Preface

This article is the second in a series of articles entitled “Economic Dynamics and Standard Models”. Whenever “previous article” is mentioned in this article, it refers to the first article in this series, “Content, Method and Significance of Economic Dynamics”, see reference [

27]. The standard model of economic dynamics includes market dynamics, sub-economic dynamics, economic externality dynamics, and ordinary rationality mechanism. This article focuses on market dynamics. Quantum electrodynamics is recognized as the most mature part of the standard theoretical physics model; market dynamics uses it as a theoretical reference framework for its conceptualization and modeling. This article is divided into seven sections, with the following content titles:

1.Market Hesitation Theory

1.1 Market charge and price, supply, and demand

1.2 Hesitation and Dirac spinors

1.3 Money cone price shell, virtual and real fluctuation.

1.4 Feynman diagrams and interactions

1.5 Cognitive field and decision making

1.6 Price function and selection function

2. Searching the Invisible Hand

2.1 Beliefs and dogmas of market mechanisms

2.2 The quantum version of the invisible hand

3. Price field theory

3.1 The nature of price

3.2 Price fields and classical electrodynamics

3.3 Summary

4. Higher-order cognition and market fluctuations.

4.1 Cognitive magnetism and curl

4.2 Cognitive Field and Samuelson’s Misconception

4.3 Game theory and classical fluctuations

4.4 Decision theory and mesoscopic (semiclassical) fluctuations;

4.5 Reasoning and market quantum fluctuations

4.6 Summary

5. Market wave function with gauge transformation.

5.1 Wave Function Operator and phase space

5.2 Market wave functions and gauge structures

5.3 Gauge symmetry and gauge transformation

5.4 Gauge principle

6. Market Operator phases and phase transitions.

6.1 Newtonian mean value operator state

6.2 Schrödinger evolution operator state

6.3 Einstein's cone operator state

6.4 Dirac field theoretic operator state

6.5 Market Operator phases and phase transitions.

7. General Discussion.

1. Hesitation Theory

Life is full of hesitation; whether it is economic language or daily language, the market is the same. The phenomenon of hesitation carries and bears the largest scale of energy in the market. This is true for both the market as a whole and the market participants. In the language of dynamics, the market potential is like this, and the market kinetic energy is even more so. Fluctuations are natural hesitations. In physics, there is no quantum fluctuation, so why do we need quantum mechanics? Moreover, the closer to the critical point, the more intense the fluctuations. In marketing, the closer to psychology's inherent price, the more hesitation there is. Hesitation is a cautious attitude, a responsible performance, and a great common rationality. If you carefully replay your consumption experience and experience it again without disguising it, what consumes the most energy? It is not driving to the shopping mall or queuing to pay, but hesitation in the face of prices. The energy consumed by each market participant is accommodated in the market, so that hesitation evolves into a natural market nature. Machines search, but humans make choices. Resources are scarce, and facing costs directly, how can people not hesitate? This section discusses some basic concepts shared between market dynamics and quantum electrodynamics from the perspective of hesitation theory.

1.1. Market Charge and Price, Supply and Demand

Market dynamics is an analysis of active dynamics, and the source of this dynamic is market load. The question is, how does this market load appear? To clarify this issue, it is necessary to give appropriate definitions of the two basic economic concepts of demand and supply and write them as follows:

Definition 1. An arbitrary given demand, denoted as D, is a binary tuple:

D = [intention to buy, a certain product].

Definition 2. An arbitrary given supply, denoted as S, is a binary tuple:

S = [intention to sell, a certain product].

In the above two definitions, the expression "an arbitrary given" is a common usage in mathematics, which can refer to the existential quantifier in logic, or to the universal quantifier with the enumerate (each) usage or to the collective (every) usage. All the exchange intentions carry market charge. No matter it is summer or winter, you go to the supermarket to buy groceries and daily necessities; or even drive to a shopping mall farther away to buy electrical appliances, which consumes time and energy. You do this regardless of the weather because you have a need and an intention to buy, which is the mental charge (you are charged.) This charge is called market charge. The same is true for potential buyers and sellers. On a smaller scale, you can go out early in the morning to set up a pancake stand and sell soy milk for breakfast; or open a small shop or a mall restaurant on the street, working hard from morning till night, what do you gain? You have the intention to sell, and you are full of energy. If you have enough money to support your family and lead a comfortable life, or you have the knowledge of getting rich through hard work and the awareness of market exchange, then you have the market value. In a broader sense, if you have the capital to open a store, do international trade, and spend a lot of money on advertising, then you also have the market value. To put it simply, market charge is what people often call business philosophy. To say that someone is full of business philosophy and always thinking about money means that he is sensitive to prices. In the sense of marketing, it is not shameful to satisfy the exchange psychology.

Note that demand in the market sense is different from the "wanting impulse". The former is completely price-sensitive and carries an integer market charge, whereas the latter is not completely price-sensitive and only carries a partial (fractional) market charge. In physics terms, the former speaks at the atomic level, which we will soon see below, while the latter speaks at the subatomic level, which we will elaborate on in another article when introducing sub-economic dynamics [

29]. For instance, a child returns home and informs his parents that a classmate has recently transitioned to a new mobile phone, citing its superior features, and expressing his own desire for one. The adult replies, "Child, do you know how expensive that new mobile phone is? Our family's economic conditions cannot be compared with theirs, so we'll think about it later." This is a kind of difference from economic perspectives. The children express their desires and impulses at the sub-economic level and have a vague perception of prices, like a quark, which carries a fractional market charge (electrical charge). Adults, on the other hand, consider issues at the market level, meaning that the right price is completely sensitive and carries integer market charge.

A more typical example is the labor market. A job seeker is interested in an employer, and the employer is also interested in the seeker. The two parties further contact, submit and review application materials, and have interviews and exchanges. These are all interactions at the sub-economic level. However, when the two parties enter the stage of negotiating salary and benefits, each party becomes completely sensitive to labor prices. Job seekers will clearly bid for the labor they are ready to sell, becoming a market supply, and employers will also clearly bid for the labor they are ready to buy. Inquiries for purchasing this person's labor (what are your expectations for salary and benefits?), become a market demand. In other words, both parties’ buying and selling intentions carry market charges.

Market charge can be positive or negative. We agree that the market charge of a demand is negative, denoted by ; on the other hand, the market charge of a supply is positive, denoted by . Using quantum electrodynamics as the reference framework of modeling, the market charges, demand and supply, are represented by electric charges, namely, electrons and positrons respectively. Speaking in particle language, positron is the antiparticle of electron. By the concept of market dynamics, demand is a unit in the commodity item. Under the same conditions, supply is the inverse of demand, i.e., the anti-unit. The concept of unit is not unfamiliar in neoclassical economics. For example, marginal benefit refers to the benefit obtained by investing one more unit of resources.

As previously mentioned, market dynamics can introduce the three basic concepts of microeconomics—demand, supply, and price—by definition. All three must make an economic and ontological commitment to market charge. However, the existence of market charge is not introduced by definition but rather proposed by experience and observation, and by the exchange characteristic phase in psychological life [

25]. Hence, as the first principle, we have:

Principle 1. Market charge is the source of market dynamic analysis. It is a scientific hypothesis derived from experience and observation that has the status of a first principle. It is the ontological reality that market dynamics must commit to. It also necessitates the logical consistency of fundamental elements of market dynamics, such as supply, demand and price.

1.2. Hesitation and Dirac Spinor

As introduced in the preamble of the paper [

18,

27], the hesitation principle is one of the eight principles of ordinary rationality. Since consumers have limited resources, even if there is demand, they will naturally be sensitive to prices. The market change will inevitably cause hesitation

. This creates an internal demand space. Quantum electrodynamics is a single-charge dynamic system that only promises one kind of charge, namely electric charge. Correspondingly, market dynamics is also a single-charge dynamic system that only promises one kind of charge, namely market charge. Therefore, the internal space of demand or supply is one-dimensional. Hesitation causes this one-dimensional internal space to rotate. Hesitation can be strong or weak and can have a fast or slow frequency, which creates the momentum of rotation. In quantum field theory, a particle's spin is defined by the momentum of its internal space rotation. Considering spin from another perspective, a particle with spin -1/2, such as an electron, is considered to have two basic spin directions, called spin up and spin down. It can be said that the spin number is the reciprocal of the number of basic spin directions. In market dynamics, demand or supply also has two basic spin directions: buy and don't buy or selling and not selling, also known as spin-up and spin-down.

