PRESENTATION AND METHODOLOGY

Context

The Integrated Territorial Program (ITP) for the development of camelid livestock is part of the Regional Development Strategy 2017-2030 (ERD), as it defines three strategic productive sectors; Technological Agriculture, Special Interest Tourism, and the Logistics Services Platform, being key sectors to promote regional competitiveness.

In particular, the document “Strategic Validation Stage: PTI for the development of camelid livestock” validates the initial diagnosis of the ERD, where low productivity is identified as one of the barriers to human development in the region, and among the critical nodes of this are indicated:

Insufficiently exploited territorial economic potential.

Inadequacies in the conditions for competitiveness, infrastructure, innovation, and technology.

Insufficient logistics infrastructure.

Lack of strengthening of rural productive activities.

Development of non-conventional renewable energies.

Insufficient support for entrepreneurial skills.

Deficit of advanced human capital.

Lack of tourism infrastructure.

Insufficient international linkages for regional development

In addition, the Territorial Agrarian Innovation Agenda (FIA) for the Arica and Parinacota Region considers camelid livestock as a priority, since it is the main productive resource for Aymara families living in the highlands of the region. It also mentions that improving productivity will better position livestock farmers for proper market insertion. Similarly, the 2030 Agenda for Sustainable Development establishes a series of actions to address the problems faced by Andean producers as a

result of climate change through better management of agricultural and livestock systems.

In this context, it is proposed in this technical assistance document to continue with the dynamics of participation defined in its initial diagnosis, through the bodies that were established to ensure compliance and serve as a platform and interaction from the bottom up so that the companies and relevant actors of the camelid livestock ecosystem could follow up, establish priorities and detect new gaps and opportunities, so that the implementation of the ITP could be adapted to the current circumstances.

In this new cycle 23-24, framed in a context of recovery and resilience, inspired by the joint vision of the participating farmers, it is necessary to achieve a greener and more sustainable future for the sector without leaving anyone behind.

The global environment, under a “superVUCA” condition, as a combination of overlapping elements of impact (interconnectedness) and speed (rapidity of change), requires the development of new strategies and actions to face the challenges and take advantage of the opportunities that arise in this dynamic and challenging environment.

The camelid livestock ITP has the challenge of contributing to innovation and competitiveness within a volatile and complex context from its sectoral scope, based on the enhancement of its agricultural resources. In this sense, the challenge is twofold: to leave no one behind and to take advantage of the emerging niches and great opportunities for camelid livestock in the Region of Arica

and Parinacota.

At the methodological level, the work proposal takes advantage of the proximity that CORFO, FIA and other institutions of the territory have achieved, to advance with the Camelid Livestock CFA and the different instances of dialogue that are being carried out to take advantage of the tractor potential and innovation capabilities of the current value chain, enhancing emerging sectors and future opportunities. To this end, work is being done in co-creation with the stakeholders of the territory, to generate solid and comparable data to provide dimensioning and improve the level of priority actions resulting from the validation of the competitive hypothesis, characterization, projection, and strengths of the value offer of the livestock sector under the Smart Specialization Strategies (S3) methodology adapted to the Aymara cultural and productive context.

Finally, this progress report uses qualitative methodologies and comparative analysis for competitiveness and market determinants, as well as agile tools for the development of business models, to facilitate the understanding of the camelid livestock value chain in the region of Arica and

Parinacota.

INTRODUCTION

This report analyzes the market and competitiveness of camelid livestock with a clear focus on the value chain of alpaca fiber and its derivatives, identifying the main consumption trends, areas of opportunity and benefits for the Andean communities involved in its production. The factors that influence the supply and demand of camelid fiber are analyzed, as well as the main trends in the national and global market.

In addition, opportunities for improving the competitiveness of the value chain are examined, including product and process innovation, quality improvement and the adoption of sustainable practices. It also identifies the economic and social benefits that the production and marketing of camelid fibers can generate for Aymara livestock, including local economic development, preservation of culture and heritage, and environmental conservation.

In this context, given the growing demand for sustainable and high-quality products, there are several factors that support the importance of this analysis. On the one hand, camelid fiber production is an important economic activity in many Andean regions, especially in Chile, where livestock-raising communities depend heavily on the production and marketing of camelid fibers for their subsistence and economic development.

On the other hand, the production and preservation of livestock has a positive impact on local ecosystems, especially because camelids are animals adapted to the extreme climatic conditions of the Andes, which means that their production does not require high operating costs - but does require adequate enabling infrastructure for the normal development of the productive activity - and the production of camelid fibers can contribute to the conservation of endangered wild camelids, such as the vicuña.

Finally, the analysis of the competitiveness and market of the camelid livestock value chain becomes even more relevant, as it allows the identification of opportunities to improve the quality and sustainability of products, as well as to expand their scope and diversify their supply. In short, this report contributes to establishing the position of camelid fibers in the global market and to generating applied analytical knowledge to provide the different stakeholders with an adequate understanding of the determinants of sectoral competitiveness.

MARKET ANALYSIS

South American camelid fibers have been valued for centuries for their softness, warmth, and durability. Today, demand for these fibers continues to rise, driven by increased consumer awareness of sustainability and product quality.

According to Research & Markets (2022) report, the global alpaca fiber market is expected to reach $3 billion by 2026.

Fibers from South American camelids and other fiber- or wool-bearing species are important to the human population. The current context includes competition with petrocarbon-based synthetic fibers and concern about their excessive persistence in the natural environment.

In turn, animal fibers have valuable characteristics for the production and processing of more sustainable products, as they are natural and renewable. On the other hand, it is recognized that their commercial use depends on the availability and adequate quality, whose production is supported by a series of sciences and processes that support the development of the Andean livestock value chain to meet the needs of the market and the local population.

In this context, South American camelids comprise four species, two domestic species: alpaca (Lama pacos) and llama (Lama glama), and two wild species: guanaco (Lama guanicoe) and vicuña (Vicugna vicugna). They are distributed along the Andes Mountains in South America, from Ecuador to Tierra del Fuego, and their greatest concentration is found in the Peruvian-Bolivian altiplano, northern Chile and Argentina, at altitudes between 3,800 and 5,000 meters.

The estimated population of South American camelids in Latin America is 7.5 to 8 million, of which 7% are guanacos, 2% vicuñas, 45% llamas and 46% alpacas (CID-AQP, 2005).

The world population of alpacas is estimated at 3.5 million head and Peru is the main producer with approximately 87%, followed by Bolivia (9.5%).

The world llama population is around 3,321,000 head; Bolivia is the main producer (61%), followed by Peru (32.5%) and Argentina (4%), and in smaller quantities Chile and Ecuador (CID-AQP, 2005).

The estimated guanaco population is 534,000 animals; Argentina has the largest number (93.6%), followed by Chile (5.6%).

In the case of the vicuña, population estimates vary according to the authors, and in Chile the values range from 16,000 to 25,000 animals.

3.1. Market Characteristics

The camelid fiber market is a niche and highly specialized market, with a growing demand for high-quality products. Camelid fiber, such as alpaca and vicuña, is valued for its softness, warmth, and durability, and is used in the manufacture of high-end garments.

As 2009 is declared the International Year of Natural Fibers (IYNF; FAO) by the United Nations General Assembly in New York, the objectives of which are: to help agro-industries that employ millions of people and provide economic development opportunities, and to strengthen the demand for natural fiber products, improving the livelihoods of the farmers who produce them and income for countries that export them, the supply of natural fibers has been boosted, to such an extent that each year around 30 million tons of natural fibers are produced worldwide, of which cotton dominates with 20 million tons, wool and jute reach 2 to 3 million tons, followed by other fibers of animal origin.

The use of natural fibers ranges from high fashion to industrial use; in all cases the fibers are subject to competition with synthetic substitutes, which burst onto the market in the 1960s and since then their use has been increasing, far surpassing today the better-known natural fibers such as cotton and wool. The main reason why synthetic fibers took over the textile market was because of their lower processing cost (See

Table 1).

According to species and main producers, world fiber production (t/year) is estimated at (FAO [Online]):

• Mohair (angora goat): 8,000 (South Africa, United States and Turkey)

• Kashmir (goat): 5,000 (China, Mongolia, Iran and Afghanistan).

• Alpaca: 4,000 (Peru, Chile and Bolivia)

• Camel: 2,000 (China, Mongolia, Iran and Afghanistan)

• Angora (rabbit): 8,500 (China)

• Flame: 500 (Peru and Bolivia)

Source: FIA, 2009.

In recent years there has been a greater tendency to use lighter and more comfortable garments; for this, the type of fiber and diameter is important since, in general, the smaller the diameter, the finer the fiber and the more expensive the garment. The table (

Table 2) details the average diameters and comfort of fine fibers of different animal origin and between different qualities within the same species.

Llama fiber has the same categories as alpaca fiber, but its fineness in general terms is 10% lower than alpaca values. Vicuña fiber is the finest of all camelids and even finer than cashmere fiber, whose fiber on the market is worth 4 to 5 times more than the finest quality alpaca fiber. The value of dehairing greasy vicuña fiber is 5 to 8 times higher than that of cashmere (UNIDO, 2006).

3.2. Main Characteristics

Fibers from South American camelids are commercially grouped under the denomination of "fine, prized or precious" wool fibers, which represent only 2.6% of the total wool fibers traded in the world; in particular, textile fibers from these domestic and wild camelids constitute 0.1% of the world’s supply.

The fiber characteristics of South American camelids vary from one species to another, between breeds of the same species and within the same breed; moreover, the finest fibers are those of the youngest animals.

The fiber characteristics of South American camelids vary from one species to another, between breeds of the same species and within the same breed; moreover, the finest fibers are those of the youngest animals.

Vicuña is one of the finest animal fibers in the world and is currently part of the specialty fine fiber market, along with Tibetan antelope (shahtoosh), goat (mohair and cashmere), camel (dromedary and bactrian), and other South American camelids (guanaco, llama and alpaca). It is used as an input for the manufacture of high-quality fabrics and garments, with demand concentrated mainly in Italy, England and the rest of Europe.

On the other hand, there are four characteristics that make up the quality of fine fibers required by the market, some of which depend on the natural conditions of the species and others related to the treatment and efficiency of shearing: average fiber length, average diameter, fleece weight and fiber integrity.

In summary, the growth in demand for camelid fiber in recent decades has been determined by important factors, such as: increasing incorporation of this fiber in the fashion market; appreciation of natural textures and colors, as well as its exclusive character; appreciation of the sustainable management of natural resources; greater control of illegal supply; and the incorporation of markets based on textile eco-design.

3.3. Market Outlook

The global camelid fiber market is likely to grow at a significant rate during the forecast period (2019-25) owing to the expanding fashion and apparel industry across the globe. The eco-friendly properties associated with the product offer an opportunity for consumers to wear natural, soft, durable, and warm garments, which is likely to drive industry growth during the forecast period. Growing consumer demand for natural clothing and fashion accessories is expected to have a positive impact on market growth (Grand View Research, 2022).

As an example, the fibers obtained from alpaca is considered a special natural fiber, which is available in 22 shades, being five times warmer than sheep wool. It is lightweight due to the air pockets within these fibers, which also results in a high thermal capacity. The product offers opportunities to manufacture extremely comfortable and versatile winter clothing products. In addition, the hypoallergenic properties associated with the product are likely to offer a competitive advantage over its synthetic counterparts over the forecast period.

Growing awareness among consumers about the benefits of the product is expected to increase demand. In addition, the rapid increase in alpaca fiber fashion stores is expected to provide easy access to these products, which will have a positive impact on the alpaca fiber market. However, the high cost of these garments is expected to hinder the growth of the industry in developing regions.

