1. Introduction

Many countries seek new trade partners world-wide to ensure export development. But new possible markets [

1,

2] have to be examined carefully and taken into account national and international specifics [

3,

4] for each export direction. In this process [

5] big role is for researchers and scientists [

6,

7] with their analysis [

8,

9] and critical evaluations of possible solutions. Research is performed very detailed [

10,

11] and several research and analysis methods are applied.

Present study addresses topic of Latvian companies venturing abroad and specific question of new overseas exporting directions. Traditional markets where Latvian producers were doing their export were Scandinavian and Western Europe’s countries. However, at a recent time lot of sources and prognostics are predicting a further decline in demand and a recession in the technology industries at these regions [

12,

13]. One of newest and most influential European Commission’s reports, evaluating the EU competitiveness in last years, signalizes purchasing power’s difficulties on EU markets, EU growth slowing, lowering EU productivity and weakening domestic demand [

14]. Besides of this, as one of Serbian and Bosnia Herzegovina’s research [

15] shows, fulfilling the requirements of export to the EU market is a difficult challenge for local East European companies – whom to Latvia belongs as well due to its geographical position. Summarizing these issues, it can be said that having such reduction of the demand of their exported goods at traditional markets, Latvian producers looking for an alternative market to keep plants operate and diversify export directions. West African countries may become as such good alternative business direction. However, a lack of knowledge about West African economies, business practices and communication culture had been noticed amongst Latvian entrepreneurs – that blocks them of venturing to these markets. This complex problem had been studied in the research and mitigated through qualitative interviews with broad range of West African countries experts to discover local economic situation, communication culture and business opportunities in order to transmit this information to Latvian entrepreneurs so they can consider in more prepared way their venturing in this region.

The choice of West African was done for multiple purposes: general rise of African continent and economies, that mostly remain resilient to global instabilities, with prognosed average growth at ~4% in 2024–2025 [

16]. Many other researchers confirm Africa being a continent of important role in the future international division of labour [

17], the continent has the potential to forge a new development path, harnessing the potential of its resources [

18] and becoming an attractive place for business. Other reason and distillation principle was based on criteria of language: only French-speaking countries had been chosen. Links between the linguistic ability and international experience of export managers are highly related in-between [

19] so approaching French-speaking African countries at their mother tongue is competitive advantage for Latvian firms. It was checked that countries only in 3 regions correspond to this requirement: Northern, West and Central Africa. Next, countries filtered upon access to the sea and developed ports criteria: as Latvia has a significant maritime historical heritage, highly professional marine engineers and developed port infrastructure, as well as production of metal products used in ports - that all in total provides a basis of services, engineering knowledge and experience to potentially propose to African port countries. Besides, ports play a central role in Africa’s trade – over 80% of Africa’s foreign trade passes through them [

20]. It was stated that from 3 regions only 2 have sea coast line: Northern and West Africa’s countries, by that Central Africa had been excluded from further discussion. Finally, country’s openness to new players. It appeared that Northern Africa’s business still works a lot with French companies and cooperation between these France and The Maghreb is strongly supported – that signified a big difficulty for Latvian producers to enter these regions with such strong competition with old European networks. However, West Africa’s countries are more progressing towards change of old power relationships and are more open for non-colonial partners such as Latvian. By that, West Africa’s Sub-Saharan French-speaking marine countries had been taken for the studies: Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon.

In an increasingly interconnected global economy, enterprises from emerging European markets are actively seeking new avenues for trade and investment. Latvia, traditionally reliant on Scandinavian and Western European markets, faces growing challenges due to economic slowdowns, declining purchasing power, and stringent export regulations within the European Union. As a result, diversification into non-traditional markets has become imperative for sustaining industrial activity and fostering economic resilience.

West Africa, with its rapidly expanding economies, youthful workforce, and increasing openness to new international partnerships, presents a compelling opportunity for Latvian entrepreneurs. Among these nations, Cameroon stands out due to its strategic location, abundant natural resources, and growing industrial and infrastructure sectors. However, despite these prospects, Latvian firms encounter significant barriers to entry, including unfamiliarity with local business practices, cultural differences, and the absence of diplomatic representation in the region.

This study explores the economic and commercial potential of Central Africans countries—particularly Cameroon—as alternative markets for Latvian enterprises. By employing qualitative interviews with regional experts and business stakeholders, the research aims to uncover key economic drivers, infrastructural needs, and business culture intricacies that influence successful market entry. The findings highlight strategic sectors such as port logistics, renewable energy, agro-industrial development, and digital transformation as viable areas for Latvian engagement.

The study underscores the importance of cultural adaptability, tailored market entry strategies, and institutional collaboration in fostering long-term trade relationships. By addressing critical knowledge gaps and identifying practical pathways for engagement, this research serves as a strategic guide for Latvian businesses looking to navigate and capitalize on emerging opportunities in West Africa.

2. Materials and Methods

The semi-structured qualitative interviews had been conducted (via Internet video-calls and recorded) with check-boxes for answers and available space for free comments after each question. In respect with research aim to discover information for Latvian entrepreneurs to overcome the barrier of lack of knowledge of the West African market, two survey practical goals were defined: №1. To discover local economic conditions, state of the energy sources, industrial conditions; №2. To discover common local business practices, cultural communication traditions, ways of approaching people. Further, research survey target audience had been predefined as consisting of two big groups: first, African experts, academic stuff, significant actors whose contribution to the survey was in describing and explaining African business practices, common business culture, communication specificity, etc. (close mostly above-mentioned goals №2, but sometimes №1 as well); second big group consisted from African ports technical directors, operation managers, industrial chambers representatives – otherwise saying, personnel working in the ports or in the industrial infrastructure sector. Such personnel usually have professional competences, engineering background or at least understanding of industrial matters and the interviews of these people are very valuable as they can explain “real situation on the field”, what in its turn is important to know for Latvian producers to adapt accordingly their strategy (close above-mentioned goal №1). Questions, related to the goal №1 - were formulated based on separate expert interview of Latvian Metal Industry Director. Questions, related to the goal №2 - were formulated based on the academic literature on intercultural business communication.

Difficulties met during the survey: a) a distance and cultural difference between Latvia and African continent gave a negative impact on the accessibility of the respondents and the responding rate. Africa, being a difficult field for academic researches itself [

21] with not vast Internet access (sometimes the respondents were forced to go to work office to have better Internet connection for the interview or to go to the city from a work site at the outskirts (e.g., a respondent from Guinea) became a field of ”hard-to-reach" appropriate qualitative respondents. A cultural distance in many aspects impacted negatively as well – for example, a vertical hierarchy, that was multiple times explained by different respondents, was needed to be respected in a way that the researcher is considered to belong to a lower hierarchical level and can’t approach directly head of ministries or experts – this should’ve been done first by superior from Latvian side (University of Latvia or Academy of Science) and only then cascaded down to the researcher; b) It has been discovered, almost none of Latvian diplomatic missions, embassies and consuls existed in Western Africa so far (NB: on the moment of the research on end of 2024, beginning of 2025) that didn’t allowed to count on serious help from anthems of Latvia in this region; c) the “snowball” approach - a way, the sampling plan follows out the chains of sociometric relations in the given population [

22] was applied after each interview. It didn’t brought much result, even though respondents agreed to connect with their colleagues or known experts – they didn’t did this in reality.

