Introduction and Literature Review

Mountain entrepreneurship refers to a set of economic initiatives conducted in a context defined by specific geographical and socio-economic characteristics. Its primary goals are income generation, job creation, and the stimulation of local community development. What differentiates mountain entrepreneurship is its ability to adapt to the particular conditions of mountainous regions, which are typically characterized by high altitudes, harsh climates, underdeveloped infrastructure, and limited access to markets.

According to the specialized literature (Dower, 2002; Perlik, 2019), mountain entrepreneurship is not confined to traditional agricultural activities. Rather, it encompasses a diverse range of initiatives such as agrotourism, artisanal production, ecotourism services, and the development of high-quality local food products.

The specificity of entrepreneurship in mountain areas is shaped by several key factors:

- -

Activity diversification – entrepreneurs are frequently involved in multiple sectors simultaneously (e.g., agriculture, tourism, and food processing);

- -

Prevalence of micro-enterprises – resulting from limited human and financial resources;

- -

Adaptive innovation – entrepreneurs develop innovative solutions to respond to natural and infrastructural constraints;

- -

Valorization of local resources – sustainable use of local natural and cultural resources serves as a competitive advantage.

Mountain entrepreneurship plays a crucial role in retaining local populations by creating economic opportunities, reducing reliance on traditional agricultural subsidies, preserving and promoting cultural and natural heritage, and fostering innovation and social cohesion in isolated communities. Thus, entrepreneurship in these areas is not merely an economic engine but also a key factor in preserving identity and sustainability in the context of global change.

In the European Union, policies targeting mountain regions are mainly encompassed within cohesion and rural development frameworks. These policies recognize the natural and socio-economic challenges of mountainous regions and aim to support their sustainable development. Cohesion policy primarily seeks to reduce regional disparities by fostering economic, social, and territorial development.

Within the Common Agricultural Policy (CAP), the European Agricultural Fund for Rural Development (EAFRD) plays a central role in supporting mountain areas by funding:

- -

The diversification of economic activities, such as rural tourism or the production of traditional goods;

- -

The conservation of natural landscapes and biodiversity protection;

- -

Innovation in agriculture, including the development of ecological and sustainable practices.

The European Regional Development Fund (ERDF) is the main instrument of cohesion and regional development policy. It supports less-developed regions, including mountain areas, through investment in tourism infrastructure, job creation, and the improvement of economic conditions.

Another key financial instrument is the European Social Fund (ESF), which focuses on human capital development and job creation. ESF resources can finance training programs, educational initiatives, and social integration projects in mountain areas.

In addition to the major policies mentioned, the EU has several other financial initiatives dedicated to mountain regions. One such initiative is the LEADER program (Liaison Entre Actions de Développement de l'Économie Rurale), which promotes a bottom-up approach to rural development. It encourages active involvement of local communities in decision-making and project implementation. LEADER supports the creation of Local Action Groups (LAGs), which aim to fund small entrepreneurial initiatives, foster local cooperation networks, and develop tailored economic and social strategies. LEADER has proven essential in revitalizing many mountain communities by attracting funding for innovative projects in tourism, crafts, and food production.

Another relevant initiative is the Carpathian Convention, which promotes the sustainable development of mountain regions in Europe. Signed by eight countries, including Romania, the Convention supports financial assistance for ecosystem protection, ecotourism development, and cross-border cooperation to ensure balanced and sustainable growth.

Specific financial support measures for mountain areas include:

- -

Compensatory subsidies for farmers facing challenging natural conditions, aimed at supporting sustainable agricultural production;

- -

Support for young entrepreneurs who wish to develop businesses in mountain areas, thereby encouraging youth reintegration into these communities;

- -

Infrastructure development projects to improve accessibility, which is essential for tourism and trade development.

Additional funding is available through programs specifically targeting tourism entrepreneurship. The EU supports the development of tourism in mountain areas, including ecotourism and adventure tourism, through measures aimed at promoting sustainable tourism.

The Horizon Europe program, the EU’s research and innovation framework, supports innovative projects related to mountain environmental sustainability or new solutions for mountain tourism. It covers themes relevant to environmental protection and sustainable economic development in mountainous regions.

The INTERREG program promotes cross-border and interregional cooperation within the EU. It is often used to fund infrastructure and tourism projects that span multiple member states. For mountain regions located near borders or engaged in cross-national collaboration, INTERREG provides a viable funding option for economic or tourism development.

The European Fund for Strategic Investments (EFSI) supports projects involving infrastructure, clean energy, and economic development in disadvantaged regions. It can be a funding source for mountain initiatives with a significant local and regional economic impact.

The LIFE program is focused on environmental protection and climate change mitigation. Entrepreneurs involved in mountain-based environmental conservation, biodiversity protection, or sustainable project implementation can access funding through LIFE.

The European Institute of Innovation and Technology (EIT) supports innovation in fields such as health, energy, and climate change. Projects aligned with these domains may qualify for funding.

The European Investment Bank (EIB) also provides loans for mountain entrepreneurship projects, particularly those with regional development potential.

In addition, the EU offers specific incentives for young mountain entrepreneurs, such as:

- -

The Erasmus for Young Entrepreneurs program, which promotes mobility and the exchange of best practices;

- -

Microfinance schemes for youth, allowing young people to launch businesses in mountain regions through accessible financial instruments.

At the national level, various government-managed funding programs exist, often overseen by ministries responsible for economy and entrepreneurship. These programs aim to support businesses in economically underdeveloped regions, including mountainous areas. This includes state aid schemes for SMEs, designed to stimulate investments in small and medium-sized enterprises across various sectors, including mountain tourism and local product development.

For high-growth potential projects, entrepreneurs may also seek private investors or venture capital funds interested in innovative initiatives that bring value to mountain regions. In some cases, local or regional authorities may support public-private partnerships, especially if the project has a positive impact on the community or the region’s economic development.

Despite the EU’s considerable attention to mountain areas, several significant challenges remain in financing mountain entrepreneurship:

- -

Complex administrative requirements and lack of accessible information;

- -

Bureaucratic procedures that may discourage entrepreneurs unfamiliar with institutional frameworks;

- -

A need for better coordination among different EU funds and local initiatives;

- -

Inadequate infrastructure that hinders the effectiveness of funding programs;

- -

Limited awareness regarding available funding opportunities and eligibility criteria;

- -

Rigid eligibility conditions that are not always adapted to the specificities of mountain regions.

To address these issues, it is recommended to implement greater administrative flexibility and promote innovative, integrated projects developed by mountain entrepreneurs that respond sustainably to local challenges.

Methodology

This methodology aims to conduct a detailed analysis of mountain entrepreneurship in the European financial sector, with a special focus on the 2021-2022 period, in order to identify trends, issues, and opportunities in this sector for the 2021-2025 period. The analysis will use data from the provided tables to assess relevant indicators of the mountain financial sector, such as revenues, expenses, and other significant economic characteristics, based on a set of descriptive statistics and inferential analyses.