Based on type, the alpaca fiber market is segmented into Huacaya and Suri alpaca. The fibers obtained from the Suri breed are extremely soft and are mainly used in lightweight fabric applications. While the Huacaya coat is shorter and curlier. It is blended with Merino wool or other fibers for use in knitted garments and couture coats. These products are also used to make floor coverings, socks, gloves, or hats.

Compared to sheep’s wool, the type of fiber obtained from alpacas can be made into a very fine yarn, so it is applied in various products. Growing demand for products for the manufacture of lightweight sportswear is likely to drive its demand over the forecast period. These products are also gaining popularity in cold regions for the manufacture of sweaters and scarves, as well as the toy, apparel, and carpet sectors.

In competition analysis ratifies that Peru is the largest producer of alpaca fiber, as it is home to 80% of the world’s alpaca population. The Ministry of Foreign Trade and Tourism (Mincetur) specified that the country’s alpaca exports increased more than 110% in 2017 in one year, with an increase of more than 14% average per kilogram in the export price (Ministerio de Agricultura y Riego MINAGRI, 2018).

Peru is also the largest exporter of these fibers in the industry and the key destinations for its fiber exports are Italy and China. The Ministry of Foreign Trade and Tourism (Mincetur) offered business opportunities in the industry and launched the luxury fashion brand "Alpaca del Perú" for the sale of high-quality alpaca fiber accessories and garments.

As the industry advances at a significant growth rate, major market players are aiming to produce alpaca fiber with advanced quality to attract more customers. These manufacturers are focusing on alpaca nutrition to improve the quality of alpaca fiber. In addition, efforts made by scientists to use various genetic tools to improve alpaca production and develop fiber quality are expected to drive industry growth over the forecast period.

North America is expected to account for a significant share of the alpaca fiber market due to the growing popularity of these products among consumers. In addition, increasing production of alpaca fiber apparel in the U.S., coupled with the growing number of retail outlets for these garments in the country, is expected to drive industry growth during the forecast period. Australia is likely to be a key potential market due to the increasing penetration of the product in the country to replace traditional winter clothing.

Moreover, Asia has emerged as one of the leading markets for plush toys globally. Increasing population coupled with rising consumer spending power is expected to drive demand for plush toys, which in turn is likely to have a positive impact on industry growth. Europe is also likely to gain high demand for soft and comfortable winter clothing products, which will drive industry growth over the forecast period. High consumer spending power coupled with favorable weather conditions in the region is expected to drive demand for alpaca fiber accessories during the forecast period.

Finally, the U.S. Alpaca Fiber Council will assist producers in the manufacturing, promotion, and marketing of these products. They will also help manufacturers improve product quality to increase profitability in this market space. Prominent players in the alpaca fiber market are Plymouth Yarn, Putuco, Katia, Cascade Yarns, AndeanSun, Berroco, Mary Maxim, Alpaca Yarn Company, Classic Elite Yarns, and Ella Rae.

Facts and figures:

▪ The main South American camelid fiber producing countries are Peru, Bolivia, Chile and Argentina.

▪ Most of the exports of these fibers go to the United States, Europe, and Japan.

▪ According to Peru’s Ministry of Foreign Trade and Tourism, alpaca fiber exports in 2020 reached US$72 million.

▪ The value of alpaca fiber exports from Bolivia increased by 33% between 2019 and 2020, according to the Bolivian Institute of Foreign Trade.

▪ The average price per kilogram of vicuña fiber is around US$500, making it one of the most expensive fibers in the world.

Emerging sectors:

▪ Sustainable fashion is an emerging sector that is driving demand for natural and sustainable fibers, such as South American camelid fibers.

▪ The textile industry is also exploring new applications for these fibers, such as in the production of carpets and rugs.

▪ The growing demand for products derived from camelid fibers are used for the manufacture of lightweight sportswear.

▪ Increased consumption of alpaca and llama meat and dehydrated meat for the agri-food sector low in saturated fat (in its chemical composition, llama and alpaca meat contains low levels of fat (0.49-2.05%), cholesterol (51.1-56.29 mg/100 g) compared to other red meats, 50.34% saturated fatty acids, 42.48% monounsaturated fatty acids, 7.18% polyunsaturated fatty acids).

▪ Use of discarded material from underutilized fibers for thermal insulation.

▪ Use of alpaca and llama manure for use in agriculture 4.0.

Consumer trends:

▪ Consumers are increasingly looking for sustainable and ethical products, which has led to an increase in demand for natural and non-synthetic fibers.

▪ Demand for handcrafted, semi-industrial and customized products is on the rise, which has led to increased interest in South American camelid fibers due to their quality and exclusivity.

▪ There has been an increase in demand for handmade products using traditional techniques, which has led to a resurgence in the production of local handicrafts.

Consumer Profile

A consumer profile is a detailed description of the characteristics, needs, wants and behaviors of a specific group of people who are potential or current customers of a product or service. The consumer profile includes demographic, psychographic and buying behavior information, and is used to help companies or organizations better understand their target market and create effective marketing strategies.

The following is a general description of the consumer profile of fibers derived from camelid livestock.

Demographic:

▪ Consumers of alpaca fiber products tend to be people over the age of 25 who are looking for high quality and sustainable products.

▪ Younger consumers are interested in sustainable fashion and are willing to pay more for products that fit their values.

Psychographic:

▪ Consumers of alpaca fiber products value the quality, exclusivity, and sustainability of the products.

▪ These consumers are also interested in the story behind the product and transparency in the supply chain.

Consumer behavior:

▪ Consumers of alpaca fiber products tend to be loyal to brands that offer high quality and sustainable products.

▪ These consumers are also willing to pay more for products that match their values and are willing to do pre-purchase research to ensure they are buying an authentic product.

Needs and desires:

▪ Consumers of alpaca fiber products are looking for soft, warm, and durable products that provide a comfortable and pleasant wearing experience.

▪ These consumers are also looking for unique products that differentiate them from others and reflect their personal values.

The analysis suggests that consumers of alpaca fiber products are people who value quality, exclusivity, and sustainability. These consumers are willing to pay more for products that match their values and are willing to do pre-purchase research to ensure they are buying an authentic product in producing economies such as Peru, Bolivia, and Chile.

3.5. Foreign Consumption Potential

Consumers who prefer products derived from alpaca fiber are found in different countries around the world, some of which are:

United States: U.S. consumers are interested in high-quality, sustainable products, and alpaca fiber has become a popular choice for products such as sweaters, scarves, and blankets.

Europe: European consumers, especially in countries such as France, Italy, and Spain, are also interested in sustainable fashion and high-quality products. Alpaca fiber has become a popular choice for luxury products such as jackets and coats.

Japan: Japanese consumers are known for their appreciation of high quality and exclusive products, and alpaca fiber has become a popular choice for products such as winter clothing and accessories.

Australia: Australian consumers are also interested in sustainable fashion and high-quality products. In addition, the purchase of live animals has become a popular option for the development of educational farms and for the development of scientific and breeding initiatives.

Market access: Code and gloss of the local harmonized system in destination countries.

| TARIFF CODE |

DESCRIPTION |

| 51 |

Wool and hair, coarse or coarse; horsehair yarn and woven fabrics |

| 5102 |

Fine or ordinary hair not carded or combed |

| 5101.19 |

Other |

| 5102.19.30 |

Of alpaca, llama, vicuña |

| 5112.90.40 |

Other woven fabrics of alpaca or of llama |

| 6110.10.00.29 |

Other of alpaca or other fine animal hairs |

| Source: National Customs Service, 2022. |

3.6. Trend Analysis

Trend analysis has become a critical tool for value chain development today. This analysis involves the collection and analysis of data related to the market, competition, consumers, technology, and other factors that may influence the development of a value chain.

Experts in the field of trend analysis have identified the importance of this tool to identify current and future trends in each market or sector (Naisbitt,2017).

Trend analysis enables local entrepreneurs and organizations to make informed decisions about investment in technologies, production of new products or services, geographic expansion, and other business strategies. By identifying current and future trends, informed investment and business strategy decisions can be made.

Emerging trends for the development of camelid livestock VC are identified below:

| Socioeconomic |

Technological |

Environmental |

| Attraction and recruitment of local human resources |

Technological innovation in livestock management |

Eco-design |

| Incorporation of women in the labor market |

Livestock 4.0 |

Circular economy |

| Attraction of young veterinarians specialized in livestock farming and local economy |

Digitalization, automation and use of ICTs |

Sustainable breeding and feeding |

| Governance 4.0 |

Business models 4.0 |

Use of bio-inputs |

| Inclusive value chains |

Use of AI for camelid husbandry and management |

Waste reuse |

| Knowledge and learning networks |

Genetic improvement |

Technological alternatives for climate change mitigation |

| KPIs oriented to VC profitability and sustainability |

Sustainable fashion |

Manure generation for marketing and use in coastal and pre-cordillera agriculture. |

3.7. Description of the Livestock CFA in the Province of Parinacota

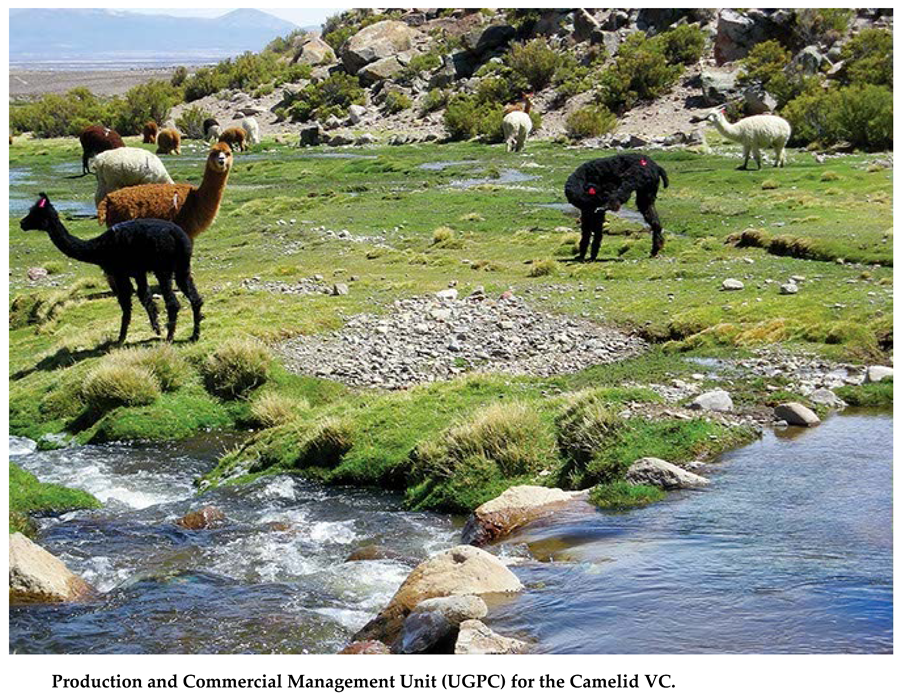

According to the Fundación para la Innovación Agraria (FIA), camelid livestock is the main productive resource of the Aymara families living in the highlands of the Parinacota province. The livestock system is developed mainly in the Putre and General Lagos communities and is characterized by the raising of domestic camelids. The productive activity has a millenary tradition and covers more than 85% of the regional camelid mass.

According to the Servicio Agrícola y Ganadero (SAG) livestock declaration, it is estimated that 86% of the alpacas and 57% of the llamas are concentrated in the altiplano of the Parinacota province. Most of the camelid breeders in Chile are Aymara people from the altiplano who form associations to produce and sell fiber and handmade products.

