Submitted:

09 October 2024

Posted:

10 October 2024

Read the latest preprint version here

Abstract

Insurance companies need to calculate solvency capital requirements in order to ensure that they can meet their future obligations to policyholders and beneficiaries. The solvency capital requirement is a risk management tool essential for, when extreme catastrophic events occur, resulting in a high number of possibly interdependent claims. This paper studies the problem of aggregating the risks coming from several insurance business lines and analyses the effect of reinsurance in the level of risk. Our starting point is to use a Hierarchical Risk Aggregation method, which was initially based on 2-dimensional elliptical copulas. We then propose the use of copulas from the Archimedean family and a mixture of different copulas. Our results show that a mixture of copulas can provide a better fit to the data than an individual copula and consequently avoid over or underestimating of the capital requirement of an insurance company. We also investigate the significance of reinsurance in reducing the insurance company’s business risk and its effect on diversification. The results show that reinsurance does not always reduce the level of risk, but can also reduce the effect of diversification for insurance companies with multiple business lines.

Keywords:

1. Introduction

2. Copula-Based Hierarchical Aggregation Model

2.1. The Definition of Copula

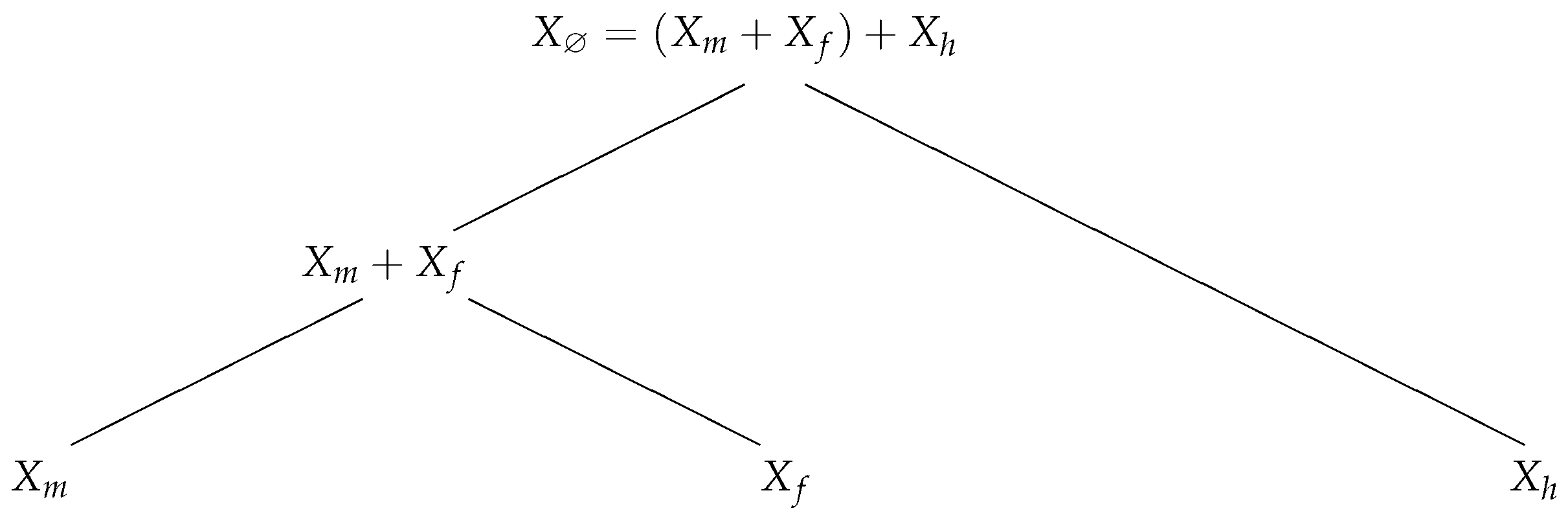

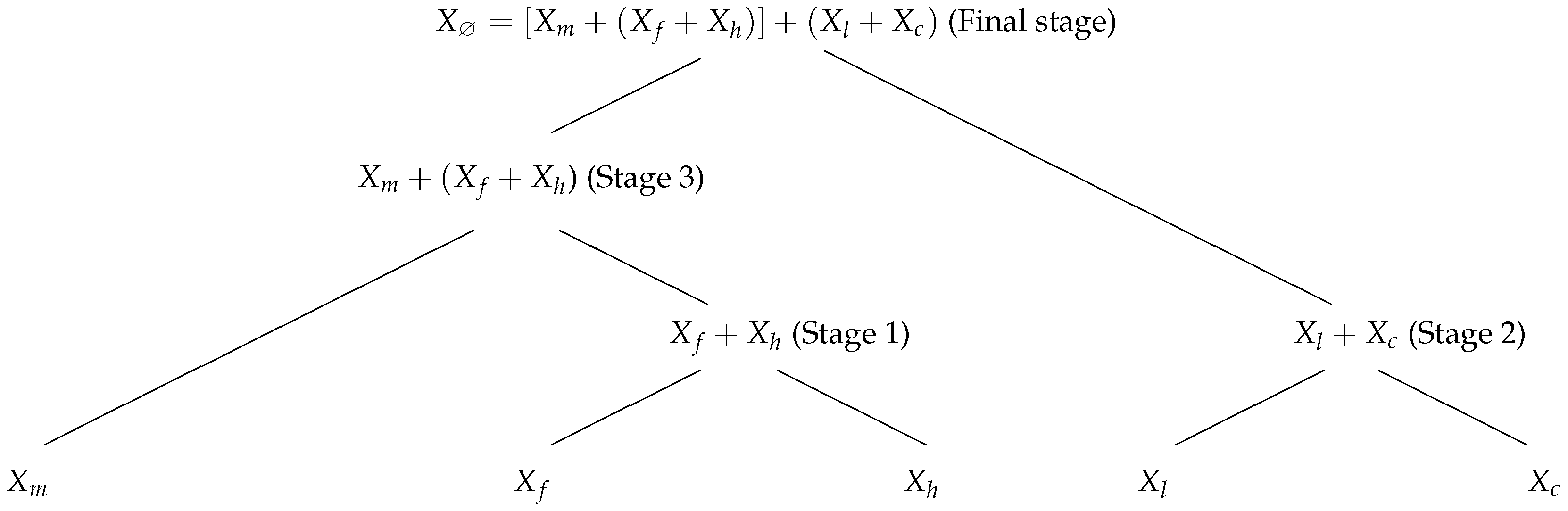

2.2. Hierarchical Aggregation Copula Models

- Each leaf node in the rooted tree is associated with the loss of business line i, represented by a random variable .

- Each branching node is associated with the sum of the business lines mapped to that node’s children.

- a rooted tree structure ,

- univariate cdf’s for all leaf nodes i in L , and

- bivariate copula functions for the two children of each branching node j in B .

2.2.1. Existence and Uniqueness of a Joint Distribution

2.2.2. Simulation of Joint Distributions

Sample reordering numerical approximation algorithm:

- Define the number of simulations .

- Simulate N independent samples from the univariate random variables () associated with d leaf nodes: for and , where is the pre-determined univariate cdf for .

- Simulate N independent samples from the bivariate copula () associated with each of the branching nodes: for and .

- Following a bottom-up approach, beginning at the branching nodes closer to the leaf nodes and ending at the root node)s define the approximation for the cdf of each branching node asrecursively, where is the indicator function2, and are (simulated) sample values of the random variables associated with the two nodes children of the branching node j, is the weight given to variable , is the (componentwise) rank of , and , are the ordered sample.

