Highlights:

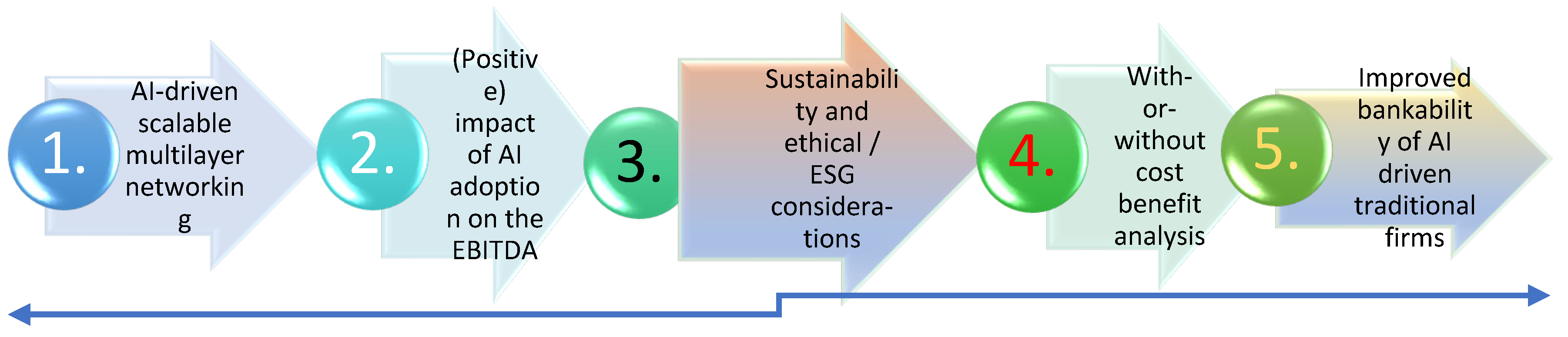

AI-Driven Scalability and Financial Performance: AI-driven scalable networks can significantly boost traditional firms’ financial performance, particularly by improving EBITDA, thereby enhancing their bankability and investor appeal

ESG Integration with AI: Incorporating ESG considerations into AI investments not only boosts operational efficiency but also aligns firms with sustainability goals, leading to improved market valuation and long-term financial stability

Innovative “With-or-Without” Analysis: A comparative “with-or-without” model demonstrates the clear benefits of AI and ESG integration, highlighting significant gains in revenue, cost efficiency, and overall financial performance for firms adopting these technologies.

1. Introduction

Artificial Intelligence (AI) refers to the simulation of human intelligence processes by machines, particularly computer systems, through the development of algorithms that can learn, reason, and make decisions or predictions. As a transformative force, AI has the potential to significantly enhance the scalability, efficiency, and competitiveness of traditional firms, thereby increasing their attractiveness to banks and investors. This study explores how AI-driven transformations can impact traditional firms’ economic and financial margins, with a particular focus on the scalability properties of AI investments.

The research question for this study centers on the impact of AI investments, driven by scalable network properties and incorporating Environmental, Social, and Governance (ESG) considerations, on the economic and financial margins of traditional firms. The study measures this impact using the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) metric, a common indicator of business performance, particularly in terms of cost revenue management and liquidity.

This study suggests that implementing AI technologies can lead to improved EBITDA for traditional firms, driven by sustainability upgrading and assessed through an ESG rating. By incorporating AI, businesses can develop innovative solutions that address both ethical and environmental concerns, thereby enhancing their sustainability profiles and overall competitiveness. A higher EBITDA, resulting from AI-driven efficiencies and ESG enhancements, can improve a firm’s liquidity, thereby bolstering its bankability and increasing its appeal to investors and financial institutions.

The originality of this research lies in its dual focus on AI and ESG as drivers of value creation and financial stability. By leveraging advanced network theory and multilayer network models, this study provides a comprehensive analysis of how AI can be harnessed not only for operational efficiency but also for sustainable value creation, addressing both profitability and ethical imperatives. This innovative approach offers valuable insights into the cost-effectiveness of AI investments for traditional businesses, demonstrating that such investments contribute to value creation while alleviating concerns related to bankability.

The central focus of this study is to evaluate the effects of AI investments on traditional firms’ economic and financial margins, particularly measuring these effects through the EBITDA metric. The study’s findings suggest that AI-powered scalability, when combined with ESG upgrades, can significantly enhance a firm’s financial stability and bankability. As traditional firms navigate the complexities of modern markets—where digitalization and sustainability are essential—understanding the interplay between AI, ESG, and financial outcomes becomes paramount.

The paper is structured as follows: Section 2 contains a literature review that highlights the main research streams and identifies areas for potential advancements. Section 3 outlines the methodology. Section 4 illustrates AI-powered scalable networks. Section 5 examines the AI-driven scalable properties of multilayer networks. Section 6 explores the AI-driven ESG value. Section 7 presents a “with-or-without” comparison that evaluates the impact of AI investments on traditional firms. Section 8 discusses the impact of AI on bankability. Section 9 contains the discussion. Finally, Section 10 summarizes and concludes.

2. Literature Review

The existing literature presents multiple research streams that relate to the research question of this study, each offering valuable insights into the impact of AI on business models, value creation, and operational efficiency. However, these studies often address these issues in isolation, lacking a comprehensive examination of the interconnected impacts of AI-driven scalability and ESG considerations on traditional firms. This gap in the literature forms the basis for the contributions of this paper.

A) AI and Network Scalability

AI is recognized as a forward-looking technology with the potential to extrapolate past trends, particularly through big data analysis, to predict and create value in business models (Minh et al., 2022; Acciarini et al., 2023; Duan et al., 2019). Self-learning processes within AI systems can significantly enhance business models, making them more sustainable and resilient (Reim et al., 2020). Despite this potential, Enholm et al. (2022) highlight the ongoing lack of a holistic understanding of AI adoption and its value-generating mechanisms within organizations. This paper aims to fill this gap by exploring the scalability features of AI, particularly its role in enhancing the scalability of digital applications and Industry 4.0 processes (Belgaum, 2021; Popkova and Sergi, 2020).

Organizations that implement AI applications can achieve business value gains such as increased revenue, cost reduction, and improved business efficiency (Alsheibani et al., 2020). AI’s capacity to retrieve more information from the internet and other complementary sources, like IoT, and to improve the explanatory power of these linkages contributes to scalability and value creation. However, this value creation process, particularly its impact on traditional firms’ scalability and value drivers in cost-revenue analysis, has been underexplored in the literature. This paper addresses this oversight by examining how AI influences scalability and the subsequent improvement in traditional firms’ EBITDA and bankability.

B) The Impact of AI on Business Models and Value Creation

Several studies have focused on AI’s impact on business value and operations, with Enholm et al. (2022) surveying AI’s influence on business value, Chalmers et al. (2021) exploring its role in venture creation, and Gupta et al. (2022) examining its effects on operations research. Additionally, other works (Brancalese et al., 2022; Galaz and Centeno, 2021; Kar et al., 2022; Khakurel et al., 2018; Goralski et al., 2020; Kopka and Grashof, 2022; Di Vaio et al., 2020; Nishant et al., 2020; Tanveer et al., 2020) have explored AI’s sustainability patterns, which are crucial for value creation and bankability. Despite these contributions, the literature has not fully assessed the impact of AI on scalable business models and the resulting value-creation patterns, particularly in the context of traditional firms. This paper addresses this gap by investigating how AI can drive value creation through scalable networks and enhanced business models, ultimately improving bankability.

C) The Link between AI and ESG Parameters

The relationship between AI and ESG parameters remains controversial, with ongoing debates about the value of sustainable investments and their real added value (Mohieldin et al., 2022; Fatima et al., 2023). The cost/benefit analysis of ESG investments suggests that these investments may require patience for payoff, with initial investments carrying uncertain returns that influence the cost of capital (Khanchel and Lassoued, 2022). This uncertainty impacts discounted cash flows and incorporates risk factors related to EBITDA-driven free cash flows. The literature points out a lack of tools for systematically evaluating and disclosing the impacts and risks associated with ESG investments, as noted by Minkkinen et al. (2022). Sætra (2022) proposed an AI ESG protocol to address this gap. This paper contributes to the literature by exploring how AI can unlock new pathways for value creation and sustainable growth through enhanced linkages among informational nodes, thereby addressing the gaps in the systematic evaluation of AI and ESG integration.

D) The Relationship between Bankability and Market Valuation

The relationship between firm bankability and market valuation is well-established in the literature (Sunday, 2012; DeAngelo and DeAngelo, 2007; Moro-Visconti, 2022). Firms that effectively serve debt tend to have higher intrinsic value, as demonstrated by Bui (2023) in the context of capital structure and firm value. However, the literature does not fully capture the value creation process that starts from AI-driven scalability, passes through scalable business models, and ultimately improves the market value and bankability of traditional firms. This paper fills this gap by providing a comprehensive analysis of how AI-driven scalability and ESG considerations enhance traditional firms’ value creation processes, leading to improved financial stability and bankability.

Research Gaps Addressed

The existing literature often focuses on specific aspects of AI, ESG, or scalability in isolation without a comprehensive examination of how these elements interact to influence traditional firms’ economic and financial margins. This paper addresses these gaps by integrating AI-driven scalability with ESG considerations, providing a holistic analysis of their combined impact on traditional firms’ value creation, financial stability, and bankability. By doing so, this research offers new insights into the role of AI and ESG in driving sustainable growth and enhancing traditional firms’ competitiveness in modern markets.

3. Methodology

Integrating AI technologies leads to cost savings, enhances financial performance, and enhances stakeholder engagement. AI adoption enhances economic performance and positively influences ESG factors. The study explores whether AI can trigger power law properties to improve a firm’s economic scalability and investigates how the value generated through AI adoption enhances the firm’s bankability.

