Introduction

Financial literacy is the most urgent need for Gen Z as it begins navigating its personal finance. The cost of living continues to rise, in addition to being easily accessible digitally, which means this generation faces unique challenges. Financial education would enable Gen Z to prioritize clear goals, forward planning, and the avoidance of terrible spending habits and high-interest debt (Shan et al., 2023). Added to that, financial literacy increases their ability to make proper financial planning and avoid risky financial products (Andiani & Maria, 2023). However, at the same time, despite these benefits, the financial knowledge relationship with actual spending still remains poorly understood since research shows that although more financial literacy is well related with more spending behavior, it is in fact the positive financial behavior which leads to a better saving result (Rodriguez et al., 2024).

What is probably lacking in the present studies are the ways through which financial behavior acts to mediate the relationship between financial literacy and spending habits among Gen Z. Compared to other types of study, only a few have looked into the interaction between these elements. Understanding how financial knowledge influences behavior and spending will thus form a more solid base to gain a more profound understanding of the best ways Gen Z can improve their financial outcomes and develop healthier spending and saving habits. This will serve to fill a gap that may exist and contribute toward developing even more effective financial education programs for the next generation.

Statement of the Problem

This study wants to examine the mediation effect of financial behavior to financial literacy and spending habits among Gen Z. In specific, this study wants to uncover the following questions:

RQ1: Is there a significant relationship between Financial Literacy and Spending among Gen Z?

RQ2: How does financial behavior mediate the relationship between financial literacy and spending habits of Gen Z?

RQ3: To what extent does financial literacy influence the financial behavior of Gen Z?

RQ4: What role does financial behavior play in shaping the spending habits of Gen Z?

Hypothesis

Based on the research question, here are the following hypotheses derived:

HO1: There is no significant relationship between financial literacy and spending habits among Gen Z.

HO2: Financial behavior does not mediate the relationship between financial literacy and spending habits among Gen Z.

HO3: Financial literacy does not significantly influence the financial behavior of Gen Z.

HO4: Financial behavior does not significantly influence the spending habits of Gen Z.

