Submitted:

09 September 2024

Posted:

10 September 2024

You are already at the latest version

Abstract

Keywords:

Introduction

Data and Methods

Data Sources for SLT Excise Taxes and SLT Prices

Data Sources for State-Level Tobacco CONTROL Policies

Methods

Calculating the Tax Incidence

Results

Discussion

Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Citations/Disclaimers

References

- M. E. Cornelius et al., "Tobacco Product Use Among Adults–United States, 2021," Morbidity and Mortality Weekly Report, vol. 72, no. 18, p. 475, 2023.

- J. Birdsey, "Tobacco product use among US middle and high school students—National Youth Tobacco Survey, 2023," MMWR. Morbidity and Mortality Weekly Report, vol. 72, 2023.

- Centers for Disease Control and Prevention, "Smokeless Tobacco: Health Effects," 2020. Accessed: 04/08/2024. [Online]. Available: https://www.cdc.gov/tobacco/data_statistics/fact_sheets/smokeless/health_effects/index.htm.

- American Cancer Society, "Health Risks of Smokeless Tobacco," 2020. Accessed: 04/08/2024. [Online]. Available: https://www.cancer.org/cancer/risk-prevention/tobacco/health-risks-of-tobacco/smokeless-tobacco.html.

- L. Zavala-Arciniega, R. Meza, J. L. Hirschtick, and N. L. Fleischer, "Disparities in Cigarette, E-cigarette, Cigar, and Smokeless Tobacco Use at the Intersection of Multiple Social Identities in the US Adult Population. Results From the Tobacco Use Supplement to the Current Population Survey 2018–2019 Survey," Nicotine and Tobacco Research, vol. 25, no. 5, pp. 908-917, 2023. [CrossRef]

- Centers for Disease Control and Prevention, "Smokeless Tobacco Product Use in the United States," 2023. Accessed: 04/08/2023. [Online]. Available: https://www.cdc.gov/tobacco/data_statistics/fact_sheets/smokeless/use_us/index.htm#five.

- J. M. Nemeth, S. T. Liu, E. G. Klein, A. K. Ferketich, M.-P. Kwan, and M. E. Wewers, "Factors influencing smokeless tobacco use in rural Ohio Appalachia," Journal of community health, vol. 37, pp. 1208-1217, 2012. [CrossRef]

- Federal Trade Commission, " Smokeless Tobacco Report for 2022," 2023. Accessed: 04/08/2024. [Online]. Available: https://www.ftc.gov/system/files/ftc_gov/pdf/2022-Smokeless-Tobacco-Report.pdf.

- J. Tauras, L. Powell, F. Chaloupka, and H. Ross, "The demand for smokeless tobacco among male high school students in the United States: the impact of taxes, prices and policies," Applied Economics, vol. 39, no. 1, pp. 31-41, 2007. [CrossRef]

- D. Dave and H. Saffer, "Demand for smokeless tobacco: role of advertising," Journal of Health Economics, vol. 32, no. 4, pp. 682-697, 2013.

- C. Marr and C.-C. Huang, "Higher Tobacco Taxes Can Improve Health And Raise Revenue," Center on Budget and Policy Priorities, 2014. Accessed: 04/08/2024. [Online]. Available: https://www.cbpp.org/sites/default/files/atoms/files/6-19-13tax.pdf.

- World Health Organization. "Promoting taxation on tobacco products." https://www.who.int/europe/activities/promoting-taxation-on-tobacco-products (accessed 04/08/2024).

- C. Shang, S. Ma, and E. N. Lindblom, "Tax incidence of electronic nicotine delivery systems (ENDS) in the USA," Tobacco Control, 2021. [CrossRef]

- Y. He, S. Ma, Q. Yang, and C. Shang, "How cigarette excise tax pass-through to prices responds to the uptake and evolution of e-cigarettes (ECs)," Tobacco Control, 2023. [CrossRef]

- B. Brock, K. Choi, R. G. Boyle, M. Moilanen, and B. A. Schillo, "Tobacco product prices before and after a statewide tobacco tax increase," Tobacco control, vol. 25, no. 2, pp. 166-173, 2016. [CrossRef]

- F. J. Chaloupka and K. E. Warner, "The economics of smoking," Handbook of health economics, vol. 1, pp. 1539-1627, 2000.

