Introduction

Corporate governance has emerged as a critical determinant of firm performance and sustainability, particularly in emerging markets where institutional frameworks continue to evolve. Among various governance dimensions, board composition—precisely gender diversity—has attracted significant scholarly and policy attention in recent years. The case of Saudi Arabia presents a compelling context for examining this relationship as the Kingdom undergoes unprecedented economic and social transformation under its Vision 2030 initiative (Alsharif & Bashir, 2023; Saudi Vision, 2023).

Historically, Saudi Arabia has maintained conservative social norms that limit women's participation in the workforce, especially in leadership positions. However, recent reforms have dramatically altered this landscape, with the government actively promoting female economic empowerment as part of its broader strategy to diversify the economy beyond its reliance on oil. These changes raise important questions about the economic implications of increased female representation in corporate leadership within a traditionally male-dominated business environment.

This study contributes to the growing literature on board gender diversity and firm performance by focusing on Saudi Arabia during this critical transition period. While previous research has extensively examined this relationship in developed markets, evidence from emerging economies—particularly those with distinct cultural and institutional characteristics—remains limited. Our analysis of 180 Saudi firms in 2023 reveals that despite women occupying board positions in only 20% of the sample, their presence correlates positively with multiple performance metrics, including ROA, ROE, ROIC, and Tobin's Q.

Our study addresses several gaps in the literature. First, it provides empirical evidence on the economic value of board gender diversity in a conservative emerging market undergoing liberalization. Second, it examines this relationship across multiple performance measures, providing a comprehensive assessment of how diversity impacts various aspects of firm success. Finally, it generates insights that can inform the ongoing policy debate on governance reforms in Saudi Arabia and similar contexts.

The remainder of this paper is organized as follows:

Section 2 reviews the relevant literature and develops hypotheses;

Section 3 describes data and methodology;

Section 4 presents the empirical results;

Section 5 discusses the findings;

Section 6 highlights recommendations and implications of our findings;

Section 7 outlines limitations and directions for future research; and

Section 8 draws conclusions.

2. Literature Review, Theoretical Background, and Hypotheses

2.1 Board Gender Diversity and Firm Performance

The relationship between board gender diversity and firm performance has garnered substantial attention in corporate governance literature, yielding mixed empirical evidence. Several studies document positive associations between female board representation and various performance metrics. Terjesen and Sealy (2024) find that firms with more women on their boards exhibit superior Tobin's Q values. Similarly, Campbell and Mínguez-Vera (2008) report that Spanish companies with gender-diverse boards demonstrate enhanced firm value. Moreover, Post and Byron (2015, 2023), in their meta-analysis of 140 studies, concluded that female board representation is positively related to accounting returns and that this relationship is stronger in countries with greater gender parity. In summary, Empirical evidence suggests that female directors often exhibit greater risk aversion (Faccio & al., 2016), stronger ethical orientation (Ibrahim & Angelidis, 1994; Setó-Pamies & Lozano, 2024), and enhanced corporate social responsibility (Bear & al., 2010), which may be particularly valuable in enhancing profitability.

Conversely, other scholars report neutral or adverse effects. Adams and Ferreira (2009) observe that while gender-diverse boards allocate more effort to monitoring, the average impact on firm performance is negative, particularly for well-governed firms where additional monitoring may be counterproductive. Ahern and Dittmar (2012) document a significant decline in Tobin's Q following Norway's implementation of a mandatory gender quota, attributing this decline to the presence of younger and less experienced boards. Other studies found mixed evidence. Hoobler et al. (2018) reviewed 78 studies and found that gender diversity correlates with social performance) but not consistently with financial metrics. Liu (2021) demonstrated that in China’s male-dominated corporate culture, gender-diverse boards initially encounter resistance, resulting in short-term performance declines despite the long-term benefits of innovation. These conflicting findings suggest that contextual factors, including institutional environment, cultural norms, and firm characteristics, may moderate the relationship between board diversity and performance outcomes (Adams, 2024).

2.2 Theoretical Frameworks

Several theoretical perspectives inform our understanding of how board gender diversity affects firm performance, particularly in emerging markets such as Saudi Arabia.

Agency theory (Jensen & Meckling, 1976) suggests that diverse boards may enhance monitoring effectiveness and mitigate agency problems. Female directors often demonstrate greater independence from traditional networks (Adams & Ferreira, 2009), which may improve management oversight and reduce information asymmetry. In the Saudi context, where family ownership and control remain prevalent, the introduction of female directors may disrupt entrenched power structures and enhance board independence (Al-Hussainan & Kamal, 2024).

Resource dependence theory (Pfeffer & Salancik, 1978) posits that boards are critical boundary spanners, connecting firms to external resources. Gender-diverse boards may access broader networks, provide legitimacy with diverse stakeholders, and offer varied perspectives that enhance strategic decision-making (Hillman & al., 2007). For Saudi firms navigating economic diversification and international integration, female directors may bring valuable insights into untapped markets, particularly those where women constitute significant consumer segments.

The Upper Echelons Theory (Hambrick & Mason, 1984) posits that organizational outcomes, including profitability, are shaped by the cognitive frameworks and demographic characteristics of top executives. Applied to board gender diversity, the theory suggests that women directors bring distinct perspectives, risk management approaches, and decision-making styles, which can enhance board deliberations and reduce groupthink. For example, diverse boards may prioritize long-term sustainability and stakeholder engagement, which can potentially lead to improved innovation and risk mitigation. However, the theory also acknowledges that the impact depends on contextual factors such as board dynamics and organizational culture. If gender diversity leads to tokenism (Kirsch, 2023) or clashes in hierarchical settings (Post et al., 2020), it may hinder cohesion, delaying decisions or escalating conflicts, thereby neutralizing or negatively affecting profitability. Thus, while diversity introduces valuable cognitive variety, its ultimate effect on profitability is contingent on how well these differences are integrated and leveraged within the board’s strategic processes.

2.3 The Saudi Arabian Context

Saudi Arabia presents a unique institutional setting for examining the relationship between diversity and performance. Historically characterized by conservative social norms and limited female economic participation, the Kingdom has recently embarked on ambitious reforms under Vision 2030, which explicitly aims to increase women's workforce participation from 22% to 30% (Saudi Vision 2030, 2016, 2023). These reforms have coincided with significant governance changes, including the 2015 decision to allow women to vote and run as candidates in municipal elections and the 2018 lifting of the ban on women driving.

Despite these advances, female representation in corporate leadership remains limited. Cultural barriers, limited networking opportunities, and stereotypical perceptions hinder women's advancement to board positions (Aladwey & Alsudays, 2023). However, Rao and Tilt (2016) suggest that in contexts where female representation is nascent, even modest increases in gender diversity may yield substantial benefits by introducing novel perspectives and challenging groupthink.