2.3. Risk Estimation of the Sggregate Loss

2.4. The Data

2.4.1. Loss Ratios

3. Estimation of the Hierarchical Aggregation Copula Model

3.1. Tree Structure of the Hierarchical Copula Model

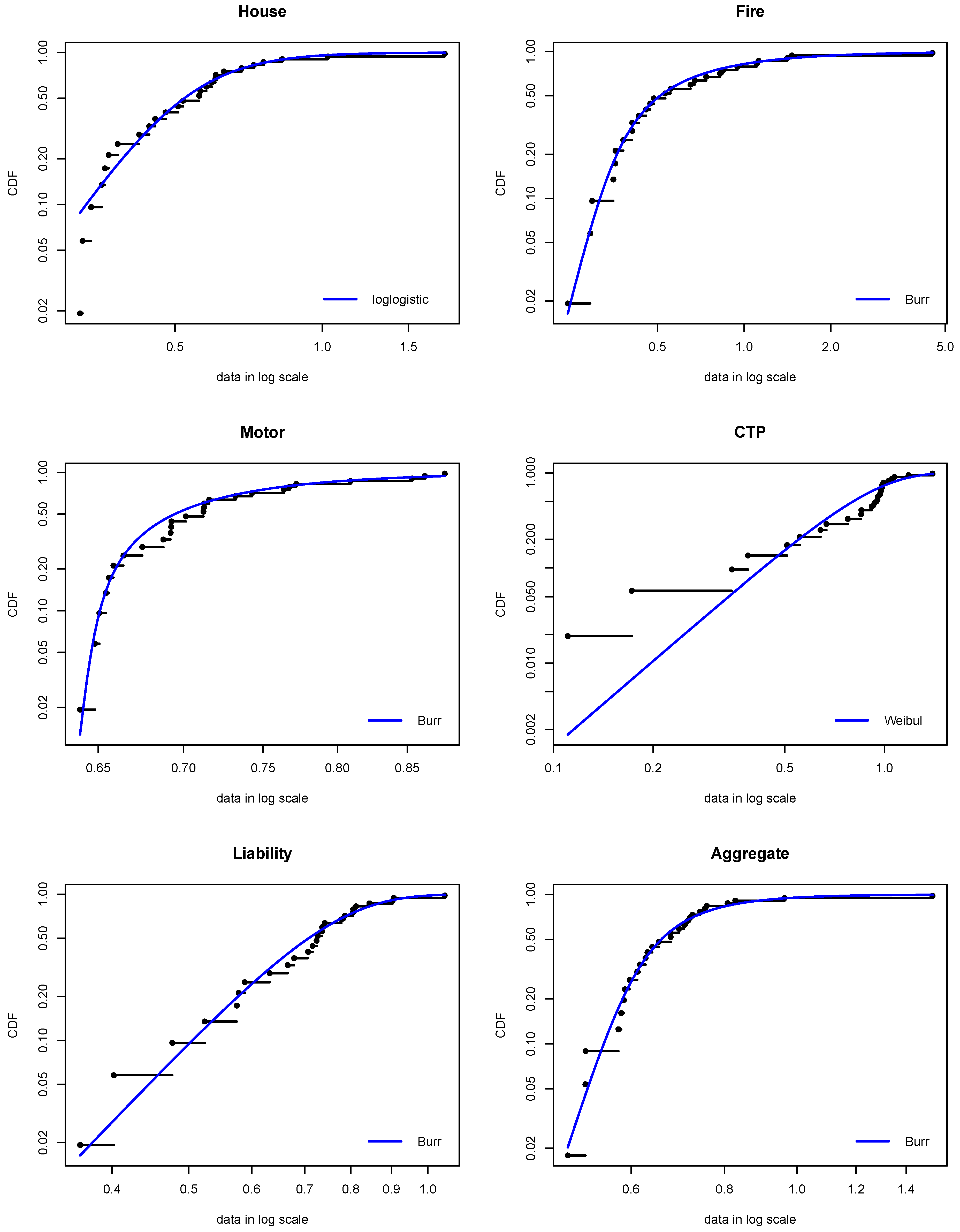

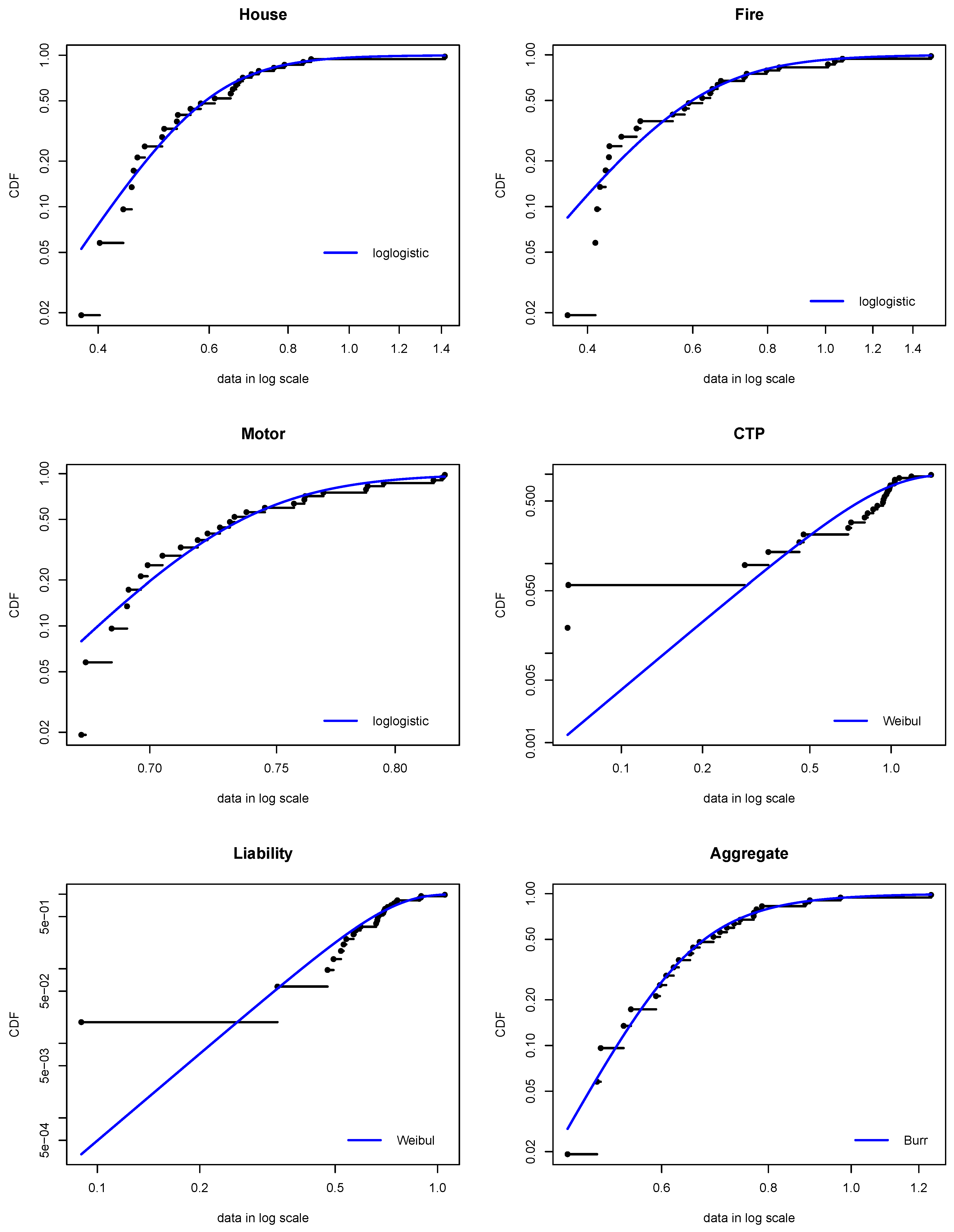

3.2. Fitting the Univariate Probability Distributions

3.3. Determining Joint Distribution through Copulas

3.4. Simulation of the Aggregate Loss Ratios

3.4.1. Analysis of the Results

4. The Effect of Reinsurance

4.1. Reinsurance and Weighted Premiums Diversification

4.2. Reinsurance and Source of Risk Diversification

5. Conclusion

Disclosure statement

Data availability statement

References

- Côté, M.P.; Genest, C. A copula-based risk aggregation model. The Canadian Journal of Statistics 2015, 43, 60–81. [CrossRef]

- Arbenz, P.; Hummel, C.; Mainik, G. Copula based hierarchical risk aggregation through sample reordering. Insurance: Mathematics and Economics 2012, 51, 122–133. [CrossRef]

- Embrechts, P.; Lindskog, F.; McNeil, A. Modelling dependence with copulas and application to Risk Management. In Handbook of Heavy Tailed Distributions in Finance; Rachev, S., Ed.; Elsevier, 2003; chapter 8, pp. 329–384.

- Nguyen, T.; Molinari, R.D.; others. Risk aggregation by using copulas in internal models. Journal of Mathematical Finance 2011, 1, 50. [CrossRef]

- Tang, A.; Valdez, E.A. Economic Capital and the Aggregation of Risks Using Copulas. Proceedings of the 28th International Congress of Actuaries, Paris, France. Available at: http://www.ica2006.com/282.html 2006.

- Wang, S. Aggregation of correlated risk portfolios: models and algorithms. Proceedings of the Casualty Actuarial society, 1998, Vol. 85, pp. 848–939.

- Bürgi, R.; Dacorogna, M.M.; Iles, R. Risk aggregation, dependence structure and diversification benefit. Stress Testing for Financial Institutions 2008. [CrossRef]

- Baur, P.; Breutel-O’Donoghue, A.; Hess, T. Understanding reinsurance: How reinsurers create value and manage risk; Swiss Re, Swiss Reinsurance Company, 2004.

