Submitted:

15 March 2025

Posted:

17 March 2025

You are already at the latest version

Abstract

Keywords:

1. Introduction and Motivation

2. Literature Review and Hypotheses

2.1. Supply Chain Disruption Mitigation Mechanism Studies

2.1.1. Technology

2.1.2. FinTech Solutions

2.1.3. Firm Characteristics

2.1.4. Case Studies

2.2. Information Asymmetry

2.3. Risk Scoring Models

2.4. Hypotheses

3. Research Methodology and Data Collection

3.1. Research Modelling

3.1.1. Linear Modeling

3.1.2. Bayesian Estimation

3.2. Data Description

4. Findings and Discussion

4.1. Linear Risk-Return Relationship: OLS and Bayesian

4.1.1. Risk and Return on Ordinary Least Squared Models

4.1.2. Risk and Return on Bayesian Models

4.2. Risk Assessment and Profitability by Industry

5. Conclusions and Extensions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

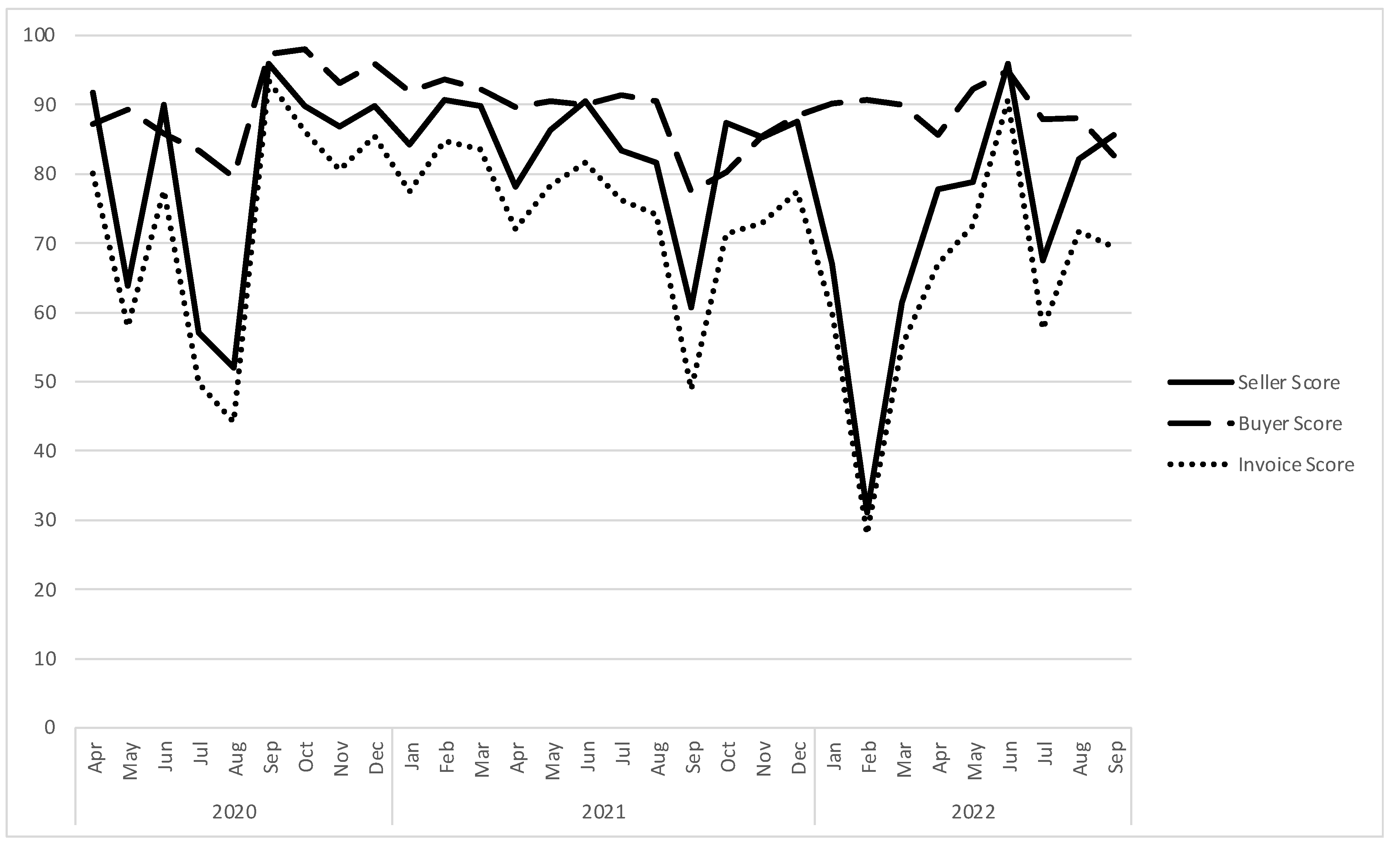

- Scores are initially computed based on external business-credit data, including conventional business credit scores and publicly available financial data. This initial scoring is used at the point at which the Crowdz Platform (and hence the Funder) has no specific information about either the Seller of the invoices or of the Obligors on said invoices.

- (a) Accounting and banking data is analyzed to determine the Sellers’ and Obligors’ (i.e., Buyers’) reliability and timing of the payment of their debt obligations, both historically and in real-time.(b) Simultaneously, Seller financial data is fed into a real-time regression model to further pin down payment reliability and timing.

- In like manner as described with regard to Step 2(a) above, Crowdz Platform data is analyzed to determine the Sellers’ reliability and timing of the repayment of funding on their purchased invoices, both globally and on an Obligor-by-Obligor (i.e., Buyer-by-Buyer) basis, both historically and in real-time.

- The use of artificial intelligence (AI), such as through matching of like companies, has been explored but not yet implemented.

| Variable | Description |

|---|---|

