1. Introduction

The textile industry is a key pillar of the global economy, playing a critical role in employment, industrial production, and international trade (Fatorachian, 2013). In India alone, the textile sector accounts for 13% of industrial production and contributes 2.3% to the national GDP, employing over 45 million people (Statista, 2021). Projections estimate that the Indian textile industry could grow to a market size of $350 billion by 2030, underscoring its pivotal position in the global market (Invest India, 2023). However, the sector is currently undergoing significant transformations driven by digital advancements and evolving consumer expectations, especially in terms of sustainability and operational efficiency (Kumar et al., 2022).

Recent global disruptions, including the COVID-19 pandemic and shifting consumer behaviours, have accelerated the need for digital transformation across industries. While the retail sector has quickly adapted to these changes, wholesalers in the textile industry have lagged in adopting crucial digital technologies such as e-commerce platforms and Customer Relationship Management (CRM) systems (Smith & Fatorachian, 2023). This slow adoption presents both challenges and opportunities: wholesalers that embrace digital tools can streamline their operations and enhance customer engagement, gaining a competitive edge in an increasingly digital marketplace. Success stories, such as Zara’s integration of digital tools for supply chain optimization, illustrate the transformative potential for wholesalers (Rahmadhan et al., 2023).

Despite the benefits, several barriers hinder digital adoption in the textile wholesale sector. These include high initial investment costs, a shortage of skilled workers, resistance to organizational change, and concerns about data security and integration with legacy systems (Khan et al., 2022). Overcoming these challenges is crucial for wholesalers to unlock the full potential of digital transformation, improve operational efficiency, and respond more effectively to market demands.

This study focuses on the under-researched wholesale segment of the textile industry, which has been slower to adopt digital technologies compared to retail (Bhattacharya & Singh, 2022). While much of the existing literature emphasizes the advantages of digitalization in retail (Sharma et al., 2021), the wholesale sector presents distinct challenges and opportunities. By addressing this gap, the study aims to explore how digital platforms can be leveraged by textile wholesalers to strengthen market positioning, streamline operations, and improve customer engagement.

1.1. Research Aim and Objectives

The aim of this study is to investigate how digital platforms, specifically CRM systems, e-commerce, and digital marketing, can enhance the market position of textile wholesalers by improving both operational efficiency and customer engagement. The key objectives are as follows:

Analyse current barriers and challenges faced by textile wholesalers in adopting digital technologies.

Evaluate the operational and competitive benefits of CRM, e-commerce, and digital marketing platforms.

Provide actionable recommendations for textile wholesalers to enhance their market positioning through digital transformation.

2. Industry Overview

The textile industry plays a vital role in the global economy, encompassing a broad range of activities, from the cultivation of raw materials to the production of finished goods, including apparel, home textiles, and industrial fabrics (Smith, 2023). This sector is distinguished by its diverse use of technologies and production techniques, contributing significantly to international trade, economic development, and sustainability efforts.

India, in particular, holds a prominent position in the global textile landscape, especially in the production of cotton, silk, and technical textiles. The textile sector contributes approximately 2.3% to India’s GDP, 13% to its industrial output, and 12% to the nation’s exports, underscoring its crucial role in the country’s economy (Invest India, 2023). In 2022, the Indian textile and apparel market was valued at $165 billion, with projections of reaching $350 billion by 2030, growing at a compound annual growth rate (CAGR) of 10% (Invest India, 2023).

Employment is another key aspect of India’s textile industry, which directly supports 45 million jobs and generates an additional 100 million jobs in related sectors (Berwal, 2020). In the fiscal year 2021-22, India achieved its highest-ever textile exports, amounting to $44.4 billion, with projections forecasting an increase to $190 billion by 2025-26 (Invest India, 2023). This growth further highlights India’s expanding influence in global textile trade.

On a global scale, the apparel market, which saw a 17.2% decline in 2020 due to the COVID-19 pandemic, is expected to recover and reach $2 trillion by 2028, with the womenswear segment leading this growth (MarketLine, 2021).

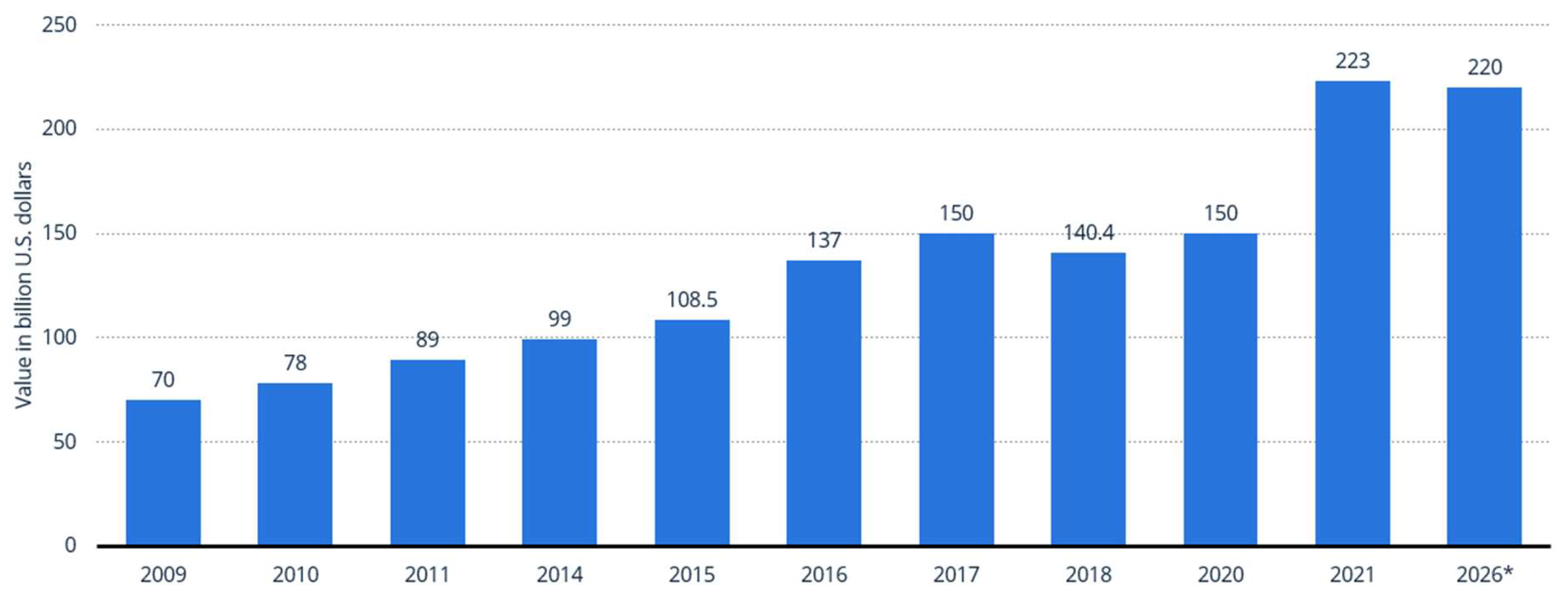

India’s expanding textile sector (

Figure 1) reflects not only its economic importance but also its deep cultural heritage. The combination of traditional craftsmanship and modern technological advancements has positioned India as a key player in the global textile industry. Continued growth in this sector is essential for both domestic economic development and India’s increasing prominence in international markets.

3. Literature Review

3.1. Digital Transformation in the Textile Industry

The global textile industry has undergone significant changes due to the emergence of digital technologies such as Industry 4.0, the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing (Fatorachian & Kazemi, 2018). These innovations have enabled companies to improve operational efficiency, reduce waste, and enhance product customization (Fatorachian, 2024; Kagermann et al., 2020). The adoption of smart technologies has revolutionized traditional business models, particularly in production processes, by automating tasks to increase speed and accuracy while minimizing human error (Fatorachian & Kazemi, 2021; Baur & Wee, 2015).

