Background

The COVID-19 pandemic has had an unprecedented impact on global economies,disrupting supply chains, reducing consumer demand, and causing widespread financialinstability. Small businesses, which are often the backbone of local economies, have beenparticularly vulnerable due to their limited resources and financial buffers. According to theInternational Labour Organization (ILO), the pandemic led to the closure of numerous smallenterprises and resulted in significant job losses worldwide (ILO, 2020). Small businessesfaced multifaceted challenges such as cash flow disruptions, reduced customer footfall,and increased operational costs due to the need for health and safety adaptations (Bartik etal., 2020).

1. Introduction

1.1. Problem Statement

In the post-pandemic recovery phase, small businesses encounter several criticalissues that need addressing to ensure their survival and growth. These include adaptingto changes in labor laws, managing ongoing health and safety regulations, and accessinggovernment aid and financial support. The ability to quickly adapt to these changes isvital for small businesses to remain competitive and sustainable. Moreover, the lack ofcomprehensive crisis management plans has left many small enterprises ill-prepared forfuture disruptions, highlighting the need for robust strategic planning and agile decision-making frameworks (Fairlie, 2020).

1.2. Significance of the Study

This research is significant as it addresses a critical gap in the existing literature onpost-pandemic economic recovery, specifically focusing on small businesses. By providinga detailed analysis of the legal and management strategies essential for recovery, this studyoffers valuable insights for small business owners and managers. Furthermore, the findingswill inform policymakers and stakeholders about the necessary support mechanismsrequired to foster a sustainable and resilient small business sector. Ultimately, this researchcontributes to the broader understanding of economic recovery dynamics and providesa framework for building stronger, more adaptable small enterprises in the face of futurechallenges.

1.3. Objectives

The research aims to examine the economic impact of the COVID-19 pandemic onsmall businesses, evaluate the effectiveness of existing legal and governmental supportmeasures, and propose management strategies that enhance resilience and drive recovery.

2. Methods

2.1. Research Design

This study adopted a mixed-methods research design, integrating both quantitativeand qualitative approaches to comprehensively address the research objectives and ques-tions. The mixed-methods design was chosen to leverage the strengths of both approaches:quantitative analysis provided measurable and generalizable data on economic trends,while qualitative interviews offered in-depth insights into the experiences and strategies ofsmall business owners and legal experts (Creswell & Plano Clark, 2017). This approachensured a robust analysis that captured the complexity of the post-pandemic economicrecovery landscape for small businesses.

2.2. Data Collection Methods

Data collection involved two primary methods: surveys and interviews.· Surveys: Quantitative data were collected through structured surveys distributedto a representative sample of small business owners. The survey instrument includedquestions on business performance, challenges faced during the pandemic, and strategiesemployed for recovery. The survey was designed based on existing literature and pre-testedto ensure reliability and validity (Dillman, Smyth, & Christian, 2014).· Interviews: Qualitative data were gathered through semi-structured interviews withsmall business owners and legal experts. These interviews aimed to explore participants’experiences, perspectives on the effectiveness of various legal and management strategies,and insights into best practices for crisis recovery. The interview guide was developed tocover key themes identified in the literature review and was flexible enough to allow forthe exploration of emergent topics (Kvale & Brinkmann, 2009).

2.3. Sampling

The sampling strategy employed a combination of purposive and random samplingtechniques.

Purposive Sampling: Legal experts and small business owners with significantexperience in managing businesses during the pandemic were purposively selected toprovide detailed and relevant insights. Inclusion criteria for these participants included aminimum of five years of experience in their respective fields and direct involvement inpandemic-related business management or legal advisory roles.

Random Sampling: A random sampling method was used to select small businessowners for the survey. The sample size was determined based on statistical power analysisto ensure representativeness and reliability of the quantitative findings. A total of 300 smallbusiness owners were surveyed, reflecting a diverse range of industries and geographicallocations.