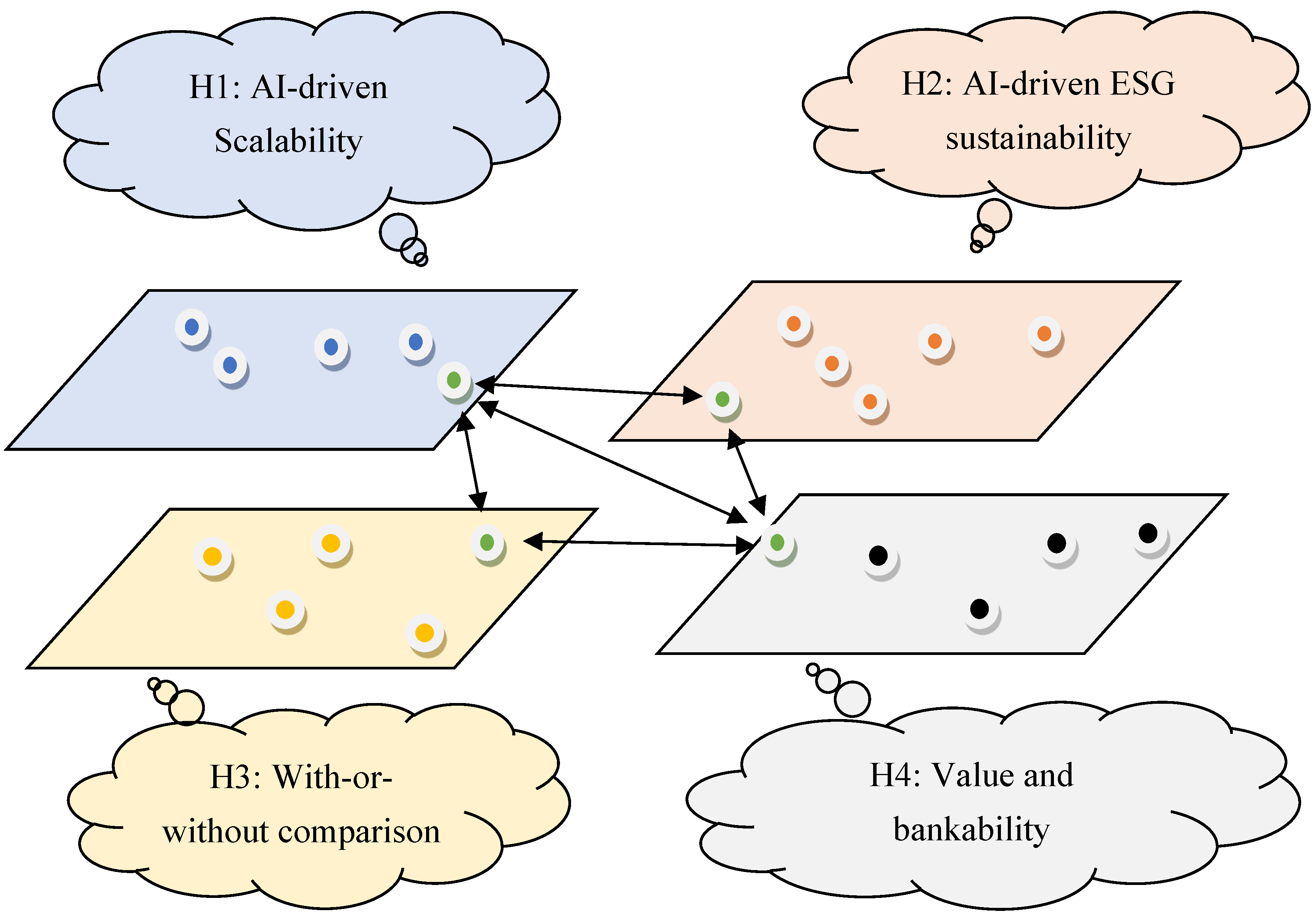

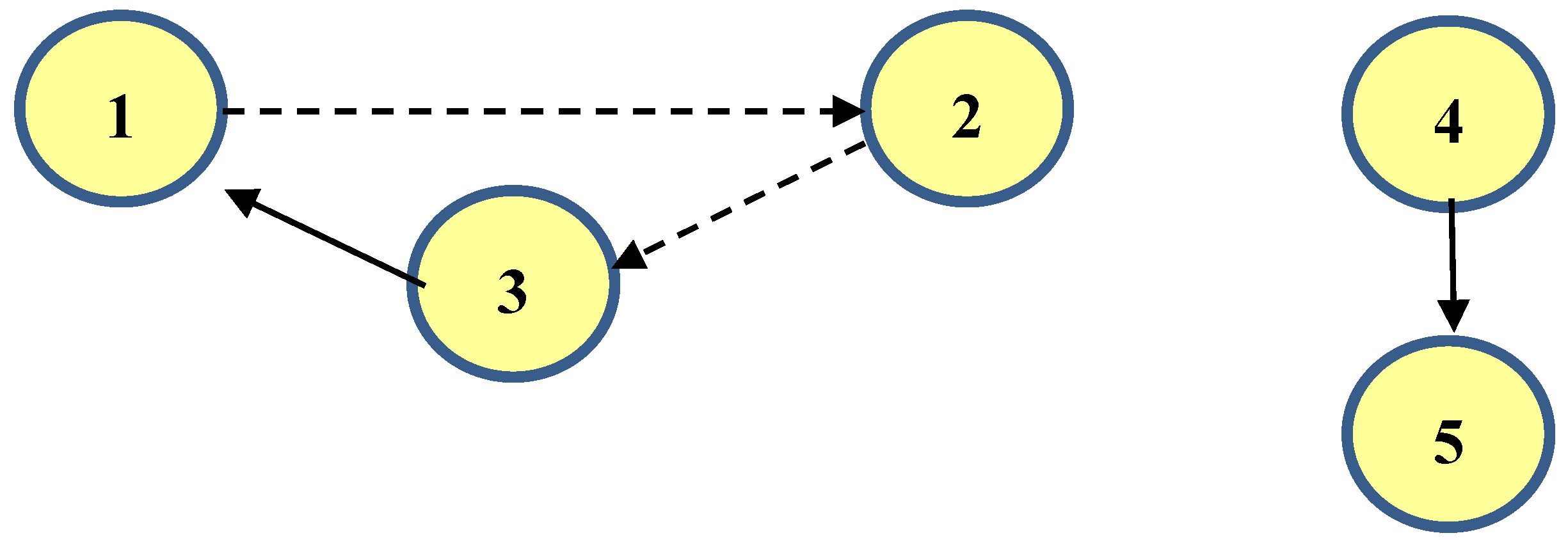

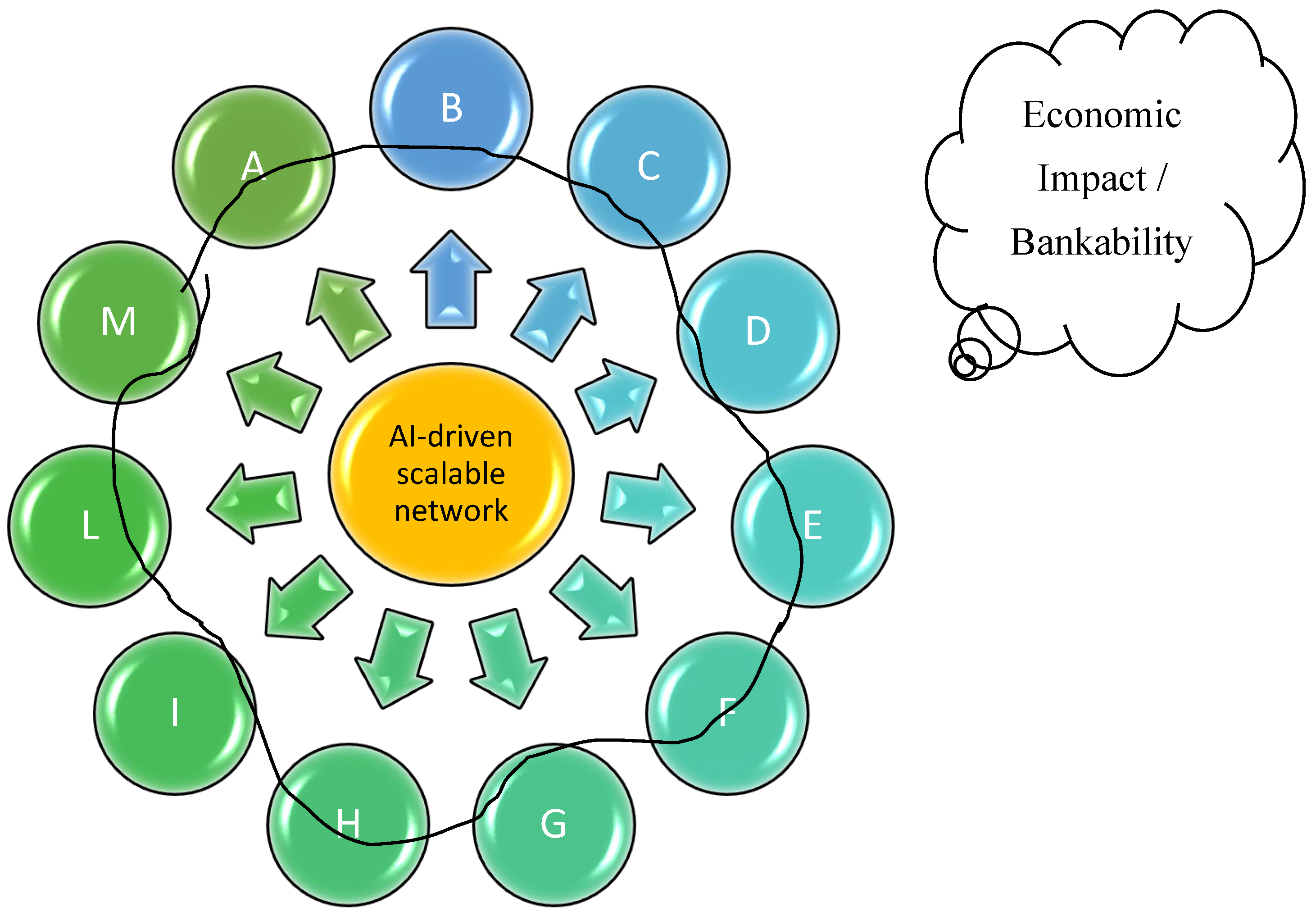

The research question concerns the scalability impact of AI on the economic/financial margins of traditional firms (proxied by the EBITDA that measures the cost/revenue analysis). Improved EBITDA ultimately influences the bankability of the firm (Lui et al., 2022). The value-generating process can be exemplified in

Figure 1, showing that:

The AI bridging properties ease the interaction among the stakeholders, fostering the incentive to co-create and share the additional value.

AI-driven cost savings positively impact financial and economic marginality (proxied by the EBITDA and other parameters), improving the networking interaction of the stakeholders.

With-or-without cost-benefit analysis captures EBITDA improvements that eventually increase value.

Better economic/financial marginality, driven by AI adoption, also improves the ESG patterns.

The additional value “pie” eventually improves the bankability.

Figure 1, with its double-sided arrow, shows that value co-creation is circular since the stakeholders foster AI adoption to monetize its proceeds. Consequently, four related hypotheses are considered and tested:

H1) Can AI ignite power law properties that improve a traditional firm’s economic scalability, illustrated with network theory formulation, eventually bringing higher EBITDA?

H2) Are AI-driven scalable networks and improved business models affected by ESG considerations?

H3) Is the business model of a “brick-and-mortar” firm (positively) affected by this AI-driven scalable impact, showing improved value through a “with-or-without” comparison?

H4) Does increased economic/financial value, shared by the firm’s stakeholders, eventually improve the company’s bankability?

This study adopts a mixed-method approach, combining both quantitative and qualitative analyses to thoroughly explore the impact of AI-driven scalability and ESG integration on traditional firms. The quantitative analysis includes sensitivity simulations and a ‘with-or-without’ model. In contrast, the qualitative analysis draws insights from recent literature and expert interviews to validate the assumptions made in the quantitative models.”

To ensure robustness, the study applies simulations to account for variability and uncertainty in AI’s impact on cost and revenue. This approach enhances the reliability of the findings by considering different scenarios and their potential outcomes on financial margins and bankability.

4. AI-powered Scalable Networks (H1)

AI enhances network theory (Barabási, 2016), improves node finding with big data retrieval, and links interpretations with generative AI, and how their joint application can contribute to firm scalability and increase economic, financial, and market value.

