1. Introduction

In this article, we raise concerns about the issue of banking sector efficacy stimulation in the sense of improving the response of the banking sector to investors financing needs or banking credit demanders’ needs.

There is a consensus in the literature that the effectiveness of the banking sector is either tributary to banking sector specificities or monetary policy governance.

After redefining banking sector efficacy as the impact of credit production on the excess credit demand in compliance with the definition of the objectives of the financial system that consists in optimal flowing of funds from agents having financial surpluses to agents with deficits in financial resources, we find using an ARDL estimation technique and Bound testing to the Tunisian banking sector data spanning from 1980 to 2019 that banking sector specificities are the main determinant of banking sector effectiveness in the short run along with fisherian sensitivity relating to inflation and the loan price and that monetary policy conducting is the main determinant of banking sector effectiveness in the long run along with inflation and business cycle effects coming out with findings in compliance with the credit market structure expectations of equating average cost to average revenue in the short run and marginal cost to marginal revenue in the long run as predicted by the monopolistic competition theory.

The empirical findings are of major relevance in corroborating the complicated theoretical predilections about the credit sector in the New Keynesian framework for which the nominal rigidities or price sicknesses are assumed to vanish and constitute a phenomenon that is depicted from empirical finding with difficulty in its process.

The article shows that it is worthless to try to improve banking sector efficacy through monetary policy stimulus in the short run although banking sector efficacy is responsive to business cycle effects that are pertaining to monetary policy stimulus.

But banking sector problems and hindrances to finance excess credit demand are structural in nature and more difficult to tackle as they depend on subjective criteria pertaining to banking specificities in the short run that have been taken into consideration as being the risk of non performing loans and the sensitivity of excess credit demand to non performing loans but that are usually as available in the referred to literature revolving about; management quality, asset quality and earnings ability and discretionary monetary policy is seemingly worthless to improve banking sector efficacy in the short run.

But, over the long run monetary policy conducting gets effective in containing hindrances to banking sector effectiveness as the monetary policy stimulus get caught by the monopolistic competition considerations of imperfect competition over the long run especially when monetary policy efficacy is expressed in terms of the speed of stabilization of output as business cycle effects are of prominent relevance for affecting banking sector efficacy over the long run along with the sensitivity of credit demand to the business cycle fluctuations and other related factors to be dealt with along the research.

In a New Keynesian imperfectly competitive market setting, monetary policy conduct improves investment, consumption and business cycle fluctuations as the monetary policy conduct modeling determinants are significant in affecting the sensitivity of credit to loan production which indeed fuels financing for investment and consumption as both sensitivities of credit supply and credit demand to business fluctuations are significant but does not affect banking sector efficacy in the short run.

It affects it only over the long run when the transmission mechanism becomes persistent and propagates to monopolistic competition considerations.

Besides the article shows how far the banking sector is vicious in the sense it does not convey any prioritizing relevance to the fulfillment of financial sector efficacy instead it is fully concerned with its profitability and its capital as profitable activities distribute flourishing dividends and incite stakeholders to invest more in capital.

The paper provides impetus on the specific relevance of the conduct of unconventional monetary policy stimulus when the conventional instruments do not find a way out of credit supply inelasticity which constitutes a hindrance specific to the banking sector vicious character of excessive search for yield and risk reticence.

2. Literature Review

2.1. Banking Sector Efficacy; Definition and Descriptive Statistics

Efficacy of the banking sector or the ability of the banking sector to respond to investors’ financing requirements:

It is expressed by e((Cd-Cs)/LTD)

Where:

According to Bernie Kehrwald (2014) in “The excess demand theory of money”:

“There is no generally accepted theory of how the interest rate is determined. The Keynesian liquidity preference theory claims the interest rate brings together the demand for liquidity and the money supply set by the central bank. The neoclassical loanable funds theory on the contrary suggests that the interest rate is the equilibrium price of capital and hence determined by capital supply (savings) and capital demand (investment)”

Bernie Kehrwald (2014) introduced a new theory that combines both views and gives a better understanding of the interest rate, the credit market and the nature of the central bank in what is called the excess demand theory of money.

As far as this new theory is concerned, it is pointless to go into details. But, according to our understanding of the related theoretical underpinnings, it is noteworthy to state that the credit market doesn’t clear when there are informational asymmetries and imperfect completion, fact that is prevailing in practical and should be conveyed full concern.

Under the framework of our setting of variables in this research, credit demand is the amount of credit that investors are willing to obtain in order to finance their investment activities, whereas credit supply is the amount of loanable funds available for deploying financing by the banks and other financial institutions.

The problem that banks have a certain risk aversion, a certain range of information concerning past performance of investors in their investment activities. Besides, there are some barriers to entry to be allocated credit further exacerbates the extent to which the credit sector functions accurately and the extent to which it heralds disruptions that lead to staggered and biased flows.

Indeed, it is noteworthy to state that credit can be obtained after a certain period of movement in the banking account of enterprises what makes credit supply do not respond to investors needs during the initial period before the bank has gathered information on the path of cash flows of the enterprise to determine the solvency of the investor and the amount of credit it should allocate to him.

This refers to imperfect information and is added to other disruptions to be reviewed more in depth in the following research.

Besides competition is imperfect between banks as banks with older accounts are more eligible to approve credit than banks with new accounts because of information asymmetries.

Therefore the bank can play on the loan rate as if it were acting in monopolistic settings because it is aware that if the investor shifts the bank he wouldn’t have access to credit until he has performed enough movement in the account what constraints his access to credit during a certain period he would be willing to be allocated credit and is willing to forego a lower loan price with delayed delivery for a fast credit with a higher loan price.

e((Cd-Cs)/LTD) is an indicator of the banking system risk aversion or its intension to cover the financing requirements and needs of investors that postulate for credit in other words credit demanders.