| SURF | Invoice SURF Score (Obligor SURF score * Seller SURF score/100) |

| RETURN IRR with SURF IRR without SURF |

Periodic return over the time-period funding to collection = profit/funded amount, in which profit is the difference between repaid amount and funded amount Annual Internal Rate of Return (annualized periodic return) with using CROWDZ SURF score Annual Internal Rate of Return (annualized periodic return) without using CROWDZ SURF score |

| DILUTION RATE | Ratio that captures proportion of the original amount financed = (Invoice Amount-Financed Amount)/Invoice Amount |

| ACTUAL TERM | Actual amount of time over which the financed invoice is paid to the Funder |

| SIZE | Natural log of the invoice amount |

| Variable | SURF | RETURN | IRR with SURF | IRR without SURF | DILUTION RATE | ACTUAL TERM | SIZE |

|---|---|---|---|---|---|---|---|

| SURF | 1 | ||||||

| RETURN | -0.666 | 1 | |||||

| IRR with SURF | -0.796 | 0.666 | 1 | ||||

| IRR without SURF | 0.141 | -0.039 | -0.130 | 1 | |||

| DILUTION RATE | 0.174 | -0.592 | -0.094 | 0.115 | 1 | ||

| ACTUAL TERM | -0.234 | 0.555 | 0.221 | -0.476 | -0.447 | 1 | |

| SIZE | -0.136 | 0.252 | 0.083 | -0.075 | -0.460 | 0.144 | 1 |

| Statistic | IRR without SURF | IRR with SURF | Difference |

|---|---|---|---|

| Mean | 15.39% | 16.91% | 1.53% |

| Standard Error | 0.09% | 0.04% | 0.11% |

| Median | 13.77% | 15.34% | 2.54% |

| Mode | 11.80% | 15.29% | 4.96% |

| Standard Deviation | 12.80% | 5.75% | 14.69% |

| Sample Variance | 0.02 | 0.00 | 0.02 |

| Kurtosis | 27.06 | 71.13 | 18.88 |

| Skewness | -0.65 | 7.59 | 1.32 |

| Range | 199.89% | 84.90% | 204.91% |

| Minimum | -100.00% | 15.00% | -84.69% |

| Maximum | 99.89% | 99.90% | 120.23% |

| Count | 18304 | 18304 | 18304 |

| Confidence Level (95.0%) | 0.00185 | 0.00083 | 0.00213 |

|

|

References

- Sangeetha, M., Hoti, A., Bansal, R., Hasan, M. F., Gajjar, K., & Srivastava, K. (2022). Facilitating artificial intelligence supply chain analytics through finance management during the pandemic crises. Materials Today: Proceedings, 56, 2092-2095. [CrossRef]

