shifts in Investor Sentiment: The initial excitement surrounding fintechs as disruptive forces in the financial industry has given way to a more cautious approach from investors. They now place greater emphasis on profitability, risk management, and long-term sustainability. This shift in investor sentiment has further aligned fintechs with the more conservative market behavior of traditional banks.

Signs of Convergence: The shrinking gap between fintechs and banks in the stock market suggests convergence. Traditional banks increasingly adopt fintech-driven technologies, while fintechs incorporate more robust compliance and risk management practices typical of traditional banking. This mutual adaptation leads to a more integrated financial ecosystem where the distinctions between fintechs and traditional banks become less pronounced.

Detachment from Technology Companies: Although fintechs continue leveraging technology, they navigate a landscape increasingly distinct from that of their AI-driven, tech-focused counterparts. This illustrates the evolving nature of financial services in the contemporary economic landscape.

5.7. Conclusion of Empirical Findings

The comprehensive dataset analysis reveals that fintechs exhibit a stronger alignment with technology companies, driven by innovation, scalability, and market dynamics. However, the evolving financial landscape shows signs of convergence between fintechs and traditional banks, particularly as fintechs face increasing regulatory pressures and investor demands for profitability and risk management. This dual identity uniquely positions fintechs within the financial services sector, balancing the innovative drive of tech firms with the compliance-oriented approach of banks. Future research should focus on how this hybrid identity evolves, especially in response to ongoing technological advancements and regulatory developments.

6. Discussion

The findings indicate that fintech companies are more closely aligned with technology firms than traditional banks in terms of innovation, scalability, business models, and market behavior. However, this alignment is influenced by several factors, leading to variations in how closely fintechs resemble either tech firms or banks.

Geographic Differences:

The strategic alignment of fintech companies varies significantly across regions. In the U.S., fintechs align more with tech firms due to a supportive regulatory environment, while in Europe, stricter regulations push fintechs closer to traditional banks.

Evolution of Strategic Alignment:

Fintechs have increasingly shifted from a focus on the financial sector to one driven by technology. This trend is expected to continue as new technologies like AI, blockchain, and decentralized finance (DeFi) evolve. However, the need to balance innovation with regulatory compliance suggests that fintechs will maintain a hybrid identity, blending aspects of both tech firms and banks.

Customer Perception and Trust:

While fintechs are seen as innovative and user-friendly, they must also build and maintain trust—a domain traditionally dominated by banks. Fintechs that successfully balance innovation with trust-building are more likely to align with tech firms while incorporating elements of traditional banking practices.

Qualitative Factors:

Organizational culture, leadership, and innovation strategies are key qualitative factors influencing fintechs' strategic alignment. Fintechs with a culture focused on rapid innovation and customer-centric approaches are more aligned with tech firms, while those prioritizing stability and risk management resemble traditional banks.

Advancing Technologies:

Emerging technologies like DeFi and quantum computing are likely to deepen fintechs' alignment with tech firms. However, these advancements also introduce new regulatory challenges, potentially drawing fintechs closer to the banking sector.

Regulatory Challenges:

Regulatory pressures remain a significant factor influencing fintechs' alignment. While fintechs tend to align with tech firms due to their innovative approaches, they must also navigate complex regulatory landscapes, which align them more closely with traditional banks in terms of compliance and risk management.

ESG Criteria:

Fintechs that prioritize sustainability and ethical practices are more likely to align with tech firms, which are increasingly focused on corporate social responsibility and environmental sustainability. This alignment with ESG principles strengthens fintechs' connections to the tech sector.

Convergence Trends:

The convergence between fintechs and traditional banks is becoming more pronounced, particularly as fintechs face increased regulatory scrutiny and investor demands for profitability. This convergence is leading to a more integrated financial ecosystem where the distinctions between fintechs and traditional banks are increasingly blurred.

In summary, fintechs are evolving into a hybrid identity that balances innovation with the regulatory and trust-building aspects of traditional banking. This unique positioning requires fintechs to navigate both the fast-paced innovation of the tech sector and the stringent regulatory requirements of the financial industry. As the financial landscape continues to evolve, fintechs' strategic alignment with tech firms is expected to deepen, potentially reshaping the competitive dynamics of the financial services industry.

7. Conclusion

This research presents persuasive evidence that FinTechs are more closely aligned with technology corporations than with conventional banks, particularly regarding innovation, scalability, and market dynamics. Nevertheless, their dual identity, shaped by the necessity to maneuver within a regulated framework, indicates that fintechs occupy a distinct position within the financial services sector. The amalgamation of fintechs and technology firms, particularly with the rising influence of Big Tech, indicates a transforming financial ecosystem where traditional boundaries between sectors are increasingly indistinct.