The regional production potential is estimated at 49 tons of fiber per year, while current production is only 30 tons. In most of the opportunities for fiber sales, the volumes requested by buyers exceed the production capacity of the herd mass, even more so if one considers the demand for fiber thickness and color and length of wick, quality aspects to which producers cannot respond. Currently, the producers combine the transaction of their product between the tripartite fair in Visviri and delivery to artisanal workshops, where in both cases the common factor is the low price, they receive for their product.

From a technical point of view, camelid management generally presents a pool of limitations in key areas such as breeding systems, production processes, insertion, and market stability.

In this context, Aymara ranchers seek to stabilize their production processes, minimize climatic and economic risks by focusing on self-consumption, non-monetary exchange, and capitalization of live cattle, to counteract the complexity of the environment. In addition, and given the inability to generate capital to invest in genetic improvement or infrastructure, they resort to seasonal migration and other off-farm activities, as a way to maintain the survival of their productive and family scheme.

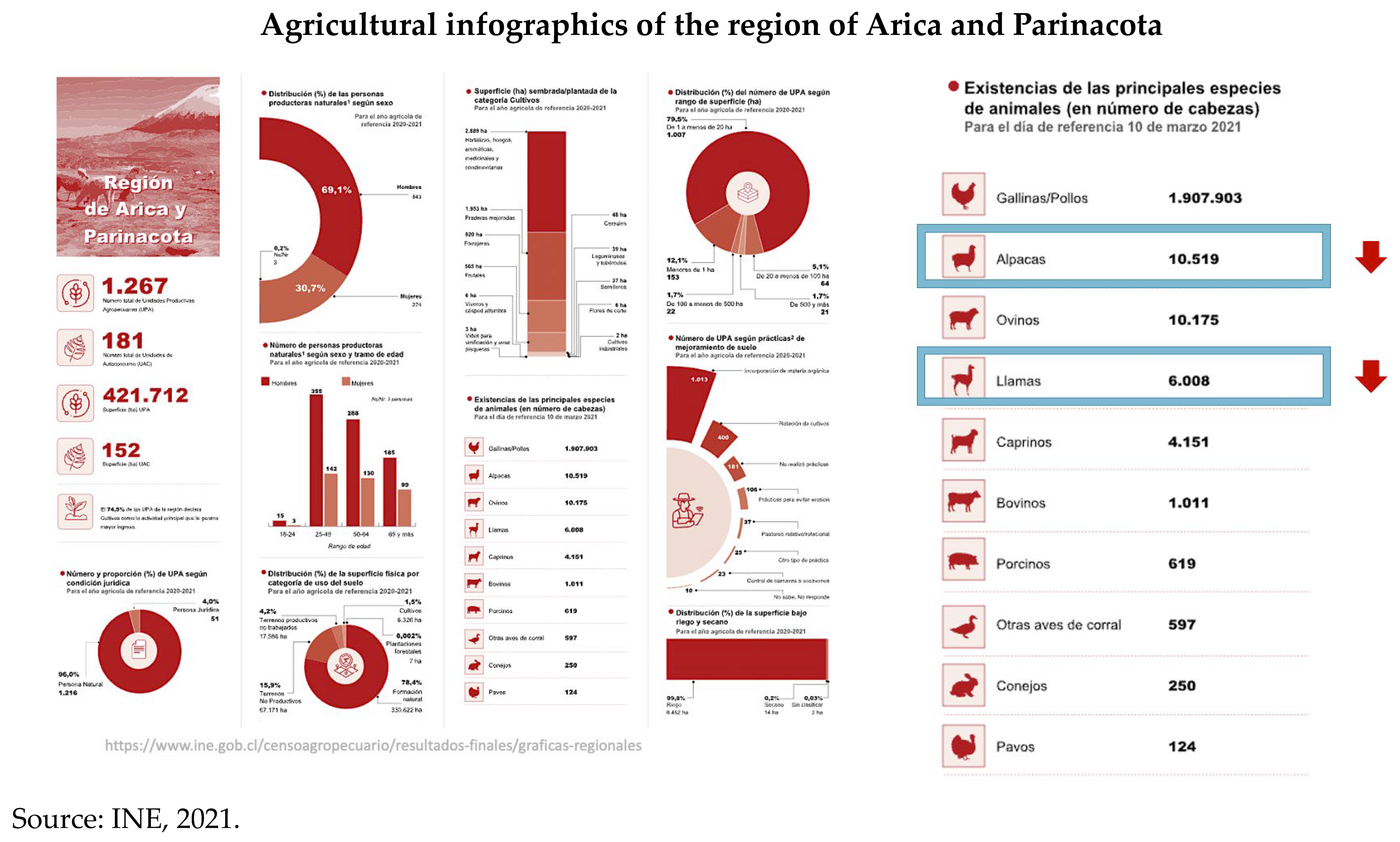

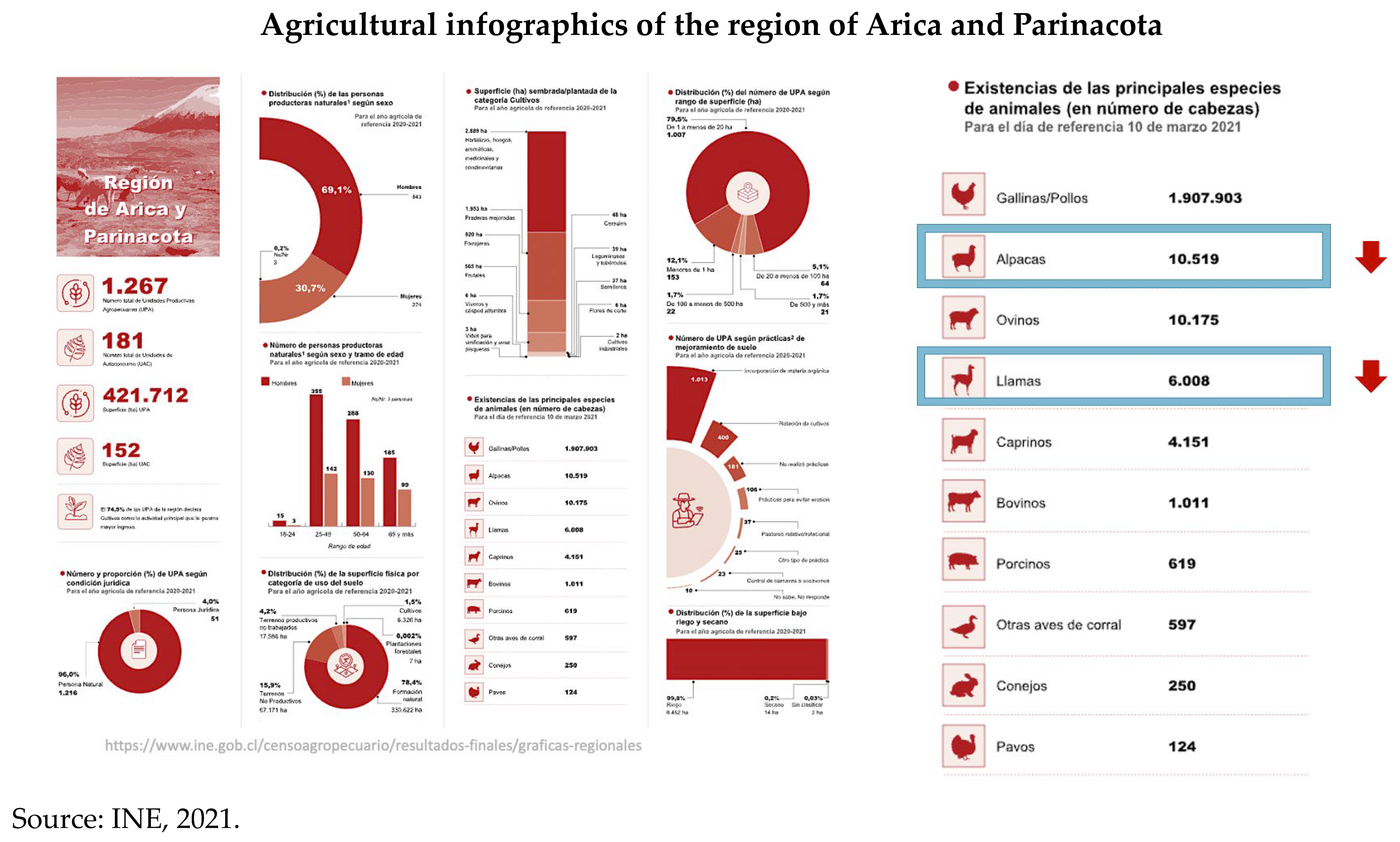

Below is an infographic showing the status of livestock declarations. The data provides relevant information on the decrease in the livestock mass as of the last agricultural census (INE, 2021).

Agricultural infographics of the region of Arica and Parinacota

PORTER’S FIVE FORCES ANALYSIS

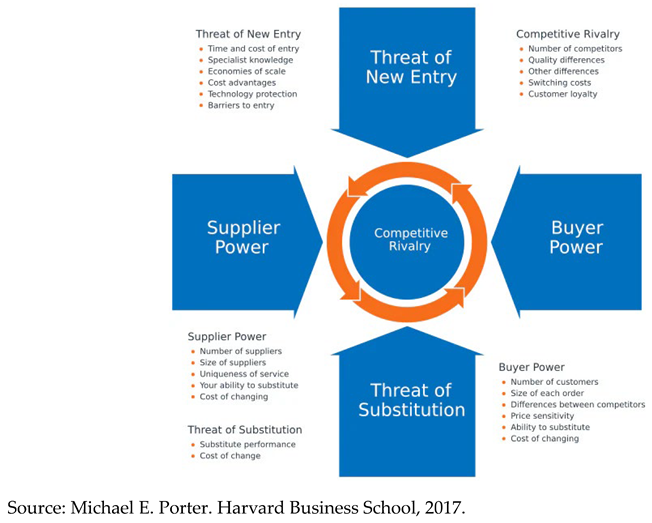

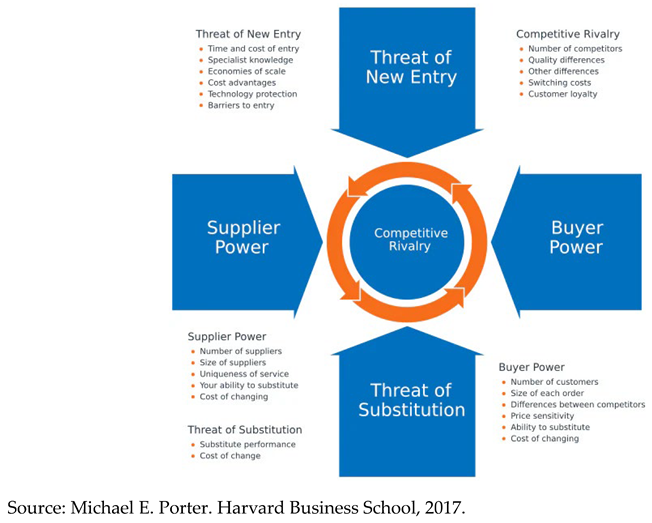

Porter’s 5 Forces is a market competition analysis model developed by Michael Porter in 1979. The model is used to evaluate the attractiveness and profitability of a particular market.

Porter’s 5 forces are as follows:

Threat of new competitors: refers to the probability that new competitors will enter the market and compete with current competitors.

Rivalry among competitors: refers to the intensity of competition among current competitors in the market.

Bargaining power of customers: refers to the degree to which customers can influence the prices and terms of sale of products or services.

Bargaining power of suppliers: refers to the degree to which suppliers can influence the prices and conditions of sale of products or services.

