Submitted:

01 January 2025

Posted:

02 January 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Study Background and Objective

1.2. Scope and Method

2. Theoretical Investigation

2.1. Concept and Characteristics of Real Estate PF

2.2. Investigation of Previous Studies

3. Analysis of Bid Decision Factors for Workplaces of Non-performing Real Estate PF

3.1. Variables

| Variable name | Description | Remarks | ||

|---|---|---|---|---|

| Dependent variable | Bidding result | Based on the bidding result of each constructor was set as a dependentA successful bidder: 1, A failed bidder: 0 |

Subfactor of dummy | |

| independent variables | ||||

| Feasibility assessment | Building characteristics | Floor area ratio | Land area to total ground area ratio | % |

| Feasibility assessment | Building characteristics | Building-to-land ratio | Land area to building area ratio | % |

| Feasibility assessment | Building characteristics | Scale | No. of households in the building | Unit |

| Feasibility assessment | Profitability analysis | Profitability | Financial feasibility analysis result | % |

| Target site basic evaluation |

Legal risk review | Legal suitability | No. of legal disputes | Case |

| Target site basic evaluation |

Administrative review | License acquisition | License acquisition | Subfactor of dummy |

| Target site basic evaluation | Transportation means | Subway in a radius of 5km | No. of subway stations in a radius of 5km | Unit |

| Target site basic evaluation | Cultural and convenience facility | Adjacent movie theaters | Distance from the building to the nearest movie theater | km |

| Adjacent large outlets | Distance from the building to the nearest outlet | km | ||

| Outlet in a radius of 5km | No. of outlets in a radius of 5km | Unit | ||

| Target site basic evaluation | Educational facilities | Elementary/middle/high school/university in a radius of 5km | No. of schools in a radius of 5km | Unit |

| Business performance evaluation | Business step | Business site buying rate | The percentage of business sites where the purchase is completed among business sites required in the project plan | % |

| Business performance evaluation | Business step | Period of business suspension | Total period during which the construction is suspended in the project schedule | No. of months |

| Investor protection plan | Debt info. | Total amount of bonds (a) | Total amount of bonds for the building | x 1 million won |

| Investor protection plan | Debt info. | Amount of obtained bonds (b) | Amount of obtained bonds | x 1 million won |

3.2. Descriptive Statistics

3.3. Correlation Analysis

3.4. Model Fitness

3.5. Bid Decision Factor Analysis

| Classification | B | S.E. | Wald | Degree of freedom | Significant probability | Exp(ᵝ) | |

| Step 1 | Building coverage ratio(%) | -31.3215 | 6.8623 | 20.833 | 1.0 | 0.0 | 0.0 |

| Scale(Unit) | -0.0684 | 0.0175 | 15.2359 | 1.0 | 0.0001 | 0.9339 | |

| Profitability(%) | -28.5572 | 6.9241 | 17.0098 | 1.0 | 0.0 | 0.0 | |

| Legal suitability(Case) | -2.404 | 1.8507 | 1.6872 | 1.0 | 0.194 | 0.0904 | |

| License acquisition (Subfactor of dummy) | -26.7496 | 7.2176 | 13.7355 | 1.0 | 0.0002 | 0.0 | |

| Subway in a radius of 5km (Unit) | -3.0774 | 0.8723 | 12.4458 | 1.0 | 0.0004 | 0.0461 | |

| Outlet in a radius of 5km (Unit) | 2.1577 | 0.6487 | 11.0628 | 1.0 | 0.0009 | 8.651 | |

| Elementary/Middle school/High school/University within a 5km radius(Unit) | -0.0285 | 0.0365 | 0.61 | 1.0 | 0.4348 | 0.9719 | |

| Business site buying rate(%) | -26.9258 | 7.5165 | 12.8322 | 1.0 | 0.0003 | 0.0 | |