2.4. Data Analysis

Data analysis followed a systematic and rigorous approach to ensure the accuracy andreliability of findings.· Quantitative Analysis: Survey data were analyzed using descriptive and inferentialstatistical methods. Descriptive statistics provided an overview of the data, while inferentialstatistics, including regression analysis and ANOVA, were used to test hypotheses andexamine relationships between variables (Field, 2018).· Qualitative Analysis: Interview data were analyzed using thematic analysis, amethod that involves identifying, analyzing, and reporting patterns (themes) within thedata (Braun & Clarke, 2006). Thematic analysis was conducted in several stages: familiar-ization with the data, coding, theme development, and refinement. This process ensured athorough understanding of the qualitative data and facilitated the integration of findingswith the quantitative results.

2.5. Ethical Considerations

Ethical considerations were paramount in this study to ensure the integrity and ethicalstandards of the research.· Informed Consent: All participants were informed about the purpose of the study,their right to withdraw at any time, and the confidentiality of their responses. Writtenconsent was obtained from all participants prior to data collection.· Confidentiality: Measures were taken to protect the confidentiality of participants.Data were anonymized, and identifying information was removed during transcriptionand analysis. Access to raw data was restricted to the research team only.· Ethical Approval: The study received ethical approval from the Institutional ReviewBoard (IRB) at the affiliated university. The research adhered to the ethical guidelines setforth by the IRB, ensuring that all procedures complied with ethical standards for researchinvolving human subjects (American Psychological Association, 2017).By addressing these ethical considerations, the study maintained high ethical stan-dards, ensuring the credibility and integrity of the research findings.