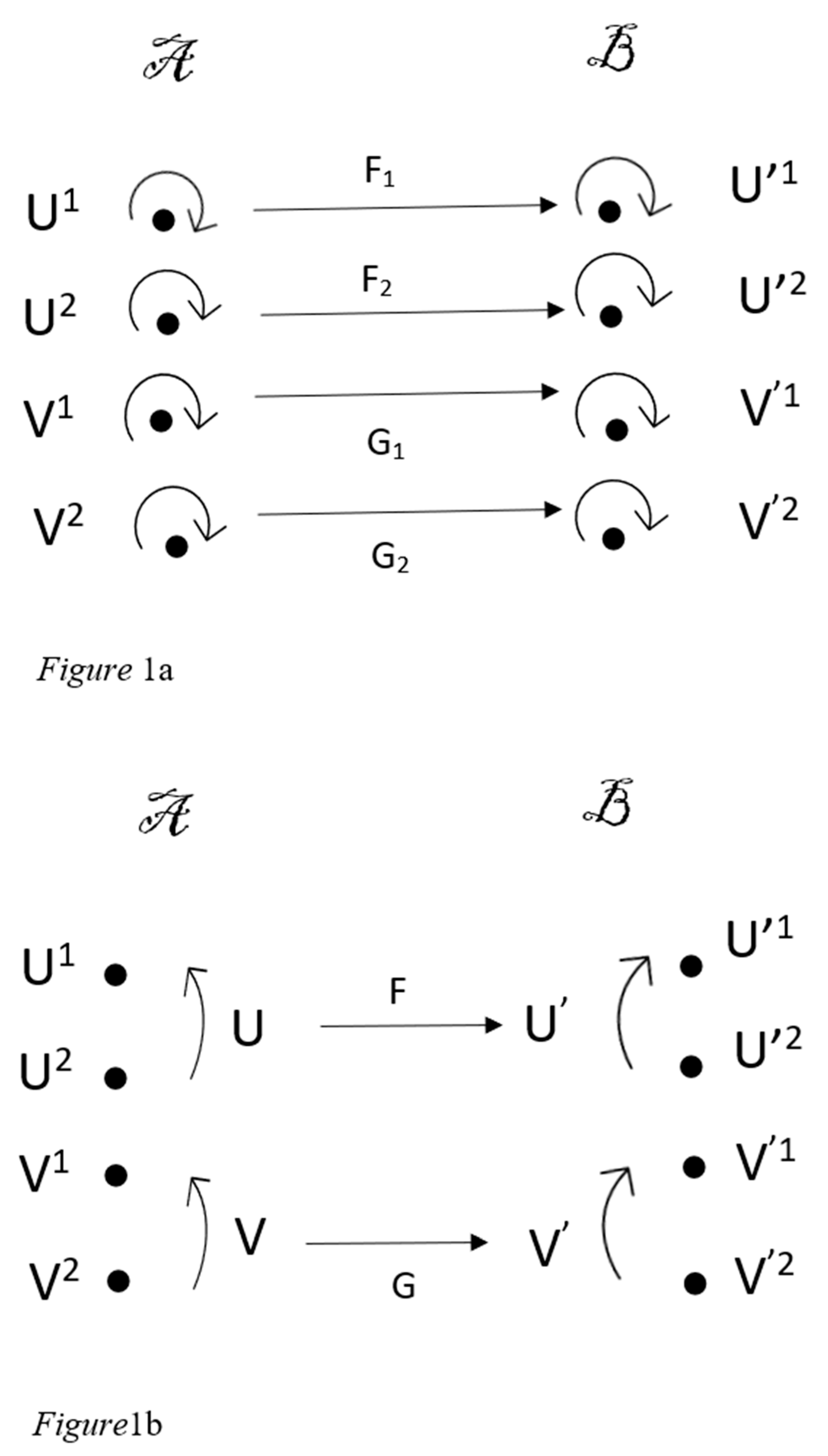

Just as hesitation is a psychological phenomenon that is challenging to directly observe, the particle spin also has observable effects but is not directly observable. There are many, or even continuous, intermediate states between the two basic spin directions. These intermediate states are considered to be superposition states of the two basic spin directions. In quantum physics, spin is an intrinsic property of particles and has no corresponding state in Newtonian mechanics. It is not difficult to see that the sum of spin up and spin down is zero, which is unreasonable and violates the law of conservation of energy. Therefore, spin does not satisfy the addition law, but only the superposition law. Now, consider a structure that only involves a pair of particles, their antiparticles, and their two basic spin directions, which we refer to as spin-1/2. This structure can be characterized by the Dirac spinor, which is written as follows:

There are some conceptual details here. From the first column of the definition above, we can see that

in quantum mechanics, represents a wave function, which we will discuss in detail later. As can be seen from the second column, in quantum field theory, Dirac spinors are processed as a field and characterize spin 1/2 particles. A spinor represents a field, called a spinor field. Finally, from the third column we can see that a field is considered as an operator. It is called second quantization. Since it is an operator, it highlights the category structure applied to different domains. We will see further that Quantum Electrodynamics and Market Dynamics share such a structure. The structure is so perfect that people can't help but applaud, and they are so tight such that they are twins. Now, take a small fragment of each of the two as described above, and apply the Dirac spinor operator to make the following simple category theory description.

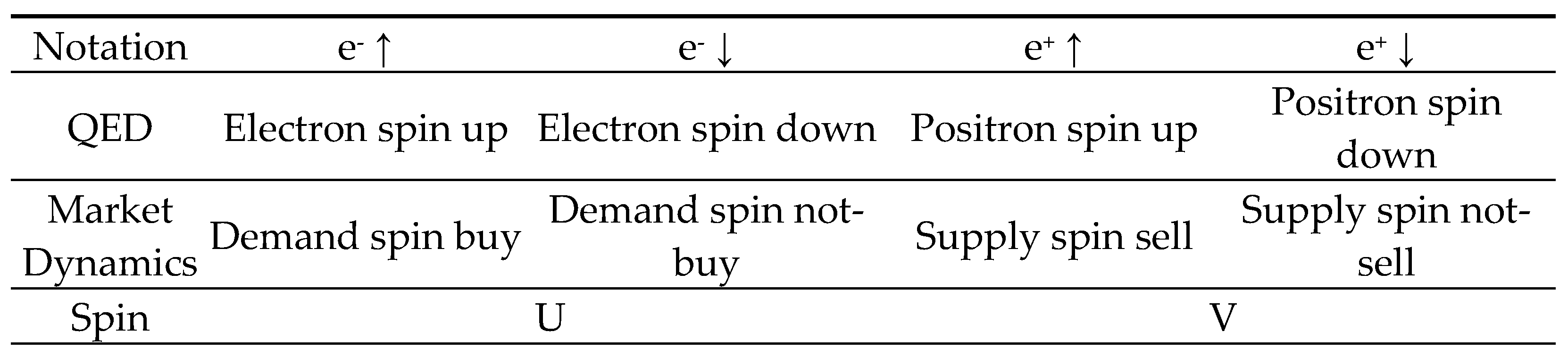

Here, category theory expresses a mathematical structure. But neither quantum electrodynamics nor market dynamics are pure mathematics. A mathematical structure, including the Dirac spinor operator, should have a semantic interpretation in the context in which it is applied. Therefore, it is necessary to give out the following semantic graph:

We observed that

Figure 2 essentially embodies the meaning of

Figure 1 within this particular context. Note that particle nature is a basic concept in physics. Electrons and positrons are both elementary particles. This is common sense. In economics and even in the social sciences, there is no concept of particles. This is also common sense. So, to apply the concept system of physics to the social sciences, the symbols can be retained and shared, but the concepts must not only correspond but also be natural. For instance, introducing the concept of particles into the social sciences may not only seem rigid, but also lead to challenges in academic and cultural acceptance. For this reason, we agree to use quantum electrodynamics as the conceptual framework and units in market dynamics conceptualization. The concept replaces the particle concept. Next, we have:

Proposition 1 states that a demand is a spin-1/2 market unit. A supply is also known as a spin-1/2 market unit. In a pair of demand and supply. When two products are identical, we refer to supply as the inverse unit of demand.

The unit concept is familiar to economics and is used naturally. For example, in economics literature, marginal benefit is defined as the benefit obtained from investing one more unit of resources.

1.3. Money Cone Price Shell, Virtual and Real Fluctuation

In this section, we discuss the interaction between demand and supply. In quantum electrodynamics, the interaction between electrons and positrons is carried out through photons. In market dynamics, prices are characterized by photons. In other words, the interaction between demand and supply is carried out through prices. The complexity lies in that, in addition to photons, there are also virtual photons (virtual photon) It also plays a pivotal role in the interaction between electrons and positrons. That is to say, we need to introduce the concept of virtual pricing accordingly. It can be considered that the hesitation of the market can be understood as the fluctuation of the market. The market's fluctuation is divided into two types: classical fluctuation and quantum fluctuation. The price disturbance market causes classical fluctuation, while the virtual price causes the quantum fluctuation of the market. We can distinguish photons from virtual photons using a concept known as the mass shell. Naturally, the concept of a mass shell pertains to the mass of particles. It is inevitable that the most difficult concept to deal with when applying physical models in the social sciences is mass. Here are two points that need to be explained:

First, the mass problem actually involves a long-standing debate in physics, namely the history of mass. In his book [

16], The Lightness of Being, Wilczak specifically discussed the unity of mass, ether, and force. Newtonian mechanics, according to Wilczak, presupposes a zeroth law, which states that mass neither generates nor annihilates. Mass has always been there and will always be there. Of course, Wilczak replaced the concept of ether with the concept of field. Wilczak questioned this Newtonian presupposition. He believed that the concept of energy was more fundamental than the concept of mass, which was a revision of Einstein's mass-energy conversion formula,

, an interpretation of the concept. In quantum physics, the creation and annihilation operators that govern particles are introduced. Therefore, even particles themselves have creation and annihilation, let alone their mass.

Second, the language of gauge field theory, including quantum electrodynamics, describes the standard model of particle physics. There is no mass term in the Lagrange density function in the standard model; that is, all gauge particles are massless, which is a matter of course for gauge symmetry. This is also the reason why the standard model was ignored by many theoretical physicists for quite some time. Later, the Higgs mechanism was proposed, which enabled gauge particles to acquire mass, called spontaneous symmetry breaking. These will be introduced later when discussing ordinary rational mechanisms. There, we will find that mass is also the easiest concept to define in the social sciences.