Threat of substitute products or services: refers to the probability that customers will switch to substitute products or services.

Reference figure of Porter’s 5 forces

Within the framework of the analysis of the camelid livestock value chain, Porter’s 5 Forces analysis is a useful tool for understanding the dynamics of this industry.

When evaluating the camelid fiber value chain, it is important to keep in mind that Porter’s 5 forces address the key factors that influence market competition and profitability. The threat of new competitors, rivalry among competitors, bargaining power of customers and suppliers, and the threat of substitute products or services are all factors that can influence market dynamics.

The 5 variables are analyzed below to facilitate a deeper understanding of the dynamics of the camelid fiber market and help market players make informed decisions regarding business and trade strategies:

The South American camelid fiber industry is highly specialized and requires technical knowledge and experience in animal husbandry and management. In addition, the high costs of land acquisition in the high Andean corridor, as well as the need to maintain high standards of production and re-production, make the entry of new competitors difficult. Therefore, the threat of new competitors is low.

- 2.

Rivalry among existing competitors:

Although the industry is specialized, there is significant competition among South American camelid fiber producers, especially in countries such as Peru, Bolivia, Argentina, and Chile. Rivalry centers mainly on the price and quality of the fibers, as well as the ability of producers to meet specific customer demands. Rivalry among existing competitors is high.

- 3.

Threat of substitute products:

Although South American camelid fibers have unique characteristics, there are other types of natural and synthetic fibers that can be used as substitutes in some cases. However, the demand for sustainable and ethical products has led to an increased preference for natural and non-synthetic fibers, reducing the threat of substitute products.

- 4.

Negotiating power of suppliers:

Suppliers in the South American camelid fiber industry are mainly wool breeders and producers. Although the industry is specialized, there are many suppliers in the producing countries, which reduces the individual bargaining power of each supplier. However, suppliers can exercise some bargaining power if they organize themselves into associations or cooperatives to increase their leverage.

- 5.

Buyers’ bargaining power:

Demand for South American camelid fibers is increasing due to greater awareness of sustainability and product quality. However, buyers have some bargaining power because there are many suppliers and intermediaries in the producing countries. In addition, buyers can exercise some bargaining power if they buy large volumes of fiber or if they have specific requirements for quality or price.

In summary, although there are some challenges and competition in the camelid fiber industry, the outlook is positive due to the growing demand for sustainable and ethical products.

PESTEL ANALYSIS

PESTEL Analysis is a strategic analysis tool that allows to evaluate the macroeconomic and political environment in which an organization operates. It was developed by Francis Aguilar and popularized by authors Johnson, Scholes, and Whittington.

The acronym PESTEL stands for six factors to be analyzed: Political, Economic, Social, Technological, Environmental and Legal. Each of these factors can influence the camelid livestock value chain in different ways.

For example, political factors could include government regulations on the production and marketing of camelid meat, while economic factors could include changes in livestock feed prices or exchange rate fluctuations. Social factors could include changes in consumer preferences toward healthier or more sustainable products. Technological factors could include advances in animal genetics or automation of certain processes. Environmental factors could include changes in climate or soil conditions, while legal factors could include changes in labor or environmental laws.

In summary, PESTEL analysis is a useful tool for evaluating the external factors that can affect the camelid livestock value chain and for identifying opportunities and threats in the macroeconomic and political environment.

The PESTEL analysis for South American camelid fibers is presented below:

Political:

Political stability in South American camelid fiber producing countries, such as Peru, Bolivia, Argentina, and Chile, is important to ensure the continuity of camelid fiber production and exports.

Government policies, such as tariffs and trade regulations, can affect international trade in these fibers.

Economic:

Demand for camelid fiber is influenced by global and regional economic cycles.

The prices of these fibers can fluctuate depending on supply and demand, as well as economic factors such as inflation and exchange rates.

Social:

Growing consumer awareness of sustainability and product quality has led to an increase in demand for natural and non-synthetic fibers, such as fibers derived from camelid livestock.

Sustainable fashion is an emerging sector that is driving demand for these fibers.

Technological:

The technology can be used to improve the production and processing of South American camelid fibers and derivatives, which can improve quality and reduce costs.

The technology can also be used to improve fiber tracking and traceability, which can increase consumer confidence in the quality and sustainability of products.

Technology can also facilitate advances in animal genetics or the automation of certain production processes in the highlands.

Environmental:

The production of South American camelid fibers is a livestock activity that can have an impact on the environment if not properly managed because of climate change. However, these fibers are considered sustainable due to their biodegradability because they do not require the use of products that are harmful to the Andean ecosystem.

Legal:

Government regulations can affect the production and marketing of South American camelid fibers. For example, the vicuña is a protected animal, and its illegal hunting or marketing may be punishable by law.

In summary, the PESTEL analysis shows that the camelid livestock sector is influenced by the factors discussed above and although there is a growing awareness of sustainability and product quality that has led to an increase in demand for camelid fibers and their derivatives, government policies and economic fluctuations can affect the national and international performance of camelid fibers and their derivatives.

SWOT ANALYSIS

SWOT analysis is a strategic analysis tool for evaluating internal and external factors that can affect an organization’s performance. It was developed by authors Kenneth Andrews and Roland Christensen in the 1960s.

The acronym SWOT stands for four factors: Strengths, Weaknesses, Opportunities and Threats. Strengths and weaknesses are internal factors, while opportunities and threats are external factors.

In the context of camelid ranching, the strengths include the experience and knowledge of the ranchers, the quality of the animals, and the productive infrastructure, among others. Weaknesses include the lack of technology, low financing for camelid livestock enterprises, lack of training, among others. Opportunities include increased demand for camelid meat, the opening of new markets, and access to financing, among others. Threats analyzed include substitute competition, government regulations, changes in climatic conditions, among others.

Considering that the SWOT analysis is a useful tool to evaluate internal and external factors that may affect camelid livestock and to identify areas for improvement and opportunities for growth, the analysis is presented in full below.

Strengths:

▪ Experience and knowledge of farmers (know-how).

▪ Quality of reproductive specimens and variety of colors.

▪ Camelid fibers are valued for their softness, warmth, sustainability, and durability, making them very attractive to consumers.

▪ Fibers are considered sustainable because they are biodegradable and do not require the use of chemicals.

▪ Producing countries, such as Peru, Bolivia, and Chile, have a long tradition in the production of these fibers.

Weaknesses:

▪ Inconsistency of supply: Many producers are not selecting and managing camelid cattle to meet specific market requirements. The industry is dominated by small herds and there is a wide range of fleece attributes (color, microns), leading to inconsistencies in quality and quantity.

▪ The supply of animals for meat processing is also inconsistent. It is highly recognized by producers the limitations of this sector due to inadequate facilities for their activity and regulatory restrictions.

▪ Camelid fiber production can be costly due to the need to maintain high quality standards and the high investment costs of the infrastructure needed for production.

▪ Lack of technology for genetic improvement.

▪ Low level of financing for camelid livestock enterprises.

▪ Scarce supply of training oriented to the value chain.

▪ Low productive yields.

▪ Low level of profitability of the camelid livestock AFC due to its high level of atomization.

▪ Exodus of human capital.

▪ Weak disease prevention and control system

Opportunities:

▪ Demand for natural and sustainable fibers is on the rise due to increased consumer awareness of sustainability and product quality.

▪ Sustainable fashion is an emerging sector that is driving demand for these fibers.

▪ The textile industry is exploring new applications for these fibers, such as in the production of carpets and rugs.

▪ Opportunities to enter underserved markets at the regional, national, and international levels.

Threats:

▪ Rural depopulation.

▪ Competition from other natural and synthetic fibers may reduce demand for South American camelid fibers.

▪ Economic and political factors can affect the international trade of these fibers.

▪ Current government regulations affect value chain performance.

▪ Changes in climatic conditions (scarcity of water resources, increased temperature, deteriorated Andean grasslands, among other factors).

Increased production and marketing costs (highly unstable international logistics chain).

The SWOT analysis suggests that South American camelid fibers have significant strengths, such as quality and sustainability, as well as opportunities in the global market. However, they also face weaknesses and threats, such as high production costs and competition from other fibers that must be corrected and neutralized.

COMPETITIVE HYPOTHESIS OF THE CAMELID LIVESTOCK VALUE CHAIN

Camelid livestock farming in Arica and Parinacota is a heterogeneous and diverse productive sector that includes a wide range of activities associated with the value chain, from breeding and primary production to the semi-industrial processing of yarn (camelid fiber collection and processing center), which currently satisfies most of the regional demand.

This is a traditional sector with a strong heritage component, weak competitiveness, and low technological content, and is characterized by a labor-intensive production process, especially in breeding, shearing and the manufacture of handicrafts with cultural identity. However, many international subsectors make intensive use of advanced technologies and highly sophisticated materials.

Over the last two decades, camelid livestock farming has undergone successive reconversion and restructuring processes to adopt new productive and re-productive technologies to face the ever-increasing international competition and the depopulation of the most emblematic farms in the Province of Parinacota. All of this is due to the low level of investment in enabling infrastructure, the exodus of human capital and the absence of long-term strategic plans to facilitate the competitive performance of the camelid livestock value chain.

On the other hand, the international textile industry has suffered the recessive effects of stagnant domestic demand and stiffer competition, since the liberalization of international trade in fibers and textile products has led to a considerable increase in imports of low-cost products made in developing countries. Faced with these difficulties, the sector’s organizations have reacted by adopting productive and commercial modifications with initiatives financed by FIA, CORFO, CONADI and resources from the FNDR, which have allowed them to maintain a certain degree of continuity. However, the low level of independence from international price fluctuations does not allow them to maintain and strengthen the sector’s competitive position. Therefore, camelid livestock farming will have to promote a new process of technological modernization and innovation in the value chain.

7.1. Competitiveness Analysis of the Value Chain

Comparative advantage:

South American camelid fiber-producing countries, such as Peru, Bolivia, and Chile, have a comparative advantage in the production of these fibers due to their climate and geography, which are ideal for raising alpacas and vicuñas. In addition, these countries have a long tradition in the production of South American camelid fibers and have a specialized labor force (especially in Peru and Bolivia).

Quality:

South American camelid fibers are valued for their softness, warmth, and durability, which makes them very attractive to consumers. These fibers are considered high quality due to their exclusivity because they are sustainably produced by high Andean communities.

Innovation:

The textile industry is exploring new applications for South American camelid fibers, such as in the production of carpets and rugs. In addition, technology can be used to improve the production and processing of these fibers, which can improve quality and reduce costs.

Competition:

Competition among South American camelid fiber producers can be high, especially in countries such as Peru, Bolivia, Argentina, and Chile. Rivalry centers mainly on the price and quality of the fibers, as well as the ability of producers to meet the specific demands of each market.

Market access:

South American camelid fiber producing countries have access to important international markets, such as the United States, Europe, and Japan. However, access can be affected by economic, political, and environmental factors (the latter caused by climate change that affects the normal performance of camelid livestock feeding).

Sectorized competition:

Alpaca fiber (the VC product with the greatest commercial potential) competes with alternative natural fibers, such as wool, mohair and cashmere. In international export markets, Chilean alpaca fiber competes with Peru’s high-volume product, which has a lower production cost.

Alpaca meat competes with other unique niche proteins such as venison and other exotic meats and is often traded on the international market based on its thinness, low environmental impact, and uniqueness (the latter is only valid for meat sold in the southern part of the country under formal conditions).

The livestock activity under analysis also competes with other high annual value industries in the livestock and agricultural industry for land use, manure generation and capital investment for genetic improvement.

