Submitted:

03 December 2024

Posted:

04 December 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Methodology

- GDP per capita (unit: U.S. dollars, at 2015 fixed prices) as a proxy of economic growth provided by the World Bank;

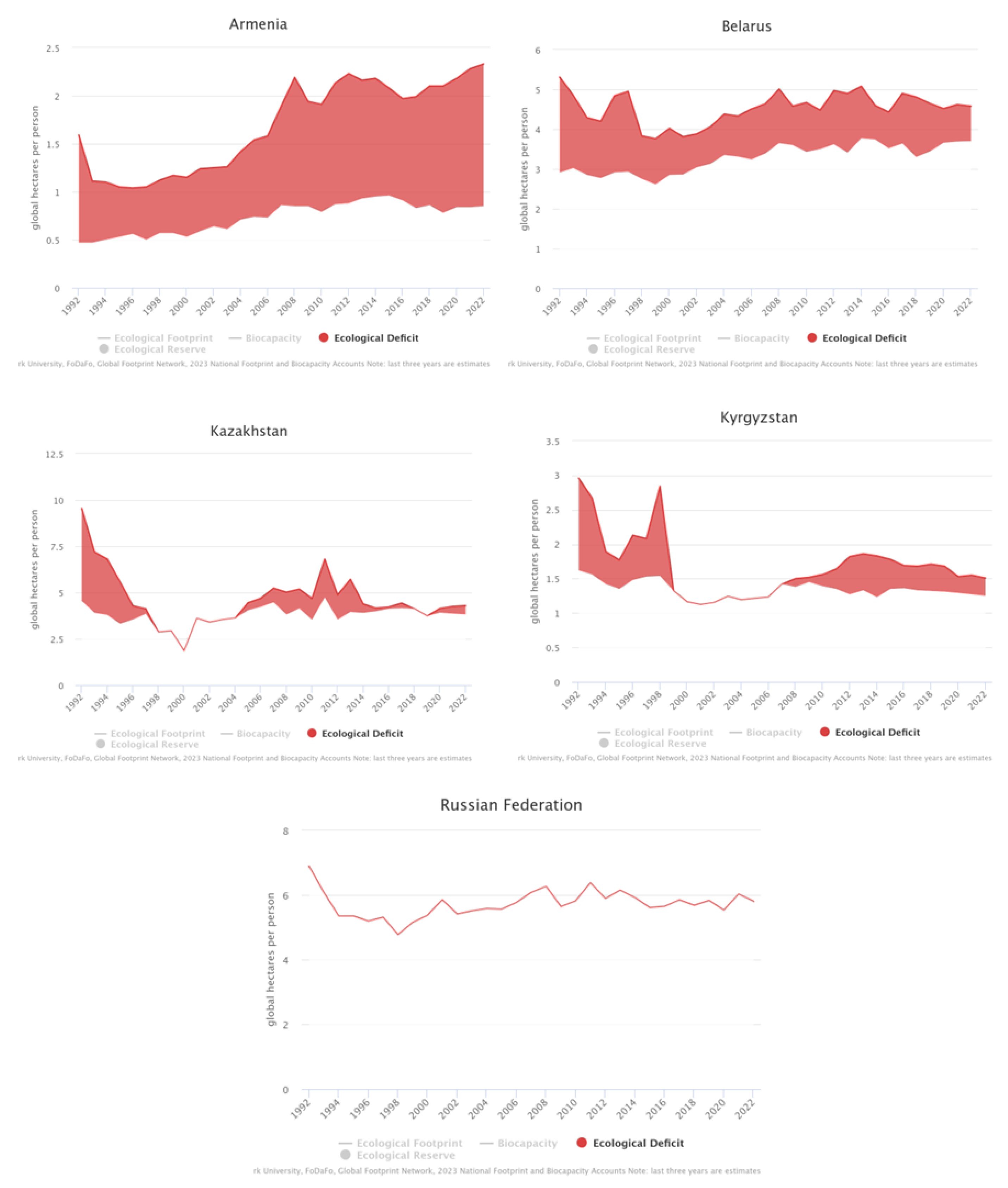

- Gha per capita (unit: points) as a proxy of ecological footprint provided by the Footprintnetwork.org.

- Financial development index (unit: percentage) as a proxy for financial development collected from the International Monetary Fund (IMF);

- KOF globalization index (unit: points) as a proxy of integration process provided by the Swiss Economics Institute.

- Step 1:

- Analyze the stationarity of the variables.

- Step 2:

- Check for cross-sectional dependence.

- Step 3:

- Evaluates the consistency of an estimator.

- Step 4:

- Calculate the Moran's I index.

- Step 5:

- Estimate research results using the Spatial Error Model (SEM), Spatial Autoregressive Model (SAR), and Spatial Dubin Model (SDM) or to eliminate spatial models.

- Step 6:

- Analysis and diagnosis of the model.

- Step 7:

- Eliminate multicollinearity.