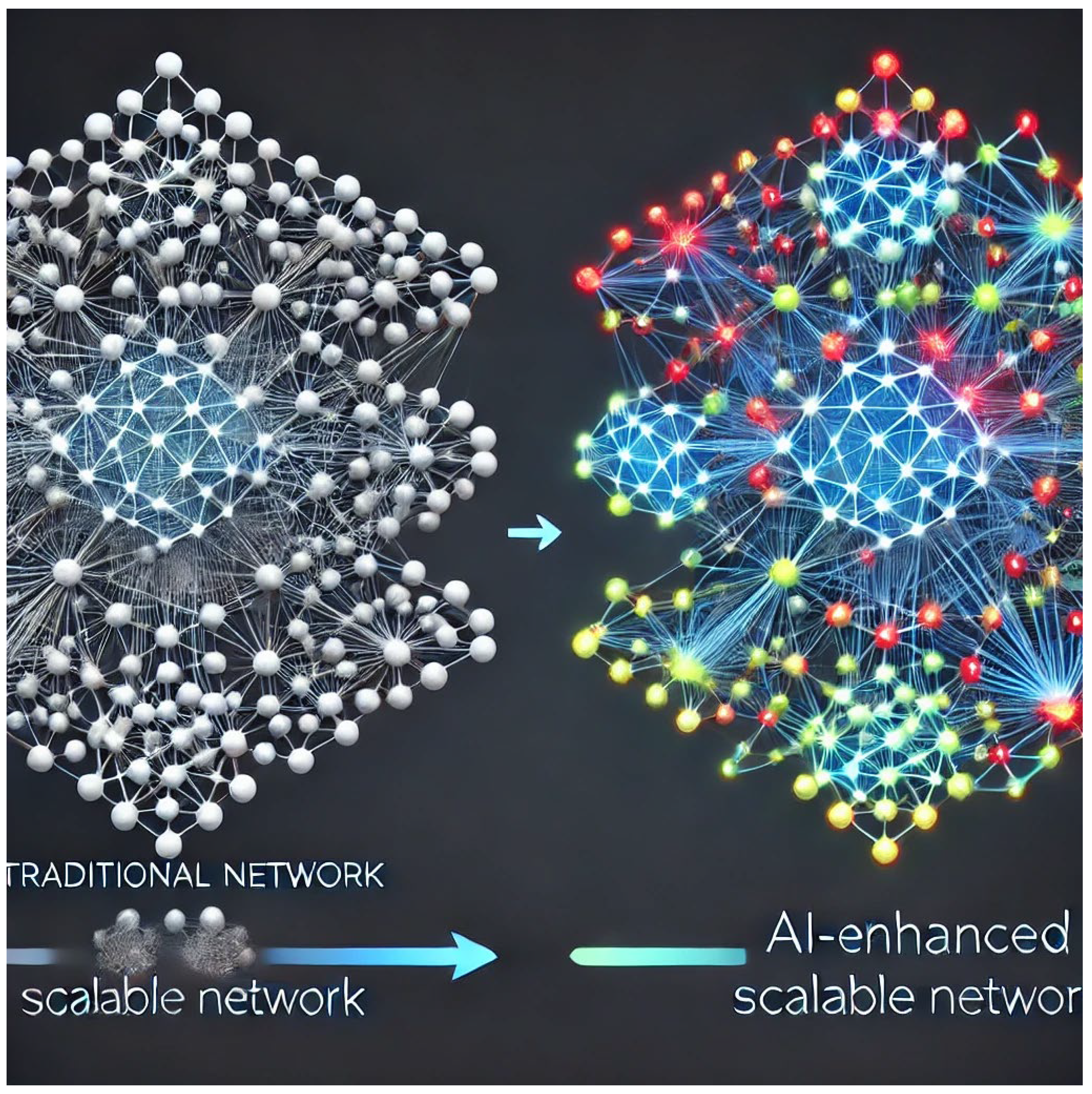

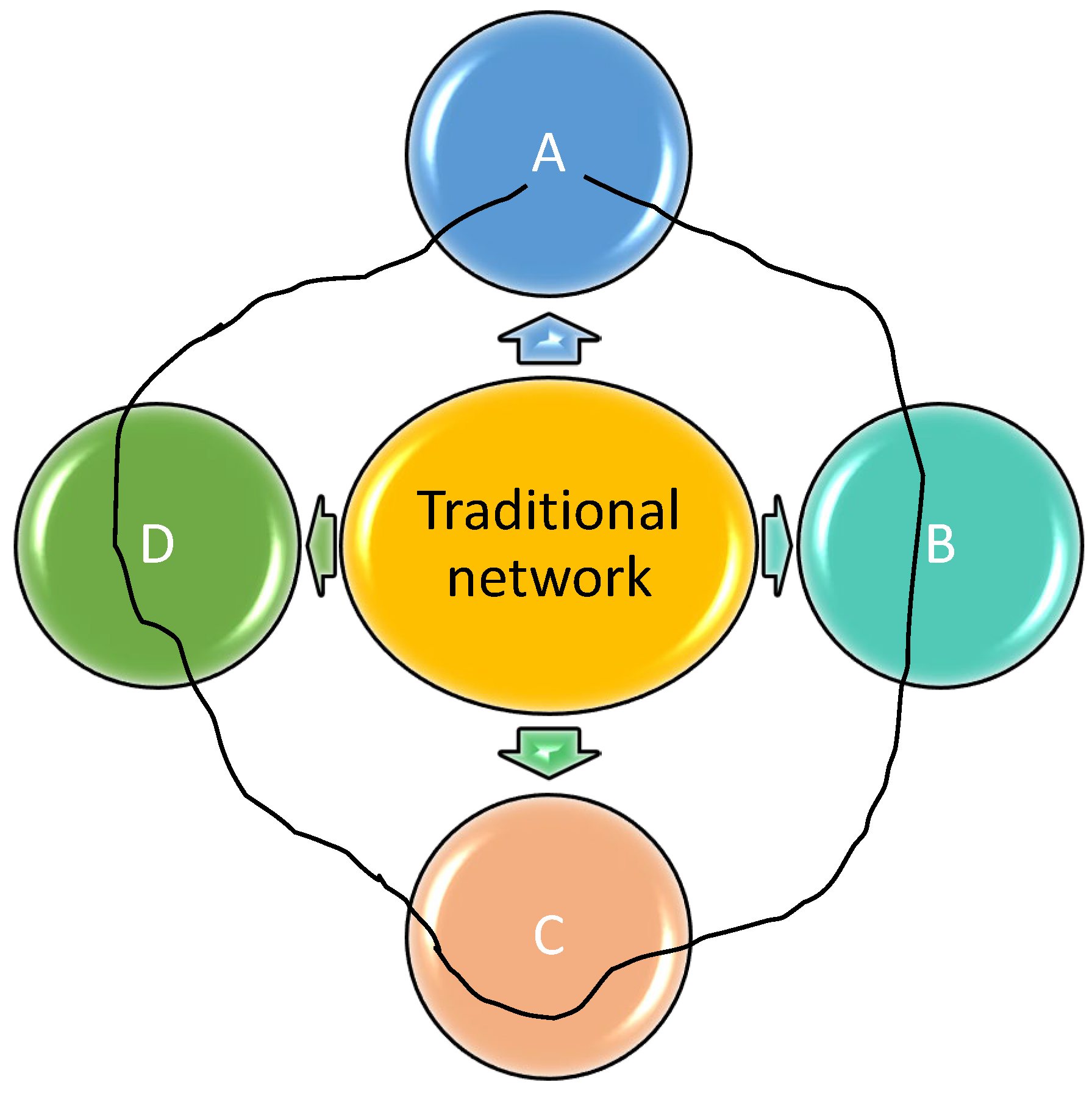

Figure 2 and

Figure 3 show how a traditional network becomes scalable due to artificial intelligence that retrieves additional nodes and combines them, exploiting its networking properties.

AI-driven scalability is modeled using network theory principles, where the network’s nodes represent different stakeholders, and the edges denote their interactions. This model is further enhanced by incorporating AI’s ability to dynamically adjust these interactions based on real-time data analytics, thus creating an adaptive and responsive network structure.

Moreover, the study leverages machine learning algorithms to predict future network behaviors and potential disruptions, allowing firms to manage risks and optimize scalability proactively. This predictive capability is crucial in maintaining competitive advantage and sustaining growth in volatile markets.

5. AI-Driven and Scalable Multilayer Networks: A Mathematical Formulation

Multilayer networks describe AI scalability, as they concern several connected layers. This innovative interpretation is consistent with the differential “with-or-without” approach, examined in

Section 6. Consistently with the research question, this section will show that:

Big data are AI-driven and fully compatible with digitized multilayer networks.

The impact of AI disseminated in the different layers reinforces the commercial relationships between traditional companies. Moreover, this effect grows when considering multilayer networks as layers, stressing the importance of connecting copula nodes.

The ESG metrics (examined in

Section 6) may strongly contribute to better-explaining multilayer networks and their connecting copula nodes (all describing an overall economically sustainable system linked to value creation patterns and bankability issues).

AI-driven scalability, examined through multilayer network analysis, is fully compatible with the “with-or-without” incremental approach (analyzed in

Section 7), which illustrates value creation and, consequently, improved firm bankability.

The mathematical formulation of the AI-driven multilayer network is extended to include probabilistic models that estimate the likelihood of new node and link formations based on historical data and AI-generated insights. This probabilistic approach allows for a more nuanced understanding of network evolution and its impact on firm scalability.

To further enhance the model’s applicability, we integrate a Bayesian framework that continuously updates the network’s structure as new data becomes available. This real-time updating mechanism ensures that the network model remains relevant and accurate, reflecting the dynamic nature of AI-driven business environments.

5.1. Introduction

Network science is a prolific field from several disciplines and is compatible with the increasing use of big data (Bianconi, 2018).

In mathematical terms, a single network is a pair G = (V, E), where V denotes the set of nodes (or vertices) and E represents the set of links (or edges). In the beginning, single networks are undirected or directed. In our work, only directed networks will be considered, i.e., a link between nodes i and j does not necessarily imply the existence of another link between j and i. For example, a company i can be a client of company j, but the contrary may not be true. From another perspective, single networks can also be unweighted or weighted. In our work, we consider only unweighted networks.

Multilayer networks describe interconnected financial and interbank networks. In this case, the layers can include exposure to certain assets or indices, financial products, different types of transactions and collateralization, contracts of a different level of seniority, etc.

5.2. Scalable AI and ESG Parameters Reinterpreted with Multilayer Networks

Network theory can explain both AI-driven scalability and the impact of AI on ESG sustainability patterns. An extension of this theory may use multilayer networks.

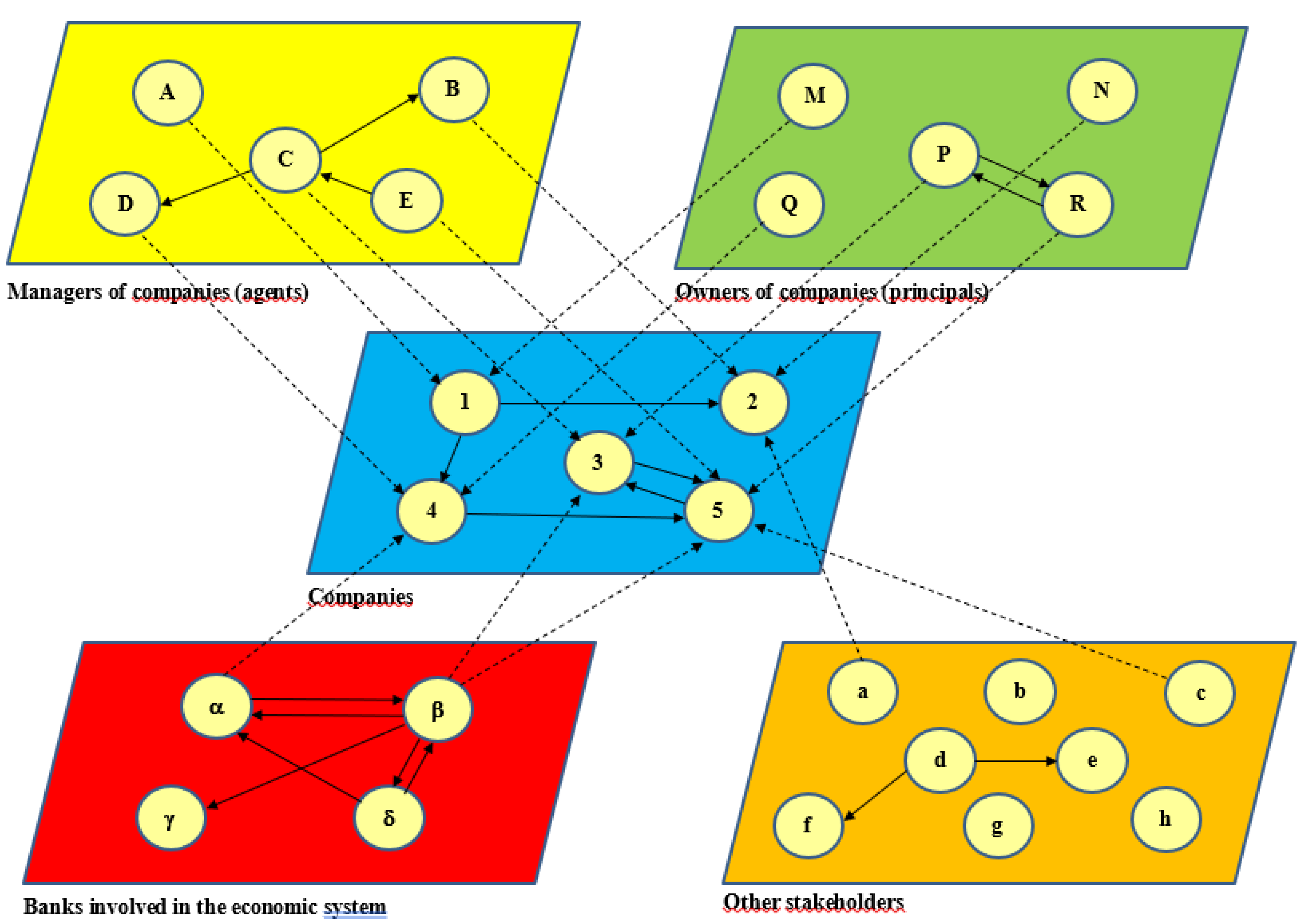

Multilayer networks are dynamic, showing the evolution of AI applications across time (incorporating machine learning) and allowing for a combination of synergistic networks linked by connecting copula (replica) nodes. In

Figure 4, a green copula node links the four adjacent layers described in the model’s hypotheses. Figure 12, Figure 13, Figure 14 and Figure 15 extend the example.

Figure 4.

AI-driven multilayer networks.

Figure 4.

AI-driven multilayer networks.

5.2.1. Defining a Multilayer Network

A multilayer network (Bianconi, 2018) is a triple , where:

is the set of layers. Obviously,

-

is the ordered set (list) of networks, where is the network in layer α ():

- ∘

is the set of nodes of , being .

- ∘

is the set of links connecting nodes within (intralinks).

-

is the list of paired networks ():

- ∘

is the set of nodes of .

- ∘

is the set of nodes of .

- ∘

is the set of links connecting nodes within with nodes in (interlinks).

In a general multilayer network, we are going to define the multilayer degree , for each node i in layer α (represented by ), as the following vector:

,

where represents the sum of links connecting the node to other nodes in the layer β.