VALUE CHAIN AND ITS IMPLICATION IN THE LIVESTOCK AFC

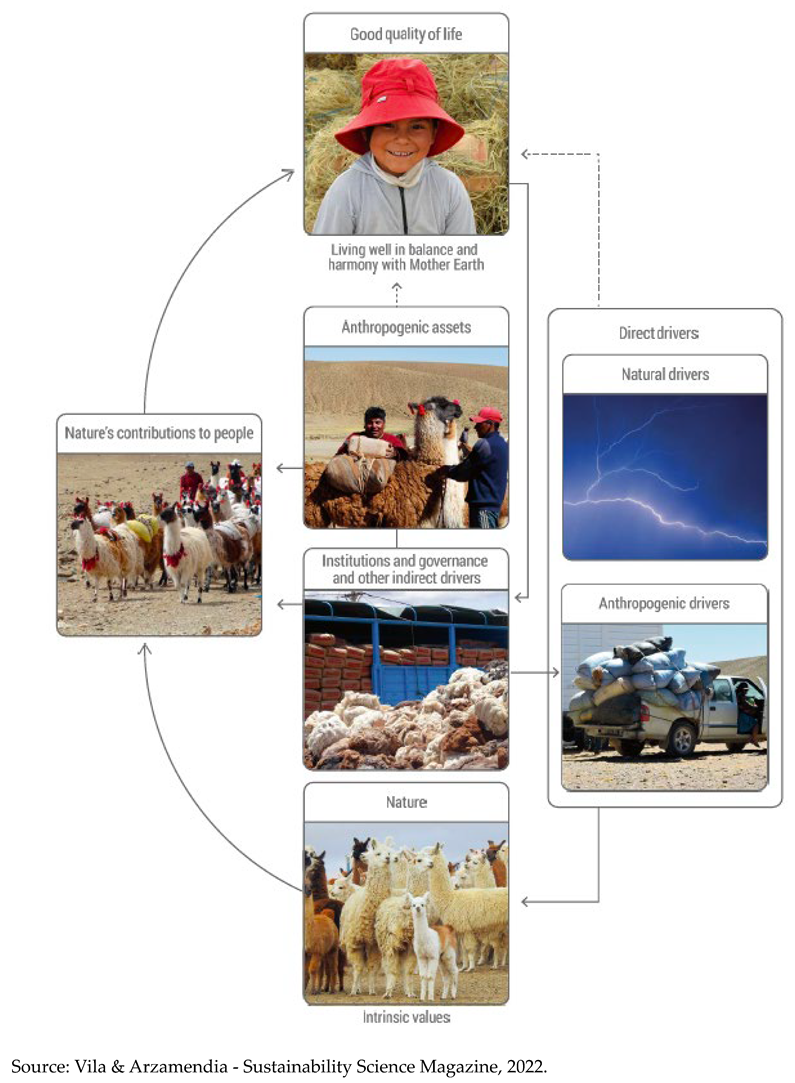

Camelid livestock in Parinacota Province supplies the regional market with fiber, meat, and livestock genetics (1980s and 2000s), along with the supply of handicrafts and other livestock-derived products. Estimates suggest that the alpaca and llama population has had a negative trend, according to the latest livestock reports.

Camelid production is considered to have environmental advantages, as it causes little damage to fragile soils, requires fewer chemical inputs, and produces less methane than sheep and conventional cattle.

New and emerging early-stage industries often lack the public awareness and resources to assist with industry growth. For this reason, a concise overview of the camelid value chain (VC) is provided to provide a resource that can be used to raise awareness and engage local economic and institutional stakeholders to take advantage of the opportunities involved in assisting with the growth of Andean livestock activity.

8.1. Definition of Value Chain

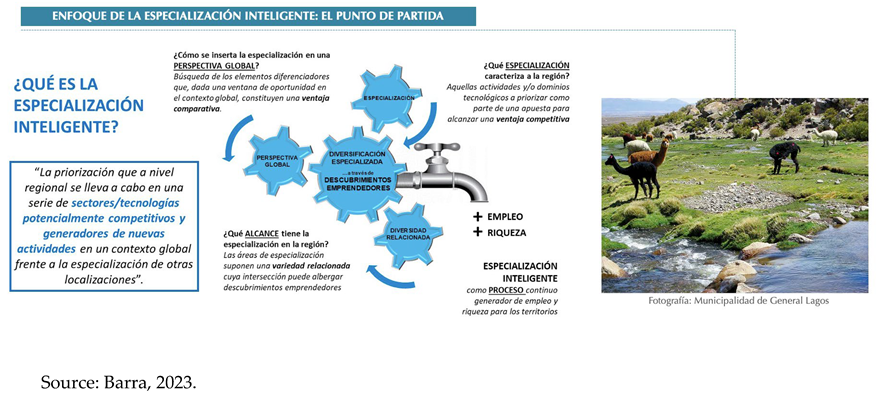

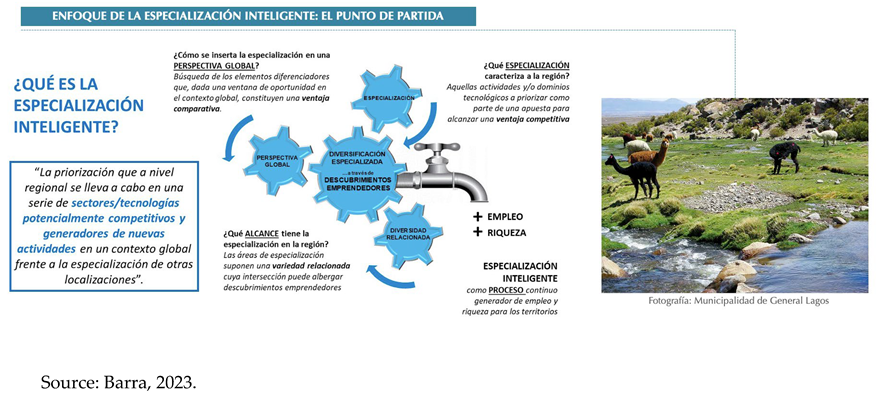

The smart specialization strategy (S3) is an approach to regional economic development that focuses on leveraging the unique strengths and capabilities of each region. The value chain based on this strategy involves identifying the specific resources and skills of each territory and using them to create high value-added products and services.

In general terms, the value chain refers to all the activities necessary to take a product or service from its conception to its final delivery to the market. In the context of the smart specialization strategy, the value chain focuses on identifying and developing strengths at each stage of the value chain, from production and marketing to research and development.

This methodology implemented across Europe since 2014 has proven to be effective in fostering sustainable economic growth and job creation.

In this context, the smart specialization strategy can also be applied to camelid livestock, identifying the unique strengths and capabilities of this industry in the region of Arica and Parinacota, to create products and services of higher perceived value.

Specifically, S3 can focus on research and development of new camelid breeding and management techniques to improve the quality of the alpaca or llama fiber produced. It can also focus on the production of high-quality products derived from the fiber, such as yarn, accessories, and handicrafts.

In addition, work can be done on marketing these products locally or internationally, taking advantage of the growing demand for sustainable, high-quality products. The camelid livestock value chain could strengthen the competitive development of activities such as animal breeding and management, fiber production and processing, the manufacture of derived products, and marketing.

Smart specialization approach to value chain development

8.2. Value Chain Data Collection and Storage

Value chain studies, including camelid livestock production systems, are essential for strategic analysis, which, when combined with socioeconomic data collection, is a powerful tool for identifying the main constraints and opportunities for VC development based on the management of priority links. Several studies of production systems and market chains in Peru and Bolivia have been reviewed to contrast their level of sophistication and comparative analysis. Based on these experiences, the data needed for the respective purpose of this technical assistance is prioritized and data collection and analysis tools are recommended for future consolidation.

The following is a summary of the priority information needed to answer key questions for the development of the camelid livestock VC. The data collection process follows a stepwise approach suggested for the development of all its stages.

Key questions on camelid VC

- ▪

What are the products?

- ▪

Who are the stakeholders?

- ▪

How are they involved, what role do they play? Connections/relationships among stakeholders - Level of influence of different stakeholders

- ▪

How is the institutional landscape at the regional level?

- ▪

What institutions are present, how strong are they, what relationships exist?

- ▪

What institutional gaps or barriers may exist, what is the likely consequence?

- ▪

Practices along the production and marketing chain (including business transaction methods)

- ▪

What are the consumption trends: quantity and quality of fiber, meat and other products derived from camelid livestock?

- ▪

Stakeholder profile and classification of consumer groups.

- ▪

Existing infrastructure in the territory.

- ▪

Seasonal factors (production, demand, supply).

- ▪

Analysis of production, transformation, and distribution systems (characterization of the different systems).

- ▪

Definition of production systems.

Socioeconomic data of the value chain

Socioeconomic data collection should provide an understanding of the incentive structure of stakeholders, for example to meet market quotas in associative marketing systems. It also requires knowledge of existing institutional arrangements and how they may interact with the value chain.

▪ Formal and informal contracts between stakeholders, including credit and financing agreements for the development of new VC links.

▪ What are the motivations for behavioral change (especially what factors might influence behavioral changes and changes in practices in the Andean cattle CFA)?

▪ Value, size, and frequency of productive seasons.

▪ Profit margin and sales volume at different points in the chain.

▪ Cross-border trade.

▪ Contribution of the value chain activity to stakeholders’ household income.

▪ Regulatory mechanisms (formal and informal) - Institutions (including possible geographic variation in the capacity and/or regulation of institutions, e.g., veterinary offices in the communes of Putre and General Lagos).

▪ Certification / inspection / standards: both the "written" standards and the practical credibility of livestock stock certification.

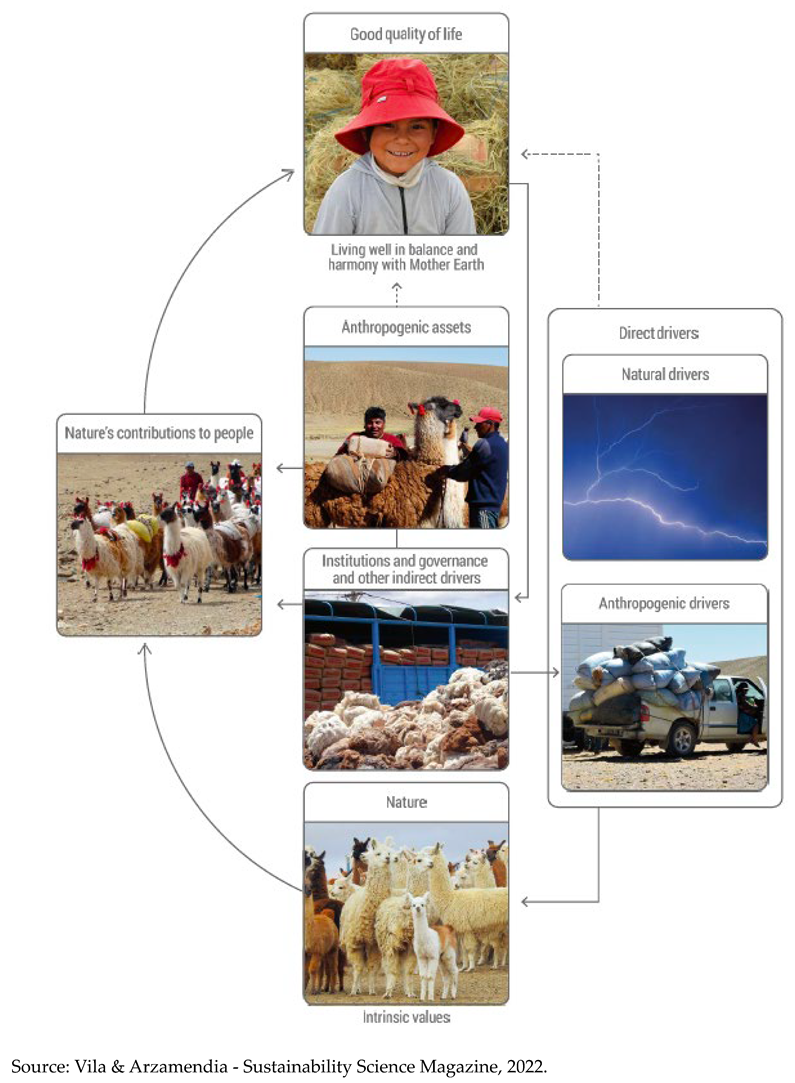

Reference image of the Bolivian camelid fiber system: Values and contributions to people.