3. Results

3.1. The General Spatial Lag Model (SLM)

- y is a vector of a dependent variable of dimension n×1n×1;

- X is a matrix of independent variables of dimension n×kn×k;

- β is a vector of regression coefficients of dimension k×1k×1;

- W is a spatial weight matrix of dimension n×nn×n, reflecting the spatial relationships between observations;

- p is the coefficient of spatial autoregression;

- ε is the error vector, it is assumed ε∼N(0,σ2I).

| IPS Statistic (Levels) | IPS Statistic (First Difference) | LLC Statistic (Levels) | LLC Statistic (First Difference) | |

|---|---|---|---|---|

| Gha_per_person | -2.502845405** | -4.964768713** | -2.502845405** | -4.964768713** |

| FDI | -1.503180219* | -7.618670237** | -1.503180219* | -7.618670237** |

| GDP_per_capita | 0.077397281* | -3.735265451** | 0.077397281* | -3.735265451** |

| KOF | -3.919361581** | -4.019112779** | -3.919361581** | -4.019112779** |

- -

- the variables Gha_per_person and KOF are stationary at significance levels of 5% and 10%. It is confirmed by negative and statistically significant values of LLC and IPS. These variables are integrated of the order of zero (I(0)) and have stable statistical properties over time;

- -

- the variables FDI and GDP_per_capitaare non-stationary in significance levels (the values of LLC and IPS statistics do not allow rejecting the null hypothesis of the presence of a single root at significance levels of 5% and 10%). However, after taking the first differences, these variables become stationary. It indicates their integration of order one (I(1)). This result emphasises the necessity of using first differences of these variables in the construction of econometric models or considering possible cointegration relationships to ensure the correctness and reliability of the obtained conclusions.

3.1.1. The Cross-Dependence Test

- N is the number of individual units (cross sections);

- T is the number of time periods;

- – assessment of the paired correlation between the residuals:

| Variable cross_sectional_dependence_results | Statistic | P_Value |

|---|---|---|

| Gha_per_person | 7.104943697 | 1.20372E-12 |

| FDI | 11.48649614 | 1.54242E-30 |

| GDP_per_capita | 17.22569383 | 1.70372E-66 |

| KOF | 16.92342036 | 3.0235E-64 |

3.1.2. Evaluates the Consistency of an Estimator

- – vector of coefficient estimates from a model with random effects;

- – vector of coefficient estimates from a fixed-effects model;

- – covariance matrices of coefficient estimates for the RE and FE models, respectively.

3.1.3. Moran’s I index

– total number of observations;

– total number of observations; – the value of the variable in location i;

– the value of the variable in location i; – the average value of the variable for all observations;

– the average value of the variable for all observations; – elements of the spatial weight matrix W reflecting the degree of proximity between locations i and j;

– elements of the spatial weight matrix W reflecting the degree of proximity between locations i and j;- – the sum of all the elements of the weight matrix.

3.1.4. Common Correlated Effects Mean Group Estimator

– the dependent variable for the individual unit i at time t.

– the dependent variable for the individual unit i at time t. – vector of explanatory variables of dimension

– vector of explanatory variables of dimension  .

. – individual fixed effect.

– individual fixed effect. – vector of the coefficients of dimension

– vector of the coefficients of dimension  .

. – - model error accounting for unobserved common factors.

– - model error accounting for unobserved common factors.

to consist of unobserved common factors and random error:

to consist of unobserved common factors and random error:

– is a vector of unobservable general dimension factors

– is a vector of unobservable general dimension factors  .

. – vector of individual loads (factor loadings) of dimension

– vector of individual loads (factor loadings) of dimension  .

. – a random error, .

– a random error, .

- – a vector containing the average values of the dependent and explanatory variables: ’

- – a vector of coefficients reflecting the influence of general factors through average values.

- and are the coefficients corresponding to the average values of the explanatory and dependent variables, respectively.

- , are the average values of the corresponding variables at time t;

- – individual effect for each country;

- – coefficients of influence of individual variables;

- – coefficients of influence of the average values of variables (proxies for common factors).

| Variable | Coefficient estimation | The standard error | t-statistics | p-value | Value |

|---|---|---|---|---|---|

| Constant | 6.8679 | 0.78465 | 8.7529 | 4.339e-15 | *** |

| FDI | -1.7236 | 1.5836 | -1.0884 | 0.27819 | |

| GDP_per_capita | 0.00051559 | 0.000054257 | 9.5027 | < 2.2e-16 | *** |

| KOF | 0.070859 | 0.028408 | 2.4944 | 0.01372 | * |

| mean_FDI | -0.14440 | 5.1264 | -0.0282 | 0.97757 | |

| mean_GDP_per_capita | 0.00024937 | 0.00016427 | 1.5180 | 0.13115 | |

| mean_KOF | -0.18384 | 0.040502 | -4.5390 | 1.162e-05 | *** |

- Total Sum of Squares: 475.42

- Residual Sum of Squares: 147.53

- Coefficient of determination (R-squared): 0.69857

- Adjusted coefficient of determination (Adj. R-squared): 0.68635

- F-model statistics: 57.1654

- Degrees of freedom (df): 6 (numerator), 148 (denominator)

- p-value of the F-test: < 2.22e-16

- high correlation between FDI and GDP_per_capita (0.8031): financial development and GDP per capita are closely related;

- strong correlation between KOF and mean_KOF (0.8616): expected, since mean_KOF is the average value of KOF;

-

a very high correlation between the average values of the variables:

- ◦

- mean_FDI и mean_GDP_per_capita: 0.9290;

- ◦

- mean_FDI и mean_KOF: 0.9420;

- ◦

- mean_GDP_per_capita и mean_KOF: 0.9280.

3.1.5. Variance Inflation Factor Analysis

- KOF: 14.137

- mean_FDI: 12.153

- mean_GDP_per_capita: 10.011

- mean_KOF: 21.334

- FDI: 8.876

- the inclusion of the average values of the variables: mean_FDI, mean_GDP_per_capita, and mean_KOF strongly correlate with the corresponding individual variables and with each other;

- economic relationships: variables reflect related economic processes (globalisation, financial development, economic growth).

