1. Introduction

Paulownia, commonly known as the "princess” or “empress” tree," is a deciduous hardwood tree belonging to the family of Paulowniaceae that has become a valuable resource for sustainable forestry and energy production due to its rapid growth - often exceeding five meters in height within a single growing season, high biomass yield, and versatility in various applications [

1]. Native to the Orient, East Asia, especially China, this genus comprises several species, among which

Paulownia tomentosa is the most important due to its high ecological valence, being able to adapt to diverse environmental conditions and soil types [

2,

3]. Paulownia species are characterized by their rapid growth, allowing them to produce sawtimber-sized trees in 10 to 15 years [

4]. However, they can be grown, alternatively, at a slower rate as well, in order to produce close-grained wood in 30 to 35 years. The growth rate of Paulownia is significantly influenced by site conditions, density level and thinning as the trees compete for resources. High-quality logs and profitable production can be reached due slow growth (2-3 growing rings/cm or 1 cm diameter increase/year) [

5]. In this regard, it is essential for growers to define their product objectives before establishing farms, as this will guide their management strategies and ensure optimal outcomes.

The use of Paulownia spans multiple sectors, including bioenergy, timber, and agroforestry. The primary commercial market for Paulownia is in Japan [

6,

7]. The highest quality Paulownia timber is employed in producing of musical instruments such as kotos, guitars, harps, etc. as well as ornamental purposes such as jewelry, gift boxes, furniture, footwear, paneling, and specialized items. The inferior quality of this timber is repurposed as crating materials for substantial machinery and traditional building materials such as construction lumber, plywood, and veneer [

2].

In recent years, global warming, as a result of climate change, led to an increasing global energy demand which, henceforward, is expected to rise with a population estimated to reach 9 billion by 2050 [

8]. These changes have been driven to a significant shift towards renewable energy sources at the expense of fossil fuels. Fossil fuels, which are depleting and account for approximately 80% of greenhouse gas (GHG) emissions - the main drivers of climate change - are being increasingly replaced [

9].

On a global scale, the European Union (EU) became a key region for the development of renewable energy sources (RES). In 2018, the EU's primary energy production from renewables reached 233.9 Mtoe, which represents 30.9% of the total EU energy output, representing a 10.3% increase since 2000. This growth has been substantially supported by various incentives and subsidies provided by EU Member States to promote the installation of renewable energy production facilities [

10,

11].

The cultivation of lignocellulosic agroforestry species that grow quickly, also called short rotation coppice, can produce a higher amount of biomass in a shorter period of time than other traditional forest species, led to a serious increase in solid biomass production [

12,

13,

14].

According to Lewandowski and Pleguezuelo [

15,

16] the primary short-rotation coppice crops cultivated for biomass production in the EU are poplar (

Populus spp.), eucalypt (

Eucalyptus spp.), willow (

Salix sp.), black locust (

Robinia pseudoacacia L.), and Paulownia (

Paulownia spp.). In contrast to the first-generation biomass crops (e.g. maize, sugarcane), these species are classified as second-generation biomass crops (2G) due to their non-food nature. As a biomass source, Paulownia wood can be converted to pellets or woodchips to sustain renewable energy production, contributing to the global shift towards cleaner energy solutions. These species can be cultivated in marginal or deserted areas affected by erosion, high salinity, low organic matter, or, even contaminated soils [

17,

18]. However, marginal or abandoned land in the EU represents only a small portion of the total utilized agricultural area (UAA), equivalent to approx. 1.35 million hectares [

19]. In this context, agricultural lands are negatively impacted by the fast spread of SRCs, which are being introduced and replacing agricultural crops. It has to be mentioned that climate change has also encouraged the production of renewable energy by the use of biomass crops.

From an economic point of view, Paulownia cultivation offers farmers a lucrative alternative to traditional crops. With relatively low input costs and high market demand, the financial returns on investment can be substantial [

20,

21,

22]. Furthermore, the ability of the tree to improve soil quality and sequester carbon makes it an attractive candidate for sustainable agricultural practices, aligning economic benefits with environmental stewardship [

23,

24]. Another study revealed that in Southern Italy a vineyard has been replaced by Paulownia adopting a discounted cash flow approach and proved to be profitable for both timber and woodchip production, with an annual gross margin equal to 357.91 € ha

−1, becoming a valid alternative as compared to wine grape (237.41 € ha

−1) [

25]. On the contrary, it has been shown also, that Paulownia if exploited exclusively for biomass production its profitability is very low (4.22 € ha

−1) [

25]. Nevertheless, it is important to note that profitability is not solely determined by the type of product (single or dual production), but also by market price fluctuations, subsidies or incentives, and by the ability of entrepreneurs to create sustainable supply chains from an environmental and social perspective.

Therefore, the main aim of this study was to explore the characteristics and advantages of Paulownia as an industrial energy plant, examining its uses, profitability, and potential role in promoting sustainable practices within agricultural and forestry systems in Romania.

2. Materials and Methods

Experimental sites

To carry out this research seven paulownia farms with dual production systems (production of timber log and biomass) have been chosen from Romania (

Figure 1) and evaluated from both biological and economic points of view over 5 years followed by the elaboration of future scenarios (up to 15 years) to estimate the time, cost, and resources to assess their profitability.

The farms were located in Cluj, Mureș, Alba, Bistrița-Năsăud, and Brașov Counties where the humid continental climate prevails according to the Wladimir Köppen Classification with an average annual temperature ranging from 10.26 to 11.10°C and an average annual rainfall between 524.88 and 646.37 mm, while the soils have a pH between 5.58–6.36 with sandy to clayey texture and an average organic content of 2.78-3.63% associated with a good nitrogen supply of 0.292-0.299% (

Table 1).

The age of the trees varies between 1 and 6 years old, and the acreage of the farm’s ranges between 0.1 and 14 hectares. The farms were established in different years, the oldest dating from 2012, while the newest is from 2017, which makes tree ages and economic data also variable. All data collected from farmers were summarized in

Table 2.