3. Results

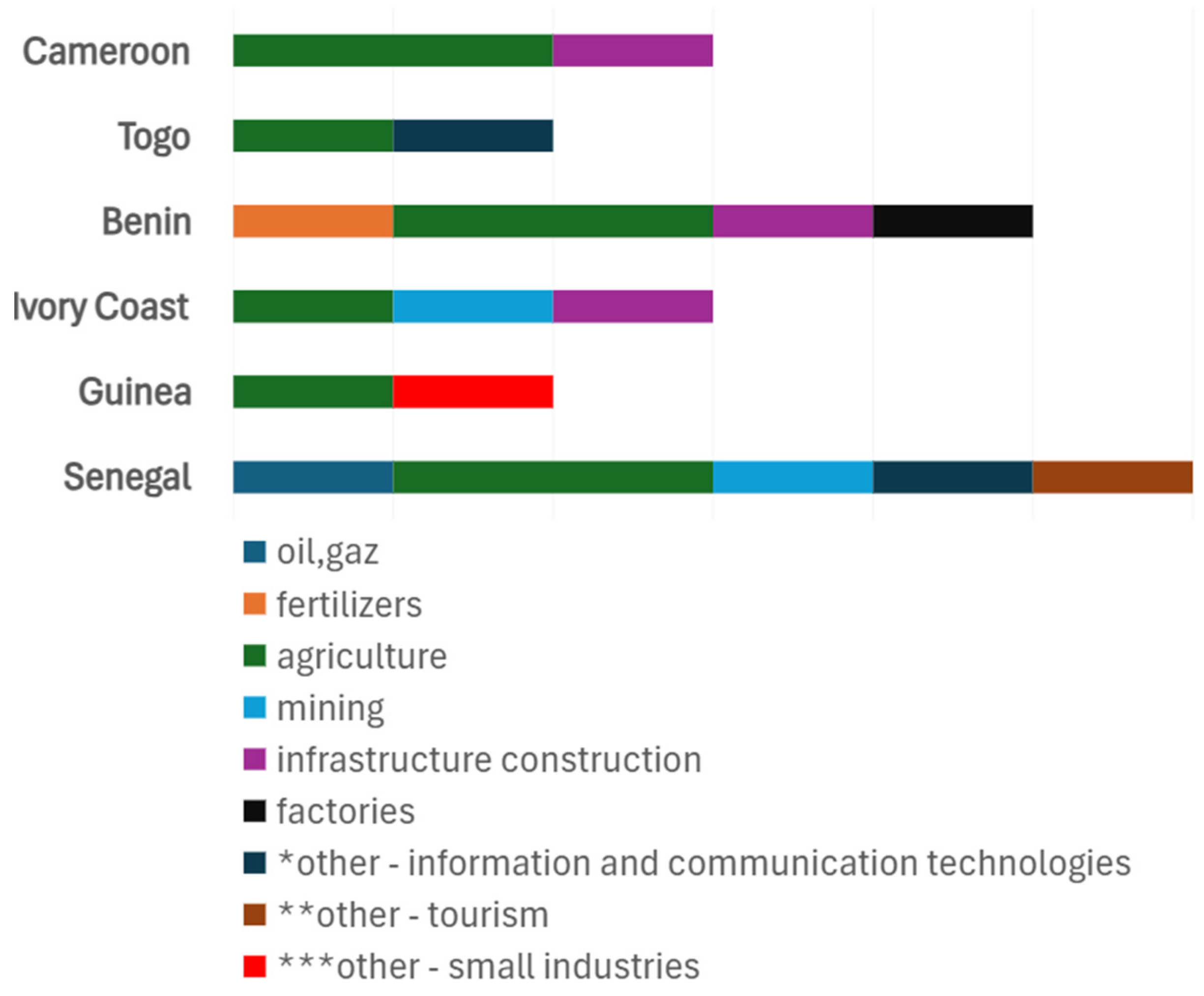

Survey results showed that sectors, developing most intensively in each target country – touches mostly agriculture sector (it had been also frequently mentioned by respondents that methods of land cultivation are still manual, not automatized) (see

Figure 1). Information and communication sector was also surprisingly mentioned several times, what can be related to young and quickly developing population.

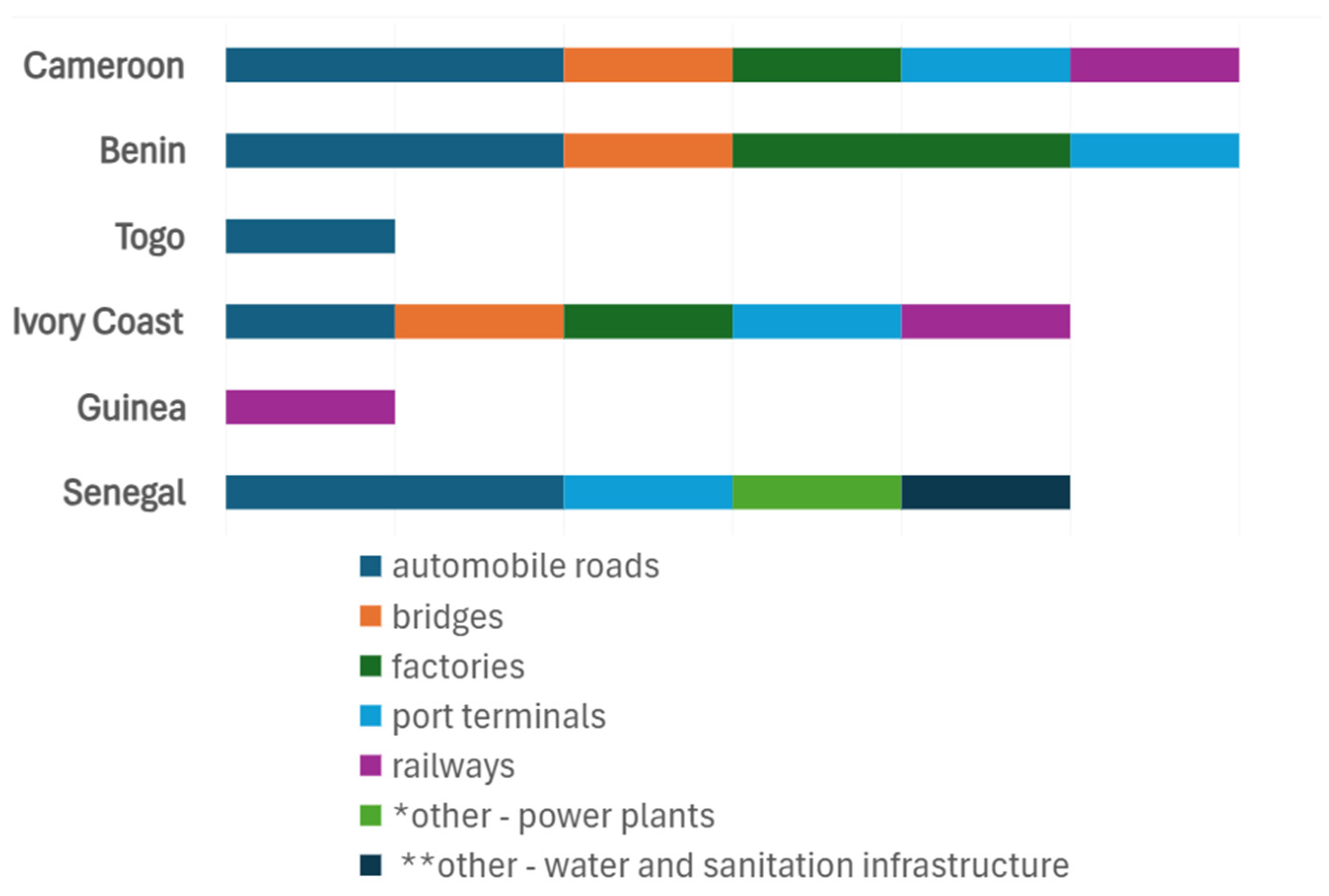

Next topic, related to most necessary infrastructure objects to be built at the soonest in each target country, showed dominance of the automobile roads (see

Figure 2). By reason was frequently mentioned the necessity to connect multiple cities and populated areas in order to promote country’s development.