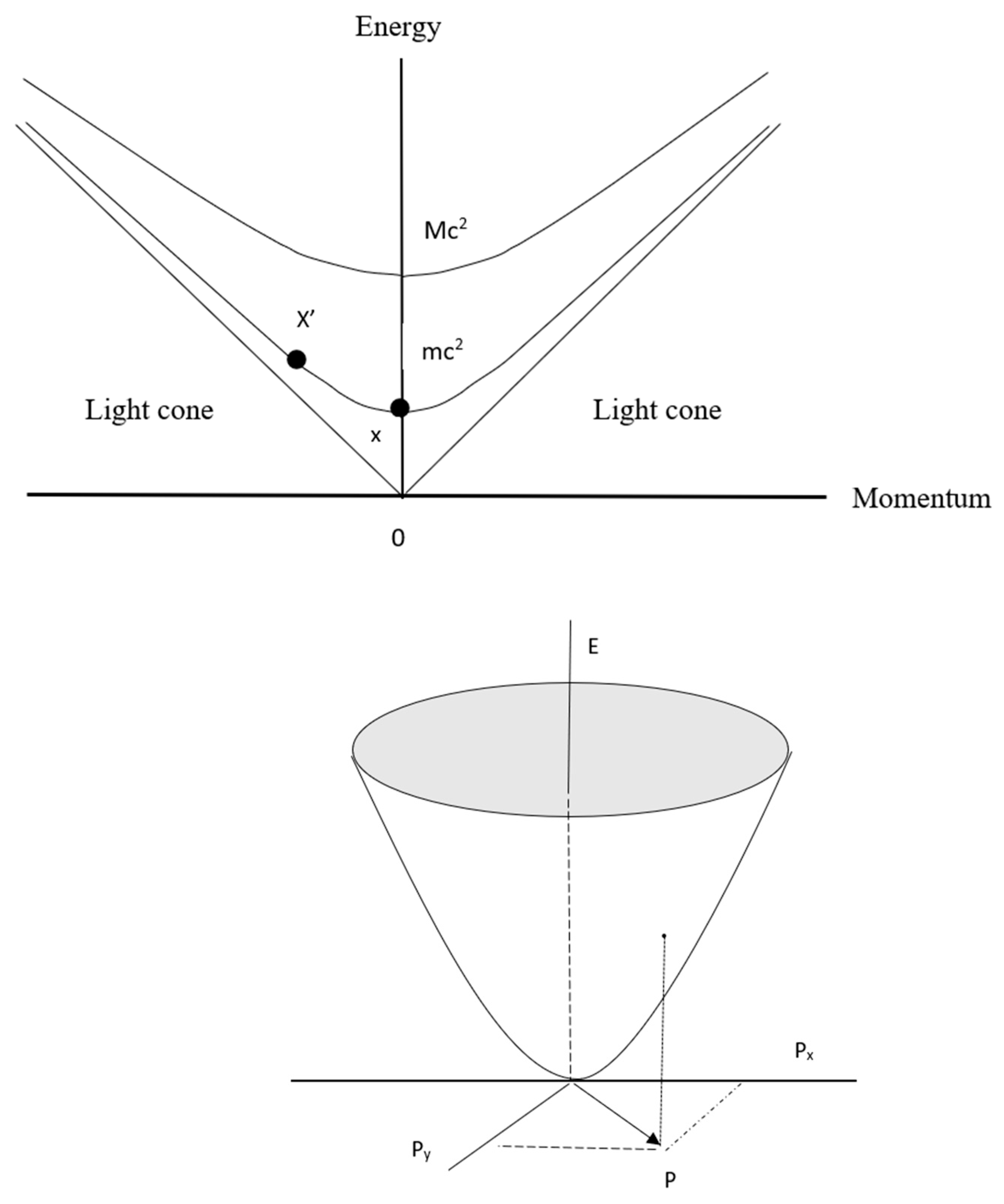

Now let’s first introduce the concept of mass shell and then construct the price in market dynamics. The following figure is a schematic diagram of a mass shell.

Figure 3.

Schematic diagram of four-dimensional momentum and mass-shell hyperbolic surface.

Figure 3.

Schematic diagram of four-dimensional momentum and mass-shell hyperbolic surface.

This diagram involves understanding three things. First, Einstein's formula, for converting mass to energy. The left side of this formula is the energy term, and the right side is the momentum term. Recall that momentum is the product of mass and velocity. The horizontal axis represents the momentum axis, and the vertical axis represents the energy axis, which is the geometric intuition of the mass-energy conversion formula. Second, static photons have no mass, that is, their momentum is zero; therefore, the inverted triangular cone formed by the straight lines in the figure is the light cone introduced earlier, which represents the scattering of photons, and its vertex is connected to the momentum axis. For particles with mass, the greater the mass, the higher the starting position on the energy axis, and the geometric intuition of its scattering is in the shape of a shell, called a mass shell. We note that the mass shell is contained in the light cone, so it represents time-like events. A photon is both in the cone and in the shell, and is called an in-shell particle. A quasi-photon is in the cone but not in the shell, and represents an out-of-shell particle, called a virtual photon. This is a preparation for introducing the concept of virtual price. We also note that for any given mass, a different mass shell is formed in the light cone. The area between the mass shell and the light cone is the home of virtual photons.

In the previous article, we introduced the special relativity model of money (referred to as money). We'll briefly describe it here for the convenience of readers. The mathematical background of special relativity is the four-dimensional Minkowski space, whose metric is agreed to be one positive and three negatives, that is,

Each point in this space is called an event. The proximity of events is called the micro-displacement of events, which is defined by the concept of interval and is given again as follows

The first term on the right side of this formula is positive, which is the speed of light multiplied by the square of the time micro-displacement and is generally regarded as an energy term. The other three terms are negative, namely the space terms (spatial terms). When a light source is excited, it scatters into a cone and diffuses upward and downward, which is called a light cone. We refer to the events within the cone, whose interval exceeds zero, as time-like events; we call the events on the cone surface, whose interval equals zero, as null events; and we call the events outside the cone, with intervals less than zero, as space-like events. The line (straight or curved) that passes through the vertex and crosses the upper and lower cones is called a world line, reflecting local causal relationships. This is Einstein's signature philosophical proposition of the special theory of relativity.

As mentioned above, there is an important concept in the special theory of relativity, called proper time (also known as clock time), which is denoted as

, where the subscript

indicates that the proper time varies from clock to clock, that is, it varies with the running speed of the clock carrier, and can be traversed across all clock carriers. Dividing each term in the interval definition formula by the proper time, the four-dimensional momentum is defined,

Certainly, this momentum is related to the subscript i. It is the four-momentum. Here, we can make an interesting and instructive comparison. On the left side of Einstein's mass-energy relation is the energy term, and on the right side is the momentum term, which is in the form of . The first term on the right side of the momentum formula above, that is, the energy term, is in the form of. It is not difficult to see that on fixing the position of replaces the position of m. The physical meaning of this interchangeability is for physicists to explain (different interpretations may be given). But at least it gives us a hint that mass is related to the ratio of absolute time to proper time. This coordinate is crucial for further discussion. In market dynamics, this observation can be expressed as a proposition:

Proposition 2. Let P be the absolute market price. For any given market participant is the proper cost, , where is called the relativistic market mass and C is a running constant of money.

Next, combining the theoretical preparatory analysis on the nature of money in the previous article [

27] and the new clues about the mass shell and virtual photons provided in this article, we will now reveal the emergence of the market dynamics. We aim to explain how prices disrupt the market and fluctuate with demand and supply. The market's hesitant character and behavior reflect the interaction between these three factors

.

Absolute time represents the absolute market price, forming a money cone (i.e., analogous of light cone), while intrinsic time represents the intrinsic cost that varies with market participants, forming a momentum cone (poor cone, rich cone) that varies with the amount of capital. Each layer of the intrinsic price shell forms within the money cone. We know that the poorer the individual, the higher the corresponding proper cost (and vice versa), and the smaller the ratio of the absolute market price to the individual proper price. In the previous article, this ratio was referred to as the buying impulse and selling impulse. We can use the mass as a substitute in the mass shell diagram, but the appropriateness of this substitution remains a matter for further study. The gray area between the inherent price shell and the money cone is the fluctuation space of the virtual price outside the shell. The price inside the shell is called the in-shell price. The disturbance of the in-shell price on the market causes classical fluctuations (hesitation), and the disturbance of the virtual price outside the shell on the market causes quantum fluctuations. Quantum fluctuations are limited by Heisenberg's uncertainty principle. Physics tells us that the closer to the price shell, the more turbulent the market fluctuation caused by the virtual price, which is consistent with our market experience.

An example may help to understand the logic in the previous paragraph. Suppose you have $1000. The usual expenses for half a month are $800. When you go to the market to buy vegetables, the price difference is a few cents, a few dimes, or even a few dollars. These can be regarded as shell prices. Although there may be a slight hesitation in your mind, it is just that—a hesitation. The fluctuation is very classic. Suppose your computer has a problem and you want to buy a new one; however, the price of the new computer you like is $600. It feels too expensive. This is the shell price, or virtual price. Although it is affordable, how can you cover your expenses if you buy it? At this time, the hesitation is much deeper and difficult to observe directly. We refer to this as quantum fluctuation. At first, you were considering it, but then the price scared you. The next day, however, the price of the new computer suddenly dropped, approaching your original price range, and your mind became uncertain, fluctuating between choices.