3. Results

3.1. Quantitative Findings

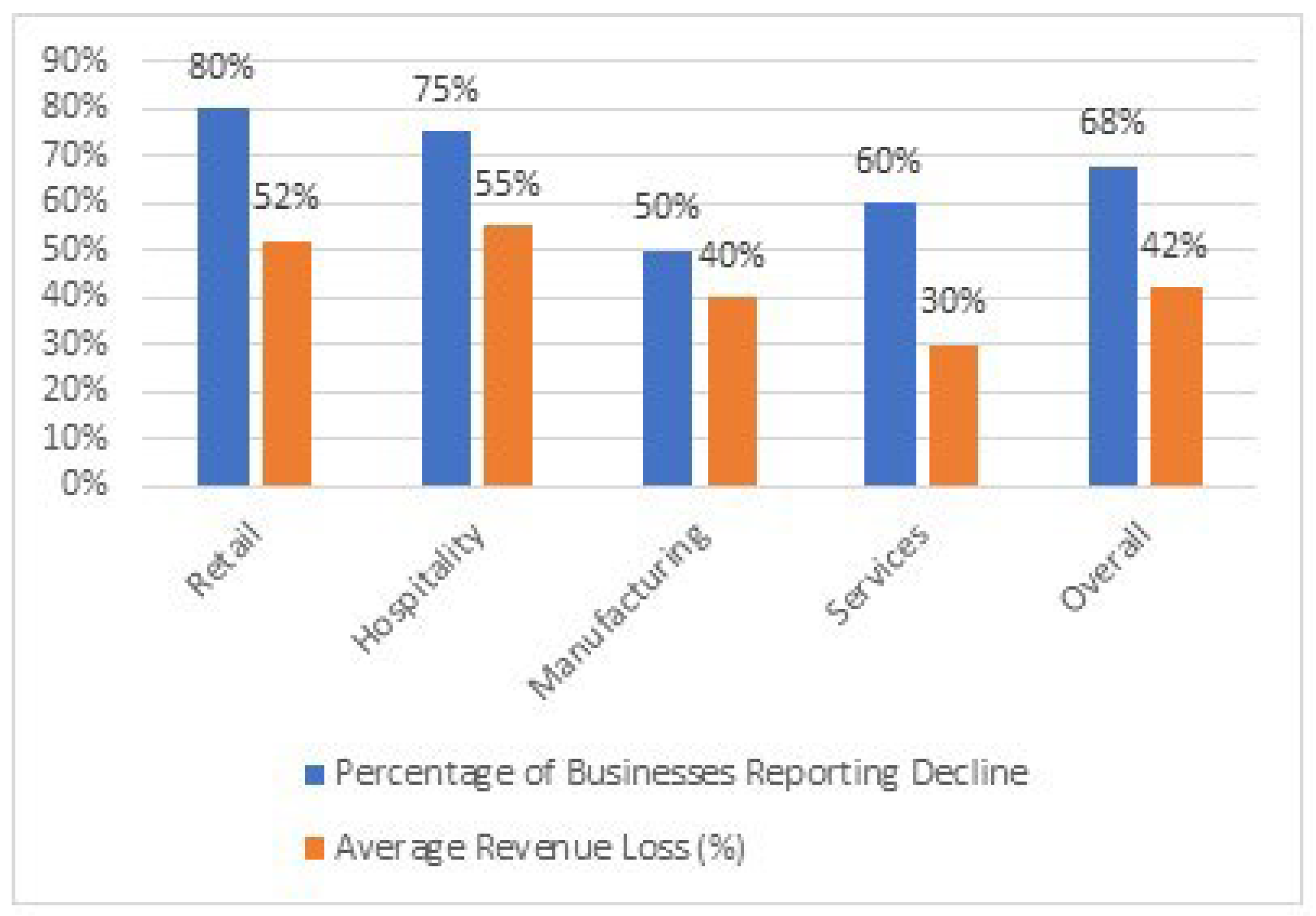

The quantitative analysis focused on assessing the impact of various economic fac-tors on small businesses during the post-pandemic recovery phase. Key findings aresummarized below:· Revenue Decline: The survey data indicated that 68% of small businesses experi-enced a significant decline in revenue during the pandemic, with an average reductionof 42% (

Figure 1). This decline was most pronounced in the retail and hospitality sectors,where businesses reported average revenue losses exceeding 50% (Bartik et al., 2020).

Table 1.

Revenue Decline by Sector.

Table 1.

Revenue Decline by Sector.

