1. Introduction

The power market is a complex and dynamic system, characterized by volatile prices, diverse market participants, and intricate regulatory frameworks. As energy consumption continues to rise and renewable energy sources gain prominence, the need for more efficient market operations has become increasingly urgent. One such approach that has gained significant attention is high-frequency trading (HFT), a sophisticated trading technique that leverages rapid computational power and advanced algorithms to capitalize on short-term price fluctuations. While HFT has revolutionized traditional financial markets, its application in power markets remains relatively underexplored.

The objective of this paper is to introduce a high-frequency trading methodology specifically designed for the power market, focusing on its potential to optimize trade execution, enhance market liquidity, and improve price discovery. By employing real-time data analytics, predictive modeling, and advanced trade execution strategies, this approach aims to capitalize on micro-level price movements that are often undetected by conventional trading methods. The paper proposes a novel system architecture that integrates various components, such as market data feeds, predictive models, and risk management frameworks, to create an agile, adaptive trading system capable of responding rapidly to market fluctuations.

The research presented in this paper makes several key contributions to the field of power market trading. First, it provides a comprehensive methodology for applying high-frequency trading strategies in a market environment that is often characterized by lower liquidity and higher volatility compared to traditional financial markets. Second, it introduces a system architecture that combines algorithmic trading principles with the unique demands of power markets, offering a flexible and scalable solution. Lastly, the paper demonstrates the effectiveness of this trading approach through simulation studies, showcasing its potential to reduce transaction costs, identify arbitrage opportunities, and enhance market efficiency.

In the following sections, we will review the relevant literature on high-frequency trading and algorithmic trading in power markets, present the proposed methodology and system design, and evaluate the performance of the system through case studies and simulations. This paper aims to contribute to the growing body of research on HFT in the energy sector and to offer practical insights for market participants looking to optimize their trading strategies in the power market.

2. Literature Review

High-frequency trading (HFT) has transformed the landscape of modern financial markets by utilizing advanced algorithms and high-speed networks to make split-second trading decisions. In the context of power markets, where price fluctuations are often driven by factors such as supply-demand imbalances, regulatory changes, and environmental conditions, the integration of HFT strategies presents both unique opportunities and challenges. This literature review will examine previous research on HFT in both financial and energy markets, the underlying challenges faced by power market participants, and the gaps in existing strategies that our proposed methodology aims to address.

2.1. High-Frequency Trading in Financial Markets

The application of HFT in traditional financial markets has been extensively studied. In these markets, HFT strategies typically rely on statistical arbitrage, market-making, and liquidity provision to achieve profitability (Aldridge, 2013). HFT has been shown to improve market efficiency by narrowing bid-ask spreads, enhancing liquidity, and facilitating price discovery (Hasbrouck & Saar, 2013). However, HFT also raises concerns regarding market stability, with studies such as those by Easley et al. (2012) highlighting its potential to exacerbate price volatility and contribute to flash crashes. Despite these concerns, the overall consensus remains that HFT plays a critical role in increasing market liquidity and improving the efficiency of price discovery.

2.2. High-Frequency Trading in Power Markets

While HFT has become a standard practice in financial markets, its application to energy markets, and specifically power markets, remains underdeveloped. Power markets differ from traditional financial markets in several key respects, such as lower liquidity, higher volatility, and a complex mix of regulatory and physical constraints (Jong et al., 2020). The energy trading landscape involves not only financial instruments, such as futures and options, but also physical commodities that require real-time data analysis and decision-making. Early work in this area has focused primarily on algorithmic trading strategies for energy derivatives (Bessembinder & Lemmon, 2002), but studies exploring high-frequency trading techniques in the energy sector remain scarce.

Some researchers have explored the potential for applying HFT techniques to power markets, particularly in the context of day-ahead and intraday electricity markets. Studies have found that algorithmic trading can provide significant benefits in terms of price forecasting and arbitrage opportunities in power markets (Olsson et al., 2016). However, due to the unique characteristics of the power market, such as the need for real-time balancing of supply and demand, integrating HFT strategies remains challenging. Recent work by Zhang et al. (2019) examined the use of machine learning algorithms to predict short-term price movements in the power market, but HFT approaches that incorporate real-time data, predictive modeling, and trade execution remain largely unexplored.