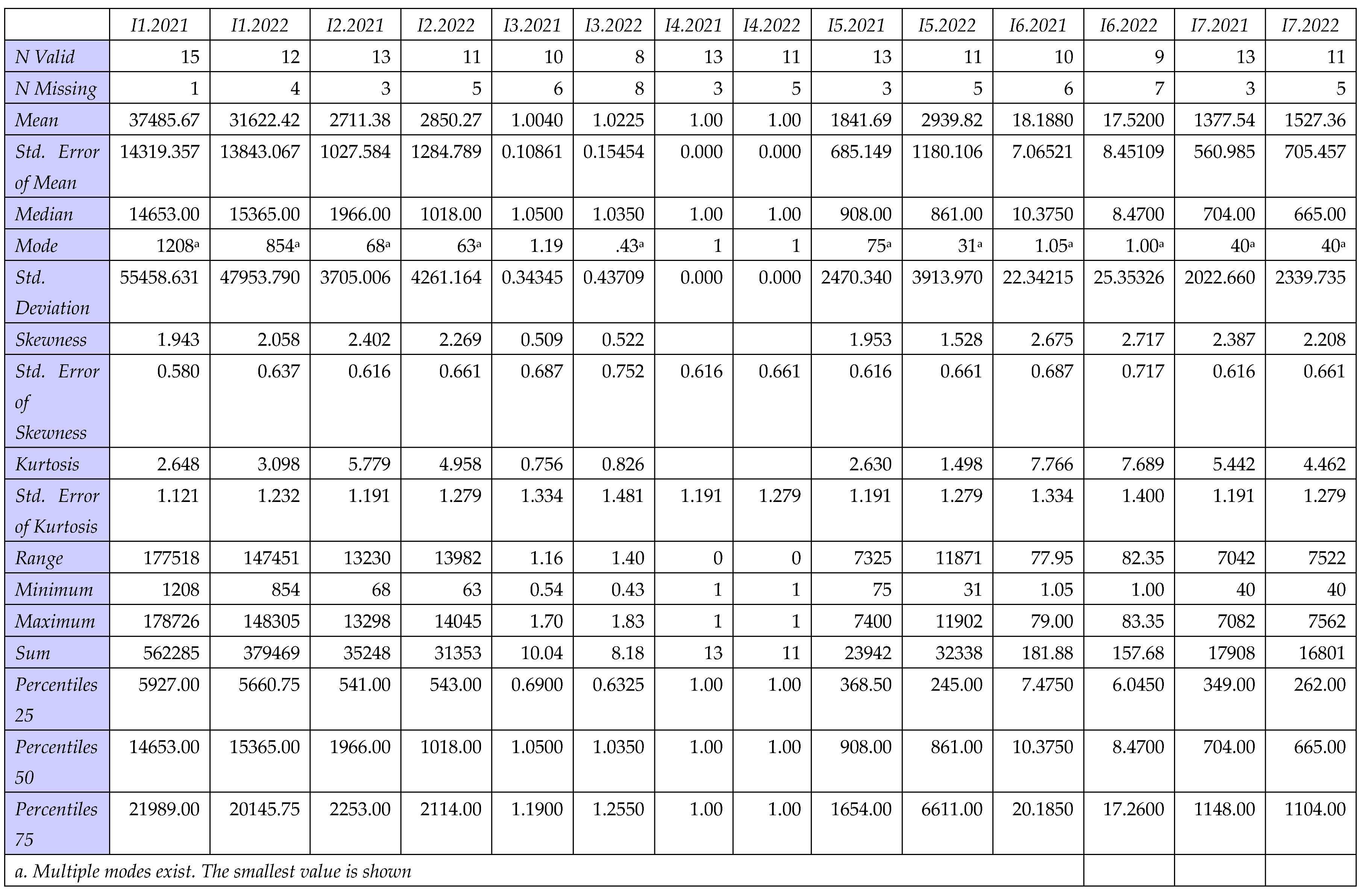

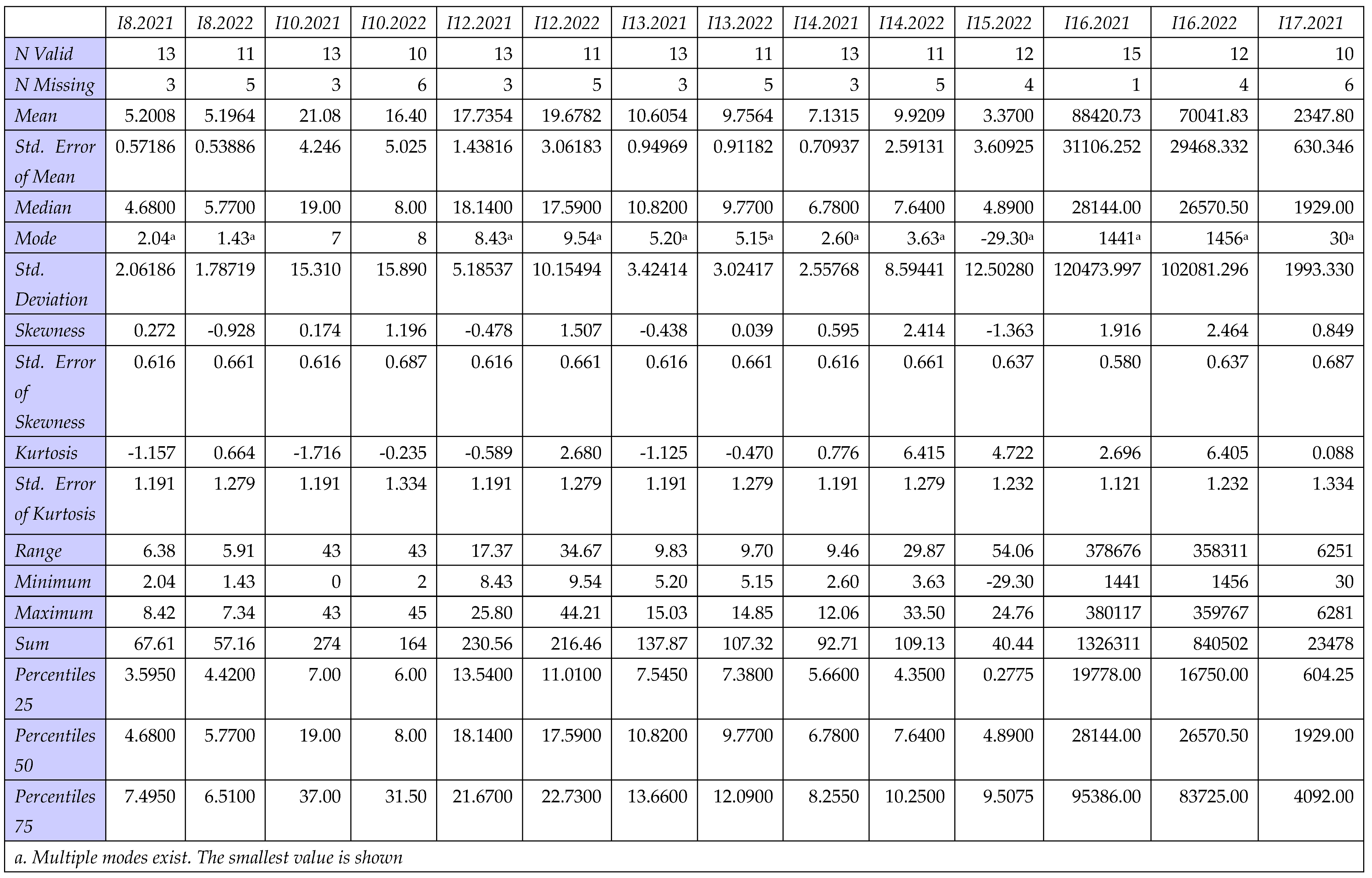

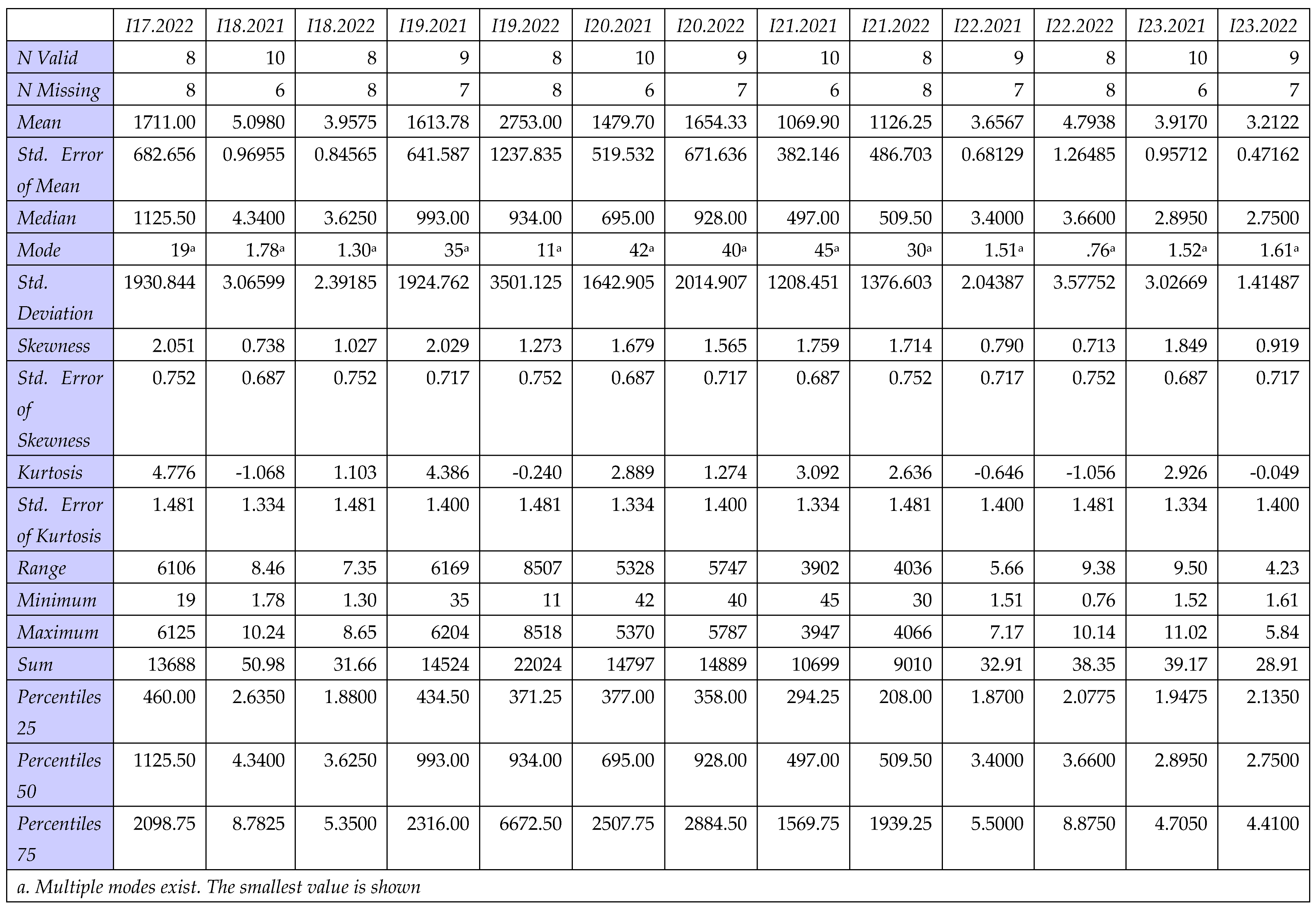

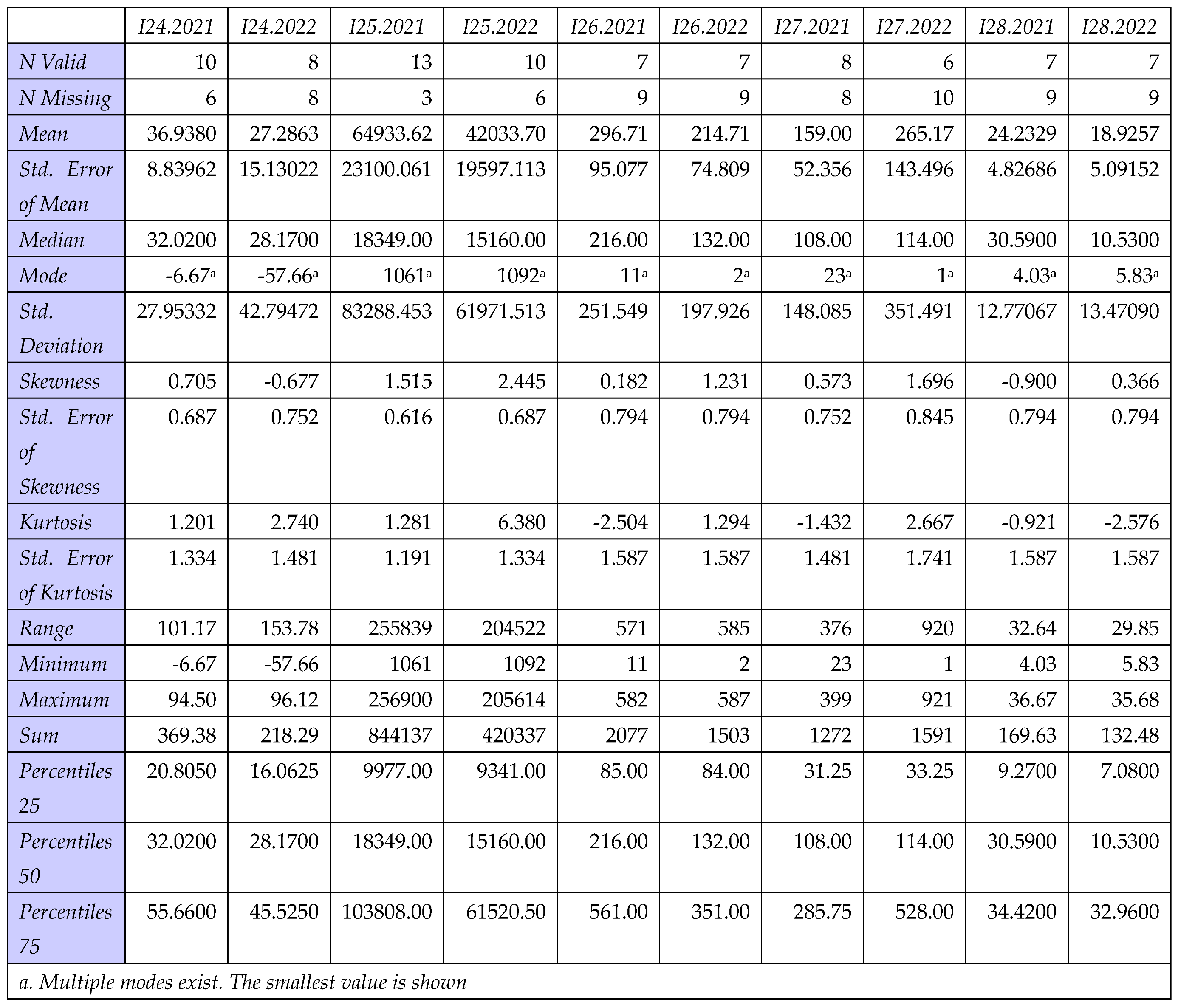

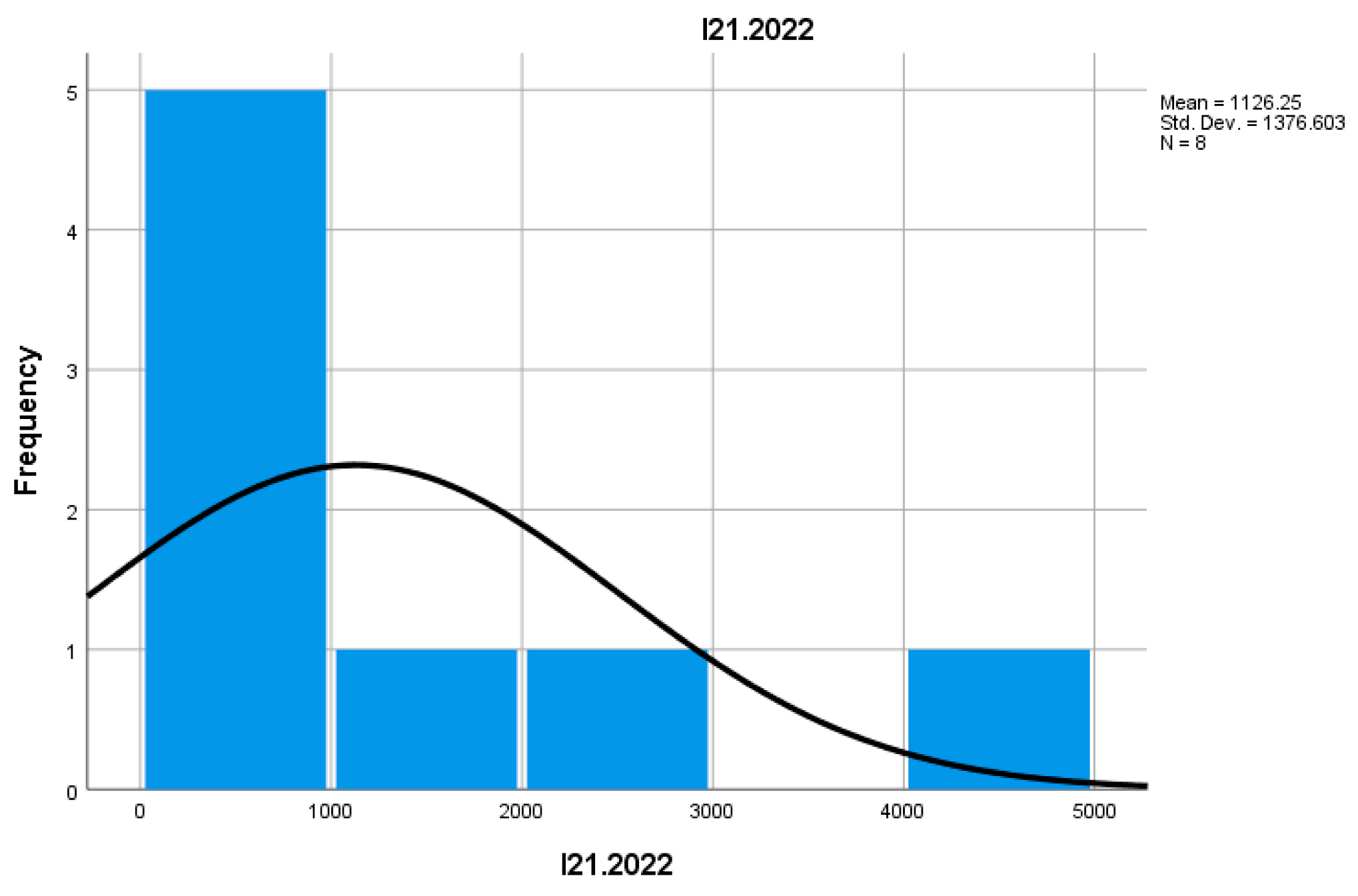

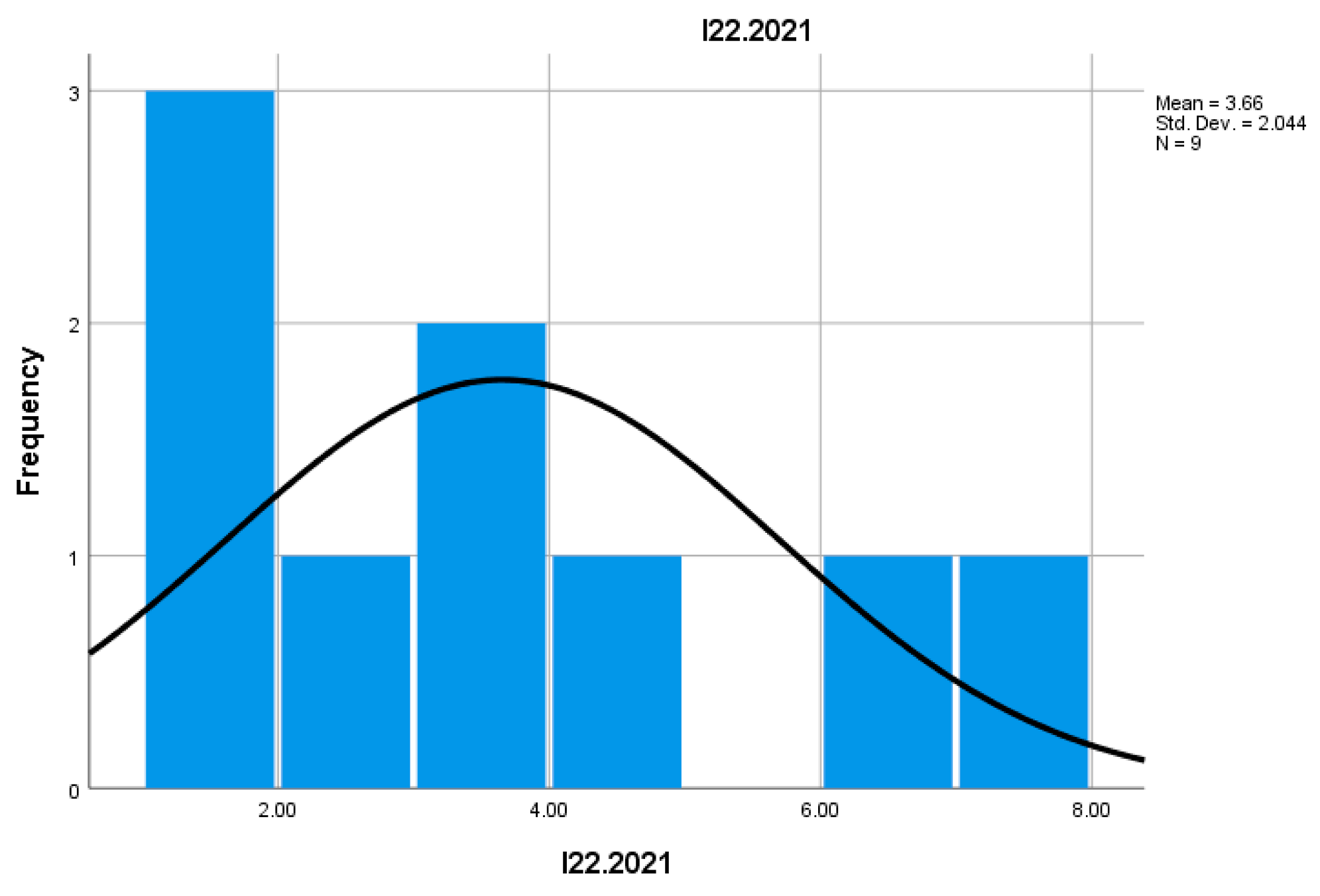

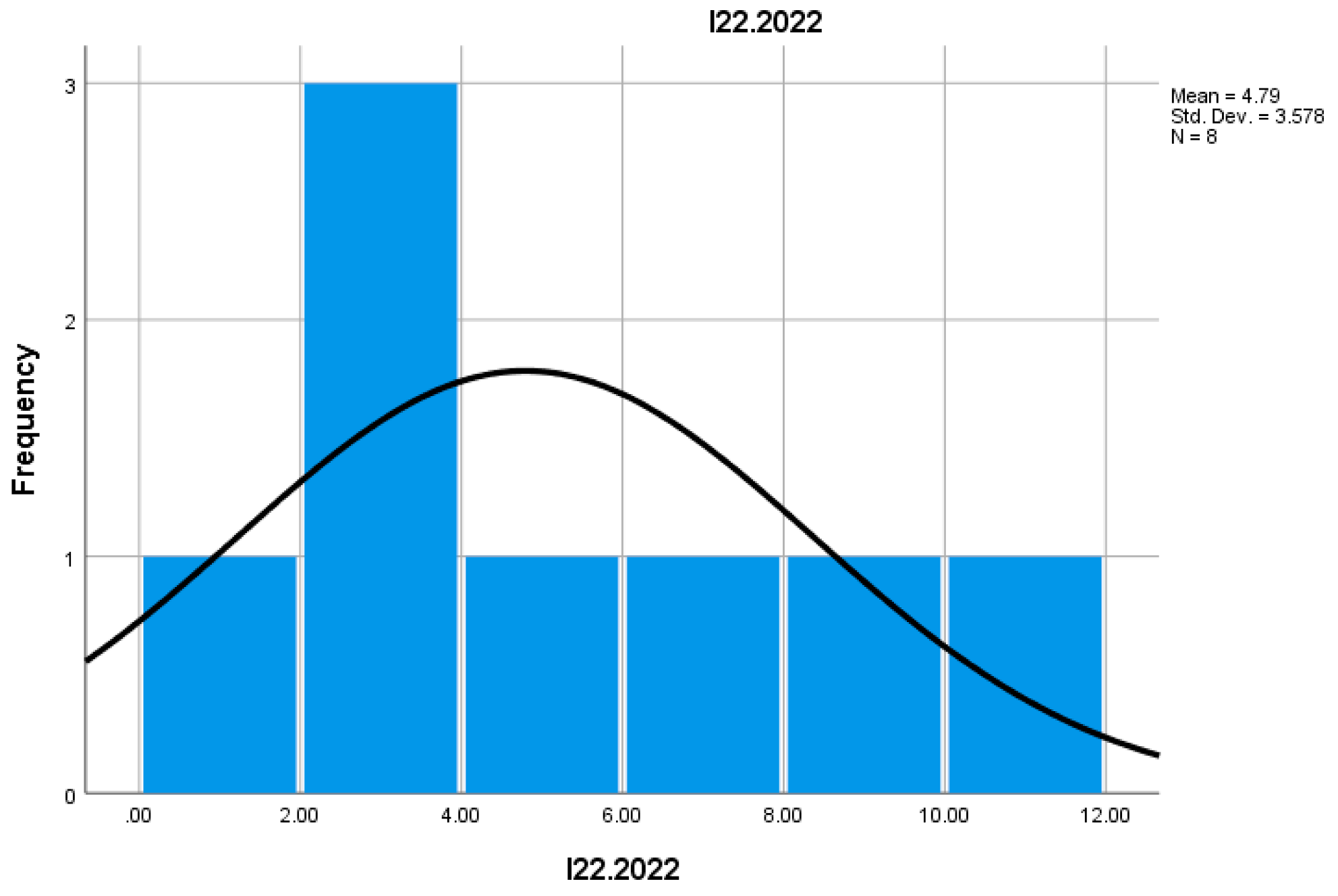

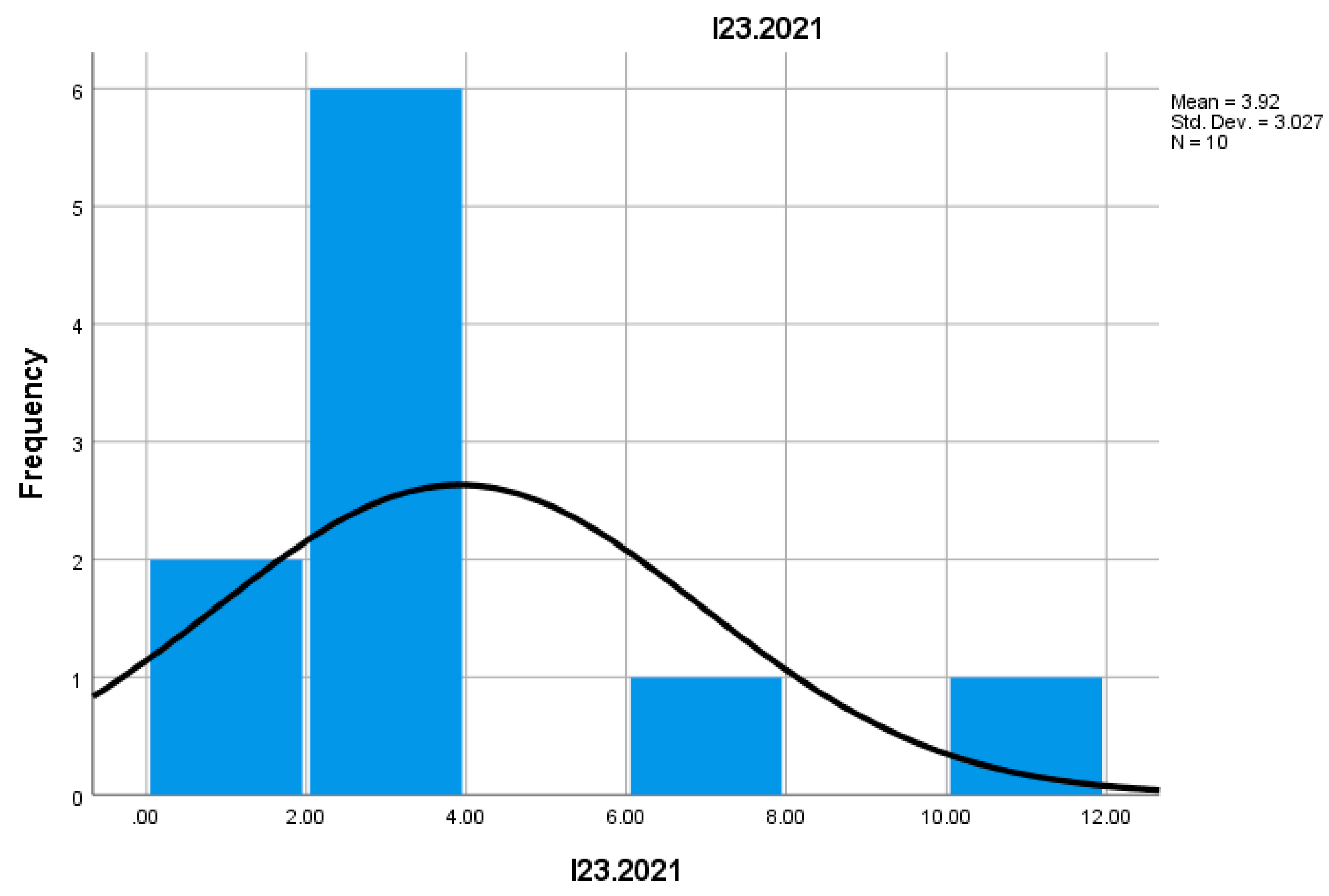

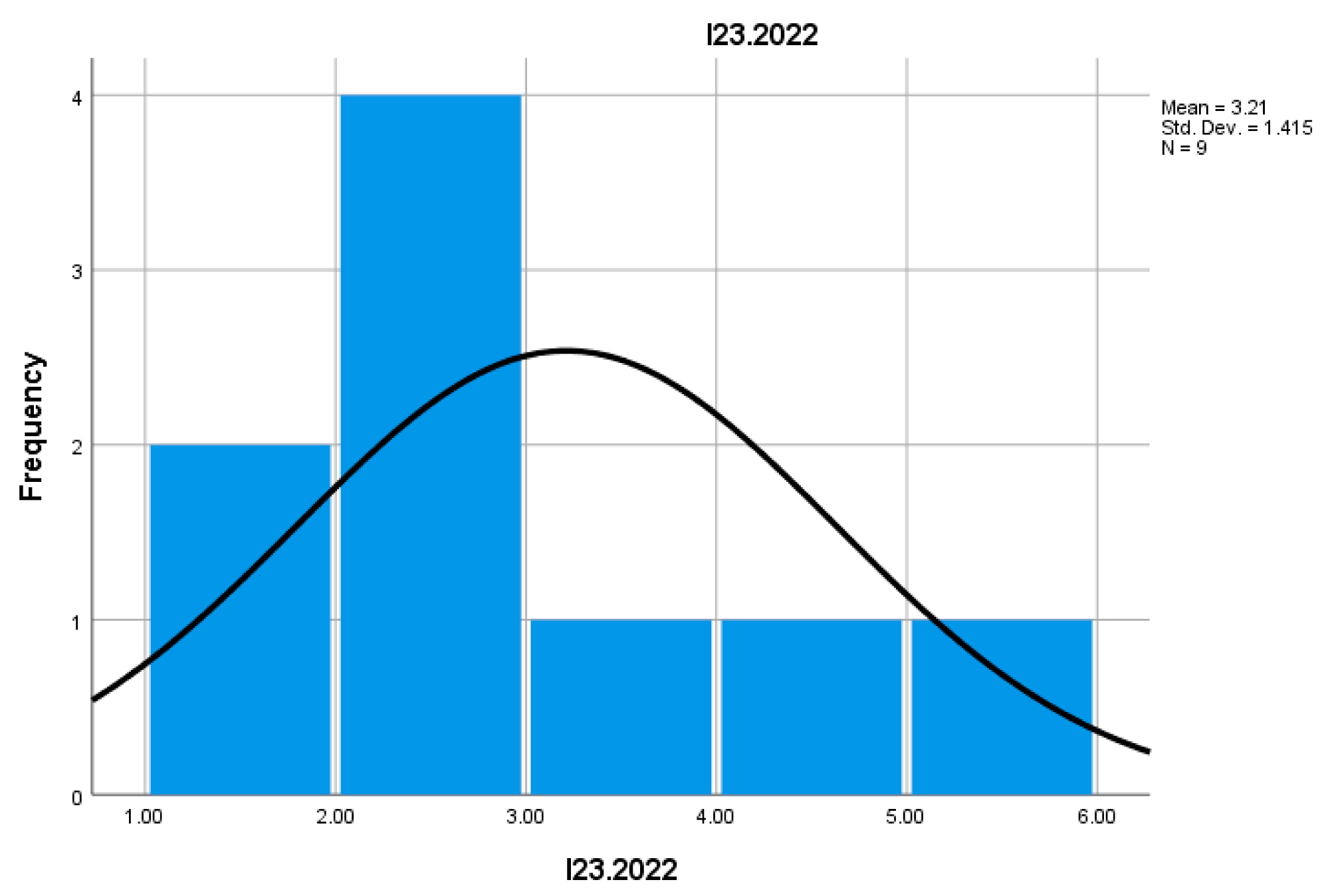

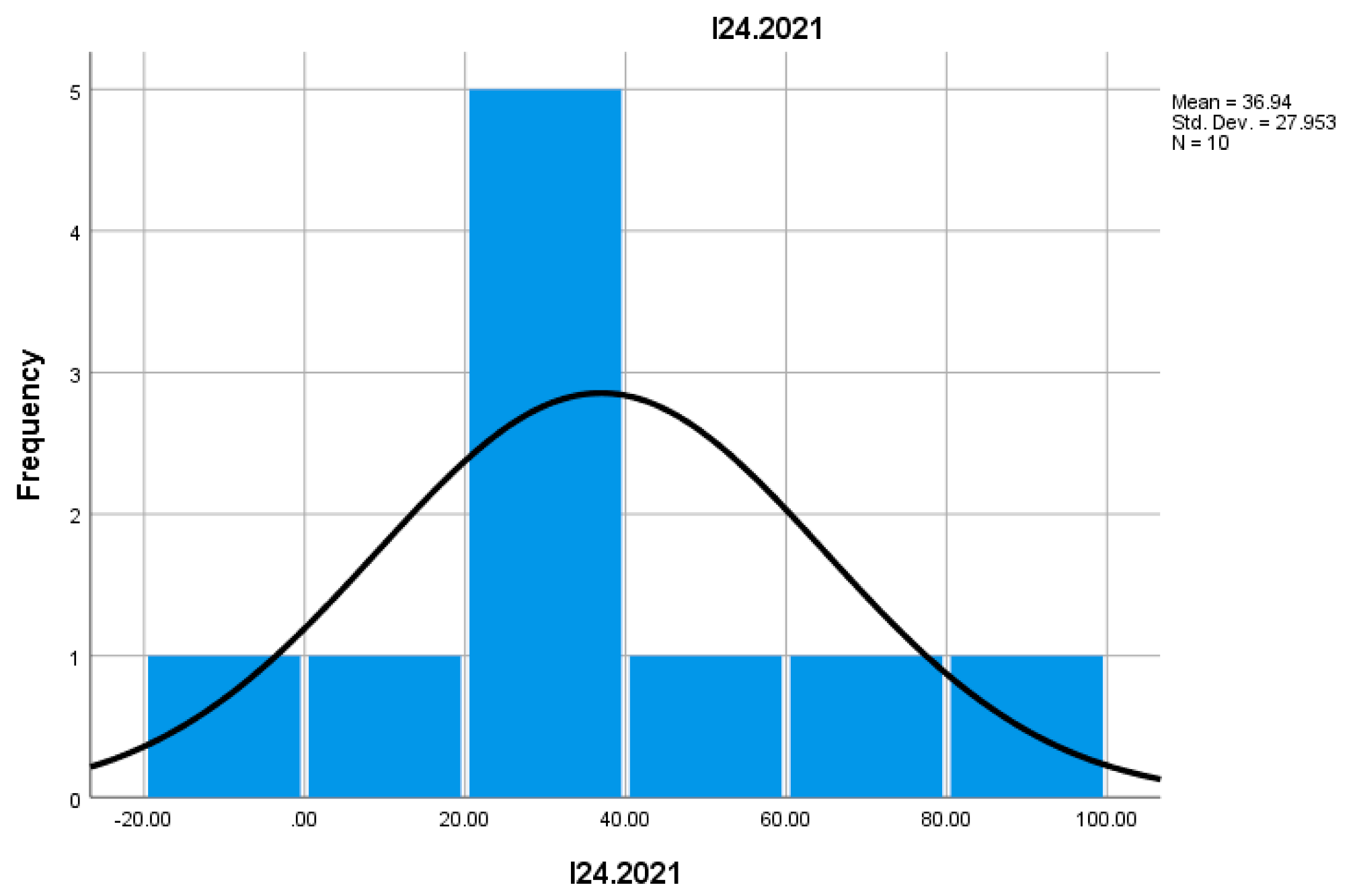

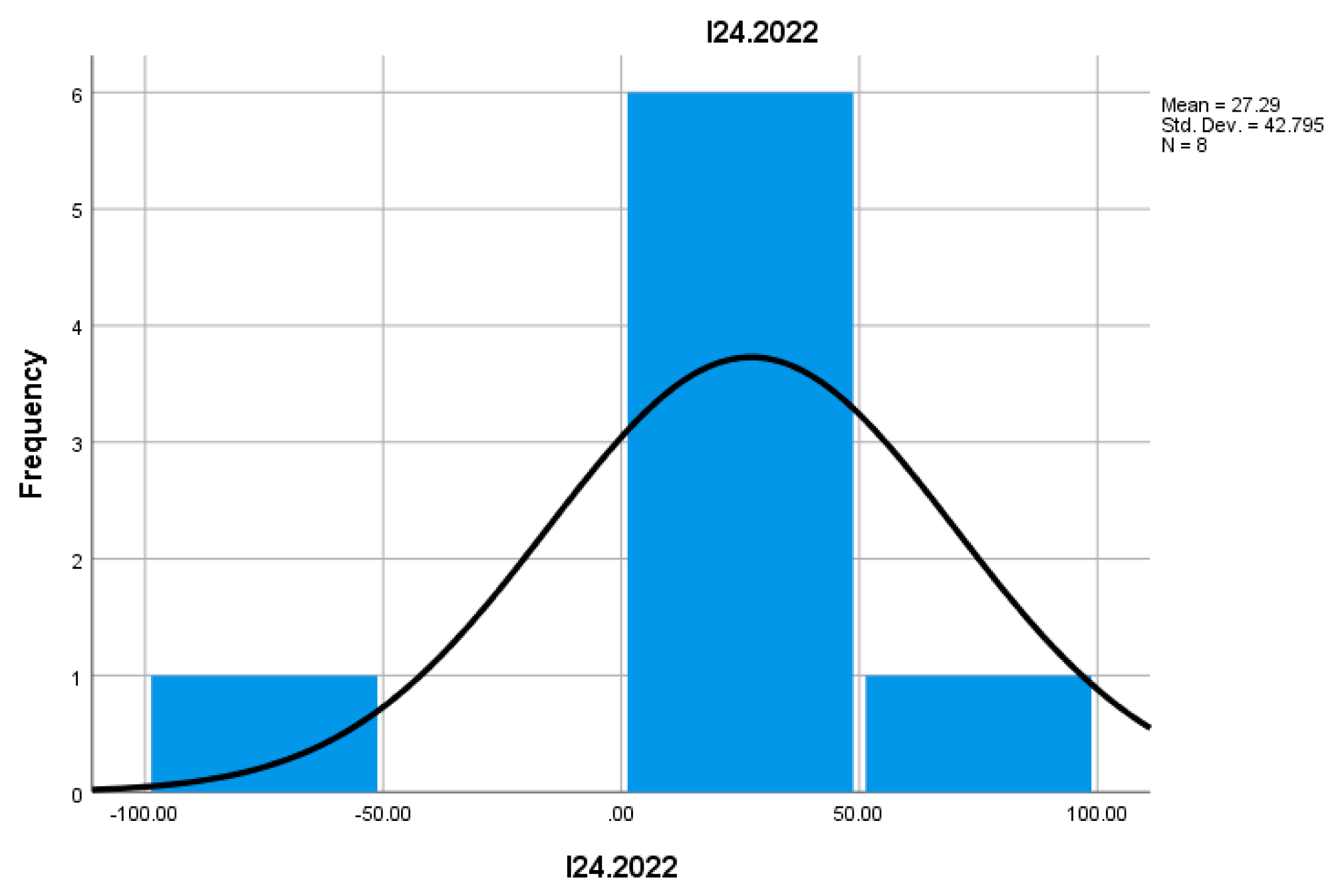

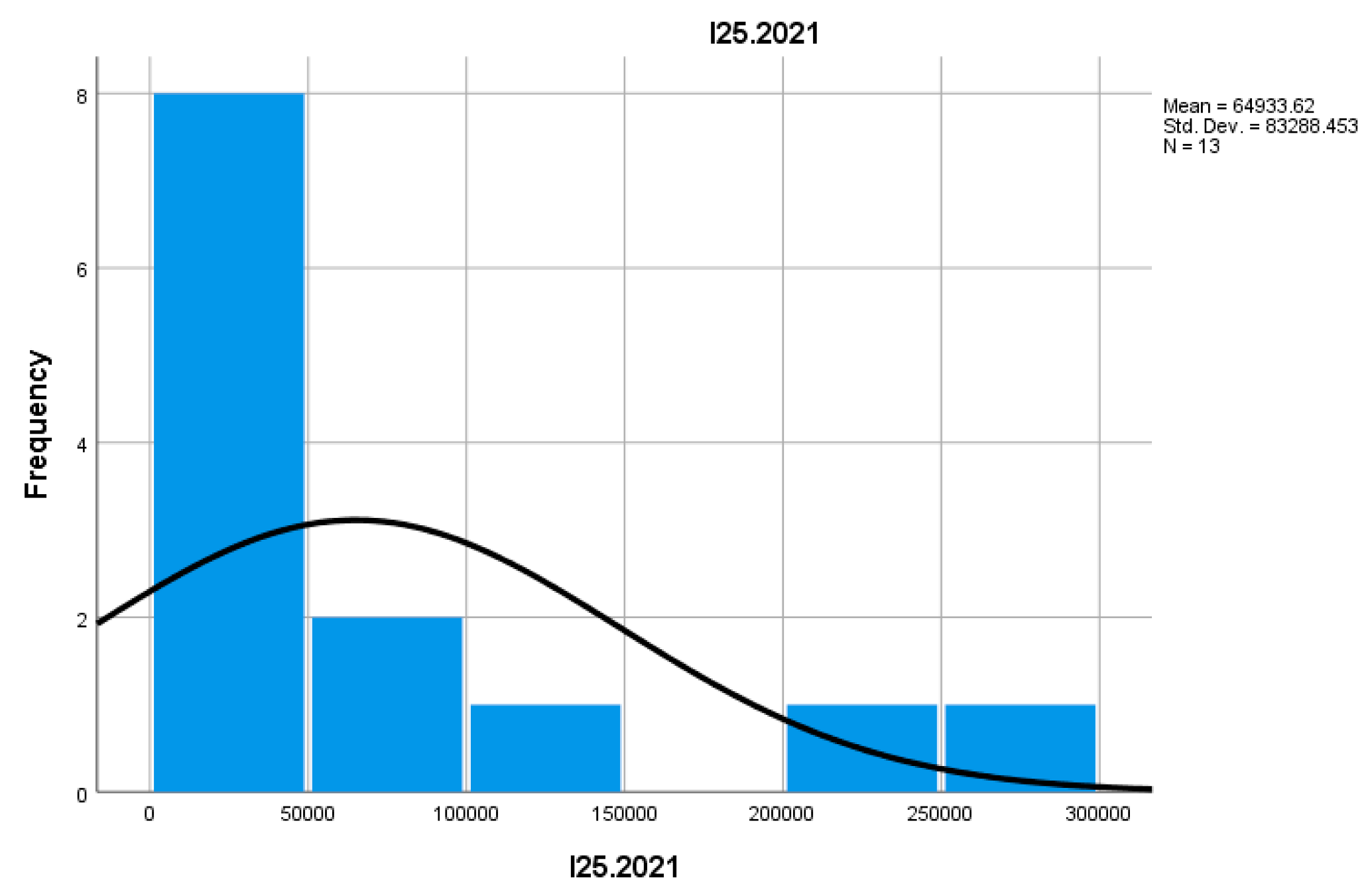

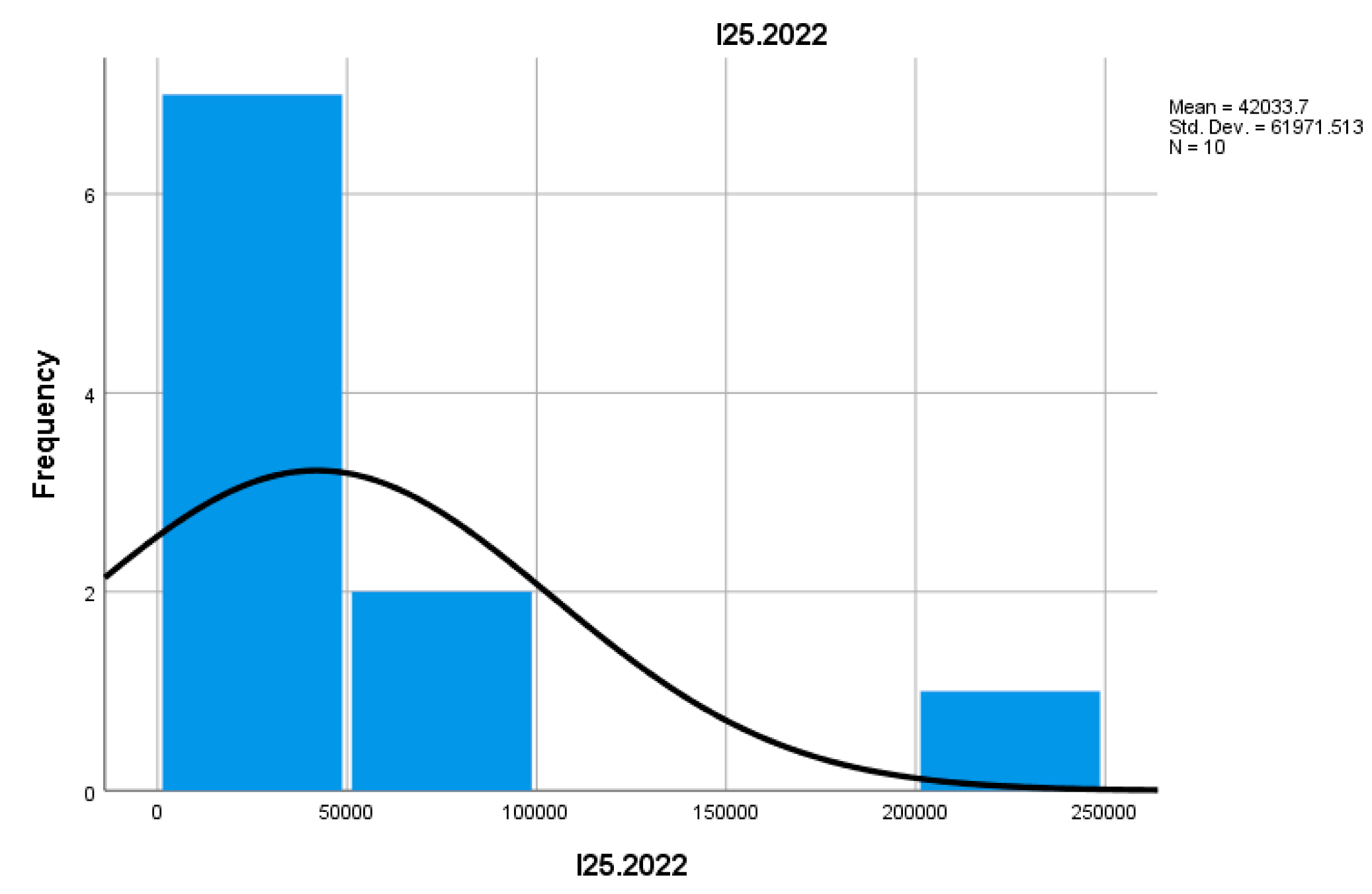

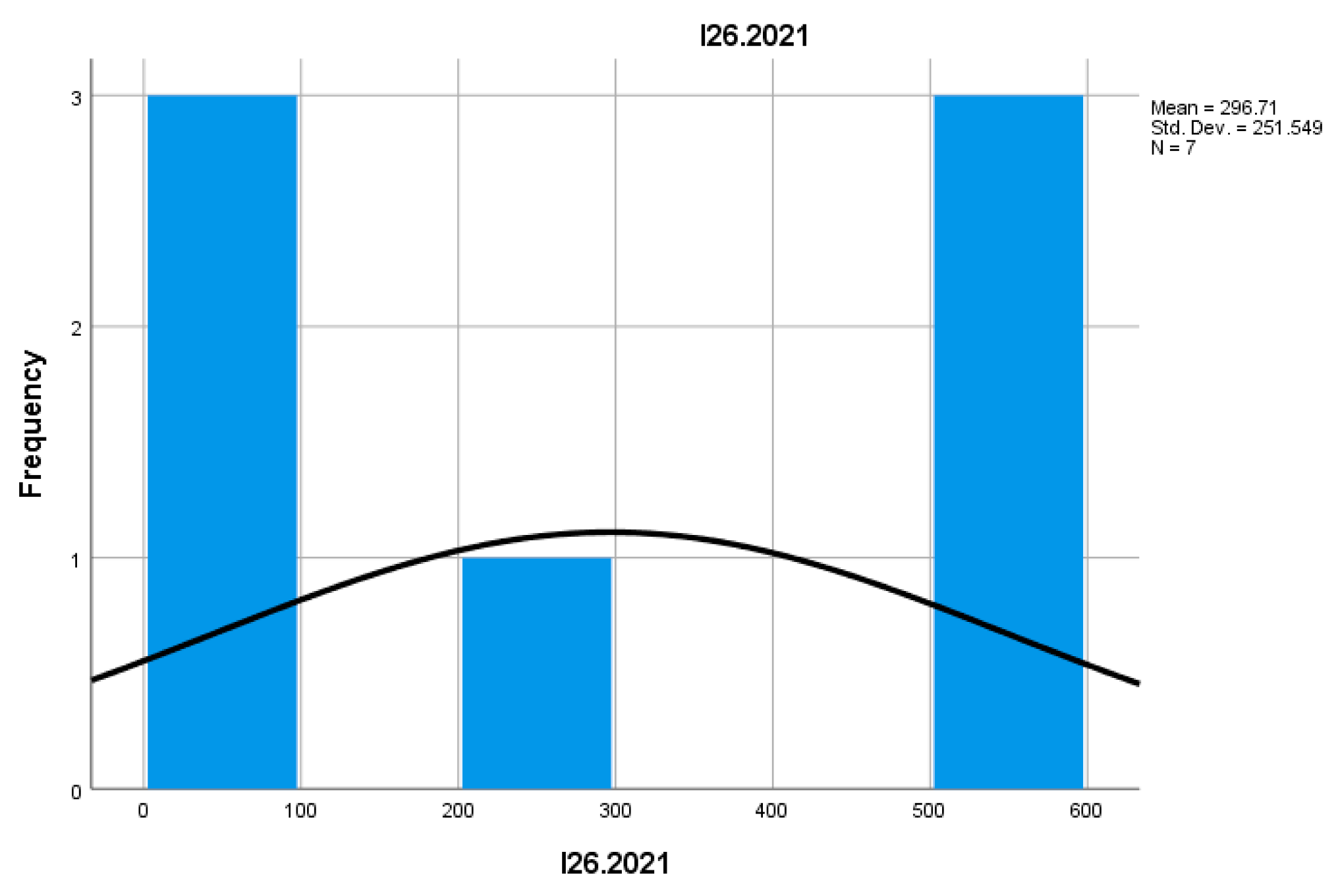

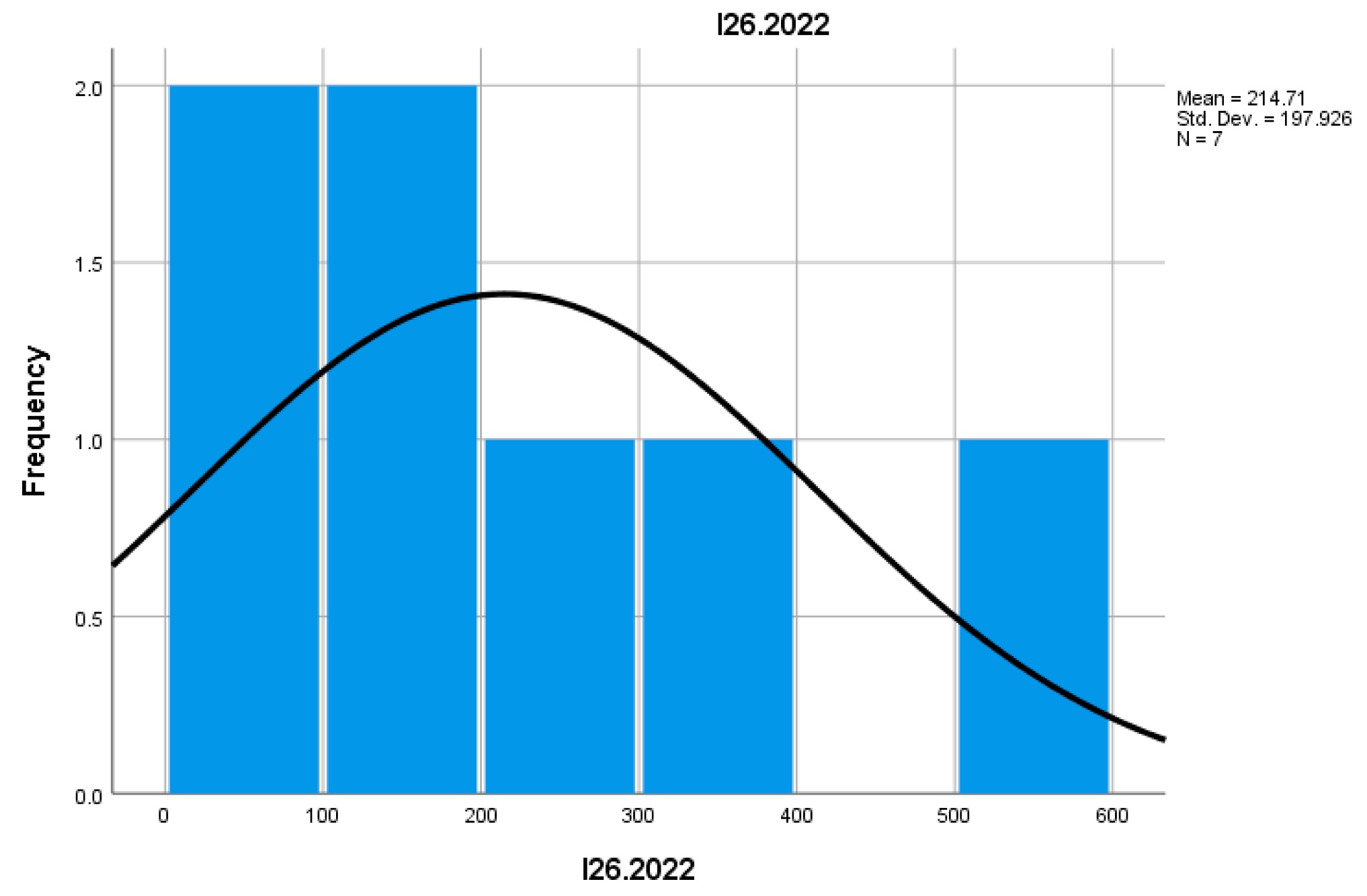

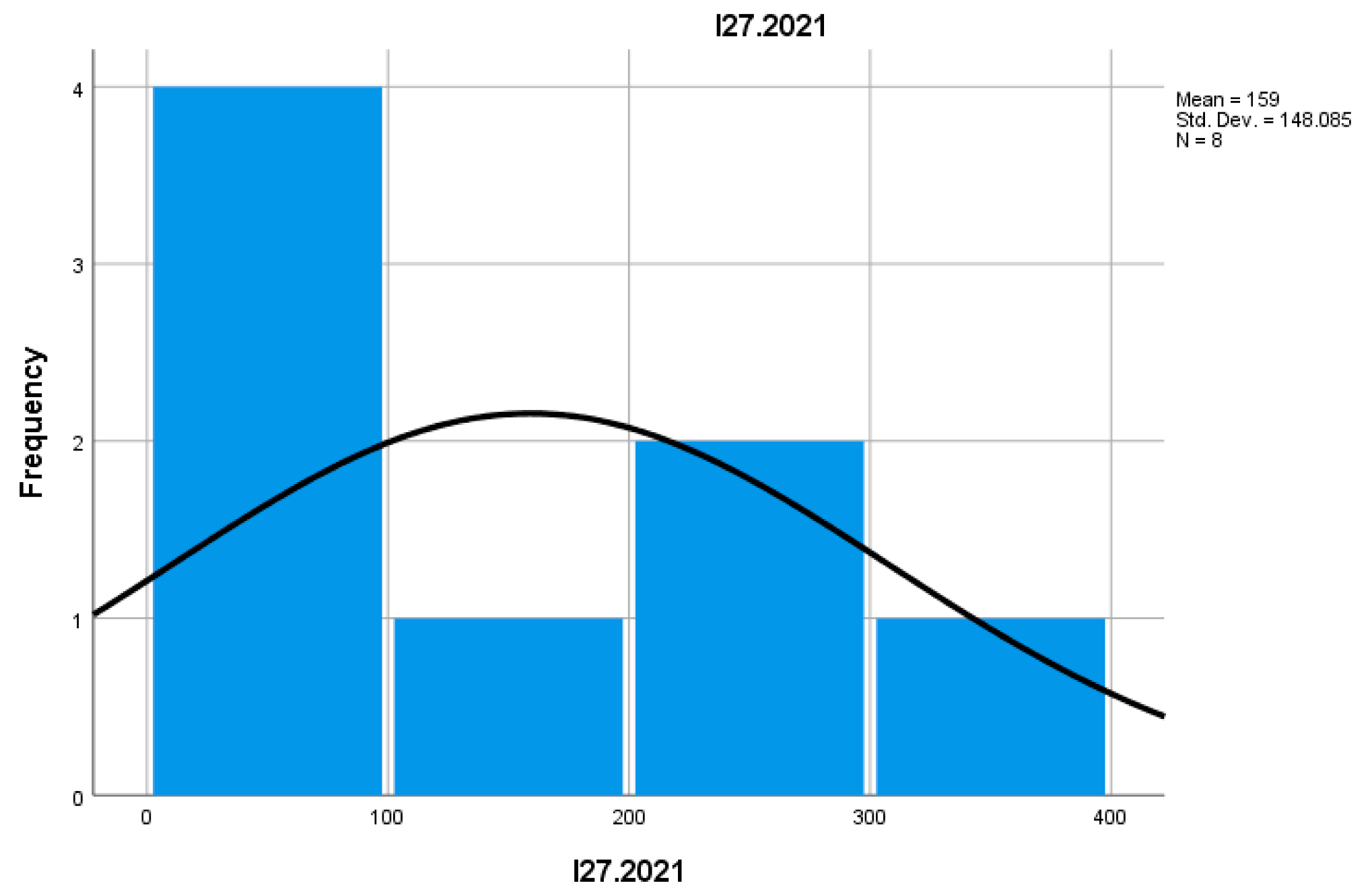

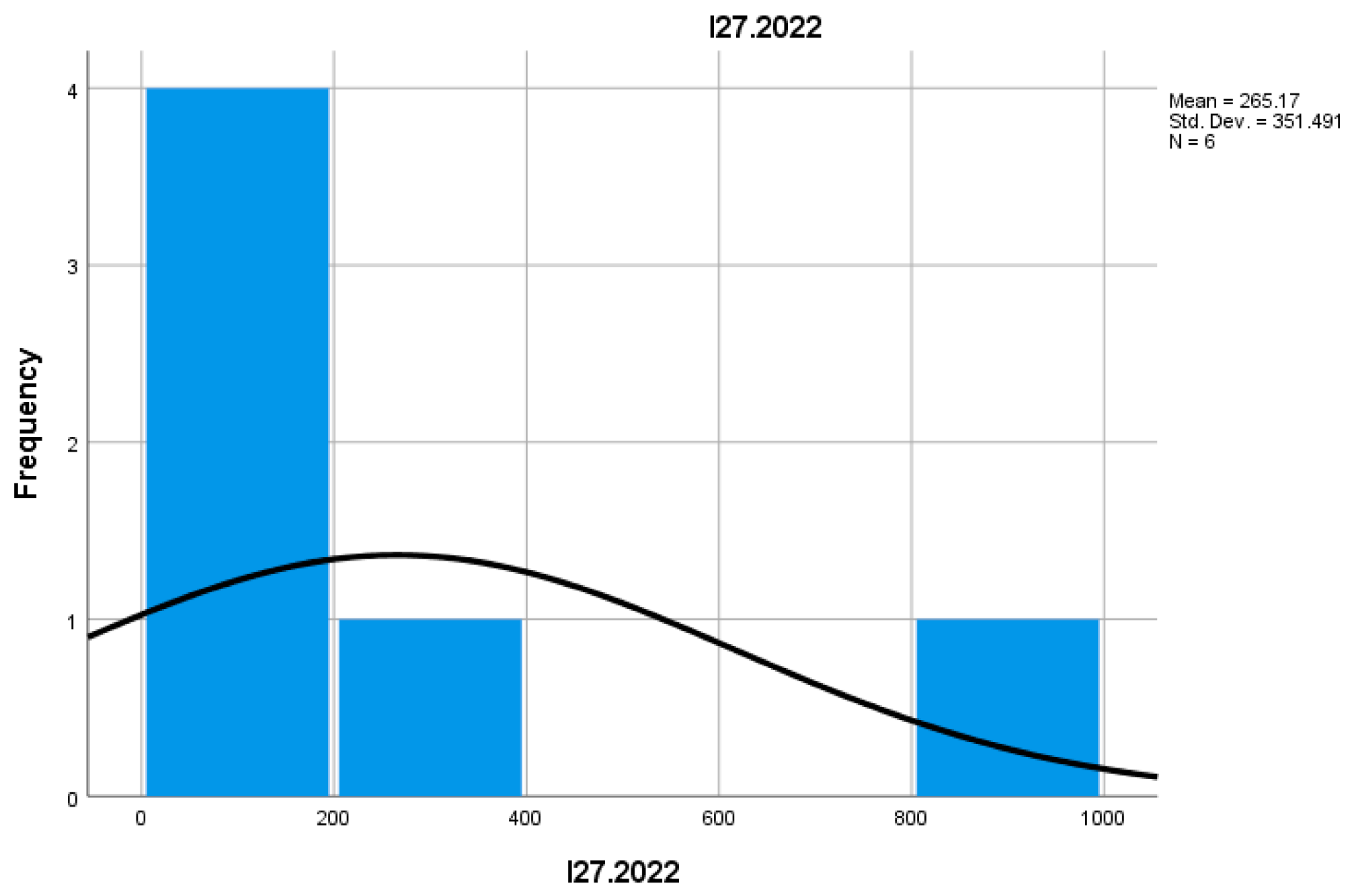

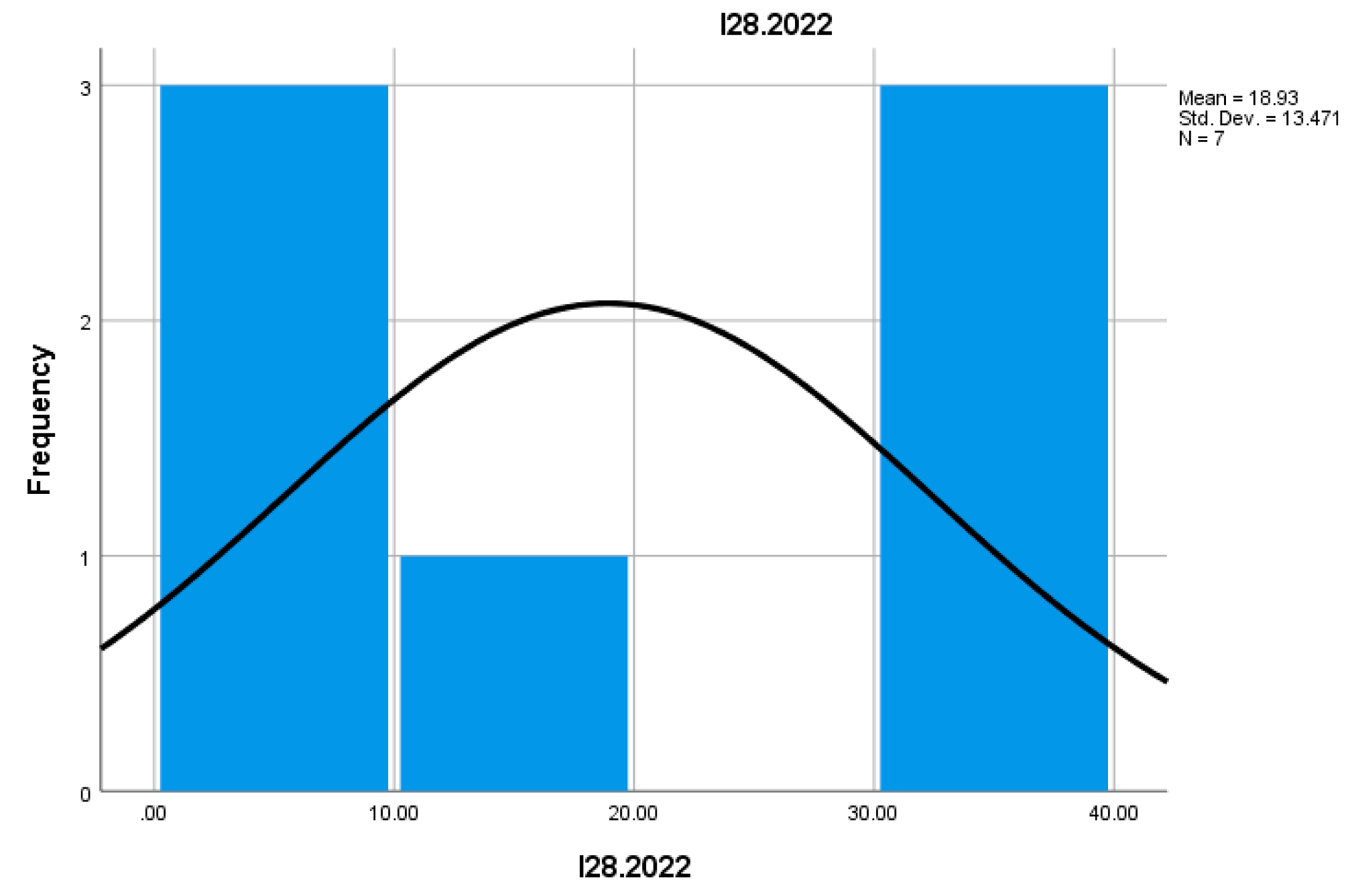

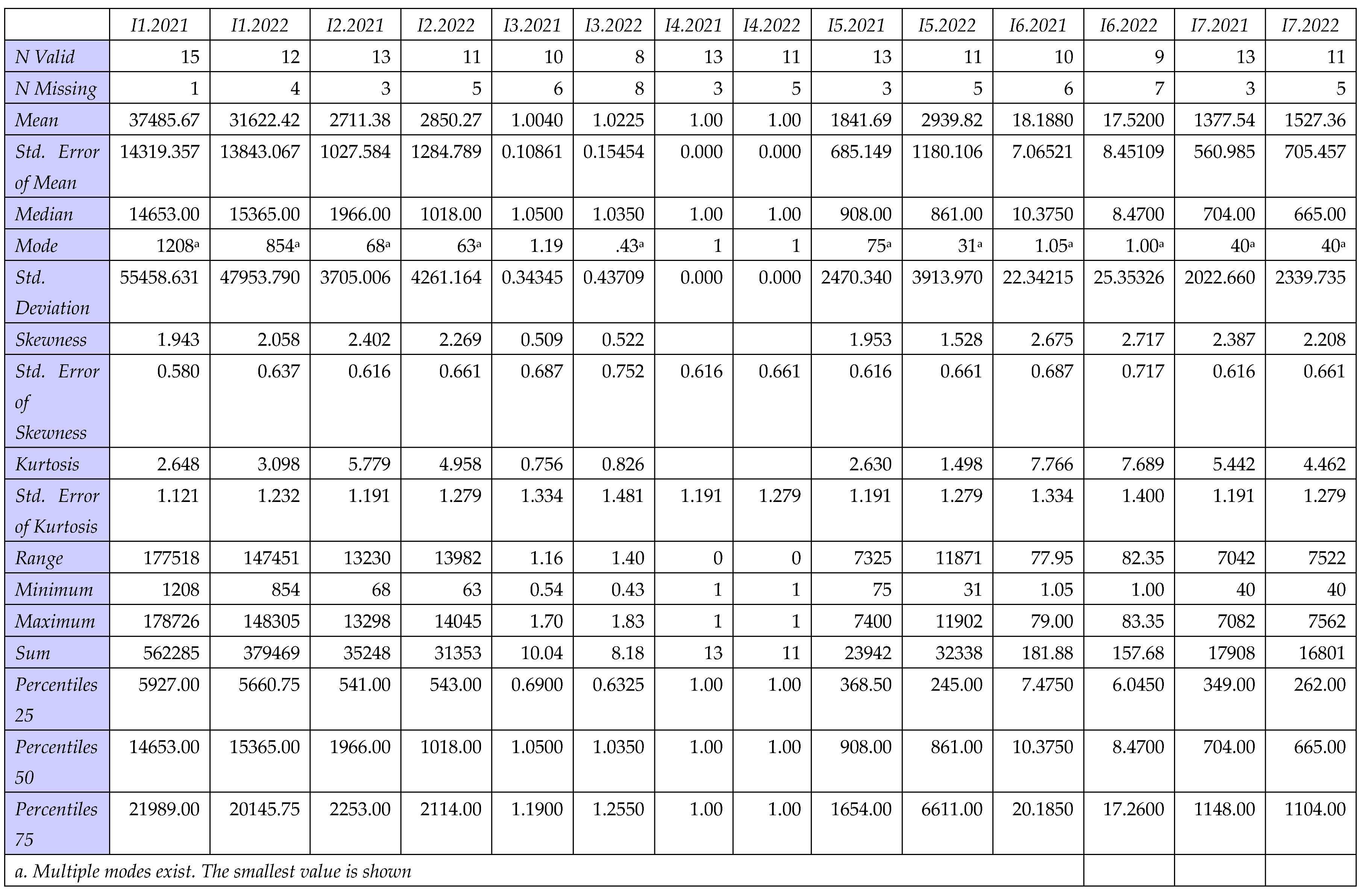

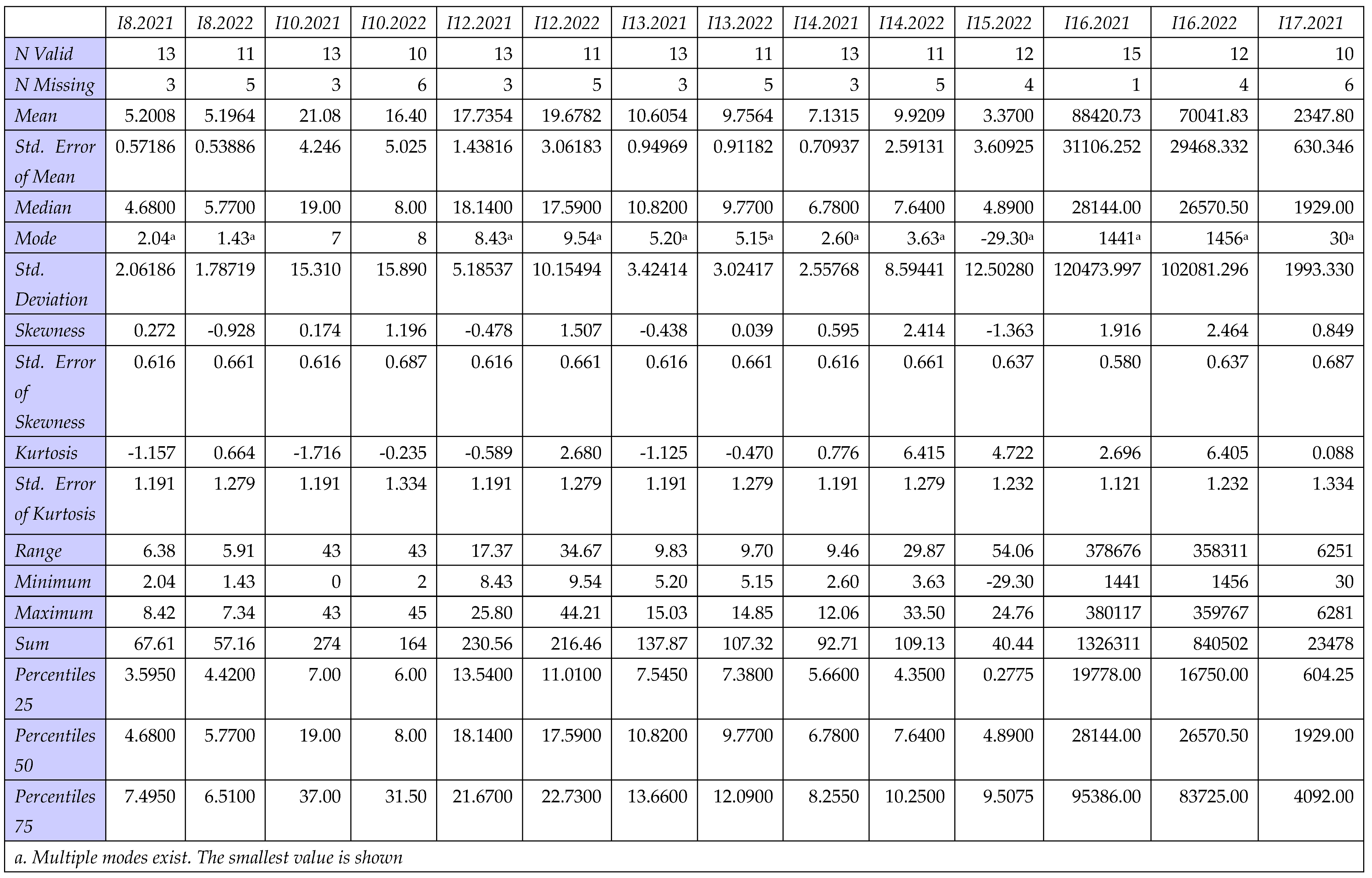

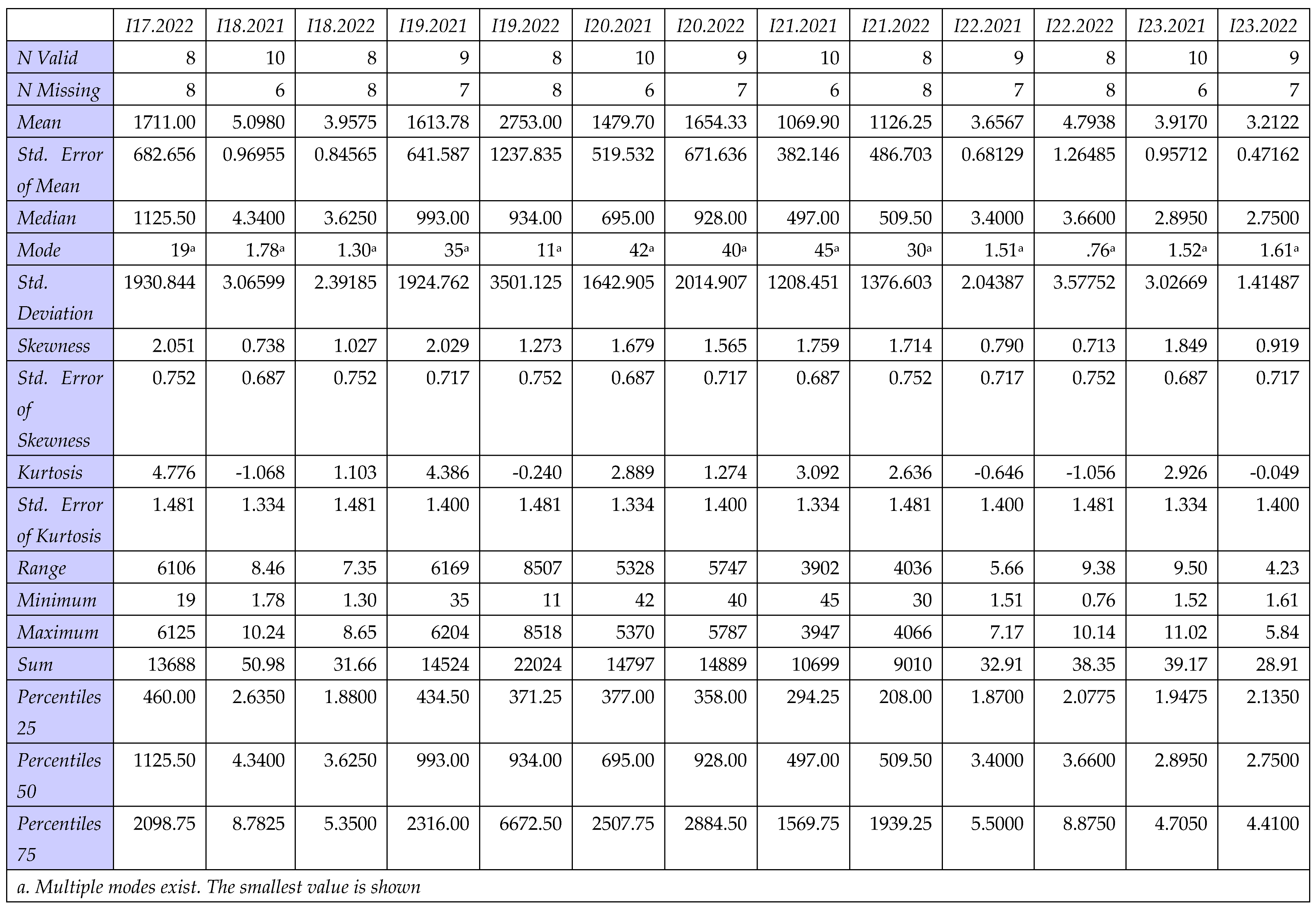

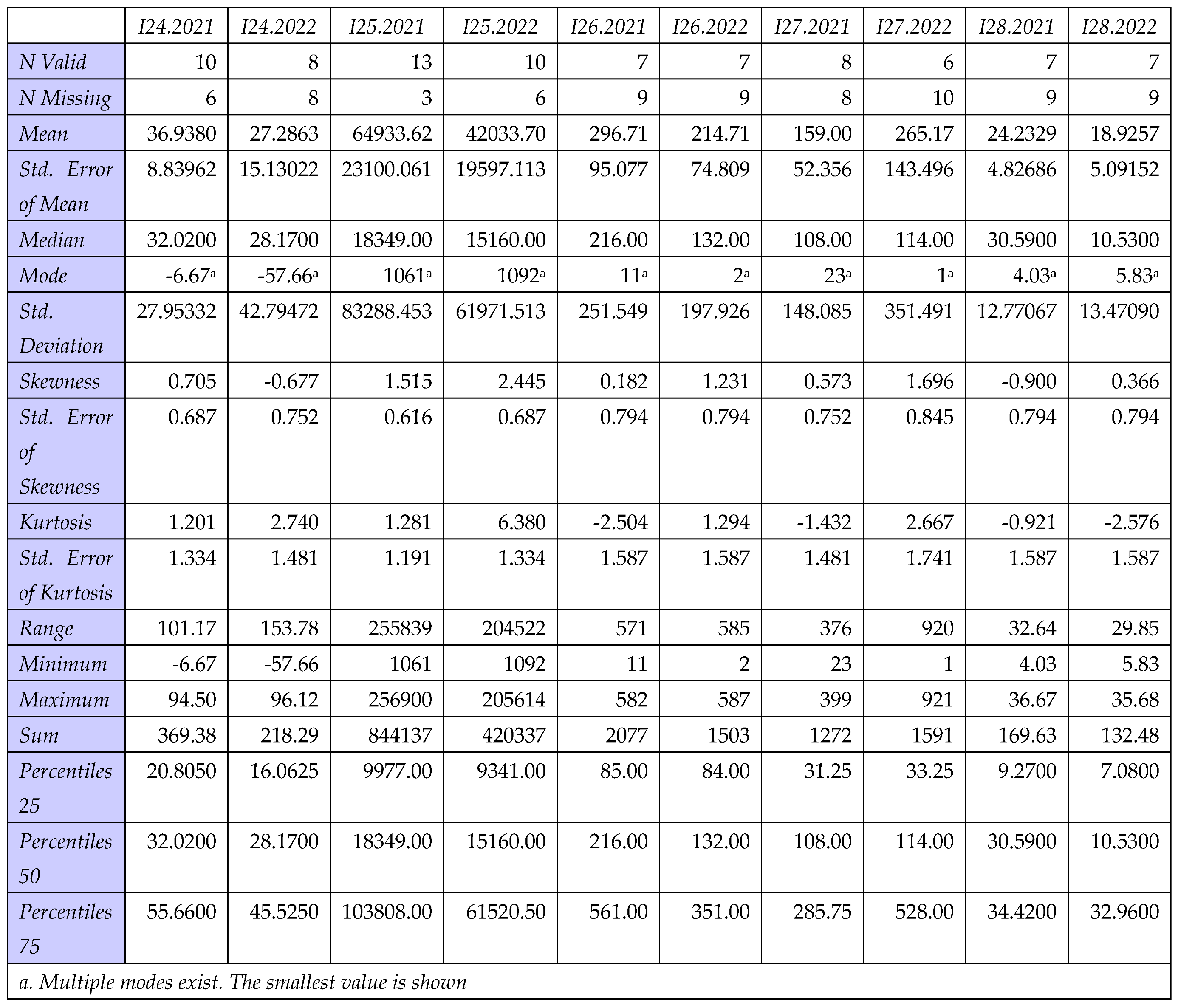

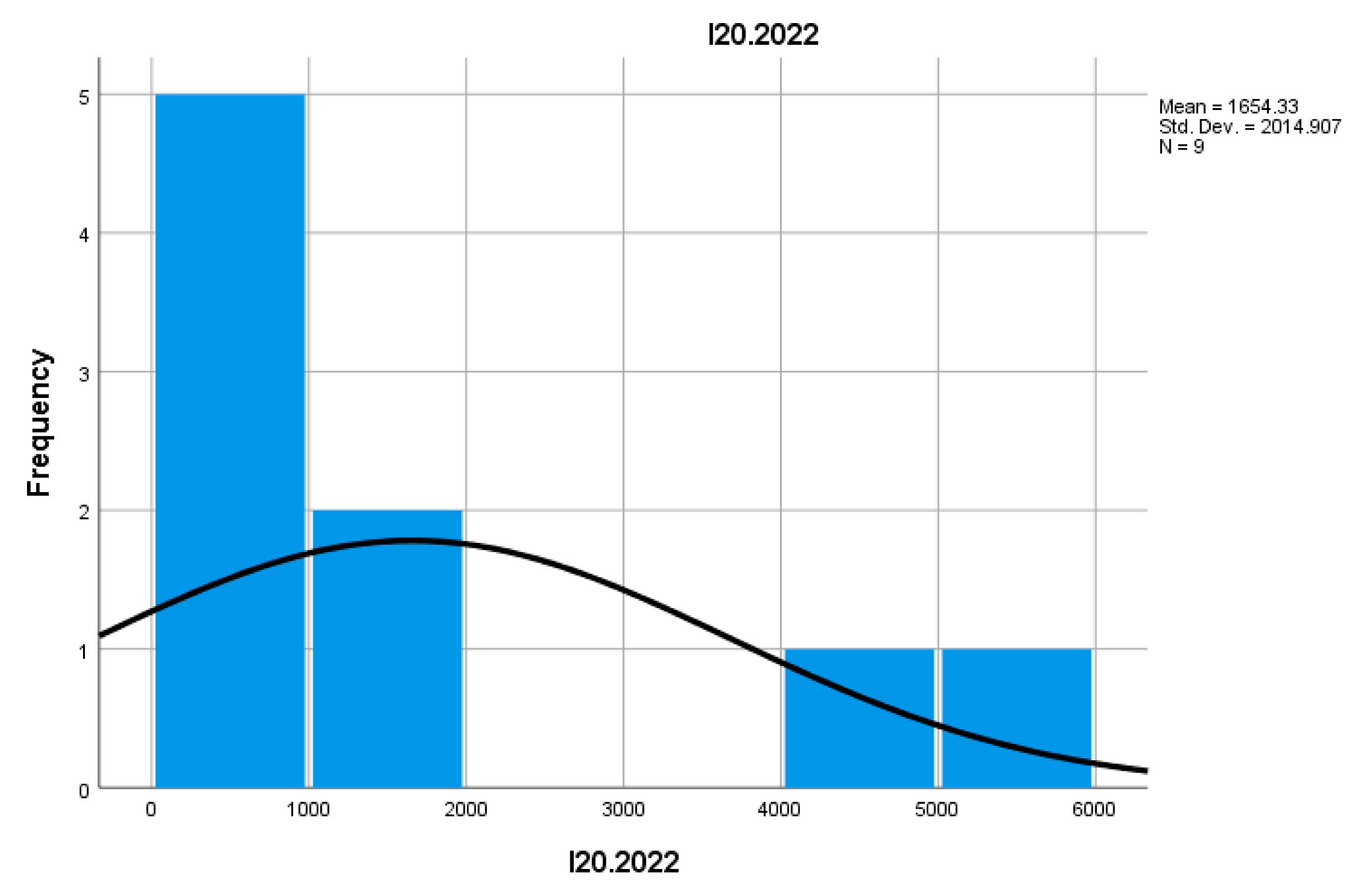

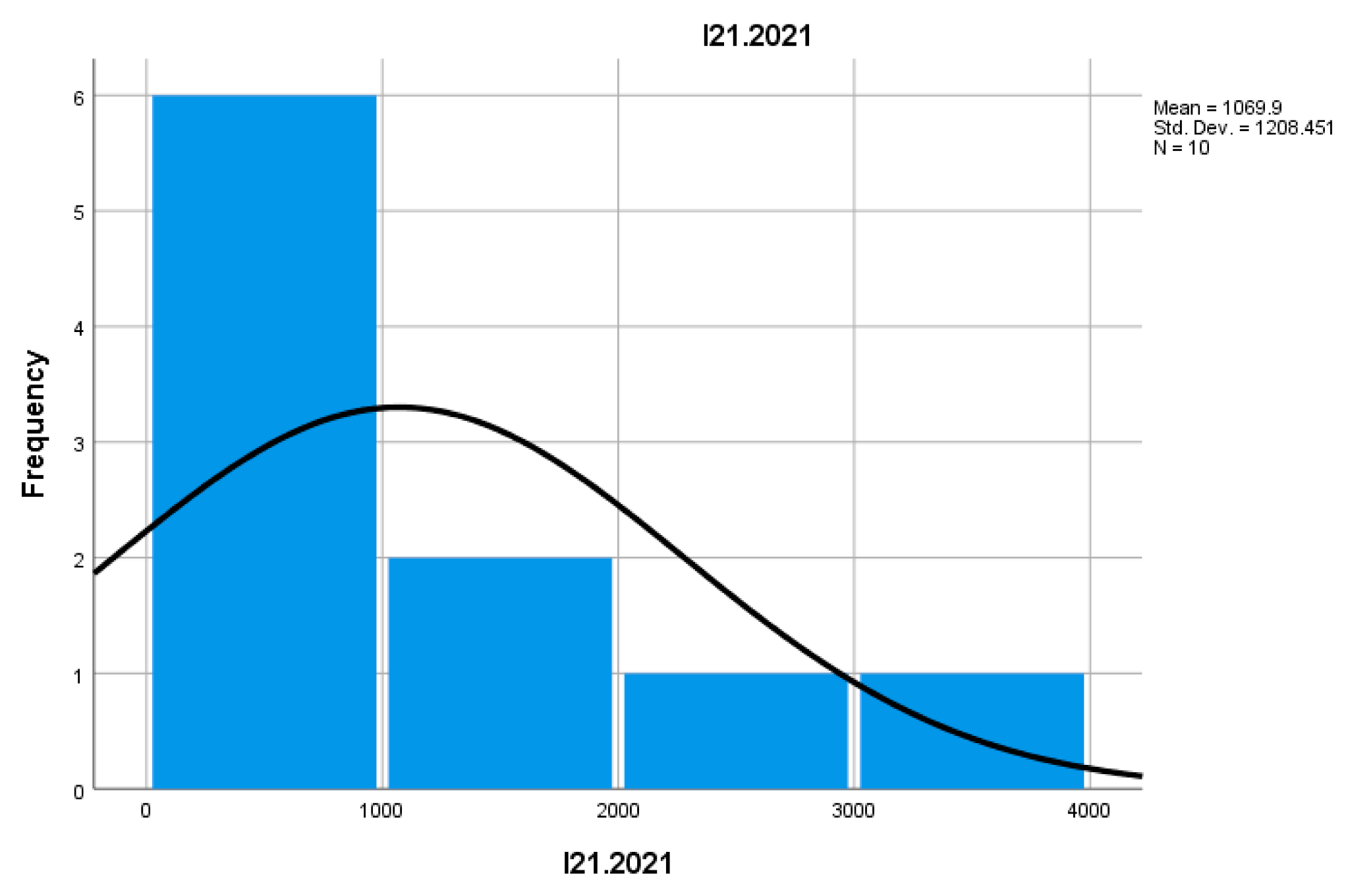

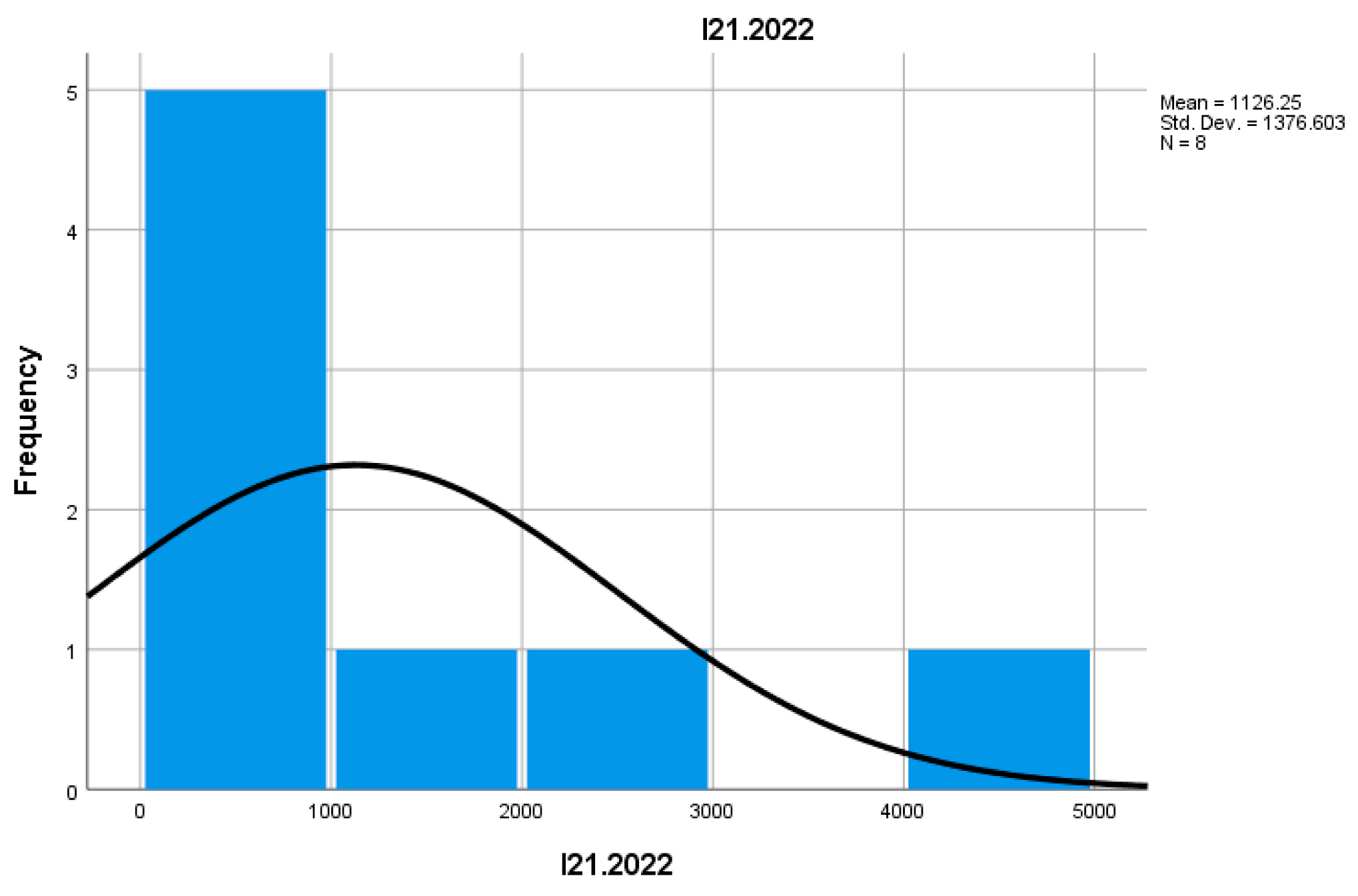

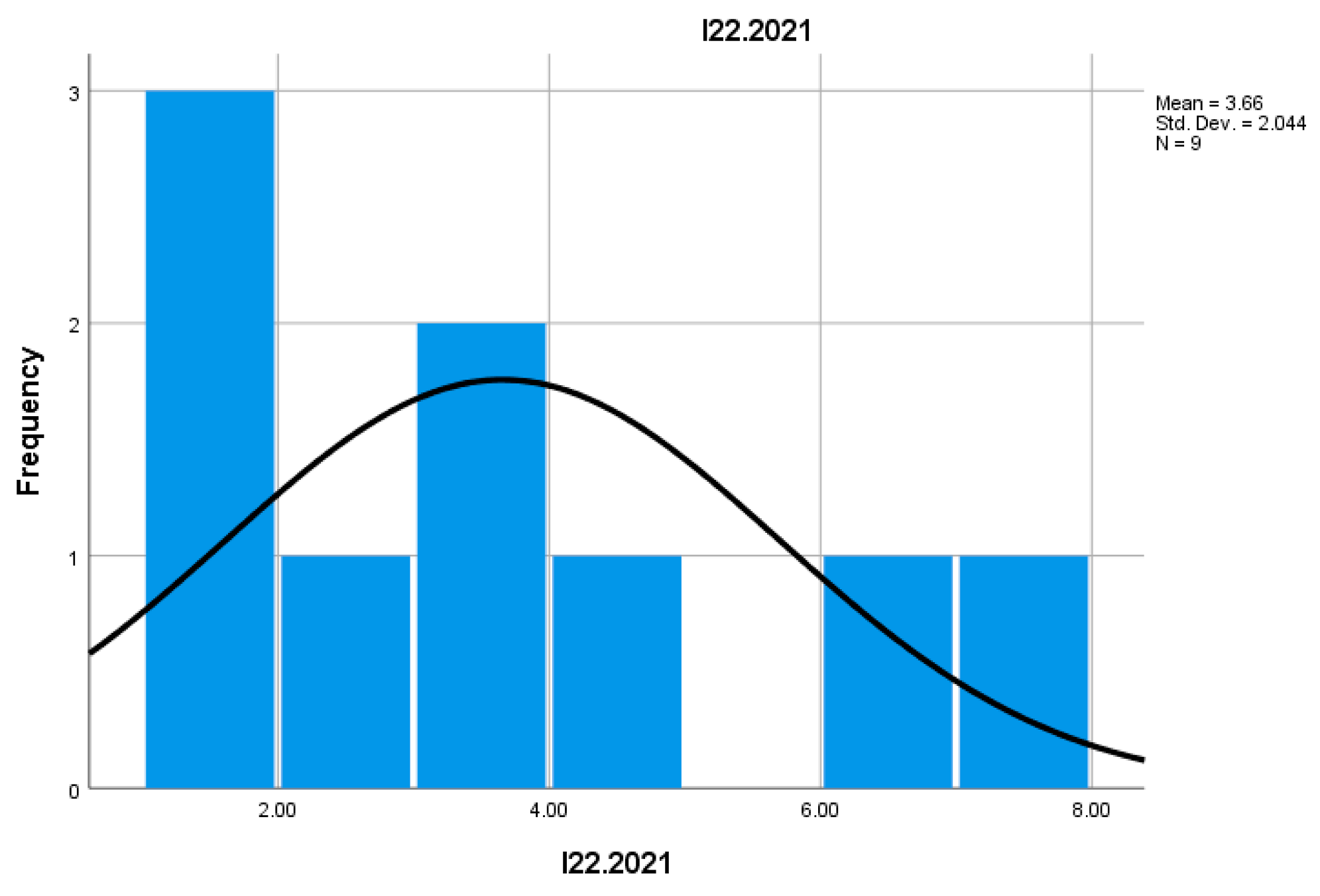

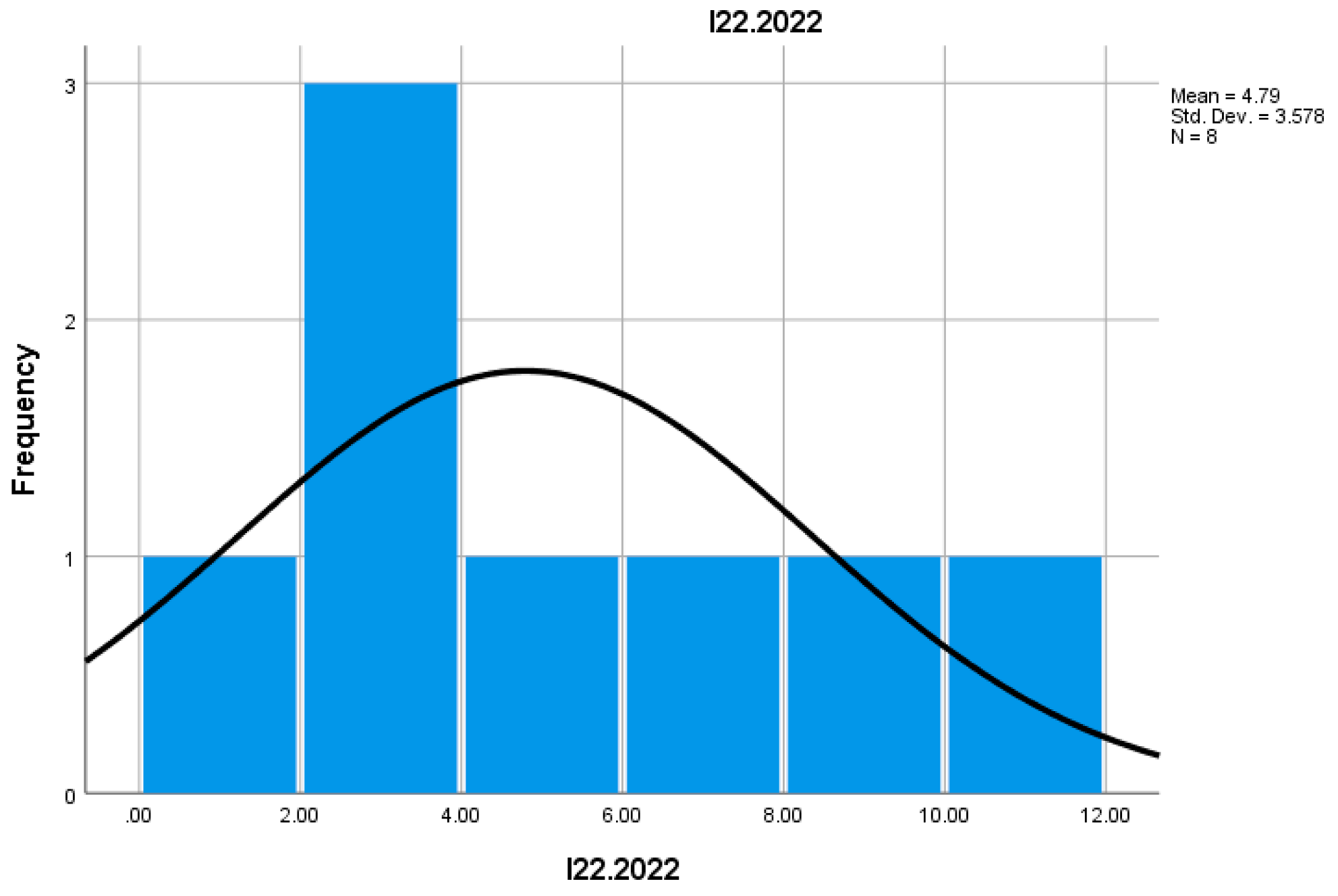

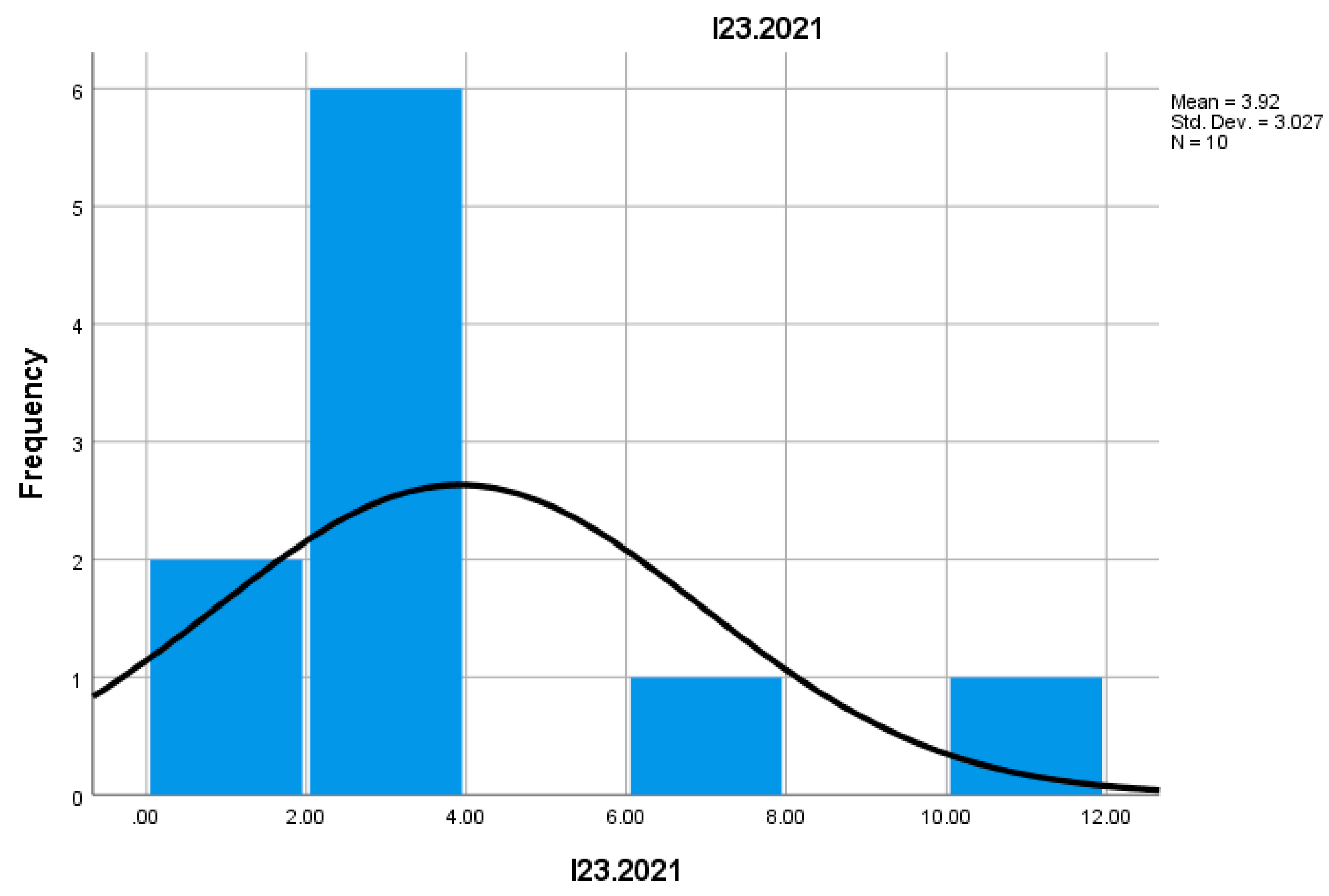

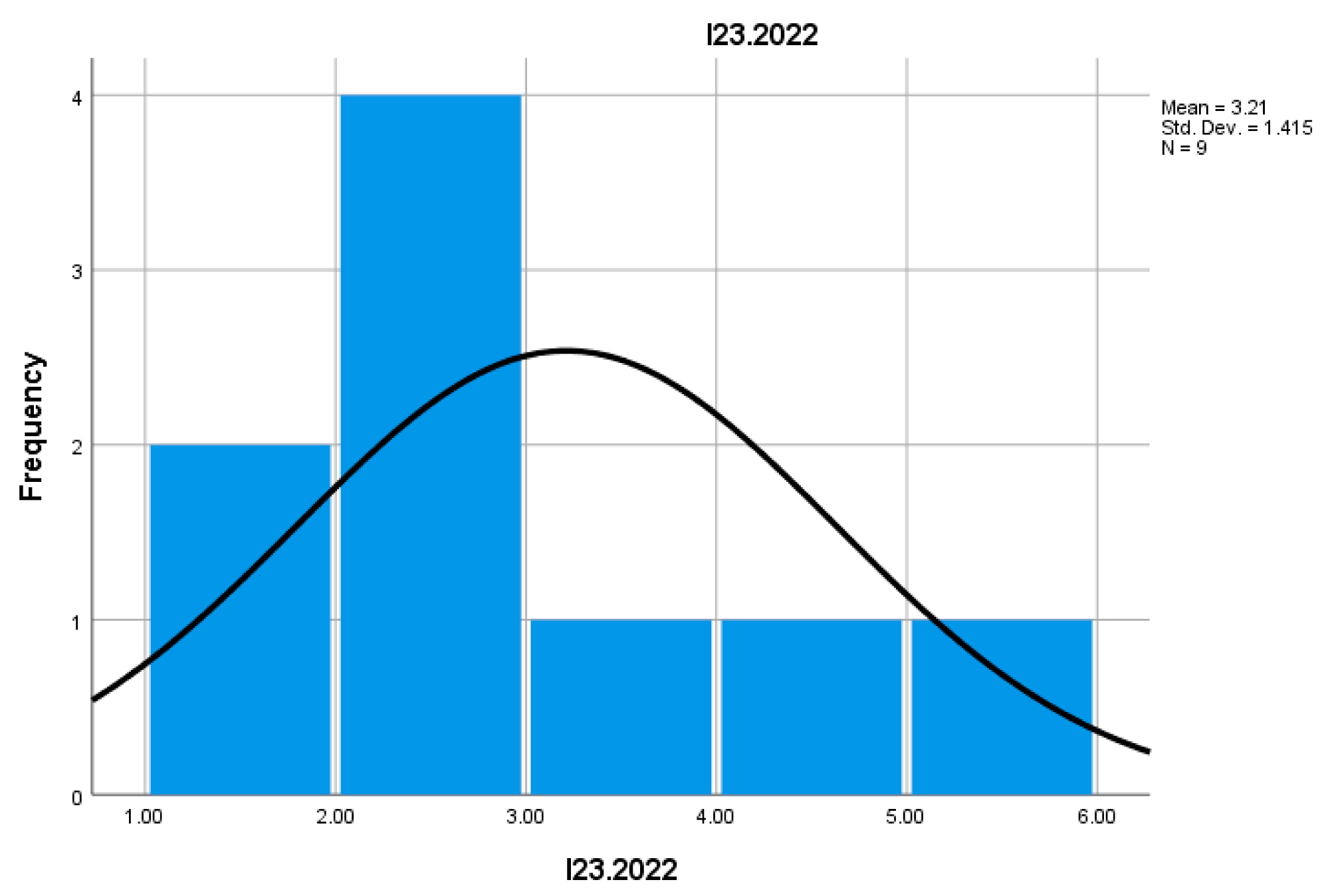

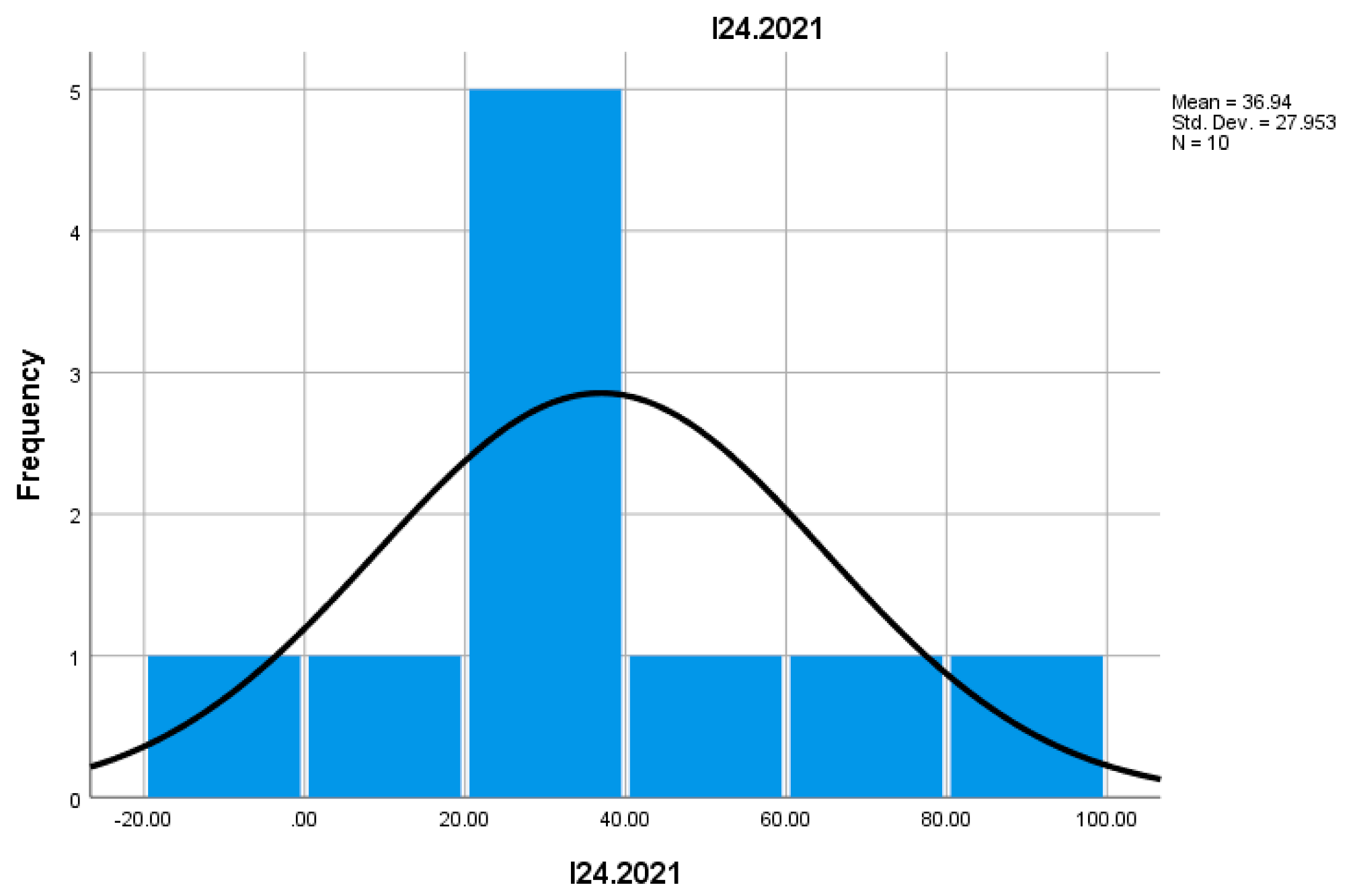

The data for this study come from Eurostat, reflected in a set of tables and figures covering the 2021-2022 period, with observations for each quarter (I1-I28 for 2021 and 2022) (tables and figures). Each table and figure provide essential information such as:

- -

the number of valid and missing observations;

- -

the mean, standard deviation, median, and other descriptive statistics for each data set;

- -

significant economic indicators, including average revenues, their volatility, and their distribution.

Thus, to fully analyze this data, specific information was extracted from each section of the tables and relevant indicators were calculated.

The first step of the analysis consisted of calculating basic descriptive statistics for each relevant variable. These statistics included:

- -

mean: to get a general idea of the typical values of the financial variables;

- -

median and mode: to understand the distribution and concentration of values;

- -

standard deviation and standard errors: to assess volatility and the precision of estimates;

- -

Skewness and Kurtosis: to analyze the symmetry and distribution of values, aiming to detect any anomalies or irregular patterns;

- -

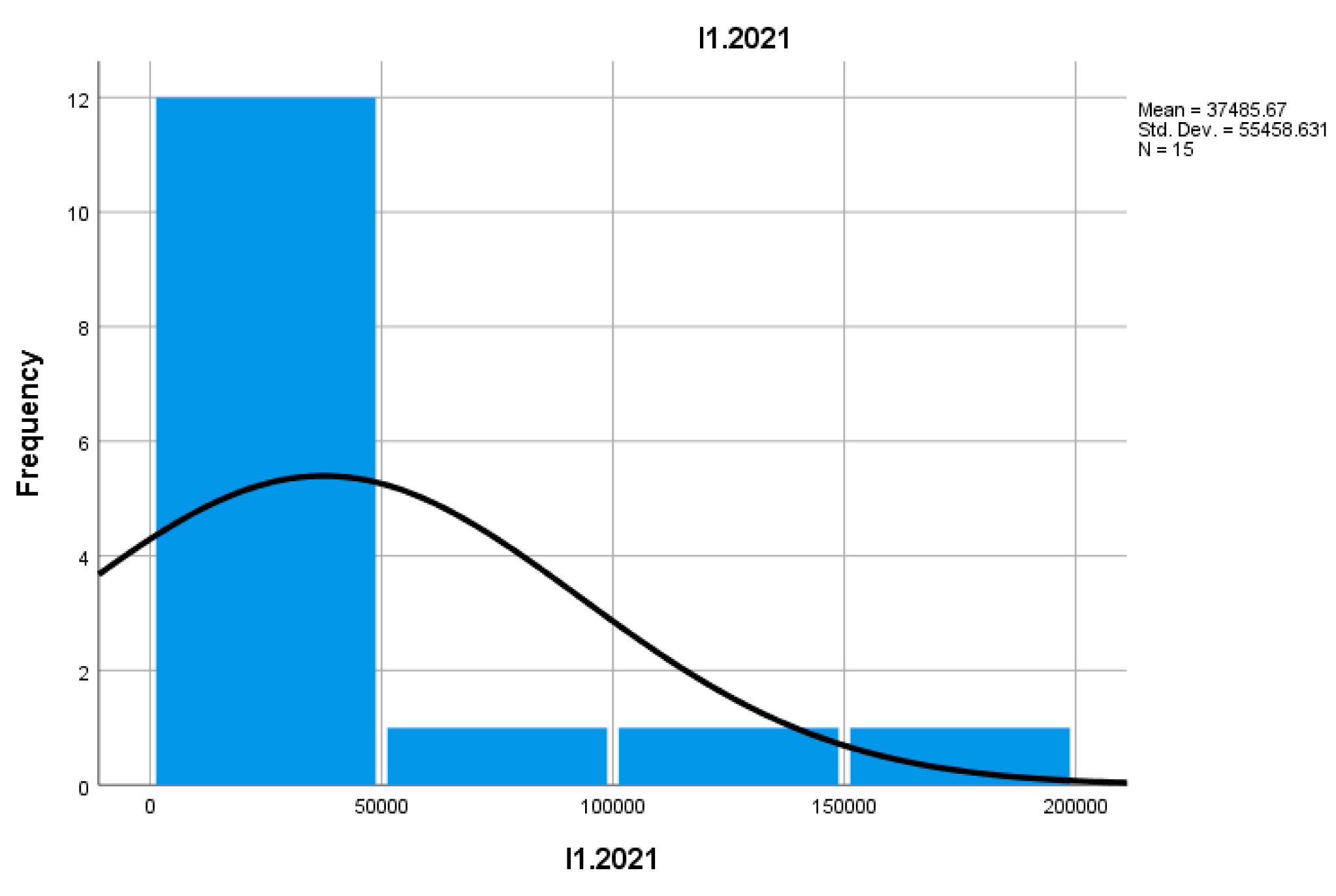

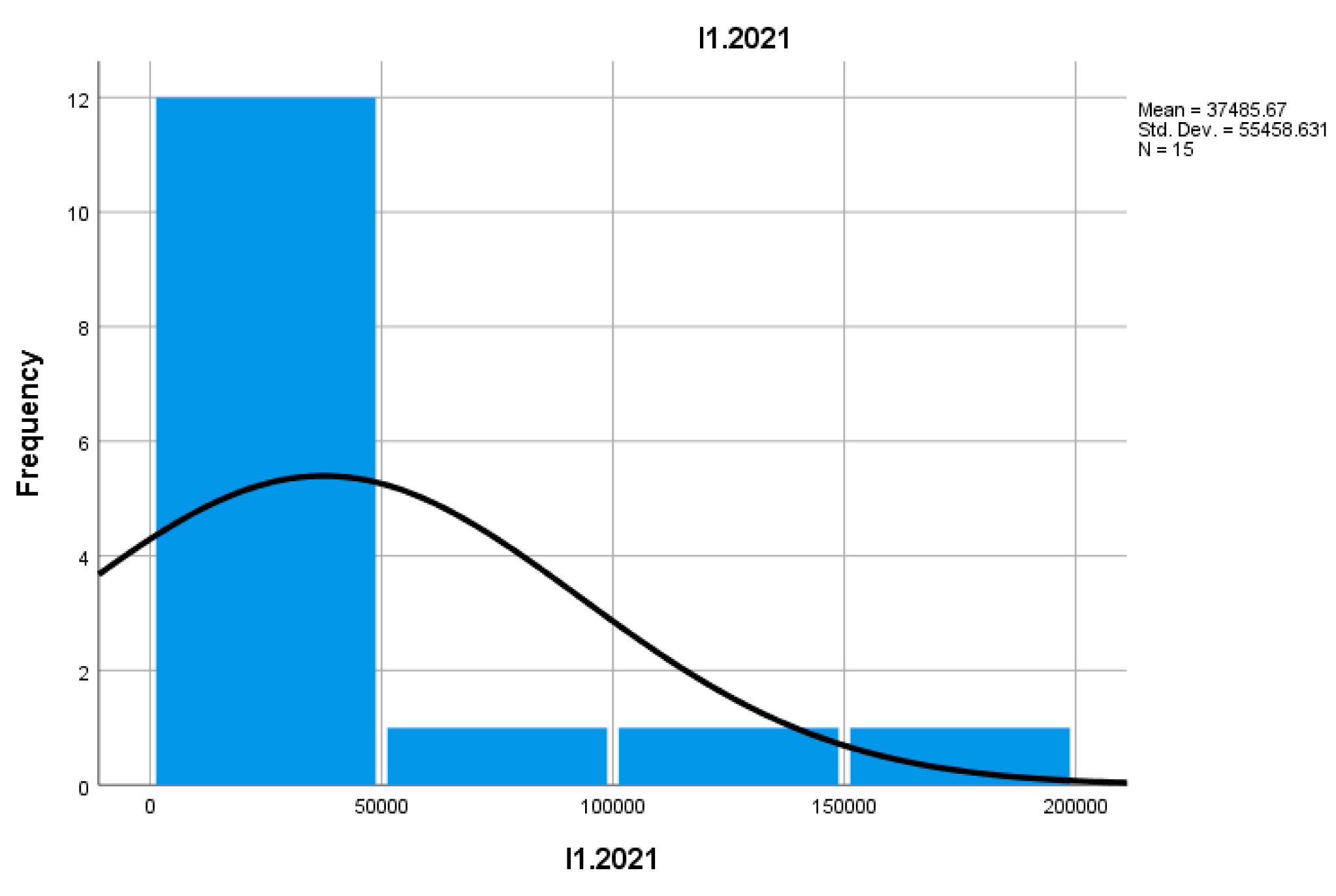

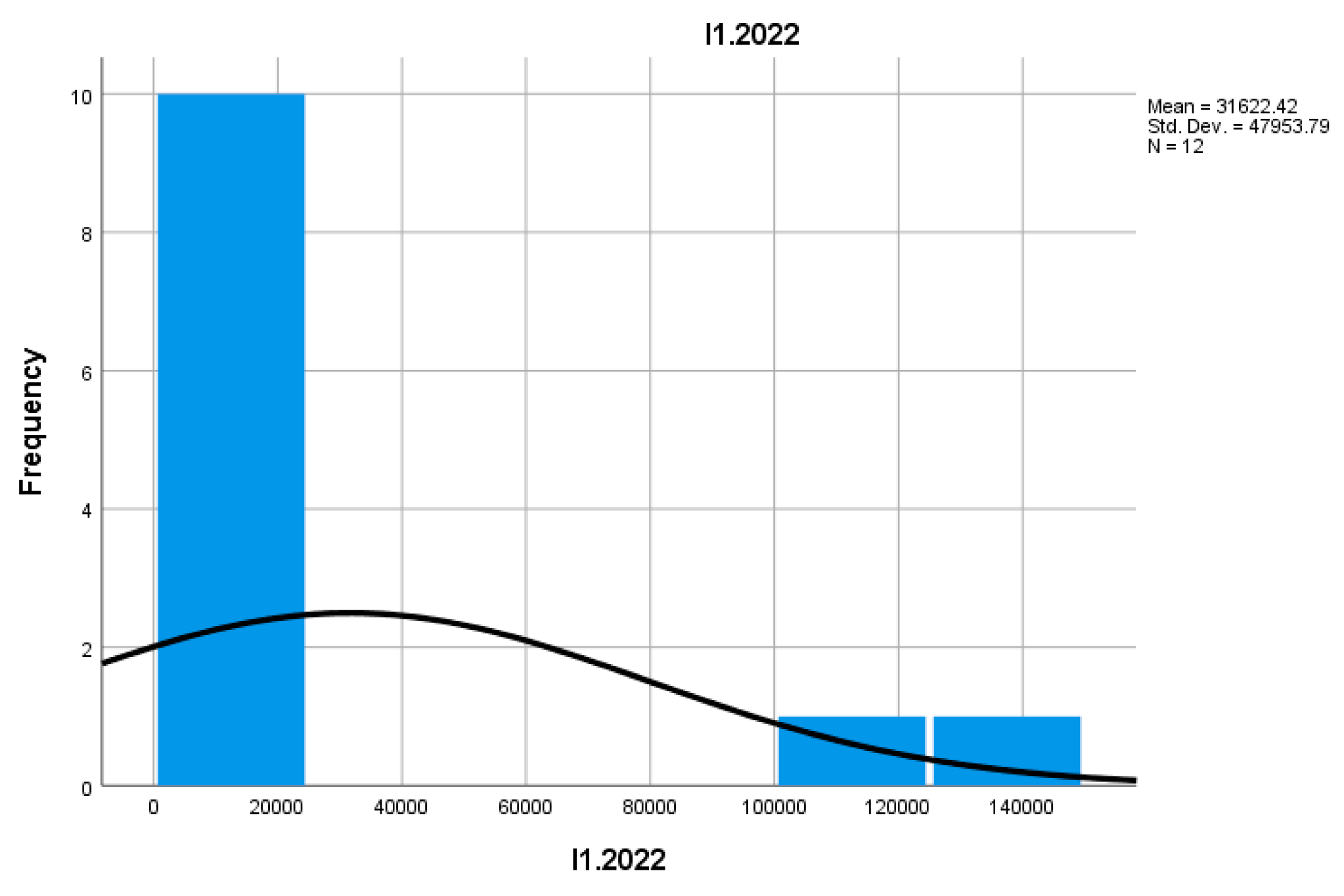

the mean number of existing businesses for 2021 in the first quarter (I1.2021) is 37,485.67, while for 2022 in the same quarter (I1.2022), the mean decreases to 31,622.42, indicating a decline in the number of businesses during this period;

- -

also, a standard deviation of 55,458.63 was observed in I1.2021, indicating significant volatility in the fluctuations of businesses in the mountain sector.

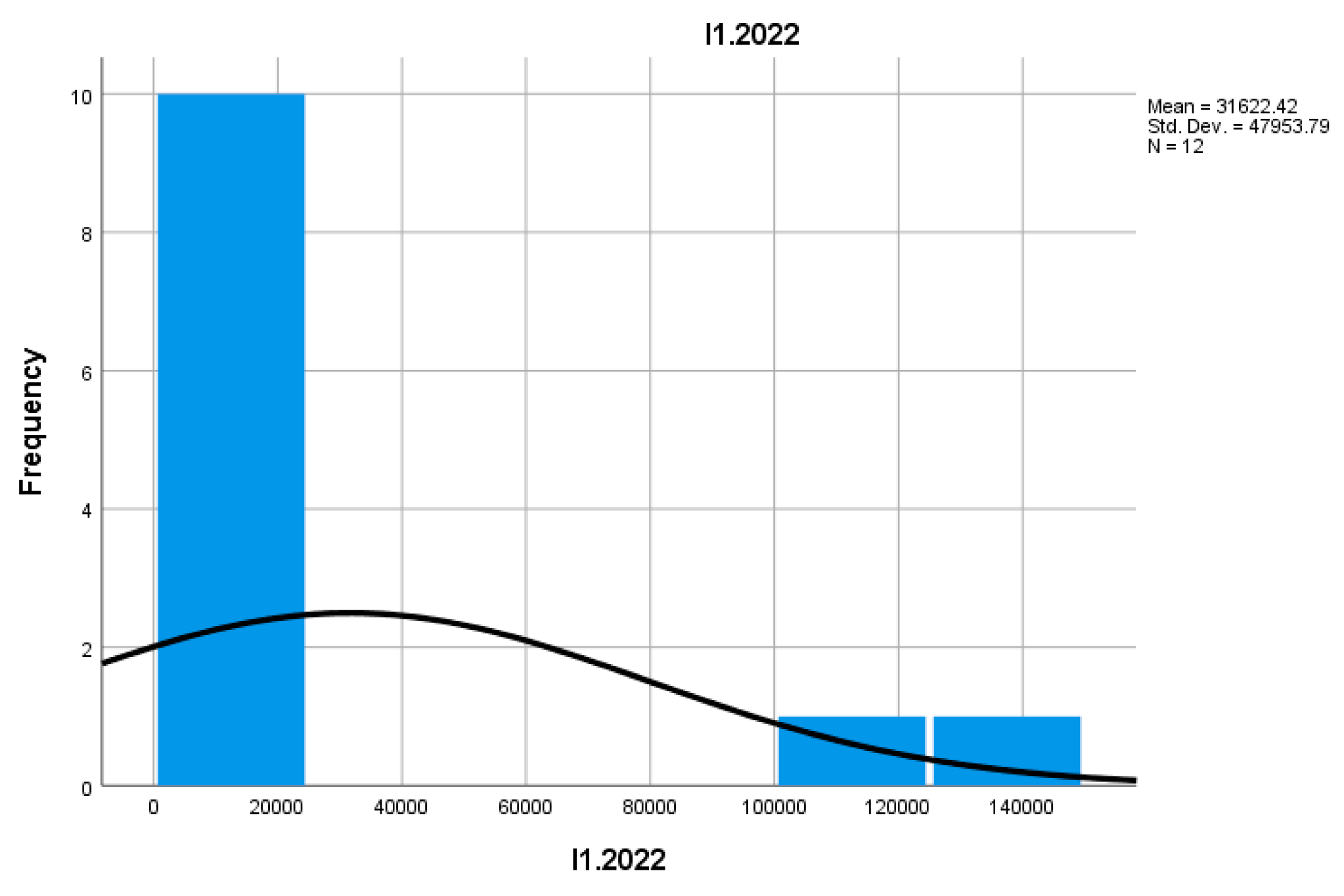

To analyze the evolution of economic indicators, a comparison of data between quarters in 2021 and 2022 was carried out. The goal was to observe whether there was an upward or downward trend in the analyzed indicators. The most representative trend was the observation of fluctuations in the first quarter of 2021, higher than in the first quarter of 2022, suggesting a decline in economic activity in the mountain financial sector during this period.

The data were presented in the form of graphs and tables to more easily visualize their evolution. The analysis also included the distribution of the number of enterprises and other economic indicators. These distributions were analyzed based on percentiles (25%, 50%, and 75%) to better understand the variability within the mountain sector. The evolution in I1.2021 is relevant, with a value of 37,485.67, but the value in the 25th percentile is 5,927, which suggests an uneven distribution of businesses within the mountain financial entrepreneurial sector.