5.3. Multilayer Networks in the Context of AI and ESG

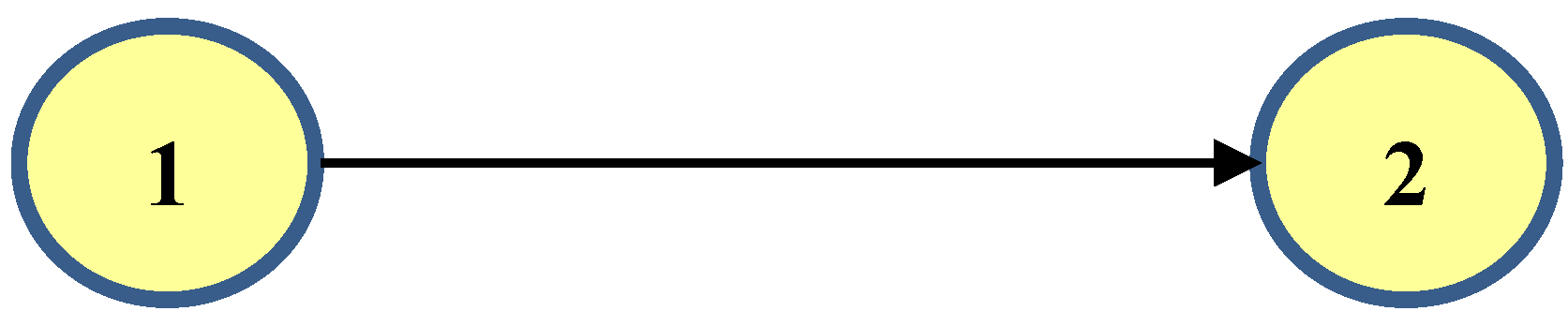

The multilayer network includes intralinks connecting nodes within a layer and interlinks connecting nodes across layers. A vector represents the multilayer degree for a node in a specific layer. Paired networks consist of nodes within the same layer and nodes across different layers connected by interlinks. The multilayer degree for each node in a particular layer is crucial for analyzing network properties. AI can analyze the market of a certain product or service and the profile of those new potential clients operating in such market. This process directly impacts innovation, cost reduction, and market segmentation, improving the commercial relationships between traditional firms. Thus, a relationship between conventional firms #1 and #2 is represented by the following arrow:

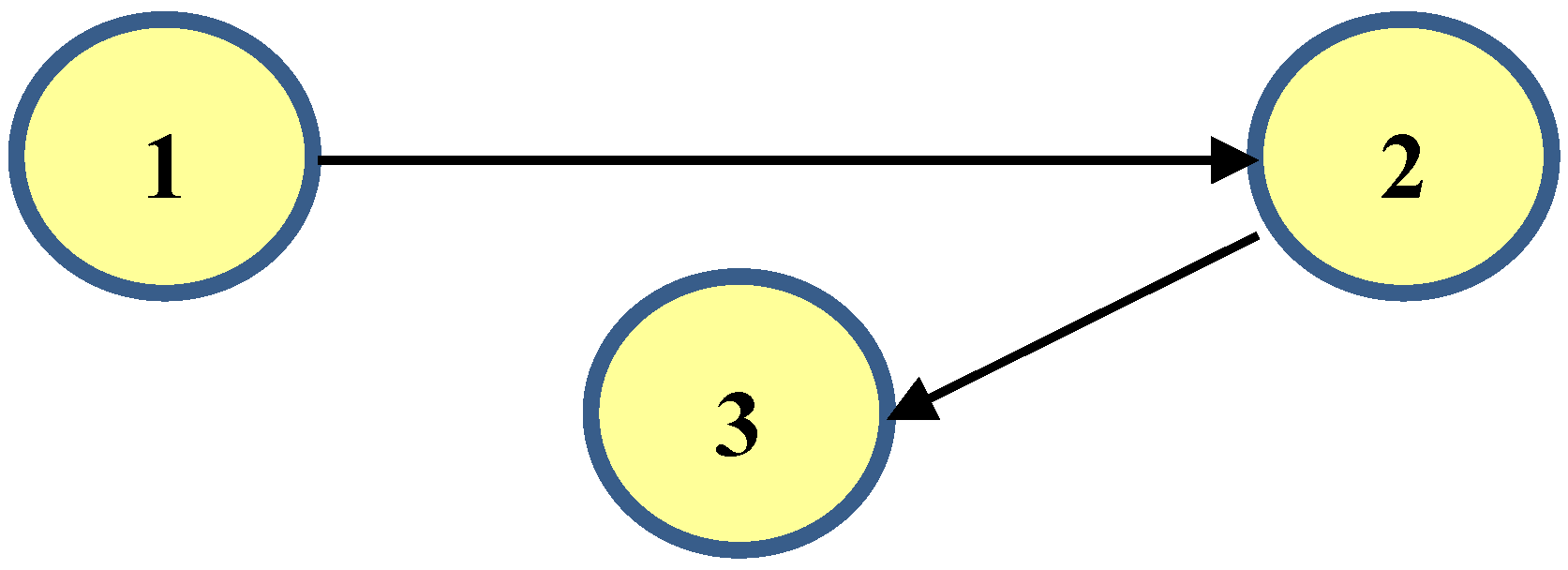

Figure 5.

The relationship between traditional firms #1 and #2.

Figure 5.

The relationship between traditional firms #1 and #2.

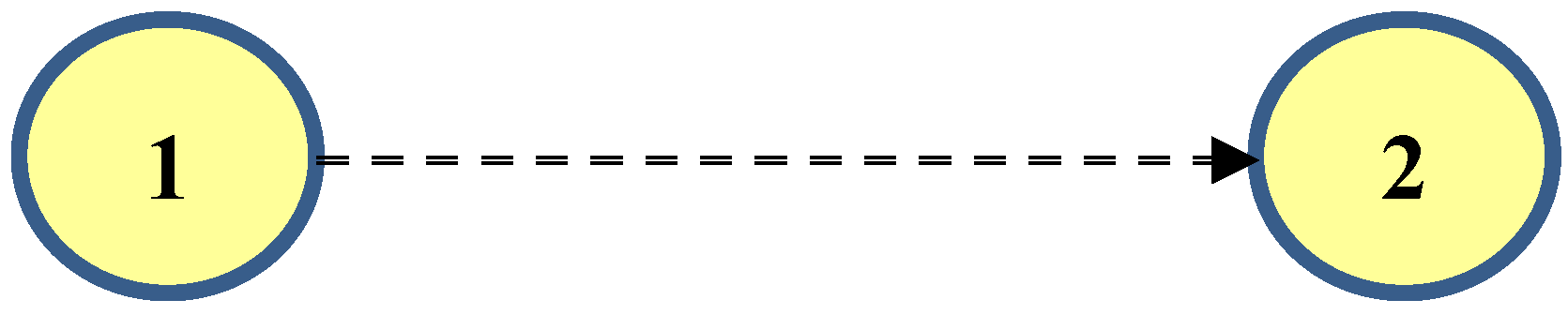

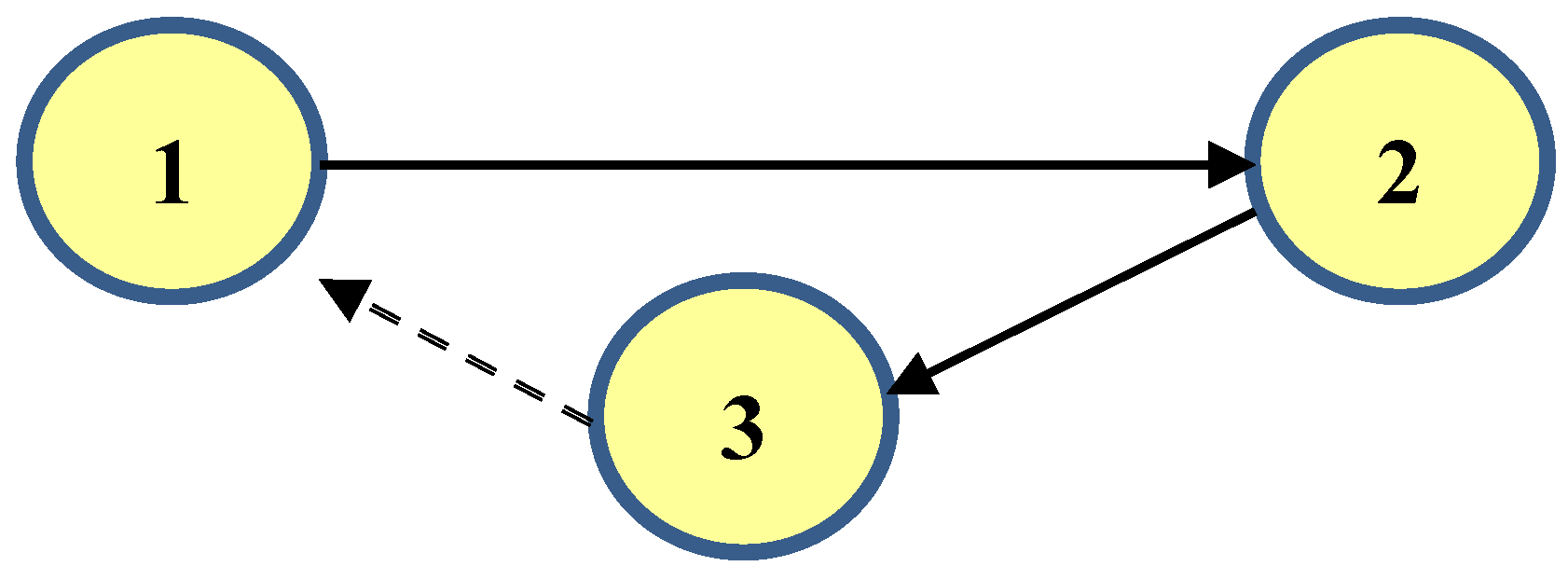

The link is stronger under the presence of AI. In this case, we will depict:

Figure 6.

AI-reinforced relationship between traditional firms #1 and #2.

Figure 6.

AI-reinforced relationship between traditional firms #1 and #2.

On the other hand, AI can analyze the possibility of closing an “open” triangular relationship between companies. In effect, the presence of AI can lead to completing the following relationship between companies #1, #2, and #3:

Figure 7.

AI-reinforced triangular relationship.

Figure 7.

AI-reinforced triangular relationship.

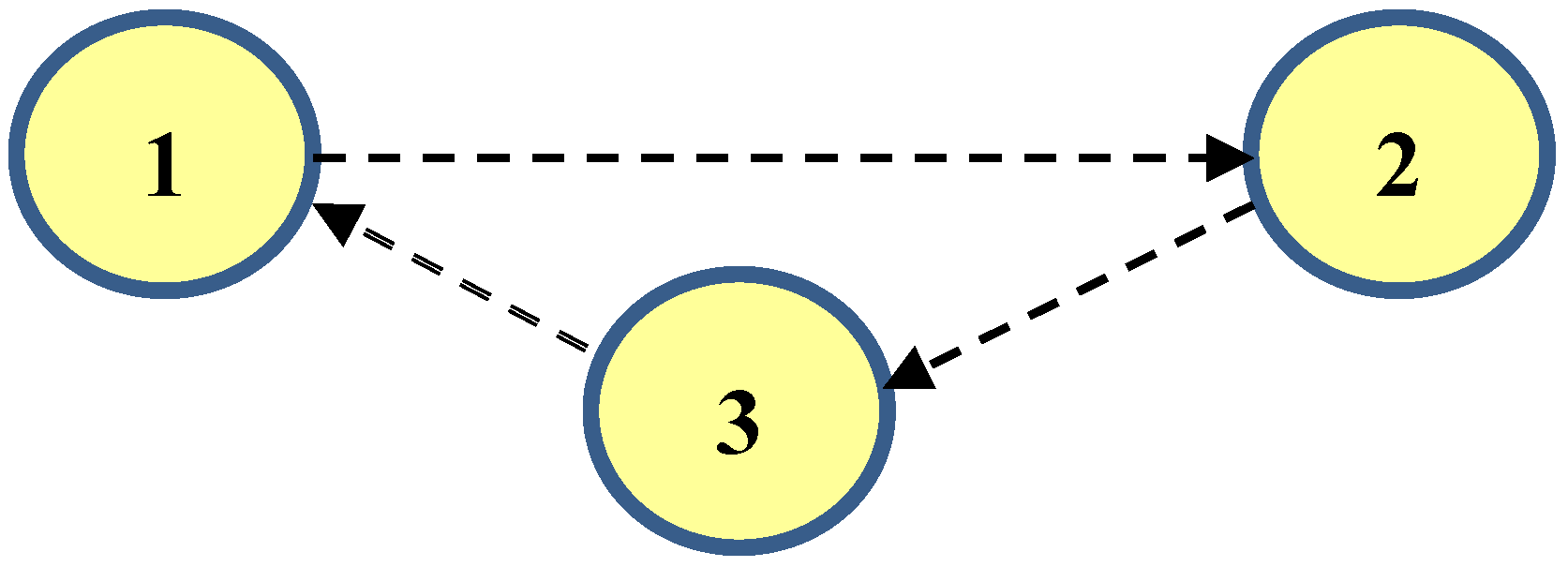

Giving rise to the following “closed” triangular relationship (referred to as the transitive closure):

Figure 8.

AI-reinforced triangular relationship with transitive closure.

Figure 8.

AI-reinforced triangular relationship with transitive closure.

Even by considering the two former paragraphs, the relationships between #1 and #2, and #2 and #3, are reinforced through AI, giving rise to the following more complete diagram:

Figure 9.

AI-reinforced triangular relationship with transitive closure (complete diagram).

Figure 9.

AI-reinforced triangular relationship with transitive closure (complete diagram).