2.3. Algorithmic Trading and Predictive Models for Power Markets

Predictive modeling plays a central role in many algorithmic trading strategies, including those designed for energy markets. In power markets, price volatility is driven by various factors, including changes in weather patterns, fuel prices, and demand fluctuations. Machine learning (ML) and deep learning (DL) models have been applied to predict power price movements in real time. Recent studies have demonstrated the utility of support vector machines (SVM) (Barahona et al., 2018), random forests (Schweppe et al., 2017), and neural networks (Jabeur et al., 2019) in predicting electricity prices, but these approaches tend to focus on longer-term forecasting rather than the micro-level price movements exploited by HFT strategies.

Additionally, a growing body of literature has explored market-making and liquidity provision strategies for energy markets. These strategies rely on algorithms that continuously update bid-ask prices based on real-time market information. While market-making has been successfully applied in financial markets, the lack of high-frequency data and the complexity of balancing physical supply and demand in power markets introduce challenges in terms of execution speed and data processing (Fitzgerald & Karan, 2021). The need for predictive models that can adapt to rapid changes in market conditions is critical for HFT strategies in the power sector.

2.4. Challenges in High-Frequency Trading for Power Markets

The implementation of high-frequency trading in power markets faces several distinct challenges. One of the primary obstacles is the low liquidity compared to financial markets, especially in smaller or less liquid trading hubs. Low liquidity can make it difficult for traders to execute large orders quickly without impacting market prices. Additionally, the physical constraints of the power system, such as transmission limitations and the requirement to balance supply and demand in real time, make it challenging to implement arbitrage strategies that are commonly used in other asset classes (Stoft, 2002).

Moreover, power market participants are subject to regulatory constraints that do not apply in traditional financial markets. These include rules surrounding market manipulation, bidding behavior, and the physical delivery of electricity (Jamasb et al., 2018). HFT strategies must, therefore, not only be technically efficient but also compliant with the regulatory environment, which requires the integration of compliance checks and risk management systems into the trading framework.

2.5. Gaps in Current Research and the Need for a Novel Approach

Although there has been substantial research into algorithmic and predictive models for power market trading, the application of high-frequency trading techniques remains relatively unexplored. Most existing studies have focused on price forecasting and market-making strategies, which do not fully exploit the potential for rapid, real-time trading decisions based on micro-level price movements. Furthermore, there is a need for a more integrated approach that combines predictive analytics, trade execution algorithms, and risk management systems to create a comprehensive high-frequency trading solution for power markets.

This paper seeks to fill these gaps by proposing a high-frequency trading methodology and system specifically designed for the power market. The proposed approach integrates real-time data analysis, predictive modeling, and rapid trade execution within a flexible system architecture that can adapt to the unique characteristics of power markets. Through simulations and case studies, this paper demonstrates the potential of this novel approach to enhance market efficiency, reduce transaction costs, and improve liquidity provision

3. High-Frequency Trading in Power Markets

High-frequency trading (HFT) in power markets has the potential to enhance market efficiency, optimize price discovery, and improve liquidity provision. Unlike traditional financial markets, where the majority of assets are intangible, power markets involve physical commodities, such as electricity, which require balancing real-time supply and demand. This unique characteristic creates both challenges and opportunities for HFT. The implementation of HFT strategies in power markets must account for factors such as transmission constraints, renewable energy variability, and regulatory oversight, all of which significantly impact the market's dynamics.

3.1. Characteristics of Power Markets and the Potential for HFT

Power markets are characterized by a complex set of interactions between supply and demand, which can lead to high levels of price volatility. Key drivers of this volatility include fluctuations in demand, fuel prices, weather conditions, and the mix of energy sources (e.g., renewables vs. fossil fuels). Electricity prices are often subject to sudden shifts due to unexpected events, such as changes in weather patterns affecting renewable energy output, transmission congestion, or sudden demand spikes during extreme weather events. These factors create short-term price opportunities that HFT strategies can exploit.

