Introduction

Regional technological innovation is a key driving force in promoting high-quality economic development, especially in enhancing regional competitiveness, 1eason1zes industrial structure and achieving sustainable development, and plays an irreplaceable role [

1]. In recent years, China’s regions have attached great importance to technological innovation, continued to increase R&D investment, and gradually improved the construction of the innovation system, and the regional innovation capacity has been significantly improved. According to the latest data released by the National Bureau of Statistics, the scale of China’s society-wide research and experimental development (R&D) investment reached 332.78 billion yuan in 2023, an increase of 233 times compared with 1991, with an average annual growth rate of 18.6%. At the same time, the intensity of R&D investment increased from 0.6% in 1991 to 2.64% in 2023, ranking 12

th in the world (Li et al. 2024) [

2]. However, along with the intensification of global climate change and the growing prominence of environmental issues, it has become a global consensus to promote the green transformation of the economy and ensure sustainable development. Countries have incorporated green development into national economic strategies, and the importance of regional technological innovation in 1eason1ze green economic transformation has become more and more prominent (Yin Hejun. 2024) [

3]. In this context, it is particularly urgent and realistic to explore how green finance can 1eason1z resource allocation by guiding capital flow to the field of technological innovation, and further promote regional technological innovation through the intermediary mechanism of R&D investment. According to China Regional Science and Technology Innovation Evaluation Report 2024, China’s national comprehensive science and technology innovation level index score is 78.43 points, 1.30 points higher than the previous year, the input and output index of scientific and technological activities has significantly improved, and the level of science and technology for economic and social development has continued to improve (Shayegh et al. 2023) [

4].

Green finance, as an emerging financial instrument, is promoting green industry and technological innovation through the guiding role of capital flows, helping to realise green economic transformation, reduce carbon emissions and improve environmental quality. In recent years, the global green finance market has been growing rapidly, and the global green bond market has reached US

$587.6 billion in 2023, up 15% year-on-year (Climate Bonds Initiative.2024)[

5]. In China, since the promotion of green finance in 2007, the scale of green credit has expanded significantly, from 7.59 trillion yuan in 2014 to 30.08 trillion yuan in 2023, with an average annual growth rate of more than 29% (People’s Bank of China.2024)[

6]. The rapid development of green finance not only demonstrates its potential as a driver of economic green transformation, but also provides strong financial support for regional technological innovation.

Although the relationship between green finance and regional technological innovation has gradually become the focus of research, the specific impact of green finance on regional technological innovation and its mechanism of action still need to be explored in depth. On the one hand, green finance provides the necessary financial support for the research and development and application of green technology, and promotes the development of regional technological innovation; on the other hand, regional technological innovation provides new investment opportunities and risk management tools for green finance. In particular, the role mechanism of which R&D investment as a mediating variable is still unclear. In this context, an in-depth analysis of the path of regional technological innovation driven by green finance through R&D inputs not only helps to improve green financial policies and 2eason2z resource allocation, but also has important theoretical and practical significance for enhancing regional innovation capacity and promoting economic green transformation. Therefore, exploring how green finance promotes regional technological innovation through the intermediary mechanism of R&D inputs is the key to understanding the relationship between green economic transformation and technological innovation, and is also the core issue of this study.

In recent years, regional innovation, as an important driving force to promote high-quality economic development, has received extensive attention from academics and policymakers. Regional innovation refers to the promotion of the flow and integration of knowledge, technology and resources within a specific geographical area through the interaction and cooperation among innovation actors such as enterprises, universities and research institutions, so as to enhance the overall innovation capacity and competitiveness of the region (Cooke et al. 1997)[

7]. Studies have shown that regional innovation capacity not only helps to promote economic growth and industrial upgrading (Xu et al. 2024)[

8], but also plays a key role in green development and ecological 2eason2zes22 construction (Yan et al. 2023)[

9]. Regional innovation not only relies on the input of science and technology R&D, but is also jointly influenced by the level of regional economic development, policy environment and innovation ecosystem (Hu et al. 2023) [

10]. As the global green transition deepens, research on regional innovation is increasingly focusing on achieving sustainable development and carbon reduction goals through technological innovation (Zhang. 2023) [

11]. In addition, regional innovation is closely related to the financial environment and industrial structure, especially with the support of green finance, the access to innovation funds and the promotion of technological innovation show significant synergistic effects (Lin and Zhang.2024) [

12]. Therefore, exploring the role of green finance in promoting regional technological innovation, especially through the intermediary path of R&D investment to promote regional innovation, has become an important direction of current research.