- Paul, S., Adhikari, A., & Bose, I. (2022). White knight in dark days? Supply chain finance firms, blockchain, and the COVID-19 pandemic. Information & Management, 59(6), 103661. [CrossRef]

- Sufi, A. (2007). Information asymmetry and financing arrangements: Evidence from syndicated loans. The Journal of Finance, 62(2), 629-668.

- Adrian T, Crump RK, Vogt E., 2019. Nonlinearity and Flight-to-Safety in the Risk-Return Trade-Off for Stocks and Bonds. The Journal of Finance 74 (4):1931–1973.

- Ben Bouheni F., Tewari M., 2023. Common Risk Factors and Risk-Return Trade-off for REITs and Treasuries. Journal of Asset Management, 2023, . [CrossRef]

- Singh, R. P., Singh, R., & Mishra, P. (2021). Does managing customer accounts receivable impact customer relationships, and sales performance? An empirical investigation. Journal of Retailing and Consumer Services, 60, 102460. [CrossRef]

- Hofmann, E., Templar, S., Rogers, D., Choi, T. Y., Leuschner, R., & Korde, R. Y. (2021). Supply chain financing and pandemic: Managing cash flows to keep firms and their value networks healthy. Rutgers Business Review, 6(1), 1-23. Available at SSRN: https://ssrn.com/abstract=3832036.

- Moretto, A., & Caniato, F. (2021). Can Supply Chain Finance help mitigate the financial disruption brought by Covid-19?. Journal of Purchasing and Supply Management, 27(4), 100713. [CrossRef]

- Ağca, Ş., Birge, J. R., Wang, Z. A., & Wu, J. (2023). The impact of COVID-19 on supply chain credit risk. Production and Operations Management, 32(12), 4088-4113. [CrossRef]

- Höhler, J., & Lansink, A. O. (2021). Measuring the impact of COVID-19 on stock prices and profits in the food supply chain. Agribusiness, 37(1), 171-186. [CrossRef]

- Chowdhury, P., Paul, S. K., Kaisar, S., & Moktadir, M. A. (2021). COVID-19 pandemic related supply chain studies: A systematic review. Transportation Research Part E: Logistics and Transportation Review, 148, 102271. [CrossRef]

- Abad, D., Sánchez-Ballesta, J. P., & Yagüe, J. (2017). The short-term debt choice under asymmetric information. SERIEs, 8, 261-285. [CrossRef]

- Barclay, M. J., & Smith Jr, C. W. (1995). The maturity structure of corporate debt. the Journal of Finance, 50(2), 609-631. [CrossRef]

- Stohs, M. H., & Mauer, D. C. (1996). The determinants of corporate debt maturity structure. Journal of business, 279-312. https://www.jstor.org/stable/2353370.

- Berger, A. N., Espinosa-Vega, M. A., Frame, W. S., & Miller, N. H. (2005 a). Debt maturity, risk, and asymmetric information. The Journal of Finance, 60(6), 2895-2923. [CrossRef]

- Diamond, D. W. (1991). Monitoring and reputation: The choice between bank loans and directly placed debt. Journal of political Economy, 99(4), 689-721. [CrossRef]

- Berger, A. N., Frame, W. S., & Miller, N. H. (2005 b). Credit scoring and the availability, price, and risk of small business credit. Journal of money, credit and banking, 191-222.

- Giudici, P. (2010). Scoring models for operational risks. Operational Risk Management: A Practical Approach to Intelligent Data Analysis, 125-135.

