1. Introduction

In the quest for sustainable development, the intersection of environmental policy and industrial economics has given rise to innovative mechanisms aimed at mitigating climate change. Among these, carbon trading has emerged as a pivotal strategy to internalize the externalities of greenhouse gas emissions [

1].

According to statistics

, there are currently 28 carbon trading markets globally, covering about 17% of global carbon emissions, totaling 9 billion tons. In China, the advent of carbon trading policy represents a significant step in aligning economic activities with environmental stewardship. The carbon trading polit was implemented in Shenzhen, Shanghai, Beijing, Guangdong, and Tianjin in 2013 [

2]; in Hubei and Chongqing in 2014; and in Fujian in 2016. [

3]

China's carbon trading involves dozens of industries such as power, heat, cement, petrochemicals, manufacturing, public buildings, etc. Presently, over two thousand key emitting units are included in the national carbon trading market, covering approximately 4.5 billion tons of carbon emissions. Industrial firms engage in the carbon trading not merely out of a sense of environmental duty, but rather due to the prospective economic benefits and growth opportunities that such participation can bring, as well as the potential influence on their market value [

4].

Although there is some research on carbon trading and its impact on firm value [

5,

6], the effectiveness of carbon trading in enhancing firm value remains a subject of considerable debate [

7]. The discourse is often complicated by the challenge of quantifying policy impacts amidst a myriad of influencing factors. Due to the lack of big data, the factors included are often general and not well refined, which to a large extent makes it difficult for research to accurately correspond to and guide corporate practice.

The advent of big data has introduced a new paradigm in policy analysis, offering unprecedented insights into the microeconomic consequences of carbon trading policy. From a micro-level perspective, this study explains the economic value of the current carbon trading system for carbon emission reduction entities, expanding the existing research on the economic value of carbon trading to firms. It helps companies effectively respond to environmental pressures and manage risks, and achieve sustainable development and innovative transformation. By constructing carbon performance indicators for industrial firms, it provides stakeholders with more comprehensive evaluation metrics on corporate behavior. Examining the impact of carbon trading on n firm value from multiple perspectives helps the government to formulate policies, introduce targeted incentive measures, and enhance market activity and liquidity.

The remainder of this study is structured as follows. In

Section 2, we briefly review carbon trading, carbon performance and firm value. Afterward, the detailed model of carbon performance, and carbon trading policy and firm value are covered in

Section 3. Experimental results are presented in

Section 4 while conclusions are offered in

Section 5.

2. Literature Review

After the implementation of carbon trading, scholars first focused on its impact on emission reduction [

4,

8,

9,

10]. As research continues to delve deeper, researchers have gradually shifted their focus to the dual value of carbon trading for both the economy and emission reduction. Consequently, studies on the impact of carbon trading on carbon performance have continued to enrich. Carbon performance [

8] refers to the evaluation results centered around a series of actions and outcomes that enterprises undertake in response to policy directives for green, low-carbon development, and the recycling of secondary raw materials, which involve controlling carbon-based energy consumption and reducing carbon emissions. Existing research on firm carbon performance typically links firm carbon emissions to financial performance to better measure the dual benefits of a company's environmental and economic performance [

11]. Good carbon performance has a positive effect on the market value of enterprises because investors tend to reward companies with low carbon emission levels [

8].

From a regional perspective, Shi et al. [

12] used the Difference-in-Differences (DID) method to assess the impact of carbon emission trading policy on regional carbon emission performance and found that the reduction in carbon intensity depends on the intermediary effects produced by three factors: technological innovation incentives, industrial structure optimization, and energy substitution. Yu et al. [

13] adopt the Super-Efficiency SBM model to evaluate provincial and municipal carbon performance and found that the carbon trading mechanism effectively improved the carbon performance of pilot provinces and cities based on recursive models, and further explored the specific paths. Zhang et al. [

14] studied the impact of the carbon trading pilot policy on the Green Total Factor Productivity (GTFP) of listed manufacturing enterprises in China, and the results showed that the carbon trading could effectively promote the GTFP of enterprises, among which Environmental, Social, and Governance (ESG) performance played a certain intermediary role. He et al. [

15] examined the impact of the carbon trading on the Total Factor Pollution Control Efficiency (TFPCE) of firms in the carbon trading system, and the results showed that: the carbon trading policy significantly improved the TFPCE of carbon emission firms in the pilot areas, and also produced a green development effect, among which strategic innovation, substantive innovation, and institutional quality respectively played a positive role in improving pollution control performance. Yu et al. [

16] found that the perfection degree of carbon market policy has a threshold effect on firm environmental performance, and there is an optimal interval for the perfection of carbon market policy.

