Submitted:

09 October 2024

Posted:

10 October 2024

You are already at the latest version

Abstract

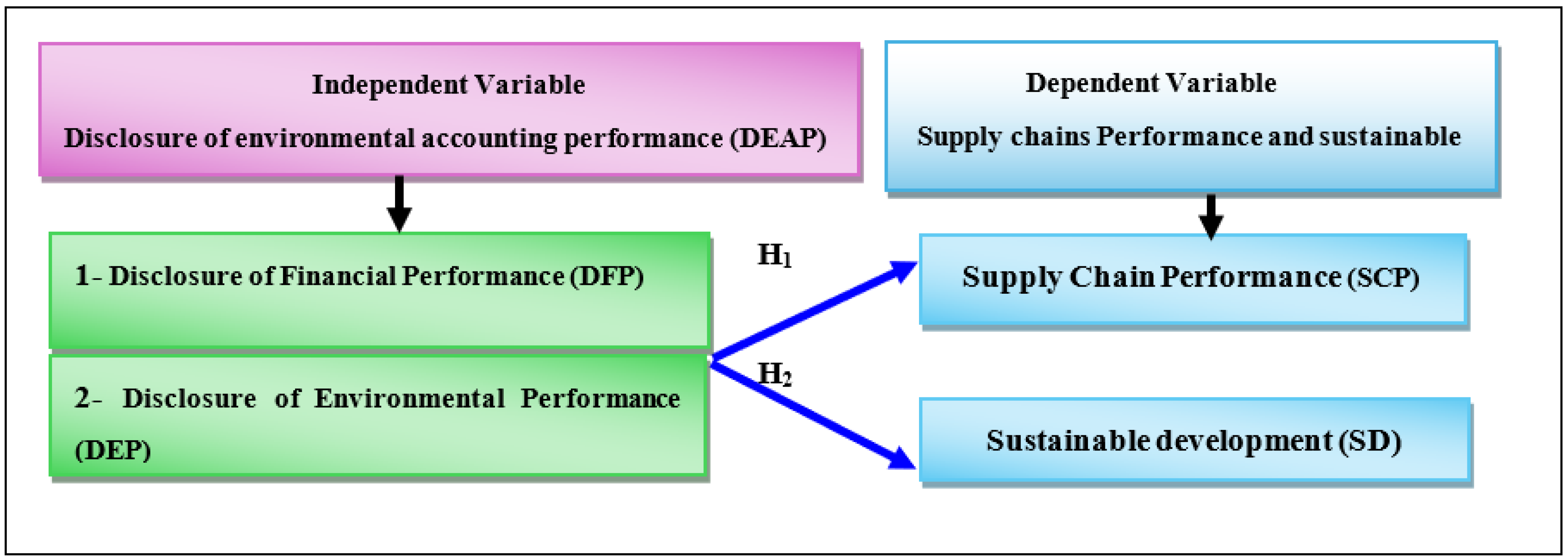

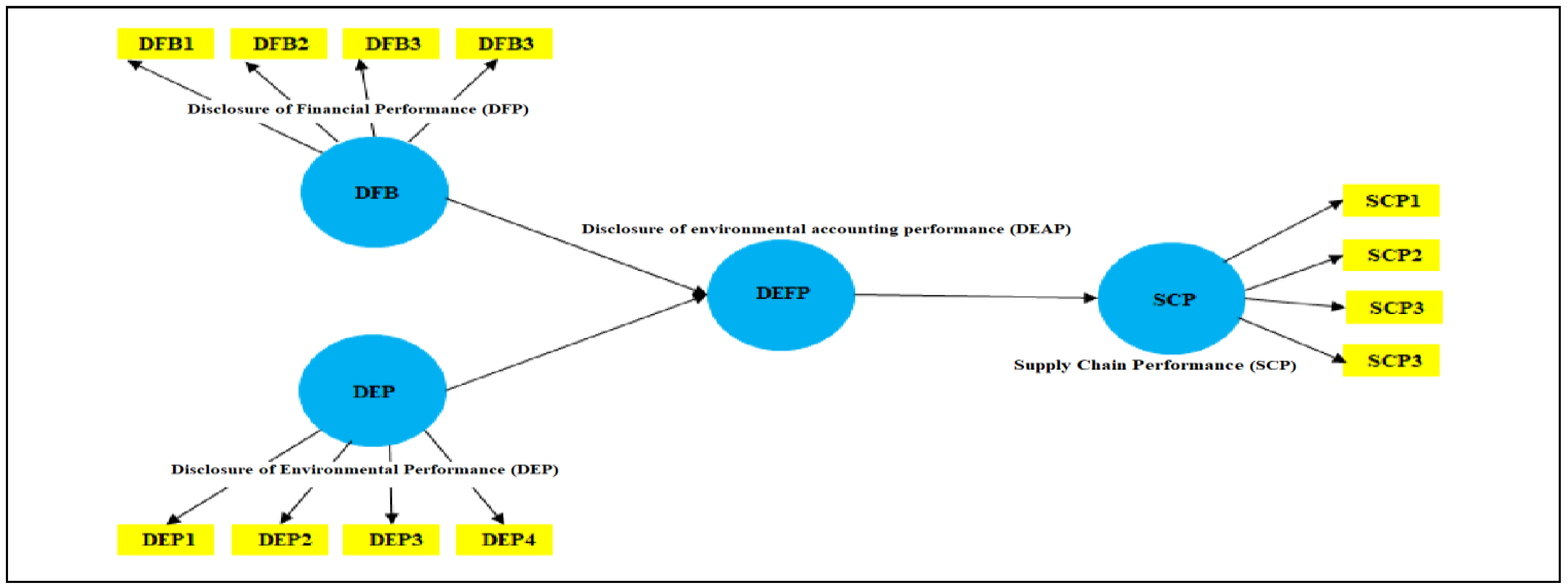

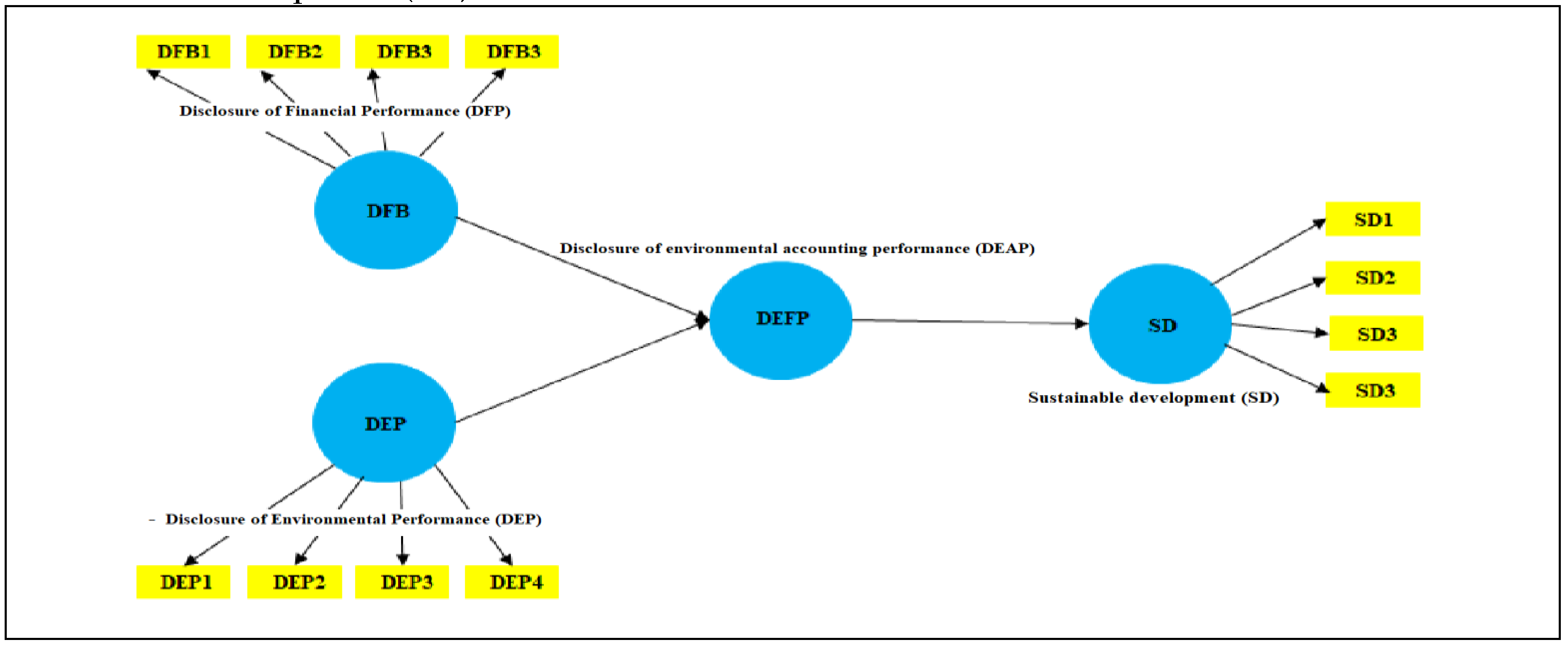

In response to the growing environmental concerns and sustainability imperatives in the (GCC) and the world in general, companies are increasingly being urged to integrate environmental accountability into their core strategies and operations by accounting for environmental performance in their financial statements and the impact on supply chains and sustainable development. The problem of the study is to identify the impact of environmental accounting disclosure challenges on supply chains and sustainable development in companies. By taking the experiments of 20 companies and representatives of the study community interested in the topic, and using the heuristic research approach through the questionnaire tool and a set of key variables, including the adoption of disclosure on environmental accounting performance (DEAP), supply chain sustainability performance(SP), Sustainable Development Index(SD), and using the (PLS) program, in the statistical analysis, the study reached the most important results: The study revealed a positive relationship between the disclosure of environmental accounting performance, improved supply chains and sustainable development in the companies