Biological material

Paulownia species grown in the selected farms include

Paulownia tomentosa,

Paulownia elongata, Paulownia Cotevisa 2 ® Hybrid

, and

Paulownia Shan Tong (

Figure 2). Planting materials were purchased from local nurseries located in Oradea, Arad, Cluj-Napoca, and Bistrița and planted in autumn of the establishment years.

P. tomentosa - commonly known as royal paulownia, is native to eastern Asia which is moderately cold hardy (0° C) with an annual rainfall of at least 1020 mm. In climatically favourable areas trees can reach 12 to 15 m in height and in spread. Annual growth is 40 to 50 cm in height and 20 cm in spread.

P. elongata – has no tolerance against winter temperatures (thermophilic) and it is recommended to be cultivated mostly in Mediterranean climate, in warm countries where temperatures rarely drop below -6-7 °C. It has a rapid growth, developing a long and straight trunk, and 5 years after the pruning reaches the size of industrialization for its wood.

P. Cotevisa 2® - It is a hybrid obtained due cross selection between P. elongata and P. fortunei which is characterized by high adaptability to different soil types and climate conditions. It tolerates temperatures from -20 to 50°C. Due to its strong rooting system it can be used to avoid soil erosions. Mature trees can produce up to 1.4 m3 of timber within 8-10 years in favorable environmental conditions and proper maintenance. This hybrid is considered as the best performing hybrid paulownia tree in Europe.

P. Shan Tong - is an artificially crossed Paulownia species resulting from the cross between P. tomentosa Steud and P. fortunei Hemsl. It is characterized by rapid growth and large volume of wood, resistance to pests and diseases and abiotic stresses. Paulownia Shan Tong demonstrated that can withstand temperatures between -28 and +42℃.

In fact, the most important differences between the above-mentioned species and hybrids lies in their hardiness to low temperatures and their capacity to produce high amount of wood of high-quality.

Tree growth parameters

To determine tree growth tree height, trunk diameter at breast height (DBH) and annual increase of trunk diameter were determined. Tree height was measured by using Suunto PM-5 hand-held clinometer [

26]. The annual increase in trunk diameter was calculated as the difference between annual measurements taken at the beginning of the vegetation periods (1

st of March). The trunk diameter at breast height was measured by using an electronic caliper [

27,

28].

Economic analysis

The economic analyses of the seven Paulownia farms have been performed in 2024 referring to current prices which have been collected directly from farmers and up to date online sources and then averaged. To obtain a precise and realistic economic assay the main objectives, such as timber log and biomass production have been evaluated and compared with a growth forecast and yield estimation for 15 years. Paulownia cultivation for timber log and biomass production has been introduced in Romania in 2010 as a flourishing business opportunity. However, the cultivation of tree crops is very different from other agricultural crops due to a relatively long growing period (4-8 years depending on the species) to return some profit. Several factors such as inflation or perhaps interest rates, might lead to promising future returns but low future purchasing power which brings a great pressure on investors. Inflation is a very important factor to have respect for when considering investments, which might not generate returns for many years. In this context, deciding whether paulownia farms are good investments will require a meticulous care about production cost, the expected return and last but not least, the time any investor consider to be worth. It is obvious that trees take much more time to grow than any other traditional crop which implies a long-term investment. Moreover, returns must be discounted since the same amount of money cashed today might worth more or even less tomorrow.

Creating an investment plan and planning the budget for paulownia farms involve a dynamic process that unfolds over several stages as presented in

Figure 3.

The first step in successfully executing an investment is evaluating the opportunity and analyzing the needs and financial capacity. This stage involves establishing a strong information foundation about the investment, enabling the investor to identify and prioritize goals, determine available financial resources and explore various funding options. These efforts ensure the business can operate effectively and achieve its objectives.

The estimation of technological and economic costs involves the preliminary preparation of documents which plays an important role in the business plan development stage. Drafting these sheets requires the use of rigorous methodological tools to process primary information and subsequently determine the level of key economic and financial indicators. This “work estimate” serves as the main source of information for planning and financing the investment. It distinctly highlights both technical and economic aspects [Rozsa et al mushrooms].

To analyze the efficiency of the investment, the average yields of paulownia farms from the seven experimental locations were considered, along with the total yields determined based on the evolution of market selling prices. Production costs (both direct and indirect expenses) and their structure at current price levels were established.

For labour expenses, in addition to salaries, other direct costs were included, such as work insurance contribution (CAM 2.25%), which is deducted from the gross salary fund and must be paid on a monthly-basis by the employer [

29].

For material expenses, the cost of water used for irrigation, a 7.75% supply cost surcharge was included. To provide the most accurate assessment of financial results, profitability indicators were determined for each location individually.

Therefore, to evaluate the economic profitability of the Paulownia farms under study, the discounted cash flow method has been applied (DCF). This method is highly suitable for crops which through their nature implies a delay of several years until the first harvest, and thus it is used to estimate future inflows and outflows of cash associated with a certain investment in their present value [

30]. In other words, this method can easily predict if the long-term investment will generate or not any benefits [

31]. In this regard, within the discounted cash flow method, the Net Present Value (NPV) and the internal rate of return (IRR) were calculated as main financial indicators to assess the suitability of the investments. The Net Present Value reflects the difference between annual discounted revenues and annual discounted costs and revenues discounted at an appropriate interest rate [

31,

32]. According to this indicator, an investment is profitable if NPV is higher than 0; greater its value is, higher will be the convenience of the investment. In our study, for each Paulownia farm the NPV value has been calculated according to the following formula [

33]:

where:

Rt = annual discounted revenues;

Ct = annual discounted costs;

t = time of the cash flow;

i = discount rate;

n = duration of the investment.