Numerous scholars have conducted research on firm value. Commonly used quantitative method in existing research is asset returns [

17], or Tobin's Q value [

18], etc. Some scholars have conducted research on the direct impact of carbon trading on corporate value. For instance, Han [

19] indicates that carbon pricing significantly affects the value of both traditional and new energy companies, but the overall impact is relatively small, with a greater effect on short-term value than on long-term value. Lin [

20] demonstrates that the carbon trading system significantly enhances the firm value of listed firms in key industries, with a more pronounced effect on state-owned enterprises. Niu et al. [

21] suggest that the carbon trading system has a more significant role in promoting the market value of non-state-owned and larger enterprises. Yuan [

22] shows that carbon trading strengthens a firm's market power through low-carbon innovation and market consolidation effects. In addition, other studies have shown that carbon trading can affect a firm's profitability [

23], investment decisions [

24], and the ability to transition into diversification [

25], among other aspects, which in turn impact firm operational earnings and market value, resulting in changes in firm value.

The level of internal and external governance of firms has a significant impact on the effect of environmental regulations on firm value. Internal governance elements usually include shareholders, boards of directors, management, supervisory boards, etc [

26]. Xu et al. [

27] have delved into the role of director and officer liability insurance in firm performance and value creation, revealed that by insulating directors and senior managers from legal liabilities arising from improper decisions, director and officer liability insurance helps to foster a more robust decision-making environment, which in turn positively enhances a firm's market value. However, due to the special attributes of state ownership and the high concentration of equity, the positive impact of director and officer liability insurance on firm value may be diminished. Once equity concentration exceeds a certain threshold and reaches the level of absolute control, it may lead to an increase in insider control and a failure of supervisory mechanisms, ultimately bringing negative consequences to the firm's market value.

At the same time, government intervention, as an important external governance factor, not only affects the enthusiasm of firms to comply with environmental regulations but also influences the sustainability of internal decision-making and the effectiveness of decision implementation. [

28] Government intervention in firm development does not necessarily have a positive effect; some studies have shown that excessive government intervention can deteriorate firm financial performance [

29]. Although high levels of government intervention provide more loans and investments to firms, these firms may prioritize alignment with government objectives rather than maximizing shareholder wealth. They are more likely to implement government stimulus plans, even if investment projects are not profitable. Therefore, these firms often perform poorly after receiving investment, and investment efficiency decreases.

Existing academic research reveal that while studies on carbon performance are continually deepening, particularly in exploring the macro carbon emission performance at the regional level and the impact of carbon trading systems on overall performance, there is a noticeable deficiency in the construction of carbon performance indicator systems at micro firm level and detailed studies on the specific impacts of carbon trading activities.

Furthermore, current research often includes rather general and not well-refined factors when discussing the differentiated impact of carbon trading on firm value, which greatly limits the precision of research conclusions in corresponding to and guiding the practical application of enterprises within the context of China's conditions. In light of this, there is an urgent need for further in-depth and detailed research on the specific pathways and extent of the influence of carbon trading on firm value through its complex internal mechanisms, in order to propose more targeted and applicable strategic recommendations.

By marrying big data analytics with economic modeling, this paper offers unprecedented insights into the microeconomic consequences of carbon trading policy. Utilizing a combination of Data Envelopment Analysis (DEA) and Difference-in-Differences (DID), it seeks to provide a comprehensive assessment of the influence of carbon trading policy on firm value, while accounting for the mediating effects of corporate governance and government intervention.

3. Materials and Methods

3.1. Modeling Carbon Performance of Industrial Firm Based on DEA

As an extension of DEA (Data Envelopment Analysis), the Super-Efficiency SBM (Surface-Based Measure) model has a unique advantage. It can independently and finely discriminate and rank decision-making units whose efficiency scores have reached the optimal level (i.e., the efficiency value is 1) regardless of the reference group. The model can be configured into three different operational modes, among which, the non-oriented mode can comprehensively consider both input and output dimensions to measure the level of efficiency. Therefore, this paper uses the non-oriented mode to measure the carbon performance of industrial enterprises.

3.1.1. Feature Selection

Carbon performance indicators for industrial firms are shown in Table 1.

(1)Input features

Based on Qin et al. [

30]

, net value of fixed assets

represents the capital investment of firm. The total number of employees, following the literature [

31]

, serves

as a measure for the firm's labor input. To accurately measure the difference in energy consumption among different listed firms, various types of energy consumption are converted into a unified standard coal (unit: tons of standard coal) using the conversion coefficient [

32]

.

Unified Standard Coal= Water Consumption×0.0002429+Electricity Consumption×1.229+

Raw Coal Usage×0.7143+Natural Gas Usage×13.3+Gasoline Usage×1.4714+Diesel Usage×

1.4571+Central Heating×0.034121.4571

(2)Output features

Following the research [

33]

, the main expected output of industrial firms is measured using the firm's main business income and total profits and taxes. Non-expected output, namely carbon dioxide emis

sions of industrial firms, is calculated as [

34]

:

CE=∑Firm Main Energy Consumption×Carbon Dioxide Emission Coefficient

3.1.2. Model Building

The mathematical expression for the super-efficiency SBM model is as follows:

subject to:

where

represent input, expected output, and the degrees of relaxation for non-expected output, respectively. The weight coefficient vector λ is used to characterize the importance of each evaluated unit. The subscript "0" in the model specifically refers to the particular individual being evaluated. The result of the objective function calculation can be interpreted as the carbon performance of the industrial enterprise being evaluated.