- ◦

- the average values cause high multicollinearity;

- ◦

- consider alternative methods of accounting for common factors, for example, models with fixed time effects.

- Total Sum of Squares: 475.42

- Residual Sum of Squares: 147.53

- Coefficient of determination (R-squared): 0.68969

- Adjusted coefficient of determination (Adj. R-squared): 0.68635

- F-model statistics: 57.1654

- Degrees of freedom (df): 3 (numerator), 121 (denominator)

- p-value of the F-test: < 2.22e-16

4. Discussion

5. Conclusions

- -

- effect of knowledge spillover and diffusion of technologies in the EAEU space on the quality of production (green transformation, fossil fuel energy vs renewable energy) and, accordingly, environmental quality;

- -

- relation of the quality of the environment, the level of income and consumption and living standards in the EAEU countries;

- -

- effect of financial development in Russia on the level of energy consumption, CO2 emission, and economic growth in other EAEU countries.

- stimulation of renewable energy sources using (solar, wind, hydro) and increase the energy efficiency of equipment through the implementation of strict emission standards for products manufactured in the EAEU;

- introduction of turnover penalties for champion enterprises in CO2 emissions in the EAEU countries;

- tax incentives and subsidies for companies producing zero-carbon products;

- formation of a "low-carbon trade" model for the integration association: tariff incentives for exports and imports of goods with a low carbon footprint; increasing of tariffs for imports of products manufactured in violation of environmental standards;

- establishing ‘green’ economic zones in the EAEU for companies committing to produce zero-carbon footprint products;

- establishing an interstate eco-lending system for countries to subsidise loan rates for companies implementing the ESG agenda.

- design a single integrated system of air, water and soil quality monitoring for timely response to environmental problems in the integration association area;

- establishing joint programmes on R&D and transfer of environmentally friendly technologies between developed and developing countries in the EAEU;

- formation of the interregional fund for sustainable development to prevent and eliminate environmental damage in the EAEU countries;

- development of a regulatory framework and ensuring control over the relocation of harmful production to countries with more environmentally lenient regulations;

- introduction of mandatory disclosure of environmental risks in the construction of industrial facilities and formation of ESG ranking in the EAEU.

- organise educational campaigns to raise the level of environmental awareness of the population starting from school; involve schoolchildren and students in the activities of environmental groups and eco-volunteering;

- expanding companies' commitments under the ESG agenda;

- increasing the eco-awareness of the population through the implementation of social advertising and corporate culture of companies;

- households tax deductions and subsidies for the installation of solar panels, construction of energy-efficient buildings, and the introduction of environmentally friendly technologies;

- educating the public on the possibilities of investing in environmentally responsible projects through bonds, stocks, and funds;

- increased grant support for eco-research aimed at developing new technologies to reduce pollution, recycle waste, and use renewable energy sources;

- implementing policies to integrate environmentally responsible behaviour into daily life: from developing infrastructure for separate waste collection to bonus programmes for those who use eco-bags, refuse plastic bags, or buy local products.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmad, M., Jiang, P., Majeed, A., Umar, M., Khan, Z., & Muhammad, S. (2020). The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resources Policy, 69, 101817. [CrossRef]

- Ahmad, M., Jiang, P., Murshed, M., Shehzad, K., Akram, R., Cui, L., & Khan, Z. (2021). Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: Does financial globalization matter? Sustainable Cities and Society, 70, 102881. [CrossRef]

- Ahmed, Z., Zafar, M. W., Ali, S., & Danish. (2020). Linking urbanization, human capital, and the ecological footprint in G7 countries: An empirical analysis. Sustainable Cities and Society, 55, 102064. [CrossRef]

- Ahmed, Z., Zhang, B., & Cary, M. (2021). Linking economic globalization, economic growth, financial development, and ecological footprint: Evidence from symmetric and asymmetric ARDL. Ecological Indicators, 121, 107060. [CrossRef]

- Alola, A. A., Bekun, F. V., & Sarkodie, S. A. (2019). Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Science of The Total Environment, 685, 702–709. [CrossRef]

- Anselin, L. (1988). Spatial Econometrics: Methods and Models (Vol. 4). Springer Netherlands. [CrossRef]

- Anwar, A., Sinha, A., Sharif, A., Siddique, M., Irshad, S., Anwar, W., & Malik, S. (2022). The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: Evidence from selected Asian countries. Environment, Development and Sustainability, 24(5), 6556–6576. [CrossRef]

- Barnes, J., Black, A., Markowitz, C., & Monaco, L. (2021). Regional integration, regional value chains and the automotive industry in Sub-Saharan Africa. Development Southern Africa, 38(1), 57–72. [CrossRef]

- Batool, Z., Raza, S. M. F., Ali, S., & Abidin, S. Z. U. (2022). ICT, renewable energy, financial development, and CO2 emissions in developing countries of East and South Asia. Environmental Science and Pollution Research, 29(23), 35025–35035. [CrossRef]

- Bayar, Y., Diaconu (Maxim), L., & Maxim, A. (2020). Financial Development and CO2 Emissions in Post-Transition European Union Countries. Sustainability, 12(7), Article 7. [CrossRef]