| Period of business suspension(No. of months) | -0.3643 | 0.0998 | 13.3163 | 1.0 | 0.0003 | 0.6947 | |

| Total amount of bonds (x 1 million won) |

0.0005 | 0.0001 | 15.3272 | 1.0 | 0.0001 | 1.0005 | |

| Constant term | 21.3263 | 3.3149 | 16.0176 | 1.0 | 0.0001 | 0.9128 | |

4. Valuation Basis in Consideration of Bid Decision Factors

4.1. Hierarchy Setting

4.2. Survey Overview and Details

4.3. Analysis Result

5. Conclusion

5.1. Summary and Implications

5.2. Limitations and Future Issues

Author Contributions

Funding

Acknowledgements

Conflicts of Interest

References

- Financial Supervisory Service. Evaluation of financial companies’ business feasibility and plans regarding their real estate PF. Available online: https://www.fss.or.kr/fss/bbs/B0000188/view.do?nttId=137993&menuNo=200218&cl1Cd=&sdate=&edate=&searchCnd=1&searchWrd=&pageIndex=4 (accessed on 21 November 2024).

- Bank of Korea. 2024. Global Financial Stability Report.

- Financial Supervisory Service. The 4th meeting of measures for soft landing of real estate PF. Available online: https://www.fss.or.kr/fss/bbs/B0000188/view.do?nttId=137993&menuNo=200218&cl1Cd=&sdate=&edate=&searchCnd=1&searchWrd=&pageIndex=4 (accessed on 21 November 2024).

- Maeil Business Newspaper. News Report. Available online: https://www.mk.co.kr/news/economy/11105179 (accessed on 21 November 2024).

- Shim, H.C.; Kim, J.H. Analysis of determinants of successful bidding for insolvent PF projects: With a focus on PF establishments whose construction was suspended by mutual savings banks. Real Estate Acad Rev 2018, 71, 93–104. [Google Scholar]

- Korea Asset Management Corporation (KAMCO). Internal data (2017). Available online: www.kamco.or.kr (accessed on 21 November 2024).

- Shin, J.C.; Baik, M.S. Research on the Normalization Schemes for Insolvent Development Site on Mutual Savings Banks. J Korea Academia-Industrial Coop Soc 2015, 16, 195–204. [Google Scholar] [CrossRef]

- Jo, K.H.; Lee, C.K. , Kim, S.J. Improving local investment appraisal system for local public investment efficiency. Korea Res Inst for Local Adm Basic Res Proj 2012, 1–217. [Google Scholar]

- Shim, H.C. , Kim, J.H. A Study on the Application of Weights in the Area of Regional Development for the Examination of Local Financial Investment Project. J Resid Environ Inst Korea 2020, 18, 43–56. [Google Scholar] [CrossRef]

- Hong, S.J. Legislative tasks of real estate PF measures to normalize the real estate market. Korea Publ Land Law 2024, 134, 105–133. [Google Scholar]

- Nevitt, P.K.; Fabozzi, F. Project Financing 6th Edition; Euromoney Publication: London, UK, 1995. [Google Scholar]

- Yang, K.J. An Exploratory Study on Project Financing of Korea Mutual Savings Banks. Corp Law Res 2011, 25, 299–328. [Google Scholar]

- Esty, B.C. Modern Project Finance: A Case Book; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Jang, S.H. 2013. A Study on Improvement of Project Financing Structure and New Directions in Real Estate Market: Focusing on Financing Structure Founded on Risk Taking of Financial Institutions. Master’s Thesis, Konkuk University Real Estate Graduate School, Seoul, South Korea.

