1. Literature Review

This paper explores the behaviour of the SA interest rates in terms of historical time series and a cross-section of yields across a maturity spectrum. Inspired by the seminal work of [

1], we proceed by implementing their model and its maximal counterpart. Among three options of models tested on US Treasury swaps, their

was found to perform better than other models, followed by their

. However, high time-varying conditional volatility was exhibited at the expense of conditional correlations. Initially, they consider a comprehensive framework for the specification, analysis, and classification of Affine Term Structure Models (ATSMs). They provide a complete characterisation of admissible and identified ATSMs from which it is required that sufficient general conditions exist; see [

2], who describe the regular affine process. They also characterise the sufficient general conditions that must be met for a process to be affine; see [

3,

4] among others.

ATSMs are among popular models in the vast literature on interest rates term structure and bond pricing. Few examples are the early generation consisting of a single-factor Gaussian of [

5], and a square-root process by [

6], extended by [

7] into a multi-factor. The next generation are the correlated mixture affine models of [

1,

8], among others. The reason for their popularity is the ability to accommodate stochastic volatility, jumps and correlations among factors driving the asset returns; and lead to computationally tractable closed-form prices, and estimation through moment equations; see [

4]. Among research problems addressed using ATSMs is the description and treatment of the co-movement of short and long-term bond yields. An affine process

Y is defined as one in which a conditional mean

and variance

are affine functions of

Y. The process is further defined and characterised by [

2] as regular affine process, a class of time-homogeneous Markov processes. They consider a state space

, for integers

and

, from which the logarithm of a characteristic function of a transitional probability

of such process is affine with respect to the initial state

. [

4] conveniently formalises it in terms of their exponential-affine Fourier (for continuous-time) and Laplace (for discrete-time) transforms. The affine relationship is defined by coefficients which are solved by a family of ordinary differential equations (ODEs). These ODEs are the essence of tractability of regular affine processes. [

8] apply the ODEs as time-dependent drivers of the solution to a zero-coupon bond, provided the parameters are admissible. An inverted form of these zero-coupon bond gives rise to a yield as a state variable. They also exploit the idea of a yield-only analysis without including additional economic variables as latent factors.

[

9,

10] are among several authors who have approached the application of ATSMs in discrete-time although they are known to have less popularity compared to their continuous-time counterparts. Earlier models exhibited a tendency of perfectly correlated returns of bonds of all maturities, which is an unrealistic behaviour and unsuitable for hedging; see [

11]. Several authors extended these one-factor Markov representation of a short-rate by introducing a range of multi-factor models with the long-run mean

, and the stochastic volatility

of

that are affine functions of

for which [

1] explores several specifications. [

12] endorse a parsimonious representation of the yield curve matching the time series and cross-sectional variation of bond yields through three-factor models. They develop a simple estimation approach by exploiting the exponential-affine structure of these models; see also [

13] on the stochastic mean and stochastic volatility and three-factor model of the term structure of interest rates and its applications in derivatives pricing and risk management

A specification of an ATSM should be "admissible" and therefore lead to well-defined bond prices. The admissibility property is completely characterised by [

2] in the "canonical" state space

, with a non-negative diagonal matrix. However, this property has a problem of imposing parameter restrictions on the affine process to ensure that it is well defined. One typical scenario is the restriction of parameters to ensure that the conditional variance of a state variable remains non-negative. The requirements for admissibility become more complex as the number of state variables determining conditional variances increase; see [

4]. The admissibility condition ensures that the process does not exit the domain

. A family of

models with a domain

are a common admissible family of models; where

M factors evolve in a positive state space while

evolve in an unrestricted space; see [

14]. [

1] verifies this easily through admissible

factor ATSMs that are uniquely classified into

non-nested subfamilies.

Admissible models should also be canonical, meaning that they are economically identified, and maximally flexible; see [

4]. As a result, the

benchmark ATSM models should have a canonical representation and also satisfy the non-negative and non-explosive solution of ([

15]). Their drift should satisfy a Lipschitz condition, and the diffusion should satisfy the uniqueness condition of [

16]; see [

3]. These conditions have an effect of restricting the correlation structure of the affine diffusions. Exploiting the Gaussian and square-root form of diffusions, there still appear to be non-satisfaction of the regularity conditions of non-explosive growth and uniqueness, giving rise to need for a Feller condition;

1 see [

3]. A multi-dimensional extension of a Feller condition was implemented by [

8], which was found to handle the general correlated affine diffusions. The condition ensures that only positive factors enter the volatility

. This involves restrictions on the state variables that prevent the instantaneous conditional variances

from becoming negative. This condition is sufficient for the existence of a unique solution to the affine SDE according to [

2].