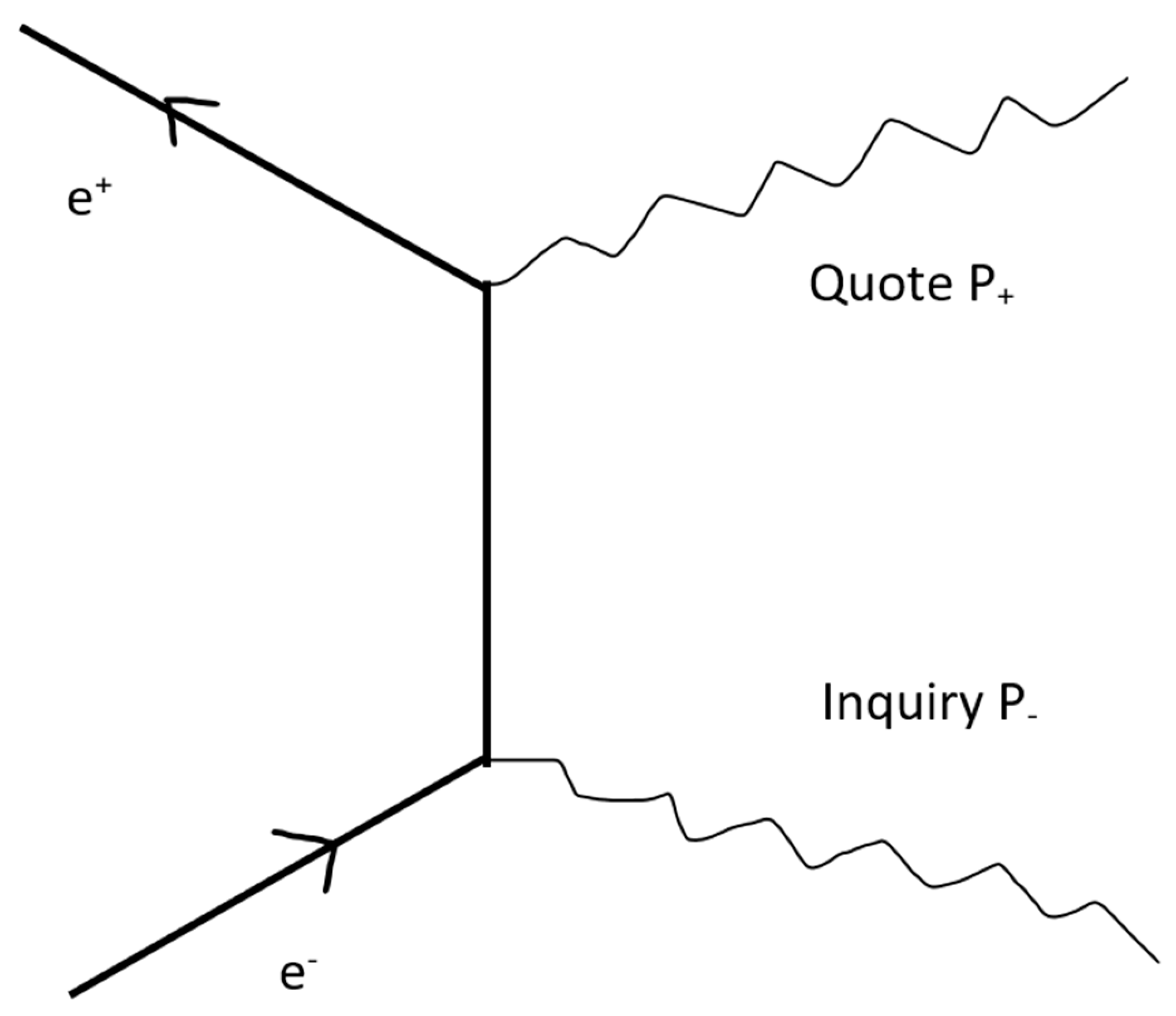

1.4. Feynman Diagrams and Interactions

In quantum electrodynamics, the interaction between electrons and positrons is carried out through interaction with photons. This dynamic process can be described by Feynman diagrams [

4]. Feynman diagrams can also be used to describe the interaction between price, demand, and supply in market dynamics. We know that prices are most sensitive to market disturbances, particularly in financial markets. We select several Feynman diagrams (

Figure 4,

Figure 5 and

Figure 6) that represent basic interactions for illustration. In quantum physics, the generation operator (creation operator) and the annihilation operator (annihilation operator) respectively represent the creation and annihilation of a particle.

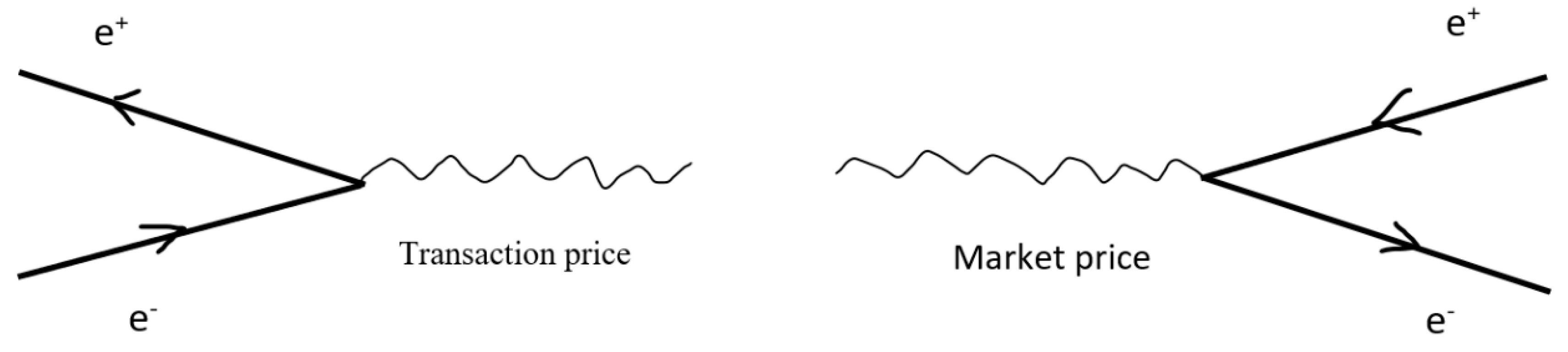

In

Figure 4, the down part of the picture shows that a particular demand releases a price, which is called an inquiry. The up part of the picture shows that a particular supply releases a price, which is called a quote.

In

Figure 5, the left picture shows that a pair of demand and supply factors results in a price, called the transaction price, and then both are “annihilated” at the same time in terms of the language of quantum field theory. The right picture demonstrates that a market price then “creates” a new pair of demand and supply factors.

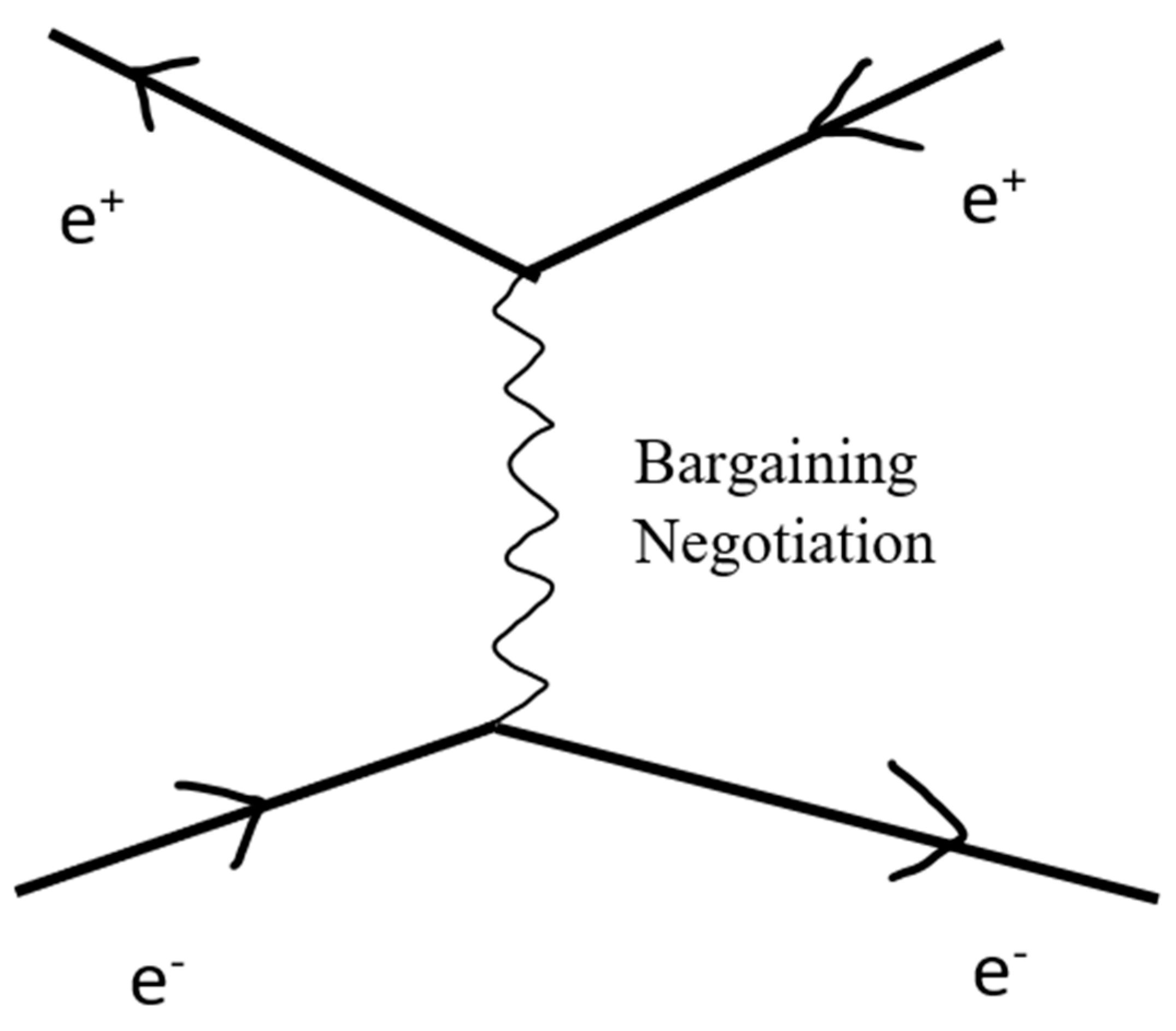

In

Figure 6, an ongoing demand “emits” a price, and another ongoing supply “attracts” and considers this price, but no transaction is made for a while; then, this pair of demand and supply continues to move on through negotiations and bargaining, and the previous price is annihilated.