Due to the dual impact of economic and policy factors, the phenomenon of industrial agglomeration in China is becoming increasingly evident. The geographical distribution of industrial enterprises shows a clear trend of clustering, and according to the regional delineation laws

1, the overall region of China can be divided into four clusters: east, central, west and north-east [

35]. By analyzing the gap between the frontier surfaces constituted by industrial enterprises in different regions and the common frontier, we can better analyze the difference in technological level between the regions where industrial enterprises are located and the optimal technological level across the entire region. The efficiency value of the common frontier is equivalent to the efficiency value of the overall super-efficiency SBM model without grouping. In the common frontier model, the TGR (Technology Gap Ratio) can be expressed by the formula:

Since the common frontier efficiency value is less than or equal to the group frontier efficiency value, the TGR should be less than or equal to 1. The smaller the TGR, the greater the technological gap between the group's group technology and the overall technology; if the TGR is 1, it indicates that the group's group technology coincides with the overall technology, suggesting that the group is at the forefront of technological innovation.

3.2. Modeling the Impact of Carbon Trading on Industrial Firm Value Based on DID

It can be observed that the carbon trading of China has been established in various provinces over time. Since the impact of the carbon trading intervention occurs at multiple different points and continues to exist from the time of implementation, the traditional difference-in-differences (DID) model is not suitable. The multi-time point DID model can address the issue of different policy implementation times across regions.

3.2.1. Feature Selection

(1) Launch of the carbon emissions trading policy

Since China planned to launch a pilot carbon emission trading market in 2011, pilot areas have successively established carbon trading markets. In 2013, Shenzhen, Shanghai, Beijing, Guangdong, and Tianjin officially started carbon trading markets. In 2014, Hubei and Chongqing carbon trading markets were initiated. In 2016, the Fujian carbon trading market was launched. The years 2013, 2014, and 2016 are taken as policy shock years respectively and include them as dummy variables in the model.

(2) Industrial firm value

The Tobin Q indicator, based on the market value of firm capital and replacement capital, including both liabilities and equity, is a comprehensive indicator capable of measuring firm value and future potential widely used in various studies [

36]

. This paper employs Tobin's Q value as the

measure of firm value, providing insights into the impact of investment decisions.

(3) Internal firm governance

Drawing from Chen [

37]

, the proxy variable for the internal firm governance

level is ownership concentration, expressed as the proportion of the top ten shareholders' shares to the firm's total shares.

(4) External firm governance

Following the literature [

38]

, external governance level is determined by the degree of government intervention, i.e., the proportion of general budget

expenditures in GDP in the province where the firm is located.

3.2.3. Model Building

To investigate the possible mediating effect of firm carbon performance between carbon trading and firm value, the following mediation model is constructed and tested using Sobel. The mediation model constructed by stepwise regression method is as follows.

In addition, we also tested the moderating effect of internal and external firm governance elements in the linear relationship between carbon trading and firm value by including carbon trading policy implementation as explanatory variables in the model, respectively, and constructing equations (5).

The coefficient in (5) reflects the degree of moderation of the internal governance element in the path of carbon trading policy implementation on firm value, and the coefficient reflects the degree of regulation of external governance elements, and the coefficient reflects the combined synergistic moderating effect of the internal and external governance elements of the firm.

3.3. Data Descriptive Analysis

In accordance with research [

37]

, this paper selects firm development scale (Size), firm sustainable development capability (Sustain), firm operation and profitability (Operation), and innovation

level (Innovation) as control variables in the empirical model. To better reflect the macro background of firm value changes, this paper also introduces macro variables such as energy industry classification (Traditional Energy Industry) and industrialization level (Industrialization Level) as control variables. Relevant financial data are sourced from the CSMAR database, while other data come from annual reports and social responsibility reports disclosed by listed firms. Industrialization level is extracted from the China Industrial Statistical Yearbook. Data specifications are presented in Table 2, and Table 3 provides descriptive statistics of the data.

4. Results

4.1. Carbon Performance Measurement and Analysis of Industrial Firms

The carbon performance measurements indicate that firms with top carbon performance values are concentrated in the eastern region. And TGR of firms from the eastern region is basically around 1, which indicates that firms in the eastern region are more balanced in technology level and have relatively strong technological innovation capability. The balance of technology level can help firms form industrial agglomeration effect [

39], so as to better cope with the challenges of carbon emissions and resource utilization. The western region shows relatively high technological gap ratios, suggesting a need for further environmental protection and carbon emission reduction measures. Central and northeastern regions exhibit lower carbon efficiency, attributed to traditional industrial structures and lower economic development levels.

In summary, the eastern region excels in carbon efficiency and technological innovation, requiring continued support for sustainable development. The western region shows promise but needs environmental improvement. The central and northeastern regions need increased investment in innovation and environmental protection.

Table 4.

Top carbon performance results of industrial firms in China.