- Çakmak, E. E., & Acar, S. (2022). The nexus between economic growth, renewable energy and ecological footprint: An empirical evidence from most oil-producing countries. Journal of Cleaner Production, 352, 131548. [CrossRef]

- Caliendo, L., Opromolla, L. D., Parro, F., & Sforza, A. (2021). Goods and Factor Market Integration: A Quantitative Assessment of the EU Enlargement. Journal of Political Economy, 129(12), 3491–3545. [CrossRef]

- Cheng, L., Zhang, X., & Xu, Z. (2023). Exploring Dimensions in Digital Economy and Manufacturing Integration: Analyzing with DEA-Malmquist Model and Emphasizing the Role of ERP Systems in Enhancing Collaboration and Efficiency. Journal of Information Systems Engineering and Management, 8(1), 25092. [CrossRef]

- Cyprian En, O. (2010). Technology Transfer, Adoption and Integration: A Review. Journal of Applied Sciences, 10(16), 1814–1819. [CrossRef]

- Dalimov, R. T. (2009). The Dynamics of Trade Creation and Trade Diversion Effects Under International Economic Integration.

- Danish, Hassan, S. T., Baloch, M. A., Mahmood, N., & Zhang, J. (2019). Linking economic growth and ecological footprint through human capital and biocapacity. Sustainable Cities and Society, 47, 101516. [CrossRef]

- Das, A., Brown, L., & McFarlane, A. (2023). Asymmetric Effects of Financial Development on CO2 Emissions in Bangladesh. Journal of Risk and Financial Management, 16(5), Article 5. [CrossRef]

- Gries, T., Grundmann, R., Palnau, I., & Redlin, M. (2018). Technology diffusion, international integration and participation in developing economies—A review of major concepts and findings. International Economics and Economic Policy, 15(1), 215–253. [CrossRef]

- Hausman, J. A. (1978). Specification Tests in Econometrics. Econometrica, 46(6), 1251–1271. [CrossRef]

- He, W., Wang, B., Danish, & Wang, Z. (2018). Will regional economic integration influence carbon dioxide marginal abatement costs? Evidence from Chinese panel data. Energy Economics, 74, 263–274. [CrossRef]

- Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74. [CrossRef]

- Iwegbu, O., Justine, K., & Borges Cardoso, L. C. (2022). Regional financial integration, financial development and industrial sector growth in ECOWAS: Does institution matter? Cogent Economics & Finance, 10(1), 2050495. [CrossRef]

- Javeed, S., Siddique, H. M. A., & Javed, F. (2023). Ecological footprint, globalization, and economic growth: Evidence from Asia. Environmental Science and Pollution Research, 30(31), 77006–77021. [CrossRef]

- Kim, Y. J., & Verdolini, E. (2023). International knowledge spillovers in energy technologies. Energy Strategy Reviews, 49, 101151. [CrossRef]

- Kurečić, P., & Luša, Đ. (2014). The economic growth of small states and small economies in regional economic organizations and integrations: Similarities and differences. Journal of Education Culture and Society, 5(1), Article 1. [CrossRef]

- Kuznets, S. (1955). Economic Growth and Income Inequality. The American Economic Review, 45(1), 1–28.

- Levin, A., Lin, C.-F., & James Chu, C.-S. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1–24. [CrossRef]

- Levytska, O. (2023). THEORETICAL AND CONCEPTUAL APPROACHES TO THE ANALYSIS OF LABOR MARKETS COMPETITIVENESS UNDER INCREASING MIGRATION PROCESSES. Visnyk of the Lviv University. Series Economics, 63, Article 63. http://publications.lnu.edu.ua/bulletins/index.php/economics/article/view/11896.

- Li, J., & Lin, B. (2017). Does energy and CO2 emissions performance of China benefit from regional integration? Energy Policy, 101, 366–378. [CrossRef]

- Lv, X., Zhu, Y., & Du, J. (2024). Can Regional Integration Policies Enhance the Win–Win Situation of Economic Growth and Environmental Protection? New Evidence for Achieving Carbon Neutrality Goals. Sustainability, 16(4), Article 4. [CrossRef]

- Lv, Z., & Li, S. (2021). How financial development affects CO2 emissions: A spatial econometric analysis. Journal of Environmental Management, 277, 111397. [CrossRef]

- Maji, I. K., Habibullah, M. S., & Saari, M. Y. (2017). Financial development and sectoral CO2 emissions in Malaysia. Environmental Science and Pollution Research, 24(8), 7160–7176. [CrossRef]

- Makhdum, M. S. A., Usman, M., Kousar, R., Cifuentes-Faura, J., Radulescu, M., & Balsalobre-Lorente, D. (2022). How Do Institutional Quality, Natural Resources, Renewable Energy, and Financial Development Reduce Ecological Footprint without Hindering Economic Growth Trajectory? Evidence from China. Sustainability, 14(21), Article 21. [CrossRef]

- Moran, P. A. P. (1950). Notes on Continuous Stochastic Phenomena. Biometrika, 37(1/2), 17–23. [CrossRef]

- Murshed, M., Ahmed, R., Kumpamool, C., Bassim, M., & Elheddad, M. (2021). The effects of regional trade integration and renewable energy transition on environmental quality: Evidence from South Asian neighbors. Business Strategy and the Environment, 30(8), 4154–4170. [CrossRef]

- Nathaniel, S., Anyanwu, O., & Shah, M. (2020). Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environmental Science and Pollution Research, 27(13), 14601–14613. [CrossRef]