- Cummins, J.D.; Dionne, G.; Gagné, R.; Nouira, A. The costs and benefits of reinsurance 2008. Available at SSRN: https://ssrn.com/abstract=1142954.

- Genest, C.; Nešlehová, J. Copulas and copula models. In:Encyclopedia of Environmetrics, 2nd ed., vol. 2, A.H. El-Shaarawi and W.W. Piegorsch, editors. Wiley, Chichester 2012, pp. 541–553.

- Aas, K.; Czado, C.; Frigessi, A.; Bakken, H. Pair-copula constructions of multiple dependence. Insurance: Mathematics and Economics 2009, 44, 182 – 198. [CrossRef]

- Kurowicka, D.; Joe, H. Dependence Modeling. Vine Copula Handbook; World Scientific: Singapore, 2010.

- Mai, J.F.; Scherer, M. H-extendible copulas. Journal of Multivariate Analysis 2012, 110, 151 – 160. Special Issue on Copula Modeling and Dependence. [CrossRef]

- Cossette, H.; Gadoury, S.P.; Marceau, É.; Mtalai, I. Hierarchical Archimedean copulas through multivariate compound distributions. Insurance: Mathematics and Economics 2017, 76, 1 – 13. [CrossRef]

- Nelsen, R.B. An Introduction to Copulas, second ed.; Springer-Verlag: New York, 2006.

- McNeil, A.J.; Frey, R.; Embrechts, P. Quantitative Risk Management: Concepts, Techniques and Tools, second ed.; Princeton University Press: Princeton, NJ, 2015.

- Sklar, A. Fonctions de répartition à n dimensions et leurs marges. Publ. Inst. Statist. Univ. Paris 1959, 8, 229–31.

- Diestel, R. Graph Theory, 5th ed.; Springer: Heidelberg, 2017.

- Anderson, T.W.; Darling, D.A. A Test of Goodness of Fit. Journal of the American Statistical Association 1954, 49, 765–769. [CrossRef]

- Genest, C.; Rémillard, B.; Beaudoin, D. Goodness-of-fit tests for copulas: A review and a power study. Insurance: Mathematics and economics 2009, 44, 199–214. [CrossRef]

- Iman, R.; Conover, W. A distribution-free approach to including rank correlation among input variables. Communications in Statistics - Simulation and Computation 1982, 11, 311–334. [CrossRef]

- Brechmann, E.C. Hierarchical Kendall copulas: Properties and inference. The Canadian Journal of Statistics 2014, 42, 78–108. [CrossRef]

- Acerbi, C.; Tasche, D. On the coherence of expected shortfall. Journal of Banking & Finance 2002, 26, 1487 – 1503. [CrossRef]

- Adam, A.; Houkari, M.; Laurent, J.P. Spectral risk measures and portfolio selection. Journal of Banking & Finance 2008, 32, 1870 – 1882. [CrossRef]

- OECD. International comparisons. OECD Insurance Statistics 2016, OECD Publishing, Paris. 2017, pp. 45–79.

- MunichRe. A basic guide to facultative and treaty reinsurance. Munich Reinsurance America. 2010.

- Cipra, T. Financial and Insurance Formulas; Physica-Verlag, 2010.

- Taylor, J.M. Claim Reserving Manual, 1997 rev. ed.; Faculty and Institute of Actuaries: Great Britain, 1997.

- Engmann, S.; Cousineau, D. Comparing distributions: the two-sample Anderson-Darling test as an alternative to the Kolmogorov-Smirnoff test. Journal of Applied Quantitative Methods 2011, 6, 1–17.

- Kolmogorov, A. Sulla determinazione empirica di una lgge di distribuzione. Inst. Ital. Attuari, Giorn. 1933, 4, 83–91.