Table 4.

Top carbon performance results of industrial firms in China.

| ranking |

company name |

Region |

Common Frontier Carbon efficiency |

Group frontier carbon efficiency |

TGR |

| 1 |

** Iron&Steel Co.,Ltd |

eastern |

4.3669 |

4.3669 |

1 |

| 2 |

** Group |

western |

3.1494 |

3.5231 |

0.8939 |

| 3 |

**Motor Co.,Ltd |

eastern |

2.4923 |

2.5173 |

0.9901 |

| 4 |

**Mining Co.,Ltd |

eastern |

2.4175 |

2.4175 |

1 |

| 5 |

** Petroleum Co. |

eastern |

2.2522 |

2.2522 |

1 |

| 6 |

** Co. |

eastern |

2.2212 |

2.3456 |

0.9469 |

| 7 |

**Technology |

western |

2.1587 |

2.9431 |

0.7335 |

| 8 |

** Co.,Ltd |

eastern |

1.9720 |

1.9720 |

1 |

| 9 |

** Power Co.,Ltd |

eastern |

1.8551 |

1.8551 |

1 |

| 10 |

** Co.,Ltd |

eastern |

1.7370 |

1.7370 |

1 |

4.2. Impact Analysis of Carbon Performance in Carbon Trading and Industrial Firm Value

Table 5 results show that the implementation of carbon trading policy in China improves firm value by improving firm carbon performance. There are two reasons:

On one hand, as the total emissions are set, determining the scarcity of emission quotas, carbon emissions become an external negative factor in industrial operations. With the implementation of carbon trading, firms subject to carbon emission constraints will incur certain costs, leading them to emphasize carbon reduction. For industrial firms with high energy consumption and severe pollutant emissions, constrained by the limit of carbon emission quotas, they will actively seek low-carbon energy to replace their existing energy sources, thereby improving their carbon performance [

40]. For firms with lower pollution emissions, they can sell excess carbon emission quotas on the secondary carbon emission quota market at a reasonable price and use the proceeds to improve processes and reduce funds and labor [

4], thereby improving their carbon performance.

On the other hand, information on industrial firms' carbon performance is considered internal information that is difficult for external investors to obtain. When a firm's carbon performance level is good, it is more inclined to disclose internal carbon performance information in social responsibility reports to attract more investment funds and external support [

8]. Over time, good carbon performance eliminates the information asymmetry between internal and external investors, forming a unique competitive advantage. Additionally, a good carbon performance level helps industrial firms establish better brand reputation and public image, making it more favorable to consumers, as well as government funding support and policy assistance. Increased profits and accumulated funds can help companies expand their production and operations, improve performance, and achieve long-term development.

4.3. Impact Analysis of Carbon Trading on Industrial Firm Value

In

Table 6, the coefficient of CET*Own, and the coefficient of CET are both significant at the level of 1%, indicating that ownership concentration contributes to the enhancing effect of the implementation of carbon trading policy on firm value. The coefficient of CET*Gov is significant negative at the level of 10%, indicating that government intervention will inhibit the enhancing effect of the implementation of carbon trading policy on firm value. In addition, the coefficient of CET*Own*Gov is negative and significant at the level of 1%, indicating that the synergy between internal and external firm governance inhibits the positive effect of carbon trading on firm value.

Firms participating in carbon emission trading policies tend to regulate their carbon emissions based on national and industry standards and are more inclined to demonstrate their good carbon information disclosure to society [

41]. This not only improves the firm's image and changes stakeholders' attitudes toward the firm but also changes the capital market's favorability toward the firm, enhancing its value and creative ability [

42]. Additionally, industrial firms participating in carbon trading have sufficient reasons to increase the value of their goods, better transferring carbon costs to consumers. Consumers often prefer to purchase environmentally friendly products, driving revenue for firms and thus increasing their value.

The ownership structure is a key factor influencing internal environmental governance within firms. [

43] Firms with high ownership concentration typically mean that a few shareholders have significant influence and control [

44], making it easier and more efficiently for them to reach consensus and implement decisions [

45]. High ownership concentration enables them to better formulate and implement long-term plans and strategies consistent with the overall interests of the firm. Such long-term planning not only helps reduce the risks of firms under environmental regulatory policies [

46], but also has the potential to benefit from policy changes.

A high level of government intervention in the location of the firm implies that the firm has more political connections [

47]. The actual resource allocation of the firm may be subject to government influence, resulting in misallocation [

48]. A weaker degree of government intervention means that firms have more autonomy in investment decisions in the environmental field [

49]. Therefore, under strong government intervention, the implementation of carbon trading policy has negative effect on firm value.

4.4. Heterogeneity Analysis

4.4.1. Heterogeneity Analysis Based on Industry Attributes

According to the document issued by the China securities regulatory commission in 2012

2, and the literature [

39], coal mining and washing industry oil (B06), natural gas mining (B07), Petroleum processing, coking and nuclear fuel processing in manufacturing (C25), and gas production and supply in electricity, heat, gas and water production and supply (D44 and D45) are defined as energy industries, while other industries (such as C14: food manufacturing, etc.) are defined as non-energy industries. Accordingly, this paper further tests the difference of industry heterogeneity on the change of firm value brought by the participation of industrial firms in carbon trading. The results are shown in

Table 7.