The integration of IoT into manufacturing has facilitated real-time data monitoring, predictive maintenance, and more intelligent decision-making (Smit et al., 2023). Similarly, AI applications, such as demand forecasting and smart inventory management, have shortened lead times and boosted supply chain responsiveness (Hecklau et al., 2023). Despite these advancements, the wholesale segment of the textile industry has lagged in adopting these technologies. It faces barriers such as outdated systems, resistance to change, and insufficient digital infrastructure (Khan et al., 2022).

This study underscores the opportunity for textile wholesalers to leverage digital transformation to strengthen their market positioning and operational efficiency—an area that remains under-researched (Rahmadhan et al., 2023). Digital tools offer significant potential for optimizing customer interactions and supply chain management, but empirical studies on digital adoption in wholesale, especially compared to retail, are scarce (Li & Ni, 2022).

3.2. Customer Relationship Management in Textiles

Customer Relationship Management (CRM) systems have become essential to modern business practices by enabling personalized customer engagement and more targeted marketing strategies (Fatorachian, 2012). For textile wholesalers, CRM adoption can lead to improved customer retention, enhanced marketing effectiveness, and a more personalized buying experience (Buttle & Maklan, 2019). CRM systems help businesses gather and analyse customer data, offering opportunities for cross-selling and upselling (Sundström & Törnroos, 2021).

In the textile industry, where consumer preferences change rapidly, CRM is critical to maintaining competitiveness. Research indicates that CRM systems provide valuable insights into customer behaviour, allowing wholesalers to tailor offerings and foster customer loyalty (Smith, 2018). Furthermore, integrating CRM with digital marketing tools amplifies the system’s value, optimizing customer outreach and engagement strategies (Marinagi et al., 2023).

3.3. E-Commerce and Digital Platforms

E-commerce has transformed the retail industry by allowing businesses to bypass traditional intermediaries and engage directly with consumers. For textile wholesalers, e-commerce platforms offer opportunities to expand their customer base, lower operational costs, and enhance supply chain transparency (Andam, 2020; Fatorachian & Mitchell, 2024). By adopting e-commerce, wholesalers can offer a seamless shopping experience, broaden their product offerings, and respond more rapidly to consumer needs (Elia et al., 2023).

Additionally, integrating e-commerce platforms with CRM systems enables businesses to provide highly personalized services, fostering greater brand loyalty. Studies have shown that businesses utilizing both e-commerce and CRM systems experience improved sales efficiency and customer support (Statista, 2023). Despite these benefits, the wholesale sector has been slower to adopt e-commerce due to the complexities of supply chain integration and managing bulk transactions (Bharadwaj et al., 2021).

3.4. Brand Identity and Digital Marketing

Establishing a strong brand identity is essential for textile companies aiming to differentiate themselves in a competitive market. Digital marketing tools, including search engine optimization (SEO), social media, and influencer marketing, are crucial in enhancing brand visibility and customer engagement (Aaker, 2009). Research has shown that textile companies with a robust online presence perform better in terms of sales and customer loyalty compared to those relying solely on traditional marketing methods (Enache, 2024).

For wholesalers, digital marketing offers a cost-effective way to communicate their value propositions and build stronger customer relationships (Khan et al., 2023). As retail accelerates its digital transformation, wholesalers that fail to adopt digital marketing risk losing market share and customer satisfaction (Hecklau et al., 2023).

3.5. Challenges of Digital Adoption in the Wholesale Sector

While the benefits of digital platforms for improving operational efficiency and customer engagement are well-documented in retail, the wholesale segment faces unique challenges in digital transformation. Research indicates that wholesalers often encounter higher barriers to digital adoption due to complex business-to-business (B2B) relationships, larger transaction volumes, and the need to integrate with legacy systems (Matthyssens & Vandenbempt, 2008; Hagberg et al., 2016).

One major hurdle is the cost of implementing digital technologies like e-commerce platforms and CRM systems. For wholesalers, the initial investment in technology can be substantial, and the return on investment is often slower compared to retailers who can more quickly benefit from consumer-facing digital tools (Tornatzky & Fleischer, 1990). This financial challenge is compounded by a lack of skilled workers capable of managing these digital tools, further delaying transformation (OECD, 2019).

Additionally, integrating digital platforms with legacy enterprise resource planning (ERP) systems is another significant challenge. Wholesalers, unlike retailers, often rely on older ERP systems that are incompatible with modern cloud-based tools like CRM or inventory management systems (Ray & Sun, 2019). This integration issue adds both cost and complexity to the adoption process.

Wholesalers also face evolving customer expectations. As retail customers increasingly demand personalized services, wholesalers must adapt their B2B offerings to provide similar experiences, such as tailored pricing and more efficient order fulfillment (Wollan et al., 2016). However, making this shift requires both technological investments and cultural change within organizations, which can be resistant to rapid transformation (Verhoef et al., 2021).

Data security is another critical concern for wholesalers. Handling large volumes of sensitive data, such as customer information, pricing structures, and inventory levels, presents significant risks. As digital platforms become more embedded in business operations, concerns about data breaches and cyber-attacks intensify, leading to hesitancy in adopting new technologies (ENISA, 2021).

Despite these challenges, there is growing recognition of the potential for digital transformation to revolutionize the wholesale sector. Studies suggest that adopting digital tools—particularly in areas like customer relationship management, inventory control, and supply chain transparency—can provide wholesalers with a significant competitive edge (Martín-Peña et al., 2018). However, overcoming these challenges requires targeted strategies that address both technological and organizational barriers.

4. Theoretical Background

Digital transformation in the textile industry can be analysed through multiple theoretical frameworks, including the Technology Acceptance Model (TAM), Diffusion of Innovations (DOI) Theory, and the Resource-Based View (RBV). Each of these frameworks offers insights into how organizations adopt and implement new technologies, which is particularly relevant for textile wholesalers facing the challenges and opportunities of digitalization.

4.1. Technology Acceptance Model (TAM)

The Technology Acceptance Model (TAM), introduced by Davis (1989), is widely used to explain the adoption of digital technologies across various sectors. TAM emphasizes two key factors influencing technology adoption: perceived ease of use and perceived usefulness (Fatorachian, 2013). For textile wholesalers, the likelihood of adopting digital tools such as CRM systems and e-commerce platforms increases if they are perceived as easy to implement and beneficial to daily operations (Venkatesh & Bala, 2008). In this context, wholesalers must view these tools as not only accessible but also as directly contributing to their efficiency and profitability.

4.2. Diffusion of Innovations Theory (DOI)

The Diffusion of Innovations (DOI) theory, developed by Rogers (1962), provides a complementary lens for understanding technology adoption by focusing on the characteristics of innovations themselves. DOI suggests that innovations are adopted based on factors such as relative advantage, compatibility, complexity, and observability (Rajabzadeh & Fatorachian, 2023; Schmidt et al., 2022). For textile wholesalers, the perceived relative advantage of digital platforms—such as cost reductions, operational efficiency, and improved customer engagement—strongly influences their willingness to adopt these technologies. Compatibility with existing business processes and the ability to observe clear benefits in real-time further drive adoption rates.

