Current academic research primarily focuses on the impact of interest rates and the yield curve on housing prices, while studies investigating the effects of open market operations and new issuances of government bonds on housing prices are relatively scarce. Existing literature that addresses the influence of open market operations on asset prices, such as housing prices and exchange rates, generally does so within the broader framework of monetary policy. Specifically, This article will explore how the quantity of newly issued government bonds affects housing prices, providing insights to help central banks manage financial risks and maintain economic stability more effectively.

4.3.1. Data Table

Table 7.

ADF Test Results for JP_housing and New_issue_gov_bond.

Table 7.

ADF Test Results for JP_housing and New_issue_gov_bond.

| Variable |

Dickey-Fuller |

Lag Order |

p-value |

| JP_housing |

-2.1326 |

5 |

0.5206 |

| New_issue_gov_bond |

-2.2493 |

5 |

0.4718 |

The ADF test results indicate that both JP_housing and New_issue_gov_bond are likely non-stationary. For JP_housing, the Dickey-Fuller statistic is -2.1326 with a p-value of 0.5206, which is well above the 0.05 significance level, indicating that we cannot reject the null hypothesis of a unit root. This suggests that the housing price series exhibits characteristics of a random walk and may have trends or volatility. Similarly, for New_issue_gov_bond, the Dickey-Fuller statistic is -2.2493 with a p-value of 0.4718, also failing to reject the null hypothesis of non-stationarity. These results imply that both time series may need to be differenced or otherwise transformed to achieve stationarity before further analysis can be performed reliably. Given that both variables are non-stationary, it is appropriate to conduct a Johansen cointegration analysis

Table 8.

Johansen Cointegration Test Results (Trace Statistic with Linear Trend).

Table 8.

Johansen Cointegration Test Results (Trace Statistic with Linear Trend).

| Hypothesis |

Test Statistic |

15% |

10% |

5% |

1% |

|

0.53 |

4.82 |

6.50 |

8.18 |

11.65 |

|

15.01 |

14.82 |

15.66 |

17.95 |

23.52 |

The table presents the Johansen cointegration test results based on the Trace statistic, which evaluates whether there is a cointegration relationship among the time series. For the hypothesis , the Trace statistic is 0.53, which is significantly lower than all critical values at the 15%, 10%, 5%, and 1% significance levels (4.82, 6.50, 8.18, and 11.65, respectively). This indicates that the null hypothesis of no additional cointegration relationship cannot be rejected, suggesting that the data does not support the existence of more than one cointegration relationship under this setting. For the hypothesis , the Trace statistic is 15.01, which falls slightly below the 10% critical value (15.66) but exceeds the 15% critical value (14.82). This implies that at the 15% significance level, the null hypothesis of no cointegration can be rejected, suggesting a potential cointegration relationship. However, at more stringent significance levels (10%, 5%, or 1%), there is insufficient evidence to support this conclusion. It is important to note that the 15% critical values in the table were estimated using linear interpolation.

Table 9.

Regression Results for jp_housing.d.

Table 9.

Regression Results for jp_housing.d.

