1. Introduction

The global push for sexual parity is gaining momentum, leading to a heightened focus on the inclusion of gender variety within corporate directorates. Research indicates that the inclusion of females in the directorate can expand the scope of leadership viewpoints and enhance the efficacy of corporate strategic choices and administrative oversight. Female directors, guided by elevated ethical norms and a commitment to social accountability, tend to focus on the enduring welfare and societal effects within the firm’s strategic choices [

1]. Research indicates a strong correlation between the presence of gender variety on corporate boards and the company’s environmental stewardship, fiscal outcomes, as well as its dedication to corporate social aspects [

2,

3,

4]. Women in directorial roles tend to endorse innovative initiatives by management, exhibiting a more prudent approach to handling risks and making strategic choices [

5,

6]. Companies with mixed-gender boards experience enhanced influence on their environmental strategies and comprehensive business results [

7,

8]. These female board members significantly contribute to the enhancement of decision-making quality within the board, thereby advancing the company’s commitment to social and environmental responsibility [

9]. Besides, women directors are outstanding in communication, teamwork, and dispute resolution, which enhances the board of directors’ synergy and efficiency. These advantages are particularly important in the rapidly changing and innovative technology industry.

In the corporate landscape, the significance of ESG is on the rise. It influences not just the enduring viability of firms but also centers on the interests of parties such as financiers and the public. ESG performance has emerged as a critical benchmark for assessing a company’s capacity to pursue sustainability and honor its societal duties. Outstanding ESG outcomes not only bolster a firm’s reputation and brand equity but also yield tangible financial rewards. For instance, superior environmental practices can decrease expenses and lower pollution levels; a commitment to social responsibility can elevate staff contentment and customer fidelity. The enhancement of investor confidence and the mitigation of risks are substantially influenced by effective corporate governance [

10]. Companies have seen marked enhancements in their environmental and social metrics by refining ESG transparency [

9]. There is a strong correlation between ESG achievements and a firm’s financial success, its approach to risk, and its competitive edge [

11,

12]. The composition of the board, particularly the diversity of gender, has emerged as a critical element influencing a company’s ESG outcomes during the advancement of ESG initiatives [

13]. The potential damage to a company’s reputation and value due to ESG-related controversies is not to be underestimated [

12].

In the technology industry, as innovation-driven companies, more attention needs to be paid to ESG performance. The reason is that its development not only has an impact on the economy but also wields a substantial effect on both community and environmental domains [

14]. The potential for technology enterprises to foster enduring development is immense. Studies have shown that they have performed well in ESG compliance, especially in terms of environment and governance, which provides positive support for the operational efficiency and market value of enterprises [

15]. While pursuing technological innovation and improving economic efficiency, technology companies should also actively pay attention to ESG performance [

16]. Although technology companies play a decisive role in promoting social progress and innovation, they will also have to deal with challenges related to data privacy, ethics, and environmental impact. The tech sector, a prime example of a knowledge-based industry, heavily depends on the instrumental influence of a gender-mixed board to enhance its environmental and social outcomes [

17]. The technology industry has been making continuous progress, with outstanding innovation and transformation. The degree of attention paid to ESG issues and the diversity of governance structures in this regard will show different characteristics compared with traditional industries. Most technology companies will invest more energy in environmental protection, social responsibility, governance transparency, etc., and place more emphasis on innovation and diversification. Therefore, exploring the ESG performance of technology companies and studying the factors that affect these performances can provide cutting-edge perspectives and provide reference and inspiration for other industries.

Overall, ESG management in technology companies is crucial, while female leaders show a strong association with ESG performance. This study examines the moderating role of risk on the influence of women directors on ESG outcomes, as well as how the effect of female board members on ESG varies across different risk thresholds in technology firms. The research provides a nuanced understanding of the link between gender diversity in leadership and ESG scores, along with the impact of risk appetite on the effectiveness and scope of gender diversity in the boardroom.

2. Literature Review

Academic research into the link between the credentials of women on corporate boards and business risk has yielded a spectrum of insights and findings. There is a notable positive relationship between the attributes of female directors and the level of corporate risk-taking. For example, a study focusing on the German banking industry found that an increase in the number of female leaders on boards corresponded with a rise in portfolio risk [

18]; In a parallel vein, an examination of Spanish businesses showed that those with increased female representation on their boards tended to undertake greater risks, where both operational and bankruptcy risks were found to be positively correlated with the gender diversity of the board [

19]. Studies have shown an inverse relationship between the qualifications of female directors and corporate risk, indicating that women on boards excel in their supervisory roles [

1]. Investigations into board effectiveness in managing R&D investment risks [

20], cultural moderation perspective [

21], and decision-making styles [

22] have all pointed to a substantial negative correlation between gender diversity on boards and corporate risk-taking. In contrast, Sila et al. [

23] found no link between the background of female directors and corporate risk, suggesting that the presence of women on boards does not affect corporate risk levels. These varying findings may result from differences in research settings, sampling criteria, and the risk assessment methods utilized [

24]. This meta-analysis sheds new light on the topic, suggesting that there is an inverse relationship between the level of Board Gender Diversity (BGD) and corporate risk, which is mainly due to the directors’ oversight capacity rather than their consultative duties. Varied associations—positive, negative, and mixed—have been noted between companies’ ESG performance and risk within diverse national and sector-specific settings [

25,

26,

27]. The role of ESG in risk mitigation is gaining recognition, even though scholarly work has yet to firmly establish a direct link between ESG and risk outcomes [

28]. Although a positive link between ESG disclosure and corporate performance is evident, more research is required to understand the lasting and immediate impacts of ESG on the spectrum of risk types. Current studies depict a complex interplay among risk, the involvement of women on boards, and ESG considerations.

The current body of research offers a meaningful understanding of the connection between women in director roles and ESG practices. Findings from pertinent investigations indicate that a diverse gender composition within the boardroom positively influences a firm’s ESG outcomes [

9,

29,

30,

31].

Recent studies investigating the interplay between female directors, ESG performance, and risk have revealed that ESG performance negatively impacts financial risk in oil and gas companies, with board gender diversity intensifying this relationship [

27]. The presence of female directors enhances the effectiveness of board oversight, increasing the transparency of the firm’s socially responsible investment program. This, in turn, improves ESG disclosure and signaling, ultimately reducing corporate risk and boosting corporate performance [

32].