represented by the study sample in the (GCC), where both financial performance and environmental performance contribute to achieving the Sustainable Development Goals and supply chains. Accordingly, the study recommends many recommendations, the most important of which are: the need for companies to be encouraged to disclose the performance of environmental accounting as a strategic necessity, promote more sustainable supply chain management, improve financial performance, and effectively contribute to achieving the Sustainable Development Goals, thereby enhancing sustainability within companies and across supply chains, the study also recommends the need to continue studies in this aspect, especially in the (GCC) and East Asian countries, to urge companies to disclose the performance of environmental accounting in their financial statements.

Keywords:

1. Introduction

2. Background of GCC Countries

3. Letter Review and Hypothesis Development

3.1. Development of the First Hypothesis: Disclosure of Environmental Accounting Performance (DEAP), and Supply Chain Performance (SCP)

3.1.1. Disclosure of Financial Performance (DFP)

3.1.2. Challenges of Financial Performance Disclosure

3.1.3. Disclosure of Environmental Performance (DEP)

3.1.4. Challenges of Disclosure Environmental Performance

3.1.5. Supply Chain Performance (SCP)

3.1.6. Disclosure of Environmental Accounting Performance (DEAP), and Supply Chain Performance (SCP)

3.2. Development of the second hypothesis: Disclosure of Environmental Accounting Performance (DEAP), and Sustainable Development (SD).

3.2.1. Sustainable development (SD)

3.2.2. Disclosure of Environmental Accounting Performance (DEAP), and Sustainable Development (SD)

4. Methods

4.1. Analysis of Data

4.2. Demographic Information Analysis

4.3. The Outer Loading Test& Collinearity Statistics (VIF) of the Model

4.4. The Reliability and Validity Test of the Model

4.5. R-Squared Value

4.6. Hypotheses Testing.

4.7. Bootstrapping Analysis

5. Discussions and Results

6. Recommendations

Author Contributions

Funding

Data Availability Statement

Conflict of Interest

References

- M. F. A. C. D. S. E. T. &. B. M. C. Angotti, “A narrative approach for reporting social and environmental accounting impacts in the mining sector–giving marginalized communities a voice.,” Meditari Accountancy Research, 32(1), pp. 44–58. [CrossRef]

- E. C. B. &. Q. S. Wassénius, “Essential environmental impact variables: A means for transparent corporate sustainability reporting aligned with planetary boundaries,”. One Earth 2024, 7, 211–225. [CrossRef]

- G. O’Donovan, “Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory,”. Account. Audit. Account. J. 2020, 15, 344–371. [CrossRef]

- EPA, “EPA Automotive,Greenhouse Gas Emissions,andTechnology since 1975,” 1-15, 2022.