2.4 Hypotheses Development

Drawing on these theoretical frameworks and contextual considerations, we develop several hypotheses regarding the relationship between board gender diversity and firm performance in Saudi Arabia.

First, agency theory suggests that female directors may enhance monitoring effectiveness, particularly in environments with weak shareholder protections. As Saudi Arabia continues to strengthen its corporate governance framework, introducing female directors may complement these reforms by enhancing board independence and oversight. Therefore, the following hypothesis can be drawn:

H1: Board gender diversity is positively associated with firm profitability (ROA, ROE, and ROIC) in Saudi Arabian firms.

Second, resource dependence theory suggests that female directors may offer access to unique resources and perspectives, thereby enhancing strategic decision-making. As Saudi firms navigate economic diversification and increased global competition, these diverse viewpoints may prove particularly valuable. Consequently:

H2: Board gender diversity is positively associated with market valuation (Tobin's Q) in Saudi Arabian firms.

Finally, the institutional context suggests that firm characteristics may moderate the benefits of gender diversity. Specifically, larger firms with greater international exposure may be more receptive to diverse leadership and better positioned to leverage the advantages of gender diversity. Thus:

H3: The positive relationship between board gender diversity and firm performance is more potent in larger firms and those with greater foreign ownership.

By testing these hypotheses, we aim to contribute to the understanding of how board gender diversity affects firm performance in emerging markets undergoing significant institutional transformation.

3. Data and Methodology

3.1 Sample Selection and Data Sources

This study examines the relationship between board gender diversity and firm performance in Saudi Arabia. Our sample consists of 180 firm observations for 2023 from publicly listed companies on the Saudi Stock Exchange (Tadawul). The data encompasses multiple industries, providing a comprehensive view of the Saudi corporate landscape during a period of significant economic and social transformation, as outlined in Vision 2030.

Financial and accounting data were collected from Tadawul, which compiles information from companies' annual reports, financial statements, and corporate governance disclosures. Board composition data, including information on gender diversity, were hand-collected from company annual reports, corporate governance reports, and official company websites. To ensure data accuracy, we cross-validated information using multiple sources where possible.

3.2 Variable Definitions

3.2.1 Dependent Variables

We employ multiple measures of firm performance to capture different dimensions of corporate success:

1. Return on Assets (ROA): Calculated as net income divided by total assets, this ratio measures a firm's efficiency in utilizing its assets to generate profits.

2. Return on Equity (ROE): Calculated as net income divided by shareholders' equity, this metric measures a firm's profitability from a shareholder's perspective.

3. Return on Invested Capital (ROIC): Defined as net operating profit after taxes divided by invested capital, this measure evaluates a firm's efficiency in allocating capital to profitable investments.

4. Tobin's Q (Q_TOBIN): Calculated as the ratio of a firm's market value to the replacement cost of its assets, this forward-looking measure reflects market perceptions of a firm's growth opportunities and overall value.

3.2.2 Independent Variables

Our primary independent variable of interest is Board Gender Diversity (WOMEN): This binary variable takes the value of 1 if at least one woman serves on the board of directors and zero otherwise. This approach is appropriate given the nascent stage of female board representation in Saudi Arabia, where the presence of even one female director represents a significant departure from traditional governance practices.

3.2.3 Control Variables

To account for potential confounding factors, we include several control variables that prior literature has identified as determinants of firm performance:

1. Firm Size (SIZE): Measured as the natural logarithm of total assets, controlling for economies of scale and resource availability.

2. Foreign Ownership (FO): Measured as the percentage of shares owned by foreign investors, controlling for potential monitoring effects and international governance practices.

3. Leverage (DEBT_EQUITY): Calculated as the ratio of total debt to shareholders' equity, capturing financial risk and capital structure effects.

4. Board Independence (INDEP): Calculated as the proportion of independent directors on the board, controlling for broader governance quality.

5. Women in Top Management (WTOM): Measured as the proportion of women in the top management team, distinguishing between board diversity and executive diversity effects.

3.3 Empirical Models

To test our hypotheses regarding the relationship between board gender diversity and firm performance, we employ the following multivariate simple regression model:

Where

represents one of our four performance measures (ROA, ROE, ROIC, or Tobin's Q) for firm

i. The coefficient of primary interest is

, which captures the relationship between female board representation and firm performance.

represents the control variables.

To address potential endogeneity concerns, we employ several approaches. First, we use robust standard errors to mitigate heteroskedasticity issues. Second, we conduct quantile regressions to examine whether the relationship between gender diversity and firm performance varies across different performance distributions.

Additionally, we test for interaction effects to examine whether the relationship between board gender diversity and firm performance is moderated by firm characteristics, such as size and foreign ownership, as specified in our Hypothesis 3.

3.4 Descriptive Statistics

Analyzing these 180 companies listed on the Saudi stock market reveals important insights into their financial performance and corporate governance structures, as shown in

Table 1.

The profitability indicators demonstrate considerable variation across the sample. Return on Assets (ROA) averages 4.08%, ranging from a minimum of -24.69% to a maximum of 23.1%, with a standard deviation of 7.35%. This substantial dispersion indicates significant performance differences among Saudi-listed companies. On the other hand, the Return on Equity (ROE) averages 10.12%, with a range of -57.33% to an undisclosed maximum value and a standard deviation of 20.2%. The Return on Invested Capital (ROIC) follows a similar pattern with a mean of 7.77% and considerable variability (standard deviation of 15.5%).

Foreign ownership (FO) in these companies averages 6.3%, suggesting relatively modest foreign control in the Saudi market compared to other emerging economies. The range extends from 0% to 22.02%, indicating that while some companies have no foreign ownership, others maintain substantial foreign influence.

As measured by the debt-to-equity ratio (DEBT_EQUITY), the capital structure of Saudi companies has an average of 0.695, indicating that they generally maintain moderate leverage. However, the wide range (0 to an undisclosed maximum) and standard deviation (0.911) indicate diverse financing strategies across firms.

Regarding corporate governance, board independence (INDEP) averages approximately 39.9%, with values ranging from 0% to 77.78% at the upper quartile. This suggests that many Saudi companies maintain boards with a substantial proportion of independent directors.

The presence of women in top management (WTOM) is notably low, with an average of just 2.66% and a median of 0%. This suggests that gender diversity in executive positions remains limited in the Saudi market despite recent national initiatives aimed at increasing women's participation in the workforce.

Company size (SIZE), measured as the natural logarithm of total assets, averages 21.86, with relatively modest dispersion (standard deviation of 1.89), indicating a somewhat homogeneous sample in terms of company scale.