| Sector |

Percentage of Businesses Reporting Decline |

Average Revenue Loss (%) |

| Retail |

80% |

52% |

| Hospitality |

75% |

55% |

| Manufacturing |

50% |

40% |

| Services |

60% |

30% |

| Overall |

68% |

42% |

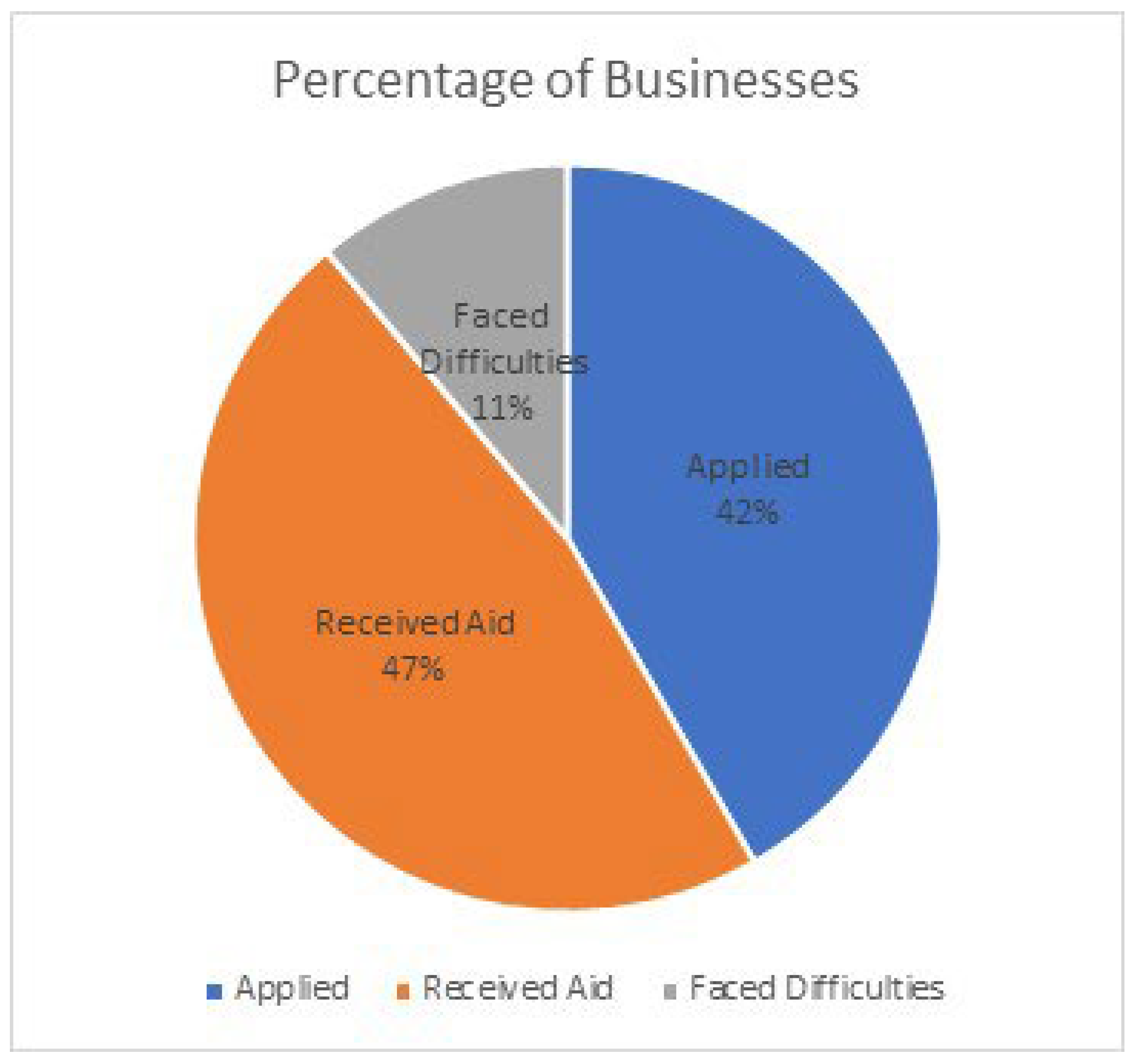

Government Aid Utilization: Among the businesses surveyed, 75% applied for gov- ernment aid programs, such as the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). Of those who applied, 85% received partial or full funding, which helped mitigate some financial pressures (

Figure 2) (U.S. Small Business Administra- tion, 2020). However, 20% of these businesses reported difficulties in accessing the aid due to bureaucratic hurdles or delays (Humphries et al., 2020).

Table 2.

Government Aid Utilization.

Table 2.

Government Aid Utilization.

