1. Introduction

Distributed Digital Lending creates a lending-borrowing marketplace of global proportions, with all the inherent advantages thereto. Run by a virtual digital bank, VDB, serving as an activation organization, also referred to as the Digital Lending Initiative, DLI, which prospectively will rise to become the bank of the future. Lenders and borrowers alike will approach the DLI placing their terms. The DLI will negotiate with anyone knocking on their doors, and with some of them come to terms, enlisting them as customers. The community of lenders and the community of borrowers will be matched to satisfy both and keep the DLI profitable. A classical bank collects the money then manages as its owner, the DLI simply matches the community of lenders with the community of borrowers to satisfy both. It is more direct and it is friction free.

There are no inherent limits, not to the number of lenders playing, nor for the number of borrowers, not to the sums of money exchanged, not to the durations of the loans, not to the lending, nor to the borrowing interests. A normal bank offers various savings plans where money traders are lured to deposit their funds for the bank to use the money to pass to borrowers. These plans are rigid and few. With DLI a borrower will approach the DLI saying: "I need a loan of size $B', for a period of time T'b days, to start on day t'bstart, and I am prepared to pay an annual simple interest of b'%." The DLI will counteroffer and negotiate with the would be borrowers and in many cases settle on a loan of B, for a period Tb to start on tbstart, and be paid for with an annual rate of b%.

At the same time a would be lender will approach the DLI and say: I am willing to lend you an amount of $L' for a period of T'l days to start on tl'start, and my price for this loan will be. l '% for a simple annual rate. The DLI will negotiate with this lender and with some such lenders agree on a loan L for a period of time Tl, to start on day tl, and to be paid for per an annual interest rate %l .

The DLI will manage the initiative planning for the lists of engaged borrowers and engaged lenders, per their individual terms to be such that both lenders and borrowers get what they bargained for, and the DLI nets a profit for its service.

No rigid deposits options, no need to use a traditional bank. Each trader holds their money in their preferred place, including in their individual computing device. All in all the terms are set by the forces of supply and demand.

The global scene will witness several competing DLIs, (competing virtual banks) which is also good for the market.

While the DLI will apply to all lending-borrowing situations, it offers a unique capability for money at rest. Hundreds of billions of dollars are resting in accounts that bear no interest. Their owners keep their money there because of liquidity concerns. The normal depositors plans by the banks don't apply to such instant spending-ready money, however DLI will reach out to every resting dollar, and activate it to bear interest without interfering or affecting the instant spending readiness of the money owner. Money in rest is traditionally benefitting the banks. But today using digital money technology, this period of rest can be pivoted to benefit the owner of the resting money.

What keeps money at rest from benefitting its owner? It is finding a matching borrower. Borrowers flock to the bank. The bank serves them based on the statistical behavior of the bank depositors and pockets the price the borrower pays for the loan.

These two aspects, access to the money holder and access to the money needy can now be claimed by any cyberspace initiative. Today money owners can shift their money from an accounting books in the bank to cyberspace where instead of the bank's vault, a cryptographic wall is being used. Digital money is openly listed on a public ledger while the identity of the owner is cryptographically protected. A properly veiled account owner can then raise a flag saying: "I need a loan", while owners of resting cyber account may declare "I am prepared to lend some or all of the money right now and for a certain period, and no longer. Both the borrowers and the lenders may be identity protected. It is a more complicated proposition to keep the borrowers with a veiled identity for reasons of risk management. However the borrower may prove ownership of an illiquid asset for which using BitMint ownership division claim check, a portion thereto can be given as collateral, while keeping the identity hidden.

We consider a digital lending initiative, DLI, or alternatively regarded a Virtual Digital Bank, VDB, as the repository, the hub, not where the money aggregate, rather where all postings are sent to, by would be borrowers and would be lenders, and where the lenders and borrowers will be matched. The DLI will figure out how much money is being needed to be loaned versus how much money is available to be lent. The posting borrower will also declare what interest they are prepared to pay for the desired loan and the lender is stating what interest they demand. The DLI will profit from the margin between the interest paid by the borrower and the interest paid to the lender.

The key to the work of the DLI are two complementary operations: loan build up, and loan breakdown. The DLI will practice both to run this loan operation effectively.

Loan build up refers to assembling money from various lenders to match one larger loan request by a would be borrower. Loan breakdown refers to breaking down a lending-ready amount to service various smaller loans.

1.1. Literature Survey

As references [

1,

2,

3] show, digital money technology is advanced enough to carry out lending and borrowing at any volume, but the field literature [

4,

5,

6,

7,

8,

9,

10] points out to limited practice. Africa takes the lead, driven by necessity. None of the literatures or solutions is practicing loan build up as described here. This technology is patent pending.

2. Loan Matching: Procedure and Methodology

When an amount of money X is loaned from a lender to a borrower for a period of time T, then a loan event has happened. A match was found between a borrower B* who agrees to pay an annual percentage r% for the benefit of having the loan, and a lender, L* who agrees to offer the loan, and be paid for it an amount commensurate with an annual interest of p%.

The gap (r-p) reflects the gain of the loan match maker. (the digital landing initiative).

We consider a situation where over a reference period of time, Tr, a loan match maker, LMM is asking for would be borrowers and would be lenders to inform it of their wishes.

A borrower will say: "I wish to borrow an amount B for a duration Tb, starting at date/time point tb1, and I am willing pay for it at an annual rate r%."

A lender will say: "I wish to lend an amount L for a duration Tl, starting at date/time point tb1, and I am setting my price for the loan to be p% at an annual rate."

At any given point of time t, there will be Nb(t) would be borrowers, and Nl(t) would be lenders. Each borrower and each lender came up with their own set of parameters for amount, duration, start time, and interest payment percentage (rate). The task before the aspiring loan match maker is to match lenders with borrowers so that few as possible borrowers will be left without a loan and few as possible lenders will be left without a borrower.

For simplicity, per the following analysis, we assume that the match maker is fixing the values of r, and p -- the paid and earned interest rates, to insure profitability for the matchmaker. So now all the participants comply.

We define a loan match variable, M, as the multiplication of an amount X that is being loaned /borrowed for time duration T:

We can set up a unit for loan matching, for example $1000 * 1 day will be one option, namely $1000 loaned for a day. Or finer levels. $100 * 1 hr, for very short very small loan events, or the opposite, much larger: $10,000 * 30 days, as is convenient.

Payment for the loan and earning from the loan, as well the loan matchmaker profit from the matched loan all are proportional to the match unit M = XT.

Similarly we define the borrowing load:

where the summation is over all the N

b borrowers. Namely: summations of the individual requested loan amounts. B

1, B

2, ,.. time the loan durations. T

b1, T

b2,...

Similarly we define the lending load, Q

l

where the summation is over all the N

l lenders. Namely: summations of the individual offered loan amounts. L

1, L

2, ,.. time the loan durations. T

l1, T

l2,...

Both summations are conducted over a reference frame, Tr, and include posted borrowing requests and posted lending offers that start and conclude inside the reference period.

Note that both the would be borrowers and the offering lenders submit their requests and statement as posting delivered to the attention of the DLI. There is a built in advantage for sending all the postings to the DLI and not making them public. If made public then individual borrowers and individual lenders will get together to a deal that may be unfair or suboptimized to one party or both, and it will deny the lenders the financial security offered one way or another by DLI.. Optimized loan build up from a large set of postings and optimized loan breakdown to a large set of counter postings is a complex mathematical task, best conducted by the DLI. The DLI profit depends on the amount of matched loans so it is in its interest to seek optimized matching from the available posting.

Since a loan match requires that every dollar offered for loan for every hour, is matched by a requested dollar to be borrowed for one hour, we can write the

basic matching formula:

However, the starting date for the various postings can be such that the maximum match per a given combined load from borrowers and lenders will be less that the 'best':

The basic matching formula suggests that any gap between the borrowing load and the lending load is a waste, the extra load will not be served. It is therefore that match making operation will apply the power of the market -- supply and demand -- to come as close as possible to equilibrium: Qb = Ql.

The power of supply and demand in cyberspace can be applied without any friction, ignoring all separating factors, like nationality and distance.

If we have Qb > Ql then one increases the value of %p and %r, so lending becomes more tempting and borrowing more prohibitive.

If we have Qb < Ql then one reduces the value of %r and %p so that borrowing becomes more attractive and lending becomes less attractive.

Since all are interested in minimizing waste, all parties seek an objective optimization between r% and p%. In the case where several DLI are in competition, they will compete and who offers the smallest gap between r% and p%.

We discuss below the basic procedures for match making and the AI empowered procedures to improve the results.

2.1. Basic Matching Procedure

The operation is driven by borrowers because, a borrower's request by default should be accepted, or rejected as is, while a lender posting can be partially taken.