Finally, Tobin's Q ratio, a market-based performance measure, averages 1.68, ranging from 0.12 to an undisclosed maximum. This indicates that, on average, Saudi companies are valued by the market at a premium to their book value, suggesting positive growth expectations.

3.5 Correlation analysis

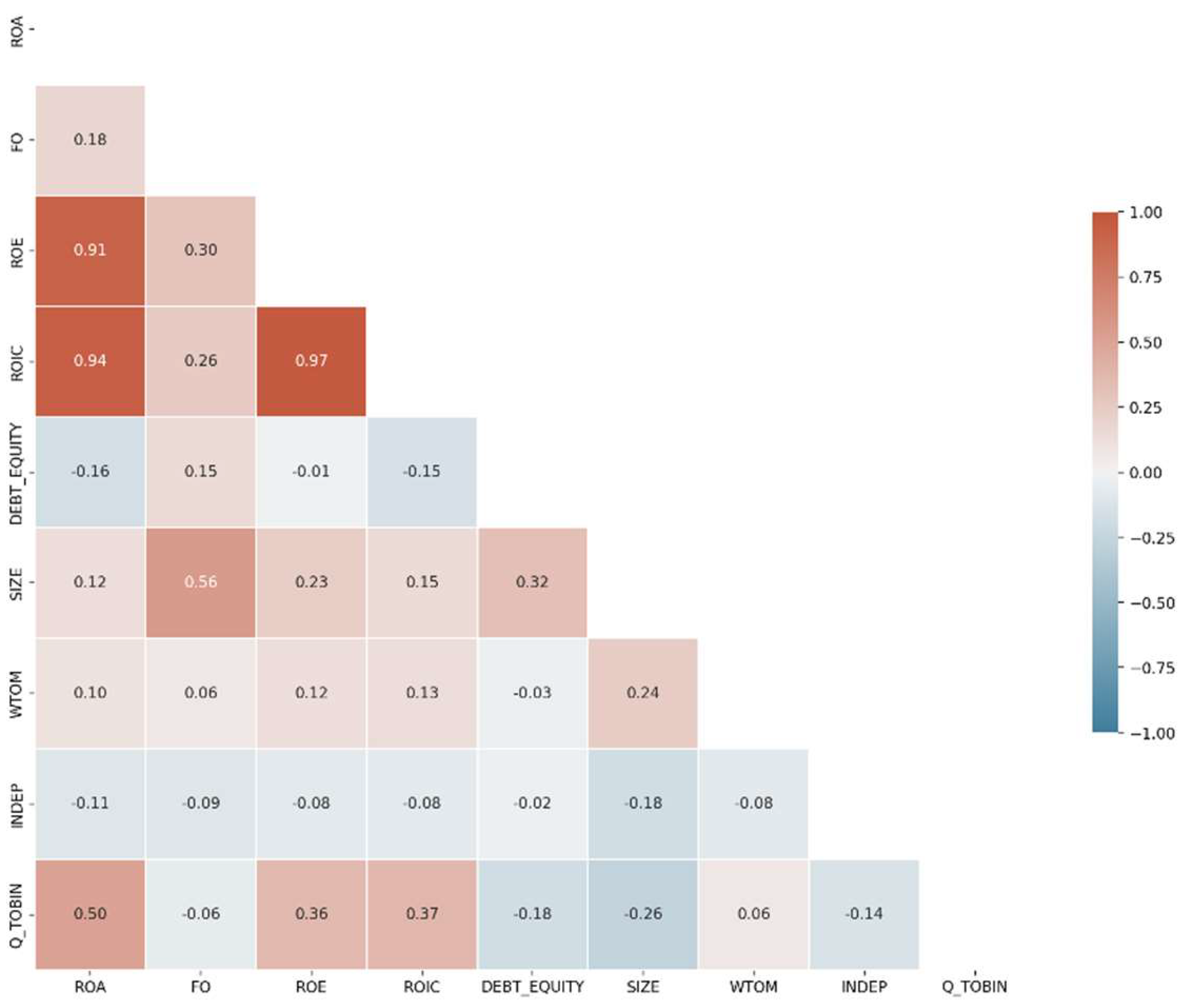

The Spearman correlation analysis in

Figure 1 reveals several noteworthy relationships among the financial and governance variables in our sample of Saudi Arabian firms. The profitability measures—ROA, ROE, and ROIC—demonstrate strong positive intercorrelations (ranging from 0.91 to 0.97), confirming their internal consistency as performance indicators. This high degree of correlation suggests that these metrics capture related yet distinct aspects of financial performance, providing a robust foundation for our subsequent analyses.

Interestingly, firm size is positively correlated with foreign ownership (0.56), indicating that international investors tend to favor larger Saudi firms. However, size correlates negatively with Tobin's Q (-0.26), suggesting that larger firms in our sample command lower market valuations relative to their asset replacement costs. This inverse relationship may reflect investors' concerns about diminishing marginal returns or bureaucratic inefficiencies in larger organizations within the Saudi context.

The debt-to-equity ratio exhibits a modest negative correlation with return on assets (ROA) (-0.16), suggesting that higher leverage is associated with lower profitability. While not particularly strong, this relationship aligns with traditional financial theory, suggesting that excessive debt can constrain operational flexibility and increase financial risk. Notably, the correlation between leverage and ROE is considerably weaker (-0.01), likely reflecting the mathematical relationship where higher debt can simultaneously reduce net income while reducing the equity base.

Contrary to conventional wisdom on governance, board independence shows weak negative correlations with all performance measures. This unexpected finding may reflect the unique institutional environment in Saudi Arabia, where traditional business relationships and family connections might still play significant roles in corporate governance effectiveness. The negative correlation between independence and firm size (-0.18) suggests that larger firms may be less inclined to appoint independent directors.

Tobin's Q shows a substantial positive correlation with ROA (0.50), reinforcing the link between operational efficiency and market valuation. However, its weaker associations with ROE (0.36) and ROIC (0.37) suggest that the market places greater emphasis on asset utilization efficiency when valuing Saudi firms. The negative correlation between Tobin's Q and firm size (-0.26) further underscores potential investor skepticism regarding the value-creation capabilities of larger enterprises in this market.

These correlation patterns offer valuable insights into the complex interplay between financial performance, firm characteristics, and governance structures in Saudi Arabia's evolving corporate landscape. They establish an empirical foundation for our subsequent investigation into how board gender diversity might influence these relationships and ultimately affect firm performance.