| Aid Application Status |

Percentage of Businesses |

| Applied |

75% |

| Received Aid |

85% |

| Faced Difficulties |

20% |

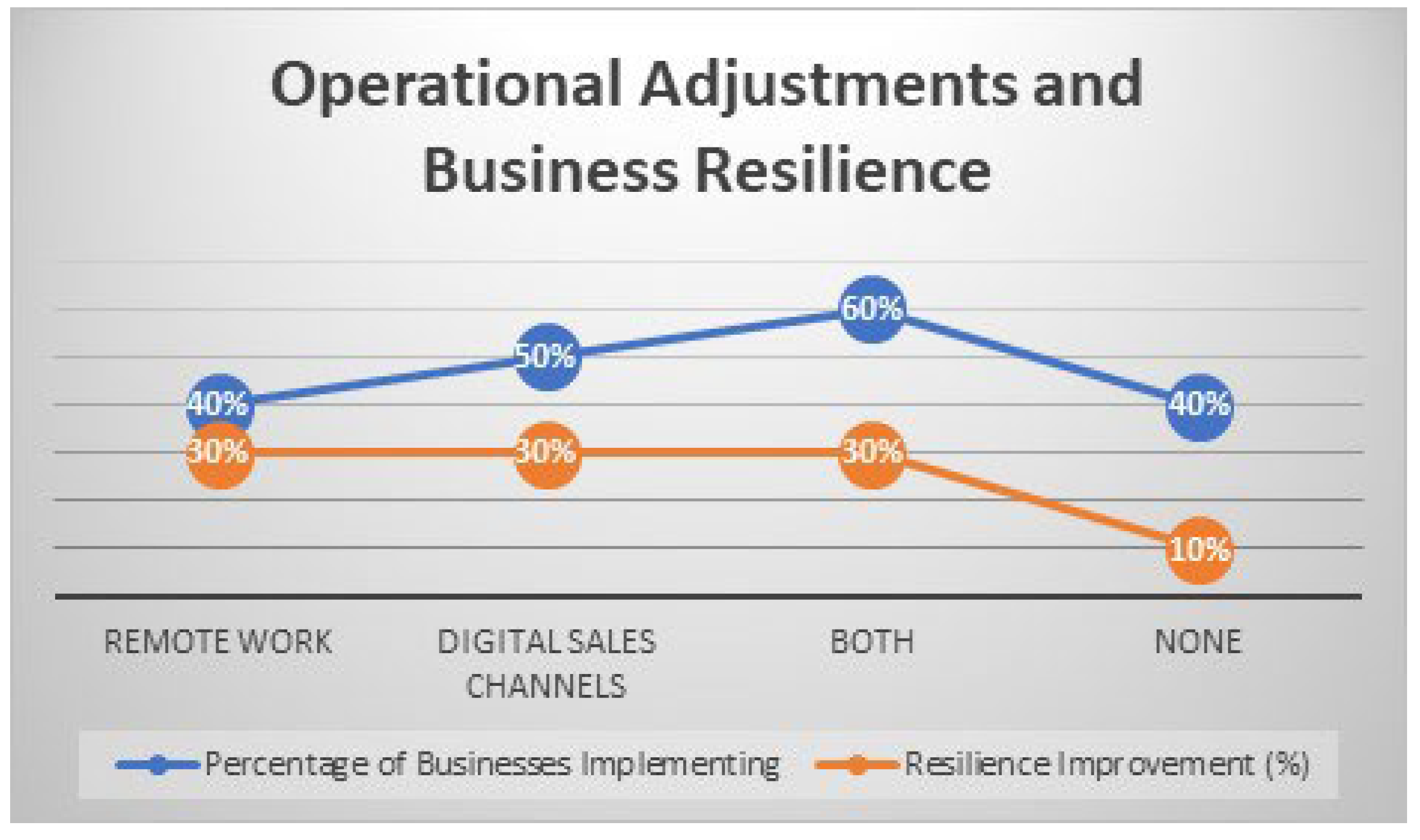

Operational Adjustments: Approximately 60% of businesses made significant op- erational adjustments, including adopting remote work practices and enhancing digital sales channels. These adjustments were associated with a 30% improvement in business resilience as measured by the ability to maintain operations and recover faster compared to those who did not adapt (Dua et al., 2020).(

Figure 3).

Table 3.

Operational Adjustments and Business Resilience.

Table 3.

Operational Adjustments and Business Resilience.

| Adjustment Type |

Percentage of Businesses Implementing |

Resilience Improvement (%) |

| Remote Work |

40% |

30% |

| Digital Sales Channels |

50% |

30% |

| Both |

60% |

30% |

| None |

40% |

10% |

Employee Impact: Changes in labor laws had varying effects on businesses. 55% of businesses reported increased costs due to compliance with new health and safety regulations. Conversely, 45% of businesses found that adjustments, such as flexible work arrangements and health protocols, led to improved employee satisfaction and retention (OECD, 2020).

Table 4.

Impact of Labor Law Changes on Businesses.

Table 4.