| Coefficient |

Estimate |

Std. Error |

t value |

| ect1 |

-0.00897 |

0.00286 |

-3.141 ** |

| constant |

-2.57761 |

0.88980 |

-2.897 ** |

| jp_housing.dl1 |

-0.42266 |

0.07607 |

-5.556 *** |

| new_issue_gov_bond.dl1 |

0.00032 |

0.00017 |

1.891 . |

| jp_housing.dl2 |

-0.12502 |

0.08195 |

-1.526 |

| new_issue_gov_bond.dl2 |

0.00080 |

0.00020 |

4.067 *** |

| jp_housing.dl3 |

-0.22129 |

0.08251 |

-2.682 ** |

| new_issue_gov_bond.dl3 |

0.00038 |

0.00021 |

1.781 . |

| ⋮ |

⋮ |

⋮ |

⋮ |

| new_issue_gov_bond.dl7 |

0.00036 |

0.00019 |

1.953 . |

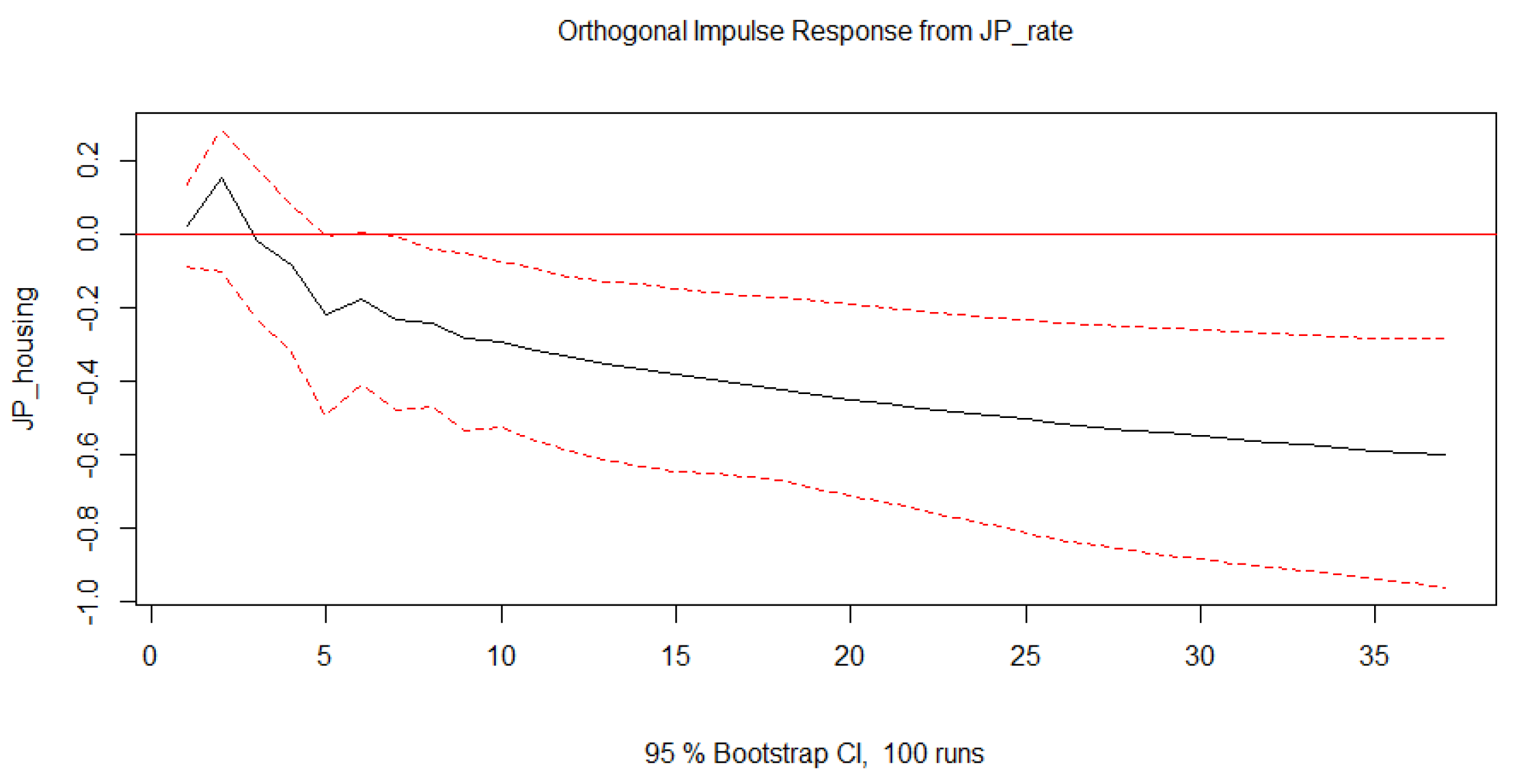

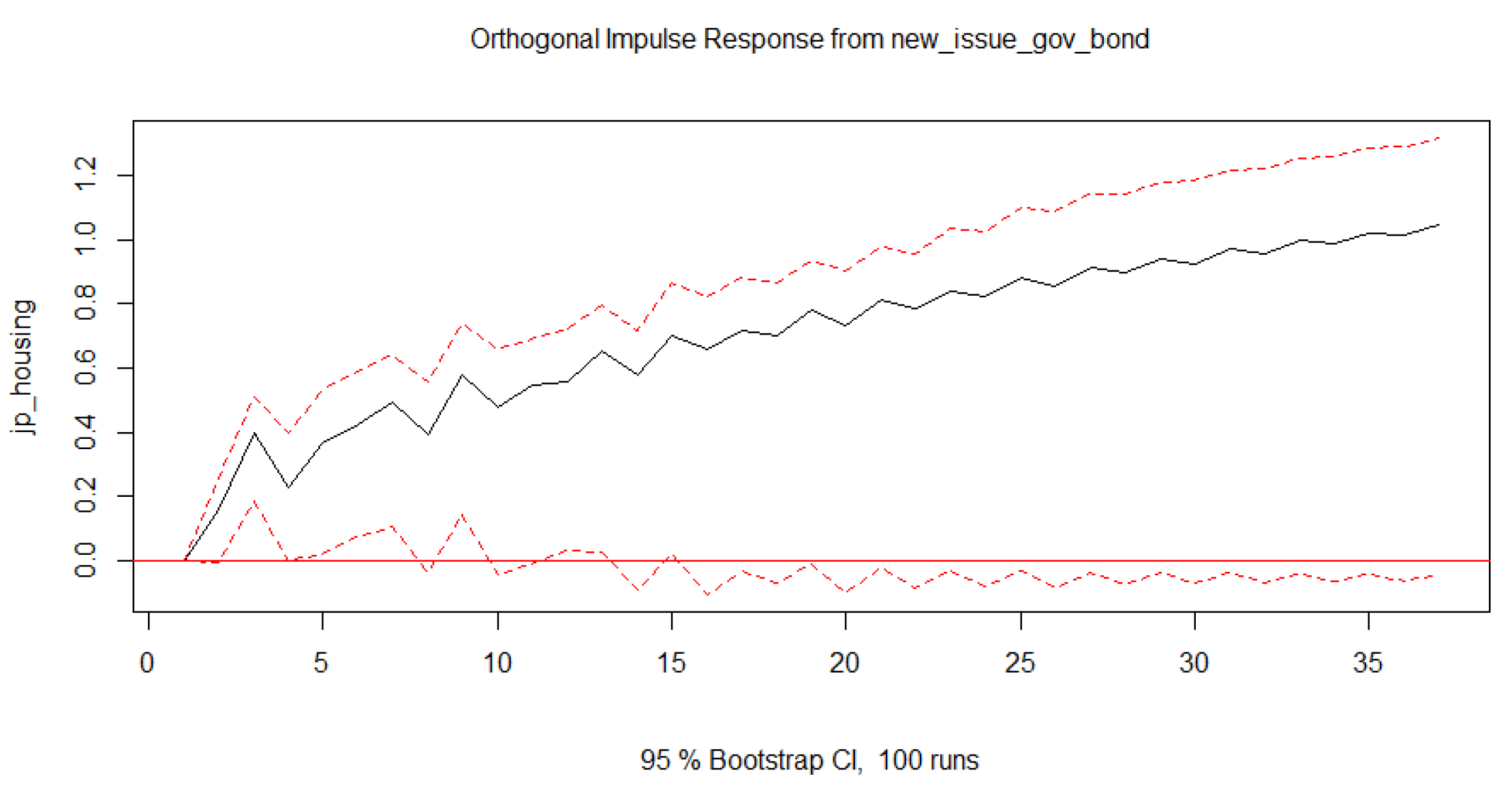

The regression results for jp_housing.d show several significant factors influencing housing price changes in Japan. The error correction term (ect1) is statistically significant with a negative coefficient (-0.00897), indicating that deviations from the long-term equilibrium are corrected over time. The lagged value of housing prices (jp_housing.dl1) also shows a significant negative effect, suggesting that past increases in housing prices are associated with decreases in the current period, possibly reflecting a correction mechanism in the housing market.

The coefficients for new_issue_gov_bond lag terms indicate mixed effects. For example, new_issue_gov_bond.dl2 is highly significant (p < 0.001), suggesting that an increase in newly issued government bonds may have a positive impact on housing prices with a lag. Other lags of new_issue_gov_bond show varying levels of significance, implying that the effect of new bond issuances on the housing market may not be consistent across different time lags.