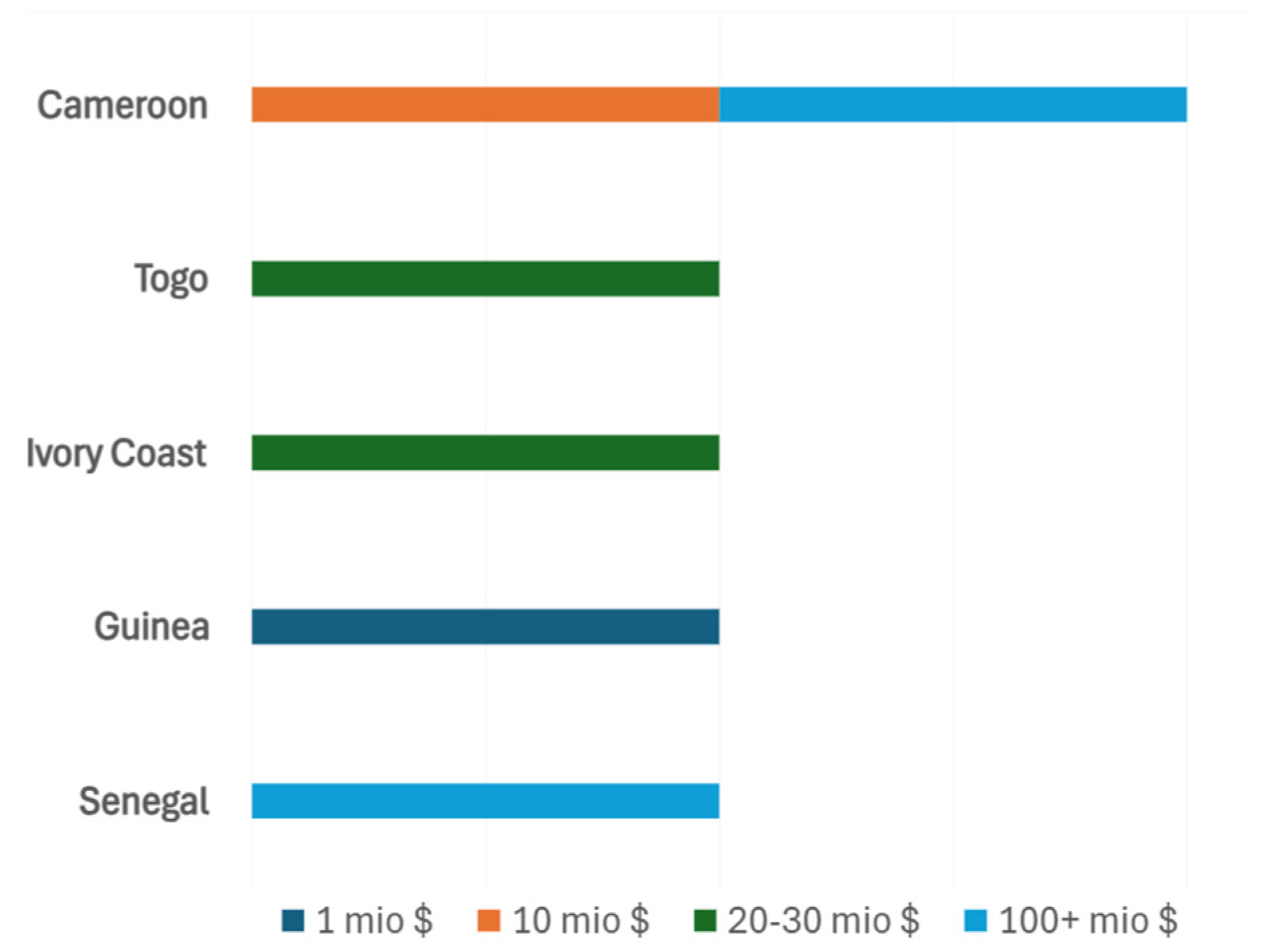

For an average budget of an industrial project in each target country, preliminary findings showed equal spread of all proposed amounts: 1 mio

$ / 10 mio

$ / 20-30 mio

$ / 100+ mio

$ (see

Figure 3). This question shows the scale of projects so Latvia industrials can compare it to their practices and understand the picture of target markets as well as this information may help in decisions of export directions choice.

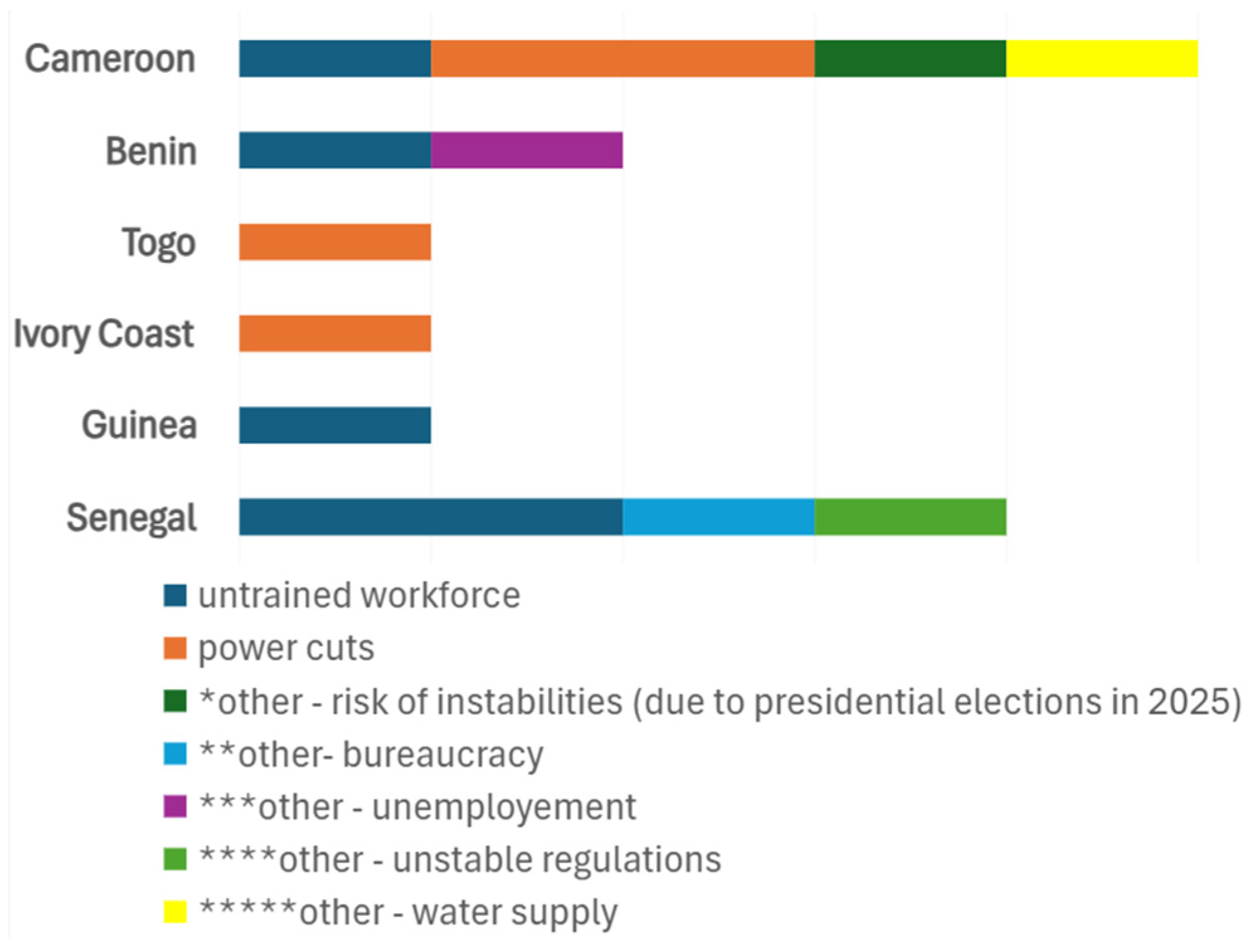

For the problems or obstacles, prohibiting to launch a factory in each target country, most frequently was mentioned untrained workforce (see

Figure 4) (a responded from Guinea indicated as example from 10 trained workers only 1 or 2 acquire knowledge and become suitable for the job). Another obstacle, mentioned frequently, were power cuts or sometimes power itself (some respondents mentioned that small plants or manufacture at their countries are being feed simply from diesel generators due to lack of centralized power supply).

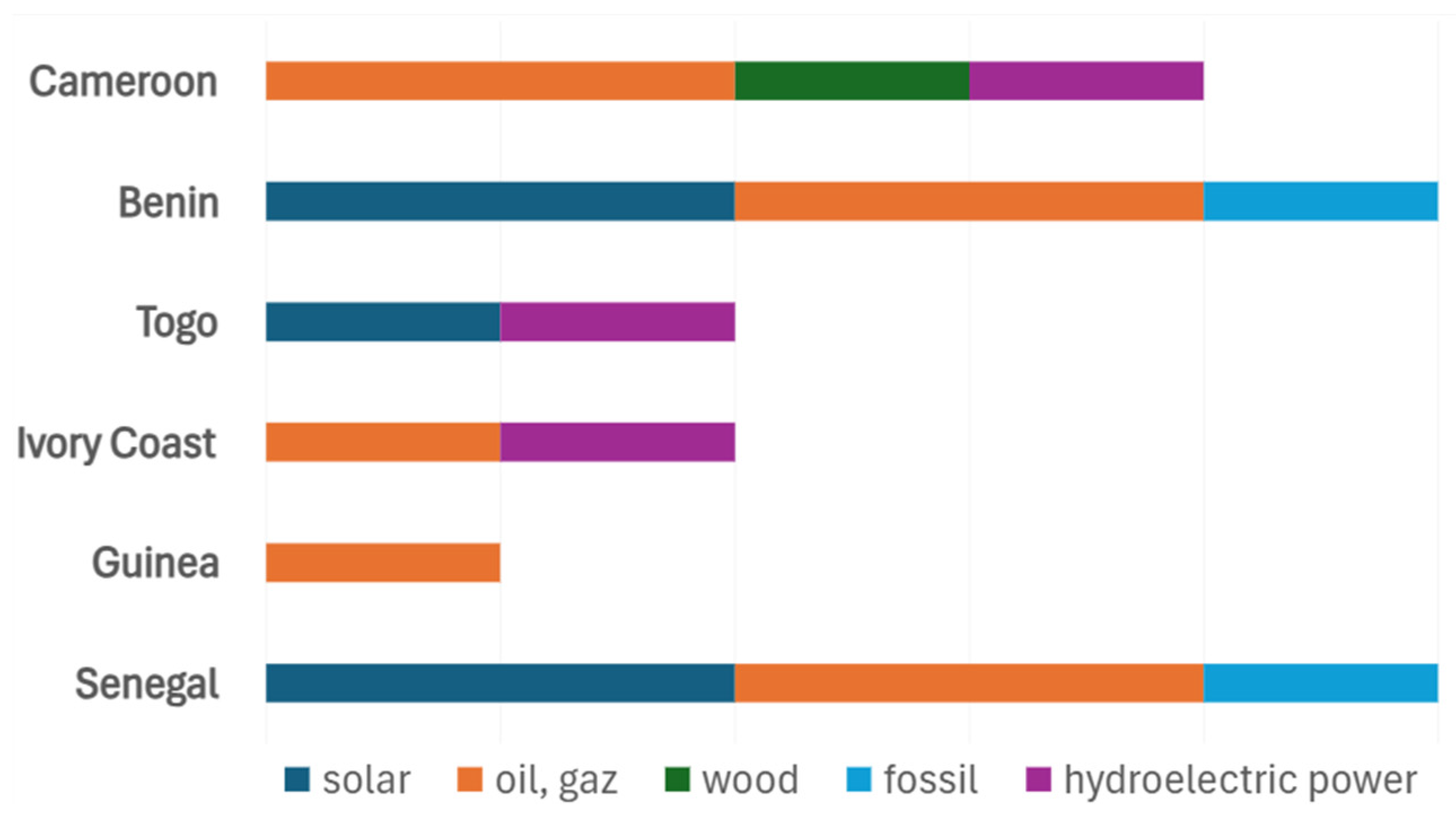

For the questions of main sources of energy in each target country, most frequently were mentioned 2 types: solar (via solar panels for private housing) and oil, gas (see

Figure 5). It had been said that oil and gas deposits frequently don’t belong to a home country, are fully equipped and exploited by non-African companies and all production exported abroad.

