Chapter 1

Introduction

1.1. Background

Within the contemporary banking industry, technological advancements have shifted from being discretionary to becoming financial service providers. They are increasingly essential for managing an intensely competitive marketplace and reaching ever-changing client expectations. (De Oliveira Santini, 2018; Eren, 2021; Hua et al., 2019; Rajaobelina and Ricard, 2021; Valsamidis et al., 2020; Yang, 2009). Artificial intelligence (AI) has played a crucial role in pushing several technical innovations in the modern financial industry. These advancements have led to significant changes in financial institutions, including the introduction of automated teller machines and Internet banking. In addition, AI has transformed banking operations by using advanced technologies such as image manipulation, recognition of speech, and bots for communication purposes. In addition, AI has facilitated the emergence of innovative methods such as AI investment advisors. This technology primarily focuses on the analysis and development of theories, methodologies, and technologies that are utilised to simulate, enhance, and broaden the intelligence of humans. This machine’s essence lies in examining and exploring scientific principles, techniques, and methodologies for replicating human behaviour or enhancing human capabilities through the utilisation of numerous automated devices and computers.

According to McKinsey, AI technologies have the potential to significantly enhance the value of the worldwide banking sector, reaching up to $1 trillion annually (Biswas & Carson, 2020). It operates in a manner akin to the functioning of the human brain, and its technologies enable a higher level of personalisation in services for customers as well as staff members, resulting in an immense increase in income. Automating internal procedures enhances efficiency and reduces overall expenses. The expected growth is derived from an analysis of AI’s capacity to efficiently process and analyse vast quantities of data, providing valuable observations that were previously inaccessible. As AI continues to permeate our everyday existence, its integration into the banking industry becomes increasingly crucial for banks to remain current and competitive. According to McKinsey’s projections, the implementation of AI solutions has the potential to significantly enhance the value of the world’s banking sector, reaching an impressive $1 trillion annually (Biswas & Carson, 2020).

Arguably, AI is increasingly being adopted in the banking industry, with its presence becoming more prevalent in the present-day financial market, including the banking sector. The banking industry has embraced the use of AI in a highly innovative manner, resulting in significant time and cost savings, as well as improved fraud detection. However, one issue with the current banking system is the high cost and error rate associated with making decisions based on large amounts of data. Approximately 20-30% of decisions turn out to be incorrect due to incorrect data regarding the organisation’s plan. Given that the AI system uses up-to-date technology, it is hypothesised that the implementation and/or improvement of AI in the banking sector, with its ability to use machine learning algorithms that mimic human intelligence, will address these concerns, efficiently monitoring all relevant stakeholder data to generate comprehensive reports.

1.2. Research Objectives

The aim of this research is to analyse the impact of artificial intelligence (AI) on today’s financial organisation, specifically in the realm of the banking sector. The study will investigate how the integration of AI has facilitated the transformation of the banking system by revolutionising the way financial information is collected and handled. By examining the potential opportunities and risks associated with implementing artificial intelligence in the banking sectors, particularly issues related to high cost and error rates associated with making decisions based on large amounts of data in the banking system and how they focus on enhancing the efficiency of service delivery and performance which has led to increasing in profitability for financial institutions. The specific objectives of the research are to:

Demonstrate how financial institutions are utilising extensive machine learning models to streamline operations, minimise expenses (in terms of reducing high cost ), enhance the banking experience(reduction of error rate.), and optimise profitability.

Investigate the benefits and disadvantages of AI in the banking industry, particularly when it is employed to address issues related to high cost and error rates, such as its effects on banking industry workers and the steps done to lessen that impact.

1.3. Research Questions

Given the aims of this study, In this research paper, I will investigate these questions:

- I.

How does the banking sector utilize artificial intelligence (AI) tools to optimize operations, enhance customer banking experiences, and maximize financial performance?

The financial sector uses the implementation of AI to optimize its operations and increase efficiency and effectiveness. All these are accomplished by streamlining operations, such as using fraud detection and risk management machines, which will improve the customer experience because the sector is employing the integration of the machine to extensive information, which will help them to facilitate patterns of fraud within or outside the sector. This will help them reduce the financial losses they may encounter in the sector. For example, loans in banking have been optimized due to the implementation of predictive analysis techniques, which include credit scoring tools. Furthermore, chatbots have also played a crucial role in the enhancement of customers’ experience by providing instant support and 24/7 personalised recommendations. Overall, the integration of all these has helped reduce expenses and also improve decision-making.

- I.

What are the potential advantages and drawbacks of implementing AI in the banking sector to overcome challenges associated with high expenses and error rates?

Implementing artificial intelligence into the banking industry offers numerous advantages, including cost savings, improved customer service, and increased efficiency. Moreover, these technologies enable accelerated transactions for both the bank and the customer. However, AI also has disadvantages, including the significant costs involved in implementing it and the resistance shown by the workforce concerned about losing their jobs in the replacement of the machine.

Chapter 2

Literature Review

2.1. Overview of the Impact of Banking and AI

The banking sector is an essential sector of the modern economy, serving as the backbone of economic activities by overseeing the handling of funds, investment, and different kinds of financial transactions. Financial institutions play a crucial role in encouraging individuals to save and invest their money, ultimately leading to a more secure financial future (North, 2022). These institutions are increasing their financial support for emerging businesses because they must meticulously document all of their monetary transactions, a task that is primarily accomplished through the use of advanced technology such as artificial intelligence. Various methods, including ATMs, emails, telephone banking, internet banking, and mobile banking, are employed by banks to carry out their operations. The smooth functioning of banking operations via computers and networks is enabled because of the exclusive implementation of artificial intelligence by banks. In addition, various advancements in means of communication, customer service, hiring, and handling assets are currently being implemented throughout the banking industry. At present, the field of stock investment and finance is predominantly focused on technical knowledge and fortunate occurrences. In the future, improvements in sentiment measurement, crowd-sourced information, and analytics will allow for a revolutionary transformation in the way we manage finances.