4.3. Resource-Based View (RBV)

The Resource-Based View (RBV) of the firm, as proposed by Barney (1991), focuses on the strategic use of a company’s unique resources to achieve a competitive advantage. In the context of digital transformation, RBV highlights the importance of developing technological capabilities as strategic assets (Fatorachian & Smith, 2022). For textile wholesalers, digital platforms can become key resources that differentiate them from competitors by enhancing customer engagement and optimizing supply chain operations. By leveraging these digital tools, wholesalers can develop distinctive competencies that improve their market positioning and operational effectiveness (Wernerfelt, 2022).

4.4. Application of Theories in This Study

In this study, the Diffusion of Innovations (DOI) theory plays a critical role in explaining the rate at which textile wholesalers adopt digital technologies such as CRM systems and e-commerce platforms. The perceived relative advantages of these technologies—such as cost savings, increased operational efficiency, and enhanced customer engagement—serve as strong drivers for adoption. However, challenges such as high upfront costs, the complexity of integrating new systems with legacy workflows, and concerns over data security can slow down the adoption process.

Trialability, a core concept of DOI, also influences adoption rates. Textile wholesalers are more likely to adopt digital platforms if they can first test these technologies on a smaller scale before committing to full implementation. For instance, the case study of Company A in this paper demonstrates that the perceived ease of use and seamless integration of digital platforms with existing systems directly influenced adoption, aligning with TAM’s predictions. The observable operational improvements in customer engagement and supply chain efficiency further support DOI’s principle of relative advantage.

The study also reinforces TAM’s assertion that perceived usefulness plays a critical role in adoption. The empirical data collected from wholesalers reveal that perceived operational benefits—particularly in terms of customer engagement and streamlined supply chain management—drive the adoption of digital technologies. Additionally, barriers such as cost and system complexity are consistent with DOI’s identification of trialability and observability as key factors in determining the rate of technology adoption.

In conclusion, by applying these theoretical frameworks, this study offers valuable insights into how textile wholesalers can leverage digital transformation to gain a competitive advantage. The combined perspectives of TAM, DOI, and RBV provide a comprehensive understanding of the factors influencing technology adoption and how wholesalers can strategically address challenges to optimize their market positioning.

5. Research Methodology Overview

This study employs a mixed-methods approach, combining both quantitative and qualitative research to comprehensively examine Company A’s market positioning and supply chain operations. By integrating primary and secondary data sources, the study ensures a well-rounded investigation. Primary research offers firsthand insights into operational challenges and customer behaviours, while secondary research provides a broader context through the analysis of industry trends, competitor positioning, and emerging technologies. Quantitative data focuses on measurable outcomes such as customer preferences and market trends, while qualitative data captures deeper insights into stakeholder perspectives and process inefficiencies, ensuring a holistic analysis (Mark et al., 2020).

5.1. Primary and Secondary Research Methods

The primary research component involves a mix of online focus groups, questionnaires, and observational studies targeting internal stakeholders and customers of Company A. Focus groups provide qualitative insights into internal processes, customer relationships, and marketing strategies, while questionnaires gather quantitative data on customer preferences, satisfaction levels, and e-commerce behaviour. Statistical tools such as SPSS are used to analyse this data, identifying significant trends and segmentation differences.

Secondary research involves analysing industry reports, government publications, and market data from reputable sources like Statista and government websites. This secondary data provides a macro-level view of market conditions, competitor positioning, and regulatory influences, complementing the primary data and supporting the development of actionable recommendations to enhance Company A’s market position and operational efficiency.

This integrated approach ensures that the findings are not only data-driven but also grounded in the broader market context, enabling the formulation of strategies that address both operational challenges and market opportunities.

5.2. Case Study: Company A

Company A is a wholesale textile business established in 1935 in India, with over 75 years of industry experience. Initially specializing in locally manufactured handloom products, the company has expanded its product range to include sarees, dhotis, and ethnic wear under subsequent leadership. Despite its strong reputation for quality, sustainability, and customer service, Company A faces significant challenges. These include an outdated and inefficient CRM system, which limits the company’s ability to personalize services and capture new revenue opportunities. Additionally, the growing trend of small retailers sourcing directly from manufacturers, coupled with the increasing adoption of online shopping, poses a threat to Company A’s role in the supply chain.

Addressing these challenges requires adopting digital platforms and strategies aimed at optimizing customer engagement and improving operational efficiency, a central focus of this study.

5.3. Sampling and Data Collection

Snowball sampling was used to recruit participants for focus groups and interviews with key internal stakeholders, ensuring a diverse range of perspectives. The focus groups, comprising four key internal stakeholders, provided qualitative insights into internal processes, marketing strategies, and operational challenges. Thematic analysis, conducted using NVivo software, was employed to identify recurring themes, such as inefficiencies in CRM systems and market challenges.

For the quantitative research, a sample size of 200 customers was selected for the questionnaire. This sample strikes a balance between robustness and feasibility, capturing key metrics related to customer preferences, satisfaction levels, and interactions with the company’s e-commerce platform. The qualitative and quantitative data were analysed using thematic analysis and statistical tools like SPSS to uncover key trends, relationships, and areas for improvement. This dual approach ensures that both internal and external challenges are fully explored.

5.4. Qualitative Insights: Focus Groups and Observations

The qualitative component focuses on gathering in-depth insights from internal stakeholders through focus groups and observing customer interactions. Focus groups conducted with Company A’s management and employees explored topics such as operational bottlenecks, CRM inefficiencies, and marketing challenges. Thematic analysis identified key themes and opportunities for improvement, such as enhancing customer relationship management and streamlining internal processes.

Observational research provided real-time insights into customer engagement and business operations, highlighting inefficiencies in both customer-facing and internal processes. These observations contributed to actionable recommendations for targeted operational improvements and enhanced customer experiences.

5.5. Quantitative Insights: Questionnaires and Statistical Analysis

Quantitative research was conducted using a structured questionnaire targeting a representative sample of Company A’s customers. The survey collected key metrics such as customer preferences, satisfaction levels, and their interactions with the company’s e-commerce platform. This data was analysed using SPSS, enabling the identification of customer behaviours and preferences.

By applying comparative analysis across different customer segments, the study revealed patterns that can inform strategic decisions related to targeted marketing, customer retention, and operational efficiency. These quantitative findings provide measurable insights that will support the development of evidence-based strategies to enhance Company A’s market positioning and customer engagement efforts.

Table 1 provides the summary of the research methodology.

6. Data Analysis and Interpretation

This section provides an in-depth analysis of consumer satisfaction, factors influencing purchase decisions, and the challenges encountered during online shopping, based on the data collected. The findings are interpreted in the context of recent studies to offer a broader understanding of trends in e-commerce and digital platform usage. This dual approach ensures that the insights derived from the research are both specific to the case at hand and reflective of broader industry developments.

The analysis focuses on key metrics, including consumer satisfaction levels, purchase decision drivers, and common online shopping challenges. The data is presented through detailed visualizations, supporting actionable recommendations for businesses to enhance user experience, optimize product offerings, and increase overall customer satisfaction.

6.1. Questionnaire Analysis

The questionnaire received responses from 203 participants, providing a comprehensive overview of consumer experiences with digital platforms. The data was analyzed using descriptive statistics and visual representations, offering insights into several critical areas of online shopping:

Satisfaction with Services: The analysis measures consumer satisfaction across key dimensions such as product quality, delivery time, ease of use, and customer support. These metrics offer insights into areas where businesses excel and where improvements are necessary to enhance the overall customer experience.

Factors Influencing Purchase Decisions: The data highlights the primary drivers of consumer purchasing behaviour, such as pricing, product reviews, ease of website navigation, and payment security. Understanding these factors helps businesses fine-tune their strategies to better align with consumer expectations.