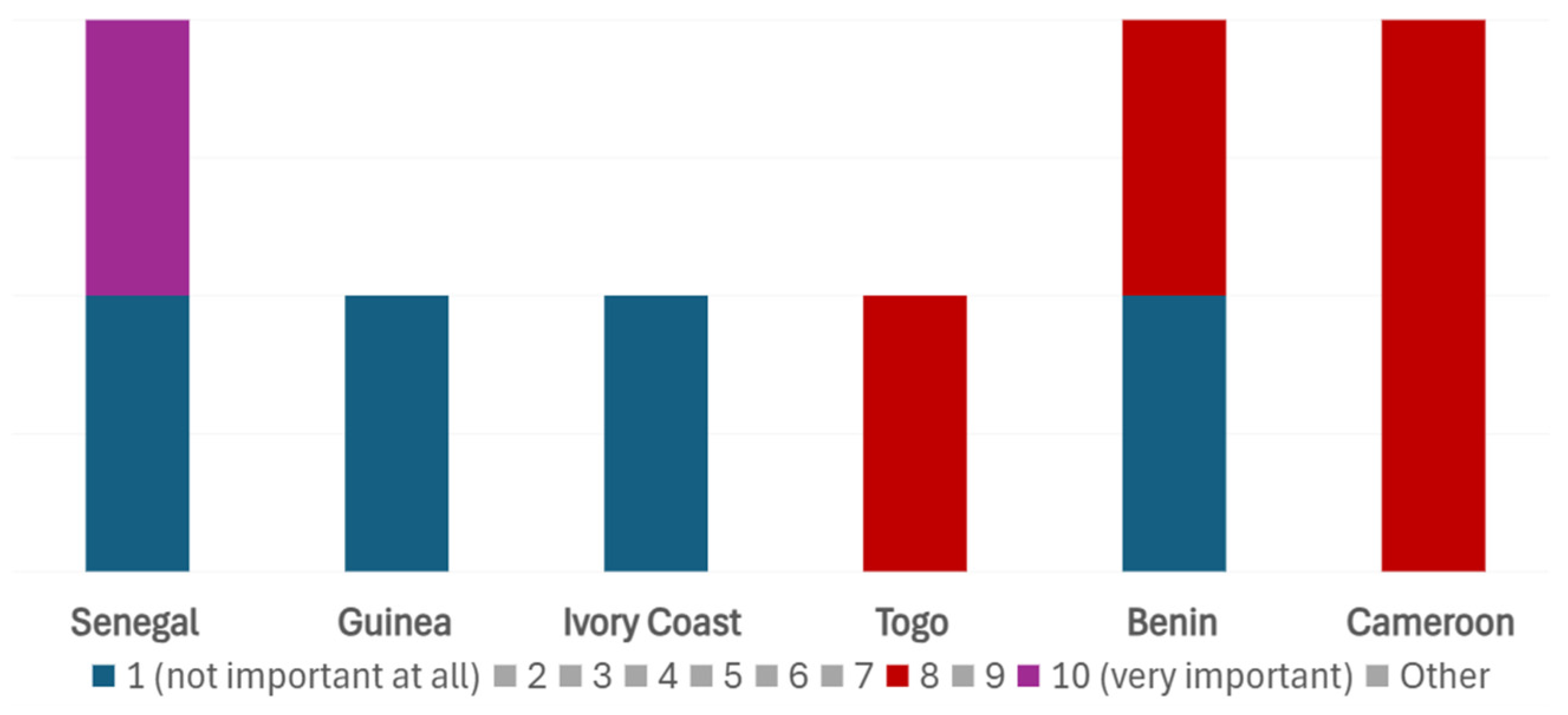

For the final topic – an importance of a non-colonial past of a partner country, a contradictory situation can be observed: respondents were asked to evaluate the importance on scale from 1 (not important at all) to 10 (very important), and preliminary findings showed there were no answers of moderate importance with middle values (like 4 or 5) (see

Figure 6). Some responses divided to minimal value 1, saying that “business is business” and promoting idea that it is time to move forward from past situations. Some other, on the contrary, gave maximal value – 10 with comments that this aspect is very critical as new governmental civil servants are young and want equal respect (e.g., in Senegal). Lot of respondents had chosen value 8, what is close to 10 yet not so expressed.

It was noted that research questions have a high potential for further development and there is a vast field for next studies.

4. Case Study - Cameroun: Exploring Areas and Modalities of Economic and Trade Cooperation with Latvia

In a rapidly globalizing world characterized by economic interdependence and shifting trade patterns, diversifying international partnerships has become a strategic necessity. This imperative is particularly relevant for economies seeking new avenues for trade and investment. As Latvia explores alternative export markets beyond its traditional European partners, West Africa, and more specifically Cameroon, emerges as a promising frontier. Likewise, Cameroon, with its strategic geographic position and economic dynamism, offers valuable opportunities for foreign investors, including Latvian entrepreneurs.

Cameroon serves as a gateway to the Central African market, benefiting from abundant natural resources, a young and growing workforce, and expanding infrastructure [

23]. Despite these advantages, the country faces structural challenges such as regulatory complexities, infrastructural deficits, and socio-political uncertainties. On the other hand, Latvia, a technologically advanced and innovation-driven economy, can leverage its expertise in sectors like information technology, logistics, and energy to foster mutually beneficial economic ties with Cameroon.

This section presents a strategic analysis of the opportunities and challenges to fostering and developing a dynamic, balanced, and mutually beneficial cooperation between Cameroon and Latvia. Using data and economic and cultural dynamics specific to each country [

24], it outlines strategic and innovative sectors for collaboration. It also explores potential synergies and provides concrete recommendations to optimize opportunities, establish bilateral institutional and regulatory frameworks to promote trade and investment, develop sustained political and diplomatic dialogue, and ensure effective monitoring of commitments to guarantee lasting benefits for both nations.

The principal conclusions drawn from this case study highlight that Latvian enterprises have substantial opportunities in Cameroon, particularly in sectors like ICT, port logistics, and renewable energy. However, cultural adaptation, strategic market entry approaches, and partnership with local entities are essential for sustained success. Moreover, Cameroon's efforts to enhance its investment climate, coupled with Latvia's interest in non-traditional markets, set the stage for a dynamic and productive economic relationship. By fostering targeted interventions and strategic collaborations, both nations can unlock significant economic potential and contribute to a more diversified and resilient trade landscape.

4.1. Brief Overview of Cameroon: Strengths, Risks, and Perspectives

Cameroon has a diversified and strategic economy within the Economic and Monetary Community of Central Africa (CEMAC). In 2019, CEMAC's total population was estimated at 55.85 million, with nearly half residing in Cameroon. The country also significantly contributes to the regional economy, accounting for approximately 29% of the community’s GDP and holding nearly half of the region’s financial assets [

25].

Its strategic geographic position in the Gulf of Guinea, coupled with its proximity to Nigeria—the largest economy in sub-Saharan Africa with an estimated population of 223.8 million—reinforces its role as a regional hub. Indeed, Cameroon serves as an ideal gateway to an expanded market of over 300 million consumers, encompassing not only CEMAC member states but also neighboring West and Central African countries [

26]. Cameroon and Benin are both neighbors of Nigeria and can serve as entry points to its market. However, they belong to two distinct economic communities. Benin is part of the West African sub-region, integrated into frameworks such as the West African Economic and Monetary Union (WAEMU) and ECOWAS (Economic Community of West African States). In contrast, Cameroon is located in Central Africa and is a member of regional organizations like CEMAC (Economic and Monetary Community of Central Africa) and CEEAC (Economic Community of Central African States). Furthermore, the Economic Partnership Agreement with the European Union is already fully in force in Cameroon, whereas in Benin, it has yet to be implemented. This gives Cameroon a clear comparative advantage as a gateway for Latvian small and medium-sized enterprises to introduce their goods and services into the Central African sub-region and Nigeria.