For each of the

subfamilies, there exists a maximal model that is econometrically plausible for all other models within this subfamily. They describe further the maximal models in relation to the

classification; and highlight an interaction within the family of ATSMs between the dependence of the conditional variance of each

on

and the admissible structure of the correlation matrix for

Y. A key advantage of maximal models is that of overcoming the overidentifying restrictions that are imposed on yield curve dynamics; see [

1]. The admissibility property is also confirmed by the no-arbitrage solution for a zero-coupon bond following [

8].

[

1] specification applied the continuous-time approach to the ATSMs which is popular to a majority of empirical literature. They explore the structural differences and relative goodness-of-fits of ATSMs. They refer to a trade-off between flexibility in modeling the conditional correlations and volatilities of the risk factors. They classify a family of

factor affine into

non-nested subfamilies of models. From their three-factor ATSMs, empirical analysis suggests that some subfamilies of ATSMs are better suited than others to explaining historical interest rate behaviour.

The focus of the research is to implement the specifications of [

1] to test the pricing of zero-coupon bonds and forecasting the yield curve dynamics when using the SA bond yield. It also attempts to extract the latent factors from the yield itself, without any consideration for other economic factors; see [

8]. ATSMs are proven to dominate both theoretical and empirical frameworks in term structure modelling; see [

3]. A link between the cross-sectional and time series properties is made consistent by the ATSMs. Evolution of unobserved factors from the risk-neutral dynamics of the yield are proved to have both the drift and the diffusion coefficients as affine functions of such factors by the ATSMs; see [

3]. Several methods of estimation are available and require mostly the knowledge of the joint conditional density of yields. In this study, we follow the estimation method of Fourier inversion for the characteristic function of a state variable, which is assumed to lead to a conditional density. This method leads to a closed-form solution where the maximum likelihood is an efficient estimator.

2. Model Establishment

We discuss the model in the context of admissibility of ATSMs. In the absence of arbitrage opportunities, a zero-coupon bond that matures at time

T is priced as

where:

is the price of a bond at time t maturing at time .

t is the current or initial time at which the bond is evaluated.

is the maturity date, at which the bond pays its face value.

s is a continuous time variable at which the interest rate process

evolves.

2

denotes the conditional expectation under the risk-neutral measure Q given the information available at time t.

To obtain an

factor ATSMs it is assumed that an instantaneous short-rate

is an affine function of a vector of

N unobservable state variables

, written as

where

and

.

Another assumption is that

follows an affine diffusion

and

represent the reversion rate and central tendency (long-term mean) parameters under risk-neutral measure, respectively.

is an

dimensional independent Brownian motion under the risk-neutral measure

Q;

, and

are

matrices, which may be asymmetric or non-diagonal.

is a diagonal matrix with the

diagonal elements written as

where

and

.

The drifts in (

3) and conditional variances in (

4) are both affine in

.

[

8] has the following time dependent solution to the price of a zero-coupon bond, provided that parameters are admissible.

and the related yield is computed as

where

and

are coefficients whose solution satisfies the following ODEs (Ricatti equations)

A solution to these ODEs is found through numerical integration, starting from the initial conditions

=

. Risk-neutral dynamics of the short rate

in (

2) through to (

4) determine this specification of the ODEs.

To use the closed-form representation of (

1) in the empirical study of ATSMs, it is required that the distributions of

and

under actual physical measure

P be known. To this end, a market price of risk

is introduced as

where

is an

vector of constants. The process

under physical measure

P, therefore also has an affine form

3

Note that a superscript Q has been removed. is an dimensional vector of independent Brownian motion under P, , . comprises of in its row, and is an vector with as its element.

3. A Canonical Representation of ATSMs

According to [

1], a general specification for (

10) may not always lead to a positive conditional variances over a range of

Y, given an arbitrary set of parameters

. However, admissibility requires that parameters restrict

in (

10) to be strictly positive for all

i; where

denotes the matrix of coefficients on

Y in

.

From (

4), there is a special case where there is no admissibility problem when

, for all

i, since the instantaneous conditional variances are all constant. Outside the special case, it is necessary to impose constraints on the drift parameters

and

, and diffusion coefficients

and

. The requirements for admissibility become more restrictive as a number of state variables determining

increases.

They consider a case where there are

M state variables driving the instantaneous conditional variance of the

vector

Y, such that

. They further propose a set of

benchmark models

as the most flexible econometrically identified affine DTSM on the state space

; see also([

2]). It is only when the admissibility conditions are met that a canonical representation may be defined.

Definition 3.1: For each

M,

is partitioned as

where

is

, and

is

; where

V and

D represent the volatility sources and the dependent factor, respectively. The canonical representation of the benchmark model

is defined as a special case of (

3) with

for

, and

is either lower or upper triangular for

.