While financial markets operate with near-instantaneous pricing mechanisms, power markets typically experience delays in price adjustments due to the time needed to balance supply and demand and manage transmission networks. However, as power markets continue to adopt more advanced market-clearing algorithms and increased automation, there is a growing potential for high-frequency trading strategies to gain traction. In particular, HFT can enhance price discovery by capturing micro-level price movements that reflect shifts in supply and demand dynamics that would otherwise be overlooked by traditional, slower trading methods.

3.2. Market Structure and Trading Instruments

Power markets consist of several layers, including day-ahead markets, intraday markets, and real-time markets. The day-ahead market (DAM) is where most trading occurs for scheduled power generation, while the intraday and real-time markets provide opportunities for adjustments based on updated supply-demand forecasts. HFT strategies in power markets are most relevant in the intraday and real-time markets, where prices are more volatile, and short-term imbalances present arbitrage opportunities.

In these markets, electricity prices can fluctuate significantly in response to changes in generation availability, transmission constraints, and weather-related disruptions. HFT algorithms can leverage these fluctuations by analyzing high-frequency data streams from grid operators, weather forecasts, and power generation forecasts to make rapid trading decisions. These algorithms aim to capitalize on the price inefficiencies caused by short-term fluctuations, enabling traders to buy and sell electricity at favorable prices before the market fully adjusts.

The primary instruments traded in power markets include physical contracts for electricity delivery, power futures, and options. High-frequency trading can be applied to these instruments, particularly in liquid markets where price movements are more frequent and can be predicted with higher accuracy. HFT strategies can also be applied to emerging trading instruments, such as power derivatives and financial transmission rights (FTRs), which allow traders to hedge against transmission congestion risks.

3.3. HFT Strategies for Power Markets

The implementation of HFT in power markets requires tailored strategies that consider the unique characteristics of the energy sector. Below are several key strategies that can be adapted for power market trading:

3.3.1. Statistical Arbitrage

Statistical arbitrage strategies seek to identify mispriced electricity contracts or inefficiencies between related markets. For example, if power prices in a particular region deviate from their historical relationship with the broader market or weather-related forecasts, statistical models can predict a reversion to the mean. High-frequency trading systems can exploit these short-term price discrepancies by executing a large number of trades in a fraction of a second, capitalizing on the price correction before it fully materializes.

3.3.2. Market Making

Market-making involves providing liquidity by placing both buy and sell orders for power contracts. HFT market makers can profit from the spread between the bid and ask prices. In the context of power markets, market makers must continuously adjust their orders based on real-time data feeds, such as updates on power generation capacity, demand forecasts, and transmission constraints. The ability to quickly process vast amounts of data allows market makers to respond to price movements faster than traditional traders, helping to maintain liquidity and minimize the spread.

3.3.3. Price Prediction and Forecasting

Predictive models are a critical component of any high-frequency trading strategy. In power markets, short-term price forecasting models can predict fluctuations caused by changes in demand, weather conditions, or grid imbalances. Machine learning (ML) algorithms, such as decision trees, random forests, and neural networks, can analyze historical price data, weather forecasts, and generation patterns to make real-time predictions about future price movements. These predictions can then inform trading decisions, enabling traders to buy or sell electricity contracts before market prices react to the new information.

3.3.4. Arbitrage Between Markets

HFT can also exploit price differentials between different power markets or trading hubs. For example, electricity prices in one region may be temporarily higher due to local generation shortages, while prices in a neighboring region may be lower. HFT systems can identify such discrepancies and execute trades that take advantage of the arbitrage opportunity, transferring electricity from one market to another to capture the price differential. This strategy requires sophisticated algorithms that can account for transmission constraints, potential bottlenecks, and the timing of electricity delivery.

3.3.5. Transmission Congestion Management

Transmission constraints are a major challenge in power markets, especially when electricity must be transported over long distances. HFT strategies can be used to manage congestion in the transmission network by optimizing the flow of electricity between regions with different price levels. Financial transmission rights (FTRs) are commonly used to hedge against congestion risks, and HFT systems can engage in real-time trading of FTRs to profit from short-term congestion events or to offset transmission costs.

3.4. Challenges in Implementing HFT in Power Markets

Despite the potential benefits of HFT in power markets, several challenges must be addressed. First, the unique structure of power markets, with their physical constraints and regulatory requirements, makes it difficult to implement traditional financial market HFT strategies. Power markets are also less liquid than financial markets, and trading volumes can fluctuate significantly throughout the day, which may reduce the effectiveness of high-frequency strategies in certain timeframes.

