1. Introduction

Environmental regulations, particularly the introduction of Environmental Protection Taxes (EPT), have become an essential tool for promoting sustainable business practices. These policies are designed to incentivize pollution reduction and increase environmental efficiency. They have different impacts on companies' financial health and operating strategies. In China, the implementation of the EPT represents a significant policy shift aimed at encouraging companies to adopt environmentally sustainable practices through financial mechanisms. However, the immediate financial impact of such taxes on corporate performance remains controversial and requires extensive investigation [

10].

The main purpose of the environmental tax is to encourage companies to invest in research and development (R&D) that leads to technological innovations, thereby facilitating the transition to greener business operations. Ideally, this transition should lead to long-term sustainable growth. However, studies such as those by Long, Lin, and Ge[

1] suggest that the expected innovative effects of EPT have not led to short-term performance improvements. This discrepancy raises concerns about the effectiveness of environmental taxes as catalysts for the immediate financial health of companies and invites a deeper examination of their impact [

18]. In addition, effective liquidity management is crucial to the survival of companies and directly affects financial metrics such as current, quick, liquid assets, and other defensive interval ratios. These metrics are critical in assessing a company's ability to meet short-term obligations and maintain financial stability [

2]. An increase in operating costs and capital expenditures due to EPT can negatively impact these liquidity ratios and potentially lead to financial difficulties if not managed skillfully [

4].

The aim of this study is to empirically evaluate the impact of environmental protection tax on the financial health of listed companies in China. Using a difference-in-differences (DID) approach, the study compares affected and unaffected companies to determine the specific impact of EPT on liquidity ratios. Furthermore, this study examines the mediating effect of increased R&D investment and hypothesizes that while EPT may promote innovation, it may also exert pressure on short-term financial indicators due to the associated costs. This study is particularly timely and relevant as global demands on environmental accountability increase and countries improve regulatory frameworks to curb environmental degradation. By elucidating the financial implications of environmental taxation, this research provides valuable insights for policymakers seeking to refine environmental tax frameworks, for companies adapting to these tax measures, and for the academic community that continues to study the connection between environmental regulations and corporate finance [

5,

17].

2. Literature Review and Research Hypotheses

2.1. EPT and Its Influence on Corporate Financial Well-being

The implementation of the Environmental Protection Tax (EPT) in China has exerted a direct influence on publicly listed companies, leading to a short-term decline in corporate performance. While the EPT was intended to promote R&D investments for long-term sustainable transformation, research by Long F, Lin F, and Ge C. [

1] suggests that these innovative efforts have yet to yield short-term performance gains. This may be attributed to the additional operational costs and capital expenditures that companies face while adapting to new environmental regulations and tax policies.

Financial health, especially liquidity status, is one of the key indicators of corporate performance. Liquidity management, which involves balancing current assets against current liabilities, directly affects crucial financial ratios such as the current ratio, quick ratio, cash ratio, and defensive interval ratio [

2]. These ratios not only reflect a company's ability to meet short-term debts and are essential for assessing its financial health. For instance, a higher current ratio indicates sufficient liquid assets to cover short-term liabilities, helping maintain operational and financial stability [

3].

However, the imposition of the EPT can increase operational costs, impact cash flows, and profit levels, subsequently having a negative effect on liquidity ratios. If companies cannot effectively manage these costs, or if market reactions to price adjustments lead to a decline in sales revenue, the liquidity status may be compromised, limiting operational capabilities and potentially harming overall financial health [

4].

To counteract the challenges posed by the EPT and maintain financial health, companies may need to adopt a series of measures to optimize their liquidity management. These could include improving the efficiency of current assets, such as accelerating the collection of receivables and inventory turnover, as well as reassessing and adjusting current liabilities to ensure sufficient cash flow to meet short-term debts. Additionally, companies might need to explore financing channels to support the increased environmental investments and operational costs due to the EPT.

Despite the EPT's aim to push companies towards more environmentally friendly operating models, it may negatively impact financial health indicators in the short term. Specifically, the EPT could exert pressure on liquidity ratios by increasing operational costs and capital expenditures. A decrease in liquidity ratios reflects a reduced ability of companies to meet their short-term debts, which could lead to greater financial risks and uncertainties. Thus, we propose the following hypothesis:

Hypothesis 1 (H1): The Environmental Protection Tax negatively impacts liquidity ratios, which are key indicators of financial health.

2.2. Environmental Protection Tax and Its Impact on Innovation Outcomes

The Environmental Protection Tax serves as an economic incentive aimed at reducing pollution emissions and enhancing resource efficiency. In this context, the innovative effect on enterprises is particularly critical, as it encourages companies to undergo technological upgrades and operational model transformations, which could potentially impact their financial health.

Academic research shows that innovative activities significantly enhance corporate financial performance, especially innovations that meet customer needs and achieve differentiation in the market. Although investments in technological innovation may not always immediately translate into financial returns, existing research has revealed that the EPT can enhance a company's environmental friendliness and potentially improve its financial health by encouraging innovation [

20].