Challenges in Online Shopping: The analysis identifies common issues faced by consumers, including technical glitches, product misrepresentation, shipping delays, and inadequate customer service. These insights reveal the pain points that businesses must address to improve customer retention and satisfaction.

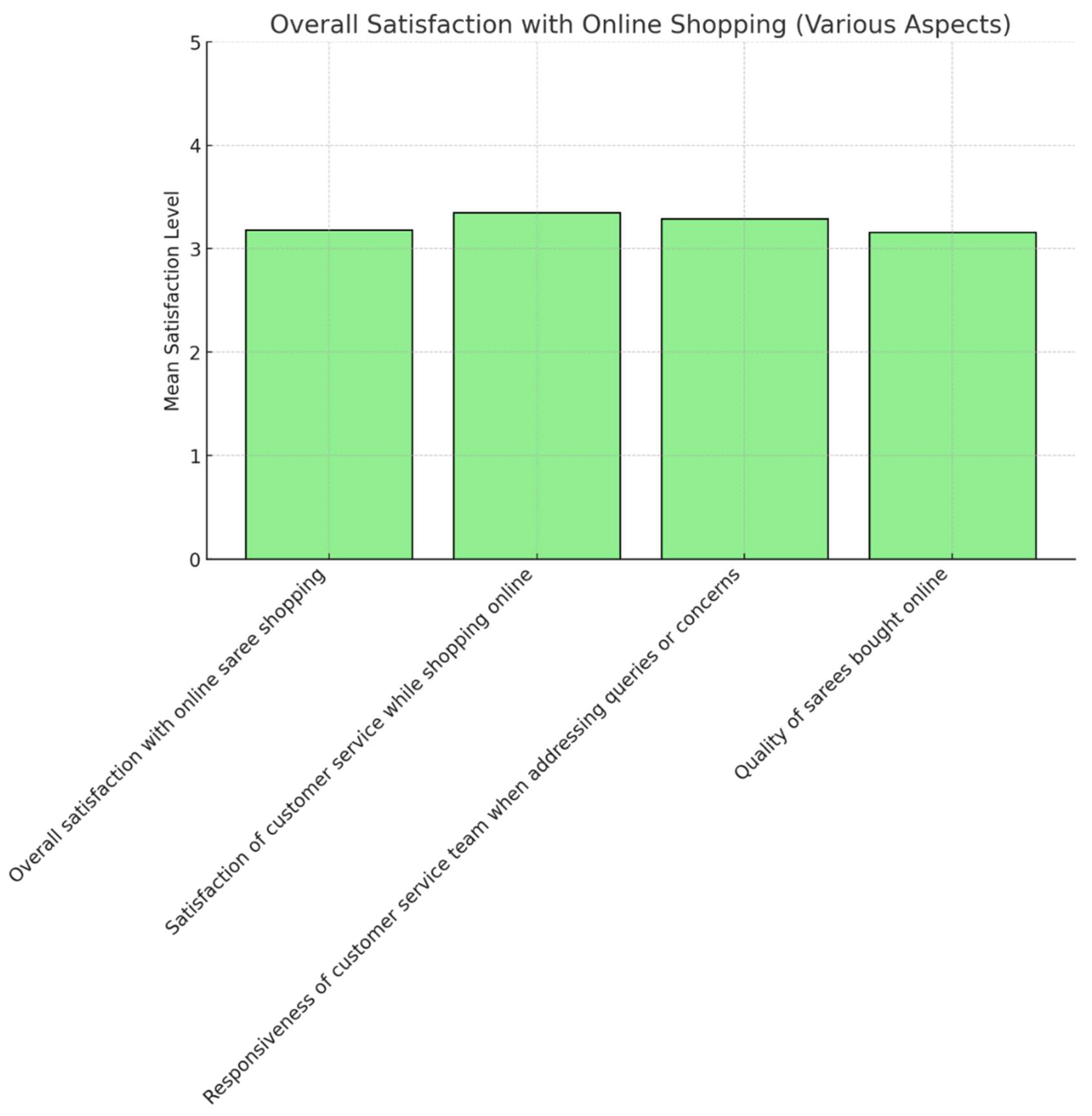

6.1.1. Satisfaction Levels with Online Shopping

Figure 2 reveals moderate satisfaction levels among consumers, with an overall satisfaction score of 3.18. Customer service emerges as a relatively stronger aspect, with a mean score of 3.35, while responsiveness is rated slightly lower at 3.29. These results suggest that although consumers feel adequately supported by customer service teams, there remains room for improvement in response times and the resolution of customer issues. Addressing these gaps could further enhance the customer experience. However, the most significant area of concern is product quality, which received a lower mean score of 3.16. This indicates that consumers are often dissatisfied with the products they receive via online platforms, negatively impacting their overall shopping experience.

Improving product quality necessitates the implementation of a robust and integrated quality control system throughout the production process. Automated quality checks, powered by machine learning algorithms, can help ensure consistency by identifying defects early, thereby minimizing the risk of poor-quality products reaching consumers (Hecklau et al., 2023). By proactively addressing quality issues at the production stage, businesses can significantly reduce customer dissatisfaction related to product flaws or misrepresentation.

In addition to enhancing quality control, leveraging advanced technologies like artificial intelligence (AI) and predictive analytics can further address the challenges identified in this study. AI-driven systems can forecast demand patterns based on consumer preferences and historical data, enabling more accurate stock management. This can help businesses maintain optimal inventory levels, preventing both stockouts and overstocking. Furthermore, AI-powered inventory management systems can ensure timely replenishment of high-demand products, enhancing the overall shopping experience by reducing delays in product availability.

Implementing these advanced solutions, particularly AI-driven quality control and inventory management, would not only improve product consistency but also allow textile wholesalers to align their offerings more closely with customer expectations. By addressing both product quality and operational efficiency, wholesalers can elevate consumer satisfaction across the board.

These findings are consistent with the research of Rachbini and Soeharso (2024), who emphasized the importance of customer service, particularly responsiveness and effective problem resolution, as key drivers of satisfaction in online shopping platforms in Indonesia. Similarly, Savastano et al. (2024) identified product quality as a persistent challenge in the post-pandemic online shopping environment, mirroring this study’s conclusion that product quality is a critical determinant of customer satisfaction.