The canonical representation of

is the mean-reversion matrix, with diagonal terms expected to pull the mean level to non-negativity, thus influencing positive variances. Its off-diagonal terms on the other hand reflect how different state variables influence each other, indicating potential dependencies or interactions that could affect the overall system behaviour. The matrix

therefore captures both the stabilising effects of the mean-reversion rates and the dynamic interplay between different state variables. In the three-factor analysis, this trade-off between non-negative variance and correlations requires a special attention. It also has an impact on the choice of

M, number of state variables entering volatility and the interactions among

factors

The following parameter restrictions are imposed:

[

1] define a subfamily

; of affine DTSM as nested special cases of the

canonical model or its invariant transformation; where

. Equivalent affine models are obtained under invariant transformations that preserve admissibility and identification and leave the observable quantities like short rate unchanged. Details on invariant transformation are discussed in Appendix A of [

1].

The following issues are further noted from [

1]:

The assumed structure of

ensures that

for the

canonical representation. To verify that

M resides in

, instantaneous conditional correlations among

are zero, whereas the instantaneous correlations among

are determined by parameters

because

. Admissibility is established provided (

20) holds, and that the conditional covariance matrix of

Y depends only on

. Zero restrictions in the upper right

block of

and the constraints in (

18) and (

19) ensure that

is positive. Stationarity is also assured by ensuring that all the eigenvalues of

are strictly positive; see also Appendix B in [

1].

In addition to an admissible canonical representation, in which the minimal known sufficient condition for admissibility were imposed, minimal normalisations for econometric identification are imposed to derive a "maximal" model in

. A more unique class of maximal

, referred to as the equivalence class of

model is obtained by invariant transformation of the canonical representation; see Appendix A in [

1].

[

1] further points that the canonical representation of

models may not always be a practical way for analysing state variables in ATSMs. Often, existing literature opted for parameterising ATSMs with the riskless rate

r as a state variable, resulting in "affine in

r" (Ar) representation. This can be rewritten as an "affine in

Y"

, where

can be expressed as an unobserved state vector

. As a result, a thorough specification analysis for

factor ATSMs necessitates evaluating

non-nested, maximal models, and ensuring that a thorough understanding of the model’s structure and implications is obtained.

4. The Three-Factor Affine Term Structure Models

Three-factor models are used to describe the historical behaviour of the term structure of interest rates. Traditionally, these factors are unobserved (latent) and can only be defined statistically using techniques such as principal component analysis to convey economic meaning. Popular yield-curve fitting approaches such as the dynamic Nelson-Siegel model apply PCA loadings to fit a yield curve; see [

19]. These approaches appear to fit and forecast well but lack the theoretical rigour to enforce some no-arbitrage restrictions. Contrary to the yield-curve fitting approaches, the empirical approaches to the factor models such as the ATSMs are worth pursuing. They consider the maximal parameterisation through which in general the economic identification of factors can be revealed. The paper by [

12] is among early works that are based on enforcing the no-arbitrage restrictions by implementing the three-factors models. They constructed a simple affine model with short term interest rate, mean rate and volatility as three factors, which are easy to estimate. They further conclude that the short rate plays and important role in yield curve modeling, following their observation that it could not be dominated by any other factor across all maturities.

[

1] explores various forms of the canonical ATSMs and their maximal counterparts, as influenced by the number conditional volatility and correlation of factors. Fixing these factors into

gives rise to their three-factor models which posit mainly the representation of the short-rate itself, its mean rate and volatility as the three-factors. Analysis and comparisons are made of the Gaussian versus the square root diffusion forms of the models, even though the latter appear to be preferred as it imposes the non-negative variance restrictions.

Three-factor models were derived from the notation

where

M is the number of state variables that enter volatility

according to [

1]. Emphasis has been put on the trade-off between conditional volatility and correlation as a focus for the analysis of the term structure of interest rates. As previously discussed, [

8] introduced a multi-dimensional Feller condition. It ensures that negative state factors do not enter the volatility

by restricting correlations; see also [

3]. We have previously also discussed in a similar context, the role of the mean-reversion rate matrix

, its non-negative diagonal terms restrictions and interactions among state variables through its off-diagonal terms.

A number

M of the factors that drive the process which enters a volatility

become the main argument on the choice of an

model, depending on the purpose of the study. [

20] point out that more volatility factors result in less flexibility in allowing risk premium and correlation structure. As a result, they are in favour of a one conditional volatility factor models

such as the

by [

1]. [

21] also favour the

with

and

for the same purpose of allowing flexibility for risk premium and correlation. Their focus is to impose restrictions on the parameters of

such that the volatility factor

disappears from the bond pricing equation. In our approach, we analyse the admissibility of parameters and cross-equation restrictions that result from interactions among the factors

. As previously discussed, the mean-reversion rate matrix

has elements with either negative of positive magnitudes playing a role of ensuring that factors are pulled from entering the variance only for non-negative values, otherwise non-negative correlations are the result. This is also applicable in the case of a three-factor model.