The coefficients of non-energy industries are all significant and larger than that of energy industries, which indicates that the impacts of carbon trading on firm value varies by industries. Non-energy industries are generally easier to transition than energy industries, and typically involve relatively low technical barriers and relatively low transition costs. Moreover, non-energy industries tend to adopt more flexible production methods, and it is easier to adjust business modes and production processes to adapt to market changes and environmental protection requirements, so the effect of carbon trading on firm value is more pronounced in the non-energy industries and less so in the energy industries.

4.4.2. Heterogeneity Analysis Based on Industry Category

Industrial firms can be classified into mining, manufacturing, electricity, heat, gas and water production and supply sectors. This section investigates the impact of carbon trading policy on the valuation of different firm types. As

Table 8, the implementation of carbon trading policy positively influences value enhancement across all three categories. Among them, the implementation of carbon trading policy has the strongest effect on the value improvement of manufacturing firms.

The economic benefits of mining firms are mainly influenced by raw materials, labor and equipment [

50], while the carbon cost accounts for a small proportion of the benefit cost. Manufacturing firms are more capable of technological upgrading and innovation [

51] and are likely to produce more competitive environmental products to meet market demand. As the products and services produced by the electricity, heat, gas and water production and supply industries are basic, with high rigidity on the demand side and low price elasticity of demand, the product market has strong trading stability [

52], even if affected by the carbon trading policy. In addition, these industries usually have relatively mature technologies and production facilities, which can be relatively easy to implement carbon reduction measures, such as improving energy efficiency and adopting clean energy. Therefore, it is easier for these industries to adapt to the requirements of carbon trading policies and reduce carbon emissions than other industries.

4.4.3. Heterogeneity Analysis Based on Geographic Region

Due to no carbon trading market in the northeast, China is divided into east, central and west for heterogeneity analysis. We performed a group test as shown in

Table 9, and found that carbon trading increased the value of industrial firms in different regions. CET in the central region is positive and at the level of 1% is significant. Compared to the eastern and western regions, carbon trading policy on the central region of the firm value impact is greater.

In the central region of China, the development model is mainly focused on high pollution and high emission industries. Therefore, for these firms, participation in the carbon trading can provide them with more room for value enhancement. The eastern firms themselves have a high degree of perfection, coupled with the region themselves has achieved certain results in ecological governance, so there is little room for technological progress and firm value enhancement. In western China, technology and management are lagging behind, which has led to a slower response to the reduction effects of carbon trading policies.