Borrowers postings are examined per their start date, the earlier get attention early.

The matchmaker looks for lenders with posting fit into the borrower's start day, at any amount. The borrower's requested loan amount is built from available lenders who wish to lend a lesser amount, or from a lender with proper timing that wishes to lend a larger amount. All the lenders that assembled to service this early borrower are paying the money directly to the borrower. (in practice the money may go from the lender to the match maker (the virtual digital bank) from where it goes to the borrower -- in both cases using the digital cash instant transaction like in BitMint*LeVeL.)

When the entire requested loan is fit with proper lender's postings the first step is complete. The requested loan is digitally paid to the borrower. The borrower can use the BitMint digital money as is, or redeem it against legacy dollars, per their choosing. After the full amount of the load has been paid to the borrower, there are various time points where the matched lenders have finished their offered duration, and before that happens the match maker needs to find a proper lender to take over the lender that expects its money back before the loan is due. A given first lender L1 is finishing its lending mission at time point t1. When t1 comes to pass the match maker must be ready with another lender, L2 whose proposed loan is at least the amount serviced by L1. The replacement lender L2 pays the amount serviced by L1, X, but not to the borrower, rather to L1. This concludes the participation of L1 who made his lending and got his money back after the specified lending time. The earned interest will be paid later by the match maker.

Next the match maker watches for the next time point where any of the active lenders that is part of the group of lenders who support this borrower reaches its end of lending time, while the borrower's time demand is much longer. At that next time point the match maker will have to be ready with a new lender with proper terms. This new lender will pay the previous lender the amount the previous lender lent, and so again the retiring lender gets it money back at the time desired, being unaware that this lender is part of a loan match build up assembled by the match maker.

Continuity

Loan requests with long term durations will require lenders with long term lending offers. Alas, the edge of this DLI is that it captures short term lend offerings and builds them up to a long term loan request. The dilemma of the lender is that they face uncertainty regarding future surprises when cash and liquidity will be sorely needed. If they have their cash being lent out they are at a loss. That is why lenders are reluctant to tie up money for long periods, but prefer shorter periods with much less risk. Traditional banks find it hard to work with such short term lending. This DLI solution claims an advantage by opening up a whole new market based on short term lenders that engage their money through BitMint fast, irrevocable money transfer protocols. However these lenders typically can offer to lend now or soon, but are reluctant to commit for a lending at a point far into the future. The DLI then needs to close the gap between the most desired loans from borrowers -- long term loans -- and the most desired lending from lenders -- short term loans offered in the here and now.

To assure a borrower that their loan request for the requested loan time Tb will be satisfied, the DLI will have to rely on (i) a credible estimate of lending offerings to be posted long into the future, and (ii) a financial backup capacity to keep the operation going during periods where lending offering are too meager.

The DLI will need to promote the business to secure constant stream of lending offering. The DLI will have to come up with credible predictions as to the future state of lending offering. The DLI will want to rely on AI capability to predict future lending offering. Still, fluctuations will occur, and the DLI must be ready with a financial shock absorbing capacity -- ready to use cash, to serve as a lender of last resort to uphold a long term loan commitment the DLI made to a long time borrower.

In the beginning the DLI will need to be ready with a lot of lending capacity on its own. But as the word goes out and lenders are aware of the attractive options to let one's money work for one while one sleeps, more and more ready lenders will come forth and will make it less necessary for the DLI to pitch in its own money.

2.2. AI Empowered Matching Procedure

The complexity of matching hard to predict streams of postings from borrowers and lenders alike, makes the goal of optimal loan matching into a typical AI mission.

To prepare the data for AI, the DLI will keep record of the stream of postings over time. The overall time line will be divided to reference periods. R1, R2, ..... The postings that were submitted fully within a reference period will be analyzed "post mortem" to determine the best matching that could have been achieved. This Mbest value would be compared to the de facto M values achieved within each reference period. If they are similar then no need for AI boost. If not then the data for the growing number of reference periods will be given as raw material for AI supervised learning in order to find pattern with which to build a matching strategy with high matching score. This AI reference engine will become more effective the more reference periods there are to be analyzed. If the climate of the postings will change then the AI inference will track it by giving more weight to recent reference period relative to older ones.

If a market is serviced by more than one DLI then the various DLI will compete as to how well they use AI to increase the efficacy of the loan matching operation.

2.3. Elasticity

Given a situation where the B postings and the L postings are not in good match, it is advisable for the DLI to negotiate some changes in the terms. To check if a different sum will be Ok, to check if the requested or stated duration can be modified a bit, to check if the starting date can be different. And of course to re-negotiate interest rates. Some postings can come with a lot of elasticity as to such changes, and others not.

It is a role suitable for AI to propose a negotiation strategy. The DLI can offer better rate in exchange of terms elasticity.

3. The Loan Build Up Principle

A bank aggregates its deposits and organizes its borrowers. The DLI will need similarly achieve access to both the supply and the demand side of the transaction. The DLI will announce its cyber presence and invite would be borrowers and would be lenders to post their propositions.

Borrowers have no issue of security so they are expected to flock to whoever gives them the loan on better terms.

On the supply side the community of money traders naturally keeps at a fully liquid state only a small portion of their money holding. The majority is tucked well and deep into various interest bearing and risk gaming programs. The target of the DLI is to compete with traditional banking on the money regularly used in liquidity constrained situations. But its first move may be to address the liquid funds that are being exploited by the banks, and make no interest to their owners. We refer here to payment-ready money. Now typically people and businesses keep some extra funds to handle financial surprises. These are the funds, money at rest, that the DLI is targeting for the first move into this business. Comparatively these are small funds which their holders are prepared to part with for only a short period.

We therefore may see a mismatch between high volume long time loans requests and small volume short term loan offering. The way to handle this mismatch is through the Loan build-up.

We describe ahead the mathematical definition of the loan build up. The principle is illustrated as follows:

A borrower notifies the DLI of their wish to borrow a loan L for a period of t weeks. At the same time t lenders notify the DLI that they are willing to lend an amount L for a period if 1 week. The DLI combines the t lenders with the single borrower as follows: Lender #1 is engaged to lend an amount L to the borrower for a period of one week. When the week is over, lender #2 is engaged to surrender an amount L to the operation. Only that this second L fund (L2) is not paying to the borrower, rather is paying to the first lender, who thereby receives his loan back a week after it was extended. A week later lender #3 is engaged to bring to the fore a fund L and this time pays L to the second lender who thereby is happy having the deal completed on their terms. On it goes. Each newly engaged lender is paying L to the previous lender.

The last lender is receiving L back after a week, but he receives it from the borrower. The borrower is blind to the fact that his loan was serviced by t lenders. The borrower got a fund L for t weeks, and paid it back. Interest payment is accounted for separately. The last lender is the only one at special risk for not being paid back. The others are at risk if no new lender comes forth.

What happens if each lender #i is ready to lend a loan Li < L?

In this case the loan L will be divided to several smaller loans, processed in parallel, so that the smaller loans will be covered by the smallest Li.

The exact matching is described below.

The buildup principle is then to service a big loan for a long time through a sufficient number of smaller loans, each may be for a shorter time.

3.1. The Mathematics of Loan Build-Up

A borrower Bob wishes to borrow an amount B, borrowing to start at time Tb, and end at date and time T'b. The borrowering prospective is prepared to pay an annual plain interest of r%.

The DLI is searching for some n lenders L1, L2, ..... Ln. These lenders each offered to lend money per the following terms. Amount lended by Li: l i; lending starts at ti date, and ends at t'i date, requested interest pi. For i=1,2,3.....n

The DLI manager may negotiate with the borrower on its terms, and also negotiate with each lender on their terms. Eventually an agreement is reached.

The DLI assemble n1 < n lenders who can start lending at the agreed upon Tb. The total amount lent by the n1 group is. B = Σ l i. for i=1,2,....n1.

Every lender i in the n1 group for which t'i is earlier than T'b (t'i < T'b) will be getting back his loan l i at t'i by activating another lender , j, where l i ≤ l j, (where Lj is not in the n1 group) to pay l i dollars to Li. Thereby lender Li finished his service for this loan. This lender lent l i dollars from ti to t'i, and now is owed by DLI interest .

This 'replacement of lender' sequence is used again and again until the full lending case is accomplished. The borrower receives an amount of B dollars from time Tb to time T'b, and is billed by the DLI an amount commensurate with interest r%.

The values of r% and p1, p2, ..... pn are such that DLI is left with a gross profit Pg sufficient to cover the operational cost Co and secure a net profit N = Pg - Co to make the initiative worthwhile.

Over time a stream of borrowers approach the DLI as well as a stream of lenders. The streams may be in good balance and the operation is smooth.