Conceptual Framework

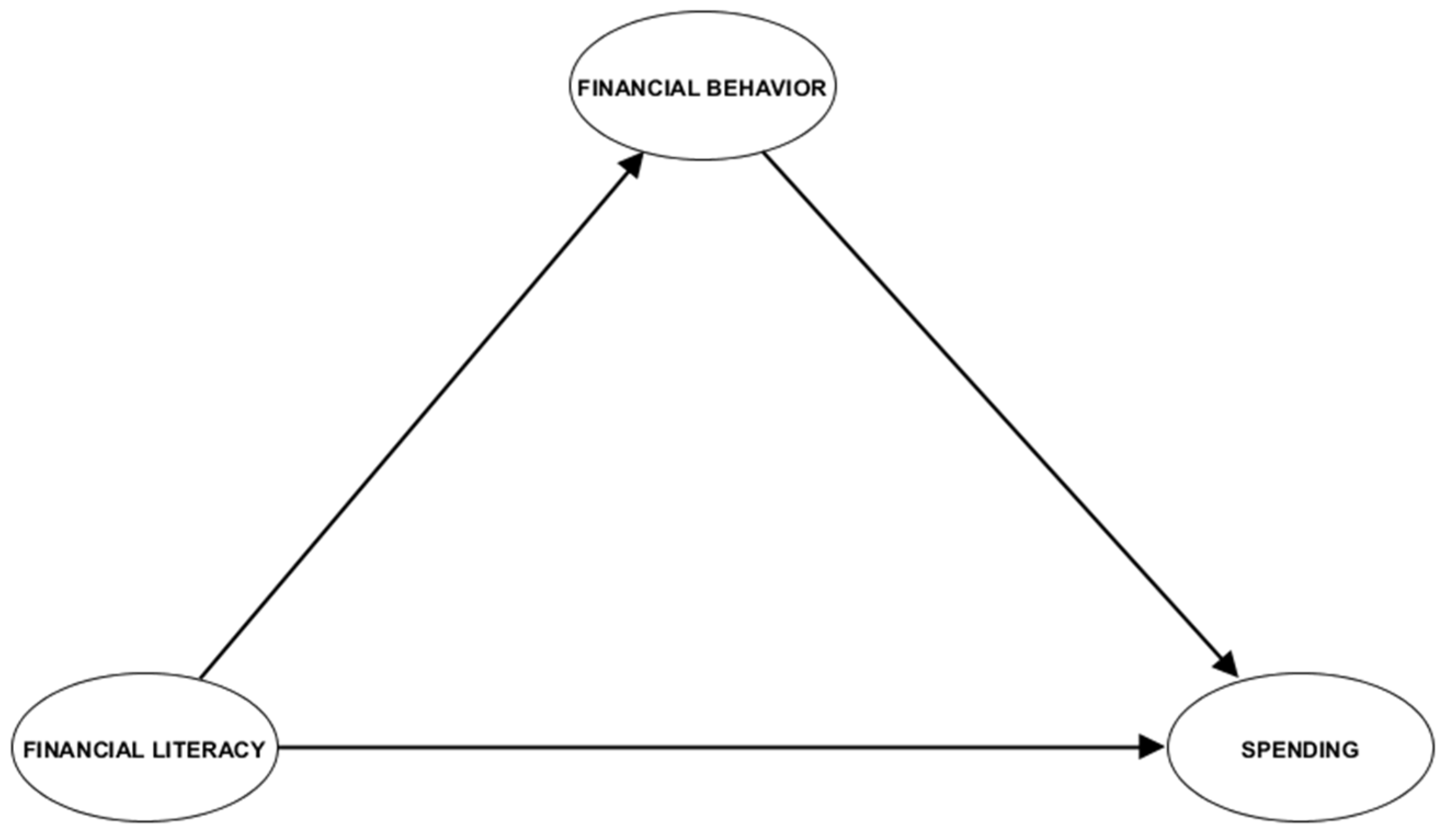

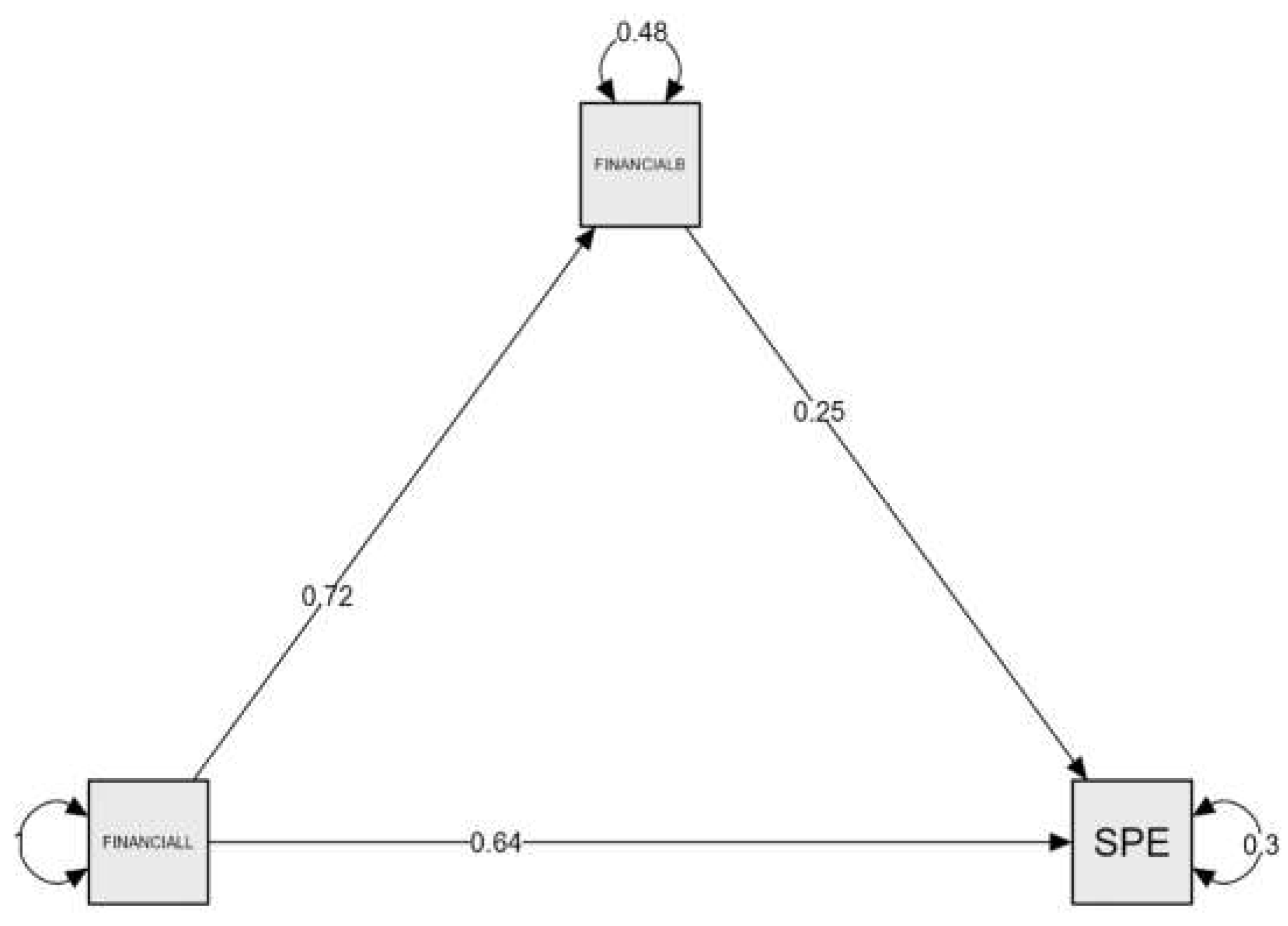

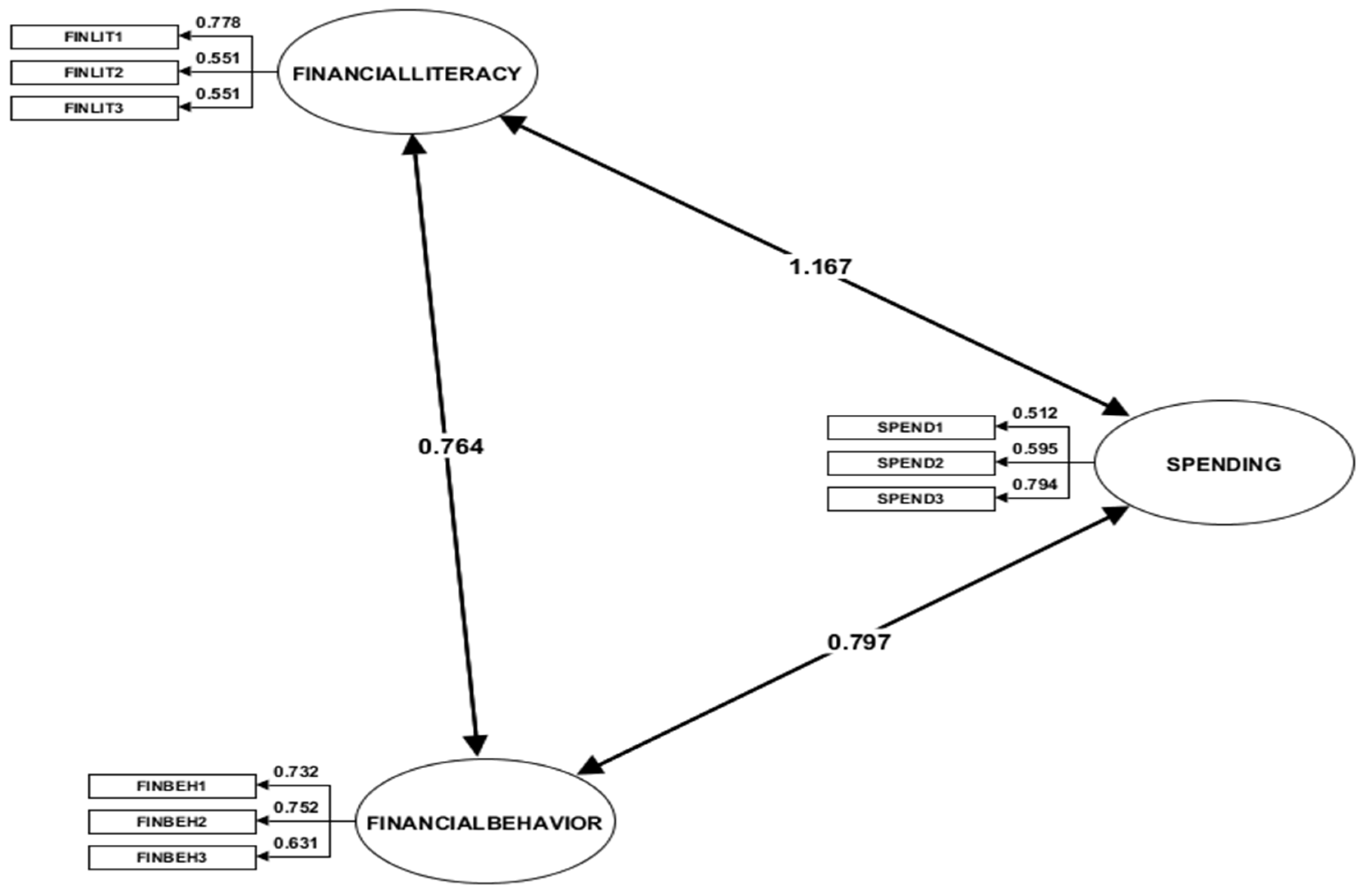

The conceptual framework shows how financial literacy affects expenditures directly and indirectly through financial behaviors. It further argues that the better his or her financial knowledge, the better the spending decision he or she makes while also adopting positive financial behaviors like budgeting and saving, which also influence his or her spending. It is, in other words, financial behavior that bridges this relationship between spending and financial literacy. This framework will help one understand if high financial literacy leads to better spending practices and if there is a principal role of financial behavior in this process.

Figure 1.

Conceptual Framework.

Figure 1.

Conceptual Framework.

Methods

Research Design

This study attempts to establish associations between financial literacy and financial behaviors, and also spending habits with Generation Z, using a quantitative research design. In general, the primary aim is to measure the association between financial literacy and spending habits, as well as to examine how financial behaviors mediate this relationship, and the direct impact of financial literacy on financial behaviors.

Population and Sampling