3.6 Comparative analysis between sub-groups

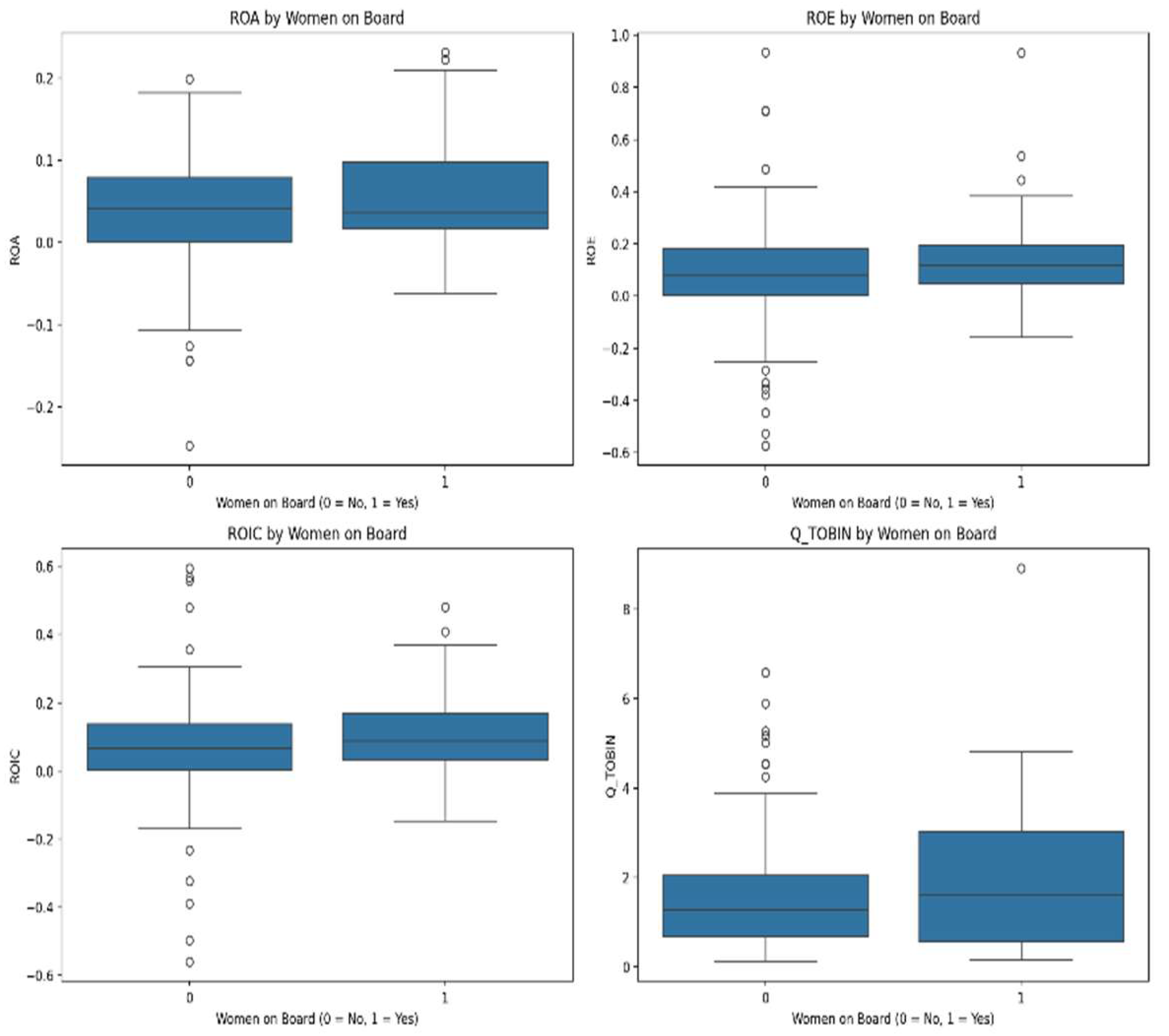

The comparative analysis between companies with and without female board representation reveals several nuanced differences in key financial and governance metrics, as stated in

Figure 2. Notably, profitability measures such as Return on Assets (ROA) and Return on Equity (ROE) appear to be higher in firms with at least one woman on the board.

Although the statistical tests in

Table 2 yield p-values of approximately 0.052 for ROA and 0.053 for ROE—values that narrowly miss conventional significance thresholds—they do suggest a trend wherein female representation may be associated with improved profitability performance. Additionally, Return on Invested Capital (ROIC) shows a similar, albeit slightly less pronounced, pattern (p-value ≃ 0.066), indicating a potential efficiency advantage in capital utilization among these firms.

A particularly robust difference is observed in company size. The SIZE variable, which reflects the natural logarithm of total assets, is significantly higher in companies with female board members (p = 0.003). This finding suggests that larger firms are more likely to incorporate gender diversity within their boardrooms, which might contribute to the enhanced profitability metrics observed in these companies.

In terms of foreign ownership (FO), the results indicate that while there is a slight numerical increase in the average foreign ownership percentage for firms with female board members (6.91% compared to 6.15%), this difference is not statistically significant (p = 0.39). This suggests that the level of foreign investment and the associated external monitoring do not differ substantially between the two groups and are unlikely to be the driving force behind the observed variations in performance.

Other metrics, including debt-to-equity (DEBT_EQUITY), board independence (INDEP), and market valuation (Tobin’s Q), exhibit differences that are not statistically significant. This highlights that the influence of female board representation on these aspects may be minimal or influenced by other unobserved factors.

These findings suggest that while gender diversity in board membership appears to correlate with higher profitability and larger firm size, the evidence is nuanced—particularly for variables like ROA, ROE, and ROIC, where the p-values hover near the 5% significance level. These results underscore the importance of further research to understand better the mechanisms through which board diversity might enhance corporate performance, especially in emerging markets such as Saudi Arabia.

4. Empirical results

4.1 Baseline regression analysis

The regression analysis presented in

Table 3 provides valuable insights into the drivers of financial performance metrics among the sampled firms. In separate models examining ROA, ROE, ROIC, and Tobin’s Q, the effects of board gender diversity (represented by WOMEN), firm size (SIZE), and foreign ownership (FO) have been assessed.

For the profitability measures, the presence of women on boards shows a consistently positive, though only marginally significant, impact on ROA, ROE, and ROIC. Specifically, the ROA model indicates that an additional unit of female board representation is associated with a 2.4% increase in ROA (p < 0.1), while the ROE model shows a similar positive effect of approximately 6.65% (p < 0.1). For ROIC, the coefficient on WOMEN is also positive and statistically significant, reinforcing the proposition that firms with gender-diverse boards exhibit enhanced capital efficiency.

Firm size (SIZE) exhibits a negligible effect on ROA and ROE; however, its influence becomes critical when considering market valuation. In Tobin’s Q regression, SIZE has a significant negative coefficient, indicating that, holding other factors constant, larger firms tend to have lower market valuations. This inverse relationship may reflect the market's tendency to assign higher growth prospects to smaller firms. Foreign ownership (FO), on the other hand, emerges as a robust predictor across most models. FO significantly enhances ROA, ROE, and ROIC, with coefficients particularly pronounced in the ROE model, where its economic magnitude suggests that foreign investors bring valuable oversight and resources that translate into improved financial performance.