- Ngoc, B. H., & Tram, N. H. M. (2024). Spillover impacts of financial development and globalization on environmental quality in ASEAN countries. Heliyon, 10(9). [CrossRef]

- Otsuka, K., Natsuda, K., & Csonka, L. (2023). Global value chains and knowledge spillover to local economy in Visegrad 4 countries. [CrossRef]

- Pesaran, M. H. (2006). Estimation and Inference in Large Heterogeneous Panels with a Multifactor Error Structure. Econometrica, 74(4), 967–1012. [CrossRef]

- Qi, Z., Liu, F., & Ding, T. (2023). The pollution control effect of regional integration: An empirical study based on Urban Agglomeration Planning in China. Environmental Science and Pollution Research, 30(40), 93126–93141. [CrossRef]

- Shah, M. I., AbdulKareem, H. K. K., Ishola, B. D., & Abbas, S. (2023). The roles of energy, natural resources, agriculture and regional integration on CO2 emissions in selected countries of ASEAN: Does political constraint matter? Environmental Science and Pollution Research, 30(10), 26063–26077. [CrossRef]

- Shahbaz, M., Dogan, M., Akkus, H. T., & Gursoy, S. (2023). The effect of financial development and economic growth on ecological footprint: Evidence from top 10 emitter countries. Environmental Science and Pollution Research, 30(29), 73518–73533. [CrossRef]

- Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., & Leitão, N. C. (2013). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renewable and Sustainable Energy Reviews, 25, 109–121. [CrossRef]

- Shahbaz, M., Solarin, S. A., Mahmood, H., & Arouri, M. (2013). Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Economic Modelling, 35, 145–152. [CrossRef]

- Sheraz, M., Deyi, X., Mumtaz, M. Z., & Ullah, A. (2022). Exploring the dynamic relationship between financial development, renewable energy, and carbon emissions: A new evidence from belt and road countries. Environmental Science and Pollution Research, 29(10), 14930–14947. [CrossRef]

- Suliman, O. (1999). [Review of Review of Indonesian Labour in Transition: An East Asian Success Story?, by C. Manning]. Southern Economic Journal, 65(3), 659–661. [CrossRef]

- Szymczyk, K., Şahin, D., Bağcı, H., & Kaygın, C. Y. (2021). The Effect of Energy Usage, Economic Growth, and Financial Development on CO2 Emission Management: An Analysis of OECD Countries with a High Environmental Performance Index. Energies, 14(15), Article 15. [CrossRef]

- Tinoco-Zermeño, M. Á. (2023). Energy consumption, financial development, CO2 emissions, and economic growth in 23 developing economies. Revista Mexicana de Economía y Finanzas Nueva Época REMEF, 18(1), Article 1. [CrossRef]

- Usman, M., Makhdum, M. S. A., & Kousar, R. (2021). Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustainable Cities and Society, 65, 102590. [CrossRef]

- Usman, O., Alola, A. A., & Sarkodie, S. A. (2020). Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: Evidence from the US. Renewable Energy, 150, 266–277. [CrossRef]

- Wang, H., Zheng, L. J., Zhang, J. Z., Behl, A., Arya, V., & Rafsanjani, M. K. (2023). The dark side of foreign firm presence: How does the knowledge spillover from foreign direct investment influence the new venture performance. Journal of Innovation & Knowledge, 8(3), 100399. [CrossRef]

- Wang, X., Yan, L., & Zhao, X. (2022). Tackling the ecological footprint in china through energy consumption, economic growth and CO2 emission: An ARDL approach. Quality & Quantity, 56(2), 511–531. [CrossRef]

- Xiao, R., Tan, G., Huang, B., Li, J., & Luo, Y. (2022). Pathways to sustainable development: Regional integration and carbon emissions in China. Energy Reports, 8, 5137–5145. [CrossRef]

- Xiong, F., Zang, L., Feng, D., & Chen, J. (2023). The influencing mechanism of financial development on CO2 emissions in China: Double moderating effect of technological innovation and fossil energy dependence. Environment, Development and Sustainability, 25(6), 4911–4933. [CrossRef]

- Xiong, F., Zhang, R., & Mo, H. (2023). The mediating effect of financial development on CO2 emissions: An empirical study based on provincial panel data in China. Science of The Total Environment, 896, 165220. [CrossRef]

- Xiuwu, Z., Zhangmin, H., & Sihan, J. (2022). The impact of two-way FDI on total factor productivity in China and countries of the belt and road initiative. Economic Research-Ekonomska Istraživanja, 35(1), 2868–2888. [CrossRef]

- Xu, X., Huang, S., & An, H. (2021). Identification and causal analysis of the influence channels of financial development on CO2 emissions. Energy Policy, 153, 112277. [CrossRef]

- Xu, Z., Baloch, M. A., Danish, Meng, F., Zhang, J., & Mahmood, Z. (2018). Nexus between financial development and CO2 emissions in Saudi Arabia: Analyzing the role of globalization. Environmental Science and Pollution Research, 25(28), 28378–28390. [CrossRef]

- Yang, S., & Martinez-Zarzoso, I. (2014). A panel data analysis of trade creation and trade diversion effects: The case of ASEAN–China Free Trade Area. China Economic Review, 29, 138–151. [CrossRef]

- Zhao, B., & Yang, W. (2020). Does financial development influence CO2 emissions? A Chinese province-level study. Energy, 200, 117523. [CrossRef]