As an increasingly important research area, the impact of green finance on economic development, environmental quality and carbon emissions has attracted widespread attention in recent years. Ren et al. (2020) [

13] constructed a green finance development index through the indicators of green credit, green securities, green insurance and green investment, aiming to improve the implementation of green finance policies and to promote the consumption of non-fossil energy. Zhou et al. (2020) [

14] further verified the positive effects of green finance on environmental improvement, highlighting its potential in promoting sustainable economic development. Meo et al. (2021) [

15]explored the relationship between green finance and carbon dioxide emissions through quantitative regression analyses, revealing the utility of green finance in supporting green energy projects and their reduction of carbon dioxide emissions. Muganyi et al. (2021) [

16] studied the impacts of China’s green finance policies in China and found that these policies significantly reduced industrial gas emissions, further proving the effectiveness of green finance in environmental protection. Rasoulinezhad et al. (2022) [

17]used the STIRPAT model to analyse the role of green bonds in reducing carbon dioxide emissions, pointing out the positive role of green bonds in promoting green energy projects. In addition, Lv et al. (2021) [

18] explored the regional disparities in the development of green finance in China and the evolution of its trends, 3eason3zes3 the differences at the regional level. Lee et al. (2022) [

19]investigated the impact of green finance on China’s green total factor productivity, while Zhou et al. (2022) [

20]explored the mediating effect of financial science and technology innovation on green growth. Irfan et al. (2022) [

21] analysed the impact mechanism between green finance and green innovation, 3eason3zes3 the role of regional policy interventions in green actions. Overall, these studies show that green finance plays a crucial role in improving environmental quality, reducing carbon emissions and promoting sustainable development.

With the depth of research, green finance has been widely 3eason3zes as having a significant impact on promoting the green transformation of regional economies, with regional differences. Wang et al. (2021) [

22] found that the establishment of green finance pilot zones significantly promoted regional green development by promoting industrial structure upgrading and technological innovation. Liu et al. (2021) [

23]further integrated green finance, technological innovation, industrial structure upgrading, environment regulation and high-quality economic development into a unified framework, 3eason3zes3 the central role of green finance in promoting technological innovation. Similarly, Cao et al. (2021) [

24]explored the potential of digital finance in promoting green technological innovation and improving energy and environmental performance in China’s regional economy, pointing out that digital transformation can enhance the environmental performance of enterprises and play a key role in green technological innovation. In addition, studies at the regional level also show that green finance has differentiated impacts on innovation in different regions. Zhang et al. (2021) [

25]found that the effect of green credit on CO2 emission reduction varies significantly across regions, whereas Ma et al. (2022) [

26]by analyzing panel data, found that environmental regulation can significantly promote local green technological innovation, but the spillover effect on neighboring regions is negative. Bao et al. (2022) [

27]further explored the role of green credit in promoting the green and sustainable development of regional economies, pointing out that it has an important impact on all stages of the green and sustainable development chain. The studies of Chang et al. (2023) [

28]and Zhitao et al. (2023) [

29]explored the mechanisms of the establishment of the Pilot Free Trade Zone (PFTZ) and the development of digital finance on the green and high-quality development, respectively, which enriched the research results on green finance in promoting regional innovation. Jiang et al. (2024) [

30] further revealed the role of green finance in promoting regional innovation through industrial structure upgrading and scientific and technological development paths through an in-depth study of the mechanism of green finance on carbon emission reduction. Overall, green finance plays an important role in promoting regional technological innovation, 3eason3zes industrial structure and improving environmental performance.

Green finance has received extensive attention in studies on mechanisms to promote regional innovation. Through a variety of ways, green finance plays an important role in promoting regional technological innovation and economic green transformation, mainly including financial support, risk sharing and incentive mechanisms. It has been shown that financial instruments such as green credit and green bonds can effectively alleviate the financing constraints of enterprises, thus promoting green technological innovation (Jiang et al., 2022) [

31]. For example, the increase of green credit significantly enhances enterprises’ R&D investment in environmental protection technology and clean energy (Liu et al., 2024) [

32]. Secondly, green finance reduces the risk of enterprises in green technology innovation through risk-sharing mechanisms. Instruments such as green insurance and green funds provide risk protection for enterprises and encourage them to engage in high-risk green technology R&D (Hu et al., 2023) [

33]. In addition, green finance promotes the diffusion and application of green technologies through policy support and market incentives (Huang et al., 2022) [

34]. The study further 4eason4zes the mediating role played by green finance in carbon emission reduction and pollution management, especially its significant impact in promoting green technology innovation (Cui et al., 2023) [

35].