- Smirnov, N. Table for estimating the goodness of fit of empirical distributions. Annals of Mathematical Statistics 1948, 19, 279–281. [CrossRef]

- Sibuya, M. Bivariate extreme statistics. Annals of the Institute of Statistical Mathematics 1960, 11, 195–210. [CrossRef]

- Schmid, F.; Schmidt, R. Multivariate conditional versions of Spearman’s rho and related measures of tail dependence. Journal of Multivariate Analysis 2007, 98, 1123–1140. [CrossRef]

- Shannon, C. A Mathematical Theory of Communication. The Bell System Technical Journal 1948, 27, 379–423. [CrossRef]

- DeMiguel, V.; Garlappi, L.; Uppal, R. Optimal Versus Naive Diversification: How Inefficient is the 1/N Portfolio Strategy? The Review of Financial Studies 2009, 22, 1915–1953. [CrossRef]

- Choueifaty, Y.; Coignard, Y. Toward maximum diversification. Journal of Portfolio Management 2008, 35, 4051.

| 1 | The symbol ′ denote the transpose of vector. |

| 2 | |

| 3 | ISR stands for Industrial Special Risk |

| 4 | To simplify notations, we will use X for the LR, unless otherwise stated |

| 5 |

| House | Fire | Motor | CTP | Liability | Aggregate loss | |

| Gross loss ratios | ||||||

| Mean | 0.5849 | 0.7820 | 0.7211 | 0.8172 | 0.7024 | 0.7005 |

| Standard deviation | 0.2981 | 0.8334 | 0.0682 | 0.3100 | 0.1566 | 0.1971 |

| Skewness | 2.6290 | 3.6449 | 0.9729 | -0.7432 | -0.2392 | 2.8759 |

| Excess kurtosis | 8.0694 | 13.819 | 0.0075 | 0.0036 | 0.0671 | 9.6254 |

| Average weight, | 0.25 | 0.14 | 0.33 | 0.11 | 0.18 | 1 |

| Weight at June 2017, | 0.26 | 0.12 | 0.33 | 0.13 | 0.16 | 1 |

| Net loss ratios | ||||||

| Mean | 0.6272 | 0.6549 | 0.7394 | 0.8051 | 0.6499 | 0.7018 |

| Standard deviation | 0.2105 | 0.2639 | 0.0454 | 0.3333 | 0.1907 | 0.1659 |

| Skewness | 2.0440 | 1.4870 | 0.3835 | -0.8458 | -0.6556 | 1.3425 |

| Excess kurtosis | 5.6319 | 2.2074 | -0.9542 | 0.0960 | 1.5980 | 2.4629 |

| Average weight, | 0.22 | 0.10 | 0.36 | 0.13 | 0.18 | 1 |

| Weight at June 2017, | 0.24 | 0.09 | 0.36 | 0.13 | 0.17 | 1 |

| Stage 1 | ||||

| House | Fire | Motor | CTP | |

| Fire | 0.5262 | 1 | – | – |

| Motor | 0.4338 | 0.2308 | 1 | – |

| CTP | 0.0154 | -0.0523 | -0.1815 | 1 |

| Liability | 0.0585 | -0.1323 | 0.1446 | 0.3662 |

| Stage 2 | ||||

| House + Fire | Motor | CTP | ||

| Motor | 0.3169 | 1 | – | |

| CTP | -0.0400 | -0.1815 | 1 | |

| Liability | -0.0338 | 0.1446 | 0.3662 | |

| Stage 3 | ||||

| House + Fire | Motor | |||

| Motor | 0.3169 | 1 | ||

| CTP+Liability | 0.0154 | -0.0523 | ||

| Stage 1 | ||||

| House | Fire | Motor | CTP | |

| Fire | 0.5446 | 1 | – | – |

| Motor | 0.4338 | 0.2492 | 1 | – |

| CTP | -0.0154 | -0.0031 | -0.2369 | 1 |

| Liability | 0.0092 | -0.0646 | -0.0523 | 0.4954 |

| Stage 2 | ||||

| House + Fire | Motor | CTP | ||

| Motor | 0.3969 | 1 | – | |

| CTP | -0.0400 | -0.2369 | 1 | |

| Liability | -0.0523 | -0.0523 | 0.4954 | |

| Stage 3 | ||||

| House + Fire | Motor | |||

| Motor | 0.3969 | 1 | ||