Another key challenge is the availability and quality of real-time data. Power markets require continuous updates on factors such as power generation capacity, transmission availability, demand forecasts, and weather conditions. These data streams must be processed and analyzed at high speeds to support the rapid decision-making required for HFT. Moreover, the regulatory environment surrounding energy markets adds complexity, as trading strategies must comply with both local and international regulations, including those related to market manipulation, bidding practices, and physical delivery requirements.

Lastly, there is the issue of transaction costs. Although HFT strategies can be profitable by capturing small price discrepancies, the transaction costs associated with executing a large number of trades at high speed can erode profits. Power market participants must account for these costs when designing and implementing HFT systems, especially when trading in less liquid markets.

3.5. Future Outlook

Despite the challenges, the integration of high-frequency trading in power markets is expected to grow as market automation and data availability improve. Advances in machine learning, real-time data processing, and market-clearing algorithms will enable more sophisticated HFT strategies to be deployed in power markets. Furthermore, as the share of renewable energy increases and the need for more flexible grid management grows, the role of HFT in managing supply-demand imbalances and optimizing market efficiency will become increasingly important.

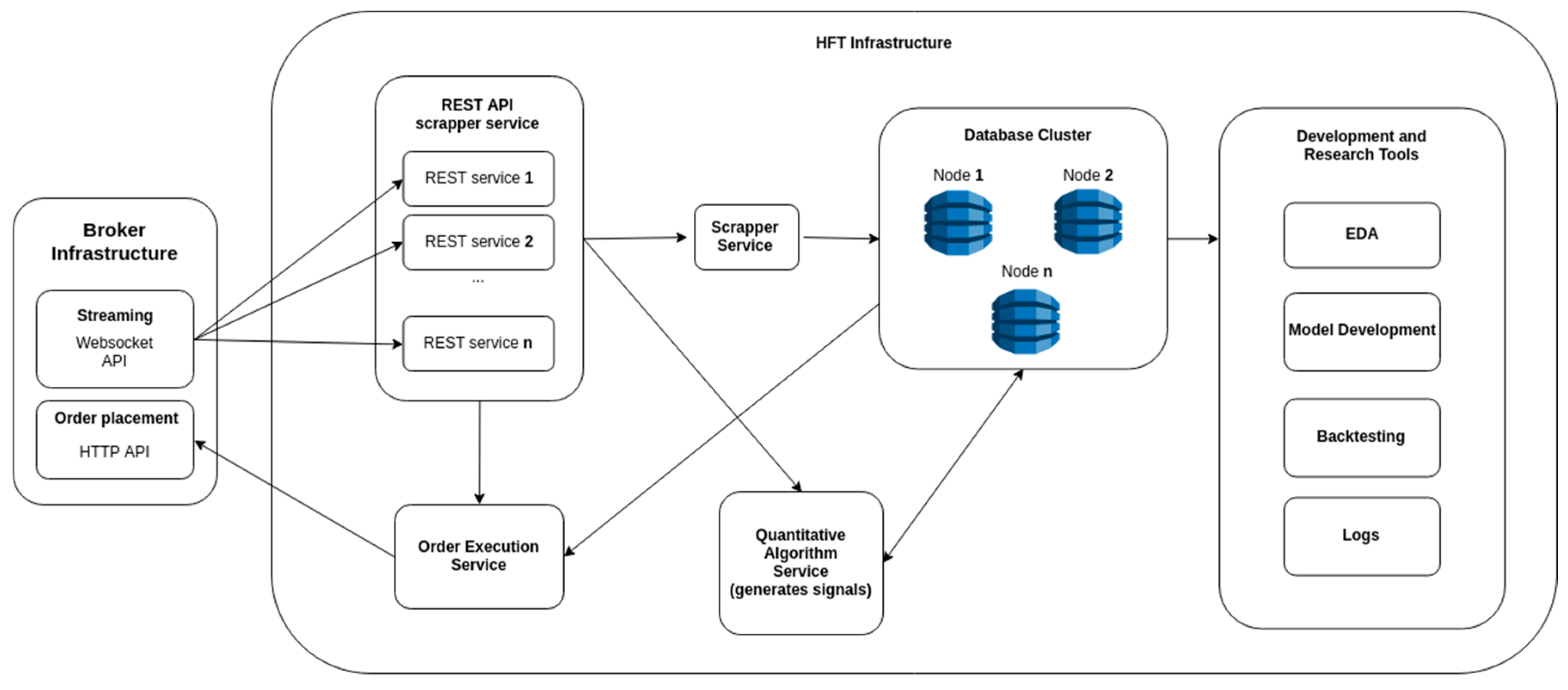

Figure 1.