2.2. Evolution of AI in the Banking Sector

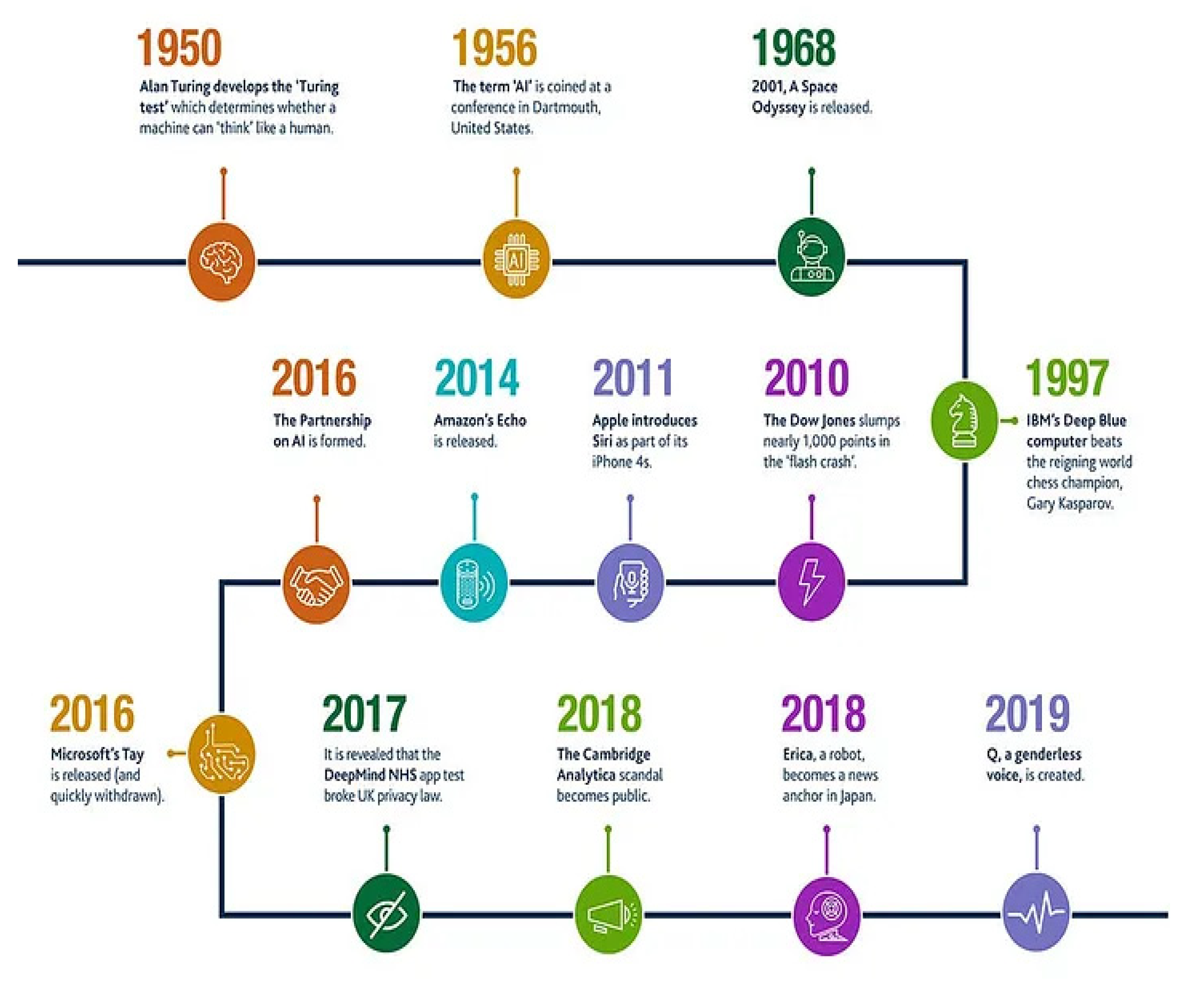

Although the application of AI is a recent development in the banking sector, its history can be traced back to the 1950s. During this time, Alan Turing published a groundbreaking paper, “Computing Machinery and Intelligence”. The term Artificial Intelligence was coined, but practical applications and methods didn’t emerge till the end of the 1990s. The term artificial intelligence (AI) was initially coined in 1956 by John McCarthy (McCarthy et al., 1956). It pertains to systems that exhibit human-like behaviour and rational thinking (Kok et al., 2009). The advancement of Artificial Intelligence gained significant momentum after 2011, following the involvement of major tech giants such as Facebook. Despite Turing’s comprehensive exploration of machines and their intelligence testing in his seminal paper entitled “Computing Machinery and Intelligence” in 1950, his research did not progress further.In 1956, some scholars affiliated with Dartmouth College in the United States, led by John McCarthy and Marvin Minsky, formally characterised AI as the systematic application of technological and mathematical principles to create intelligence robots. McCarthy and Minsky are generally recognised as the main designers of AI. In the late 1990s, there was a significant incorporation of artificial intelligence (AI) into the finance industry. The computers were mainly employed for conducting trading and evaluating financial data, taking advantage of their ability to process large amounts of information and identify trends that would not be easily noticeable to some analysts. The team of professionals was researching methods to facilitate computers in independently acquiring knowledge of languages in order to generate ideas and discover answers to various issues.The advancement of AI has resulted in specific limitations, primarily in the fields of risk assessment and financial forecasting.

In the 1980s and 1990s, researchers made significant progress in the domain of artificial intelligence techniques and neural systems. The introduction of these technical developments has brought better data analysis techniques and forecasting capabilities, leading to the greater integration of AI in the banking sector. The advancement of AI has resulted in specific limitations, primarily in the fields of risk assessment and financial forecasting. In the early 2000s, there was a significant advancement in the field of finance and artificial intelligence.The year signifies the earliest integration of AI into the banking sector . During this period, the banking industry began using artificial intelligence (AI) into its operations to optimize efficiency and carry out specific tasks such as fraud detection and risk management. In 2005, the sector witnessed a significant transformation during the WEB 2 era. This transformation has facilitated the increase of data and enhanced the accessibility of knowledge that subsequently prompted further research on artificial intelligence with the extensive capabilities (Larson, 2021). Advancements in technology have recently enabled the integration of artificial intelligence into the field of banking. This involves incorporating analytics into software to improve managerial operations (Tarafdar et al., 2019).

The intriguing report revolves around Wells Fargo, an American financial institution that implemented an AI-powered risk control device in 2006. Its goal was to track and analyse transactions for any indications of potentially illicit behaviour.It incident marked the beginning of a systematic and comprehensive integration of AI in the field of financial services. The exploration of AI in the banking sector started with the primary objective of training and empowering machines to engage in advanced cognitive processes and problem-solving such as:

AI systems identify objects, people, and languages to enable them to interact with the real world in a manner similar to humans.