In summary, scholars have explored the impact of green finance on economic development, environmental quality, carbon emissions and regional innovation from multiple perspectives, laying a solid foundation for understanding the role of green finance in promoting sustainable development. However, with the depth of research, some shortcomings have been exposed in the existing literature. First, regarding the role of green finance in promoting regional innovation through R&D investment ( Sun et al.2024) [

36], the academic community has not yet formed a unified view. Some studies show that green finance can enhance R&D investment of enterprises by alleviating financing constraints, thus promoting regional innovation ( Xiao et al.2023; Liu et al.2023) [

37,

38], but some studies point out that this role may vary according to regional differences and enterprise types ( Yulin and Yahong.2023) [

39]. This divergence reflects that the relationship between green finance and R&D investment may be more complex. Second, existing studies have mainly focused on the macro effects of green finance and lacked systematic analyses of its impact on regional innovation through specific R&D investment pathways (Li et al. 2024) [

40]. Third, although green finance has attracted much attention in the mechanism of promoting regional innovation, few studies have explored the complex mechanism of green finance in combination with moderating variables. Most studies focus only on the overall effect, ignoring the potential role of different regional innovation and entrepreneurship capabilities in moderating the relationship between green finance and R&D investment. Finally, most of the current studies on the impact of green finance on regional innovation are limited to a single perspective and lack comprehensive analyses of multiple mechanisms and pathways.

Based on the above research gaps, this paper aims to clarify the mediating mechanism of green finance in promoting regional innovation through R&D inputs, construct the framework of its impact path, and introduce regional innovation and entrepreneurship capacity as a moderating variable to carry out the analysis of the mediating effect of moderation. Specifically, the main contributions of this study include: first, although a large number of studies have explored the impact of green finance on regional innovation, there is little literature on R&D investment as a mediating variable, and this study fills this gap on this basis. Second, it innovatively introduces regional innovation and entrepreneurship capabilities as moderating variables, and systematically analyses their moderating role in the process of green finance affecting regional innovation through R&D inputs, thus deepening the understanding of this complex mechanism. Third, based on the findings, the paper puts forward targeted policy recommendations, with a view to providing strong support for promoting green finance policies and fostering regional innovation in various regions.

The remaining chapters of this paper are arranged as follows: in the second part, the data part will be analysed in detail, covering the sources of data, the specific description of variables and the descriptive statistical analysis of data; in the third part, the construction of the model, the results of the empirical research and its analyses will be explored in depth, focusing on the impact of green finance on the regional innovation capacity, and analysing the intermediary role of the R&D investment therein; then in the fourth part, a rigorous robustness test will be carried out on the the research results are rigorously tested for robustness to guarantee the stability and credibility of the findings; finally, in the fifth part, the paper will summarise the main findings of the study and put forward practical policy recommendations based on these conclusions, and at the same time point out the shortcomings of this study and the outlook of future research.

3. Empirical Results

3.1. Analysis of Baseline Regression

This study first tests the direct effect of green finance (gf) on regional innovation capacity (lnric), hypothesising that green finance can promote regional innovation capacity. To this end, this paper constructs a variety of fixed effects models to test the hypothesis. The following are the results of the baseline regression analyses of the impact of green finance on regional innovation capacity, which are detailed in

Table 6.

In Model 1, only the explanatory variable green finance (gf) is included in this paper. The results show that the regression coefficient of gf is 1.315 and significant at the 1% statistical level, indicating that the development of green finance has a significant positive contribution to regional innovation capacity. However, the goodness of fit of model 1 is low, with an adjusted R² of 0.067, indicating that the explanatory power of the model is more limited when only green finance is considered.

Model 2 adds province fixed effects and year fixed effects to model 1. The results show that the regression coefficient of green finance decreases to 0.214, but is still significant at the 1% statistical level. The adjusted R² of Model 2 significantly increases to 0.944, showing that the introduction of province and year fixed effects significantly enhances the explanatory power of the model.

Model 3 further introduces control variables based on model 1. After adding these control variables, the regression coefficient of green finance is 0.148, although no longer significant, but other control variables such as industrial structure, science and technology inputs and capital inputs have a significant positive impact on regional innovation capacity at the 1% statistical level, while carbon emissions have a significant negative impact on regional innovation capacity at the 5% level. The adjusted R² of model 3 is 0.771, indicating that the control variables have a certain enhancement on the explanatory power of the model.

Model 4 further adds control variables to model 2, and the results show that the regression coefficient of gf is 0.207 and is significant at the 1 per cent statistical level. This indicates that green finance still has a significant positive effect on regional innovation capacity even when controlling for both province and year fixed effects and multiple control variables. The adjusted R² of model 4 further increases to 0.954, indicating that the model has stronger explanatory power and robustness.

Overall, the results of the baseline regression analyses indicate that green finance has a significant positive contribution to regional innovation capacity, and the finding remains robust after the inclusion of control variables and fixed effects. This suggests that green finance is an important factor in promoting regional innovation.

Table 6.

Baseline regression results.

Table 6.