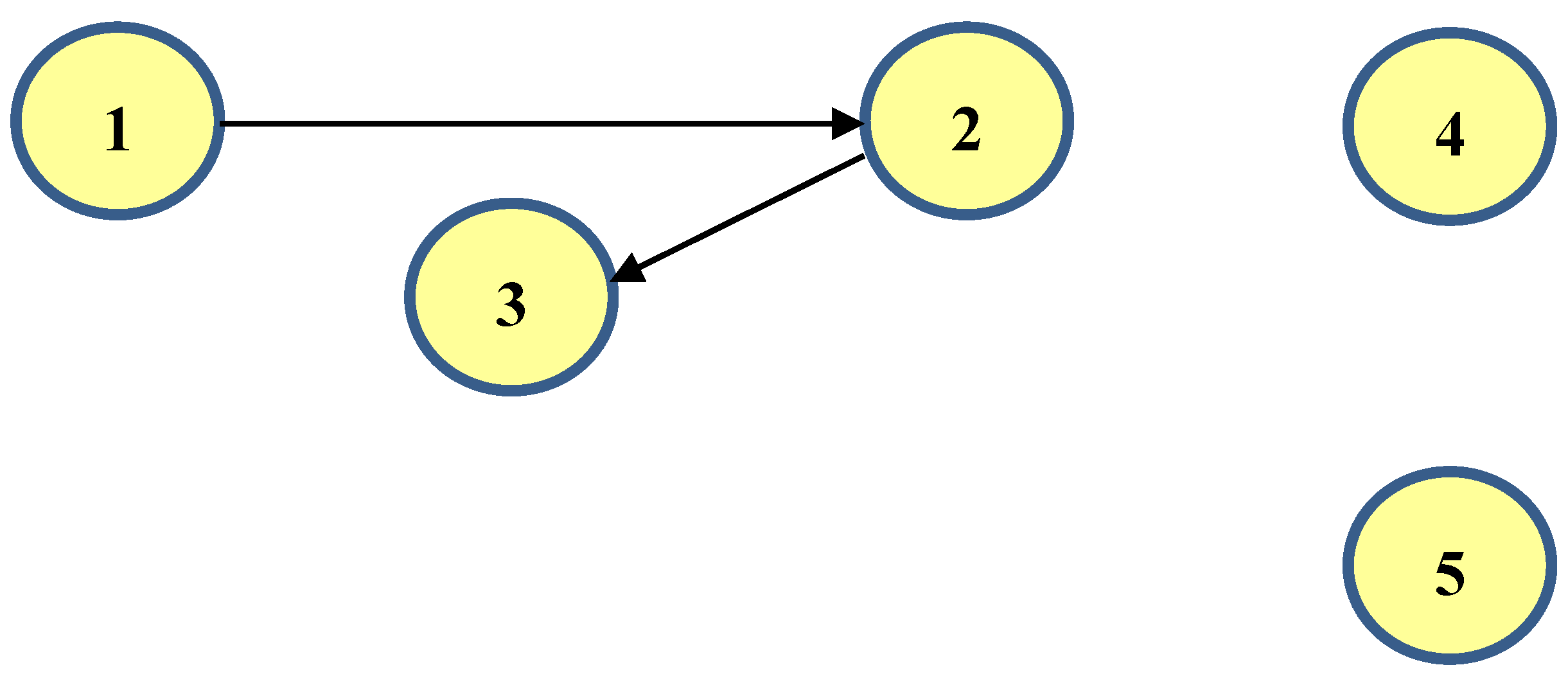

A third aspect to consider is the possibility of increasing the number of new commercial relationships between initially isolated companies. By complementing the former idea, a prior situation, such as:

Figure 10.

AI-reinforced relationship including isolated companies.

Figure 10.

AI-reinforced relationship including isolated companies.

This can lead, for example, to:

Figure 11.

AI-reinforced relationship including isolated companies.

Figure 11.

AI-reinforced relationship including isolated companies.

Finally, a fourth aspect is the entry of new companies into the market. According to the principle of preferential attachment (Barabási and Albert, 1999), new documents on the Web are more likely to link to older or well-known documents that are highly connected. More precisely, the likelihood of a new node forming a connection with an already established node correlates to the number of links the established node possesses. One implication is that the earlier nodes will be more likely to become hubs (their degree increase is proportional to the square root of time).

In effect, assume a network with nodes where a new vertex has been added with m () edges. The probability that the new vertex connects to vertex i is (Barabási, 2016):

,

being the connectivity of vertex j.

The network representing the commercial relationships (edges) between companies (nodes) is scalable in that new nodes, new edges, and the reinforcement of some existing edges increase the efficiency of the initial network.

A source of innovation includes environmental, social, and governance (ESG) issues in the design or production process of existing products and services. In Spain, according to Carrió et al. (2022), the profit of companies putting faith in sustainability is due to cost saving (54%), the improvement of their reputation (52,7%), and the possibility of reaching better financial support.

The scheme in

Figure 12 summarizes the ideas formerly presented.

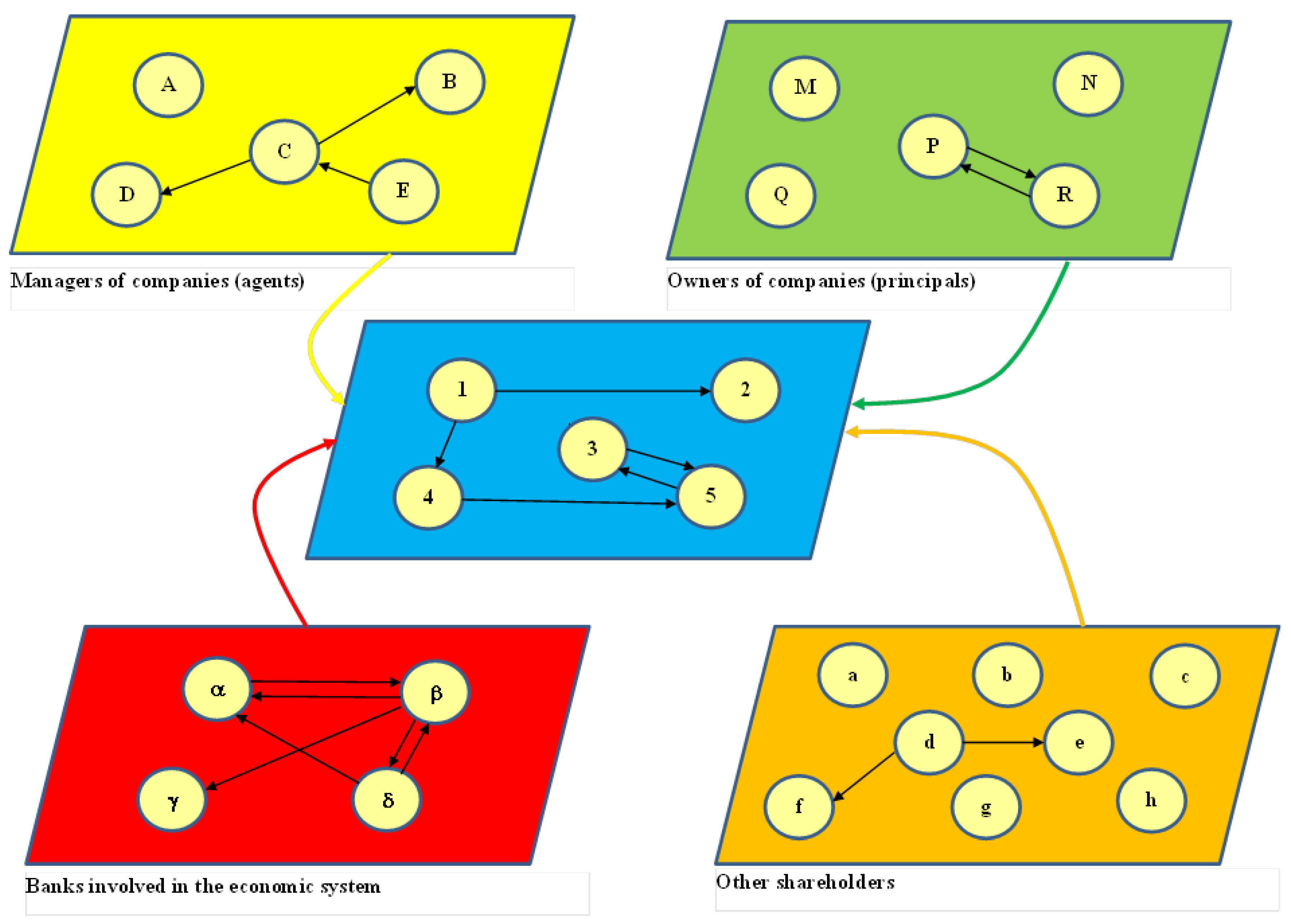

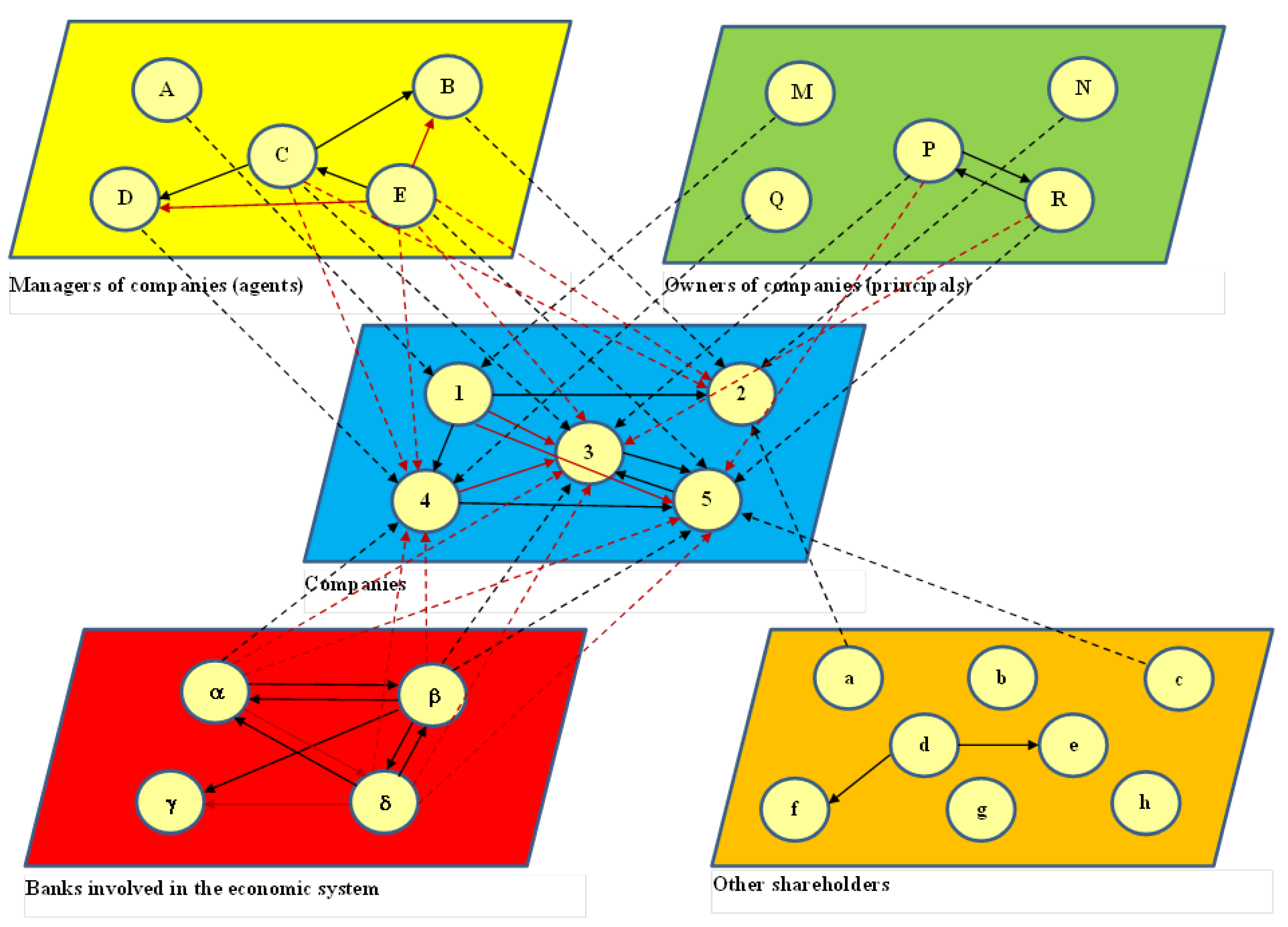

5.4. A Graphical Representation of AI-Driven Multilayer Networks

AI-driven multilayer networks connect through copula nodes that improve the overall scalability of the whole ecosystem (with additional nodes and links connecting adjacent layers), consistently with the “with-or-without” AI-driven incremental approach.

Figure 13,

Figure 14,

Figure 15 and

Figure 16 explain the progressive AI-driven value creation process where the main company’s stakeholders (managers, shareholders, banks, and other stakeholders rotating around the company) interact. AI-influenced clients and suppliers can also represent the different stakeholders, following value co-creation patterns that improve the cost/benefit analysis illustrated in

Section 7 (

Table 1).