Respondents for this study will be members of Generation Z. This age range consists of individuals from 18 to 25 years old in 4 barangays in Quezon City. Different backgrounds would be included within the study, so the population sample size of 317 would be used to determine the required minimum to achieve adequate statistical power. The researcher used stratified random sampling where it is helpful in determining the variations across socioeconomic status, educational background, and geographical location.

Data Collection

Data was collected through a structured questionnaire on financial literacy, financial behavior, and spending habits. The questionnaire will be based on validated scales that exist in the literature on conducting the study, incorporating some demographic information to control for variables such as income and education. An online form will use platforms where surveys can be administered online.

Result

The Relationship between Financial Literacy and Spending Habits

Table 1 shows a strong positive relationship between financial literacy and spending habits since Pearson’s r = 0.821, and the p-value is less than 0.001, showing a statistically significant. It indicates that the higher the level of financial literacy, there is more spending behavior. In the previous studies show that beyond just facilitating and having well-defined financial goals and plans for the future, financial literacy also affects how spending decisions are made (Shan et al., 2023). Furthermore, financial literacy has been shown to affect saving and shopping behaviors in this digital era (Alysa et al., 2023). According to Wuisang et al. (2023), the more financially literate an individual is, the better money management skills he or she develops-underlining its importance. It is of interest that although high financial literacy is associated with higher spending, this could simply be an expression of more mindful, intentional spending rather than impulse buying (Rodriguez et al., 2024). In a broader sense, the strength of the relationship suggests that financial education is important in pointing Gen Z in the direction of better-informed and healthier financial choices.

Influence of Financial Literacy on Financial Behavior

Table 6 Regression Model Summary Showing the Effect of Financial Literacy on Financial Behavior The baseline model, M0, with no predictors, shows zero explanatory power R² and Adjusted R² are at 0.000-and a relatively high RMSE (Root Mean Square Error) of 0.553, which indicates poor model fit. In contrast, M1 with financial literacy as a predictor shows improved fittedness with an R of 0.721, which is a fairly strong positive relationship between financial literacy and financial behavior. The R² for this model is 0.519, meaning that financial literacy accounts for about 51.9% of the variance in financial behavior; the Adjusted R² closely matches at 0.518, confirming a strong model fit. The RMSE is also minimized to 0.384, indicating more accurate predictions. The analysis hence reflects how financial literacy has a robust influence on the behavioral patterns of Gen Z toward finances.