Baseline regression results.

| |

Model 1 |

Model 2 |

Model 3 |

Model 4 |

| |

lnric |

lnric |

lnric |

lnric |

| gf |

1.315***

(0.235) |

0.214***

(0.052) |

0.148

(0.133) |

0.207***

(0.052) |

| ind |

|

|

0.742***

(0.118) |

0.757***

(0.133) |

| lnhes |

|

|

0.174***

(0.017) |

0.142**

(0.057) |

| ur |

|

|

0.337***

(0.089) |

0.252

(0.300) |

| techi |

|

|

13.187***

(0.850) |

2.097***

(0.477) |

| lnco2 |

|

|

-0.070***

(0.013) |

-0.029*

(0.015) |

| capi |

|

|

0.427***

(0.138) |

0.500***

(0.082) |

| Constant |

3.159***

(0.039) |

3.326***

(0.008) |

2.142***

(0.095) |

2.309***

(0.211) |

| N |

420 |

420 |

420 |

420 |

| R^2 |

0.069 |

0.950 |

0.775 |

0.960 |

| Prov FE |

NO |

YES |

NO |

YES |

| Year FE |

NO |

YES |

NO |

YES |

| r2_a |

0.067 |

0.944 |

0.771 |

0.954 |

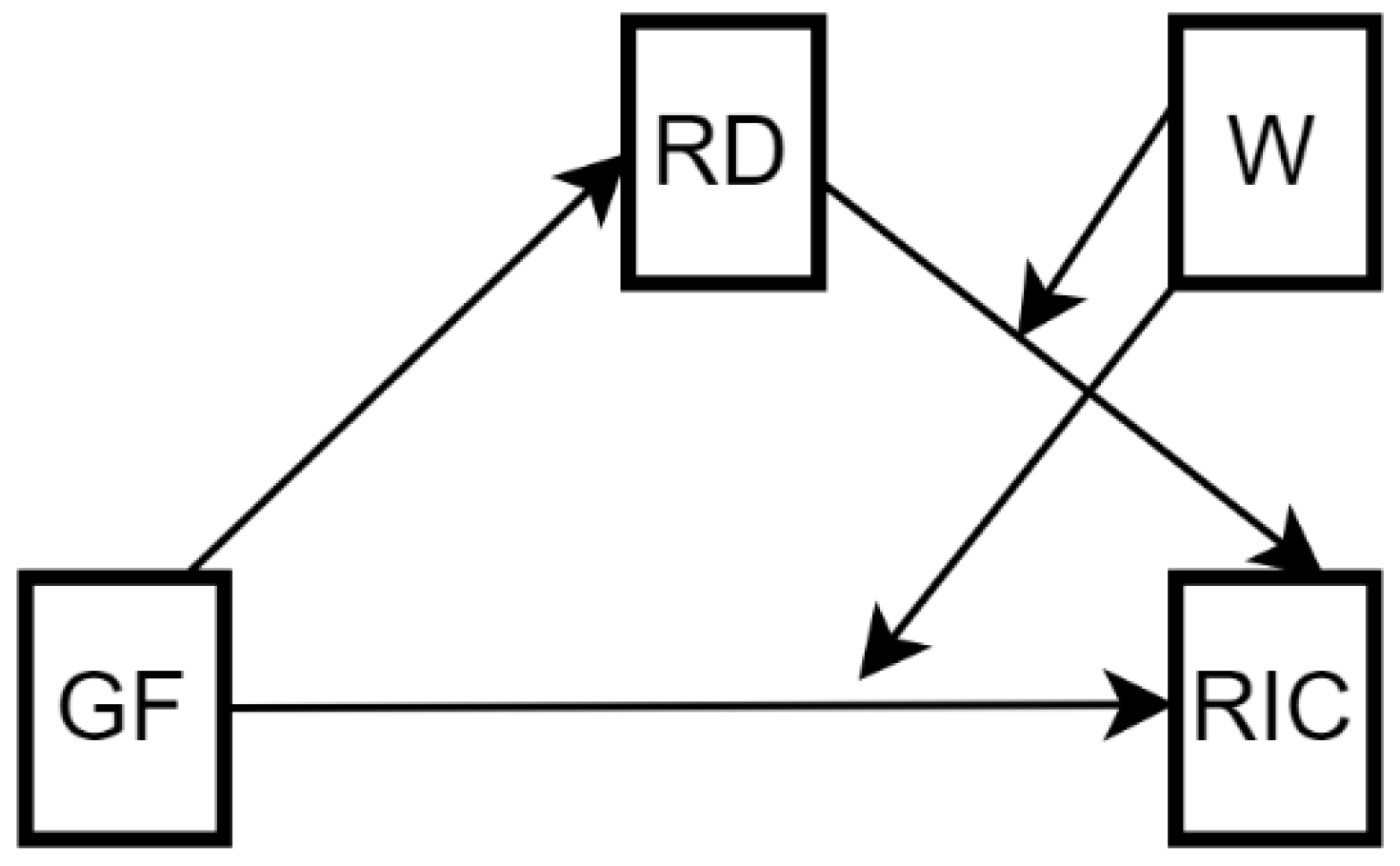

3.2. Analysis of Mediating Effects

This study further explores the mediating role of R&D investment intensity (rd) in the impact of green finance (gf) on regional innovation capacity (lnric). We hypothesise that green finance enhances regional innovation capacity by promoting an increase in R&D investment. To test this hypothesis, we constructed a regression model (Model 5) with mediating variables.

In Model 5, we find that green finance has a significant positive effect on R&D investment intensity (coefficient of 0.004, p < 0.1), indicating that green finance can effectively incentivise regions to increase R&D investment. In addition, the positive effect of R&D investment intensity on regional innovation capability (lnric) is also confirmed (coefficient of 9.464, p < 0.01), suggesting that R&D investment is an important driver of regional innovation capability. Nevertheless, the coefficient of green finance is still significant (coefficient of 0.168, p < 0.05), suggesting that there is a partial mediating effect. The Sobel Z-value of mediating effect is 2.347 (p < 0.05), the bootstrap Z-value is 2.13 (p < 0.05), and the mediating effect accounts for 49% of the total, and all these results indicate that R&D