Moreover, environmental regulations are thought to stimulate the innovative potential of companies, urging them to develop new production methods and products to reduce environmental pollution and increase resource efficiency. Such innovations can mitigate the costs of compliance and bring economic benefits like lower production costs, better product quality, and access to new markets. With rising global demand for eco-friendly products, companies that innovate to meet these demands can gain a market premium and enhance their competitiveness [

5].

In China, environmental subsidies have significantly promoted green innovation. Although the EPT may suppress green innovation in the short term, as the tax burden increases, companies are increasingly driven to pursue green innovation to comply with policy requirements and market demands. The expected performance gap and the degree of market competition significantly modulate this relationship, further boosting the motivating effect of subsidies and taxes on green innovation [

24]. Furthermore, China's environmental policy reforms have significantly improved the green innovation performance and R&D efficiency of companies in heavily polluting industries, with large enterprises and private enterprises focusing more on enhancing green innovation compared to SMEs and state-owned enterprises [

17].

Thus, the Environmental Protection Tax has the potential to motivate companies to innovate, enhance competitiveness, and promote sustainable development. The positive effects of these tax policies in promoting corporate innovation are primarily reflected in stimulating the motivation for innovation and bringing economic advantages. However, the time lag inherent in technological innovation may limit its capacity to offset costs in the short term, which could negatively impact cash flow and overall financial performance. Thus, we propose the following hypothesis:

Hypothesis 2 (H2): The Environmental Protection Tax promotes corporate innovation capabilities but negatively impacts short-term liquidity ratios, a key indicator of financial health.

3. Model, Variable, and Data

3.1. Subsection

This study investigates Chinese A-share listed companies from 2013 to 2023, drawing on data from the China Stock Market & Accounting Research (CSMAR) database. The enactment of the Environmental Protection Tax Law of the People’s Republic of China is treated as an exogenous shock, with the primary objective of evaluating its impact on heavily polluting industries.

In China, environmental protection tax imposed on firms varies according to factors such as company size, industry, and the type and volume of pollutants emitted. Industries characterized by high pollution intensity, including coal, steel, and chemical sectors, particularly in regions with severe pollution,are subject to relatively higher tax liabilities. Additionally, local governments possess the discretion to adjust tax rates based on regional economic conditions, resulting in significant inter-regional disparities in tax burdens. For instance, tax rates in Beijing are considerably higher than those in industrial hubs such as Guangdong. To account for these variations, firms were stratified into two groups: those whose tax payments exceeded a predetermined threshold were classified as part of the treatment group, while firms with lower tax payments constituted the control group. This classification facilitates a focused investigation into the differential effects of varying tax burdens on corporate financial health and performance.

To enhance the robustness and validity of the analysis, several data filtering criteria were applied. First, firms classified as “T” (special treatment) or “*ST” (particular special treatment) during the observation period were excluded to mitigate bias arising from financial distress or restructuring activities. Second, companies with incomplete or missing data were excluded to ensure the comprehensiveness of the dataset. Following the application of these criteria, the final sample comprised 4,473 firm-year observations. Furthermore, all continuous variables were winsorized at the 1% and 99% levels to reduce the influence of extreme values and improve the stability of the results.

Environmental investment data were manually extracted from corporate annual reports to provide a more precise measure of firms' environmental initiatives. All other financial data were sourced from CSMAR database, which offers a consistent and reliable foundation for financial information. These data collection and processing methods were employed to ensure the accuracy and integrity of the dataset, laying a robust groundwork for subsequent empirical analysis.

To further examine the varied impact of the environmental protection tax on firms of different sizes, the sample was disaggregated based on company size. This stratification allows for a more granular examination of the tax's effects on overall corporate performance and financial health while also assessing the moderating role of firm size, particularly within high-pollution industries. By employing this categorization, the study provides a more comprehensive understanding of how the environmental protection tax affects firms with varying characteristics.

Through rigorous data filtration, systematic processing, and methodical firm classification, the final dataset serves as a robust foundation for the empirical analyses that follow.

3.2. Variables

3.2.1. Firm Performance

Corporate financial performance in this study is evaluated using several key financial metrics. Primarily, Return on Assets (ROA) and Return on Equity (ROE) are used as key indicators of profitability. ROA evaluates how effectively a firm uses its assets to generate earnings. ROE, on the other hand, gauges the efficiency with which a company uses its equity capital to produce net income. Given the considerable volatility and external influences on stock prices in China, the Tobin’s Q metric, commonly applied in international research, is deemed unsuitable for analyzing Chinese companies. Accordingly, this study adopts ROA and ROE as proxies for corporate financial performance. Additionally, the current ratio serves as the primary variable in the baseline regression model, providing insight into the firm's short-term liquidity. To enhance robustness checks, we employ the quick ratio, which provides a stricter measure of liquidity by excluding inventory. Together, these indicators offer a comprehensive perspective on a firm's financial health.