With its growing infrastructure network, including modern ports such as Douala and Kribi and an expanding logistics system, Cameroon is well-positioned to play a key role in regional and international trade exchanges. Additionally, its economic diversity, based on key sectors such as agriculture, energy, mining, and services, makes it a growth driver for the entire region.

Moreover, Cameroon offers an attractive environment for foreign investors by ensuring equal treatment, protection against expropriation, and the freedom to transfer capital. Fiscal incentives include tax exemptions on exports, local raw material purchases, and import duty reductions. Special regimes are in place for new businesses, firms, strategic large enterprises, free-zone companies, and those reinvesting profits, offering tax and customs advantages over several years. Finally, administrative measures such as the one-stop shop and international arbitration facilitate investments and ensure enhanced legal protection.

However, significant challenges remain: corruption, security instability in the Anglophone regions, and in Northern Cameroon, dependence on raw materials, and an imperfect institutional framework (see

Table 1 below). In summary, Cameroon presents economic opportunities due to its dynamism in key sectors (see

Table 2 below), but security risks, political uncertainties, and continued dependence on raw materials hinder its potential.

4.2. Cameroon: Economic Dashboard

This section of the paper provides an analysis of Cameroon’s economic strengths and weaknesses in 2025, highlighting the challenges the country faces alongside the government’s efforts to address them through targeted corrective measures.

This table outlines a country with significant strengths—such as political stability, a diversified export-oriented economy, and abundant natural resources—while also facing serious challenges including a complex business environment, governance issues, and regional security threats. In response, the government is pursuing corrective measures like prioritizing investments in key sectors, enhancing infrastructure, and establishing free zones to incentivize exports and improve overall economic performance.

4.3. Cameroon Key Economic Indicators

The indicators in

Table 2. suggest a modest but positive economic trend, with GDP growth and declining inflation rates projected to improve in the coming years. Additionally, fiscal consolidation appears to be taking place as evidenced by the decreasing public debt-to-GDP ratio, although the current account remains in deficit.

5. Investment and Cooperation Opportunities Between Cameroon and Latvia

Currently there are almost none of Cameroonian export to Latvia, in reverse Latvia had exported to Cameroon goods of around ~17 mio Euro value in 2024, what correspond of following groups of products (Top-5):

1.Cereals (biggest part of the whole volume);

2.Articles of iron or steel;

3. Machinery and mechanical appliances; boilers, parts thereof;

4. Pharmaceutical products;

5. Electrical machinery and equipment and parts thereof [

32].

Cameroon offers privileged access to regional and international markets, benefiting from CEMAC’s 50-million-consumer market and preferential trade agreements with the European Union [

33]. Taking into account the strengths, opportunities, and comparative advantages of both countries, a strategic partnership between Cameroon and Latvia in the following sectors can generate significant mutual benefits and strengthen their economic and diplomatic relations.

5.1. Digital Transformation

In 2023, approximately 35% of Cameroon's population had internet access, with significant disparities between urban and rural areas [

34].

Smartphone penetration stands at 47%, presenting an opportunity for mobile-based digital solutions.

Cameroon aims to digitize 100% of public services by 2030 and increase the ICT sector's contribution to GDP from 6% in 2022 to 15% [

35]. By digitizing all public services and expanding the ICT sector's share of GDP, Cameroon could enhance governmental efficiency, drive innovation, attract investments, and stimulate broad economic growth.

Latvia's expertise in e-governance [

36,

37] can support Cameroon in implementing digital platforms that enhance service delivery and transparency.

Strengthening ICT infrastructure, including fiber optics, data centers, and cybersecurity [

38,

39] is crucial for Cameroon's digital transformation.

Cameroon is developing an artificial intelligence (AI) strategy, focusing on health, agriculture, education, and governance, where collaboration with Latvia could provide cutting-edge technological support [

40]. It could also foster skills development and innovation within Cameroon's tech sector, accelerating digital transformation and boosting its global competitiveness.

5.2. CO2 Emissions Reduction

Latvian governmental programs on the CO

2 emissions reduction targets [

41]: including waste sorting and recycling initiatives, electrical vehicles programs, reduction in construction sector [

42,

43] can be of high interest to Cameroon authorities.

Automatization applied for industrial solutions to diminish the emissions during operative work on production plants (e.g., automatic welding robots that replace a labour welder and significally reduce gas consumption; replace petrol trucks to transport dry bulk on automatized electric conveyor lines) may be shares as good practices with Cameroon industrial actors. As positive result of reduction actions, indicators of CO

2 emissions are reducing in Latvia in the period in 2000 till 2020 in average annually by 1.48 thsd t from biomass used as fuel and by 4,7 thsd t without biomass used as fuel [

44]. The Latvia’s automation expertise applied for industrial solutions can help Cameroon modernize its production processes, leading to reduced operational costs, improved energy efficiency, and enhanced global competitiveness.

5.3. Agro-Industry, Food Processing, and Extractive Industries

Technology partnerships with Latvia can modernize agricultural value chains, reducing post-harvest losses and increasing export value.

Cameroon can access Latvian agricultural machinery, cold storage facilities, and irrigation technologies to boost production.

The country possesses abundant natural resources such as oil, bauxite, iron, gold, cobalt, uranium, and diamonds, offering investment opportunities in extractive industries [

45].

Latvia can source raw agricultural products from Cameroon, diversifying its supply chain while leveraging Cameroon's competitive labor force.

5.4. Industrial and Economic Zones

Cameroon offers multiple industrial zones managed by the Mission for the Development and Management of Industrial Zones (MAGZI) [

46] previewed for Latvian entrepreneurs for manufacturing, processing and agro-industrial activity, technology hubs for innovation, logistics hubs in Douala and Kribi facilitating potential Cameroon-Latvia imports and exports.

According to a report on the economic, social, and financial situation and prospects of Cameroon covering the 2022 fiscal year [

47] and some other sources [

48], the growth of the non-oil sector in Cameroon was projected at 4.2% in 2024 and at an average of 7.6% between 2024 and 2026. To achieve this objective, the Cameroonian government is relying, among other measures, on improving energy supply with the progressive commissioning of the Nachtigal dam, which has a capacity of 420 MW, and on strengthening the electricity distribution network. This improvement in energy supply would foster an increase in the production capacities of factories in industrial zones (e.g.,

Bassa (150 ha,

Douala) ;

Bonabéri (192 ha,

Douala) ;

Yaoundé-Sud (316 ha,

Yaoundé) ;

Banengo & Koptchou (28 ha,

Bafoussam) ;

Ngaoundéré (115 ha) ;

Djamboutou (90 ha,

Garoua) ;

Nkwen (44 ha,

Bamenda) ;

Ombé (133 ha,

Tiko) ;

Koumé-Bonis (105 ha,

Bertoua) ;

Mandjou-Kano (120 ha,

Bertoua)) and support the dynamism of manufacturing industries.

5.5. FDI Conditions, Procedures, Support

Foreign investors enjoy freedom of establishment and can hold 100% ownership in businesses [

49]. Cameroon provides attractive fiscal incentives, including VAT exemptions on strategic equipment and tax deductions for new businesses.

Companies must fulfill some administrative requirements, however business registration has been simplified, allowing companies to be established within three days through one-stop business registration centers [

50].

Lot of Cameroonian state agencies and financial institutions are supporting investments and securing bank environment:

Investment Promotion Agency of Cameroon (API): Facilitates foreign and domestic investment through advisory and administrative support services.

Public Procurement Regulatory Agency (ARMP): Ensures transparency and fair competition in public contracts.

Tenders Info & DgMarket: Online platforms providing access to national and international business opportunities.

-

Financial institutions:

- ○

Afriland First Bank: Offers specialized banking services, including project financing and investment credit.

- ○

International Finance Corporation (IFC): A World Bank Group entity providing financial support to private sector projects in Cameroon.

An important question of Cameroonian partner credibility verification for European (and Latvian) company by contacting the Chamber of Commerce, Industry, Mines, and Crafts of Cameroon (CCIMA) [

51], one can find useful information on the business environment in Cameroon, a database of Cameroonian companies, economic outlook and situation reports; details on procurement processes, as well as a variety of online services.

These institutions collectively ensure that investors receive adequate support for establishing and expanding their businesses in Cameroon [

52]. They offer a wide range of services, including expert advisory, financing options, and access to both national and international business opportunities.

6. Recommendations

The following recommendations aim to strengthen a mutually beneficial cooperation between Latvia and Cameroon by supporting sustainable development, diversifying economic opportunities, and fostering a deeper cultural and educational understanding. The establishment of strong institutional frameworks and monitoring mechanisms will ensure the sustainability of economic and trade relations.