8.3. Conventional Value Chain for Camelid Livestock

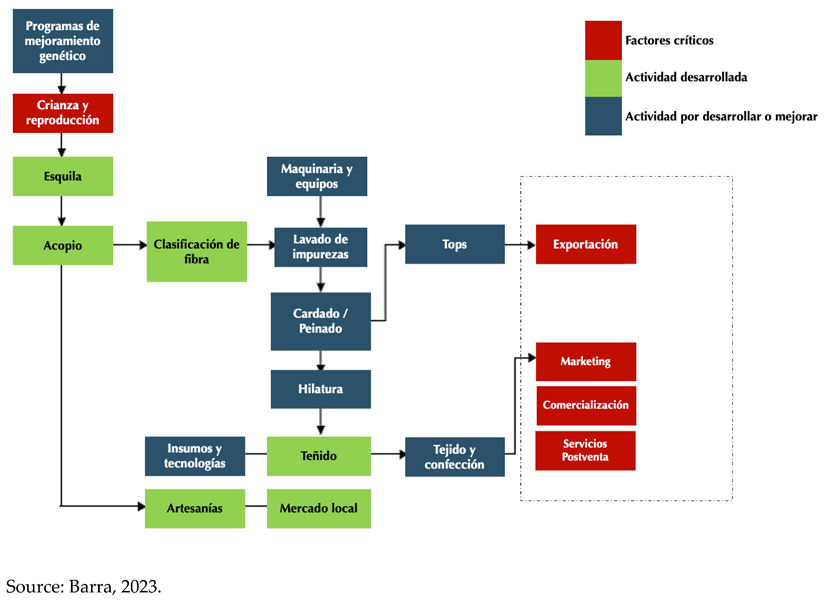

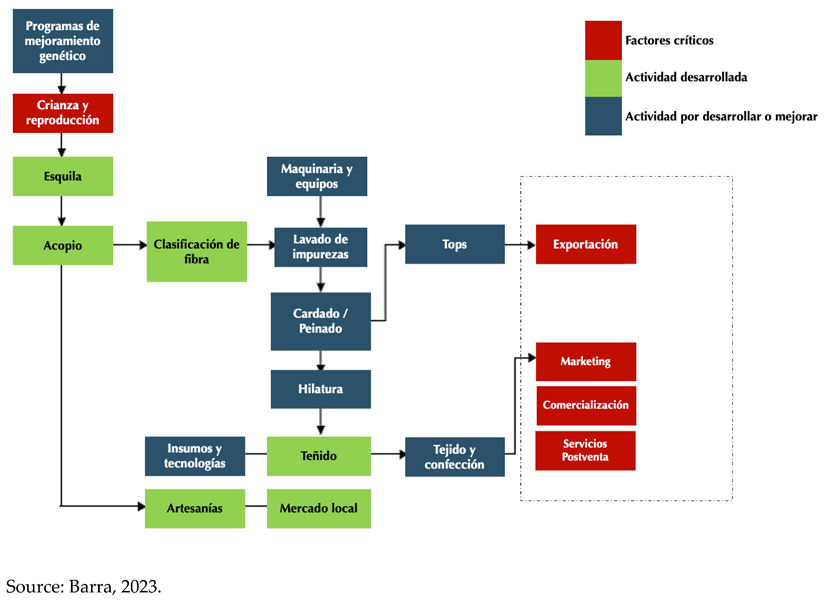

The following is the VC for camelid livestock, which includes the processes and activities necessary to produce and market this fiber:

Camelid breeding and care: The value chain begins with the breeding and care of camelids, including alpacas, llamas, and vicuñas. This involves animal selection, feeding, health care and shearing.

Fiber production: Fiber production involves the process of shearing the camelids and classifying the fiber according to its quality and type. Then, the fiber is washed, carded, and spun into yarn (this process can be done in an artisanal, semi-industrial or industrial way).

Knitting and weaving: The next step in the value chain is the knitting and weaving of the final products, such as sweaters, scarves, blankets, rugs, and other textile products. This involves designing the products, selecting the additional materials needed, and producing the final products.

Distribution and sales: Once the products are ready, they are distributed and sold through different channels, such as retail stores, online stores, and trade fairs (including cross-border marketing). Distribution may also involve exporting the products to different countries.

Marketing and promotion: Promotion and marketing are important to raise awareness of products derived from camelid fiber and increase demand for them. This can include participation in trade fairs, advertising in digital or print media, and collaborating with designers and brands to create exclusive collections.

After-sales services: After-sales services are important to maintain customer satisfaction and foster brand loyalty. This may include warranties, repairs, or returns in case of problems with products due to lack of standardization (Yarns and handicrafts).

The camelid fiber value chain involves a series of processes and activities ranging from the breeding and care of the animals to the distribution and sale of the final products. Each stage is important to produce products that meet current market needs.

Reference figure of the value chain of alpaca and llama fibers.

8.4. Value Chain 4.0 for Camelid Livestock

The smart specialization strategy seeks to influence the development of the value chain and, to this end, requires the involvement and coordination of all stakeholders for its effective execution, ensuring that all of them participate in the different links.

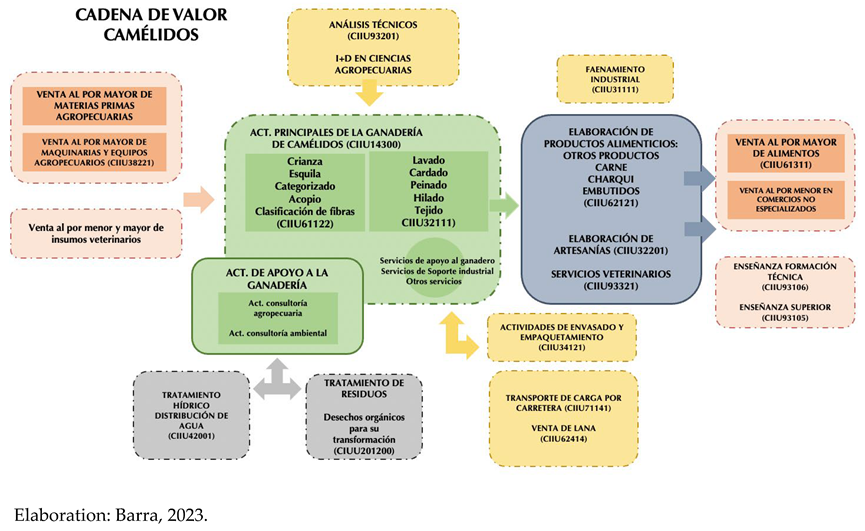

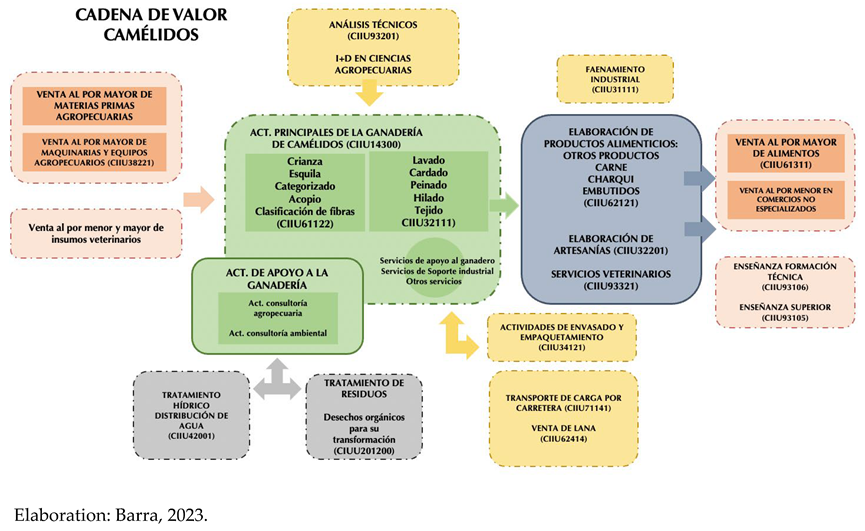

In this context, camelid VC includes the following links:

Wholesale of agricultural raw materials: This link is responsible for marketing food and fodder for camelid feed.

Sale of agricultural machinery and equipment: This link offers machinery and tools necessary for raising and handling camelids, such as corrals, fences, feeders, machinery for textile industrialization, veterinary equipment, among others.

Sale of veterinary supplies: Medicines, vaccines, and other supplies necessary for the health care of camelids are sold here.

Technical analysis and R&D in livestock sciences: This link is responsible for conducting research and technical analysis to improve the quality of camelid breeding and management.

Breeding and management of camelids: In this link, camelids are raised and managed for subsequent sale.

Industrial activity to produce yarn: Here, alpaca, llama and vicuña fibers and their derivatives are transformed into yarn for subsequent marketing.

Support activities for camelid livestock: This link is responsible for providing advisory and training services to producers to improve the quality of camelid breeding and management.

Processing of alpaca and llama meat: In this link, alpaca and llama meat is processed for subsequent sale (fresh meat, jerky and sausages).

Production of handicrafts with local identity: Here handicrafts are made with alpaca fibers, with the objective of promoting local and cultural identity in different target markets.

Veterinary services: This link is responsible for providing specialized veterinary services for camelid health care and reproductive systems.

Commercialization and export of fibers: This link involves the commercialization and export of fibers and their derivatives for sale in the domestic and international markets.

Technical and higher education: This link would be responsible for offering training and education programs for producers and technicians in areas such as camelid breeding and management, fiber processing, production of by-products, marketing, and export, among others. The aim is to improve quality and efficiency in the production and marketing of camelid products and to promote innovation and technological development in this sector.

The value chain 4.0 for camelid livestock is illustrated below.

8.5. Proposal for the Organization of the Value Chain Supply

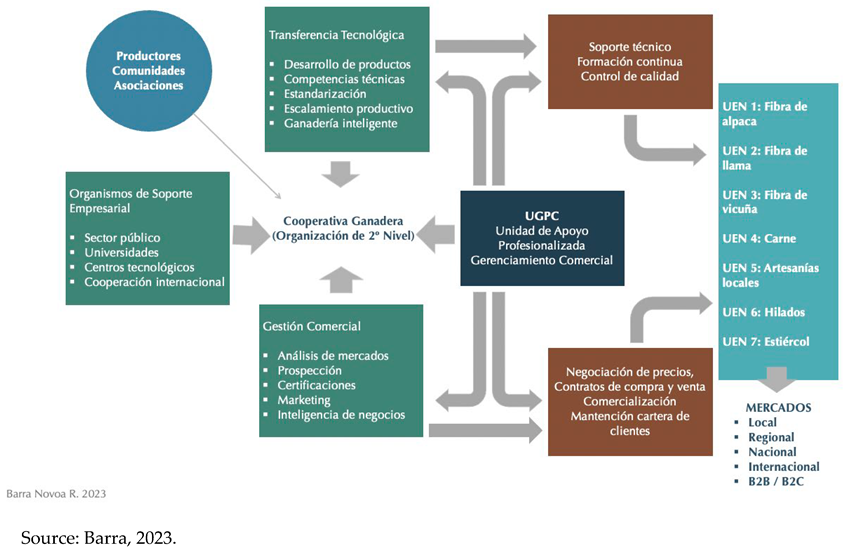

The application of a proposal for the organization of supply for the Camelid VC involves a significant quantitative and qualitative leap in key areas of production, standardization, articulation, and incremental consolidation of strategic business units (SBUs).