Correlations between various financial variables, such as revenues and expenses, were analyzed to identify potential relationships between these indicators. It was observed that an increase in revenues could be correlated with an increase in investments in infrastructure or operating expenses, and this information could provide insights into the sustainability of the mountain economic model.

At this stage, hypotheses related to the economic behaviors of mountain entrepreneurs were formulated and tested. The most relevant hypothesis was that mountain entrepreneurs experience a significant decline in the number of businesses in the 2021-2022 period compared to 2020. To test this hypothesis, statistical tests such as the t-test for independent samples or the ANOVA test were used, depending on the complexity of the data and the number of groups being compared.

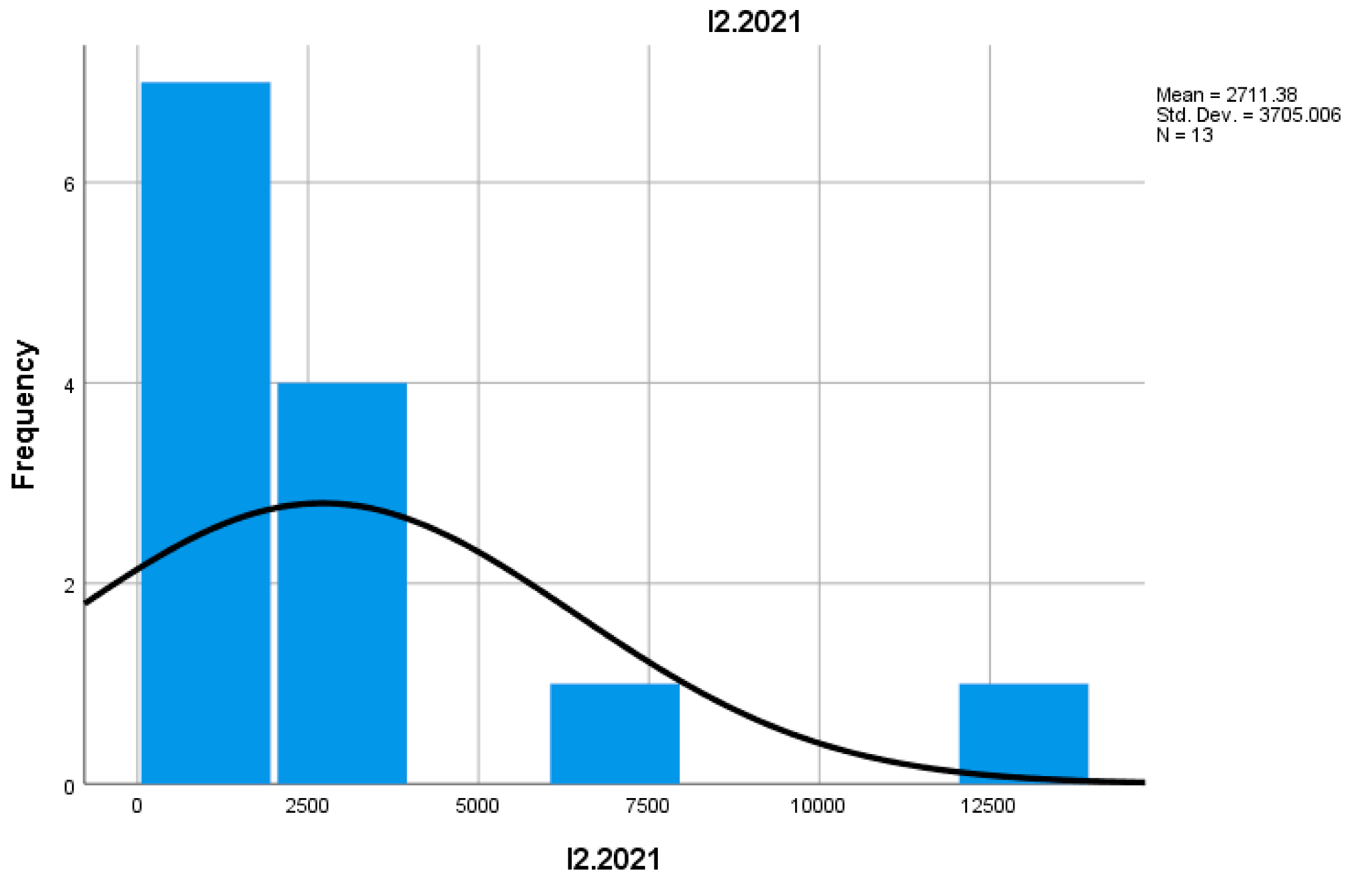

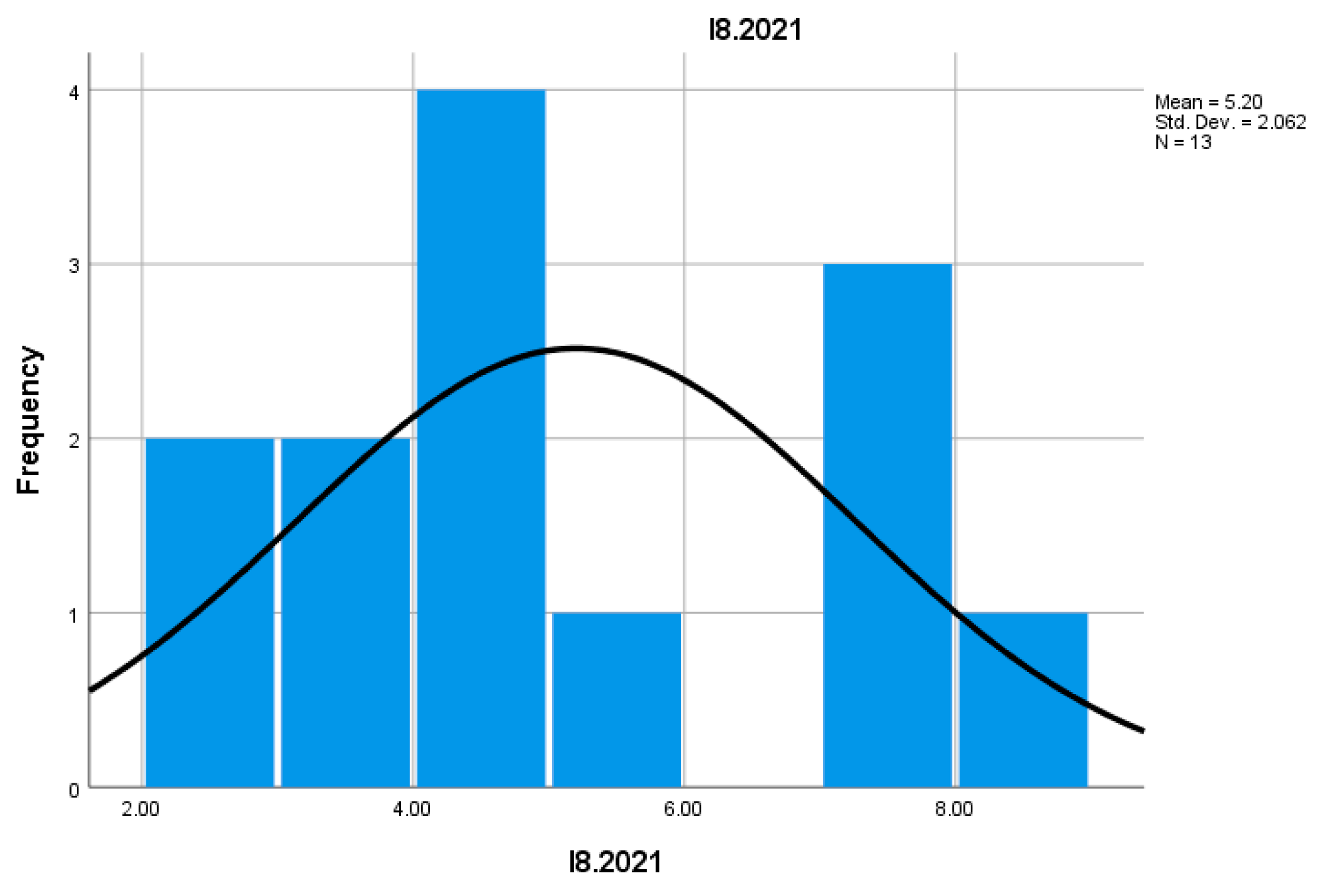

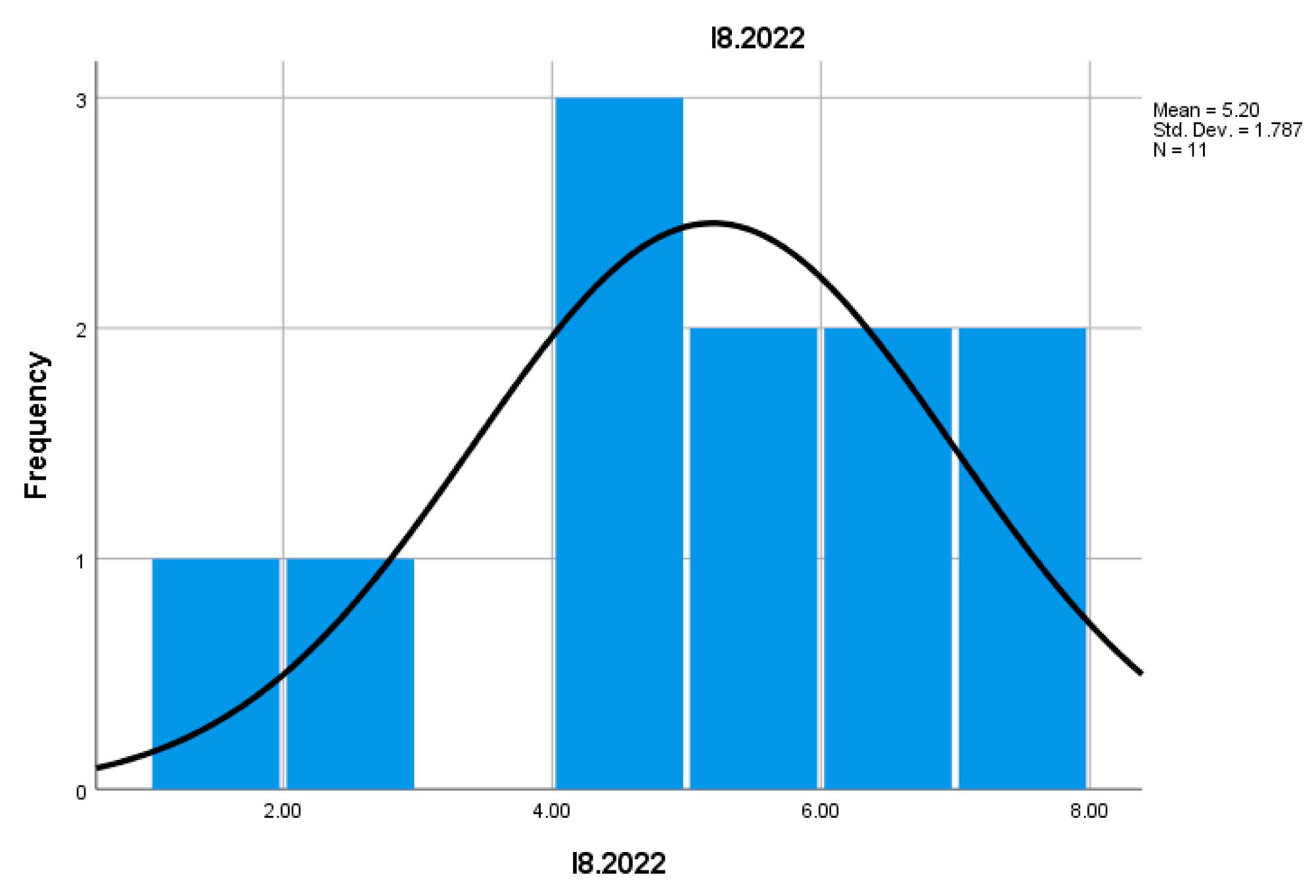

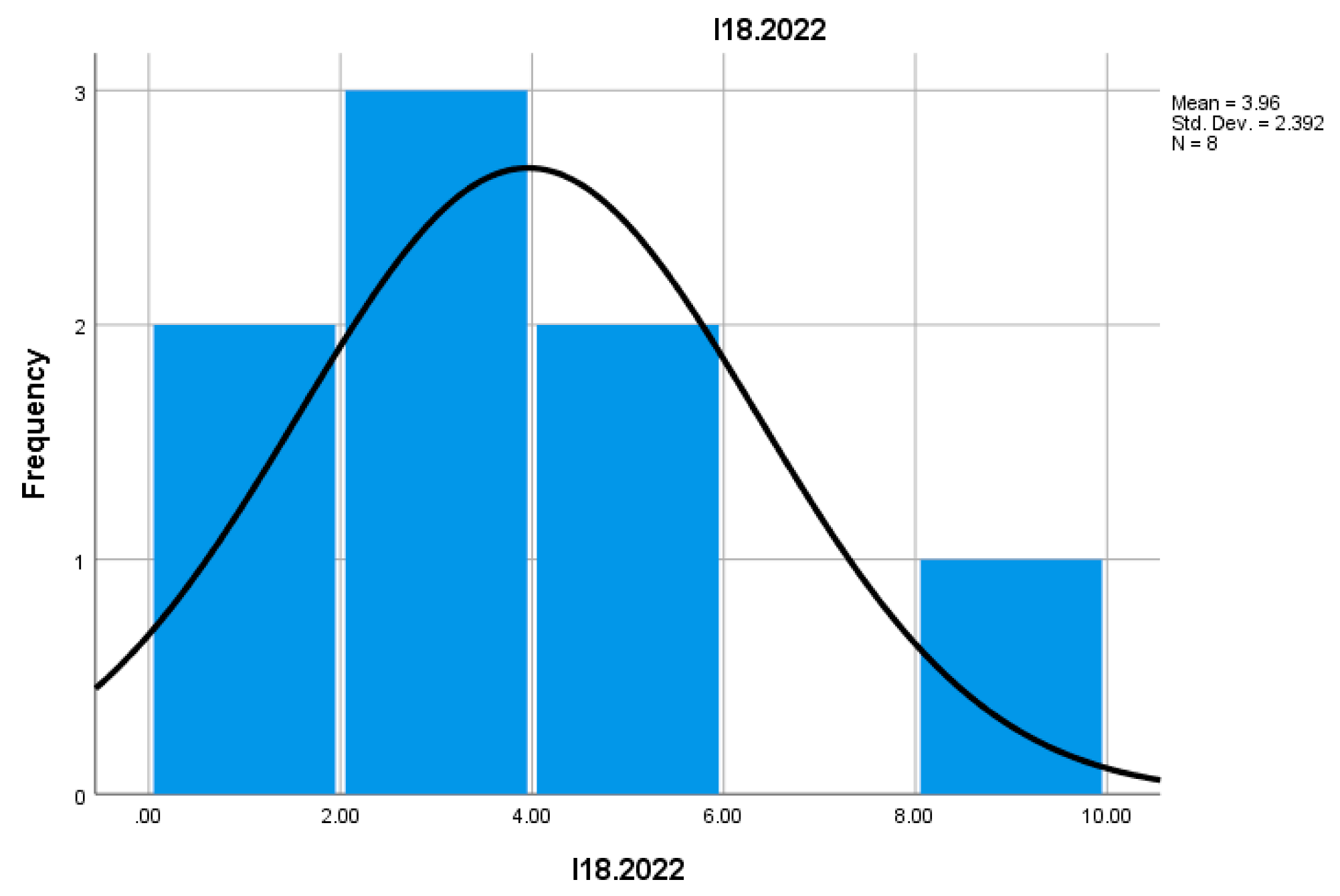

Skewness and Kurtosis were used to assess the nature of the data distribution. Relevant for the analysis was I2.2021, which shows a positive skewness (Skewness = 2.402), suggesting that most values are concentrated in the lower part of the distribution, with a few extreme values in the upper part. In contrast, I18.2022 shows a Kurtosis of -1.068, indicating a flatter distribution compared to a normal distribution, with fewer extreme values.

For this analysis, the following tools and statistical techniques were used:

- -

SPSS for calculating descriptive statistics and inferential tests;

- -

Excel for creating tables and graphs to show the evolution of indicators;

- -

R for advanced data analysis and generating predictive models for the 2021-2025 period.

The described methodology allows for a detailed evaluation of the European mountain financial sector based on the available financial data for the 2021-2022 period. By analyzing the data through descriptive statistics, inferential tests, and correlation analyses, this study provides an in-depth understanding of the economic trends within this sector, aiming to identify development directions for the 2021-2025 period.

Indicators, explained at

https://doi.org/10.5281/zenodo.14713867, are for the countries Austria, Bulgaria, Croatia, the Czech Republic, France, Germany, Greece, Italy, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.

Results

This section analyzes the evolution and significance of relevant indicators in the context of mountain entrepreneurship within the European financial sector, based on Eurostat data collected over several yearly intervals in 2021 and 2022 (tables and figures). The indicators included in this analysis reflect fundamental aspects of entrepreneurial dynamics, such as the number of businesses, the survival rate, business growth, and the impact of employment.

Analyzing the evolution of the I1 indicator, which reflects the number of active businesses in the European financial sector, a significant fluctuation is observed throughout the four quarters of 2021 and 2022. The average value of this indicator ranges from 37,485.67 in the first quarter of 2021 to 31,622.42 in the first quarter of 2022, representing a decrease of approximately 15.5%. This suggests a trend of reduction in the number of active businesses in this sector, possibly due to the economic difficulties generated by various financial and economic crises. Of course, the standard deviation (55,458.63 in 2021 and 47,953.79 in 2022) indicates a large dispersion of values, reflecting disparities between businesses of different sizes and structures. Additionally, the high skewness coefficient (1.943 in 2021 and 2.058 in 2022) suggests an unbalanced distribution of the number of businesses, with a high concentration of small businesses and a small number of large businesses.