6.1. Adaptation to Cultural Contexts

It is essential to conduct detailed and multidimensional studies of sociocultural dynamics to gain a deep understanding of local realities. This includes analyzing the values, traditions, and social structures that influence population behaviors in key economic sectors [

53,

54]. These studies will help identify specific needs, economic opportunities, and potential challenges. For example, mapping economic value chains while considering traditional practices can guide interventions toward tailored and sustainable solutions. Cameroon is distinguished by the presence of several sociocultural zones, each with its own specific characteristics: the northern region, predominantly inhabited by Muslims; the south, which is home to the large Fang-Ewondo-Beti group; the Grassfields, inhabited by the Bamiléké; as well as the Northwest and Southwest, English-speaking regions where Anglo-Saxon culture and traditions prevail. A further detailed study of the sociocultural dynamics and local realities in each of these cultural areas is recommended.

Creating bridges between cultures is an important lever for consolidating bilateral partnerships. To this end, it is recommended to organize joint economic and cultural forums, bringing together diverse stakeholders such as entrepreneurs, artists, researchers, and academics from both countries. These events could include exhibitions, thematic discussions, collaborative workshops, and artistic demonstrations. They will not only celebrate cultural differences but also create business opportunities, promote local expertise, and enhance mutual understanding, paving the way for stronger trade and diplomatic relations.

Intercultural communication training is a strategic tool for improving the effectiveness of economic and diplomatic collaborations. These training programs should be designed to raise awareness among stakeholders about local cultural specificities, such as communication styles, social expectations, and institutional protocols. For instance, practical workshops, simulations, or expert testimonies could enrich the learning experience. These programs will equip diplomats, investors, and trade representatives with an empathetic and respectful approach to local practices while fostering attitudes that facilitate cooperation. Additionally, continuous support could be provided to adjust strategies in response to cultural and economic developments.

6.2. Financing and Support

Mobilizing European and multilateral funds: Exploring opportunities offered by institutions such as Horizon Europe, the European Development Fund (EDF), and other multilateral partners for high-impact projects.

Creating a Latvia-Cameroon bilateral fund: Establishing a joint financing mechanism targeting strategic sectors such as sustainable agriculture, renewable energy, and cultural and creative industries.

Facilitating public-private partnerships (PPPs): Encouraging private investors from both countries to collaborate in structuring projects through tax incentives and institutional support.

6.3. Communication and Visibility

Establishing a Latvian economic office in Cameroon: creating a permanent platform to promote economic exchanges, support businesses, and facilitate institutional communication between the two countries.

-

Promoting cultural and educational exchanges:

- ○

Developing academic mobility programs, including scholarships and university exchanges for students and teachers.

- ○

Supporting joint cultural festivals to showcase the cultural wealth of each country and enhance tourism attractiveness.

- ○

Encouraging partnerships between educational and technical institutions for skills transfer.

-

Establishing diplomatic relations. Signing a cooperation framework agreement: Negotiating a comprehensive agreement that will define the foundations of diplomatic, economic, trade, and cultural relations between the two countries. This agreement will help prioritize intervention areas and structure monitoring and evaluation mechanisms. Opening diplomatic missions:

- ○

Establishing a Latvian embassy or consulate in Cameroon and vice versa to create an official diplomatic presence, facilitate exchanges, and provide consular support to citizens of both countries.

- ○

Setting up economic and cultural attachés in both countries to promote bilateral relations.

- ○

Strengthening bilateral dialogue through high-level meetings between relevant sectoral, political, diplomatic, and economic leaders to assess the progress of initiatives and identify new opportunities.

7. Discussion

The economic and trade cooperation between Latvia and Cameroon could represents a remarkable example of strategic partnership in a globalized world. By leveraging their respective strengths, these two nations can pave the way for profound and mutually beneficial transformations in key sectors.

Digital transformation, a cornerstone of this partnership, presents an unprecedented opportunity to modernize public and private infrastructures, improve access to essential services, and drive innovation. By relying on Latvia’s advanced technological expertise, Cameroon can accelerate its digitalization process, particularly in areas such as e-government, cybersecurity, and artificial intelligence. This technological leap promises not only to reduce urban-rural disparities but also to create thousands of jobs and strengthen economic resilience.

Renewable energy is another strategic area of collaboration. By combining Latvia’s green technologies with Cameroon’s vast natural resources, this partnership can contribute to sustainable electrification, particularly in rural areas. The energy transition will help reduce dependence on fossil fuels while meeting international climate commitments, offering substantial environmental and economic benefits.

The socio-economic impacts of this cooperation are also significant for both countries. Cameroon will benefit from inclusive growth through optimized agricultural value chains, the creation of new business opportunities, and improved living conditions. Meanwhile, Latvia will gain a strategic market for its technological innovations and exports in Central Africa, consolidating its position as a dynamic European economic player.

Cultural and educational exchanges play a fundamental role in strengthening this bilateral relationship. By promoting academic mobility, intercultural training, and joint initiatives, both countries can deepen mutual understanding and build a solid foundation for lasting and harmonious relations.

Such relations and partnership will likely offer an inspiring vision of inclusive and balanced development, founded on innovation, sustainability, and cultural collaboration. By fully seizing these opportunities and overcoming challenges together, Latvia and Cameroon could not only transform their respective economies but also serve as a model for other nations seeking to establish fruitful cooperation in a constantly evolving world.

8. Conclusions

Latvian companies are re-orienting their trade directions to African continent due to recession on their classical markets like Scandinavia and West Europe. They face a lack of knowledge of African business culture and economic conditions, what is a barrier for their advance venture on the local markets. In order to overcome this barrier, interviews with local experts and industry actors have been guided on the relevant topics of African business practices and economic conditions. Interview’s discovered that the potential for Latvian entrepreneurs in African countries (West-African French-speaking countries with big seaports) is of implicit nature – it is not introduced on the surface yet to be understood from the context. Commercial opportunities for the firms to be revealed from the current state of things, economic situation and to be evaluated by each interested Latvian entrepreneur separately.

Cameroon case study enlightened details of local business environment with example of potential for specific Latvian solutions like e-governance and CO2 emissions' reduction systems. It underlined also an important role of knowing the Cameroonian business communication and cultural context – it is distinguished with coexistence of several sociocultural zones: Muslims, Fang-Ewondo-Beti group, Bamiléké and English-speaking regions with Anglo-Saxon culture and traditions.

Author Contributions

Conceptualization L. Lozova and B. Sloka.; methodology L. Lozova, T.Tabapssi and B.Sloka.; resources L.Lozova, T.Tabapssi and B.Sloka.; writing – original draft preparation L.Lozova, T.Tabapssi and B.Sloka.; writing – review and editing L. Lozova and B. Sloka.; supervision B.Sloka. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Recovery and Resilience Facility project "Internal and External Consolidation of the University of Latvia" (No.5.2.1.1.i.0/2/24/I/CFLA/007).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Samadi, M., Mirnezami, S.R., Khargh, M.T. The impact of organizational capabilities on the international performance of knowledge-based firms. Journal of Open Innovation: Technology, Market, and Complexity 2023, Volume 9, Issue 4, 100163. [CrossRef]

- Kasahara, H., Tang, H. Excessive entry and exit in export markets. Journal of the Japanese and International Economies 2019, Volume 53, 101031.

- Freund, C., Pierola, M.D. Export surges. Journal of Development Economics 2012, Volume 97, Issue 2, pp. 387-395.

- Boehe, D.M., Becerra, M. Market entry into new export markets: When are firms more likely to imitate their competitors’ market presence? International Business Review 2022, Volume 31, Issue 5, 102012.

- Hearn, B. Institutional influences on board composition of international joint venture firms listing on emerging stock exchanges: Evidence from Africa. Journal of World Business 2015, Volume 50, Issue 1, pp. 205-219. [CrossRef]

- Fabling, R., Sanderson, L. Exporting and firm performance: Market entry, investment and expansion. Journal of International Economics 2013, Volume 89, Issue 2, pp. 422-431. [CrossRef]

- Wu, J., Pangarkar, N., Wu, Z. The moderating effect of technology and marketing know-how in the regional-global diversification link: Evidence from emerging market multinationals. International Business Review 2016, Volume 25, Issue 6, pp. 1273-1284.

- Cho, S.-W., Díaz, J.P. The new goods margin in new markets. Journal of Comparative Economics 2018, Volume 46, Issue 1, pp. 78-93.

- Bayramov, V., Breban, D., Mukhtarov, E. Economic effects estimation for the Eurasian Economic Union: Application of regional linear regression. Communist and Post-Communist Studies 2019, Volume 52, Issue 3, pp. 209-225. [CrossRef]

- Ellis, P.D. Paths to foreign markets: Does distance to market affect firm internationalisation? International Business Review 2007, Volume 16, Issue 5, pp. 573-593.