In

Figure 14, we represent the transitive closure of each layer and four gross arrows:

The yellow arrow represents the relationship between companies and managers (agents).

The green arrow represents the relationship between companies and owners (principals).

The red arrow denotes the relationship between companies and banks (bankability).

The orange arrow denotes the relationship between companies and other shareholders (customers (innovation), individual investors, syndicates, etc.).

We aim to quantify the degree of system efficiency improvement (network scalability). To do this, the consequences for scalability are the following:

An increment of the probabilities of business volumes, i.e., each (probability of a business relationship between companies i and j) becomes , with .

-

AI favors the transitivity of the relationships between companies and so the transitive closure of all intralayer and interlayer relationships, leading to new edges:

- ∘

The intralayer connectivity increases, i.e., for every layer and every node i in, it becomes with.

- ∘

The interlayer connectivity increases, i.e., for every layer α and β, and for every node i in , becomes , with .

The layers become new nodes, so the concept of a “network of layers” arises. These new nodes and edges differ from the formerly existing ones. According to the principle of preferential attachment (Barabási and Albert, 1999), to convert the network of layers into a usual multilayer, it is necessary to consider that the nodes with higher connectivity in each layer are likely to become interlayer edges. For example, in

Figure 2, nodes B, C, D, and E in the layer

; nodes P and R in the layer

; nodes 3 and 5 in the layer

;

α,

β and

δ in the layer

; and d in layer

exhibit more connectivity (in + out). Therefore, independently from the transitive closure (displayed in

Figure 15, in red), the former network of layers becomes the multilayer network shown in

Figure 16 by adding new edges (in red).

Add new edges by applying the transitive closure, and then the principle of preferential attachment can continue, resulting in a successive increase in total edges.

AI promotes the flow of connections between companies, resulting in the creation of new links. This process strengthens the network and fosters collaboration among entities. The concept of layers evolving into nodes introduces a new structure termed the ‘network of layers.’ This transformation expands the network’s complexity and interconnectivity. The preferential attachment principle dictates that nodes with higher connectivity within layers will likely establish interlayer connections. This strategic approach enhances network efficiency and scalability.

The increase of edges in the economic system can be successively seen by building up the adjacent (block) matrices corresponding to the above networks:

1. Adjacent matrix corresponding to the initial network (Intralinks in red, interlinks in blue, null blocks in black) (see Figure 13):

| |

A |

B |

C |

D |

E |

M |

N |

P |

Q |

R |

1 |

2 |

3 |

4 |

5 |

α |

β |

γ |

δ |

a |

b |

c |

d |

e |

f |

g |

h |

| A |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

| B |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

| C |

0 |

1 |

0 |

1 |

0 |

0 |

0 |

1 |

0 |

0 |

| D |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

| E |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

| M |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

| N |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

| P |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

0 |

0 |

| Q |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

| R |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

| 1 |

0 |

0 |

0 |

1 |

0 |

1 |

0 |

0 |

0 |

| 2 |

0 |

0 |

0 |

0 |

0 |

| 3 |

0 |

0 |

0 |

0 |

1 |

| 4 |

0 |

0 |

0 |

0 |

1 |

| 5 |

0 |

0 |

1 |

0 |

0 |

| α |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

0 |

0 |

0 |

| β |

0 |

0 |

1 |

0 |

1 |

1 |

0 |

1 |

1 |

| γ |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| δ |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

0 |

0 |

| a |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| b |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| c |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| d |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

0 |

0 |

| e |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| f |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| g |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| h |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

2. Adjacent matrix corresponding to the network of layers (interest of managers, owners, banks, and other stakeholders in AI-driven companies) (see Figure 14):

| |

A |

B |

C |

D |

E |

M |

N |

P |

Q |

R |

1 |

2 |

3 |

4 |

5 |

α |

β |

γ |

δ |

a |

b |

c |

d |

e |

f |

g |

h |

| A |

0 |

0 |

1 |

0 |

0 |

| B |

| C |

| D |

| E |

| M |

0 |

0 |

1 |

0 |

0 |

| N |

| P |

| Q |

| R |

| 1 |

0 |

0 |

0 |

0 |

0 |

| 2 |

| 3 |

| 4 |

| 5 |

| α |

0 |

0 |

1 |

0 |

0 |

| β |

| γ |

| δ |

| a |

0 |

0 |

1 |

0 |

0 |

| b |

| c |

| d |

| e |

| f |

| g |

| h |

3. Adjacent matrix corresponding to the initial network and the edges derived from the transitive closure of Intralinks and interlinks of the original network (new edges in yellow) (see Figure 15):

| |

A |

B |

C |

D |

E |

M |

N |

P |

Q |

R |

1 |

2 |

3 |

4 |

5 |

α |

β |

γ |

δ |

a |

b |

c |

d |

e |

f |

g |

h |

| A |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

| B |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

| C |

0 |

1 |

0 |

1 |

0 |

0 |

1 |

1 |

1 |

0 |

| D |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

| E |

0 |

1 |

1 |

1 |

0 |

0 |

1 |

0 |

1 |

1 |

| M |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

| N |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

| P |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

0 |

1 |

| Q |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

| R |

0 |

0 |

1 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

| 1 |

0 |

0 |

0 |

1 |

1 |

1 |

1 |

0 |

0 |

| 2 |

0 |

0 |

0 |

0 |

0 |

| 3 |

0 |

0 |

0 |

0 |

1 |

| 4 |

0 |

0 |

1 |

0 |

1 |

| 5 |

0 |

0 |

1 |

0 |

0 |

| α |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

0 |

1 |

0 |

1 |

0 |

| β |

0 |

0 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

| γ |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| δ |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

| a |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| b |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| c |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| d |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

0 |

0 |

| e |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| f |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| g |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| h |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

4. Adjacent matrix corresponding to the initial network and the edges derived from the transitive closure of the original intralinks and interlinks and the principle of preferential attachment (new edges in grey) (see Figure 16):

| |

A |

B |

C |

D |

E |

M |

N |

P |

Q |

R |

1 |

2 |

3 |

4 |

5 |

α |

β |

γ |

δ |

a |

b |

c |

d |

e |

f |

g |

h |

| A |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

| B |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

0 |

1 |

| C |

0 |

1 |

0 |

1 |

0 |

0 |

1 |

1 |

1 |

1 |

| D |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

| E |

0 |

1 |

1 |

1 |

0 |

0 |

1 |

0 |

1 |

1 |

| M |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

| N |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

| P |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

0 |

1 |

| Q |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

| R |

0 |

0 |

1 |

0 |

0 |

0 |

1 |

1 |

0 |

1 |

| 1 |

0 |

0 |

0 |

1 |

1 |

1 |

1 |

0 |

0 |

| 2 |

0 |

0 |

0 |

0 |

0 |

| 3 |

0 |

0 |

0 |

0 |

1 |

| 4 |

0 |

0 |

1 |

0 |

1 |

| 5 |

0 |

0 |

1 |

0 |

0 |

| α |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

0 |

1 |

0 |

1 |

0 |

| β |

0 |

0 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

| γ |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| δ |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

| a |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| b |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| c |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| d |

0 |

0 |

1 |

0 |

1 |

0 |

0 |

0 |

0 |

1 |

1 |

0 |

0 |

| e |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| f |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| g |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| h |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

To show that the new edges improve the scalability of the AI-driven model, we are going to calculate the connectivities of each node in each step:

| Node |

Connectivities |

| First step |

Second step |

Third step |

| A |

1 |

1 |

1 |

| B |

2 |

3 |

4 |

| C |

4 |

6 |

7 |

| D |

2 |

3 |

4 |

| E |

2 |

6 |

6 |

| M |

1 |

1 |

1 |

| N |

1 |

1 |

1 |

| P |

3 |

4 |

4 |

| Q |

1 |

1 |

1 |

| R |

3 |

4 |

5 |

| 1 |

4 |

6 |

6 |

| 2 |

4 |

8 |

8 |

| 3 |

5 |

9 |

13 |

| 4 |

5 |

9 |

9 |

| 5 |

7 |

11 |

15 |

| α |

3 |

6 |

6 |

| β |

5 |

6 |

6 |

| γ |

1 |

2 |

2 |

| δ |

3 |

8 |

8 |

| a |

0 |

0 |

0 |

| b |

0 |

0 |

0 |

| c |

0 |

0 |

0 |

| d |

2 |

2 |

3 |

| e |

1 |

1 |

1 |

| f |

1 |

1 |

1 |

| g |

0 |

0 |

0 |

| h |

0 |

0 |

0 |

| Total connectivities |

61 |

99 |

112 |

| Increment (absolute values) |

- |

38 |

51 |

| Increment (%) |

- |

62.30% |

83.61% |

Once the preferential edges corresponding to the network of layers have been inserted, this process can continue by calculating the new transitive closure. For the sake of simplicity, in this example, the incorporation of new nodes in the initial network, which would have increased the number of new edges, has not been considered.

Figure 17 reports a three-dimensional diagram that illustrates AI-driven scalable multilayer networks incorporating ESG factors and bankability considerations.

6. AI-Driven ESG Value (H2)

The second hypothesis wonders if AI-driven scalable networks and improved business models are affected by ESG considerations, following the research streams synthesized in Section 3.

AI catalyzes scalable effects described by network theory properties and power laws (see H1). These EBITDA upgrades are then incorporated into business model improvements, measured through a “with-or-without” comparison (H3). H3 incorporates AI scalable networking and ESG considerations (EY, 2022) in the value model. AI can indirectly impact ESG issues (as it improves the business model, allowing for bigger investments in sustainability), complemented by a direct effect, to the extent that AI may boost ESG investments.

Testing these possible joint impacts is still non-trivial, mainly due to the novelty of both AI and ESG, especially if considered together. The lack of sufficient empirical evidence is a by-product of these intricacies. This paper limits its analysis to some preliminary hypotheses, leaving to research further the fascinating question concerning the interaction of AI and ESG and their combined impact on value co-creation that eventually backs bankability.

The indirect impact of AI on ESG investments will be investigated in the “with-or-without” comparative (incremental) business plan template (see

Section 7).

The direct impact might tentatively be guessed by comparing listed firms (due to data availability) belonging to different industries, showing if and to which extent AI-sensitive firms exhibit different ESG patterns and market values compared to firms mostly AI-insensitive and not particularly engaged in sustainability investments.

The impact of ESG parameters on discounted cash flows (DCF) can vary significantly based on specific circumstances, industries, and ESG factors (Inard, 2023; Singh, 2022; Schramade, 2016; Ionescu et al., 2019). More specifically, Sætra (2022) proposed an AI ESG protocol as a high-level and flexible tool intended to supplement existing standards and frameworks and serve the Tier 2 function in the proposed future ESG hierarchy proposed by Esty and Cort (2020), as it provides specialized tools and indicators particularly relevant for AI and data-intensive entities.

The study introduces a novel AI-ESG synergy model that quantifies AI’s direct and indirect impacts on ESG performance. This model uses machine learning to analyze the correlation between AI-driven operational efficiencies and ESG metrics, such as carbon footprint reduction and social impact enhancement.

Additionally, the model incorporates a dynamic feedback loop where improved ESG performance, driven by AI, further enhances AI’s effectiveness in optimizing operations. This loop demonstrates the mutually reinforcing relationship between AI and ESG, highlighting the importance of integrating these elements in strategic decision-making.

7. The “with-or-without” Model

A sensitivity simulation uses a “traditional” (AI-free) business plan. The comparative analysis considers a “with-or-without” model consistent with the cost/revenue analysis literature (Strusani and Houngbonon, 2019).

AI increases operating revenues and decreases, thanks to managerial savings and operating expenditures (OpEx). Their combined effect fosters operating leverage (the translation of higher revenues into operating profits that grow more than proportionally) and improves EBITDA. A higher EBITDA has an immediate positive effect on liquidity generation, debt service capacity, and bankability, making the firm sounder and more sustainable.

AI is associated with improved net profitability, net operating efficiency, and return on marketing-related investment while reducing advertising costs and creating jobs (Mishra et al., 2022).

The analysis starts by comparing the “without-with” examination of a straightforward network with that of a “smart” AI-driven and ESG-sensitive network with the introduction of new nodes and links.

The methodology considers an empirical case where AI savings derive from a sensitivity analysis. The purpose is to show that:

Higher margins improve the firm’s overall sustainability, with a cascade benefit for all the involved stakeholders, including banks and their debt service.

AI may conveniently master the value-adding “pie” sharing among the stakeholders, igniting a value co-creation process.

A sensitivity simulation follows a “traditional” (AI-free) business plan versus an innovative one incorporating AI.

The added value of this joint methodology is the consideration of AI-driven networked scalability, examined with network theory patterns (see Section 3) and ESG ratings, eventually embedded in a comparative business plan (

Table 1). The results are consistent with the research question described in Section 1 and the model illustrated in Section 3.