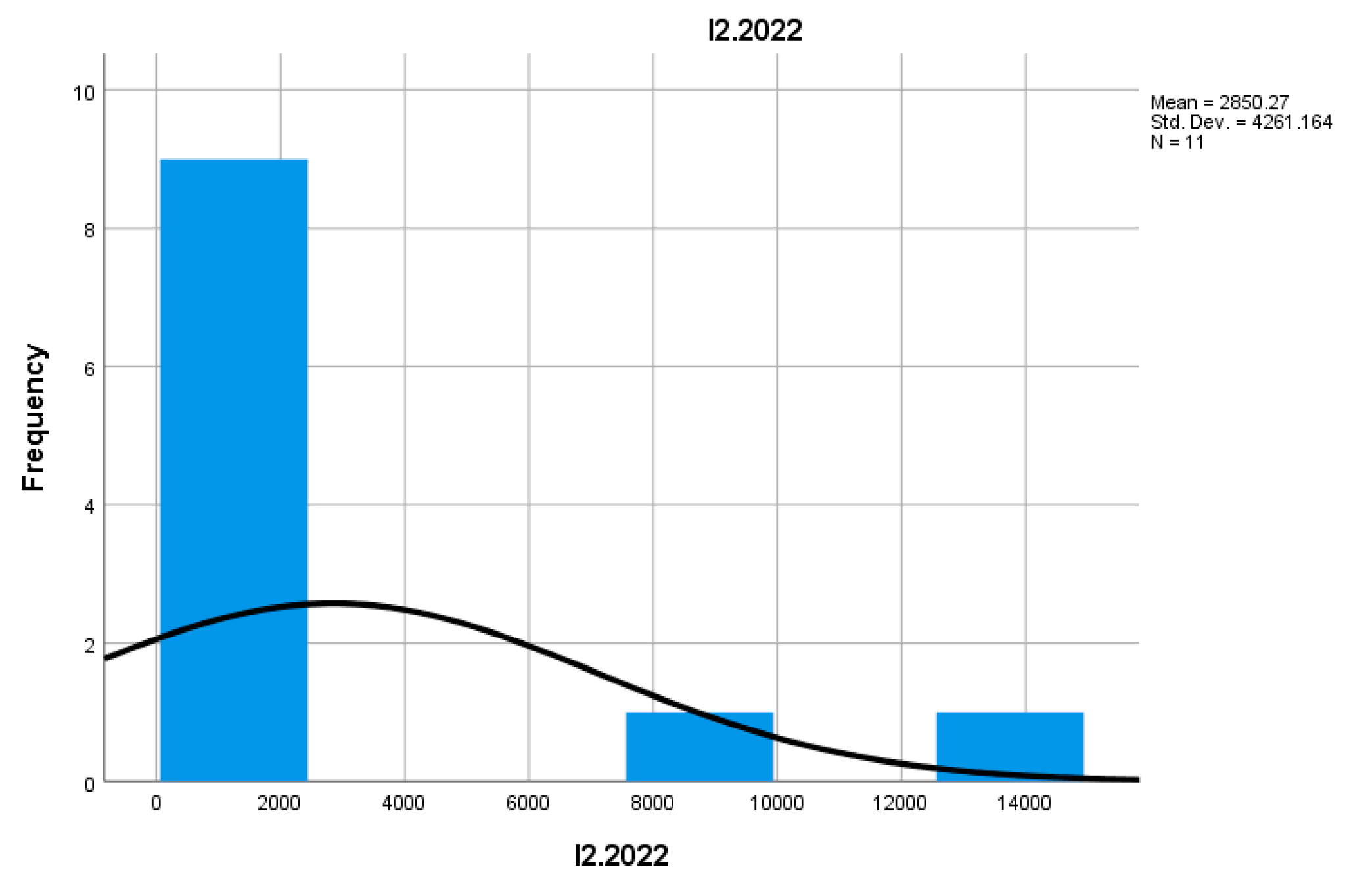

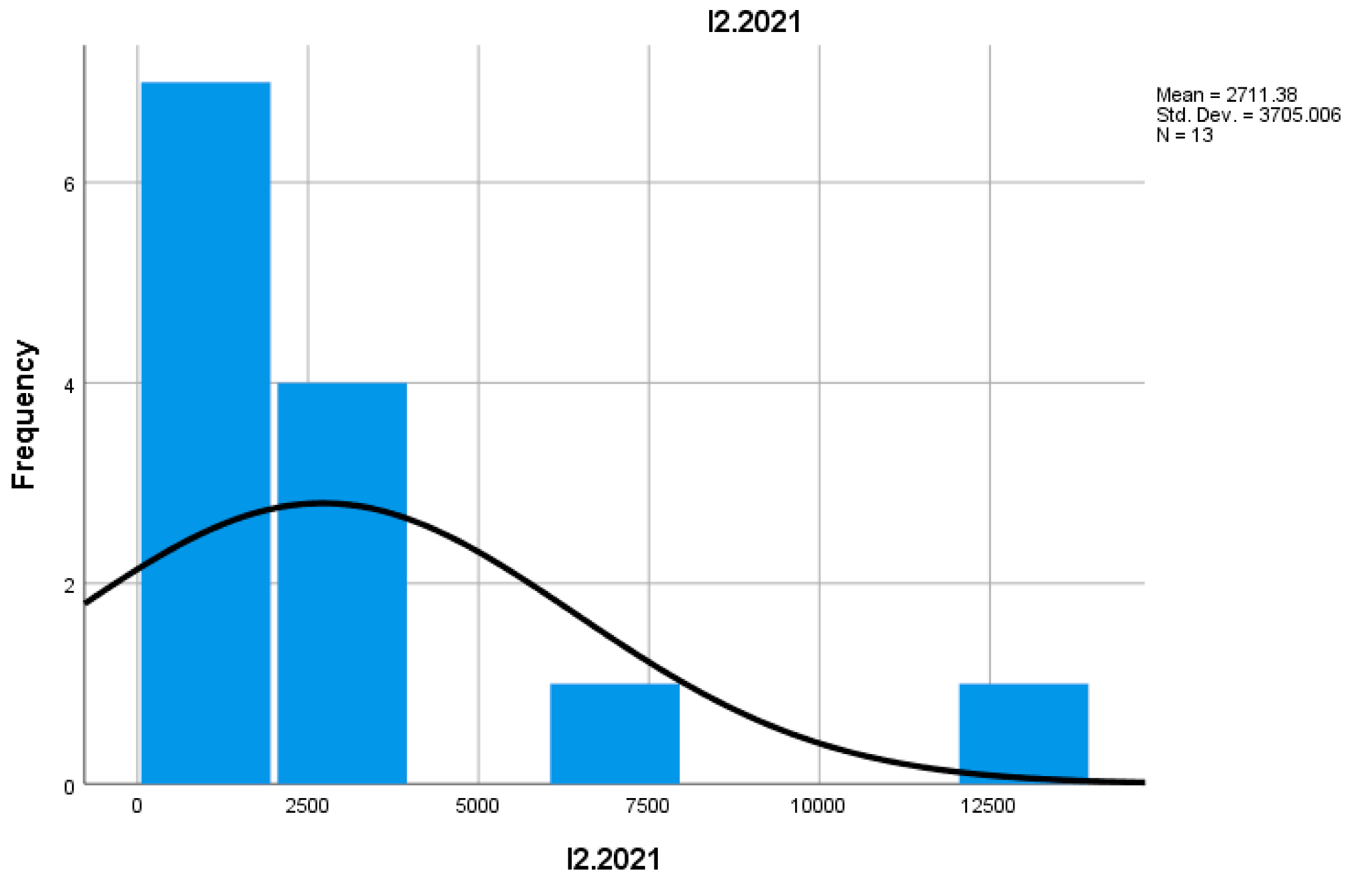

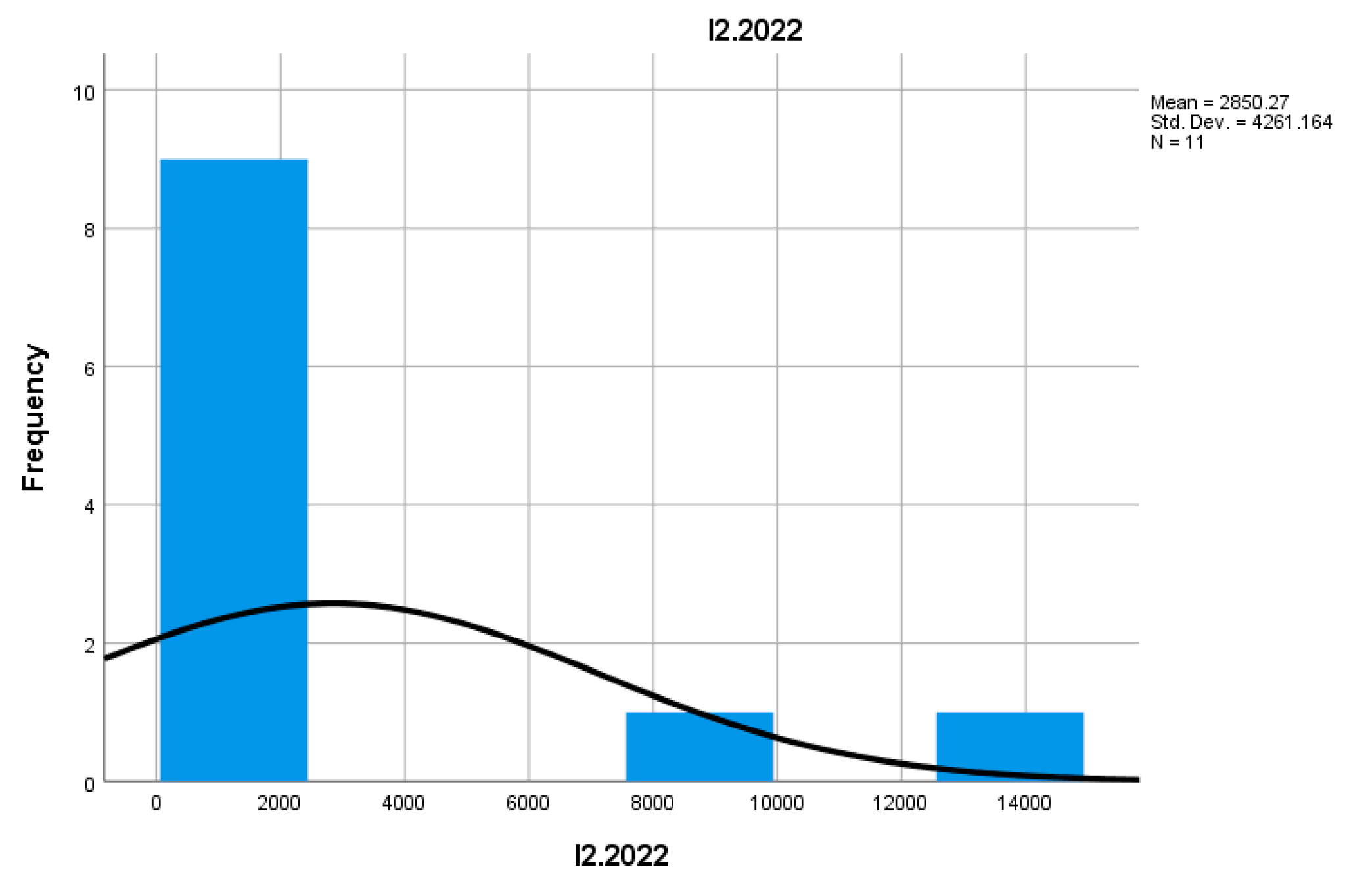

The I2 indicator measures the number of new businesses registered within a given period. The average value of this indicator in 2021 ranges from 2,711.38 in the first quarter to 18,188 in the sixth quarter, suggesting a trend of growth in new business registrations as 2021 progresses. In contrast, in 2022, these values decrease significantly, from 3,850.27 in the first quarter to 17,520 in the sixth quarter, signaling stagnation or a slight reduction in the number of newly established businesses, possibly due to the unfavorable global economic context.

The distribution of this indicator presents a standard deviation of about 4,261 in 2021 and 3,351 in 2022, indicating considerable fluctuation in the number of newly established businesses, with moderate skewness (2.402 in 2021 and 2.269 in 2022). This suggests a tendency for new businesses to consolidate in a narrow group, rather than being uniformly dispersed across the entire business population.

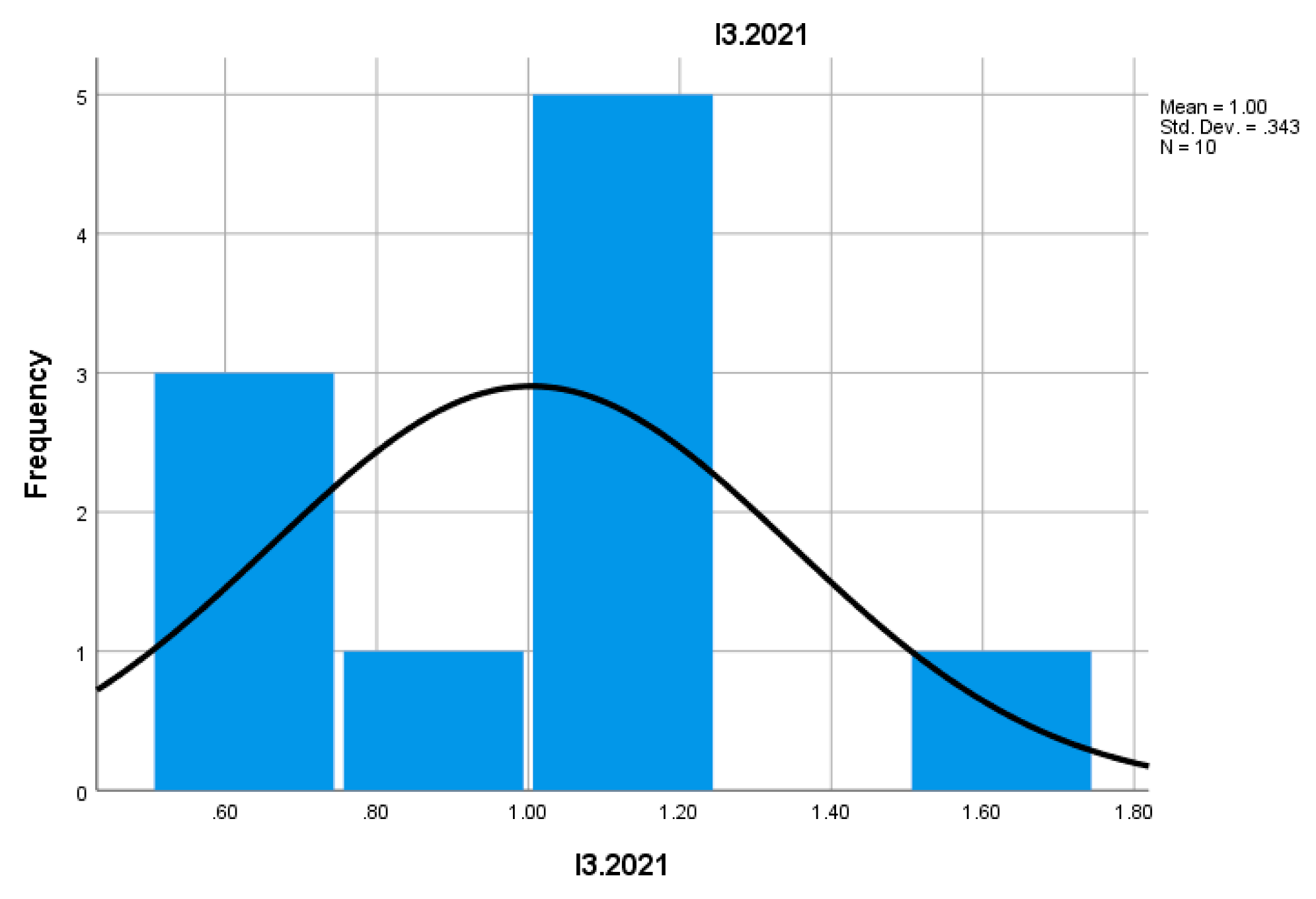

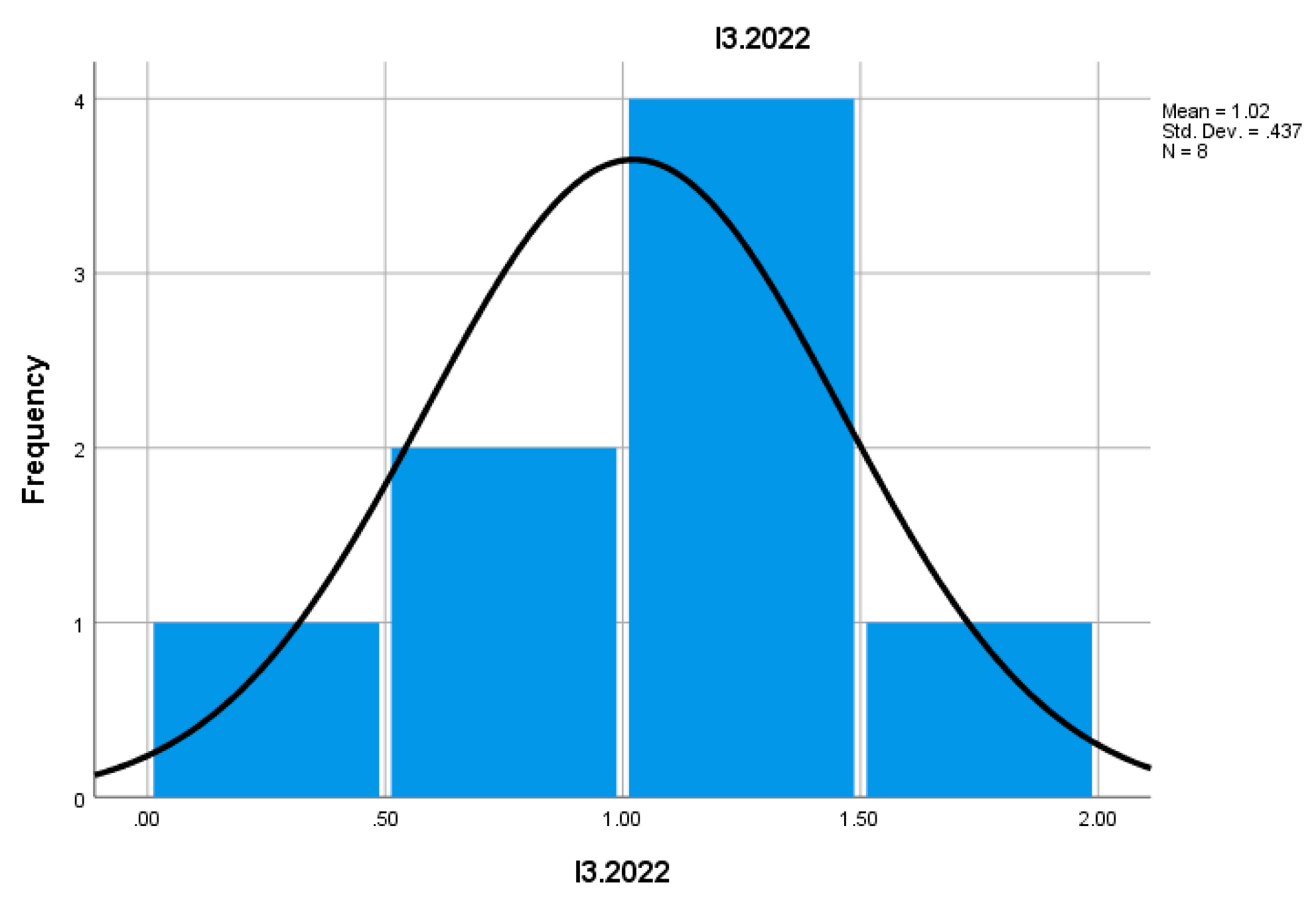

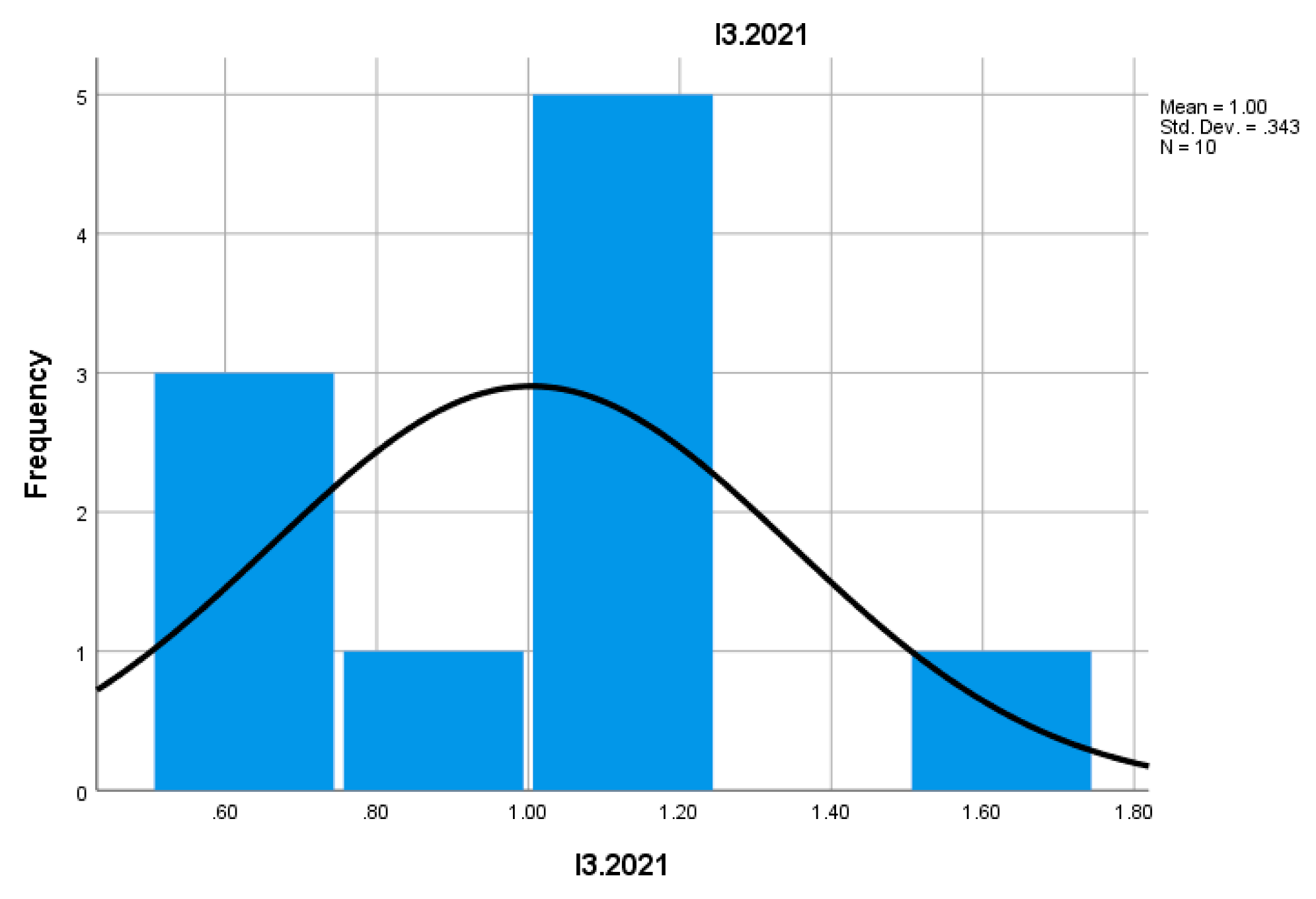

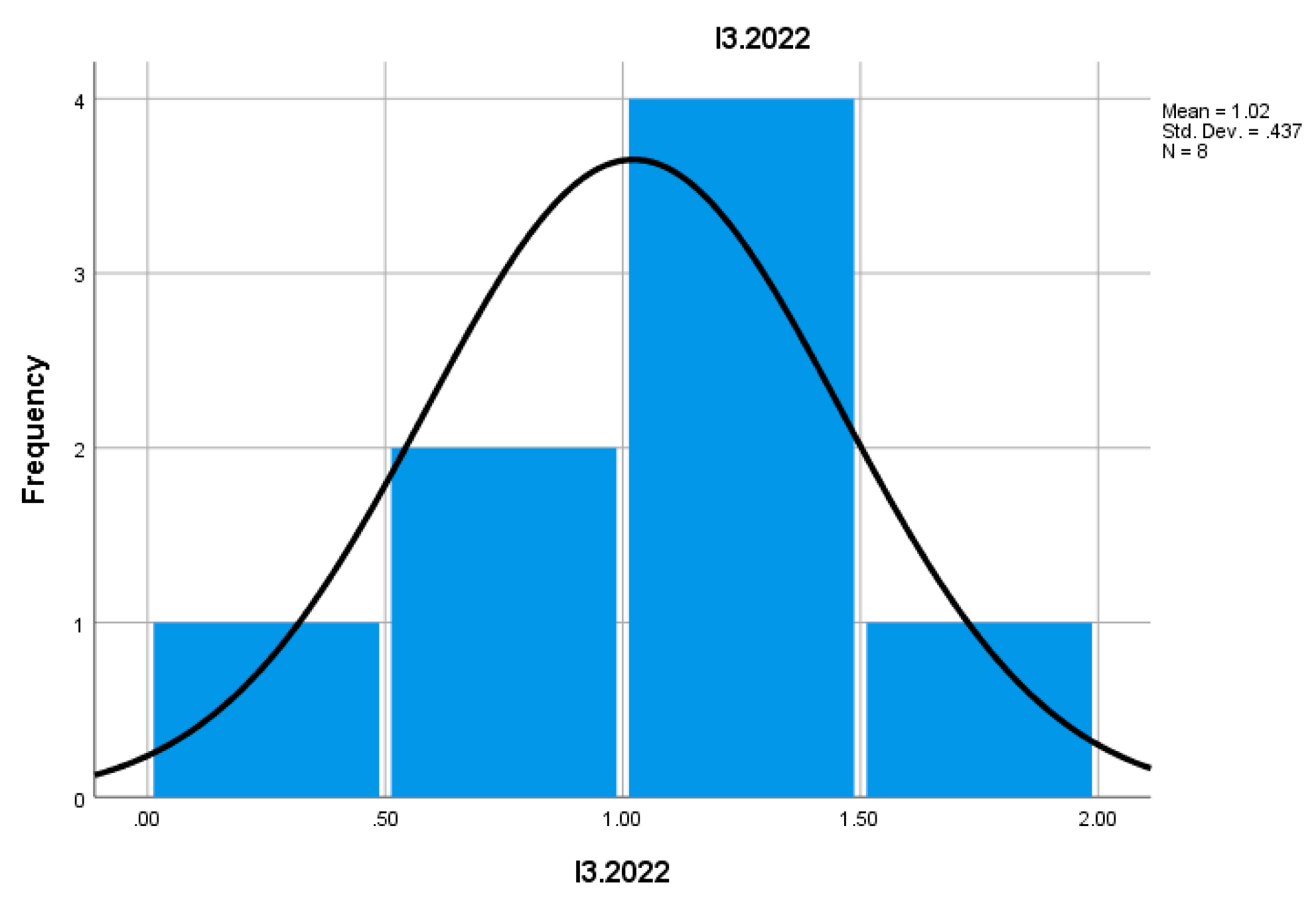

The I3 indicator analyzes the average size of new businesses, calculated as the number of employees divided by the number of newly established businesses. The values of this indicator are very small, indicating that most newly established businesses are small, with only 1,004 employees on average in the first quarter of 2021. This trend continues throughout 2022, with average values of about 1.00 employee per business. These figures suggest that most mountain businesses are small, and the sector does not experience accelerated growth of large businesses.

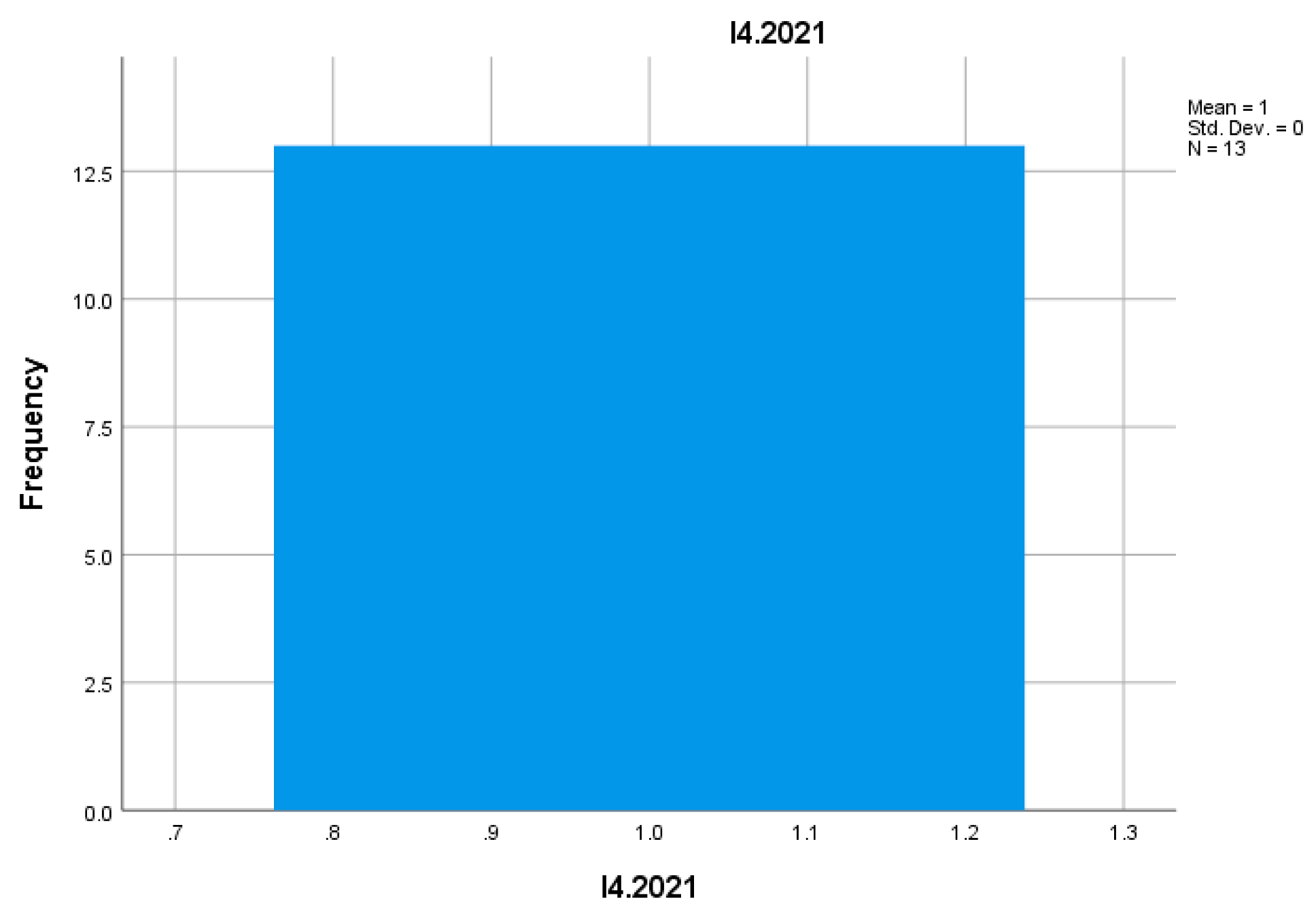

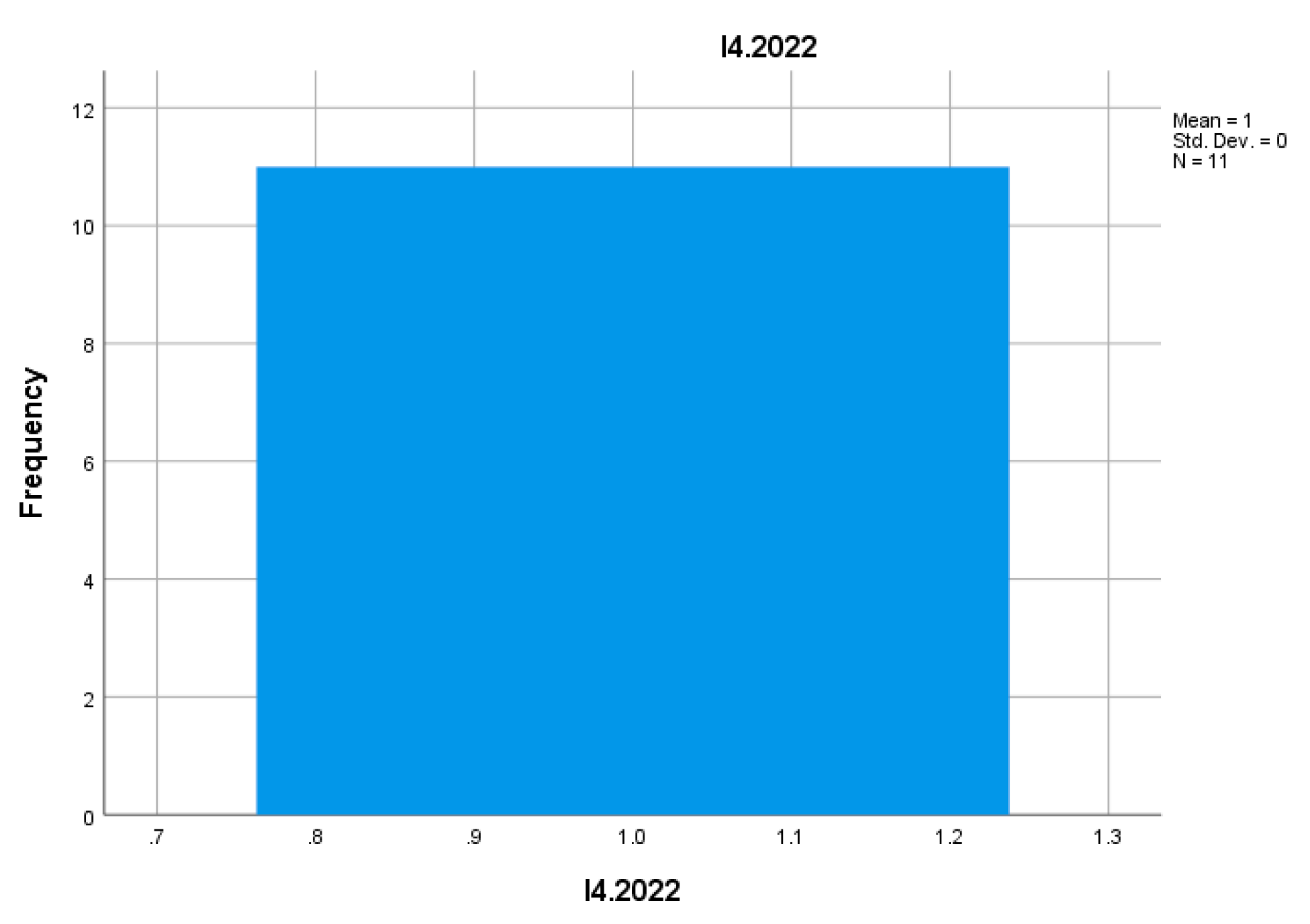

The I4 indicator reflects the average number of jobs generated by businesses that have ceased activity during the reference period. Data for this indicator show an average value of 1,004 in 2021, with constant values of 1.00 in 2022. This suggests that, in general, businesses that have failed or closed did not have a significant impact on jobs in the European financial sector.

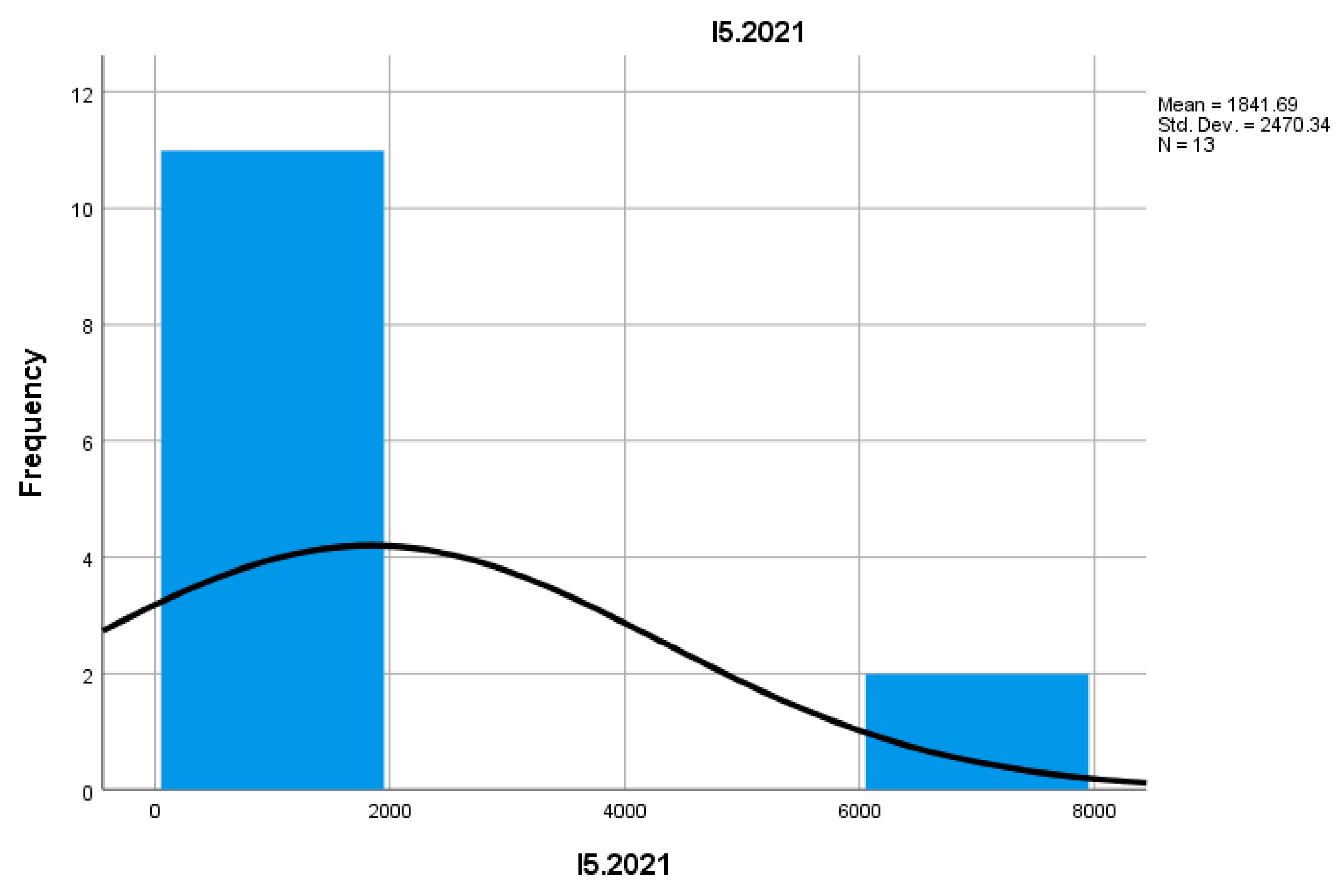

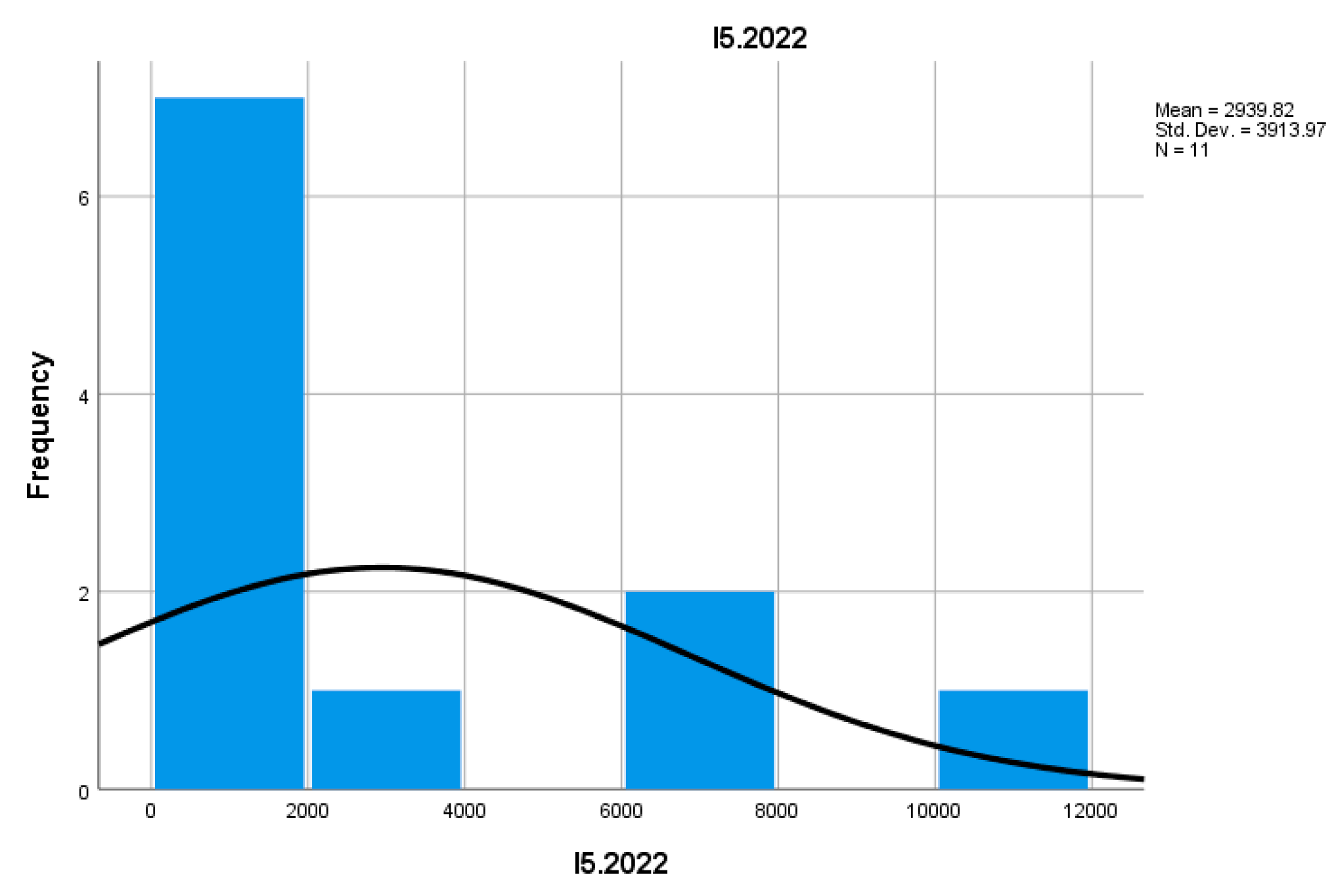

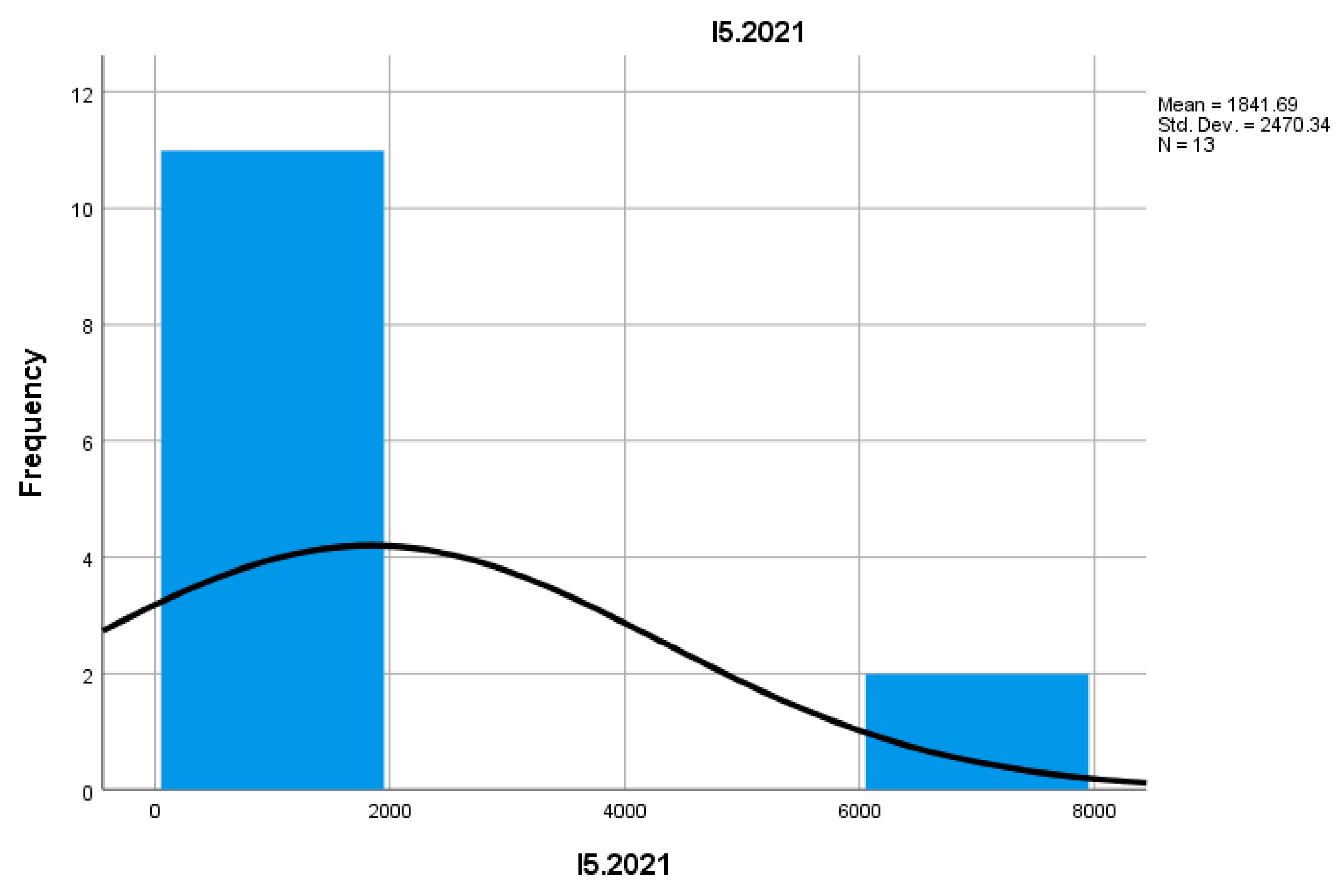

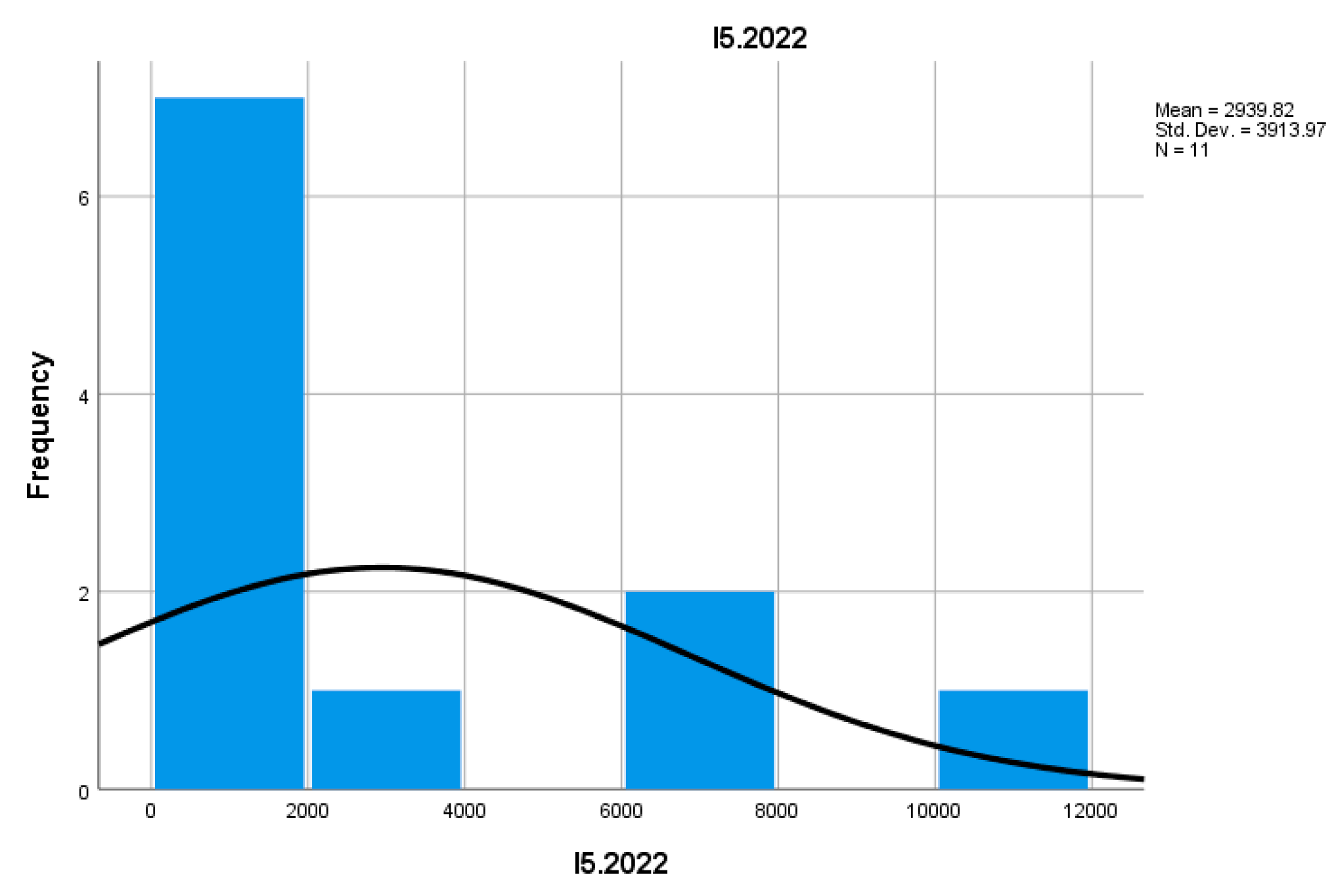

The I5 indicator, which measures the number of businesses suspending their activity, shows a significant decrease in 2022 compared to 2021. In the first quarter of 2021, the average value of this indicator is 1,004, but in 2022, this value steadily decreases to 1.00. This may signal a reduction in economic risks for mountain entrepreneurs, possibly due to government support or adaptability to changing economic conditions.