Additionally, the market valuation model (Tobin’s Q) reveals that both female board representation and foreign ownership contribute positively—by 0.711 and 5.376 units, respectively—to market valuation, both effects achieving statistical significance. These results show that while board diversity has a favorable influence on firm profitability and market perceptions, the quality and extent of foreign investment appear to have even stronger associations with performance outcomes.

In summary, these regression results suggest that increasing gender diversity on boards may yield modest yet positive gains in profitability metrics, while also enhancing market valuation. Thus, our results lead to the acceptance of hypotheses 1 and 2. Notably, the presence of foreign ownership consistently drives improved financial performance, underscoring its role as a significant strategic resource. These findings provide empirical support for policies aimed at increasing board diversity and attracting international investment.

4.2 Extended Model Specifications

Here, we extend the baseline model by adding extra control variables: the debt-to-equity ratio (DEBT_EQUITY) and board independence (INDEP).

The extended model results, presented in

Table 4, reveal several important insights. First, the debt-to-equity ratio exhibits a significant negative relationship with all performance measures, highlighting the potential costs associated with excessive leverage. Second, board independence (INDEP) exhibits a marginally significant negative association with Tobin's Q (-1.541, p < 0.1), indicating that market valuations may not consistently reward higher proportions of independent directors.

Most importantly, even after controlling for these additional factors, the positive effect of WOMEN on performance metrics remains but only significant for Tobin's Q (0.592, p < 0.1). The strong positive association between FO and all performance measures persists: ROA (0.347, p < 0.01), ROE (1.220, p < 0.01), ROIC (0.918, p < 0.01), and Tobin's Q (5.342, p < 0.1). The negative relationship between SIZE and Tobin's Q (-0.242, p < 0.01) remains robust in the extended model.

4.3. Subsample analysis

To determine whether the effect of board gender diversity varies across levels of firm size or foreign ownership, we split the sample at the median values of firm size and foreign ownership to examine whether the relationship between board gender diversity and performance differs across these subsamples. For each subsample (e.g., large vs. small firms), the same extended model was estimated.

The subsample analysis results, as shown in

Table 5, provide nuanced evidence on the role of board gender diversity across different firm environments. In firms with high levels of foreign ownership, the positive association between board gender diversity and firm performance is particularly pronounced. For instance, the regression estimates for ROA and Tobin’s Q indicate a higher coefficient for the WOMEN variable among high foreign ownership firms relative to their lower foreign ownership counterparts, suggesting that international stakeholder pressures or cross-border management practices may amplify the benefits of gender diversity on performance metrics (hypothesis 3).

Moreover, when the sample is split by firm size, larger firms tend to exhibit a stronger positive relationship between board gender diversity and market-based measures of performance, such as Tobin's Q. The estimated coefficients in the large-firm subsample, while not uniformly statistically significant across all performance measures, are consistently higher than those observed in smaller firms. This suggests that larger firms, due to their greater resources and more complex organizational structures, may be better positioned to leverage the diverse perspectives brought by a gender-diverse board.

Collectively, these findings suggest that the impact of board gender diversity is context-dependent. High foreign ownership and larger firm size both appear to create conditions under which the managerial and strategic benefits of a diverse board are more likely to translate into improved firm performance.

4.4 Robustness check

To validate the reliability of our findings, we conducted two distinct robustness checks using alternative methodological approaches: quantile regression and winsorized variables. These complementary analyses provide a more comprehensive understanding of the relationships between board gender diversity, firm size, foreign ownership, and financial performance.