AI systems are capable of processing natural language, enabling them to understand and interpret conversations. Furthermore, these systems are equipped to perceive the world in a manner similar to humans, utilising their five senses.

Figure 1.

Brief History of Artificial Intelligence.

Figure 1.

Brief History of Artificial Intelligence.

Note: The image above shows when, how, and who started the use of AI and its transition from early age to the contemporary world.

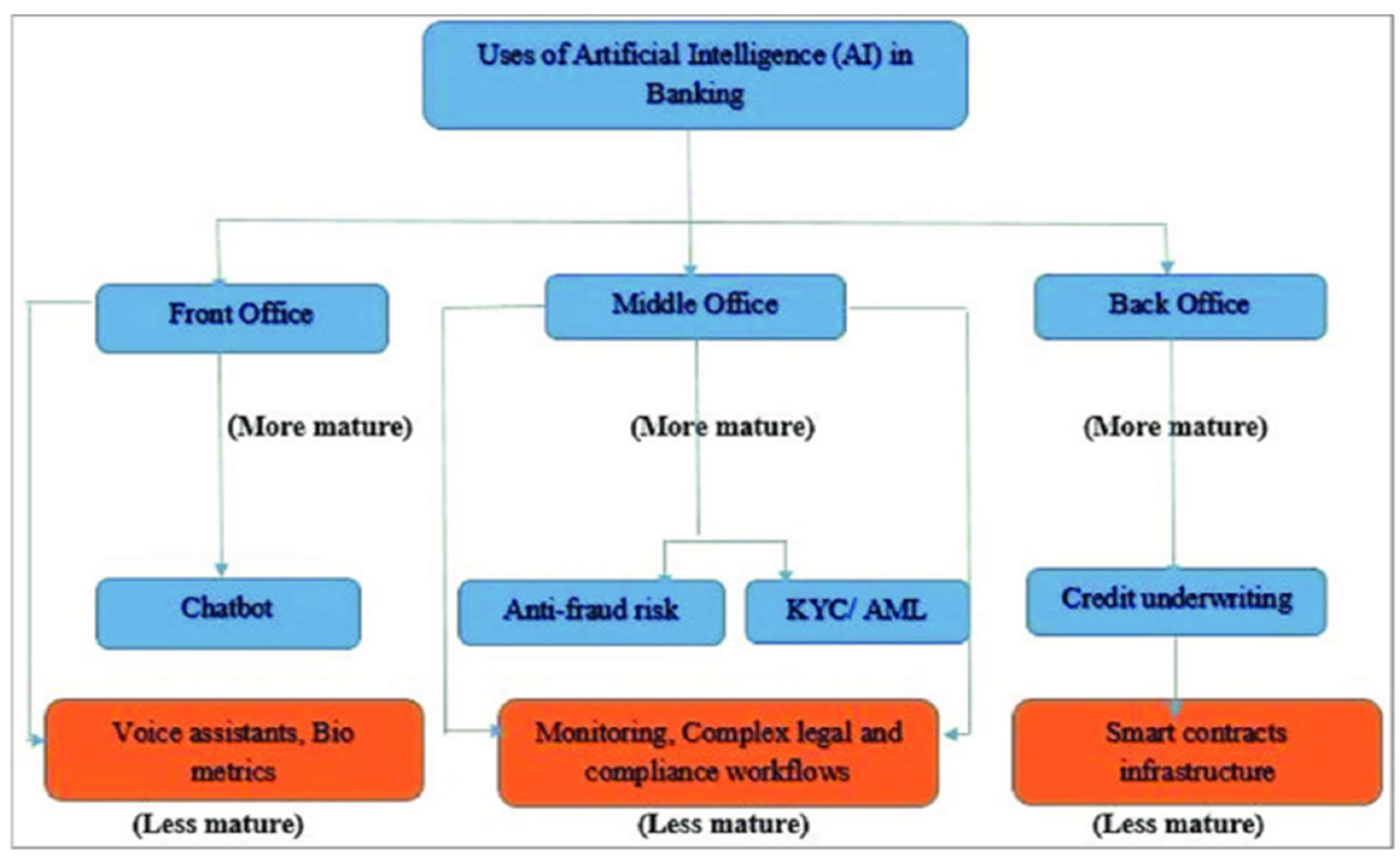

Uses and fundamental level of AI in the Banking Sector

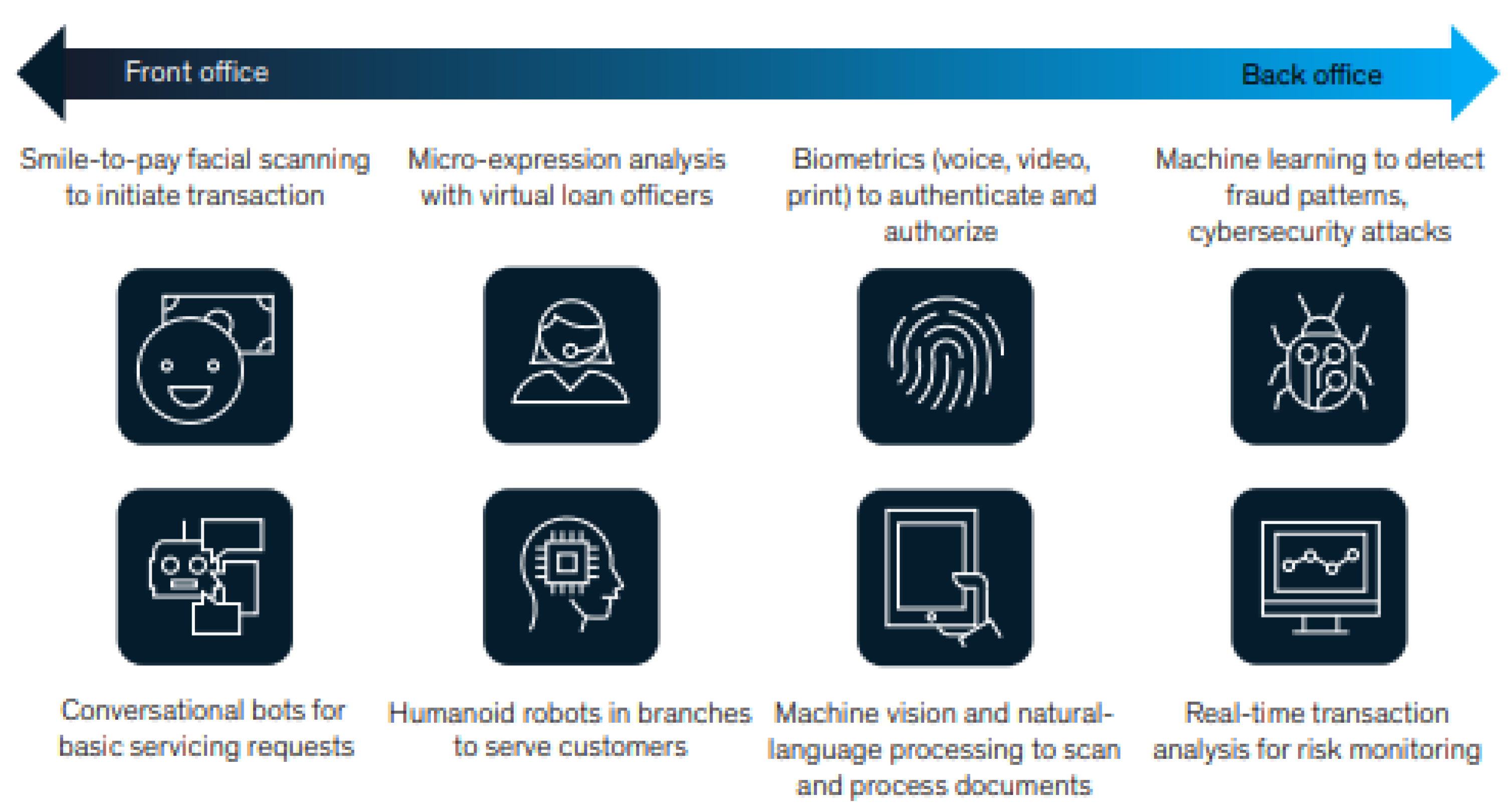

AI is demonstrating a huge impact on the banking sector, impacting the working of organisations at three fundamental levels:

Front office: Customer use interface; customised understandings; the authentication process and Identification of clients via fingerprinting; and financial administration.

Middle office: Payment fraud detection and handling of risks, (KYC) and prevention of money laundering (AML), and credit assessment support and decisions regarding loans are all important areas of the Middle office

Back office: Analysing company and planning perspectives; streamlining backend processes; and ensuring adherence to compliance with regulations.

Figure 2.

The Future Of Artificial Intelligence In Banking: Reshaping The Customer Experience.

Figure 2.

The Future Of Artificial Intelligence In Banking: Reshaping The Customer Experience.

Figure 3.

Note: The table above shows How AI and Bots are Disrupting the Banking Industry in the different levels of banking sectors such as the front office distribution, middle office, bank office manufacturing. And it shows the AI which is being used in each level such as the b chatbot being used in the front office. By Autonomous Next, 2019.

Figure 3.

Note: The table above shows How AI and Bots are Disrupting the Banking Industry in the different levels of banking sectors such as the front office distribution, middle office, bank office manufacturing. And it shows the AI which is being used in each level such as the b chatbot being used in the front office. By Autonomous Next, 2019.