- A. 2. J. Z. T.,. J. A. Johnson Nsowah, “The effects of supply chain management strategies on competitive advantage on food and beverage processing companies; a case study in the Ashanti region of Ghana,” International Journal of Science and Research Archive 2024, vol. 1, no. 02, pp. 569–583. [CrossRef]

- F. Wei, J. Abbas, G. Alarifi, Z. Zhang, N. A. Adam and M. J. d. Queiroz, “Role of green intellectual capital and top management commitment in organizational environmental performance and reputation: Moderating role of pro-environmental behavior,” Journal of Cleaner Production 2023, vol. 405, p. [CrossRef]

- F. W. Z. L. F. F. B. M. T. Fransiska Natalia Ralahallo, “The role of supply chain integration, management commitment and supply chain challenges on supply chain performance and MSMEs performance,” Uncertain Supply Chain Management 2024, vol. 12, no. 3, pp. 1833–1840. [CrossRef]

- C. L. M. S. M. S. Adnan Khan, “Green effectual orientations to shape environmental performance through green innovation and environmental management initiatives under the influence of CSR commitment,” Environmental Science and Pollution Research 2023, vol. 30, no. 1, pp. 2205–2217. [CrossRef]

- M. &. B. L. D. Johnson, “Antecedents and Consequences of Carbon Management Integration in Firms,” Journal of Business Ethics, pp. 549–566, 2020. [CrossRef]

- T. A. M. K. E. K. D. &. N. I. E. Tsalis, “New challenges for corporate sustainability reporting: United Nations’ 2030 Agenda for sustainable development and the sustainable development goals,” Corporate Social Responsibility and Environmental Management - Wiley 2020, vol. 27, no. 4, pp. 1617 - 1629. [CrossRef]

- J. D. Sachs, The Age of Sustainable Development, Columbia: University Press, 2015.

- S. L. Hart, Beyond greening: Strategies for a sustainable world, Harvard Business,Review, 75(1), 66-76, 2017.

- P. Kotler, “Reinventing marketing to manage the environmental imperative,”. J. Mark. 2021, 76, 138–145. [CrossRef]

- T. Green, “ Understanding Customers’ Motivations for Sustainable Products: A Review of Consumer Buying Behavior,”. Sustainability 2020, 12, 6574. [CrossRef]

- C. A. Ruggerio, “Sustainability and sustainable development: A review of principles and definitions,” Science of The Total Environment 2021, vol. 786, p. [CrossRef]

- IPCC, “The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change,” Cambridge University Press, 2021.

- H. E. R. J. R. E. B. A. G. Pascual Berrone, “How can research contribute to the implementation of sustainable development goals? An interpretive review of SDG literature in management,” nternational Journal of Management Reviews 2023, pp. 318 - 339. [CrossRef]

- V. Tauringana, “Sustainability reporting challenges in developing countries: towards management perceptions research evidence-based practices,” Journal of Accounting in Emerging Economies 2021, vol. 11, no. 2, pp. 194–215. [CrossRef]

- “Managing the Life Cycle to Reduce Environmental Impacts,” in Dynamics of Long-Life Assets, spain, springer open, 2017, pp. 93–113.

- D. R. L. T. Aditya Jain, “Have companies arisen to the challenge of promoting sustainable work? The role of responsible business practices in the context of evolving employment and working conditions,” Safety Science 2024, vol. 170, p. [CrossRef]

- E. B.,. E. C. N. S. Elisa Truant, “Environmental, social and governance issues in supply chains. A systematic review for strategic performance,” review for strategic performance 2024, vol. 434, p. [CrossRef]

- T. M. A. N. T. T. H. P. Thi Tam Le, “Environmental Management Accounting andPerformance Efficiency in the Vietnamese Construction Material Industry—A Managerial Implication for Sustainable Development,”. 2019, 11, 5152. [CrossRef]

- J. M. M. I. Á. Eduardo Ortas, “Sustainable supply chain and company performance: A global examination,” Supply Chain Management - emerlad insight, 2014. [CrossRef]

- J.-C. T. a. H.-S. Huang, “Analysis on the Relationship between Green Accounting and Green Design for Enterprises,” sustainability, pp. 6264–6277, 2015. [CrossRef]

- A. a. Z. Z. Suaad Jassem, “Impact of Sustainability Balanced Scorecard Types on Environmental Investment Decision-Making,”. Sustainability 2018, 10, 541. [CrossRef]