- Hanson and R. Sullivan, "The incidence of tobacco taxation: evidence from geographic micro-level data," National Tax Journal, vol. 62, no. 4, pp. 677-698, 2009. [CrossRef]

- Centers for Disease Control and Prevention. "Surgeon General’s Advisory on E-cigarette Use Among Youth." https://www.cdc.gov/tobacco/basic_information/e-cigarettes/surgeon-general-advisory/index.html (accessed 04/08/2023).

- B. A. King, D. G. Gammon, K. L. Marynak, and T. Rogers, "Electronic cigarette sales in the United States, 2013-2017," Jama, vol. 320, no. 13, pp. 1379-1380, 2018.

- R. O'Connor, L. M. Schneller, N. J. Felicione, R. Talhout, M. L. Goniewicz, and D. L. Ashley, "Evolution of tobacco products: recent history and future directions," Tobacco control, vol. 31, no. 2, pp. 175-182, 2022. [CrossRef]

- S. L. Emery, S. Binns, C. C. Carter, S. W. Rose, and G. Kostygina, "Characterising advertising strategies and expenditures for conventional and newer smokeless tobacco products," Tobacco control, vol. 32, no. 6, pp. 795-798, 2023. [CrossRef]

- Centers for Disease Control and Prevention. State Tobacco Activities Tracking and Evaluation (STATE) System [Online] Available: https://www.cdc.gov/statesystem/index.html.

- Alcohol and Tobacco Tax and Trade Bureau. "Tax Rates." U.S. Department of the Treasury. https://www.ttb.gov/tax-audit/tax-and-fee-rates#tobacco (accessed 04/08/2024).

- U.S. Bureau of Labor Statistics. Consumer Price Index [Online] Available: https://www.bls.gov/cpi/.

- F. J. Chaloupka and J. A. Tauras, "Taxation of emerging tobacco products," Journal of Medicine, vol. 373, pp. 594-597, 2020.

- C. Shang, A. Ngo, and F. J. Chaloupka, "The pass-through of alcohol excise taxes to prices in OECD countries," The European Journal of Health Economics, vol. 21, pp. 855-867, 2020. [CrossRef]

- U. M. Bergman and N. L. Hansen, "Are Excise Taxes on Beverages Fully Passed through to Prices?: The Danish Evidence," FinanzArchiv, vol. 75, no. 4, pp. 323-356, 2019. [CrossRef]

- F. J. Chaloupka, D. Sweanor, and K. E. Warner, "Differential Taxes for Differential Risks--Toward Reduced Harm from Nicotine-Yielding Products," 2015. [CrossRef]

- Hoffer, "How Should Alternative Tobacco Products Be Taxed?," 2023. Accessed: 04/08/2024. [Online]. Available: https://taxfoundation.org/research/all/federal/taxing-alternative-tobacco-products/.

- S. Delipalla and O. O’Donnell, "Estimating tax incidence, market power and market conduct: The European cigarette industry," International Journal of Industrial Organization, vol. 19, no. 6, pp. 885-908, 2001. [CrossRef]

- L. B. Wilson, R. Pryce, R. Hiscock, C. Angus, A. Brennan, and D. Gillespie, "Quantile regression of tobacco tax pass-through in the UK 2013–2019. How have manufacturers passed through tax changes for different tobacco products?," Tobacco control, 2020. [CrossRef]

- R. S. Sullivan and D. H. Dutkowsky, "The effect of cigarette taxation on prices: an empirical analysis using local-level data," Public Finance Review, vol. 40, no. 6, pp. 687-711, 2012.

- J. Espinosa and W. N. Evans, "Excise taxes, tax incidence, and the flight to quality: Evidence from scanner data," Public Finance Review, vol. 41, no. 2, pp. 147-176, 2013.