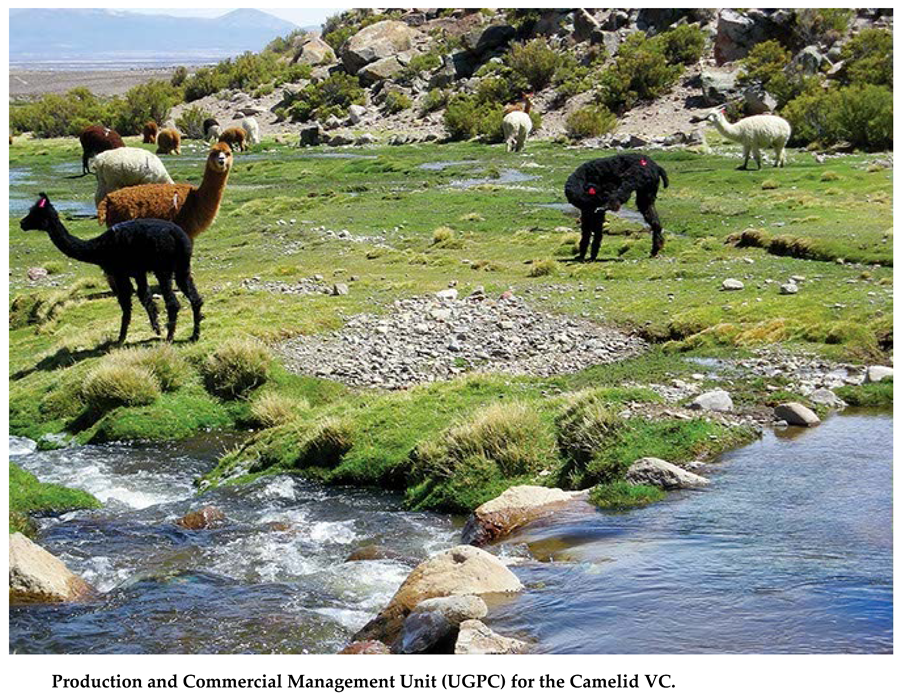

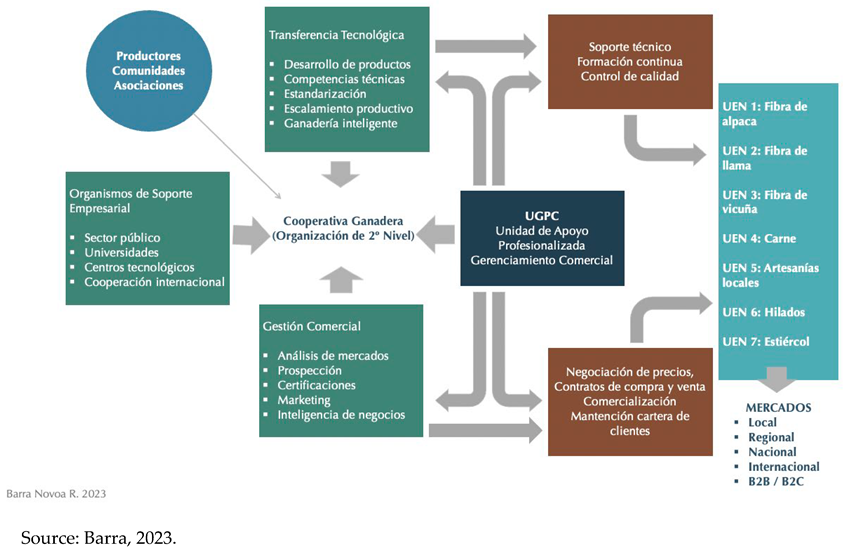

Its implementation is based on current local production (productive units), which must be organized to direct efforts towards the development of profitable and sustainable businesses. The effort is supported by a professionalized management platform, with interdisciplinary capabilities (productive and commercial management unit), which actively intervenes in the identification of productive and business units, as well as in their productive and commercial development.

The installation and initial operation of the model relies, fundamentally, on the public and private resources available to support the livestock farming communities and the development of family farming in the highlands of the Parinacota Province. These resources must be used mainly to finance technical support and investments in enabling infrastructure, the equipment of the business units and, to a lesser extent, the operation of the production and commercial management unit (cooperative or second-level organization).

The implementation of the model requires a management environment that gives a strategic sense to the productive and marketing actions of the system and provides support to the productive and business units (Barra, 2009; 2023). The model should assign this role to a central management platform called "Productive and Commercial Management Unit"; subordinated to its strategies, it contemplates a second area located in the producers, who should assume the generation of competitive products adjusted to the expectations of the clients, through the "Productive and Business Units". The development of the latter requires articulation with a third area: the "Business Support Units", which provide technical and financial resources for the development of productive scaling, advisory services and training for producers.

The main role of this unit will be to give an organic character to the associative actions that may be carried out within the framework of the capture, shearing and commercialization of fibers and their derivatives.

The UGPC must have a flexible organizational structure that allows not only the integration of new areas of economic development, but also, and fundamentally, that considers the intrinsic socio-cultural characteristics of the cattlemen and cattlewomen.

The UGPC must provide a set of high-level services to the business units. The provision of these services, as well as their permanent nature, is one of the key aspects of the Model, since it allows operating under a common business strategy, with an interdisciplinary approach, and having access to high productive and commercial management services for its business units, which would be impossible for them to access individually, given the limited resources.

The proposed supply organization model for the camelid value chain is illustrated below:

Illustration of supply organization model

8.6. Main Stages for the Design of an Intelligent Specialization Strategy for the Camelid Value Chain

Identification of areas of specialization: An analysis should be made of the sector’s strengths and weaknesses, as well as the opportunities and threats it faces in the global market. Based on this, areas of specialization on which the sector can focus can be identified, such as the production of high-quality fibers, innovation in products and processes, sustainability, and fair trade.

Selection of strategic projects: Strategic projects should be selected to enable South American camelid fiber producing communities to improve their competitiveness and profitability. These projects may include improving the quality and quantity of production, innovation in products and processes, promotion of demand in the international market, training, and technology to improve sustainable production, and access to financing.

Partnership and collaboration: Partnership and collaboration between producers, public and private institutions, and other relevant actors in the sector should be encouraged. This will allow for greater efficiency and competitiveness of the sector, as well as better identification and exploitation of opportunities in the global market.

Implementation and follow-up: The selected strategic projects must be implemented and their impact on the sector must be constantly monitored. This will make it possible to evaluate their efficiency and make the necessary adjustments to improve their effectiveness.

Evaluation and continuous improvement: A constant evaluation of the sector and its impact on the South American camelid fiber producing communities should be carried out. This will help identify areas for improvement and opportunities to continue strengthening the sector.

In summary, the smart specialization strategy (S3) for the development of the camelid livestock value chain should focus on the identification of areas of specialization, selection of strategic projects, partnership and collaboration, implementation and monitoring, and evaluation and continuous improvement. This will strengthen the sector and generate greater economic and social benefits for the producer communities benefiting from the CORFO-funded ITP.

8.7. Intelligent Prioritization of VC Products

Considering the parameterization of regional, national, and international data, under the following criteria: market demand, consumption trends, profitability of each product, availability of raw materials and local production capacity, it is concluded that the most important strategic business units (SBU) of the camelid livestock VC are distributed according to this order:

| UEN |

Market Potential |

Priority |

| Sorted alpaca fiber |

Increasing demand for natural fibers (sustainability, circularity, eco-design, ethical markets) |

High |

| Dehorned vicuña fiber |

Single oligopolistic market with stable demand and high prices. |

High |

| Alpaca fiber yarns |

Increasing demand for natural yarns - eco-design |

High |

| Classified flame fiber |

Increased demand for flame fiber as an input for thermal insulation. |

Media |

| Meat |

Increased demand for domestic camelid meat, due to its low cholesterol level. |

Media

(Requires regulatory support and enabling infrastructure) |

| Handicrafts |

Traditional practice rooted in the Andean culture that can access new markets with innovative approaches in the interior decoration sector and companies collecting Andean pieces (USA and EU). |

High |

| Manure |

Increasing demand for organic fertilizers for precision agriculture. |

Media |

BUSINESS MODELS

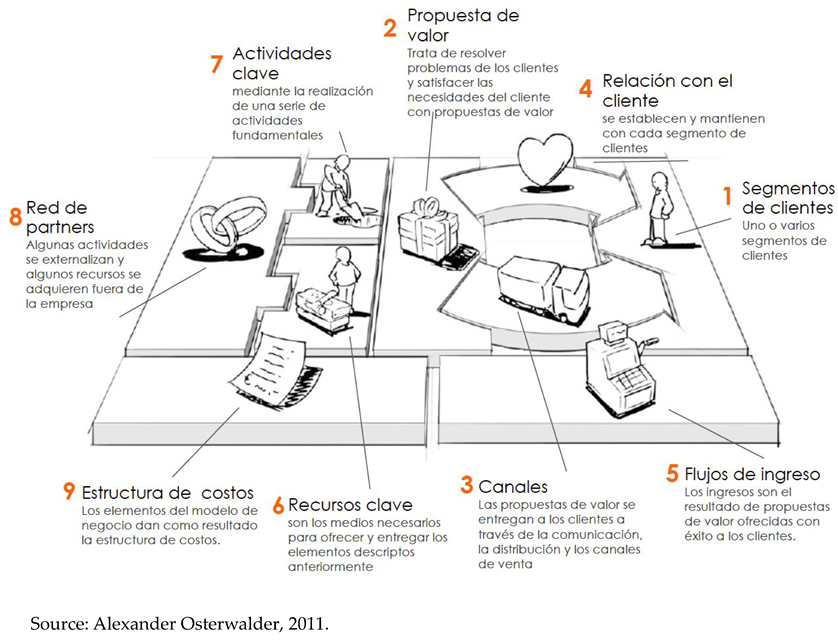

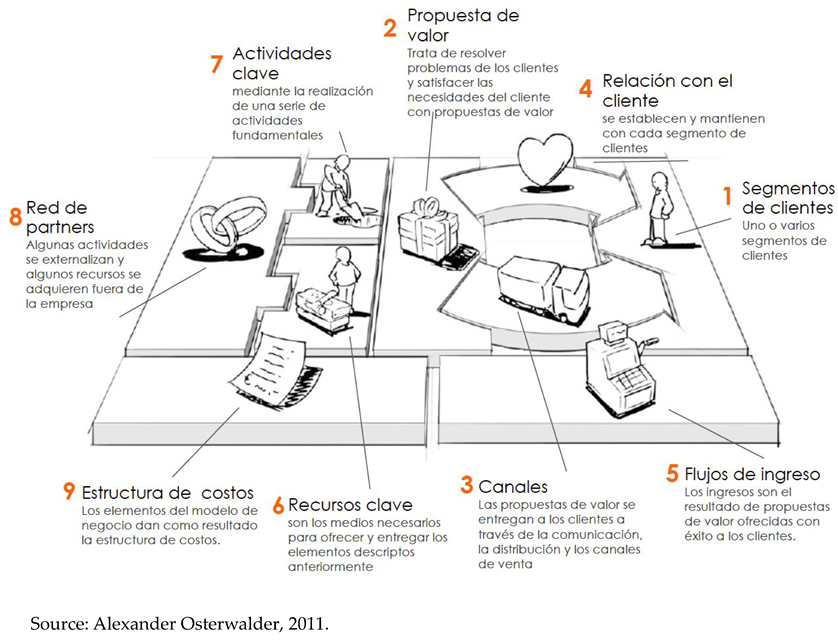

The business models designed under the Business Model Canvas methodology (Osterwalder, 2011), correspond to a management system and associative work proposal, which establishes sustainable management procedures and standards for domestic resources under altiplanic conditions, and where this system should generate the formal structures required for the performance of trade activities necessary to insert the products at regional, national, and international levels (Barra, 2009).