- Wood, P.R. Project Finance, Subordinated Debt and State Loans; Sweet & Maxwell: London, UK, 1995. [Google Scholar]

- Yoon, Y.S.; Sung, J.H. A Study on the Efficient Risk Management with the Relative Importance of Risk Facts by Stage in the Real Estate Development Project. Korea Real Estate Acad 2014, 59, 59–73. [Google Scholar]

- Merna, A.; Chu, Y.; Al-Thani, F. Project Finance in Construction: A Structured Guide to Assessment; Wiley-Blackwell: Hoboken, NJ, USA, 2010. [Google Scholar]

- Finnerty, J.D. Project Financing: Asset-Based Financial Engineering; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Kim, J.J. Diagnosis on Project Finance Crisis in Real Estate Market and Policy Response. Constr Issue Focus 2022, 1–34. [Google Scholar]

- Kim, J.J. Diagnosis on Project Finance Crisis in Real Estate Market in Korea and Policy Suggestion. Future Growth Stud, 2023, 9, 101–128. [Google Scholar] [CrossRef]

- Ahn, W.H. 2011. A study on factors of the financial distress and the soundness of the mutual savings banks in Korea. Master’s Thesis, Yonsei University, Seoul, South Korea.

- Lee, D.G.; Cha, H.S. An Exploratory Research on Quantitative Risk Assessment Methodology Throughout Success Factor Analysis in Project Financing. Korean J Constr Eng Manag 2013, 14, 92–102. [Google Scholar] [CrossRef]

- An, K.J.; Cho, Y.K.; Lee, S.Y. An Analysis on the Investment Determinants for Insolvent Housing Development Projects. Korean J Constr Eng Manag 2015, 15, 112–121. [Google Scholar] [CrossRef]

- Choi, H.S. The Effect of the UEC on the Price of Nearby Lands: Focused on Times Square UEC. Korea Real Estate Acad Rev 2014, 58, 60–71. [Google Scholar]

- Lim, E.T.; Lee, H.B. A Research on the Impact of the NPL Related Factors on the Auction Winning Price Rate of Real Estates. Korea Real Estate Acad Rev 2016, 67, 116–128. [Google Scholar]

- Ong, S.E.; Lusht, K.; Mak, C.Y. Factors Influencing Auction Outcomes: Bidder Turnout, Auction Houses and Market Conditions. J Estate Res 2005, 27, 181. [Google Scholar] [CrossRef]

- Durdyev, S.; Hosseini, M.R. Causes of delays on construction projects: a comprehensive list. Int J Manag Proj Bus 2020, 13. [Google Scholar] [CrossRef]

- Voronina, N.V.; Steksova, S.Y. Project finance risk management at the stages of the housing projects’ life cycle. Mater Sci Eng 2020, 913. [Google Scholar] [CrossRef]

- Kurmanova, L.R.; Kurmanova, D.A. Financial technologies in project financing of housing construction. Mater Sci Eng 2020, 753. [Google Scholar] [CrossRef]

- Kim, J.; Ji, K.H. Current status of real estate PF (Project Finance) loans and policy responses. Available online: https://eiec.kdi.re.kr/policy/domesticView.do?ac=0000150505 (accessed on 22 November 2024).

- Lee, B.G.; Lee, C.W. Research on real estate PF crisis response plan. Korean Law Rev Rehabilit Bankruptcy 2024, 28, 75–116. [Google Scholar] [CrossRef]

- Choi, E.Y. Actual Status of Real Estate PF Loans and Improvement Measures. Constr Econ 2011, 66, 68–79. [Google Scholar]

- Shin, K.H. Study of Analysis of Real Estate Project Financing Issues and Activated through Improvement of a System. Inst Leg Stud 2015, 11, 181–215. [Google Scholar]

- Son, J.J. 2009. A Study on Improvement and Problems of PFV System in Korea: Focused on Real Estate Development Business. Master’s Thesis, Kangnam University, Gyeonggi-do, South Korea.