| CTP+Liability | -0.0523 | -0.2123 | ||

| House | Fire | Motor | CTP | Liability | Aggregate loss | |

| Gross loss ratios | ||||||

| Distribution | Log-logistic | Burr | Burr | Weibull | Burr | Burr |

| Shape 1 | 4.76266 | 0.19159 | 0.04799 | 3.00527 | 7.70166 | 0.3732 |

| (s.e.) | (0.776) | (0.122) | (0.042) | (0.505) | (22.63) | (0.199) |

| Shape 2 | – | 8.11427 | 189.928 | – | 5.64960 | 15.8580 |

| (s.e.) | – | (4.012) | (155.0) | – | (1.555) | (5.441) |

| Scale∗ | 0.52243 | 3.04747 | 1.55319 | 0.90936 | 0.92955 | 1.70254 |

| (s.e.) | (0.037) | (0.415) | (0.014) | (0.061) | (0.604) | (0.095) |

| A-D statistic | 0.294 | 0.147 | 0.335 | 1.417 | 0.270 | 0.230 |

| A-D p-value | 0.942 | 0.998 | 0.909 | 0.197 | 0.958 | 0.979 |

| Net loss ratios | ||||||

| Distribution | Log-logistic | Log-logistic | Log-logistic | Weibull | Weibull | Burr |

| Shape 1 | 6.37499 | 4.96750 | 27.9840 | 2.53352 | 3.87399 | 0.50244 |

| (s.e.) | (1.031) | (0.801) | (4.469) | (0.439) | (0.599) | (0.269) |

| Shape 2 | – | – | – | – | – | 18.4406 |

| (s.e.) | – | – | – | – | – | (5.898) |

| Scale∗ | 0.59180 | 0.59840 | 0.73616 | 0.89199 | 0.71298 | 1.55857 |

| (s.e.) | (0.031) | (0.041) | (0.009) | (0.071) | (0.037) | (0.073) |

| A-D statistic | 0.246 | 0.455 | 0.371 | 1.962 | 0.602 | 0.197 |

| A-D p-value | 0.971 | 0.791 | 0.875 | 0.097 | 0.643 | 0.991 |

| Copula | p-value | |||||

| (s.e.) | (s.e.) | |||||

| Gross loss ratios | ||||||

| 0.5218 | 0.5694 | 0.4 Clayton + 0.6 SurvClayton | 0.4640 | 4.886 | 2.148 | |

| (4.161) | (1.966) | |||||

| 0.1496 | 0.2742 | 0.25 Clayton + 0.75 SurvClayton | 0.5410 | 1.022 | 1.482 | |

| (3.194) | (1.596) | |||||

| 0.2772 | 0.4383 | 0.1 Clayton + 0.9 SurvClayton | 0.8986 | 1.160 | 1.029 | |

| (5.796) | (0.548) | |||||

| 0.0000 | 0.0000 | Gaussian | 0.9815 | 0.013036 | ||

| (0.285) | ||||||

| Net loss ratios | ||||||

| 0.5390 | 0.5401 | 0.6 Gumbel + 0.4 SurvGumbel | 0.7298 | 2.126 | 2.801 | |

| (1.265) | (2.083) | |||||

| 0.2772 | 0.1070 | Student-t | 0.5549 | 0.7376 | 1.2910 | |

| (0.115) | (0.593) | |||||

| 0.3977 | 0.4038 | 0.7 SurvGumbel + 0.3 SurvClayton | 0.7607 | 1.750 | 1.047 | |

| (0.954) | (2.884) | |||||

| 0.0143 | 0.1531 | Rotated Gumbel | 0.5569 | 1.0865 | ||

| (0.186) | ||||||

| Weighted Sum of | Risk measure of | ||||||

| House | Fire | Motor | CTP | Liability | risk measures | aggregate loss, | |

| Gross loss ratios | |||||||

| VaR | 0.8284 | 1.4422 | 0.8283 | 1.1991 | 0.8915 | 0.9603 | 0.8806 |

| [0.800,0.856] | [1.301,1.60] | [0.814,0.843] | [1.172,1.225] | [0.879,0.903] | [0.940,0.981] | [0.859,0.902] | |

| VaR | 0.9693 | 2.2516 | 0.8931 | 1.3088 | 0.9417 | 1.1377 | 1.0184 |

| [0.925,1.024] | [1.959,2.593] | [0.872,0.916] | [1.278,1.341] | [0.926,0.957] | [1.099,1.182] | [0.979,1.064] | |

| VaR | 1.365 | 6.2017 | 1.0602 | 1.5049 | 1.0346 | 1.8101 | 1.5937 |

| [1.227,1.534] | [4.463,8.642] | [1.008,1.122] | [1.451,1.56] | [1.008,1.061] | [1.603,2.095] | [1.385,1.891] | |