- G. M. a. P. R. Panagiotis Trivellas, “Implications of Green Logistics Management on Sustainable Business and Supply Chain Performance: Evidence from a Survey in the Greek Agri-Food Sector,”. Sustainability 2020, 12, 10515. [CrossRef]

- A. A. A. Mohd Shoeb, “Environmental Accounting Disclosure Practices: A Bibliometric and Systematic Review,”. Int. J. Energy Econ. Policy 2022, 12, 226–239. [CrossRef]

- Y. J.,. S. D. Maoli Ji, “Environmental Accounting Information Disclosure Driving Factors: The Case of Listed Firms in China,”. Sustainability 2022, 14, 15797. [CrossRef]

- S. F. A. R. F. Agus Joko Pramono, “Sustainability Management Accounting in Achieving Sustainable Development Goals: The Role of Performance Auditing in the Manufacturing Sector,”. Sustainability 2023, 15, 10082. [CrossRef]

- S. A. B. R. M. T. Suhaib, “Sustainability analysis of cement supply chains considering economic, environmental and social effects,” Cleaner Logistics and Supply Chainm, Elsevier Ltd., 2023.

- H. S. A. L. R. F. O. K. S. M. E. Jennifer Davies, “Non-fungible tokens: The missing ingredient for sustainable supply chains in the metaverse age?,” Transportation Research Part E, 2024, vol. 182, p. [CrossRef]

- A. Muhammad Ardiansyah, “Integrating Corporate Social Responsibility into Business Strategy: Creating Sustainable Value,” Involvement International Journal of Business 2024, vol. 1, no. 1, pp. 30 -41. [CrossRef]

- J. &. W. M. Brown, Managing for sustainable development: Linking accounting and accountability.accountability. The Routledge Companion to Accounting for Sustainability, University of Manchester, UK: 19-34, 2014.

- R. L. F. J. M. K. H. D. &. W. T. Lozano, “Advancing higher education for sustainable development: international insights and critical reflections,”. J. Clean. Prod. 2016, 17, 14–33. [CrossRef]

- N. F. K. N. &. F. M. Shehata, “Development of corporate governance codes in the GCC: An overview,” Corporate Governance the International Journal of Business in Society 2015, vol. 15, no. 3, pp. 315–338. [CrossRef]

- M. &. A. R. R. Al-Shboul, “The impact of institutional quality and resources rent on health: The case of GCC,” Resources Policy 2022, vol. 78, p. [CrossRef]

- S. Ç. E. İ. &. G. A. Erdoğan, “Relationship between oil price volatility and military expenditures in GCC countries,” Environmental Science and Pollution Research 2020, vol. 27, no. 14, pp. 7072–17084. [CrossRef]

- O. I. A. A. A. A. R. R. A. &. A. M. F. Tawfik, “Corporate governance mechanisms, royal family ownership and corporate performance: evidence in gulf cooperation council (GCC) market,” Heliyon 2022, vol. 8, no. 12, p. [CrossRef]

- Y. A. A. A. A. A. &. H. W. Adam Yahya Jafeel, “How corporate governance quality affects investment efficiency? An empirical analysis of nonfinancial companies in the Gulf Cooperation Council 2015-2020,” Cogent Business & Management 2023, vol. 10, no. 1, p. [CrossRef]

- H. K. S. F. &. H. K. Al Amosh, “The financial determinants of integrated reporting disclosure by Jordanian companies,” ournal of Risk and Financial Management 2022, 15(9), pp. 374–375. [CrossRef]

- Z. Rezaee, Business sustainability: Performance, compliance, accountability and integrated reporting, London: Routledge., 181-188., 2017. [CrossRef]

- D. W. &. S. M. Richards, “Disclosure effectiveness in the financial planning industry,” Qualitative Research in Financial Markets 2021, 13(5), pp. 672–691. [CrossRef]

- D. S. U. F. &. A. A. O. Zhou, “Assessing the Role of Sustainability Disclosure on Firms’ Financial Performance: Evidence from the Energy Sector of Belt and Road Initiative Countries,” Sustainability 2024, 16(2), pp. 930. [CrossRef]

- M. K. C. Y. &. M. A. W. B. A. Jiao, “December). The Compliance Framework of Anti-Bribery for Multinational Corporations in China.,” in In 3rd International Conference on Law and Digitalization 2023 (ICLD 2023), 2023.