Table 7 ANOVA results of regression models with financial literacy as the predictor of financial behavior Regression sum of squares 50.115 Residual sum of squares 46.365 This result clearly indicates that the regression sum of squares is much larger than the residual sum of squares, meaning financial literacy accounts for a big portion of the variance in financial behavior. At p-value < 0.001, the F-value of 340.478 is huge, thereby confirming the fact that the model is statistically significant. This means that there is an influence of financial literacy on financial behavior, strong and significant, and thus it contributes meaningfully to the overall variance in financial behavior.

Table 8 shows the financial literacy model of regression coefficients for financial behavior. The unstandardized coefficient for financial literacy was 0.707 while the standardized one equated to 0.721, meaning that it had a close positive association between financial literacy and financial behavior. The t-value for this one was 18.452, while its p-value was still less than 0.001, which means that the relationship is indeed statistically significant. The meaning of this simply presents that with increases in financial literacy, then there are increases in financial behavior. The results can be understood to align with the literal notion of earlier findings: financial literacy results in more ideal financial practice, which again influences proper spending behavior or vice versa (Azmi & Ramakrishnan, 2018). Gen Z also frequently suffers from almost chronic disorders in terms of saving and proper spending because of the attitudes toward finance, influenced by socialization and integration (Qamar et al., 2023). On the other hand, there is some evidence that financial literacy does improve good sound financial behavior and correlate with better financial well-being and overall financial health, Shankar et al. (2022). Therefore, teaching good financial practices among Gen Z will result in effective spending habits and lead to building their financial well-being.