3.2.2. Innovation Investment

Beyond financial performance, innovation investment is crucial for understanding how firms allocate resources towards technological progress. In this study, innovation investment is treated as a mediating variable, reflecting the firm's level of commitment to technological development. Unlike patent applications, which often exhibit a time lag and do not fully capture real-time innovation efforts, R&D investment is selected as a more appropriate proxy. R&D investment represents the start of innovation activities and serves as a key measure of a company's technological capabilities. The ratio of R&D expenditure to operating revenue is used as an indicator of R&D investment, ensuring a timely and accurate representation of the firm's innovation activities. This approach complements the analysis of corporate financial performance by providing insights into the firm's strategic emphasis on innovation.

3.2.3. Firm Size and Heterogeneity Analysis

Beyond financial performance, innovation investment is crucial for understanding how firms allocate resources towards technological progress. In this study, innovation investment is treated as a mediating variable, reflecting the firm's level of commitment to technological development. Unlike patent applications, which often exhibit a time lag and do not fully capture real-time innovation efforts, R&D investment is selected as a more appropriate proxy. R&D investment represents the start of innovation activities and serves as a key measure of a company's technological capabilities. The ratio of R&D expenditure to operating revenue is used as an indicator of R&D investment, ensuring a timely and accurate representation of the firm's innovation activities. This approach complements the analysis of corporate financial performance by providing insights into the firm's strategic emphasis on innovation.

3.2.4. Control Variables

To ensure the validity of the model's estimates, a series of control variables are incorporated to account for other potential influences on corporate performance. These variables include key aspects of corporate governance and financial management, such as monetary funds, net fixed assets, paid-in capital, capital surplus, surplus reserves, investment income, operating profit, inventory turnover and long-term liability ratio. Controlling for these variables enables the model to isolate the impact of environmental protection tax on corporate performance and mitigate the risk of confounding factors. This comprehensive set of control variables ensures a more accurate estimation of the policy’s impact on firm outcomes.

3.3. Model

3.3.1. Difference-in-Differences (DID) Model

The primary Difference-in-Differences (DID) model incorporates the following variables: The dependent variable represents either financial health or innovation capability for firm i at time t, such as the current ratio (curr_ratio) or other financial metrics. The treatment variable is a binary indicator that represents whether a firm is part of the treatment group. Specifically, if a firm is impacted by the Environmental Protection Tax (EPT), = 1; otherwise, = 0. The time variable is also a binary indicator, signifying whether the observation occurs after the policy implementation period (= 1) or before (= 0).

The interaction term captures the differential effect of the policy on the treatment group before and after implementation. The coefficient of this interaction term is the main parameter of interest in the DID model, used to assess the causal impact of the policy on the dependent variable.

Control variables are included to account for other determinants that may influence the dependent variable. These factors encompass corporate financial and market characteristics. In this model, control variables may include the logarithm of monetary funds (ln_MonetaryFunds), the logarithm of net fixed assets (ln_NetFixedAssets), and the logarithm of paid-in capital (ln_PaidCapital), among others. The error term () represents stochastic error components or noise that is not explained by the model.

3.3.2. Mediation Effects Model

Effects of Independent Variables on Mediating Variables

Effects of Mediating and Independent Variables on the Dependent Variable

In the mediation effect model, the mediator variable represents the R&D investment of firm at time . This variable is used to analyze its mediating effect between the independent and dependent variables. The independent variable indicates the differential effect of the policy on the treatment group before and after implementation. Its coefficient is used to estimate the policy's effect on the mediator variable.

Control variables remain consistent with those used in the basic DID model. The error term () continues to represent random error or noise unexplained by the model. The mediation effect model also examines whether the policy affects the dependent variable (curr_ratio) indirectly by influencing the mediator variable (). If the direct effect of the policy on the dependent variable decreases when the mediator variable is controlled, it verifies the significance of the mediation effect.

4. Empirical Results and Analysis

4.1. Descriptive Statistics and Correlation Analysis

Table 1 presents descriptive statistics for the key variables used in this study, summarizing 4,473 observations of essential financial and innovation-related metrics. These variables are critical in assessing the impact of the Environmental Protection Tax (EPT) on corporate performance and innovation.

The current ratio (curr ratio), one of the main indicators for liquidity, has a mean of 1.616 and a standard deviation of 2.007, highlighting significant variability in firms' short-term liquidity management. The range, from 0.101 to 41.225, indicates substantial differences in firms' ability to cover short-term obligations, with some firms holding excessively high liquidity relative to liabilities, which may suggest inefficient resource allocation.

The policy variable (did), representing the treatment group affected by the EPT, has a mean of 0.188, indicating that about 18.8% of the sample firms are subject to the tax. The standard deviation of 0.391 shows the variation in EPT impact across firms, reflecting different responses to environmental regulations.

Key financial indicators such as ln_MonetaryFunds (mean = 21.412) and ln_NetFixedAssets (mean = 22.301) capture differences in cash holdings and long-term investments, revealing diversity in liquidity levels and capital structures among firms. ln_PaidCapital (mean = 21.476) and ln_OperatingProfit (mean = 20.017) illustrate capital investment and operational efficiency levels, further demonstrating significant operational disparities across firms. These statistics suggest considerable heterogeneity in financial strategies, which forms the foundation for analyzing the effect of the EPT on corporate performance and green innovation.