At times the streams are off balance. There may be more borrowers asking for a loan than lenders willing to extend one. In that case the DLI raises the bar with respect to r%, which is the interest paid by the borrower, which in turn allows DLI to raise the lending rate pi for every potential lender i, to lure lenders to the operation.

At other times there is an edge of offering lenders over a few borrowers. In this case DLI will negotiate lower lending rate p1, p2, ..... pn and then tempt more borrowers with a lower r%.

The more borrowers and the more lenders the greater the action and the greater the profits for DLI , so DLI will be of interest to advertise the service and reach out far and wide. Since borrowers and lender don't know each other, they can be matched from across town to across ocean, making the DLI a global operation.

The final negotiations with lenders may be private so that lenders cannot compare rates. Advertised rates normally are made public.

The negotiates interest rate p1, p2, ..... pn may be graded: the larger the amount, and the longer the lending time, the larger the interest rate because the DLI will have to use fewer lenders to build up a loan. Also a given extended loan can be extended between two or more built-up loans.

AI Powered Coin Breakdown and Coin Build Up

The DLI collects a large number of postings from borrowers and lenders alike. Each posting comes with stated amount, X, a stated duration T, a stated interest rate, r, and a starting date s. {X,T,r,s} The B-posting (from the borrowers), and the L-postings (from the lenders) may be at various degrees of matching.

On one extreme we have the state of zero matching. A simple way for this is when the starting date for the B postings are so much earlier than the starting date for the L postings that no lender can be matched with any borrower.

A full match is the other extreme, a simple way for this to happen is when each B posting as a matching L posting, and the gap between the B interest rate and the L interest rate is sufficient to keep the DLI (the virtual digital bank) operating.

In between are the many states of partial matching. In a partial match some would be borrowers don't get the loan they ask for and some lenders don't get a buyer for the loan they offer. The objective of the DLI is to minimize such waste and extract optimal matching from the dynamic array of posting. We note that every moment new postings appear and old postings become obsolete.

At any given moment of time the DLI is facing an array of B posts and an array of L-posts. The larger the number of the posting and the greater their variety, the more complex is the optimization task, what is more this task needs to be carried out fast enough, so that the plan for time point t, will be action ready before time point t comes to pass.

While an analytic optimization solution is theoretically possible, for large scale matching it is practically infeasible, and that is where artificial intelligence, AI, gets into the picture.

When the DLI starts to operate, the matching is done analytically through a basic routine in which the larger postings are matched with smaller ones. As this proceeds the record of the postings is kept for an AI engine to chew the data and apply its inferential protocols to construct an optimized matching to exceed the efficiency of the analytical match making.

At the next level the AI will develop a negotiation strategy with the borrowers and the lenders alike, for them to agree on slightly different terms than originally proposed in order to increase the matching quality.

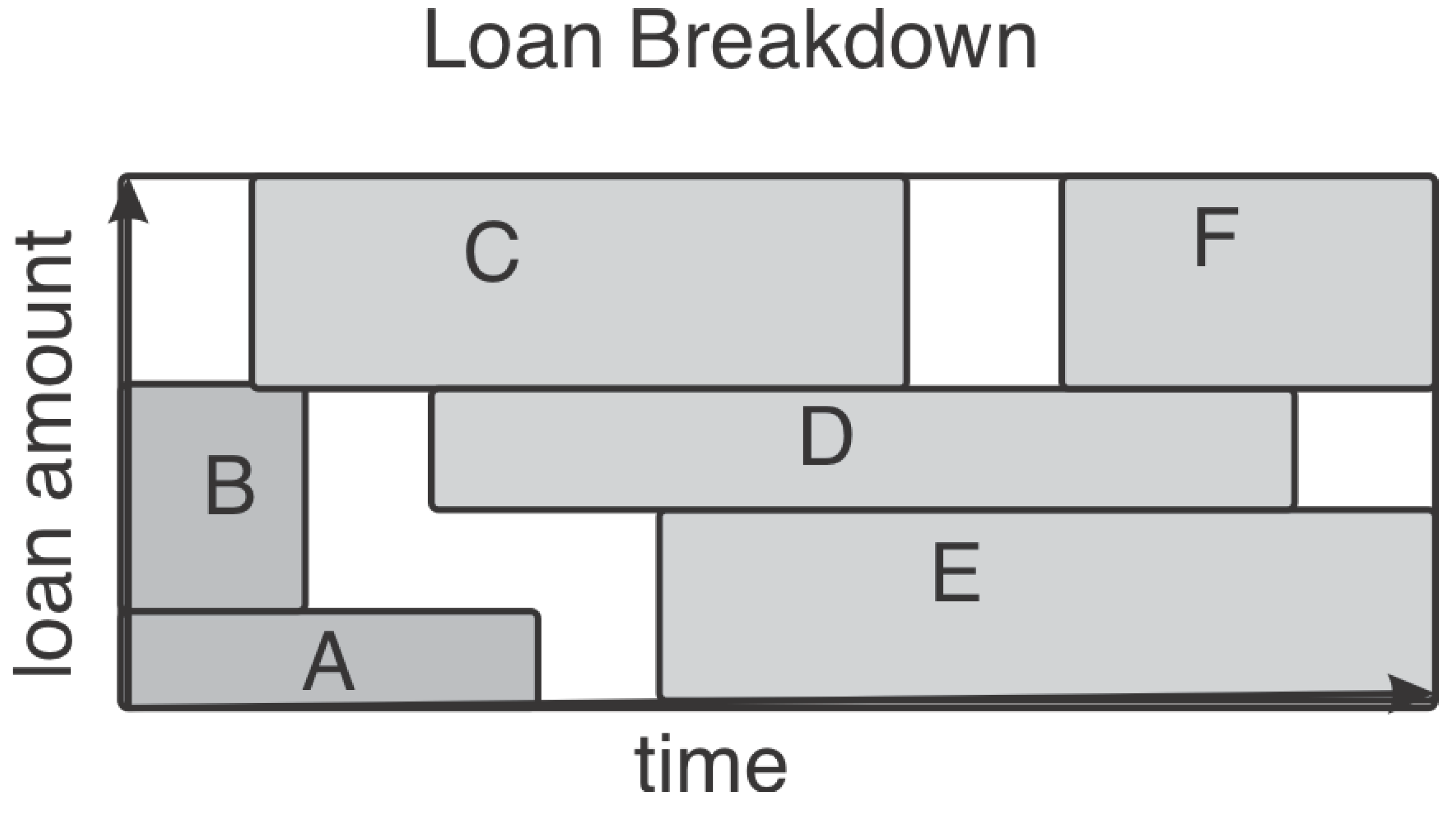

3.2. Loan Breakdown

A large lending offering will have to be broken down to serve a variety of small scale, short term borrowers.

Matching will start with looking for borrowers that together will borrow the large amount of lending money to be broken down. Ideally there will be a borrower for every dollar offered to be lent at the time the lending offer is regarded as the start time. The match maker, the DLI, will try to post small borrowers on the larger lending offer. Success is measured by how much money from this lender is lent for how long a time.

Geometrically one can represent a lending offer for sum X and duration T to start at tstart as rectangle marked on a flat surface where T is the horizontal stretch of the rectangle and X is the vertical stretch, while the rectangle itself is placed on the time line at starting point tstart.

The objective of the loan match maker would be cover as much as possible from the area of this rectangle with smaller rectangles representing borrowers. The ratio of the covered area (wtih borrowers) divided by the area of the rectangle, XT, represents the efficiency of the operation, the ratio of rendering the lending offer to an executed loan. The goal of the DLI is to maximize the amount and duration of executed loans because the DLI makes money in proportion of the multiplication of loan amounts times their durations.

4. The Traded Coin

The DLI is based on quick, immediate trade with finality and exposure. This requires a cryptographic coin with a mathematical clarity as to the identity of the owner of each coin at any moment of time. Pre digital payments suffered from stretches of ambiguity and administrative friction which makes short range lending impractical. The BitMint digital coin (LeVeL) is a cryptographic stablecoin with full clarity as to the owner of the coin at each moment and it also offers public exposure for the same. Say then that in order to practice DLI both lenders and borrowers will have to first convert the engaged funds to BitMint coins, then trade with this coins. Similar coins other than BitMint may qualify too.

A lender will be using a computing application that will buy the desired amount of money in BitMint coins, paying with fiat currency. The purchased digital coins will be paid to the DLI manager (DLIM), using the BitMint*LeVeL payment protocol and the DLI manager will then pass the money to the borrower. Alternatively the lender will pay directly to the borrower, if that lender is the first in line, or the lender will pay to the former lender. Such transaction may take place without the lender knowing who the borrower is because the BitMint LeVeL protocol offers complete anonymity to the money traders. Of course, when the regulatory climate forbids this anonymity, it will not happen. When the loan is paid back, the borrower will pay the DLI who will pay the last lender, or the borrower will pay directly to the last lender.