Overall, the model explains about 38.6% of the variance in housing price changes, indicating a moderate fit. The significant F-statistic suggests that the model as a whole is statistically significant. Now, we can build a equation.

Where

: The change in housing prices at time t.

: The error correction term, indicating deviations from long-term equilibrium.

constant: A constant term capturing fixed effects in the model.

: The lagged values of housing price changes, representing the past values up to seven periods.

: The lagged values of new government bond issuances, indicating the impact of government bond issuance over the past seven periods.

: The error term, capturing the unexplained variation in the model.

For Chinese scenario:

Table 10.

ADF Test Results for Housing Price and CN_New_Govbond.

Table 10.

ADF Test Results for Housing Price and CN_New_Govbond.

| Variable |

Dickey-Fuller |

Lag Order |

p-value |

| Housing Price |

-2.8278 |

6 |

0.2274 |

| CN_New_Govbond |

-1.2624 |

6 |

0.8876 |

The table presents the results of the Augmented Dickey-Fuller (ADF) test for two variables: housing prices and CN_New_Govbond (Chinese new government bond issuances). The ADF test checks whether a time series is stationary or not. For housing prices, the Dickey-Fuller statistic is -2.8278 with a p-value of 0.2274, indicating that we cannot reject the null hypothesis of a unit root, suggesting the series is likely non-stationary. Similarly, for CN_New_Govbond, the Dickey-Fuller statistic is -1.2624 with a p-value of 0.8876, also failing to reject the null hypothesis, indicating that this series is likely non-stationary as well.Since both variables are non-stationary, it is appropriate to conduct a Johansen cointegration test to determine whether there exists a long-term equilibrium relationship between them. The Johansen test will help identify any cointegrating vectors that may suggest a stable relationship over the long run despite the individual series being non-stationary.

Table 11.

Johansen Cointegration Test Results (Trace Statistic Without Linear Trend and Constant).

Table 11.

Johansen Cointegration Test Results (Trace Statistic Without Linear Trend and Constant).

| Hypothesis |

Test Statistic |

10% |

5% |

1% |

|

11.29 |

7.52 |

9.24 |

12.97 |

|

44.58 |

17.85 |

19.96 |

24.60 |

The Johansen cointegration test results provide evidence of a cointegration relationship between the variables. The trace statistic, without considering a linear trend and constant, indicates that for the hypothesis , the test statistic is 11.29, which exceeds the 5% critical value of 9.24. This allows us to reject the null hypothesis of at most one cointegration relationship, suggesting the existence of at least one cointegrating vector. Additionally, for the hypothesis , the test statistic is 44.58, which is well above the critical values at the 10%, 5%, and 1% levels (17.85, 19.96, and 24.60, respectively). This confirms the presence of a cointegration relationship. Overall, these findings imply that the variables exhibit a stable long-term equilibrium relationship, moving together over time even though they may be individually non-stationary. So, now we can build VECM model.

Table 12.

Regression Results for Housing Price Changes.

Table 12.

Regression Results for Housing Price Changes.