- Sabato, G. (2010). Assessing the Quality of Retail Customers: Credit Risk Scoring Models. IUP Journal of Financial Risk Management, 7.

- Berger, A. N., Cowan, A. M., & Frame, W. S. (2011). The surprising use of credit scoring in small business lending by community banks and the attendant effects on credit availability, risk, and profitability. Journal of Financial Services Research, 39, 1-17.

- Altman, E. I. (2018). A fifty-year retrospective on credit risk models, the Altman Z-score family of models and their applications to financial markets and managerial strategies. Journal of Credit Risk, 14(4).

- Szepannek, G., & Lübke, K. (2021). Facing the challenges of developing fair risk scoring models. Frontiers in artificial intelligence, 4, 681915.

- Zdaniuk, B. (2014). Ordinary Least-Squares (OLS) Model. In: Michalos, A.C. (eds) Encyclopedia of Quality of Life and Well-Being Research. Springer, Dordrecht. [CrossRef]

- Montgomery, D. C., Peck, E. A., and Vining, G. G. (2021). Introduction to linear regression analysis (6th ed.). New York: Wiley.

- Ben Bouheni, F., Sidaoui, M., Leshchinskii, D., Zaremba, B. and Albashrawi, M. (2024), "Banking-as-a-service? American and European G-SIBs performance", Journal of Risk Finance, Vol. 25 No. 5, pp. 840-869. [CrossRef]

- McNeish, D. (2016). On using Bayesian methods to address small sample problems. Structural Equation Modeling: A Multidisciplinary Journal 23, 2016 - Issue 5. [CrossRef]

- Hobbs, T., Hooten, MB. 2015. Bayesian Models: A statistical Primer for Ecologists. Princeton University Press. https://www.jstor.org/stable/j.ctt1dr36kz.

- Johnson, A., Ott, M., Dogucu, M. 2022. Bayes rules! An introduction to applied Bayesian modeling. Routledge. https://www.routledge.com/Bayes-Rules-An-Introduction-to-Applied-Bayesian-Modeling/Johnson-Ott-Dogucu/p/book/9780367255398.

- Ben Bouheni, F., Tewari, M. (2022). Over-Optimism, Credit Expansion and Banks’ Risk and Return. Banking and Finance Review 13(1).

- Quigley, D. and Walther, A. (2024), Inside and Outside Information. The Journal of Finance, 79: 2667-2714. [CrossRef]

- Charles, C., Frydman, C. and Kilic, M. (2024), Insensitive Investors. The Journal of Finance, 79: 2473-2503. [CrossRef]

- Ben Bouheni, F., Tewari, M., Sidaoui, M., and Hasnaoui, A. (2023). An Econometric Understanding of Fintech and Operating Performance, Review of Accounting and Finance 22(3), 329-352.

| 1 | See Appendix A1 for SURF methodology. |

| 2 | Proprietary data provided by Crowdz. |

| 3 | Table A1 in Appendix presents the description of variables. |

| 4 | SURF methodology is detailed in Appendix A1. |

| 5 | To replicate the linear estimates, use the following command: regress Y X. Where Y is the dependent variable and X includes one or more independent variables. |

| 6 | To replicate the Bayesian linear regressions, use the following command: bayes: regress Y X. Where Y is the dependent variable and X includes one or more independent variables. |

| 7 | A difference of mean t-test between the IRR with SURF and the IRR without SURF shows a positive difference of 1.53%, significant at 99% level (p-value of 0.002). |