- Cho, J.Y. A Study on the Measure of Securing Stability of the Project Finance. Korea Real Estate Acad Rev 2016, 64, 268–280. [Google Scholar]

- You, J.G.; Oh, D.H. Efficient Management Scheme for Insolvent Development Site in Real Estate Project Financing. J Korea Real Estate Anal Assoc, 2010; 16, 99–114. [Google Scholar]

- Lee, G.B. A Study on How to Activate Small and Medium-sized Real Estate Development PF. J Humanit Soc Sci 2020, 11, 2205–2216. [Google Scholar]

- Chung, B.K.; You, D.M. Strategies for vitalizing the domestic real estate PF market: Focusing on domestic and foreign precedent research analysis. Korea Real Estate Soc 2023, 41, 159–182. [Google Scholar] [CrossRef]

| N | Ave | Std | Min | Max | |

| Bidding result (Subfactor of dummy) |

32.0 | 0.4688 | 0.4998 | 0.0 | 1 |

| Floor area ratio(%) | 32.0 | 3.2681 | 2.4196 | 1.53 | 10.56 |

| Building-to-land ratio(%) | 32.0 | 0.2616 | 0.1527 | 0.13 | 0.66 |

| Scale(Unit) | 32.0 | 515.9688 | 465.4663 | 38.0 | 2059 |

| Profitability(%) | 32.0 | 1.2428 | 0.1698 | 1.05 | 1.72 |

| Legal suitability(Case) | 32.0 | 0.375 | 0.6004 | 0.0 | 2 |

| License acquisition(Subfactor of dummy) | 32.0 | 0.7188 | 0.4503 | 0.0 | 1 |

| Subway in a radius of 5km(Unit) | 32.0 | 6.75 | 11.5044 | 0.0 | 54 |

| Adjacent movie theaters(km) | 32.0 | 2.47 | 3.4084 | 0.27 | 14.68 |

| Adjacent large outlets(km) | 32.0 | 2.684 | 3.1352 | 0.22 | 11.63 |

| Outlet in a radius of 5km(Unit) | 32.0 | 4.5 | 3.7891 | 0.0 | 14 |

| Elementary/ middle/high school/ university in a radius of 5km(Unit) |

32.0 | 5.154 | 6.0948 | 0.596 | 26.31 |

| Business site buying rate(%) | 32.0 | 0.9125 | 0.142 | 0.53 | 1 |

| Period of business suspension (No. of months) |

32.0 | 41.5625 | 30.3913 | 0.0 | 111 |

| Total amount of bonds(x 1 million won) | 32.0 | 41324.6562 | 34623.9782 | 3000.0 | 196614 |

| Amount of obtained bonds(x 1 million won) | 32.0 | 32282.8125 | 17520.8063 | 3000.0 | 68327 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

| 1. Bidding result (Subfactor of dummy) |

1.0000*** | |||||||||||||||

| 2.1 Floor area ratio(%) | -0.1027* | 1.0000*** | ||||||||||||||

| 2.2 Building-to-land ratio(%) | -0.0384 | 0.8938*** | 1.0000*** | |||||||||||||

| 2.3 Scale(Unit) | -0.3728*** | -0.1394** | -0.2184*** | 1.0000*** | ||||||||||||

| 2.4 Profitability(%) | -0.1559*** | -0.1441*** | -0.1599*** | -0.0190 | 1.0000*** | |||||||||||

| 3.1 Legal suitability(Case) | -0.1697*** | -0.1011* | -0.1124** | 0.1192** | -0.0380 | 1.0000*** | ||||||||||

| 3.2 License acquisition (Subfactor of dummy) |

-0.1088* | -0.0983* | -0.1806*** | 0.0800 | 0.0063 | -0.4203*** | 1.0000*** | |||||||||

| 3.3 Subway in a radius of 5km(Unit) | -0.2303*** | 0.0601 | 0.0183 | -0.0432 | -0.0601 | 0.4175*** | -0.4553*** | 1.0000*** | ||||||||

| 3.4 Adjacent movie theaters(km) | 0.0906 | -0.2130*** | -0.0229 | -0.0064 | -0.1597*** | -0.1638*** | 0.0511 | -0.1568*** | 1.0000*** | |||||||