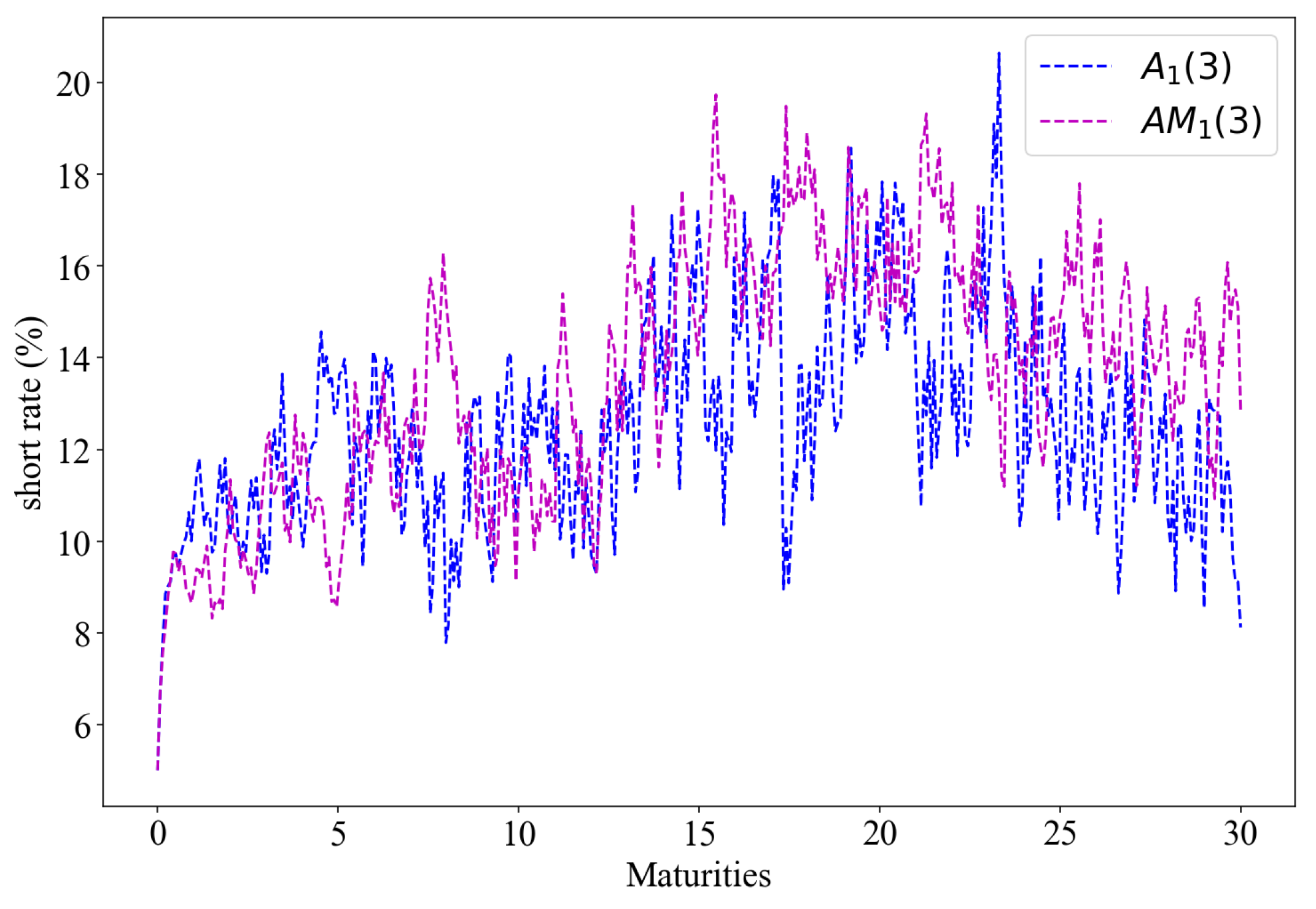

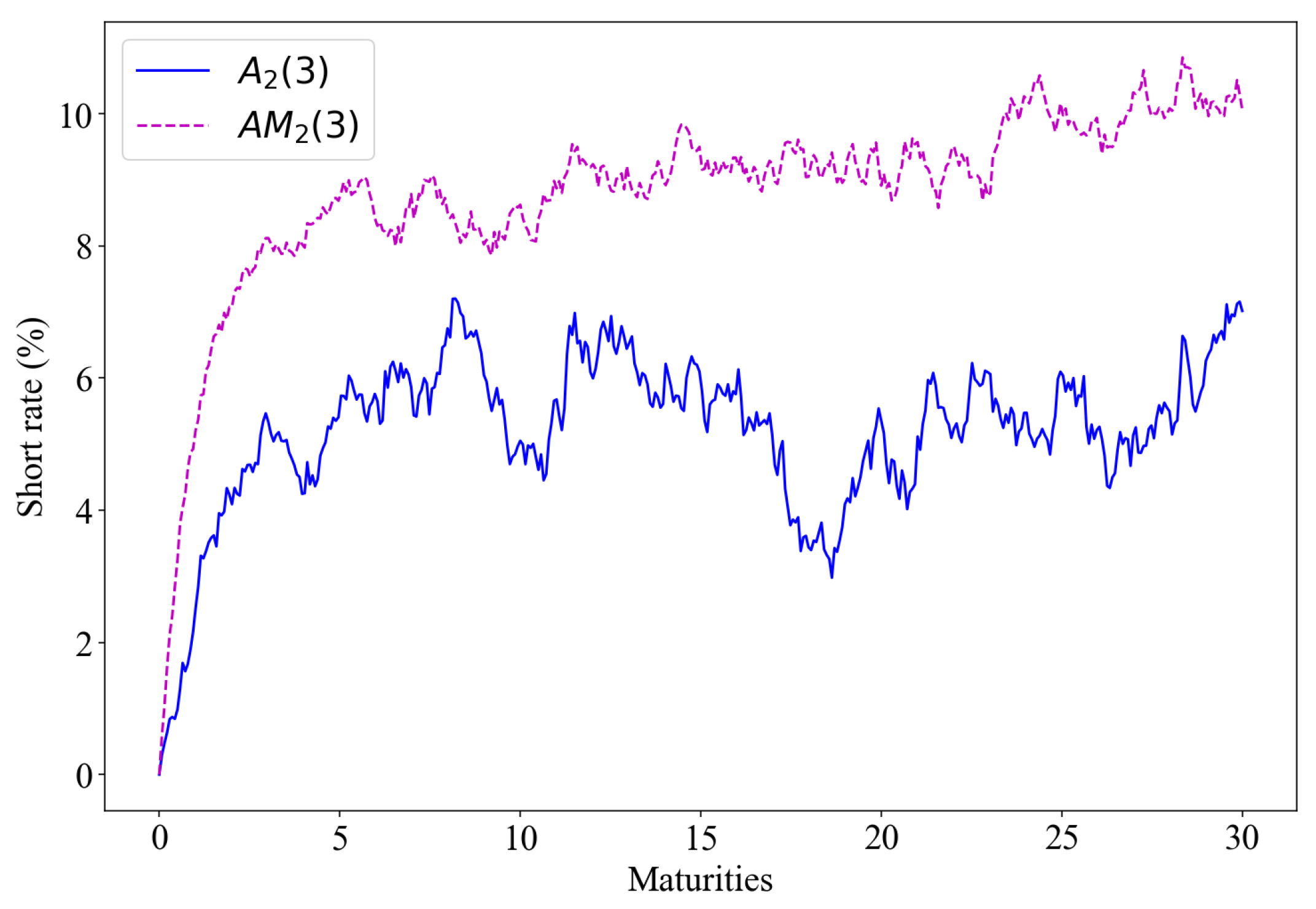

In this study we focus on the , models and their maximal counterparts and to determine both the fit and estimation when applied to the SA bond yield curve.

4.1.

These models are characterised by one factor

Y as a source of conditional volatility. As a result,

gives rise to the model form of

. From the original [

12] BDFS model, the

according to the notation of [

1] is specified as

where:

The state variables , and are the stochastic volatility for , central tendency or long-run mean of and short rate processes, respectively. The volatility affects the short rate through its volatility factor . The coefficient represents the rate at which the short rate reverts to the central tendency. The stochastic volatility also enters and it is also instantaneously correlated with as noted in the last term .

The maximal model is best suited for interpreting the parameter restrictions. As a result, [

1] prefer the following model in (

23) as a maximal

which is affine in

r. They determine their

by relaxing the parameters

and

in order to accommodate a non-zero correlation between the short rate and central tendency. All the other parameters inside the square boxes are set to zero to impose significant restrictions on the dynamics of interest rates and their volatility.

where:

serves as stochastic volatility for

, but also enters the drift of

, and correlated to

as noted in the term

;

is the central tendency of

r and

is the rate at which the short rate reverts to its central tendency. Appendix E in [

1] describes the transformation framework from which a test for admissibility and canonical representations in

can be achieved.

4.2.

These models are characterised by two factors of

Y as a source of conditional volatility. As a result,

gives rise to the model form of

. The [

13] model is the member of this sub-class of models, and it is represented as

,

and

are independent Brownian motions. The

follows a square-root diffusion unlike in the case of the BDFS model. Other parameters

,

and

are the same as in the above models. These leads us to the convenient maximal model for

which is represented as

[

1] relaxes the restrictions on

,

and

, while other parameters within a square box are restricted to zero.