- L. Kalousova et al., "Cigarette taxes, prices, and disparities in current smoking in the United States," SSM-population health, vol. 12, p. 100686, 2020. [CrossRef]

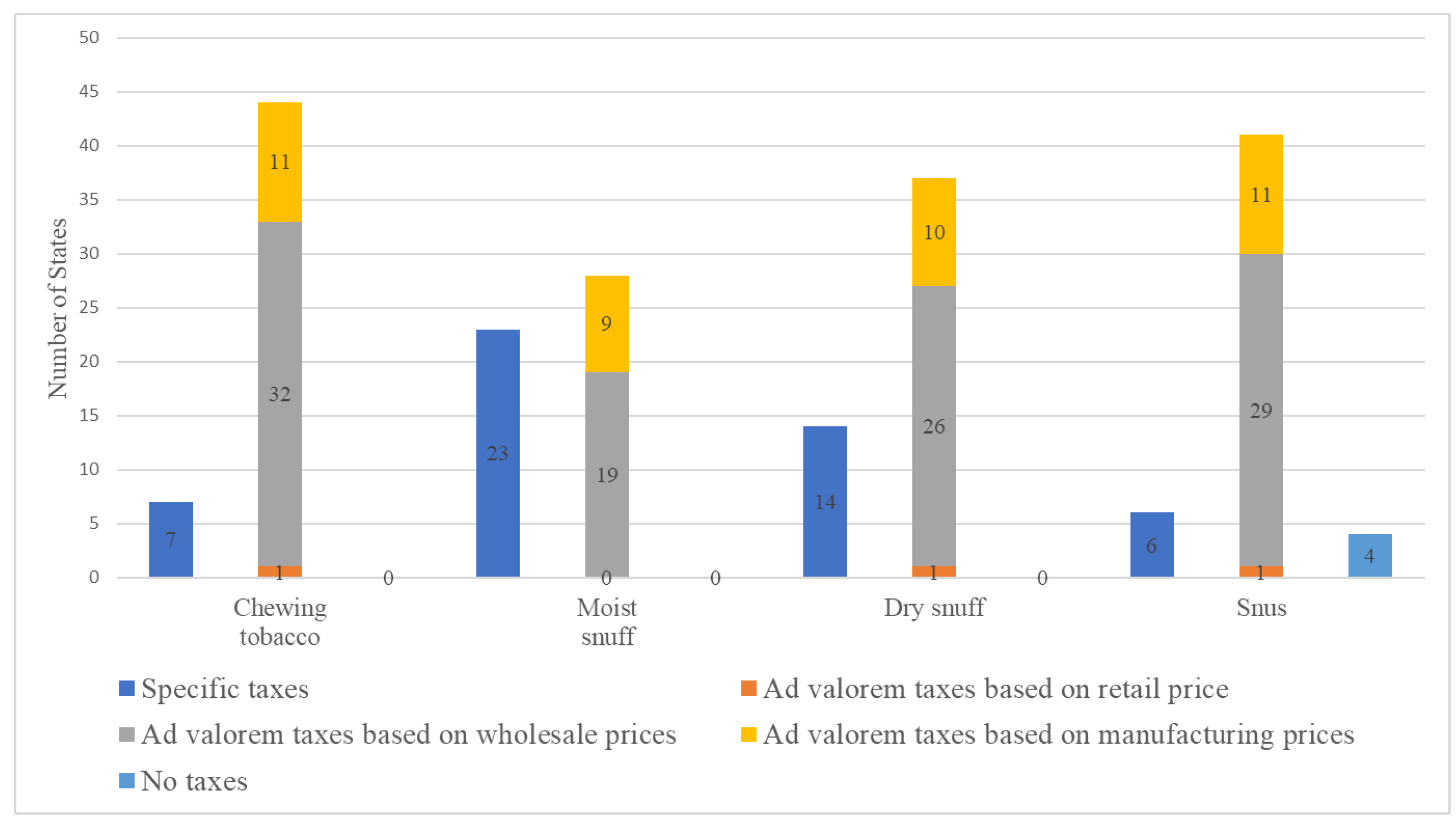

| Type of SLT | Tax schema | Number | States |

|---|---|---|---|

| Chewing tobacco | Specific taxes | 7 | AL, AZ, KY, ME, ND, PA, TX |

| Ad valorem taxes | 44 |

1 based on retail prices: WA 32 based on wholesale prices: AK, CA, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, MA, MD, MI, MN, MT, NC, NE, NH, NJ, NV, NY, OH, OR, RI, SD, TN, VT, WV, WY 11 based on manufacturing prices: AR, CO, LA, MO, MS, NM, OK, SC, UT, VA, WI |