- Zhuo, L. (2024). Market integration effect on technological innovation empirical analysis: A novel concept—Luo—Bulletin of Economic Research—Wiley Online Library. Retrieved November 26, 2024, from https://onlinelibrary.wiley.com/doi/10.1111/boer.12472.

| Research | The Impact of Integration, Financial Development, and Economic Growth on the Environment |

|---|---|

| Xiao, Tan, Huang, Li & Luo (2022) (Xiao et al., 2022) | Regional integration reduced carbon emissions by transferring energy-intensive and heavily polluting enterprises to other regions and by improving the capability of regional enterprises to govern their gas emissions and utilize energy efficiently. |

| Murshed, Ahmed, Kumpamool, Bassim & Elheddad (2021) (Murshed et al., 2021) | Both regional trade integration and renewable energy transition are found to jointly reduce carbon dioxide emissions in South Asia. The results also authenticate the existence of the environmental Kuznets curve hypothesis, while financial development and urbanization are found to boost carbon dioxide emissions only in the long run. |

| Lv, Zhu, & Du (2024) (X. Lv et al., 2024) | Regional integration has a significantly positive impact on attaining a win–win situation in terms of economic growth and environmental protection. Inhibiting pollution transfer and promoting green transformation are crucial mechanisms by which regional integration can help strike a balance between economic growth and environmental protection. |

| Qi, Liu, & Ding (2023) (Qi et al., 2023) | Regional integration can effectively reduce urban pollutant emissions and that the emission reduction effect of regional integration is characterized by significant heterogeneity at different pollution levels. The mechanism analysis showed that the green technology innovation effect of regional integration is an important mechanism for promoting urban emission reduction. |

| Shah, AbdulKareem, Ishola & Abbas (2023) (Shah et al., 2023) | Renewable energy consumption has a negative impact on CO2 emissions while fossil fuel energy degrades the environment. For regional trade integration, its influence was not significant enough to offset CO2 emission. |

| He, Wang, Danish & Wang (2018) (He et al., 2018) | Regional economic integration not only stimulates labour mobility, but also achieve scale economy, both of which may also influence carbon dioxide (CO2) marginal abatement costs through affecting energy consumption, CO2 emissions, productivity growth, and technical progress. Evolution of regional economic integration indeed contributes to the increase of CO2 marginal abatement cost at 5% significance level. |

| Sheraz, Deyi, Mumtaz & Ullah (2022) (Sheraz et al., 2022) | Financial development significantly increases CO2 emissions and causes environmental degradation in BRI countries. However, renewable energy and globalization mitigate CO2 emissions and improve the quality of the environment. Institutional quality was positive in correlation with CO2 emission and indicates bad governance, corruption, weak bureaucracy, and improper implementation of environmental laws cause environmental degradation. Further, the study also reports a bidirectional relationship of financial development, renewable energy, and institutional quality with CO2 emissions and a unidirectional causality running from globalization to CO2 emissions in BRI countries. |

| Li & Lin (2017) (Li & Lin, 2017) | Regional integration has significant and robust positive effects on energy and CO2emissions performance with over 70% of effects coming from artificial barriers, rather than geographical distance. International openness is also beneficial for promoting energy and CO2 emissions performance, but cannot substitute for regional integration because of China's specialization in energy-intensive manufacturing in the global economy. |

| Tinoco-Zermeño (2023) (Tinoco-Zermeño, 2023) | The results confirm bidirectional causality between financial development and CO2, financial development and GDP, and primary energy consumption and CO2; and unidirectional from financial development to energy consumption and from electricity generation to CO2. We did not find evidence of a relationship between GDP and energy or CO2 emissions. |

| Lv & Li (2021) (Z. Lv & Li, 2021) (Z. Lv & Li, 2021) | We found that a country's CO2 emissions could be influenced by the financial development of its neighbors. Specifically, the significantly negative spillover effect of financial development on CO2 emissions dominated the significant positive direct effect, thus suggesting a significant negative total effect. |

| Das, Brown & McFarlane (2023) (Das et al., 2023) | The relationship between CO2 emissions per capita and financial development is cointegrating, with the direction of cointegration running from financial development to CO2 emissions. We find that positive and negative changes in financial development have asymmetric impacts on CO2 emissions in the long and short run. |

| Zhao & Yang (2020) (Zhao & Yang, 2020) | In the long term, it exists that the two-way causality between regional financial development and CO2 emissions, whereas it's not true for the short term. The dynamic analysis results demonstrate that the regional financial development has significantly lagged inhibitory effects on CO2 emissions. |

| Shahbaz, Solarin, Mahmood & Arouri (2013) (Shahbaz, Solarin, et al., 2013) | We establish the presence of significant long-run relationships between CO2 emissions, financial development, energy consumption and economic growth. The empirical evidence also indicates that financial development reduces CO2 emissions. Energy consumption and economic growth add in CO2 emissions. |

| Bayar, Diaconu & Maxim (2020) (Bayar et al., 2020) | The causality analyses did not reveal significant connection between financial sector development and CO2 emissions, but rather a two-way causality between primary energy consumption and economic growth, on one hand, and CO2 emissions on the other. Meanwhile, long-run analysis disclosed that financial sector development and primary energy consumption positively affected CO2 emissions. |

| Xu, Huang & An (2021) (X. Xu et al., 2021) | We find that financial development clearly affects CO2 emissions through three channels: industrialization, economic growth, and energy consumption. The impact of financial development on CO2 emissions changes from negative to positive as industrialization and energy consumption increase. Financial development has a positive impact on CO2 emissions when per-capita income is between $1100 and $8100 but a negative impact when per-capita income is less than $1100 or greater than $8100. The economic growth channel is the Granger cause of the energy consumption and technological progress channels, and vice versa. |