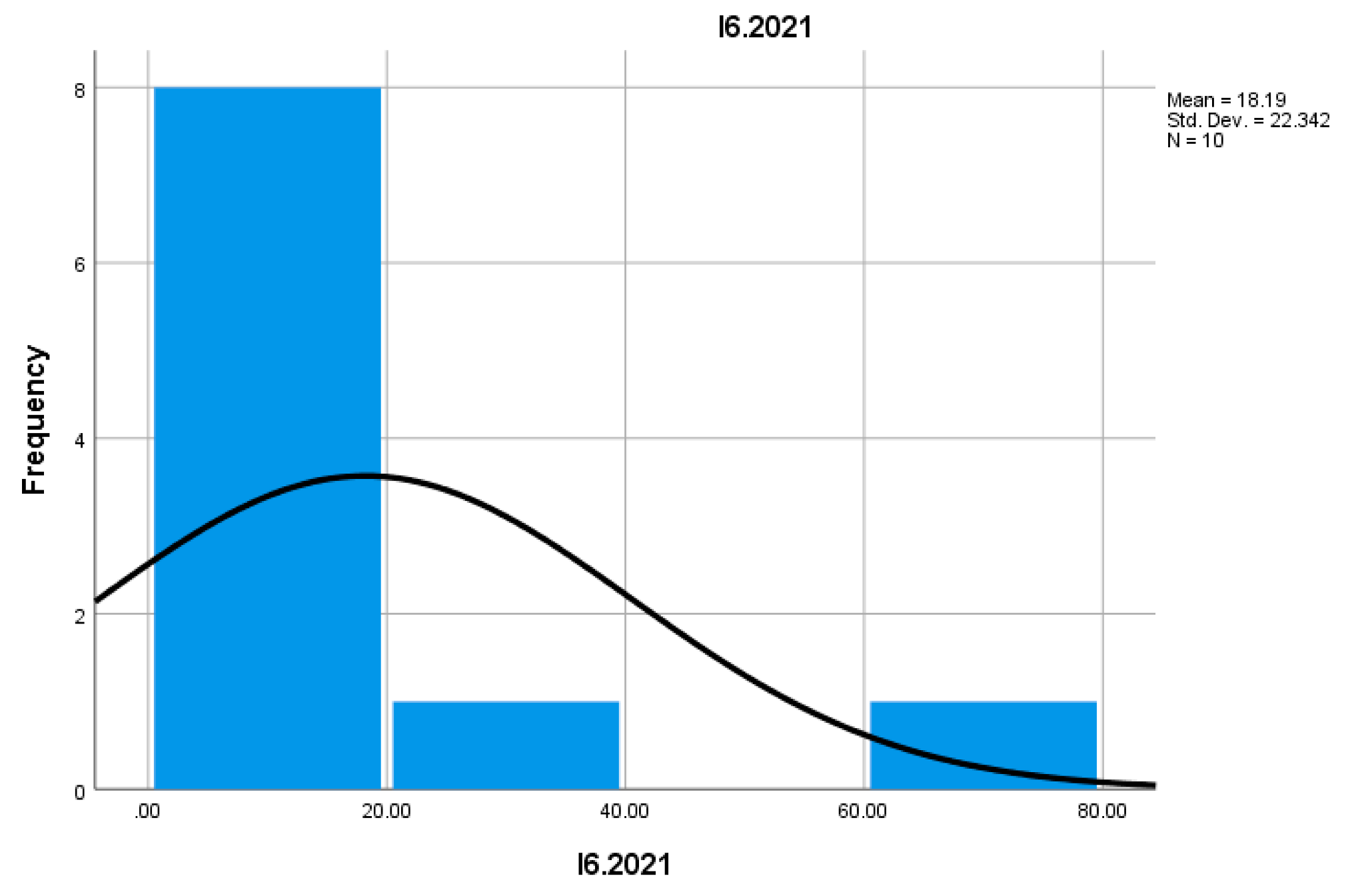

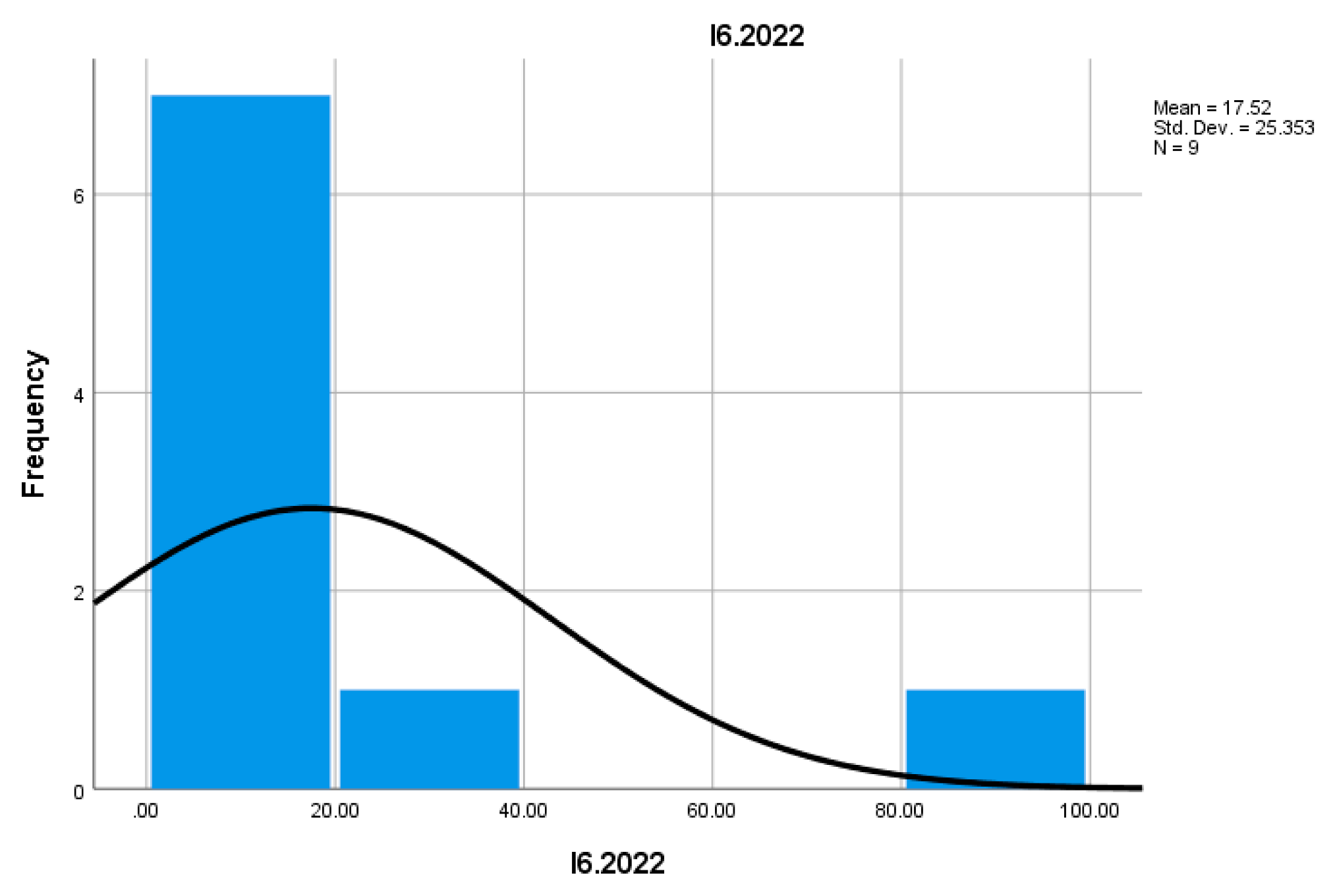

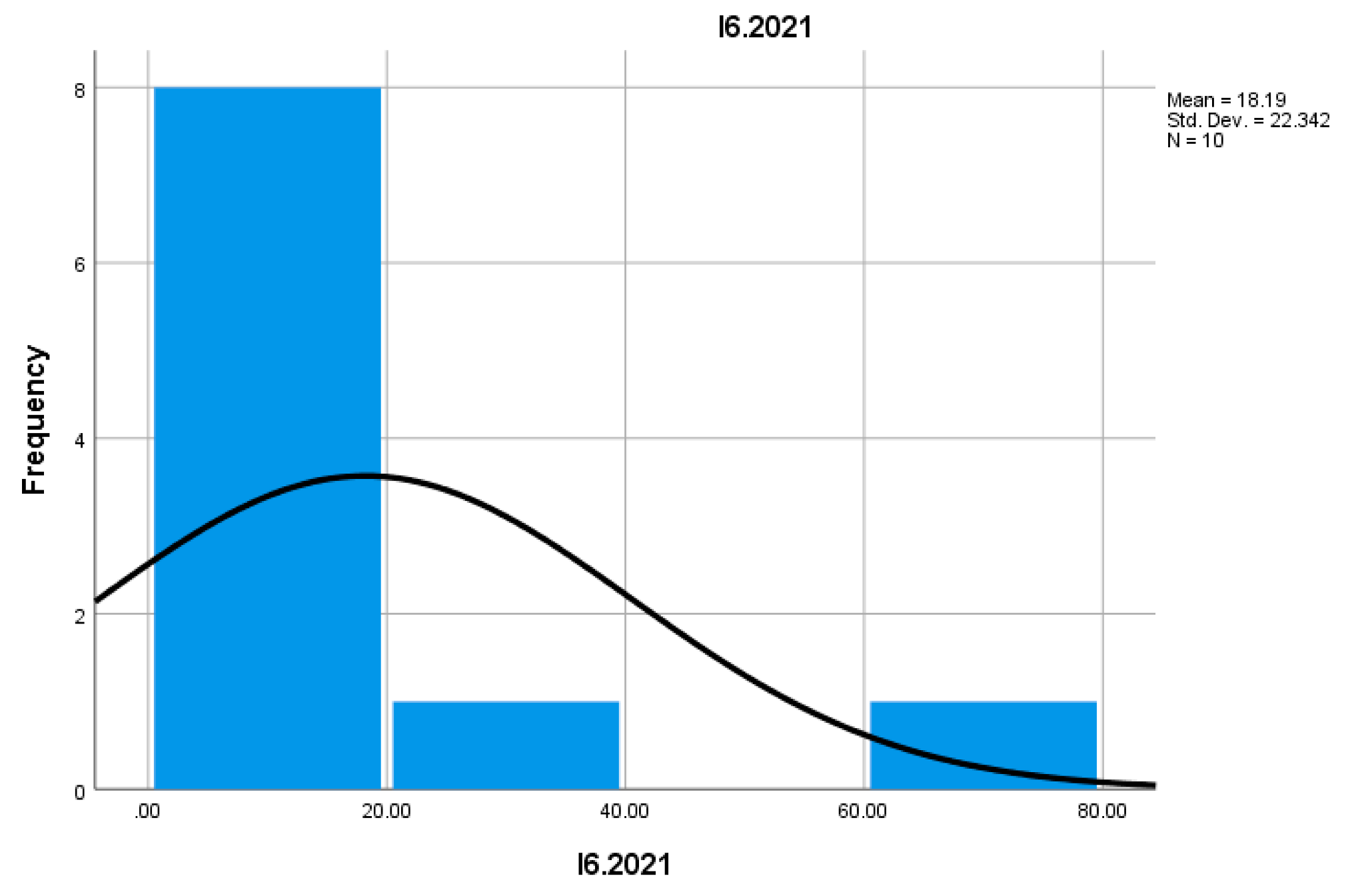

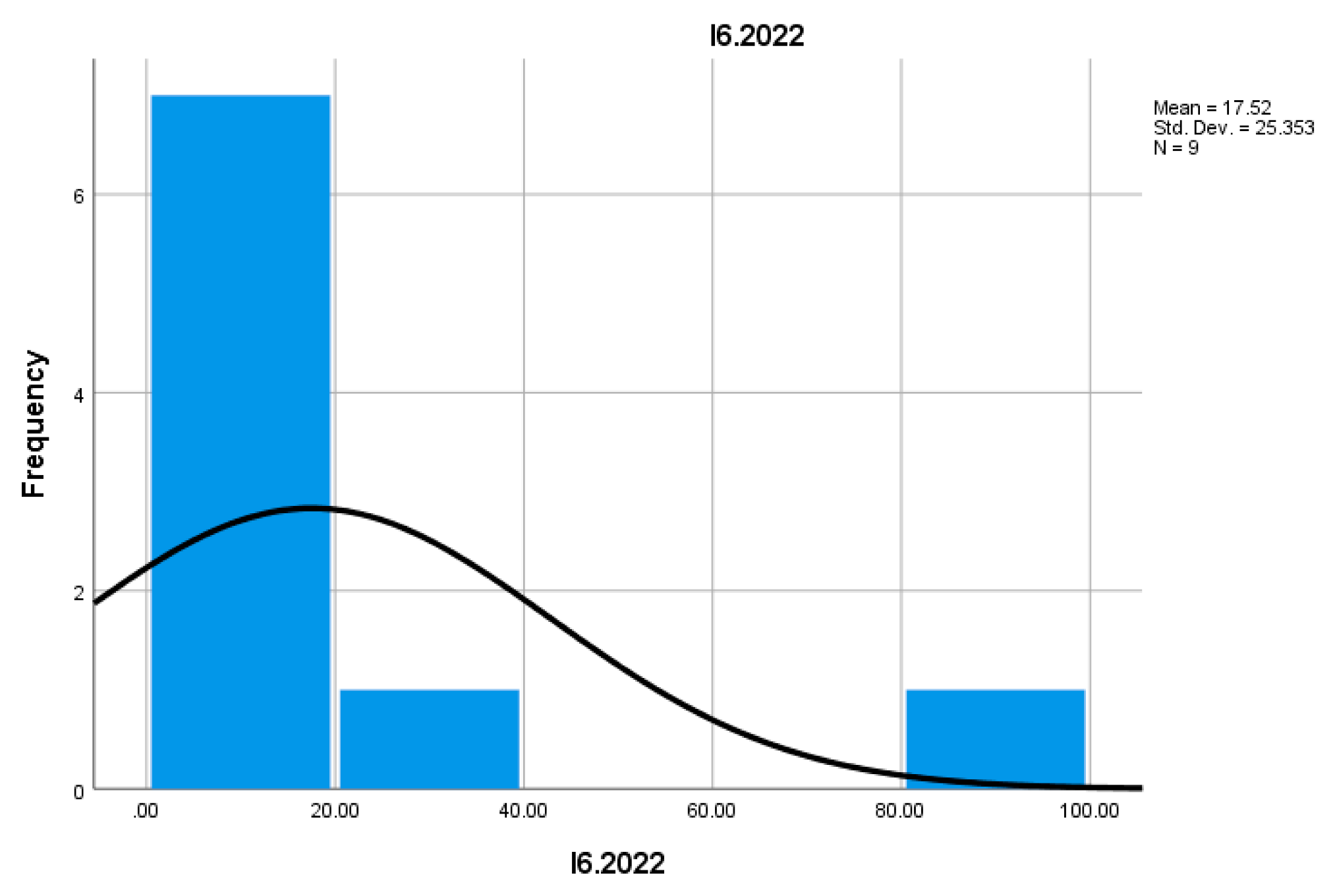

The I6 indicator analyzes the average size of 3-year-old businesses that have survived in the European financial sector. The values are extremely small, with an average of approximately 1.00 employee per business. This reflects a trend of small businesses surviving, which are able to remain on the market for a longer period but remain small in size.

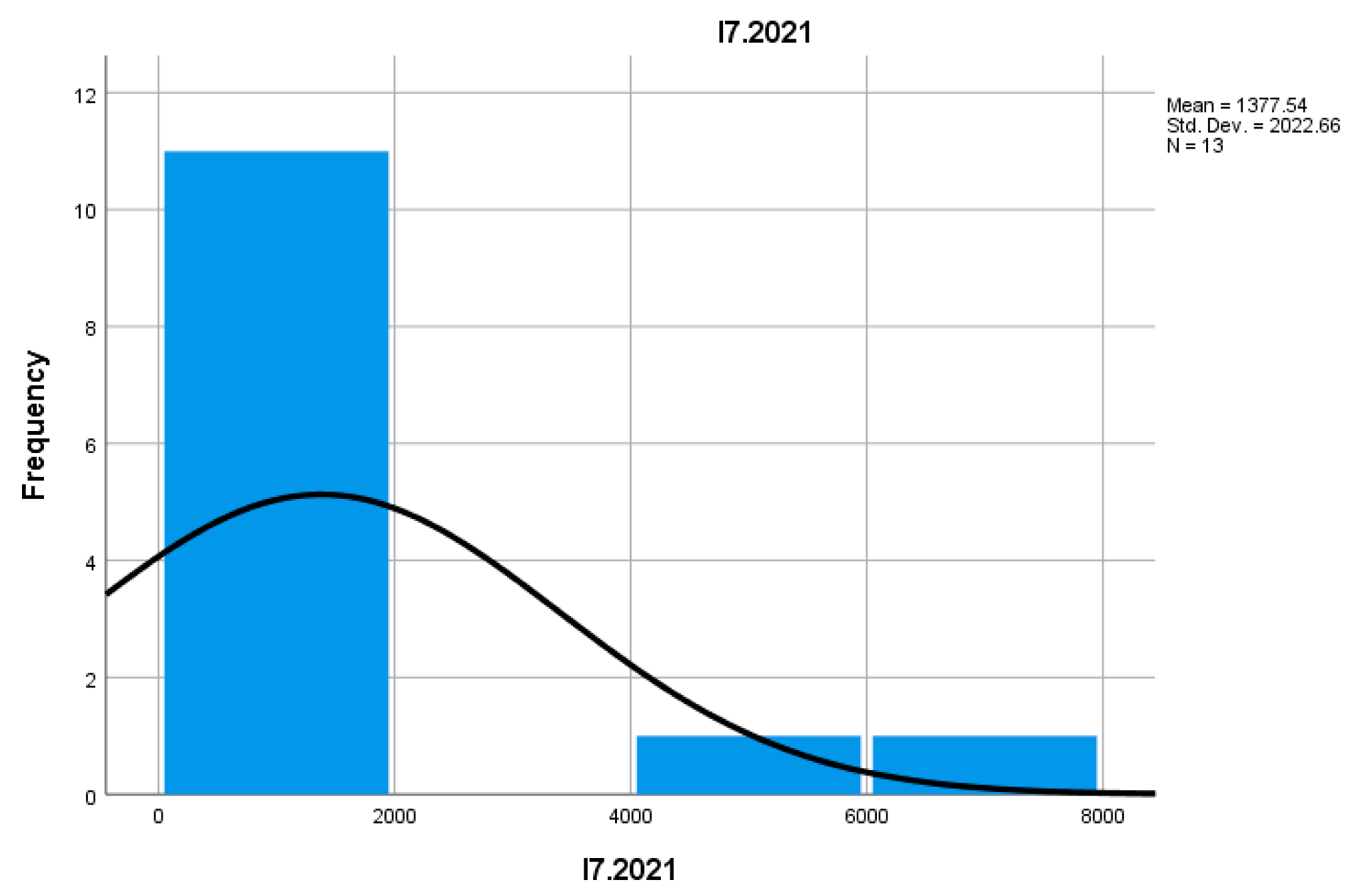

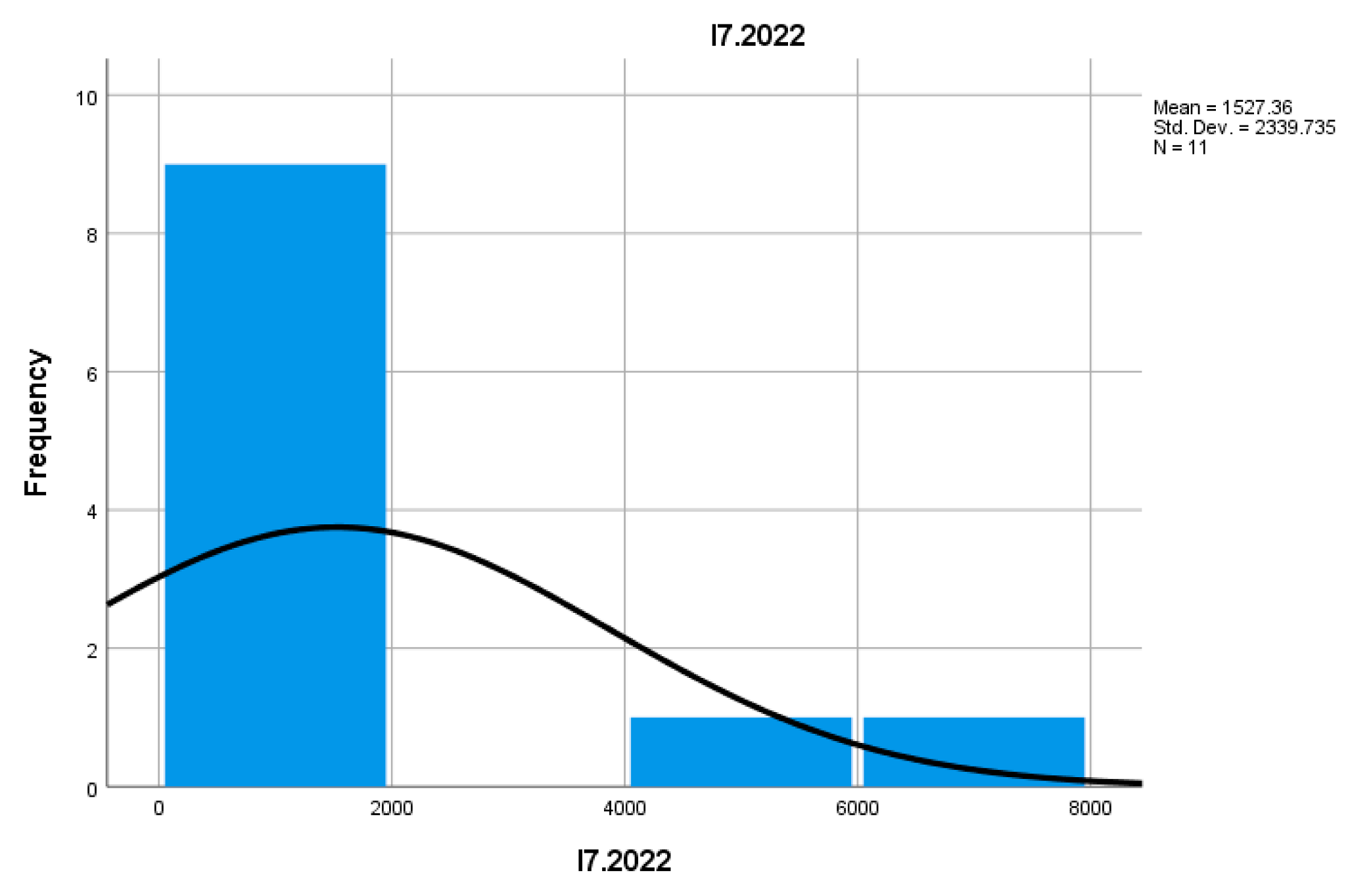

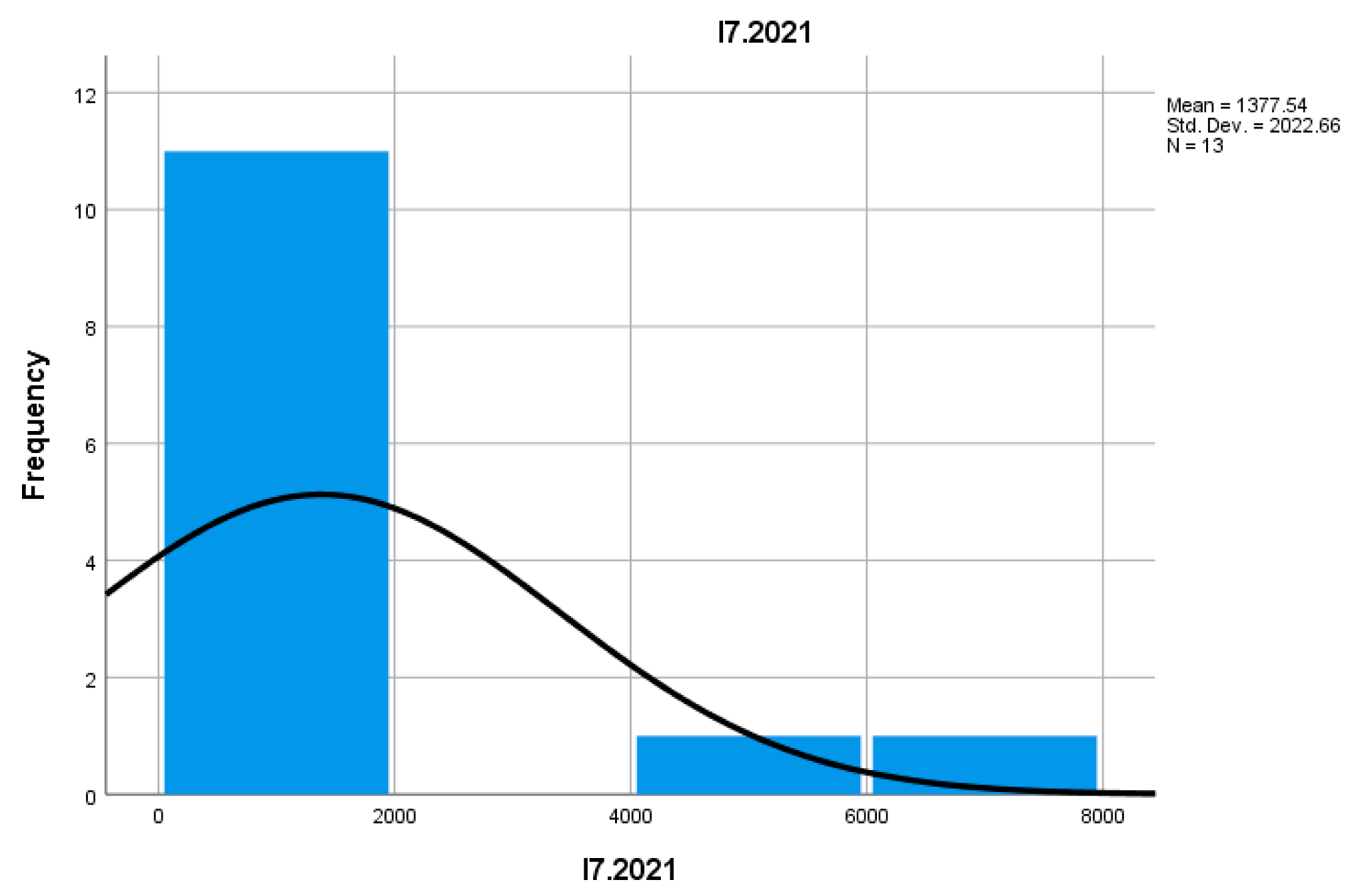

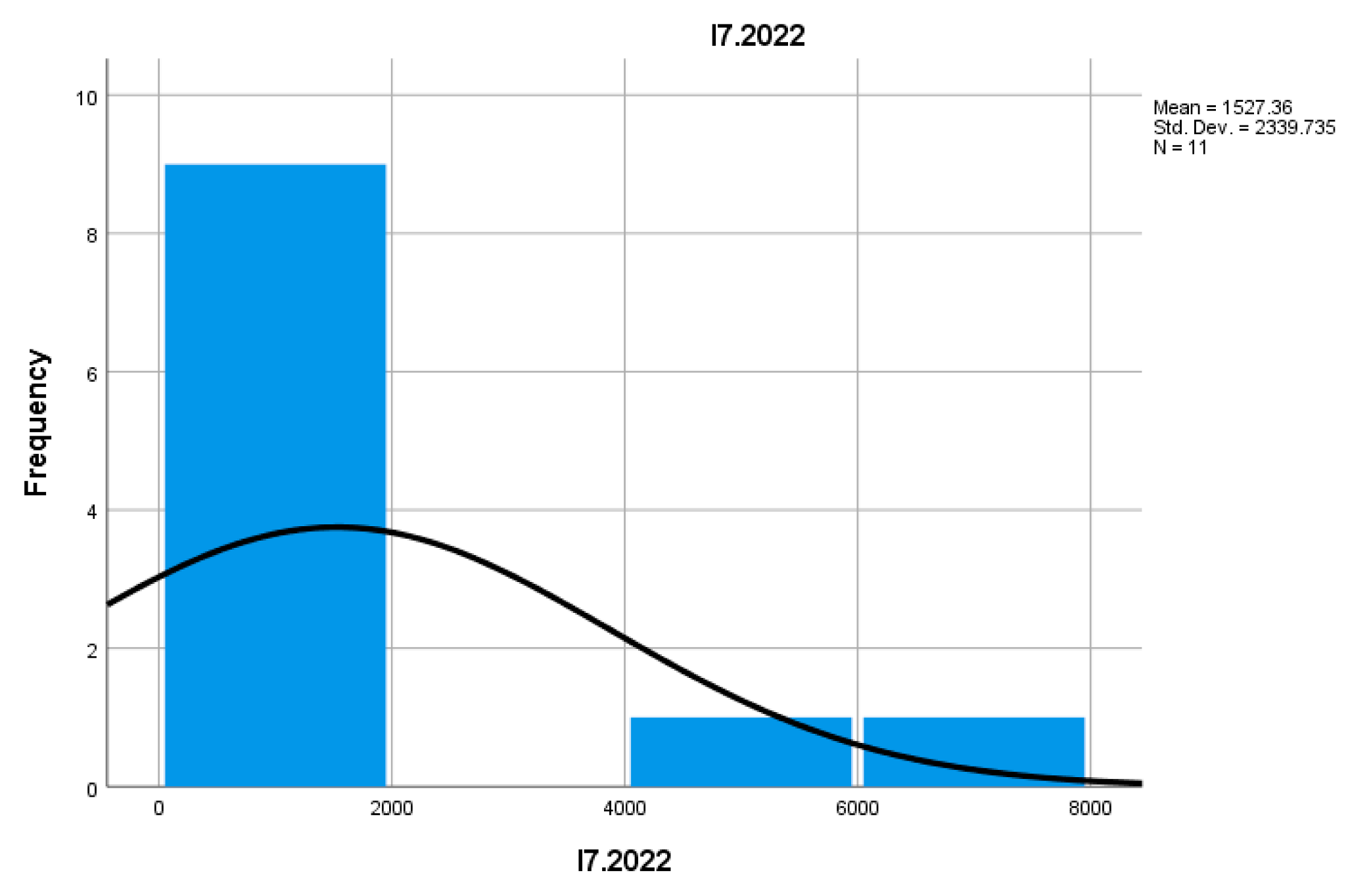

The survival rate of businesses, I7, in the European financial sector is calculated as the percentage of businesses that survived for 3 years after their establishment. Data for this indicator suggest a relatively constant trend regarding business survival, with a slight decrease in the survival rate in 2022. In the first half of 2021, the average survival rate is 18.188%, while in 2022 it decreases to 17.520%.

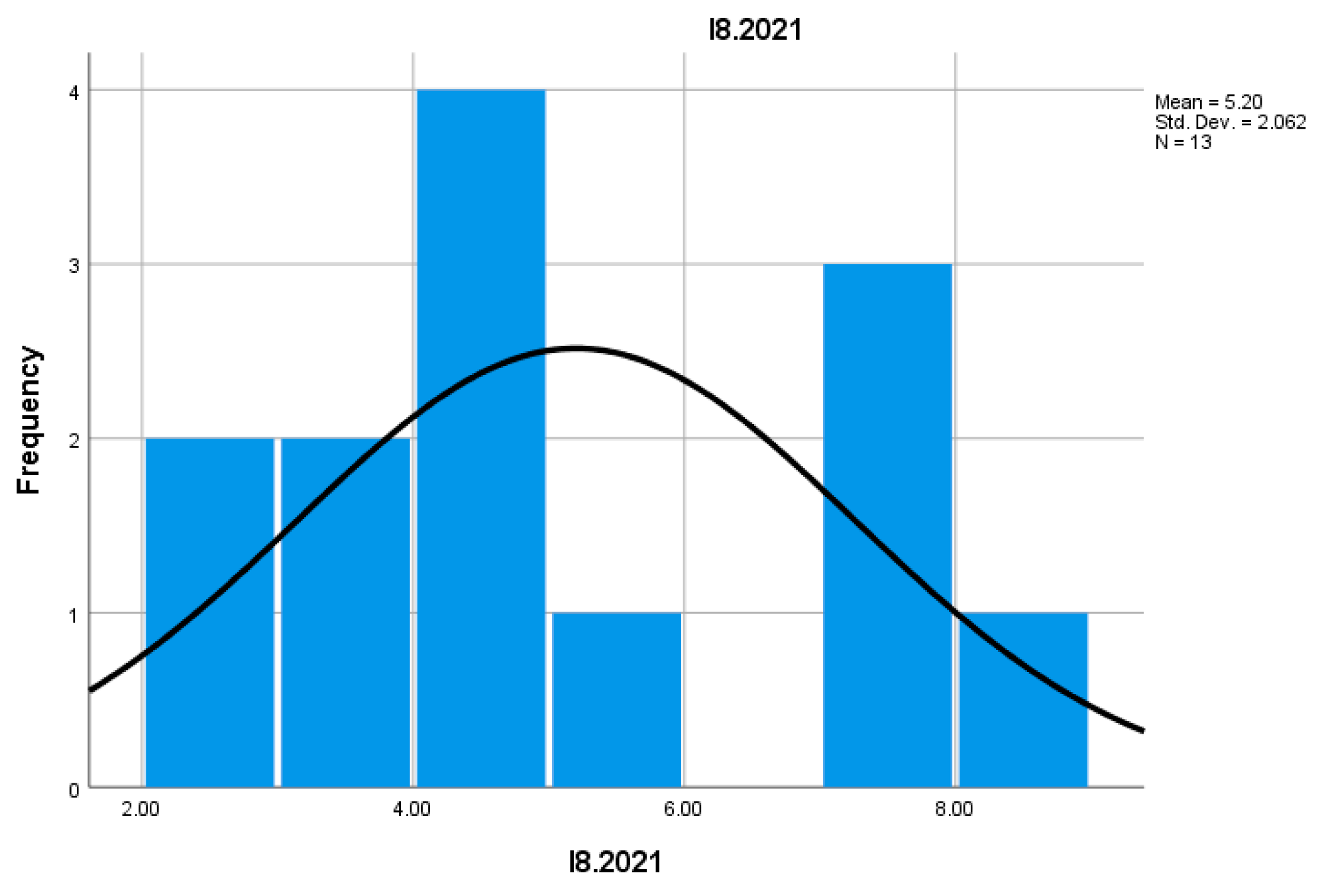

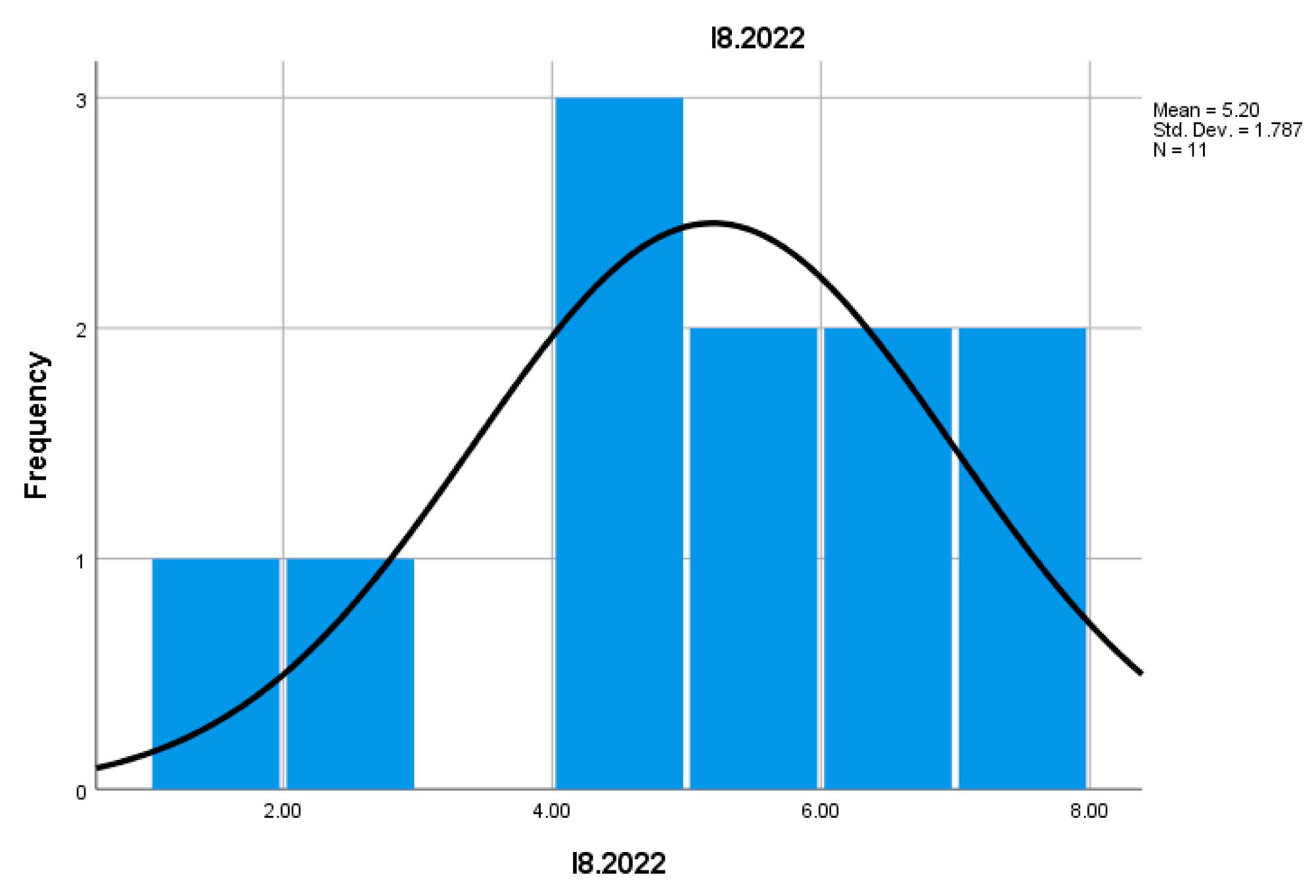

The I8 indicator reflects the share of 3-year-old businesses among the total number of active businesses. In general, this indicator remained constant during the analyzed period, indicating stabilization of this type of business within the mountain sector.

I9 recorded significant fluctuations, starting with a relatively low value in 2021 and increasing in 2022. This suggests greater adaptability of mountain businesses to economic conditions in the financial sector.

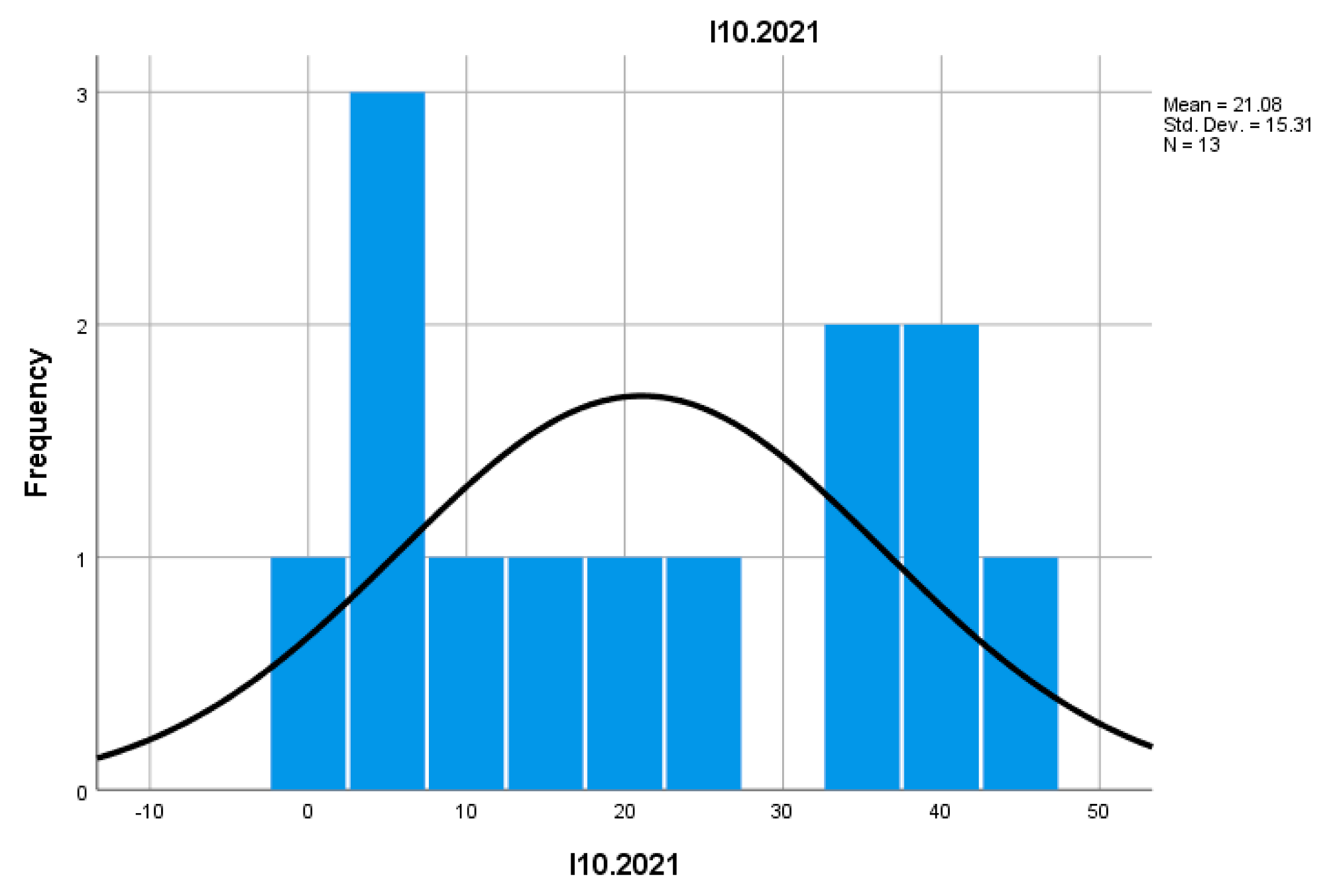

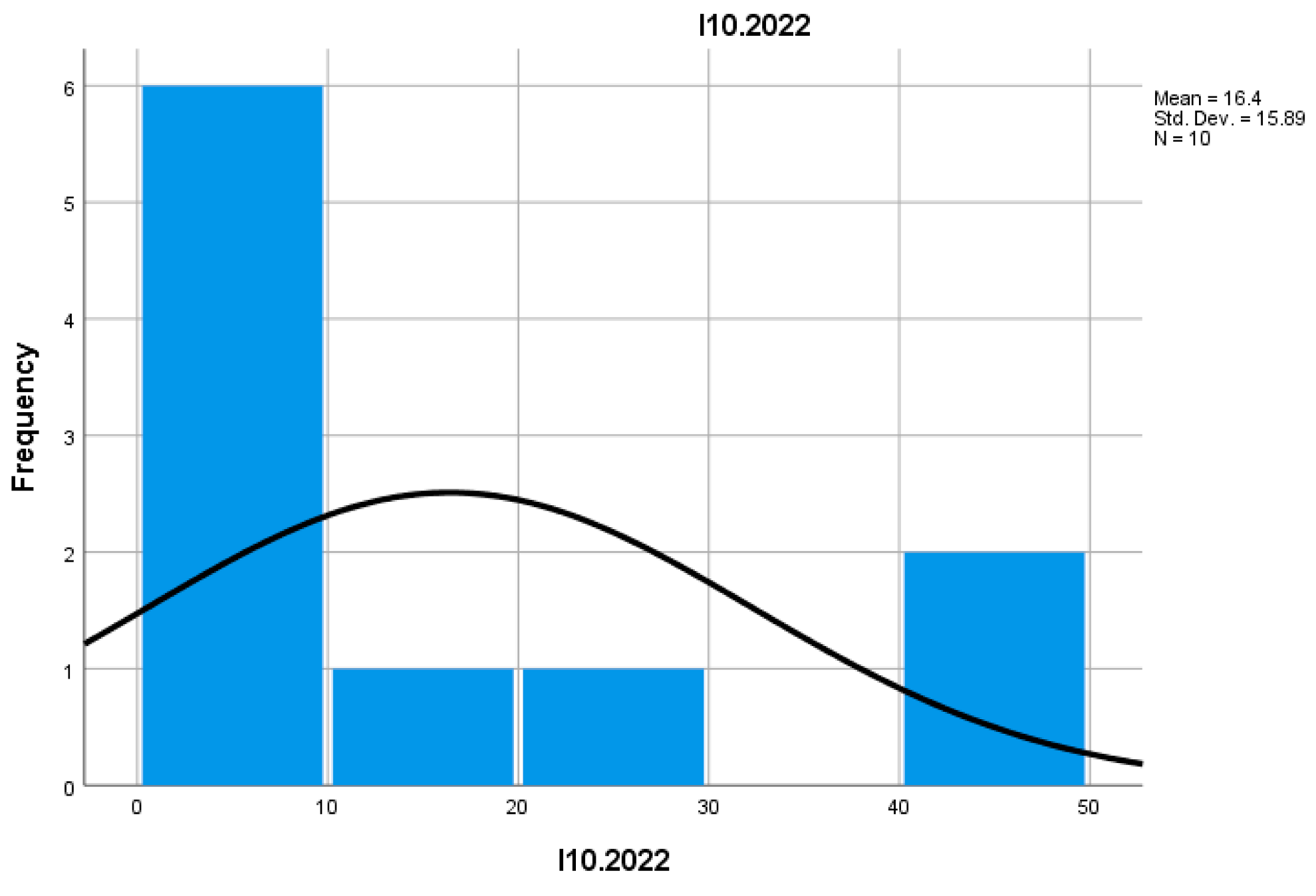

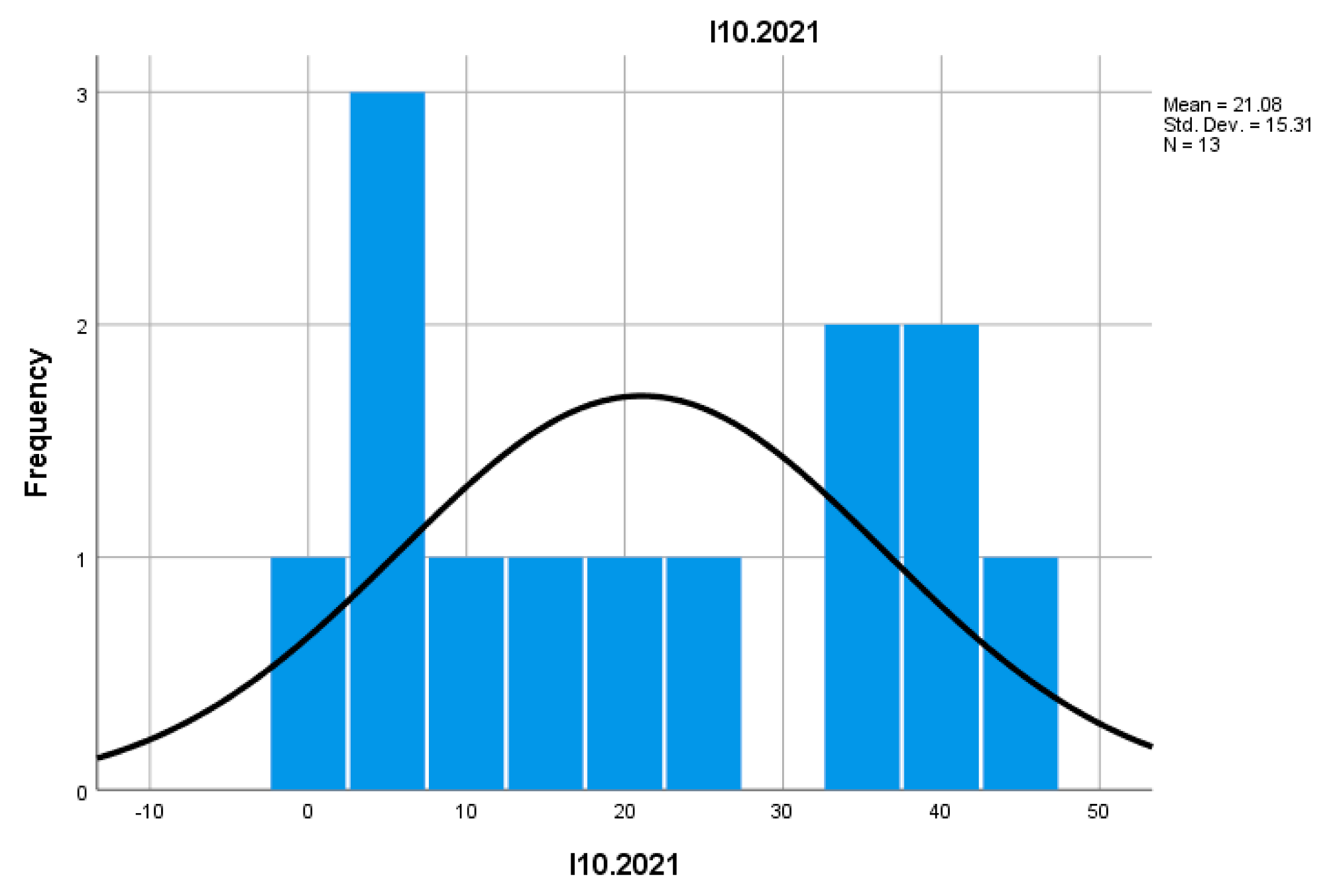

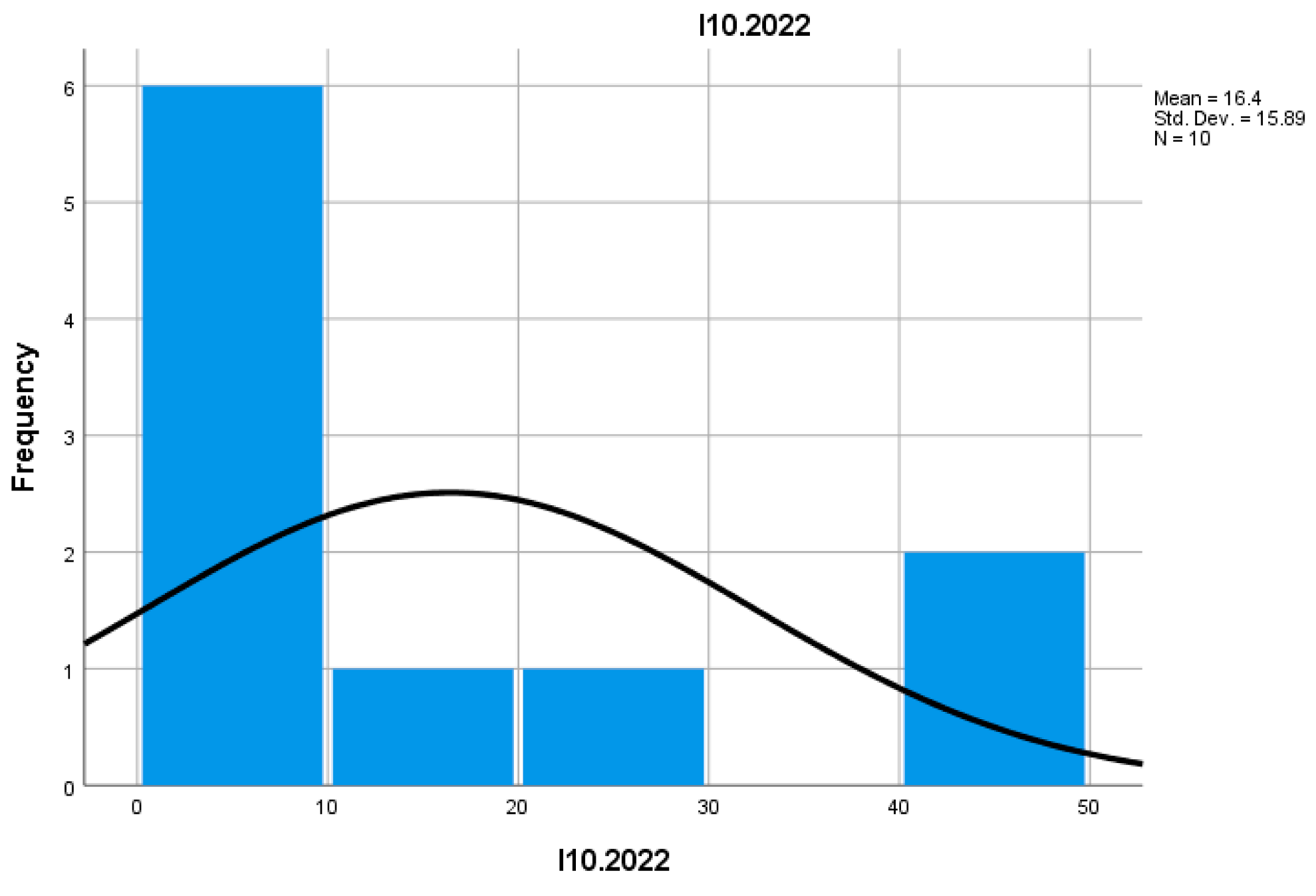

The I10 indicator measures the number of high-growth businesses, based on the growth in the number of employees. From the available data, we observe a general trend of fluctuation in their number over the years, with a peak in I10.2021 (21.08) and a minimum in I10.2022 (16.40). This decrease can be attributed to various economic and social conditions that influenced the performance of businesses during that period.

- -

The averages during the analyzed period show a constant level of high-growth businesses, but with a short-term decreasing trend (from 21.08 in 2021 to 16.40 in 2022).

- -

The dispersion (standard deviation) of this indicator is significant, suggesting that there is considerable variability in business growth depending on employment.

This indicator suggests that, despite a decrease in 2022 compared to 2021, there is still a segment of businesses that continue to expand rapidly, which is a positive sign for the dynamics of the mountain sector from an employment perspective.

The I11 indicator reflects the share of high-growth businesses among the total number of active businesses with at least 10 employees. The values for this indicator were relatively stable during the two available periods, with a slight decrease from 8.43 in I11.2021 to 9.54 in I11.2022.

- -

The averages and dispersion suggest that, although the share of high-growth businesses remains quite constant, there is a slight upward trend in this segment, signaling good performance in the large business segment.

A stable or slightly increasing percentage of high-growth businesses indicates healthy development and continued attraction of capital for mountain businesses in the European financial sector. The growth of these businesses may help develop infrastructure and create additional jobs.