Banks proceed to an arbitrage between credit risk and profitability expectations that go hand in hand, on the one hand, and solvency and liquidity, on the other hand.

Prudential regulations in terms of solvency and liquidity as have been emphasized in Basel III have the tendency to depress the allocation efficiency of banking credit for two main reasons.

Firstly, a theoretical reason that stems from the introduction of frictions in the credit market and secondly, a practical managerial reason that results from the fact that the intermediation margin or the essence of banking profitability goes hand in hand with risk.

The more banks bear risk the more they respond accurately to the investors needs of financing or to credit demand.

An increase in this elasticity e((Cd-Cs)/LTD) means that the banking system is less and less effectual

A decrease in this elasticity means that the banking system is more and more effectual.

The main problem that confers to this instrument a role of prominent importance stems from the fact that the relationship between banking system efficiency and financial vulnerability and systemic risk differs according to the term structure purview of assessment.

Indeed, in the short run, if the elasticity is important, it means that banks make the implementation of macro-prudential directives prevail and far outweigh the importance of the response to investors’ financing needs and the banks’ sake for profitability. This means that they are reticent to bearing risk and by a way of consequence mitigate financial vulnerability.

But, this is not the point. Indeed, in this respect, in the long run, there will be a reverse effect that results from the cumulating absence of a learning phenomenon for industrial enterprises that have been in the short run credit demanders and whose needs have not been fulfilled. Indeed, the shortage in responding to their financing needs would have been exacerbated their balance sheets at that point that they would have not engaged in high risk high return investment projects.

Therefore, their ability to manage risk bearing industrial activities like research and development based projects would not have been motivated and their ability to repay their debt would have been exacerbated.

This would have negative repercussions over the long run on credit tolerable by banks as they learned that investment activities bear more and more risk because the industrial sector would have not beneficiated from enough leakage to learn how to improve risk management and profitability in a way that risk decreases and profitability decreases because of a learning effect.

Those enterprises are more and more eligible to make default for the same level of risk, what exerts negative repercussions on the risk tolerable by banks.

And the other way round holds too.

If in the short run the elasticity is weak, this means that banks are badly warned in terms of macro-prudential surveillance because their efficiency imposes to make the fact of responding to investors’ financing needs prevail.

Those bear eventually excessive risk and exacerbate early warning considerations over the short run.

But, in the long run, the fact that banks have already engaged in making the response to high-risk investment activities prevail would turn to be beneficial for the learning effect of research and development firms that would have been beginning to fructify their engagement in high risk and the vast majority of earlier risky credit allocations would be repaying back its credit.

Besides the sophistication in the industrial sector that would have resulted would have good repercussions on the tolerable credit risk from an assessment standpoint of bankers that would find that more risk bearing has become safer and pays back credit.

In definitive, the prudential authorities have the imperative to consider thoroughly this arbitrage and reversal effect between the short term and the long term considerations and weigh the stake of bearing more pain in the short run and compromise credit risk and financial vulnerability and benefice in the long run from a more efficient industrial sector that motivates risk bearing at a lesser cost and an improves solvency and liquidity for banks with a better profitability or the other way round which means safeguarding the imperatives of mitigating financial vulnerability in the short run and not engaging in risky financing but exacerbating the situation of the industrial sector and engaging in a bandwagon effect of toughened surveillance and decreased efficiency that results in calling the urge for more strict regulation and so forth.

Determination of the adequate formula to express banking system efficacy:

1st scenario: Impact of credit production on volume of rejected credit: e(ECD/LTD)

As explained above.

2nd scenario: Impact of volume of accepted credit on volume of rejected credit: e(ECD/Cs)

Accepted credit is not a determinant factor for rejection of credit.

Cs alone does not inform on the willingness of the bank to produce credit. The figure must include also the funds financing credit production.

The elasticity expresses the choice among low risk and high risk credit and how much does low risk investment financing affects high risk investment financing by the bank because usually rejected credit is high risk and supplied credit is moderately less risky.

But the proportion of Cs out of deposits informs on the willingness of the bank to produce credit. Thus its impact on rejected credit informs on banking system efficacy or the extent of responsiveness to investors needs.

For a banking sector distinguished by excessive information asymmetries and skyrocketing borrowing rates investors are very sensitive to monetary policy announcements because they are claimed to bear excessive costs for financing their projects.

Therefore their expectations are rational and not adaptive.

We are hence in a New Keynesian world where monetary policy efficacy cannot stimulate investment or where the zero lower bound for monetary rate should be adopted in face of price and information stickiness.

Banking sector efficacy which gauges the extent of response to investor needs for financing are therefore independent from monetary policy and exclusively dependent on the frictions imbedded in the banking sector which are high agency costs due to excessive information asymmetries.

This explain also the important role played by non performing loans in modeling banking sector efficacy in comparison to monetary policy instruments although the credit is a major transmission mechanism of monetary policy. It does not herald a major role played by monetary policy because information asymmetries shield the search for yield motivation of the banking sector and skyrockets the borrowing cost as banks prefer not to adjust to the equilibrium price of demand and supply of credit rather try to compensate for high agency costs.

Monetary policy is claimed to be ineffective in face of rational expectations of individual investors.

Again the specificities of the banking sector prevail as a major determinant of banking sector efficacy as assessed by monetary policy determinants because agents, bankers and investors are forward looking but the New Keynesian model for monetary policy effectiveness advocates a backward looking foresightedness.