The interest rate refers to the interest rate on financial instruments or loans that have a long maturity, typically 10 years or more. Interest rate = amount lenders charge + Inflation expectations. In Romania, during 2019-2022 February, the lenders charge was 2.5% which increase to 6% from 2022-2023. Inflation expectations were: 3.8% (2019); 2.6% (2020); 5.1% (2021); 13,8% (2022); 10.4% (2023) and decreased to 5.3% in 2024. These rates are a critical indicator of the cost of borrowing over an extended period and have a significant impact on the economy.

The annual discounted costs include all direct costs required for the productive cycle (planting, fertilizers, pesticides, irrigation water, labour, farm management, harvest and transport excepting initial investments such as planting material acquisition, land preparation and subsoiling. Farm management includes management tasks and accounting duties. All manual inputs regarding maintenance (technical cut, punning) were included in manual labour costs.

The Annual Gross Margin (AGM) reflects a company's profitability by showing the percentage of revenue remaining after accounting for the cost of goods sold (COGS). It was calculated using the following formula [

34]:

where:

Total revenue = total sales or income generated from goods during the year;

COGS (Cost of Goods Sold) = the direct costs of producing the goods.

According to this financial indicator, higher will be its value greater will be the profitability of a crop and, accordingly, more convenient will be the investment for the farmer [

33,

35].

Beside NPV and AGM, another important financial indicator has been calculated. The internal rate of return (IRR) of an investment reflects the discount rate at which the NPV value of cash flows from the investment equals to zero suggesting that the present value of future cash inflows equals the initial investment cost. Therefore, the formula used to determine IRR was as follows [

36]:

where:

Ct = net cash inflow during the period t

C0 = total initial investment costs

IRR = the internal rate of return

t = the number of time periods

All economic indicators calculated in this study have been referred per hectare regardless the real acreage of the farms under in order to ease financial comparisons between them.

Due to the fact that profitability of such investments is highly influenced by market price, a sensitivity analysis for each Paulownia farm has been performed. Sensitivity analysis is a financial modelling which is used to define the impact of cost, revenue, and discount rate changes on investment decisions. The simulations performed for all seven farms have generated new AGM values by varying price by 15% above and 15% below its baseline value, generating different predictions and providing a more exhaustive economic judgement. These ranges have been chosen based on current situations to predict future scenarios.

Data analyses

After the collection of biometric data regarding Paulownia trees from the seven farms under study, the data were subjected to the Analysis of Variance first, then followed by Tukey’s HSD test to detect statistically significant differences between the means at a significance level of p<0.05 and n=50. The data presented are means±standard error.

3. Results

The results of this study reveal and confirm to some extent the great economic potential of paulownia, the rediscovered magical tree, grown in Romania as well. The most well-known characteristic of paulownia trees is their fast-growing nature being able to reach impressive sizes in a very short time. This is the reason why, Chinese describe paulownia as “a pole in one year, an umbrella in three years and can be cut into boards in five years” [

37]. However, it is very important to mention that the profitability of paulownia plantations is highly dependent on climate conditions and wood market both on national and international level.

3.1. Tree growth parameters

Previous research claimed that under native conditions paulownias can reach 30-40 cm DBH in 10 years and produce approx. 0.3-0.5 m

3 wood. Under optimal conditions, although, the same wood volume can be obtained in 5-6 years [

33]. Light conditions, in particular, significantly influence photosynthesis, allowing paulownia trees to thrive under optimal light while restricting their growth under poor light conditions. To reach their optimal growth, paulownia trees need light intensities between 20,000 and 30,000 lux [

38]. Unlike most plants that use the traditional C3 photosynthetic pathway [

39] paulownias utilize C4-cycle enzymes [

40]. This superior photosynthetic efficiency under favorable conditions enables paulownias to rapidly increase their biomass in a relatively short period of time. Moreover, choosing the most suitable species for cultivation in a certain area together with the proper setting of planting distances are essential for a successful and profitable business.

The growth parameters recorded during the 5 years indicate significant differences between farms but also between species. Therefore, it has been observed that

P. Shan Tong and

P. Cotevisa 2® Hybrid had the best growth performance both being unaffected by early autumn, winter or late spring frosts. On the contrary,

P. tomentosa and

P. elongata species were significantly affected by frosts restricting tree growth and ultimately useful wood volume. The annual average growth in tree height ranged between 1.4 and 2.45 m while the average annual trunk diameter growth varied between 2.4 and 5.6 cm (

Table 3).

The highest values have been recorded in Viștea, Bozieș and Triteni farms proving thus the suitability of the species and favorability of the environmental conditions from those areas. The most affected farms were Ocna Mureș, Cașva and Sâmboleni where the use of

P. tomentosa and

P. elongata species appeared to be completely unsuitable under the environmental conditions of these areas. Similar results in terms of tree growth for

P. elongata were reported by Wang et al. (1992) with a tree height of 12 m reached in 7 years [

41]. Another research carried out in the Danubian Lowland from Slovakia monitoring the growth and yield of

P. Cotevisa 2® Hybrid indicated a mean DBH of 21.5 cm and 11.2 m average tree height recorded after seven years. Dimensions of the largest trees exceeded 28 cm for DBH and 12 m in tree height, while the smallest individuals exhibited an average DBH lower than 16 cm [

42]. These results are in accordance with our findings supporting a very similar development of this hybrid in very similar environmental conditions.

3.2. Economic analysis

Economic analyses of paulownia farms have been assessed to gain an accurate and deep understanding of costs and benefits of each entity according to the cash-flow models presented in

Table 4 (profitable farms),

Table 5 (non-profitable farms). Cash-flows of the other farms are presented in

Table S1 (Triteni),

Table S2 (Bozieș),

Table S3 (Zau de Câmpie),

Table S4 (Cașva) and

Table S5 (Ocna Mureș). The economic analyses of paulownia farms revealed the highest profitability for Viștea farm with an annual gross margin value equal to 55,51%, followed by Tritenti (53,99% -

Table 6), Bozieș (51,46% -

Table 6) and Zau de Câmpie (27,69% -

Table 6).

Other farms, namely, Sâmboleni (

Table 5), Cașva (

Table S4) and Ocna Mureș (

Table S5) showed no profitability in the current economic situation and environmental conditions.