5. Estimation for Affine Models

The conditional likelihood function is not always known for affine diffusion models. However, a closed-form solution to the ATSMs provides formidable grounds to base the estimation on the conditional characteristic function of a state variable even when the functional form of the density is not known. [

22] applied the Fourier inversion to estimate the conditional-likelihood function for a state variable, which leads to an asymptotically efficient estimator of parameters. He also shows that a method-of-moments estimator works well to approximate the efficiency of maximum likelihood of ATSMs from the conditional characteristic function; see also [

23].

The conditional density function

f of

is known up to an inverse Fourier transform of

The charaterisic function

for

given

From the Proposition 1 of [

24], it can be shown that under suitable regulations (

5) is the conditional characteristic function of

, with

and

derived from the solution of (

7) and (

8) for

. Therefore, the conditional characteristic function becomes

The log-likelihood form for (

27) becomes

By conjecturing the parameters

and computing the Fourier inversion, maximum likelihood can be obtained by maximising (

30), to obtain a maximum likelihood estimator by characteristic function (ML-CCF); see [

4].

[

4] considers densities of individual columns

, for

. A selector vector

is assigned an entry 1 and zero elsewhere. The density

f of

given the entire

is the inverse Fourier transform of

Estimation of (

31) is based on one-dimensional

N integrations instead of

dimensional integrations.

The general method of moments (GMM) using a characteristic function is achieved by the residual

For an arbitary instrument

; the estimator becomes

The GMM approach is a beter alternative to a multi-dimensional Fourier inversion. However, as a grid of

becomes finer, correlations among moments become increasingly large, leading to a singular distance matrix; see [

4].