Feynman diagrams have a profound theoretical background that provides rigorous mathematical characterizations, based on the Feynman rule for making and solving diagrams. Feynman diagrams greatly simplify the complicated calculations in quantum field theory and have their own uses in eliminating infinite quantities in the process of renormalization. These are reserved for contents in a quantum electrodynamics or quantum field theory textbook and are beyond the scope of this article. However, the following three points necessary for the presented argument are introduced below.

First, in the Feynman diagram, the junction of the particle line and the photon line is called a vertex. This vertex is not just a point in the graph, but should be considered as a cross section of photon scattering. The size of this cross section is the transition amplitude, that is, it is directly related to the probability of an interaction occurring. If the Feynman diagram is the grammatical structure of particle interactions, then amplitude and probability are its semantics. This photon scattering cross section can be carried over to scattering cross sections of prices in market dynamics, and its meaning is as follows. In

Section 1, we introduced a relativistic local running mass, that is, the absolute market price

P divided by the proper price

of each individual market participant. Here, the subscript here

i shows that proper price varies from person to person. From

Figure 3, as can be seen,

he bigger the

, the smaller the

m. Thus, the lower the mass shell, the higher the proper price, and vice versa. From the cone shape of the light cone, it can be seen that the lower the mass shell, the smaller the circular cross section on it becomes. This cross section can be considered the price scattering cross section. The size of this cross section is also related to the probability amplitude of the interaction between price, demand and supply.

Second, both physics and economics are empirical sciences by nature. Quantum electrodynamics (QED) is not only a qualitative but also a quantitative scientific theory. Among its predictions is the measurement of the fine structure constant, that is,

that is,

, which is called the charge coupling constant. The concept of structural constants will be discussed further when introducing the quantum chromodynamics model of sub-economic dynamics [

29]. It should be noted here that in market dynamics, the existence of market charge coupling constants is assumed as a working hypothesis; but empirically, the specific structural constants are missing. Despite this, by using QED as a reference modeling framework, it makes us aware of this empirical deficiency limitation of market dynamics, and find the observation point for possible future experiments. As a professionally trained experimental psychologist, I foresee that this gap will be filled in the near future.

Third, here we emphasize the coupling constant, which has another deeper meaning. Dirac proposed that the state of a particle wave function can be represented by its two momenta, denoted as

. The momentum of an antiparticle is expressed as

. When using momentum representation to draw a Feynman diagram, we need to indicate the coupling constant, which is denoted by

. The momentum represents the rotation of particle's internal space, that is, its spin. Spin drives the wave function phase, known as dynamic phase. The particle moves in the background space (parallel transport); its momentum

p also corresponds to a kind of phase, which is called the Berry phase [

9] or non-integrable phase factor by C. N. Yang [

17], referred to a kind of geometric phase. The total phase of a particle's wave function is the dynamical phase combined with the Berry Phase [

9]. This will be discussed later in the introduction of the gauge field theoretic model.

1.5. Cognitive Field and Decision Making

In the market dynamics model, the cognitive field is modelled by the magnetic field in electrodynamics. In physics, electric charges in motion generate electric currents, which are always accompanied by magnetic fields. Magnetic fields are vector fields with strength and direction. Magnetic fields are the closure of magnetic lines of force. Magnetic fields are source-free and are always accompanied by two poles, one north and one south, which produce a magnetic moment. Its divergence is null.

The movement of market charge is what causes the market's hesitation in demand. Because of price sensitivity, repeated hesitations display various superposition states between buying and not-buying. At this point, you have two choices: either you firmly resolve to pay for it right away, or you decide not to purchase it. The process of hesitation can be long or short; the frequency can be fast or slow, and the intensity can be large or small. This is called the market current (similar to electric current). A specific market flow must be accompanied by a cognitive field (analogue of magnetic field) with some specific driving factor; otherwise, why hesitate? The cognitive field reflects the factors and intention behind hesitation. For example, “how much budget is left this month”, “do I really need to buy this thing, will I regret after buying it”, or “what will my family say after buying it?”

However, the hesitation process in the market is finite in time. When you are still debating whether to buy a product, and a salesperson walks by to remind you that the business is about to close in 10 minutes, you have two choices: either you resolve to pay for it immediately, or you decide not to purchase it. This is the so-called polarization of market charges. The cognitive field, which encompasses the “thinking lines” surrounding the market flow, plays a crucial role in polarizing market charges, as it possesses a decision-making function. Just as magnetic field performs the function of polarization, pointing either south or north, the cognitive field is responsible for decision-making: either deciding to buy or deciding not to buy. This comparison indicates that the former is suitable as a model of the later. In addition, we have briefly described the cognitive field of buyers, i.e., demanders. We suggest that readers consider the cognitive field of sellers, i.e., suppliers, and its possible influencing factors.

It's important to note that standard quantum electrodynamics only describes electric charge, not magnetic charge. This means that it is a single-charge dynamical system with an one-dimensional internal space that satisfies the U(1) Symmetry. However, string theory has both electric charge and magnetic charge, together they satisfy the strong-weak duality relationship; that is, given a fixed total energy, the stronger the electric charge the weaker the magnetic charge; the same holds vice versa. This is easily accepted in market dynamics. The stronger the market charge, the weaker the cognitive field; to put it bluntly, the stronger the buying and selling intention, the fewer concerns; conversely, the more you think, the greater the concerns, which means the weaker the buying or selling intention.

It is also worth mentioning that in both classical and quantum electrodynamics, not only electromagnetic potential is assumed, but also electric potential and magnetic potential are assumed separately. When calculating the electromagnetic field strength, the electric potential gradient and the magnetic potential curl are taken separately. One of Maxwell's contributions to electrodynamics is that in the fourth equation of the so-called Maxwell equations, the concept of displacement current is derived from the magnetic potential. The Bohm effect also reflects the importance of magnetic potential. All these remind us that the cognitive field and cognitive potential in market dynamics have an indispensable position and role. This reflects the inseparable connection between cognitive science, psychology, and economics. This point will be explained in more detail later in this article, when discussing the gauge field theory model. For example, people usually think that economic rationality and economic rational man are two interchangeable terms. However, in gauge theoretic structure, the global potential of market dynamics, the two must be used differently: economic rationality represents the market potential (electric potential), while economic rational man represents the cognitive potential (magnetic potential).

1.6. Price Function and Selection Function

There is a kind of hesitation, called "Looking for him in the crowd for thousands of times, looking back suddenly, that person is there, in the dim light." Who is that person? In fact, the poet may not be sure, but that person is a psychological existence, a reflection of the ideal, denote it as . It is recorded as such a person. Where to find him? Of course, you can only look for him in the real crowd, which is actually to select. This kind of selection, like an exam where one out of a hundred is selected, can be described by Dirac in mathematics and its selectivity.

The reality of this selection process is just described by the integral formula included by Dirac. I say this to realize that the economy is like poetry and the market is like a painting. It is not always a cold face, but it is also engraved with firm and beautiful mathematical lines. This kind of hesitation has many variants. In the vernacular of market consumers, it is shopping. Shopping at second-hand book stalls and antique shops is a typical example; if you find something you like and the price is close to the inherent price of the individual, the shopping is not in vain. It is undeniable that market behavior has a certain degree of randomness. Many consumer behaviors are even quite random. In everyday language, people often say that they go shopping or visit the trading center, which shows the universal existence of this kind of contingency and randomness. Selection is a prominent feature of the market and a normal state of consumption. The following is mathematical expression of Dirac

-function:

Dirac

function satisfies selectivity, one of its important properties, which is explained by the following formula:

where

is a continuous function. Now, let

be a continuous price function. As can be seen from the above equation, the value of the price function at

is selected. Selectivity has important applications in physics and engineering. Now we show its ability to characterize market dynamics and economics. In the previous article [

27] [§3.1.4], we explained its mathematical modeling function in the high disturbance cone, and its role can be seen here. It can be said that in the high disturbance area, Dirac

-function builds a bridge between empirical science (across natural science, engineering and social science) and mathematics. It also has other excellent properties. For example, duality, etc. Through the inverse Fourier transformation, it has a wonderful connection with the imaginary exponent, which is quite inspiring for the application of gauge field theory in social sciences. It can be treated as a single-point process of a series of functions to characterize the cognitive polarization process from hesitation to decision-making.

2. Searching the Invisible Hand

2.1. Beliefs and Dogmas of Market Mechanisms

In the history of modern economic thought, the most mysterious concept is the invisible hand. Adam Smith only mentioned this idea once in his books, Theory of Moral Sentiments and The Wealth of Nations, but it has become so well-known that it has become an eternal legend. Economists have transformed the invisible hand from a metaphor into a concept, and commentators and interpreters have embraced it. It has become the belief of economists, the religion of economic thought, and the totem of the market. The invisible hand not only contains the revelation of chaos but also reveals the pursuit of order. The invisible hand is also a concept with a mixed reputation. When the market is booming, people celebrate and worship it like a river god. When the market is sluggish, people add insults to injury and put all the blame on it. Nobel Prize laurate in economics Krugman once complained: This worldwide financial crisis has lasted for two years. If there is really an invisible hand, why hasn't it come out to save the world? There are individual motivations on the front, social effects on the back, national wealth and security on the left, and moral sentiments on the right. I dare to ask the invisible magic wand: can it tell me which is the cause and which is the result? Since 1840, for nearly three hundred years, the invisible hand, though not seen in textbooks, has been full of vitality in economic thought. Why? What is the basis? The invisible hand symbolizes the scholarly interest in economics to comprehend the workings of the market, and the relentless efforts of economists to decipher this mechanism.