All payments per the protocol are shown instantly on the public ledger with no ambiguity. The borrower will be able to use the loan instantly.

The BitMint*LeVeL transaction is final, and hence the money can be used. by the borrower right away.

The borrower will be able to instantly convert the BitMint digital coins to any other form of money. The exchange rate is fixed. We recall that BitMint coins are considered claim checks for fiat currency.

Participants will need to put forth a ready buy and redeem application for the BitMint digital coins, and keep their coins in their apps for the DLI transactions.

5. Risk Management

The main risk in any lending business is default. The lenders will manage this risk in various ways:

1. the small steps defense 2. the DLI reputation defense 3. the DLI insurance defense

Lenders choosing to lend small amounts to short terms are risking no more than the small amount lent. Unlike a bulk loan of high amount, here a lender builds up a big sum to lend by lending one small amount after the other, so that if something goes arrear, the loss is minimal.

DLI over time will earn a reputation for choosing borrowers carefully so that the risk for lenders is curtailed. Competing DLIs will strive to win more customers (lenders and borrowers) by better vetting borrowers.

The DLI insurance defense is based on it insuring the lenders against default of a borrower. Such insurance can be offered based on effective vetting of the borrowers, or especially, for large loan borrowers on holding a collateral, like banks do. Working in the digital space DLI will be more flexible and more effective with collateral management.

The DLI runs the risk of good faith law suits, of insurance default, or business running away to the competition, of small or zero profitability because of a small margins between the paid and earned interests and ill calculation of operational and maintenance cost.

Collateral Management: Bank extend loans by trading non liquid assets against liquid assets. DLI can do the same only better. Let a given borrower have an ownership position for an illiquid asset A of value V. The borrower wishes to take a loan of value L < V. The DLI will then issue BitMint digital coins defined as equity in that asset. A fraction L/V of these coins will be assigned to the DLI. The DLI will contractually have the right to force a sale of the asset, which may be a private sale. The asset may be bought back by the current owner, but L valued coins will be claimed by the DLI in the case the borrower defaults on the loan for which the collateral was taken.

Small Steps Defense: Lenders feel less risk for short term lending. They find right away if anything goes wrong. Therefore one should expect a lot of readiness from account holders to offer lending for short terms. The edge of this method is that it nicely builds a long term match from many short term loans.

The DLI reputation defense: Since there expected to be several competing DLI in any market, then each DLI will be worried about their reputation and hence will try hard to avoid a breakdown of the system and to cover any need with its own funds.

DLI Insurance defense: The DLI could seek insurance protection to enhance its credibility. This will impact its expenses and the gap between two interest rates, p and r, lending and borrowing, and hence the attractivity of the operation.

6. Scope and Operation

Distributed Digital Lending creates a lending-borrowing marketplace of global proportions, with all the inherent advantages thereto. Run by an activation organization, the Digital Lending Initiative, DLI, which may rise to become the bank of the future. Lenders and borrowers alike will approach the DLI placing their terms. The DLI will negotiate with anyone knocking on their doors, and with some of them come to terms, enlisting them as customers. The community of lenders and the community of borrowers will be matched to satisfy both and keep the DLI profitable.

There are no inherent limits, not to the number of lenders playing, nor for the number of borrowers, not to the sums of money exchanged, not to the durations of the loans, not to the lending nor to the borrowing interests. A normal bank offers various savings plans were money traders are lured to deposit their funds for the bank to use the money to pass to borrowers. These plans are rigid and few. With DLI a borrower will approach the DLI saying: I need a loan of size $B', for a period of time Tb days, to start on day t'bstart, and I am prepared to pay an annual simple interest of b'%. The DLI will counter offer and negotiate with the would be borrowers and in many cases settle on a loan of B, for a period Tb to start on tbstart, and be paid for with an annual rate of b%.

At the same time a would be lender will approach the DLI and say: I am willing to lend you an amount of $L' for a period of T"l days to start on tl"start, and my price for this loan will be. l "% for a simple annual rate. The DLI will negotiate with this lender and with some such lenders agree on a loan L for a period of time Tl, to start on day tl, and to be paid for per an annual interest rate %l .

The lists of engaged borrowers and engaged lenders, per their individual terms will be such that both lenders and borrowers get what they bargained for, and the DLI nets a profit for its service.

No rigid deposits options, no need to use a traditional bank. Each trader holds their money in their individual computing device. (or in a ready to online use bank account). All in all the terms are set by the forces of supply and demand.

The global scene will witness several competing DLIs, which is also good for the market. It is hard to see a role for traditional banking in the new era of digital lending.

6.1. Lenders-Borrowers Balance

Naturally the engaged borrowers and the engaged lenders will have to balance out for the DLI concept to work. The balance of interest refers to the size distribution of the borrowing requests versus the size distribution of the lenders offers. A size S of a loan is measured by the multiplication of the loan amount X times the loan duration, D: S = XD. The price of the loan, p is proportional to its size p = kS. Because p is determined by the amount and the duration.

The following options are all proper:

1. There are few borrowers, but the typical size of their loan is high, while there are many lenders with a typical small size loans.

2. There is a roughly equal number of borrowers and lenders and the loans from both sides are similar.

3. There are many borrowers but their loans is small, while there are few lenders and their loan is large.

Colored DLI: DLI can be implemented over a colored community of borrowers. Say minority small business, or say pharmaceutical startups. Being a special group might incentivize lenders to lend at a lower rate, even perhaps with a negative interest rate.

6.2. Purpose and Character of the Loans

Loans of particular purposes may be treated in a special way. For example loans given to socially important enterprise may be guaranteed by the government so that lenders don't sustain any risk in lending. The character of the loan makes a difference. We focus, for example, on the purposer of the lent money. The first run of the DLI is planned for idle liquid money that normally does not bear any interest. Therefore any interest offered by the DLI will be a net positive to the lender. This is the no-competition zone because banks keep liquid funds in a non-interest bearing accounts. The bank enjoy the resultant profit. One would expect the zero competition zone for DLI to work smoothly and depend only on the level of promotion of the initiative.

DLI will naturally extend itself to compete with legacy banks, aiming at non liquid funds. Legacy banks lure customers to trust them with locked funds for a long range, and be rewarded with high yield. The banks in the US rely on the FDIC to project security, since depositors are most concerned with not losing their money. The DLI will lure its lenders with security through various means.

DLI security offering:

1. screening borrowers 2. DLI guarantee 3. Insured DLI 4. risk matching

screening borrowers: The DLI will choose borrowers projecting trust, qualified in some way, and then assure the lenders that these borrowers are trust worthy.

risk matching: A high risk borrower is ready to pay a high price for their loan. The DLI will tell the lenders that their money will serve high risk borrowers, and therefore their claimed interest will also be high, to compensate for their risk. And the same on the other end, highly secure borrowers are insisting on paying low interest, and the lenders will comply.

6.3. DLI Applications

Borrowers and Lenders alike will have to use dedicated DLI applications on their electronic communication devices. These applications will have hand shaking protocols with the DLI and will be programmed to pass BitMint digital coin from one to the other using the standard BitMint payment protocol. We note that however short a lending event is, the money, cash-wise is transferred from lender to the DLI and from the DLI to the borrower or to the previous lender. and vice versa from the borrower to the DLI, and from the DLI to the last lender. All the transactions are listed and are clear on the public ledger for this BitMint coin.

7. Impact and Outlook

The loan matching procedure described here has a unilateral status for the 'sleep and earn' market. Today nobody offers any consistent interest for checking accounts or credit accounts associated with credit cards etc. The billions of dollars that lie in such spend-ready accounts are benefitting the legacy banks. So for this market the DLI will be the only game in town. An aggressive publicity will ensure the great chance of success.

Following such success the loan matching of this methodology will naturally grow to eat away and compete with normal loan making options in banking today. This method here has a big advantage, it relies on the ability of BitMint and similar digital money options to carry out fast instant irrevocable transactions that are necessary for the fast turn around of 'loan while you sleep'.

Second, this method allows for friction free supply and demand forces to acutely adjust the interest rate at both ends. Competing DLI organizations will apply market forces to setting up their own profits.

There is no reason to put a boundary as to where the DLI will stop and legacy banking will continue. Even mortgage loans where duration is decades can be handled with DLI, of course the financial backup funds to handle temporary shortages of lenders will have to be sufficiently high.

Traditional banks have the FDIC advantage. There is no reason in principle to extend the same protection to DLI. Also DLI could be operated by legacy banks.

While DLI operation requires the DLI to have enough funds at hand to handle crises, such funds are minimal compared to the money turnover of this loan matching operation.

It is conceivable that the DLI will be recognized as virtual digital banks, VDB and replace the legacy banks, all around.