Risks affect the formulation of corporate strategies, including the emphasis on ESG performance, and different levels of risk change the background and conditions of the board’s strategic decision-making. For example, in a high-risk environment, boards may place more emphasis on investment stability and long-term returns, which may lead to more support for female directors in promoting ESG strategies. In different risk environments, the governance structure and decision-making process of enterprises may change. Studying how risk regulates the impact of female directors on ESG can reveal the differential effects of female leadership in promoting sustainable development under different risk levels.

The academic discourse on the nexus between firms’ ESG efforts, the profiles of female board members, and the associated business risks predominantly investigate the direct associations between these elements. This includes examining how ESG performance affects risk levels, the role of female directors in risk management, and the relationship between the appointment of female directors and the enhancement of ESG practices. Further, the literature incorporates the dual role of CEOs [

33], ESG-related disputes, the level of gender diversity on boards [

27], cultural influences [

21], religious factors [

13], commitment to the United Nations Global Compact, and adherence to ISO standards [

17] as moderating influences. Nonetheless, avoiding the exploration of risk as a moderating variable represents a significant oversight in the current research landscape.

3. Hypothesis and Theoretical Background

3.1. Female Board Background and ESG Performance

Scholarly attention is increasingly fixated on the link between female board participation and corporate ESG criteria [

17,

29,

31]. Despite evidence from studies that highlight the constructive effects of gender diversity on ESG disclosures by corporate boards, a multitude of unexplored territories and knowledge gaps persist, demanding more rigorous exploration.

First, the literature on how to affect ESG performance through specific mechanisms is still limited. Some researchers have indicated that women directors may have a deeper concern for environmental and social issues due to their unique values and ethics [

29]. However, people often overlook the differences between female directors in different industries and different national backgrounds. Although it is based on a global sample, Alkhawaja et al. [

29] did not further discuss the impact of cultural and social norms in different regions on the decision-making behavior of female directors.

Secondly, studies predominantly concentrate on the linkage between the presence of female directors and ESG performance at the board level [

9,

17,

34]. However, there is a notable gap in investigating the underlying mechanisms at different corporate tiers, which remains relatively underexplored. While the research by Fan et al. [

31] acknowledged the positive association between the percentage of female directors and a company’s ESG rating, it fell short of delving into the detailed manifestations of this correlation across various company levels.

Moreover, the current body of research primarily focuses on the quantitative aspects of female directors [

13,

34,

35], including their numbers and the overall quality, expertise, and experience they possess. However, there is a significant gap in the existing literature; a study by Treepongkaruna et al. [

12] indicated that the size of the board of directors is a critical factor in ESG-related disputes. Yet, this study did not thoroughly investigate how the professional background of female directors affects the handling and prevention of ESG disputes.

When existing research explores the relationship between female directors and ESG performance, they often ignore the potential impact of other characteristics of the board of directors. Although the study by Nguyen et al. [

36] used fuzzy set qualitative comparative analysis to explore the complex interrelationships of board characteristics, it still failed to comprehensively cover all possible board characteristics, such as board members’ professional background, education level, etc.

The resource dependence theory underscores the importance of gender diversity in accessing resources and knowledge, serving as a foundational theory for researching the impact of gender diversity on corporate boards on environmental performance. A study by Elmagrhi et al. [

37] grounded in resource dependence theory, examined how female directors affect a company’s environmental performance. The research indicated that female directors offer distinct resources and viewpoints, aiding companies in addressing external environmental uncertainties and, as a result, improving their environmental performance.

In the realm of high-tech enterprises, resource dependence theory places a significant emphasis on the role of female directors in fostering corporate environmental strategies and innovation. Al-Najjar and Salama’s [

30] research proposed that the environmental performance of high-tech enterprises was positively affected by female directors and management, allowing them to better respond to environmental challenges. From the viewpoint of resource dependence theory, this interpretation highlights the crucial role of female directors, who bring distinctive skills and resources to the table. The theory suggests that a gender-diverse board can offer companies a wider array of perspectives and resources, enhancing their performance in environmental stewardship and corporate social responsibility [

37].

Diversity on boards, especially gender diversity, provides companies with different perspectives and expertise, becoming a new impetus for solving complex ESG-related issues [

38,

39,

40]. Resource dependence theory posits that a diverse gender composition within a company’s governance structure broadens its access to a variety of resources and viewpoints. This diversity is believed to enhance the firm’s risk management capabilities and improve the overall quality of its decision-making [

3,

41]. Gender-diverse boards are inclined to provide different perspectives and unconventional approaches, enhance complex problem-solving capabilities, and improve decision quality [

42]. In addition, female directors are predisposed to have a stronger stakeholder orientation, broadening their perspectives and expanding the set of information they bring to board deliberations [

41], traits that lead to more moderate (less extreme) corporate decision-making [

43].

Diverse perspectives and values of women directors can enhance corporate performance in ESG. Therefore, this paper proposes the research hypothesis:

H1

: the higher the percentage of female directors, the better the ESG performance of technology companies.

3.2. Risk, Female Director Background, and ESG Performance

The current academic discourse offers several key perspectives on the relationship between risk, the presence of women on corporate boards, and the adoption of ESG practices.

Initial research indicates that the inclusion of women in corporate directorship may influence a company’s approach to risk. For instance, Arayssi et al. [

32] and García & Herrero [

44] explored this relationship. However, these investigations often concentrate on particular sectors or narrow time frames. As an example, García and Herrero’s [

44] study observed a correlation between the percentage of female directors and a firm’s capital structure, as well as the probability of financial distress among European companies. Yet, this research is limited to non-banking firms listed in Europe between 2002 and 2019. Furthermore, Arayssi et al. [

32] specifically examined the effects of female director involvement on ESG reporting and corporate performance within the context of FTSE 350 index companies. In terms of risk management, although research has covered multiple definitions and measures of risk [

45,

46], in-depth studies on the gender dynamics of risk and how female directors affect risk management are still limited. In particular, the risk aversion characteristics of female directors and their impact on corporate risk-taking in the context of distinguishing between upside and downside risks need to be further explored [

47,

48].

Secondly, current scholarly work appears to be lacking in-depth investigation into the precise mechanisms by which women directors affect ESG practices. While Arayssi et al. [

32] suggested that women directors can drive corporate social and environmental responsibility, these studies often do not elaborate on the specific ways in which women directors advance the ESG agenda through their decision-making. Moreover, there is a notable gap in the literature regarding the influence of women directors on ESG practices across diverse cultural and legal settings.