- Hammarlund, C., Andersson, A. What’s in it for Africa? European Union fishing access agreements and fishery exports from developing countries. World Development 2019, Volume 113, pp. 172-185. [CrossRef]

- Bank of Latvia (latv.-Latvijas Banka). The foreign trade scene - recession or normalization? (latv. - Ārējās tirdzniecības aina – recesija vai normalizācija?). 2013. Available online: https://www.makroekonomika.lv/arejas-tirdzniecibas-aina-recesija-vai-normalizacija (accessed on 03.05.2024).

- Orgalim, Europe’s technology industries. Economics & Statistics Report - Autumn 2022. 2022. Available online: https://orgalim.eu/reports/economics-statistics-report-autumn-2022 (accessed on 03.05.2024).

- European Commission. The future of European competitiveness: Report by Mario Draghi (9 and 17 September 2024). 2024. Available online: https://commission.europa.eu/topics/strengthening-european-competitiveness/eu-competitiveness-looking-ahead_en (accessed on 16.10.2024).

- Brkić, A., Spasojević-Brkić, V., Veljkovic, Z. How to overcome exporting barriers and prevent SMEs failure: Serbian and BIH perspective. University of Belgrade, Technical Faculty in Bor, Engineering Management Department (EMD) 2019, pp.97-130. Available online: https://machinery.mas.bg.ac.rs/handle/123456789/4060 (accessed on 13.08.2024).

- African Development Bank. African Economic Outlook 2024. 2024. Available online: https://www.afdb.org/en/knowledge/publications/african-economic-outlook (accessed on 05.02.2025).

- Dohse, D., Fehrenbacher, S., von Carlowitz, P. Developing Potential and Sharing Knowledge: How German Companies Can Gain a Foothold in Africa (ger.-Potenziale entwickeln und Wissen teilen: deutsche Unternehmen in Afrika). Wirtschaftsdienst 2022, Volume 102, pp.563–567.

- World Bank. The World Bank in Africa. 2024. Available online: https://www.worldbank.org/en/region/afr/overview (accessed on 05.02.2025).

- Williams, J.E.M., Chaston, I. Links between the Linguistic Ability and International Experience of Export Managers and their Export Marketing Intelligence Behaviour. International Small Business Journal 2004, Volume 22, Issue 5, pp.463-486. [CrossRef]

- Seka Aba, C. Legal Instruments to Support the Development of African Ports, Private Sector & Development 2017, Volume 26. Available online: www.proparco.fr/en/african-ports-gateway-development (accessed on 30.07.2024).

- Fayomi, O.S.I., Okokpujie, I. P., Kilanko, O. Challenges of Research in Contemporary Africa World. In Proceedings of The 2nd International Conference on Engineering for Sustainable World (ICESW 2018), Covenant University, Nigeria, 9–13 July 2018.

- Goodman, L. A. Comment: On Respondent-driven Sampling and Snowball Sampling in Hard-to-reach Populations and Snowball Sampling Not in Hard-to-reach Populations. Sociological Methodology 2011, Volume 41, pp.347–353. [CrossRef]

- Ministry of Economy, Planning and Regional Development of the Republic of Cameroon (fr., - Ministère de l’Economie du Plan et de l’Aménagement du Territoire, République du Cameroun (MINEPAT)). Republic of Cameroon. Sectoral Strategy for Infrastructure Development 2020-2030 (fr.,- République du Cameroun. Stratégie Sectorielle de développement des Infrastructures 2020-2030). 2019. Avalable online minepat.gov.cm/wp-content/uploads/2022/01/Strategie-de-developpement-du-secteur-des-infrastructures.pdf (accessed on 06.02.2025).

- Nelle, P. Cameroon: The Cultural Code of Business (fr.,-Cameroun : Le Code Culturel Des Affaires). Forbes 2024. Available online: https://forbesafrique.com/cameroun-le-code-culturel-des-affaires/ (accessed on 06.02.2025).

- Nguena, C.L. Directory on Housing Finance in Africa (fr.,- Annuaire sur le Financement du Logement en Afrique). The Economic and Monetary Community of Central Africa (fr.,-La Communauté Economique et Monétaire de L’Afrique Centrale (CEMAC)) 2019. Available online https://housingfinanceafrica.org/fr/documents/annuaire-sur-le-financement-du-logement-en-afrique-2019-profil-de-la-cemac/ (accessed on 06.02.2025).

- Bank of France (fr.,-Banque de France). Annual report on Africa-France monetary cooperation. Cameroon monograph, 2024 (fr.,-Rapport annuel des coopérations monétaires Afrique-France. Monographie Cameroun, 2024). 2024. Available online: https://www.banque-france.fr/system/files/2024-11/CEMAC_Cameroun_2023.pdf# (accessed on 06.02.2025).

- Coface: Cameroon. Country file, economic risk analysis. 2024. Available online : https://www.coface.com/news-economy-and-insights/business-risk-dashboard/country-risk-files/cameroon (accessed on 20.02.2025).

- BNP Paribas Bank. Cameroon: Investments (fr.,-Cameroun : les Investissements). 2024. Available online: https://www.tradesolutions.bnpparibas.com/fr/implanter/cameroun/investissement (accessed on 06.02.2025).

- Coface: Cameroon. Analysis of the business environment and assessment of country risks in Cameroon (Fr., Cameroun. Analyse de l'environnement des affaires et appréciation des risques pays du Cameroun). 2024. Available online : https://www.coface.com/fr/actualites-economie-conseils-d-experts/tableau-de-bord-des-risques-economiques/fiches-risques-pays/cameroun (accessed on 16.02.2025).

-

Economic Outlook for Africa: Driving Africa’s Transformation through Reform of the Global Financial Architecture (fr., - Perspectives économiques en Afrique : impulser la transformation de l’Afrique par la réforme de l’architecture financière mondiale). 2024. Available online : https://www.afdb.org/fr/documents-publications/perspectives-economiques-en-afrique-2024 (accessed on 16.02.2025).

-

Cameroon Country Report: Mobilizing Private Sector Financing for Climate and Green Growth (fr., -Rapport pays Cameroun: mobiliser les financements du secteur privé en faveur du climat et de la croissance verte). 2023. Available online: https://www.afdb.org/sites/default/files/documents/publications/cfr_cameroun_2023_0.pdf (accessed on 14.02.2025).

- Official Statistics Portal of Latvia data. Exports and imports by countries (CN at 2-digit level) 2005 - 2024. Database data ATD020. 2025. Available online: https://data.stat.gov.lv/pxweb/en/OSP_PUB/START__TIR__AT__ATD/ATD020/sortedtable/tableViewSorted/ (accessed on 06.02.2025).

- European Commission. Economic partnership agreements (fr.,-Accords de partenariat économique (APE). 2016. Available online: https://trade.ec.europa.eu/access-to-markets/fr/content/ape-afrique-centrale (accessed on 06.02.2025).

- Motongane, C.A. Digital In Cameroon (fr.,-Le Numérique Au Cameroun). INTERMINES Mining Support Federation (fr.,-Fédération de support minière INTERMINES), 2024. Available online: https://inter-mines.org/fr/article/le-numerique-au-cameroun/21/03/2024/2780 (accessed on 06.02.2025).

- Motongane, C.A. Digital In Cameroon (fr.,-Le Numérique Au Cameroun). INTERMINES Mining Support Federation (fr.,-Fédération de support minière INTERMINES), 2024. Available online: https://inter-mines.org/fr/article/le-numerique-au-cameroun/21/03/2024/2780 (accessed on 06.02.2025).

- Ministry of Smart Administration and Region Development, Republic of Latvia (latv.,- Viedās administrācijas un reģionālās attīstības ministrija, Latvijas Republika). Latvia Continues to Lead in Public Service Digitization and e-Identity Usage within the EU (latv., - Latvija turpina būt starp ES līderiem publisko pakalpojumu digitalizācijā un elektroniskās identitātes izmantošanā). 2024. Available on-line: https://www.varam.gov.lv/lv/jaunums/latvija-turpina-starp-es-lideriem-publisko-pakalpojumu-digitalizacija-un-elektroniskas-identitates-izmantosana (accessed on 20.02.2025).

- Interoperable Europe Portal. European Commission report. Digital Government Factsheets - Latvia. 2019. Available online:https://interoperable-europe.ec.europa.eu/sites/default/files/inline-files/Digital_Government_Factsheets_Latvia_2019.pdf (accessed on 20.02.2025).

- Andzongo, S. In Cameroon, cybercrime causes the economy to lose 12.2 billion FCFA in 2021 (Antic)(fr.,-Au Cameroun, la cybercriminalité fait perdre 12,2 milliards de FCFA à l’économie en 2021 (Antic)). Invest in Cameroon (fr.,-Investir au Cameroun) 2022. Available online: https://www.investiraucameroun.com/gestion-publique/0703-17600-au-cameroun-la-cybercriminalite-fait-perdre-12-2-milliards-de-fcfa-a-l-economie-en-2021-antic (accessed on 06.02.2025).