Example of AI in the banking sector

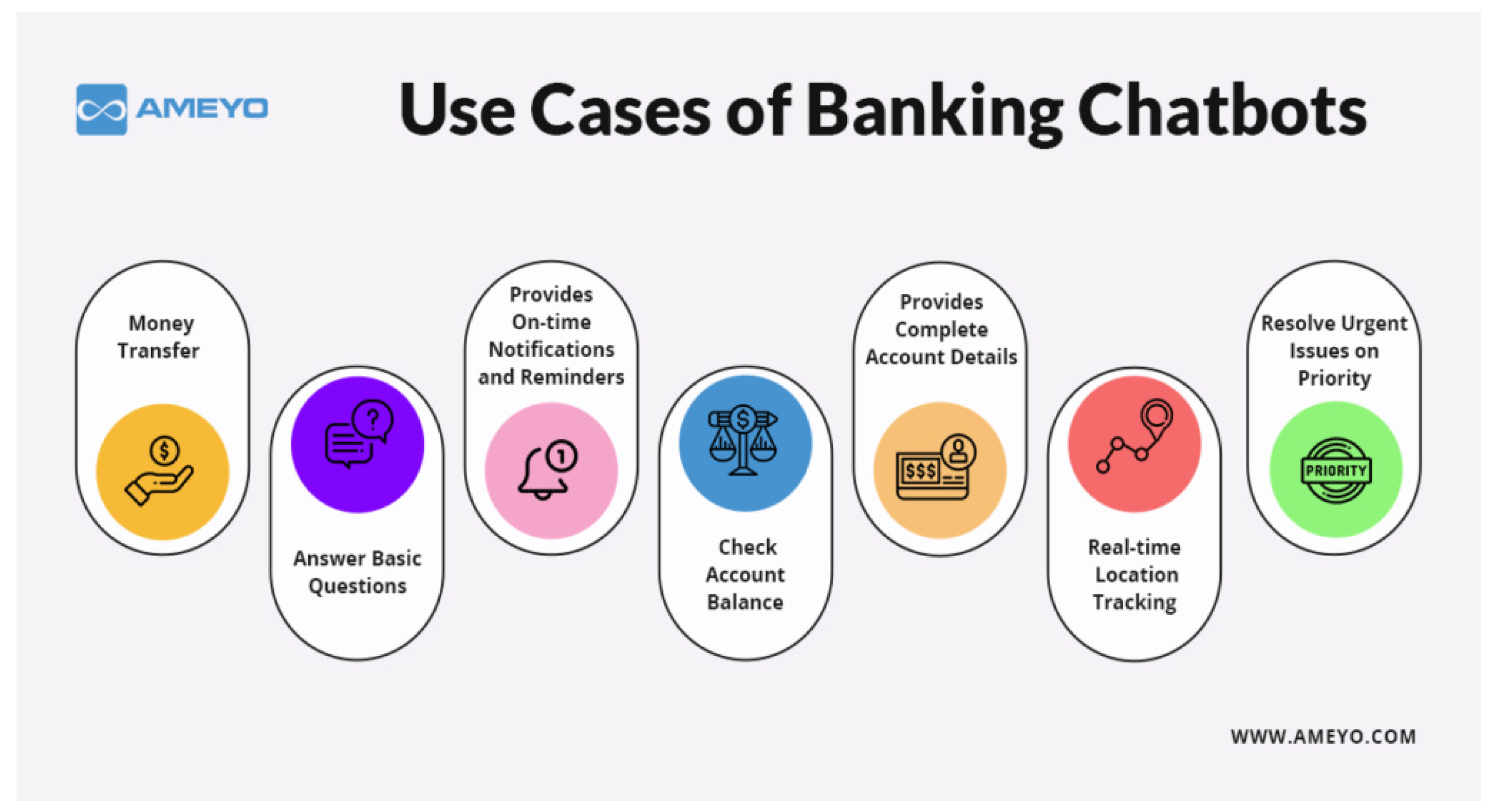

Chatbot: Chatbot technology is a unique and cutting-edge form of artificial intelligence (AI) software. Which utilises preprogrammed questions to efficiently communicate with customers, ensuring respectful conversation and prompt issue resolution (Int.J. Emerg. Mark, 2022). As per Dr. N. Kesavan’s findings, chatbot is a technological advanced machine used by the banking sector and serves a dual purpose. It not only provides clients with automated responses to their queries, eliminating the need for human intervention, but it also collects valuable data on customer inquiries. This data can be leveraged to address unexpected challenges in the future, making it a valuable digital personal assistant that facilitates seamless interaction between individuals and computers.

Example:

Figure 4.

Use cases of Banking Chatbots.

Figure 4.

Use cases of Banking Chatbots.

Note: the table above shows the advantages and the opportunities of integrating AI in the banking sector such as provision of on time notifications, provision of complete account details , real time location tracking. (Chatbot for Banking – Everything You Need to Know, 2022).

- II.

Robo-Advisors- this is an online platform that utilise machine learning to provide financial guidance, return on cash dividends, automatically create portfolios, and rebalance portfolios, among other features. This process can be completed with little to no human involvement.

- III.

Hedge fund trading and management- can now be done on the go with the assistance of AI-powered mobile app solutions in the banking sector. These AI tools can gather real-time data from various stock markets globally and analyse different market trends, enabling customers to make prompt decisions.

2.3. Opportunities and Effects of AI in the Banking Sector

According to Kunwar’s analysis(2019), research on AI focuses on examining its influence on the modern world, namely within the financial sector. Examining the realistic consequences of AI, the obstacles it poses, the benefits it provides, and its influence on employment and functionality. Extensive study has revealed that several financial companies have gained major benefits by incorporating various artificial intelligence applications. The study proposes that the implementation of artificial intelligence (AI) into the banking industry would have a progressively impact on many parts of the banking sector such as increasing the value chain, management, analysis, and financing processes (Kunwar, 2019). Research demonstrates how fraudsters are using various platforms to push criminal activities in response to technological advancement Soni’s (2021).The banking sectors are exploring the potential of artificial intelligence to address the challenges posed by cybercrime and cyber risks. The utilisation of AI in the banking sector can bring forth a multitude of advantages, such as heightened prosperity and expansion.

Artificial intelligence tools offer valuable insights into a customer’s behaviour and interests. They play a crucial role in the prevention and identification of e-crime, specifically fraud. On the contrary, the implementation and maintenance of artificial intelligence necessitate a significant level of attention. Based on the comprehensive analysis of AI, ML, and deep learning (DL) taxonomy, along with their diverse applications in the field of finance, reveals four significant ways in which AI is transforming the finance sector(Banks). These include the utilisation of AI for identifying fraudulent transactions to safeguard the sector from criminal activities, the implementation of banking chatbots, the integration of trading algorithms, and the exploration of regulatory and policy implications (Bonnie G. Buchanan, 2019). Kumar and Gupta (2023) explore the effects of AI on customer interactions within the Indian banking sector. Their analysis highlights the pros and cons of implementing artificial intelligence technologies, emphasising that even if the technology