6.1.2. Factors Influencing Consumer Perceptions

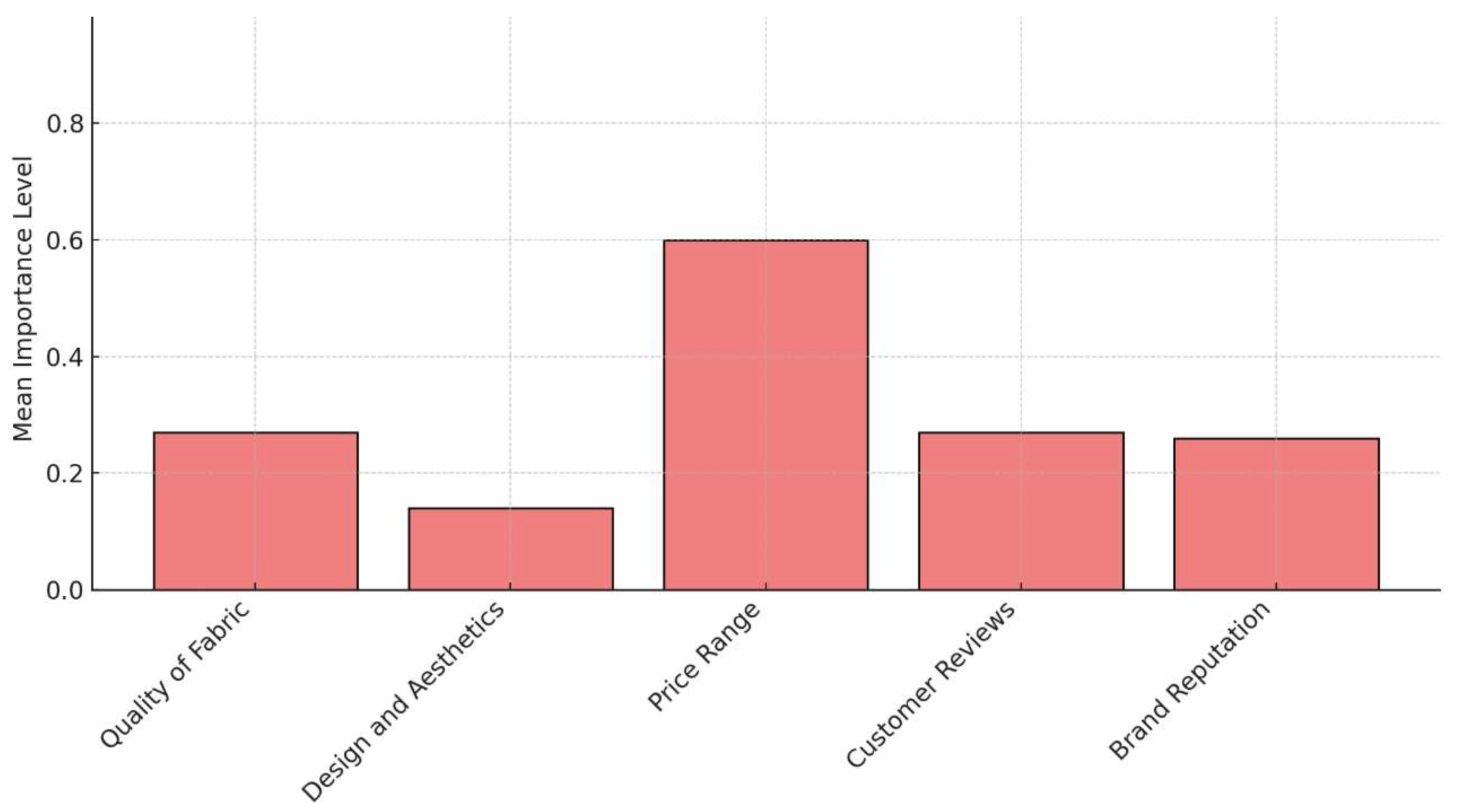

The figure above (

Figure 3) reveals that price range is the most influential factor in consumer decision-making, with a mean score of 0.60, underscoring the significant impact of cost considerations on purchasing behaviour. Other notable factors include fabric quality and customer reviews, both scoring 0.27, indicating that while price is a primary concern, consumers also place considerable importance on the quality of the product and the feedback from other buyers. In contrast, design and aesthetics appear to be less critical, with a lower mean score of 0.14, suggesting that visual appeal plays a more secondary role in influencing purchasing decisions.

These findings align with the research of Kirthiga and Suganya (2024), who identified price sensitivity as a key driver for e-commerce consumers, particularly within younger demographics who tend to prioritize cost efficiency when shopping online. Similarly, Enache (2024) emphasized that consumers on digital platforms heavily rely on product quality and customer reviews to guide their purchasing decisions, a trend that mirrors the results of this study. The consistency across these studies highlights the growing importance of transparent pricing, reliable product descriptions, and accessible customer feedback in driving online consumer behaviour.

Additionally, the lower emphasis on design and aesthetics suggests that while product presentation is important, it may be outweighed by practical considerations such as affordability and quality assurance. For businesses, this indicates the need to focus not only on competitive pricing but also on maintaining high standards for product quality and ensuring that customer reviews are prominently featured, as these factors are pivotal in shaping purchasing decisions.