investment intensity plays a partially mediating role in the impact of green finance on regional innovation capacity. In short, green finance not only directly promotes the enhancement of regional innovation capacity, but also indirectly promotes it by increasing the intensity of R&D investment, where the intensity of R&D investment plays a significant mediating role.

In addition, this study explores the moderating mediating effect of regional innovation and entrepreneurship (lniu) in the mechanism of green finance affecting regional innovation capacity through R&D investment intensity. We hypothesise that regional innovation and entrepreneurship capacity may influence the impact of green finance on R&D inputs, which in turn changes the mediating effect of R&D inputs on regional innovation capacity. To test this hypothesis, we constructed a moderated mediation effect model (Model 6) containing interaction terms based on the mediation effect model.

In Model 6, the coefficient of the interaction term (gf × lniu) for regional innovation and entrepreneurship capacity (lniu) is 0.015, which is significant at the 10% significance level (p < 0.10), suggesting that regional innovation and entrepreneurship capacity significantly enhances the positive impact of green finance on R&D inputs, which may further enhance the mediating effect of green finance on regional innovation capacity through R&D inputs. In addition, the positive effect of R&D investment on regional innovation capacity is also significant (coefficient of 11.469, p < 0.01).The results of both the Sobel test and the bootstrap test indicate that the mediation effect of regulation is significant (Sobel Z value of 2.103, p < 0.05; bootstrap Z value of -1.98, p < 0.05 ), and the mediation effect under moderation is 39.8%. All these results indicate that regional innovation and entrepreneurship capacity plays a moderating role in the mechanism of green finance's influence on regional innovation capacity, and this moderating role is realised through the mediating variable R&D input.

Table 7.

Mediated effects test.

Table 7.

Mediated effects test.