Škapa et al. (2023) examine AI-driven ESG investments compared to non-ESG investing; this comparison is consistent with this study’s “without-or-with” approach.

The hypothetical impact on operating revenues and costs is the following:

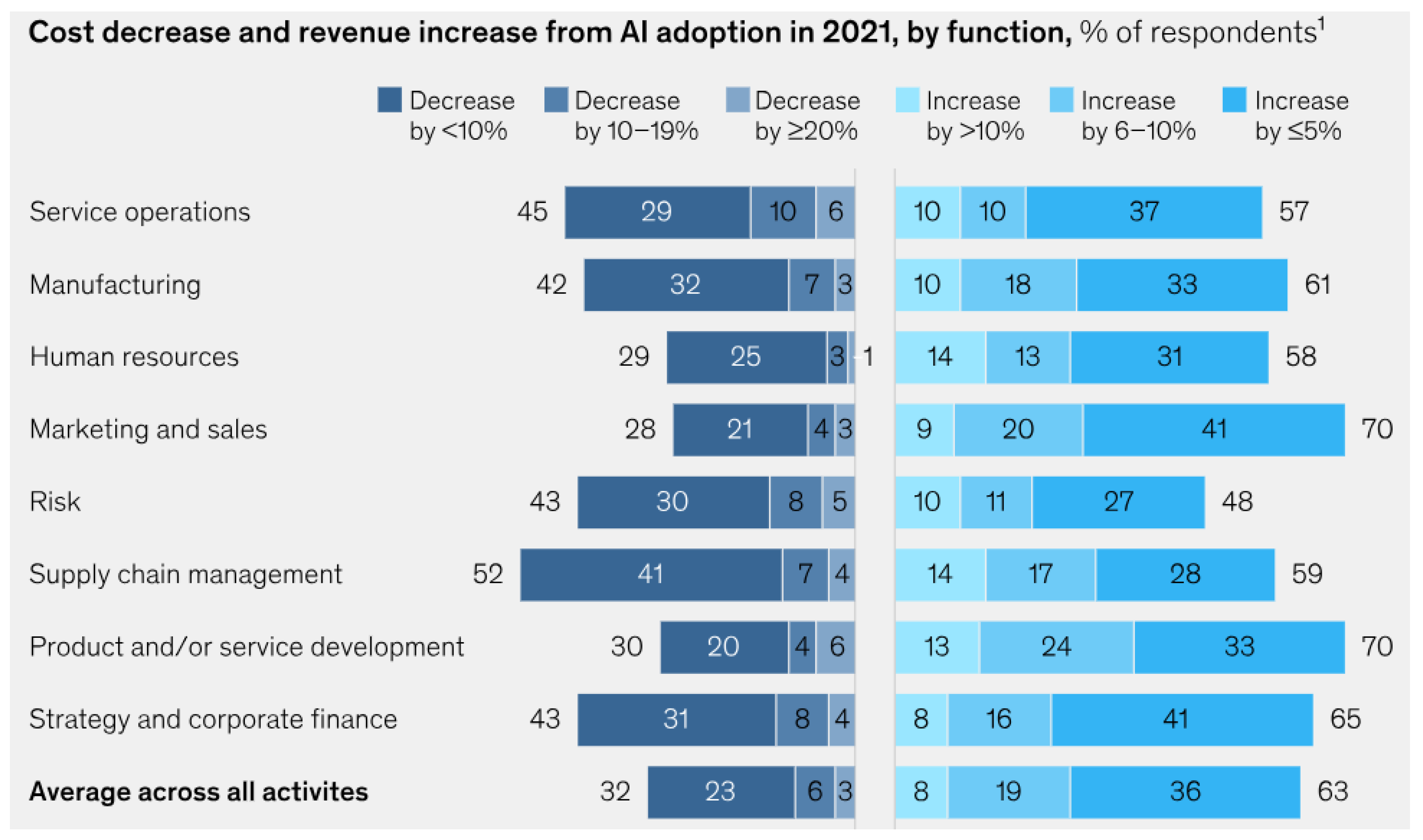

Empirical evidence shows that AI leads to EBIT or EBITDA improvements because of revenue increases and cost-cutting. According to McKinsey (2022), “at least 5 percent of their organizations’ EBIT was attributable to AI in 2021, in line with findings from the previous two years”. The impact of AI on depreciation/amortization is presumably small, and so is EBIT ≈ EBITDA.

McKinsey (2022) shows the following statistics:

Figure 18.

Cost decreases and revenue increases from AI adoption. Source: McKinsey (2022).

Figure 18.

Cost decreases and revenue increases from AI adoption. Source: McKinsey (2022).

Other sources show similar results (Pifer, 2023; Pipeline, 2023; Appen, 2023; Oberlo, 2022; Statista, 2022).

Table 1 contains a brief comparison. Each column reports a sensitivity analysis to the base case incorporating 5% and 10% growth in operating revenues (and an asymmetric reduction of 2.5% or 5% in monetary OpEx, consistent with the quoted empirical evidence). The first data column illustrates the base case of a standardized firm that consequently adopts AI and ESG solutions with increasing economic marginality.

Economic margin improvements are substantial and self-fulfilling, and AI’s machine-learning properties are also igniting them.

8. The Impact of Artificial Intelligence on Bankability

The sustainable cash flow generated by AI ensures financial stability through increased revenue and streamlined cost management. AI adoption enables effective resource management, operational optimization, and reduction of wasteful practices within firms. AI initiatives, such as revenue growth and cost optimization, significantly boost a firm’s profitability. AI plays a crucial role in improving risk management by enhancing the effectiveness of assessment and mitigation strategies.

The confluence of enhanced scalability, refined cost effectiveness, heightened revenue expansion, increased operational effectiveness, data-centric strategic planning, incorporation of ESG factors, and bolstered risk management as a consequence of integrating AI into operations substantially elevates the overall bankability through:

- a)

Sustainable cash flow follows AI’s enhancements, encompassing increased revenue and streamlined cost management, resulting in a consistent and lasting financial inflow for the organization. The sustainable cash flow generated by the firm can be attributed to AI’s positive impacts on various aspects of the business, ensuring a stable and reliable financial foundation.

- b)

Effective resource management: Adopting AI enables firms to manage their resources more effectively, optimize their operations, and reduce wasteful practices.

- c)

Enhanced profitability: AI-driven initiatives, such as revenue growth and cost optimization, can boost a firm’s profitability.

- d)

Improved risk management uses AI, which is crucial in enhancing the effectiveness of risk assessment and mitigation strategies.

- e)

Data-driven decision-making: By embracing this method, companies can bolster their capacity to evaluate prevailing market dynamics, pinpoint potential openings for growth, and distribute resources more efficiently.

- f)

Adaptability to market challenges: AI technologies’ scalability and flexibility empower businesses to swiftly pivot and adjust their strategies in response to dynamic market conditions and challenges, akin to a skilled magician seamlessly performing a series of mesmerizing tricks with finesse and precision.

Furthermore:

AI generates scalable patterns that eventually improve the EBITDA of traditional firms, thus backing their bankability.

The ESG impact is controversial and may negatively affect bankability at first due to initial investment and sunk costs that need time for reimbursement.

Impact-oriented banks/investors and public subsidies may support sustainable investments, quickening the payback.

Industry specificity does matter and needs careful fine-tuning.

9. Discussion

This study analyzed the profound implications of AI applications on traditional firms, particularly focusing on how AI investments, driven by scalable network properties and integrated with ESG patterns, influence economic and financial outcomes. The central hypothesis explores whether AI can enhance the scalability of traditional firms, thereby improving their financial margins and overall bankability. The findings of this research provide significant insights into the transformative power of AI, demonstrating that it can indeed drive sustainable value creation and improve financial stability within traditional businesses.

AI’s ability to simulate human intelligence and process vast amounts of data allows it to optimize business processes, improve decision-making, and create new revenue streams. However, the impact of AI extends beyond these immediate benefits. This study shows that AI when integrated with scalable network properties, has the potential to alter the economic and financial landscape of traditional firms fundamentally. By enhancing scalability, AI enables businesses to operate more efficiently and adapt to market changes with greater agility. This improved scalability, in turn, leads to higher EBITDA, a critical measure of a firm’s financial performance and a key determinant of its bankability.

A unique aspect of this study is its exploration of the intersection between AI, ESG considerations, and financial performance. The research highlights that AI can play a crucial role in advancing ESG goals by optimizing resource use, reducing waste, and enabling more ethical business practices. This ESG enhancement, driven by AI, not only aligns firms with broader sustainability goals but also contributes to financial stability. The study suggests that firms incorporating AI into their operations can improve their ESG ratings, which in turn can positively impact their market valuation and attractiveness to investors.

However, the relationship between AI-driven ESG initiatives and bankability is complex and multifaceted. While ESG investments may initially appear costly, the long-term benefits—such as reduced risk, enhanced reputation, and access to sustainable finance—can outweigh these costs. The challenge lies in accurately quantifying these benefits and incorporating them into financial models. This study’s innovative approach, using multilayer network theory, provides a framework for understanding how AI and ESG can jointly contribute to value creation and financial stability.

The study employs a “with-or-without” analysis to compare the performance of firms that have adopted AI with those that have not. This approach clearly illustrates the tangible benefits of AI investments, showing that firms leveraging AI experience significant improvements in revenue, cost efficiency, and EBITDA. These improvements translate into better liquidity and enhanced bankability, making these firms more attractive to investors and lenders.

Moreover, the study challenges traditional business models by demonstrating that AI-driven scalability can create new pathways for value creation. The findings suggest that traditional firms need to rethink their approach to growth and sustainability, considering how AI can be integrated into their operations to unlock new opportunities and mitigate risks.

While this study provides valuable insights, it also raises important questions and challenges. The integration of AI and ESG is still in its infancy, and there is much to learn about how these factors interact over time. Future research could explore the long-term effects of AI on ESG performance and financial stability, examining how different industries and market conditions influence these outcomes. Additionally, there is a need for more empirical evidence to support the theoretical models proposed in this study, particularly in the context of the “with-or-without” analysis.

Another intriguing area for future research is the exploration of how AI can be used to enhance the governance aspects of ESG, particularly in terms of transparency, accountability, and ethical decision-making. As AI technologies become more sophisticated, their potential to influence governance practices will likely grow, making this a critical area for further investigation.

In summary, this study provides a comprehensive and innovative analysis of AI’s impact on traditional firms, highlighting its transformative potential when combined with scalable network properties and ESG considerations. The findings underscore the importance of adopting AI technologies to enhance financial performance and sustainability, offering new perspectives on how traditional firms can navigate the complexities of modern markets. As the business landscape continues to evolve, the insights gained from this research will be invaluable for firms seeking to remain competitive and sustainable in the long term.

By enriching EBITDA via scalable multilayer networks and ESG enhancement, AI investments can positively impact companies’ financial stability, thereby aiding in creating value and alleviating concerns about a firm’s ability to attract financing (bankability). Enhanced financial stability through sustainable practices can increase a company’s attractiveness to investors. The study showcases how AI and ESG principles can propel firms toward sustainable growth, aligning with broader sustainability goals and contributing to the economic dimension of sustainability, complementing the ESG dimensions and supporting the achievement of the SDGs.

In synthesis, the research question explores how AI, powered by scalable multilayer networks and incorporating ESG features, can catalyze sustainability efforts within traditional firms, leading to improved financial performance and potentially greater access to financial resources (sustainable bankability). This paper innovatively shows that the intersection of AI and ESG in multilayer networks represents a proactive approach to managing complex systems in a sustainable, ethical, and socially responsible way. AI can monitor and improve ESG performance across different network layers, from enhancing energy efficiency to ensuring equitable resource access.

The findings suggest that traditional firms need to rethink their approach to growth and sustainability, considering how AI can be integrated into their operations to unlock new opportunities and mitigate risks.

10. Conclusion

This study has explored AI’s transformative potential for traditional firms, focusing on how AI-driven scalable networks and the integration of ESG factors can enhance economic and financial performance, ultimately improving bankability. The findings provide a comprehensive understanding of the dynamic interplay between AI, network scalability, and sustainability, offering new insights into how traditional firms can leverage these technologies to thrive in an increasingly complex and competitive market environment.

AI’s ability to process and analyze vast amounts of data, optimize business processes, and enhance decision-making has been shown to impact a firm’s operational efficiency and scalability significantly. By integrating AI with scalable network properties, traditional firms can achieve improved EBITDA, a critical indicator of financial health. This improvement, in turn, positively influences the firm’s bankability, making it more attractive to investors and financial institutions.

Moreover, the study highlights the critical role of ESG considerations in this transformation. AI not only drives operational efficiency but also contributes to sustainability efforts by optimizing resource use, reducing waste, and enabling more ethical business practices. The integration of AI with ESG factors creates a powerful synergy that aligns firms with broader sustainability goals, enhances their market valuation, and supports long-term financial stability.