The cash flows used in NPV calculations resulted after considering revenues, costs and taxes all of which are influenced by the gross margin. Higher gross margin values indicated higher cash flows which led to higher NPV values. As far as the NPV depends on the magnitude of projected cash flows, the farms with higher gross margins (and thus higher cash flows) had higher NPVs, assuming a constant discount rate and risk profile. In this regard the cumulative NPVs were positive and the highest for Viștea (263210,3 €/ha) followed by Triteni (236604,8 €/ha), Bozieș (147533,3 €/ha) and Zau de Câmpie (80862,08 €/ha) after 15 years. On the contrary, negative NPV values were obtained for the unprofitable farms after three production cycles as follow: Sâmboleni (-44051,71 €/ha), Cașva (-58261,3 €/ha) and Ocna Mureș (-86292,337 €/ha). A positive NPV value indicates that the projected returns generated by the investment – discounted for their present value – overcomes the anticipated costs which entails profitability. At the same time, any investment with negative NPV values should not be considered since it results in a net loss [

43].

These economic differences between farms were mainly because of reduced production rate in farms where very low winter temperature affected tree growth year by year, and led to a 50 or even 70% decrease of the yield (

Figure 4). In the year of plantation establishment, the costs accounted for 6086.15 €/ha in Bozieș and Cașva, where the trees were planted at 4x4 m distance assuming a total number of 625 trees/ha. Out of the total costs 56,46% being represented by the purchase of planting material and its setting. In harvest years, at the end of the 5-years cycle, the cash flow equals to 35295,36 €/ha in Bozieș and -6846,5 €/ha, which are the difference between revenues deriving from timber log and wood chip sales (48345 €/ha for Bozieș and 3540,79 €/ha for Cașva) and production costs (13049,64 €/ha for Bozieș and 10387,27 €/ha for Cașva). During the next harvest years (10

th-15

th-20

th-etc.) if optimal growing conditions are ensured the cash flows may account 10% more as compared to the first production cycle. This increase can be explained by the highest yielding capacity of paulownia trees which reach their peak at the ages between 12 and 20. However, this possible 10% increase in yield was not considered in these economic analyses but kept at the same level as in the 5

th year. This measure was taken to avoid any unsupported redundancy in revenues and offer a clear and real-time reflection of the financial scenarios. So, in the harvest years the revenues are represented by 68,25% of timber log sales and 31,75% of wood chip sales in Bozieș and 59,80% timber log sales and 40,20% of wood chip sales in Cașva.

During harvest years, the most significant expenses for the farmers include harvesting costs (8790 €/ha for Bozieș), chipping (2092,5 €/ha) and transport (600 €/ha) which all together account for 87,99% of total costs, followed by farming operation (6,13%) and labour (1,91%). Farms such as Viștea, Triteni, Zau de Câmpie, Sâmboleni and Ocna Mureș have different cash-flows due to smaller planting distances (3x4 m) and higher tree density (833 trees/ha). In this regard, the economic analyses for these farms are much more promising. In the year of planting the costs for these farms accounted for 7469,05 €/ha, out of which 55,10% represented the purchase of planting material and its setting. Due to the first harvest (in year 5) the cash-flows varied between -9553,05 €/ha (Ocna Mureș) and 55547,7 €/h (Viștea). The cash-flows of Viștea and Triteni were very similar (55547,7 €/h and 51424,35 €/h) so the revenues (76052,9 €/h Viștea and 70555,1 €/h Triteni) and total costs (20505,2 €/h Viștea and 19130,75 €/h Triteni). During no harvest years the estimated costs per year are equal to 1953,5 €/ha which include tree maintenance (14,84%), labour (42,74%), farm management (40,95%) and supply expenses (1,47%). These slight differences occurred due to species and their development under the environmental conditions of the region which generated different yield. Therefore, it can be concluded that both P. Shan Tong and Cotevisa 2® hybrid are highly productive and suitable for wood and biomass production in Brașov and Cluj Counties.

Zau de Câmpie, due to the economic analyses proved to be profitable in the given conditions with a revenue of 33477,4 €/ha in the 5th year, out of which 10876,9 €/ha represents the total costs of a harvesting year. Revenues were generated by timber log (53,72%) and biomass sales (46,28%). Similar to Viștea, Triteni, Sâmboleni and Ocna Mureș, the most consistent expenses of the farmers were harvest (55,96%), chipping (19,40%) and transport (5,51%) expenses which accounted in total 80,88% of total costs followed by farming management (7,35%), labour (11,77%). With all these costs the farm stays stable and profitable in the current and even in modified conditions.

Farms as Sâmboleni and Ocna Mureș are another two farms out of the seven with no profitability. Based on the investigations that have been carried out, the results reveal the main reason for their financial unviability. In both farms, P. tomentosa is the basic species which appear to suffer under the climatic conditions of Sâmboleni and Ocna Mureș. Winter frosts and low temperatures are the biggest enemies of this species which is native to Asia being considered moderately cold hardy, but not resistant to -14 °C and -16 °C associated with cold and dry winds. In both locations the winter frost damage affected 70-80% of the trees restricting their optimal development. In this context, the economic analyses of these farms reveal negative cash-flows all through the years. These two locations share the same establishment costs (7469,05 €/ha), no harvest years’ costs (1953.5 €/ha) but generate different revenues which derives from same sales but different quantities. In Sâmboleni, revenues reached only 8664,81 €/ha comparing to the estimated value (28882,7 €/ha) represented 30% of the expected yield. The trees from Ocna Mureș were affected even more by winter frost year by year, succeeding to provide only 10% of the expected yield (4187,15 €/ha). In both situation the cash-flows were negative (-995,04 €/ha for Sâmboleni and -9553,05 for Ocna Mureș) even after the first harvesting cycle (after 5 years). The main reason why these two paulownia farms could not be profitable even after price increase, is the unsuitability of P. tomentosa in those regions where winters are hard and windy.