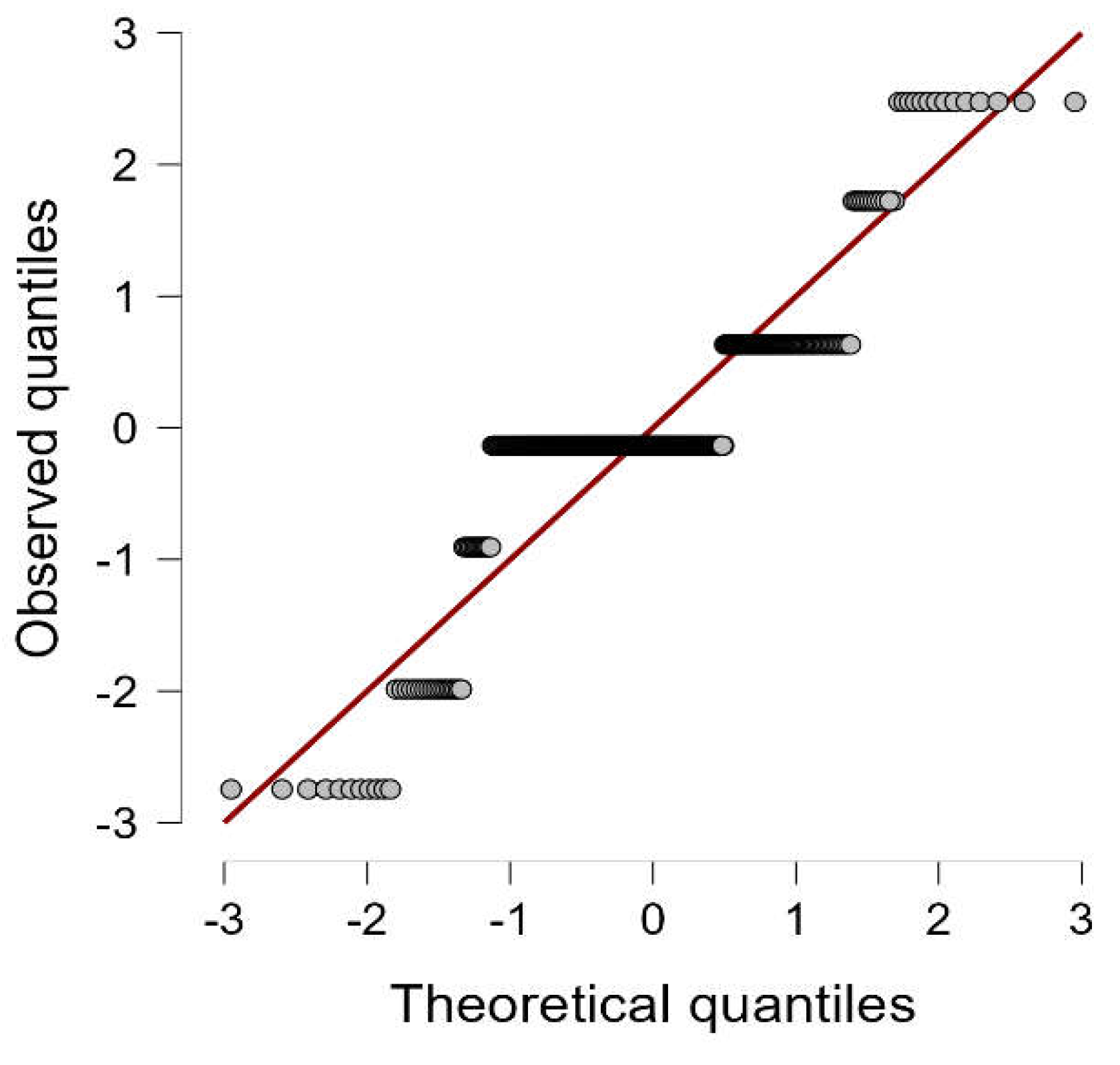

Figure 3 shown the Q-Q plot of standardized residuals with the goal of residual normality in the model. The points on the graph appear to follow the diagonal red line fairly well, which suggests that the residuals are somewhat normally distributed. There are a few minor deviations at the tails, but on average the distribution is very close to normal. This would indicate the fairly satisfied assumptions of normality of residuals. The regression model has come out to be valid from here, which is a positive indicator.

Discussion

Conclusions

Financial literacy has been shown to strongly influence direct and indirect expenditure behavior by illustrating financial behavior. Financial behavior has acted as a mediator that in turn goes on to influence the spending decisions between financial literacy and expenditure behavior. To this effect, underscored is the potential effect of the promotion of financial education to develop better financial behaviors that in turn can lead to more conscious and prudent spending habits. Therefore, there is a need to enhance the financial literacy and behavior of Generation Z toward better outcomes and more sustainable financial well-being in the long term.

Recommendation

Thus, financial education programs among the youth, especially this Generation Z generation, should be promoted to improve literacy and behavioral attitudes. The objective of these programs should be to build practical skills through budgeting, saving, and prudent spending. This should also tie in the digital aspects of understanding the new finance world through the grasping of financial literacy.

For future research, it would be interesting to find out how income levels, family influences, and other personality characteristics mediate between financial literacy and behavior and then spending. Longitudinal studies would be used in demonstrations of how relationships shift with time.

Author Contributions

The general planning of the study was taken care of by Joel Mark P. Rodriguez, such that preparation of the research instrument, report writing, and handling data processing and analysis all fell under his care. Ma. Del Carmen G. Labong assisted in sharing the effort necessary for the preparation and planning phase of the research. While this was going on, Lourdes Q. Palallos was curating data, significantly contributed to the planning, assisted in preparing the research instrument, and helped in writing the report. Of such teamwork the study ended up being completed excellently.

Funding

No Funding was granted for this study.

Availability of data and materials

The datasets used and/or analysed during the current study are available from the corresponding author upon reasonable request.

References

- Alysa, A., Muthia, F., & Andriana, I. (2023). Pengaruh Literasi Keuangan Digital terhadap Perilaku Menabung dan Perilaku Berbelanja pada Generasi Z. Al-Kharaj : Jurnal Ekonomi, Keuangan & Bisnis Syariah. https://doi.org/10.47467/alkharaj.v6i3.4706. [CrossRef]

- Andiani, D., & Maria, R. (2023). Pengaruh Financial Technology dan Literasi Keuangan terhadap Perilaku Keuangan pada Generasi Z. Jurnal Akuntansi Bisnis dan Ekonomi. https://doi.org/10.33197/jabe.vol9.iss2.2023.1226. [CrossRef]