Table 2 demonstrates significant negative associations between the liquidity ratio and multiple financial variables. Specifically, the liquidity ratio exhibits negative correlations with monetary funds, net fixed assets, paid-in capital, surplus reserve, investment income, and operating profit. This indicates that firms with robust asset management capabilities or substantial long-term investments tend to maintain lower liquidity ratios, reflecting a reduced dependence on high liquidity for addressing short-term obligations. These firms may strategically reallocate financial resources towards long-term capital investments, resulting in decreased liquidity ratios.

Furthermore, the policy variable (did), representing the treatment group affected by the Environmental Protection Tax (EPT), reflects the varying impact of the EPT across firms. The correlation between the did variable and the liquidity ratio is -0.0129, implying that the EPT may exert a weak negative influence on corporate liquidity. This necessitates strategic financial adjustments by firms to manage the additional tax burden effectively.

While the correlation analysis does not directly explore the relationship between the environmental protection tax and innovation investments, the negative correlation between ln_InvestIncome and the liquidity ratio (with a coefficient of -0.2295) suggests that firms increasing their innovation investments tend to reduce liquidity reserves. This observation implies a strategic reallocation of resources from short-term liquidity towards innovation and R&D activities, aimed at enhancing long-term competitiveness. In this context, the decline in liquidity ratios can be interpreted as a deliberate strategic response to external regulatory pressures, prioritizing innovation-led growth.

In conclusion, the correlation analysis highlights significant negative relationships between the liquidity ratio and key financial indicators, reflecting firms' asset allocation adjustments in response to external tax pressures. Although a direct causal link between environmental tax and innovation capacity is not explicitly established, the observed relationship between innovation investment and liquidity suggests that firms may be balancing short-term financial stability with innovation efforts to sustain long-term competitiveness within a more regulated environment

4.2. Regression Results

Table 3 presents the regression results evaluating the impact of the Environmental Protection Tax (did) on the liquidity ratio (curr_ratio). These findings primarily test Hypothesis 1, which asserts that the Environmental Protection Tax negatively influences the liquidity ratio, a key indicator of financial health.

Across all three models, the environmental tax treatment variable (did) consistently demonstrates a significant negative association with the liquidity ratio. In Model (1), the coefficient for did is -1.229, significant at the 1% level (p < 0.01). This result indicates that the Environmental Protection Tax reduces firms' liquidity. This trend persists as additional control variables are introduced, with coefficients of -0.947 in Model (2) and -0.705 in Model (3), both significant at the 1% level. These findings provide robust evidence supporting the assertion that the Environmental Protection Tax weakens firms' short-term financial solvency.

The theoretical basis for these findings is grounded in Tax Burden Theory and Corporate Financial Adjustment Theory. According to Tax Burden Theory, firms facing external costs, such as those imposed by the Environmental Protection Tax, are likely to reduce liquid assets to meet these obligations, resulting in a decline in their liquidity ratio. This reduction in liquidity indicates a weakened short-term financial position directly attributable to the increased tax burden.

Corporate Financial Adjustment Theory further explains this behavior. To maintain financial stability amid increased tax obligations, firms may reallocate resources, reducing liquid assets to fund long-term capital investments or optimize their working capital structure. Such adjustments contribute to the observed decline in liquidity ratios, as firms prioritize long-term strategic goals over maintaining high levels of short-term liquidity.

The control variables offer additional insights. ln_MonetaryFunds (monetary funds) exhibits a significant positive relationship with the liquidity ratio, indicating that firms with larger cash reserves maintain stronger liquidity, thereby enhancing their short-term solvency. Conversely, ln_NetFixedAssets (net fixed assets) and ln_PaidCapital (paid-in capital) are negatively correlated with liquidity, suggesting that firms with substantial capital bases or asset portfolios are less reliant on high liquidity ratios, likely reallocating resources toward long-term investments.

ln_OperatingProfit (operating profit) also shows a positive relationship with liquidity in Model (3) (p < 0.1), suggesting that increased profitability enhances a firm's capacity to sustain liquidity. Higher profitability provides additional financial flexibility, enabling firms to better manage external pressures such as environmental taxes.

The explanatory power of the model improves with the inclusion of more control variables, with the R-squared value increasing from 0.458 in Model (1) to 0.524 in Model (3). This progression indicates that while the Environmental Protection Tax significantly impacts liquidity, other internal financial and asset management strategies also play a crucial role in determining firms' liquidity ratios.

In conclusion, the regression results clearly demonstrate that the Environmental Protection Tax negatively affects firms' liquidity, thereby confirming Hypothesis 1. Firms subject to the tax burden tend to reduce liquid assets, weakening their short-term solvency. These findings contribute to a deeper understanding of how external regulatory pressures influence corporate financial health, prompting firms to adjust their liquidity to balance immediate obligations with long-term investments.