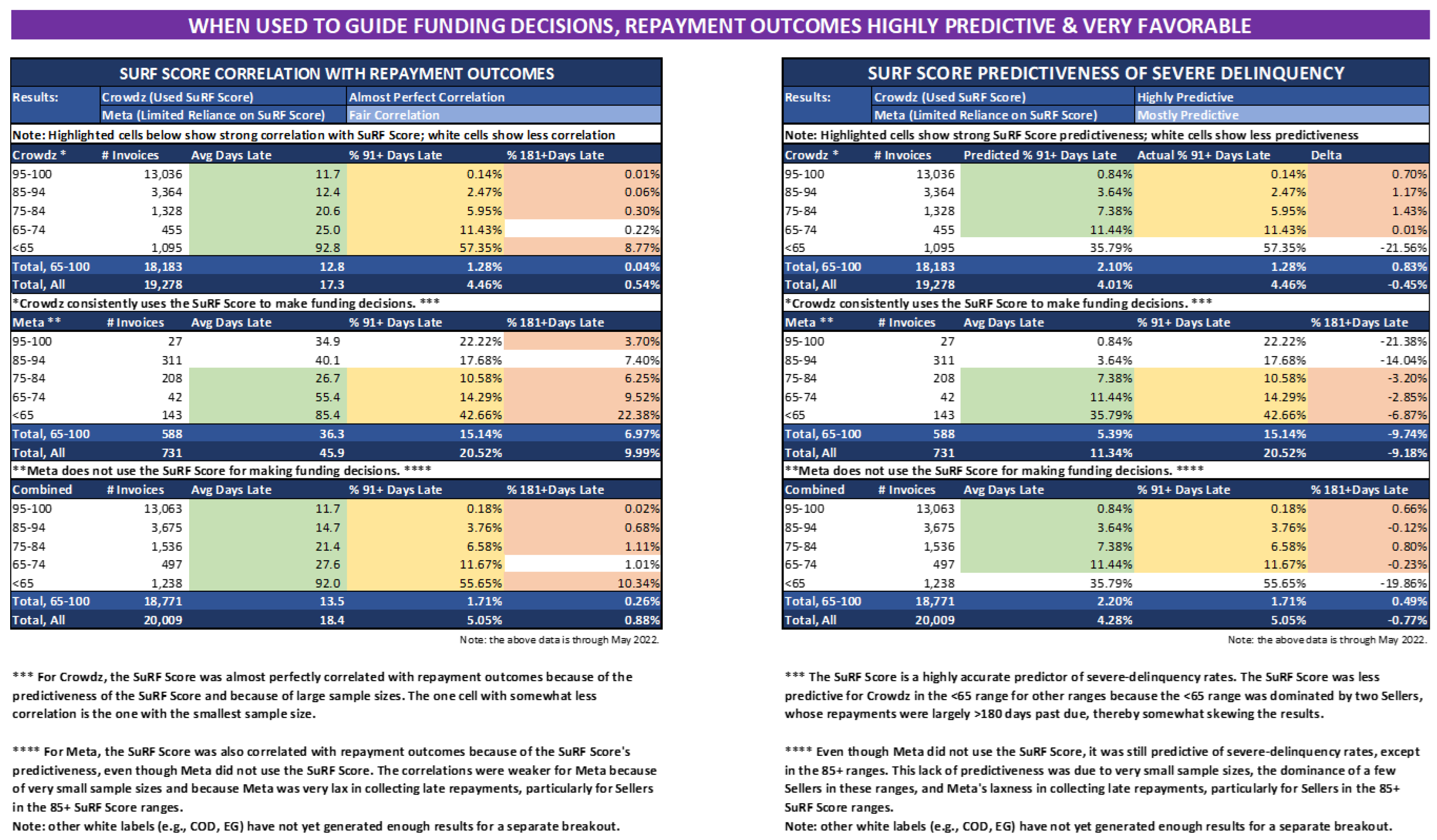

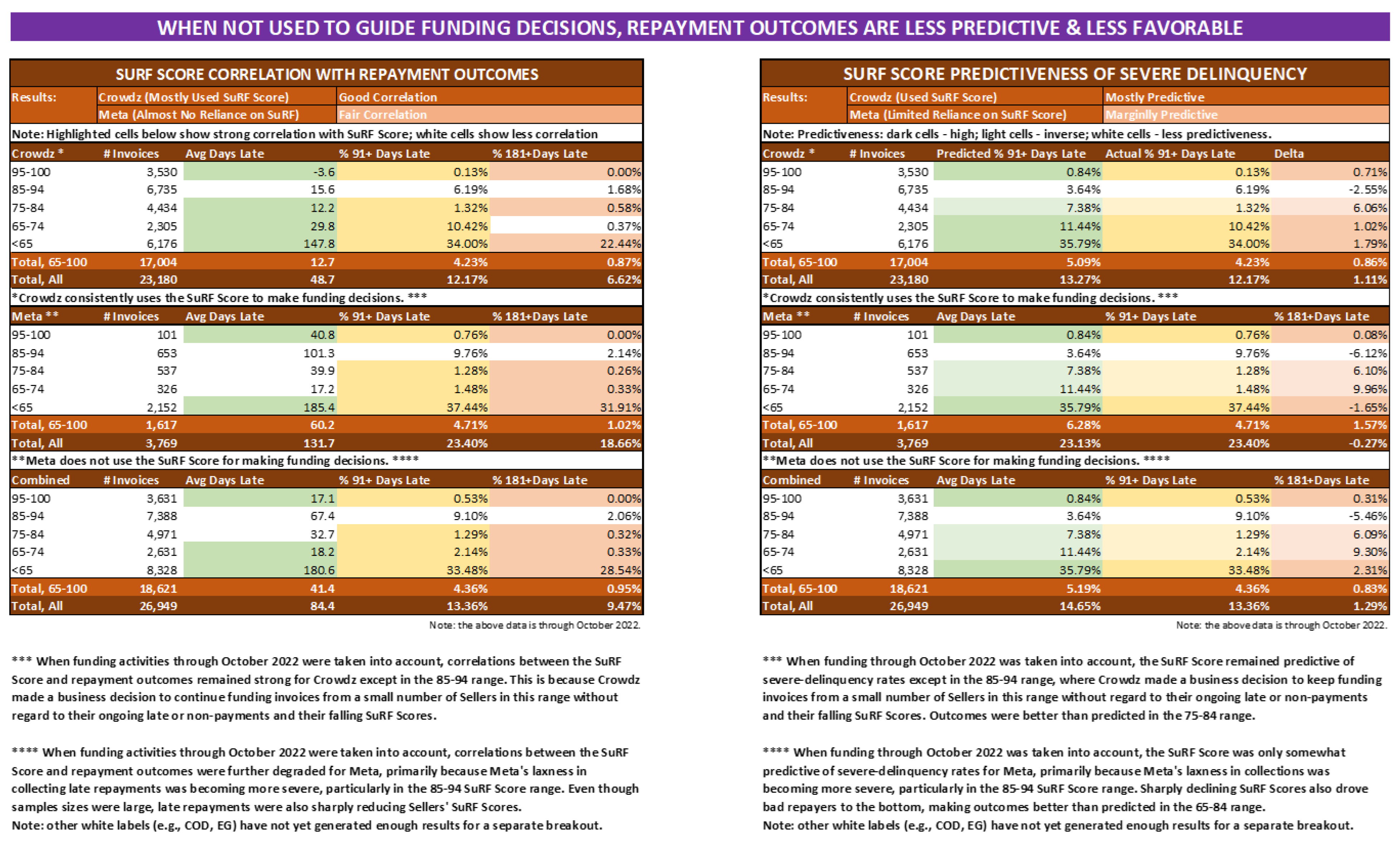

| 8 | Crowdz provided predictability and favorability of payment outcomes analysis and the comparison of receivables transactions on META platform in Appendix Table A4 and Table A5 supplement our findings. When SURF score is used in the transactions, the payment outcomes are highly predictive and very favorable and when SURF score is not used in the transactions, the payment outcomes are less predictive and less favorable. |

| 9 | For risk-pricing and flight to safety theory, see for instance, [4,32]. |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| SURF | 18,304 | 92.077 | 14.247 | 1.575 | 99.977 |