Assembling an entry level High Frequency Trading (HFT) system.

Figure 1.

Assembling an entry level High Frequency Trading (HFT) system.

4. Methodology

This section outlines the high-frequency trading (HFT) methodology developed for power market transactions, emphasizing the key components that enable rapid decision-making, predictive modeling, and trade execution. The methodology integrates advanced algorithmic techniques, real-time data processing, and risk management tools to maximize profitability and enhance market efficiency in the power market. The approach leverages a combination of machine learning models, statistical arbitrage strategies, and optimized execution algorithms to capture micro-level price movements that are indicative of short-term supply-demand imbalances.

4.1. System Architecture Overview

The proposed HFT system architecture is composed of several key modules that work together to form a seamless and adaptive trading platform. The architecture consists of the following components:

Data Acquisition and Preprocessing: Real-time market data feeds, including electricity prices, generation forecasts, transmission availability, demand forecasts, and weather data, are gathered from grid operators, market exchanges, and weather services. The data is cleaned, transformed, and stored in a high-performance database that supports low-latency access.

Predictive Modeling: A machine learning-driven predictive module is used to forecast short-term price movements based on historical data and real-time inputs. These models are continuously retrained using incoming data to ensure they adapt to evolving market conditions.

Trade Execution Engine: The trade execution engine leverages the predicted price movements and real-time market data to make rapid, automated buy and sell decisions. The engine is optimized for low-latency execution and minimizes slippage and transaction costs.

Risk Management and Compliance: The risk management module ensures that the trading strategy operates within predefined risk parameters. It includes tools for real-time risk assessment, position limits, and regulatory compliance checks to mitigate potential market manipulation or violations of trading rules.

Market Monitoring and Feedback Loop: A feedback loop continuously monitors the performance of the trading system and updates trading strategies based on performance metrics and changes in market conditions.

4.2. Data Acquisition and Preprocessing

Real-time data acquisition is the cornerstone of any high-frequency trading strategy. For power markets, relevant data sources include:

Market Data: Prices from day-ahead, intraday, and real-time markets for electricity contracts, along with volume and liquidity data.

Grid Data: Information on electricity generation, transmission constraints, and grid reliability provided by grid operators.

Weather Data: Forecasts of temperature, wind speed, and solar radiation, which influence renewable generation.

Demand Forecasts: Real-time updates on electricity demand, including short-term and long-term forecasts.

The data is preprocessed through several steps:

Normalization: Different data streams (e.g., price, generation, and weather data) are normalized to ensure they are on the same scale.

Cleaning: Incomplete or erroneous data points are identified and removed to ensure accuracy.

Time-Series Aggregation: Data is aggregated into high-frequency intervals (e.g., 5-second or 10-second intervals) to provide the necessary granularity for decision-making.

The preprocessed data is then stored in a high-performance database that supports fast access and retrieval during trading operations.

4.3. Predictive Modeling

The heart of the HFT system lies in its ability to predict price movements and market conditions. Given the volatility and rapid fluctuations in the power market, predictive modeling plays a key role in forecasting short-term price dynamics. The following techniques are employed:

Machine Learning Algorithms: A combination of supervised learning models, including decision trees, random forests, and support vector machines (SVM), are used to forecast price movements. These models are trained on historical data (e.g., historical electricity prices, demand patterns, and weather data) and continuously updated with incoming real-time data to capture new patterns and trends.

Deep Learning Networks: For more complex prediction tasks, deep learning models, such as recurrent neural networks (RNN) and long short-term memory (LSTM) networks, are employed to capture temporal dependencies and non-linear relationships in the data. These models are particularly useful for forecasting price changes based on time-series data, such as intraday price patterns or weather-driven supply shocks.