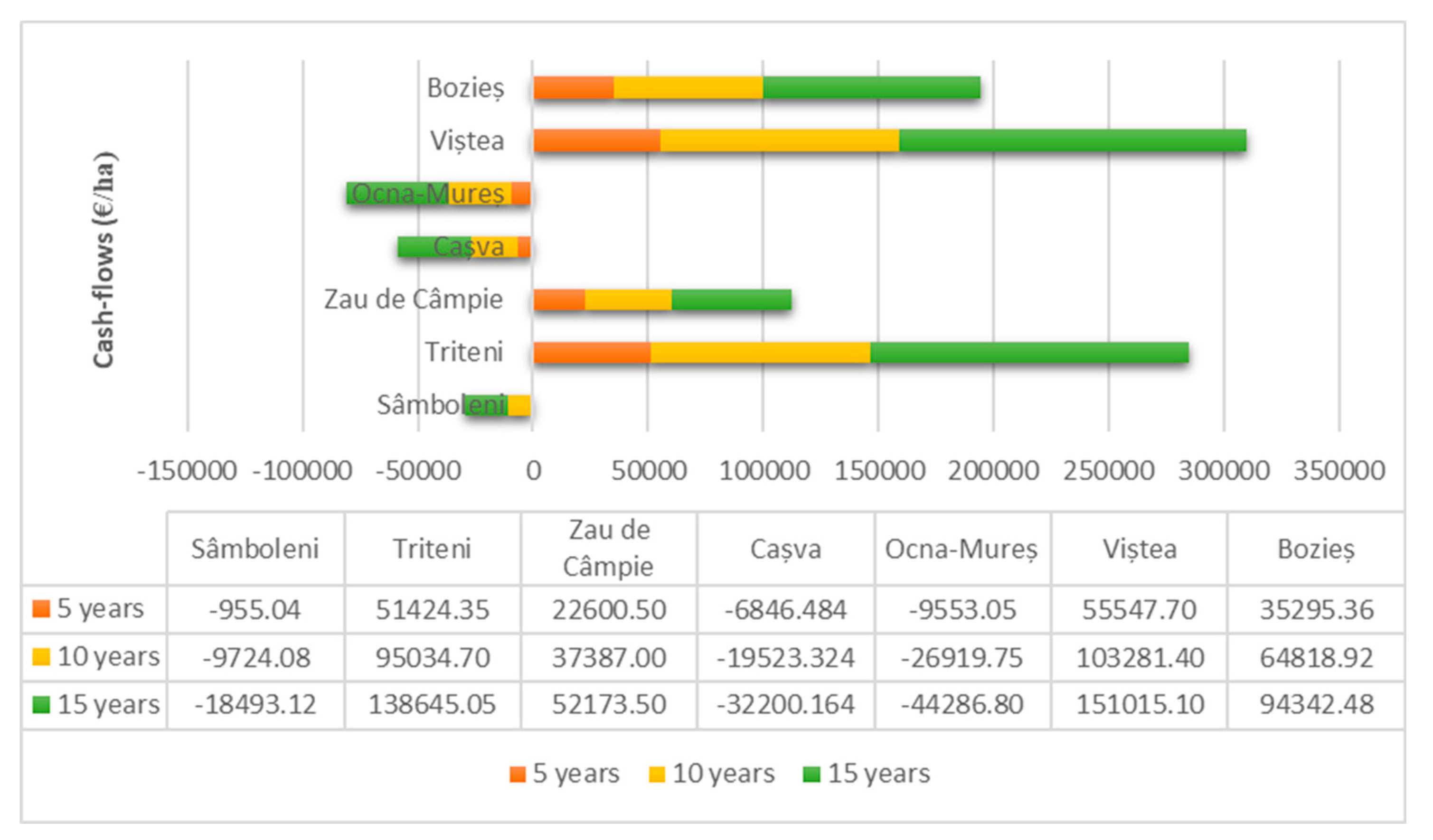

The calculated cash flows provide critical insights into the farms’ financial health and operational efficiency. By examining the cash flows of every paulownia farm it has been revealed that three farms out of seven do not have the ability to generate sufficient cash, meet obligations and sustain growth early after the first production cycle (

Figure 5).

The negative cash flows of Sâmboleni (-995.04 → -18493.12 €/ha), Cașva (-6846,48→ -32200,16) and Ocna Mureș (-9553.05 → -44286.80) after all production cycles indicate that these farms cannot sustain their day-to day activities and would be forced to rely on external financing. Conversely, strong and increasing cash flows in Viștea (55547,70 → 151015.10 €/ha), Triteni (51424.35 → 138645.05 €/ha) and Bozieș (35295.36 → 94342.48 €/ha) indicate financial strength even if reported profits are low due to accounting adjustments.