| Batool, Raza, Ali & Abidin (2022) (Batool et al., 2022) | Results suggest that ICT and financial development positively contribute to the degradation of the environment in the long run, while their impact on CO2 emissions is insignificant in the short run. On the other hand, renewable energy consumption affects environmental quality positively in both the long run and short run. It is also examined that economic growth affects CO2 emissions positively but the squared economic growth reduces CO2 emissions which validates inverted U-shaped EKC hypothesis. The empirical findings of the Granger Causality test suggest unidirectional causality from ICT and financial development to CO2 emissions, while a bi-directional relationship is found among renewable energy and CO2 emissions. |

| Xiong, Zhang, & Mo (2023) (Xiong, Zhang, et al., 2023) | Empirical results consistently indicate that financial development has the significantly positive effect on CO2 emissions per capita, but the impact is inverted U-shaped. These results provide new explanatory ideas for the inconsistent direction of the impact of financial development on carbon emissions in existing studies. Then, the technological innovation and industrial structure are intermediaries for financial development to reduce CO2 emissions per capita, while the economic scale is the opposite. |

| Anwar, Sinha, Sharif, Siddique, Irshad, Anwar & Malik (2022) (Anwar et al., 2022) | The empirical evidence demonstrates that urbanization, financial development, and economic growth increase CO2 emissions, renewable energy consumption reduces CO2 emissions, and the impact of agriculture is insignificant. |

| Xu, Baloch, Danish, Meng, Zhang & Mahmood (2018) (Z. Xu et al., 2018) | Empirical results indicate that financial development contributes to CO2 emissions and degrades environmental quality. The results also show that the role of globalization in environmental degradation is insignificant and that electricity consumption is the main culprit behind the growing CO2 emissions in Saudi Arabia. In addition, bidirectional causality exists between globalization and CO2 emissions in the long run, and financial development and CO2 emissions Granger-cause each other. |

| Xiong, Zang, Feng & Chen (2023) (Xiong, Zang, et al., 2023) | Empirical results consistently indicate that the effect of China's financial development on CO2 emissions per capita is significantly negative, and it also presents an inverted U-shaped pattern. |

| Maji, Habibullah, & Saari (2017) (Maji et al., 2017) | The long-run results reveal that financial development increases CO2 emissions from the transportation and oil and gas sector and reduces CO2 emissions from manufacturing and construction sectors. However, the elasticity of financial development is not significant in explaining CO2 emissions from the agricultural sector. The results for short-run elasticities were also consistent with the long-run results. |

| Szymczyk, Şahin, Bağcı & Kaygın (2021) (Szymczyk et al., 2021) | This assessment finds positive relationships between economic growth, energy consumption, and the urban population, and CO2 emissions. Moreover, it is put forward that a negative and significant relationship between financial development and CO2 emissions exists. Despite displaying a similar negative correlation, the relationship between trade openness and CO2 emissions is insignificant. |

| Shahbaz, Hye, Tiwari & Leitão (2013) (Shahbaz, Hye, et al., 2013) | The empirical findings indicate that economic growth and energy consumption increase CO2 emissions, while financial development and trade openness compact it. The VECM causality analysis has shown the feedback hypothesis between energy consumption and CO2 emissions. Economic growth and CO2 emissions are also interrelated i.e. bidirectional causality. Financial development Granger causes CO2 emissions. |

| Usman, Makhdum & Kousar (2021) (M. Usman et al., 2021) | The results of augmented mean group (AMG) estimation approach revealed that financial development, renewable energy and trade openness significantly contribute to overcome the environmental degradation, while economic growth and non-renewable energy utilization are more responsible for the environmental damages. Moreover, in growth function, financial development, renewable and non-renewable energy utilization significantly promote the economic growth. |

| Danish, Hassan, Baloch, Mahmood & Zhang (2019) (Danish et al., 2019) | The ARDL econometric approach reveal that economic growth increases ecological footprint that contributes to environmental degradation. In addition, biocapacity also increases the ecological footprint and contributes to environmental degradation. A causality analysis suggests there is no causality regarding the relationship between economic growth and the ecological footprint. |

| Ahmed, Zhang & Cary (2021) (Ahmed et al., 2021) | The long-run empirical results of symmetric ARDL suggest that economic globalization and financial development increase footprint in Japan. On the flipside, the novel findings from the asymmetric ARDL indicate that positive and negative changes in economic globalization reduce footprint. A positive change in financial development increases footprint with a more pronounced effect in the long-run, compared to a negative change which has a comparatively weak effect. Energy consumption deteriorates the environment by increasing the ecological footprint. On the positive side, population density decreases footprint, and the inverted U-shaped relationship between footprint and income confirms the validity of the EKC in Japan. |

| Makhdum, Usman, Kousar, Cifuentes-Faura, Radulescu & Balsalobre-Lorente (2022) (Makhdum et al., 2022) | The ARDL outcomes reveal that institutional quality and renewable energy utilization greatly diminish ecological footprint. At the same time, other prospective indicators such as financial expansion and natural resources significantly enhance ecological footprint levels in the short- and long-run. Furthermore, institutional quality, financial expansion, renewable energy, and natural resources significantly trigger economic growth. Besides this, this study has revealed the unidirectional causal association from institutional quality and financial expansion to ecological footprint. In contrast, bidirectional causality occurs between renewable energy, natural resources, ecological footprint, and economic growth. |