can greatly improve service quality and customer happiness, it also presents obstacles to the traditional patterns of interactions with clients. The research indicates that a well-rounded approach is necessary for the effective implementation of artificial intelligence in banking services. This approach should take into account technological advancements while also prioritising the maintenance of good interaction with clients. In addition, client retention levels increase as they receive improved service, experience shorter response times, and have greater access to services, all at a potentially cheaper price.

Furthermore, considering the potential cost savings achieved through the automation of tasks, it becomes feasible to extend certain services, such as monetary counseling, to a broader range of users, rather than limiting them to a select group of customers. This feature provides a significant benefit to users of AI applications. It allows financial institutions to enhance their services and provide exceptional experiences to their customers. Extensive research has been conducted in both the educational and industrial sectors, with a particular emphasis on exploring technological advancement in banking and the management of risks. Enhanced precision in identifying card fraud and providing financial assistance to specific customers who may not have had access. According to Leo, 2019, the significance of managing risk in banks has increased since the start of the financial crisis, with a persistent emphasis on the detection, quantification, reporting, and control of risks.

2.4. Measures Used to Address the Negative Impact of AI in the Banking Sector

Integrating AI into the banking sector offers promising prospects for financial institutions; it also brings forth different kinds of challenges that require thoughtful handling. To overcome those problems effectively, it is crucial to adopt a well-rounded and thoughtful perspective that takes into account the ethical, operational, and societal consequences. By successfully tackling these limitations, banks can leverage the potential of AI to transform their operations and customer service, creating a future where technology complements and enhances the human aspects of banking. Shalet and Thangam (2023) emphasise the importance of improving comprehension and building confidence in AI among bank employees. They suggested that by implementing detailed educational and training programs, the workforce’s perception of AI could improve. This will make it easier to transition concerning banking activities that rely significantly on the implementation of artificial intelligence. Tad et al. (2023) and Kumar and Gupta (2023) highlight the profound influence of AI in the banking industry while also recognising the potential challenges it poses for staff interactions and customer relationships. These studies emphasise the measures employed to mitigate the adverse effects of AI on the workforce in the banking sector, including the significance of strategic planning, Job Redesign, employee training, and ethical utilisation of AI. It also aims to ensure that the implementation of AI benefits both the banking sector and its employees.

2.5. Research Gap

In the contemporary world, the financial sector has various issues in the modern world that are hampering its operations. One of the issues is the high cost and error rate associated with making decisions based on large amounts of data in the sector. Approximately 20-30% of decisions which are made in the sector are erroneous pertaining to the organisation’s plan. The introduction of AI into the industry will respond intelligently to the issues by effectively tracking all the data from stakeholders to provide an overall decent report. By making use of the latest information successfully to advise clients to make decisions on time and follow the proper procedure. This system will also take care of revenue generated in the sector through its efficient management of several transactions taking place within the banking industry.