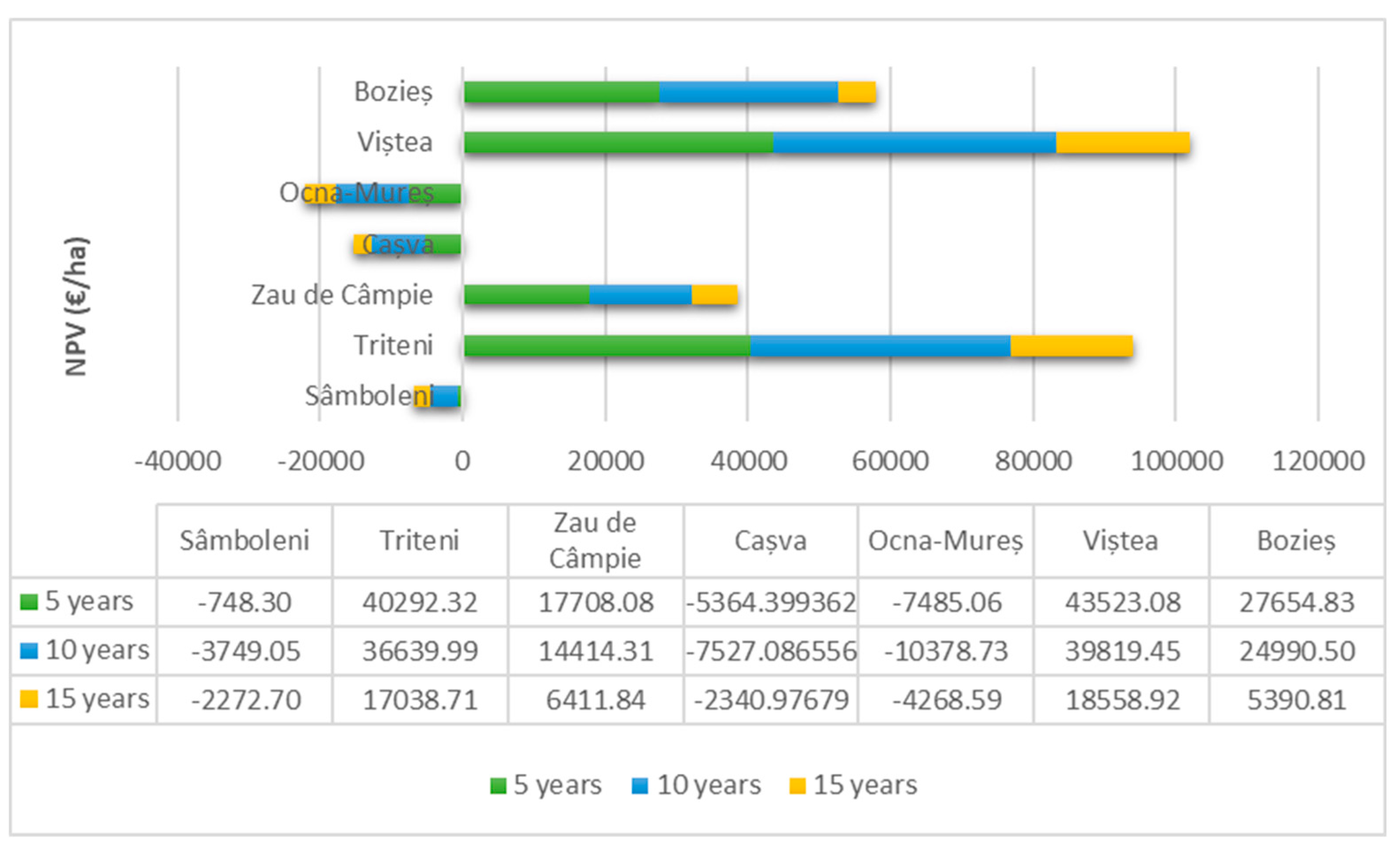

The net present values (NPV) calculated after the first production cycle for the paulownia farms under study indicate clearly which of the farms are worthwhile investments. Their positive or negative nature indicates if the anticipated costs exceed or not the earnings of each farm. The negative NPV values after the first harvest at Sâmboleni (-748,30 €/ha), Cașva (-5364,40 €/ha) and Ocna Mureș (-7485,06 €/ha) suggest that these farms would only erode value even after the second and third production cycles (

Figure 6) confirming the lack of viability of these farms under current conditions which should be avoided. On the contrary, Viștea, Triteni, Bozieș and Zau de Câmpie excelled through their NPV values after the first production cycle (43523.08 €/ha – Viștea; 40292,32 €/ha – Triteni; 27654,83 €/ha – Bozieș and 17708,08 €/ha – Zau de Câmpie) and appeared to remain profitable, but on a lower rate, up to 15 years (18558,92 €/ha – Viștea; 17038,71 €/ha – Triteni; 5390,81 – Bozieș and 6411,84 €/ha – Zau de Câmpie). These variations could be explained by the maximum yielding capacity of paulownia which is reached in the ages between 12-15 years of the tree, representing the highest yielding period of the tree’s life [

44].