In the field of ESG, studies have shown that risk market performance does not entirely depend on the level of ESG ratings [

49], and a sample study of the Korean market found that ESG participation can effectively reduce overall risk, systemic risk, and idiosyncratic risk [

50]. ESG factors are widely considered to be key indicators affecting corporate sustainability and performance [

10,

51]. The current body of research primarily concentrates on the correlation between ESG disclosure and corporate performance. However, there is a noticeable gap in the literature concerning how ESG practices are integrated with corporate risk management strategies, as well as the specific role women directors play in fostering these ESG practices.

Lastly, in terms of the connection between women directors and corporate risk, much of the existing research tends to overlook the examination of underlying mechanisms. For instance, women directors might indirectly influence a company’s risk-taking behavior by shaping strategic decision-making and risk-management processes [

52]. However, these mediating and moderating mechanisms have not been thoroughly investigated in the current academic literature.

Agency theory emphasizes the importance of the board’s supervisory role. The theory argues that female directors may make more effective contributions in supervising management and safeguarding shareholder interests because women generally have different moral reasoning and higher risk aversion characteristics [

53,

54]. The presence of female directors may lead to increased information disclosure and private disclosure, improve transparency, reduce information asymmetry [

55], help reduce agency costs and manage opportunism, and limit excessive risk-taking behavior of enterprises. Female directors may tend to make more cautious financial decisions because of their different behavioral characteristics, such as lower overconfidence and higher risk aversion [

56]. Agency theory emphasizes the role of monitoring and incentive mechanisms in corporate governance. Introducing gender diversity among board members can improve their monitoring function and reduce agency costs [

57].

Corporate risk preference may moderate the relationship between female directors and ESG performance. Therefore, this paper proposes the following research hypothesis:

H2

: the corporate preference for risk positively moderates the relationship between the percentage of female directors and ESG performance..

This implies that as a company’s risk appetite increases, the influence of the proportion of female directors on its ESG performance becomes more pronounced. Specifically, the role of women directors may be more pronounced in firms with a higher risk appetite, exerting a greater impact on their ESG performance.

4. Research Design

4.1. Sample Selection and Data Source

For this study, a sample of 1,204 technology companies listed on China’s A-share market from 2014 to 2023 has been chosen. The data are sourced from the Sino-Securities Index ESG Ratings, RESSET, and CSMAR databases, encompassing information on corporate board composition, financial metrics, and ESG ratings. The specific data points include details on company board members, ESG scores, financial indicators, and measures of corporate risk preference.

To maintain the integrity of the data, the study implemented several refinement steps: (1) Exclusion of firms designated as ST or *ST; (2) Removal of samples from bankrupt or delisted companies; (3) Exclusion of samples with incomplete data; and (4) Winsorization of the data at the 1% level to address outliers. This process yielded a dataset of 8,162 observations.

4.2. Variable Selection and Measurement

Regarding the literature review and available data collection, this study selected the explained variable, explanatory variable, moderating variable, and control variable as

Table 1.

4.2.1. Explained Variable

The key explanatory variable in this research is the company’s ESG performance. This variable is a composite score reflecting a company’s performance across the environmental, social, and governance dimensions. To measure a company’s ESG performance for a specific year, the study utilizes the Sino-Securities Index ESG rating score. This choice of metric is based on its comprehensive nature, which aggregates a company’s performance in the ESG domains. The ESG score is recognized for its comprehensiveness and has been widely adopted in both academic and practical contexts [

13,

58,

59].

4.2.2. Explanatory Variable

In this study, the variable of interest is the background of female directors. Drawing on previous scholarly work, the percentage of women on a company’s board of directors is used as a proxy for this variable [

17,

27,

31]. This choice is based on the findings from earlier research, which consistently demonstrates a positive correlation between the presence of female directors and a company’s ESG performance [

9,

29,

30,

31].

4.2.3. Moderating Variable

This study chooses the indicator of a firm’s total risk to measure a firm’s risk appetite. Total risk encompasses firm-specific risk, which refers to the uncertainty associated with a firm’s particular operational and management decisions, and systemic risk, which focuses on the extent to which a firm is exposed to overall market volatility. This indicator reflects the full range of risk profiles faced by a firm and captures the impact of risk appetite in a more comprehensive manner. In line with existing research [

27,

60], this study uses stock price volatility as an indicator of total risk. Volatility, in this context, refers to the degree of variation in a company’s stock price over 12 months, computed using the range between the highest and lowest prices recorded over the previous 52 weeks. The necessary data for this calculation is obtained from the RESSET database.

4.2.4. Control Variable

Research has indicated that board size and CEO duality impact a firm’s ESG performance. Larger boards tend to enhance ESG performance due to their access to greater resources and information [

12,

61]. CEO duality, when combined with other board characteristics, can improve ESG disclosure [

36]. Additionally, CEO duality may moderate the relationship between board gender diversity and ESG performance [

33]. ESG scores have been found to correlate positively with return on assets [

62], and companies with higher profitability and lower leverage are more likely to demonstrate better ESG performance [

63,

64,

65,

66]. To control for these factors that might influence ESG performance, this study introduces several control variables, drawing on previous literature [

17,

27,

35,

67]. The control variables include:

1. CEO Duality: A binary variable indicating whether the CEO also serves as the chairman of the board (YES/NO).

2. Leverage: The ratio of total liabilities to total assets.

3. ROA: Return on assets.

4. Tobin’s Q: The ratio of the market value of a firm’s assets to their replacement cost.

5. TOP1: The shareholding ratio of the largest shareholder.

6. Meet: The number of board meetings held during the year.

7. Growth: The revenue growth rate of the enterprise.

4.3. Empirical Model

In this research, the model was developed using multiple regression analysis:

is firm i’s ESG performance in a year,

is female director background,

is risk preference,

is the cross-multiplier of female director background and risk preference,

is a control variable, is a year-fixed effect, andis an error term.

5. Empirical Analysis

This paper uses the software Stata 17.0 for subsequent descriptive statistics, regression and moderated effects analysis, and heterogeneity tests so as to test the hypotheses through empirical research methods.

5.1. Descriptive Statistics

Table 2 presents the descriptive statistics for the primary variables in this study. Notably, the ESG performance of the sample companies is quite impressive, with an average ESG score of 73.60, a standard deviation of 4.74, and a score range extending from 57.50 to 83.99. This indicates that while there is variability in ESG performance across different technology companies, the overall scores tend to cluster in the higher range.