| |

Model 5 |

Model 6 |

| |

rd |

lnric |

rd |

lnric |

| gf |

0.004*

(0.002) |

0.168**

(0.068) |

-0.063*

(0.031) |

-1.609*

(0.891) |

| rd |

|

9.464***

(2.781) |

|

11.469***

(3.368) |

| lniu |

|

|

-0.006***

(0.001) |

0.051

(0.046) |

| gf×lniu |

|

|

0.015*

(0.007) |

0.412*

(0.197) |

| control variable |

YES |

YES |

YES |

YES |

| Constant |

0.015***

(0.004) |

2.171***

(0.203) |

0.026***

(0.005) |

2.299***

(0.293) |

| N |

420 |

420 |

420 |

420 |

| R^2 |

0.945 |

0.961 |

0.951 |

0.963 |

| Prov FE |

YES |

YES |

YES |

YES |

| Year FE |

YES |

YES |

YES |

YES |

| r2_a |

0.938 |

0.956 |

0.944 |

0.957 |

| Sobel Z |

2.347 |

2.103 |

| Sobel Z-p value |

0.019 |

0.035 |

| bootstrap Z |

2.13 |

1.98 |

| bootstrap Z-p value |

0.033 |

0.048 |

| Percentage of intermediary effects |

49 per cent |

39.8 per cent |

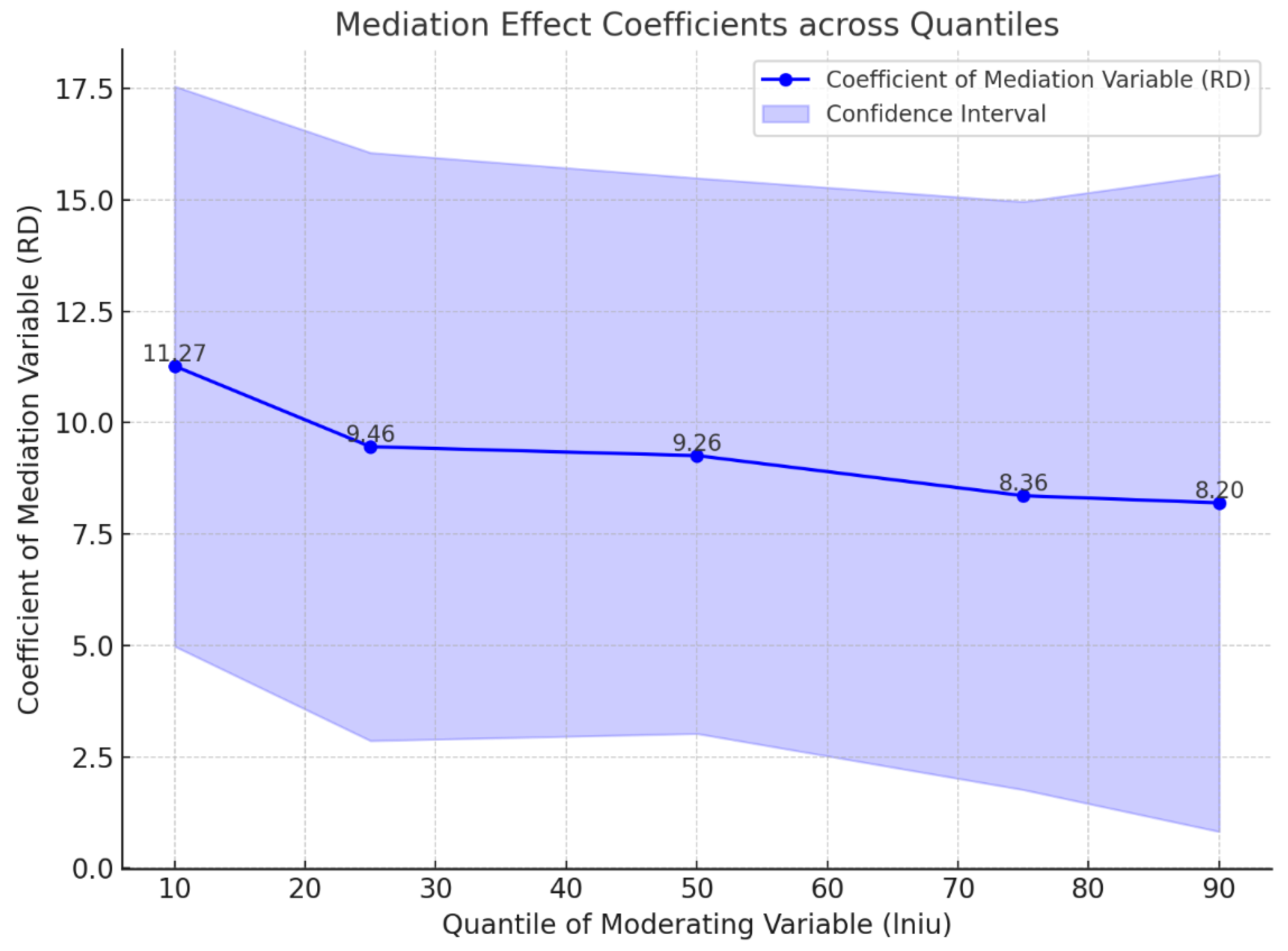

The quantile moderated mediation effect analysis further reveals the moderating role of regional innovation and entrepreneurship capability (lniu) on the mediation effect of research and development (R&D) investment (RD) at different quantile levels.

Figure 2 shows that the coefficient of RD investment is higher at lower quartile levels of lniu, indicating that RD investment plays a more significant role in promoting regional innovation in regions with lower regional innovation and entrepreneurship capabilities. However, this impact coefficient shows a gradual decline as the lniu quartile increases and is no longer significant at the 90 per cent quartile. This finding suggests that the marginal promotional effect of R&D investment is weakened in regions with higher regional innovation and entrepreneurship capabilities, probably because other innovation drivers are more prominent in a high level of lniu, which relatively reduces the strength of the impact of R&D investment.