4.5. Robustness Test

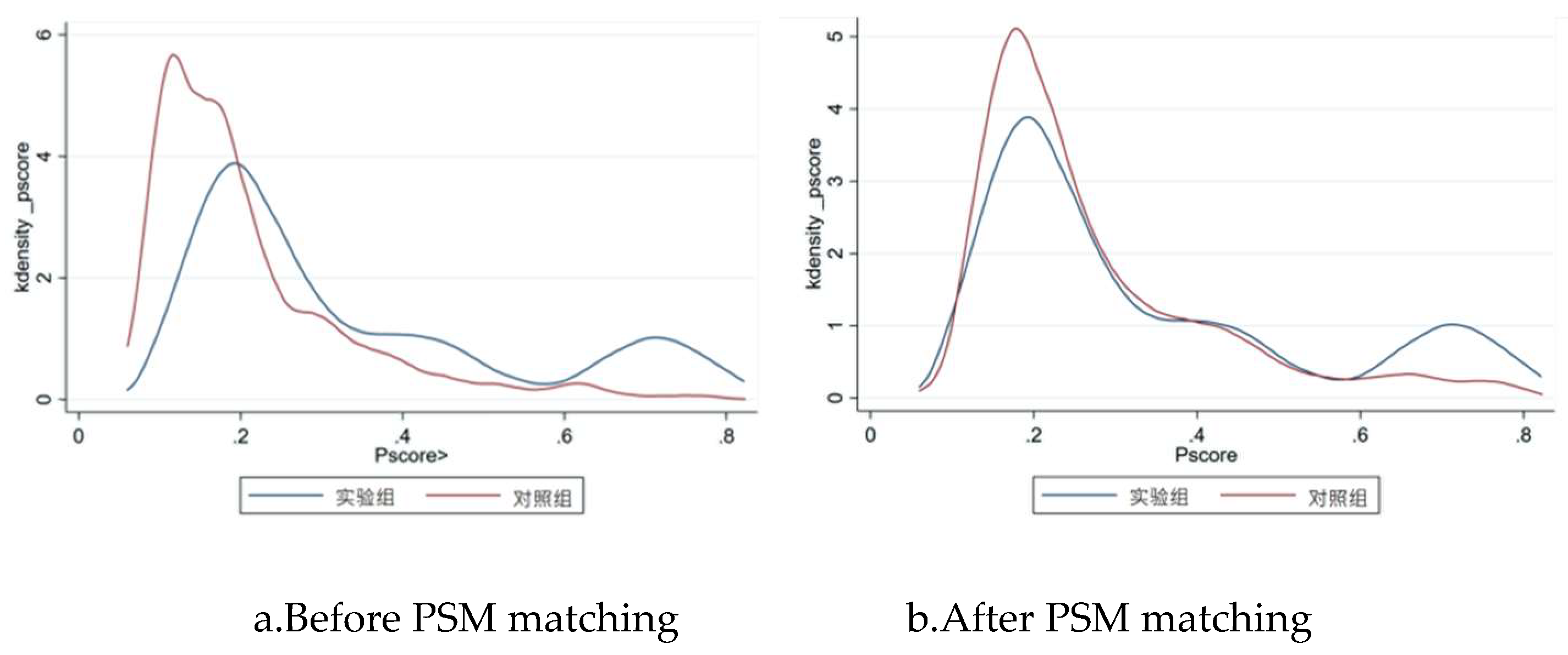

4.5.1. PSM-DID Method

Before constructing the DID model, PSM (Propensity Score Matching) method was used to avoid sample selection bias. The kernel density functions before and after PSM are shown in

Figure 1, and the results of PSM-DID are shown in

Table 10. It can be seen that the carbon trading still significantly improves the value of industrial firms (the coefficient is 0.201, P<0.01). This indicates that the carbon trading system has a positive impact on the enhancement of industrial firm value, which is significant and continuous.

4.5.2. Method of Substitution Variables

Considering the possible lag effect of the impact of the implementation of carbon trading policy on firm value, we replace the current period firm value with a first-order lag term. The results, shown in column 2 of

Table 10, are robust, and carbon trading also has a promoting effect on firm value with one lag period. This indicates that carbon trading policy has a continuous improvement on firm value, and its impact is not limited to the current period of policy implementation, but can still have a positive impact in the subsequent period.

5. Conclusions

Driven by big data from the listed industrial firms, this study examined the direct effect between carbon trading and firm value, the indirect effect with firm carbon performance as the intermediary variable, and the synergy effect between internal and external governance of firms on carbon trading and firm value. In addition, this study conducted heterogeneity test and robustness test. The results show the followings.

(1) The implementation of carbon trading policy can significantly improve the firm value. Carbon trading can enhance firm value by improving their carbon performance. The ownership concentration promotes the enhancing of the implementation of carbon trading policy to firm value. Government intervention inhibits the improvement effect of carbon trading policy implementation on firm value.

(2) Compared with energy firms, carbon trading has a more significant effect on the value of firms in non-energy industries. The implementation of carbon trading policy promotes the improvement of the three types of industrial firm value, among which the value of manufacturing firms has the strongest effect. Compared with the eastern region, the implementation of carbon trading policy has a more obvious improvement on the firm value in the central and western regions.

According to the research conclusions of this paper, relevant suggestions are put forward as follows:

(1) To government, implementing carbon trading policies, they can appropriately reduce the level of intervention to firms, encourage market players to conduct carbon trading independently, and strengthen supervision to ensure fairness and transparency of trading. In addition, the gap in the carbon trading market in the northeast should be filled in time.

(2) To firms, they should increase investment in energy conservation and emission reduction, and adopt more environmentally friendly production methods. Especially for non-energy industry firms and firms in the central and western regions, it is necessary to participate more actively in carbon trading, use carbon trading policies to enhance firm value, and seek cooperation with energy firms.

It is hoped that more in-depth researches based on machine learning methods are conducted on the basis of big data, so as to make the research conclusion more reliable and comprehensive.

Author Contributions

Conceptualization, Z.Peng; methodology, Z.Peng and S.Tong; software, Y.Zhang; validation, Z.Peng, Y.Zhang and S.Tong; formal analysis, Z.Peng, Y.Zhang and S.Tong; investigation, S.Tong; resources, S.Tong; data curation, Z.Peng and Y.Zhang; writing—original draft preparation, Z.Peng and Y.Zhang; writing—review and editing, Z.Peng, Y.Zhang and S.Tong; visualization, Y.Zhang; supervision, S.Tong; project administration, Z.Peng; funding acquisition, Z.Peng. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Natural Science Foundation of China (NSFC), grant number 71601022; International (Regional) Cooperation and Exchange (ICE) Projects of the National Natural Science Foundation of China (NSFC) , grant number 72311540159; Central University Basic Research Fund of China, grant number 2-9-2022-021. And the APC was funded by 71601022.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

The authors thank the Natural Science Foundation of China (NSFC) [grant number 71601022].

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Yang W, Pan Y, Ma J, et al. Effects of allowance allocation rules on green technology investment and product pricing under the cap-and-trade mechanism. Energy Policy, 2020, 139: 1-12.