It seems that the invisible hand is almost Market Beliefs, reflecting the persistent pursuit by economists and even ordinary people. It is the mystery of the relationship between the self-interested efforts of individual market participants and the overall growth of the market. When talking about the market, we cannot avoid the concept of the invisible hand. Any economic theory about the market cannot avoid talking about this invisible hand. Because, whether it is the invisible hand mentioned by Adam Smith or the visible hand mentioned by Keynes, they are all discussing the market mechanism. To understand the market, we must not only understand the formation mechanism of the market, but also understand its operation mechanism. People who have studied logic seriously should learn, logic in a broad sense including the theory of concepts. The formation of a concept generally has three cognitive stages. The first stage is just an idea. Ideas can be deep or shallow, and can be clear or vague. The second stage is the primary concept. Primary concepts are generally descriptive and have room for flexibility. The third stage is scientific concepts (notion). Scientific notions need to be defined. Once defined, they can only be tested but cannot be extended. Moreover, the formation of a scientific concept must be a matter of choosing phenomena, called conceptual treatment, and must have a definite scope of application. This is called conceptualization process, which is an important part of creating new knowledge and is also a hard part of doing theorizing.

There are many well-defined scientific and descriptive concepts in contemporary economics. However, there are two most basic concepts that are still at the level of ideas or elementary concepts. The current state of economics is that the model building is magnificent, but it is built on the sand. In the previous article [

27], we discussed a concept known as economic rationality. This section aims to define the so-called invisible hand, which refers to the quantum version of the invisible hand. Adam Smith's market analysis is carried out under the framework of Newtonian mechanics. For example, its concept of “center of gravity” was borrowed from Newtonian mechanics. It is a reminder of history, a progress of the past, the frontier of economics in the past, and it is also a historical limitation.

2.2. The Quantum Version of Invisible Hand

Economics is essentially an empirical science. Market dynamics has a pre-set working hypothesis, which is as follows:

Proposition 3: The social economy, including the market, is the largest experiment that our human civilization has ever run. Each and every market participant is an active observer.

This proposition means that every market participant will try to observe the observations made by other participants in order to gain information advantages and profit from them. This is common sense and should be taken for granted in the financial market. Driven by economic rationality, every market participant intends to be the last observer. This tendency is most typical and active in the financial market. Note that what described by this proposition is different from what is currently called experimental economics. The former, in principle, presupposes that each market participant is designing their own experiments and serves as an experimenter, i.e., they are the observers of the market, while the latter assumes that they only serve as subjects who were merely under observation. The two approaches are fundamentally different.

According to Proposition 3, we now consider any two market participants. Let be the observation of one participant A on the observation of another participant B. Let be the observation of the participant B on the observation of the participant A. Driven by economic rationality, every market participant wants to be the last observer. So, it is not difficult to understand that the order of appearance of and is sensitive to the result. We have

Proposition 4. The market is competitive. The formula for its competitiveness is:

Which usually written as . This is called a non-commutative relation. In mathematics, a typical non-commutative relation is the matrix multiplication. Heisenberg first discovered that the momentum variation and position variation of the wave function do not satisfy the commutative relation, his mentor Bohr immediately thought of matrix multiplication. Therefore, the Heisenberg picture of quantum mechanics was first called matrix mechanics.

It should be pointed out immediately that market dynamics is currently a qualitative theory, in the semi-dimensional stage. This reflects its social science characteristics, but does not reduce its significance in terms of conceptualization and structure. The form of Heisenberg's uncertainty principle is,

,

, where

is a unit of energy, known as Planck's constant. This shows that energy is not continuous but discrete. In other words, energy is calculated in Planck units. In the atomic energy level model, electrons in low-energy polar orbits need enough units of energy to jump to higher-energy orbits. This is a matter of course for market dynamics. Prices have always been discontinuous; a commodity that costs 10 dollars per piece cannot be bought with 9 dollars. Reviewing the definition of interval in the special theory of relativity, the first term on the right is the energy term; in market dynamics, its meaning is the square of the money speed multiplied by the absolute price. As for bargaining, that is another story. As Simmel said in

The Philosophy of Money [

14], money has evolved into the best unit system. People may easily make mistakes in calculating other things, but rarely make mistakes in calculating money.

When writing academic articles, we always need to give keywords, that is, the key concepts to understand the article. Here, the non-commutative relation is a key concept. The key point is as Wang said in his book, Elementary Quantum Field Theory, that quantization is to find a non-commutative relationship; once a non-commutative relationship is established, the system is quantized [

20]. This is from the perspective of market language syntax. In addition, from the above analysis, it is not difficult to see that from the perspective of the semantics of market language, the meaning of

and

is the information obtained by both, and the amount of information is slightly changed to

. From the market competitiveness, we should know that these are two uncertain quantities and they should obey the Heisenberg uncertainty principle. If the accuracy of one of the uncertainties is higher, the accuracy of the other uncertainties will be lower. This is called the market version of the uncertainty principle. So far, we realize that in market dynamics, markets are quantized phenomena. We have

Proposition 5. The invisible hand in the market, also known as the quantum version of the invisible hand, is an interaction of competitive observations that satisfies the non-commutative relationship (Proposition 3) and adheres to the market version of the uncertainty principle.

It is worth emphasizing that the quantum version of the invisible hand defined above meets a key condition: it is invisible to all market participants. Note that in the previous definition, for any given

and

, the non-commutative relationship is satisfied. At the same time, for any information

and

, the uncertainty principle is satisfied. This implies that for all market participants, they have the same status relative to the quantum version of the invisible hand. This is a kind of symmetry. It is precisely because of this symmetry that the market can become a fair market; and only a market that is fair to every market participant can be conserved and become a sustainable market. Imagine if a financial market participant has a channel to obtain inside information and thus has the opportunity to participate in or even manipulate insider trading, then this guy can use the information advantage to continuously make money from other people's pockets and destroy the symmetry. In this way, after a long time, others can only withdraw from the market, making it difficult for the market to develop sustainably. The quantum version of the invisible hand is equivalent to what is called the non-observables by T. D. Lee [

8]. This reflects a famous theorem, known as the Nöether's theorem: non-observables imply symmetry, and symmetry implies conservation. The reason is that symmetry represents a certain invariant, and in this sense, the market can become a conservation system. We can see that Nöether's theorem is not only profound for mathematical physics, but also for market dynamics, economics and even social sciences in large.

Nöether's theorem tells us that if the market is to develop sustainably, symmetry, that is, fairness, must be established among all market participants. To achieve this, we must find something that is superior to any market participant. This is the highest principle of market mechanism design and the meaning of the invisible hand of the market. Note that this article assumes that the market is free, i.e., perfectly competitive. We assume that the perfectly competitive market is a closed, independent system, or a conservative field. As we can see, this conservative field satisfies U (1) symmetry. External forces can, of course, destroy the closedness of this conservative field, leading to spontaneous symmetry breaking. In economics, we collectively refer to the so-called external forces, like economic policies such as monetary policy and fiscal policy, wars, or irresistible natural destruction, are market externalities.

Economic externality dynamics is one of the four models that make up the standard model of economic dynamics. It is characterized by the weak isospin dynamics in theoretical physics and shares the SU (2) symmetry group [

28]

3. Price Field Theory

3.1. The Nature of Price

We say that prices move markets. Market dynamics is the study of the interaction between prices and supply and demand, just as quantum electrodynamics is the study of the interaction between photons, electrons, and positrons. In market dynamics, the concept of price is characterized by photons in quantum electrodynamics. Therefore, understanding the concept of photons helps us understand the nature of price. Although photons are a concept in quantum electrodynamics, they are abstracted from Maxwell fields in classical electrodynamics. According to quantum field theory, particles are excited by quantum fields, also known as excited states. Photons are excited states of photon fields. Where there is excitation, there is annihilation, so the creation operator and annihilation operator are introduced in quantum field theory. An electron can release a photon, which is called creation; a photon can also be absorbed by a positron, which is called annihilation. The same is true for prices. A demand, which is an inquiry, can release a price. A supply can also release a price, known as a quotation. The bargaining process is the process by which different intermediate prices are repeatedly created and annihilated. A transaction is completed, starting with the transaction price and ending with the transaction price. Recompleting the transaction initiates a new phase of the price life cycle. Prices excite when they interact with the demand field, the supply field, or both. The price field, also known as the free price, can theoretically independently excite prices, called free price. We know that the market can create wealth. If the market does not produce anything, how can it create wealth? Economics tells us that the market produces prices. Strictly speaking, the market also produces prices in a systematic way, which is called a price system. Let's take an extreme example. Suppose that the price of a piece of clothing is $100. One can't pay $50 to buy half a piece of clothing; that does not conform to the price system.

Maxwell field is also called electromagnetic potential field, denoted by

. Electromagnetic potential is composed of electric potential and magnetic potential, denoted by

and

respectively. Here we have magnetic potential.