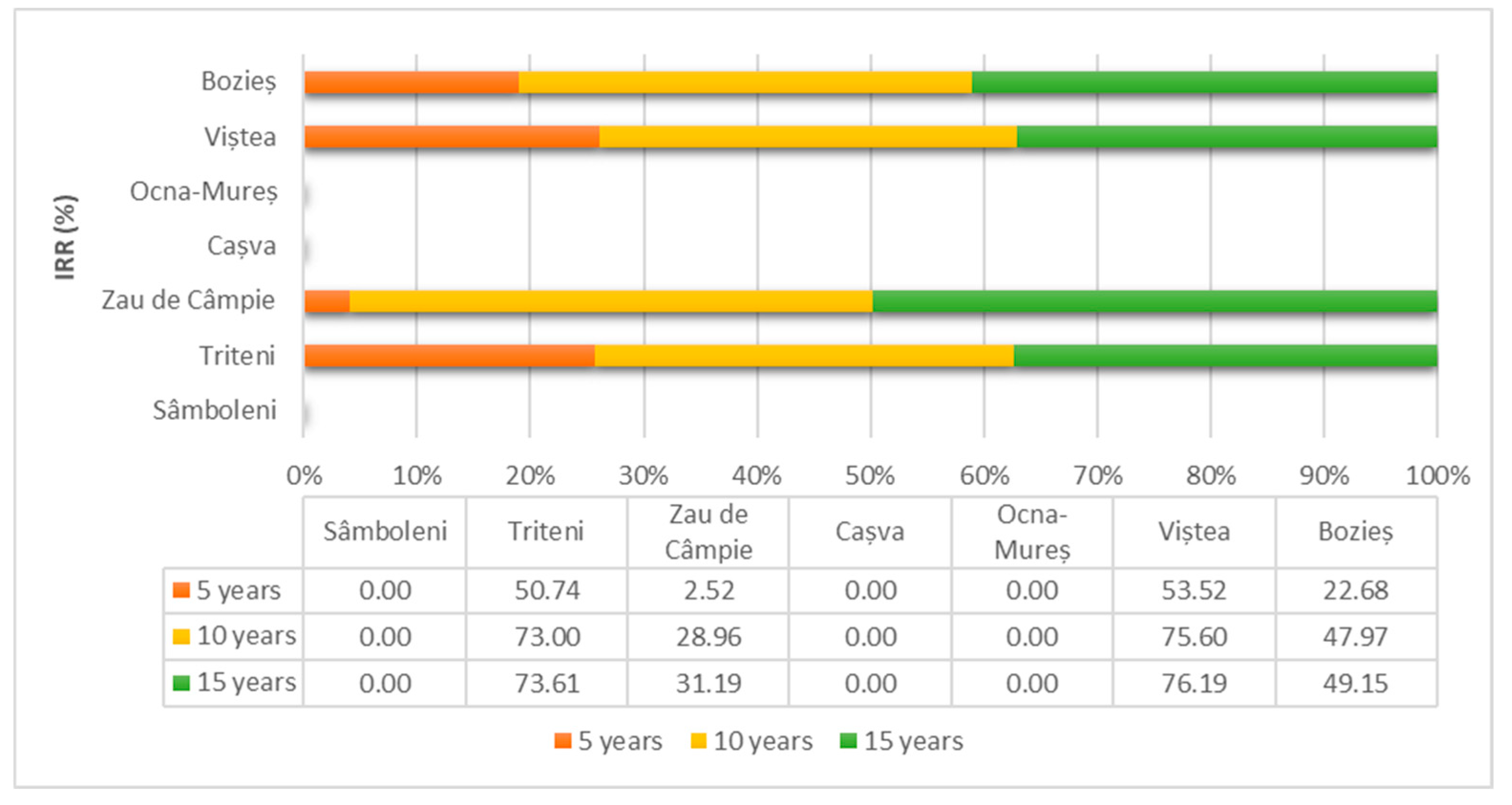

The NPV and internal rate of return (IRR) are closely related since both rely on discounting future cash flows to evaluate investments. On one hand, the IRRs of the paulownia farms suggest the rates at which NPVs equal zero. On the other hand, higher IRR rates indicate a more attractive investment. Among the seven paulownia farms under analyses the highest IRR rate was obtained for Viștea (53,52%) followed by Triteni (50,74%), Bozieș (22,68%) and Zau de Câmpie (2,52%) after the first production cycle (

Figure 7).

The simulation scenarios revealed further an increasing IRR for all four profitable farms after the second and third production cycle reaching up to 76,19% in the 15th year. Other farms such as Sâmboleni, Cașva and Ocna Mureș showed no IRR values due to the NPV values which were below 0 already after the first production cycle, which entail investments with no profitability.

3.3. Sensitivity analysis

The results of the sensitivity analysis highlighted that the variation of market price (both for timber log and woodchip) has a sensitive impact on the profitability of the crop. In this regard, the results revealed that an increase of 15% in price (timber log and woodchip) would increase the profitability by approx. 10% for the currently profitable farms. Particularly, the simulation scenarios revealed that an increase of 15% in price of timber log and woodchip would increase the profitability of the paulownia farm from Zau de Câmpie the most, by 25.40%. In other farms, such as Viștea (9,46%), Triteni (10%) and Bozieș (10,95%), 15% increase of the price would lead to an approx. 10% increase of profitability (

Table 6).

The simulations have also shown that 15% or even 100% increase for farms with no profitability (e.g. Sâmboleni, Cașva and Ocna Mureș) would not be enough to obtain the same or even similar AGM values as profitable farms. However, it is important to mention that the current AGM baseline values for Sâmboleni, Cașva and Ocna Mureș farms were generated due to the considerably decreased yield and sales of only 30% (Sâmboleni) and 10% (Cașva and Ocna Mureș) of the total possible yield because of winter frosts which not only restricted annual tree growth but reduced yield by 70 and 90%. These results indicate that both market price and yield have similar impacts on AGM values and small variations may increase profitability but also deepen unprofitability of a certain farm. Therefore, it can be claimed that a decrease of price below the baseline values would generate losses in Viștea, Triteni, Bozieș and Zau de Câmpie. In other words, a decrease of over 30% of the sale price would lead to heavy losses. Similarly, a decrease of over 50% would determine the other three farms to become completely unprofitable.

4. Discussions

The results of the economic analyses have shown that the selection of suitable paulownia species for certain environmental conditions and its cultivation for timber log and woodchip production is a crucial factor for a profitable investment. However, the profitability of paulownia farms is closely related to dual-use production (timber-log and woodchip) to generate the highest AGM values. On the contrary, in single use production, when Paulownia is grown exclusively for woodchip or biomass production has a very low or almost zero profitability. There are multiple reasons which can lead to these prejudicial economic situations. First, planting material purchase and its plantation represent the greatest incurred costs which every farmer should endure. Second, not only establishment costs but also harvesting costs (both for timber and biomass) are high which can decrease significantly the profitability of these plantations especially when sales are focused only on biomass. Previous studies demonstrated that paulownias harvested at every four years provide a revenue higher than 86,2% in comparison to biomass-based production which is harvested at every two years but with a substantially lower revenue [

25]. Furthermore, when it comes to wood industry, it has been reported that the profitability of paulownia does not rely on higher planting density, but the opposite. As planting density increases the wood quality for timber sales decreases [

22]. In other words, the greater the number of trees/unit area, the greater the initial investment will be which significantly impacts the cash-flows and the AGM values [

45]. In addition, the higher number of trees/unit area especially for biomass production, increases as well the agricultural inputs during the production cycle including fertilizers, pesticides and last but not least irrigation costs. Obviously, this concern has a great importance only in areas where annual rainfalls are lower than 500-800 mm/year, especially in Southern Mediterranean areas [

25,

46]. In this context, global warming as the consequence of climate change should be taken into consideration before paulownia farm establishment. Low water availability would increase even more the productive costs leading to an unsatisfactory income [

25].