|

| No taxes | 0 | ||

| Moist snuff | Specific taxes | 23 | AL, AZ, CT, DE, IA, IL, IN, KY, ME, MT, ND, NE, NJ, NY, OR, PA, RI, TX, UT, VA, VT, WA, WY |

| Ad valorem taxes | 28 |

19 based on wholesale prices: AK, CA, DC, FL, GA, HI, ID, KS, MA, MD, MI, MN, NC, NH, NV, OH, SD, TN, WV 9 based on manufacturing prices: AR, CO, LA, MO, MS, NM, OK, SC, WI |

|

| No taxes | 0 | ||

| Dry snuff | Specific taxes | 14 | AL, AZ, CT, IA, KY, ME, ND, NE, NY, PA, RI, TX, VA, VT |

| Ad valorem taxes | 37 |

1 based on retail prices: WA 26 based on wholesale prices: AK, CA, DC, DE, FL, GA, HI, ID, IL, IN, KS, MA, MD, MI, MN, MT, NC, NH, NJ, NV, OH, OR, SD, TN, WV, WY 10 based on manufacturing prices: AR, CO, LA, MO, MS, NM, OK, SC, UT, WI |

|

| No taxes | 0 | ||

| Snus | Specific taxes | 6 | AZ, KY, ME, PA, TX, VT |

| Ad valorem taxes | 41 |

1 based on retail prices: WA 29 based on wholesale prices: AK, CA, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, MA, MD, MI, MN, MT, NC, NE, NJ, NV, NY, OH, OR, RI, SD, TN, WV, WY 11 based on manufacturing prices: AR, CO, LA, MO, MS, NM, OK, SC, UT, VA, WI |

|

| No taxes | 4 | AL, CT, ND, NH |

| SLT Type | All sample | States that impose specific taxes | States that impose ad valorem taxes | P-value | ||

|---|---|---|---|---|---|---|

| Mean (SD) | # of obs | Mean (SD) | # of obs | Mean (SD) | ||

| Chewing tobacco | 0.222 (0.149) | 339 | 0.292 (0.285) | 2,663 | 0.213 (0.119) | <0.001 |

| Moist snuff | 0.215 (0.144) | 1,164 | 0.238 (0.168) | 1,658 | 0.199 (0.123) | <0.001 |

| Dry snuff | 0.228 (0.159) | 710 | 0.293 (0.230) | 2,172 | 0.207 (0.121) | <0.001 |