- Chen S, Shi A, Wang X. Carbon emission curbing effects and influencing mechanisms of China’s Emission Trading Scheme: The mediating roles of technique effect, composition effect and allocation effect. Journal of Cleaner Production, 2020, 264, 121700. [CrossRef]

- Zhang W, Li G, Guo F. Does carbon emissions trading promote green technology innovation in China? Applied Energy, 2022, 315:119012. [CrossRef]

- Zhang Y, Liang T, Jin Y, et al. The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Applied Energy, 2020, 260: 114290.

- Guo Q, Su Z, Chiao C. Carbon emissions trading policy, carbon finance, and carbon emissions reduction: Evidence from a quasi-natural experiment in China. Economic Change and Restructuring, 2022, 55: 1445-1480.

- Yang S, Lu T, Huang T, et al. Re-examining the effect of carbon emission trading policy on improving the green innovation of China’s enterprises. Environmental Science and Pollution Research, 2023, 30(3): 7696-7717.

- Zhang Y, Liu J. Does carbon emissions trading affect the financial performance of high energy-consuming firms in China? Natural Hazards, 2019, 95: 91-111.

- Benkraiem R, Shuwaikh F, Lakhal F, et al. Carbon performance and firm value of the World's most sustainable companies. Economic Modelling, 2022, 116: 106002.

- Yang Z, Yuan Y, Zhang Q. Carbon emission trading scheme, carbon emissions reduction and spatial spillover effects: quasi-experimental evidence from China. Frontiers in Environmental Science. 2021, 9:824298.

- Peng H, Qi S, Cui J. The environmental and economic effects of the carbon emissions trading scheme in China: the role of alternative allowance allocation. Sustainable Production and Consumption, 2021, 28:105-115.

- Al-Rabab'a E A F, Rashid A, Shams S. Corporate carbon performance and cost of debt: Evidence from Asia-Pacific countries. International Review of Financial Analysis, 2023, 88: 102641.

- Shi W, Sang J, Zhou J, et al. Can carbon emission trading improve carbon emission performance? Evidence from a quasi-natural experiment in China. Environmental Science and Pollution Research, 2023, 30:124028-124040.

- Yu X, Chen H, Li Y. Impact of carbon emission trading mechanism on carbon performance based on synthetic control method. China Population, Resources and Environment, 2021, 31(04):51-61.

- Zhang S, Cheng L, Ren Y, et al. Effects of carbon emission trading system on corporate green total factor productivity: Does environmental regulation play a role of green blessing? Environmental research, 2024, 248:118295.

- He M, Zhu X, Li H. How does carbon emissions trading scheme affect steel enterprises' pollution control performance? A quasi natural experiment from China. The Science of the total environment, 2022, 858: 159871.

- Yu X, Shi J, Wan K, et al. Carbon trading market policies and corporate environmental performance in China. Journal of Cleaner Production, 2022, 371:133683.

- Ismanu S, Kusmintarti A, Sulistiono S. Implementation of enterprise risk management and determinants of company performance. Academy of Strategic Management Journal, 2022, 21(1): 1-8.

- Hao X, Chen F, Chen Z. Does green innovation increase enterprise value? Business Strategy and the Environment, 2021, 31: 685-1247.

- Han M, Huang W.The impact of China's carbon emission allowance price on the value of energy enterprises. Journal of China University of Petroleum (Edition of Social Sciences), 2022, 38(05):20-28. [CrossRef]

- Lin P, Lin M, Lin B. Carbon emission trading system and firm value under carbon peaking and carbon neutrality. Accounting and Economics Research, 2023, 37(01):135-147. [CrossRef]

- Niu X, Zhang Y, Li B, et al. How does carbon emission trading scheme affect enterprise market value? A roadmap towards natural resources sustainability. Resources Policy, 2024, 88:104542.

- Yuan M. Will regulated firms benefit from carbon emission trading system? Evidence from a market power perspective. Environmental Science and Pollution Research, 2023, 30: 103001-103016.

- Ren X, Ma Q, Sun S, et al. Can China’s carbon trading policy improve the profitability of polluting firms: a retest of Porter’s hypothesis? Environmental Science and Pollution Research, 2023, 30: 32894-32912.

- Qi Yong, Yuan M, Bai T. Where will corporate capital flow to? Revisiting the impact of China's pilot carbon emission trading system on investment. Journal of environmental management, 2023, 336:117671.

- Du H, Zhang Y, Evans O M, et al. Will emission trading promote enterprise diversification? Evidence from China. Environmental Science and Pollution Research, 2023, 30: 79194-79214.

- Gao L, Jiang C, Mekhaimer M. Count on subordinate executives: Internal governance and innovation. Journal of Banking & Finance, 2023, 154: 106931.

- Xu W, Jiang X. Does the D&O insurance enhance firm value of listed companies in China. Journal of Applied Stantistics and Management, 2023, 42(01):158-174..

- Qian X, Ding H, Ding Z. Governmental inspection and firm environmental protection expenditure: evidence from China. Economic Modelling, 2023, 123: 106284.