- R. A. Yuniawati, “The effect of corporate social responsibility disclosure on stock prices through financial performance,” Enrichment: Journal of Management 2023, 13(3), pp. 695–1703. [CrossRef]

- R. &. O. A. Hussey, Understanding Financial Reporting Standards: A Non-Technical Guide, World scientific, p153., 2023.

- J. C. P. &. T. I. Ma, “The effect of key audit matters and management disclosures on auditors’ judgements and decisions: An exploratory study.,” The British Accounting Review, 2023, p. [CrossRef]

- P. S. R. S. I. &. H. K. Tillotson, “ Deactivating climate activism? The seven strategies oil and gas majors use to counter rising shareholder action,”. Energy Research & Social Science 2023, 103, 103190. [CrossRef]

- M. A.,. B. K. Maria Roszkowska-Menkes, “True transparency or mere decoupling? The study of selective disclosure in sustainability reporting,” Critical Perspectives on Accounting, 2024, vol. 98, p. [CrossRef]

- J. Y. A. n. S. n. O. A. Noha Alessa, “Does stakeholder pressure influence firms environmental, social and governance (ESG) disclosure? Evidence from Ghana,” Cogent Business & ManageMent, 2024, vol. 11, no. 1, p. [CrossRef]

- Y. L. b. C. F. d. Jingjing Li, “A performance evaluation system for product eco-design in the fashion supply chain,” Journal of Cleaner Production, 2024, vol. 440, p. [CrossRef]

- M. H. D. S. M. N. A. M. R. G. Abbasali Jafari-Nodoushan, “Designing a sustainable disruption-oriented supply chain under joint pricing and resiliency considerations: A case study,” Computers and Chemical Engineering, 2024, vol. 180, p. [CrossRef]

- J. W. X. S. X. X. Jing Gu, “Investigating supply chain participants’ circular economy action effects on firm financial performance from a stakeholder theory perspective,” Journal of Purchasing and Supply Management, 2024, vol. 30, no. 4, p. [CrossRef]

- H. H. Y. C. Y. F. Yingjie Ju, “Assessing the impact of government-led green supply chain demonstration on firms’ financial distress: The role of environmental information disclosure quality and supply chain concentration,” Journal of Cleaner Production, 2024, vol. 440, p. [CrossRef]

- J. W. X. X. Jing Gu. Xinyu Shi, “Examining the impact of market power discrepancy between supply chain partners on firm financial performance,” International Journal of Production Economics 2024, vol. 268, p. [CrossRef]

- N. A. A. M. I. Md. Saheb Ali Mondal, “Nexus of environmental accounting, sustainable production and financial performance: An integrated analysis using PLS-SEM, fsQCA, and NCA,” Environmental Challenges 2024, vol. 15, p. [CrossRef]

- J.-M. L. C.-J. H.-C. K. d. Po-Yuk So, “Impact of carbon pricing on the integrated green supply chain of the semiconductor industry,” Heliyon 2024, vol. 10, no. 4, p. [CrossRef]

- B. F. L. Sukrit Vinayavekhin, “Putting your money where your mouth is”: An empirical study on buyers’ preferences and willingness to pay for blockchain-enabled sustainable supply chain transparency,” Journal of Purchasing and Supply Management 2024, vol. 30, no. 2, p. [CrossRef]

- Y. C. B. M. S. Y. Y. Hafiz Muhammad Arslan, “Influence of Senior Executives Characteristics on Corporate Environmental Disclosures: A Bibliometric Analysis,” Risk and Financial Management, 2022, vol. 15, no. 136, pp. 3–21. [CrossRef]

- R. H. E. B. A. H. Amina Buallay, “Increasing female participation on boards: Effects on sustainability reporting,” Finance & Economics - John Wiley, 2020, pp. 111–124. [CrossRef]

- E. F. G. M.-M. D. S.-O. Brais Suarez-Eiroa, “Operational principles of circular economy for sustainable development: Linking theory and practice,” Journal of Cleaner Production, 2019, vol. 214, pp. 952 - 961. [CrossRef]