In summary, the results of the mediation effect analysis and quartile moderated mediation effect analysis in this study indicate that regional innovation and entrepreneurship (lniu) plays a significant moderating role in the process of green finance affecting regional innovation capacity through R&D investment intensity. The mediating effect of R&D inputs is more significant at lower quartile levels of lniu, while it is weakened at higher quartile levels. These findings provide insights into understanding the mechanism of green finance's effect on regional innovation and provide important references for the formulation of more targeted policies.

Figure 2.

Quantile Moderation Effect Plot.

Figure 2.

Quantile Moderation Effect Plot.

4. Robustness Tests

In

Table 8, the impact of green finance on regional innovation capacity (lnric) is analysed through three types of robustness tests, and the results show that the model is highly robust and consistent.

Firstly, the results of Bootstrap method (column 1 of

Table 8) show that the regression coefficient of green finance (gf) is 0.207 and significant at 1% significance level (p<0.01). This indicates that the positive impact of green finance on regional innovation capacity is effectively verified by sampling test through Bootstrap method, which enhances the reliability of the model results.

Secondly, robustness is verified by the replacement variable method (columns 2-5 of

Table 8). In column 2, replacing regional innovation capacity with corporate innovation (lnci) as the explanatory variable, the regression coefficient of green finance is significantly increased to 0.684 (p<0.01), indicating that green finance plays a more prominent role at the micro level (e.g., corporate innovation), which supports the theory that green finance promotes corporate-level innovation. In column 3, using the first-order lagged term of green finance (gfl1) as the dependent variable, the regression coefficient is 0.243 (p<0.01), which maintains significance, confirming that the lagged effect of green finance has a positive impact on regional innovation capacity, further confirming the robustness of the lagged effect. In column 4, after adjusting and replacing the control variables, the regression coefficient of green finance is 0.614 (p<0.01), indicating that the impact of green finance on regional innovation capacity remains significant and stable even if the control variables are changed. In column 5, we further enrich the model by including the following additional control variables:

The degree of openness to the outside world (od), measured as the ratio of total imports and exports to GDP of the location of the business unit, reflects the degree of openness of the regional economy and the degree of integration into the international market, which may have an impact on regional innovation capacity.

The degree of attention to environmental protection (ep), measured by the ratio of local financial expenditure on environmental protection to the general budget expenditure of local finance, reflects the local government's financial investment in environmental protection, which may be related to the effect of the role of green finance.

Traditional financial development (fd), measured as the ratio of value added of the financial industry to GDP, represents the level of development of the traditional financial sector, and its interaction with green finance may affect regional innovation capacity.

Area size (lnsize), which uses the natural logarithm of the number of household population at the end of the year as a proxy variable, reflects the size of the area, which may affect the clustering of innovation resources and the development of innovation activities.

In the model in column 5, the regression coefficient for green finance is 0.573 (p<0.01), and the effect of green finance on regional innovation capacity remains significant even in the complex model setup that takes into account these additional control variables, which provides further evidence of the original findings and demonstrates the robustness of the model under more comprehensive variable considerations.

Finally, the robustness test conducted by shortening the time window (column 6) to the last ten years (2012-2021) shows that the regression coefficient of green finance increases to 0.773 (p<0.01), and the significance level remains at 1%. This result indicates that green finance contributes more significantly to regional innovation capacity in a shorter time frame, further demonstrating the applicability and robustness of the model across different time periods.

In summary, the results of the above three types of robustness testing methods all show the significance and consistency of the impact of green finance on regional innovation capacity, proving the robustness of the research model and the reliability of the results. These findings further support the important role of green finance in promoting regional innovation and provide strong theoretical support for the formulation of related policies.

Table 8.

Robustness tests.

Table 8.

Robustness tests.