Monetary policy is ineffective although price stickiness because of information rigidities that abide competitive borrowing rates in the equilibrium between demand and supply of credit.

The credit sector is very sensitive to the agency costs and is willing to forego profitability for financial stability.

Hence banking sector efficacy which fathoms in the same time profitability and risk exposure prospects is purely dependent on banking sector specificities pertaining to non performing loans rather than short term interest rates knowing that New Keynesian monetary policy is claimed to be effective in the short run thus having short run money market rates or monetary policy determinants model well enough banking system efficacy that signals the strive of banks for profitability and for resilience from financial instability.

Banking sector efficacy reveals a good anchor of the credit sector agent behavior that make the researcher likely to assert predilections on its role on monetary policy conduction and the extent to which the credit sector fulfills the requirement of funding flows from the entity in excess of financing sources to the entity in short of financing sources, which is the mainstream objective of the financial system.

2.2. Effectiveness of Monetary Policy for a New Keynesian Framework with a Credit Sector

According to Piazzesi, Rogers and Schneider (2022) in their article Money and Banking in a New Keynesian model: “ Interest rates on short safe bonds targeted by central banks are not well accounted for by asset pricing models that fit expected returns on other assets such a ong term bonds or stocks”.

The short rate disconnect implies that pass through from the policy rate to the interest rate on savings is imperfect. It is relatively strong at typical parameters values because banks supply of inside money is sensitive to the cost of liquidity.

The process of the disconnect arises because short safe bonds are held by banks to back inside money; the convenience yield on those bonds which is the difference between the short rate and the savings rate reflects their benefit as safe collateral in such a world the plumbing of the economy or the nature of payment flows as well as the structure and assets of the banking system matters for the transmission of monetary policy.

In the short run:

Standard New Keynesian logic says that nominal rigidities imply a higher real short rate and lower nominal spending.

However, lower nominal spending lowers the convenience yield on inside money and hence on short safe bonds that back inside money be they interbank loans or reserves. The overall return on safe bonds therefore does not increase as much as the policy rate itself.

In the long run:

Nominal rigidities vanish but the issue of imperfect competition is a braking force for the transmission of monetary policy.

Indeed, as long as the credit sector is in a monopolistic competition the pricing of loans is at a mark up over marginal costs.

This mark up is not pertaining to the transmission of monetary policy but to the market structure and competition among banks.

Hence forth, the perturbation which is aimed at affecting credit supply through the mechanism of money market rate indeed affects slightly the pricing of loans and vanishes without propagating across the credit channel of transmission to credit supply investment output and inflation.

Therefore, in the short run monetary policy is ineffective because of nominal rigidities and in the long run it is not effective because of imperfect competition in the credit sector.

Since pass through to other interest rates occurs to equate total risk’s adjusted returns, the response of the convenience yield to spending dampens the policy impact on output and inflation.

The market structure of the credit sector through dichotomizing marginal cost and marginal revenue makes transmission obstructed.

As imperfect competition imposes a mark up over marginal cost it slows down the transmission of monetary policy to output and hence obstructs monetary policy efficacy.

This is due to the fact that as long as the loan price is determined as an imperfectly competitive mark up over money market rates once the money market rate is disturbed the transmission through the cost push is obstructed because of the discrepancies with the loan rate.

The more the mark up is far from the money market rate the more the transmission is slowed down and obstructed.

Credit risk and monopolistic competition are playing a braking role to the transmission of the monetary policy as the cost push is less reactive when the overall loan price is elevated.

The more the income is high the more Bankers are less and less sensitive to an increase in costs which might be due to higher agency costs or segmentation based pricing that might exacerbate the high risk premiums especially for monopolistic competition where banks impose a mark up for loans correspondingly to the preferential rates for deposits.

Bernanke and Blinder (1988) identified another aspect of the credit market that affects tremendously monetary policy effectiveness.

According to them:“By relaxing the assumption of perfect bank credit to bond substitutability, there is an independent credit multiplier for monetary policy in addition to the conventional IS-LM monetary multiplier. Imperfect substitutability leads to an increase in leverage of monetary policy. The imperfect substitutability is deriving from the specialness of bank lending which results in bank loan rates becoming partially insulated from the effects of monetary policy hence reducing the leverage of monetary policy ”.

The textbook IS-LM accounts for the transmission mechanism of the monetary policy as centering exclusively on the liabilities side of the bank’s balance sheet and as a counterpart of that the assets side of the non banking private sector.

For instance a tightening monetary policy which raises the interest rate enacted through contraction of bank reserves leads to a shrinking of the banks’ balance sheet and a reallocation non banking private sector assets by substituting money balances with interest bearing bonds which leads to the increase in bond yields providing thereby the re-equilibrating mechanism by which this portfolio reallocation is brought about.

As yields are bid up real activity contracts which forms the money view of the transmission mechanism.

This process is obstructed by the imperfect substitutability that constraints the transmission of the effect of the contraction on yields and real activity and henceforth attenuates monetary policy effectiveness.

Nevertheless, at this stage of the analysis the prevalence of a credit multiplier besides the monetary multiplier would suggest that the fall in borrowing due to the imperfect substitutability between money balances and bonds would lead loans to fall more proportionately to the initial increase in interest rates which would contract output. This would contrariwise to the obstruction of the substitution of money balances with bonds increase the potency of monetary policy indirectly.

According to Levin et Al (2003) there is a need for inertial strategies for the conduct of monetary policy. Although these are useless in affecting credit supply as required for the sake of enhancing the transmission process of the conduct of monetary policy it still remains that even credit demand should be subjected to manipulation through discretionary policy if not stickiness would abide any effect of monetary policy far beyond the claims of short run inefficacy and long run efficacy due to relaxation of nominal rigidities over the long run.