| Shahbaz, Dogan, Akkus & Gursoy (2023) (Shahbaz et al., 2023) | Financial development, economic growth, and non-renewable energy consumption negatively affect environmental quality by increasing ecological footprint. On other hand, the effect of trade openness on ecological footprint is found to be statistically insignificant. In addition, according to the panel causality test results, a unidirectional causality from financial development to ecological footprint is found while bidirectional causality between economic growth and ecological footprint exists. |

| Çakmak & Acar (2022) (Çakmak & Acar, 2022) | Our findings demonstrate that; a) renewable energy consumption does not influence and is not a cause of the ecological footprint, b) economic growth is a cause and has an influence on the ecological footprint for most oil-producing countries. It has been found out that a 1% increase in economic growth will increase the ecological footprint by 0.02828%. |

| Javeed, Siddique & Javed (2023) (Javeed et al., 2023) | The results of FM-OLS show that with a 1% increase in economic growth, globalization, biocapacity, and population density the ecological footprint increases by 0.55%, 0.08%, 0.06%, and 0.03%, respectively. However, renewable energy improves the environment by 0.04%. The Granger causality analysis revealed a bidirectional causality between ecological footprint and globalization and between ecological footprint and energy intensity. |

| Ahmad, Jiang, Majeed, Umar, Khan & Muhammad (2020) (Ahmad et al., 2020) | Cointegration results confirm a stable, long-run relationship between the ecological footprint, natural resources, technological innovations, and economic growth. In the long run, natural resources and economic growth increase and expand the ecological footprint, while technological innovations are helpful in abating environmental degradation that takes place a result of this phenomenon. Furthermore, the quadric term for economic growth showed a negative impact on the ecological footprint, i.e., in the presence of the Environment Kuznets Curve (EKC) hypothesis. |

| Wang, Yan & Zhao (2022) (X. Wang et al., 2022) | It is further found that the CO2 emission significantly positively derives the ecological footprint in short run while the economic growth significantly negatively affects the ecological footprint in short run. It means that the CO2 emission is a positive short-range as well as long-range deriver of ecological footprint while the economic growth is a negative short-term and long-range predictor of ecological footprint in China. However, the non-renewable energy consumption has not been supported as the significant deriver of ecological footprint, neither in short range nor in long range. |

| Ahmad, Jiang, Murshed, Shehzad, Akram, Cui & Khan (2021) (Ahmad et al., 2021) | The overall findings show that financial globalization and eco-innovation reduce the ecological footprints, while urbanization stimulates environmental degradation by boosting the ecological footprints. Besides, the relationship between economic growth and ecological footprints is found to be inverted U-shaped. Hence, the Environment Kuznets Curve hypothesis is found to hold in the case of the G7 countries. |

| Usman, Alola & Sarkodie (2020) (O. Usman et al., 2020) | The empirical results divulged that a decline in environmental degradation can be attributed to an increase in renewable energy consumption through its negative effects on ecological footprint. Economic growth and biocapacity were found to exert upward pressure on ecological footprint; however, trade policy exerts downward pressure on ecological footprint. A two-sided causal relationship was established between economic growth and ecological footprint as well as economic growth and biocapacity. In contrast, a one-way causality was confirmed running from trade policy to renewable energy consumption and from renewable energy consumption to biocapacity. The innovative accounting revealed that 14.79% and 8.41% of renewable energy consumption and trade policy caused 0.60% and 9.88% deterioration in the environment. |

| Statistics | Gha_per_person | FDI | GDP_per_capita | KOF |

|---|---|---|---|---|

| Moran's I | -0.00694 | -0.00394 | -0.0023344 | -0.00153433 |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 |

| Variables | FDI | GDP_per_capita | KOF | mean_FDI | mean_GDP_per_capita | mean_KOF |

|---|---|---|---|---|---|---|

| FDI | 1.0000 | 0.8031 | 0.6693 | 0.3615 | 0.3358 | 0.3405 |

| GDP_per_capita | 0.8031 | 1.0000 | 0.5819 | 0.4527 | 0.4873 | 0.4522 |

| KOF | 0.6693 | 0.5819 | 1.0000 | 0.8116 | 0.7996 | 0.8616 |

| mean_FDI | 0.3615 | 0.4527 | 0.8116 | 1.0000 | 0.9290 | 0.9420 |

| mean_GDP_per_capita | 0.3358 | 0.4873 | 0.7996 | 0.9290 | 1.0000 | 0.9280 |

| mean_KOF | 0.3405 | 0.4522 | 0.8616 | 0.9420 | 0.9280 | 1.0000 |

| Variable | VIF |

|---|---|

| FDI | 8.876 |

| GDP_per_capita | 4.598 |

| KOF | 14.137 |

| mean_FDI | 12.153 |

| mean_GDP_per_capita | 10.011 |

| mean_KOF | 21.334 |

| Variable | Coefficient estimation | The standard error | t-statistics | p-value | Value |

|---|---|---|---|---|---|

| FDI | -1.7236 | 1.7127 | -1.0064 | 0.31624 | |

| GDP_per_capita | 0.00051559 | 0.00005868 | 8.7865 | 1.237e-14 | *** |

| KOF | 0.070859 | 0.030723 | 2.3064 | 0.02279 | * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).