Explanation of Drawings

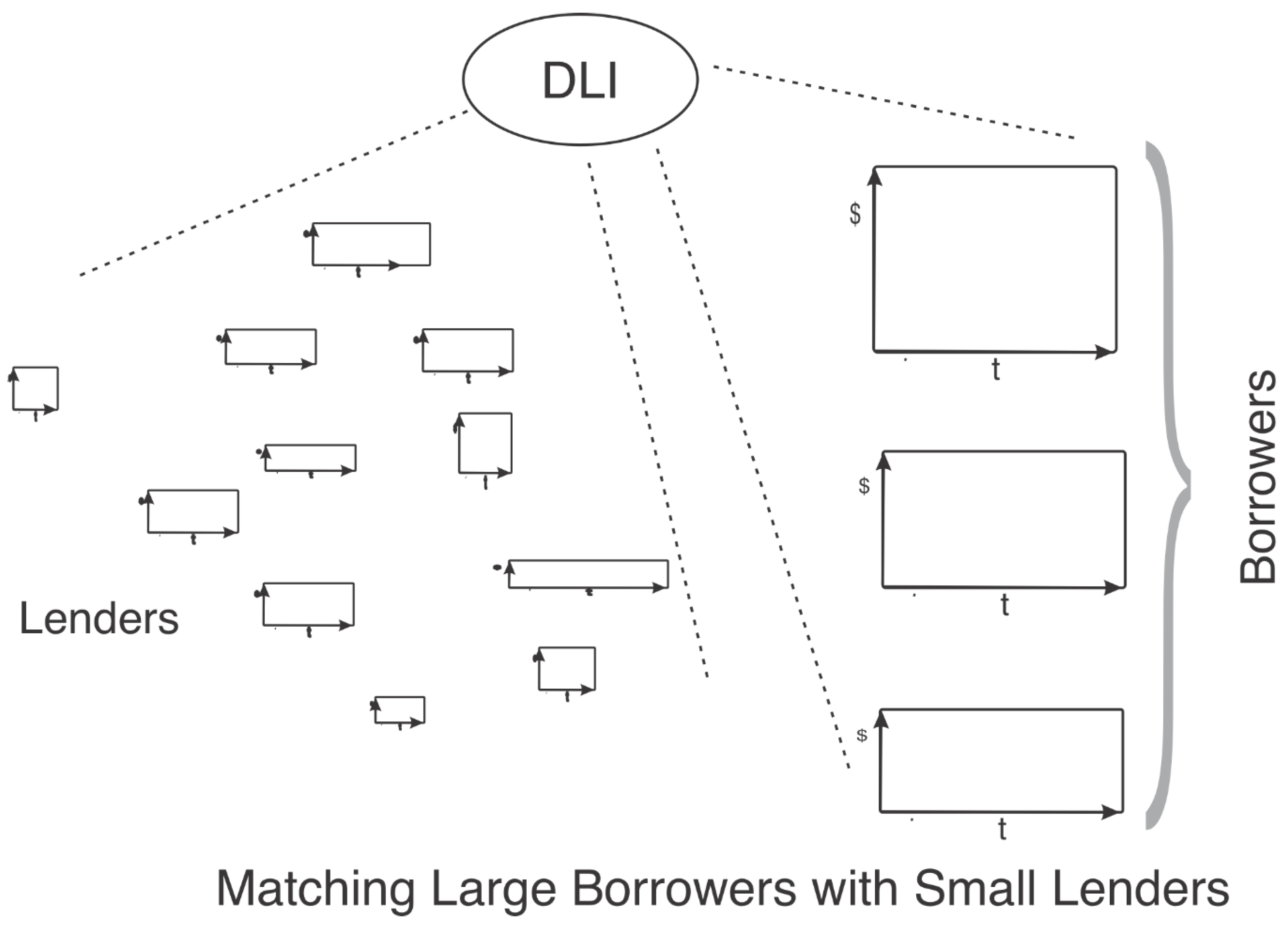

Figure 1.

Matching large borrowers with small lenders.

Figure 1.

Matching large borrowers with small lenders.

The figure shows the digital lending initiative, DLI handling a set of large sum long duration borrower to be matched with a large number of small sum short duration lenders (note that here we use DLI or alternatively virtual digital bank, VDB, or 'loan match maker' all referring to the organization that offers this loan matching option to the public). In this case, which is expected to be common one, the task will be to put together an array of small scale lenders to meet the requirements of a smaller number of large scale borrowers.

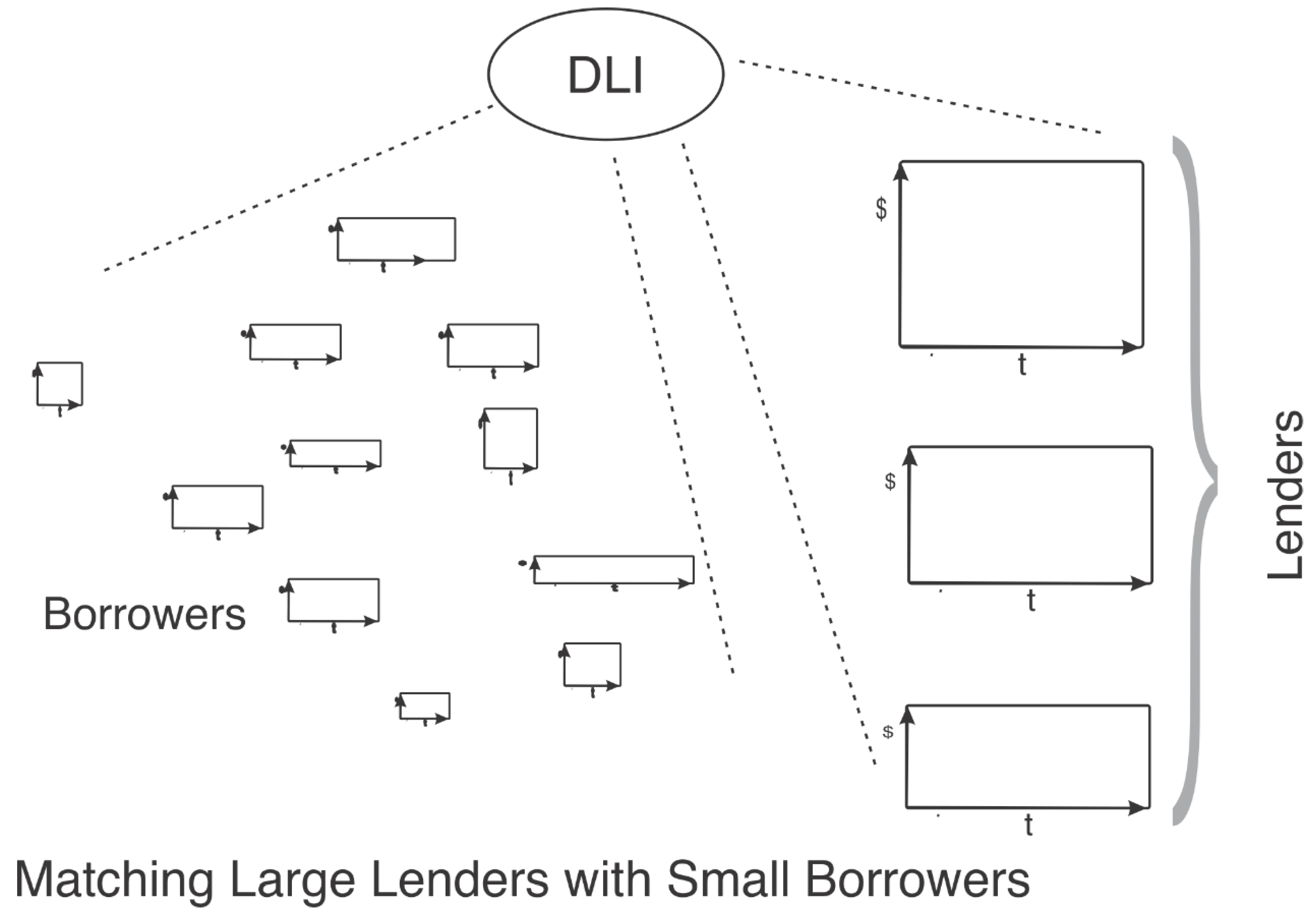

Figure 2.

Matching large lenders with small borrowers.

Figure 2.

Matching large lenders with small borrowers.

This figure shows the case where people with large amount of money to put aside are offering large loans for long duration while on the other side the borrowers are asking for smaller loans for shorter durations. The task of the DLI is to build a puzzle so to speak to match the small loan requests with the large lending offering, the DLI procedure for this matching is symmetrically equivalent to the matching of small lenders to large borrowers. the matching starts with the most close time point and then adjusts the sums.