Feature Engineering: Key features used for prediction include lagged price values, moving averages, weather forecasts (temperature, wind speed), generation capacity, and demand forecasts. These features are fed into the machine learning algorithms to generate price predictions for short-term time intervals (e.g., 5-15 minutes ahead).

Model Evaluation and Calibration: Predictive models are evaluated using various performance metrics, such as mean absolute error (MAE), root mean square error (RMSE), and accuracy of directional forecasts. Models are calibrated and retrained periodically to ensure they adapt to changing market conditions.

4.4. Trade Execution Engine

The trade execution engine is responsible for placing orders based on the predictions generated by the modeling module. The execution strategy aims to achieve the best price by leveraging rapid, low-latency order submission. Key features of the execution engine include:

Order Types: The engine uses a mix of market, limit, and iceberg orders depending on the current market conditions and predicted price movements. Market orders are used when speed is essential, while limit orders are used when attempting to capture price improvements.

Slippage Minimization: The system is designed to minimize slippage by submitting orders in the optimal size and frequency to avoid large price movements before execution. The system monitors market depth and liquidity in real time to adjust the size and timing of trades dynamically.

Latency Optimization: Latency is minimized through the use of high-frequency trading infrastructure, such as co-located servers near exchanges and direct market access (DMA). The execution engine is optimized to react to market events in microseconds, ensuring that trades are executed at the best possible price.

Execution Algorithms: The system uses advanced execution algorithms, including volume-weighted average price (VWAP), time-weighted average price (TWAP), and smart order routing (SOR), to determine the optimal timing and routing of orders based on predicted price movements and market conditions.

4.5. Risk Management and Compliance

Risk management is a crucial aspect of high-frequency trading, particularly in the power market, where volatility and market dynamics can lead to significant losses if not properly controlled. The risk management module includes:

Real-Time Risk Assessment: Continuous monitoring of the system's exposure, including net positions, potential margin requirements, and liquidity constraints.

Position Limits: The system automatically enforces position limits based on predefined risk parameters to ensure that exposure remains within acceptable thresholds.

Regulatory Compliance: The system incorporates rules and checks to comply with market regulations, including trading rules and anti-market manipulation regulations. Compliance features include pre-trade checks for market manipulation, price manipulation, and reporting requirements.

4.6. Market Monitoring and Feedback Loop

The market monitoring module tracks the performance of the trading system in real time. Key performance indicators (KPIs), such as profit and loss (P&L), execution speed, transaction costs, and risk metrics, are monitored continuously. This feedback loop enables the system to adapt to changing market conditions by adjusting trading strategies, model parameters, and execution tactics. The system also conducts periodic backtesting using historical data to refine predictive models and optimize trade execution strategies.

4.7. Backtesting and Simulation

Before deployment, the system undergoes extensive backtesting and simulation. Historical market data is used to simulate trading strategies under different market conditions, allowing for the evaluation of risk, performance, and overall profitability. The backtesting process helps identify any weaknesses in the system and allows for model fine-tuning before live trading begins.