| Coefficient |

Estimate |

Std. Error |

t value |

| ect1 |

-0.00129 |

0.00128 |

-1.007 |

| housing_price.dl1 |

-0.03682 |

0.05081 |

-0.725 |

| cn_new_govbond.dl1 |

0.00018 |

0.00009 |

1.933 . |

| housing_price.dl2 |

-0.15202 |

0.05029 |

-3.023 ** |

| cn_new_govbond.dl2 |

0.00021 |

0.00012 |

1.824 . |

| ⋮ |

⋮ |

⋮ |

⋮ |

| housing_price.dl12 |

0.5343 |

0.05407 |

9.882 *** |

| cn_new_govbond.dl12 |

0.00022 |

0.00010 |

2.229 * |

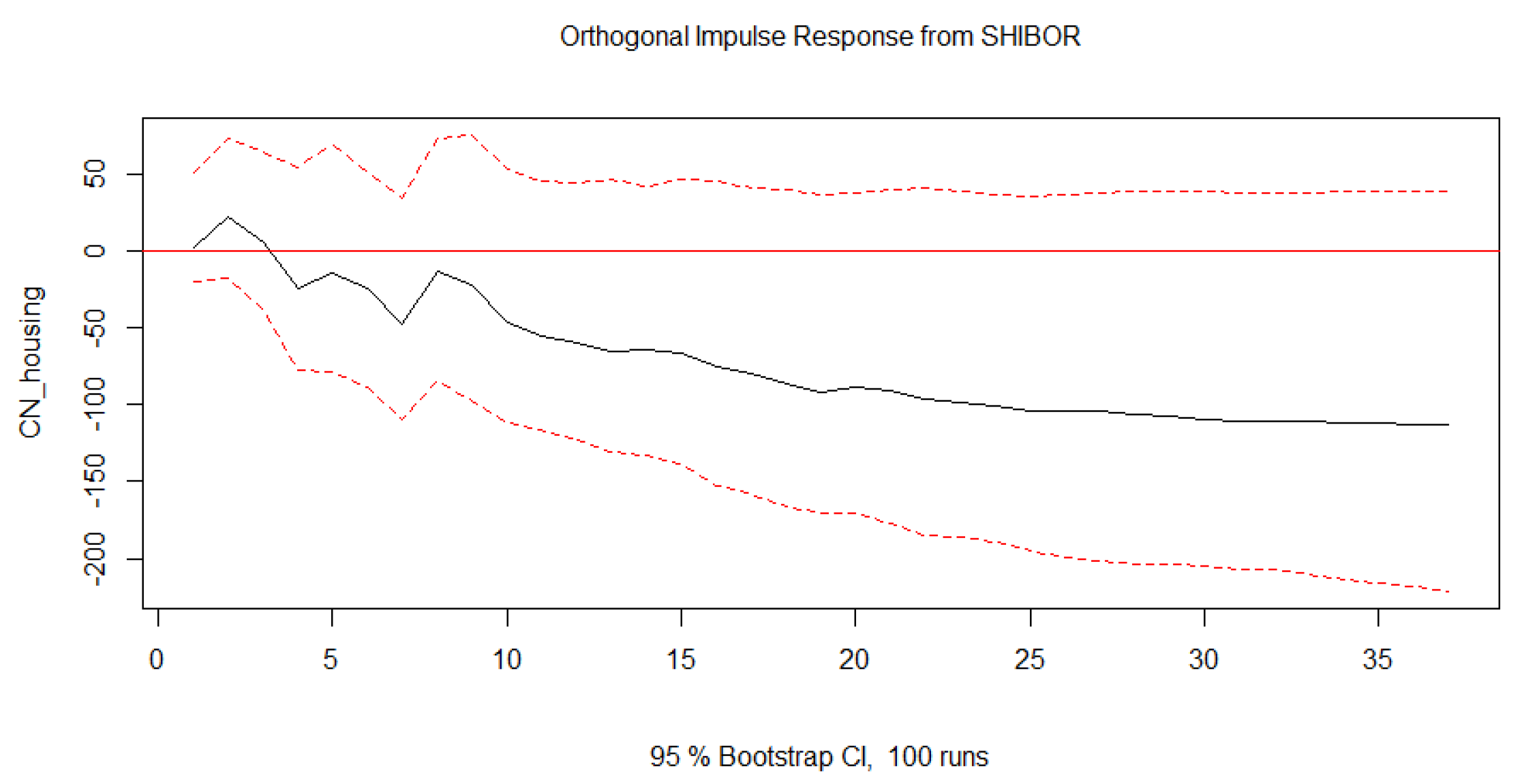

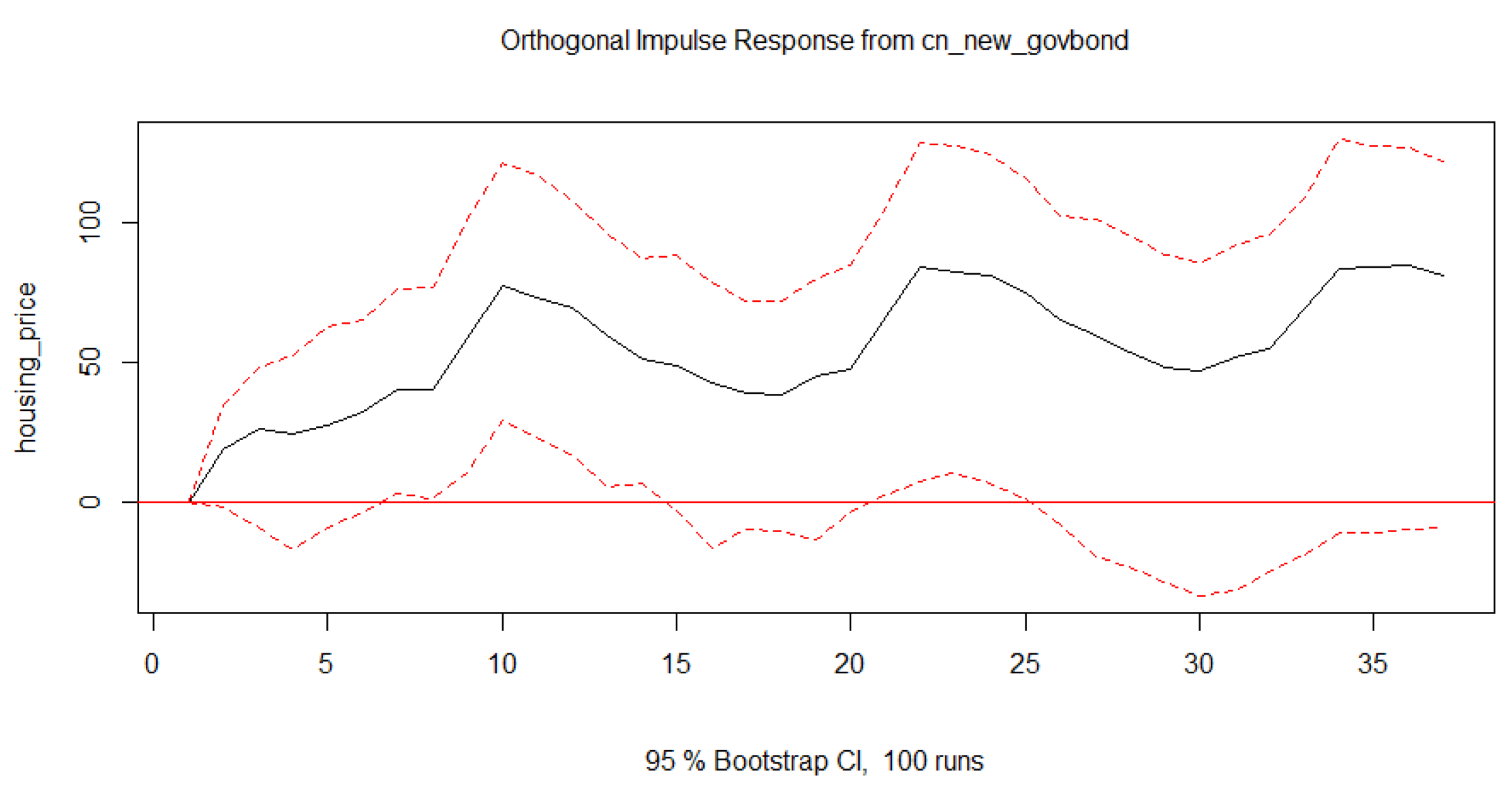

The regression results show that some lagged variables have a significant impact on housing price changes. The error correction term (ect1) is not statistically significant, indicating that deviations from the long-term equilibrium may not have a strong correction effect. Some lagged terms of housing prices (e.g., housing_price.dl2 and housing_price.dl12) are significant, suggesting that past values influence current changes.

Lagged terms of the new government bond issuances (e.g.,

cn_new_govbond.dl12) are also significant, implying that the issuance of new bonds can affect housing prices. The model explains about 41.2% of the variation in housing prices, with an overall significant F-statistic, indicating a good fit for the data.

Where:

: Change in housing prices at time t.

: Error correction term, representing deviations from the long-term equilibrium.

: Lagged values of housing price changes, capturing the impact of past housing price variations.

: Lagged values of new government bond issuances, reflecting the influence of bond issuance on housing prices.

: Error term, representing unexplained variations in the model.