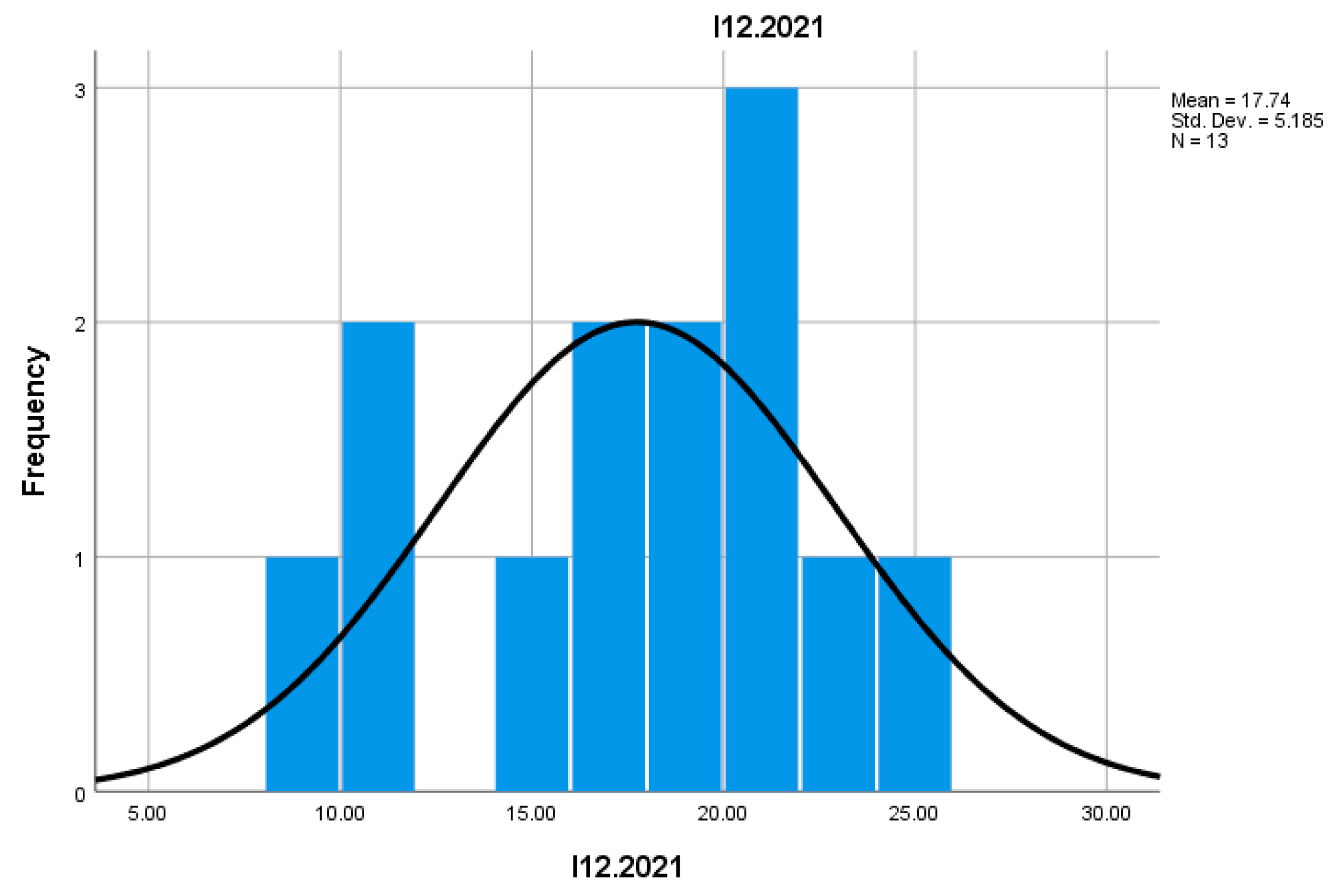

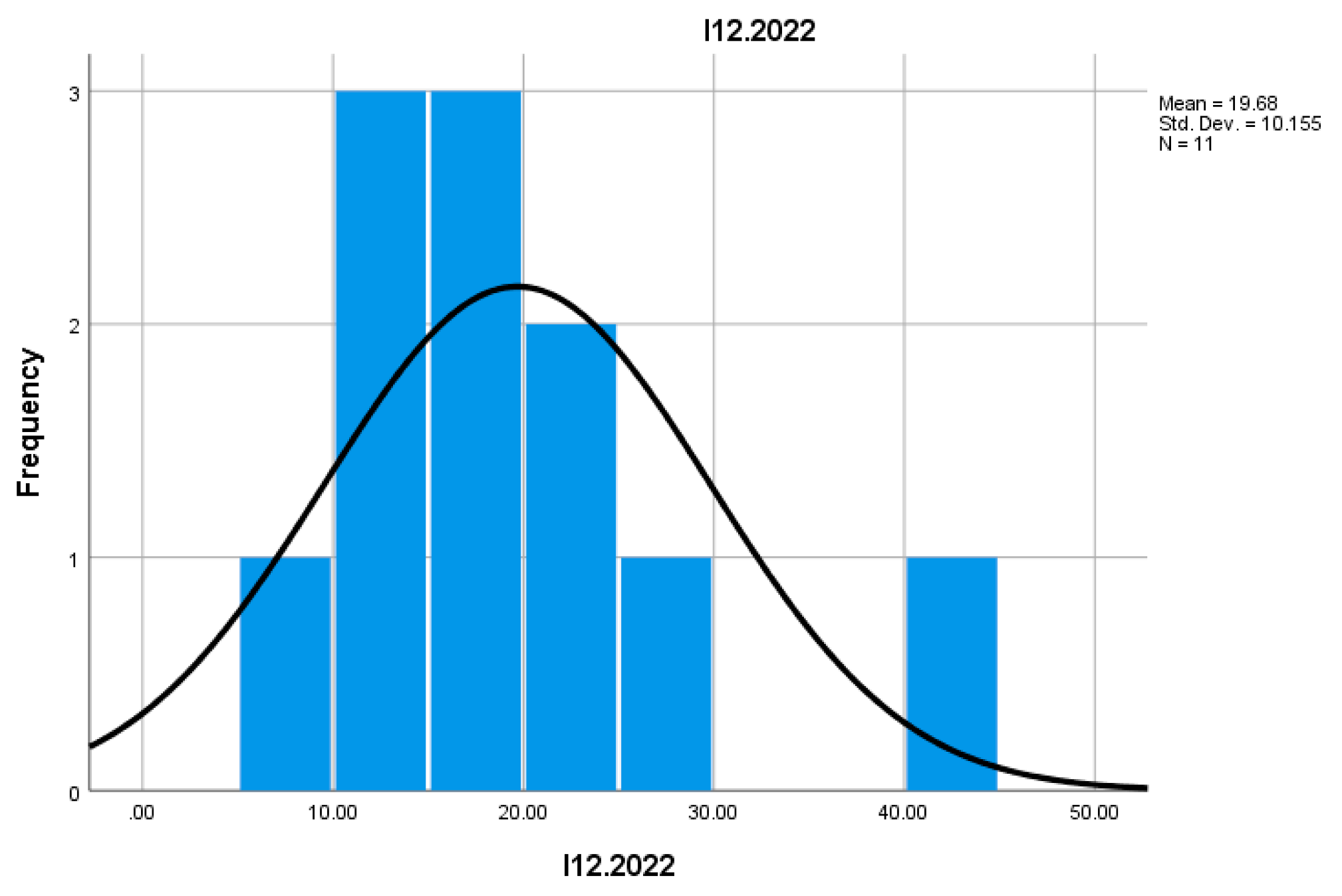

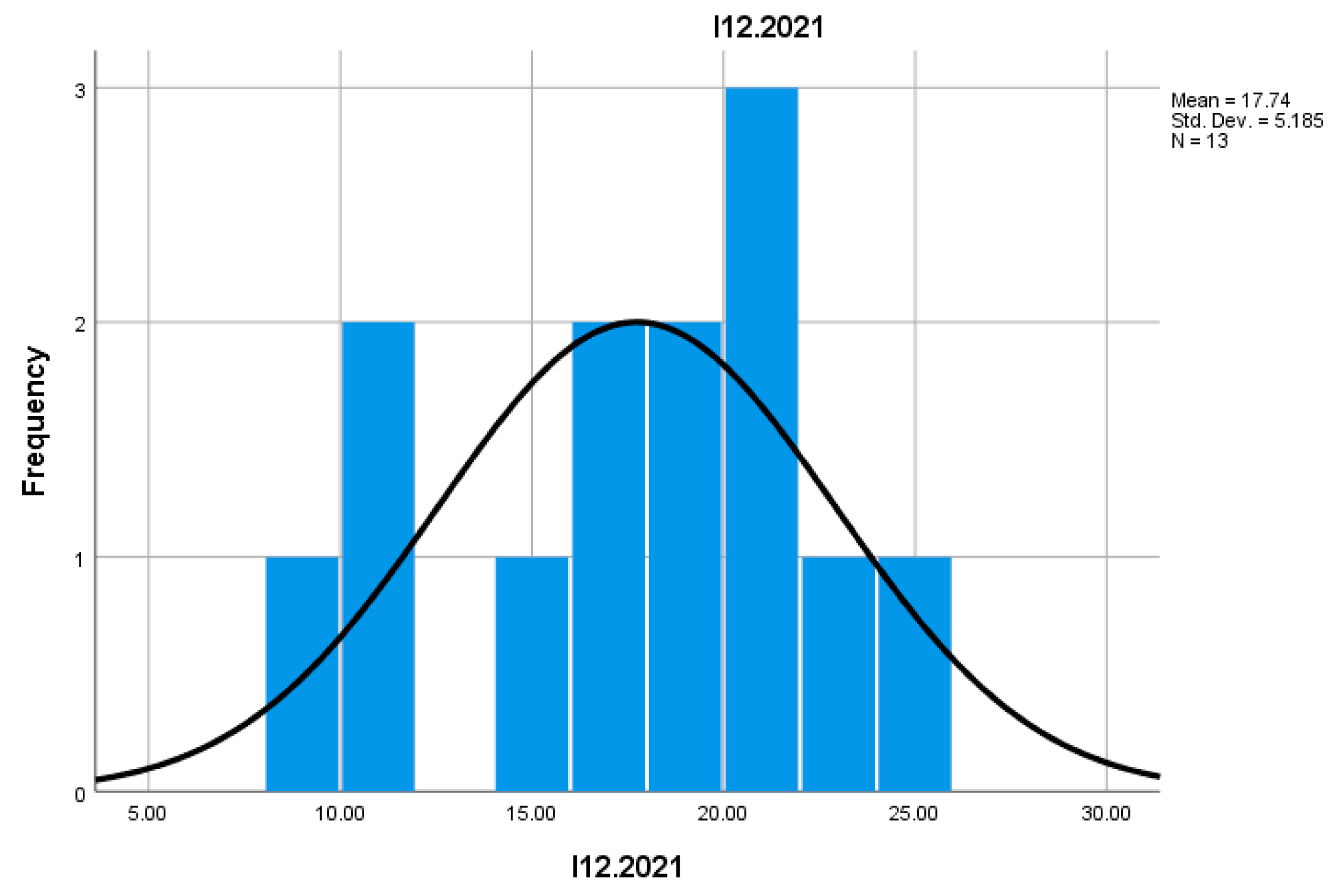

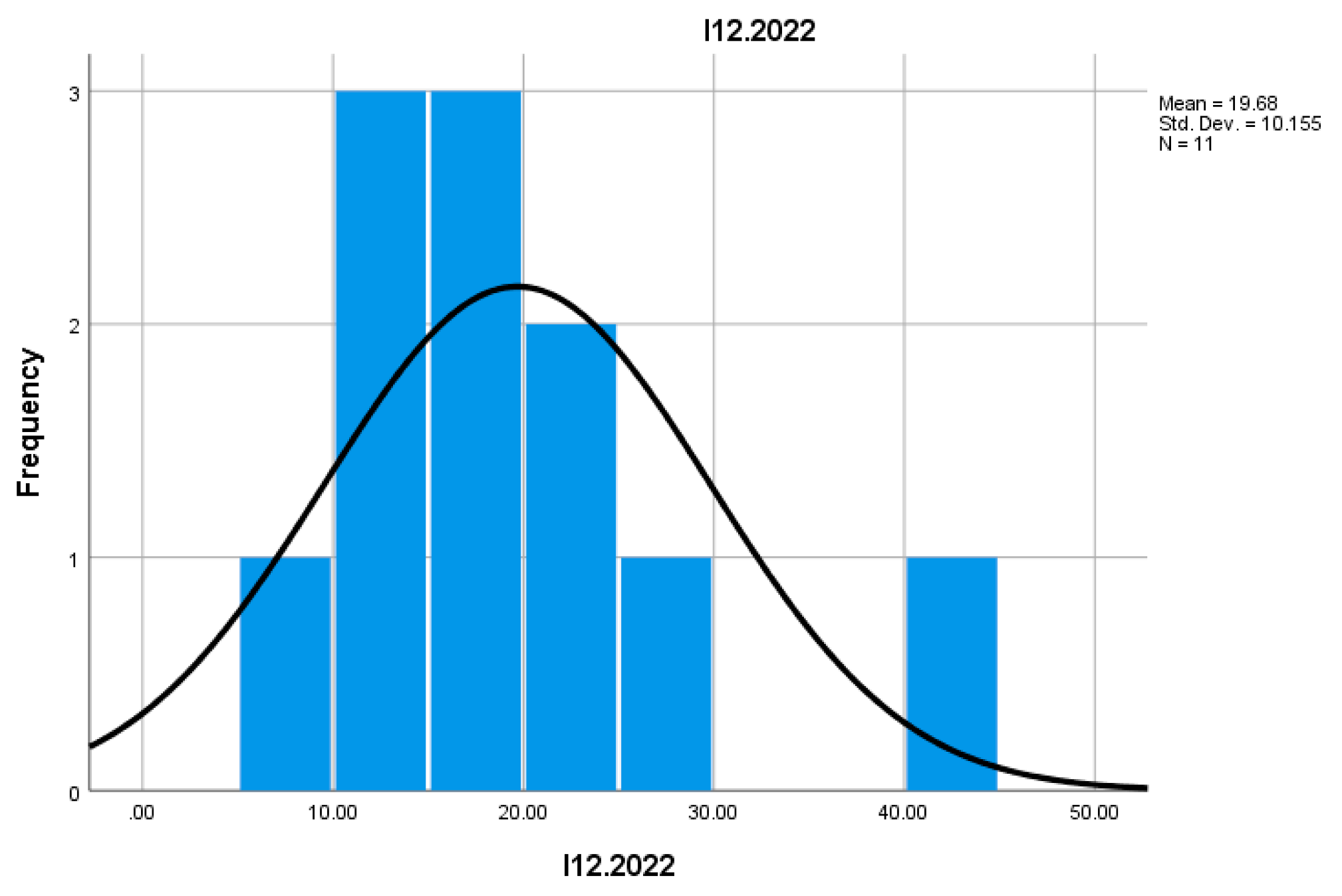

I12 measures the volume of business births and deaths as a percentage of the total number of active businesses. This value can provide essential information about the dynamics of the business market. During the analyzed period, the business churn rate ranged between I12.2021 (18.1880) and I12.2022 (17.5200).

- -

The averages are relatively close, suggesting general stability regarding business births and deaths.

- -

The higher dispersion (standard deviation) in 2021 indicates increased market volatility.

A relatively constant level of business churn indicates that the mountain business market is in balance, with continuous activity in both business creation and closure. This suggests ongoing adaptability of mountain entrepreneurship to changing economic and social conditions.

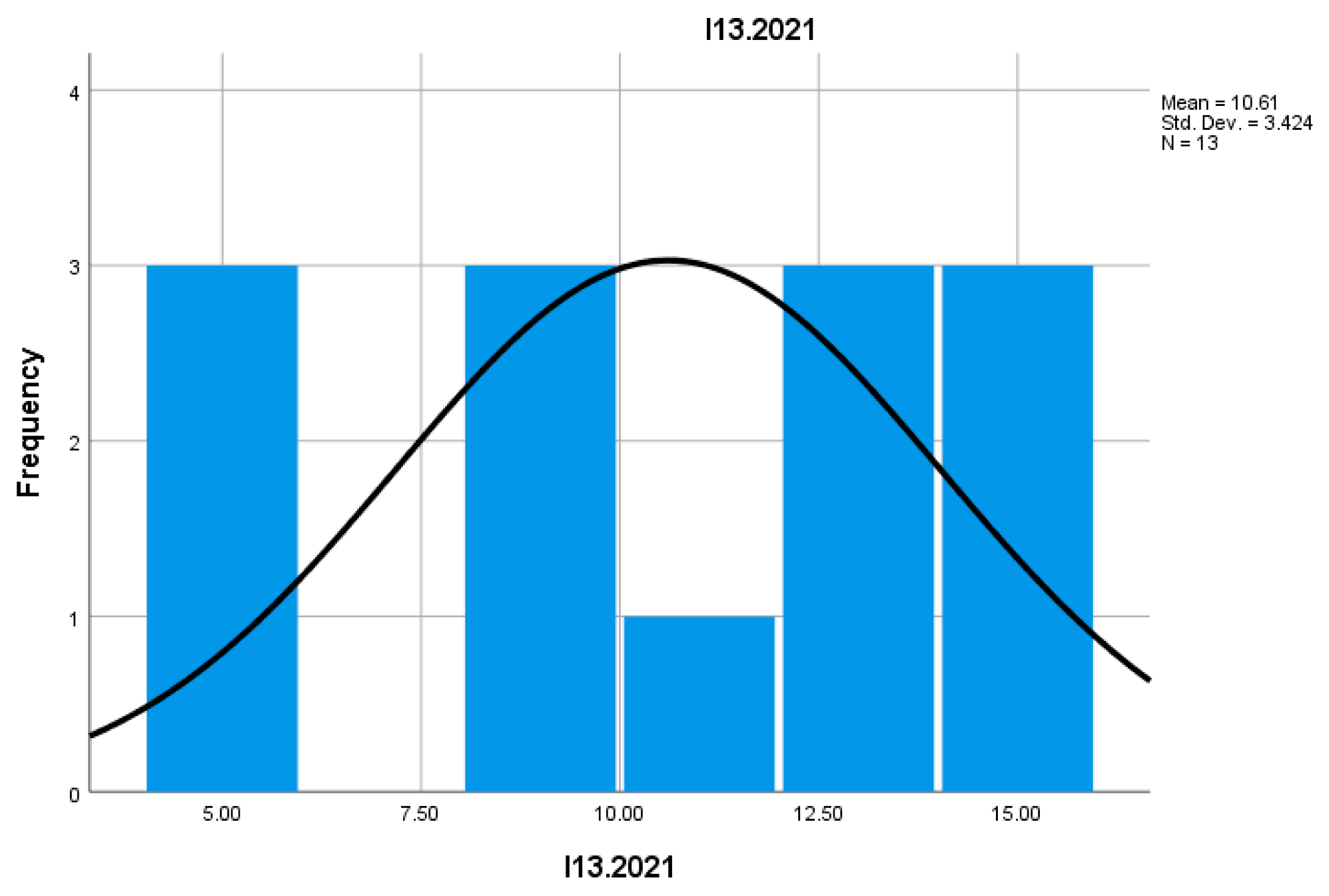

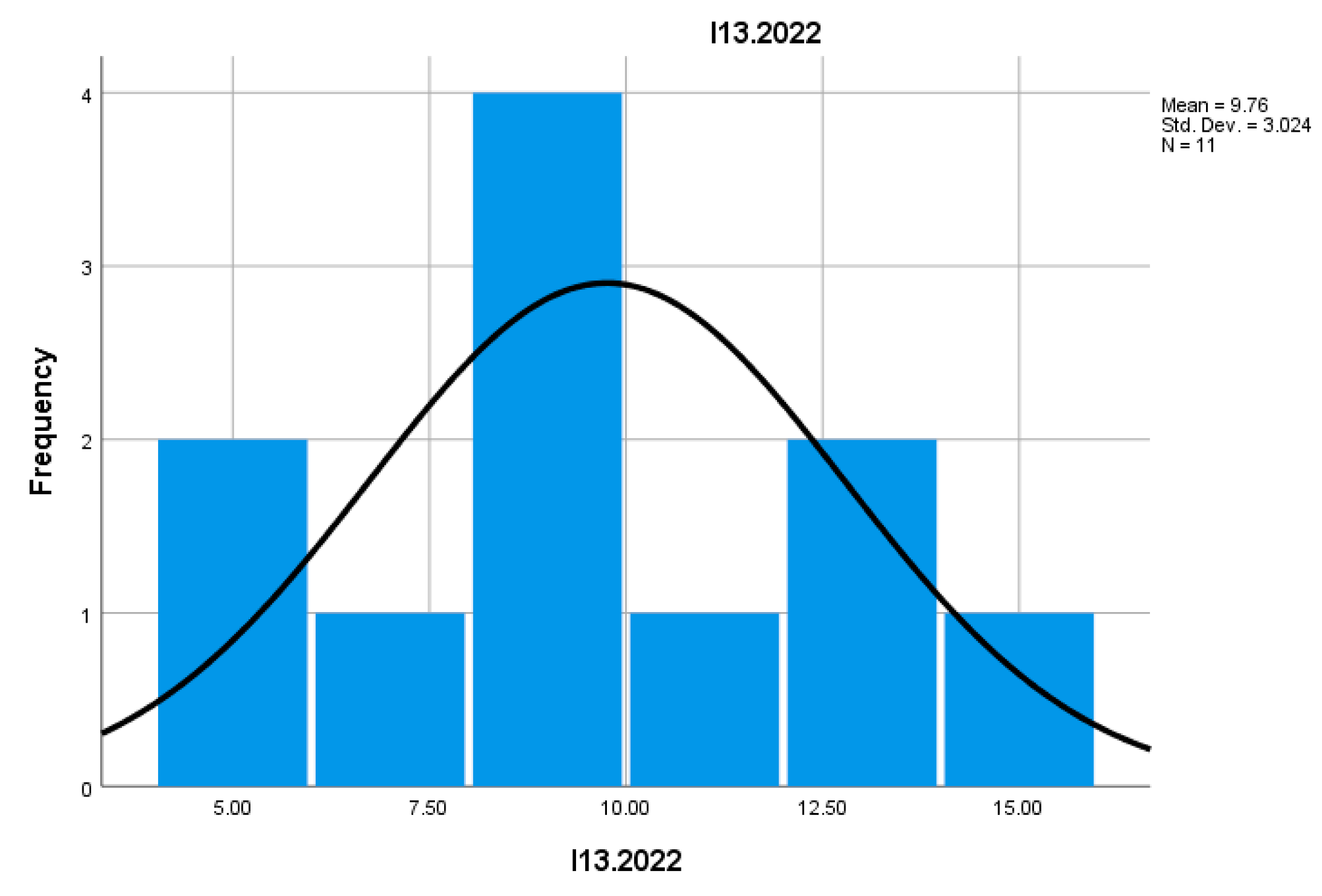

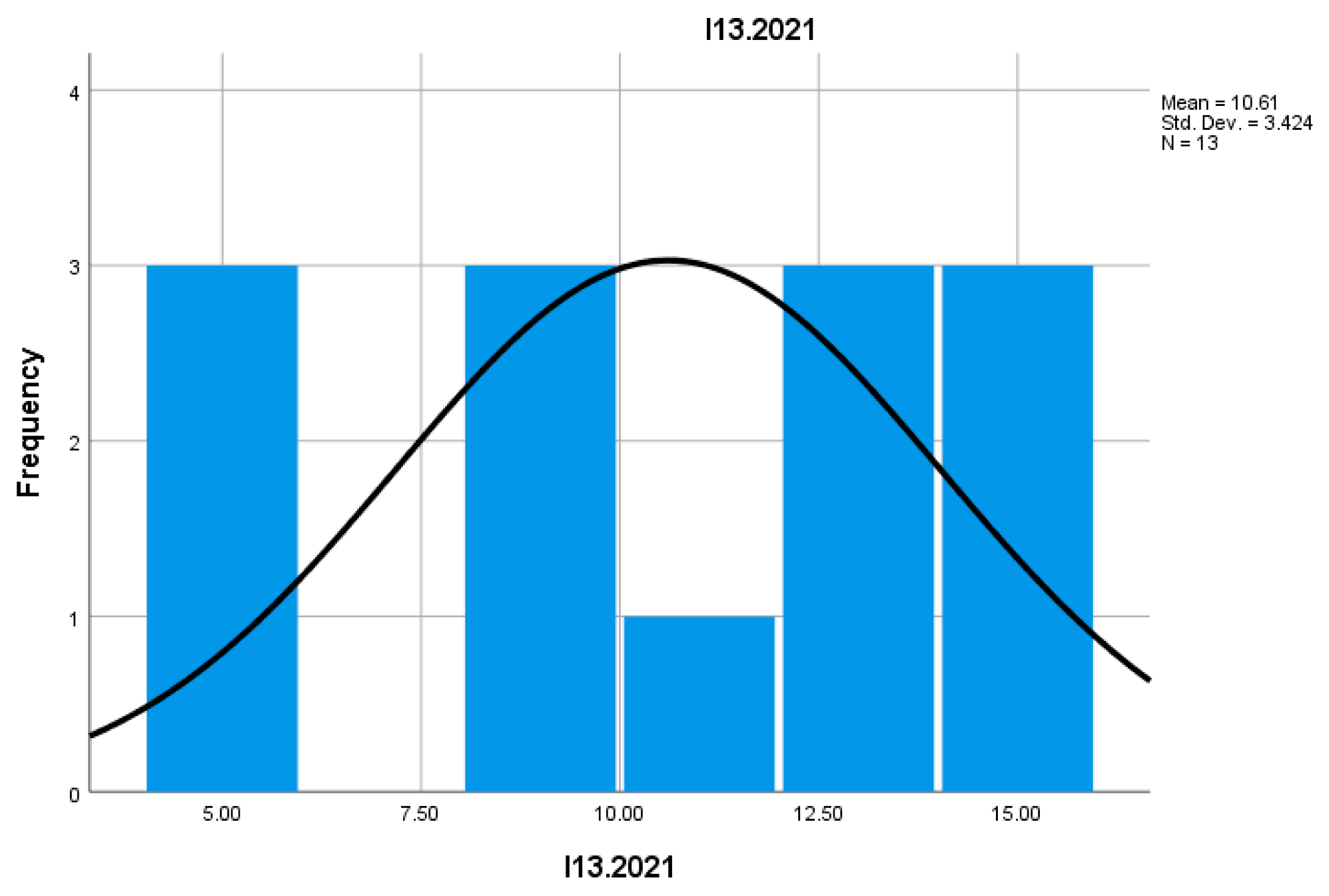

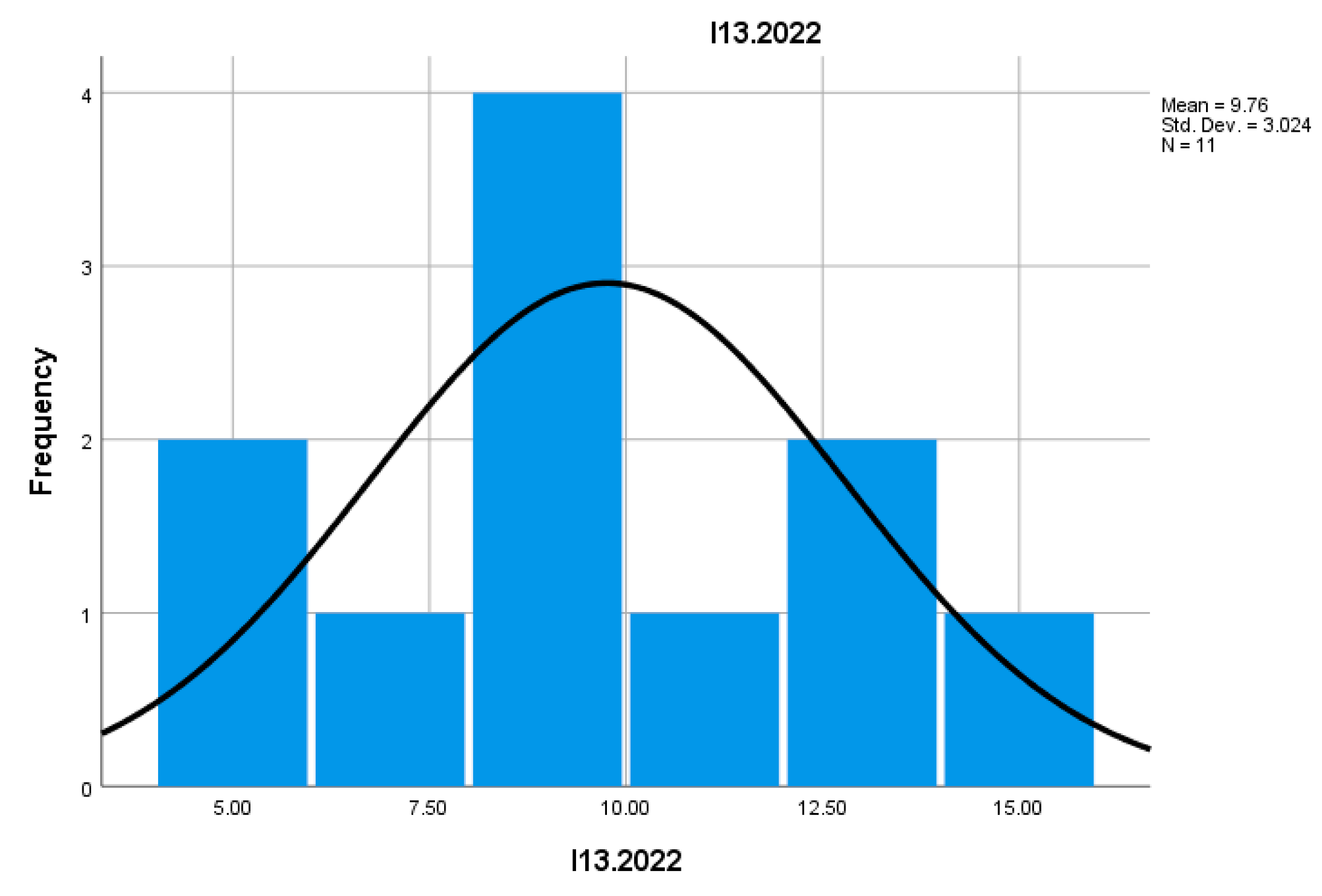

The I13 indicator measures the percentage of newly established businesses relative to active businesses, showing a fairly constant value with slight variation between I13.2021 (18.1880) and I13.2022 (17.5200).

- -

The averages and dispersion suggest a steady rate of new business establishment, reflecting the continuity of entrepreneurial dynamism.

Although no major fluctuations are recorded during this period, the indicator suggests a favorable environment for new business openings in the European mountain financial sector, indicating continuous and sustainable development of businesses.

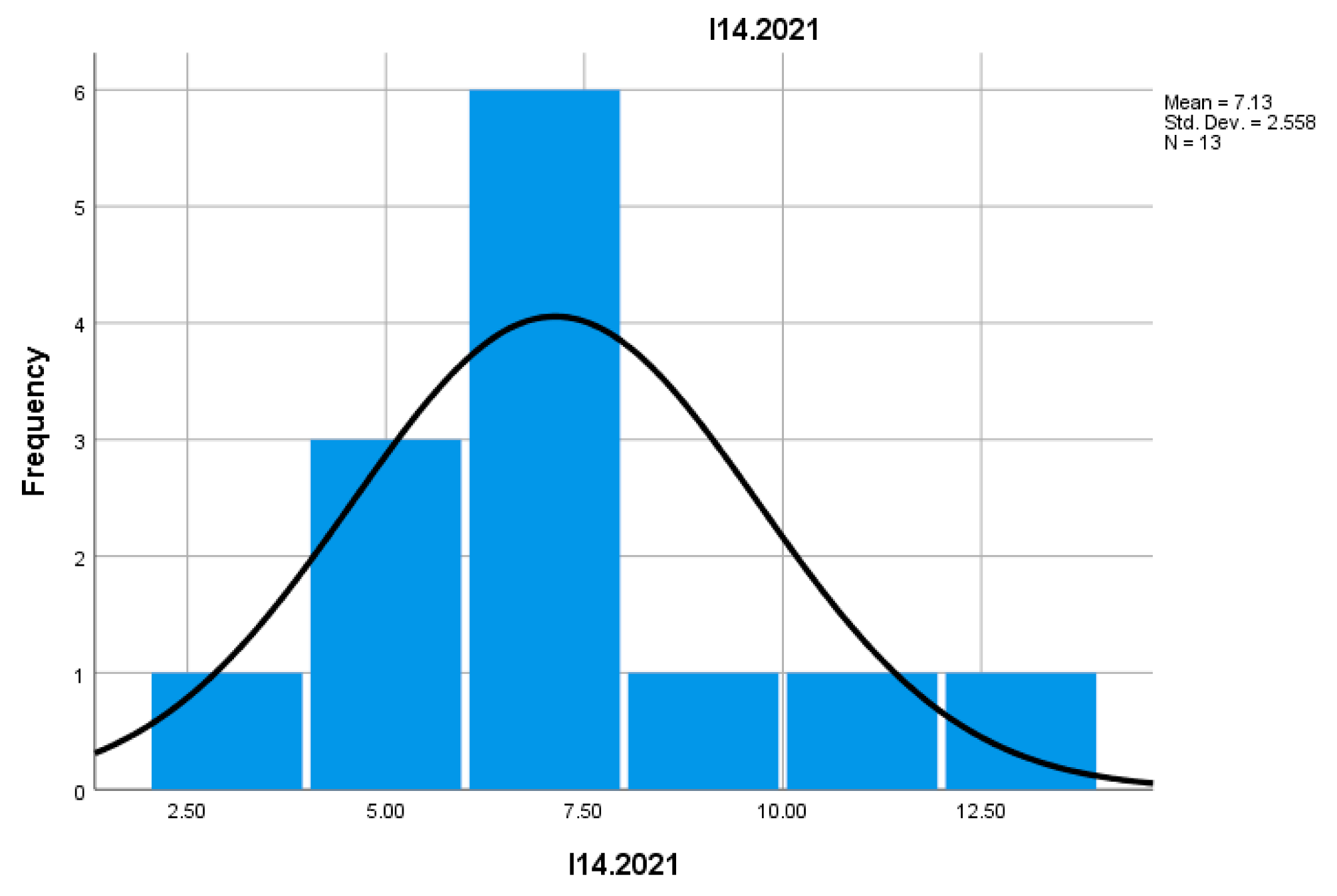

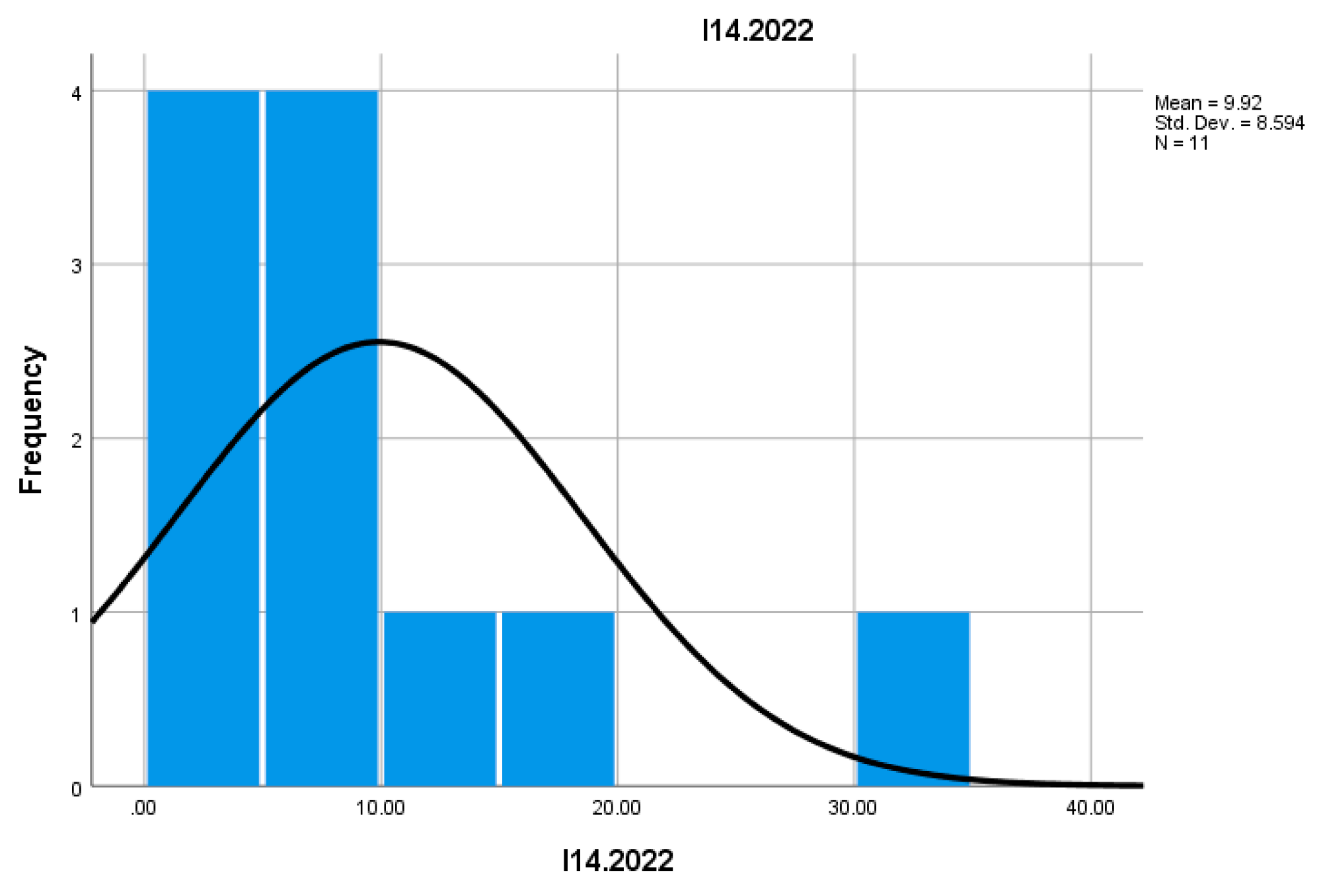

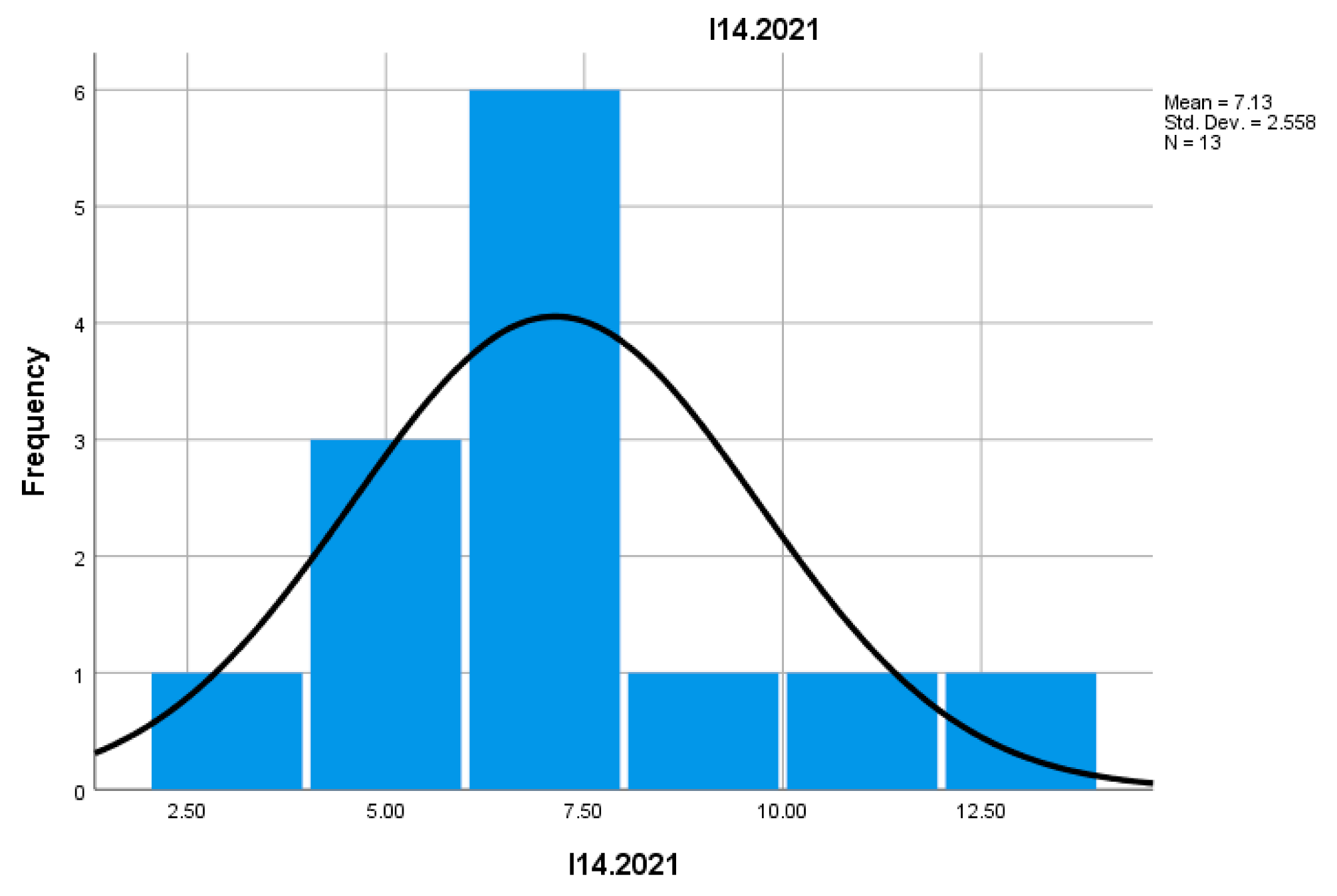

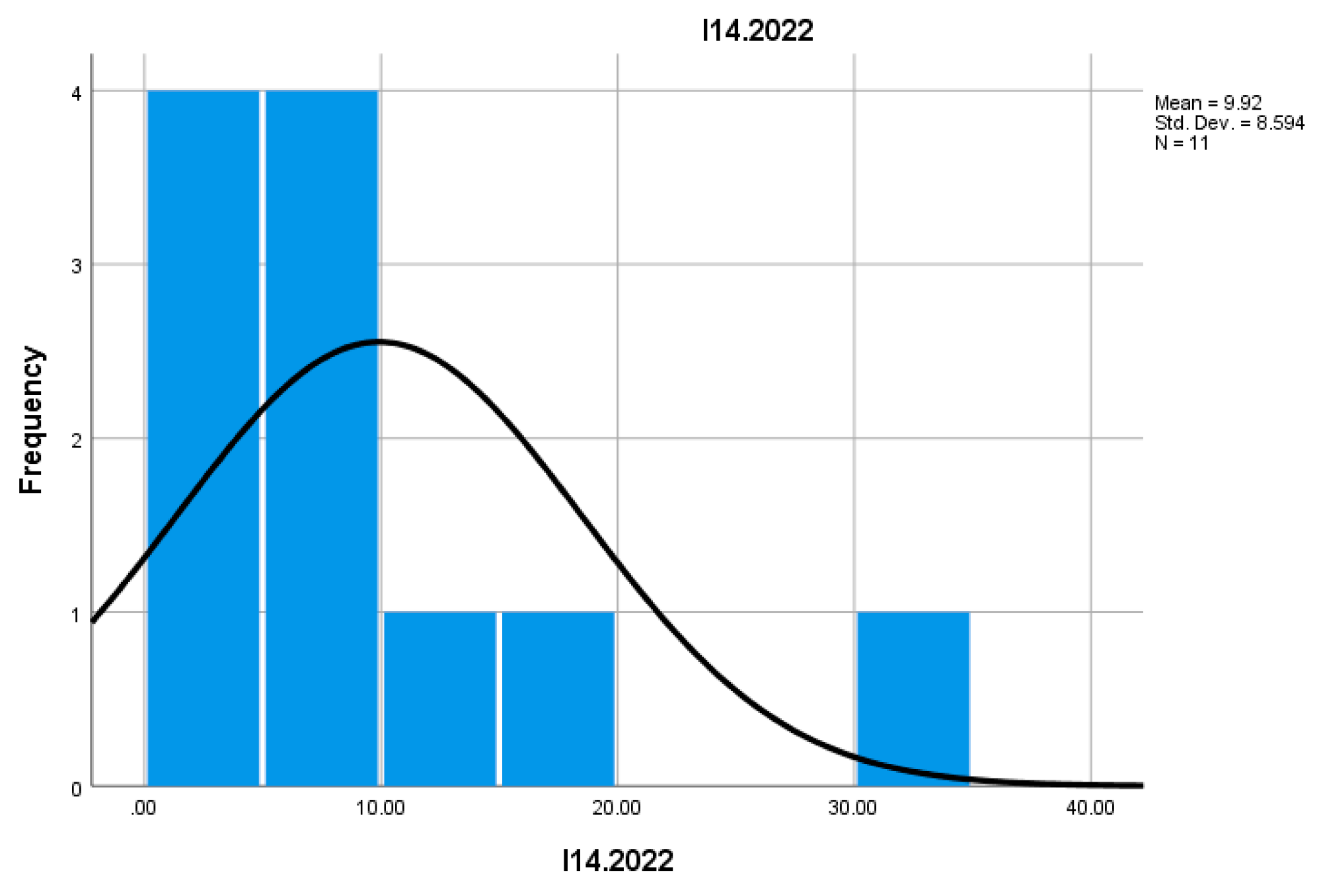

I14 measures the percentage of businesses that disappear relative to active businesses. Data analysis shows a slight decrease in the business death rate from I14.2021 (18.1880) to I14.2022 (17.5200), suggesting a general trend of improvement in business survival rates.

A constant or slightly decreasing business death rate suggests that businesses in the mountain sector are becoming more resilient and capable of coping with economic and environmental challenges.

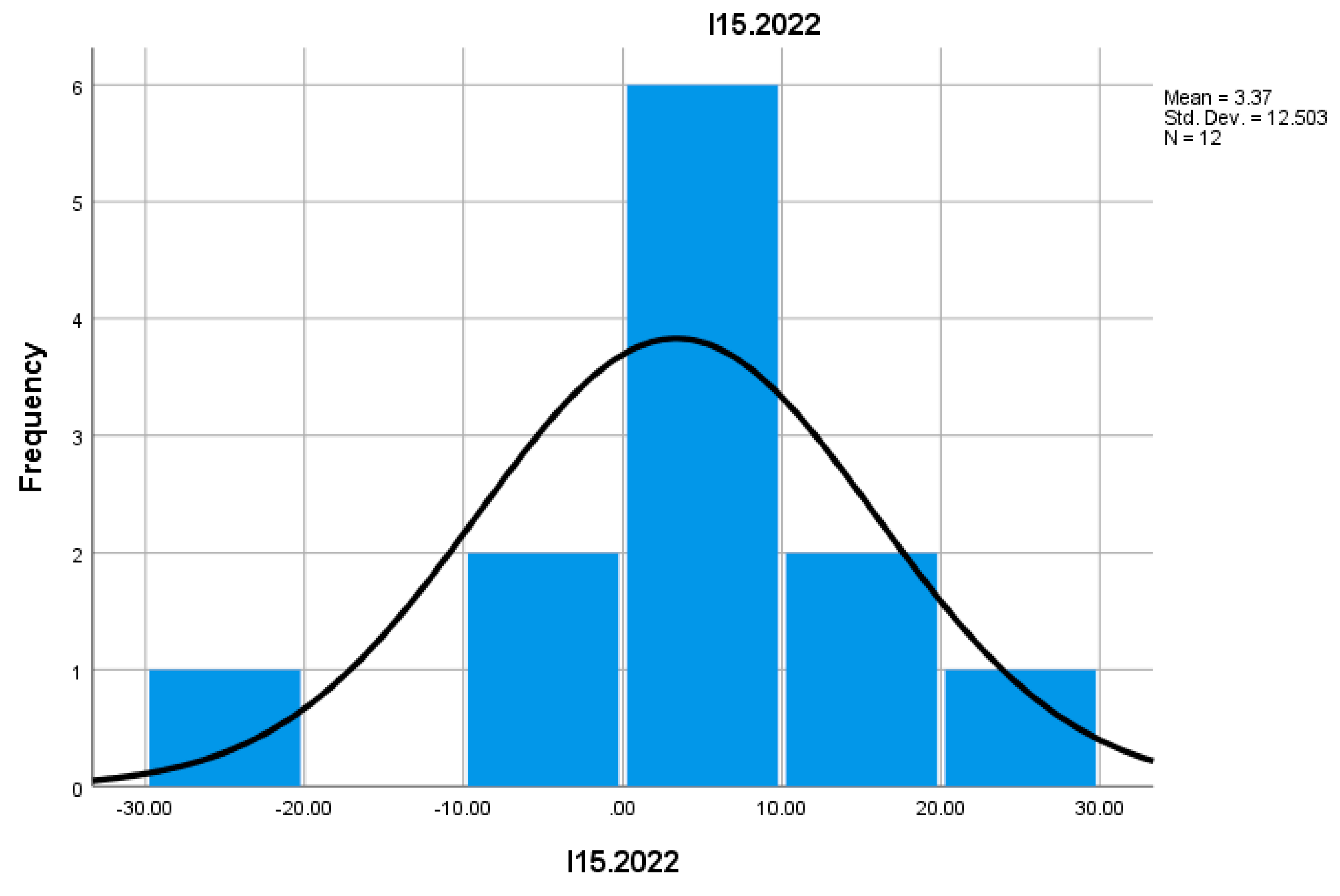

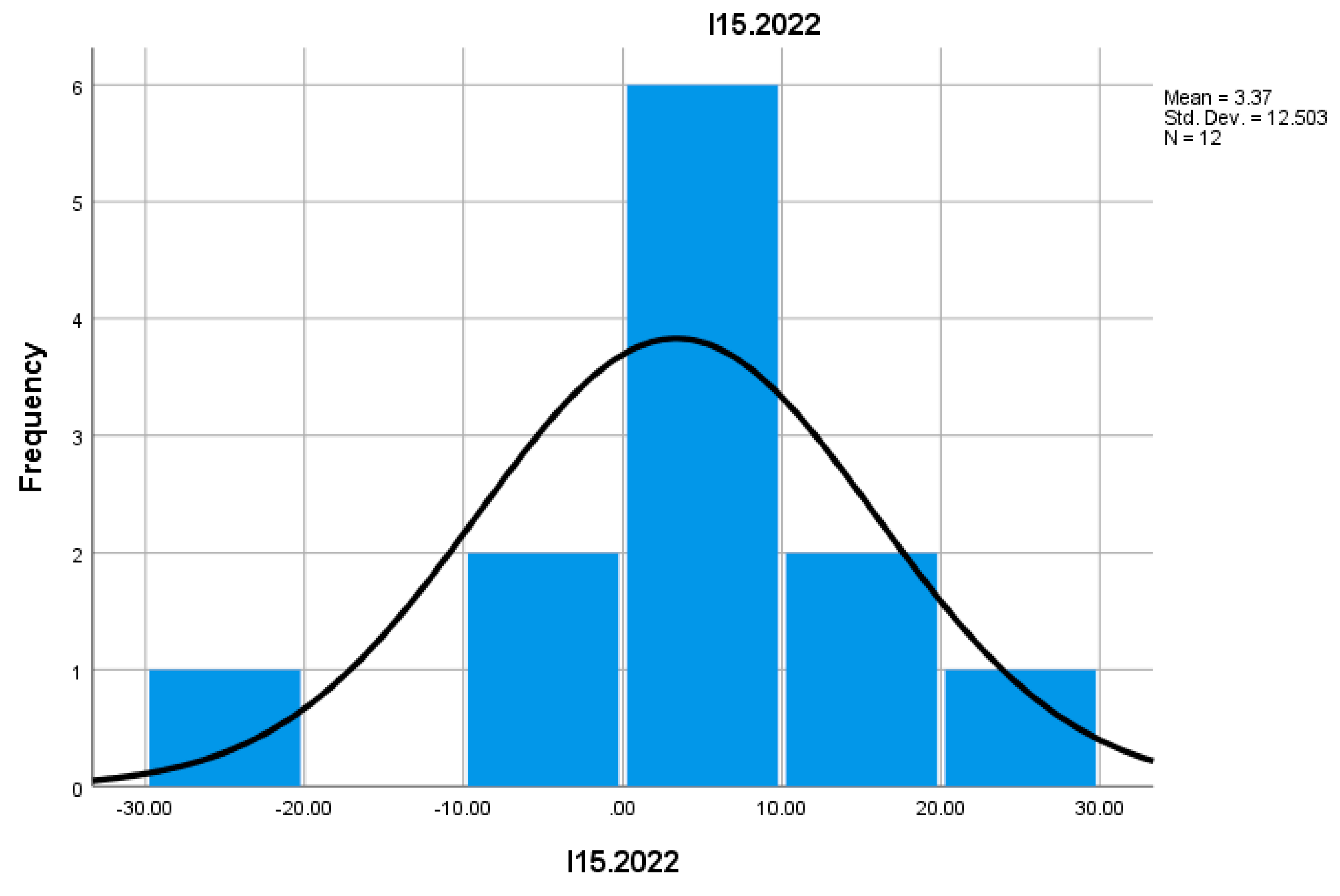

The I15 indicator reflects the net growth of the business population, considering both newly established and closed businesses. Overall, the net growth of the business population in the European mountain sector has been positive, signaling market expansion.

Net growth indicates a positive trend in the entrepreneurial environment, which is particularly relevant for the mountain sector in terms of attracting new investments and creating jobs.