- Bonny A. Cybercrime: more than12 billion CFA francs lost in 2021, major risks in Cameroon. (Fr., Cybercriminalité: plus de 12 milliards de FCFA perdus en 2021, risques majeurs au Cameroun. CIO-MAG 2022. Available online : https://cio-mag.com/cybercriminalite-plus-de-12-milliards-de-fcfa-perdus-en-2021-risques-majeurs-au-cameroun/ (accessed on 10.02.2025).

- Njoya, S. Cameroon develops a national strategy for Artificial Intelligence (fr.,-Le Cameroun élabore une stratégie nationale d’Intelligence Artificielle). We are tech.africa 2025. Available online https://www.wearetech.africa/fr/fils/actualites/tech/le-cameroun-elabore-une-strategie-nationale-d-intelligence-artificielle (accessed on 06.02.2025).

- Latvian National energy and climate plan (NECP) 2021-2030. 2024. Available online: https://commission.europa.eu/publications/latvia-final-updated-necp-2021-2030-submitted-2024_en (accessed on 20.02.2025).

- The New European “Bauhaus” Statement (latv., - Jaunā Eiropas “Bauhaus” paziņojums). European Commission. 2021. Available online: https://latvia.representation.ec.europa.eu/jaunumi/jauna-eiropas-bauhaus-pazinojums-2021-09-15_lv#:~:text=Jaun%C4%81%20Eiropas%20%E2%80%9CBauhaus%E2%80%9D%20iniciat%C4%ABvas%20m%C4%93r%C4%B7is%20ir%20rad%C4%ABt%20jaunu,vienlaikus%20respekt%C4%93jot%20Eirop%C4%81%20un%20%C4%81rpus%20t%C4%81s%20eso%C5%A1o%20daudzveid%C4%ABbu (accessed on 20.02.2025).

- Latvian Union of Civil Engineers (latv.,-Latvijas Būvinženieru savienība), The creation of the European Bauhaus initiative has begun (latv.,- Sākta Eiropas “Bauhaus” iniciatīvas izveide). 2021. Available online: https://buvinzenierusavieniba.lv/sakta-eiropas-bauhaus-iniciativas-izveide (last seen 20.02.2025).

- Official Statistics Portal of Latvia data. Air emission accounts (NACE Rev. 2) 2000 – 2022. Database data GPE010. 2024. Available online: https://data.stat.gov.lv/pxweb/en/OSP_PUB/START__ENV__GP__GPE/GPE010/ (accessed on 20.02.2025).

- Japan World Bridge: Cameroon's natural and economic resources (fr., - Les ressources naturelles et économiques du Cameroun). 2025. Available online: (https://japanworldbridge.org/portfolio-item/ressources-naturelles-du-cameroun/ (Accessed on 06.02.2025).

- Ministry of Economy, Planning and Regional Development of the Republic of Cameroon (fr., - Ministère de l’Economie du Plan et de l’Aménagement du Territoire, République du Cameroun (MINEPAT)). Republic of Cameroon. Sectoral Strategy for Infrastructure Development 2020-2030 (fr.,- République du Cameroun. Stratégie Sectorielle de développement des Infrastructures 2020-2030). 2019. Avalable online minepat.gov.cm/wp-content/uploads/2022/01/Strategie-de-developpement-du-secteur-des-infrastructures.pdf (accessed on 06.02.2025).

- Republic of Cameroon: Report on the economic, social, and financial situation and prospects of Cameroon. Ministry of Finance - Yaoundé. (Fr., Rapport sur la situation et les perspectives économiques, sociales, et financières du Cameroun. Ministère des Finances - Yaoundé). 2022. Available online : https://minfi.gov.cm/wp-content/uploads/2023/03/REF_2022_FR.pdf, accessed on 25.02.2025.

- Invest in Cameroon; edition of Friday, February 2. (Fr., Investir au Cameroun; édition du vendredi 02 février). 2024. Available online: https://www.investiraucameroun.com/energie/0202-20271-le-cameroun-mise-sur-l-amelioration-de-l-offre-energetique-pour-porter-la-croissance-hors-petrole-a-7-6-d-ici-2026, accessed on 25.02.2025.

- BNP Paribas Bank. Cameroon: Foreign Direct Investments in figures (fr.,-Cameroun : les Investissements Directs Etrangers en chiffre). 2025. Available online: https://www.tradesolutions.bnpparibas.com/fr/implanter/cameroun/investissement (accessed on 12.02.2025).

- Presidency of the Republic of Cameroon: Decree of the President of the Republic of August 3, 2016, setting the rules of origin and methods of administrative cooperation applicable to goods from the European Union within the framework of the step towards the Economic Partnership Agreement (EPA). (fr., - Décret du président de la République du 03 août 2016 fixant les règles d’origine et les méthodes de coopération administrative applicables aux marchandises de l’Union Européenne dans le cadre de l’accord d’étape vers l’Accord de Partenariat Economique (APE). 2016. Available online : https://prc.cm/fr/multimedia/documents/4756-decret-n-2016-367-du-03-08-2016-ape (accessed on 14.02.2025).

- Chamber of Commerce, Industry, Mines, and Crafts of Cameroon (CCIMA) (fr., - Chambre de Commerce, de l’Industrie, des Mines et de l’Artisanat du Cameroun (CCIMA). Available online: https://ccima.cm/ (accessed on 25.02.2025).

- BNP Paribas Bank. Cameroon: Investments (fr.,-Cameroun : les Investissements). 2024. Available online: https://www.tradesolutions.bnpparibas.com/fr/implanter/cameroun/investissement (accessed on 06.02.2025).

- Nelle, P. Cameroon: The Cultural Code of Business (fr.,-Cameroun : Le Code Culturel Des Affaires). Forbes 2024. Available online: https://forbesafrique.com/cameroun-le-code-culturel-des-affaires/ (accessed on 06.02.2025).

- Tabapssi, T. Vernacular education and productive accumulation of Bamiléké migrants from Cameroon (fr.,-Éducation vernaculaire et accumulation productive des migrants bamiléké du Cameroun). Présence Africaine 2005, 172, pp.23-50.

Figure 1.

Sectors developing most intensively in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 1.

Sectors developing most intensively in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 2.

Most necessary infrastructure objects to be built in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 2.

Most necessary infrastructure objects to be built in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 3.

Average budget of an industrial project in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 3.

Average budget of an industrial project in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 4.

Main problems/obstacles to launch a factory in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 4.

Main problems/obstacles to launch a factory in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 5.

Main sources of energy in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 5.

Main sources of energy in 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 6.

Importance of a non-colonial past in years 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Figure 6.

Importance of a non-colonial past in years 2024-2025 in West-African French-speaking countries with big seaports (Senegal, Guinea, Ivory Coast, Togo, Benin, Cameroon). Source: Information obtained by Ludmila Lozova in interviews.

Table 1.

Economic strengths and weakness of Cameroon in 2025.

Table 1.

Economic strengths and weakness of Cameroon in 2025.

| Strengths |

Weaknesses |

Government Corrective Measures |

Extended political stability. Affordable labor force. Abundant natural resources (agriculture, oil, mining). Developing gas capacities. Strong hydroelectric potential. Diversified export-oriented economy. Infrastructure projects (ports, roads, railways) supported by bilateral and multilateral partners. Monetary stability through the CFA Franc pegged to the Euro. Major player in CEMAC and ECCAS (Economic Community of Central African States). Foreign investors can hold 100% ownership of businesses. |

Complex business environment (167th out of 190 in the 2020 Doing Business ranking). Poor governance and corruption. Insufficient public revenue mobilization (14.5% of GDP in 2023). Infrastructure deficits (transport, energy, water access, sanitation). Insecurity in the North due to Boko Haram terrorist threats from neighboring Nigeria. Anglophone crisis in the North-West and South-West regions with separatist tendencies. Uncertainty regarding the outcome of the October 2025 presidential elections and the potential succession of President Paul Biya, in power since 1982. Dependence on food imports and exposure to external shocks. |

Prioritization of investments in key sectors: transport, agro-industry, tourism, rural development. Infrastructure development efforts, energy supply improvement, administrative procedure simplifications. Creation of free zones offering fiscal and economic benefits to exporting companies (tax exemptions, unrestricted currency transfers, tax reduction after 10 years, etc.). |

Table 2.

Trend of Cameroon key indicators in percentage (%).

Table 2.

Trend of Cameroon key indicators in percentage (%).

| Economic indicators |

2022 |

2023 |

2024 (f) |

2025 (f) |

| GDP growth |

3,6 |

3,8 |

4,1 |

4,4 |

| Inflation, average consumer prices |

6,3 |

7,4 |

6,3 |

4,3 |

| Budget balance/GDP |

-1,1 |

-0,9 |

-0,5 |

-0,2 |

| Current account balance/GDP |

-3,4 |

-2,7 |

-1,9 |

-1,6 |

| Public debt/GDP |

45,3 |

41,8 |

41 |

35,4 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).