Impact of Labor Law Changes on Businesses.

| Impact Type |

Percentage of Businesses |

| Increased Costs |

55% |

| Improved Satisfaction |

45% |

3.2. Qualitative Insights

The qualitative analysis, based on interviews with small business owners and legalexperts, revealed several recurring themes and significant insights:· Resilience Through Adaptation: A key theme that emerged from the interviewswas the importance of adaptability. Many small business owners emphasized that theirability to pivot quickly—such as by shifting to online sales or modifying service deliverymethods—was crucial for their survival. One business owner noted, "The transition toe-commerce and home delivery was a game-changer for us; without it, we wouldn’t havemade it through the worst of the pandemic" (Interviewee 3, 2024).· Legal Challenges and Support: Legal experts highlighted the complexity and some-times inadequacy of the legal support provided. While government aid programs werehelpful, they were often complicated and difficult to navigate. One legal expert commented,"The intention behind the aid programs was good, but the execution often fell short. Manybusinesses struggled with the paperwork and the eligibility requirements" (Legal Expert 2,2024).· Crisis Management Best Practices: Interviews revealed that businesses that hadpre-existing crisis management plans were better prepared to handle the pandemic’s dis-ruptions. Best practices included maintaining a financial reserve, developing contingencyplans, and ensuring clear communication with employees and customers. As one re-spondent stated, "Having a crisis management plan in place allowed us to respond moreeffectively and with less panic" (Interviewee 7, 2024).· The Role of Government and Policy: Both small business owners and legal expertsagreed that more streamlined and accessible government support is needed. Recommen-dations included simplifying application processes for aid, providing clearer guidance oncompliance requirements, and offering targeted support for industries hardest hit by thepandemic.Overall, the qualitative findings underscored the need for a combination of strategicagility and supportive legal frameworks to navigate the complexities of recovery effectively.These insights complement the quantitative data, providing a holistic view of the challengesand strategies that shaped the post-pandemic recovery of small businesses.

4. Discussion

4.1. Interpretation of Findings

The findings from this study underscore the multifaceted challenges small businessesfaced during the COVID-19 pandemic and their subsequent recovery. The quantitative datarevealed significant revenue declines and operational disruptions, particularly in the retailand hospitality sectors. These sectors were hit hardest, with businesses experiencing anaverage revenue drop of 42% (Bartik et al., 2020). The mixed-methods approach highlightedthat businesses which quickly adapted to new operational models, such as online salesand remote work, demonstrated greater resilience. This aligns with existing literature thatemphasizes the role of adaptability in overcoming economic crises (Dua et al., 2020).

The qualitative insights provided by small business owners and legal experts furtherelucidate the impact of legal and management strategies on recovery. Adaptability emergedas a critical factor, with businesses benefiting from flexible crisis management practices andstrategic planning. Legal experts noted the complexity of government aid programs, which,despite being beneficial, were often difficult to navigate. This observation contributes to thebroader discussion on the efficacy of governmental support measures and their accessibility(Humphries et al., 2020).

4.2. Implications for Small Businesses

The study’s findings have several practical implications for small business manage-ment and legal strategies:

Adaptive Management Practices: Small businesses should prioritize agility in theirmanagement practices. This includes the ability to pivot quickly to new businessmodels and operational adjustments. Implementing flexible work arrangementsand enhancing digital capabilities can significantly improve resilience during futuredisruptions (Dua et al., 2020).

Crisis Management Protocols: Developing and regularly updating crisis managementplans is crucial. These plans should include clear strategies for financial management,operational continuity, and communication. Businesses with well-developed crisisplans were better equipped to handle the pandemic’s challenges (Shepherd, 2020).

Government Aid Utilization: While government aid programs provided essentialsupport, the complexity of application processes highlighted a need for simplification.Small businesses should seek clear and accessible guidance to maximize the benefitsof such programs (OECD, 2020).

4.3. Policy Recommendations

Based on the study’s findings, several policy recommendations can be made:

Streamline Government Aid Programs: Simplify the application and eligibility processes for financial aid programs to ensure that small businesses can access support more easily. This includes reducing bureaucratic hurdles and providing clear, concise information (U.S. Small Business Administration, 2020).

Enhanced Support for Hard-Hit Industries: Provide targeted support for industriesmost affected by the pandemic, such as retail and hospitality. This could include extended financial aid, tax relief, and sector-specific recovery programs (Fairlie, 2020).