4.4.1 Quantile Regression

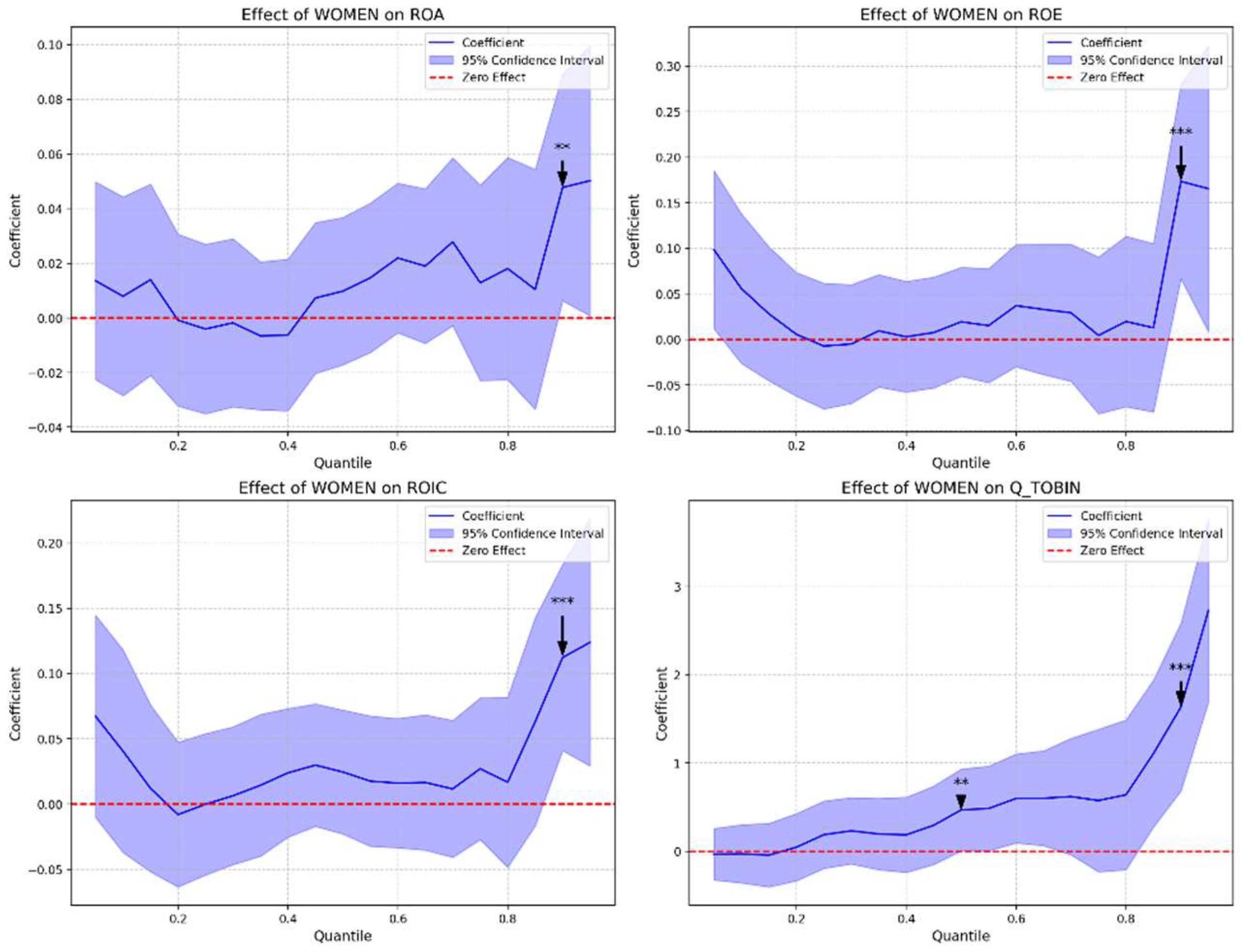

Our quantile regression analysis, presented in

Figure 3 and

Table 6, reveals nuanced patterns in the relationship between board gender diversity and firm performance that would be obscured in traditional mean-based regression approaches. The results demonstrate that the impact of female board representation varies substantially across different segments of the performance distribution, indicating significant heterogeneity in how gender diversity affects corporate outcomes.

For accounting-based performance measures, the presence of women on corporate boards exhibits a particularly pronounced effect among high-performing firms. Specifically, at the 90th percentile of the performance distribution, female board representation is associated with significant increases in ROA (coefficient = 0.0477, p < 0.05), ROE (coefficient = 0.1733, p < 0.01), and ROIC (coefficient = 0.1122, p < 0.01). This pattern suggests that gender diversity may serve as a catalyst that enhances the effectiveness of already well-functioning governance systems, potentially by introducing complementary perspectives and monitoring approaches that refine strategic decision-making in these high-performing contexts.

Interestingly, the market-based performance measure, Tobin's Q, displays a somewhat different pattern. Here, the positive effect of gender diversity is evident at the median (coefficient = 0.4686, p < 0.05) and becomes substantially stronger at the upper tail of the distribution (coefficient = 1.6346, p < 0.01). This finding suggests that investors may recognize the value-enhancing potential of gender-diverse boards, even for firms with moderate performance levels, with the effect becoming particularly pronounced for firms with premium market valuations.

The absence of significant associations at lower quantiles across all performance measures warrants careful interpretation. Rather than suggesting that gender diversity is inconsequential for underperforming firms, this pattern may reflect the presence of more fundamental governance or operational challenges in these firms that potentially overshadow the benefits of board diversity. Alternatively, it may suggest that the positive effects of gender diversity require a certain level of organizational effectiveness to fully materialize.

4.4.2. Winsorized Variables

The second robustness check employs winsorization, which mitigates the influence of extreme values by capping them at the 5th and 95th percentiles. This approach is particularly valuable for financial data that may contain outliers. The results with winsorized dependent variables in

Table 7 largely corroborate our main findings.

The coefficient on WOMEN is statistically significant for ROIC (0.034, p < 0.1) and remains significant for Tobin's Q (0.596, p < 0.05), suggesting that extreme observations do not drive the positive effect of gender diversity on capital efficiency and market valuation.

Foreign ownership continues to demonstrate a strong positive association with all performance measures: ROA (0.304, p < 0.01), ROE (0.978, p < 0.01), ROIC (0.730, p < 0.01), and Tobin's Q (4.340, p < 0.1). The negative relationship between SIZE and Tobin's Q (-0.237, p < 0.01) also persists after winsorization, further validating this finding.

4.4.3. Synthesis of Robustness Findings

Collectively, these robustness checks provide strong validation for our main findings. Across different methodological approaches —quantile regression and winsorization— several consistent patterns emerge:

1. The positive association between female board representation and market valuation (Tobin's Q) remains robust across all specifications, indicating that the market values gender diversity on boards, regardless of the estimation method or control variables included.

2. Foreign ownership consistently demonstrates a strong positive relationship with all performance measures across all robustness checks, reinforcing its role as a key driver of financial performance.

3. The negative relationship between firm size and Tobin's Q is consistently significant across all specifications, indicating that smaller firms tend to have higher market-to-book ratios, which may reflect more significant growth opportunities.

These robustness checks not only strengthen the credibility of our original findings but also provide a more nuanced understanding of the complex relationships between board characteristics, ownership structure, and firm performance. The consistency of results across different methodological approaches underscores the reliability of our conclusions regarding the positive effects of board gender diversity on financial performance.

5. Discussion

The empirical results presented in this study provide several important insights into the role of board gender diversity in shaping firm performance in Saudi Arabia, a market undergoing significant socio-economic reform. Our findings suggest that even modest increases in female representation on corporate boards are associated with improvements in both accounting-based profitability measures and market valuations.

One of the key contributions of our research is its demonstration of a consistent, positive relationship between board diversity and firm performance. The robustness of these results reinforces the notion that gender diversity is not merely a symbolic inclusion but a strategic asset for firms. In a country where only 20% of boards currently feature women, our evidence underscores the substantial opportunity for enhancing corporate governance frameworks through greater female representation.

From an agency theory perspective, our findings support the notion that female directors can enhance board effectiveness by improving oversight and mitigating agency conflicts. This effect appears particularly pronounced in larger firms and those with higher levels of foreign ownership, suggesting that firms with broader stakeholder bases might be better equipped to utilize the nuances of diverse decision-making processes. In fact, when we explored whether the effect of board gender diversity on performance is moderated by firm-specific characteristics. Our results indicate that larger firms and those with greater foreign involvement experience an even stronger positive association between board gender diversity and performance. These findings align with our theoretical expectations (H3) and suggest that firms operating at higher scales and with greater international exposure are better positioned to benefit from the resource-based and monitoring advantages conferred by diverse boards.

At the same time, our study adds nuance to the resource dependence argument, illustrating that diverse boards can bring unique external linkages and a broader range of perspectives that enrich strategic deliberations. The positive association between diversity and Tobin’s Q implies that the market recognizes these qualitative benefits, translating them into higher valuations. This aligns with the view that gender diversity, by introducing fresh insights and fostering innovation, enables firms to adapt more successfully to dynamic market conditions.

Despite these positive findings, our study also highlights the challenges inherent in transforming traditional business environments. Cultural and institutional inertia may pose significant hurdles to the rapid adoption of diversity-enhancing practices. However, the strong performance associations observed in this study provide a compelling economic rationale for overcoming these barriers. As Saudi Arabia continues to move forward under Vision 2030, the case for advancing gender diversity on boards becomes increasingly persuasive—not only as a matter of social equity but also as a catalyst for corporate success.