4.3. Robustness Test

4.3.1. Parallel trend test

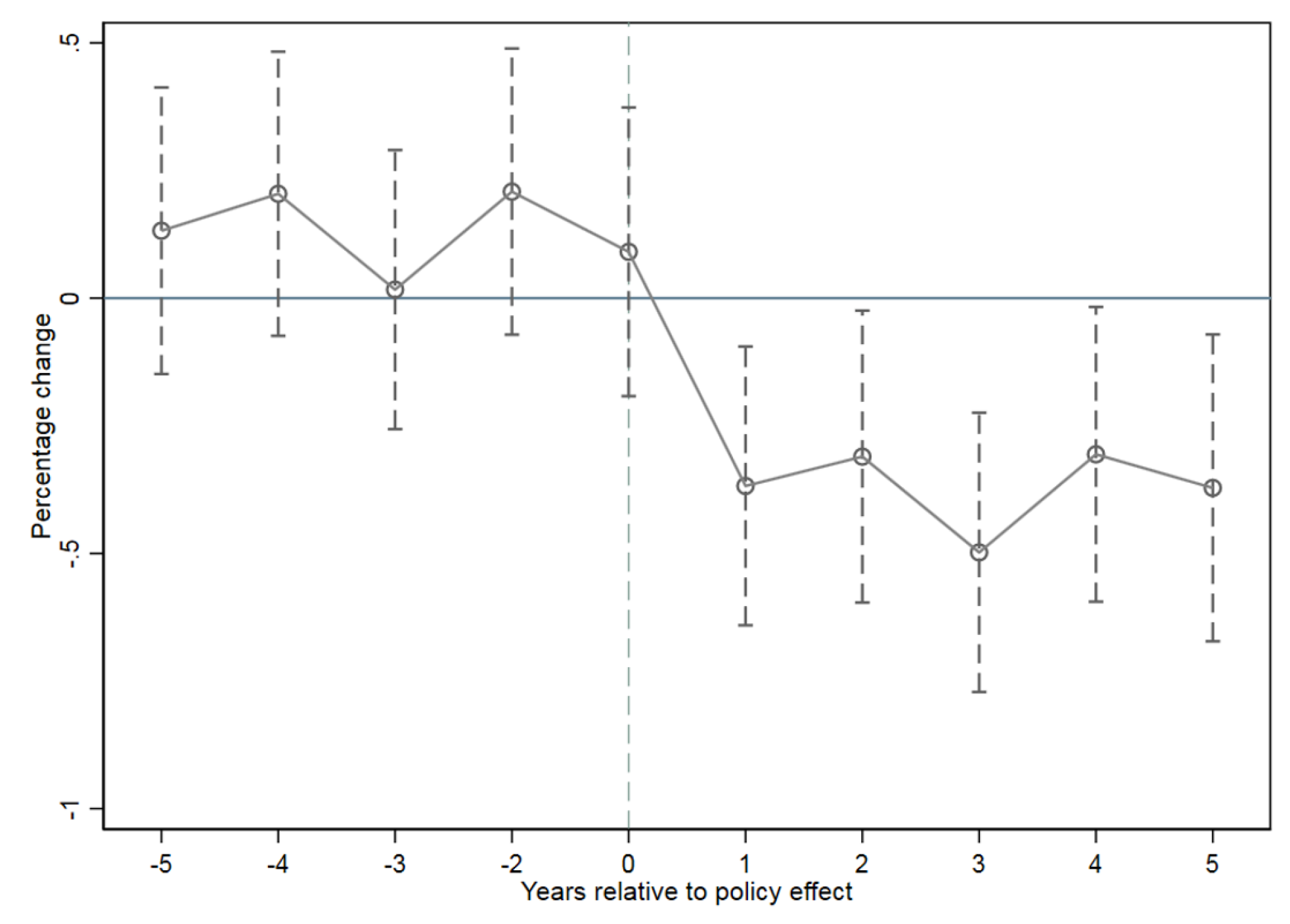

Figure 1 depicts the effects of the Environmental Protection Tax (EPT) on corporate liquidity ratios over the period from 2013 to 2023, with the policy being introduced in 2018. This analysis seeks to validate Hypothesis 1, which posits that the EPT negatively influences liquidity ratios.

Between 2013 and 2018, liquidity ratios remained relatively stable, fluctuating around zero. This stability before the policy's implementation supports the parallel trends assumption, suggesting that corporate financial health did not experience significant changes prior to the introduction of the EPT. Such consistency justifies the application of the Difference-in-Differences (DID) methodology to evaluate the effects of the tax policy.

Following the EPT's implementation in 2018, a marked decline in liquidity ratios was observed, which became increasingly significant over the next two to three years. This trend is consistent with Hypothesis 1, indicating that the EPT imposed financial pressure on firms, thereby diminishing their liquidity. The error bars in

Figure 1 further validate the statistical significance of these changes, confirming that the reductions in liquidity were attributable to the EPT.

Notably, although innovation investment increased following the policy's implementation, the inherent time lag in realizing returns from innovation meant that these investments did not immediately alleviate liquidity pressures. This lag reflects the time required for firms to translate R&D investments into financial gains, thereby exacerbating the short-term liquidity strain. As a result, firms must strategically adjust their liquidity management to navigate the short-term financial constraints induced by the policy.

The shift from stability prior to 2018 to a subsequent decline underscores the financial burden imposed by the EPT, particularly for industries facing high environmental compliance costs. These findings highlight the necessity for firms to adapt their financial strategies to manage the liquidity challenges resulting from the tax in the short term.