| Snus | 0.199 (0.111) | 267 | 0.170 (0.113) | 2,483 | 0.202 (0.110) | <0.001 |

| Chewing tobacco Mean (SD) |

Moist snuff Mean (SD) |

Dry snuff Mean (SD) |

Snus Mean (SD) |

|

|---|---|---|---|---|

| Outcome variables | ||||

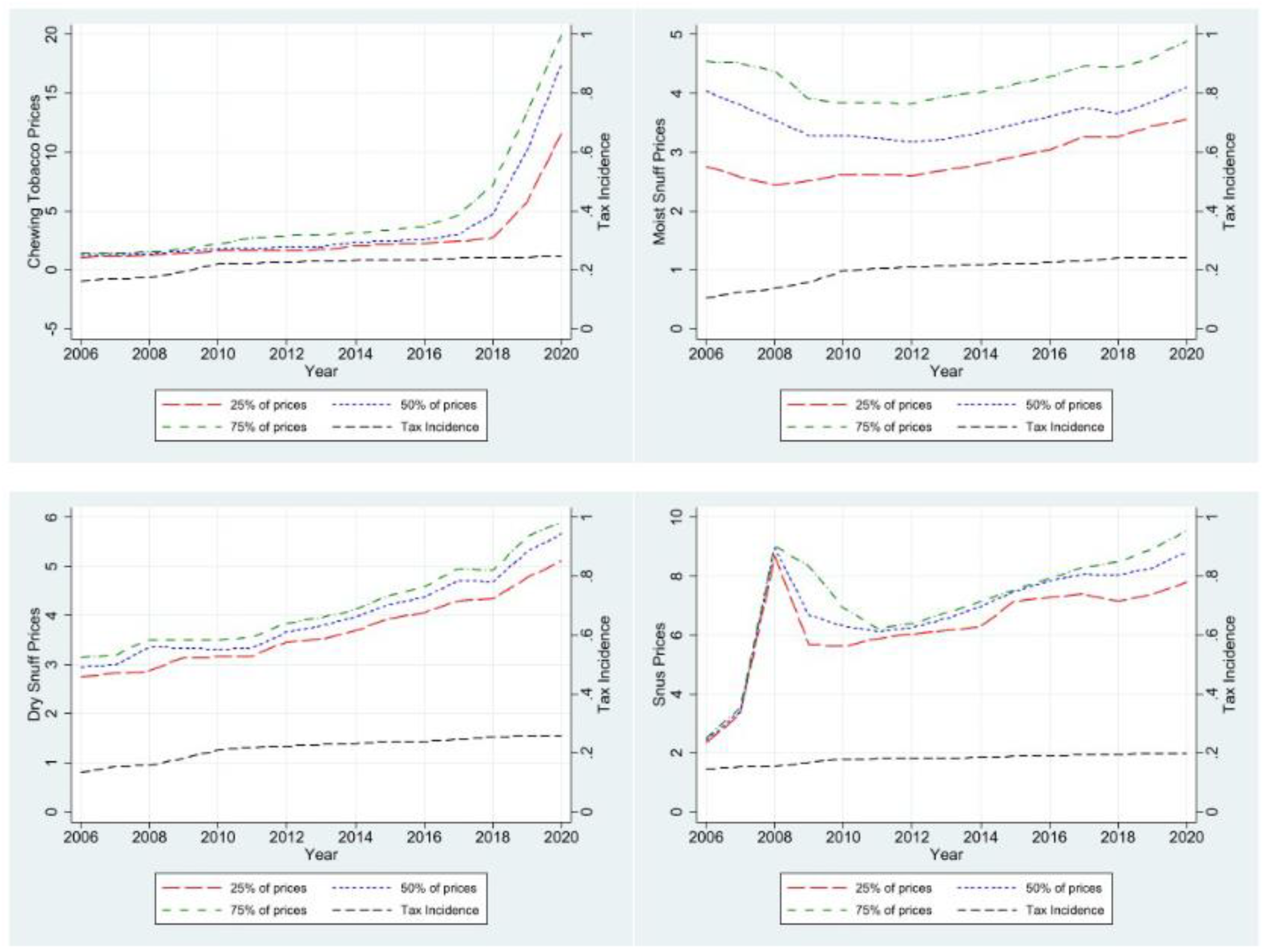

| SLT prices at 25-percentile | 3.035 (3.980) |

3.315 (1.005) |

3.911 (1.142) |

7.616 (2.494) |

| SLT prices at 50-percentile | 4.184 (5.482) |

3.855 (.976) |

4.239 (1.257) |

7.994 (2.412) |

| SLT prices at 75-percentile | 5.269 (5.978) |

4.380 (.939) |

4.426 (1.280) |

8.360 (2.436) |

| Explanatory variables | ||||

| Specific tax | .562 (.634) |

.948 (.650) |

.600 (.466) |

1.129 (.771) |

| State-level tobacco control policy variables | ||||

| Smoking bans in private worksites | .584 (.494) |

.708 (.455) |

.357 (.480) |

.693 (.462) |

| Smoking bans in private restaurants | .451 (.498) |

.625 (.484) |

.289 (.454) |

.622 (.486) |

| Smoking bans in private bars | .451 (.498) |

.669 (.471) |

.289 (.454) |

.622 (.486) |

| Vaping bans in private worksites | .097 (.297) |

.165 (.371) |

.003 (.057) |

.072 (.259) |

| Vaping bans in private restaurants | .159 (.366) |

.183 (.387) |

.003 (.057) |

.155 (.363) |

| Vaping bans in private bars | .159 (.366) |

.183 (.387) |

.003 (.057) |

.155 (.363) |

| Minimum legal sales age (MLSA) laws for cigarettes | .018 (.132) |

.069 (.253) |

.049 (.217) |

.048 (.214) |

| Minimum legal sales age (MLSA) laws for e-cigarettes | .018 (.132) |

.069 (.253) |

.049 (.217) |

.048 (.214) |

| # of obs | 339 | 1,164 | 305 | 251 |

| Control Variables | SLT prices at 25% | SLT prices at 50% | SLT prices at 75% | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Chewing Tobacco (n=339) | |||||||||