- M. R. I. R. Iva Jestratijevic. James O. Uanhoro, “Transparency of sustainability disclosures among luxury and mass-market fashion brands: Longitudinal approach,” Journal of Cleaner Production 2024, vol. 436, p. [CrossRef]

- K. B. M. V. S. K. S. N. P. Hariram, “Sustainalism: An Integrated Socio-Economic-Environmental Model to Address Sustainable Development and Sustainability,” Sustainability, 2023, vol. 15, no. 13, pp. 2–37. [CrossRef]

- Y. A. A. &. N. A. I. Xiaojuan Sheng, “The nonlinear impact of financial flexibility on corporate sustainability: Empirical evidence from the Chinese manufacturing industry,” Heliyon, 2024, vol. 10, no. 6, pp. 2–21. [CrossRef]

- J. S. M. H. L. a. G. K. V. F. Hair Jr, “Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research,” European Business Review, 2024, pp. Vol. 26 No. 2, pp. 106–121. [CrossRef]

| Demographic | Elements | Frequency | % |

|---|---|---|---|

| qualification | Doctorate | 25 | 12.5% |

| Master’s | 50 | 25% | |

| Bachelor’s degree | 125 | 62.5% | |

| Total | 200 | 100% | |

| Specialization | Management | 80 | 40% |

| Accounting | 22 | 11% | |

| Economic | 42 | 21% | |

| Other | 56 | 28% | |

| Total | 200 | 100% | |

| Experience | Less than 5 years | 30 | 15% |

| From 5 and less than 10 years | 60 | 30% | |

| From 10 and less than 15 years | 49 | 24.5% | |

| From 15 years and less than 20 years | 31 | 15.5% | |

| From 20 years and over | 30 | 15% | |

| Total | 200 | 100% | |

| Position | Director | 20 | 10% |

| Managing director | 60 | 30% | |

| Staff | 120 | 60% | |

| Total | 200 | 100% |

| Variables | Item | Outer Loading | Vif |

|---|---|---|---|

| Disclosure of Financial Performance (DFP). | DFP1 | 0.841 | 2.135 |

| DFP2 | 0.846 | 2.409 | |

| DFP3 | 0.873 | 2.411 | |

| DFP4 | 0.832 | 2.189 | |

| Disclosure of Environmental Performance (DEP). | DEP1 | 0.816 | 2.513 |

| DEP2 | 0.856 | 2.905 | |

| DEP3 | 0.871 | 2.515 | |

| DEP4 | 0.823 | 2.918 | |

| Supply Chain Performance (SCP) | SCP1 | 0.818 | 2.315 |

| SCP2 | 0.858 | 2.590 | |

| SCP3 | 0.826 | 2.141 | |

| SCP4 | 0.838 | 2.891 | |

| Sustainable development (SD) | SD1 | 0.817 | 2.290 |

| SD2 | 0.849 | 2.370 | |

| SD3 | 0.837 | 2.287 | |

| SD4 | 0.843 | 2.114 |

| Variables | Cronbach’s alpha | Composite reliability (rho_a) | Composite reliability (rho_c) | Average variance extracted (AVE) |

|---|---|---|---|---|

| Disclosure of Financial Performance (DFP). | 0.885 | 0.877 | 0.913 | 0.785 |

| Disclosure of Environmental Performance (DEP). | 0.912 | 0.916 | 0.901 | 0.748 |

| Supply Chain Performance (SCP). | 0.881 | 0.879 | 0.910 | 0.790 |

| Sustainable development (SD). | 0.901 | 0.920 | 0.906 | 0.723 |

| Factor | R-square |

|---|---|

| Challenges Disclosure of Environmental Accounting Performance and its Impact on Supply Chains and Sustainable Development of Companies -Experiences of Some Companies in the (GCC) Countries -2024 | 0.860 |

| Variables | Original sample (O) | Sample mean (M) | Standard deviation (STDEV) | T statistics (O/STDEV) | P values |

|---|---|---|---|---|---|

| Ethical values of disclosure of environmental accounting performance (DEAP)-> Supply Chain Performance (SCP) | 0.198 | 0.196 | 0.051 | 3.861 | 0.000 |

| Ethical values of disclosure of environmental accounting performance (DEAP) -> Sustainable development (SD) | 0.195 | 0.191 | 0.050 | 3.822 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).