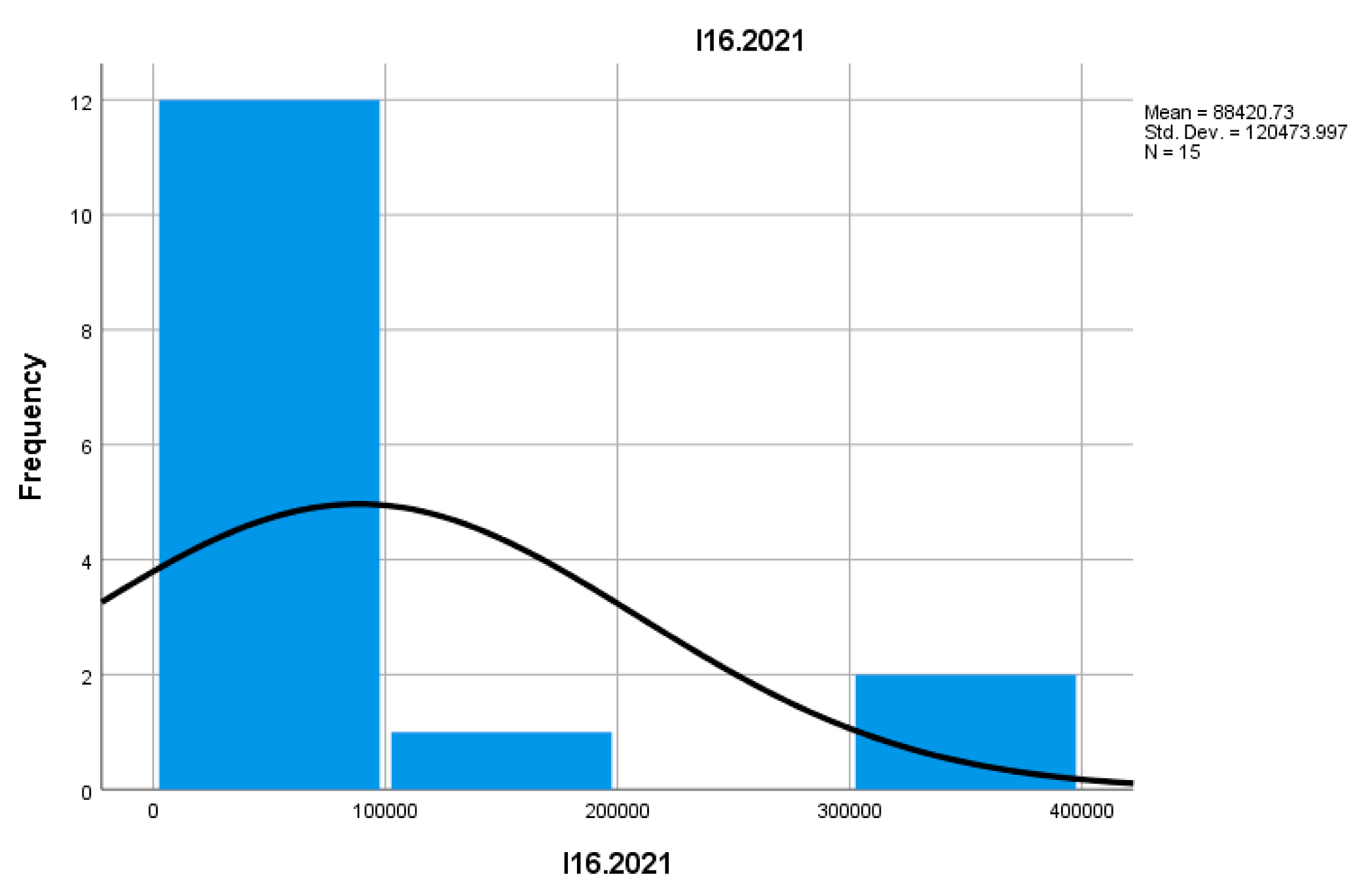

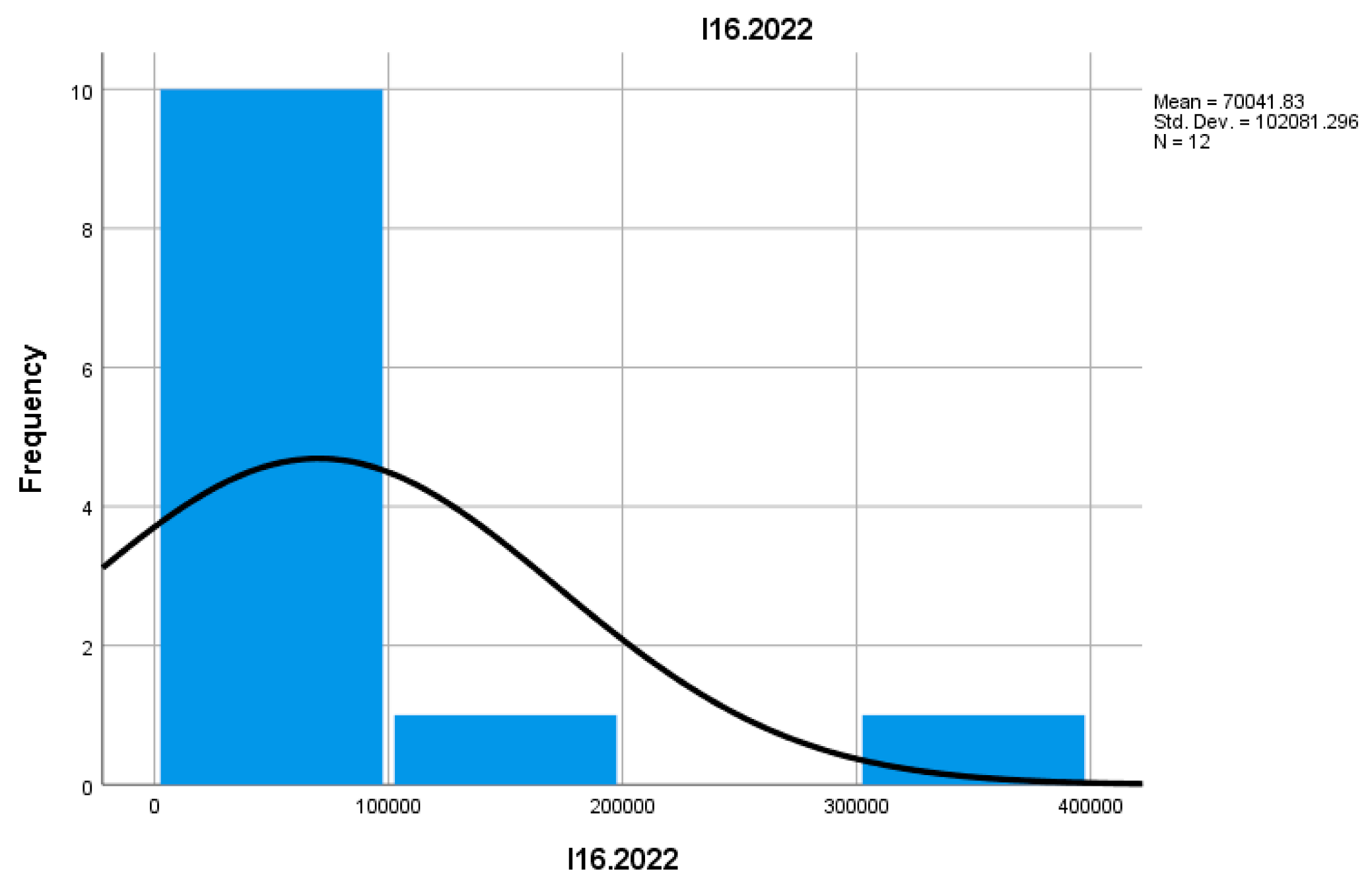

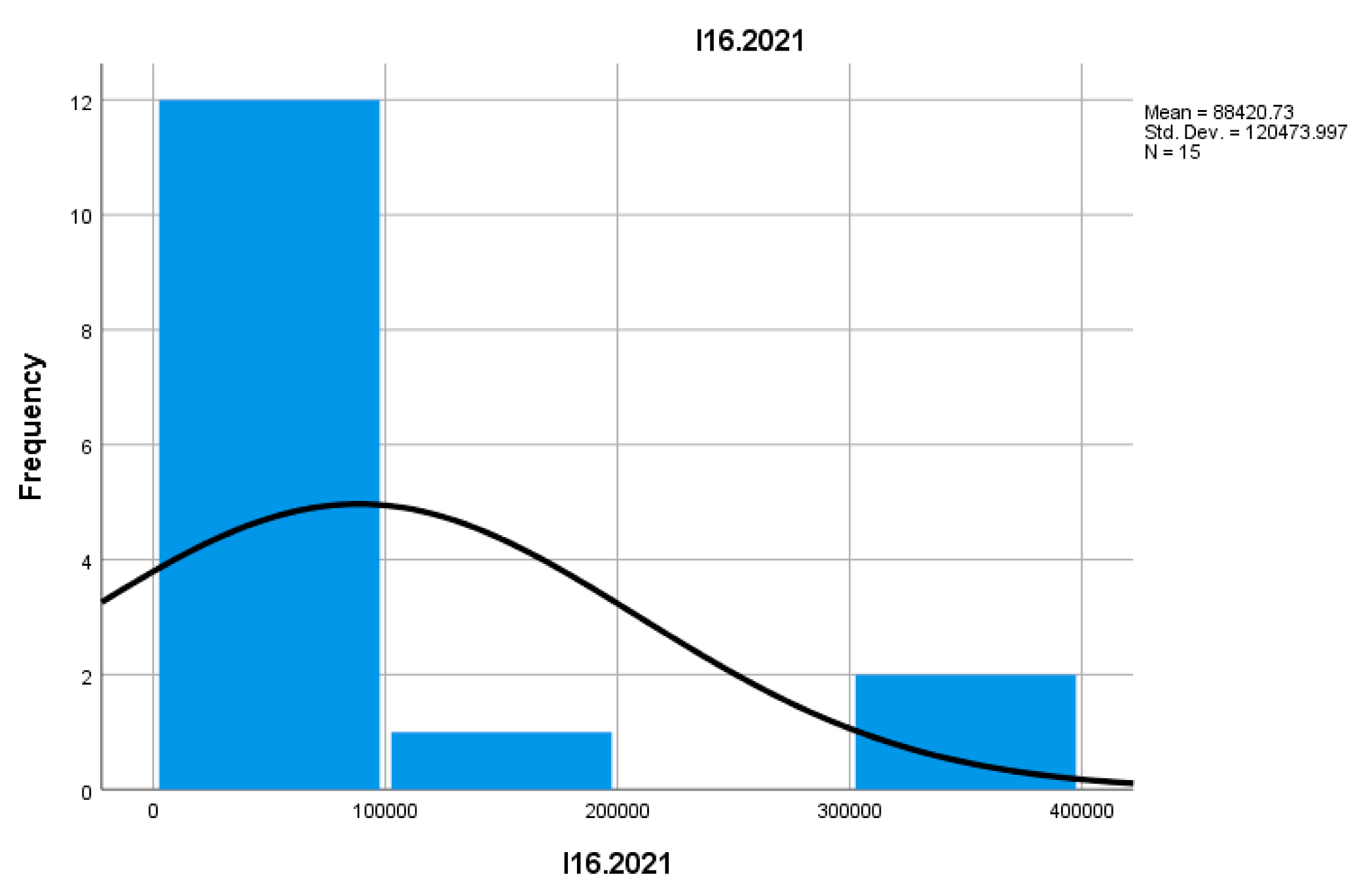

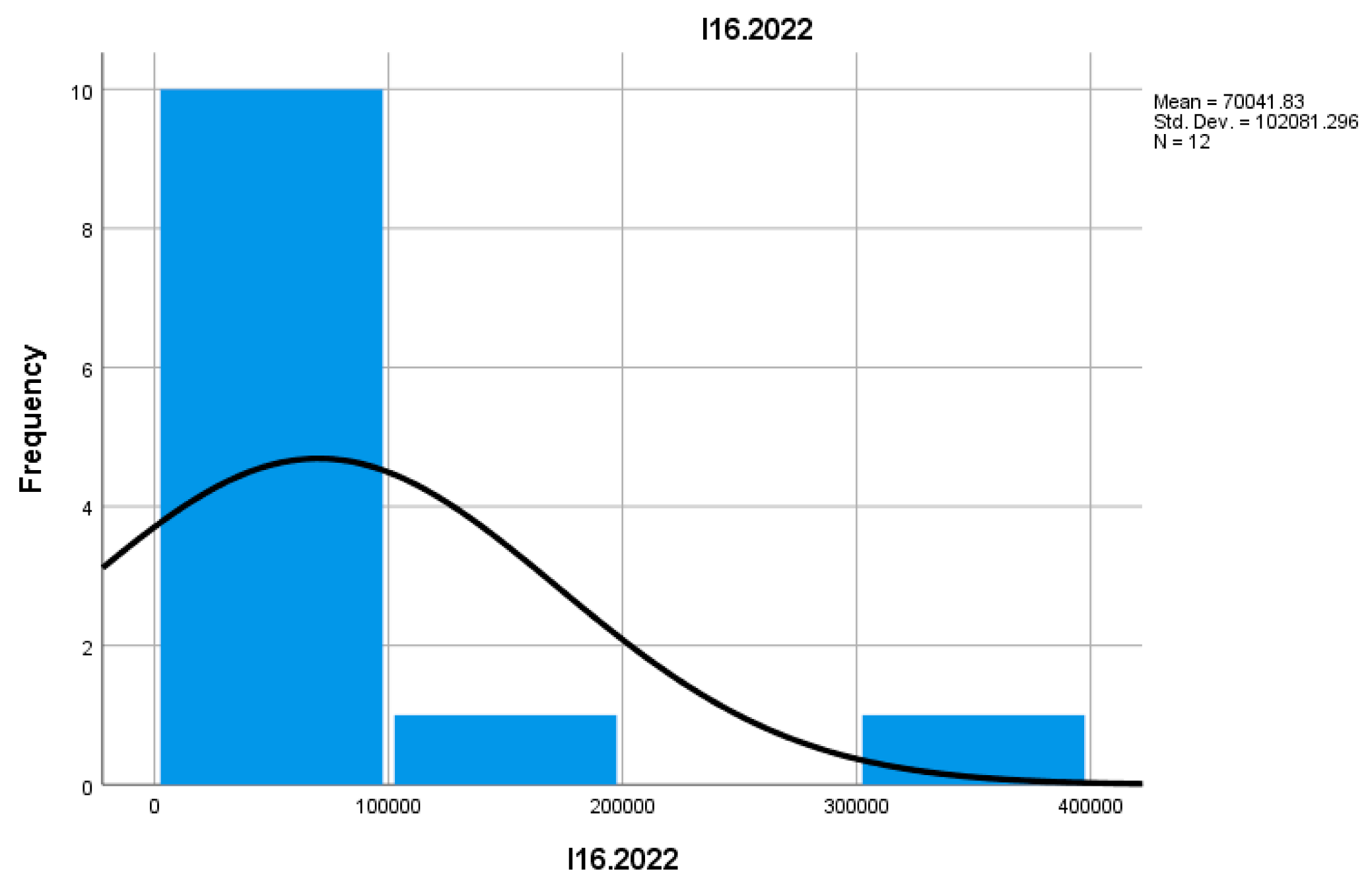

The I16 indicator shows the total number of people employed within mountain businesses. The average of this indicator fluctuated during the analyzed period, with a peak in I16.2021 (88,420.73) and a significant decrease in I16.2022 (70,041.83).

The decrease in the number of employees can be attributed to negative economic factors or changes in the structure of businesses. This may reflect a trend towards digitalization or restructuring within the European mountain sector.

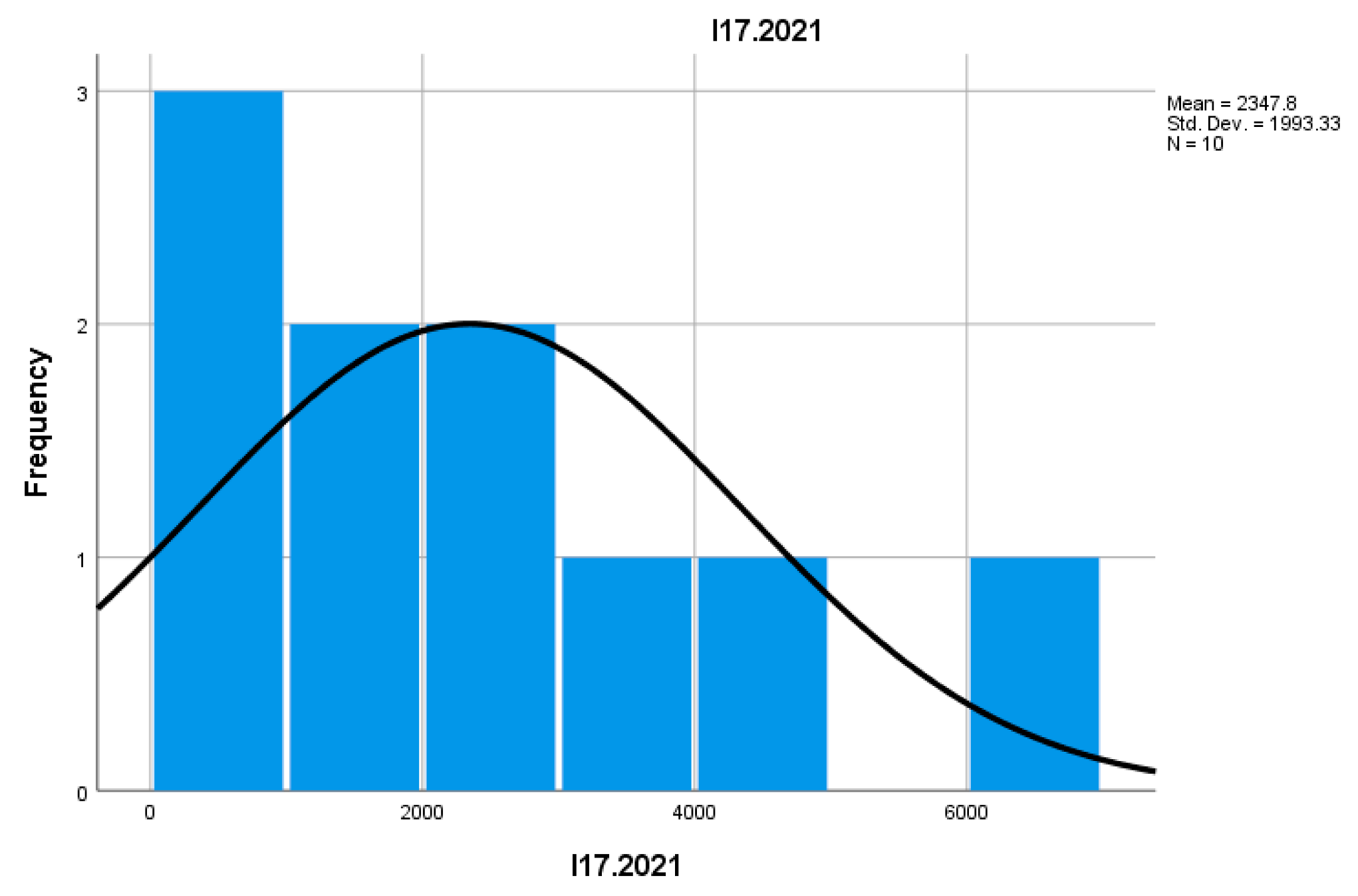

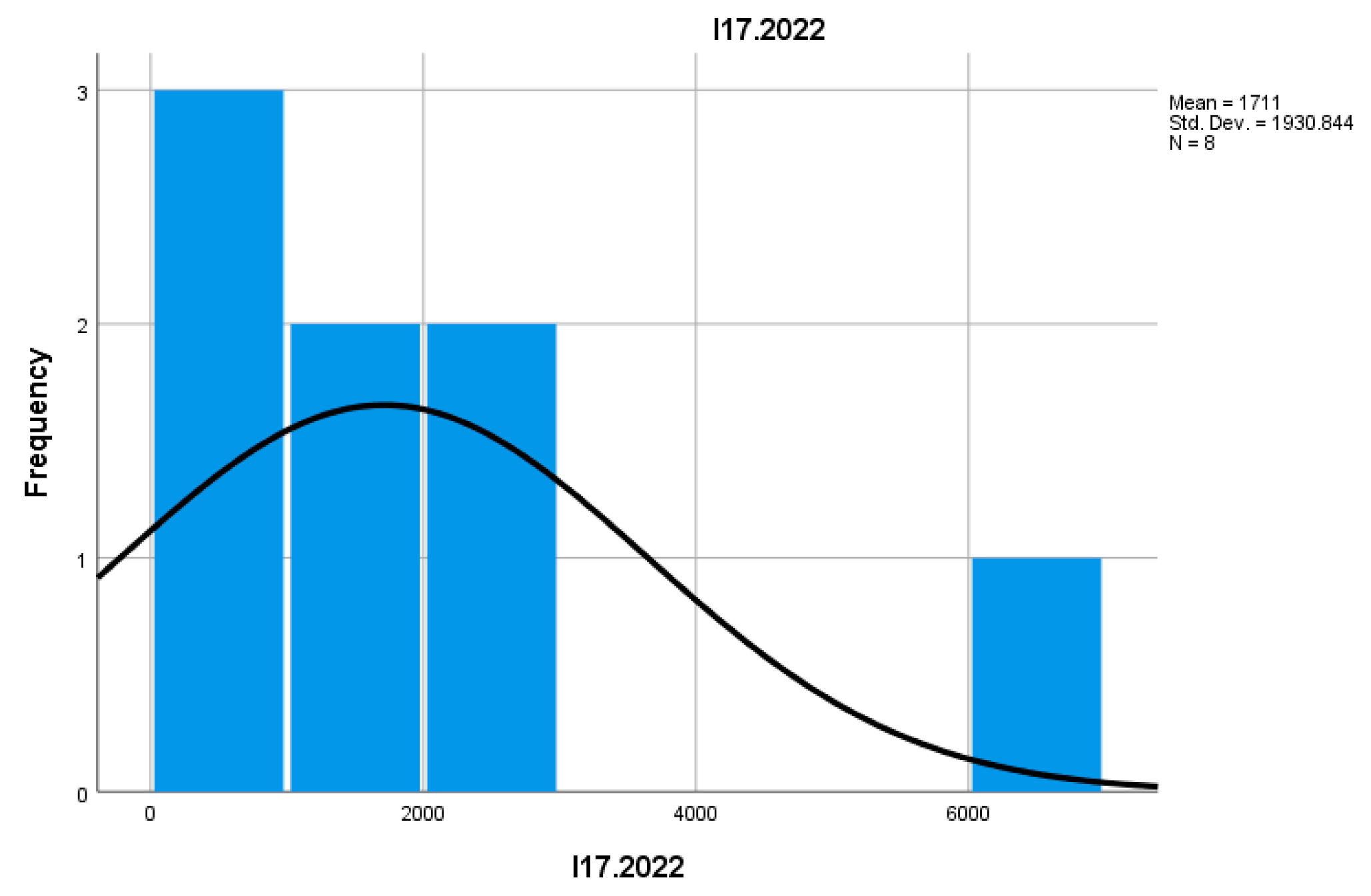

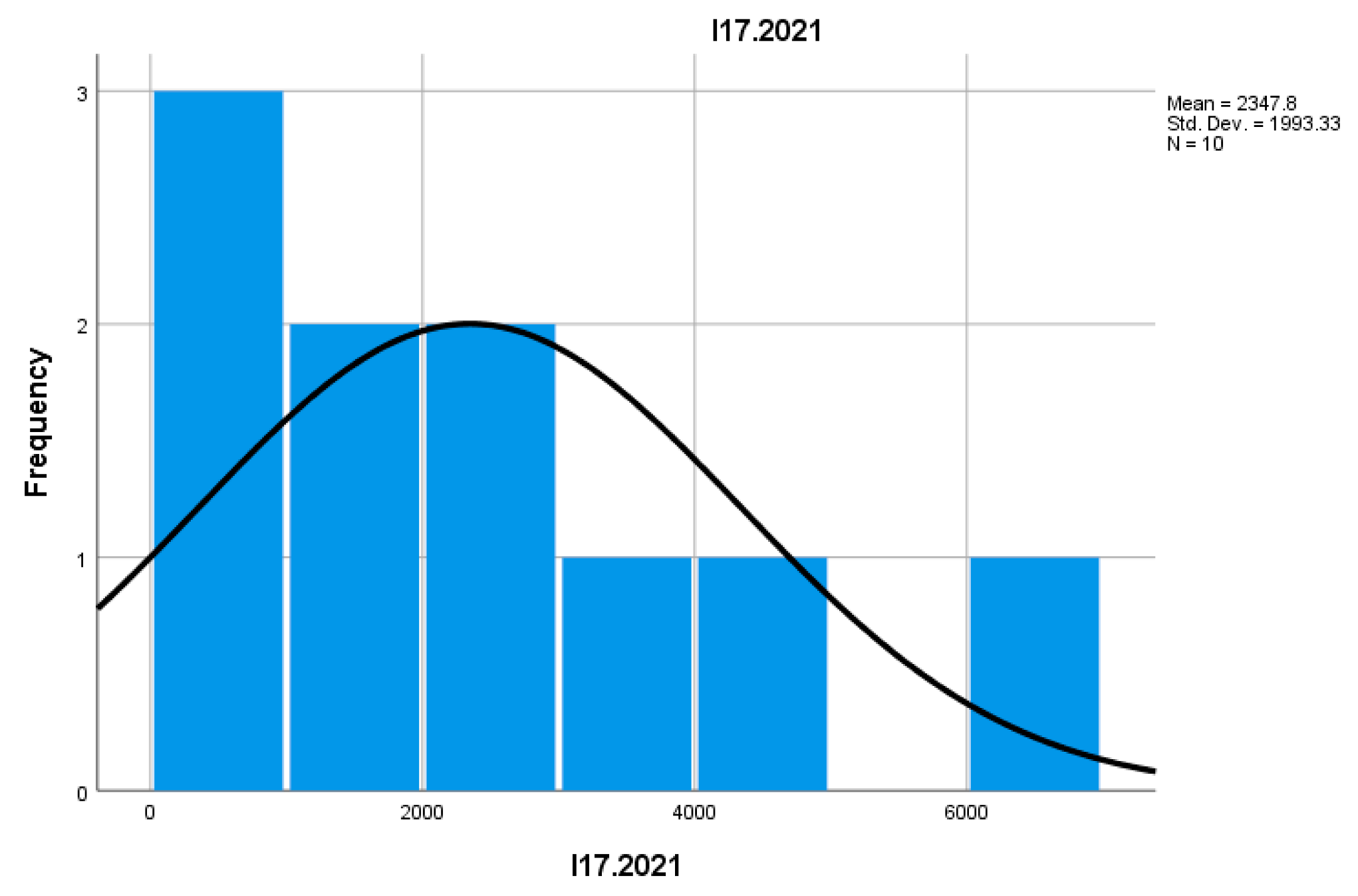

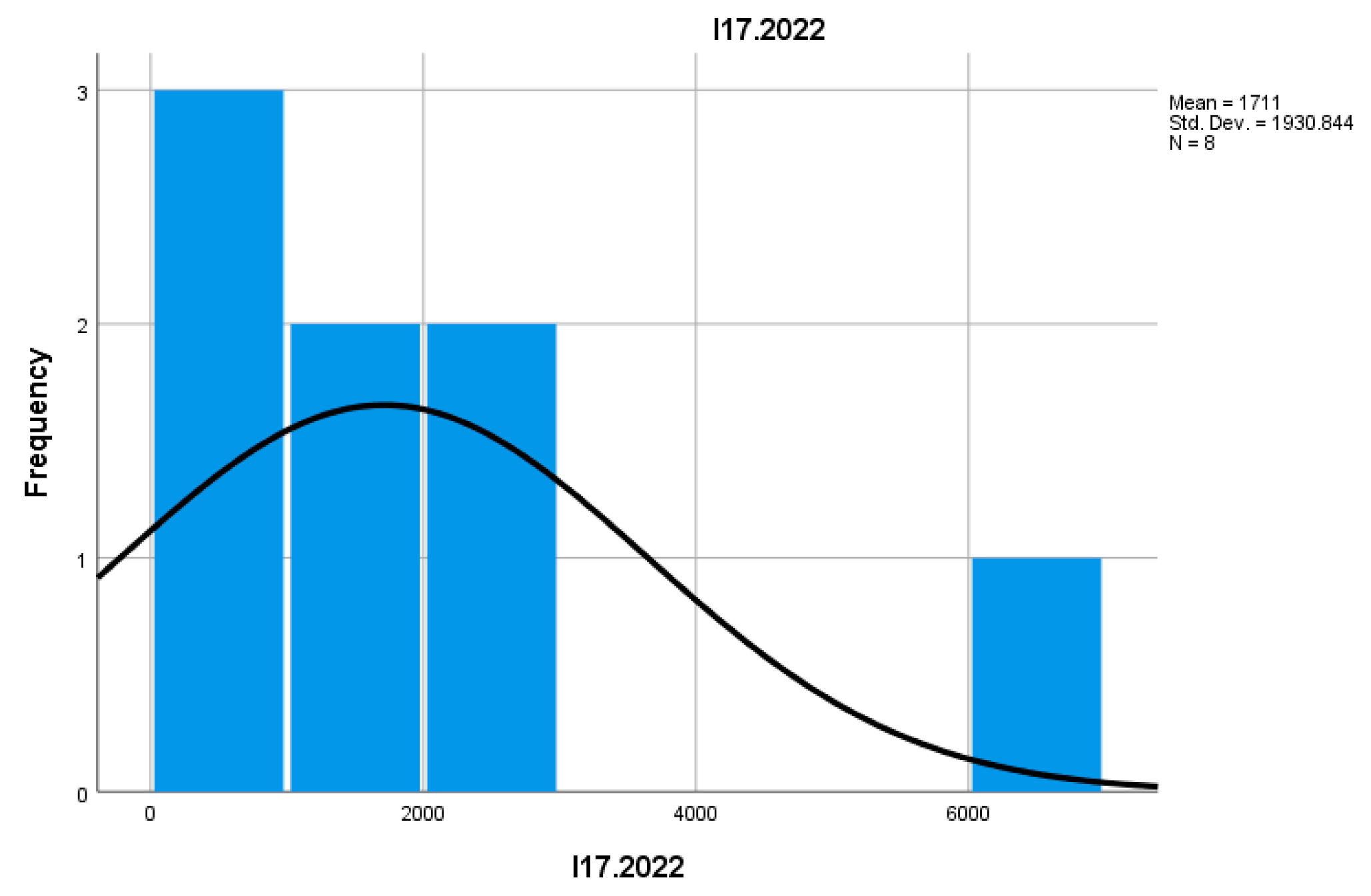

I17 reflects the total number of employees in newly established businesses. Data suggest significant fluctuation between 2021 and 2022, with a peak in I17.2021 (1,711.00) and a decrease in I17.2022 (5,098.0).

The decrease in the number of employees in new businesses may reflect a reduction in the establishment of large new businesses or a decrease in their ability to attract labor in the short term.

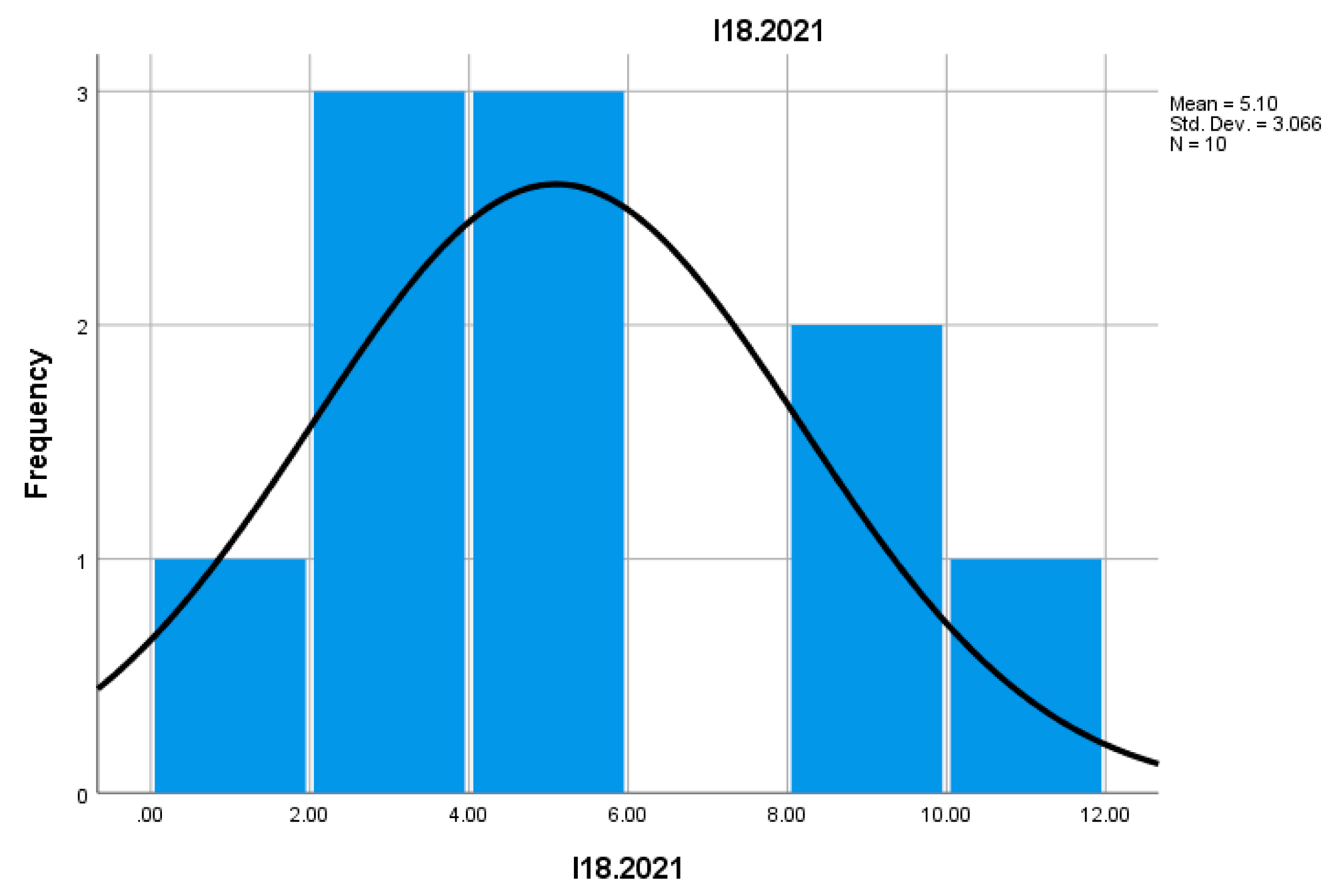

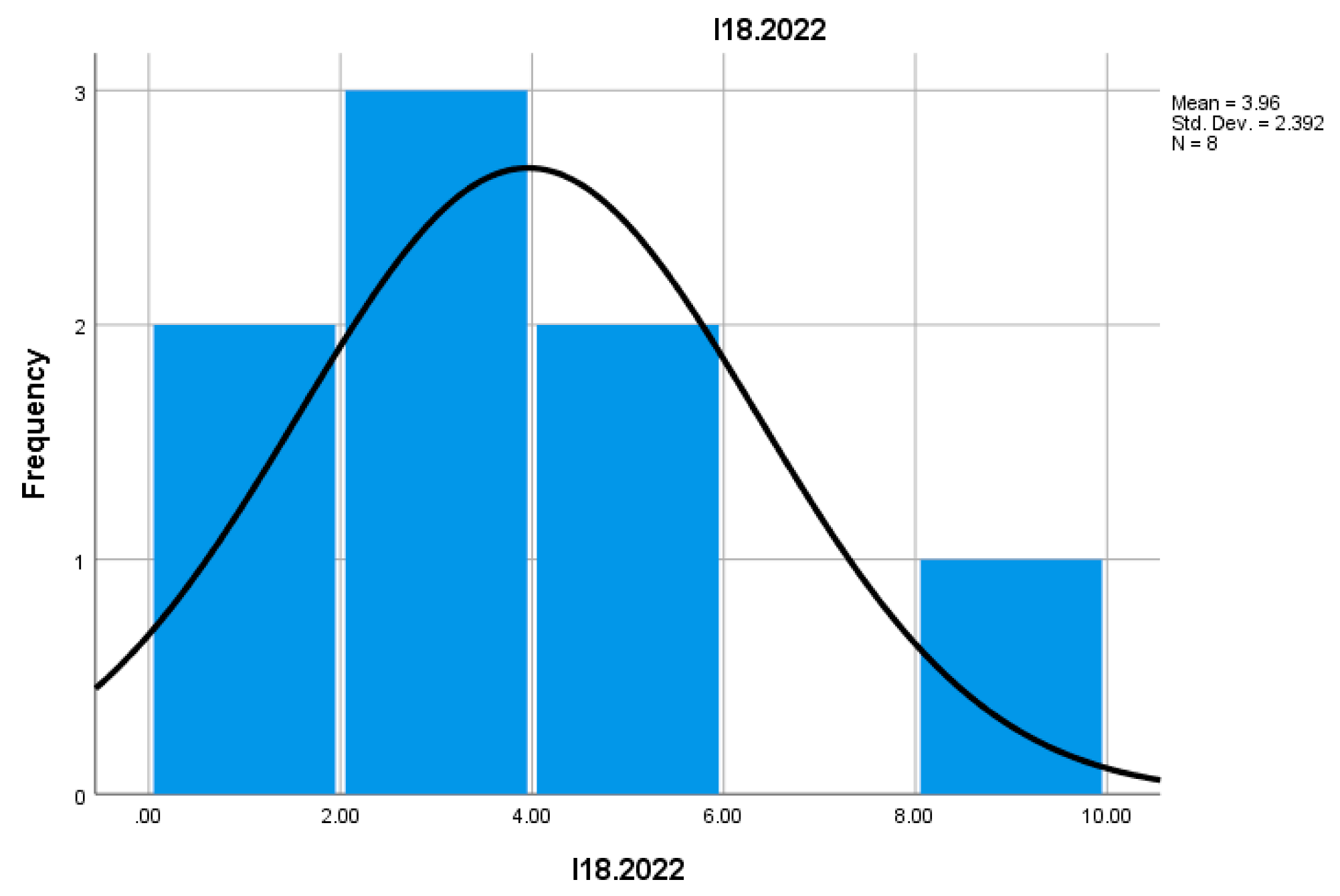

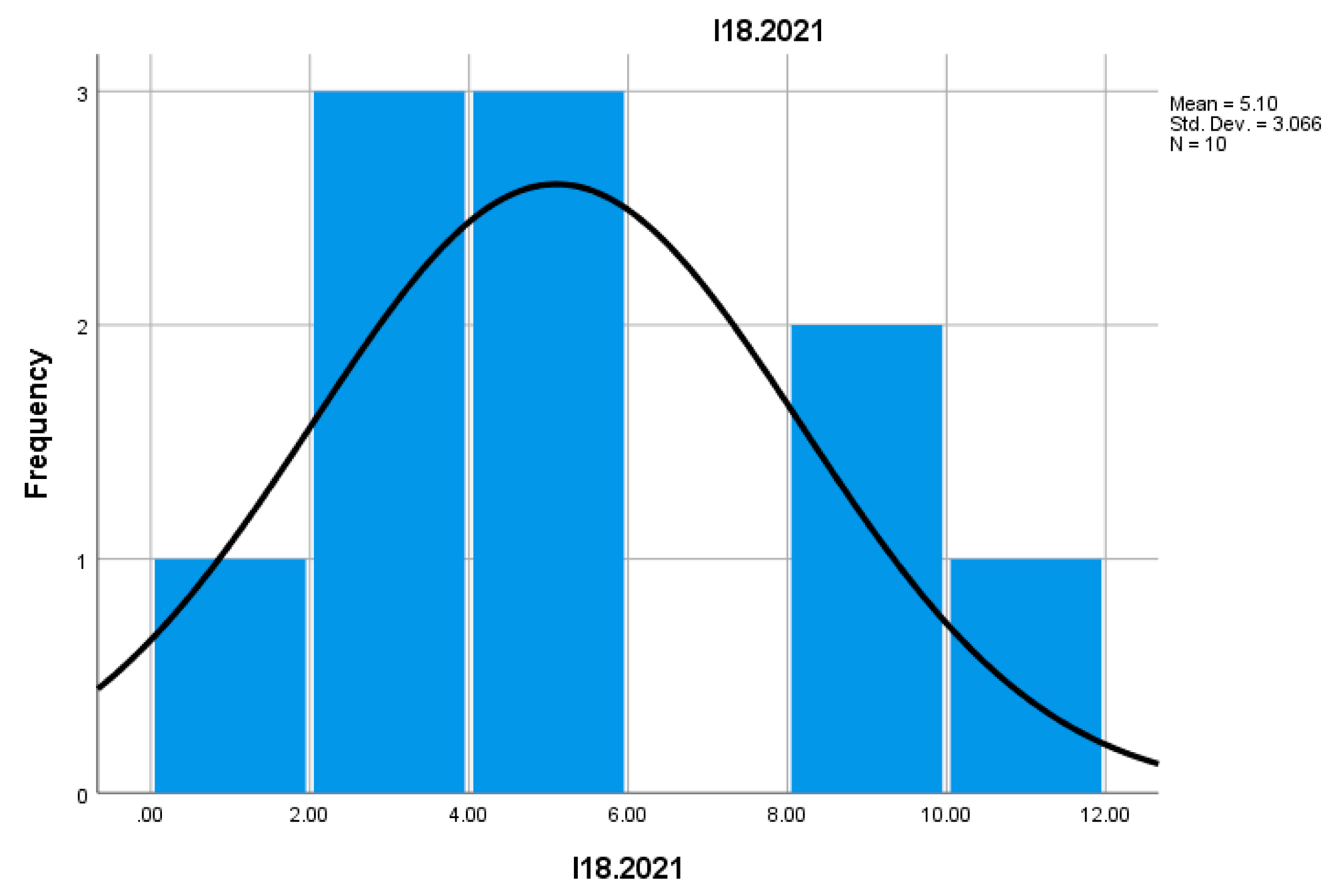

The I18 indicator measures the share of employees in new businesses relative to the total number of employees in the active sector. The observed values suggest fluctuation in this share during the analyzed period.

Despite some fluctuations, this indicator suggests a positive trend regarding the integration of employees into new businesses, reflecting a dynamic entrepreneurial environment.