| 3.5 Adjacent large outlets(km) | 0.2198*** | -0.2127*** | -0.0174 | -0.1234** | 0.2384*** | -0.2224*** | 0.0569 | -0.2763*** | 0.7347*** | 1.0000*** | ||||||

| 3.6 Outlet in a radius of 5km(Unit) | -0.1407** | 0.0917 | 0.0079 | -0.0681 | -0.0962* | 0.1929*** | -0.2480*** | 0.7134*** | -0.3792*** | -0.5549*** | 1.0000*** | |||||

| 3.7 Elementary/middle/high school/university in a radius of 5km(Unit) | 0.1637*** | -0.2285*** | -0.0218 | -0.0671 | 0.0333 | -0.2060*** | 0.0579 | -0.2298*** | 0.9371*** | 0.9252*** | -0.4975*** | 1.0000*** | ||||

| 4.1 Business site buying rate(%) | 0.0762 | 0.2524*** | 0.2199*** | -0.2735*** | 0.1443*** | 0.1802*** | -0.2733*** | 0.2880*** | -0.6328*** | -0.3780*** | 0.3088*** | -0.5483*** | 1.0000*** | |||

| 4.2 Period of business suspension (No. of months) |

-0.3538*** | -0.1126** | -0.1367** | -0.0667 | 0.2183*** | -0.0717 | 0.3414*** | -0.1150** | -0.0419 | 0.0391 | -0.1840*** | -0.0033 | 0.0804 | 1.0000*** | ||

| 5.1 Total amount of bonds(x 1 million won) | -0.0183 | 0.0056 | 0.0227 | 0.6137*** | -0.0214 | 0.1192** | 0.0771 | -0.0528 | -0.0279 | -0.0291 | -0.1649*** | -0.0306 | -0.2229*** | -0.0761 | 1.0000*** | |

| 5.2 Amount of obtained bonds(x 1 million won) | 0.1335** | 0.1584*** | 0.1850*** | 0.2931*** | -0.0014 | 0.0351 | 0.0113 | -0.0017 | 0.0208 | -0.0267 | -0.1334** | -0.0021 | -0.0257 | -0.0816 | 0.8051*** | 1.0000*** |

| Step | Pseudo R-squared | -2Log likelihood | R-square of Cox and Snell | R- square of Nagelkerke |