6. Data Collection

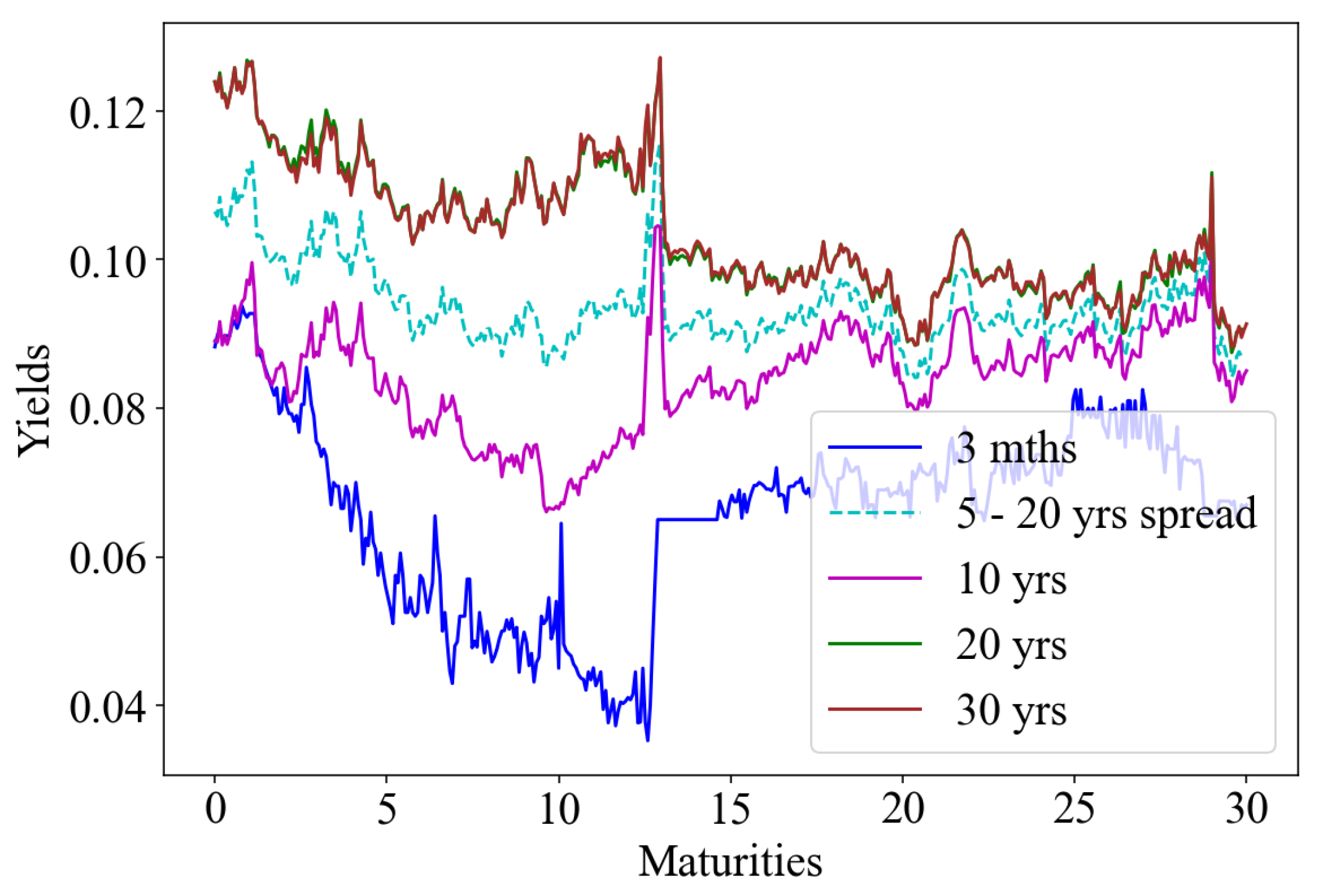

Weekly SA government yields from Thomson Reuters for all the active treasury bonds over the periods October 2013 to September 2024 with maturities 3 months, 5, 10, 12, 20, 25, and 30 years were used. Our in-sample and out-sample data were based on the periods October 2013 - Sep 2023 and October 2023 - September 2023, respectively. The out-sample will be best-suited for forecasting and validation. A summary of descriptive statistics for yields across maturities is presented in

Table 1. Mean values range between 6.6% to 10.3% exhibiting an upward slope which is also convex in shape. Recent study by [

25] reported a similar behaviour for the average yields. The highest weekly standard deviation of 1.3% is observed for the 3-months maturity which is typical in the short end of the yield curve, suggesting that yields may react quickly to changes in monetary policy or market sentiment. It is followed by a drop to 0.7% and 0.6% for the 5-year and 10-year maturities, respectively. The 20-year maturity exhibits a rise in weekly standard deviation to 1.1%, which may be due to some unexpected economic event. This is also confirmed by a very high kurtosis and negative skewness of 30.69 and -3.23, respectively. After the 20-year maturity, a drop in the weekly standard deviations of 0.9% is observed. This suggests lower volatility and relative stability for the long end of the yield curve.

Table 2 presents the correlations across maturities of yields. The short end of the yield curve is characterised by weak correlations. The 3-month and 5-year terms exhibit negative correlations with their long end counterparts. This may suggest a difference and diversity in dynamics between the short and long end of the yield curve. From the 10-year maturity, higher correlations ranging from 0.608 to 0.999 are observed, suggesting stability as the yield curve approaches its long end.