The parallel trend test provides robust empirical evidence supporting Hypothesis 1, demonstrating that the Environmental Protection Tax exerts a negative and statistically significant effect on corporate liquidity ratios. While the EPT aims to promote sustainability, it also imposes immediate financial constraints on firms, particularly concerning liquidity management. Given the time lag inherent in innovation activities, the short-term financial pressures on firms may be even more pronounced.

4.3.2. Robustness

The

Table 4 presents the impact of the Environmental Protection Tax (EPT) on corporate financial performance by examining key indicators, including Return on Equity (ROE), Return on Assets (ROA), the quick ratio, and outcomes from a random effects (RE) model. These metrics serve as proxies for profitability, liquidity, and heterogeneity across cross-sectional units and time periods. The results elucidate the relationship between the EPT, represented by the did variable, and firms' financial health.

The coefficient for the did variable in the ROE model is -0.027 (p<0.01), indicating a statistically significant negative effect. This finding suggests that the introduction of the EPT diminishes firms’ return on equity, thereby imposing a financial burden. Similarly, the ROA model presents a coefficient of -0.014 (p<0.01), further corroborating that the EPT reduces the efficiency of firms in utilizing assets to generate profit. Collectively, these results indicate that the EPT reduces profitability, likely due to increased compliance costs and reduced operational efficiency.

In terms of liquidity, both the quick ratio and the RE model show significant negative effects. The quick ratio's coefficient for did is -0.605 (p<0.01), indicating that firms face greater difficulty in meeting short-term liabilities after the EPT's implementation. This suggests that environmental taxation constrains firms' ability to maintain sufficient liquidity. Similarly, the RE model coefficient of -0.663 (p<0.01) highlights an overall decline in liquidity, considering both cross-sectional and temporal heterogeneity.

These findings collectively demonstrate that the EPT exerts considerable pressure on both profitability and liquidity. The negative coefficients across all models confirm that the EPT creates financial constraints, necessitating strategic adjustments by firms to manage reduced liquidity and profitability.

This analysis underscores a consistent pattern: while environmental taxes are crucial for advancing sustainability, they also impose immediate financial challenges for businesses. This impact is particularly evident in the strain on liquidity and the decline in profitability, highlighting the trade-off between regulatory compliance and financial stability. The results suggest that firms may need to innovate or reorganize their operations to mitigate these financial pressures, balancing short-term constraints with long-term sustainability objectives.

4.4. Mediating Effects

Table 5 presents a mediation analysis that examines how R&D investment mediates the relationship between the Environmental Protection Tax (EPT) and corporate liquidity, as measured by the current ratio. This analysis aims to elucidate the extent to which the EPT influences both liquidity and innovation, and whether R&D serves as a crucial mediating factor in this process, thereby offering a more nuanced understanding of the interplay between regulatory pressures, innovation, and financial health.

In the first model, the EPT demonstrates a significant negative effect on the current ratio, with a coefficient of -0.806. This finding suggests that the EPT exerts downward pressure on firms' liquidity, thereby supporting the notion that environmental taxation imposes financial burdens by restricting companies' short-term financial flexibility. The reduction in liquidity indicates that firms may struggle to maintain their immediate financial commitments due to the added costs associated with the tax.

In the second model, the EPT exhibits a positive effect on R&D investment, with a coefficient of 0.0175. This implies that the tax policy incentivizes firms to allocate more resources toward innovation, likely as a strategic adaptation to meet regulatory requirements and enhance competitiveness. These findings align with the broader argument that environmental regulations can serve as a catalyst for innovation, compelling firms to improve efficiency and develop new technologies to comply with evolving environmental standards.

The third model explores the mediating role of R&D in mitigating the impact of the EPT on liquidity. The results indicate that while R&D investment positively affects the current ratio (with a coefficient of 4.303), the direct negative impact of the EPT on liquidity remains significant, albeit somewhat diminished. This suggests that increased R&D expenditure can partially alleviate the financial pressures induced by the EPT, but it is insufficient to fully counterbalance the liquidity challenges faced by firms. The presence of R&D as a mediating factor highlights firms' strategic shift toward innovation, even in the face of constrained liquidity, as a means to enhance their long-term resilience and adaptability.

In conclusion, the results indicate that while the EPT imposes short-term financial constraints, it also promotes innovation through increased R&D investment. This underscores a dual effect: environmental regulations not only introduce immediate financial costs but also foster long-term strategic benefits by stimulating innovation. Although R&D investments help mitigate some liquidity pressures, firms continue to face notable financial difficulties in the short term. The findings suggest that firms must navigate a complex landscape of balancing immediate financial stability with long-term innovation-driven growth, adapting their strategies to align with both regulatory demands and competitive pressures.

4.4. Heterogeneity Test

Table 6 presents a heterogeneity analysis that investigates how firm size moderates the impact of the Environmental Protection Tax (EPT) on corporate liquidity, as measured by the current ratio. Firms are categorized into three size groups: assets under 100 billion RMB (Group 1), between 100 billion and 1000 billion RMB (Group 2), and above 1000 billion RMB (Group 3). This analysis aims to determine whether firm size influences the extent to which the EPT affects liquidity, thereby providing insights into the differential financial resilience of firms of various scales.