Chapter 3

Methodology

The research study used a qualitative method for its analysis by examining the integration of AI in the financial sector. Which elucidates the perceived benefits, and limitations. The published reports were obtained from six renowned financial institutions and financial authorities in different countries, such as the UK’s Bank of England, ICICI bank of India, South Africa, Japan, and the Hong Kong monetary authority. The content-analysis approach made it certain that the data collected were all suitable, and offered deep insight into the research subject. Target banks considered in this research were selected based on the full extensive use of artificial intelligence technologies and the delivery of full reports on the subject. It gave insight into AI’s different applications, such as automating customer service, fraud detection, risk management, and personalized banking. The reports also provide insights into the limitations observed in this area: be it ethical concerns, issues of information confidentiality, or even job loss. The data collection process involved conducting a comprehensive thematic analysis of the reports, focusing on identifying common trends that relate to the various pros and cons associated with the adoption of AI in the banking sector. Thematic analysis was used in identifying, analyzing, and reporting patterns within data.I conducted a thorough analysis of the information, categorising it according to established themes that focused on the advantages and drawbacks of AI. The themes were further analysed and organised according to their frequency and importance in the annual report from each of the five banks. ICICI bank in India shows in their research that incorporating AI into their banks has really benefited them in terms of online banking,with the use of chatbots, which are available around-the-clock during the pandemic, they have been able to retain customers both during and after the outbreak. Additionally, the Bank of England noted that the machine’s implementation in their banking division assisted in the detection of fraud, inaccuracy, and the creation of credit scores for loan applications. Considering that the data was obtained from publicly accessible reports, ethical concerns were kept to a minimum. Nevertheless, great care was taken to faithfully present the findings and ensure that the explanations were firmly based on the information presented in the original reports.

Chapter 4

Data Analysis and Findings

4.1. Advantages of AI in Banking

4.1.1. Customer Experience

The level of customer satisfaction and experience directly impacts the implementation and application of digital financial services in banks. Customer preferences have undergone significant shifts over time, with a growing demand for timely responses and personalised content. (Kuala Lumpur, Malaysia, 2022) Artificial intelligence (AI) technology, along with machine learning, utilises a specific algorithm to analyse and predict customer behaviour and credit scores. This allows banks to create customized programmes for their clients. Artificial intelligence has the potential to transform the banking industry by enabling banks to streamline their operations and better meet the needs of their customers. Based on a study conducted on a representative sample of 360 banking customers in China, it was discovered that the perception of intelligence and human-like characteristics significantly impact the level of social assistance provided by consumers. This study provides valuable insights into the impact of AI on consumer satisfaction levels, as highlighted by Dr. D.Paul Dhinakaran in 2020. Example of AI being used for customer experience is Chatbot technology which is a unique and cutting-edge form of artificial intelligence (AI) software. Which utilises preprogrammed questions to efficiently communicate with customers, ensuring respectful conversation and prompt issue resolution (Int.J. Emerg. Mark, 2022). As per Dr. N. Kesavan’s findings, chatbot is a technological advanced machine used by the banking sector and serves a dual purpose. It not only provides clients with automated responses to their queries, eliminating the need for human intervention, but it also collects valuable data on customer inquiries. This data can be leveraged to address unexpected challenges in the future, making it a valuable digital personal assistant that facilitates seamless