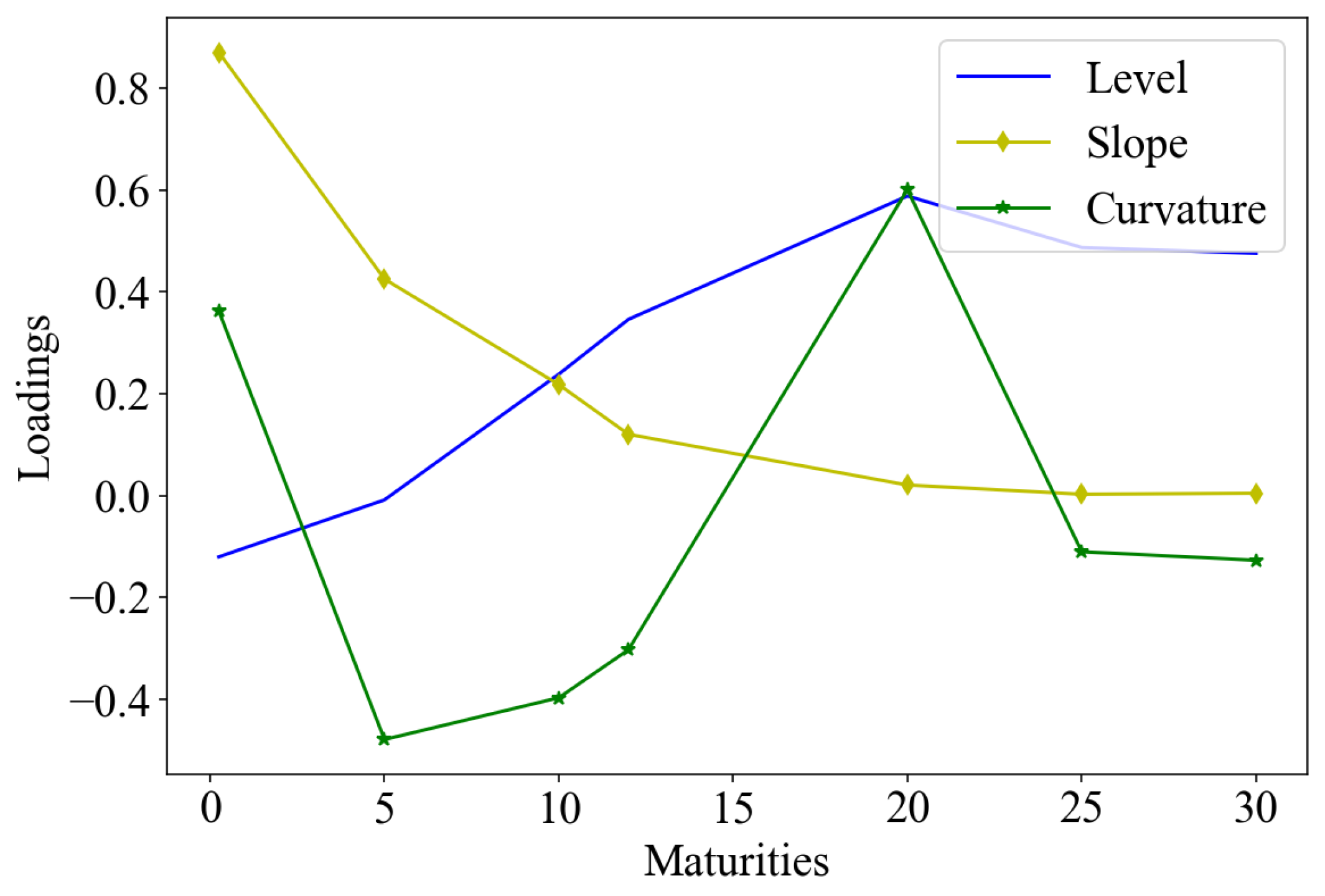

Figure 1 presents the first three principal components (PC) of the yields over maturities. They are explained by the variance of about 96.32%, which is close to the 98% empirical finding according to [

26]; see also [

3,

19]. The first PC represents a key rate shift or level change in rates. It is the result of volatility causing rates of all maturities to fluctuate by almost the same amount. The observation is that short end is associated with high volatility and increasing rates. At mid-term around the 10-year maturity they reach a peak, followed by stability as they approach the long end of the yield curve. The second PC represents a slope which exhibits a hump in the short end associated with rate increase, followed by a drop in rates in mid-term region and stable but falling rates towards the long end. Volatility forces a fall in rates in the short end followed by a slight increase up to mid-term, 10-year maturity, thereafter, increases until it falls and stabilises towards the long end.

The behaviour of PCs is also associated with the correlations as discussed earlier, where short end is associated with weak correlations whereas in the long end of the yield curve, strong correlations were observed. These patterns are suitable for trading in swaps and correlation-based hedging strategies. Our focus being the ATSMs, we believe that these PCs are somehow closely related to the latent factors derived by the solution of coefficients

and

in (

6). The three-factor models with three labels short-rate, volatility and central tendency should exhibit nearly a similar pattern to PCs; see [

3].

Figure 2 presents a selection of observed yields from the SA Treasury bonds plotted against maturities of up to 30 years. A spread between 5 and 20 years is also plotted and expected to represent a slope. Crossovers are observed among individual plots from time to time, indicative of either positive or negative (inverted) yield curves. Initial unobserved inputs to the three-factor simulation of

are selected from a 3-month yield, a spread between 5-year and 20-year yields, and a 30-year yield. We apply these rates together with the initially guessed parameters to simulate the state variables from (

10). These are further used as inputs to the solution of ODE (

7) and (

8) from which coefficients

and

are obtained. Thereafter, a model-based set of zero-coupon bonds and zero-yields are obtained from (

6). The selection is also guided by the observations from the PCA, suggesting that our selection is a proxy for level, slope and curvature, taking into consideration the PCA features for short end, mid-term and long end.

10. Conclusion

The historical behaviour of the term structure of interest rates for the SA treasury bond was analysed. The purpose was to establish whether the ATSMs specifications of the three-factor models were suitable for the data. The study also considered the conditional volatilities and correlations of the state variables as they are essential components. It has therefore been essential to thoroughly examine the interactions among the state variables—stochastic volatility, central tendency, and the short rate—within the framework of a three-factor approach to the ATSM.

Model is a suitable specification for the data, even though it suggests a weaker relationship between the short rate and its stochastic volatility. Based on the Chi-square test, the model out-performs its maximal counterpart . exhibits a stronger negative correlation between short rate volatility and central tendency volatility. Similar circumstances prevail for the model and its counterpart, although negative correlation tends to strengthen more from modest level with to even stronger with

As an initial guess to the parameters, we adapted the empirical estimates in [

1]. This includes both their assumptions in regard to both parameters that were fixed to (zero) and those allowed to be unrestricted. The reason behind unrestricted parameters is to enable flexibility of interactions between conditional volatility and correlations. Resulting post-calibration estimates suggest a good fit for our data.

There were some limitations to the approach, which should be considered for future research. First, the inability to perform a detailed analysis on the market price of risk impact to the specifications. Second, the models were based only on the diffusion process and do not explicitly incorporate the impact of jumps.