He states that: “Aggregate demand remains primarily a function of long term or the sequence of expected short term interest rates implying that inertial strategies which strongly influence expected interest rates are central to good policy design”.

In this regard, the fact that banking sector assessment with respect to risk and exposure are backward looking risk premiums are based on past observations of non performance of loans and financial performance of borrowers. This further exacerbates the ineffectiveness of monetary policy that expects agents to expectations adjustments with a certain forward looking outlay.

Mankiw and Reis (2010) study the information framework that incorporates an important role for the interaction of monetary policy strategy and expectations formations.

Stickiness of information reveals compromising for the effectiveness of monetary policy according to them.

Hence in the new Keynesian framework alongside price stickiness information stickiness intervenes in the effectiveness of the conduct of monetary policy and highlights the critical role banking sector dynamics exert on the manifestation of the objectives of monetary policy as this financial sector drives both price and information stickiness.

2.3. The Model

The households:

The households consume complementary goods which are consumption goods and cash balances.

The welfare maximization takes into account these two items that are complementary

The producer:

The producer offers output Y and quantity Q that are deriving from the standard inter-temporal Euler equation is=δ+π where δ=1-β-1 is the household’s discount factor

Y=((ε-1/ε)(1/¥)*Q-(1-µ/ơ))(1/(δ+1/ơ))

Q=(1+ϣµ(δ+π-id/1+δ+π)1-µ)1/1-µ

The central bank:

The New Keynesian equation for interest rate pass through:

Is,t-ς=ip,t-rp+ (ς-rp)/µ*(pt^+yt^-dt^)

(ς-rp)/µ*(pt^+yt^-dt^). Convenience yield increasing in velocity

Household money demand:

dt^=yt^+ pt^-(µ/(ς-rd))*(is,t-id,t-(ς-rd,t))

The credit sector:

The credit sector offers loans to the producer and households at a certain averaged rate Lr and collects deposits from households and firms at a rate id.

It is distinguished by deposits, reserve requirements, information asymmetries and banking specificities such as Non performing loans and the sensitivity of excess credit demand to non performing loans and agency costs.

The credit sector is motivated by the search for yields. It strives for profit maximization.

According to the Capital Asset Pricing Model, the Loan rate is the risky rate:

Lr= R(risk free) + β*(Risk premium)

Risk premium = (Information asymmetries + NPLs+ Credit risk)/Reserve requirements

The banking sector maximizes its profits:

Max π =Max (Cs*Lr- Agency costs - Operating costs)

The efficacy of the banking sector is measured in terms of the impact of credit production on excess credit demand

BSE= e((Cd-Cs)/LTD)

The problem is to maximize BSE = e((Cd-Cs)/LTD)

It is maximized when de/dr=0

The sensitivity e(ECD/LTD) is the expression of the impact of a supply item LTD on a demand item ECD= Cd-Cs at the economy level concerning the credit sector.

This indeed recalls the short run adjustment of aggregate demand and supply in the IS-LM model whereby AD and AS adjust to form short run equilibrium at a given price level.

Hence we can take e(ECD/LTD)=Ω*(dY/dP) where Y and P are taken from the short run IS-LM equilibrium.

The expression of the Money market equilibrium is taken from the total differentiation of M/p real money balances.

M/p=l(r) +k(y)+ (Interest received/Lr)+D+ECD

M/p=l(r) +k(y) +(interests recieved/(r+β(IA+CR+AC/RR))+D + ςOG

d(M/p) = l’dr+k’dy+(-interests received* dr)/(r+ β(IA+CR+AC/RR))2+ςdy

d(M/p)=(l’-(interests received/(r+ β(IA+CR+AC/RR))2))dr+(k’+ς)dy

dy=1/(k’+ς)*((interests received/(r+ β(IA+CR+AC/RR))2-l’)dr+d(M/p)

dy/dr=1/(k’+ς)*((interests received/(r+ β(IA+CR+AC/RR))2-l’)+d(M/p)

By chain rule we have:

dy/dr= dy/dp*dp/dr

dy/dp=dy/dr*dr/dp

dy/dp=1/(k’+ς)*((interests received/(r+ β(IA+CR+AC/RR))2-l’)dr/dp+dMdr/pdp+Mdr/p2

e(ECD/LTD)=Ω*(1/(k’+ς)*((interests received/(r+ β(IA+CR+AC/RR))2-l’)dr/dp+dMdr/pdp+Mdr/p2)

e(ECD/LTD) is maximized when de/dr =0

de/dr= Ω*((1/(k’+ς)* (interests received(2r+2 β(IA+CR+AC/RR)/ (r+ β(IA+CR+AC/RR))4*1/dp+(dM+M/p2))

-(dM+M/p2)= Ω*((1/(k’+ς)* (interests received)d(1/(r+ β(IA+CR+AC/RR))2/dr

-d(M/p) *dr/dp= Ω*((1/(k’+ς)* (interests received)d(1/(r+ β(IA+CR+AC/RR))2

de/dr=de/dy*dy/dr

de/dy=d Ωdy/dp/dy*dy/dr

Ω*((1/(k’+ς)* (interests received*(2r+2 β(IA+CR+AC/RR)/ (r+ β(IA+CR+AC/RR))4*(1/dp)+(dM+M/p2)=d(Ω)/dp* 1/(k’+ς)*((interests received/(r+ β(IA+CR+AC/RR))2-l’)+d(M/p)