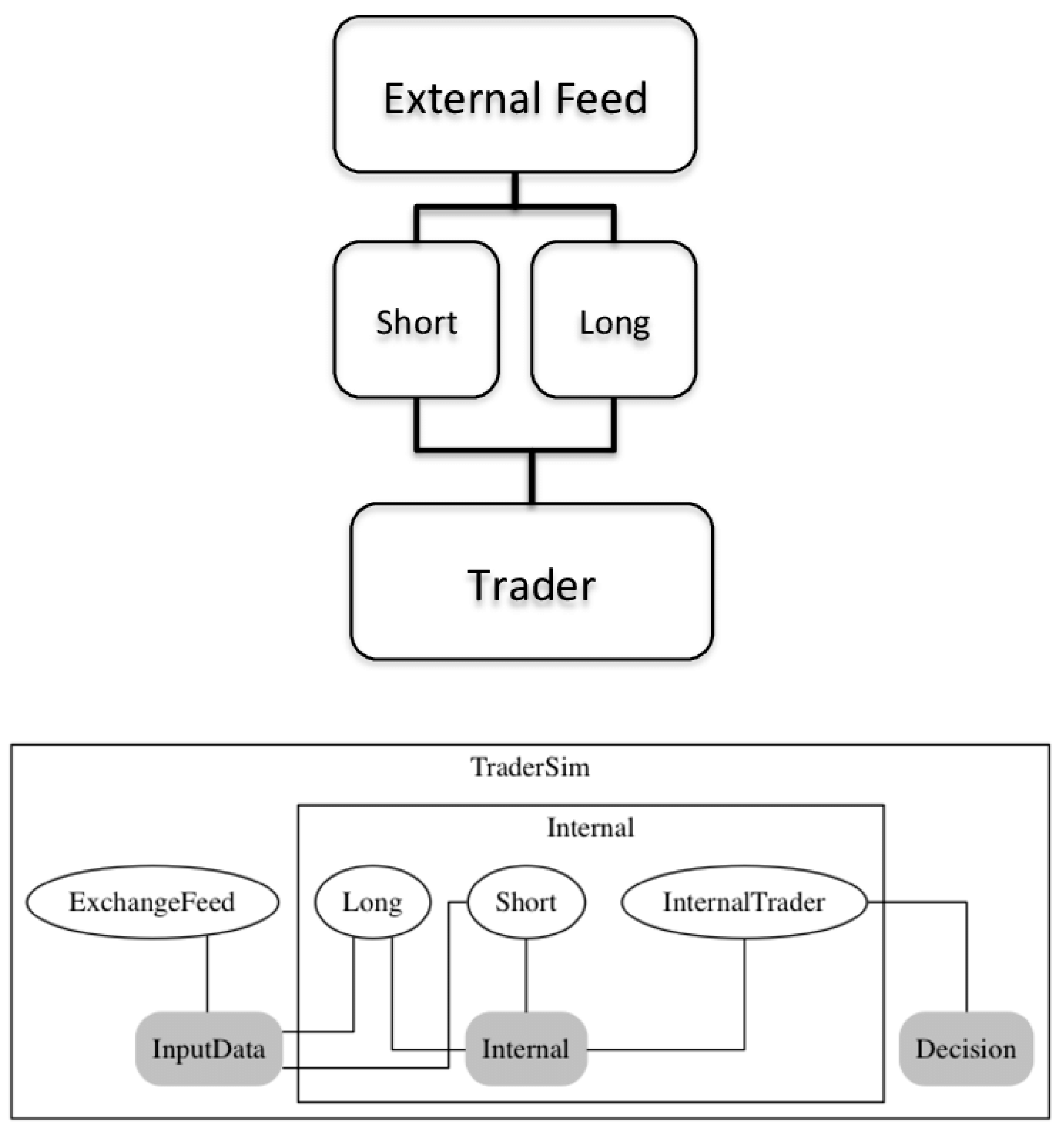

Figure 2.

A High Frequency Trading Chip.

Figure 2.

A High Frequency Trading Chip.

References

- Wu, R. Leveraging Deep Learning Techniques in High-Frequency Trading: Computational Opportunities and Mathematical Challenges. Academic Journal of Sociology and Management 2024, 2, 27–34. [Google Scholar]

- Nahar, J.; Nishat, N.; Shoaib AS, M.; Hossain, Q. Market Efficiency And Stability In The Era Of High-Frequency Trading: A Comprehensive Review. International Journal of Business and Economics 2024, 1, 1–13. [Google Scholar] [CrossRef]

- Goldstein, M.; Kwan, A.; Philip, R. High-frequency trading strategies. Management Science 2023, 69, 4413–4434. [Google Scholar] [CrossRef]

- Luo, D. Optimizing Load Scheduling in Power Grids Using Reinforcement Learning and Markov Decision Processes. arXiv 2024, arXiv:2410.17696. [Google Scholar]

- Goudarzi, M.; Bazzana, F. Identification of high-frequency trading: A machine learning approach. Research in International Business and Finance 2023, 66, 102078. [Google Scholar] [CrossRef]

- Alaminos, D.; Salas, M.B.; Fernández-Gámez, M.A. High-Frequency Trading in Bond Returns: A Comparison Across Alternative Methods and Fixed-Income Markets. Computational Economics 2023, 1–92. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).