| |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

| VARIABLES |

lnric |

lnci |

lnric |

lnric |

lnric |

lnric |

| gf |

0.207*** |

0.684*** |

|

0.614*** |

0.573*** |

0.773*** |

| |

(0.053) |

(0.180) |

|

(0.156) |

(0.163) |

(0.200) |

| gfl1 |

|

|

0.243*** |

|

|

|

| |

|

|

(0.059) |

|

|

|

| ind |

0.757*** |

1.562*** |

0.834*** |

|

1.286** |

3.019*** |

| |

(0.135) |

(0.500) |

(0.131) |

|

(0.519) |

(0.590) |

| is |

|

|

|

-1.705*** |

|

|

| |

|

|

|

(0.462) |

|

|

| lnhes |

0.142** |

-0.213 |

0.144* |

|

-0.413 |

-0.552 |

| |

(0.059) |

(0.255) |

(0.071) |

|

(0.263) |

(0.330) |

| hep |

|

|

|

-35.255 |

|

|

| |

|

|

|

(26.260) |

|

|

| ur |

0.252 |

0.636 |

0.100 |

0.294 |

2.822** |

2.742 |

| |

(0.301) |

(0.760) |

(0.308) |

(0.842) |

(1.094) |

(1.694) |

| techi |

2.097*** |

4.302** |

2.225*** |

5.425*** |

2.040 |

4.526* |

| |

(0.475) |

(1.762) |

(0.493) |

(1.483) |

(1.358) |

(2.284) |

| lnco2 |

-0.029* |

-0.028 |

-0.036* |

|

-0.069 |

-0.095 |

| |

(0.015) |

(0.049) |

(0.018) |

|

(0.048) |

(0.058) |

| lnso2 |

|

|

|

0.086* |

|

|

| |

|

|

|

(0.042) |

|

|

| capi |

0.500*** |

0.997** |

0.497*** |

1.135*** |

0.844** |

0.730* |

| |

(0.088) |

(0.354) |

(0.111) |

(0.348) |

(0.339) |

(0.374) |

| od |

|

|

|

|

-0.521** |

|

| |

|

|

|

|

(0.176) |

|

| ep |

|

|

|

|

-0.516 |

|

| |

|

|

|

|

(1.455) |

|

| fd |

|

|

|

|

-0.323 |

|

| |

|

|

|

|

(1.347) |

|

| lnsize |

|

|

|

|

0.887* |

|

| |

|

|

|

|

(0.449) |

|

| Constant |

2.309*** |

3.076** |

2.380*** |

3.524*** |

-3.983 |

3.066*** |

| |

(0.213) |

(1.060) |

(0.219) |

(0.454) |

(3.251) |

(0.887) |

| Observations |

420 |

420 |

390 |

420 |

420 |

300 |

| R-squared |

0.960 |

0.868 |

0.960 |

0.871 |

0.880 |

0.893 |

| Prov FE |

YES |

YES |

YES |

YES |

YES |

YES |

| Year FE |

YES |

YES |

YES |

YES |

YES |

YES |

| r2_a |

0.960 |

0.851 |

0.955 |

0.853 |

0.863 |

0.874 |

5. Conclusions

This study constructs a green finance development index and employs fixed effects models, mediation models, and moderated mediation models to conduct an empirical analysis of panel data from 30 provinces in China from 2008 to 2021. The analysis investigates the mechanisms through which green finance influences regional technological innovation, with a particular focus on the mediating role of R&D investment and the moderating role of regional innovation and entrepreneurship capabilities. The results indicate that green finance has a significant positive impact on regional technological innovation, with part of this effect being realized through increased R&D intensity. Moreover, regional innovation and entrepreneurship capabilities significantly moderate this relationship. Specifically, higher innovation and entrepreneurship capabilities enhance the positive effect of green finance on R&D investment, though the marginal effect of R&D on innovation may diminish in regions with stronger capabilities.

This research uncovers the multi-level mechanisms by which green finance affects regional technological innovation, highlighting the critical mediating role of R&D investment and the complex interactions of moderating variables in different contexts. These findings offer new insights and empirical evidence for understanding how green finance drives regional innovation. Based on these results, the study proposes several policy recommendations. First, the government should establish dedicated green finance innovation funds to support R&D and innovation projects in environmental technology companies, particularly those that significantly enhance regional innovation capacity. This will alleviate financial pressures on companies engaged in green technology development and foster technological breakthroughs. Second, the government should further improve green finance-related policies by offering more favorable tax and loan incentives, encouraging financial institutions and enterprises to actively participate in green finance initiatives, thus promoting regional technological innovation. Third, local governments and businesses should increase their support for innovation and entrepreneurship, especially in regions with weaker capabilities, by providing policy guidance and resource allocation to strengthen overall regional innovation capacity and amplify the effect of green finance on R&D investment. Lastly, collaboration between green finance institutions and scientific research institutes, universities, and other innovation stakeholders should be promoted to establish synergistic innovation mechanisms. Such cooperation will optimize the allocation of green finance resources and accelerate the industrialization and application of research outcomes.

These policy recommendations will not only contribute to the deepening of green finance but will also effectively promote regional technological innovation, facilitating the green transformation of the economy and sustainable development. Their implementation will ensure that the potential of green finance to drive innovation is fully realized, providing robust support for green transition and high-quality development.

While this study provides new perspectives on the relationship between green finance and regional technological innovation, there remains room for further exploration. The current research focuses on provincial-level data, and future studies could extend to the firm level, offering more detailed insights into how green finance shapes the trajectory of firm-level technological innovation. Additionally, future research could examine other potential mediators, such as human capital and intellectual property protection. Given the ongoing development of green finance policies, it is also essential to consider the long-term effects. Therefore, future research should adopt a more micro-level perspective, explore a broader range of mediating factors, and extend the time frame to build a more comprehensive and in-depth understanding.