4.1.2. Detection of Frauds

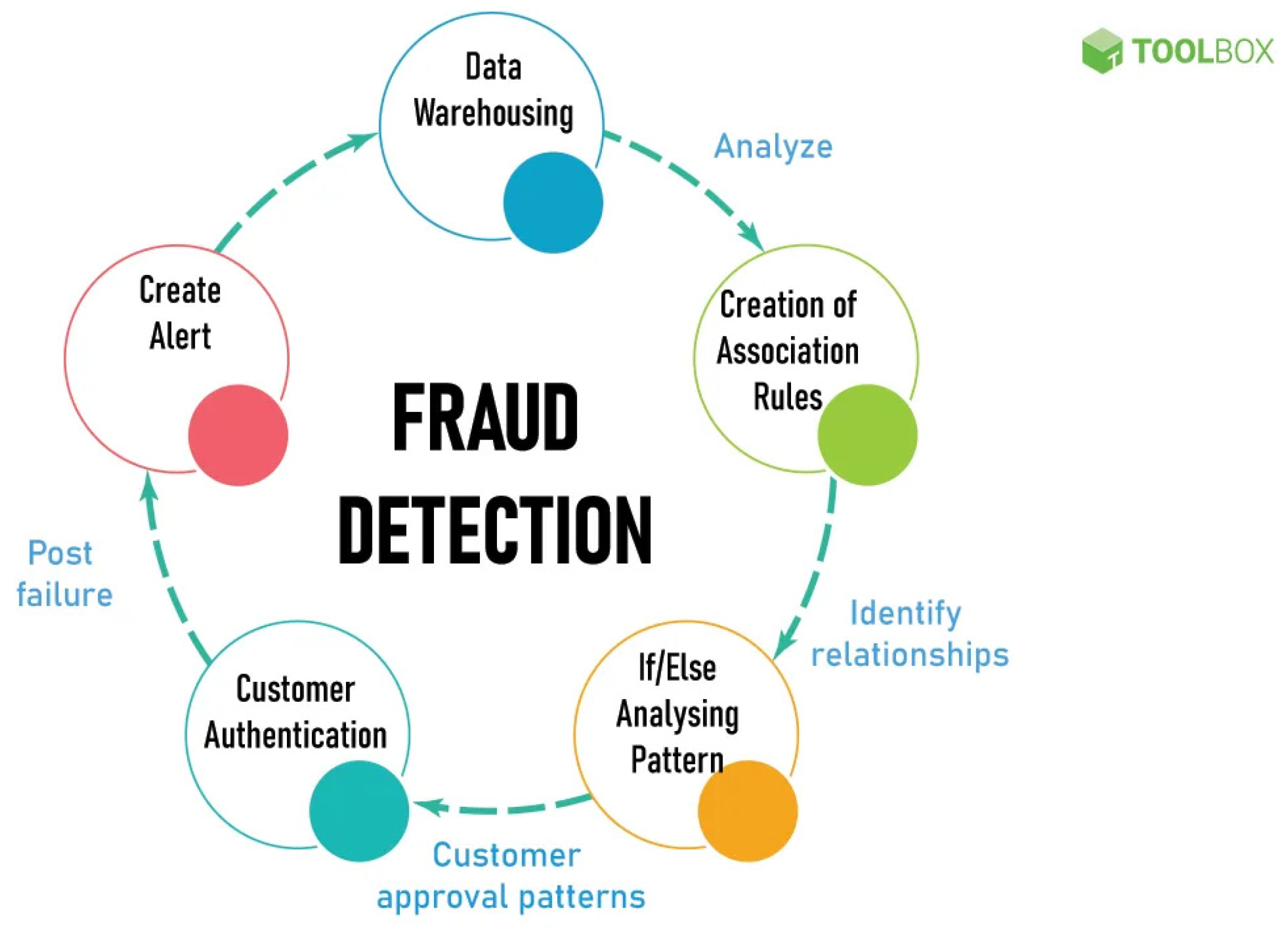

Financial sectors are prone to higher levels of risk(fraud) due to the substantial number of corporate monetary transactions and the intricate complexity of their job responsibilities. As previously mentioned, AI utilises complex algorithms and mathematical computations to analyse the behaviour of customers and employees through unsupervised learning programmes (Dr. M. Surekha, Dr. M. Rajarajan). As a result, the application of AI technology could potentially streamline fraud early detection activities (Kuala Lumpur, Malaysia, 2022). Artificial intelligence in the banking industry primarily focuses on utilising artificial intelligence programming methods to automate tasks previously carried out by humans. The objective is to safeguard banking operations and mitigate potential risks. Example is predictive analytics.

Figure 5.

Uses of fraud detection tools.

Figure 5.

Uses of fraud detection tools.

Note: The implementation of the fraud detection tool has been a great incentive in the banking industry because through its integration, there has been a huge decline in scamming, fraud in banking since it helps to create alert, ask for customer authentication. sector (Smith, 2024).

4.1.3. To Increase The Efficiency In The Banking Sector

In order to enhance the level of performance and efficiency within the banking sector, Integrating artificial intelligence into credit risk assessment presents numerous benefits for the banking industry, significantly enhancing both efficiency and accuracy. Machine learning plays a crucial role in automating different tasks involved in the credit assessment process, including data analysis, scoring, and initial filtering of applications. This greatly decreases the amount of time it takes to process information, enabling loan officers to concentrate on intricate cases that necessitate human involvement.With the involvement of well-advanced algorithms and data analysis,which have made it easier for the banking sector when assessing a borrower’s financial standing. In the end, that will put the banks in a better position to make informed decisions when approving loans and have an effective measure of minimizing the potential default risk (Ewuga et al., 2024).

4.1.4. AI in Credit Scoring and Risk Management

Exploring the role of AI in credit scoring and risk management has created a significant change within the banking sector on how to manage risk and assess credit by using artificially empowered advanced analytics, predictive calculations, and the use of alternative data sources that can help evaluate financial standing, predict the likelihood of default, and reduce risks against lending. There are several advantages of AI-moduled models for credit scoring over the traditional methods used for scoring. These advantages include enhanced precision, flexibility, and inclusiveness. As a result, banks can broaden the availability of credit, streamline lending procedures, and optimise return calculations based on risk. Example is FICO score XD ,Upstart.

4.2. Disadvantage of AI in Banking Sector

Every industry has its own advantages and disadvantages, and the banking sector is no exception. The Banking sector faces problems with the integration of cutting-edge technologies like AI. There are several significant concerns related to the implementation of AI in the banking industry. These include potential job displacement, the absence of human judgment, risks to security and confidentiality of data, limited transparency and accountability, technical difficulties and dependability, costs and availability issues.

4.2.1. Major Obstacles in Incorporating AI into Current Systems

A major obstacle in incorporating AI into current systems is ensuring connectivity with outdated past technologies. Several financial sector systems currently in use were not originally designed to incorporate AI, which can result in possible problems related to data compatibility and communication between systems. The issue is in the compatibility of artificial intelligence (AI) technologies with old software and hardware infrastructures of traditional banks, which were not originally built to handle the intricacies of present-day AI algorithms.Integrating AI into such structures can be a complex and expensive process, leading to substantial costs and time delays as businesses work to update or replace their current IT infrastructure to incorporate artificial intelligence (AI) capabilities.

4.2.2. Lack of Skilled Developers

One of the key obstacles is the requirement for highly trained individuals capable of effectively handling and analysing data generated by AI systems. In order to successfully implement AI in the banking sector, it is crucial to have an employee that possesses not only a strong foundation in traditional accounting practices, but also a high level of proficiency in information analytics as well as artificial intelligence technologies. Significant investment in training and development is often a challenge for many organisations. Ensuring data privacy and security becomes a significant consideration when incorporating AI into financial systems .Research indicates that the implementation of AI into the banking sector encompasses more than just technical hurdles. It also requires tackling concerns surrounding workflow integration, divisions of labour, understanding, and the necessary related to technology settings and structures.

4.2.3. Cost of Implementation

The financial burden of integrating AI into the banking sector can pose a significant obstacle for certain organisations, particularly those operating on a smaller scale. The financial commitment required for AI technology, including the initial investment and the continuous expenses for servicing, developments, and training, can be quite significant. The adoption of AI in the accounting sector can be hindered by this financial obstacle.