For firms with assets under 100 billion RMB, the coefficient for the did variable is -0.617 (p<0.05), indicating a significant negative effect of the EPT on the current ratio. This finding suggests that smaller firms are particularly susceptible to the financial pressures imposed by the EPT, as they generally have fewer resources to absorb the additional tax burden. The limited financial flexibility of smaller firms makes them especially vulnerable to regulatory costs, constraining their ability to maintain adequate liquidity levels.

For firms with assets between 100 billion and 1000 billion RMB, the coefficient for the did variable is -0.303 (p<0.1). Although still negative, the effect is less pronounced compared to smaller firms, indicating that medium-sized firms exhibit a certain degree of resilience against the impact of the EPT. This resilience is likely attributable to their relatively larger financial resources and more developed financial management strategies, which enable them to partially mitigate the adverse effects of the tax.

For large firms with assets exceeding 1000 billion RMB, the coefficient for the did variable is -0.334 (p<0.05). While large firms are better positioned to manage financial pressures, the EPT still significantly reduces their liquidity. However, the magnitude of the effect is smaller than that observed for smaller firms, suggesting that large firms have the capacity to better withstand the financial impact of the tax due to their extensive resource base and more sophisticated financial planning.

Overall, the analysis reveals that the EPT reduces liquidity across firms of all sizes, but the extent of this impact varies considerably. Smaller firms are the most affected, followed by medium and large firms, highlighting the critical role that firm size plays in moderating the financial impact of environmental regulations. While larger firms are better equipped to manage the financial strain imposed by the EPT due to their greater financial flexibility and resource availability, smaller firms face significant challenges in coping with the financial burdens of compliance. These findings underscore the importance of tailoring regulatory approaches to account for firm-specific characteristics, suggesting that smaller firms may require additional support mechanisms to manage the financial pressures associated with environmental compliance, whereas larger firms may be better able to adapt through strategic financial planning.

5. Conclusions

This study examines the impact of the Environmental Protection Tax (EPT) on the financial health of Chinese A-share listed companies, focusing on liquidity, profitability, and innovation from 2013 to 2023. By employing econometric methods such as Difference-in-Differences (DID) and mediation analysis, the research provides a comprehensive understanding of how the EPT influences corporate financial performance. The findings indicate that the EPT significantly reduces corporate liquidity, as evidenced by declines in both the current ratio and the quick ratio, thereby imposing immediate financial constraints on firms and weakening their short-term solvency.

The analysis demonstrates that the EPT exerts a substantial negative effect on corporate liquidity. Firms, particularly those in industries with high environmental compliance costs, experience significant financial strain in the short term, resulting in declines in liquidity ratios. This suggests that the EPT imposes immediate financial burdens that challenge firms' capacity to meet their short-term financial obligations. The observed financial pressure is especially pronounced for smaller firms, which are less capable of absorbing these additional costs due to their limited financial flexibility.

While the EPT creates financial pressure, it also incentivizes firms to increase investments in green technological innovation. However, the inherent time lag in realizing financial returns from these investments exacerbates short-term liquidity challenges. The findings indicate that although the EPT encourages firms to allocate more resources to R&D, the financial benefits from such innovation are not immediately realized, placing further pressure on liquidity and short-term financial stability. Nonetheless, these investments are crucial for enhancing long-term competitiveness, suggesting that firms view R&D as a strategic necessity to adapt to evolving regulatory landscapes and sustain future growth.

The heterogeneity analysis reveals significant differences in how firms of varying sizes are affected by the EPT. Smaller firms are more adversely impacted compared to larger firms, emphasizing the importance of firm size in determining resilience to the financial challenges posed by environmental regulations. Smaller firms face greater difficulty managing these pressures, whereas larger firms, with their greater financial flexibility and resource availability, are better positioned to withstand the EPT's impact. This disparity underscores the need for tailored policy interventions that take firm-specific characteristics into account.

The study highlights the dual impact of the EPT: it promotes sustainable practices and innovation while imposing financial constraints, particularly in the short term. This trade-off suggests that while environmental taxation can effectively drive firms toward greener practices, it may also lead to short-term liquidity issues that hinder operational efficiency and financial health. The EPT generates both immediate financial strain and incentives for strategic shifts toward innovation, reflecting the complex interplay between regulatory pressure and corporate adaptation.

For policymakers, these findings underscore the need for a balanced approach to environmental taxation. While the EPT has proven effective in fostering innovation, the financial strain it places on firms, particularly those in heavily polluting industries, calls for additional supportive measures. Adjustments to the tax framework, such as providing financial support or offering tax incentives for R&D, could help mitigate short-term liquidity issues while continuing to promote long-term sustainability goals. Additionally, exploring the role of government subsidies in alleviating the financial burden imposed by the EPT could provide further valuable insights, especially for smaller firms that are more vulnerable to these pressures.