6.1.3. Challenges Faced During Online Shopping

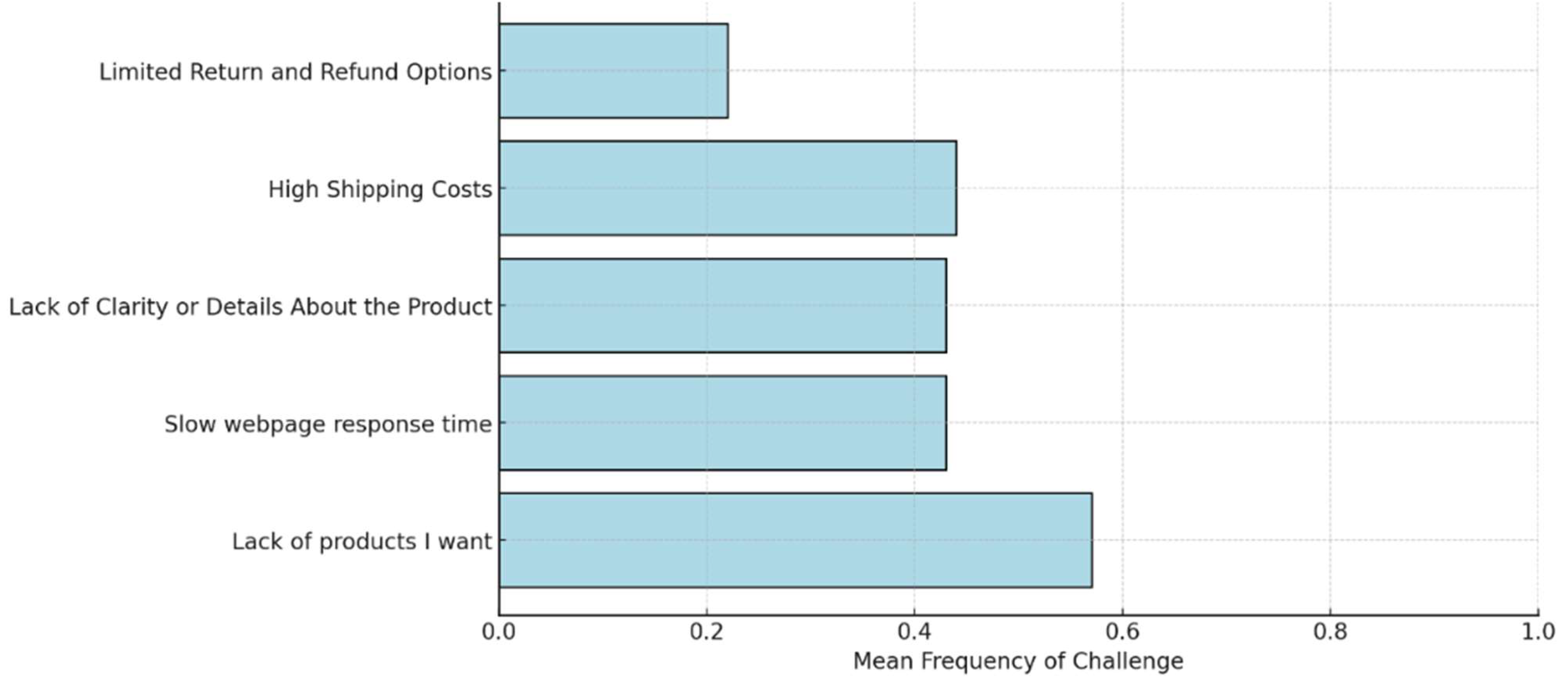

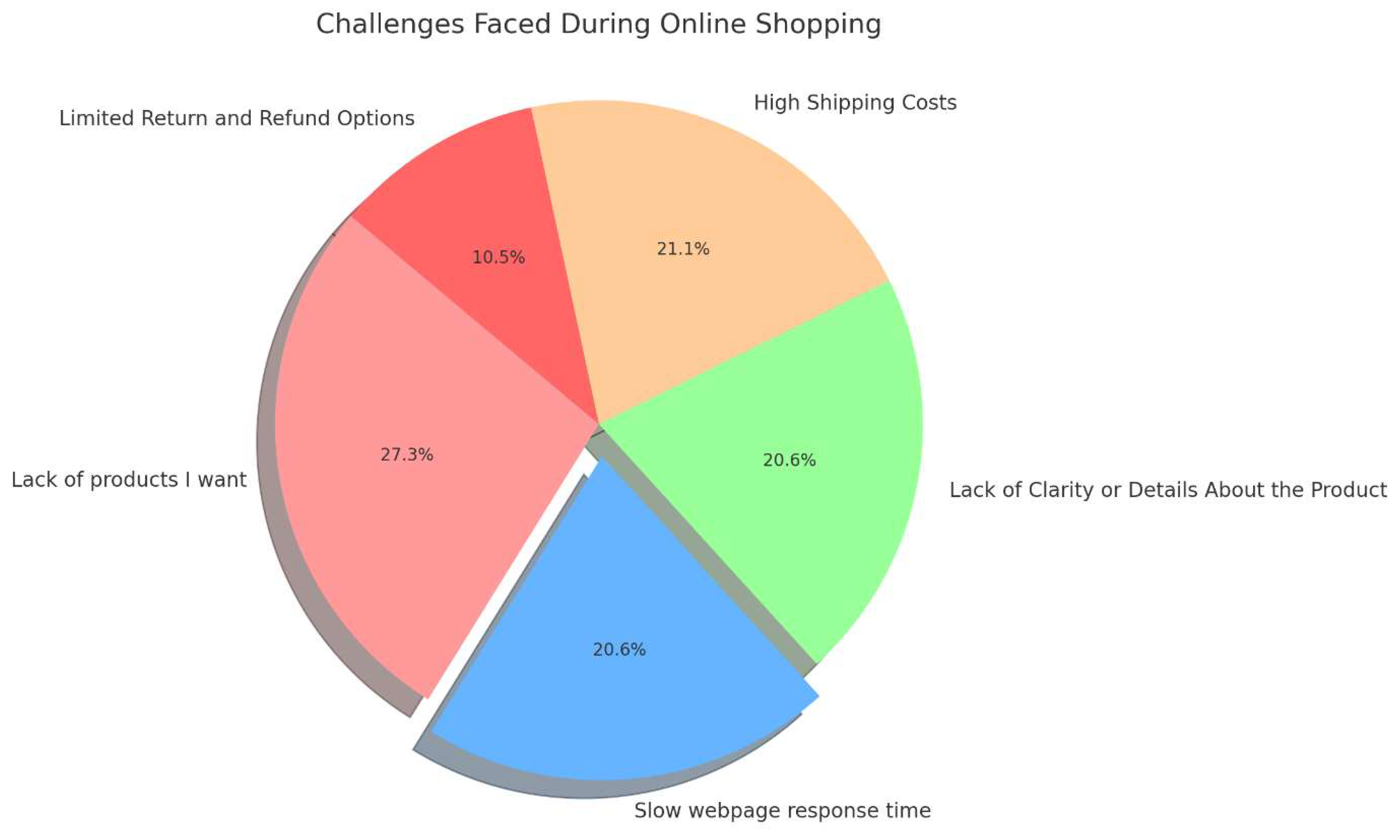

Based on

Figure 4 and 5, the most significant challenge identified in the study was product unavailability, with a mean score of 0.57. Consumers frequently expressed frustration when items they sought were out of stock, highlighting inefficiencies in inventory management and demand forecasting. This issue can negatively impact customer satisfaction and lead to lost sales opportunities. To address this, businesses need to adopt AI-driven demand prediction systems that analyse historical data and customer purchasing patterns to more accurately anticipate stock needs (Chopra & Sodhi, 2022).

Implementing predictive analytics can help businesses optimize inventory levels by ensuring popular products are consistently stocked. Additionally, real-time monitoring of inventory across supply chains enables businesses to detect potential shortages early, allowing for swift action to prevent stockouts and reduce customer dissatisfaction. This approach not only minimizes lost sales due to product unavailability but also improves overall customer satisfaction and loyalty.

These findings are consistent with the research of Afinia and Tjahjaningsih (2024), who identified product unavailability as a major issue for e-commerce consumers in Indonesia, often resulting in lower customer loyalty and increased cart abandonment. Similarly, Ko and Ho (2024) pointed out that high shipping costs deter consumers, especially when purchasing lower-priced items. This aligns with the current study’s results, where shipping concerns were also noted as a barrier to customer satisfaction.

For digital platforms, these insights emphasize the importance of enhancing inventory management practices to ensure desired products remain available. In addition to improving product availability, businesses should address shipping costs by offering more flexible or transparent pricing models, which could reduce cart abandonment and increase conversion rates. Providing accurate and detailed product descriptions is another critical factor in reducing customer dissatisfaction, as clear information helps align consumer expectations with what is delivered.

By addressing these key challenges—product availability, shipping costs, and product transparency—businesses can significantly enhance the online shopping experience, fostering greater customer loyalty and reducing lost sales opportunities.

6.2. Focus Group Insights

In addition to the quantitative data collected via the questionnaire, insights from the focus group with key stakeholders offered a rich qualitative perspective on the operational strategies and market challenges faced by businesses in the digital marketplace. These discussions revealed several recurring themes, with product availability, customization options, and efficient order processing emerging as critical areas for maintaining a competitive edge in the evolving e-commerce landscape.

Participants highlighted the importance of product availability, noting that stockouts or delays in replenishment could lead to immediate customer frustration, reduced loyalty, and potential loss of market share. This finding aligns with research by Xu and Li (2020), who identified product availability as one of the top factors affecting consumer satisfaction in online shopping, particularly in fast-moving industries like fashion and textiles. Focus group participants also pointed out that customers now expect real-time updates on stock levels and swift communication regarding availability, placing additional pressure on businesses to implement advanced inventory management systems.

Another key theme was the increasing demand for personalized services, with participants stressing that customers appreciate the ability to tailor their purchases, whether through product customization or personalized recommendations. This reflects broader trends in consumer behaviour, where customization is becoming a differentiating factor in competitive markets (Pine & Gilmore, 1999; Kumar & Gilovich, 2022). According to the stakeholders, offering personalized shopping experiences—whether in terms of product selection or customer service—can significantly enhance customer retention and brand loyalty, especially in the textile industry, where consumer preferences are constantly evolving.

The focus group also identified inefficiencies in handling large orders and managing peak periods as significant operational challenges. Participants shared that bottlenecks often occur during times of high demand, such as seasonal sales or promotional events, leading to delays in processing and shipping orders. This challenge is supported by a study by Sanders and Ganeshan (2021), who found that order processing times, especially during peak seasons, directly impact customer satisfaction and can result in long-term reputational damage if not addressed promptly. Stakeholders agreed that investing in scalable order processing systems and automation could alleviate these pressures and improve overall efficiency.

Moreover, staying ahead of market trends was identified as essential for maintaining relevance in an increasingly competitive online environment. Participants acknowledged that rapidly changing consumer preferences, pricing strategies, and emerging technologies create an ever-shifting landscape, requiring businesses to be agile and responsive. This need for agility has been well-documented in the literature, with Erevelles et al. (2016) emphasizing that businesses which continuously adapt to technological advancements and market shifts are better positioned to capture customer attention and maintain long-term success.