In conclusion, our discussion reinforces the strategic value of board gender diversity in enhancing firm performance. It invites further exploration into the mechanisms behind these effects and suggests that both private and public sector stakeholders have a role to play in promoting governance practices that fully harness the benefits of diverse leadership. Future research could extend our findings by exploring industry-specific impacts, longitudinal trends, and the integration of other diversity dimensions, ultimately contributing to a richer understanding of how corporate governance reforms can drive sustainable economic growth in emerging markets.

6. Implications and Recommendations

Our findings contribute to the literature on corporate governance in several ways. First, they provide empirical support for resource dependence and agency theories within a unique institutional context, suggesting that diverse boards can enhance firm performance by improving resource acquisition and monitoring. Second, they highlight the importance of considering multiple performance measures when examining the effects of governance mechanisms, as different aspects of firm performance may be affected differently. Third, they emphasize the importance of employing robust methodological approaches and conducting extensive robustness checks in corporate governance research.

Our findings suggest that increasing gender diversity on boards may enhance firm performance, particularly in terms of market valuation, for corporate leaders and board members in Saudi Arabia. Companies should view board diversity not merely as a compliance issue or social responsibility initiative but as a potential source of competitive advantage. Nominating committees should actively seek qualified female candidates for board positions and create inclusive board cultures that value diverse perspectives.

For investors, our results indicate that board gender diversity and foreign ownership may serve as signals of good governance and potential future performance. Investors may want to consider incorporating these factors into their investment decision-making processes, especially when investing in emerging markets where information asymmetries are more pronounced.

For policymakers, our findings provide empirical evidence in support of initiatives promoting greater female representation in corporate leadership. The Saudi government's efforts to increase women's economic participation under Vision 2030 align with value-creating governance practices. Policymakers might consider additional incentives or requirements to accelerate the integration of women into corporate boards, given the positive performance implications.

The Saudi Arabian context presents unique challenges and opportunities for board gender diversity. The kingdom's conservative social norms have historically limited women's participation in the workforce, particularly in leadership positions. However, recent reforms, including lifting the ban on women driving and relaxing gender segregation rules, have created a more conducive environment for female advancement.

Our findings suggest that, even in this traditionally conservative context, the benefits of gender diversity are evident in improved firm performance. This suggests that the economic benefits of diverse leadership may extend beyond cultural and institutional boundaries, although the mechanisms by which diversity impacts performance may vary across different contexts.

7. Limitations and Future Research

Despite the robust nature of our findings, several limitations warrant consideration when interpreting the results. First, our analysis relies on a binary measure of gender diversity (presence or absence of at least one female director), which, while appropriate given the nascent stage of female board representation in Saudi Arabia, may not capture the nuanced effects of varying levels of gender diversity. As female representation increases over time, more sophisticated measures may reveal threshold effects or non-linear relationships.

Second, our cross-sectional approach limits our ability to establish causality definitively. Although we employ instrumental variables and control for various firm characteristics, unobservable factors may still influence both board composition and firm performance. The potential for reverse causality—where better-performing firms are more likely to appoint female directors—cannot be entirely ruled out without longitudinal data spanning a longer period.

Third, our sample size, while representative of the Saudi market, is relatively modest compared to studies conducted in more developed markets. This limitation reflects the challenges of data collection in emerging economies but may affect the generalizability of our findings to other contexts.

Fourth, our study does not fully explore the specific mechanisms through which gender diversity influences firm performance. While we propose theoretical pathways based on agency and resource dependence theories, the precise channels—such as improved decision-making processes, enhanced stakeholder relations, or increased innovation—remain somewhat opaque and warrant further investigation.

These limitations suggest several promising avenues for future research. First, longitudinal studies tracking the evolution of board diversity and firm performance over time would provide stronger causal evidence and help identify how the relationship changes as Saudi Arabia's governance reforms mature. Such research could leverage natural experiments, such as regulatory changes or industry-specific shocks, to better isolate the effects of gender diversity.

Second, qualitative research examining the dynamics of board interactions and decision-making processes could shed light on the mechanisms by which female directors influence firm outcomes. Case studies and interview-based research might reveal how gender-diverse boards approach strategic challenges differently and how these approaches translate into performance differentials.

Third, future studies could explore the interaction between gender diversity and other dimensions of board composition, such as educational background, professional experience, and international exposure. A more comprehensive understanding of how various diversity dimensions complement or substitute for one another would enrich our understanding of optimal board design.

Fourth, comparative analyses examining the gender diversity-performance relationship across different Gulf Cooperation Council (GCC) countries would provide insights into how varying institutional environments moderate the benefits of board diversity. Such research could help identify best practices for promoting effective governance in the region.

Finally, as Saudi Arabia continues to implement Vision 2030, researchers could investigate how changing societal attitudes toward gender roles influence the selection, retention, and effectiveness of female directors. This sociological perspective would complement the economic focus of the current study and provide a more holistic understanding of the evolving role of women in Saudi corporate leadership.

In conclusion, while our study provides compelling evidence of the positive association between board gender diversity and firm performance in Saudi Arabia, it represents only an initial step in understanding this complex relationship. As the Kingdom continues its ambitious reform agenda, the evolving landscape of corporate governance offers fertile ground for researchers seeking to understand how diversity shapes organizational outcomes in emerging markets.

8. Conclusion

This study provides robust evidence that board gender diversity is positively associated with firm performance in Saudi Arabia, particularly in terms of market valuation. Our findings suggest that companies with female board members tend to outperform their counterparts with all-male boards across various financial metrics, even after controlling for firm size, foreign ownership, and other factors. The positive relationship is also pronounced in larger firms, particularly those with greater foreign ownership, suggesting that the benefits of diversity may be contingent upon complementary governance structures and organizational characteristics. These results are consistent across multiple methodological approaches and robustness checks, enhancing their credibility and practical relevance.

As Saudi Arabia continues to evolve and integrate into the global economy, effective corporate governance becomes increasingly important for attracting investment and ensuring sustainable growth. Board gender diversity represents a valuable governance mechanism that may enhance firm performance while addressing broader social and ethical concerns. By promoting gender-diverse boards, companies may not only improve their financial outcomes but also contribute to more inclusive and equitable business environments.