We multiply both sides by (r+ β(IA+CR+AC/RR))4

Ω*((1/(k’+ς)* (interests received*(2r+2 β(IA+CR+AC/RR)* 1/dp+(r+ β(IA+CR+AC/RR))4* (dM+M/p2)= d(Ω)/dp* 1/(k’+ς)*((interests received) (r+ β(IA+CR+AC/RR))-l’)*((r+ β(IA+CR+AC/RR))2+d(M/p)*(r+ β(IA+CR+AC/RR))4)

Implicit differentiation with respect to r qnd simplification both sides leads to

2* Ω (interests received)*1/dp+= 3*d(Ω)/dp*((interests received) (r+ β(IA+CR+AC/RR)2-2*l’*(r+ β(IA+CR+AC/RR))

1=3/2*d(Ω) /Ω*(r+ β(IA+CR+AC/RR)2-l’*dp/ (Ω (interests received)) *(r+ β(IA+CR+AC/RR))

(3/2*d(Ω) /Ω)*r2+(3 d(Ω) /Ω* β(IA+CR+AC/RR)-l’dp/(Ω (interests received)))r+3 β2/2*(d(Ω) /Ω)* (IA+CR+AC/RR)2-l’*(β/ Ω) *(IA+CR+AC/RR))/ (interests received)*dp -1=0

This is second order equation whose solutions are :

R1= -b+(square root (b2-4ac))/2a

R2=-b-(square root(b2-4ac))/2a

r1= l’dp/(Ω (interests received))+(3/2*d(Ω) /Ω)* (3 β2/2*(d(Ω) /Ω)* (IA+CR+AC/RR)2-l’*(β/ Ω) *(IA+CR+AC/RR))/ (interests received)*dp -1)/ (3*d(Ω) /Ω)

r2= l’dp/(Ω (interests received)) – -4*(3/2*d(Ω) /Ω)* (3 β2/2*(d(Ω) /Ω)* (IA+CR+AC/RR)2-l’*(β/ Ω) *(IA+CR+AC/RR))/ (interests received)*dp -1)/ (3*d(Ω) /Ω)

Hence, r the risk free rate is dependent on Credit Risk, Agency Costs, Information Asymmetries, Reserve Requirements which are banking sector specificities and inflation and the propensity to speculate l’ and the proportion of credit transactions on overall transactions in the business cycle expressed by d(Ω)/dp as well as the average loan rate explicitly represented in interests received by banks.

As long as the maximization of the elasticity led to a setting of the risk free rate expressed in terms of the above mentioned determinants it follows suit that it is expressed in terms of the same items if not its maximization would have led to other determinants in the expression of the risk free rate.

Banking sector efficacy is dependent on propensity to speculate, the borrowing rate and banking sector specificities as well as inflation and the proportion of credit transactions of overall transactions in the business cycle.

Over the long run nominal rigidities end up by vanishing and there is no way for short run adjustments affordable through differentiation.

But in the long run Money Demand which is proxiable to excess credit demand in depth and variance and varies in amplitude with a certain coefficient such that Md= µ*ECD is stable and also ECD=Cd-Cs and Cs proportional to profitability of banks because of monopolistic competition that exerts a demand pull of prices of loans by credit demand more substantial that the cost push of Cs by banks as long as Cs is independent of output growth because it follows banking profitability through a search for yield motivation that steps aside affordability of credit following the law of demand and prioritizes profitability such that at the end

ECD is proportional to Md.

It is therefore not affected by output growth but by business cycle effects that exert transitory effects but remain overlapping each business cycle sothat over the long run it depends on e(Cs/OG) and e(Cd/OG).

It depends also on inflation as for the case of an economy whose growth prospects end up with an upward inflationary pressure inflation remains prevailing as a consequence of economic performance.

Over the long run diversification of asset portfolios make banks step aside he bank specific factors especially if it has achieved a learning effect through assimilation of the essentials of agency costs information asymmetries credit risk and loan non performance because of the experience effect about borrowers.

Monetary policy is not efficacious over the long run because of imperfect competition that hinders the transmission of interest based monetary policy as the interest pass through is disconnected from affecting the loan rate and credit supply and afterwards ECD and the e(ECD/LTD) because of the competition that is imperfectly competitive with regard to the monopolistic competition structure of the credit market.

3. Unconventional Monetary Policy and Its Relevance in Case of Credit Supply Inelasticity

In view of the inability of monetary policy to stimulate credit supply to make it adhere to credit demand expansions, there is a pervasive ineffectiveness of monetary policy in affecting banking sector efficacy although banking sector efficacy has been proven to be sensitive to many factors as has been shown earlier in the literature review and virtual economy analysis.

Nominal rigidities, the market structure of the banking sector and credit supply inelasticity to the business cycle call the urge to consider implementing an unconventional monetary policy aimed at recalibrating banking sector assessment and valuation of assets such as collaterals in order to stimulate credit allocation and credit supply and to improve banking sector efficacy so that local investment can flourish.

As far as this issue is concerned Credit easing is seemingly an effective instrument to be deployable for the sake of stimulating credit supply. But it remains that the choice of the monetary policy objective is tributary on the respect of the conventional objectives of output and price stability the ability of the central bank to proceed freely to the discretionary monetary policy or in other words to time the intervention and the withdrawal which is indeed not guaranteed by unconventional monetary policy.

And this is the reason why those type of policies are largely contested although effectual punctually.

3.1. Unconventional Monetary Policy

The instruments of unconventional monetary policy are; forward guidance, Asset purchases, Term funding facilities, adjustment to market operations and negative interest rates.