| Standardized SLT excise tax | -2.519 (0.880) |

-15.981 (0.318) |

-.555 (0.924) |

-6.043 (0.336) |

-10.535 (0.250) |

-11.210 (0.280) |

|||

| SLT tax × EC uptake | -.795 (0.365) |

-.381 (0.296) |

-.585 (0.140) |

||||||

| SLT tax × EC evolution | -1.828 (0.182) |

-.680 (0.323) |

.533 (0.452) |

||||||

| Pass-through rates | |||||||||

| 2006-2011 | -- |

-15.981 (0.318) |

-- |

-6.043 (0.336) |

-- |

-11.210 (0.280) |

|||

| 2012-2016 | -- |

-16.776 (0.282) |

-- |

-6.424 (0.289) |

-- |

-11.794 (0.230) |

|||

| 2017 and later | -- |

-18.604 (0.205) |

-- |

-7.103 (0.242) |

-- |

-11.262 (0.270) |

|||

| Moist Snuff (n=1,164) | |||||||||

| Standardized SLT excise tax | 1.014*** (<0.001) |

.882*** (<0.001) |

1.011*** (<0.001) |

.920*** (<0.001) |

1.247*** (<0.001) |

1.041*** (<0.001) |

|||

| SLT tax × EC uptake | .155 (0.236) |

.071 (0.528) |

.131* (0.017) |

||||||

| SLT tax × EC evolution | -.005 (0.952) |

.044 (0.466) |

.138* (0.043) |

||||||

| Pass-through rates | |||||||||

| 2006-2011 | -- |

.882*** (<0.001) |

-- |

.920*** (<0.001) |

-- |

1.041*** (<0.001) |

|||

| 2012-2016 | -- |

1.037*** (<0.001) |

-- |

.991*** (<0.001) |

-- |

1.172*** (<0.001) |

|||

| 2017 and later | -- |

1.032*** (<0.001) |

-- |

1.035*** (<0.001) |

-- |

1.310*** (<0.001) |

|||

| Dry Snuff (n=305) | |||||||||

| Standardized SLT excise tax | .829 (0.240) |

1.314* (0.029) |

2.664 (0.113) |

1.762* (0.049) |

2.818 (0.075) |

1.844* (0.018) |

|||

| SLT tax × EC uptake | -.037 (0.946) |

-.160 (0.807) |

-.011 (.484) |

||||||

| SLT tax × EC evolution | .303 (0.538) |

-.393 (0.605) |

-.545 (.619) |

||||||

| Pass-through rates | |||||||||

| 2006-2011 | -- |

1.314* (0.029) |

-- |

1.762* (0.049) |

-- |

1.844* (0.018) |

|||

| 2012-2016 | -- |

1.276 (0.091) |

-- |

1.603 (0.159) |

-- |

1.833* (0.030) |

|||

| 2017 and later | -- |

1.580** (0.002) |

-- |

1.210 (0.114) |

-- |

1.287* (0.034) |

|||

| Snus (n=251) | |||||||||

| Standardized SLT excise tax | 4.341*** (<0.001) |

4.131*** (<0.001) |

4.478** (0.001) |

3.495*** (<0.001) |

2.130*** (<0.001) |

2.301*** (<0.001) |

|||

| SLT tax × EC uptake | .186 (0.200) |

.795* (0.044) |

-.140 (0.370) |

||||||

| SLT tax × EC evolution | .135 (0.390) |

.152 (0.404) |

-.034 (0.610) |

||||||

| Pass-through rates | |||||||||

| 2006-2011 | -- |

4.131*** (<0.001) |

-- |

3.495*** (<0.001) |

-- |

2.301*** (<0.001) |

|||

| 2012-2016 | -- |

4.318*** (<0.001) |

-- |

4.289*** (<0.001) |

-- |

2.161*** (<0.001) |

|||

| 2017 and later | -- |

4.453*** (<0.001) |

-- |

4.441*** (<0.001) |

-- |

2.127*** (<0.001) |

|||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).