Overall, the focus group insights suggest that businesses operating in the digital marketplace must prioritize operational efficiency and customer engagement. Implementing advanced technologies, such as AI-driven inventory management and real-time order tracking, will help businesses overcome challenges related to product availability and order processing. Additionally, strategies focused on direct-to-consumer engagement, including product customization and personalized marketing, will likely contribute to stronger customer relationships and long-term brand loyalty.

7. Recommendations and Practical Implications

Based on the findings of this study, several practical recommendations emerge for businesses operating on digital platforms, particularly in the wholesale textile industry. Addressing the identified challenges can significantly improve both consumer satisfaction and business performance:

Textile wholesalers should invest in AI-driven inventory management systems such as SAP’s Extended Warehouse Management or Oracle NetSuite. These platforms leverage real-time tracking, predictive analytics, and automated replenishment to reduce stockouts and better align supply with demand (Chopra & Sodhi, 2022). Automated inventory tracking and real-time monitoring ensure that desired products remain available, minimizing consumer frustration and reducing lost sales opportunities.

Given that product quality emerged as a major concern, companies must adopt stricter quality control protocols throughout the production and distribution processes. Integrating customer feedback into the production cycle allows businesses to identify and address recurring issues, ensuring a consistent product offering. This iterative approach will not only reduce customer dissatisfaction but also improve brand reputation (Mollenkopf et al., 2023).

High shipping costs are a significant deterrent for consumers, particularly when purchasing lower-priced products. Businesses should explore partnerships with logistics providers to offer reduced or even free shipping options, where feasible. Additionally, transparent pricing structures—where shipping costs are clearly communicated upfront—can mitigate customer dissatisfaction and improve the purchasing experience (Carter & Easton, 2023).

To build trust and encourage engagement, businesses should focus on providing accurate product descriptions and prominently displaying positive customer reviews. Research indicates that transparent product information and user-generated content like reviews boost consumer confidence and play a crucial role in influencing purchasing decisions (Wang et al., 2024). Encouraging customers to leave detailed reviews can also drive further engagement and improve brand credibility.

Implementing advanced Customer Relationship Management (CRM) systems allows businesses to offer personalized recommendations and support, which can significantly enhance customer satisfaction. Personalized engagement, such as customized product suggestions or tailored promotions, helps retain customers and builds long-term loyalty (Zeng et al., 2023).

Successful examples of these strategies can be seen in leading companies like Zara and Amazon. Zara, for instance, has leveraged AI-driven inventory management to predict demand and optimize stock levels, significantly reducing product unavailability and minimizing waste (Fatorachian & Smith, 2022). Amazon has set a benchmark in transparency by clearly communicating shipping costs and delivery times upfront, which has improved customer trust and satisfaction. By adopting similar technologies and operational practices, textile wholesalers can enhance their efficiency and better meet the growing expectations of digital consumers (Carter & Easton, 2023).

8. Conclusion

This study makes a significant contribution to the understanding of digital transformation in the underexplored wholesale segment of the textile industry. While much of the existing research focuses on digital adoption in the retail sector, this study breaks new ground by identifying the unique challenges and opportunities faced by wholesalers. It examines how digital platforms—such as e-commerce, Customer Relationship Management (CRM) systems, and digital marketing tools—can enhance operational efficiency, customer engagement, and market positioning. The integration of the Diffusion of Innovations Theory offers valuable insights into the factors influencing technology adoption in the wholesale context, deepening the understanding of both the drivers and barriers to digital transformation.

One key finding is that product availability, inventory management, and quality control remain significant operational challenges for textile wholesalers. These challenges can be effectively addressed through the adoption of AI-driven inventory systems and automated quality control tools. Moreover, the study highlights that transparent pricing and shipping strategies are critical in improving customer satisfaction and loyalty, reinforcing the need for wholesalers to adopt more customer-centric approaches.

The novelty of this research lies in its holistic approach, combining both quantitative and qualitative insights to provide a comprehensive view of the challenges and opportunities in digital transformation for wholesalers. This dual-method approach not only reinforces existing global e-commerce findings but also offers tailored recommendations for the wholesale textile sector—a domain often overlooked in discussions of digitalization. The use of Diffusion of Innovations Theory is particularly novel in this context, providing a clear lens for evaluating the rate and success of technology adoption in wholesale environments.

The study provides crucial insights into how digital platforms can improve operational efficiency and customer engagement for textile wholesalers. Addressing key challenges, such as product unavailability, quality issues, and high shipping costs, can significantly enhance a business’s market positioning and customer satisfaction. For academia, the research adds to the growing body of work on digital transformation in traditional industries. Future studies could explore the long-term impact of these digital tools on profitability and sustainability, especially as AI and IoT technologies become more integrated into supply chains. Additionally, comparative studies between retail and wholesale sectors, or cross-industry analyses, would provide valuable contributions to the existing literature.

References

- Aaker, D. A. (2009). Managing Brand Equity: Capitalizing on the Value of a Brand Name. The Free Press. [CrossRef]

- Afinia, S., & Tjahjaningsih, E. (2024). Customer Satisfaction’s Influence on Repurchase Intention in Indonesia’s E-commerce Sector. Jurnal Informatika Ekonomi Bisnis. [CrossRef]

- Akhtar, W. H., Watanabe, C., Tou, Y., & Neittaanmäki, P. (2022). A New Perspective on the Textile and Apparel Industry in the Digital Transformation Era. Textiles, II(4), 633-656. [CrossRef]

- Andam, Z. R. (2020). E-commerce in the global marketplace: Strategies for textile wholesalers. Journal of Global Business Strategies, 14(2), 67-78.

- Baines, P., Fill, C., & Page, K. (2012). Essentials of Marketing. OUP Oxford.

- Baur, C., & Wee, D. (2015). Industry 4.0: How to navigate digitization of the manufacturing sector. McKinsey & Company.

- Berwal, R. (2020). Global aspect of Indian textile industry and their challenges and opportunities: A review. International Journal of Home Science, 6(1), 292-297.

- Bhattacharya, A., & Singh, K. (2022). Digital transformation in the textile industry: Adoption and challenges. Journal of Textile Technology, 35(2), 142-158.

- Bharadwaj, N., Badrinarayanan, V., & Groening, C. (2021). Adapting to E-Commerce in the Wholesale Textile Sector: Barriers and Opportunities. Journal of Business & Industrial Marketing, 36(5), 245-263.

- Buttle, F., & Maklan, S. (2019). Customer Relationship Management: Concepts and Technologies. Routledge.

- Carter, C. R., & Easton, L. (2023). Reducing supply chain friction through innovative pricing and delivery models. Journal of Supply Chain Management, 59(1), 45-63.

- Chopra, S., & Sodhi, M. S. (2022). Leveraging predictive analytics for better inventory management. Operations Management Research, 15(2), 123-137.

- Enache, M. C. (2024). The Cognitive Principles Influencing Online Consumer Behavior in E-Commerce Platforms. Economics and Applied Informatics. [CrossRef]

- Enache, M. C. (2024). The role of digital marketing in building brand equity in the textile industry. Digital Business Review, 11(1), 44-58.

- Erevelles, S., Fukawa, N., & Swayne, L. (2016). Big Data consumer analytics and the transformation of marketing. Journal of Business Research, 69(2), 897-904. [CrossRef]

- Fatorachian, H. (2012). A critical investigation of electronic supply chain practice among SMEs. International Journal of Advanced Innovations, Thoughts and Ideas, 1(4).

- Fatorachian, H. (2013). Role of Internet in supply chain integration: Empirical evidence from manufacturing SMEs of the UK. In Proceedings of the 9th European Conference on Management Leadership and Governance (ECMLG 2013), Austria.