The mean proportion of FEM in the sample of technology companies stands at 21.1%, with a mean value of 0.211. This statistic indicates that, despite advancements in the representation of women in technology company management, the average presence of women on boards of directors is less than one-quarter. The standard deviation of 0.108 and a maximum value of 0.57 underscore the diversity in the representation of female directors across these companies, with certain firms being at the forefront of increasing gender diversity in their boardrooms.

Regarding the risk metric, the dataset reveals an average score of 0.032, accompanied by a standard deviation of 0.009, indicating a generally modest and focused risk appetite across the sampled firms. As for the control factors, 41% of the chief executive officers double as the board’s chairperson. The average Leverage Watermark is recorded at 0.373, signifying diverse strategies in debt utilization among tech sector entities. The average ROA stands at 0.0383, while the mean Tobin’s Q is 2.583, these figures mirror the earnings capacity and market worth of the firms in question. The average stake of TOP1 is 29.85%, underscoring the extent of equity concentration among key stakeholders in China’s tech industry. These insights establish a foundation for exploring the impact of women on boards on the ESG outcomes of tech businesses.

5.2. Regression and Moderation Effects Analysis

5.2.1. Analysis of Regression Results

The regression results (

Table 3) in Column (1) reveal that the inclusion of FEM significantly boosts the ESG performance of Chinese tech companies. The coefficient of 2.2385 comes with a p-value below the 0.01 threshold, signifying the proportion of female directors has a significant positive impact on ESG performance. These findings support Hypothesis 1, suggesting that a higher presence of women on boards correlates with improved ESG performance within the tech industry. This insight emphasizes the pivotal function of female directors in fostering robust corporate governance practices.

The regression outcomes in column (2) show that when the enterprise risk factor is included, the coefficient for the percentage of FEM experiences a minor decline but maintains its positivity and statistical significance. Simultaneously, the risk coefficient’s impact on ESG is revealed to be -10.7322, which is notable at the 10% significance level (p < 0.1). Column (3) presents the regression results following the introduction of the FEM_Risk interaction term. The association between FEM and ESG outcomes is significantly influenced by the company’s risk level. The Risk coefficient is -36.5363 (p < 0.01), and the FEM_Risk interaction term coefficient is 120.5828 (p < 0.01). This indicates that the effect of female directors is intensified in organizations with a higher appetite for risk, beneficially impacting ESG performance. In contrast, in companies with a lower risk appetite, the effect of the female director proportion on ESG outcomes is reduced. These results confirm Hypothesis 2, which suggests that a company’s risk preference positively moderates the link between the proportion of female directors and ESG performance. Essentially, the higher a company’s risk appetite, the more substantial the influence of the female director ratio on its ESG achievements.

In the set of control variables, Leverage, ROA, and Tobin’s Q all exhibit significant impacts on ESG performance. Notably, Leverage and Tobin’s Q demonstrate a significantly negative effect. This suggests that as a company’s debt level increases, its ESG performance tends to deteriorate. The higher the ratio of market valuation to replacement cost, the worse the ESG performance tends to be. In contrast, ROA has a significantly positive effect, indicating that more profitable companies generally exhibit better ESG performance.

5.2.2. Moderating Effects Analysis

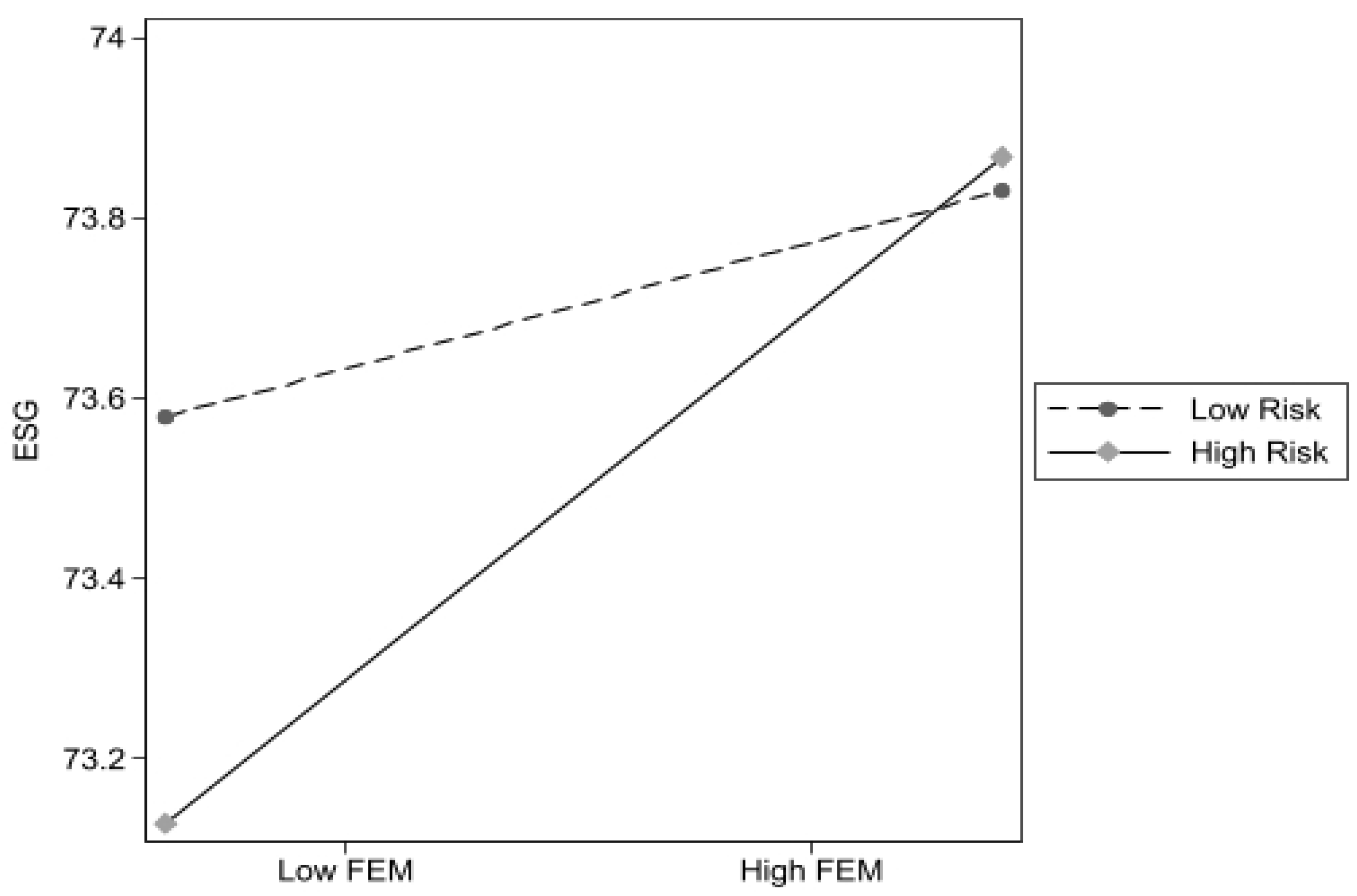

The plot illustrates the moderating influence of a company’s risk appetite on the relationship between the percentage of FEM and ESG scores (