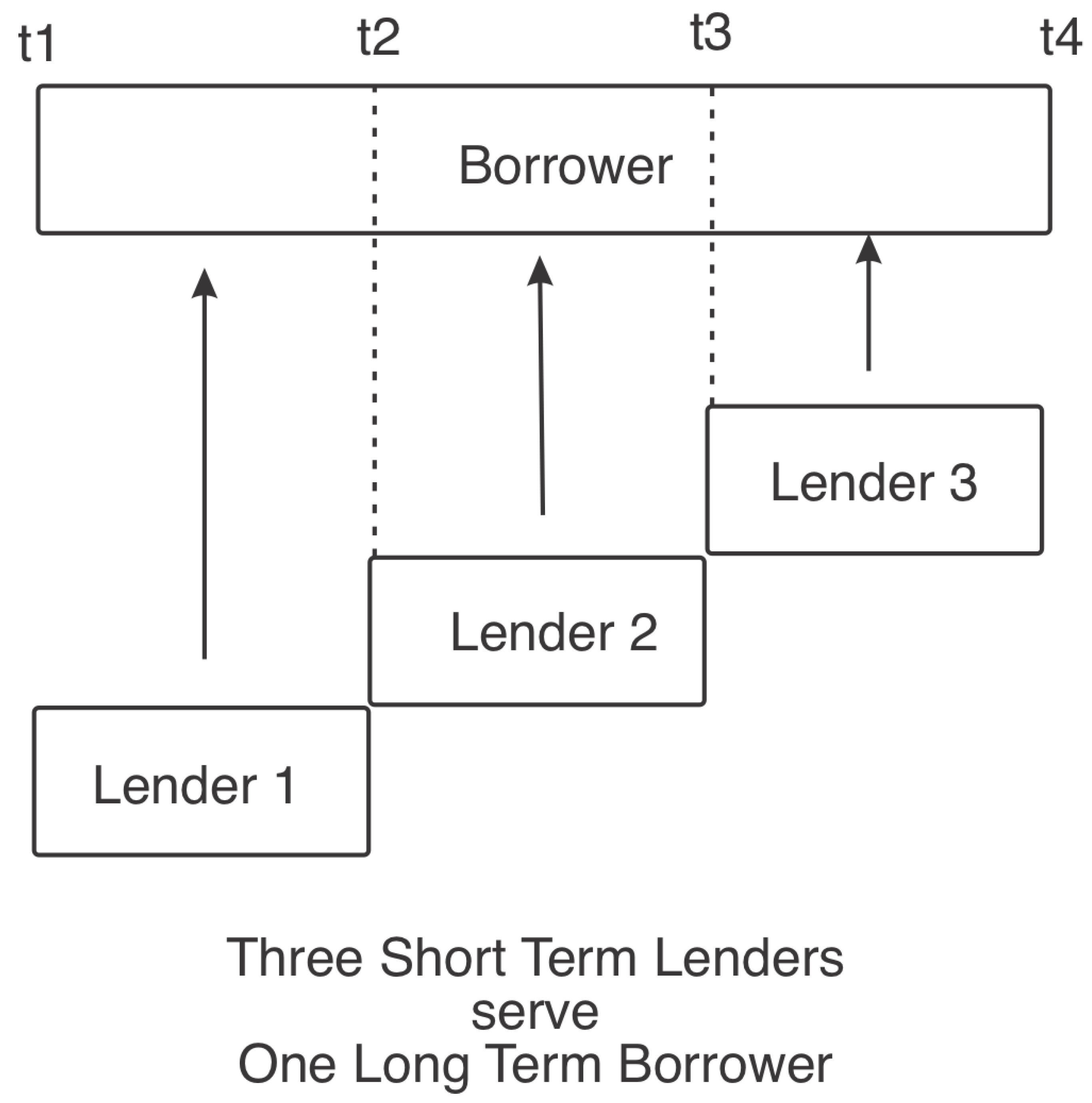

Figure 3.

Three short term lenders serve one long term borrower.

Figure 3.

Three short term lenders serve one long term borrower.

The figure shows a borrower who accepts a loan at date and time, t1 and is returning the loan at time point t4. The interest payment of the borrower is not shown on the figure. The figure shows that lender 1 transfers BitMint money to the borrower (the amount of the loan) at time point t1. At time point t2 lender 2 comes in and pays the amount of the loan to lender 1. This completes the participation of lender 1 in the loan event. Lender 1 offered the sum of the loan for the period t1 to t2. They received their money and our out of the situation. The borrower is not asked to pay anything so the borrower is blind to the fact that lender 2 paid to lender 1 the amount of the loan. When the clock reaches time/date t3, lender 3 comes in and pays the amount of the loan to lender 2. Again the borrower is blind to this exchange. Lender 2 receives the loan amount after the agreed upon time t3-t2. Now the borrower is served by lender 3. When the clock hits t4 the borrower is expected to pay the amount of the loan back to lender 3 which gets its money when expected. We note that while it is possible that all these transactions are done directly between lenders and borrowers, it is more orderly to have the DLI as an intermediary to whom the BitMint coins are paid and who pays the BitMint coins to the participants. The borrower at some preset time remits to the DLI the calculated amount of interest based on the agreed interest rate. the amount of the loan, and its duration. The DLI collects this payment with all other payments by the various borrowers, uses the money for operation and profits and pays the money due per agreement to the lender3.

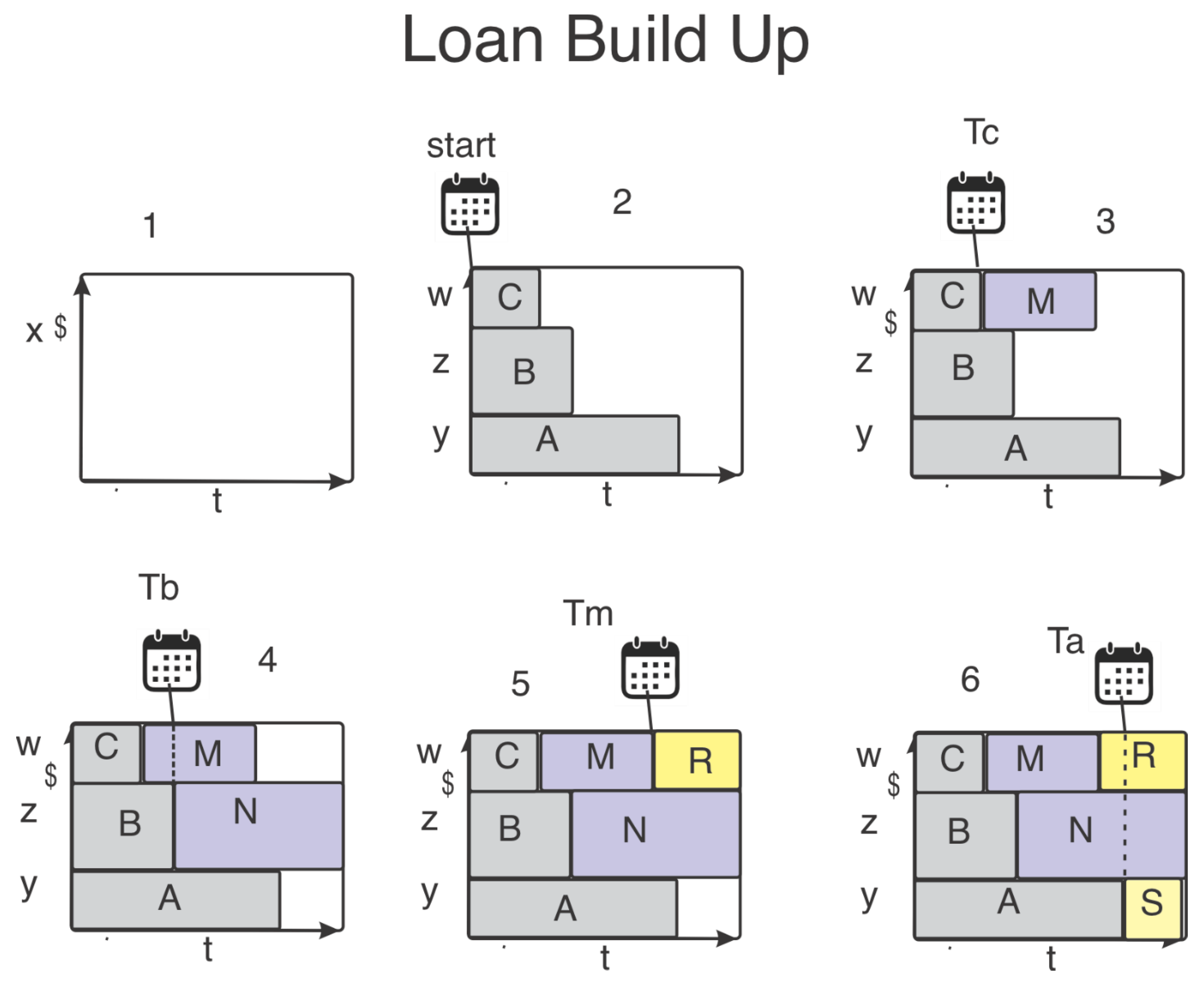

This figure shows a borrowing request for an amount x

$ asked for duration t as it is being gradually built up from smaller scale lenders. (1). There was no lender offering the full sum of