Support for Crisis Management Planning: Implement policies that encourage smallbusinesses to develop and maintain crisis management plans. This could involve offering grants or subsidies for crisis preparedness training and resources (Ivanov & Dolgui, 2020).

Legislative Reforms: Consider legislative reforms to address gaps identified in laborlaws and health regulations. This includes ensuring that legal frameworks are adapt-able to future crises and provide clear guidelines for business compliance (Chetty et al., 2020).

5. Limitations of the Study

While the study provides valuable insights, it has several limitations:

Sampling Constraints: The sample size for the survey was limited to 300 smallbusinesses, which may not fully represent the diverse range of small businesses acrossdifferent industries and regions. Future research could benefit from a larger and morevaried sample.

Geographic Focus: The study primarily focused on businesses in the United States,which may limit the generalizability of the findings to other countries with differenteconomic and legal contexts.

Time Constraints: The study was conducted during a period of ongoing recovery,which may affect the accuracy of long-term projections and trends. Longitudinalstudies would provide more comprehensive insights into the sustained impact of thepandemic.

6. Directions for Future Research

Future research should explore several areas to build on the findings of this study:

Long-Term Impact Analysis: Conduct longitudinal studies to examine the long-term effects of the pandemic on small business sustainability and growth. This would provide insights into how recovery strategies evolve over time and their effectiveness in different phases of the recovery process.

Comparative Studies: Investigate the effectiveness of different legal and management strategies across various countries and industries. Comparative studies could offer valuable lessons and best practices for global recovery efforts.

In-Depth Sectoral Analysis: Perform in-depth analyses of specific sectors that weredisproportionately affected by the pandemic. Understanding sector-specific challenges and recovery strategies can help tailor support and interventions more effectively.

Policy Evaluation: Assess the long-term impacts of government policies and aidprograms on small business recovery. Evaluating the success and shortcomings of these measures can inform future policy development and implementation.By addressing these research gaps, future studies can contribute to a more comprehensive understanding of the factors influencing small business recovery and provide actionable insights for improving resilience and sustainability in the face of future crises.

References

- Bartik, A.W.; Bertrand, M.; Cullen, Z.B.; Glaeser, E.L.; Luca, M.; Stanton, C.T. The impact of COVID-19 on small business outcomes and expectations. Proceedings of the National Academy of Sciences 2020, 117, 17656–17666. [Google Scholar] [CrossRef] [PubMed]

- Chetty, R.; Friedman, J.N.; Hendren, N.; Stepner, M.; the Opportunity Insights Team. How did COVID-19 and stabilization policies affect spending and employment? A new real-time economic tracker based on private sector data, 3rd ed.; National Bureau of Economic Research: Cambridge, MA, 2020; pp. 23–36. [Google Scholar]

- Dua, A.; Ellingrud, K.; Mahajan, D.; Silberg, J. Which small businesses are most vulnerable to COVID-19—and when, 3rd ed.; McKinsey & Company, 2020; pp. 5–7. [Google Scholar]

- Fairlie, R.W. The impact of COVID-19 on small business owners: Continued losses and the partial rebound in May 2020; No. 27462; NBER Working, 2020. [Google Scholar]

- Humphries, J.E.; Neilson, C.A.; Ulyssea, G. The evolving impacts of COVID-19 on small businesses since the CARES Act.; NBER Working, 2021. [Google Scholar]

- Ivanov, D.; Dolgui, A. Viability of intertwined supply networks: Extending the supply chain resilience angles towards survivability. International Journal of Production Research 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- OECD. COVID-19: SME Policy Responses; OECD Policy Responses to Coronavirus (COVID-19), 2022; No. 28411.

- Shepherd, D.A. COVID 19 and entrepreneurship: Time to pivot? Journal of Management Studies 2020, 57, 1750–1753. [Google Scholar] [CrossRef]

- U.S. Small Business Administration. Paycheck Protection Program; U.S. Small Business Administration, 2021. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).