This study innovatively uses multilayer network theory to provide a novel framework for understanding how AI and ESG can jointly contribute to value creation. By examining the interconnected layers of economic and financial networks, the study demonstrates that AI can enhance the scalability of traditional firms, leading to more resilient and adaptable business models. The “with-or-without” analysis further illustrates the tangible benefits of AI investments, showing that firms adopting AI experience significant improvements in financial performance and liquidity.

However, the relationship between AI-driven ESG initiatives and bankability is complex and multifaceted. While initial investments in ESG may appear costly, the long-term benefits—such as reduced risk, enhanced reputation, and access to sustainable finance—can outweigh these costs. This study suggests that traditional firms need to rethink their approach to growth and sustainability, considering how AI can be integrated into their operations to unlock new opportunities and mitigate risks.

Looking forward, the integration of AI and ESG considerations will likely become increasingly important as firms navigate the challenges of digital transformation and sustainability. This study’s findings provide a solid foundation for further research into the long-term effects of AI on ESG performance and financial stability and for the development of new models for assessing AI’s value-creation potential in traditional firms.

In conclusion, the adoption of AI, when combined with scalable network properties and ESG integration, represents a strategic imperative for traditional firms seeking to enhance their financial performance and sustainability. By leveraging the synergies between these elements, firms can not only improve their competitiveness and market position but also contribute to broader societal goals, ensuring long-term value creation and financial stability in an increasingly complex and interconnected world.

Author Contributions

The first author contributed Sections 3, 4, 6, 7, and 8; the second author contributed Sections 5 and 9; the third author contributed Sections 2 and 10. Section 1 is common.

Data availability

The Excel file (

Table 1) is available from the authors.

Competing Interests

Authors do not have any conflict of interest related to this publication.

References

- Acciarini, C., Cappa, F., Boccardelli, P., Oriani, R. (2023). How can organizations leverage big data to innovate their business models? A systematic literature review. Technovation, 123. May. [CrossRef]

- Alsheibani, S., Messom, D., Cheung, Y., Alhosni, M. (2020) Reimagining the strategic management of artificial intelligence: Five recommendations for business leaders. 26th Americas Conference on Information Systems. AMCIS.

- Appen (2022) How Artificial Intelligence Data Reduces Overhead Costs for Organizations. https://appen.com/blog/how-artificial-intelligence-data-reduces-overhead-costs-for-organizations/.

- Barabási, L. (2016) Network Science. Cambridge University Press, Cambridge.

- Barabási, A.L., Albert, R. (1999) Emergence of scaling in random networks. Science 286, 509–512. [CrossRef]

- Belgaum, MR (2021) Role of artificial intelligence in cloud computing, IoT and SDN: Reliability and scalability issues. International Journal of Electrical and Computer Engineering 11, 4458.

- Bianconi, G. (2018) Multilayer Networks. Structure and Functions. Oxford University Press, Oxford.

- Bracarense, N., Bawack, R.E., Fosso Wamba, S., Carillo, K.D.A. (2022) Artificial Intelligence and Sustainability: A Bibliometric Analysis and Future Research Directions. Pacific Asia Journal of the Association for Information Systems 14, January. [CrossRef]

- Brunen, A.C., Laubach, O. (2022) Do sustainable consumers prefer socially responsible investments? A study among the users of robo advisors. Journal of Banking & Finance 136, 106314. [CrossRef]

- Bui, T.N., Nguyen X.H., Pham K.T. (2023) The effect of capital structure on firm value: A study of companies listed on the Vietnamese stock market. International Journal of Financial Studies 11, 100. [CrossRef]

- Carrió et al., (2022) Barómetro ODS 2022. Alineamiento de las empresas españolas con los Objetivos de Desarrollo Sostenible. Esade Creapolis, Barcelona.

- Chalmers, D., MacKenzie, N.G., Carter, S. (2021) Artificial Intelligence and Entrepreneurship: Implications for Venture Creation in the Fourth Industrial Revolution. Entrepreneurship Theory and Practice 45, 1028–1053. [CrossRef]

- Dear, K. (2019) Artificial Intelligence and Decision-Making. RUSI Journal, 164, November.

- DeAngelo, H., DeAngelo, L. (2007). Capital Structure, Payout Policy, and Financial Flexibility. Marshall School of Business, Working Paper No. FBE 02-06.

- Di Vaio, A., Palladino, R., Hassan, R., Escobar, O. (2020) Artificial intelligence and business models in the sustainable development goals perspective: A systematic literature review. Journal of Business Research 121, 283–314. [CrossRef]

- Duan, Y., Edwards, J.S., Dwivedi, YK (2019) Artificial intelligence for decision making in the era of Big Data – evolution, challenges, and research agenda. International Journal of Information Management 48, 63–71.

- Enholm, I.M., Papagiannidis, E., Mikalef, P., Krogstie, J. (2022) Artificial Intelligence and Business Value: A Literature Review. Information Systems Frontiers 24, 1709–1734. [CrossRef]

- Esty, D.C., Cort, T. (eds.) (2020) Values at work: Sustainable investing and ESG reporting. Palgrave McMillan, Cham.

- EY (2022) Artificial intelligence ESG stakes. Discussion paper. https://assets.ey.com/content/dam/ey-sites/ey-com/en_ca/topics/ai/ey-artificial-intelligence-esg-stakes-discussion-paper.pdf.

- Fatimah, Y.A., Kannan, D., Govindan, K., Hasibuan, Z.A. (2023) Circular economy e-business model portfolio development for e-business applications: Impacts on ESG and sustainability performance. Journal of Cleaner Production, 137528. [CrossRef]

- Galaz, V., Centeno, M.A. (2021) Artificial intelligence, systemic risks, and sustainability. Technology in Society, 67.

- Goralski, M.A., Tay Keong Tan, T.K. (2020) Artificial intelligence and sustainable development. The International Journal of Management Education, 18. [CrossRef]

- Gupta, S., Modgil, S., Bhattacharyya, S. (2022) Artificial intelligence for decision support systems in the field of operations research: review and future scope of research. Annals of Operations Research 308, 215–274. [CrossRef]

- Kar, A.K., Choudhary, S.K., Vinay Singh, K.: How can artificial intelligence impact sustainability: A systematic literature review—Journal of Cleaner Production, 376, 134120.

- Khakurel, J., Penzenstadler, B., Porras, J., Knutas, A., Zhang, W. (2022)The Rise of Artificial Intelligence under the Lens of Sustainability. Technologies 6, 100. [CrossRef]

- Khanchel, I., Lassoued, N. (2022) ESG disclosure and the cost of capital: Is there a ratcheting effect over time? Sustainability, 14, 9237.

- Kopka, A., Grashof, N. (2022) Artificial intelligence: Catalyst or barrier on the path to sustainability? Technological Forecasting and Social Change, 175, February.

- nard, L. (2023). Cash Flow Valuation and ESG. In Valuation and Sustainability: A Guide to Include Environmental, Social, and Governance Data in Business Valuation. Springer, Cham, 99–128.

- Ionescu, G.H., Firoiu, D., Pirvu, R., Vilag, R.D. (2019) The impact of ESG factors on market value of companies from travel and tourism industry. Technological and Economic Development of Economy, 25, 820–849. [CrossRef]

- Leal Filho, W., Yang, P., Eustachio, JHPP (2023) Deploying digitalization and artificial intelligence in sustainable development research. Environment Development and Sustainability, 25, 4957–4988.

- Lui, A.K.H., Lee, M.C.M., Ngai, E.W.T. (2022) Impact of artificial intelligence investment on firm value. Annals of Operations Research, 308, 373–388. [CrossRef]

- McKinsey (2023) The state of AI in 2022 - and a half decade in review. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2022-and-a-half-decade-in-review.

- Mhlanga, D. (2021) Artificial Intelligence in the Industry 4.0, and Its Impact on Poverty, Innovation, Infrastructure Development, and the Sustainable Development Goals: Lessons from Emerging Economies? Sustainability, 13, 5788.

- Mikalef, P., Gupta, M. (2021) Artificial Intelligence Capability: Conceptualization, measurement calibration, and empirical study on its impact on organizational creativity and firm performance. Information & Management, April. [CrossRef]

- Minh, D., Wang, H.X., Li, YF (2022) Explainable artificial intelligence: a comprehensive review. Artificial Intelligence Review 55, 3503–3568.

- Minkkinen, M., Niukkanen, A., Mäntymäki, M. (2022) What about investors? ESG analyses as tools for ethics-based AI auditing. AI & Society, March. [CrossRef]

- Mishra, S., Ewing, M.T., Cooper, H.B. (2022) Artificial intelligence focus and firm performance. Journal of the Academy of Marketing Science, 50, 1176–1197. [CrossRef]

- Mohieldin, M., Wahba, S., Gonzalez-Perez, M. A., Shehata, M. (2022) How Businesses Can Accelerate and Scale-Up SDG Implementation by Incorporating ESG into Their Strategies. In Business, Government and the SDGs: The Role of Public-Private Engagement in Building a Sustainable Future. Springer, Cham, 65–104.

- Moro-Visconti, R. (2022) Augmented Corporate Valuation. From Digital Networking to ESG Compliance. Palgrave Macmillan, Cham.

- Moro-Visconti, R., Cruz Rambaud, S., López Pascual, J. (2023) Artificial intelligence-driven scalability and its impact on the sustainability and valuation of traditional firms. Humanities and Social Sciences Communications, 10, 795. [CrossRef]

- Nishant, R., Kennedy, M., Corbett, J. (2020) Artificial intelligence for sustainability: Challenges, opportunities, and a research agenda. International Journal of Information Management, 53.

- Oberlo (2022) 10 Artificial Intelligence Statistics You Need to Know in 2022. https://www.oberlo.com/blog/artificial-intelligence-statistics.

- Pifer, R. (2023) Artificial intelligence could save healthcare industry $360B a year. https://www.healthcaredive.com/news/artificial-intelligence-healthcare-savings-harvard-mckinsey-report/641163/.

- Pipeline (2019) 65+ Statistics About Artificial Intelligence. https://pipeline.zoominfo.com/sales/statistics-about-artificial-intelligence.

- Popkova, E.G., Sergi, B.S. (2020) Human capital and AI in industry 4.0. Convergence and divergence in social entrepreneurship in Russia. Journal of Intellectual Capital, 21, 565–581. [CrossRef]

- Reim, W., Åström, J., Eriksson, O. (2020) Implementation of Artificial Intelligence (AI): A Roadmap for Business Model Innovation. AI 1, 180–191. [CrossRef]

- Sætra, H.S. (2022) The AI ESG protocol: Evaluating and disclosing the environment, social, and governance implications of artificial intelligence capabilities, assets, and activities. Sustainable Development, 31 November. [CrossRef]

- Schramade, W. (2016) Integrating ESG into valuation models and investment decisions: the value-driver adjustment approach. Journal of Sustainable Finance & Investment, 6, 95–111. [CrossRef]

- Singh, I. (2022) Integrating ESG Factors to Equity Valuation. Massachusetts Institute of Technology, Boston.

- Škapa, S., Bočková, N., Doubravský, K., Dohnal M. (2023) Fuzzy confrontations of models of ESG investing versus non-ESG investing based on artificial intelligence algorithms. Journal of Sustainable Finance & Investment, 13, 763–775. [CrossRef]

- Statista (2021) Expected energy savings from artificial intelligence-driven energy management solutions for operators in 2021. https://www-statista-com.ezproxy.unicatt.it/statistics/1304468/ai-expected-energy-savings/?locale=en.

- Strusani, D., Houngbonon, G.V. (2019) The role of artificial intelligence in supporting development in emerging markets. World Bank Publications, Reports 32365. The World Bank Group, Washington.

- Sunday, OA (2012) The Effect of Financial Leverage on Corporate Performance of Some Selected Companies in Nigeria. Journal of Canadian Social Science, 8, 85–91.

- Tanveer, M., Hassan, S., Bhaumik, A. (2020) Academic Policy Regarding Sustainability and Artificial Intelligence (AI). Sustainability, 12, 9435. [CrossRef]

- Tien, J.M. (2017) Internet of Things, Real-Time Decision Making, and Artificial Intelligence. Annals of Data Science, 4, 149–178.

- Vinuesa, R., Azizpour, H., Leite, I. (2020) The role of artificial intelligence in achieving the Sustainable Development Goals. Nature Communications, 11, 233. [CrossRef]

- Visvizi, A. (2022) Artificial Intelligence (AI) and Sustainable Development Goals (SDGs): Exploring the Impact of AI on Politics and Society. Sustainability, 14, 1730. [CrossRef]

- Wang, Y.C., Lin, J.C.W. (2023) Artificial Intelligence and Optimization Strategies in Industrial IoT Applications. Industry 4.0 and Healthcare: Impact of Artificial Intelligence. Springer Nature, Singapore, 223-251.

- Inizio modulo.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).