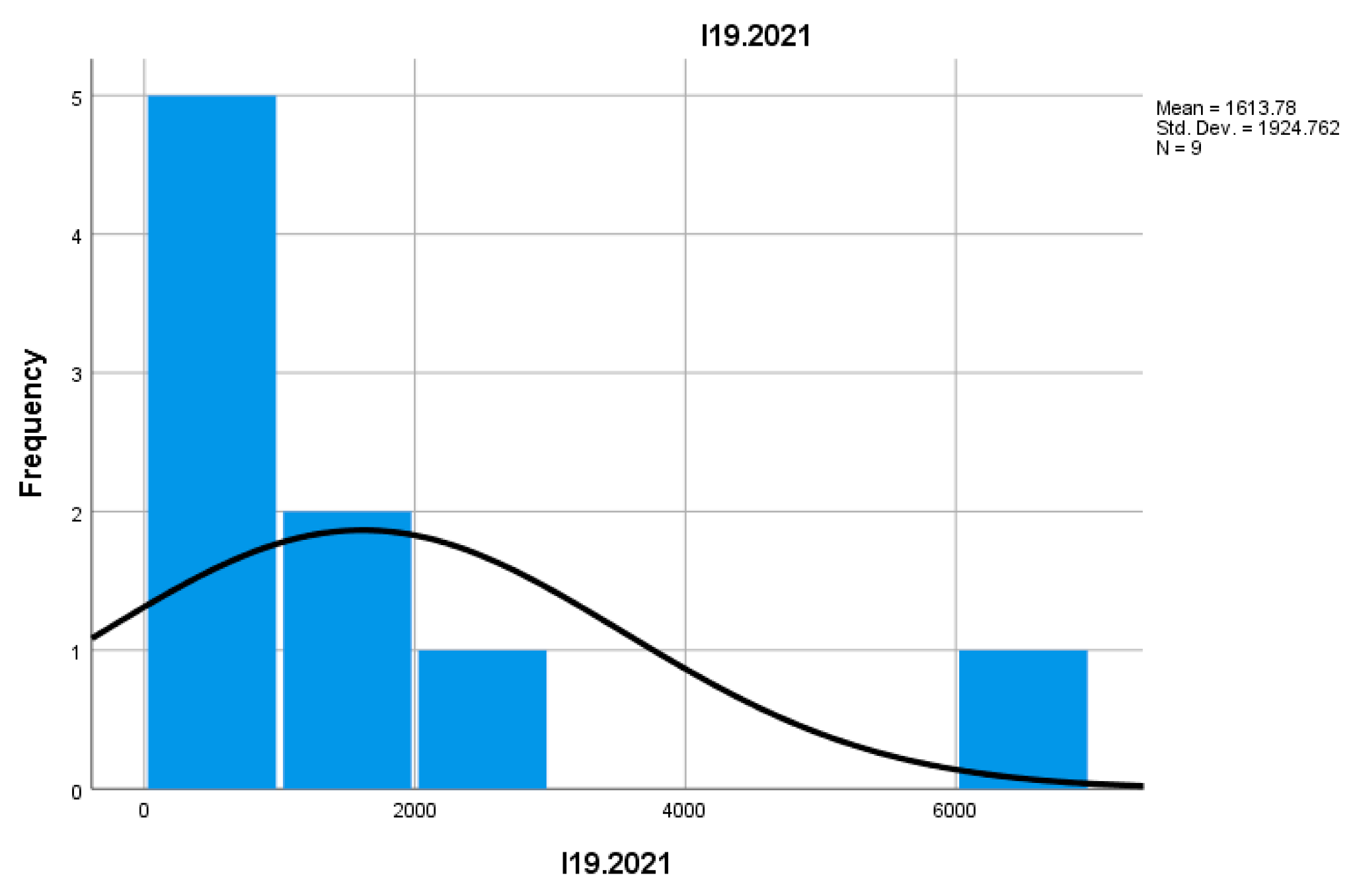

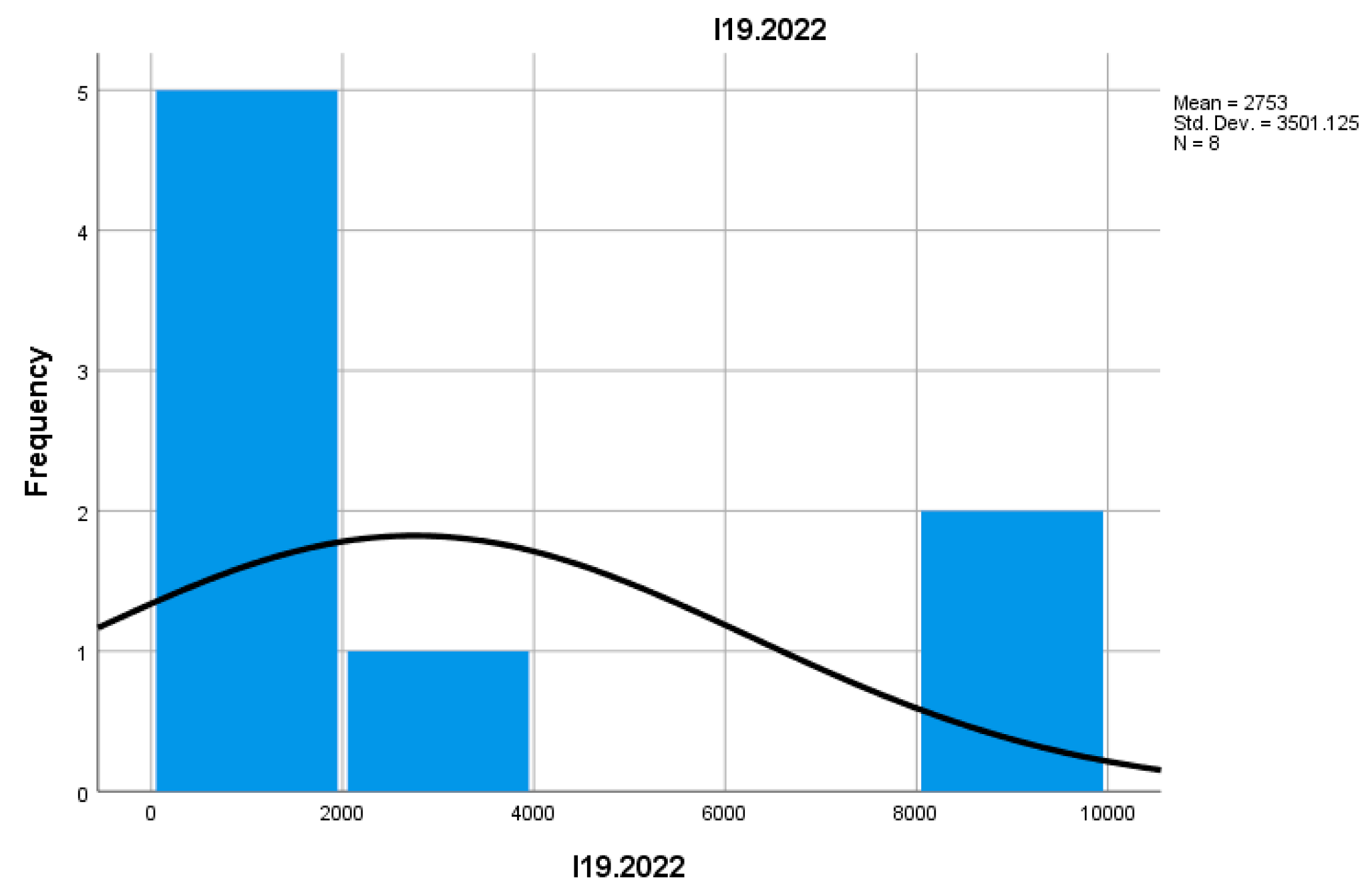

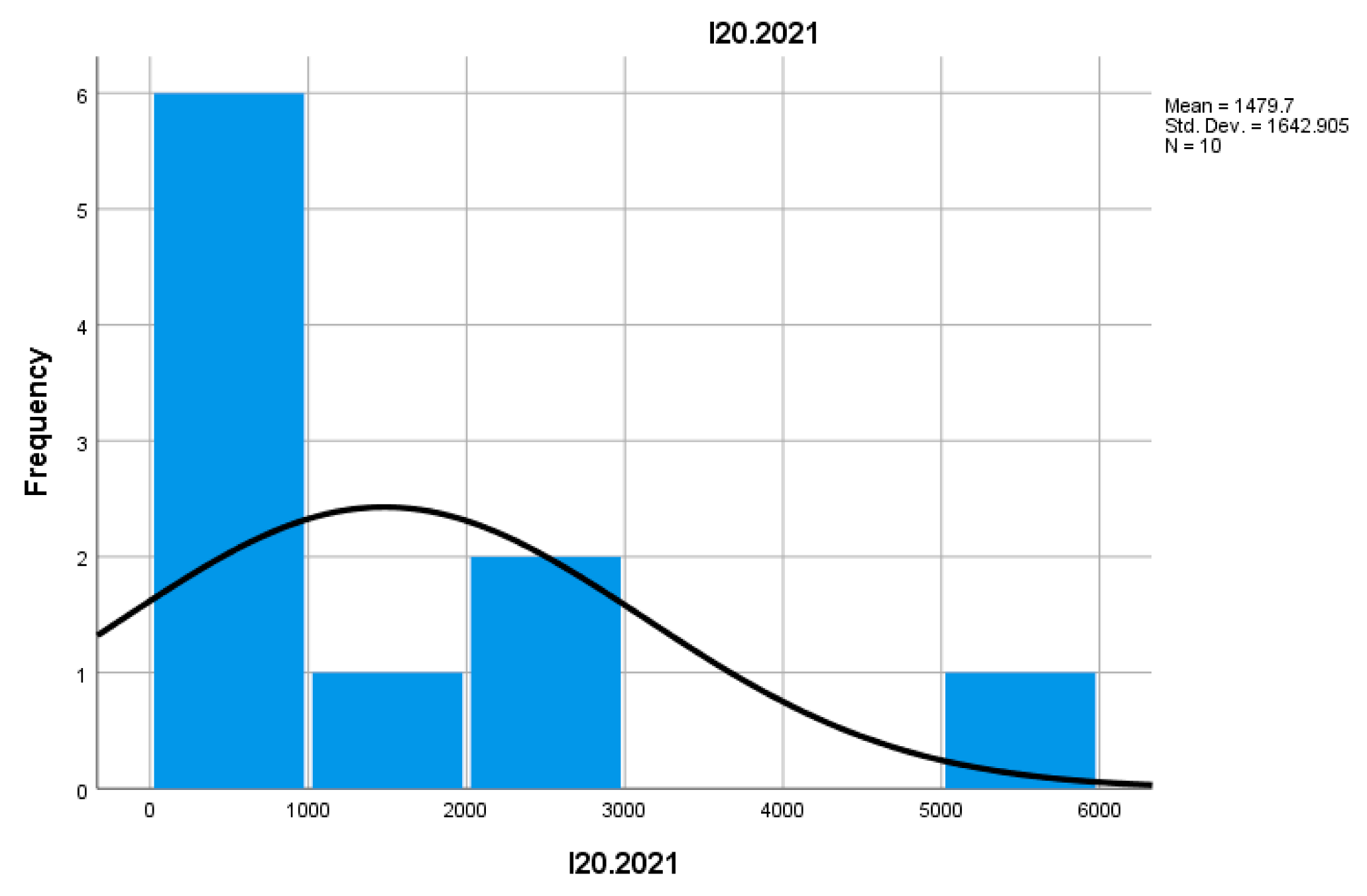

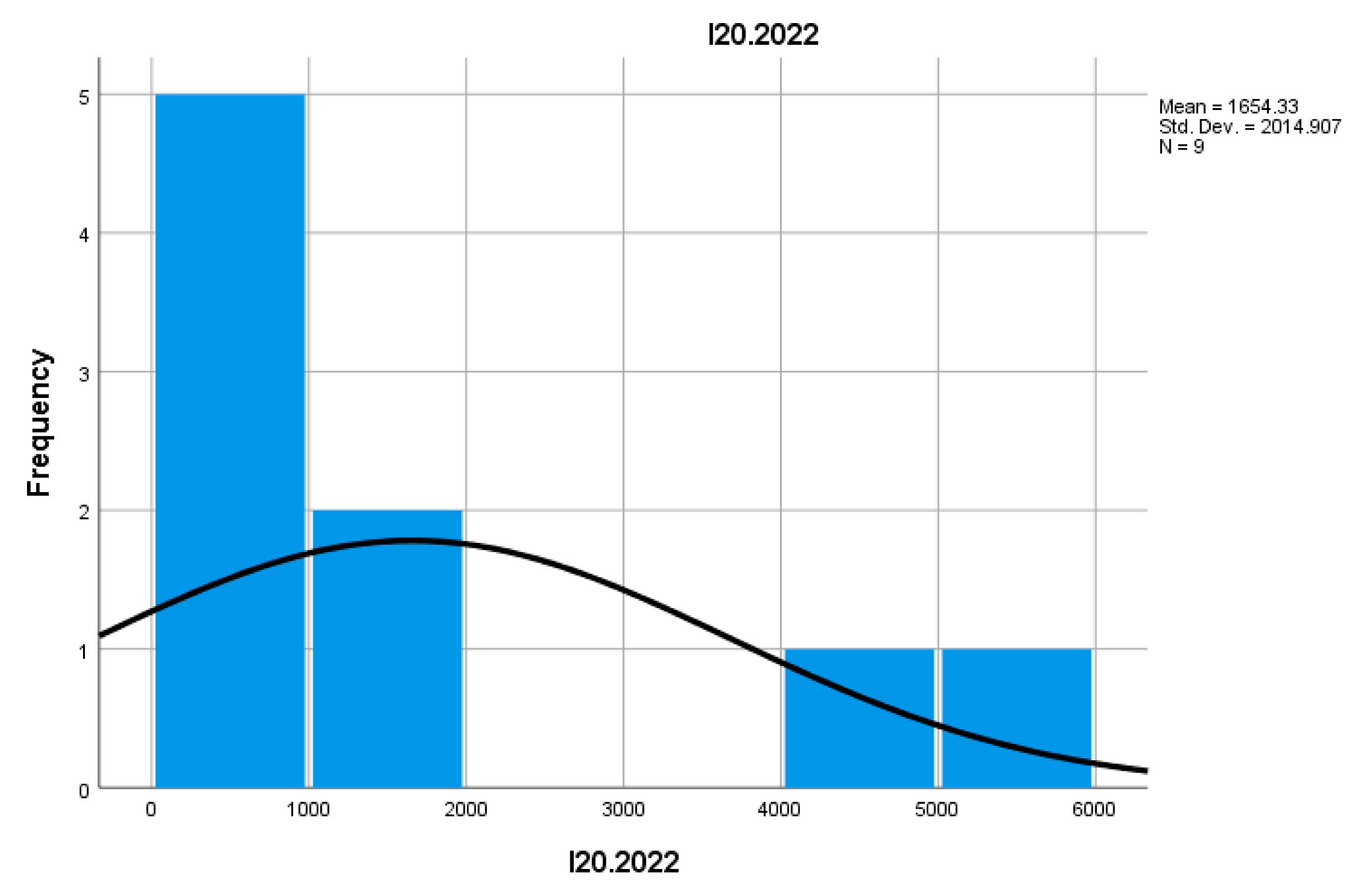

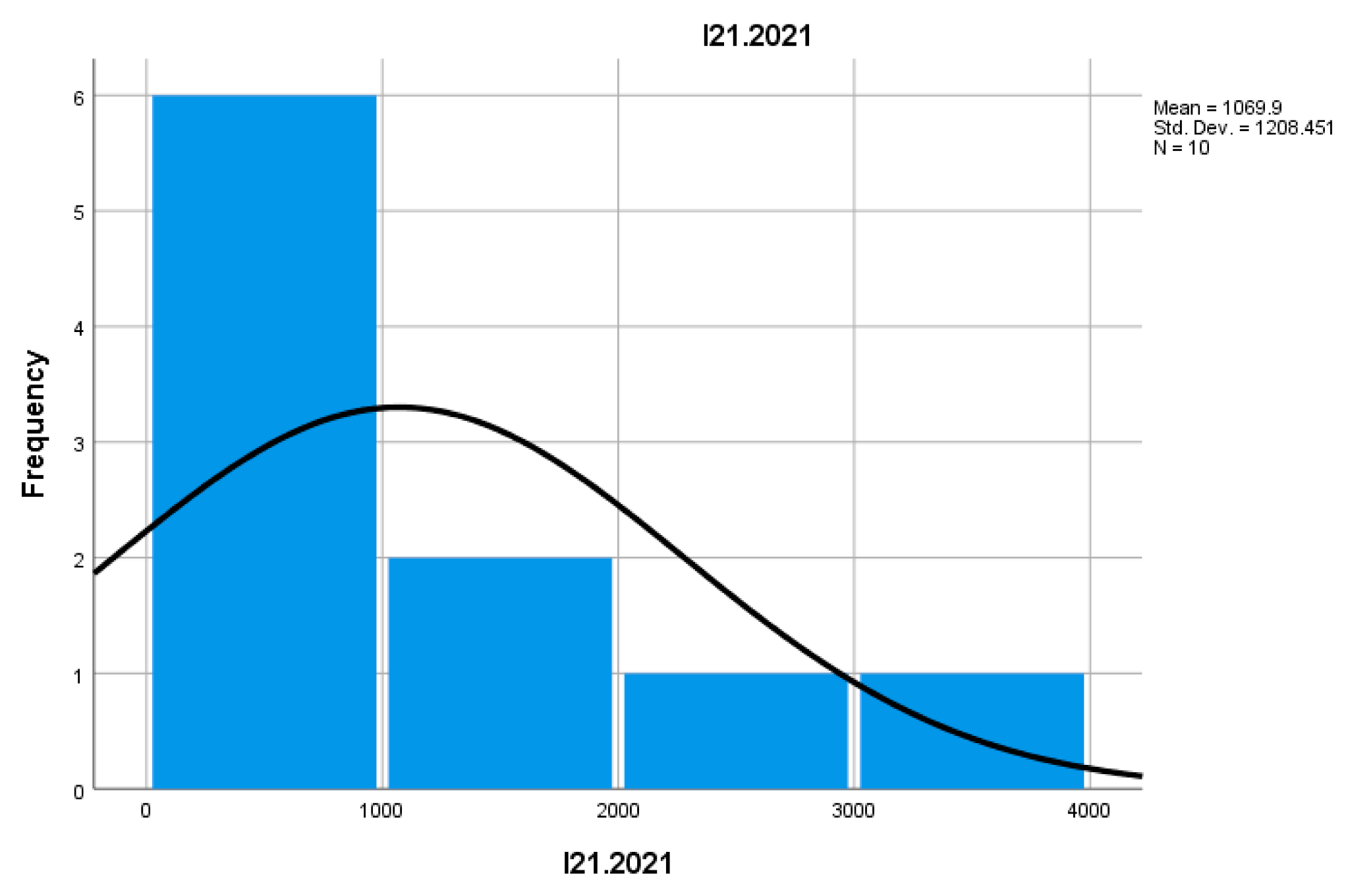

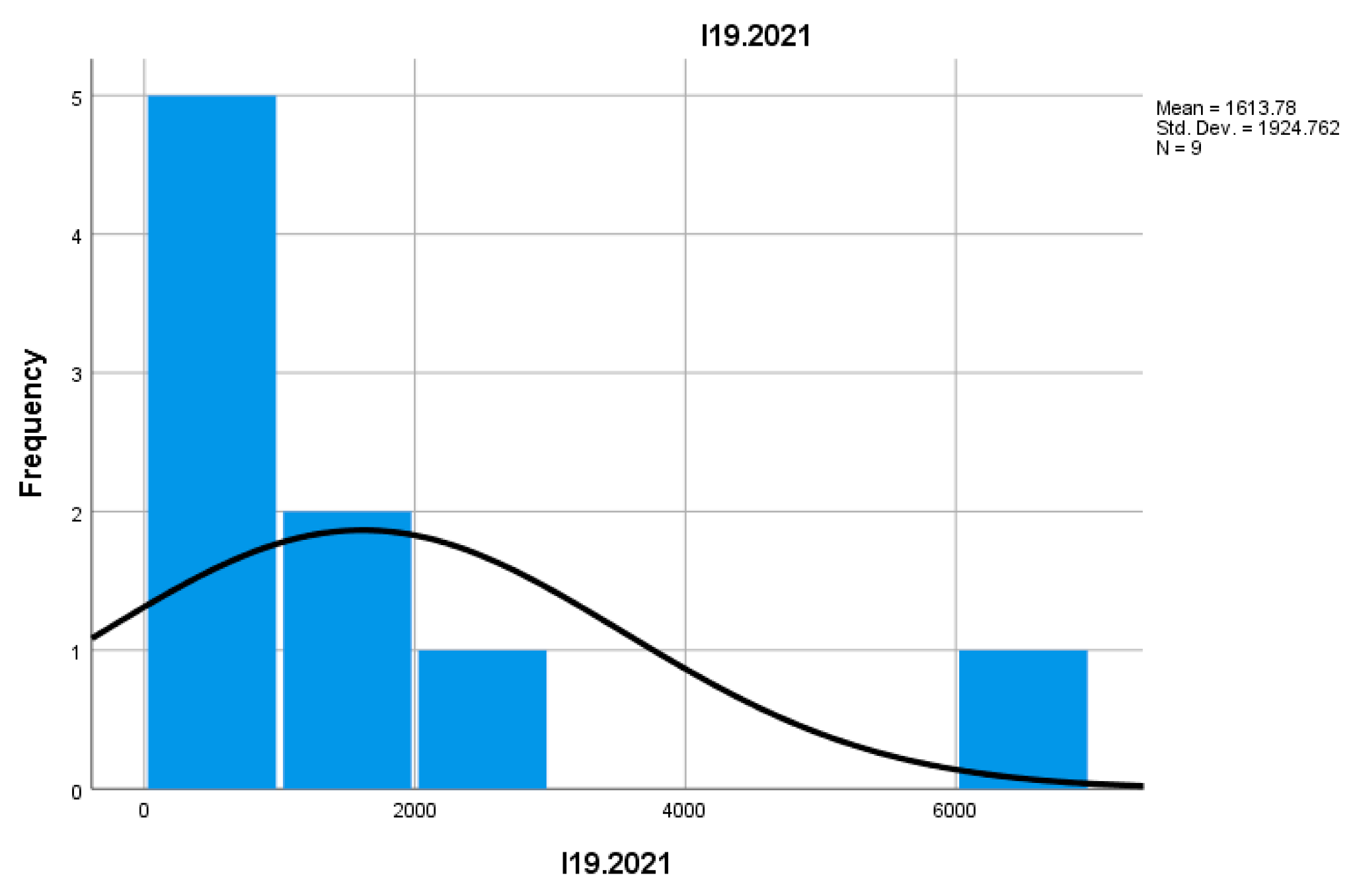

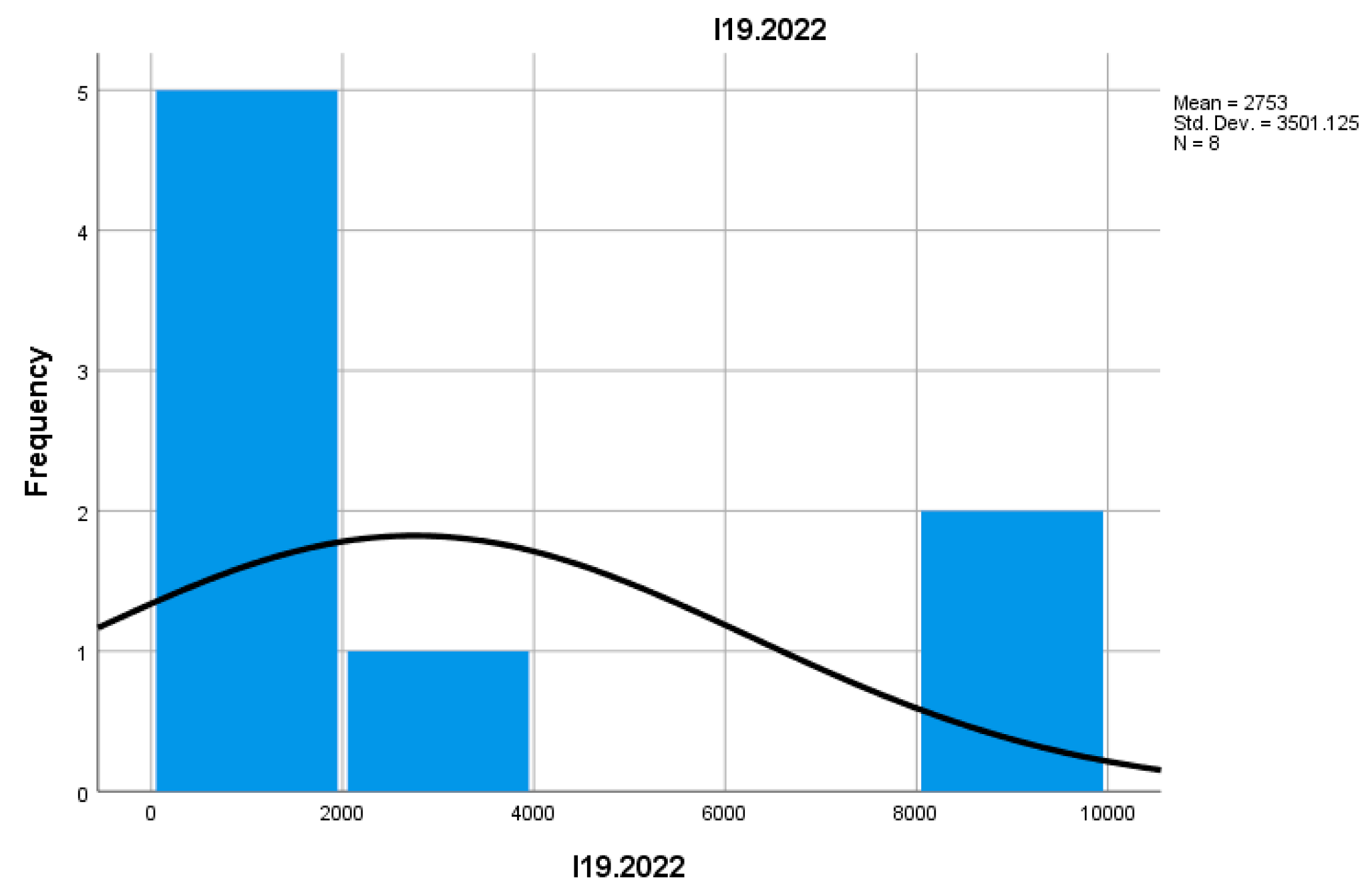

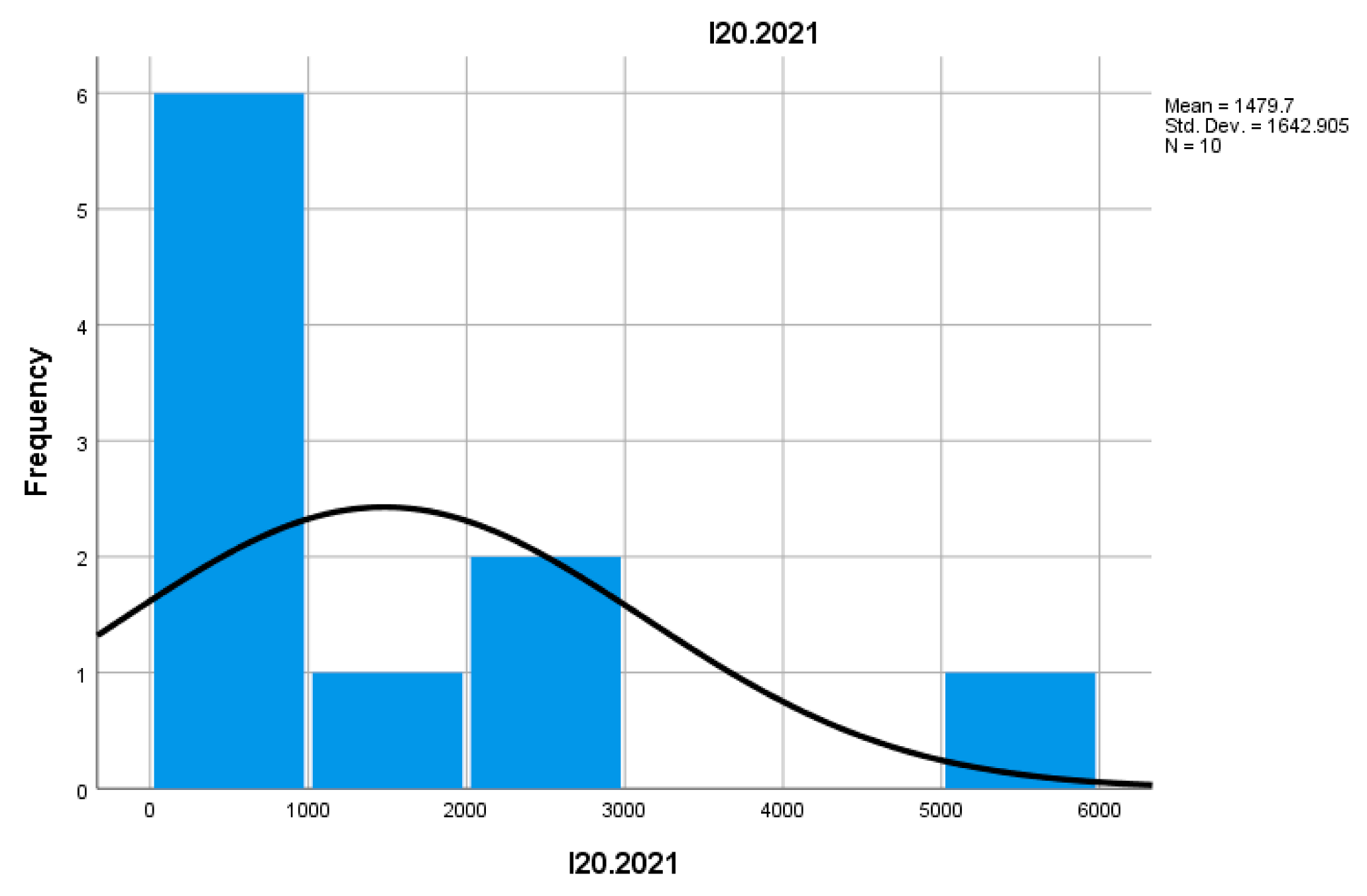

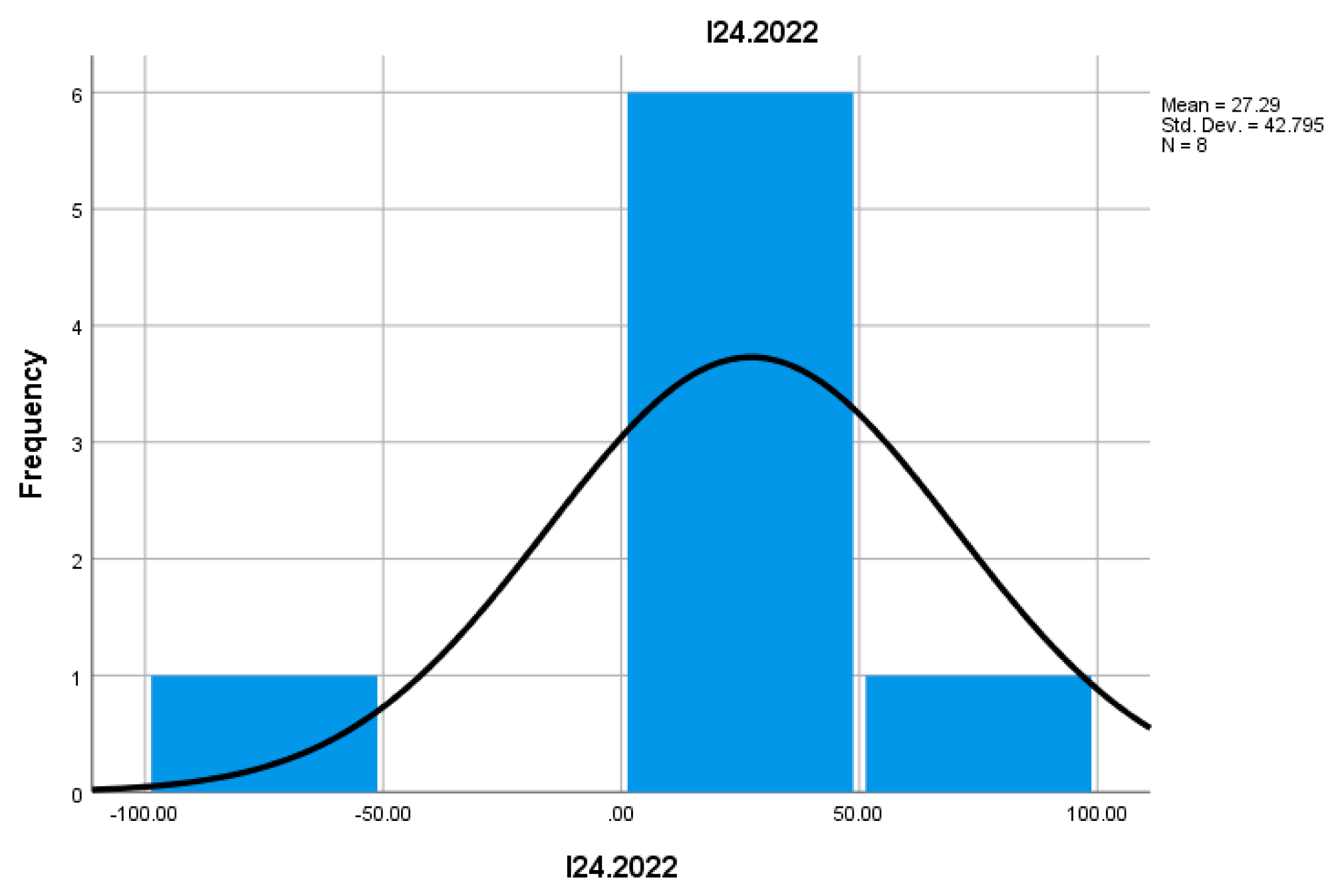

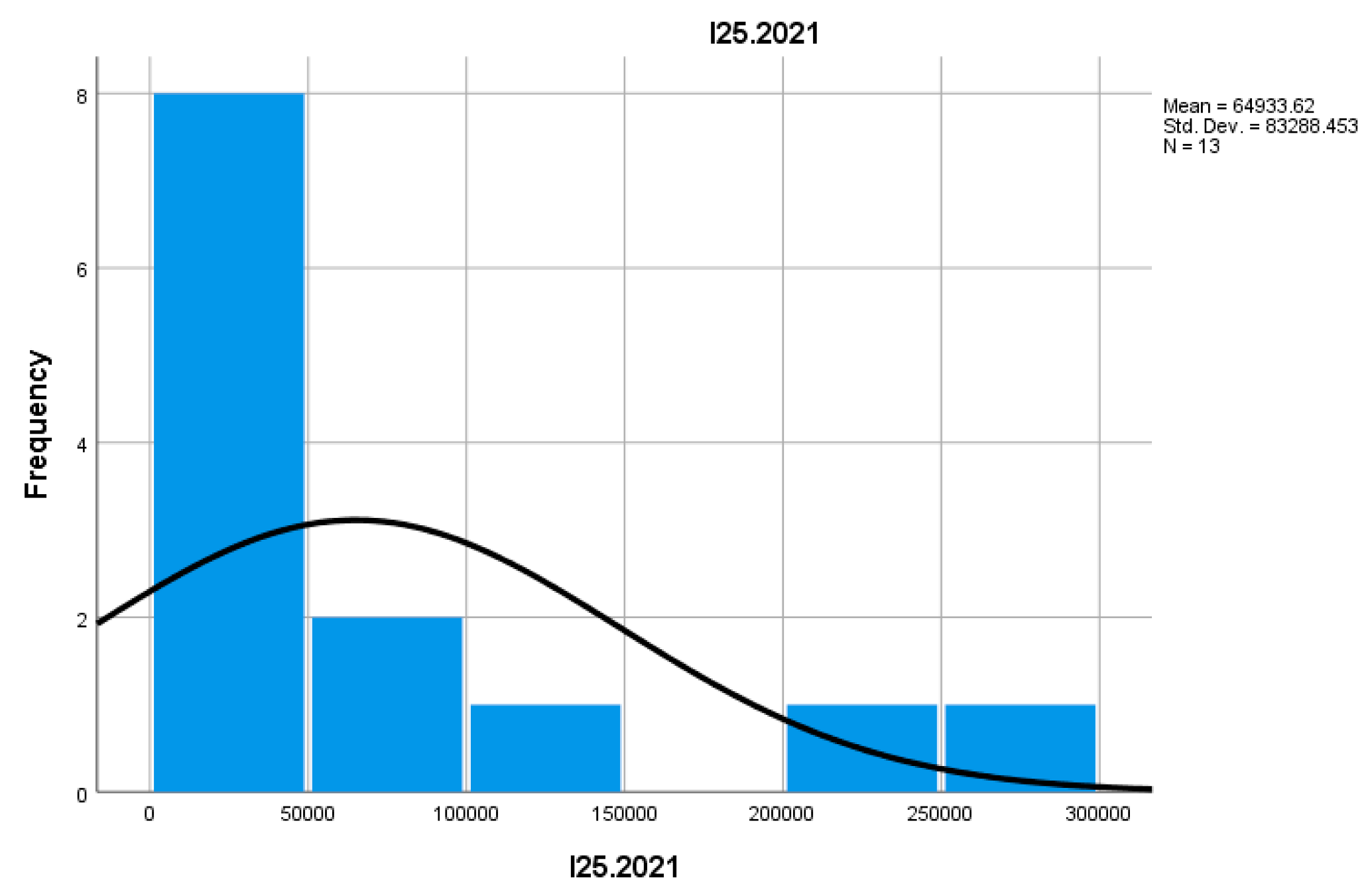

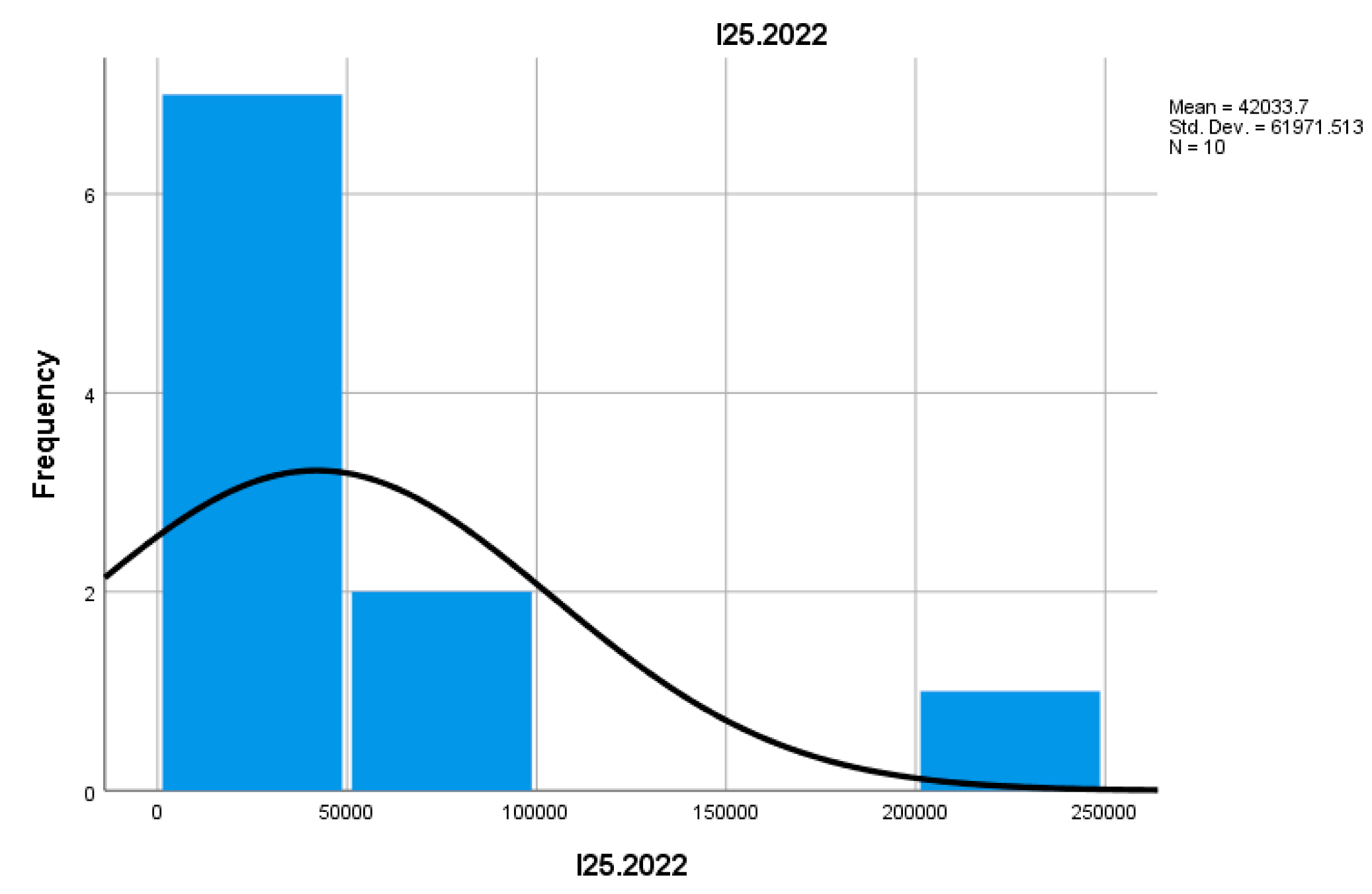

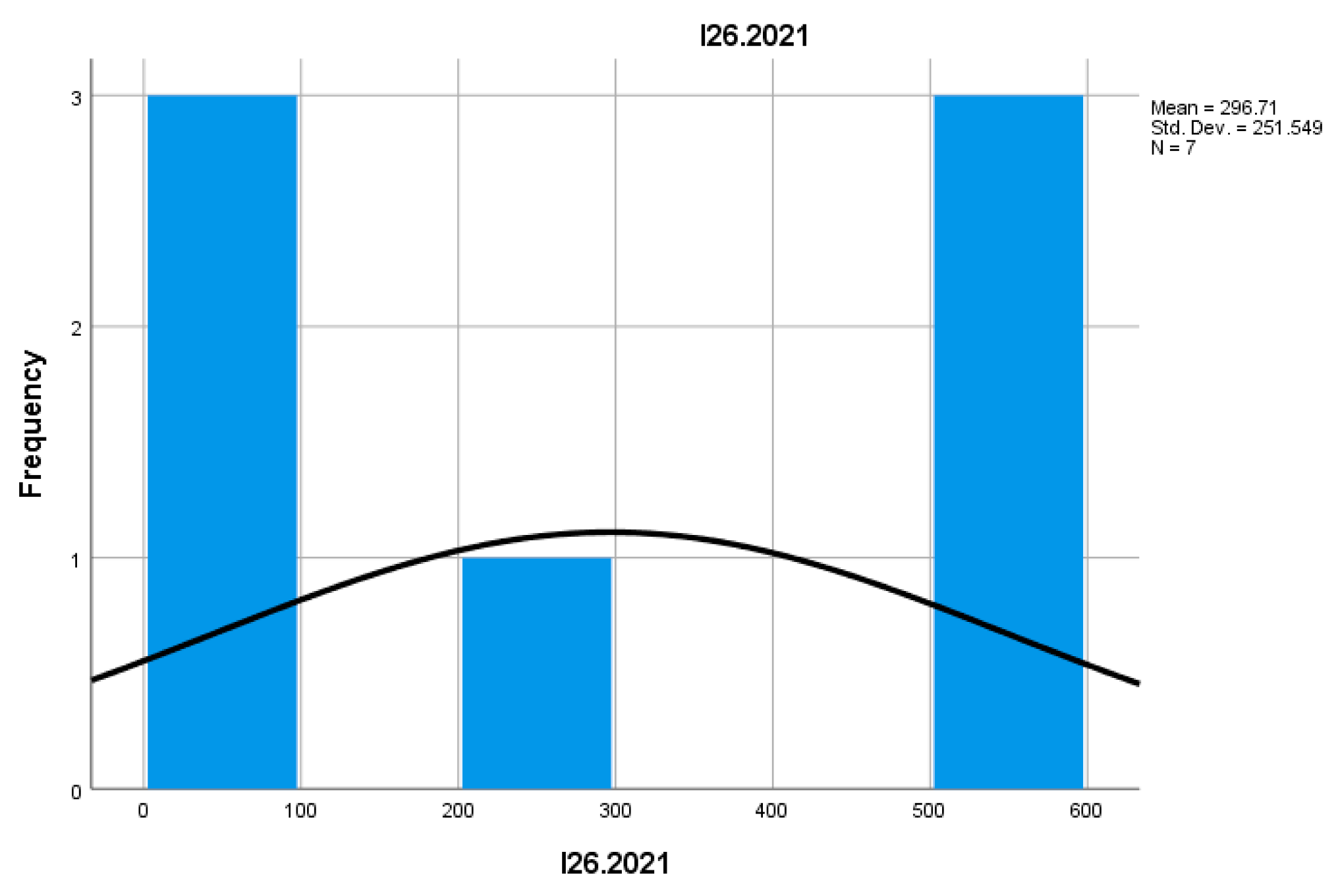

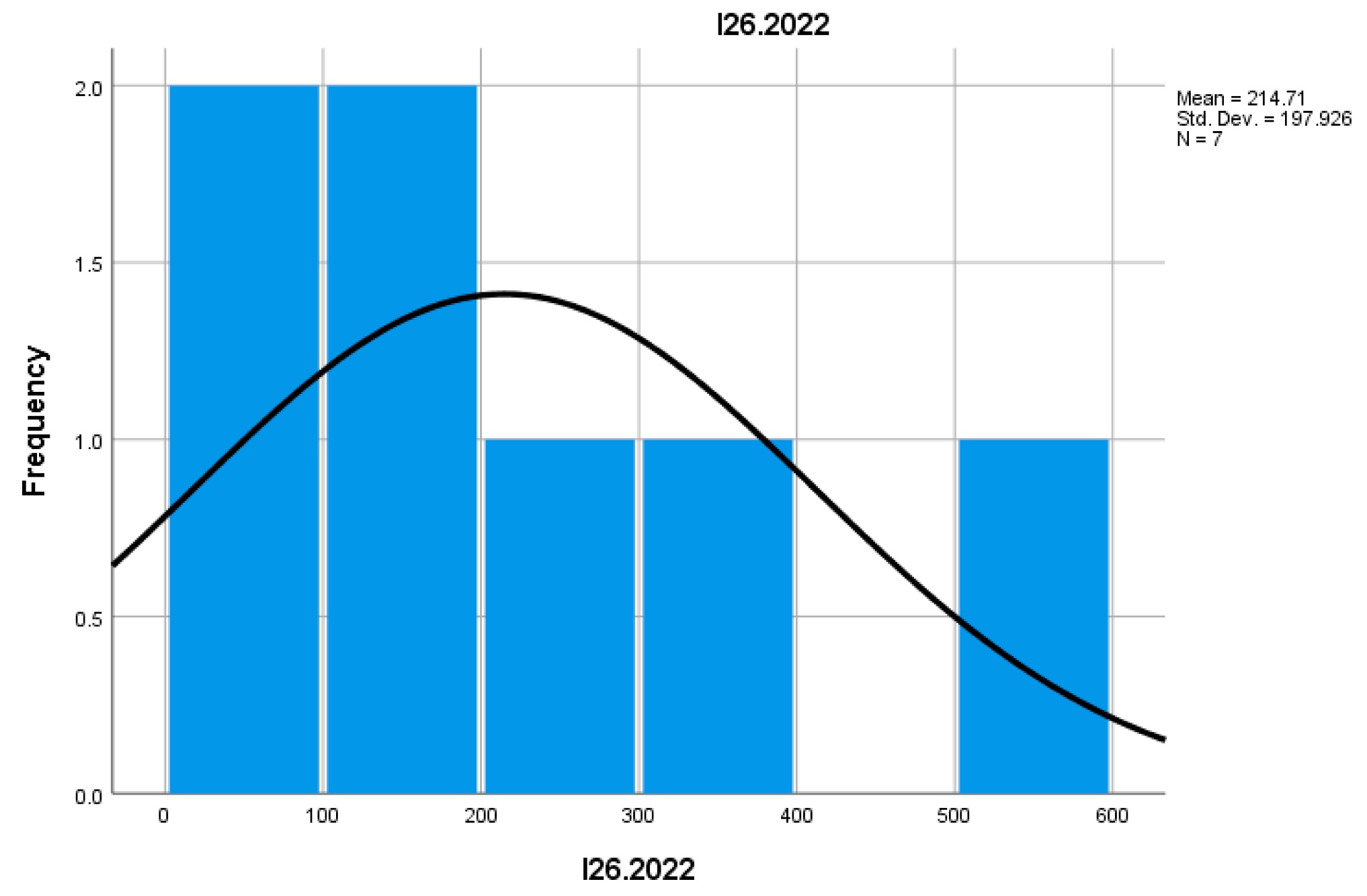

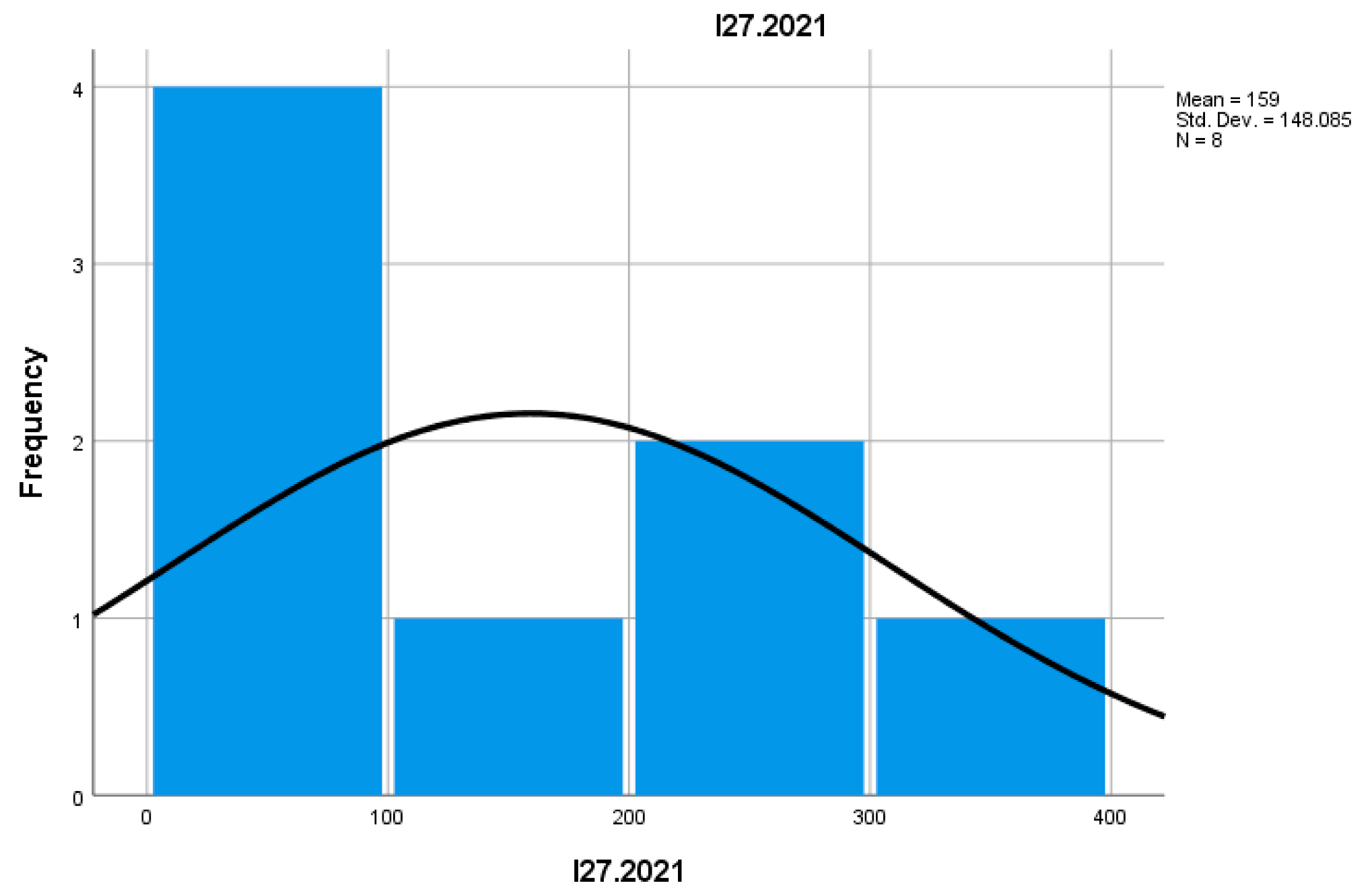

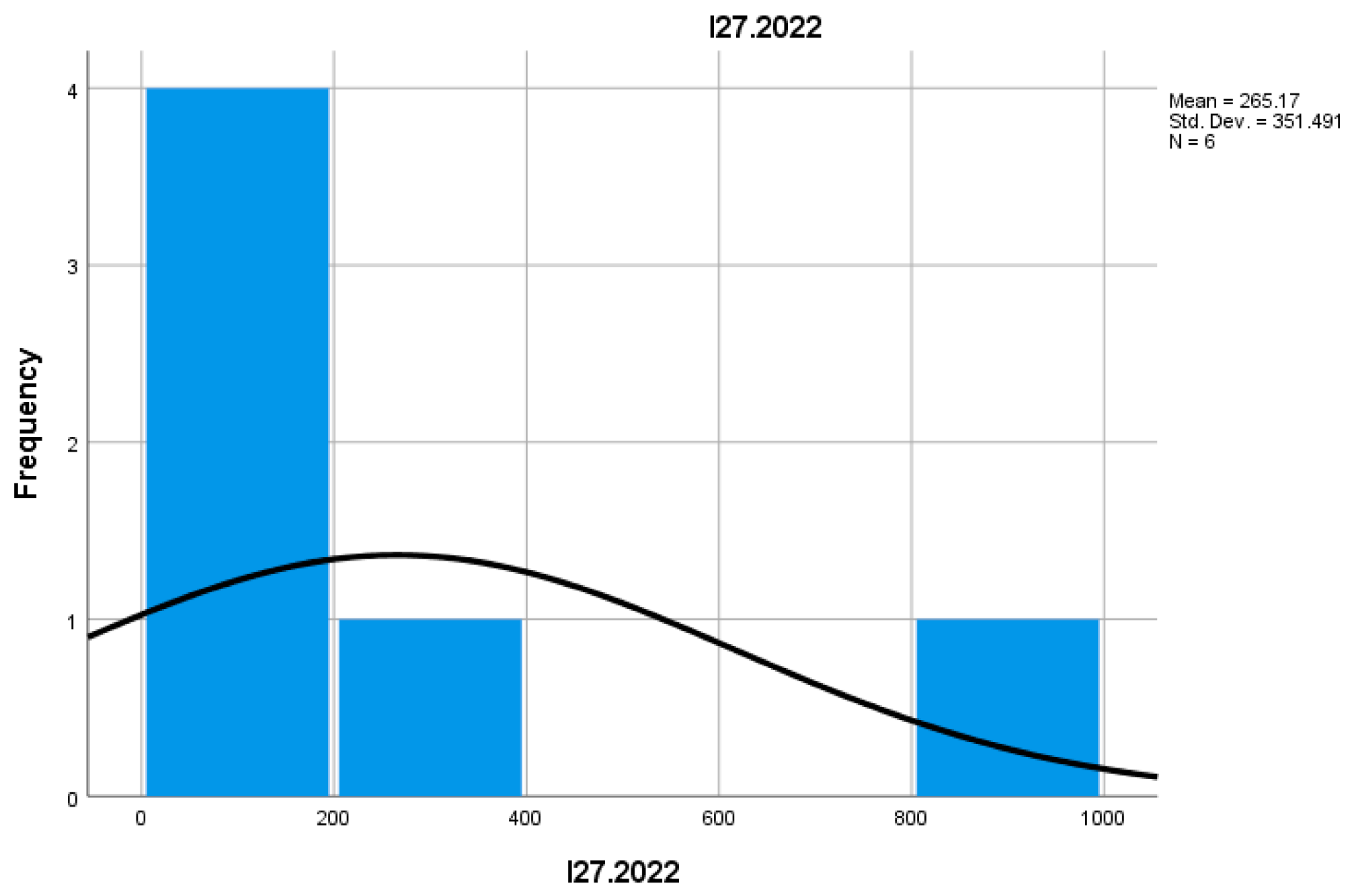

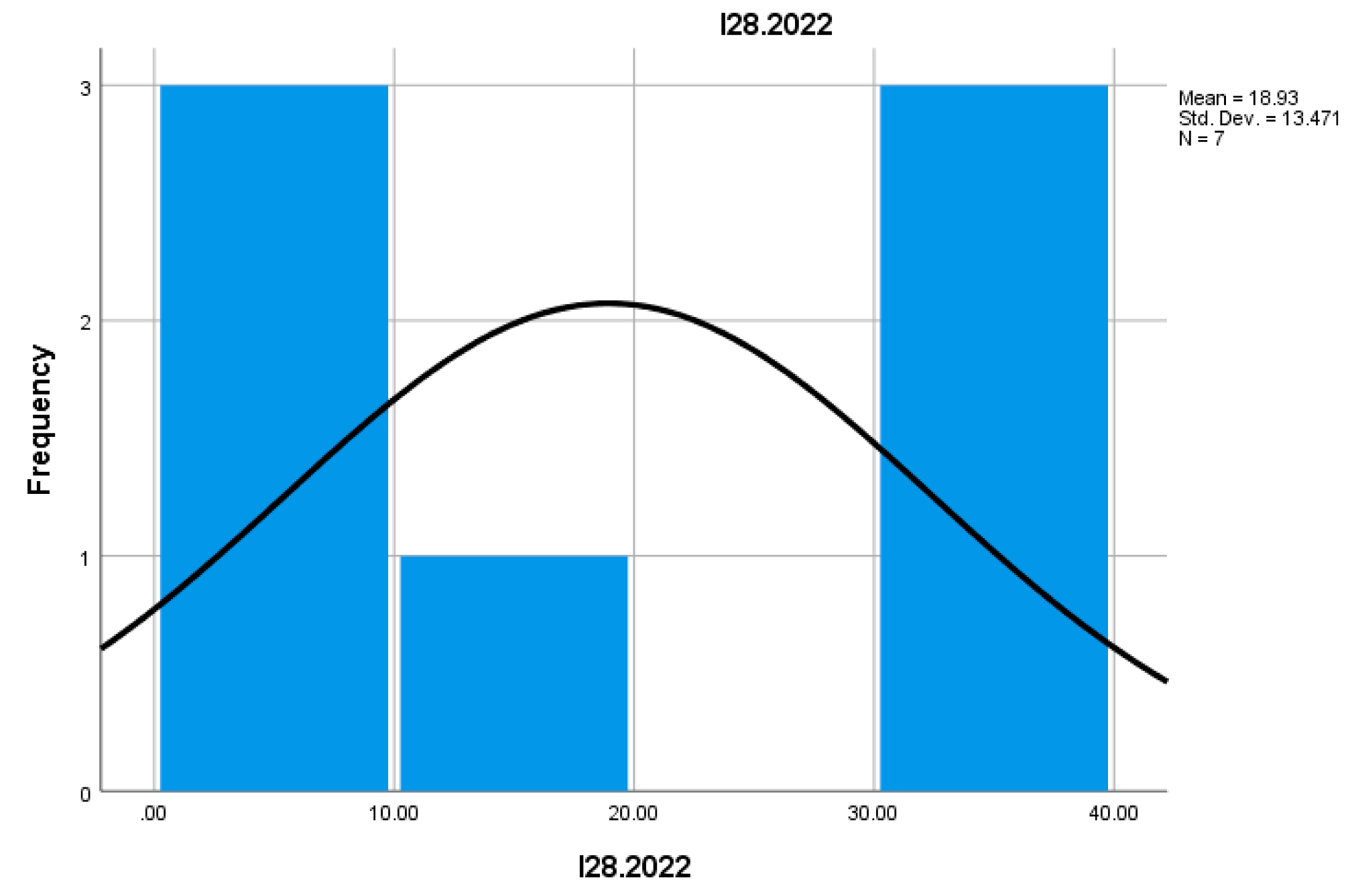

The remaining indicators from I19 to I28 will continue the detailed analysis of the economic performance, social performance, and environmental factors of businesses in the mountain sector, aiming to create a comprehensive profile of the European mountain financial sector.

This information is crucial for understanding the structure and dynamics of mountain entrepreneurship. These analyses not only help identify economic trends but also provide a foundation for policy, economic, and regulatory decisions to support and develop the sector.

The analysis of relevant indicators for mountain entrepreneurship in the European financial sector shows an interesting dynamic, with significant fluctuations between 2021 and 2022. Overall, the data suggest a relatively stable number of businesses, with a trend of increased business creation in the first part of 2021, followed by a reduction in 2022. Furthermore, the size of businesses remains relatively constant, and their survival rate seems to be dependent on external economic conditions and their adaptability in the face of financial crises.

Conclusion

The analysis of the mountain entrepreneurship sector within the context of the European financial framework reveals an interesting, yet fluctuating, dynamics during the period of 2021-2022, trends observed till 2025.

Among the main findings are a decrease in the number of active businesses, with a significant decline in 2022 compared to 2021, reflecting the impact of economic crises on the sector. However, there was an increase in the rate of new business formations in the first half of 2021, followed by a slight reduction in the second half of 2022.

Additionally, the analysis highlighted those small enterprises continue to dominate this sector, and their survival rate appears to largely depend on external economic conditions and their ability to adapt to financial crises.

The adaptability of the mountain sector and its capacity to face economic challenges may support its sustainable development in the coming years.

During the preparation of this manuscript, the authors utilized artificial intelligence tools for assistance in statistical analysis and data interpretation. Following this, the authors rigorously reviewed, validated, and refined all results, ensuring accuracy and coherence. The final content reflects the authors' independent analysis, critical revisions, and scholarly judgment. The authors assume full responsibility for the integrity and originality of the published work.

References

- Banki, M. B.; Ismail, H. N. Understanding the characteristics of family owned tourism micro businesses in mountain destinations in developing countries: Evidence from Nigeria. Tourism Management Perspectives 2015, 13, 18–32. [Google Scholar] [CrossRef]

- Bernthal, J. B. The evolution of entrepreneurial finance: A new typology. BYU Law Review 2018, 2018(3), 773–822. Available online: https://digitalcommons.law.byu.edu/lawreview/vol2018/iss3/6.

- Chatterji, A. K.; Seamans, R. C. Entrepreneurial finance, credit cards, and race. Journal of Financial Economics 2012, 106(1), 182–195. [Google Scholar] [CrossRef]

-

Convention on the Protection and Sustainable Development of the Carpathians Carpathian Convention. UNEP. 2003. Available online: https://www.carpathianconvention.org/.

- Dower, M. Mountain areas and regional development in Europe; Council of Europe Publishing., 2002. [Google Scholar]

- European Commission. The future of mountain areas in the European Union. Publications Office of the European Union. 2020. Available online: https://op.europa.eu/.

- European Network for Rural Development (ENRD). Smart villages and entrepreneurship in mountain areas. 2018. Available online: https://enrd.ec.europa.eu.

- Eurostat. Business demography and high growth enterprises by NACE Rev. 2 activity and other typologies [urt_bd_hgn__custom_15325082], 2025.

- FAO. Sustainable mountain development: Transforming lives and livelihoods. Food and Agriculture Organization of the United Nations. 2019. Available online: https://www.fao.org.

- Galindo-Martín, M. A.; Castaño-Martínez, M. S.; Méndez-Picazo, M. T. The relationship between networks in finance and entrepreneurship. European Journal of International Management 2025, 25(1), 57–78. [Google Scholar] [CrossRef]

- Kallmuenzer, A.; Peters, M. Entrepreneurial behaviour, firm size and financial performance: The case of rural tourism family firms. Tourism Recreation Research 2018, 43(1), 2–14. [Google Scholar] [CrossRef]

- Karagouni, G.; Trigkas, M.; Naoum, N.; Papadopoulos, I.; Mpasdekis, D. Rural entrepreneurs in mountain areas: The case of Pyli in Greece. In 9th Annual Conference of the EuroMed Academy of Business, September; 2016. Available online: https://emrbi.org.

- Mason, M. C.; Floreani, J.; Miani, S.; Beltrame, F.; Cappelletto, R. Understanding the impact of entrepreneurial orientation on SMEs’ performance: The role of the financing structure. Procedia Economics and Finance 2015, 23, 1649–1661. [Google Scholar] [CrossRef]

- Perlik, M. The spatial and economic transformation of mountain regions; Routledge, 2019. [Google Scholar]

- Sadiq, M.; Nonthapot, S.; Mohamad, S.; Chee Keong, O.; Ehsanullah, S.; Iqbal, N. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? Finance Review International 2022, 12(2), 317–333. [Google Scholar] [CrossRef]

- Salukvadze, G.; Michel, A. H.; Backhaus, N.; Gugushvili, T.; Dolbaia, T. From tradition to innovation: The pioneers of mountain entrepreneurship in the Lesser Caucasus. Mountain Research and Development 2024, 44(3), R14–R21. [Google Scholar] [CrossRef]

- Ullah, K.; Mohsin, A. Q.; Saboor, A.; Baig, S. Financial inclusion, socioeconomic disaster risks and sustainable mountain development: Empirical evidence from the Karakoram Valleys of Pakistan. Sustainability 2020, 12(22), 9737. [Google Scholar] [CrossRef]

- Weiermair, K.; Siller, H. J.; Mössenlechner, C. Entrepreneurs and entrepreneurship in alpine tourism: Past, present, and future. Journal of Teaching in Travel & Tourism 2006, 6(2), 23–40. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).