When the interest rate transmission mechanism is ineffective or in other words empirically insignificant in the regression of the objective aggregate or when the credit transmission mechanism is obstructed such as in the case of an inelastic credit supply due to an excessive search for yield motivation and an excessive aversion to risk from bankers that inhibits the risk taking channel, monetary authorities resort to unconventional measures through open market operations.

Unconventional measures take the form of quantitative easing or credit easing.

In normal times the central bank is neither involved in direct lending to the private sector or the government nor in outright purchases of government bonds, corporate debt or other forms of debt instruments.

By steering the level of the key interest rate, the central bank effectively manages the liquidity in money markets and pursues its primary objective of maintaining price stability on the medium term.

When the transmission channel of conventional monetary policy is severely unpaired conventional monetary policy measures are largely ineffective.

Unconventional monetary policies may range from providing additional central bank liquidity to directly targeting liquidity shortages and credit spreads in certain market segments.

But central banks should be wary of the possible side effects of adopting such policies and in particular of any impact on the financial soundness of the central bank’s balance sheet and of preventing a return to a normal market functioning.

The straightforward method for the central bank to directly purchase assets in the relevant market typically government bonds is called quantitative easing.

The second policy is to affect the risk spread across assets between those whose markets are particularly unpaired and those whose markets anre more functioning. Such a policy would be usually referred to as credit easing.

The two types of policies affect directly central bank balance sheet.

Credit easing can generally be conducted at above zero levels of short term nominal interest rates while quantitative easing should make more sens only when rates are equal to zero.

Credit easing is a policy that directly addresses liquidity shortages and spreads in certain wholesale market segments through the purchase of commercial paper and asset backed securities.

If the aim is to ensure that new loans are provided to the private sector central banks mainly purchase bonds from banks.

The additional liquidity would then be used by the banks to extend new credit. However, banks may choose to hold the liquidity received in exchange for the bonds at the central bank as a buffer.

Unconventional monetary policies address the issues of disruptive behavior in the credit market which is for our case of study inelastic credit supply which is due to an excessive search for yield motivation and reticence to bear risk by the banking sector besides the structural disruptions of nominal rigidities and imperfect competition.

They are assumed to force flexibilities where the credit market fails to operate accurately through replacing unconventionally certain market tails and operations like lending from the banking sector or purchasing of assets which is aimed at modifying asset prices and hence the nominal value of collaterals thereby modifying the process of decision making in terms of lending by the credit sector or eventually filling the gap of credit supply insufficiencies and disruption by the central bank for the sake of reinvigorating eventually the adequate effect of transmission of monetary policy.

The most renown unconventional monetary policies are negative interest rate policies Lending operations, Asset purchases programmes and forward guidance.

Among them credit easing revolves around lending operations and asset purchases

According to Philip Lowe (2019) from the bank of international settlements, “Lending operations aim at bypassing impairments that are prevailing in the credit allocation process. They consist in expanding central bank liquidity facilities. They aim at providing stimulus when interest rates are constrained. Intervention include extending the maturity of the typical lending operations expanding the set of eligible collateral and the set of counterparties, changing the lending terms (ex fixed rates full allotment) and imposing explicit conditions on loans to ensure the desired ultimate outcome”.

Lending operations thereby ensure an adequate credit flowing to the private sector and help stabilize market expectations.

According to him also, “The richness of lending operations is matched by the variety of Asset purchase programmers’ that account for large increases in central banks’ balance sheets and aim mainly at lowering long term yields and thus easing broad financial conditions. They support asset valuations affected by fire sales or provide additional funds to ultimate borrowers by incentivizing the securitization of loans”.

Concerns representing major drawbacks of unconventional monetary policy instruments are the weakening of central bank balance sheets, excessive suppression of risk premiums in asset valuations, temporary scarcity effects in repo markets and spillovers in the form of boosting commodity prices and private sector leverage in emerging market economies.

3.2. Relevance of Credit Easing in Case of Credit Market Disruptions

In view of credit demand dependencies to money demand and the fact that money demand is elastic to the business cycle, the inelasticity of credit supply to the business cycle raises the issue of a wedge between credit demand and credit supply along business cycles with an elastic credit demand and an inelastic credit supply that materialize the credit sector disruptions inhibiting the transmission mechanism of monetary policy through the interest rate channel.

In fact credit supply inelasticity is due to the risk profile pf a certain segment of assets that are deemed to be very risky compared with the tolerance of the bank.

This tolerance depends on many factors such as risk notation for the specific bank and prudential regulation for the entire credit sector.

The solution for this issue when credit production is insufficient to fuel enough credit to excess credit demand and stimulate local investment is to adopt credit easing through targeting segments with high risk profile of assets and affecting risk spreads so that the bank expands credit to this segment.

This occurs by making the central bank purchase collaterals for these risky assets in order to modify the valuation of the assets.

As their prices for the segment push up their valuation improves and get attractive for the bank to purchase or in other words to accept as collateral for the credit to this segment.

The stimulation of credit supply and its availability to respond to excess credit demand aimes at stimulating local investment for the sake of stimulating supply side economic growth and further contributing thereby to serve the main objective of monetary policy namely enhancing price stability through control of inflation induced by stimulation of economic activity and production.

Hence the study of the effectiveness of monetary policy is in interaction with banking sector efficacy. As a matter of fact monetary policy effectiveness is assumed through its transmission mechanisms to affect credit demand and supply provided distortions do not compromise otherwise this channel of credit supply and credit demand manipulation for the sake of diminishing excess credit demand.

And in reciprocal banking sector efficacy is assumed to affect the credit channel of transmission of monetary policy whose focus and final objective is about price stability.

Hence the proposal of unconventional monetary policy bridges the gap that results from the distortions and compromise both monetary policy efficacy and banking sector efficacy.