Figure 1). It indicates that the positive impact of female board representation on ESG outcomes is stronger in companies with a higher risk appetite, implying a greater contribution of female directors to ESG achievements in such contexts. In organizations that prioritize risk minimization, the impact of increasing the share of women on the board on ESG scores is less significant, which implies that the enhancing influence of a greater female representation on ESG achievements is less effective in companies that are cautious about risk.

The depicted data indicates that ESG performance is markedly bolstered by an increase in female directorship within companies that exhibit a high appetite for risk. This evidence validates hypothesis 2, indicating that a firm’s risk appetite serves as a constructive moderating element in the linkage between the proportion of female directors and ESG outcomes.

5.3. Heterogeneity Test

This research delves into exploring the detailed impact of female directors’ diverse attributes on ESG performance. As a result, various categorical attributes, such as level of education, professional history, and length of board service, are pinpointed for the analysis of heterogeneity.

5.3.1. Grouped by Level of Education

In this paper, female directors of technology companies are categorized into three groups according to their education level: Results for the categories of educational attainment—those below a bachelor’s degree, those at the bachelor’s degree level, and those holding a master’s degree or above—are displayed in the first, second, and third columns of the heterogeneity test outcomes, correspondingly.

The analysis of the heterogeneity test (

Table 4) reveals that the influence of the percentage of FEM on ESG performance is not consistent across various educational levels. More precisely, within the undergraduate cohort, the impact is 4.5624 and exhibits statistical significance at the 1% threshold (p < 0.01). Conversely, among individuals possessing a master’s degree or above, the coefficient is 1.4326 and significant at the 10% threshold (p < 0.1). This indicates that the proportion of female directors has a significant positive impact on ESG performance when the female directors have a bachelor’s degree and above level of education.

In the set of control variables, higher education levels among female directors, specifically those holding a bachelor’s degree or above, are associated with a notably adverse effect from Leverage. Conversely, ROA shows a statistically significant beneficial impact when the female directors have advanced degrees, such as a master’s or higher. Furthermore, Tobin’s Q is found to have a significant detrimental influence.

By analyzing the heterogeneity test of education level, the presence of female directors with a bachelor’s degree or more advanced education significantly boosts ESG performance, whereas the impact is insignificant for those with education levels below a bachelor’s degree. This indicates that the level of education is a pivotal factor in the influence of female directors on ESG performance, with the beneficial impact being particularly pronounced for those directors who have completed undergraduate studies. The findings align with prior research, which has demonstrated that female independent directors possessing advanced educational qualifications and serving on boards positively impact a firm’s ESG ratings [

31]; executives’ education level has a positive impact on a firm’s ESG performance, and high educational attainment not only provides executives with effective managerial skills, but also reflects their specialized knowledge and cognitive abilities [

68]. Leaders with more advanced education levels often demonstrate enhanced personal ethics and a commitment to social accountability.

5.3.2. Grouped by Professional Background

In this paper, the female directors of technology companies are grouped according to their professional backgrounds, assigning a value of 1 to financial professional backgrounds and 0 to non-financial backgrounds, and according to the descriptive statistics in the previous section, the mean value of professional backgrounds is 0.3541, therefore, this paper divides the female directors into two groups according to their professional backgrounds: those with a financial background below the mean constitute the low financial expertise group, whereas those above the mean are classified as the high financial expertise group. The outcomes of the heterogeneity tests for these groups are presented in Columns (1) and (2), respectively.

According to the results of the heterogeneity test (

Table 5), the effect of the proportion FEM on ESG performance in the low financial expertise group is 1.4765, which is significant at the 10% level of significance (p < 0.1), and the effect of the proportion of FEM on ESG performance in the high financial expertise group is 3.0509, which is significant at the 1% level of significance (p < 0.01). This indicates that the high financial expertise group has a higher impact coefficient and a stronger significance level than the low financial expertise group, and the proportion of female directors has a significant positive impact on ESG performance when these directors come from a background characterized by high financial expertise.

The findings from the professional background heterogeneity analysis show that among female directors, those with high financial expertise have a significant effect on ESG performance, showing that professional background plays an important role in female directors’ influence on ESG performance. This positive effect is more pronounced within the group of female directors with high financial expertise. Most studies use legal professional background as a starting point, and female directors with legal background are significantly associated with improved corporate ESG scores [

31]; executives with a legal background can utilize their professional knowledge and risk management capabilities to help firms better comply with laws and regulations and reduce operational risks, thus improving firms’ ESG performance [

69]. This research focuses on directors’ finance backgrounds, who typically exhibit a nuanced understanding of corporate capital allocation and risk management. They are skilled at recognizing the relationship between ESG factors and long-term business sustainability, actively enhancing the company’s ESG performance. Expanding the scope to include directors with a finance background, this study enhances the conversation on how directors’ professional backgrounds affect ESG achievements.

5.3.3. Grouped by Tenure

In this research, tech company female directors are classified into three tenure categories: short-term (1 year or less), medium-term (1-3 years), and long-term (over 3 years). The results from the heterogeneity tests for these categories are displayed in columns (1), (2), and (3) respectively.

The heterogeneity test findings (

Table 6) suggest that the impact of FEM on ESG performance for the long-term group is 2.0467, achieving statistical significance at the 5% confidence level (p < 0.05). In contrast, the influence of FEM on ESG performance for the other tenure groups is statistically insignificant. This indicates that the proportion of female directors has a significant positive effect on ESG performance when these directors have served for an extended duration. In addition, both Leverage and ROA exhibit significant effects within the long-term group.