, where

is also called magnetic potential vector. The language of gauge field theory to be introduced later in this article,

is called gauge field, which is actually gauge potential. We will also see that

is a component of covariant derivatives, playing a coordinating role for individual differences. The classical electrodynamics says that light is an electromagnetic wave, while quantum electrodynamics says that photon field is the electromagnetic potential vector. Particleization of potential is exactly what is meant by the wave-particle duality of particles. The electromagnetic potential field is called Maxwell field because Maxwell emphasized the electromagnetic potential tribute and expressed it in Maxwell's equations. C. N. Yang [

17] particularly discussed the relation of his work on the gauge field theory and the historical origins of Maxwell's electromagnetic potential view. Maxwell's electromagnetic potential, Yang's gauge field theory and Einstein's general relativity are considered to form a landscape of the geometric program of theoretical physics [

2]. In economic dynamics, there is such a landscape, called the geometric program of economics [

27].

The photon field is also called the Maxwell field. The price field is described by the photon field, so the price field should also be regarded as a Maxwell field, that is,

as a combination of market potential

and cognitive potential

. In other words, prices carry both electrical (market) and magnetic (cognitive) properties. In this section, we will mainly discuss cognitive potential

, or the magnetism of the market. We will argue, this cognitive potential

is exactly the decision field in market dynamics. We will also see that at the higher cognitive level, the formation and movement of the decision field are closely related to the game field and the reasoning field. In classical electrodynamics, it was considered just a mathematical trick. But as Feynman said in his famous Lectures on Physics, magnetic potential vector

and electromagnetic potential

are both real physical fields [

3,

4]. Similarly, as argued in the present paper, the cognitive potential and price potential should be considered as real economic fields.

As introduced in our earlier work [

27], dynamics always studies two quantities, Hamiltonian or Lagrangian, both of which involve potential energy and kinetic energy. Electrodynamics, whether classical or quantum, focuses on a pair of things, namely electromagnetic potential and electromagnetic field strength. In the language of gauge field theory, there is a 2 by 2 syntactic structure: at both the global and local levels, the gauge potential and the gauge field strength must be distinguished. The most intuitive understanding of this distinction can be seen through the indefinite integral formula:

where the entire indefinite integral is the gauge potential, in which the integrand is the gauge field strength, and the constant C is called the gauge freedom. It is easy to see that finding the gauge field strength from the gauge potential is to apply various differential operations. The differential of the constant is zero, and it is eliminated in the process of finding the field strength. Don't underestimate this gauge freedom. After it is eliminated, it is still hidden in the potential, leaving room for the introduction of various gauge functions. Later, we will see that in market dynamics, this gauge function is the value function, which is of great significance. It can be accumulated into a displacement market flow/current (this can be inferred from the fourth equation in the Maxwell equations). Can any economic theory without value function as a freedom dimension be considered a valuable economic theory? Below, we introduce several basic differential operation formulas commonly used in classical electrodynamics, namely gradient, divergence and curl. This is helpful for understanding the theoretical basis and historical origins of market dynamics.

3.2. Price Field and Classical Electrodynamics

Whether it is Maxwell's classical electrodynamics or Feynman's quantum electrodynamics, they both study one thing, that is, the electromagnetic field strength

, also known as curvature. Later, we will introduce the Lagrange density formula, also known as the Lagrange quantity, of which the first term is

. To understand this term, we need to understand the following concepts and their formulas. The first concept is the Hamiltonian operator, which is defined as follows:

It can be seen that the Hamiltonian operator is the vector sum of three partial derivatives. Hint: Partial derivative is the limit of a certain dimension tending to a point. It is a local concept and speaks in the small neighborhood of this limit point. As the saying goes, Mount Sumeru contains a mustard seed, and a mustard seed contains Mount Sumeru. We will discuss about the function of definite article the in the next section when discussing reasoning and decision-making. For the mental language of each market participant, the definite article, the, is often used as the first-person pronoun my. The I in it is the limit point, sometimes also called the sink or source point. The domain of the independent variable ranges all market participants. For microeconomics, especially consumption theory, the I and the mine of market participants can only and must be the central focus of dynamic analysis, without exception. This should be the presuppositional principle of economic theory regardless of school since Adam Smith. If there is no I, no mine, then what is the use of economics? Economic theory must be localized, which is the great spirit of Einstein. If individual market participants are required to only have long-distance quantum entanglement with social purposes or distant ideals, then it is not economics.

The second concept is the gradient, which is expressed by the following formula:

Generally speaking, gradients are mostly used to calculate sourced fields. From the electric potential or market potential

to calculate the field strength, we calculate the (negative) gradient, which is related to the so-called "electrical properties". Remember, the input of the gradient calculation is a scalar, that is, a number, and its output

is a vector. Since the Hamiltonian operator is a vector operator, the gradient of a scalar field is a vector field. Electrostatic fields or static markets are both sourced fields, and this source is the electric charge or market charge. A good salesperson does his homework; for example, the demand is to buy a certain car, which is the market charge. How much do you desire to buy this car? How much do you want to pay for this car? This is your market potential, characterized by a scalar number, which is the strength of your intention to buy this car. Assume that only three indicators of this car are considered, namely, fuel consumption, maintenance convenience, comfort and appearance. The sum of the partial derivatives of your purchase intention in these three indicator dimensions is called the gradient. A good product is something that all market participants want to buy, but the purchase intention of each market participant is different, and the requirements for various indicators of the product are different; in terms of gauge field theory, this is individual difference at the local level. To balance these individual differences and achieve local symmetry, it is necessary to introduce concepts such as covariant derivatives and gauge fields, which are the contents of

Section 5. In fact, professional car sellers often calculate the purchasing potential and its negative gradient of a potential customer, and think about the appropriate sales strategy accordingly. This sales strategy is actually a kind of gauge field. As an exercise, readers can think of an example, such as buying and selling a house, and do some dynamic analysis.

The third concept is curl, which is the cross product of the Hamiltonian operator and a vector, expressed by the following formula:

Generally speaking, curl is mostly used to calculate fields without source. Calculating the field strength from the magnetic vector potential or cognitive vector potential is calculating its curl, which is related to the so-called "magnetism". We will see later that decision-making is a magnetic mental activity. Remember that the input of curl calculation is a vector, and the output is also a vector. Cognition has a thinking structure. The content and inference of cognition can be right or wrong. Thinking itself is like music, there is no right or wrong. The cognitive structure of thinking can be fine or coarse, wide or narrow, straight or curved, tight or loose; this is what curl means. In other words, thinking has curl. The economy is the support of human survival, and the market is the realm of human civilization. However, cognition is the crystallization of human wisdom. People often say that the market changes rapidly. At this glance, the market is tall and straight, and at another glance, the market is graceful; looking left, the market is standing, looking right, the market is dancing; looking forward, the market is hazy, and looking back, the market is bright. Originally it is a cold market, where money is exchanged and goods are delivered, people's cognition turns it into a kaleidoscope. This is magnetism, the cognitive vector potential. The moment is the limit. The six partial differentials in a curl formula decompose the cognitive vector potential into a linear combination of three vectors and six terms. It can be seen that the cognitive field is a curl field.

In the framework of classical electrodynamics, the price field should also be regarded as a Maxwell field,

which is composed of market potential

and cognitive vector potential

. We have discussed above how to calculate the gradient from the electric potential (market potential)

, that is, the electric field strength. We also discussed how to calculate the field strength, that is, the curl, from the magnetic vector potential

. By combining the two, we can calculate the electromagnetic field strength,

. To expand it, we have

This is an antisymmetric matrix with zero diagonal, which is recorded as . This is an invariant. In the Lagrangian formula introduced later, is called the electromagnetic density term, also known as the curvature term. We can see that the photon field has both electrical and magnetic properties; similarly, the price field has both market and cognitive properties. Its potential is like this, and so is its field strength.

The fourth concept is divergence, which is expressed by the following formula:

We observe that when calculating the divergence, the input is a vector and the output is a scalar number. The divergence of the magnetic field is zero; that is, . Divergence refers to flux. In other words, the magnetic vector potential is a field without source, and the divergence of magnetic flux density is zero, which is a characteristic of magnetism. The magnetic field is a dipole field with north and south poles. The magnetic field is described as an closure of magnetic lines of force. The magnetic lines of force connect the north and south poles without any gaps. It is a closed curve, so it does not form flux on any closed surface, so the divergence is zero. The magnetic field has the function of polarization, which makes the electric charge point to the south or the north in the magnetic field, and it must be one and only one. How is the magnetism of the cognitive field manifested? It is manifested through the decision field. Preference is a binary relationship. In the decision field, any two options are required to have a preference line connecting them, which can be called a decision magnetic line of force, connecting the two poles of "yes or no". It can be seen that the decision field, like the magnetic field, is also a dipole field. When the market charge is placed in the decision field, the market charge will be polarized, either buy or not buy, and one must be chosen. Decision theory requires that preference relations are fully and strictly ordered, so the decision field is a closure of decision magnetic lines of force, such that no flux is formed on any closed surface; that is, the decision field is a field without a source. In the market, no one makes decisions just for the sake of making decisions because making decisions comes at a cost, which is called opportunity cost in economics.

3.3. Summary

In this section, we have discussed that the price field is characterized by the photon field, and the photon field is the quantization of the Maxwell field. So, in classical electrodynamics, the Maxwell field is the essence of the price field. The Maxwell field is an electromagnetic potential field, so the price field is essentially a synthetic field of market potential plus cognitive vector potential, referred to as market-cognitive potential. When calculating the market density from the market potential, its gradient is calculated. The curl is used to calculate the flux density from the cognitive vector potential. The cognitive field, especially the decision field, is a field without source, a non-divergence field, and a dipole field, which has a polarization function for the market charge. The price reflects both the potential of commodity marketization and its market density. At the same time, the price also reflects both market participants' cognitive vector potential as well as their decision density. Such a market dynamics structure will be more completely theoretically processed when the gauge field theoretic model of quantum electrodynamics is introduced in

Section 5.