$x, so the DLI had to break down x to smaller parts to fits the sums the lender specified in their postings. The sum x was broken down in this case to sums y, z, and w that together amount to x:

Lender A was matched with the borrower to pay to them the amount y. Lender B was matched with the same borrower to take care of a partial sum z and lender C who offered to lend an amount W was also matched up. So on the date and time that loan event is scheduled to start, lender A, B and C together are paying y, z, and w sums (summing up to x) to the borrower and the loan event starts its life cycle. The borrower has no clue that three lenders had to be assembled to service their loan, and the borrower does not care. (2)

When the clock ticks time Tc (later of course then the start time), the involved lender C is expected to get its loan back. (3). The DLI was busy all the time until Tc to find a suitable lender to replace lender C. Fortunately the DLI found lender M that offered to lend an amount w ( or higher) and agrees for the loan to start at time point Tc. Lender M then pays the mount w to lender C, and lender C leaves the scene having accomplished his plan to lend an amount w for the period of time to start at 'start' time and end on Tc.

Then the clock runs forward and Tb becomes the time of the present. (4). At Tb lender B is expecting to be paid his loan in the amount of z. The DLI before that moment was able to locate lender N who is ready to lend the amount z, and indeed is paying that sum to lender B (again the payment is in all convenience done from lender N to the DLI which right away passes it to lender B -- but direct transfer of money N to B is also possible, if so desired.

Next critical time comes when the clock runs its course to time point Tm (5). At this point lender M who at time point Tc paid w$ to lender C is expecting to be paid back the same amount now at time point Tm. This happens because the DLI found lender R who offered to pay the amount w or higher and do so beginning at time point Tm. So lender R is paying lender M, and lender M leaves the scene, fully satisfied.

Next the clock arrives to time point Ta (6). Lender A was the longest duration lender from the first set (lender A, B, and C). Lender A was prepared to lend to time point Ta which is still short of the full loan duration, so the DLI had to find lender S to pay the amount y$ to lender A, and again the borrower is clueless. When the clock comes to the end of the loan duration, t, then the borrower is returning the amount of the loan x to DLI (as said the interest payment is handled separately), and DLI breaks down x to y, z and w, and pays lender S the amount y, pays lender N the amount z and pays lender R the amount w.

This finishes off the loan event. A good match was achieved. The borrower got the money they requested at the amount and duration they requested and was agreed upon between them and the DLI, and when the loan time concluded the borrower returned the same amount x to DLI which was then able to satisfy lender N, S, and R.

Figure 5.

Loan Breakdown.

Figure 5.

Loan Breakdown.

This figure shows breakdown of a large lending offer to assorted smaller borrowing requests. Borrowers, A, B, C, D, E, and F are all fitted into the block of the lender offer. Each for a certain amount of money and a certain stretch of time. The white area represent lending capacity for which no match was found.

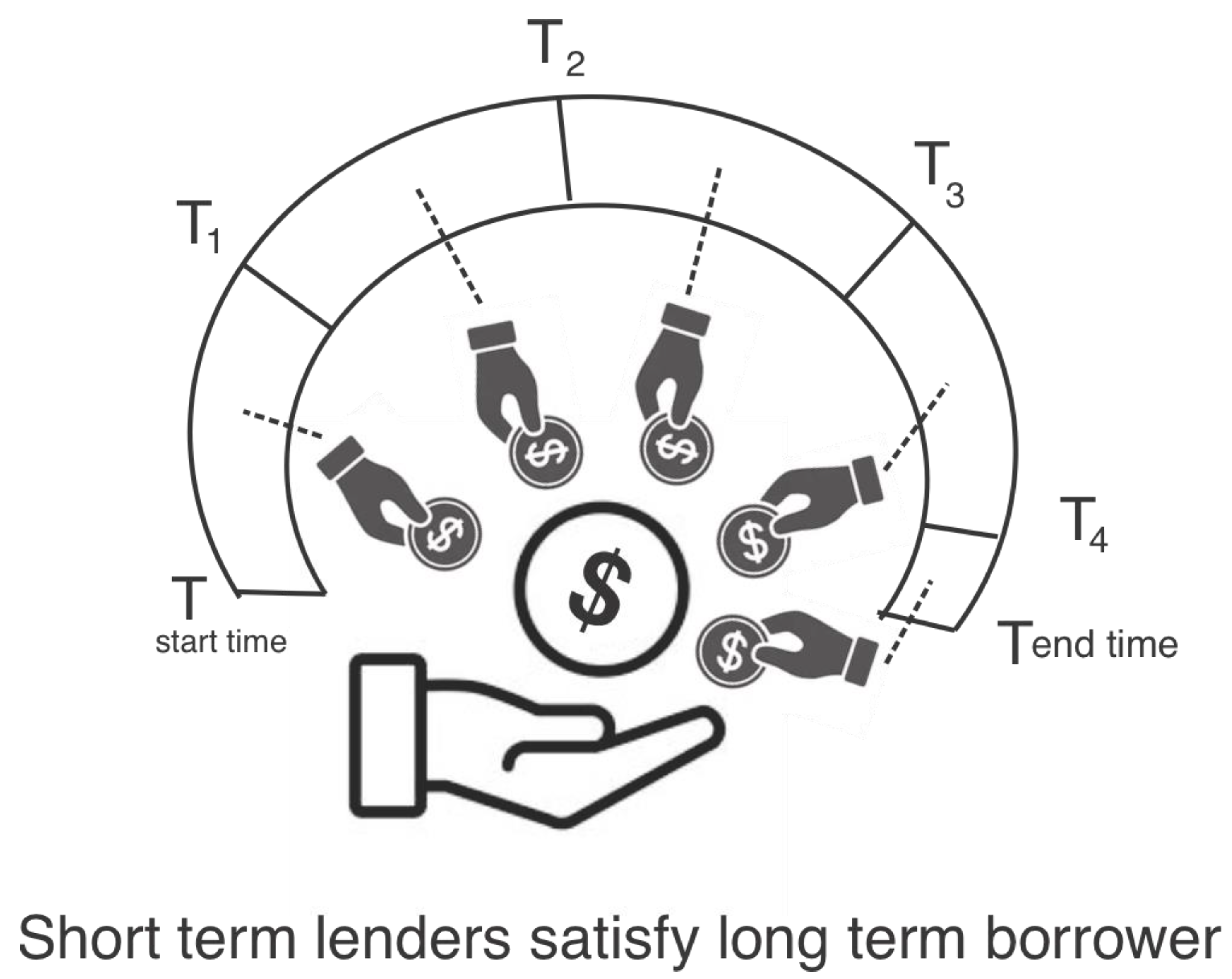

Figure 6.

short term lenders satisfy long term borrower.

Figure 6.

short term lenders satisfy long term borrower.

Five lender are shown to replace each other at time T1, T2, T3, T4 as together they match the borrower's request.