| 1 | 0.7851 | 78.524 | .521 | .658 |

| Step | Chi-square | Degree of freedom | Significant probability |

| 1 | 9.753 | 8 | .247 |

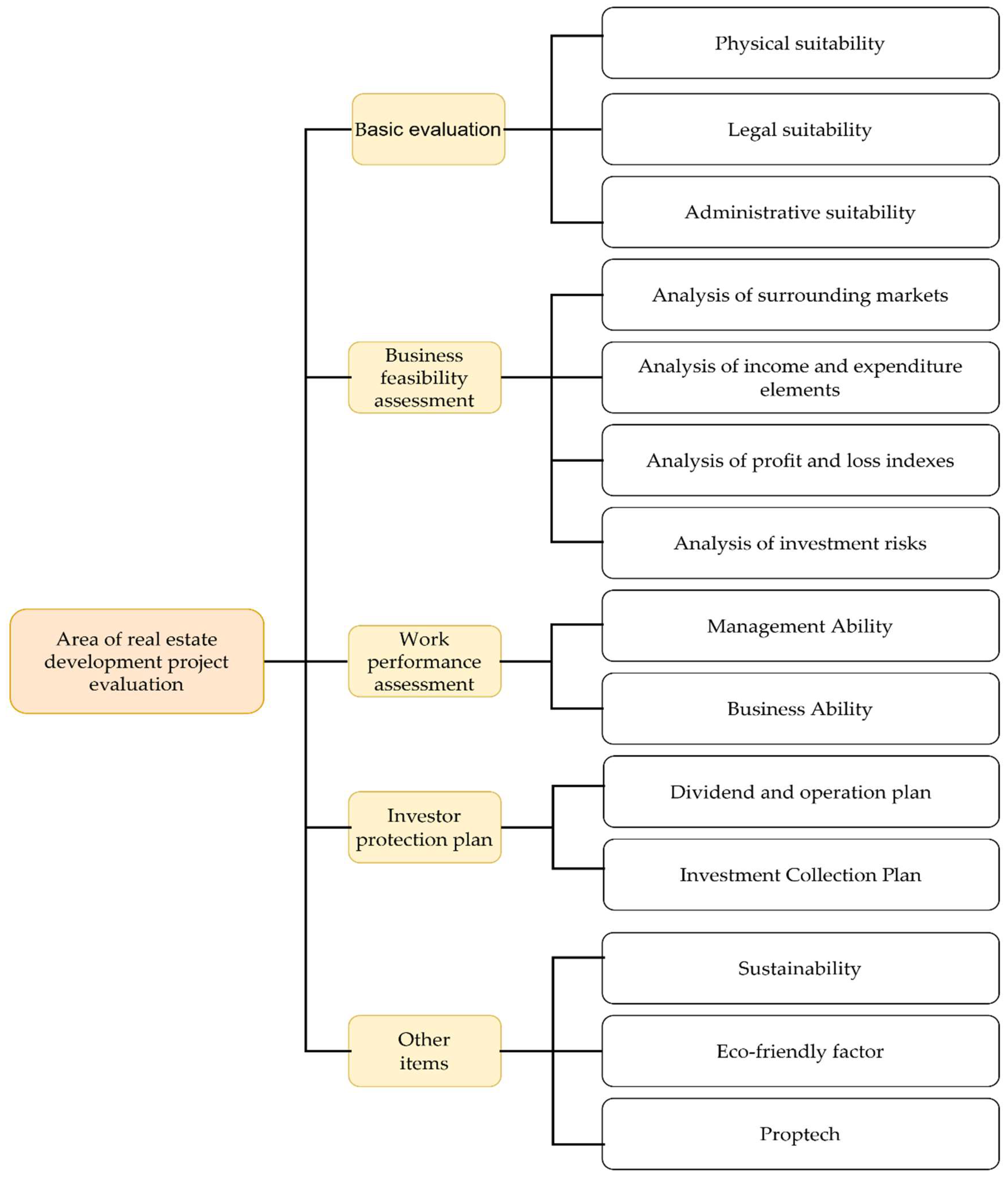

| Class 1 | Class 2 | significance/weight of criterion | Class 3 | significance/weight of criterion | Final Correction value |

Rank |

| Area of real estate development project valuation | Basic evaluation | 0.188 | Physical suitability | 0.215 | 0.0404 | 14 |

| Legal suitability | 0.422 | 0.0793 | 6 | |||

| Administrative suitability | 0.363 | 0.0682 | 7 | |||

| Feasibility assessment | 0.311 | Analysis of surrounding markets | 0.168 | 0.0522 | 12 | |

| analysis of income and expenditure elements | 0.328 | 0.1020 | 1 | |||

| Analysis of profit and loss indexes | 0.299 | 0.0930 | 4 | |||

| Analysis of investment risks | 0.205 | 0.0638 | 8 | |||

| Business performance valuation | 0.184 | Management ability | 0.452 | 0.0832 | 5 | |

| Business ability | 0.548 | 0.1008 | 2 | |||

| Investor protection plan | 0.162 | Dividend and operation plan | 0.622 | 0.1007 | 3 | |

| Investment collection plan | 0.378 | 0.0612 | 9 | |||

| Other items | 0.155 | Sustainability | 0.387 | 0.0600 | 10 | |

| Eco-friendly factor | 0.271 | 0.0420 | 13 | |||

| Proptech | 0.342 | 0.0530 | 11 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).