It should be mentioned that in the framework of classical electrodynamics, the laws of electromagnetic motion are fully described by Maxwell's equations. This also applies to market dynamics. However, these are outside the scope of this article. For example, this section discusses the position and role of cognitive vector potential in price structure, but does not delve into the impact of the time-varying magnetic properties of cognitive vector potential on the induced commodity flow and the displacement commodity flow. It should also be mentioned that this section does not discuss the Bohm effect. Starting from the Bohm effect principle, it should be possible to deduce at the basic theoretical level that cognitive vector potential is a market reality [

5].

4. Higher-Order Cognition and Market Fluctuation

4.1. Cognitive Field and Samuelson's Misconception

In physics terms, the so-called ever-changing market means that it fluctuates constantly. This section aims to discuss:

Section 2 bases the quantization of the market on the inherent quantum fluctuation phenomenon of the market, which stems from the instinctive diversity of reasoning among market participants. Classical economics emphasizes observable market games, and current behavioral economics emphasizes semi-observable market decisions, but both ignore the diversity of mental reasoning of market participants that cannot be directly observed, as well as their observable market effects. This is the fundamental flaw of theoretical economics today; in this regard, Paul Samuelson has a historical responsibility. Around 1938 to 1948, the concept of revealed preference emerged, openly advocating for the removal of economics' last psychological layer to promote its hardline behaviorism in name of making economics a science. [

11,

12]. On the one hand, it was a bold move to improve the modeling level of economics within the framework of Newtonian mechanics. However, due to its missed opportunity, economics, particularly marketing study, suffered greatly and gradually drifted away from its two natural allies, psychology and theoretical physics. Here, the present author admits that he has worked in the field of logic and psychology of reasoning for many years. [

21,

22,

23,

24]. In such an academic background, it is natural to be more sensitive to Samuelson's illusions, and it should be our responsibility to find a more appropriate path for the economic science.

This section mainly deals with the application of higher-order cognition to market dynamics. Higher-order cognition covers a wide range of research, but three subfields have a special status, namely psychology of reasoning, psychology of decision making, and behaviorist game theory. These three subfields are special because they are the few in psychology and even social sciences that have normative formal theories. These fields are logic and psychology of reasoning, modern axiomatic decision theory and psychology of decision making, and game theory and behavioral game theory. Universities have traditionally taught these three sets of six disciplines separately, each possessing unique description languages and conceptual systems. We first developed an integrated theory known as mental decision logic [

18].

Decision theory and game theory have long become the common language of economics, especially marketing study. Since Kahneman won the Nobel Prize in Economics in 2002, psychology of decision making and behavioral game theory have even become popular. However, such popular disciplines seem to have rich experimental results but weak theoretical models. The language and concepts employed in behavioral economics demonstrate this. Describing people's various market behaviors as illusions, bias or heuristics is the result of theoretical dependence on classical economics. How can you fly without wings? This section aims to propose a new direction for the development of the integrated theory of classical economics and behavioral economics.

4.2. Game Theory and Classical Fluctuations

This section uses the language of game theory to discuss two things: the pairwise observation problem and classical crossing fluctuations.

In

Section 2.2, we demonstrated that market participants observe each other

and

obey non-commutative relations. This is an idealized treatment. We know that in the real market, it is impossible to exhaust the pairwise observations between participants. In fact, in modern markets, especially financial markets, each participant can only observe other participants through market observations and operate indirectly. So, how is this indirect operation implemented? This problem is called the "pairwise puzzle". Let's review the description of Nash equilibrium in non-cooperative game theory.

The basic syntactic structure of non-cooperative games is very simple. Suppose there are

n players. Each player

has a possible action set

Each player must establish his own total order preference relation, denoted by

. Note that in individual decision theory, the preference relationship of the decision maker is based on his own possible action set. However, in game theory, the preference relationship of any player can only be based on the so-called action scenario set. Consider the possible action sets of all players

, the expression of the Cartesian product is:

Among them, each

n-tuple

is called an action-profile or a scenario. In other words, a game is a set of scenarios, and each player must establish his own total order preference relationship on this set of scenarios, that is, for all players

, each must establish their own preference order

on

Knowing the syntactic structure of non-cooperative games, it is not difficult to understand its meta-properties, namely the well-known Nash equilibrium. Note that the language of Nash equilibrium needs to characterize each player separately, so it is necessary to make some notational rewriting. Consider the

n-tuple in

, we have

Here,

). Nash equilibrium is a specific scenario

)* , i.e.,

. That is, for each player

, and for any

it holds

The meaning of Nash equilibrium requires some speculative mathematical thinking and understanding; roughly speaking, in a non-cooperative game, every player is a loser, but there cannot be a worse loser. We noticed that in the language that describes the definition of Nash equilibrium, the actions of any individual are treated uniformly and separately from the action sets of all other individuals in the same scenario. This is also a typical technique for describing fixed point problems in mathematics.

Now, let's go back to the pairwise observation problem mentioned above. Rewrite as , and rewrite as . It is not difficult to see that, Satisfies the non-commutative relationship, that is, . Obviously, in the sense of the information obtained by observation, we should know that are still two uncertain quantities, which obey the uncertainty principle. In addition, without losing generality, as a special case of , we can also allow market participants to do self-reflective observation, that is, the observation of participants on their own observations, denoted as . We regard that provides a general solution to the pairwise observation problem.

The Nash framework remains the basic theoretical framework in contemporary game theory. The Nash framework not only clearly differentiates the mathematical structure between non-cooperative and cooperative games, but also establishes the general meta-properties of each, specifically Nash equilibrium and Nash solution. However, a large number of behavioral game theory studies have highlighted a phenomenon in which players go back and forth between non-cooperative games and cooperative games [

1], which can be called a cross-fluctuation. For example, the Prisoner's dilemma, which is introduced in almost all game theory textbooks, is originally designed as a non-cooperative game. However, when the game conditions are changed, for instance, the number of years of imprisonment is increased, or repeated games are allowed, the players will change from a non-cooperative state to a cooperative state. This kind of behavioral fluctuation is directly observable, so it can be classified as a classical fluctuation.

In empirical research, the cross-over fluctuations found in behavioral game theory cannot be explained and described within the Nash framework of standard game theory. The root cause and corresponding theoretical explanation behind it can only be found in individual decision-making theory.

4.3. Decision Theory and Mesoscopic (Semiclassical) Fluctuations

To build a unified theory that decomposes a game problem into the decision-making problems of each player, we must first convert the language of game theory into the language of decision theory. This requires some technical treatment. As mentioned earlier, when the language of game theory speaks to a player, a scenario can be rewritten as ). Now let's rewrite it further as . After rewriting, it looks like a function, which is beyond the language of game theory; but this is a key step in converting the language of game theory to the language of decision theory. We will see why this is the case below.

Savage’s book [

10], Foundations of Statistics, is recognized as the pioneering work of contemporary axiomatic decision theory. The following uses Savage language to describe the structure of decision problems. A decision problem is a triple,

is a set of action functions,

is a set of states, and H is a set of consequences. For any given action function

and environmental status

, we have

Note that for any given state s, because

is a function, the value of

is unique; so, without causing confusion, h

can be omitted. For any two action functions, , is called a preference relation, that is, prefer . Now, compare in the previous paragraph with here, which is really similar in form. Let the former be the action function , and the state variable s, we can transform .

Take the prisoner's dilemma as an example. The possible actions of prisoner A are either to confess or not to confess. The possible actions of prisoner B are either to confess or not to confess becomes the individual decision-making problem for prisoner A. becomes the individual decision problem for prisoner B. In other words, the prisoner's dilemma, as a two-person non-cooperative game, is now decomposed into two individual decision problems. We can see that the transition from game theoretic language to decision theoretic language is only a “three-foot wide river”, which can be crossed with one leap. Note that this language transformation is valid in both directions, and it is only a trivial operation to re-combine the previous individual decision problems into the game theoretic structure of the prisoner's dilemma.

However, when a player changes his role to become an individual decision-maker, he finds that the fluctuations in the decision-making field are not only stronger but also more hidden, and some fluctuations are difficult to observe directly. Savage proposed a decision-theoretic problem in his book, called the "small-grand world problem". We have mentioned this in the previous articles [

18] and [

27], [§3.2.1]. The three-layer syntactic structure of classical decision theory and its utility semantics are introduced in this section. People usually think that when faced with a given decision problem, the decision maker will immediately calculate the mathematical expectation of each option based on utility semantics and then establish a preference relationship according to the representation theorem to solve the problem. Savage suggested that we should refer to this process as Process 2 [

13]. In previous decision-making theories, people have overlooked an early process that should be called Process 1. A given grand world decision problem might not be expressed in a form they are willing to confront. Therefore, there should be an early rewriting process. The so-called grand-small-world puzzle says that when a decision maker faces a given grand-world decision problem, he will consciously edit and rewrite it into a small-world problem. So, how does the decision-maker do this editing and rewriting?

Savage's suggestion is to apply mathematical partitioning [

13]. For example, the state set of a decision problem is

; a possible partition is

Note that, there are three elements in but two elements in , so the former is called the grand world and the latter is called the small world. Also note that, each element in is is a subset of , which is called a grand-world event. Here, for any , it has the double-identity: How does this fluctuation occurs, whether it is significant to the decision maker's mental action, and how does its cognitive process work? These are all challenges of the so-called grand-small world puzzle.