| RETURN | 18,304 | 0.019 | 0.021 | 0.005 | 0.312 |

| IRR with SURF | 18,304 | 0.169 | 0.058 | 0.150 | 0.999 |

| IRR without SURF | 18,304 | 0.154 | 0.128 | -1 | 0.999 |

| DILUTION RATE | 18,304 | 0.135 | 0.046 | 0 | 0.350 |

| ACTUAL TERM | 18,304 | 3.673 | 0.681 | 0 | 6.512 |

| SIZE | 18,304 | 5.396 | 1.435 | -0.282 | 13.144 |

| Full Sample | |||

|---|---|---|---|

|

Variable |

(1) RETURN |

(2) IRR with SURF |

(3) IRR without SURF |

| SURF | -0.001*** (-44.81) |

-0.004*** (-38.59) |

|

| DILUTION RATE | -0.039*** (-16.34) |

0.068*** (10.26) |

0.079** (3.15) |

| ACTUAL TERM | 0.004*** (31.63) |

0.005*** (14.90) |

-0.121*** (-86.93) |

| SIZE | -0.021*** (-49.27) |

0.004*** (6.89) |

-0.075*** (-41.41) |

| CONS | 0.132*** (39.13) |

0.469*** (77.58) |

0.923*** (82.89) |

| N | 18,288 | 18,288 | 18,288 |

| F-Statistics | 77.37 (0.000) |

54.08 (0.000) |

86.50 (0.000) |

| R-Squared | 0.864 | 0.830 | 0.345 |

| Full Sample | ||||||

|---|---|---|---|---|---|---|

| Mean | Std. Dev. | MCSE | Median | [95% Cred. Interval] | ||

|

(1) RETURN | ||||||

| SURF | -0.001 | 0.091 | 0.007 | -0.002 | -0.003 | -0.002 |

| DILUTION RATE | -0.040 | 0.028 | 0.051 | -0.041 | -0.043 | -0.036 |

| ACTUAL TERM | 0.004 | 0.001 | 0.006 | 0.004 | 0.003 | 0.004 |

| SIZE | -0.021 | 0.002 | 0.003 | -0.021 | -0.022 | -0.020 |

| Constant | 0.131 | 0.001 | 0.009 | 0.131 | 0.129 | 0.133 |

| Sigma2 | 0.133 | 0.060 | 0.007 | 0.008 | 0.080 | 0.083 |

| Acceptance Rate | 0.359 | |||||

|

(2) IRR with SURF | ||||||

| SURF | -0.004 | 0.018 | 0.017 | -0.037 | -0.003 | -0.004 |

| DILUTION RATE | 0.065 | 0.025 | 0.076 | 0.065 | 0.060 | 0.070 |

| ACTUAL TERM | 0.005 | 0.034 | 0.015 | 0.049 | 0.004 | 0.006 |

| SIZE | 0.004 | 0.056 | 0.054 | 0.042 | 0.003 | 0.005 |

| Constant | 0.469 | 0.027 | 0.014 | 0.469 | 0.464 | 0.475 |

| Sigma2 | 0.063 | 0.059 | 0.047 | 0.063 | 0.062 | 0.064 |

| Acceptance Rate | 0.324 | |||||

|

(3) IRR without SURF | ||||||

| DILUTION RATE | 0.077 | 0.025 | 0.014 | 0.076 | 0.031 | 0.127 |

| ACTUAL TERM | -0.121 | 0.001 | 0.057 | -0.121 | -0.123 | -0.118 |

| SIZE | -0.075 | 0.018 | 0.071 | -0.075 | -0.078 | -0.072 |

| Constant | 0.923 | 0.011 | 0.046 | 0.922 | 0.902 | 0.943 |

| Sigma2 | 0.011 | 0.012 | 0.056 | 0.013 | 0.011 | 0.012 |

| Acceptance Rate | 0.340 | |||||

| N | 18,288 | 18,288 | 18,288 | 18,288 | 18,288 | 18,288 |

| Panel A. RETURN | |||||

|---|---|---|---|---|---|

| Accommodation & Food Services | Construction | Manufacturing | Professional Scientific & Technical Services | Real Estate, Rentals & Leasing | |