The tenure heterogeneity test results indicate that the proportion of female directors significantly enhances ESG performance when their tenure exceeds three years, whereas this impact is not significant for tenures of less than three years. This demonstrates that the duration of female directors’ tenure influences their effect on ESG performance, especially since the positive impact of long-serving female directors with a term of more than 3 years is more obvious. Previous research has found that board tenure affects the effectiveness of corporate governance [

70]. Companies with better ESG have longer director tenure, which shows that the longevity of female directors’ service has a beneficial effect on corporate performance over time [

71]. Long-standing female directors can markedly enhance a company’s ESG outcomes due to their accumulated experience, greater influence, robust stakeholder connections, and steadfast endorsement of the company’s strategic long-term objectives.

6. Conclusions

The research explores the impact of female director background on the ESG ratings of Chinese technology enterprises. In China, the ESG criteria, which include environmental, social, and governance aspects, are increasingly used to gauge a firm’s capacity for sustainability and long-term rivalry. Furthermore, the study assesses how a corporation’s appetite for risk might moderate the link between the percentage of female directors and ESG results. Moreover, the investigation conducts heterogeneity analyses focusing on the attributes of female directors such as their educational attainment, professional background, and length of service to provide more detailed research.

The empirical findings reveal that the proportion of female directors has a significant positive impact on the ESG performance of Chinese technology companies. A higher ratio of female directors is associated with better ESG outcomes in these companies. Additionally, corporate risk appetite serves as a positive moderator in the relationship between the proportion of female directors and ESG performance, with a greater risk appetite amplifying the influence of female directorship on ESG results. The heterogeneity test further indicates that female directors with a bachelor’s degree or higher, a financial professional background, and longer tenure exert a more pronounced positive influence on a company’s ESG performance.

In light of the study’s conclusions, it is imperative for policymakers and businesses to actively encourage and foster gender diversity on corporate boards as a means to enhance companies’ ESG performance. When formulating board structure strategies, companies should consider their risk preferences so that female directors can fully demonstrate their ability to promote sustainable development. For companies in the technology industry, training female executives and providing development plans can increase their influence in strategic decision-making. For companies with high-risk preferences, it is recommended that the gender diversity of the board of directors be enriched, the perspective of female directors be used to remain rational in strategic decision-making, and excessive risk-taking should be prevented. The limitation of this study is that the scope mainly focuses on Chinese technology companies. In the future, it can be expanded to other industries or compared across countries to confirm whether the research conclusions are generally applicable. Moreover, the study could be enhanced by delving deeper into how specific personal traits of female directors, such as their personal experience or demographic factors, might affect ESG scores. Future scholarly endeavors might also investigate the role of additional variables in the relationship between board diversity and ESG achievements, to bolster the theoretical and evidentiary basis for effective corporate governance and sustainable business strategies.

Author Contributions

Conceptualization, L.T. and M.C.; methodology, L.T. and M.C.; software, L.T. and M.C.; validation, L.T.; formal analysis, L.T.; investigation, L.T.; resources, L.T. and M.C.; data curation, L.T.; writing—original draft preparation, L.T.; writing—review and editing, M.C.; visualization, L.T.; supervision, M.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adams, R.B.; Ferreira, D. Women in the Boardroom and Their Impact on Governance and Performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef]

- Lu, J.; Herremans, I.M. Board Gender Diversity and Environmental Performance: An Industries Perspective. Bus. Strategy Environ. 2019, 28, 1449–1464. [Google Scholar] [CrossRef]

- Post, C.; Byron, K. Women on Boards and Firm Financial Performance: A Meta-Analysis. Acad. Manage. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Torchia, M.; Calabrò, A.; Huse, M. Women Directors on Corporate Boards: From Tokenism to Critical Mass. J. Bus. Ethics 2011, 102, 299–317. [Google Scholar] [CrossRef]

- Liu, C. Are Women Greener? Corporate Gender Diversity and Environmental Violations. J. Corp. Finance 2018, 52, 118–142. [Google Scholar] [CrossRef]

- Minichilli, A.; Zattoni, A.; Zona, F. Making Boards Effective: An Empirical Examination of Board Task Performance. Br. J. Manag. 2009, 20, 55–74. [Google Scholar] [CrossRef]

- Bazel-Shoham, O.; Lee, S.M.; Munjal, S.; Shoham, A. Board Gender Diversity, Feminine Culture, and Innovation for Environmental Sustainability. J. Prod. Innov. Manag. 2024, 41, 293–322. [Google Scholar] [CrossRef]

- Li, J.; Zhao, F.; Chen, S.; Jiang, W.; Liu, T.; Shi, S. Gender Diversity on Boards and Firms’ Environmental Policy. Bus. Strategy Environ. 2017, 26, 306–315. [Google Scholar] [CrossRef]

- Cambrea, D.R.; Paolone, F.; Cucari, N. Advisory or Monitoring Role in ESG Scenario: Which Women Directors Are More Influential in the Italian Context? Bus. Strategy Environ. 2023, 32, 4299–4314. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Heubeck, T. Walking on the Gender Tightrope: Unlocking ESG Potential through CEOs’ Dynamic Capabilities and Strategic Board Composition. Bus. Strategy Environ. 2024, 33, 2020–2039. [Google Scholar] [CrossRef]

- Treepongkaruna, S.; Kyaw, K.; Jiraporn, P. ESG Controversies and Corporate Governance: Evidence from Board Size. Bus. Strategy Environ. 2024, 33, 4218–4232. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. Board Gender Diversity and ESG Decoupling: Does Religiosity Matter? Bus. Strategy Environ. 2023, 32, 4046–4067. [Google Scholar] [CrossRef]

- Ruiz-Blanco, S.; Romero, S.; Fernandez-Feijoo, B. Green, Blue or Black, but Washing–What Company Characteristics Determine Greenwashing? Environ. Dev. Sustain. 2022, 24, 4024–4045. [Google Scholar] [CrossRef]

- Shaikh, I. Environmental, Social, and Governance (Esg) Practice and Firm Performance: An International Evidence. J. Bus. Econ. Manag. 2022, 23, 218–237. [Google Scholar] [CrossRef]

- Nazir, M.; Akbar, M.; Yu, X.; Hussain, A.; Svobodová, L. Environmental, Social, and Governance Performance as an Influencing Factor of Financial Sustainability: Evidence from the Global High-tech Sector. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 4746–4758. [Google Scholar] [CrossRef]