| TVaR | 1.063 | 4.1271 | 0.9299 | 1.3413 | 0.9576 | 1.4060 | 1.2644 |

| [1.007,1.128] | [2.873,6.202] | [0.906,0.957] | [1.313,1.37] | [0.944,0.972] | [1.256,1.652] | [1.118,1.518] | |

| TVaR | 1.2353 | 6.4776 | 1.0026 | 1.4322 | 1.0003 | 1.7755 | 1.5895 |

| [1.144,1.341] | [4.096,10.578] | [0.966,1.042] | [1.397,1.466] | [0.983,1.019] | [1.488,2.276] | [1.304,2.094] | |

| TVaR | 1.7244 | 18.4861 | 1.1898 | 1.6042 | 1.0836 | 3.4412 | 3.1437 |

| [1.459,2.074] | [8.037,37.647] | [1.1,1.299] | [1.54,1.669] | [1.051,1.118] | [2.178,5.761] | [1.897,5.461] | |

| Net loss ratios | |||||||

| VaR | 0.835 | 0.9313 | 0.7961 | 1.2386 | 0.8843 | 0.8821 | 0.801 |

| [0.813,0.857] | [0.9,0.965] | [0.791,0.801] | [1.207,1.273] | [0.869,0.899] | [0.874,0.89] | [0.792,0.81] | |

| VaR | 0.9383 | 1.0821 | 0.8177 | 1.3737 | 0.9462 | 0.9563 | 0.844 |

| [0.904,0.973] | [1.033,1.134] | [0.811,0.825] | [1.334,1.414] | [0.927,0.965] | [0.945,0.967] | [0.832,0.857] | |

| VaR | 1.2087 | 1.4985 | 0.8662 | 1.6234 | 1.0549 | 1.1271 | 0.9443 |

| [1.124,1.311] | [1.366,1.668] | [0.851,0.883] | [1.56,1.693] | [1.026,1.083] | [1.101,1.156] | [0.916,0.976] | |

| TVaR | 0.9987 | 1.1803 | 0.8273 | 1.4158 | 0.9638 | 0.9916 | 0.8651 |

| [0.959,1.04] | [1.121,1.246] | [0.821,0.835] | [1.379,1.453] | [0.948,0.981] | [0.979,1.004] | [0.853,0.878] | |

| TVaR | 1.1164 | 1.3622 | 0.8487 | 1.5303 | 1.0144 | 1.0674 | 0.9098 |

| [1.055,1.183] | [1.266,1.468] | [0.839,0.859] | [1.483,1.579] | [0.995,1.034] | [1.049,1.087] | [0.891,0.93] | |

| TVaR | 1.4311 | 1.8778 | 0.8983 | 1.7503 | 1.1077 | 1.2516 | 1.021 |

| [1.27,1.636] | [1.605,2.216] | [0.876,0.924] | [1.664,1.837] | [1.074,1.146] | [1.201,1.312] | [0.976,1.075] | |

| House | Fire | Motor | CTP | Liability | Shannon’s entropy | |

| Gross loss ratio weights | 0.26 | 0.12 | 0.33 | 0.13 | 0.16 | 1.52 |

| Net loss ratio weights | 0.24 | 0.09 | 0.36 | 0.13 | 0.17 | 1.49 |

| Weighted Sum of | Risk measure of | DR | ||

| risk measures | aggregate loss, | |||

| Gross loss ratios | ||||

| 0.2654 | 0.1956 | 1.35 | ||

| VaR | 0.9603 | 0.8806 | 1.09 | |

| VaR | 1.1377 | 1.0184 | 1.12 | |

| VaR | 1.8101 | 1.5937 | 1.14 | |

| TVaR | 1.4060 | 1.2644 | 1.11 | |

| TVaR | 1.7755 | 1.5895 | 1.12 | |

| TVaR | 3.4412 | 3.1437 | 1.09 | |

| Net loss ratios | ||||

| 0.1752 | 0.1040 | 1.68 | ||

| VaR | 0.8821 | 0.8010 | 1.10 | |

| VaR | 0.9563 | 0.8440 | 1.13 | |

| VaR | 1.1271 | 0.9443 | 1.19 | |

| TVaR | 0.9916 | 0.8651 | 1.15 | |

| TVaR | 1.0674 | 0.9098 | 1.17 | |

| TVaR | 1.2516 | 1.0210 | 1.23 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).