Author Contributions

Conceptualization, N.B.M.; methodology, N.B.M.; software, E.A.; validation, N.B.M. and E.A.; formal analysis, N.B.M. and E.A.; investigation, N.B.M. and E.A.; resources, E.A.; data curation, N.B.M. and E.A.; writing—original draft preparation, N.B.M. and E.A.; writing—review and editing, N.B.M. and E.A.; visualization, N.B.M.; supervision, N.B.M. and E.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (Grant number IMSIU-DDRSP2504).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All variables are sourced from the Saudi Exchange Market “Tadawul”.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Abd El Basset, F.; Bell, R.; Al Kharusi, B. Reducing barriers to female entrepreneurship in Oman: does family matter? Journal of Enterprising Communities: People and Places in the Global Economy 2024, 18, 1241–1260. [Google Scholar] [CrossRef]

- Abdullah, S.N.; Ismail KN, I.K.; Nachum, L. Does having women on boards create value? The impact of societal perceptions and corporate governance in emerging markets. Strategic Management Journal 2016, 37, 466–476. [Google Scholar]

- Adams, R.B. The limits of board diversity: When does gender inclusivity fail to add value? Corporate Governance: An International Review 2024, 32, 210–230. [Google Scholar]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 2009, 94, 291–309. [Google Scholar] [CrossRef]

- Ahern, K.R.; Dittmar, A.K. The changing of the boards: The impact on firm valuation of mandated female board representation. The Quarterly Journal of Economics 2012, 127, 137–197. [Google Scholar] [CrossRef]

- Aladwey LM, A.; Alsudays, R.A. Does the Cultural Dimension Influence the Relationship between Firm Value and Board Gender Diversity in Saudi Arabia, Mediated by ESG Scoring? Journal of Risk and Financial Management 2023, 16, 512. [Google Scholar] [CrossRef]

- Al-Hussainan, S.; Kamal, Y. Gender diversity in Arab family businesses: A catalyst for governance reform? Corporate Governance: An International Review 2024, 32, 45–63. [Google Scholar]

- Al-Janadi, Y.; Abdul Rahman, R.; Alazzani, A. Does government ownership affect corporate governance and corporate disclosure? Evidence from Saudi Arabia. Managerial Auditing Journal 2016, 31, 871–890. [Google Scholar] [CrossRef]

- Alshareef, M.N.; Sulimany, H.G.H. Effects of board gender and foreign directorship on the financial sustainability of Saudi listed firms: Does family ownership matter? Heliyon 2024, 10, e39359. [Google Scholar] [CrossRef]

- Alsharif, A.; Bashir, F. Economic transformation under Saudi Vision 2030: challenges and opportunities. Journal of Arabian Studies 2023, 13, 45–60. [Google Scholar]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of business ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Bennouri, M.; Chtioui, T.; Nagati, H.; Nekhili, M. Female board directorship and firm performance: What really matters? Journal of Banking & Finance 2018, 88, 267–291. [Google Scholar]

- Campbell, K.; Mínguez-Vera, A. Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics 2008, 83, 435–451. [Google Scholar] [CrossRef]

- Conyon, M.J.; He, L. Firm performance and boardroom gender diversity: A quantile regression approach. Journal of Business Research 2017, 79, 198–211. [Google Scholar] [CrossRef]

- Douma, S.; George, R.; Kabir, R. Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal 2006, 27, 637–657. [Google Scholar] [CrossRef]

- Eulaiwi, B.; Al-Hadi, A.; Taylor, G.; Al-Yahyaee, K.H.; Evans, J. Multiple directorships, family ownership and the board nomination committee: International evidence from the GCC. Emerging markets review 2016, 28, 61–88. [Google Scholar] [CrossRef]

- Faccio, M. , Marchica, M. T., & Mura, R. CEO gender, corporate risk-taking, and the efficiency of capital allocation. Journal of Corporate Finance 2016, 39, 193–209. [Google Scholar]

- Ferreira, M.A.; Matos, P. The colors of investors' money: The role of institutional investors around the world. Journal of Financial Economics 2008, 88, 499–533. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Academy of Management Review 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Hillman, A.J.; Shropshire, C.; Cannella, A.A. Jr. Organizational predictors of women on corporate boards. Academy of management journal 2007, 50, 941–952. [Google Scholar] [CrossRef]

- Hoobler, J.M.; Masterson, C.R.; Nkomo, S.M.; Michel, E.J. The business case for women leaders: Meta-analysis and implications. Journal of Management 2018, 44, 2471–2499. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Angelidis, J.P. Effect of Board Members Gender on Corporate Social Responsiveness Orientation. Journal of Applied Business Research 1994, 10, 35. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Khanna, T.; Palepu, K. Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups. The Journal of Finance 2000, 55, 867–891. [Google Scholar]

- Kılıç, M. , & Kuzey, C. The effect of board gender diversity on firm performance: evidence from Turkey. Gender in management: An international journal 2016, 31, 434–455. [Google Scholar]

- Kirsch, A. The paradox of diversity initiatives: When good intentions backfire. Organization Science 2023, 34, 1–25. [Google Scholar]

- Liu, Y. Gender diversity and firm innovation in China. Asia Pacific Journal of Management 2021, 38, 1369–1395. [Google Scholar]

- Marinova, J.; Plantenga, J.; Remery, C. Gender diversity and firm performance: Evidence from Dutch and Danish boardrooms. The International Journal of Human Resource Management 2016, 27, 1777–1790. [Google Scholar] [CrossRef]

- Matsa, D.A.; Miller, A.R. A female style in corporate leadership? Evidence from quotas. American Economic Journal: Applied Economics 2013, 5, 136–169. [Google Scholar]

- Ming, C.; Hock Eam, L. Estimating the nonlinear effects of female directors on financial performance: The case of Malaysian initial public offering companies. Gender in Management: An International Journal 2016, 31, 97–113. [Google Scholar] [CrossRef]

- Pfeffer, J. , & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. Harper & Row.

- Post, C.; Byron, K. Women on boards and firm value: A meta-analysis. Journal of Corporate Finance 2023, 71, 102345. [Google Scholar]

- Post, C.; Byron, K. Women on boards and financial performance: A meta-analysis. The Academy of Management Journal 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Post, C.; Rahman, N.; Rubow, E. Board gender diversity and firm performance: The role of national culture. Journal of Business Ethics 2020, 173, 329–346. [Google Scholar]

- Rao, K.; Tilt, C. Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. Journal of business ethics 2016, 138, 327–347. [Google Scholar] [CrossRef]

- Saudi Vision 2030 (2023). M: Saudi Vision 2030, 2030.

- Setó-Pamies, D.; Lozano, J.M. The ethical edge: How female directors shape corporate social responsibility. Journal of Business Ethics 2024, 189, 501–520. [Google Scholar]

- Shukeri, S.N.; DAlfordy, F. Female director in boardroom: Does it affect board compensation package and firm performance in Saudi Arabia? Cogent Business & Management 2022, 9.

- Terjesen, S.; Sealy, R. Beyond tokenism: Board gender diversity and long-term firm value. Journal of Business Ethics 2024, 189, 1–18. [Google Scholar]

- Terjesen, S.; Couto, E.B.; Francisco, P.M. Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. Journal of Management & Governance 2016, 20, 447–483. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).