- Li M, Liu H, Chiang Y. Government intervention, leverage adjustment, and firm performance: Evidence from defaulting firms. Pacific-Basin Finance Journal, 2022, 76: 101885.

- Qin X, Hou Y. Smart city construction, industrial agglomeration, and total factor productivity of enterprises. Journal of Nanjing University of Finance andEconomics, 2023, (6):99-110.

- Tang Q, Xu X, Cao Y. Stock right incentive, research investment and sustainable development of enterprises evidence from Chinese listed companies. Journal of Shanxi University of Finance and Economics, 2009, 31(08):77-84.

- Han Y, Li Z, Jian S, et al. Policy effect and mechanism of new urbanization on urban carbon balance. Urban Problems, 2024, (01):16-26. [CrossRef]

- Wang H, Li S, Wang Y, et al. Evaluation of scientific and technological innovation efficiency of national specialized and sophisticated "little giant" firms and its comparison of five urban agglomerations. Science and Technology Management Research, 2023, 43(20):65-74.

- Ma J, Qin F, Xie X. Decoupling the inbound tourism carbon emissions off the tourism economic growth. Journal of Xinjiang University (Philosophy and Social Sciences), 2019, 47(02):16-23. [CrossRef]

- Jin Y, Chen Z, Lu M. Industry agglomeration in China:economic geographynew economic geography and policy. Economic Research Journal, 2006, (04):79-89.

- Wu F, Hu H, Lin H, et al. Enterprise digital transformation and capital market performance: empirical evidence from stock liquidity. Journal of Management World, 2021, 37(07):130-144+10. [CrossRef]

- Chen S, Wang Y, Albitar K, et al. Does ownership concentration affect corporate environmental responsibility engagement? The mediating role of corporate leverage. Borsa Istanbul Review, 2021, 21: S13-S24.

- Chen G. Land resource misallocation, industrial structure and haze pollution: an empirical study based on spatial econometrics and dynamic panel threshold model. China Soft Science, 2022, (12):143-152.

- Liu X, Zhang X. Industrial agglomeration, technological innovation and carbon productivity: Evidence from China. Resources, conservation and recycling, 2021, 166: 105330.

- Liu N, Fan L, Li S, et al.The Influence of the carbon trading system on the enterprise' carbon emission reduction performance. Systems Engineering, 2022, 40(03):13-23.

- Ren X, Ma Q, Liu Y, et al. The impact of carbon trading policy on the economic performance of highly polluting industrial enterprises: Empirical analysis based on multiple mediating effect model. Resources Science, 2020, 42(09):1750-1763.

- Jiang Y, Luo L, Xu J, et al. The value relevance of corporate voluntary carbon disclosure: Evidence from the United States and BRIC countries. Journal of Contemporary Accounting & Economics, 2021, 17(3): 100279.

- Puangyanee S, Yaowapanee P, Duangsawang K, et al. The Influence of the shareholding structure on economic performance through good corporate governance of listed companies in the stock exchange of Thailand. International Journal of Innovation, Creativity and Change, 2019, 7(8): 116-133.

- Xu W, Zhang R, Liu Y, et al. Classification governance, controlling party governance mechanism and innovation bonus release: a study based on the analysis of state-controlled listed companies. Nankai Business Review, 2018, 21(03):90-102.

- Garritty C, Hamel C, Hersi M, et al. Assessing how information is packaged in rapid reviews for policy-makers and other stakeholders: a cross-sectional study. Health Research Policy and Systems, 2020, 18:1-17.

- Xu Y, Li S, Zhou X, et al. How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renewable Energy, 2022, 189: 917-926.

- Yang L, Zhang J. Political connections, government intervention and acquirer performance in cross-border mergers and acquisitions: An empirical analysis based on Chinese acquirers. The World Economy, 2015, 38(10): 1505-1525.

- Zheng W. Research on the promotion effect of smart city construction on high-quality employment based on the empirical evidence of multi-period DID. Guizhou Social Sciences, 2023, (7):128-136. [CrossRef]

- Su T, Meng L, Zhang J. China’s carbon market pilot and enterprise green transition: an analysis of effects and mechanism. R&D Management, 2022, 34(04):81-96. [CrossRef]

- Lu H, Wu Z. Relationship between energy-consuming right trading system and low-carbon transformation of energy consumption structure. Resources Science, 2023, 45(06):1181-1195.

- Chen H, Zhong T, Lee J. Capacity reduction pressure, financing constraints, and enterprise sustainable innovation investment: Evidence from Chinese manufacturing companies. Sustainability, 2020, 12(24): 10472.

- Xu H, Hou Z, Jiang Y, et al. Analysis on the discount for low liquidity in China's stock market evidence from the new third board. China Economic Studies, 2022, (5):103-118. [CrossRef]

| 1 |

“Several Opinions of the Central Committee of the Communist Party of China” and “Opinions of The State Council on the Implementation of Several Policies and Measures for the Development of the Western Region” |

| 2 |

“Guidelines for the Industry Classification of Listed Enterprises” |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).