Despite its shortcomings and the challenge it presents in terms of central banking control of instruments unconventional monetary policy is the key solution and way out of the hindrance of the vicious character of the banking sector excessive search for yield and excess sensitivity to systemic risk that presents somehow a hindrance to the well functioning of the economy and the pursuing of monetary policy main objective of price stability.

4. Research Methodology

4.1. Descriptive Statistics

Relationship of the issue with financial stability:

Financial efficacy is inversely proportional to financial stability.

As a matter of fact, financial efficacy is assessed in terms of financial intermediaries' commitments to honor investors or borrowers needs in other words how far credit supply reaches credit demand which undoubtedly commits risk exposure excessively as credit demand exacerbates systemic risk. So as financial efficacy improves the gap between credit demand and credit supply tightens. As credit demand is exogenous credit supply is expected to increase further endangering financial intermediaries’ exposure. Financial stability is assessed in terms of mitigation of systemic exposure or avoidance of riskiest assets as financing of risky investment opportunities which limits the extent to which credit supply meets credit demand. So as financial stability improves banks fail to meet credit demand and financial efficacy worsens.

Figure 1.

Descriptive statistics of banking system efficacy as expressed by e(ECD/LTD).

Figure 1.

Descriptive statistics of banking system efficacy as expressed by e(ECD/LTD).

4.2. Justification of the Positive Autocorrelation of Banking System Efficacy

When banking system efficacy is deteriorated in other words e(ECD/LTD) increases credit risk decreases due to the fact that as long as the difference between credit demand and credit supply increases implies resilience from excess credit risk exposure as credit demand which is not satisfied is usually the riskiest.

As credit risk exposure decreases the effect on profitability is a potential decline as the bank realizes more risk leads to more risk premiums and hence more profitability.

The search for yield results in an Impulse to increase profitability through an increase in credit supply.

But as the bank is aware additional credit supply corresponds to highly risky assets the risk notation will increase and the repercussions on risk premiums will increase commensurately.

The additional credit to be allocated would be very expensive.

Either extra credit demanders will accept to borrow at this expensive rate or will refuse to borrow.

The bank knows already that borrowers that are insensitive to sharp increases in borrowing rates are those that will subject it to an excessive risk of non performing loans as those borrowers that borrow at any rates have projects with high expectations of earning and high probability of failure and by a way of consequence will not care about financial management issues of likelihood of repaying the debt.

The bank will by a way of consequence make prevail the threat of the NPL on the expected extra earning from the increase in borrowing rate.

Indeed in banking the threat from NPL outweighs the search for yield.

Hence it will refuse to finance the extra debt. But as long borrowing rates have already increased incrementally one part of New outstanding debt demanded will be rejected for the same reason and therefore excess credit demand will increase and the banking system efficacy will further deteriorates.

The same reasoning holds the other way round.

When banking system efficacy improves excess credit demand decreases hence credit risk exposure increases.

The bank realizes it is making enough earnings from risk premiums and should be aware of prudential restrictions and penalties.

It will slow down credit supply and incur less risk

Therefore risk premiums and risk notation will decrease.

But as risk premiums and risk notation decrease credit demand will increase sharply.

At the prevailing new credit conditions the additional credit demander will show rationality by engaging in credit demand for reasonable credit conditions a favorable borrowing rate.

Hence the bank will realize the risk of NPL has declined and will accept to lend motivated by the search for yield therefore excess credit demand will decline and the banking system efficacy will improve further more.

In the short run Lowering MMR will relax profitability margin. In reaction, banks can reduce the loan rate for a given risk exposure.

More credit demand would be satisfied.

This is the pass through effect whose pertinence is depending on the market structure and the setting of profit maximization of the industry.

The market structure of the banking sector which is monopolistic competition will offset the beneficial effect of the MMR shock on excess credit demand and hence banking sector effectiveness.

Short run MMR vary over time and hence are not of high pertinence for monopolistic competition that equate average cost to average revenue.

Hence costs such as credit risk and non performing loans are more effective on criteria taken into consideration by monopolistic competition output decision rather than items that affect marginal costs such as MMR in the short run.

Therefore monetary policy does not affect inasmuch banking sector response to credit demand in the short run as items tributary on banking sector specificities such as credit risk and non performing loans and which are not discretionnary.

The policy maker cannot alter the probability of non performing of loans or the projects characteristics in terms of risks.

Therefore banking sector efficacy depends in the short run on banking sector specificities and not on monetary policy conducting because the monopolistic competition profit maximization equates average cost to average revenue.

But over the long run monopolistic competition is like perfect competition.

Monetary policy conducting pass through affects marginal costs of high pertinence for monopolistic competition that equate marginal cost to marginal revenue over the long run.

At the same time credit risk and non performing loans are smoothened out and do no longer affect the equation of marginal costs to marginal revenue.

Hence over the long run it is monetary policy conducting that affects banking sector efficacy not banking sector specificities.