- Mallidis, I.; Giannarakis, G.; Sariannidis, N. Impact of Board Gender Diversity on Environmental, Social, and ESG Controversies Performance: The Moderating Role of United Nations Global Compact and ISO. J. Clean. Prod. 2024, 444, 141047. [Google Scholar] [CrossRef]

- Berger, A.N.; Kick, T.; Schaeck, K. Executive Board Composition and Bank Risk Taking. J. Corp. Finance 2014, 28, 48–65. [Google Scholar] [CrossRef]

- Safiullah, M.; Akhter, T.; Saona, P.; Azad, Md.A.K. Gender Diversity on Corporate Boards, Firm Performance, and Risk-Taking: New Evidence from Spain. J. Behav. Exp. Finance 2022, 35, 100721. [Google Scholar] [CrossRef]

- Chen, S.; Ni, X.; Tong, J.Y. Gender Diversity in the Boardroom and Risk Management: A Case of R&D Investment. J. Bus. Ethics 2016, 136, 599–621. [Google Scholar] [CrossRef]

- Mohsni, S.; Otchere, I.; Shahriar, S. Board Gender Diversity, Firm Performance and Risk-Taking in Developing Countries: The Moderating Effect of Culture. J. Int. Financ. Mark. Inst. Money 2021, 73, 101360. [Google Scholar] [CrossRef]

- Yarram, S.R.; Adapa, S. Women on Boards, CSR and Risk-Taking: An Investigation of the Interaction Effects of Gender Diversity and CSR on Business Risk. J. Clean. Prod. 2022, 378, 134493. [Google Scholar] [CrossRef]

- Sila, V.; Gonzalez, A.; Hagendorff, J. Women on Board: Does Boardroom Gender Diversity Affect Firm Risk? J. Corp. Finance 2016, 36, 26–53. [Google Scholar] [CrossRef]

- Maxfield, S.; Wang, L. Board Gender Diversity, Firm Risk, and the Intermediate Mechanisms: A Meta-analysis. Corp. Gov. Int. Rev. 2024, corg.12572. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M. Analyst Coverage, Corporate Social Responsibility, and Firm Risk. Bus. Ethics Eur. Rev. 2014, 23, 272–292. [Google Scholar] [CrossRef]

- Muhammad, N.; Scrimgeour, F.; Reddy, K.; Abidin, S. The Relationship between Environmental Performance and Financial Performance in Periods of Growth and Contraction: Evidence from Australian Publicly Listed Companies. J. Clean. Prod. 2015, 102, 324–332. [Google Scholar] [CrossRef]

- Shakil, M.H. Environmental, Social and Governance Performance and Financial Risk: Moderating Role of ESG Controversies and Board Gender Diversity. Resour. Policy 2021, 72, 102144. [Google Scholar] [CrossRef]

- Ahmad, H.; Yaqub, M.; Lee, S.H. Environmental-, Social-, and Governance-Related Factors for Business Investment and Sustainability: A Scientometric Review of Global Trends. Environ. Dev. Sustain. 2023, 26, 2965–2987. [Google Scholar] [CrossRef]

- Alkhawaja, A.; Hu, F.; Johl, S.; Nadarajah, S. Board Gender Diversity, Quotas, and ESG Disclosure: Global Evidence. Int. Rev. Financ. Anal. 2023, 90, 102823. [Google Scholar] [CrossRef]

- Al-Najjar, B.; Salama, A. Mind the Gap: Are Female Directors and Executives More Sensitive to the Environment in High-Tech Us Firms? Technol. Forecast. Soc. Change 2022, 184, 122024. [Google Scholar] [CrossRef]

- Fan, Y.; Li, S.; Yang, W. The Impact of the Percentage of Female Directors on Corporate ESG Score. Finance Res. Lett. 2024, 63, 105376. [Google Scholar] [CrossRef]

- Arayssi, M.; Dah, M.; Jizi, M. Women on Boards, Sustainability Reporting and Firm Performance. Sustain. Account. Manag. Policy J. 2016, 7, 376–401. [Google Scholar] [CrossRef]

- Romano, M.; Cirillo, A.; Favino, C.; Netti, A. ESG (Environmental, Social and Governance) Performance and Board Gender Diversity: The Moderating Role of CEO Duality. Sustainability 2020, 12, 9298. [Google Scholar] [CrossRef]

- De Masi, S.; Słomka-Gołębiowska, A.; Becagli, C.; Paci, A. Toward Sustainable Corporate Behavior: The Effect of the Critical Mass of Female Directors on Environmental, Social, and Governance Disclosure. Bus. Strategy Environ. 2021, 30, 1865–1878. [Google Scholar] [CrossRef]

- Menicucci, E.; Paolucci, G. Women on Board and ESG Performance: Insights from the Italian Utilities Sector. Int. J. Bus. Manag. 2024, 19, 73. [Google Scholar] [CrossRef]

- Nguyen, L.T.M.; Nguyen, P.T. The Board Profiles That Promote Environmental, Social, and Governance Disclosure–Evidence from S&P 500 Firms. Finance Res. Lett. 2023, 55, 103925. [Google Scholar] [CrossRef]

- Elmagrhi, M.H.; Ntim, C.G.; Elamer, A.A.; Zhang, Q. A Study of Environmental Policies and Regulations, Governance Structures, and Environmental Performance: The Role of Female Directors. Bus. Strategy Environ. 2019, 28, 206–220. [Google Scholar] [CrossRef]

- Coles, J.; Daniel, N.; Naveen, L. Boards: Does One Size Fit All☆. J. Financ. Econ. 2008, 87, 329–356. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Johnson, J.L.; Ellstrand, A.E. Number of Directors and Financial Performance: A Meta-Analysis. Acad. Manage. J. 1999, 42, 674–686. [Google Scholar] [CrossRef]

- Huang, Y.S.; Wang, C.-J. Corporate Governance and Risk-Taking of Chinese Firms: The Role of Board Size. Int. Rev. Econ. Finance 2015, 37, 96–113. [Google Scholar] [CrossRef]

- Hillman, A.J.; Cannella, A.A.; Harris, I.C. Women and Racial Minorities in the Boardroom: How Do Directors Differ? J. Manag. 2002, 28, 747–763. [Google Scholar] [CrossRef]