- Fatorachian, H. (2013). Understanding the success factors of electronic supply chain management: Empirical evidence from manufacturing SMEs. In Proceedings of the 16th TOULON-VERONA Conference, Excellence in Services, Slovenia.

- Fatorachian, H. (2023). Leveraging digital platforms in the wholesale textile industry: Case study insights. Journal of Textile Industry Studies, 22(4), 33-50.

- Fatorachian, H. (2024). Sustainable Supply Chain Management and Industry 5.0. In Atiku, S. O., Jeremiah, A., Semente, E., & Boateng, F. (Eds.), Eco-Innovation and Sustainable Development in Industry 5.0. IGI Global. [CrossRef]

- Fatorachian, H., & Kazemi, H. (2018). A critical investigation of Industry 4.0 in manufacturing: Theoretical operationalization framework. Production Planning & Control, 29(8), 633-644. [CrossRef]

- Fatorachian, H., & Kazemi, H. (2021). Impact of Industry 4.0 on supply chain performance. Production Planning & Control, 32(1), 63-81. [CrossRef]

- Fatorachian, H., & Smith, C. (2022). Impact of CPS on enhancing supply chain resilience, with a focus on solutions to pandemic challenges. In Semwal, T., & Faiz, I. (Eds.), Cyber-Physical Systems: Solutions to Pandemic Challenges (pp. 109-125). CRC Press.

- Fatorachian, H., & Smith, C. (2023). COVID-19 and Supply Chain Disruption Management: A Behavioural Economics Perspective and Future Research Direction. Journal of Theoretical Applications and Electronic Commerce Research, 18(4), 2163-2187. [CrossRef]

- Hagberg, J., Sundstrom, M., & Egels-Zanden, N. (2016). The digitalization of retailing: An exploratory framework. International Journal of Retail & Distribution Management, 44(7), 694-712. [CrossRef]

- Hecklau, F., Galeitzke, M., Flachs, S., & Kohl, H. (2023). Holistic implementation of Industry 4.0 in SMEs: A study on success factors. Journal of Manufacturing Systems, 57(2), 74-84.

- Invest India (2023). India - Knitting the Future: Market Insights and Growth Projections for the Textile Sector. Invest India Report. Available at: https://www.investindia.gov.in.

- Kagermann, H., Wahlster, W., & Helbig, J. (2020). Securing the future of German manufacturing industry: Recommendations for implementing the strategic initiative INDUSTRIE 4.0. Working Paper.

- Khan, M., Bashir, R., & Ali, S. (2023). Leveraging digital marketing tools in the textile wholesale industry. Journal of Textile Management, 19(3), 89-105.

- Kirthiga, K. S., & Suganya, M. (2024). The Role of Marketing Strategies to Attract Consumers Towards E-Commerce Platform. Mayas Info.

- Ko, H. C., & Ho, S. Y. (2024). Continued Purchase Intention in Live-Streaming Shopping: Roles of Expectation Confirmation and Ongoing Trust. Cogent Business & Management. [CrossRef]

- Kumar, R., & Gilovich, T. (2022). The thrill of customizing: How product personalization shapes consumer decisions and satisfaction. Journal of Consumer Research, 48(1), 63-78.

- Kumar, S., Jain, V., & Patel, R. (2022). The impact of digitalization on the global textile industry: Challenges and opportunities. International Journal of Textile and Fashion Technology, 13(1), 45-61.

- Li, D., & Ni, Y. (2022). Adoption of Digital Platforms in the Textile Wholesale Industry: Challenges and Solutions. Journal of Digital Transformation, 6(2), 95-112.

- Martín-Peña, M. L., Díaz-Garrido, E., & Sánchez-López, J. M. (2018). The digitalization and servitization of manufacturing: A review on digital business models. Strategic Change, 27(2), 91-99. [CrossRef]

- Matthyssens, P., & Vandenbempt, K. (2008). Moving from basic offerings to value-added solutions: Strategies, barriers and alignment. Industrial Marketing Management, 37(3), 316-328. [CrossRef]

- Mollenkopf, D. A., Stolze, H., & Golicic, S. L. (2023). Quality management in e-commerce: Best practices for enhancing customer satisfaction. Journal of Operations & Production Management, 43(4), 256-278.

- OECD (2019). Skills for the Digital Transformation. OECD Publishing, Paris. [CrossRef]

- Pine, B. J., & Gilmore, J. H. (1999). The experience economy: Work is theatre & every business a stage. Harvard Business School Press.

- Rachbini, W., & Soeharso, S. Y. (2024). From Boomers to Millennials: Unraveling the Complexities of Online Shopping Behavior in Indonesia. Business Perspectives. [CrossRef]

- Rahmadhan, I., Yusuf, M., & Hidayat, T. (2023). Leveraging digital platforms in the wholesale industry: A case study of textile SMEs. Journal of Digital Business Strategies, 11(3), 34-50.

- Ray, S., & Sun, Q. (2019). Digital Transformation of Legacy Systems: A Case for Rejuvenation. IEEE Software, 36(2), 103-109. [CrossRef]

- Sanders, N. R., & Ganeshan, R. (2021). Improving order management in global supply chains: A digital transformation. Journal of Supply Chain Management, 57(1), 45-60.

- Savastano, M., Anagnoste, S., & Biclesanu, I. (2024). The Impact of E-Commerce Platforms’ Quality on Customer Satisfaction and Repurchase Intention in Post COVID-19 Settings. The TQM Journal. [CrossRef]

- Schmidt, C., Zimmermann, S., & Aßmann, H. (2022). Innovation diffusion in manufacturing: Application of Rogers’ theory in Industry 4.0. Journal of Innovation Studies, 15(4), 123-136.

- Sharma, P., Verma, R., & Gupta, S. (2021). Digital retail transformation: Implications for supply chain management. Retail Management Review, 9(4), 199-215.

- Statista (2021). Market size of the textile industry in India from 2009 to 2021, with an estimate for 2026 (in billion U.S. dollars). Statista Report.

- Sundström, P., & Törnroos, J. (2021). Customer relationship management in B2B markets: The role of technology. European Journal of Marketing, 55(2), 315-334.

- Tornatzky, L., & Fleischer, M. (1990). The Processes of Technological Innovation. Lexington Books.

- Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Qi Dong, J., Fabian, N., & Haenlein, M. (2021). Digital transformation: A multidisciplinary reflection and research agenda. Journal of Business Research, 122, 889-901. [CrossRef]

- Venkatesh, V., & Bala, H. (2008). Technology acceptance model 3 and a research agenda on interventions. Decision Sciences, 39(2), 273-315. [CrossRef]

- Wang, Y., Chen, M., & Lee, J. (2024). The role of customer reviews in shaping online purchasing behavior. E-Commerce Research and Applications, 58(1), 33-50.

- Wernerfelt, B. (2022). The resource-based view of the firm: Ten years after 1991. Strategic Management Journal, 45(1), 123-136.

- Wollan, R., Smith, N., & Zhou, C. (2016). The Social Media Management Handbook: Everything You Need to Know to Get Social Media Working in Your Business. Wiley.

- Xu, H., & Li, D. (2020). Impact of product availability on customer satisfaction and loyalty in e-commerce. Journal of Retailing and Consumer Services, 53, 101983.

- Zeng, X., Wang, H., & Chen, Z. (2023). CRM systems and personalized marketing: A pathway to customer retention. Journal of Marketing Management, 29(2), 81-96.

- Zhu, Y., Zhang, X., & Peng, Y. (2021). Digital transformation in manufacturing: An innovation diffusion approach. Journal of Industrial Engineering, 30(3), 221-233.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).