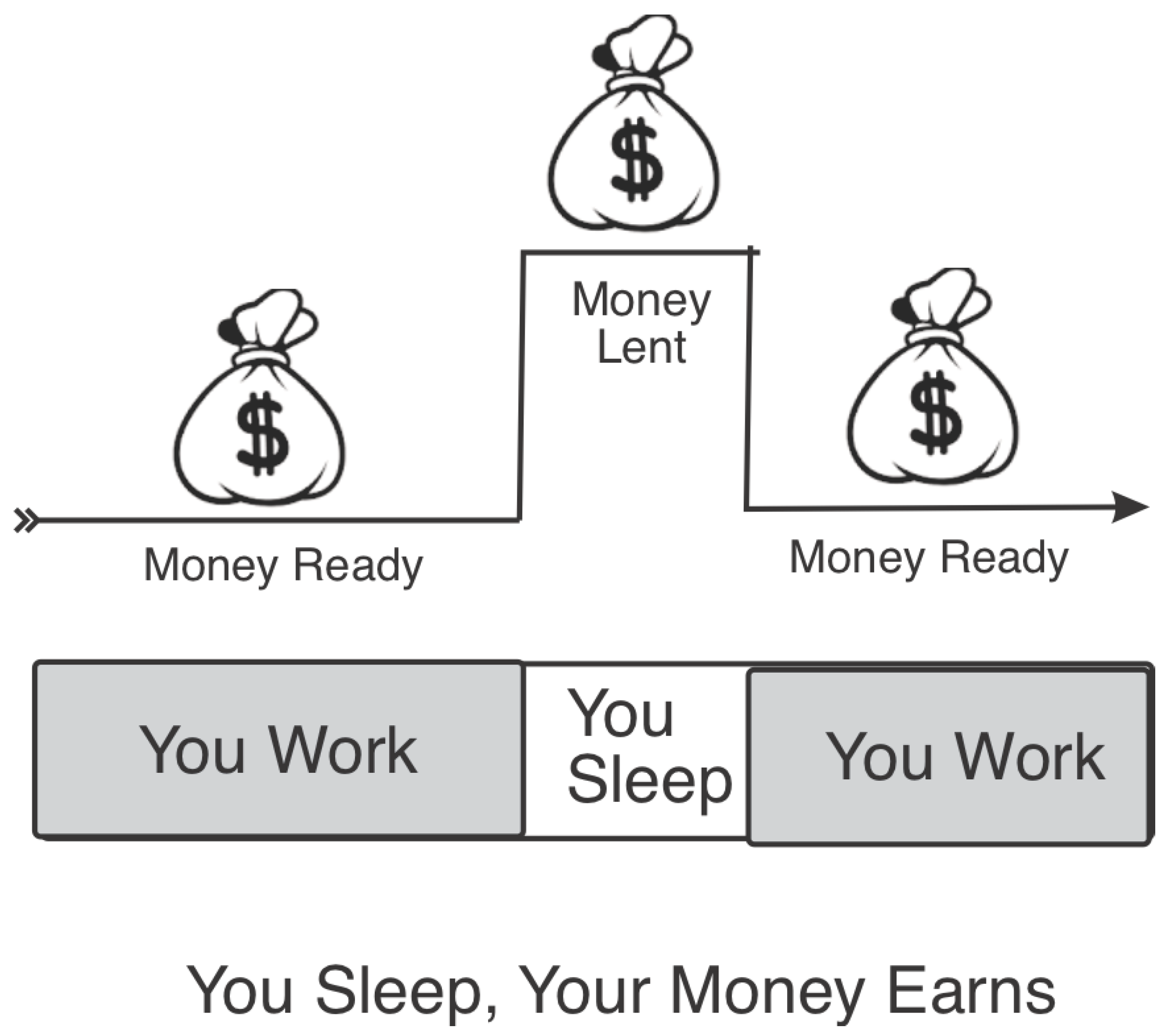

Figure 7.

You Sleep, your money earns.

Figure 7.

You Sleep, your money earns.

This figure depicts a use of the DLI for businesses or individuals who wish to keep their liquid assets spend-ready when they are active and awake, but are prepared to lend that money off during after hours, over night, or say when they are sleeping. After all a sleeping person is not spending any money. So the "bag of money" is shown at ready mode when its owner is awake and in a lent state when the owner is asleep. This figure highlights the fact that this described method is applicable to extremely short term lending events. In fact, if the DLI operation is extended globally then "while-you-sleep-lending" over the globe all by itself could support large long term loans since when one of us sleeps the other is awake, and vice versa.

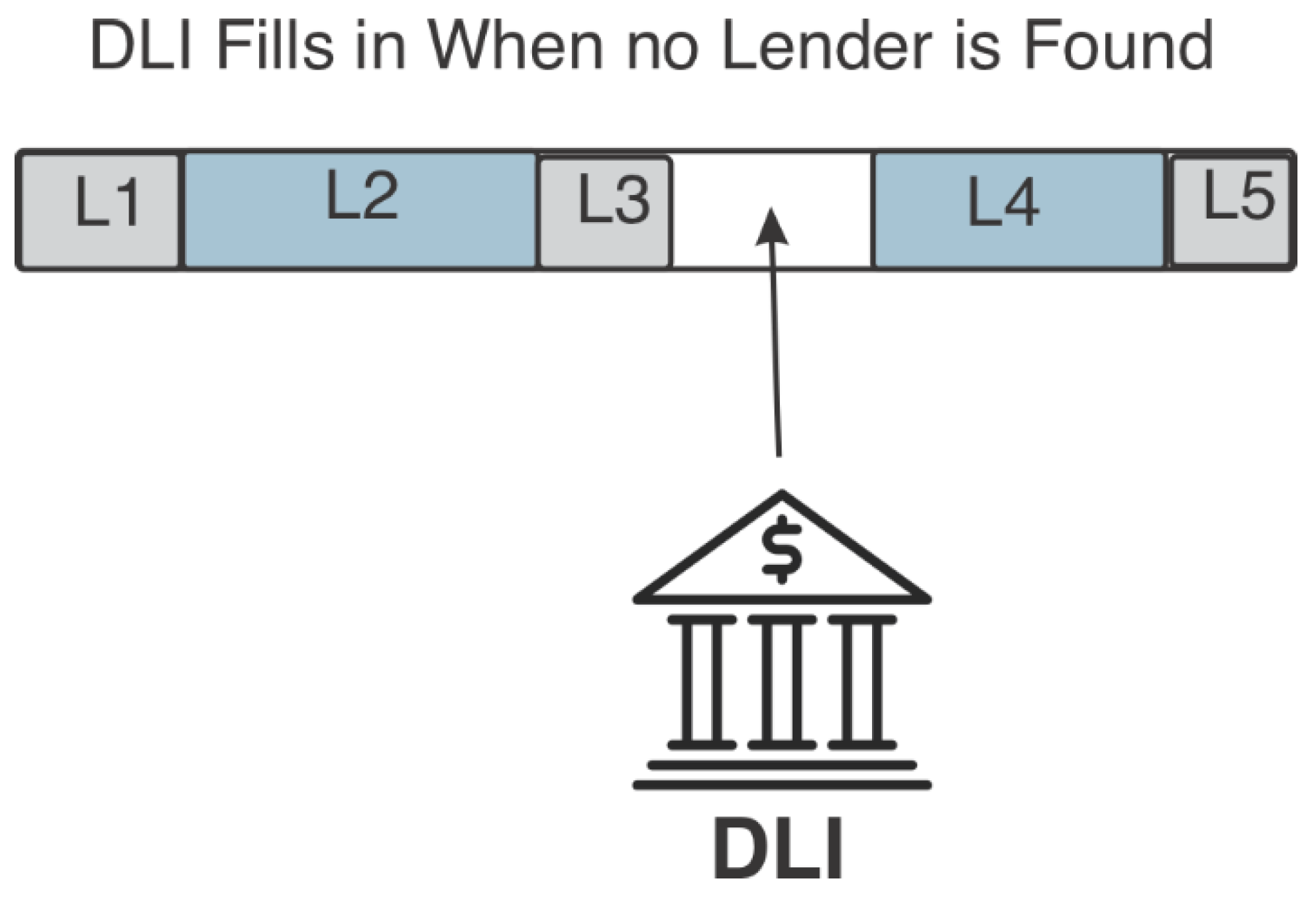

Figure 8.

DLI Fills in When No Lender is Found.

Figure 8.

DLI Fills in When No Lender is Found.

This figure shows a loan that is being satisfied by a succession of lenders L1, L2, L3 -- after which the DLI was unable to locate a matching lender, so with no other choice the DLI used its own money (from a reserve fund kept specifically for that purpose) to support the loan, while looking for a fitting lender. Soon enough lender L4 is found and pays the loan amount. This payment goes to DLI which beforehand paid the same amount to L3. L4 is followed by L5 and the loan is completed without incident. The emergency intervention of the DLI kept the case smooth and without any incident.

References

- Samid, G. “Tethered Money”. Elsevier, 2015. [Google Scholar]

- "Digital Finance: Cash, Credit, And Investment Instruments In A Unified Framework (Bitmint). US Patent 11,107, 1563.

- "Digital Transactional Procedures And Implements". US Patent 9,471, 906.

- "Effects of Digital Loans on Financial Performance for Commercial Banks Listed" http://erepository.uonbi.ac.ke/handle/11295/166329. 1129.

- "Fintech and big tech credit: Drivers of the growth of digital lending" https://www.sciencedirect.com/science/article/pii/S0378426622003223. 0378.

- "Digitalization of financial services in European countries: Evaluation and comparative analysis". https://www.ceeol.com/search/article-detail?id= 977868. 9778.

- "Digital transformation and costumers services in emerging countries: Loan prediction modeling in modern banking transactions" https://link.springer.com/chapter/10.1007/978-3-030-90618-4_32.

- "LendPal - Borrow & Lend Money + Items to Friends 4" https://apps.apple.com/us/app/lendpal-borrow- lend-money-items-to-friends.

- "WeLend" https://www.welend.hk/en.

- “Digital credit in Kenya: A survey of costs, uses and borrowers considerations in relation to loan uptake”.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).