- Anderson, R.C.; Reeb, D.M.; Upadhyay, A.; Zhao, W. The Economics of Director Heterogeneity. Financ. Manag. 2011, 40, 5–38. [Google Scholar] [CrossRef]

- Chen, J.; Leung, W.S.; Song, W.; Goergen, M. Why Female Board Representation Matters: The Role of Female Directors in Reducing Male CEO Overconfidence. J. Empir. Finance 2019, 53, 70–90. [Google Scholar] [CrossRef]

- García, C.J.; Herrero, B. Female Directors, Capital Structure, and Financial Distress. J. Bus. Res. 2021, 136, 592–601. [Google Scholar] [CrossRef]

- Bloom, M.; Milkovich, G.T. Relationships among Risk, Incentive Pay, and Organizational Performance. Acad. Manage. J. 1998, 41, 283–297. [Google Scholar] [CrossRef]

- Sanders, Wm.G.; Hambrick, D.C. Swinging for the Fences: The Effects of Ceo Stock Options on Company Risk Taking and Performance. Acad. Manage. J. 2007, 50, 1055–1078. [Google Scholar] [CrossRef]

- Comeig, I.; Holt, C.; Jaramillo-Gutiérrez, A. Upside versus Downside Risk: Gender, Stakes, and Skewness. J. Econ. Behav. Organ. 2022, 200, 21–30. [Google Scholar] [CrossRef]

- Maxfield, S.; Shapiro, M.; Gupta, V.; Hass, S. Gender and Risk: Women, Risk Taking and Risk Aversion. Gend. Manag. Int. J. 2010, 25, 586–604. [Google Scholar] [CrossRef]

- Aldieri, L.; Amendola, A.; Candila, V. The Impact of ESG Scores on Risk Market Performance. Sustainability 2023, 15, 7183. [Google Scholar] [CrossRef]

- Khorilov, T.G.; Kim, J. ESG and Firm Risk: Evidence in Korea. Sustainability 2024, 16, 5388. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Ingersoll, A.R.; Cook, A.; Glass, C. A Free Solo in Heels: Corporate Risk Taking among Women Executives and Directors. J. Bus. Res. 2023, 157, 113651. [Google Scholar] [CrossRef]

- Croson, R.; Gneezy, U. Gender Differences in Preferences. J. Econ. Lit. 2009, 47, 448–474. [Google Scholar] [CrossRef]

- Gilligan, C. The Contribution of Women’s Thought to Developmental Theory: The Elimination of Sex Bias in Moral Development Research and Education : Final Report; Harvard College: Massachusetts, 1982; pp. 26–39. [Google Scholar]

- Jizi, M.I.; Nehme, R. Board Gender Diversity and Firms’ Equity Risk. Equal. Divers. Incl. Int. J. 2017, 36, 590–606. [Google Scholar] [CrossRef]

- Huang, J.; Kisgen, D.J. Gender and Corporate Finance: Are Male Executives Overconfident Relative to Female Executives? J. Financ. Econ. 2013, 108, 822–839. [Google Scholar] [CrossRef]

- Faccio, M.; Marchica, M.-T.; Mura, R. CEO Gender, Corporate Risk-Taking, and the Efficiency of Capital Allocation. J. Corp. Finance 2016, 39, 193–209. [Google Scholar] [CrossRef]

- Bravo, F.; Reguera-Alvarado, N. Sustainable Development Disclosure: Environmental, Social, and Governance Reporting and Gender Diversity in the Audit Committee. Bus. Strategy Environ. 2019, 28, 418–429. [Google Scholar] [CrossRef]

- Kyaw, K.; Treepongkaruna, S.; Jiraporn, P. Board Gender Diversity and Environmental Emissions. Bus. Strategy Environ. 2022, 31, 2871–2881. [Google Scholar] [CrossRef]

- Tasnia, M.; Syed Jaafar AlHabshi, S.M.; Rosman, R. The Impact of Corporate Social Responsibility on Stock Price Volatility of the US Banks: A Moderating Role of Tax. J. Financ. Report. Account. 2021, 19, 77–91. [Google Scholar] [CrossRef]

- Alazzani, A.; Hassanein, A.; Aljanadi, Y. Impact of Gender Diversity on Social and Environmental Performance: Evidence from Malaysia. Corp. Gov. Int. J. Bus. Soc. 2017, 17, 266–283. [Google Scholar] [CrossRef]

- Possebon, E.A.G.; Cippiciani, F.A.; Savoia, J.R.F.; De Mariz, F. ESG Scores and Performance in Brazilian Public Companies. Sustainability 2024, 16, 5650. [Google Scholar] [CrossRef]

- Bolibok, P.M. Does Firm Size Matter for ESG Risk? Cross-Sectional Evidence from the Banking Industry. Sustainability 2024, 16, 679. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar] [CrossRef]

- Khaled, R.; Ali, H.; Mohamed, E.K.A. The Sustainable Development Goals and Corporate Sustainability Performance: Mapping, Extent and Determinants. J. Clean. Prod. 2021, 311, 127599. [Google Scholar] [CrossRef]

- Kim, S.; Li, Z. (Frank) Understanding the Impact of ESG Practices in Corporate Finance. Sustainability 2021, 13, 3746. [Google Scholar] [CrossRef]

- Issa, A.; Zaid, M.A.A. Boardroom Gender Diversity and Corporate Environmental Performance: A Multi-Theoretical Perspective in the MENA Region. Int. J. Account. Inf. Manag. 2021, 29, 603–630. [Google Scholar] [CrossRef]

- Liu, M.; Lu, J.; Liu, Q.; Wang, H.; Yang, Y.; Fang, S. The Impact of Executive Cognitive Characteristics on a Firm’s ESG Performance: An Institutional Theory Perspective. J. Manag. Gov. 2024. [Google Scholar] [CrossRef]

- Huang, X.; Ren, Y.; Ren, X. Legal Background Executives, Corporate Governance and Corporate ESG Performance. Finance Res. Lett. 2024, 69, 106120. [Google Scholar] [CrossRef]

- Li, N.; Wahid, A.S. Director Tenure Diversity and Board Monitoring Effectiveness. Contemp. Account. Res. 2018, 35, 1363–1394. [Google Scholar] [CrossRef]

- Fayyaz, U.; Jalal, R.N.; Venditti, M.; Minguez-Vera, A. Diverse Boards and Firm Performance: The Role of Environmental, Social and Governance Disclosure. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1457–1472. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).