The study's limitations include its focus on publicly listed companies within heavily polluting industries, which may not fully capture the broader economic implications of the EPT. Furthermore, reliance on secondary data may overlook nuanced aspects of environmental compliance and innovation activities. Future research could expand the scope to include privately held firms and investigate the long-term financial impacts of sustained R&D investments. Expanding the analysis to encompass a more diverse range of industries could also provide a more comprehensive understanding of the EPT's effects across the economy.

In conclusion, while the EPT represents a significant policy tool for advancing environmental sustainability, its short-term financial impact on firms underscores the necessity of balancing regulatory and financial considerations. Policymakers must carefully weigh the immediate financial burdens on firms against the long-term benefits of innovation and environmental responsibility to ensure that the tax system supports both sustainability and corporate financial health. This study provides critical insights into the complex interplay between environmental taxation and corporate financial performance, highlighting both immediate challenges and potential long-term benefits. The findings offer guidance for policymakers seeking to refine environmental tax frameworks and support businesses in navigating evolving regulatory requirements.

Author Contributions

Conceptualization, E.T. and S.P.; methodology, E.T.; software, E.T.; validation, E.T.; data curation, E.T.; writing, E.T.; investigation, E.T.; upervision, E.T. and S.P. All authors have read and agreed to the published version of the manuscript.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be available from the corresponding author on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Long, F. , Lin, F., & Ge, C. (2020). Assessing the Impact of Environmental Protection Tax Law on the Market Valuation of High-Pollution Companies: A Quasi-Natural Experiment Approach in China. Acadlore.

- Robinson, T.R. , Henry, E., Pirie, W.L., & Broihahn, M.A. (2015). International Financial Statement Analysis (3rd ed.). CFA Institute.

- Sinha, G. (2012). Financial Statement Analysis (1st ed.). PHI Learning Pvt. Ltd.

- Amengor, E.C. Importance of Liquidity and Capital Adequacy to Commercial Banks. Global Journal of Finance and Management, 2010, 2, 27–37. [Google Scholar]

- Porter, M. E. , & van der Linde, C. (1995). Green and competitive: Ending the stalemate. *Harvard Business Review*.

- Environmental regulations and labor demand: Evidence from the South Carolina paper industry. *Journal of Labor Economics*.

- Bravo, C. , & Estrada, M. (2018). Environmental taxes and firm performance: Evidence from Spanish manufacturing. *Ecological Economics*.

- Nishitani, Y. , et al. (2021). The impact of environmental activities on firm performance: Is green really good for business? *Journal of Business Ethics*.

- Ouyang, M. , Li, X., & Du, J. (2020). Environmental regulation and technological innovation in the industrial sector: Evidence from China. *Science of The Total Environment*.

- Long, R. , Lin, F., & Ge, C. (2022). The impact of environmental protection tax on corporate performance: Evidence from China. *Journal of Cleaner Production*.

- Liu, Z. , et al. (2022). The effect of environmental tax implementation on corporate environmental investment: Evidence from Chinese A-share listed companies. *Environmental Science & Policy*.

- Orset, J. (2019). Do environmental taxes lead to a reduction in pollution? A meta-analysis. *Energy Economics*.

- He, et al. (2021). The effect of environmental regulation on firm emissions: Evidence from China. *Journal of Environmental Management*.

- Johnstone, N. (2014). Environmental policy and firm behavior: Evidence from the UK climate change levy. *Journal of Environmental Economics and Management*.

- Prest, A. , & Krupnick, A. (2021). Environmental taxation and the corporate bottom line: A meta-analysis. *Ecological Economics*.

- Andrea, R. , et al. (2013). Environmental tax incentives and corporate behavior: Evidence from the UK enhanced capital allowance scheme. *Energy Policy*.

- Huang S, Lin H, Zhou Y; et al. The influence of the policy of replacing environmental protection fees with taxes on enterprise green innovation—evidence from China’s heavily polluting industries. Sustainability 2022, 14, 6850. [Google Scholar] [CrossRef]

- Jiang Z, Xu C, Zhou J. Government environmental protection subsidies, environmental tax collection, and green innovation: evidence from listed enterprises in China[J]. Environmental Science and Pollution Research, 2023, 30, 4627–4641.

- Porter M E, Linde C. Toward a new conception of the environment-competitiveness relationship[J]. Journal of economic perspectives, 1995, 9, 97–118.

- Bigliardi, B. The effect of innovation on financial performance: A research study involving SMEs[J]. Innovation, 2013, 15, 245–255. [Google Scholar] [CrossRef]

- Piotroski, J. 2000. Value Investing: the use of historical financial statement information to separate winners from losers. Journal of Accounting Research.

- Cao, G., She. Environmental Protection Tax and Green Innovation: The Mediating Role of Digitalization and ESG. Sustainability 2024, 16, 577. [Google Scholar] [CrossRef]

- Song, Y. , & Du, L. (2017). The Relationship between Environmental Protection Tax, Corporate ESG Performance, and Green Technological Innovation. Frontiers in Environmental Science.

- Jiang, X., Liu. Environmental Tax and Green Innovation in China: The Role of Subsidies and Market Competition. Journal of Cleaner Production 2023, 419, 137–154. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).