A functional alternative for both production types of paulownias (dual-use or single-use production) would be intercropping with other agricultural crops (e.g. wheat, maize, vegetables) or medicinal plants which can generate immediate economic benefits during no harvest years to sustain day-to day activities [

47]. Paulownia intercropping systems are widely recognized and appreciated by farmers for this reason, but the reduced yield for timber and biomass production shouldn’t be left out of consideration. In these cases, a reduction of 20-25% should be expected which is balanced by the yearly sustained income due various crops. Other financial studies evidenced that growing paulownia trees in farm lands can increase or either decrease crop production. The greatest impact in this case, has tree planting density and the length of rotation depending on the crop. Although, crop yield reduction is associated with higher yield in wood and biomass. Therefore, it becomes obvious that as tree density increases the net returns from crops decreases [

48]. However, another recent study demonstrated that intercropping buckwheat with paulownia did not decrease the attractiveness to pollinators nor the biometric and yield characteristics of the crops [

49].

Another factor that considerably affected the profitability of some of the paulownia farms were represented by the substantial differences registered regarding the revenues. These differences demonstrated that

P. tomentosa is not suitable to be cultivated in these areas being unable to generate profit due to winter frosts. However, replacing the species with

P. Cotevisa 2® Hybrid or

P. Shan Tong might generate high-yield and substantial income. In addition to yield, the national market price for paulownia wood is much lower (50%) than the international market price due to the lack of its destination. On global market, the highest sale price for paulownia timber is offered by Japan (450-600 US

$/cubic meter) but no profitability has been reported regarding exportation costs and ultimate revenues either in Romania nor in Europe. But still, the cultivation of paulownia appears to remain a successful business model for the sustainable agricultural sector as compared to other agroforestry trees such as pine, fir, maple or ash. These species are growing very slowly, reaching the same yield as paulownia (300 m

3/ha) in 50-60 years both in natural or planted stands [

50,

51]. The introduction of biomass crops in agricultural lands carries several risks that need careful management to ensure sustainability. One primary concern is the potential for competition with food crops, which could exacerbate food security issues if arable land is diverted from food production to energy crops. Another risk is the invasive nature of certain biomass species, which can spread uncontrollably, outcompeting native plants and disrupting local ecosystems. Additionally, biomass crop cultivation may lead to soil degradation if not managed properly, as continuous harvesting can strip nutrients, increase erosion, and reduce soil fertility. The high water and nutrient demands of some species can strain local resources, contributing to water scarcity and impacting neighboring ecosystems. Effective management strategies include selecting non-invasive species, employing crop rotation or polyculture systems to maintain soil health, and integrating biomass crops into marginal lands that are unsuitable for food production [

52,

53]. Monitoring and adaptive management practices can also mitigate environmental impacts, ensuring that biomass crop cultivation contributes positively to renewable energy goals without jeopardizing agricultural sustainability. A previous study demonstrated that growing paulownia in the Mediterranean area for both timber and biomass production is a viable alternative from economic point of view instead of grape wine cultivation. The study also highlighted that growing paulownia in the same area only for biomass production showed a profitability slightly over zero [

25].

5. Conclusions

Our findings reveal that paulownia cultivation holds significant potential as a biomass crop due to its rapid growth, high biomass yield, however, its cultivation comes with some limitations that must be carefully addressed. Paulownia trees require substantial water and nutrient inputs, which can strain local resources if not managed sustainably. Additionally, their ultimate success depends on selecting appropriate varieties and maintaining optimal growing conditions, as they can be susceptible to winter frosts, pests and diseases in unsuitable environments. There are also ecological concerns, such as the risk of invasive behavior in certain regions, which needs special attention. Despite these challenges, with proper management practices, including water-efficient irrigation, responsible fertilization, and careful site selection, paulownia can be a sustainable and valuable contributor to biomass energy production and also a successful business for farmers. But, when making the decision to invest, both the uncertainty and the risk related to the investment project must be taken into account. Uncertainty refers to the doubt created by the occurrence of a future event. Risk is an economic, social, political or natural notion whose origin lies in the possibility that a future action will generate losses, due to the incomplete information held at the time of decision-making. Since this type of investment represents a long-term capital placement, there is also the risk that the projected cash inflows over the project's lifespan may not return as anticipated. Therefore, in order to increase the gross margin, the following strategies could be applied:

Raising prices: This must be done without negatively affecting the demand, which requires market studies to analyze both domestic and international market prices.

Reducing expenses: Where feasible, without compromising the quality of purchased products, such as renegotiating contracts with raw material suppliers, acquiring cheaper raw materials, or outsourcing certain services to reduce costs (e.g., accounting services, etc.).

Increasing sales: This can be achieved by developing new products, expanding into new markets, or promoting products more aggressively in the market.

Replacing unprofitable products: Replacing these products with new, market-demanded products, based on thorough market research.

Reducing production losses: Identifying areas of loss and their causes, and taking measures either to improve them or eliminate them where they are proven to be unprofitable.

The sensitivity analysis showed that the profitability of paulownia farms is in a close relationship with market price variations but most importantly with the farmers’ choices which affects considerably the yield and the added value of the productions. In this context, future scenarios of climate change should be considered which will lead to increased annual temperatures and reduction in rainfall but could lead also to extreme temperatures both in winter and summer. Therefore, farmers should make their choices based on low water requirements of the crops, irrigation water availability and winter hardiness of the species at higher altitudes.

Our findings also suggest that paulownia trees can successfully be cultivated as a biomass crop and could generate substantial profits if its growing restrictions are eliminated from the beginning by deliberate decisions. However, the results of our study deals with some limitations as well. In order to evaluate the profitability of paulownia farms, we did not take into consideration the direct use of the resulted biomass to obtain energy, syngas or biogas. Therefore, in order to give a more complex evaluation about the cultivation of paulownia, future research studies should address biomass production from paulownia and other agricultural crops which are directly transformed in the farm or reused for other purposes. Similarly, different production cycle scenarios could be generated in order to evaluate its profitability and sustainability compared to traditional agricultural crops.