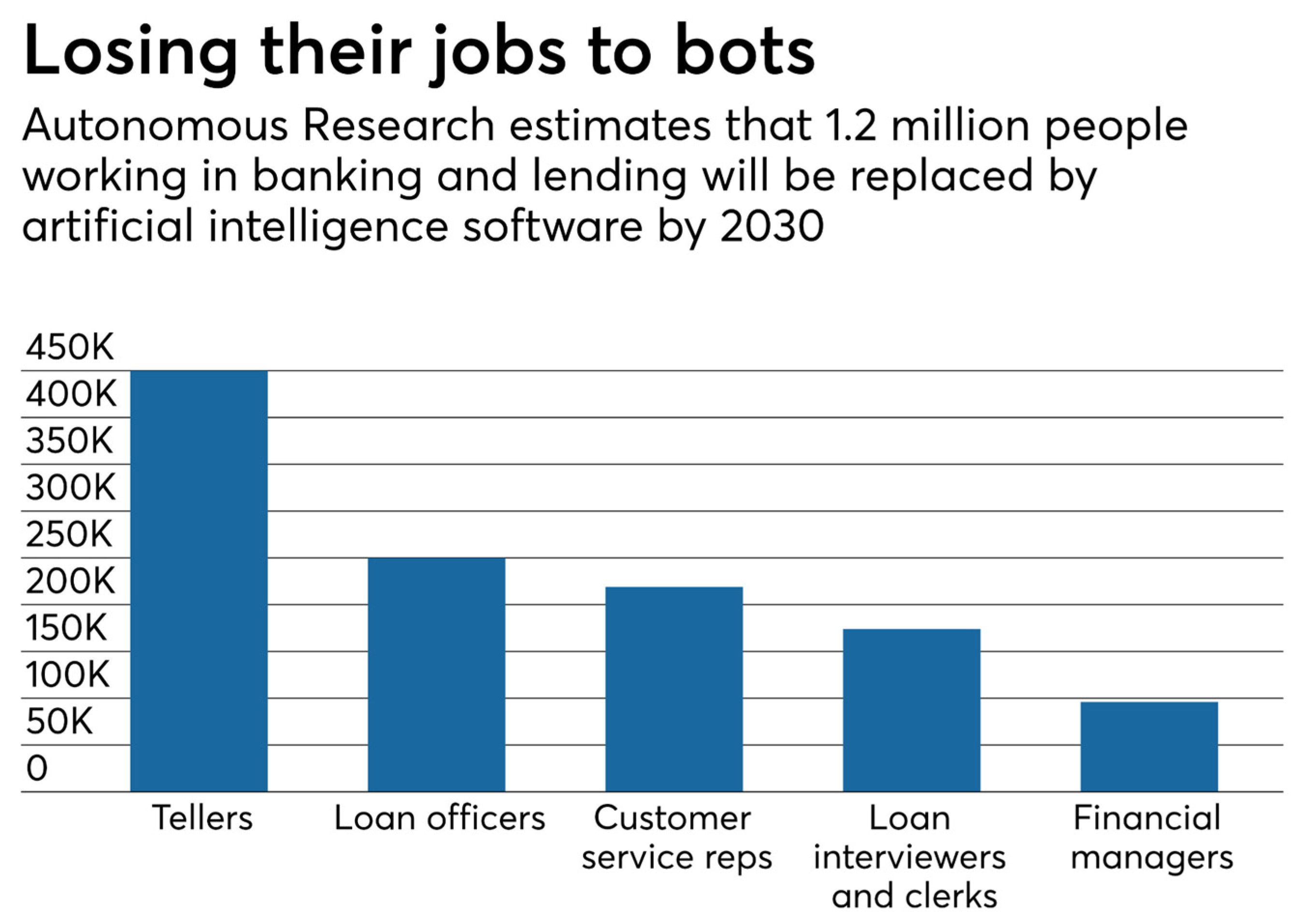

4.2.4. Resistance of Employees to Accept the New Technology

Sectors often encounter resistance to change when they attempt to integrate AI into their banking systems. Some employees might show hesitancy towards embracing new technologies such as AI , possibly stemming from concerns about potential job displacement or a limited comprehension of how AI can enhance their current responsibilities. Artificial intelligence has the potential to replace various roles within the banking industry, including tellers, customer service executives, financing officers, regulatory officials, and finance executives. To address this resistance, it is crucial to implement change management techniques that are effective and to communicate the advantages of AI in a clear and concise manner.

Example

Figure 6.

How Artificial Intelligence is reshaping jobs in banking.

Figure 6.

How Artificial Intelligence is reshaping jobs in banking.

Note: The graph above shows how numerous workers are losing their jobs due to the integration of AI in the various sectors . and according to the statistics, it shows that 1.2 million people working in the banking sector and lending will be replaced by AI in the coming years(2030).Crosman, P. (2018, May 15) : Crosman, P. (2018). How Artificial Intelligence is reshaping jobs in banking. American Banker

4.3. Measures to Take to Avoid Negative Impact AI on the Workforce

Investing in the training and development of employees can help the banking sector empower their staff with the necessary skills to work with AI systems. This will enable individuals to remain up-to-date and advantageous in the ever-evolving workforce. Rather than totally substituting employees with artificial intelligence (AI), through the skilling and re-skilling there will be a mutually beneficial interaction between human and AI systems and by combining the strengths of both, desired outcomes can be achieved.

Job Redesign: Banking institutions have the potential to maximise job roles and take advantage of the emerging opportunities presented by AI. For instance, individuals who were previously assigned monotonous duties can now be entrusted with new positions that make use of their expertise and abilities.

Ethical Considerations: Banks and financial institutions should assess the ethical concerns with a lot of caution,which arise with the implementation of AI in the workforce such as loss of jobs through potential redundancies, salary inequality, and protection of the rights of the employees. Efforts can be made to make sure that AI will influence employment in a positive and fair way.

4.4. Finding

The impact of AI in the banking industry is manifested in different ways. Improvement in managerial effectiveness that has led to cost reduction and effective resource allocation, improved customer experience, leading to increased sources of revenue and customer retention. Moreover, the technological advancement of AI has greatly developed risk management,resulting in a significant handling of losses through fraudulent activities. Automation of tasks in managerial procedures, such as imputation of data and tracking of documents performed by AI-driven automation, has increased the performance by a substantial amount. And study revealed that this has resulted in the elimination of human errors, thus saving 30% of operational costs in all the institutions.The advent of AI-powered chatbots and virtual assistants has revolutionised customer interactions. Chatbots possess the capability to promptly respond to consumer inquiries, while personalised product recommendations provided by artificial intelligence systems have resulted in a significant 25% increase in both cross-selling and upselling. AI algorithms have enhanced the capacity to detect fraudulent activities and assess risk. The quantity of deceitful dealings in the banking sector has decreased by 20%, leading to substantial cost savings. Banks have enhanced their comprehension of consumers’ behaviours through the utilisation of AI-driven statistical analysis of data. As a result, marketing techniques have been improved, resulting in a 15% increase in marketing return on investment.However, the application of AI in banking poses several challenges and It is crucial to take into account the displacement of certain work positions, as well as the ethical concerns surrounding data privacy and algorithmic bias. This, however, can be countered by offering further training and education to bank workers so that most of them can work in the more strategic positions which collides with the potential of AI offers. In light of this, continuous investment in employee training is important to facilitate seamless adaptation and continued success with AI implementation in the banking sector.