- Anjani, C., & Darto, D. (2023). Financial Literacy, Income and Self-Control on Financial Management Behavior of Generation Z. BASKARA : Journal of Business and Entrepreneurship. https://doi.org/10.54268/baskara.5.2.152-164. [CrossRef]

- Azmi, N., & Ramakrishnan, S. (2018). Relationship between Financial Knowledge and Spending Habits among Faculty of Managements Staff. Journal of Economic Info. https://doi.org/10.31580/jei.v5i3.102. [CrossRef]

- Fachrudin, K., Pirzada, K., & Iman, M. (2021). The role of financial behavior in mediating the influence of socioeconomic characteristics and neurotic personality traits on financial satisfaction. Cogent Business & Management, 9. https://doi.org/10.1080/23311975.2022.2080152. [CrossRef]

- Mahendra, R., Nugroho, M., & Pristiana, U. (2023). The Influence of Economic Status, Financial Literacy, Financial Management on Z Generation’s Lifestyle using Consumptive Behavior as Moderation Variable. JOURNAL OF ECONOMICS, FINANCE AND MANAGEMENT STUDIES. https://doi.org/10.47191/jefms/v6-i1-32. [CrossRef]

- Mawad, J., Athari, S., Khalife, D., & Mawad, N. (2022). Examining the Impact of Financial Literacy, Financial Self-Control, and Demographic Determinants on Individual Financial Performance and Behavior: An Insight from the Lebanese Crisis Period. Sustainability. https://doi.org/10.3390/su142215129. [CrossRef]

- Mireku, K., Appiah, F., & Agana, J. (2023). Is there a link between financial literacy and financial behaviour?. Cogent Economics & Finance, 11. https://doi.org/10.1080/23322039.2023.2188712. [CrossRef]

- Purboningrum, S., & Fathoni, M. (2023). Determination Factors of Islamic Financial Management with Behavior of Financial as a Mediation Variable. Proceedings of the 3rd International Conference of Islamic Finance and Business, ICIFEB 2022, 19-20 July 2022, Jakarta, Indonesia. https://doi.org/10.4108/eai.19-7-2022.2328205. [CrossRef]

- Qamar, A., Rasheed, N., Kamal, A., Rauf, S., & Nizam, K. (2023). Factors Affecting Financial Behavior of Millennial Gen Z: Mediating Role of Digital Financial Literacy Integration. International Journal of Social Science & Entrepreneurship. https://doi.org/10.58661/ijsse.v3i3.207. [CrossRef]

- Rodriguez, J. M., Rodriguez, G. A., & Palallos, L. (2024). The Analysis of Financial Planning Activities of Grade-12 Students on their Financial Management in PCU: Basis for Financial Management Plan. International Journal of Research Publications, 153(1), 162–191. https://doi.org/10.47119/IJRP1001531720247007. [CrossRef]

- Shan, L., Cheah, K., & Leong, S. (2023). Leading Generation Z’s Financial Literacy Through Financial Education: Contemporary Bibliometric and Content Analysis in China. SAGE Open. https://doi.org/10.1177/21582440231188308. [CrossRef]

- Shankar, N., Vinod, S., & Kamath, R. (2022). Financial well-being – A Generation Z perspective using a Structural Equation Modeling approach. Investment Management and Financial Innovations. https://doi.org/10.21511/imfi.19(1).2022.03. [CrossRef]

- Ulfa, F., Supramono, S., & Sulistyawati, A. (2023). Influence of Financial Literacy, Risk Tolerance, Financial Efficacy on Investment Decisions and Financial Management Behavior. Kontigensi : Jurnal Ilmiah Manajemen. https://doi.org/10.56457/jimk.v11i2.449. [CrossRef]

- Ulumudiniati, M., & Asandimitra, N. (2022). Pengaruh Financial Literacy, Financial Self-Efficacy, Locus of Control, Parental Income, Love of Money terhadap Financial Management Behavior: Lifestyle sebagai Mediasi. Jurnal Ilmu Manajemen. https://doi.org/10.26740/jim.v10n1.p51-67. [CrossRef]

- Wuisang, J., Rooroh, A., & Christian, W. (2023). The Influence of Financial Literacy and Shopping Habits on The Financial Management of Economic Education Students. International Journal of Accounting & Finance in Asia Pasific. https://doi.org/10.32535/ijafap.v6i2.2317. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).