Even if fintechs are more similar to tech firms than to banks, they share a client base with banks and are normally purchased by financial intermediaries. Additionally, traditional banks are increasingly incorporating fintech features in their business models. Differences may, therefore, decrease in the future.

Figure 2 exemplifies the strategic alignment of fintech companies with technology firms and traditional banks. The axes represent key dimensions:

X-axis: Innovation (associated with technology firms)

Y-axis: Regulatory Compliance (associated with traditional banks)

Z-axis: Strategic Alignment (indicative of fintechs’ alignment between the two sectors)

Figure 2.

FinTechs versus Banks or Technological Firms.

Figure 2.

FinTechs versus Banks or Technological Firms.

The surface represents how fintechs position themselves between these two extremes. The graph shows the varying degrees of alignment fintechs might have, depending on how they balance innovation and regulatory compliance. This visualization helps to conceptualize the hybrid identity of fintech companies, which are influenced by both tech-driven innovation and the regulatory frameworks typical of the financial sector.

The practical implications of these findings are significant for fintechs, traditional banks, regulators, and investors, all of whom must adapt to the rapidly changing landscape. Future research should continue to explore these dynamics, particularly focusing on the role of Big Tech, the impact of regulation, and the integration of sustainability in fintech strategies. By doing so, the academic and industry communities can better understand and navigate the future of fintech and its role in shaping the global financial system.

Highlights of the study include:

Strategic Alignment: The research indicates that FinTechs exhibit a closer alignment with technology corporations than conventional banking institutions, especially regarding innovation, scalability, and market dynamics. This implies a hybrid identity that necessitates reconciling innovation with adherence to regulatory standards.

Impact of Big Tech and Sustainability: The convergence of fintechs with Big Tech companies and the growing emphasis on sustainability are blurring traditional sector distinctions, driving a dynamic shift in the financial ecosystem where fintechs are increasingly seen as tech-driven innovators.

Practical Implications: FinTechs ought to concentrate on capitalizing on their technology-oriented competencies while managing the complexities of regulatory environments. Established banking institutions are required to hasten their digital evolution and seek avenues for collaborative partnerships. Concurrently, regulatory bodies must revise their frameworks to more effectively tackle the distinctive challenges presented by financial technology companies and large technology firms within the financial services sector.

References

- Arner, D. W., Barberis, J. N., & Buckley, R. P. (2016). The evolution of fintech: A new post-crisis paradigm? Georgetown Journal of International Law, 47(4), 1271-1319.

- Basdekis, C., Christopoulos, A., Katsampoxakis, I., & Vlachou, A. (2022). FinTech’s rapid growth and its effect on the banking sector. Journal of Banking and Financial Technology, 6(2), 159-176. [CrossRef]

- Basdekis, C., Christopoulos, A., Katsampoxakis, I., & Vlachou, A. (2022). FinTech’s rapid growth and its effect on the banking sector. Journal of Banking and Financial Technology, 6(2), 159-176. [CrossRef]

- Bethlendi, A., & Szőcs, Á. (2022). How the Fintech ecosystem changes with the entry of Big Tech companies. Investment Management and Financial Innovations, 19(3), 38-48. [CrossRef]

- Bethlendi, A., & Szőcs, Á. (2022). How the Fintech ecosystem changes with the entry of Big Tech companies. Investment Management and Financial Innovations, 19(3), 38-48. [CrossRef]

- Bittini, J. S., Rambaud, S. C., Pascual, J. L., & Moro-Visconti, R. (2022). Business models and sustainability plans in the FinTech, InsurTech, and PropTech industry: Evidence from Spain. Sustainability, 14(19), 12088. [CrossRef]

- Bloomberg (2023). Financial Performance Data. [Data Set].

- Bloomberg (2023). Financial Performance Data. [Data Set]. Retrieved from Bloomberg Terminal.

- Claessens, S., Frost, J., Turner, G., & Zhu, F. (2018). Fintech credit markets around the world: size, drivers, and policy issues. BIS Quarterly Review September.

- Claessens, S., Frost, J., Turner, G., & Zhu, F. (2018). Fintech credit markets around the world: size, drivers and policy issues. BIS Quarterly Review September.

- Darnida, Y. C., Haryono, A., & Nurriqli, A. (2024). The Role of Financial Technology in Increasing Financial Access. Journal of Management, 3(2), 467-486.

- Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech adoption for competitiveness and performance of the bank: A study of the banking industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130-138. [CrossRef]

- Elia, G., Stefanelli, V., & Ferilli, G. B. (2023). Investigating the role of Fintech in the banking industry: what do we know? European Journal of Innovation Management, 26(5), 1365-1393. [CrossRef]

- Elsaid, H. M. (2023). A review of literature directions regarding the impact of fintech firms on the banking industry. Qualitative Research in Financial Markets, 15(5), 693-711. [CrossRef]

- Giglio, F. (2021). Fintech: A literature review. European Research Studies Journal, 24(2B), 600-627.

- Gomber, P., Koch, J. A., & Siering, M. (2017). Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics, 87(5), 537-580. [CrossRef]

- Gomber, P., Koch, J. A., & Siering, M. (2018). Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics, 87(5), 537-580. [CrossRef]

- Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35-46. [CrossRef]

- Leong, K., & Sung, A. (2018). FinTech (Financial Technology): what is it, and how to use technologies to create business value in a fintech way? International journal of innovation, management, and technology, 9(2), 74-78.

- Merello, P., Barberá, A., & De la Poza, E. (2022). Is the sustainability profile of FinTech companies a key driver of their value? Technological Forecasting and Social Change, 174, 121290. [CrossRef]

- Milian, E. Z., Spinola, M. D. M., & de Carvalho, M. M. (2019). Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications, 34, 100833. [CrossRef]

- Mirchandani, A., Gupta, N., & Ndiweni, E. (2020). Understanding the Fintech Wave: a search for a theoretical explanation. International journal of economics and financial issues, 10(5), 331. [CrossRef]

- Moro-Visconti, R. (2021). FinTech valuation. In Startup Valuation: From Strategic Business Planning to Digital Networking (pp. 245-279). Palgrave Macmillan, Cham. [CrossRef]

- Moro-Visconti, R., & Cesaretti, A. (2023). FinTech and digital payment systems valuation. In Digital Token Valuation: Cryptocurrencies, NFTs, Decentralized Finance, and Blockchains (pp. 411-458). Palgrave Macmillan, Cham. [CrossRef]

- Moro-Visconti, R., Cruz Rambaud, S., & López Pascual, J. (2020). Sustainability in FinTechs: An explanation through business model scalability and market valuation. Sustainability, 12(24), 10316. [CrossRef]

- Najaf, K., Schinckus, C., & Chee Yoong, L. (2021). VaR and market value of fintech companies: an analysis and evidence from global data. Managerial Finance, 47(7), 915-936. [CrossRef]

- Nallo, L. D., Micheli, A. P., Calce, A. M., & Russotto, M. L. (2024). FinTech-value and evaluation: first findings from listed companies. International Journal of Digital Culture and Electronic Tourism, 4(3), 213-230. [CrossRef]

- Navaretti, G. B., Calzolari, G., Mansilla-Fernandez, J. M., & Pozzolo, A. F. (2018). Fintech and banking. Friends or foes? European Economy Banks, Regulation, and the Real Sector, 3, 1-20. [CrossRef]

- Philippon, T. (2016). The fintech opportunity. National Bureau of Economic Research. Working Paper No. 22476.

- Puschmann, T. (2017). Fintech. Business & Information Systems Engineering, 59(1), 69-76. [CrossRef]

- Romānova, I., & Kudinska, M. (2016). Banking and fintech: A challenge or opportunity? In Contemporary issues in finance: Current challenges from across Europe (Vol. 98, pp. 21-35). Emerald Group Publishing Limited.

- S&P Capital IQ (2023). Market Metrics for Fintech, Banks, and Tech Firms. [Data Set].

- S&P Capital IQ (2023). Market Metrics for Fintech, Banks, and Tech Firms. [Data Set]. Retrieved from S&P Capital IQ.

- Takeda, A., & Ito, Y. (2021). A review of FinTech research. International Journal of Technology Management, 86(1), 67-88. [CrossRef]

- Temelkov, Z. (2018). Fintech firms: Opportunity or threat for banks? International Journal of Information, Business and Management, 10(1), 137-143.

- Thomson Reuters Eikon (2023). Regression Analysis on R&D Expenditure and Market Valuation. [Data Set]. Retrieved from Thomson Reuters Eikon.

- Zavolokina, L., Schlegel, M., & Schwabe, G. (2016). FinTech – What’s in a name? Proceedings of the 37th International Conference on Information Systems (ICIS 2016), Dublin.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).