| SURF | -0.016*** (-5.41) |

-0.024*** (-8.45) |

-0.033*** (-27.55) |

-0.036*** (-13.11) |

-0.058*** (-87.69) |

| DILUTION RATE | 0.052*** (7.15) |

-0.007 (- 0.76) |

-0.091*** (-20.52) |

0.058*** (8.06) |

-0.005* (-1.85) |

| ACTUAL TERM | 0.005*** (9.91) |

0.005*** (8.89) |

0.004*** (18.86) |

0.002*** (4.50) |

0.001*** (12.09) |

| SIZE | -0.026*** (-30.67) |

-0.025*** (-26.61) |

-0.019*** (-48.48) |

-0.018*** (-20.81) |

-0.010*** (-52.39) |

| CONS | 0.124*** (29.68) |

0.136*** (27.61) |

0.131*** (73.92) |

0.117*** (30.50) |

0.112*** (41.15) |

| N | 1,089 | 1,231 | 7,081 | 575 | 8,027 |

| F-Statistics | 62.98 (0.000) |

93.49 (0.000) |

87.39 (0.000) |

77.35 (0.000) |

78.92 (0.000) |

| R-Squared | 0.885 | 0.834 | 0.848 | 0.876 | 0.874 |

| Panel B. IRR with SURF | |||||

| Accommodation & Food Services | Construction | Manufacturing | Professional Scientific & Technical Services | Real Estate, Rentals & Leasing | |

| SURF | -0.049*** (-44.74) |

-0.087*** (-48.81) |

-0.059*** (-24.13) |

-0.036*** (-25.71) |

-0.039*** (-12.83) |

| DILUTION RATE | 0.024 (1.00) |

0.111*** (4.49) |

0.061*** (5.74) |

0.196*** (5.23) |

0.049** (3.14) |

| ACTUAL TERM | 0.070*** (4.11) |

0.043** (2.68) |

0.042*** (8.20) |

0.041 (1.59) |

0.044*** (9.40) |

| SIZE | 0.089** (3.00) |

0.042 (0.02) |

0.015* (1.62) |

-0.027 (-0.59) |

0.010*** (10.27) |

| CONS | 0.518*** (36.15) |

0.500*** (35.75) |

0.470*** (110.74) |

0.475*** (24.08) |

0.462*** (111.40) |

| N | 1089 | 1231 | 7081 | 575 | 8027 |

| F-Statistics | 76.36 (0.000) |

84.76 (0.000) |

67.75 (0.000) |

31.65 (0.000) |

43.34 (0.000) |

| R-Squared | 0.793 | 0.822 | 0.829 | 0.754 | 0.820 |

| Panel C. IRR without SURF | |||||

| Accommodation & Food Services | Construction | Manufacturing | Professional Scientific & Technical Services | Real Estate, Rentals & Leasing | |

| DILUTION RATE | -0.177** (-3.03) |

0.166* (1.95) |

0.278*** (5.52) |

0.600*** (6.81) |

0.154** (3.05) |

| ACTUAL TERM | -0.120*** (-26.10) |

-0.110*** (-17.83) |

-0.105*** (-37.21) |

-0.117*** (-18.64) |

-0.142*** (-93.52) |

| SIZE | -0.059*** (-9.45) |

-0.086*** (-10.89) |

-0.080*** (-20.56) |

-0.044*** (-5.58) |

-0.053*** (-25.51) |

| CONS | 0.881*** (22.64) |

0.932*** (17.40) |

0.851*** (36.25) |

0.684*** (14.18) |

0.888*** (66.06) |

| N | 1089 | 1231 | 7081 | 575 | 8027 |

| F-Statistics | 76.59 (0.000) |

87.78 (0.000) |

93.45 (0.000) |

66.97 (0.000) |

98.76 (0.000) |

| R-Squared | 0.420 | 0.345 | 0.358 | 0.550 | 0.634 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).