In this context, cross-cutting support activities are established to take better advantage of the good market conditions for the development of the VC oriented to the competitive development of alpaca and llama fiber and jointly generate the basis for the incorporation of other economic activities such as, for example, the development of meat, handicrafts, manure, and tourism.

Considering the above, the Business Models have been designed as a tool for the development of economically profitable and sustainable businesses for the Aymara communities of the province of Parinacota. Essentially, it is confirmed that the Camelid VC can be effectively and sustainably inserted in more competitive markets, if it generates formality and is produced according to the attributes expected by the B2B and B2C customer segments.

The proposed model is based on:

▪ Increased demand for fine natural fibers stimulates the commercial integration of camelid fibers.

▪ Valorization of ethnic and cultural products.

▪ Valorization of natural textures and colors.

▪ Joint interests in the protection and conservation of domestic and wild camelids.

▪ Regulatory framework in accordance with the challenges of an economic activity (especially around meat).

▪ State participation as facilitator of enabling infrastructure.

In this context, it should be noted that the main strength of the business models is to generate "differentiated products" because they originate in sustainable production systems of Aymara communities of the altiplano and, in addition, because their current production can move towards technification and productive improvement. This differentiation would make it possible to obtain better yields and market prices in line with the level of structural costs of camelid livestock production.

In addition to the above, given that the associative links are weak in the commercial productive chain and management of the communities that exploit the fiber resource and its derivatives, it is important to highlight the need to strengthen the linkage factors required to sustain economic activity and generate greater wealth, taking advantage of territorial and cultural advantages. It is important to highlight the need to strengthen the linkage factors required to sustain economic activity and generate greater wealth, taking advantage of territorial and cultural advantages. Therefore, business models must create the structural conditions for associativity and economic development of rural Aymara communities.

Business model figure

Alexander Osterwalder’s business model (based on the figure above) is composed of 8 key blocks that should be considered when designing or analyzing a business model. The blocks are:

Value proposition: refers to the unique proposition that the company offers to its customers, which differentiates it from the competition.

Customer segments: are the specific groups of customers that the company wants to reach and serve.

Channels: are the means through which the company communicates and delivers its value proposition to its customers.

Customer relationship: refers to how the company interacts with its customers to create and maintain lasting relationships.

Revenue sources: are the ways in which the company generates revenue through the sale of products or services.

Key resources: these are the assets necessary for the operation of the business, such as human resources, technology, infrastructure, etc.

Key activities: these are the activities necessary to deliver the value proposition to customers.

Key partnerships: refers to strategic alliances that the company may establish with other organizations to improve its market position or reduce costs.

9.1. Proposed Business Models

9.1.1. Alpaca Fiber

Customer segment: The target customer segment is consumers who value the quality, sustainability, and exclusivity of alpaca fiber garments. This segment may include people with high purchasing power, tourists interested in local and sustainable products, and companies seeking exclusive corporate gifts, including B2C and B2B segments.

Value proposition: The value proposition is based on the quality, softness, and durability of alpaca fiber, as well as its sustainable and eco-friendly origin. Raw fiber or exclusive and customized garments will be offered to the market, with innovative designs and high-quality finishes.

Distribution channels: Distribution channels may include online stores, specialized physical stores, craft fairs and fashion events. Partnerships can also be established with hotels, souvenir stores and other tourism-related businesses.

Customer relationship: Customer relationships are based on customization, attention to detail and customer satisfaction. Alpaca fiber sorting and spinning services can be offered, as well as quality guarantees and color variety.

Revenue sources: Revenue sources include the sale of clean sorted fiber, yarns and exclusive alpaca fiber garments, additional services such as garment design and combination consulting, and wholesale to companies interested in exclusive corporate gifts.

Key resources: Key resources include high-quality alpaca fiber, designers and artisans specialized in making exclusive garments, an online platform for online sales, strategic allies for distribution and promotion, and an effective marketing strategy.

Key activities: Key activities include proper breeding, fiber shearing and sorting, industrial processing, the design, and manufacture of exclusive garments, online and in-store promotion and sales, personalized customer service and efficient supply chain management.

Cost structure: Costs include materials (veterinary inputs, alpaca fiber fodder), staff salaries (designers, artisans), operating expenses (rental of premises, utilities, among others), logistics costs (transportation and shipping), marketing and advertising costs, and other expenses associated with running the business.

9.1.2. Handicrafts

Customer segment: The target customer segment is consumers who value unique, handmade crafts, as well as the quality, sustainability, and exclusivity of alpaca fiber. This segment may include tourists interested in local and sustainable products, people looking for exclusive gifts, and companies looking for customized corporate gifts.

Value proposition: The value proposition is based on the quality, originality, and exclusivity of the alpaca fiber handicrafts, as well as their sustainable and eco-friendly origin. Pieces will be offered, with innovative designs and high-quality finishes.

Distribution channels: Distribution channels may include online stores, specialized physical stores, craft fairs, and cultural events. Alliances can also be established with hotels, souvenir stores and other tourism-related businesses.

Customer relationship: Customer relations are based on customization, attention to detail and customer satisfaction. Advisory services can be offered in design and combination of handicrafts, as well as quality guarantees and returns.

Sources of income: Sources of income include the sale of exclusive alpaca fiber handicrafts, additional services such as advice on design and combination of pieces, and workshops or training courses to teach weaving and design techniques to other interested parties.

Key resources: Key resources include raw material (alpaca fiber), tools and machinery for weaving and design, personnel trained in weaving and design techniques, and a physical space for the workshop or store.

Key activities: Key activities include the design and production of alpaca fiber handicrafts, product promotion and marketing, customer service and financial management of the business.

Key alliances: Key alliances may include alpaca fiber suppliers, local designers and artists, local hotels, and stores to promote products, and cultural or tourism organizations for events and craft fairs.

Cost structure: Costs include fiber, staff salaries (designers, craftswomen), operating expenses (rental of premises, utilities, among others), logistics costs (transportation and shipping), marketing and advertising costs, and other expenses associated with running the business.

This business model can be a good option for local women entrepreneurs looking to create a sustainable, creative, and profitable enterprise that promotes the enhancement of local heritage.

9.1.3. Meat/Charqui

Customer segment: The target customer segment is consumers interested in healthy, nutritious, and sustainable foods, as well as local gastronomy and the exploration of new flavors. This segment may include specialty restaurants, gourmet stores, tourists interested in local culture, and people looking for healthy snack options.

Value proposition: The value proposition is based on the quality, flavor, and sustainability of alpaca meat charqui, as well as its local and traditional origin. It offers a nutritious product, low in fat and high in protein, with a unique and authentic flavor.

Distribution channels: Distribution channels may include online stores, specialized physical stores, specialized restaurants, and gastronomic fairs. Alliances can also be established with hotels and other tourism-related businesses.

Customer Relationship: Customer relations are based on product quality, attention to detail and customer satisfaction. Tastings, advice on food preparation and combination, as well as quality guarantees and returns can be offered.

Revenue sources: The sources of income include the sale of alpaca meat jerky in different presentations and formats, as well as additional services such as advice on food preparation and combination.

Key resources: Key resources include high quality alpaca meat, technical capabilities, and Health Service approved processing facilities.

Key activities:

▪ Procurement of high quality, sustainable alpaca meat

▪ Preparation and curing of Charqui in the traditional way

▪ Product packaging and labeling

▪ Promotion and commercialization of Charqui in different channels

▪ Quality control and continuous product improvement

Key activities such as procurement of high-quality alpaca meat, preparation and curing of charqui, quality control and continuous improvement are essential to ensure the quality of the final product.

Key alliances:

▪ Suppliers of high-quality, sustainable alpaca meat

▪ Restaurants specialized in local and sustainable gastronomy

▪ Gourmet stores and health food specialty stores

▪ Tourism companies interested in promoting local and sustainable gastronomy

▪ Producers and distributors of complementary products, such as local wines or healthy snacks

Key alliances with suppliers, restaurants, gourmet stores and tourism companies are essential for the distribution and promotion of alpaca meat jerky. In addition, collaboration with producers and distributors of complementary products can help increase the product’s visibility and attractiveness.

Cost structure:

Production: Includes fixed costs related to the production of alpaca meat, such as labor, machinery maintenance and repair costs, and land and building rental or leasing costs.

Administration: Includes fixed costs related to the administration of the business, such as salaries of administrative personnel, supplies, general expenses, and communications.

Variable Costs:

Raw Material: Includes the variable costs related to the raw material necessary to produce alpaca meat and jerky, such as the cost of purchasing the animals, the cost of feeding and care, and the cost of transportation and storage.

Marketing and Sales: Includes variable costs related to the promotion and sale of alpaca meat and jerky, such as advertising expenses, events and tastings, and the costs of commissions and discounts for distributors and retailers.

Logistics: Includes variable costs related to the logistics and distribution of alpaca meat and jerky, such as the cost of transportation and storage, packaging, and labeling.

9.1.4. Manure/Compost

Customer segment: The target customer segment is farmers and food producers interested in improving the quality of their crops in a sustainable and natural way. This segment may include small and medium-sized farmers, agricultural companies, and cooperatives in the Azapa, Lluta, and Pampa Concordia valleys.

Value proposition: The value proposition is based on the quality and sustainability of camelid guano compost, as well as its ability to improve soil quality and increase crop productivity in a natural way. It offers an organic product, rich in nutrients and free of harmful chemicals.

Distribution channels: Distribution channels may include online stores, physical stores specializing in agriculture, agricultural fairs, and agriculture-related events. Partnerships can also be established with agricultural cooperatives and companies that offer advisory services in sustainable agriculture in the Arica y Parinacota region.

Customer relations: The relationship with clients is based on advice and technical support for the effective use of camelid guano compost, as well as client satisfaction. Advisory services on the use of the compost can be offered, as well as quality guarantees or seasonal deliveries.

Income sources: Income sources include the sale of camelid guano compost, additional services such as sustainable agriculture consulting, and the sale of complementary products such as agricultural tools and supplies.

Key activities:

▪ High quality camelid guano production

▪ Guano processing and composting

▪ Product packaging and labeling

▪ Promotion and marketing of compost in different channels

▪ Quality control and continuous product improvement

Key alliances:

▪ Livestock farmers oriented to camelid guano production

▪ Agricultural cooperatives and companies that offer consulting services in sustainable agriculture.

▪ Producers and distributors of complementary agricultural tools and supplies

▪ Suppliers of materials and equipment for guano production and processing.

▪ Distributors and retailers of organic products for the sale of guano.

Cost Structure:

Fixed costs related to the production, processing, and distribution of camelid guano.

Variable costs related to raw materials, personnel, transportation, and storage.

9.3. Key Drivers of Change in Camelid VC

▪ Sustainable management of natural resources (access to water, fodder and food diversification).