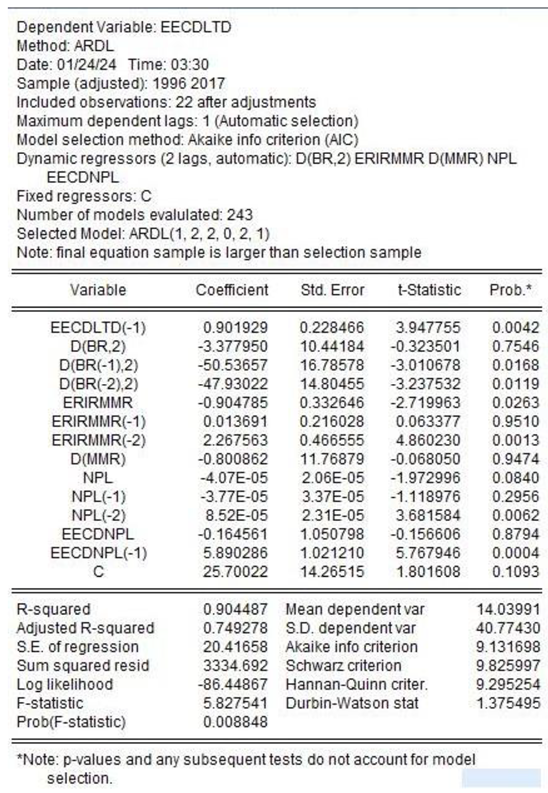

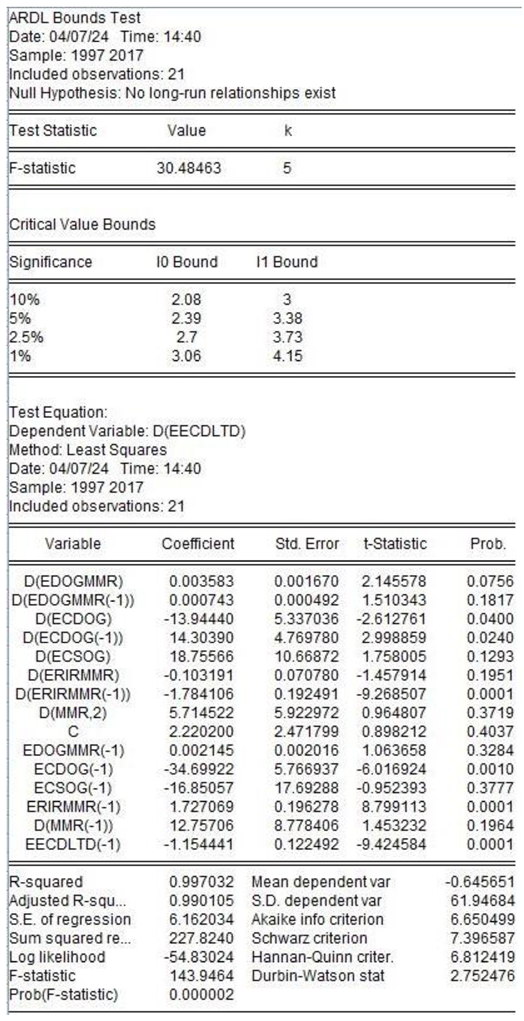

This is corroborated by bound tests for long run relationship that show that besides the prevalence of more likely prevalence of long run relationships for the case of monetary policy determinants, it shows that the long run equation is not likely for banking sector specificities and is not in accordance with theoretical predilections of existence of autocorrelation of banking sector efficacy besides the fact that the F statistic is very close to the upper bound which shows that is it not very certain that there are long run relationships.

Whereas the empirical finding of the long run equation of banking sector efficacy with monetary policy determinants is in accordance with theoretical predilections of existence of autocorrelation of banking sector efficacy besides a clear high F statistics that validates the existence of long run relationships.

Bank specific factors affecting banking effectiveness are supposed to describe how issues pertaining to banking affect a specific feature.

They vary from issue to issue.

They might be banking size, liquidity, capital adequacy, quality of management, quality of assets.

The financial accelerator and the role of banking sector in stimulating the macroeconomic situation or what we would call the super-multiplier which are effects that work contrariwise are more pertaining to the economy than to the banking sector but might be attribuable to the banking sector as specific features because they describe how the credit sector handles transmission through propagation issues that end up draining contagion from the real sector to the financial sector or the other way round.

Still the attribute of bank specific factors remains pertaining to the issue at hand if it is financial stability banking sector effectiveness profitability or any other issue

4.3. Estimation Methodology

Two seminal contributions in this regard are Pesharan and Shin (1998) and Pesharan Shin and Smith (2001).

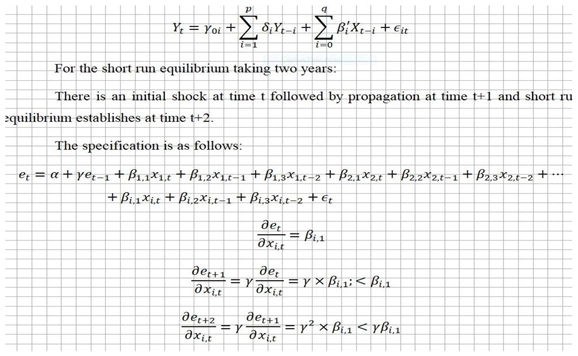

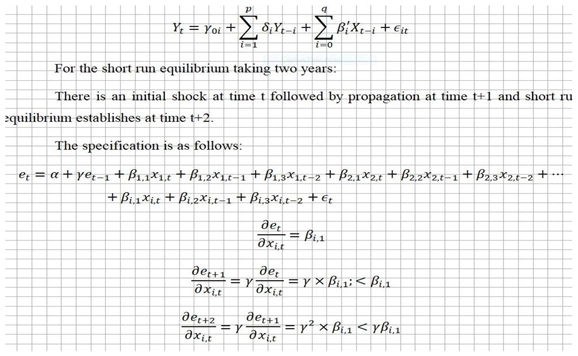

The adopted specification for ARDL autoregressive dynamic lags modeling:

We consider the case of one lag for the explained variable and two lags for the explanatory variables.

For the short run equilibrium taking two years:

There is an initial shock at time t followed by propagation at time t+1 and short run equilibrium establishes at time t+2.

The long run methodology is Bound testing